UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22349

Capital Group Private Client Services Funds

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Gregory F. Niland

Capital Group Private Client Services Funds

5300 Robin Hood Road

Norfolk, Virginia 23513

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

|

Capital Group California Core Municipal Fund

Annual report for the year ended October 31, 2022 |

Research-driven

approaches to seeking

wealth preservation

and tax-exempt income

Capital Group California Core Municipal Fund seeks to provide current income exempt from federal and California income taxes while preserving your investment.

Capital Group California Short-Term Municipal Fund seeks to preserve your investment and secondarily to provide current income exempt from federal and California income taxes.

Each fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For over 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report are at net asset value. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended September 30, 2022 (the most recent calendar quarter-end), and the total annual fund operating expense ratios as of the prospectus dated January 1, 2023 (unaudited):

| Cumulative | Average annual | |||||||||||||||||||

| total returns | total returns | Gross | ||||||||||||||||||

| 1 year | 5 years | 10 years | Lifetime* | expense ratios | ||||||||||||||||

| Capital Group California Core Municipal Fund | –6.34 | % | 0.59 | % | 1.24 | % | 1.87 | % | 0.27 | % | ||||||||||

| Capital Group California Short-Term Municipal Fund | –4.42 | 0.28 | 0.55 | 0.87 | 0.30 | |||||||||||||||

| * | Since April 13, 2010 |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. Visit capitalgrouppcsfunds.com and capitalgroup.com for American Funds for more information.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Income from municipal bonds may be subject to state or local income taxes. Certain other income, as well as capital gain distributions, may be taxable. Refer to the funds’ prospectuses and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

| 1 | Letter to investors | |

| 2 | Funds’ 30-day yields and 12-month distribution rates | |

| Investment portfolios | ||

| 6 | Capital Group California Core Municipal Fund | |

| 18 | Capital Group California Short-Term Municipal Fund | |

| 24 | Financial statements | |

| 41 | Board of trustees and other officers |

Fellow investors:

Bond markets slipped in the 12 months ended October 31, 2022, as repeated central bank interest rate hikes weighed heavily across the fixed income market.

Both Capital Group California Core Municipal Fund and Capital Group California Short-Term Municipal Fund fared well against their respective benchmarks despite posting negative returns. Portfolio managers sought to limit interest rate sensitivity and, where appropriate, moved to take advantage of the changing environment by directing cash into securities paying higher yields.

Markets and economy

The funds’ fiscal year began on a cautious note, with both stock and bond markets pausing amid regulatory clampdowns in China and political jockeying in the U.S. over President Joe Biden’s spending and taxation proposals. Those issues were abruptly overshadowed by Russia’s invasion of Ukraine in February, which injected significant volatility into the global financial system. Stubbornly high inflation — partly fed by energy disruptions related to the war in Ukraine — spurred global central banks to aggressively raise rates. The U.S. Federal Reserve raised rates five times over the 12-month period to combat rising consumer prices, including a series of unusually aggressive three-quarter point moves.

Economic data was mixed. Some indicators — particularly the job market and consumer spending — remained strong, while others such as housing weakened. Gross domestic product fell in the first and second quarters of 2022, reflecting tighter household budgets in the face of high oil and food costs. Though back-to-back contractions would normally indicate a recession, solid employment and wage gains suggested that a downturn had not taken hold. Indeed, GDP rose in the third quarter.

Nevertheless, high inflation and rising interest rates took their toll on both fixed income and equity markets. Indeed, the Fed’s rate increases created one of the most challenging periods for fixed income in decades.

Even so, bonds still broadly held up better than stocks, highlighting the essential role they play in a balanced portfolio. Bonds can help to preserve capital, generate income and provide much-needed diversification, enabling them to mitigate occasionally sharp setbacks in the stock market.

Capital Group California Core Municipal Fund and Capital Group California Short-Term Municipal Fund

Capital Group California Core Municipal Fund declined 6.02% for the year, holding up better than the Bloomberg California Short-Intermediate Municipal Index*, which lost 6.89%. Capital Group California Short-Term Municipal Fund fell 4.17%, less than the 4.80% drop realized by the Bloomberg Short Municipal Index.*

Rapidly rising interest rates weighed on the funds. However, the portfolios benefited relative to their associated indexes from a higher emphasis on securities that were less sensitive to changing rates and less exposure to

| * | Index definitions can be found on page 3. |

| Private Client Services Funds | 1 |

California and local government general obligation bonds.

Market outlook

It remains to be seen if the Fed can achieve a hoped for “soft landing” in which inflation falls to its target range of 2% without triggering a recession. Though consumer price gains have moderated somewhat, the Fed has remained aggressive, perhaps recalling the difficulty policymakers encountered in subduing price growth in the 1970s.

On the flip side, rising yields can reward investors over the long term. Until the past year, bond yields had declined steadily for the better part of the last 40 years. That was a double-edged sword for investors: Falling interest rates boosted the value of bonds, but the years’ long run of lower yields weighed heavily on investors seeking income.

The recent rise in rates gives portfolio managers the opportunity to reinvest proceeds of maturing securities into offerings with higher yields. That could provide relief in the fixed income portion of investor portfolios.

Given the uncertain economic environment, our investment team continues to proceed cautiously. Portfolio managers have limited interest rate sensitivity and avoided unwarranted credit risk. They have sought to take advantage of periodic volatility by investing in attractively priced securities featuring compelling yields and the potential to boost long-term returns.

Thank you for your trust and continued investment.

Sincerely,

John S. Armour

President

Mark Marinella

Senior Vice President

December 14, 2022

The funds’ returns for the 12 months ended October 31, 2022, can be found on page 3.

Funds’ 30-day yields and 12-month distribution rates

Below is a summary of each fund’s 30-day yield and 12-month distribution rate as of October 31, 2022. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ.

| SEC | Distribution | |||||||

| 30-day yield | rate | |||||||

| Capital Group California Core Municipal Fund | 2.69 | % | 1.41 | % | ||||

| Capital Group California Short-Term Municipal Fund | 2.19 | 0.84 | ||||||

| 2 | Private Client Services Funds |

Results at a glance

For periods ended October 31, 2022, with all distributions reinvested

| Cumulative | ||||||||||||||||

| total returns | Average annual total returns | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime1 | |||||||||||||

| Capital Group California Core Municipal Fund | –6.02 | % | 0.59 | % | 1.23 | % | 1.87 | % | ||||||||

| Bloomberg California Short-Intermediate Municipal Index2 | –6.89 | 0.43 | 1.20 | 1.95 | ||||||||||||

| Lipper California Short-Intermediate Municipal Debt Funds Average3 | –6.04 | 0.19 | 0.71 | 1.17 | ||||||||||||

| Capital Group California Short-Term Municipal Fund | –4.17 | 0.30 | 0.56 | 0.87 | ||||||||||||

| Bloomberg California Short Municipal Index2 | –4.80 | 0.38 | 0.79 | 1.17 | ||||||||||||

| Lipper Short Municipal Debt Funds Average3 | –3.36 | 0.34 | 0.45 | 0.73 | ||||||||||||

| 1 | Since April 13, 2010. |

| 2 | The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Source: Bloomberg Index Services Ltd. |

| 3 | Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper categories are dynamic, and averages may have few funds, especially over longer periods. Lipper source: Refinitiv Lipper. |

Bloomberg California Short-Intermediate Municipal Index is a market value-weighted index that includes only investment-grade tax-exempt bonds that are issued from California with maturities of one to 10 years. Bloomberg California Short Municipal Index is a market value-weighted index that includes only investment-grade tax-exempt bonds that are issued from California with maturities of one to five years. For additional information about the funds, their investment results, holdings and portfolio managers, visit capitalgrouppcsfunds.com. You can also read our insights about the markets, industries and more at capitalgroup.com/pcs.

| Private Client Services Funds | 3 |

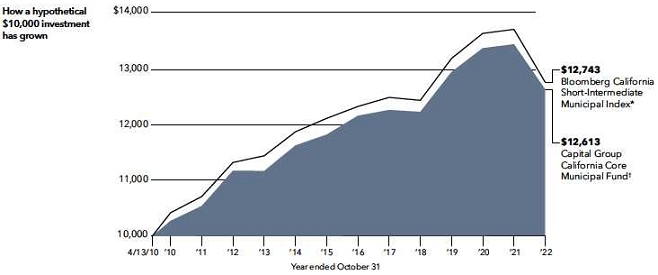

Capital Group California Core Municipal Fund

(For the period April 13, 2010, through October 31, 2022, with dividends reinvested)

| * | Bloomberg California Short-Intermediate Municipal Index is a market value-weighted index that includes only investment-grade tax-exempt bonds that are issued from California with maturities of one to 10 years. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index. Source: Bloomberg Index Services Ltd. |

| † | Includes capital gain distributions. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended October 31, 2022

| 1 year | 5 years | 10 years | ||||

| Capital Group California Core Municipal Fund | –6.02% | 0.59% | 1.23% |

| 4 | Private Client Services Funds |

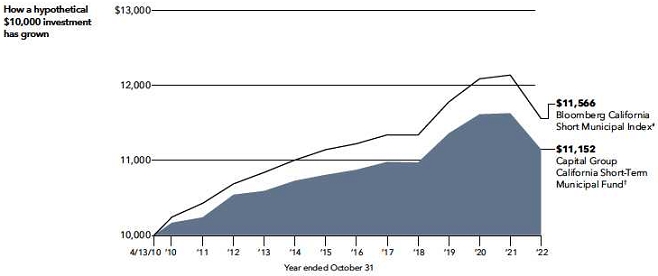

Capital Group California Short-Term Municipal Fund

(For the period April 13, 2010, through October 31, 2022, with dividends reinvested)

| * | Bloomberg California Short Municipal Index is a market value-weighted index that includes only investment-grade tax-exempt bonds that are issued from California with maturities of one to five years. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index. Source: Bloomberg Index Services Ltd. |

| † | Includes capital gain distributions. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended October 31, 2022

| 1 year | 5 years | 10 years | ||||

| Capital Group California Short-Term Municipal Fund | –4.17% | 0.30% | 0.56% |

| Private Client Services Funds | 5 |

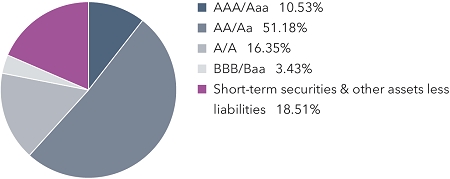

Capital Group California Core Municipal Fund

Investment portfolio October 31, 2022

| Portfolio quality summary* | Percent of net assets |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| Bonds, notes & other debt instruments 81.49% | Principal amount (000) |

