Exhibit 99.2

Dietz on the Day: Pure Storage Q1 FY17 Results

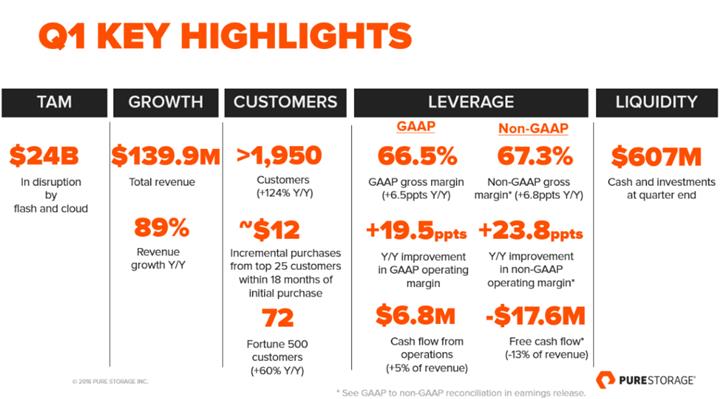

Pure Storage (NYSE: PSTG) had a very good first quarter, beating our own guidance and Wall Street consensus for top-line growth. Q1 revenues were $139.9 million, up 89% from the year ago quarter. We increased our customer count to over 1,950—now serving 72 of the Fortune 500, up from 66 at the end of last year. Customers added in the latest quarter include BNY Mellon, The World Bank, SoftBank, GMO Cloud and the University of Melbourne. About a quarter of our business continues to come from SaaS (we now count seven of IDC’s top 20 SaaS companies as customers), IaaS and the consumer cloud.

We continue to combine hyper-growth with improved operating efficiency: Operating margin has improved by approximately 20 percentage points year-over-year. We recorded modest cash burn in the quarter as we invested in field personnel and engineering among other areas—Q1 is an ideal time to hire talented people who have recently closed out their years at other companies, which gives us the ability to ramp them up quickly for optimal productivity in our seasonally stronger second half. We finished the quarter with more than $600 million in cash and zero debt.

Let’s talk about FlashBlade. Seven years ago, with the advent of FlashArray, Pure set out to disrupt the market for performance storage. Three years ago we saw an opportunity to be just as disruptive to the rest of the storage market: To address the need for dramatically better scale-out file and object storage for big data environments. The result is our second product FlashBlade, which we unveiled this last quarter.

FlashBlade targets larger unstructured and semi-structured datasets, complementing the structured databases and virtual machines that are the focus of FlashArray. While we don’t expect significant revenue in FY17, customers like the MERCEDES AMG PETRONAS Formula One™ Team, Mentor Graphics and Shutterfly are actively testing FlashBlade on a broad spectrum of use cases including Internet of Things, log analysis, security event correlation, genomics, chip design, bioinformatics, machine learning, media production and transcoding, among others. Such Big Data workloads are expanding far faster than structured data, but customers’ ability to mine insights from this data has been limited by the slow performance of disk-based storage systems.

Like its sibling FlashArray, we set out to make FlashBlade dramatically faster, simpler, denser and less costly to maintain than the disk-centric storage it is replacing, all for a comparable purchase price. The product is targeted to be generally available later this year. You can read more about FlashBlade in The New York Times: “As a Data Deluge Grows, Companies Rethink Storage.”

Pure//Accelerate. We launched FlashBlade at our inaugural Pure//Accelerate user conference in March 2016. The conference attracted more than 1,450 attendees, including representatives from 22 countries and more than 300 partners. Pure//Accelerate also featured keynotes from top-tier Cisco, VMware and Arista leadership, reflecting Pure’s expanding industry footprint. The champion MERCEDES AMG PETRONAS Formula One™ Team revealed how it uses Pure Storage FlashArrays to process analytic data from its race cars - the datasets are sufficiently large and the workload performance intensive enough that Pure FlashArrays now travel with the racing team, as public networks and cloud infrastructure just aren’t fast enough.

We also heard from Shutterfly. With more than 28 billion pictures on file and an additional seven billion anticipated over the next year, Shutterfly needed a highly scalable, highly performant solution for its vast image archive. And, with five people managing 175 petabytes of data, could not afford to increase the complexity of its environment. Shutterfly, a FlashBlade beta customer, was able to configure and begin storing data on FlashBlade in just over half an hour.

