UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a–12 |

NOVA LIFESTYLE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11. |

NOVA LIFESTYLE, INC.

6565 E. Washington Blvd.

Commerce, CA 90040

July 17, 2023

Dear Stockholder:

You are cordially invited to attend a special meeting of the stockholders of Nova LifeStyle, Inc., a Nevada corporation, to be held at the corporate headquarters of Nova LifeStyle, Inc., located at 6565 E. Washington Blvd, Commerce, California 90040 on August 31, 2023, at 10:30 a.m. local time.

Information regarding each of the matters to be voted on at the Special Meeting is contained in the attached Proxy Statement and Notice of Special Meeting of Stockholders. We urge you to read the proxy statement carefully. Our directors and officers will be present at the meeting to respond to appropriate questions from stockholders.

The proxy statement and proxy card are being mailed to all stockholders of record on or about July 18, 2023.

Because it is important that your shares be voted at the Special Meeting, we urge you to complete, date and sign the enclosed proxy card and return it as promptly as possible in the accompanying envelope, whether or not you plan to attend in person. If you do attend the Special Meeting, you may withdraw your proxy and vote personally on each matter brought before the meeting.

Sincerely,

| /s/ Thanh H. Lam | |

| Thanh H. Lam | |

| President, Chief Executive Officer and Chairperson of the Board of Directors |

NOVA LIFESTYLE, INC.

6565 E. Washington Blvd.

Commerce, CA 90040

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held August 31, 2023

TO THE STOCKHOLDERS OF NOVA LIFESTYLE, INC.:

NOTICE HEREBY IS GIVEN that a Special Meeting of Stockholders of Nova LifeStyle, Inc., a Nevada corporation, will be held at the corporate headquarters of Nova LifeStyle, Inc., located at 6565 E. Washington Blvd, Commerce, California 90040 on August 31, 2023, at 10:30 a.m. local time, to consider and act upon the following:

| 1. | To approve an amendment to our Articles of Incorporation to increase the total number of our authorized shares of common stock, par value $0.001 per share, from 3,000,000 shares to 250,000,000 shares (the “Amendment”); |

| 2. | To adopt and approve the Nova LifeStyle Inc. 2023 Omnibus Equity Plan (“2023 Plan”); |

| 3. | To approve a proposal to grant discretionary authority to the Company’s Chairperson of the Board of Directors to adjourn the Special Meeting for the purpose of soliciting additional proxies to approve Proposals 1 and 2 (“Adjournment”). |

The Board of Directors of the Company (the “Board of Directors” or the “Board”) and the Company’s management has fixed the close of business on July 5, 2023 as the record date for determining the stockholders entitled to notice of, and to vote at, the Special Meeting and any adjournment and postponements thereof (the “Record Date”).

After careful consideration, the Board of Directors recommends a vote IN FAVOR OF the Amendment, a vote IN FAVOR OF the 2023 Plan and a vote IN FAVOR OF the grant of discretionary authority to the Company’s Chairperson of the Board to adjourn the Special Meeting.

Stockholders are cordially invited to attend the Special Meeting in person. Whether you plan to attend the Special Meeting or not, please complete, sign and date the enclosed Proxy Card and return it without delay in the enclosed postage-prepaid envelope. If you do attend the Special Meeting, you may withdraw your proxy and vote personally on each matter brought before the meeting. YOUR VOTE IS VERY IMPORTANT.

By Order of the Board of Directors

| /s/ Thanh H. Lam | |

| Thanh H. Lam | |

| President, Chief Executive Officer and Chairperson of the Board of Directors |

Commerce, California

July 17, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 31, 2023:

WHETHER OR NOT YOU PLAN TO ATTEND OUR SPECIAL MEETING OF STOCKHOLDERS, YOUR VOTE IS IMPORTANT. PLEASE FOLLOW THE INSTRUCTIONS IN THE PROXY MATERIALS TO VOTE YOUR PROXY VIA THE INTERNET OR BY TELEPHONE OR REQUEST AND PROMPTLY COMPLETE, EXECUTE AND RETURN THE PROXY CARD BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU ATTEND OUR SPECIAL MEETING OF STOCKHOLDERS, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU SO DESIRE.

NOVA LIFESTYLE, INC.

6565 E. Washington Blvd.

Commerce, CA 90040

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To Be Held August 31, 2023

We are furnishing this Proxy Statement to the Stockholders of Nova LifeStyle, Inc., a Nevada corporation in connection with the solicitation, by the Board of Directors of Nova LifeStyle, Inc. (the “Board”), of proxies to be voted at the Special Meeting of Stockholders to be held at the corporate headquarters of Nova LifeStyle, Inc. located at 6565 E. Washington Blvd, Commerce, California 90040 on August 31, 2023, at 10:30 a.m. local time, and at any adjournments or postponements of the meeting.

When used in this Proxy Statement, the terms “Nova LifeStyle,” “Nova,” the “Company,” “we,” “our” and similar terms refer to Nova LifeStyle, Inc., a Nevada corporation, and its wholly-owned subsidiaries, and the terms “Board of Directors” and “Board” refers to the Board of Directors of the Company.

On May 22, 2023, the Company filed a Certificate of Change Pursuant to NRS 78.209 with the Nevada Secretary of State to effect a one-for-five reverse stock split, which became effective upon filing (“Reverse Stock Split”). As a result of the Reverse Stock Split, every 5 shares of the Company’s common stock authorized or issued and outstanding immediately prior to the filing of the Certificate of Change were consolidated into one share. All stockholders who would be entitled to receive fractional shares as a result of the Reverse Stock Split received one whole share for their fractional share interest. There was no change in the par value of our common stock. The references to shares and per share data in this proxy statement have been retroactively restated to reflect such split.