Value (000) |

||||||

| California 80.95% | ||||||||

| Alameda Corridor Transportation Auth., Rev. Ref. Bonds, Series 2016-A, 5.00% 10/1/2024 | USD | 600 | $ | 612 | ||||

| Alameda Corridor Transportation Auth., Rev. Ref. Bonds, Series 2016-A, 5.00% 10/1/2025 | 500 | 510 | ||||||

| City of Alhambra, Insured Rev. Ref. Bonds (Atherton Baptist Homes Project), Series 2016, 5.00% 1/1/2027 | 630 | 654 | ||||||

| Antelope Valley Community College Dist., G.O. Rev. Ref. Bonds, Capital Appreciation Bonds, Series 2015, 0% 8/1/2035 (preref. 2/15/2025) | 2,300 | 1,365 | ||||||

| Antelope Valley Community College Dist., G.O. Rev. Ref. Bonds, Capital Appreciation Bonds, Series 2015, 0% 8/1/2036 (preref. 2/15/2025) | 2,800 | 1,589 | ||||||

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Eskaton Properties, Inc. Obligated Group), Series 2013, 5.00% 11/15/2022 | 1,000 | 1,000 | ||||||

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Eskaton Properties, Inc. Obligated Group), Series 2013, 5.00% 11/15/2023 | 500 | 503 | ||||||

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Windemere Ranch Infrastructure Fncg. Program), Series 2014-A, 5.00% 9/2/2023 | 370 | 375 | ||||||

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Windemere Ranch Infrastructure Fncg. Program), Series 2014-A, 5.00% 9/2/2024 | 395 | 407 | ||||||

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Windemere Ranch Infrastructure Fncg. Program), Series 2014-A, 5.00% 9/2/2025 | 510 | 525 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2001-A, (SIFMA Municipal Swap Index + 1.25%) 3.49% 4/1/2036 (put 4/1/2027)1 | 1,000 | 1,012 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2013-S-4, 5.00% 4/1/2043 (preref. 4/1/2023) | 1,000 | 1,008 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2008-B-1, (SIFMA Municipal Swap Index + 1.10%) 3.34% 4/1/2045 (put 4/1/2024)1 | 4,275 | 4,290 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2021-D, (SIFMA Municipal Swap Index + 0.30%) 2.54% 4/1/2056 (put 4/1/2027)1 | 1,895 | 1,847 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2017-S-7, 5.00% 4/1/2024 | 1,200 | 1,229 | ||||||

| Bay Area Water Supply and Conservation Agcy., Rev. Bonds, Series 2013-A, 5.00% 10/1/2023 | 500 | 504 | ||||||

| City of Beaumont, Wastewater Rev. Bonds, Series 2018-A, Assured Guaranty Municipal insured, 5.00% 9/1/2026 | 500 | 530 | ||||||

| City of Burbank, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Redev. Bonds, Series 2015, BAM insured, 5.00% 12/1/2022 | 1,305 | 1,307 | ||||||

| California County Tobacco Securitization Agcy., Tobacco Settlement Rev. Bonds (Los Angeles County Securitization Corp.), Series 2020-A, 5.00% 6/1/2026 | 600 | 616 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2015-A, 5.00% 11/1/2024 | 500 | 517 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-A, 5.00% 11/1/2028 | 2,705 | 2,859 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-B-2, 0.55% 11/1/2049 (put 11/1/2026) | 1,980 | 1,715 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-B-3, 4.00% 11/1/2051 (put 11/1/2023) | 2,500 | 2,506 | ||||||

| Cathedral City, Successor Agcy. to the Redev. Agcy., Tax Allocation Housing Rev. Ref. Bonds (Merged Redev. Project Area), Series 2021-C, BAM insured, 4.00% 8/1/2023 | 225 | 226 | ||||||

| 6 | Private Client Services Funds |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| Cathedral City, Successor Agcy. to the Redev. Agcy., Tax Allocation Housing Rev. Ref. Bonds (Merged Redev. Project Area), Series 2014-B, Assured Guaranty Municipal insured, 5.00% 8/1/2024 | USD | 260 | $ | 266 | ||||

| Cathedral City, Successor Agcy. to the Redev. Agcy., Tax Allocation Housing Rev. Ref. Bonds (Merged Redev. Project Area), Series 2014-A, Assured Guaranty Municipal insured, 5.00% 8/1/2025 | 620 | 637 | ||||||

| Cerritos Community College Dist., G.O. Bonds, Capital Appreciation Bonds, 2004 Election, Series 2012-D, 0% 8/1/2027 | 830 | 692 | ||||||

| City of Chino, Community Facs. Dist. No. 2003-3, Special Tax Bonds, Series 2021, 4.00% 9/1/2027 | 465 | 452 | ||||||

| City of Chino, Community Facs. Dist. No. 2003-3, Special Tax Bonds, Series 2021, 4.00% 9/1/2028 | 480 | 464 | ||||||

| City of Chino, Community Facs. Dist. No. 2003-3, Special Tax Bonds, Series 2021, 4.00% 9/1/2029 | 500 | 481 | ||||||

| City of Chino, Community Facs. Dist. No. 2003-3, Special Tax Bonds, Series 2021, 4.00% 9/1/2030 | 520 | 493 | ||||||

| City of Chino, Community Facs. Dist. No. 2003-3, Special Tax Bonds, Series 2021, 4.00% 9/1/2031 | 540 | 507 | ||||||

| City of Chino, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2014-A, BAM insured, 5.00% 9/1/2025 | 665 | 683 | ||||||

| City of Chino Hills, Fin. Auth., Rev. Ref. Bonds (Community Facs. Dist. Bond Program), Series 2019-D, 5.00% 9/1/2024 | 465 | 473 | ||||||

| City of Chino Hills, Fin. Auth., Rev. Ref. Bonds (Community Facs. Dist. Bond Program), Series 2019-D, 5.00% 9/1/2026 | 780 | 804 | ||||||

| City of Chino Hills, Fin. Auth., Rev. Ref. Bonds (Community Facs. Dist. Bond Program), Series 2019-D, 5.00% 9/1/2027 | 430 | 446 | ||||||

| City of Chino Hills, Fin. Auth., Rev. Ref. Bonds (Community Facs. Dist. Bond Program), Series 2019-D, 5.00% 9/1/2028 | 355 | 369 | ||||||

| City of Chino Hills, Fin. Auth., Rev. Ref. Bonds (Community Facs. Dist. Bond Program), Series 2019-D, 5.00% 9/1/2029 | 225 | 235 | ||||||

| City of Chino Hills, Fin. Auth., Rev. Ref. Bonds (Community Facs. Dist. Bond Program), Series 2019-D, 5.00% 9/1/2030 | 60 | 62 | ||||||

| Clovis Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2004 Election, Series 2006-B, National insured, 0% 8/1/2030 | 1,000 | 726 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2021-B-1, 4.00% 2/1/2052 (put 8/1/2031) | 7,475 | 6,978 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2022-A-1, 4.00% 5/1/2053 (put 8/1/2028) | 6,670 | 6,410 | ||||||

| Compton Community College Dist., G.O. Rev. Ref. Bonds, Series 2014, BAM insured, 5.00% 7/1/2026 (preref. 7/1/2024) | 1,290 | 1,329 | ||||||

| Compton Community College Dist., G.O. Rev. Ref. Bonds, Series 2015, BAM insured, 5.00% 8/1/2029 (preref. 8/1/2025) | 1,000 | 1,046 | ||||||

| Compton Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2015 Election, Series 2019-B, BAM insured, 0% 6/1/2033 | 1,000 | 620 | ||||||

| City of Concord, Successor Agcy. to the Redev. Agcy., Rev. Ref. Bonds, Series 2014, BAM insured, 5.00% 3/1/2023 | 825 | 829 | ||||||

| Del Mar Union School Dist., Community Facs. Dist. No. 99-1, Special Tax Bonds, Series 2019, 4.00% 9/1/2026 | 400 | 397 | ||||||

| Del Mar Union School Dist., Community Facs. Dist. No. 99-1, Special Tax Bonds, Series 2019, 5.00% 9/1/2027 | 880 | 914 | ||||||

| Del Mar Union School Dist., Community Facs. Dist. No. 99-1, Special Tax Bonds, Series 2019, 5.00% 9/1/2028 | 925 | 971 | ||||||

| Del Mar Union School Dist., Community Facs. Dist. No. 99-1, Special Tax Bonds, Series 2019, 5.00% 9/1/2029 | 675 | 713 | ||||||

| Desert Community College Dist., G.O. Rev. Ref. Bonds, Series 2016, 5.00% 8/1/2032 (preref. 2/1/2026) | 1,885 | 1,989 | ||||||

| City of Dublin, Community Facs. Dist. No. 2015-1 (Dublin Crossing), Improvement Area No. 3, Special Tax Bonds, Series 2021, 3.00% 9/1/2023 | 205 | 203 | ||||||

| City of Dublin, Community Facs. Dist. No. 2015-1 (Dublin Crossing), Improvement Area No. 3, Special Tax Bonds, Series 2021, 3.00% 9/1/2025 | 265 | 254 | ||||||

| East Bay Municipal Utility Dist., Water System Rev. Ref. Bonds, Series 2015-A, 5.00% 6/1/2027 | 3,550 | 3,708 | ||||||

| Eastern Municipal Water Dist., Fin. Auth., Water and Wastewater Rev. Ref. Bonds, Series 2020-A, 2.75% 7/1/2028 | 535 | 509 | ||||||

| Eastern Municipal Water Dist., Water and Wastewater Rev. Ref. Bonds, Series 2021-A, 4.00% 7/1/2029 | 1,210 | 1,260 | ||||||

| Educational Facs. Auth., Rev. Bonds (Chapman University), Series 2021-A, 5.00% 4/1/2028 | 1,375 | 1,461 | ||||||

| Educational Facs. Auth., Rev. Ref. Bonds (Stanford University), Series 2009-T-5, 5.00% 3/15/2023 | 1,290 | 1,299 | ||||||

| City of El Centro, Fncg. Auth., Wastewater Rev. Ref. Bonds, Series 2014-A, Assured Guaranty Municipal insured, 5.00% 10/1/2026 | 530 | 545 | ||||||

| City of El Centro, Fncg. Auth., Wastewater Rev. Ref. Bonds, Series 2014-A, Assured Guaranty Municipal insured, 5.00% 10/1/2027 | 500 | 514 | ||||||