Intuit, a provider of accounting and tax software for consumers and small businesses, also shared its story. Within Intuit’s massive cloud environment, customer security and application performance are paramount. Intuit now stores several petabytes on Pure FlashArray, connected to more than 10,000 nodes of compute. With Pure, Intuit has taken applications that ran access times between 4-17 minutes, down to an average of 560 microseconds.

We look forward to hosting Pure//Accelerate again in 2017 and meanwhile, are taking the show on the road with "Pure Live.” Pure Live kicked off in Sao Paulo/Brazil and Sydney/Australia just last week, with 38 more cities across six continents to follow through early September.

International expansion. In Q1 we also opened a new support center in Dublin, Ireland to expand and enhance our support capabilities for customers whose first language is French, German, Spanish, Italian or Arabic. It is our first major support center outside the US. Our new Dublin center is designed to provide deep technical expertise in the EMEA region as well as multi-language support, further enhancing our reputation for great customer service.

Competition. In our view, refurbished mechanical disk-era designs from the last century cannot fulfill the needs of the modern data center: solid-state flash memory and cloud demand a holistic rethink. Yet the majority of FlashArray’s and all of FlashBlade’s competition comes from pre-cloud disk-centric retrofits. Why? It turns out that getting the software and hardware right is really hard, and the cloud further demands a rethink of the business model. We believe that our rivals remain 2-3 years behind us in embracing the secular shifts to flash- and cloud-friendly storage (see our recent blog This Is Your Father’s Storage Industry, But Not for Long).

With both FlashArray and FlashBlade, Pure Storage will be able to play across nearly the entire storage market—from block to file to object. We would argue only EMC enjoys similar reach across the market today, and EMC is poised to become part of Dell. While Dell/EMC is likely to remain our strongest competitor over time, the merger is creating confusion that Pure is well positioned to take advantage of in the near term. Pure fulfills virtually 100% of its business via channel partners, while we understand that EMC only does about 1/3 of its business via the channel and Dell is known for its direct sales DNA. And together Dell and EMC have nine distinct all-flash storage offerings. The uncertainty over which of those products will survive (e.g., all-flash VMAX now appears to have a leg up on XtremIO), and what role the channel will play in its combined go to market, as well as their level of integration with non-Dell servers, is creating uncertainty for others and an opportunity for Pure.

Our innovations are changing the storage industry. This is why Pure expects to grow and thrive while many of our competitors are seeing their businesses flatten or contract. With by far the highest customer satisfaction ratings in the industry (based on Pure’s Satmetrix-certified NetPromoter Score of 79!), we simply need to continue to increase our “at bats” while maintaining our innovation and our outstanding execution to achieve our ultimate goal of being the number one vendor in a $24 billion market.

What’s Ahead: As the leader in flash and cloud, and amidst an industry experiencing a perfect storm of disruption, we very much look forward to serving customers and partners in the coming months and years. What an incredibly exciting time to be in enterprise storage, so long as your recipe is right, as we so confidently believe ours is. We will remain focused on winning new customers and delighting current customers to continue driving healthy repeat business metrics and customer retention percentage (currently in the mid 90’s as of Q1). Additionally – with close to 70% of new logos in Q1 being brought to us by channel partners -- we look forward to keeping our foot firmly on the channel pedal for additional go-to-market acceleration. With our top five partners driving triple digit year-over-year growth in their sales of Pure technology, there is no doubt we will continue to invest to ensure this momentum continues.

Thank you. Let me close with our sincere gratitude for all those who have joined Pure along our journey. To our customers and partners: we will continue to give you our best—striving to deliver storage that pays for itself by both unlocking innovation in your business and substantially reducing your cost of ownership! To our investors: we will continue to substantially improve our operating efficiency year over year even as we maintain the greatest growth in storage industry history. And to the Pure team: Your smarts and hard work are remaking the storage industry and transforming the businesses of our customers.

Forward Looking Statements. This post contains forward-looking statements regarding industry and technology trends, our positioning and opportunity, technical and business advantages, competitive position, go-to-market strategy, and our current and new products, business and operations, including our future results, roadmap, growth prospects and operating model. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Annual Report on Form 10-K for the fiscal year ended January 31, 2016, which is available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended April 30, 2016. All information provided in this post is as of May 25, 2016, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures. This post contains certain non-GAAP financial measures about the company’s performance. For the most directly comparable GAAP financial measures and a reconciliation of these non-GAAP financial measures to GAAP measures, please see our earnings release issued on May 25, 2016, which includes tables captioned “Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures” and “Reconciliation from net cash provided by (used in) operating activities to free cash flow.”