Questions and Answers about these Proxy Materials and the Special Meeting

Why am I receiving this proxy statement?

The board of directors of the Company is soliciting your proxy to vote at the Special Meeting because you owned shares of the Company common stock at the close of business on July 5, 2023, the “Record Date” for the Special Meeting, and are therefore entitled to vote at the Special Meeting. This proxy statement, along with a proxy card or a voting instruction card, is being mailed to stockholders on or about July 18, 2023. The Company has made these materials available to you on the Internet, and the Company has delivered printed proxy materials to you or sent them to you by e-mail. This proxy statement summarizes the information that you need to know in order to cast your vote at the Special Meeting. You do not need to attend the Special Meeting in person to vote your shares of common stock of the Company.

When and where will the Special Meeting be held?

The Special Meeting will be held at 10:30 a.m., local time, on August 31, 2023, at the Company’s corporate headquarters located at 6565 E. Washington Blvd, Commerce, California 90040.

What information is contained in this Proxy Statement?

This information relates to the proposals to be voted on at the Special Meeting, the voting process, and certain other required information.

How do I vote?

Stockholders of Record

If your shares are registered directly in your name with our transfer agent, Issuer Direct Corporation, you are considered the “stockholder of record” with respect to those shares. As the stockholder of record, you may vote in person at the Special Meeting or vote by proxy using the accompanying proxy card. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and vote in person even if you have already voted by proxy.

By Internet – stockholders may vote on the internet by logging on to www.proxyvote.com and following the instructions given.

By Telephone – stockholders may vote by calling 1-800-690-6903 (toll-free) with a touch tone telephone and following the recorded instructions.

By Mail – stockholders must request a paper copy of the proxy materials to receive a proxy card and follow the instructions given for mailing. A paper copy of the proxy materials may be obtained by logging onto www.proxyvote.com and following the instructions given. To vote using the proxy card, simply print the proxy card, complete, sign and date it and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. In the alternative, the proxy card can be mailed directly to the Company: Thanh H. Lam, our Chief Executive Officer, located at 6565 E. Washington Blvd., Commerce, CA 90040. Our Board has selected Thanh H. Lam to serve as proxy.

If you vote by telephone or via the Internet, you do not need to return your proxy card. Telephone and Internet voting are available 24 hours a day and will close at 11:59 P.M. Eastern Time on August 30, 2023.

In Person - stockholders may vote in person at the Special Meeting. To vote in person, come to the Special Meeting and we will give you a ballot when you arrive. The Board recommends that you vote using one of the other voting methods, since it is not practical for most stockholders to attend the Special Meeting.

Shares of our common stock represented by proxies properly voted that are received by us and are not revoked will be voted at the Special Meeting in accordance with the instructions contained therein.

If instructions are not given, such proxies will be voted:

| ● | “FOR” the amendment to our Articles of Incorporation to increase the total number of our authorized shares of common stock, par value $0.001 per share, from 3,000,000 shares to 250,000,000 shares; and | |

| ● | “FOR” the adoption of Nova LifeStyle Inc. 2023 Omnibus Equity Plan; and | |

| ● | “FOR” the grant of discretionary authority to the Company’s Chairperson of the Board to adjourn the Special Meeting for the purpose of soliciting additional proxies to approve Proposals 1 and 2. |

Street Name Stockholders

If you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you are considered the “beneficial owner” of such shares. Because a beneficial owner is not a stockholder of record, you may not vote these shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote those shares at the meeting. The Board recommends that you vote using one of the other voting methods, since it is not practical for most stockholders to attend the Special Meeting.

If you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you can most conveniently vote by telephone, Internet or mail. Please review the voting instructions on your voting instruction form.

Your proxy is revocable at any time before it is voted at the Special Meeting in any of the following three ways:

1. You may submit another properly completed proxy bearing a later date.

2. You may send a written notice that you are revoking your proxy to Thanh H. Lam, our Chairperson of the Board, located at 6565 E. Washington Blvd., Commerce, CA 90040.

3. You may attend the Special Meeting and vote in person. However, simply attending the Special Meeting will not, by itself, revoke your proxy.

What does it mean if I receive more than one set of proxy materials?

It means your shares are registered differently or are in more than one account. Please provide voting instructions for each account for which you have received a set of proxy materials.

Who is soliciting my vote pursuant to this Proxy Statement?

Our Board is soliciting your vote at the Special Meeting. The cost of solicitation will be borne by us. Our directors and employees may also solicit proxies in person, by telephone, fax, electronic transmission or other means of communication. We will not pay these directors and employees any additional compensation for these services. We will ask banks, brokerage firms, and other institutions, nominees, and fiduciaries to forward these proxy materials to their principal, and to obtain authority to execute proxies, and will reimburse them for their expenses.

Who is entitled to vote?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Special Meeting.

How many shares are eligible to be voted?

As of the Record Date, we had 1,464,790 shares of common stock outstanding. Each outstanding share of our common stock will entitle its holder to one vote on each of the matters to be voted on at the Special Meeting.

What am I voting on?

You are voting on the following matters:

| 1. | To approve an amendment to our Articles of Incorporation to increase the total number of our authorized shares of common stock, par value $0.001 per share, from 3,000,000 shares to 250,000,000 shares (the “Amendment”); |

| 2. | To adopt and approve the Nova LifeStyle Inc. 2023 Omnibus Equity Plan (“2023 Plan”); |

| 3. | To approve a proposal to grant discretionary authority to the Company’s Chairperson of the Board to adjourn the Special Meeting for the purpose of soliciting additional proxies to approve Proposals 1 and 2. (“Adjournment”) |

How does the Board recommend that I vote?