| City of El Centro, Fncg. Auth., Wastewater Rev. Ref. Bonds, Series 2014-A, Assured Guaranty Municipal insured, 5.00% 10/1/2030 | 1,000 | 1,027 | ||||||

| County of El Dorado, Community Facs. Dist. No. 1992-1 (El Dorado Hills Dev.), Special Tax Rev. Ref. Bonds, Series 2012, 5.00% 9/1/2024 | 855 | 856 | ||||||

| City of Elk Grove, Fin. Auth., Special Tax Rev. Bonds, Series 2015, BAM insured, 5.00% 9/1/2025 | 580 | 600 | ||||||

| Etiwanda School Dist., G.O. Bonds, 2016 Election, Series 2020-A, 4.00% 8/1/2029 | 570 | 585 | ||||||

| Private Client Services Funds | 7 |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| City of Eureka, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2017-B, 5.00% 11/1/2022 | USD | 835 | $ | 835 | ||||

| City of Fillmore, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2015, BAM insured, 5.00% 6/1/2024 | 1,000 | 1,025 | ||||||

| Folsom Cordova Unified School Dist., School Facs. Improvement Dist. No. 1, G.O. Bonds, Capital Appreciation Bonds, 2002 Election, Series 2004-B, National insured, 0% 10/1/2026 | 1,000 | 859 | ||||||

| City of Fontana, Community Facs. Dist. No. 22 (Sierra Hills South), Special Tax Bonds, Series 2014, 5.00% 9/1/2023 | 535 | 536 | ||||||

| City of Fontana, Community Facs. Dist. No. 86 (Etiwanda Ridge), Special Tax Bonds, Series 2020, 4.00% 9/1/2026 | 100 | 98 | ||||||

| City of Fontana, Community Facs. Dist. No. 86 (Etiwanda Ridge), Special Tax Bonds, Series 2020, 4.00% 9/1/2027 | 120 | 117 | ||||||

| City of Fontana, Public Facs. Fin. Auth., Special Tax Rev. Ref. Bonds, Series 2021-A, 4.00% 9/1/2027 | 625 | 618 | ||||||

| City of Fontana, Public Facs. Fin. Auth., Special Tax Rev. Ref. Bonds, Series 2021-A, 4.00% 9/1/2029 | 390 | 379 | ||||||

| G.O. Bonds, Series 2021, 5.00% 10/1/2029 | 2,000 | 2,202 | ||||||

| G.O. Bonds, Series 2018, 5.00% 10/1/2030 | 1,000 | 1,085 | ||||||

| G.O. Bonds, Series 2021, 5.00% 12/1/2031 | 85 | 89 | ||||||

| G.O. Bonds, Series 2022, 5.00% 4/1/2032 | 3,030 | 3,396 | ||||||

| G.O. Bonds, Series 2021, 5.00% 12/1/2032 | 70 | 74 | ||||||

| G.O. Bonds, Series 2022, 5.00% 4/1/2033 | 1,250 | 1,387 | ||||||

| G.O. Bonds, Series 2021, 5.00% 12/1/2034 | 70 | 73 | ||||||

| G.O. Rev. Ref. Bonds, Series 2019, 5.00% 4/1/2027 | 745 | 796 | ||||||

| G.O. Rev. Ref. Bonds, Series 2019, 5.00% 4/1/2028 | 685 | 741 | ||||||

| G.O. Rev. Ref. Bonds, Series 2019, 5.00% 10/1/2029 | 1,000 | 1,101 | ||||||

| G.O. Rev. Ref. Bonds, Series 2017, 5.00% 11/1/2029 | 6,000 | 6,451 | ||||||

| G.O. Rev. Ref. Bonds, Series 2020, 5.00% 11/1/2029 | 6,500 | 7,162 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 9/1/2030 | 3,500 | 3,879 | ||||||

| G.O. Rev. Ref. Bonds, Series 2020, 5.00% 11/1/2030 | 2,850 | 3,163 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 12/1/2030 | 520 | 577 | ||||||

| G.O. Rev. Ref. Bonds, Series 2019, 5.00% 4/1/2031 | 3,000 | 3,337 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 9/1/2031 | 2,500 | 2,787 | ||||||

| G.O. Rev. Ref. Bonds, Series 2020, 5.00% 3/1/2032 | 4,000 | 4,390 | ||||||

| City of Glendale, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds (Central Glendale Redev. Project), Series 2016, BAM insured, 5.00% 12/1/2024 | 425 | 438 | ||||||

| Golden State Tobacco Securitization Corp., Enhanced Tobacco Settlement Asset-Backed Bonds, Capital Appreciation Bonds, Series 2005-A, AMBAC insured, 0% 6/1/2024 (escrowed to maturity) | 2,000 | 1,895 | ||||||

| Greenfield Elementary School Dist., G.O. Bonds, Capital Appreciation Bonds, 2006 Election, Series 2007-A, Assured Guaranty Municipal insured, 0% 8/1/2029 | 1,270 | 956 | ||||||

| City of Grossmont, Healthcare Dist., G.O. Bonds, Capital Appreciation Bonds, 2006 Election, Series 2007-A, AMBAC insured, 0% 7/15/2032 | 1,500 | 992 | ||||||

| City of Hawthorne, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2016, Assured Guaranty Municipal insured, 5.00% 9/1/2024 | 250 | 257 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Adventist Health System/West), Series 2013-A, 5.00% 3/1/2023 | 910 | 915 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Adventist Health System/West), Series 2013-A, 5.00% 3/1/2024 | 1,105 | 1,112 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Cedars-Sinai Medical Center), Series 2016-A, 5.00% 8/15/2023 | 650 | 659 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (El Camino Hospital), Series 2017, 5.00% 2/1/2025 | 1,000 | 1,032 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Kaiser Permanente), Series 2017-B, 5.00% 11/1/2029 (put 11/1/2022) | 1,025 | 1,025 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Lucile Salter Packard Children’s Hospital at Stanford), Series 2014-A, 5.00% 8/15/2025 | 400 | 410 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (PIH Health), Series 2020-A, 5.00% 6/1/2030 | 1,900 | 1,979 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Providence St. Joseph Health), Series 2019-B, 5.00% 10/1/2039 (put 10/1/2027) | 2,135 | 2,279 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Stanford Health Care), Series 2021-A, 3.00% 8/15/2054 (put 8/15/2025) | 1,000 | 981 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Sutter Health), Series 2018-A, 5.00% 11/15/2024 | 3,000 | 3,090 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Sutter Health), Series 2016-A, 5.00% 11/15/2026 (preref. 11/15/2025) | 300 | 316 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Sutter Health), Series 2013-A, 5.00% 8/15/2052 (preref. 8/15/2023) | 1,665 | 1,690 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Adventist Health System/West), Series 2016-A, 4.00% 3/1/2025 | 1,270 | 1,275 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Lucile Salter Packard Children’s Hospital at Stanford), Series 2022-A, 5.00% 5/15/2026 | 830 | 872 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Marshall Medical Center), Series 2015, 5.00% 11/1/2022 | 175 | 175 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Marshall Medical Center), Series 2015, 5.00% 11/1/2023 | 135 | 137 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Stanford Health Care), Series 2017-A, 5.00% 11/15/2024 | 1,000 | 1,036 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Stanford Health Care), Series 2017-A, 5.00% 11/15/2026 | 1,750 | 1,870 | ||||||

| Hemet Unified School Dist., Fncg. Auth., Special Tax Rev. Bonds, Series 2015, 5.00% 9/1/2026 | 600 | 614 | ||||||

| Hemet Unified School Dist., G.O. Rev. Ref. Bonds, Series 2014, Assured Guaranty Municipal insured, 5.00% 8/1/2023 | 885 | 897 | ||||||

| 8 | Private Client Services Funds |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| Housing Fin. Agcy., Municipal Certs., Series 2021-A-3, 3.25% 8/20/2036 | USD | 1,242 | $ | 1,018 | ||||

| Infrastructure and Econ. Dev. Bank, Charter School Rev. Bonds (Equitable School Revolving Fund), Series 2019-B, 5.00% 11/1/2025 | 100 | 104 | ||||||

| Infrastructure and Econ. Dev. Bank, Charter School Rev. Bonds (Equitable School Revolving Fund), Series 2019-B, 5.00% 11/1/2026 | 125 | 131 | ||||||

| Infrastructure and Econ. Dev. Bank, Charter School Rev. Bonds (Equitable School Revolving Fund), Series 2019-B, 5.00% 11/1/2027 | 110 | 116 | ||||||

| Infrastructure and Econ. Dev. Bank, Charter School Rev. Bonds (Equitable School Revolving Fund), Series 2019-B, 5.00% 11/1/2028 | 375 | 397 | ||||||

| Infrastructure and Econ. Dev. Bank, Charter School Rev. Bonds (Equitable School Revolving Fund), Series 2019-B, 5.00% 11/1/2029 | 140 | 148 | ||||||

| Infrastructure and Econ. Dev. Bank, Charter School Rev. Bonds (Equitable School Revolving Fund), Series 2019-B, 5.00% 11/1/2030 | 340 | 357 | ||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2020-A-1, 4.00% 4/1/2030 | 825 | 861 | ||||||

| City of Inglewood, Successor Agcy. to the Redev. Agcy., Tax Allocation Bonds (Merged Redev. Project), Series 2017-A, BAM insured, 5.00% 5/1/2031 | 500 | 529 | ||||||

| City of Inglewood, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds (Merged Redev. Project), Series 2017-A, BAM insured, 5.00% 5/1/2027 | 650 | 685 | ||||||

| City of Irvine, Reassessment Dist. No. 12-1, Limited Obligation Improvement Bonds, Series 2013, 5.00% 9/2/2024 | 725 | 735 | ||||||

| City of Irvine, Reassessment Dist. No. 13-1, Limited Obligation Improvement Bonds, Series 2013, 3.375% 9/2/2023 | 850 | 851 | ||||||

| City of Irvine, Reassessment Dist. No. 19-1, Limited Obligation Improvement Bonds, Series 2019, 5.00% 9/2/2023 | 200 | 203 | ||||||

| City of Irvine, Reassessment Dist. No. 19-1, Limited Obligation Improvement Bonds, Series 2019, 5.00% 9/2/2024 | 210 | 215 | ||||||

| City of Irvine, Reassessment Dist. No. 19-1, Limited Obligation Improvement Bonds, Series 2019, 5.00% 9/2/2025 | 250 | 259 | ||||||