The Board unanimously recommends that you vote your shares as follows:

| ● | “FOR” the amendment to our Articles of Incorporation to increase the total number of our authorized shares of common stock, par value $0.001 per share, from 3,000,000 shares to 250,000,000 shares; and | |

| ● | “FOR” the adoption of Nova LifeStyle Inc. 2023 Omnibus Equity Plan; and | |

| ● | “FOR” the grant of discretionary authority to the Company’s Chairperson of the Board to adjourn the Special Meeting for the purpose of soliciting additional proxies to approve Proposals 1 and 2. |

None of our directors have informed us in writing that he or she intends to oppose any action intended to be taken by us at the Special Meeting.

How many votes are required to hold the Special Meeting and what are the voting procedures?

Quorum Requirement: As of the Record Date, 1,464,790 shares of the Company’s common stock were issued and outstanding. The presence of at least one-third of all of our shares of common stock issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum at the meeting. If you submit a properly executed proxy, then you will be considered part of the quorum.

Required Votes: Each outstanding share of our common stock is entitled to one vote on each proposal at the Special Meeting. If there is a quorum at the Special Meeting, the matters to be voted upon by the stockholders require the following votes for such matter to be approved:

| ● | Approval of the Amendment: The affirmative vote of the holders of at least the majority of the voting power of the votes cast (in person or by proxy) at the Special Meeting is necessary to approve the Amendment. Abstentions and broker non-votes will have no effect on the outcome of this proposal. | |

| ● | Approval of the 2023 Plan: The affirmative vote of the holders of at least the majority of the voting power of the votes cast (in person or by proxy) at the Special Meeting is necessary to approve the 2023 Plan. Abstentions and broker non-votes will have no effect on the outcome of this proposal. | |

| ● | Approval of the Adjournment: The affirmative vote of the holders of at least the majority of the voting power of the votes cast (in person or by proxy) at the Special Meeting is necessary to approve the Adjournment. Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

If a broker indicates on its proxy that it submits to the Company that it does not have authority to vote certain shares held in “street name,” the shares not voted are referred to as “broker non-votes.” Broker non-votes occur when brokers do not have discretionary voting authority to vote certain shares held in “street name” on particular proposals, and the “beneficial owner” of those shares has not instructed the broker how to vote on those proposals. If you are a beneficial owner and you do not provide instructions to your broker, bank or other nominee, your broker, bank or other nominee is permitted to vote your shares for or against “routine” matters. Brokers are not permitted to exercise discretionary voting authority to vote your shares for or against “non-routine” matters.

How may a stockholder bring any other business before the Special Meeting?

The Company’s Amended and Restated Bylaws (the “Bylaws”) provide that at the special meetings the only business which may be transacted is that relating to the purpose or purposes set forth in the notice thereof, and, as such, stockholders shall not be permitted to propose other business at the Special Meeting.

Who is paying for the costs of this proxy solicitation?

The Company will bear the cost of preparing, printing and mailing the materials in connection with this solicitation of proxies. In addition to mailing these materials, directors, officers and employees of the Company may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile or electronic communication.

Are there any rights of appraisal?

Under the Nevada Revised Statutes and the Company’s Articles of Incorporation, Stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the Special Meeting.

Who will count the votes?

The inspector of election appointed for the Special Meeting will receive and tabulate the ballots and voting instruction forms.

Where do I find the voting results of the Special Meeting?

The voting results will be disclosed in a Current Report on Form 8-K that we will file with the SEC within four (4) business days after the Special Meeting.

How can I obtain the Company’s corporate governance information?

Our corporate governance information is available on our website at www.novalifestyle.com under “Investor Relations—Corporate Governance.” Our stockholders may also obtain written copies at no cost by writing to us at Nova LifeStyle Inc, at 6565 E. Washington Blvd., Commerce, CA 90040, Attention: Corporate Secretary, or by calling (323) 888-9999.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following sets forth information as of July 5, 2023, regarding the number of shares of our common stock beneficially owned by (i) each person that we know beneficially owns 5% or more of our outstanding common stock, (ii) each of our named executive officers, (iii) each of our directors and (iv) all of our executive officers and directors as a group.

The amounts and percentages of our common stock beneficially owned are reported on the basis of SEC rules governing the determination of beneficial ownership of securities. Under the SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has the right to acquire beneficial ownership within 60 days through the exercise of any stock option, warrant or other right. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

On May 22, 2023, the Company filed a Certificate of Change with the Secretary of State of Nevada with an effective date of filing date, to effect a one-for-five reverse stock split of the Company’s authorized shares of common stock, par value $0.001, accompanied by a corresponding decrease in the Company’s issued and outstanding shares of common stock.

Unless otherwise indicated, each of the stockholders named in the table below, or his or her family members, has sole voting and investment power with respect to such shares of our common stock. Except as otherwise indicated, the address of each of the stockholders listed below is: c/o Nova LifeStyle, Inc., 6565 E. Washington Blvd., Commerce, CA 90040.

As of July 5, 2023, there were 1,464,790 shares of our common stock issued and outstanding.

| Name of beneficial owner | Number of shares | Percent of class | ||||||

| Directors and named executive officers | ||||||||

| Thanh H. Lam, Chairperson, Chief Executive Officer, President and Director | 11,857 | * | ||||||

| Jeffery Chuang, Chief Financial Officer | 2,800 | (1) | * | |||||

| Min Su, Corporate Secretary and Director | 8,100 | * | ||||||

| Charlie Huy La, Director | 8,485 | (2) | * | |||||

| Umesh Patel, Director | 8,000 | (3) | * | |||||

| Ming-Cherng Sky Tsai, Director | - | * | ||||||

| Steven Qiang Liu, Vice President | 400,614 | 27.4 | % | |||||

| Directors and executive officers as a group (7 persons) | 439,856 | 30.0 | % | |||||

| (1) | Shares beneficially owned include 2,800 shares subject to stock options exercisable as of July 5, 2023. |

| (2) | Shares beneficially owned include 8,000 shares subject to stock options exercisable as of July 5, 2023. |

| (3) | Shares beneficially owned include 8,000 shares subject to stock options exercisable as of July 5, 2023. |

* Represents less than 1% of shares outstanding.

NON-EMPLOYEE DIRECTOR COMPENSATION

Director Compensation (excluding Named Executive Officers)

As of December 31, 2022, none of our independent directors has received any compensation from us for serving as our directors, except for the director fees described below. Our directors who are also executive officers of the Company do not receive additional compensation for their services on the Board.

In connection with their respective appointments to the Board of Directors, the Company entered into director agreements with Mr. Tsai, Mr. La and Mr. Patel. Pursuant to the amended agreements and certain board resolutions, the directors received reimbursement of certain expenses incurred with respect to attendance at board meetings and the following director fees in 2022: (i) $22,560 annually with respect to Mr. Tsai, (ii) $25,308 annually with respect to Mr. Patel, and (iii) $22,560 annually with respect to Mr. La. The Board also approved payment of nominal meeting attendance fees to non-employee directors. The director agreements impose certain customary confidentiality and non-disclosure obligations on the directors.

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to our non-employee directors for the year ended December 31, 2022.

| Name | Fees earned or paid in cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation Earnings ($) | Non- Qualified Deferred Compensation ($) | Nonqualified deferred compensation earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||

| Umesh Patel | 27,661 | - | - | - | - | - | - | 27,661 | ||||||||||||||||||||||||

| Charlie Huy La | 24,845 | - | - | - | - | - | - | 24,845 | ||||||||||||||||||||||||

| Ming-Cherng Sky Tsai | 24,845 | - | - | - | - | - | - | 24,845 | ||||||||||||||||||||||||

Except as set forth above, we do not currently compensate our directors for acting as such, although we may do so for independent directors, including with cash and equity. All directors are eligible to receive reimbursement of expenses incurred with respect to attendance at board meetings. We do not maintain a medical, dental or retirement benefits plan for our independent directors.

Outstanding Equity Awards at Fiscal Year-end

The following tables set forth certain information regarding outstanding stock options held by our directors (excluding our NEOs) as of December 31, 2022.

| Name | Outstanding | Vested | ||||||

| Umesh Patel | 8,000 | 8,000 | ||||||

| Charlie Huy La | 8,000 | 8,000 | ||||||

| Ming-Cherng Sky Tsai | - | - | ||||||

* The shares numbers have been retroactively restated to reflect the Reverse Stock Split in May 2023.

EXECUTIVE COMPENSATION

General

Certain information concerning our executive officers as of the date of this proxy statement is set forth below. Officers are elected annually by the Board and serve at the discretion of the Board.

| Name | Position | Age | ||

| Thanh H. Lam | Chairperson, Chief Executive Officer, President and Director | 55 | ||

| Jeffery Chuang | Chief Financial Officer | 53 | ||

| Min Su | Corporate Secretary, Director | 39 |

Summary Compensation Table

The following table sets forth information concerning the compensation for the years ended December 31, 2022 and 2021, of each of our named executive officers.

Summary Compensation Table

| Name and Principal Position | Year | Salary | Bonus | Stock Awards | Option Awards | Nonequity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||||||

| Thanh H. Lam | 2021 | 100,000 | 0 | 0 | 0 | 0 | 0 | 0 | 100,000 | |||||||||||||||||||||||

| Chairperson, Chief Executive Officer, President and Director | 2022 | 109,808 | 0 | 0 | 0 | 0 | 0 | 0 | 109,808 | |||||||||||||||||||||||

| Jeffery Chuang | 2021 | 50,000 | 0 | 0 | 0 | 0 | 0 | 0 | 50,000 | |||||||||||||||||||||||

| Chief Financial Officer | 2022 | 56,635 | 0 | 0 | 0 | 0 | 0 | 0 | 56,635 | |||||||||||||||||||||||

| Min Su | 2021 | 80,000 | 0 | 12,017 | (1)(2) | 0 | 0 | 0 | 0 | 92,017 | ||||||||||||||||||||||

| Corporate Secretary and Director | 2022 | 88,862 | 0 | 10,785 | (2)(3) | 0 | 0 | 0 | 0 | 99,647 | ||||||||||||||||||||||

(1) Represents the grant date fair value of the stock award granted to Ms. Su on November 10, 2020, under the 2014 Omnibus Long-Term Incentive Plan (which is described below under the section entitled “Equity Incentive Plan”) computed in accordance with FASB ASC Topic 718.

(2) Represents the grant date fair value of the stock award granted to Ms. Su on November 11, 2021, under the 2021 Omnibus Equity Plan (which is described below under the section entitled “Equity Incentive Plan Plan”) computed in accordance with FASB ASC Topic 718.