| City of Irvine, Reassessment Dist. No. 21-1, Limited Obligation Improvement Bonds, Series 2021, BAM insured, 4.00% 9/2/2025 | 500 | 504 | ||||||

| City of Irvine, Reassessment Dist. No. 21-1, Limited Obligation Improvement Bonds, Series 2021, 4.00% 9/2/2028 | 500 | 506 | ||||||

| City of Irvine, Reassessment Dist. No. 21-1, Limited Obligation Improvement Bonds, Series 2021, BAM insured, 4.00% 9/2/2030 | 1,265 | 1,278 | ||||||

| Irvine Unified School Dist., Community Facs. Dist. No. 09-1, Special Tax Bonds, Series 2019-A, BAM insured, 5.00% 9/1/2027 | 140 | 146 | ||||||

| Irvine Unified School Dist., Community Facs. Dist. No. 09-1, Special Tax Bonds, Series 2019-A, BAM insured, 5.00% 9/1/2028 | 350 | 366 | ||||||

| Irvine Unified School Dist., Community Facs. Dist. No. 09-1, Special Tax Bonds, Series 2019-A, BAM insured, 5.00% 9/1/2030 | 215 | 223 | ||||||

| City of Jurupa, Public Fncg. Auth., Special Tax Rev. Bonds, Series 2014-A, 5.00% 9/1/2023 | 500 | 506 | ||||||

| City of Jurupa, Public Fncg. Auth., Special Tax Rev. Bonds, Series 2014-A, 5.00% 9/1/2029 | 710 | 729 | ||||||

| City of Jurupa, Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2020-A, BAM insured, 5.00% 9/1/2023 | 750 | 760 | ||||||

| City of Jurupa, Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2020-A, BAM insured, 4.00% 9/1/2027 | 1,615 | 1,647 | ||||||

| Jurupa Unified School Dist., Fncg. Auth., Special Tax Rev. Ref. Bonds (Community Facs. Dists. Nos. 10, 12, 13 and 15), Series 2021-A, BAM insured, 4.00% 9/1/2029 | 335 | 342 | ||||||

| Jurupa Unified School Dist., Fncg. Auth., Special Tax Rev. Ref. Bonds (Community Facs. Dists. Nos. 10, 12, 13 and 15), Series 2021-A, BAM insured, 4.00% 9/1/2031 | 375 | 379 | ||||||

| Kern Community College Dist., Safety Repair and Improvement G.O. Bonds, Capital Appreciation Bonds, 2002 Election, Series 2006, FSA insured, 0% 11/1/2022 | 1,500 | 1,500 | ||||||

| Kings Canyon Joint Unified School Dist., G.O. Rev. Ref. Bonds, Series 2016, Assured Guaranty Municipal insured, 5.00% 8/1/2029 | 1,600 | 1,670 | ||||||

| La Habra School Dist., G.O. Bonds, Capital Appreciation Bonds, 2000 Election, Series 2002-A, FSA insured, 0% 8/1/2026 | 1,010 | 877 | ||||||

| Lakeside Union School Dist., G.O. Rev. Ref. Bonds, Series 2016, 5.00% 8/1/2029 | 1,785 | 1,888 | ||||||

| City of Lodi, Public Fin. Auth., Rev. Ref. Bonds, Series 2018, Assured Guaranty Municipal insured, 5.00% 9/1/2024 | 260 | 267 | ||||||

| Long Beach Community College Dist., G.O. Bonds, Capital Appreciation Bonds, 2008 Election, Series 2008-A, Assured Guaranty Municipal insured, 0% 6/1/2027 | 3,865 | 3,260 | ||||||

| Los Altos School Dist., G.O. Bonds, 2014 Election, Capital Appreciation Bonds, Series 2019-A, 4.00% 8/1/2029 | 1,000 | 1,030 | ||||||

| City of Los Angeles, Community Facs. Dist. No. 4 (Playa Vista - Phase 1), Special Tax Rev. Ref. Bonds, Series 2014, 5.00% 9/1/2023 | 690 | 699 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. and Rev. Ref. Bonds, Series 2021-B, 5.00% 5/15/2031 | 420 | 465 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. and Rev. Ref. Bonds, Series 2021-B, 5.00% 5/15/2034 | 1,025 | 1,109 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2019-E, 5.00% 5/15/2039 | 1,130 | 1,171 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2018-D, 5.00% 7/1/2024 | 535 | 551 | ||||||

| Private Client Services Funds | 9 |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2018-B, 5.00% 7/1/2025 | USD | 1,875 | $ | 1,959 | ||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2018-D, 5.00% 7/1/2025 | 500 | 523 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2019-D, 5.00% 7/1/2027 | 1,100 | 1,184 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2022-A, 5.00% 7/1/2030 | 775 | 861 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2022-B, 5.00% 7/1/2032 | 870 | 981 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2021-C, 5.00% 7/1/2033 | 1,500 | 1,666 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2022-B, 5.00% 7/1/2033 | 1,345 | 1,509 | ||||||

| City of Los Angeles, Dept. of Water and Power, Water System Rev. Bonds, Series 2020-A, 5.00% 7/1/2028 | 650 | 710 | ||||||

| City of Los Angeles, Solid Waste Resources Rev. Bonds, Series 2013-A, 2.00% 2/1/2023 | 1,110 | 1,105 | ||||||

| County of Los Angeles, Community Facs. Dist. No. 2021-01 (Valencia Facs.), Improvement Area No. 1, Special Tax Bonds, Series 2022, 5.00% 9/1/2031 | 225 | 230 | ||||||

| County of Los Angeles, Community Facs. Dist. No. 2021-01 (Valencia Facs.), Improvement Area No. 1, Special Tax Bonds, Series 2022, 5.00% 9/1/2032 | 175 | 178 | ||||||

| County of Los Angeles, Community Facs. Dist. No. 2021-01 (Valencia Facs.), Improvement Area No. 1, Special Tax Bonds, Series 2022, 5.00% 9/1/2033 | 170 | 172 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Mortgage Rev. Bonds (Long Beach Senior Housing), Series 2022, 2.00% 2/1/2026 (put 2/1/2025) | 3,350 | 3,156 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Rev. Bonds (Cantamar Villas), Series 2021-D-1, 0.30% 2/1/2025 (put 2/1/2024) | 1,295 | 1,235 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Rev. Bonds (Sunny Garden Apartments), Series 2021-C-1, 0.20% 7/1/2024 (put 1/1/2023) | 3,175 | 3,159 | ||||||

| County of Los Angeles, Metropolitan Transportation Auth., Measure R Sales Tax Rev. Bonds, Series 2021-A, 4.00% 6/1/2036 | 3,450 | 3,380 | ||||||

| County of Los Angeles, Metropolitan Transportation Auth., Proposition C Sales Tax Rev. Bonds, Series 2021-A, 5.00% 7/1/2030 | 3,610 | 4,019 | ||||||

| County of Los Angeles, Metropolitan Transportation Auth., Proposition C Sales Tax Rev. Bonds, Series 2021-A, 5.00% 7/1/2034 | 1,000 | 1,107 | ||||||

| County of Los Angeles, Public Works Fncg. Auth., Lease Rev. Bonds, Series 2016-D, 5.00% 12/1/2027 | 1,500 | 1,575 | ||||||

| Los Angeles Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Rev. Ref. Bonds, Series 2021-A, 4.00% 7/1/2032 | 1,395 | 1,406 | ||||||

| Los Angeles Unified School Dist., G.O. Rev. Ref. Bonds, Series 2014-C, 5.00% 7/1/2023 | 520 | 527 | ||||||

| Madera Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2002 Election, Series 2006, Assured Guaranty Municipal insured, 0% 8/1/2029 | 585 | 447 | ||||||

| Manhattan Beach Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, Series 1999-C, FGIC-National insured, 0% 9/1/2024 | 3,800 | 3,542 | ||||||

| Manteca Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2004 Election, Series 2006, MBIA insured, 0% 8/1/2027 | 560 | 466 | ||||||

| Menifee Union School Dist., Community Facs. Dist. No. 2011-1, Improvement Area No. 5, Special Tax Bonds, Series 2021, 4.00% 9/1/2028 | 275 | 267 | ||||||

| City of Merced, Irrigation Dist., Electric System Rev. Ref. Bonds, Series 2015-A, Assured Guaranty Municipal insured, 5.00% 10/1/2028 | 250 | 262 | ||||||

| Merced Union High School Dist., G.O. Bonds, Capital Appreciation Bonds, 2008 Election, Series 2011-C, 0% 8/1/2033 | 615 | 384 | ||||||

| Metropolitan Water Dist. of Southern California, Water Rev. Ref. Bonds, Series 2022-B, 5.00% 7/1/2033 | 500 | 562 | ||||||

| Metropolitan Water Dist. of Southern California, Water Rev. Ref. Bonds, Series 2022-B, 5.00% 7/1/2034 | 500 | 558 | ||||||

| Montebello Unified School Dist., G.O. Rev. Ref. Bonds, Series 2015, 5.00% 8/1/2028 | 1,545 | 1,602 | ||||||

| Mountain View - Los Altos Union School Dist., G.O. Bonds, 2018 Election, Series 2022-C, 4.00% 8/1/2031 | 2,465 | 2,521 | ||||||

| Mountain View School Dist., G.O. Bonds, 2020 Election, Series 2021-A, Assured Guaranty Municipal insured, 4.00% 8/1/2023 | 1,290 | 1,298 | ||||||

| Municipal Fin. Auth., Certs. of Part. (Palomar Health), Series 2022-A, Assured Guaranty Municipal insured, 5.00% 11/1/2028 | 125 | 129 | ||||||

| Municipal Fin. Auth., Educational Rev. Bonds (American Heritage Education Foundation Project), Series 2016-A, 4.00% 6/1/2026 | 165 | 162 | ||||||

| Municipal Fin. Auth., Multi Family Housing Rev. Bonds (Walnut Apartments), Series 2021-A, 0.45% 12/1/2024 (put 12/1/2023) | 2,935 | 2,821 | ||||||

| Municipal Fin. Auth., Rev. and Rev. Ref. Bonds (HumanGood California Obligated Group), Series 2019-A, 4.00% 10/1/2030 | 1,785 | 1,729 | ||||||

| Municipal Fin. Auth., Rev. Bonds (California Institute of the Arts), Series 2021, 4.00% 10/1/2033 | 250 | 228 | ||||||

| Municipal Fin. Auth., Rev. Bonds (California Lutheran University), Series 2018, 5.00% 10/1/2026 | 300 | 308 | ||||||