(3) Represents the grant date fair value of the stock award granted to Ms. Su on November 11, 2022, under the 2021 Omnibus Equity Plan (which is described below under the section entitled “Equity Incentive Plan Plan”) computed in accordance with FASB ASC Topic 718.

Employment Agreements

On May 8, 2018, the Company entered into an employment agreement with Ms. Lam for a term of five years, unless earlier terminated by the Company or Ms. Lam in accordance with its terms. The employment agreement provides for an annual salary of $100,000 to Ms. Lam as the Chief Executive Officer and President of the Company and annual bonuses at the sole discretion of the Board of Directors. Upon termination of employment, Ms. Lam is entitled to accrued but unpaid salary but no severance. The agreement contains confidentiality, non-competition and non-solicitation covenants in favor of the Company. On December 30, 2021, the Company and Ms. Lam entered into an amendment to the employment agreement which increased her annual salary to $110,000, effective on January 1, 2022. On May 8, 2023, the Company renewed employment agreement with Ms. Lam for a term of five years, unless earlier terminated by the Company or Ms. Lam in accordance with its terms. The employment agreement provides for an annual salary of $110,000 to Ms. Lam as the Chief Executive Officer and President of the Company and annual bonuses at the sole discretion of the Board of Directors. Upon termination of employment, Ms. Lam is entitled to accrued but unpaid salary but no severance. The agreement contains confidentiality, non-competition and non-solicitation covenants in favor of the Company.

On August 11, 2021, the Company entered into an employment agreement with Mr. Jeffery Chuang with a term of one year, commencing on August 22, 2021, unless earlier terminated by the Company or Mr. Chuang in accordance with its terms. On December 30, 2021, the Company and Mr. Chuang entered into an amendment to the employment agreement which increased his annual salary to $55,000, effective on January 1, 2022. On August 18, 2022, the Company entered into an employment agreement with Mr. Jeffery Chuang with a term of one year, commencing on August 22, 2022, unless earlier terminated by the Company or Mr. Chuang in accordance with its terms. This agreement is in substantially the same form as the previous one-year employment agreement entered into on August 11, 2021, as amended. Pursuant to the agreement, Mr. Chuang is entitled to a base salary of $55,000 per year and reimbursement of certain business expenses. Mr. Chuang is eligible for an annual cash bonus at the sole discretion of the Board. Upon termination of employment, Mr. Chuang is entitled to accrued but unpaid salary but no severance. The agreement contains confidentiality, non-competition and non-solicitation covenants in favor of the Company.

On November 11, 2021, the Company entered into an employment agreement with its Corporate Secretary Ms. Min Su to renew the terms of her employment, effective as of November 14, 2021 with a term of one year, unless earlier terminated by the Company or Ms. Su in accordance with its terms. Pursuant to the agreement, Ms. Su is entitled to: (i) a base salary of $80,000 per year, (ii) a one-time grant of 1,200 restricted stock units, as described below under the section entitled “Share Award and Option Agreements,” and (iii) reimbursement of certain business expenses. Ms. Su is eligible for an annual cash bonus at the sole discretion of the Board. Upon termination of employment, Ms. Su is entitled to accrued but unpaid salary but no severance. The agreement contains confidentiality, non-competition and non-solicitation covenants in favor of the Company. On December 30, 2021, the Company and Ms. Su entered into an amendment to the employment agreement which increased her annual salary to $88,000, effective on January 1, 2022. On November 11, 2022, the Company extended the employment agreement with Ms. Su for one more year with the same terms, effective from November 14, 2022.

We do not have any other arrangements providing for payments or benefits in connection with the resignation, severance, retirement or other termination of any of our named executive officers, and we do not have any arrangements providing for payments or benefits on a change in control of the Company.

Share Award and Option Agreements

We entered into a Stock Option Agreement with Mr. Chuang under 2014 Plan, dated August 12, 2019, pursuant to which Mr. Chuang was granted an option to purchase 1,400 shares of common stock at a per share purchase price of $19.25 per share. The shares subject to the option vested in two equal installments on the date of the Stock Option Agreement and the sixth month anniversary thereof.

We entered into a Restricted Stock Unit Award Agreement with Ms. Su under 2014 Plan, dated November 10, 2020, pursuant to which Ms. Su was awarded 1,200 RSUs. Shares of common stock underlying the RSUs vested as follows: (i) 300 shares vested on the date of the Restricted Stock Unit Award Agreement, (ii) 300 shares vested on March 31, 2021; (iii) 300 shares vested on June 30, 2021; and (iv) 300 shares vested on September 30, 2021.

We entered into a Restricted Stock Unit Award Agreement with Ms. Su under 2021 Omnibus Equity Plan, dated November 11, 2021, pursuant to which Ms. Su was awarded 1,200 RSUs. Shares of common stock underlying the RSUs vested as follows: (i) 300 shares vested on the date of the Restricted Stock Unit Award Agreement, (ii) 300 shares vested on March 31, 2022; (iii) 300 shares vested on June 30, 2022; and (iv)300 shares vested on September 30, 2022.

We entered into a Restricted Stock Unit Award Agreement with Ms. Su under 2021 Omnibus Equity Plan, dated November 11, 2022, pursuant to which Ms. Su was awarded 1,200 RSUs. Shares of common stock underlying the RSUs vest as follows: (i) 300 shares vested on the date of the Restricted Stock Unit Award Agreement, (ii) 300 shares vested on March 31, 2023; (iii) 300 shares vested on June 30, 2023; and (iv)300 shares will vest on September 30, 2023. If Ms. Su ceases to be providing continuous services to the Company for any reason, any unvested shares will be forfeited.