| Municipal Fin. Auth., Rev. Bonds (Community Health System), Series 2021-A, Assured Guaranty Municipal insured, 5.00% 2/1/2027 | 800 | 828 | ||||||

| Municipal Fin. Auth., Rev. Bonds (Community Health System), Series 2021-A, Assured Guaranty Municipal insured, 5.00% 2/1/2028 | 750 | 776 | ||||||

| 10 | Private Client Services Funds |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| Municipal Fin. Auth., Rev. Bonds (Community Health System), Series 2021-A, Assured Guaranty Municipal insured, 5.00% 2/1/2029 | USD | 825 | $ | 854 | ||||

| Municipal Fin. Auth., Rev. Bonds (Retirement Housing Foundation), Series 2017-A, 5.00% 11/15/2024 (escrowed to maturity) | 300 | 308 | ||||||

| Municipal Fin. Auth., Rev. Bonds (University of La Verne), Series 2017-A, 5.00% 6/1/2023 | 750 | 758 | ||||||

| Municipal Fin. Auth., Rev. Ref. Bonds (Biola University), Series 2017, 5.00% 10/1/2026 | 335 | 346 | ||||||

| Municipal Fin. Auth., Rev. Ref. Bonds (Harbor Regional Center Project), Series 2015, 5.00% 11/1/2022 | 885 | 885 | ||||||

| Municipal Fin. Auth., Rev. Ref. Bonds (Harbor Regional Center Project), Series 2015, 5.00% 11/1/2025 | 500 | 523 | ||||||

| Municipal Fin. Auth., Rev. Ref. Bonds (HumanGood Obligated Group), Series 2019-A, 4.00% 10/1/2028 | 750 | 740 | ||||||

| Municipal Fin. Auth., Rev. Ref. Bonds (HumanGood Obligated Group), Series 2019-A, 4.00% 10/1/2029 | 1,085 | 1,062 | ||||||

| Municipal Fin. Auth., Rev. Ref. Bonds (HumanGood Obligated Group), Series 2019-A, 4.00% 10/1/2035 | 1,000 | 920 | ||||||

| Municipal Fin. Auth., Student Housing Rev. Bonds (CHF-Riverside I, LLC - UCR Student Housing Project), Series 2019, BAM insured, 5.00% 5/15/2027 | 530 | 548 | ||||||

| Murrieta Valley Unified School Dist., G.O. Bonds, 2014 Election, Series 2020, 4.00% 9/1/2023 | 335 | 337 | ||||||

| Murrieta Valley Unified School Dist., Public Fncg. Auth., Special Tax Rev. Bonds, Series 2016-A, 5.00% 9/1/2023 | 2,530 | 2,555 | ||||||

| Napa Valley Community College Dist., G.O. Rev. Ref. Bonds, Convertible Capital Appreciation Bonds, Series 2018, 4.00% 8/1/20332 | 2,190 | 2,201 | ||||||

| Napa Valley Unified School Dist., G.O. Bonds, 2016 Election, Series 2019-C, Assured Guaranty Municipal insured, 4.00% 8/1/2034 | 1,030 | 1,030 | ||||||

| New Haven Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, Series 2008-C, Assured Guaranty insured, 0% 8/1/2030 | 5,075 | 3,769 | ||||||

| Oak Park Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2006 Election, Series 2009-B, Assured Guaranty Municipal insured, 0% 8/1/2029 | 605 | 457 | ||||||

| Oakland Unified School Dist., G.O. Bonds, 2006 Election, Series 2016-A, 5.00% 8/1/2026 | 1,325 | 1,397 | ||||||

| Oakland Unified School Dist., G.O. Bonds, 2012 Election, Series 2019-A, Assured Guaranty Municipal insured, 5.00% 8/1/2028 | 1,000 | 1,072 | ||||||

| Oakland Unified School Dist., G.O. Bonds, 2012 Election, Series 2019-A, Assured Guaranty Municipal insured, 4.00% 8/1/2034 | 2,000 | 1,993 | ||||||

| Oakland Unified School Dist., G.O. Rev. Ref. Bonds, Series 2016, 5.00% 8/1/2024 | 1,310 | 1,346 | ||||||

| Oakland Unified School Dist., G.O. Rev. Ref. Bonds, Series 2016, 5.00% 8/1/2025 | 3,000 | 3,123 | ||||||

| Oakland Unified School Dist., G.O. Rev. Ref. Bonds, Series 2015, Assured Guaranty insured, 5.00% 8/1/2026 | 1,125 | 1,176 | ||||||

| County of Orange, Airport Governmental Rev. Ref. Bonds, Series 2019-B, 5.00% 7/1/2025 | 1,065 | 1,111 | ||||||

| County of Orange, Airport Private Activity Rev. Ref. Bonds, Series 2019-A, 5.00% 7/1/2025 | 1,000 | 1,043 | ||||||

| County of Orange, Community Facs. Dist. No. 2016-1 (Village of Esencia), Special Tax Bonds, Series 2016-A, 5.00% 8/15/2026 | 570 | 588 | ||||||

| County of Orange, Community Facs. Dist. No. 2021-1 (Rienda), Special Tax Bonds, Series 2022-A, 5.00% 8/15/2031 | 1,025 | 1,052 | ||||||

| County of Orange, Community Facs. Dist. No. 2021-1 (Rienda), Special Tax Bonds, Series 2022-A, 5.00% 8/15/2032 | 1,000 | 1,024 | ||||||

| County of Orange, Community Facs. Dist. No. 2021-1 (Rienda), Special Tax Bonds, Series 2022-A, 5.00% 8/15/2033 | 500 | 509 | ||||||

| County of Orange, Transportation Auth., Bond Anticipation Notes (I-405 Improvement Project), Series 2021, 5.00% 10/15/2024 | 2,000 | 2,067 | ||||||

| County of Orange, Water Dist. Rev. Certs. of Part. (Interim Obligations), Series 2019-A, 2.00% 8/15/2023 | 2,725 | 2,691 | ||||||

| City of Oxnard, Fncg. Auth., Wastewater Rev. Ref. Bonds, Series 2014, Assured Guaranty Municipal insured, 5.00% 6/1/2024 | 250 | 256 | ||||||

| City of Oxnard, Water Rev. Ref. Bonds, Series 2018, BAM insured, 5.00% 6/1/2024 | 450 | 462 | ||||||

| Palomar Health, G.O. Rev. Ref. Bonds, Series 2016-A, 5.00% 8/1/2026 | 630 | 658 | ||||||

| Paramount Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 1998 Election, Series 2001-B, Assured Guaranty Municipal insured, 0% 9/1/2025 | 3,000 | 2,709 | ||||||

| Peninsula Corridor Joint Powers Board, Farebox Rev. Bonds, Series 2019-A, 5.00% 10/1/2026 | 250 | 263 | ||||||

| Peninsula Corridor Joint Powers Board, Farebox Rev. Bonds, Series 2019-A, 5.00% 10/1/2027 | 200 | 212 | ||||||

| Peninsula Corridor Joint Powers Board, Farebox Rev. Bonds, Series 2019-A, 5.00% 10/1/2028 | 285 | 305 | ||||||

| Peninsula Corridor Joint Powers Board, Farebox Rev. Bonds, Series 2019-A, 5.00% 10/1/2029 | 400 | 432 | ||||||

| Perris Union High School Dist., Fncg. Auth., Rev. Bonds, Series 2015, 5.00% 9/1/2024 | 1,000 | 1,019 | ||||||

| Perris Union High School Dist., G.O. Bonds, 2012 Election, Series 2021-C, 4.00% 9/1/2028 | 185 | 190 | ||||||

| Perris Union High School Dist., G.O. Bonds, 2012 Election, Series 2021-C, 4.00% 9/1/2029 | 200 | 206 | ||||||

| Perris Union High School Dist., G.O. Bonds, 2012 Election, Series 2021-C, 4.00% 9/1/2030 | 215 | 220 | ||||||

| Perris Union High School Dist., G.O. Bonds, 2012 Election, Series 2021-C, 4.00% 9/1/2031 | 350 | 357 | ||||||

| Pleasant Valley School Dist., G.O. Bonds, 2018 Election, Series A, 5.00% 8/1/2029 (preref. 8/1/2026) | 645 | 686 | ||||||

| Pollution Control Fncg. Auth., Water Facs. Rev. Ref. Bonds (American Water Capital Corp. Project), Series 2020, 0.60% 8/1/2040 (put 9/1/2023) | 3,270 | 3,182 | ||||||

| Poway Unified School Dist., Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2016-A, 5.00% 9/1/2023 | 885 | 898 | ||||||

| Private Client Services Funds | 11 |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| Public Fin. Auth., Electric System Rev. Ref. Bonds, Series 2018, Assured Guaranty Municipal insured, 5.00% 9/1/2023 | USD | 730 | $ | 740 | ||||

| Public Fin. Auth., Reassessment Rev. Ref. Bonds, Series 2019, 5.00% 9/2/2029 | 1,000 | 1,055 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2017, Assured Guaranty Municipal insured, 5.00% 10/1/2023 | 500 | 506 | ||||||

| Public Fin. Auth., Rev. Bonds (Hoag Memorial Hospital Presbyterian), Series 2022-A, 5.00% 7/15/2028 | 250 | 269 | ||||||

| Public Fin. Auth., Rev. Bonds (Hoag Memorial Hospital Presbyterian), Series 2022-A, 5.00% 7/15/2030 | 250 | 272 | ||||||

| Public Fin. Auth., Rev. Bonds (Hoag Memorial Hospital Presbyterian), Series 2022-A, 5.00% 7/15/2033 | 330 | 356 | ||||||

| Public Fin. Auth., Rev. Bonds (Hoag Memorial Hospital Presbyterian), Series 2022-A, 5.00% 7/15/2034 | 350 | 374 | ||||||

| Public Fin. Auth., Rev. Ref. Bonds (O’Conner Woods), Series 2022, 4.00% 1/1/2028 | 450 | 463 | ||||||

| Public Fin. Auth., Rev. Ref. Bonds (O’Conner Woods), Series 2022, 4.00% 1/1/2029 | 500 | 516 | ||||||

| Public Fin. Auth., Rev. Ref. Bonds (O’Conner Woods), Series 2022, 4.00% 1/1/2031 | 520 | 537 | ||||||

| Public Works Board, Lease Rev. Ref. Bonds (Various Capital Projects), Series 2021-A, 5.00% 2/1/2032 | 1,000 | 1,109 | ||||||

| City of Rancho Cucamonga, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds (Rancho Redev. Project Area), Series 2014, Assured Guaranty Municipal insured, 5.00% 9/1/2026 | 600 | 616 | ||||||

| City of Rancho Cucamonga, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds (Rancho Redev. Project Area), Series 2014, Assured Guaranty Municipal insured, 5.00% 9/1/2028 | 300 | 308 | ||||||

| City of Redding, Joint Powers Fin. Auth., Electric System Rev. Bonds, Series 2015-A, 5.00% 6/1/2024 | 15 | 15 | ||||||

| Rialto Unified School Dist., G.O. Bonds, 2010 Election, Series 2019, 3.00% 8/1/2026 | 600 | 588 | ||||||

| Rialto Unified School Dist., G.O. Bonds, 2010 Election, Series 2019, 3.00% 8/1/2027 | 750 | 725 | ||||||

| City of Richmond, Successor Agcy. to the Redev. Agcy., Rev. Ref. Bonds, Series 2014-A, BAM insured, 5.00% 9/1/2025 | 200 | 205 | ||||||

| Rio Elementary School Dist., Community Facs. Dist. No. 1, Special Tax Bonds, Series 2016, BAM insured, 5.00% 9/1/2032 | 240 | 251 | ||||||

| River Islands Public Fncg. Auth., Community Facs. Dist. No. 2003-1, Special Tax Rev. Ref. Bonds, Series 2022-A-1, Assured Guaranty Municipal insured, 5.00% 9/1/2028 | 500 | 536 | ||||||

| River Islands Public Fncg. Auth., Community Facs. Dist. No. 2003-1, Special Tax Rev. Ref. Bonds, Series 2022-A-1, Assured Guaranty Municipal insured, 5.00% 9/1/2029 | 500 | 539 | ||||||

| County of Riverside, Public Fncg. Auth., Tax Allocation Rev. Bonds (Project Area No. 1, Desert Communities and Interstate 215 Corridor Projects), Series 2015-A, Assured Guaranty Municipal insured, 5.00% 10/1/2023 | 1,075 | 1,091 | ||||||

| County of Riverside, Public Fncg. Auth., Tax Allocation Rev. Ref. Bonds (Hemet Project), Series 2014, BAM insured, 5.00% 9/1/2023 | 500 | 507 | ||||||

| Riverside Community Properties Dev., Inc., Lease Rev. Bonds (Riverside County Law Building Project), Series 2013, 6.00% 10/15/2038 (preref. 10/15/2023) | 2,585 | 2,654 | ||||||

| Riverside Unified School Dist., Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2015, BAM insured, 5.00% 9/1/2025 | 350 | 362 | ||||||

| Riverside Unified School Dist., Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2015, BAM insured, 5.00% 9/1/2026 | 400 | 415 | ||||||

| Riverside Unified School Dist., G.O. Bonds, 2016 Election, Series 2019, 4.00% 8/1/2029 | 850 | 867 | ||||||

| City of Roseville, Community Facs. Dist. No. 1 (Westpark), Special Tax Rev. Ref. Bonds, Series 2015, 5.00% 9/1/2024 | 1,000 | 1,019 | ||||||

| Roseville Joint Union High School Dist., G.O. Bonds, Capital Appreciation Bonds, 2004 Election, Series 2007-C, 0% 8/1/2025 | 700 | 635 | ||||||

| City of Sacramento, Municipal Utility Dist., Electric Rev. Bonds, Series 1997-K, AMBAC insured, 5.25% 7/1/2024 | 525 | 537 | ||||||

| City of Sacramento, Municipal Utility Dist., Electric Rev. Bonds, Series 2019-A, 5.00% 8/15/2049 (put 7/13/2023) | 3,580 | 3,611 | ||||||

| County of Sacramento, Airport System Rev. Ref. Bonds, Series 2018-E, 5.00% 7/1/2027 | 1,015 | 1,074 | ||||||

| County of Sacramento, Airport System Rev. Ref. Bonds, Series 2018-E, 5.00% 7/1/2030 | 200 | 213 | ||||||

| Sacramento Unified School Dist., G.O. Bonds, 2012 Election, Series 2019-D, BAM insured, 4.00% 8/1/2027 | 585 | 596 | ||||||

| Sacramento Unified School Dist., G.O. Bonds, 2012 Election, Series 2017-E, 5.00% 8/1/2027 | 555 | 590 | ||||||

| Sacramento Unified School Dist., G.O. Bonds, 2012 Election, Series 2019-D, BAM insured, 4.00% 8/1/2028 | 610 | 618 | ||||||

| Sacramento Unified School Dist., G.O. Bonds, 2012 Election, Series 2019-D, BAM insured, 4.00% 8/1/2029 | 635 | 642 | ||||||

| Sacramento Unified School Dist., G.O. Bonds, 2020 Election, Series 2022-A, BAM insured, 5.00% 8/1/2023 | 5,680 | 5,746 | ||||||

| Sacramento Unified School Dist., G.O. Rev. Ref. Bonds, Series 2015, Assured Guaranty Municipal insured, 5.00% 7/1/2030 | 1,000 | 1,024 | ||||||

| Sacramento Unified School Dist., G.O. Rev. Ref. Bonds, Series 2022, BAM insured, 5.00% 7/1/2030 | 1,050 | 1,150 | ||||||

| City of San Diego, Community Facs. Dist. No. 2 (Santaluz), Improvement Area No. 1, Special Tax Rev. Ref. Bonds, Series 2021, 4.00% 9/1/2027 | 635 | 643 | ||||||

| City of San Diego, Community Facs. Dist. No. 2 (Santaluz), Improvement Area No. 1, Special Tax Rev. Ref. Bonds, Series 2021, 4.00% 9/1/2028 | 875 | 882 | ||||||

| City of San Diego, Community Facs. Dist. No. 2 (Santaluz), Improvement Area No. 1, Special Tax Rev. Ref. Bonds, Series 2021, 4.00% 9/1/2029 | 430 | 432 | ||||||

| City of San Diego, Limited Obligation Rev. Bonds (Sanford Burnham Prebys Medical Discovery Institute Project), Series 2015-A, 5.00% 11/1/2022 | 200 | 200 | ||||||

| 12 | Private Client Services Funds |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| City of San Diego, Public Facs. Fncg. Auth., Lease Rev. Bonds (Capital Improvement Projects), Series 2021-A, 5.00% 10/15/2030 | USD | 200 | $ | 221 | ||||

| City of San Diego, Public Facs. Fncg. Auth., Lease Rev. Bonds (Capital Improvement Projects), Series 2021-A, 5.00% 10/15/2031 | 150 | 164 | ||||||

| City of San Diego, Public Facs. Fncg. Auth., Water Rev. Bonds, Series 2020-A, 5.00% 8/1/2029 | 500 | 549 | ||||||

| County of San Diego, Community Facs. Dist. No. 2008-1 (Harmony Grove Village), Improvement Area No. 2, Special Tax Bonds, Series 2020-A, 4.00% 9/1/2026 | 255 | 251 | ||||||

| County of San Diego, Grossmont Healthcare Dist., G.O. Rev. Ref. Bonds, Series 2021-E, 5.00% 7/15/2030 | 500 | 550 | ||||||

| County of San Diego, Grossmont Healthcare Dist., G.O. Rev. Ref. Bonds, Series 2021-E, 5.00% 7/15/2031 | 625 | 691 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. and Rev. Ref. Bonds, Series 2019-A, 5.00% 7/1/2027 | 400 | 423 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. and Rev. Ref. Bonds, Series 2019-A, 5.00% 7/1/2028 | 320 | 342 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. and Rev. Ref. Bonds, Series 2019-A, 5.00% 7/1/2029 | 585 | 631 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. Bonds, Series 2013-A, 5.00% 7/1/2023 (escrowed to maturity) | 245 | 248 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. Ref. Bonds, Series 2020-A, 5.00% 7/1/2028 | 1,000 | 1,068 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. Ref. Bonds, Series 2020-A, 5.00% 7/1/2029 | 1,000 | 1,079 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. Ref. Bonds, Series 2020-B, 5.00% 7/1/2031 | 1,405 | 1,493 | ||||||

| County of San Diego, Regional Transportation Commission, Limited Sales Tax Rev. Bonds, Series 2021-B, 5.00% 4/1/2029 | 320 | 353 | ||||||

| County of San Diego, Regional Transportation Commission, Limited Sales Tax Rev. Green Bonds, Series 2020-A, 5.00% 4/1/2028 | 850 | 927 | ||||||

| County of San Diego, Water Auth. Rev. Ref. Bonds, Series 2013-A, 5.00% 5/1/2031 (preref. 11/1/2022) | 900 | 900 | ||||||

| County of San Diego, Water Auth., Water Rev. Bonds, Series 2022-A, 5.00% 5/1/2028 | 250 | 272 | ||||||

| County of San Diego, Water Auth., Water Rev. Bonds, Series 2022-A, 5.00% 5/1/2029 | 500 | 549 | ||||||

| San Diego Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Bonds, Series 2016-SR-1, 4.00% 7/1/2031 | 3,000 | 3,048 | ||||||

| San Diego Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Rev. Ref. Bonds, Series 2015-R-4, 5.00% 7/1/2026 | 1,000 | 1,048 | ||||||

| San Diego Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Rev. Ref. Bonds, Series 2015-R-4, 5.00% 7/1/2027 | 3,000 | 3,142 | ||||||

| San Diego Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Rev. Ref. Bonds, Series 2016-R-5, 5.00% 7/1/2029 | 1,500 | 1,595 | ||||||

| City and County of San Francisco, Airport Commission, San Francisco International Airport, Rev. Bonds, Series 2019-D-2, 5.00% 5/1/2024 | 1,000 | 1,025 | ||||||

| City and County of San Francisco, Airport Commission, San Francisco International Airport, Rev. Ref. Bonds, Series 2022-B-2, 5.00% 5/1/2027 | 4,000 | 4,260 | ||||||

| City of San Francisco, Bay Area Rapid Transit Dist., G.O. Bonds, 2016 Election, Series 2020-C-1, 5.00% 8/1/2027 | 1,500 | 1,619 | ||||||

| San Francisco Unified School Dist., G.O. Bonds, 2016 Election, Series 2020-B, 4.00% 6/15/2029 | 1,000 | 1,025 | ||||||

| San Jacinto Unified School Dist., Fncg. Auth., Special Tax Rev. Bonds, Series 2019, 5.00% 9/1/2023 | 40 | 40 | ||||||

| San Jacinto Unified School Dist., Fncg. Auth., Special Tax Rev. Bonds, Series 2019, 5.00% 9/1/2024 | 65 | 66 | ||||||