The Company effected a 1 for 5 reverse stock split in May 2023 and all references to shares and per share data have been retroactively restated to reflect such split.

Equity Incentive Plan

The Nova Lifestyle, Inc. 2014 Omnibus Long-Term Incentive Plan (the “2014 Plan”) was approved by the stockholders at the 2014 Annual Meeting, effective on May 13, 2014. The 2014 Plan provides for the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, unrestricted stock and performance awards. The Nova Lifestyle, Inc. 2021 Omnibus Equity Plan (the “2021 Plan”) was approved by the stockholders at the 2021 Annual Meeting, effective on April 12, 2021. The 2021 Plan provides for the grant of stock options, stock appreciation rights, restricted stock, restricted stock units and unrestricted stock.

During the years ended December 31, 2022 and 2021, the Company granted stock awards to its directors and executive officers.

The Company entered into a Stock Option Agreement with Mr. Chuang under the 2014 Plan, dated August 12, 2019, pursuant to which Mr. Chuang was granted an option to purchase 1,400 shares of common stock at a per share purchase price of $19.25 per share. The shares subject to the option vested in two equal installments on the date of the Stock Option Agreement and the sixth month anniversary thereof.

The Company entered into a Restricted Stock Unit Award Agreement with Ms. Su under the 2014 Plan, dated November 10, 2020, pursuant to which Ms. Su was awarded 1,200 RSUs. Shares of common stock underlying the RSUs vested as follows: (i) 300 shares vested on the date of the Restricted Stock Unit Award Agreement, (ii) 300 shares vested on March 31, 2021; (iii) 300 shares vested on June 30, 2021; and (iv)300 shares vested on September 30, 2021.

The Company entered into a Restricted Stock Unit Award Agreement with Ms. Su under the 2021 Plan, dated November 11, 2021, pursuant to which Ms. Su was awarded 1,200 RSUs. Shares of common stock underlying the RSUs vested as follows: (i) 300 shares vested on the date of the Restricted Stock Unit Award Agreement, (ii) 300 shares vested on March 31, 2022; (iii) 300 shares vested on June 30, 2022; and (iv)300 shares vested on September 30, 2022.

The Company entered into a Restricted Stock Unit Award Agreement with Ms. Su under 2021 Plan, dated November 11, 2022, pursuant to which Ms. Su was awarded 1,200 RSUs. Shares of common stock underlying the RSUs vest as follows: (i) 300 shares vested on the date of the Restricted Stock Unit Award Agreement, (ii) 300 shares vested on March 31, 2023; (iii) 300 shares vested on June 30, 2023; and (iv)300 shares will vest on September 30, 2023. If Ms. Su ceases to be providing continuous services to the Company for any reason, any unvested shares will be forfeited.

The Company effected a 1 for 5 reverse stock split in May 2023 and all references to shares and per share data have been retroactively restated to reflect such split.

Retirement Plans

We currently do not have any defined contribution plan, defined benefit pension plan, supplemental retirement plan or nonqualified defined contribution plan for our named executive officers and we do not currently intend to establish any such plan.

Outstanding Equity Awards at 2022 Fiscal Year-End Table

The following table sets forth information concerning the outstanding equity awards for the year ended December 31, 2022 of each of our named executive officers.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||

| Name | # of Securities Underlying Unexercised Options - Exercisable | # of Securities Underlying Unexercised Options - Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | # of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested ($) (2) | Equity Incentive Plan Awards: # of Unearned Shares, Units or Other Rights That Have Not Vested | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||||||||||||||||

| Jeffery Chuang | 1,400 | 0 | 0 | 46.25 | 8/24/2023 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| Jeffery Chuang | 1,400 | 0 | 0 | 19.25 | 8/12/2024 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

EQUITY COMPENSATION PLAN INFORMATION

Information about our equity compensation plans that were either approved or not approved by our stockholders is as follows (as of December 31, 2022):

| Plan Category | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | (b) Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | (c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||||||||

| Equity compensation plans approved by security holders | 26,800 | (1) | $ | 22.9 | 536,354 | (2) | ||||||

| Equity compensation plans not approved by security holders | — | $ | — | — | ||||||||

| Total | 26,800 | (1) | $ | 22.9 | 536,354 | (2) | ||||||

(1) Granted under our 2014 Omnibus Long-Term Incentive Plan (“2014 Plan”)

(2) Under our 2021 Omnibus Equity Plan, the maximum number of shares of common stock available for issuance is 600,000. As of December 31, 2022, a total of 104,946 shares and/or restricted stock units have been granted pursuant to the 2021 Omnibus Equity Plan. It also includes 41,300 shares under 2014 Plan due to the unexercised stock options expired in November 2022.

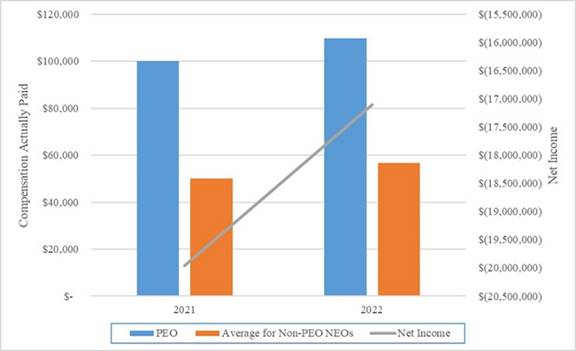

PAY VERSUS PERFORMANCE

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the relationship of “compensation actually paid” (“CAP”) to our principal executive officer (“PEO”) and other named executive officers (“Non-PEO NEOS”) and our performance.