| San Jacinto Unified School Dist., Fncg. Auth., Special Tax Rev. Bonds, Series 2019, 5.00% 9/1/2025 | 90 | 92 | ||||||

| San Jacinto Unified School Dist., Fncg. Auth., Special Tax Rev. Bonds, Series 2019, 5.00% 9/1/2026 | 155 | 159 | ||||||

| San Joaquin Hills Transportation Corridor Agcy., Toll Road Rev. Ref. Bonds, Capital Appreciation Bonds, Series 1997-A, National insured, 0% 1/15/2025 | 285 | 260 | ||||||

| City of San Jose, Airport Rev. Ref. Bonds, Series 2021-A, BAM insured, 5.00% 3/1/2029 | 500 | 539 | ||||||

| City of San Jose, Airport Rev. Ref. Bonds, Series 2021-A, BAM insured, 5.00% 3/1/2030 | 250 | 271 | ||||||

| City of San Jose, Airport Rev. Ref. Bonds, Series 2021-B, 5.00% 3/1/2032 | 1,250 | 1,330 | ||||||

| City of San Jose, Fin. Auth., Lease Rev. Ref. Bonds (Civic Center Project), Series 2013-A, 5.00% 6/1/2030 (preref. 6/1/2023) | 1,625 | 1,643 | ||||||

| City of San Jose, G.O. Bonds (Disaster Preparedness, Public Safety and Infrastructure), Series 2021-A, 5.00% 9/1/2030 | 2,250 | 2,518 | ||||||

| San Jose Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2002 Election, Series 2006-C, National insured, 0% 8/1/2025 | 795 | 722 | ||||||

| San Jose Unified School Dist., G.O. Rev. Ref. Bonds, Series 2017, 5.00% 8/1/2023 | 375 | 380 | ||||||

| San Jose Unified School Dist., G.O. Rev. Ref. Bonds, Series 2017, 5.00% 8/1/2024 | 500 | 515 | ||||||

| San Ramon Valley Unified School Dist., G.O. Bonds, 2012 Election, Series 2018, 5.00% 8/1/2024 | 1,000 | 1,031 | ||||||

| Santa Margarita Water Dist., Community Facs. Dist. No. 99-1 (Talega), Special Tax Rev. Ref. Bonds, Series 2014-B, 5.00% 9/1/2024 | 530 | 540 | ||||||

| Santa Margarita Water Dist., Community Facs. Dist. No. 99-1 (Talega), Special Tax Rev. Ref. Bonds, Series 2014-B, 5.00% 9/1/2025 | 375 | 382 | ||||||

| Santa Monica-Malibu Unified School Dist., School Facs. Improvement Dist. No. 1 (Santa Monica Schools), G.O. Bonds, 2018 Election, Series 2021-B, 4.00% 8/1/2025 | 405 | 414 | ||||||

| Private Client Services Funds | 13 |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| Santa Monica-Malibu Unified School Dist., School Facs. Improvement Dist. No. 2 (Malibu Schools), G.O. Bonds, 2018 Election, Series 2021-B, 4.00% 8/1/2024 | USD | 1,235 | $ | 1,253 | ||||

| Santa Monica-Malibu Unified School Dist., School Facs. Improvement Dist. No. 2 (Malibu Schools), G.O. Bonds, 2018 Election, Series 2021-B, 4.00% 8/1/2025 | 345 | 352 | ||||||

| Santa Rosa High School Dist., G.O. Bonds, 2014 Election, Series 2021-E, BAM insured, 4.00% 8/1/2027 | 500 | 517 | ||||||

| Santa Rosa High School Dist., G.O. Bonds, 2014 Election, Series 2021-E, BAM insured, 4.00% 8/1/2029 | 500 | 515 | ||||||

| Saugus Union School Dist., G.O. Rev. Ref. Bonds, Capital Appreciation Bonds, Series 2006, FGIC-National insured, 0% 8/1/2024 | 1,210 | 1,137 | ||||||

| Saugus Union School Dist., Saugus/Hart School Facs. Fin. Auth., Community Facs. Dist. No. 2006-1, Special Tax Rev. Bonds, Series 2016, 5.00% 9/1/2024 | 500 | 507 | ||||||

| Saugus Union School Dist., Saugus/Hart School Facs. Fin. Auth., Community Facs. Dist. No. 2006-1, Special Tax Rev. Bonds, Series 2016, 5.00% 9/1/2025 | 1,110 | 1,134 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (Granada Hills Charter Obligated Group), Series 2019, 4.00% 7/1/20273 | 740 | 722 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (Granada Hills Charter Obligated Group), Series 2019, 4.00% 7/1/20293 | 805 | 774 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (Granada Hills Charter Obligated Group), Series 2019, 5.00% 7/1/20313 | 875 | 881 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP LA Projects), Series 2014-A, 4.125% 7/1/20243 | 315 | 315 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP LA Projects), Series 2017-A, 5.00% 7/1/20243 | 585 | 594 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP LA Projects), Series 2015-A, 3.625% 7/1/20253 | 460 | 452 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP LA Projects), Series 2017-A, 5.00% 7/1/20263 | 505 | 514 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP LA Projects), Series 2017-A, 5.00% 7/1/20273 | 600 | 612 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2019-A, 5.00% 7/1/20233 | 225 | 227 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2019-A, 5.00% 7/1/20243 | 130 | 132 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20243 | 100 | 101 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2019-A, 5.00% 7/1/20253 | 150 | 152 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20253 | 105 | 107 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2019-A, 5.00% 7/1/20263 | 105 | 107 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20263 | 110 | 112 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2019-A, 5.00% 7/1/20273 | 220 | 224 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20273 | 100 | 102 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20283 | 100 | 102 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20293 | 200 | 204 | ||||||

| School Fin. Auth., School Fac. Rev. Bonds (KIPP SoCal Projects), Series 2020-A, 5.00% 7/1/20303 | 200 | 204 | ||||||

| City of Seal Beach, Community Facs. Dist. No. 2005-1 (Pacific Gateway Business Center), Special Tax Rev. Ref. Bonds, Series 2016, 3.00% 9/1/2023 | 150 | 148 | ||||||

| City of Seal Beach, Community Facs. Dist. No. 2005-1 (Pacific Gateway Business Center), Special Tax Rev. Ref. Bonds, Series 2016, 3.00% 9/1/2024 | 145 | 140 | ||||||

| City of Seal Beach, Community Facs. Dist. No. 2005-1 (Pacific Gateway Business Center), Special Tax Rev. Ref. Bonds, Series 2016, 3.00% 9/1/2025 | 365 | 346 | ||||||

| City of Seal Beach, Community Facs. Dist. No. 2005-1 (Pacific Gateway Business Center), Special Tax Rev. Ref. Bonds, Series 2016, 3.00% 9/1/2026 | 150 | 139 | ||||||

| City of Signal Hill, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2015-A, BAM insured, 5.00% 10/1/2023 | 500 | 508 | ||||||

| Silicon Valley Clean Water, Wastewater Rev. Notes, Series 2019-A, 3.00% 3/1/2024 | 4,065 | 4,043 | ||||||

| Silicon Valley Clean Water, Wastewater Rev. Notes, Series 2021-B, 0.50% 3/1/2026 | 5,040 | 4,489 | ||||||

| Solano Community College Dist., G.O. Bonds, 2015 Election, Series 2013-A, 4.375% 8/1/2047 (preref. 8/1/2023) | 595 | 601 | ||||||

| South Placer Wastewater Auth., Wastewater Rev. Ref. Bonds, Series 2020, 5.00% 11/1/2031 | 2,885 | 3,172 | ||||||

| South Placer Wastewater Auth., Wastewater Rev. Ref. Bonds, Series 2020, 5.00% 11/1/2032 | 500 | 551 | ||||||

| Southern California Public Power Auth., Rev. Ref. Bonds (Magnolia Power Project A), Series 2020-1, 5.00% 7/1/2027 | 1,100 | 1,185 | ||||||

| Southern California Public Power Auth., Rev. Ref. Green Bonds (Milford Wind Corridor Phase II Project), Series 2021-1, 5.00% 7/1/2026 | 200 | 212 | ||||||

| Southern California Public Power Auth., Rev. Ref. Green Bonds (Milford Wind Corridor Phase II Project), Series 2021-1, 5.00% 7/1/2027 | 400 | 431 | ||||||

| Stanislaus Union School Dist., G.O. Rev. Ref. Bonds, Series 2019, BAM insured, 5.00% 8/1/2025 | 500 | 521 | ||||||

| Statewide Communities Dev. Auth., Multi Family Housing Rev. Bonds (Harriet Tubman Terrace Apartments), Series 2021-Q, 0.24% 4/1/2024 (put 4/1/2023) | 7,000 | 6,890 | ||||||

| Statewide Communities Dev. Auth., Multi Family Housing Rev. Bonds (Noble Creek Apartments), Series 2022-J, 3.50% 8/1/2025 (put 8/1/2024) | 6,887 | 6,782 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (Adventist Health System/West), Series 2015-A, 5.00% 3/1/2025 | 750 | 770 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (Adventist Health System/West), Series 2015-A, 5.00% 3/1/2028 | 2,085 | 2,143 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (Adventist Health System/West), Series 2018-A, 5.00% 3/1/2034 | 975 | 995 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (American Baptist Homes of the West), Series 2015, 5.00% 10/1/2023 | 1,110 | 1,120 | ||||||

| 14 | Private Client Services Funds |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| Statewide Communities Dev. Auth., Rev. Bonds (Cottage Health System Obligated Group), Series 2015, 5.00% 11/1/2043 (preref. 11/1/2024) | USD | 5,000 | $ | 5,167 | ||||

| Statewide Communities Dev. Auth., Rev. Bonds (Jewish Home of San Francisco), Series 2016, 5.00% 11/1/2026 | 575 | 608 | ||||||

| Statewide Communities Dev. Auth., Rev. Ref. Bonds (Huntington Memorial Hospital), Series 2014-B, 5.00% 7/1/2026 (preref. 7/1/2024) | 200 | 206 | ||||||

| Statewide Communities Dev. Auth., Rev. Ref. Bonds (Rady Children’s Hospital), Series 2016-B, 5.00% 8/15/2028 | 860 | 927 | ||||||

| Statewide Communities Dev. Auth., Student Housing Rev. Bonds (CHF-Irvine, LLC - University of California, Irvine East Campus Apartments, Phase I Ref. and Phase IV-B), Series 2021, BAM insured, 5.00% 5/15/2029 | 1,865 | 1,983 | ||||||