Pay Versus Performance Table

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Customer Protection Act, and item 402(v) of Regulation S-K promulgated under the Exchange Act, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance of the Company.

For purposes of the tables below, the principal executive officer (“PEO”) and non-PEO named executive officers for 2021 and 2022 are the following:

| Year | PEO | Non-PEO named executive officers | ||

| 2022 | Thanh H. Lam | Jeffery Chuang | ||

| 2021 | Thanh H. Lam | Jeffery Chuang |

| Year | Summary Compensation

table total for PEO (1) ($) | Compensation Actually

Paid to PEO(2) ($) | Average Summary

Compensation Table Total for Non-PEO NEOs(3) ($) | Average Compensation

Actually Paid to Non-PEO NEOs(4) ($) | Value of Initial

Fixed $100 Investment Based On Total Shareholder Return(5) ($) | Net Loss(6) ($) | |||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | |||||||||||||||||||

| 2022 | 109,808 | 109,808 | 56,635 | 56,635 | (81.93 | ) | 17,101,671 | ||||||||||||||||||

| 2021 | 100,000 | 100,000 | 50,000 | 50,000 | (21.43 | ) | 19,962,493 | ||||||||||||||||||

| (1) | The dollar amounts reported in column (b) are the amounts of total compensation reported for the PEO for each corresponding year in the “Total” column of the Summary Compensation Table. | |

| (2) | The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to the PEO, as computed in accordance with Item 402(v) of Regulation S-K. No adjustments were required to be made to the PEO’s total compensation for each year to determine the compensation actually paid pursuant to the requirements of Item 402(v) of Regulation S-K. | |

| (3) | The dollar amounts reported in column (d) represent the average of the amounts reported for the Company’s non-PEO named executive officers as a group in the “Total” column of the Summary Compensation Table in each applicable year. | |

| (4) | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the non-PEO named executive officers as a group, as computed in accordance with Item 402(v) of Regulation S-K. No adjustments were required to be made to average total compensation for the non-PEO named executive officers as a group for each year to determine the compensation actually paid pursuant to the requirements of Item 402(v) of Regulation S-K. | |

| (5) | Cumulative total shareholder return (“TSR”) is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. | |

| (6) | The dollar amounts reported represent the amount of net loss reflected in the Company’s audited financial statements for the applicable year. |

Description of Relationships Between Information Presented

In accordance with Item 402(v) of Regulation S-K, the Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance table.

COMPENSATION ACTUALLY PAID AND CUMULATIVE TSR

COMPENSATION ACTUALLY PAID AND NET INCOME

COMPENSATION ACTUALLY PAID AND STOCK PRICE PERFORMANCE

PROPOSAL NO. 1— AMENDMENT TO THE ARTICLES OF INCORPORATION

The Company is asking you to approve the Amendment to the Articles of Incorporation of Nova LifeStyle, Inc., which would increase the amount of authorized shares of common stock, par value $0.001 per share (“Common Stock”), of the Company from 3,000,000 to 250,000,000 shares.

On June 28, 2023, the Board unanimously adopted a resolution setting forth a proposed amendment to Company’s Articles of Incorporation, which would, subject to stockholder approval, increase the total number of our authorized shares of our Common Stock from 3,000,000 shares to 250,000,000 shares (the “Amendment”). The resolution also provided that the proposed Amendment be presented to the stockholders for approval at a Special Meeting of the Stockholders with the recommendation of the Board that the stockholders approve the proposed Amendment in accordance with the Chapter 78 of Nevada Revised Statutes. A copy of the proposed amendment to the Articles of Incorporation is attached hereto as Annex A.

Except as set forth in the Amendment, all of the remaining provisions of the current Articles of Incorporation of the Company will remain in full force and effect without change.

If the proposal to amend our Articles of Incorporation to increase the total number of our authorized shares of our Common Stock from 3,000,000 shares to 250,000,000 shares is approved by our stockholders at the Special Meeting, a Certificate of Change to our Articles of Incorporation will be filed with the Secretary of State of the State of Nevada as soon as practicable after the Special Meeting. Upon such filing with the Secretary of State of Nevada, the Amendment will become effective.

Reasons and Effects of the Increase in Authorized Shares of Common Stock

Potential uses of the additional authorized shares of Common Stock may include public or private offerings, conversions of convertible securities, issuance of stock or stock options to employees, acquisition transactions and other general corporate purposes. Increasing the authorized number of shares of the Common Stock will give us greater flexibility and will allow the Company to issue such shares, in most cases, without the expense or delay of seeking shareholder approval. The Company may issue shares of its Common Stock in connection with financing and/or acquisition transactions and other corporate purposes which the Board of Directors believes will be in the best interest of the Company’s stockholders. The additional shares of Common Stock will have the same rights as the presently authorized shares, including the right to cast one vote per share of Common Stock. Increasing the number of authorized shares of common stock will not alter the number of shares of common stock presently issued and outstanding or reserved for issuance and will not change the relative rights of holders of any shares. The additional authorized shares of common stock, if and when issued, would have the same rights and privileges as the shares of common stock previously authorized, issued and outstanding. Those rights do not include preemptive rights with respect to the future issuance of any additional shares. Although the authorization of additional shares will not, in itself, have any effect on the rights of any holder of our Common Stock, the future issuance of additional shares of Common Stock (other than by way of a stock split or dividend) would have the effect of diluting the voting rights, and could have the effect of diluting earnings per share and book value per share, of existing stockholders. The Board has declared the proposed Amendment to be advisable and in the best interests of the Company and its stockholders and is submitting the Amendment to a vote of our stockholders.