| Statewide Communities Dev. Auth., Student Housing Rev. Bonds (CHF-Irvine, LLC - University of California, Irvine East Campus Apartments, Phase I Ref. and Phase IV-B), Series 2021, BAM insured, 5.00% 5/15/2031 | 3,000 | 3,209 | ||||||

| Statewide Communities Dev. Auth., Student Housing Rev. Bonds (CHF-Irvine, LLC - University of California, Irvine East Campus Apartments, Phase I Ref. and Phase IV-B), Series 2021, BAM insured, 5.00% 5/15/2032 | 3,500 | 3,732 | ||||||

| Statewide Communities Dev. Auth., Student Housing Rev. Ref. Bonds (CHF-Irvine, LLC - University of California, Irvine East Campus Apartments), Series 2016, 5.00% 5/15/2029 | 1,250 | 1,273 | ||||||

| Stockton Unified School Dist., G.O. Bonds, 2012 Election, Series 2018-C, BAM insured, 5.00% 8/1/2030 | 2,145 | 2,309 | ||||||

| Sweetwater Union High School Dist., G.O. Bonds, 2006 Election, Series 2006, 4.00% 8/1/2026 | 515 | 521 | ||||||

| Sweetwater Union High School Dist., G.O. Rev. Ref. Bonds, Series 2014, BAM insured, 5.00% 8/1/2025 | 1,715 | 1,761 | ||||||

| Tobacco Securitization Auth. of Southern California, Tobacco Settlement Asset-Backed Rev. Ref. Bonds (San Diego County Tobacco Asset Securitization Corp.), Series 2019-A, 5.00% 6/1/2025 | 1,000 | 1,020 | ||||||

| City of Tracy, Successor Agcy. to the Community Dev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2016, Assured Guaranty Municipal insured, 5.00% 8/1/2030 | 545 | 565 | ||||||

| Transbay Joint Powers Auth., Senior Tax Allocation Green Bonds, Series 2020-A, 5.00% 10/1/2027 | 600 | 632 | ||||||

| Transbay Joint Powers Auth., Senior Tax Allocation Green Bonds, Series 2020-A, 5.00% 10/1/2028 | 700 | 742 | ||||||

| Transbay Joint Powers Auth., Senior Tax Allocation Green Bonds, Series 2020-A, 5.00% 10/1/2029 | 660 | 704 | ||||||

| Transbay Joint Powers Auth., Senior Tax Allocation Green Bonds, Series 2020-A, 5.00% 10/1/2030 | 300 | 320 | ||||||

| City of Turlock, Irrigation Dist., Rev. Ref. Bonds, Series 2020, 5.00% 1/1/2031 | 1,600 | 1,760 | ||||||

| City of Tustin, Community Facs. Dist. No. 06-1 (Tustin Legacy / Columbus Villages), Special Tax Rev. Ref. Bonds, Series 2015-A, 5.00% 9/1/2024 | 860 | 881 | ||||||

| Twin Rivers Unified School Dist., G.O. Rev. Ref. Bonds, Series 2016-B, Assured Guaranty Municipal insured, 5.00% 8/1/2024 | 400 | 410 | ||||||

| Ukiah Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2005 Election, Series 2006, MBIA insured, 0% 8/1/2023 | 1,500 | 1,462 | ||||||

| Union City, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Redev. Bonds, Series 2015-A, 5.00% 10/1/2023 | 375 | 381 | ||||||

| Regents of the University of California, Limited Project Rev. Bonds, Series 2022-S, 5.00% 5/15/2031 | 1,150 | 1,289 | ||||||

| Val Verde Unified School Dist., G.O. Rev. Ref. Bonds, Series 2016-A, Assured Guaranty Municipal insured, 4.00% 8/1/2023 | 600 | 604 | ||||||

| City of Vernon, Electric System Rev. Bonds, Series 2022-A, 5.00% 4/1/2028 | 590 | 608 | ||||||

| Dept. of Veterans Affairs, Home Purchase Rev. Bonds, Series 2016-B, 3.50% 12/1/2045 | 2,780 | 2,743 | ||||||

| Dept. of Veterans Affairs, Home Purchase Rev. Bonds, Series 2019-A, 4.00% 12/1/2049 | 2,320 | 2,293 | ||||||

| Dept. of Veterans Affairs, Home Purchase Rev. Bonds, Series 2020-A, 3.00% 12/1/2050 | 6,685 | 6,395 | ||||||

| Dept. of Veterans Affairs, Home Purchase Rev. Bonds, Series 2022-A, 5.50% 12/1/2052 | 2,705 | 2,819 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2017-CQ, 4.00% 12/1/2047 | 1,075 | 1,065 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2018-CR, 4.00% 12/1/2048 | 3,780 | 3,741 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2019-CS, 4.00% 12/1/2049 | 2,220 | 2,196 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2020-CT, 3.00% 12/1/2050 | 4,700 | 4,496 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2022-CU, 5.50% 12/1/2052 | 1,900 | 1,970 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Rev. Ref. Bonds, Series 2016-CN, 3.50% 12/1/2045 | 470 | 465 | ||||||

| Victor Valley Union High School Dist., G.O. Rev. Ref. Bonds, Series 2016-B, Assured Guaranty Municipal insured, 4.00% 8/1/2024 | 730 | 738 | ||||||

| Victor Valley Union High School Dist., G.O. Rev. Ref. Bonds, Series 2016-B, Assured Guaranty Municipal insured, 4.00% 8/1/2026 | 270 | 278 | ||||||

| City of Vista, Successor Agcy. to the Redev. Agcy., Tax Allocation Rev. Ref. Redev. Bonds, Series 2015-B-1, Assured Guaranty Municipal insured, 4.00% 9/1/2025 | 400 | 405 | ||||||

| Dept. of Water Resources, Water System Rev. Bonds (Central Valley Project), Series 2016-AV, 4.00% 12/1/2033 | 3,260 | 3,317 | ||||||

| West Basin Municipal Water Dist., Rev. Ref. Bonds, Series 2021-A, 5.00% 8/1/2030 | 1,575 | 1,749 | ||||||

| West Basin Municipal Water Dist., Rev. Ref. Bonds, Series 2021-A, 5.00% 8/1/2031 | 745 | 833 | ||||||

| West Contra Costa Unified School Dist., G.O. Bonds, 2010 Election, Series 2020-F, Assured Guaranty Municipal insured, 4.00% 8/1/2028 | 600 | 614 | ||||||

| Private Client Services Funds | 15 |

Capital Group California Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| West Contra Costa Unified School Dist., G.O. Bonds, 2012 Election, Series 2020-E, Assured Guaranty Municipal insured, 4.00% 8/1/2030 | USD | 900 | $ | 920 | ||||

| West Contra Costa Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2002 Election, Series 2005-D, National insured, 0% 8/1/2026 | 2,425 | 2,108 | ||||||

| West Contra Costa Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2002 Election, Series 2005-D, National insured, 0% 8/1/2031 | 2,585 | 1,786 | ||||||

| West Contra Costa Unified School Dist., G.O. Rev. Ref. Bonds, 2005 Election, Series 2008-B, 6.00% 8/1/2027 | 3,000 | 3,332 | ||||||

| Westminster School Dist., G.O. Bonds, Capital Appreciation Bonds, 2008 Election, Series 2009-A-1, Assured Guaranty insured, 0% 8/1/2023 | 1,000 | 974 | ||||||

| Westside Union School Dist., G.O. Bonds, Capital Appreciation Bonds, Series 2002-A, National insured, 0% 8/1/2027 | 800 | 669 | ||||||

| Whittier City School Dist., G.O. Rev. Ref. Bonds, Series 2016, 4.00% 8/1/2030 | 825 | 837 | ||||||

| City of Woodland, Community Facs. Dist. No. 2004-1 (Spring Lake), Special Tax Capital Projects Bonds, Series 2021, Assured Guaranty Municipal insured, 4.00% 9/1/2029 | 215 | 214 | ||||||

| City of Woodland, Community Facs. Dist. No. 2004-1 (Spring Lake), Special Tax Capital Projects Bonds, Series 2021, Assured Guaranty Municipal insured, 4.00% 9/1/2030 | 235 | 230 | ||||||

| City of Woodland, Community Facs. Dist. No. 2004-1 (Spring Lake), Special Tax Capital Projects Bonds, Series 2021, Assured Guaranty Municipal insured, 4.00% 9/1/2031 | 260 | 252 | ||||||

| Yosemite Community College Dist., G.O. Bonds, Capital Appreciation Bonds, 2004 Election, Series 2010-D, 0% 8/1/2031 | 500 | 345 | ||||||

| 474,086 | ||||||||

| Missouri 0.01% | ||||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (Special Homeownership Loan Program), Series 2015-A, 3.75% 5/1/2038 | 70 | 69 | ||||||

| Texas 0.09% | ||||||||

| Tarrant County Cultural Education Facs. Fin. Corp., Rev. Ref. Bonds (Christus Health), Series 2018-A, 5.00% 7/1/2024 | 500 | 511 | ||||||

| United States 0.44% | ||||||||

| Freddie Mac, Multi Family Mortgage Bonds, Series 2019-ML-05, Class ACA, 3.35% 11/25/2033 | 2,864 | 2,603 | ||||||

| Total bonds, notes & other debt instruments (cost: $512,382,000) | 477,269 | |||||||

| Short-term securities 15.12% | ||||||||

| Municipals 15.12% | ||||||||

| Fin. Auth., Recovery Zone Fac. Bonds (Chevron U.S.A., Inc. Project), Series 2010-A, 1.38% 11/1/20351 | 3,500 | 3,500 | ||||||

| Fin. Auth., Recovery Zone Fac. Bonds (Chevron U.S.A., Inc. Project), Series 2010-B, 1.38% 11/1/20351 | 9,900 | 9,900 | ||||||

| City of Irvine, Reassessment Dist. No. 87-8, Limited Obligation Improvement Bonds, Series 1999, 1.28% 9/2/20241 | 1,000 | 1,000 | ||||||

| Irvine Ranch Water Dist. Nos. 105, 140, 240 and 250, Consolidated G.O. Bonds, Series 1993, 1.27% 4/1/20331 | 17,400 | 17,400 | ||||||

| Kern Community College Dist., Facs. Improvement Dist. No. 1, G.O. Bond Anticipation Notes, Capital Appreciation Notes, Series 2020, 0% 8/1/2023 | 2,000 | 1,951 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Demand Rev. Bonds, Series 2002-A-2, 1.28% 7/1/20351 | 7,080 | 7,080 | ||||||