Anti-takeover Effects

SEC rules and regulations require disclosure of the possible anti-takeover effects of an increase in authorized capital stock and other charter and bylaw provisions that could have an anti-takeover effect. Although the Board has not proposed the Amendment and the increase in the number of authorized shares of common stock with the intent of using the additional shares to prevent or discourage any actual or threatened takeover of the Company, under certain circumstances, such shares could have an anti-takeover effect. The additional shares of common stock could be issued to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company or could be issued to persons allied with the Board or management and, thereby, have the effect of making it more difficult to remove directors or members of management by diluting the stock ownership or voting rights of persons seeking to effect such a removal. Accordingly, if the proposed Amendment and authorized common stock increase is approved, the additional shares of authorized common stock may render more difficult or discourage a merger, tender offer or proxy contest, the assumption of control by a holder of a large block of common stock, or the replacement or removal of the Board or management.

This proposal is not prompted by any specific effort or takeover threat currently perceived by the Board or management.

As of July 5, 2023, the Company is authorized to issue up to 3,000,000 shares of its common stock, of which, 1,464,790 shares were issued and outstanding. Additional shares of common stock were reserved for issuance under our equity incentive plan and other outstanding securities, including (collectively, the “Anticipated Share Reserves”):

| ● | 300 shares of unvested restricted stock and vested stock options to purchase 26,800 shares of the Company’s stock; | |

| ● | 488,521 shares of common stock reserved for future issuance under the Company’s 2021 Omnibus Equity Plan (the “2021 Plan”) and 41,300 shares of common stock reserved for future issuance under the Company’s 2014 Plan; and | |

| ● | 245,192 shares of common stock reserved for future issuance upon the exercise of outstanding warrants. |

*The references to shares have been retroactively restated to reflect Reverse Stock Split in May 2023.

Other than the reserved shares of common stock described above and 2023 Omnibus Equity Plan that is subject to approval by our stockholders at the Special Meeting, we do not currently have any definitive agreements or plans to issue the additional shares of common stock that would be authorized as a result of approving the proposed Amendment. We review and evaluate potential capital raising activities, transactions and other corporate actions on an ongoing basis to determine if such actions would be in the Company’s best interest and the best interest of our stockholders.

Dissenter’s Rights

Our stockholders have no right under the Nevada Revised Statutes, our Articles of Incorporation or our Amended and Restated Bylaws to dissent from the provision adopted in the Amendment.

Required Vote

Approval of the Amendment requires a quorum to be present and an affirmative vote of a majority of our common stock voted at the Special Meeting. Broker non-votes and abstentions will not be taken into account in determining the outcome of the proposal. Adoption of the Amendment is not conditioned upon the adoption of any of the other proposals.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT COMPANY’S STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION.

PROPOSAL NO. 2 – NOVA LIFESTYLE INC. 2023 OMNIBUS EQUITY PLAN

Background

Our stockholders are being asked to consider and vote on this proposal to approve the Nova LifeStyle Inc. 2023 Omnibus Equity Plan (the “Equity Plan”).

On June 30, 2014, the Company’s stockholders approved the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan (the “2014 Plan”) at the annual stockholders meeting, which permitted the grant of stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), unrestricted stock and performance awards to its employees, directors, consultants and advisors up to 160,000 shares (after reflecting the 1 for 5 reverse stock splits in December 2019 and May 2023, respectively) of Common Stock of the Company. As of December 31, 2020, all shares of Common Stock available for issuance under the 2014 Plan have been granted to employees, officers, directors and consultants of the Company. As of December 31, 2022, 41,300 shares under 2014 Plan are available for issuance due to the unexercised stock options expired in November 2022.

On May 28, 2021, the Company’s stockholders approved the Nova LifeStyle, Inc. 2021 Omnibus Equity Plan (the “2021 Plan”) at the annual stockholders meeting, which permitted the grant of stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), unrestricted stock and performance awards to its employees, directors, consultants and advisors up to 600,000 shares (after reflecting the 1 for 5 reverse stock split in May 2023) of Common Stock of the Company. As of December 31, 2022, a total of 104,946 shares and/or restricted stock units have been granted pursuant to the 2021 Plan.

The Equity Plan’s purpose is to attract and retain high caliber employees, directors, consultants and advisors; motivate participants to achieve long-range goals; provide competitive incentive compensation opportunities; and align the participants’ interests with the interests of the stockholders by offering the participants compensation that is based on our common stock.

The description of the Equity Plan below is a summary and is qualified in its entirety by reference to the provisions of the Equity Plan, which is attached as Annex B to this proxy statement. Capitalized terms used in the summary but otherwise not defined herein shall have the meanings ascribed to such terms in the Equity Plan.

The Board of Directors of the Company approved and adopted the Equity Plan on June 28, 2023, subject to stockholders’ approval.

Recommendation of Board of Directors

The Board of Directors has approved and unanimously recommends that the stockholders vote “FOR” the proposal to approve the Equity Plan.

Description of the Equity Plan

Administration. The Equity Plan requires that a committee of non-employee directors to administer the Equity Plan. Currently, our Compensation Committee, which we refer to in this proposal as the Committee, administers the Equity Plan. Among other powers and duties, the Committee determines the employees who will be eligible to receive awards and establishes the terms and conditions of all awards. Unless prohibited by applicable law or the applicable rules of a stock exchange, the Committee may delegate its authority and administrative duties under the Equity Plan.

Shares Subject to the Equity Plan. The shares issuable under the Equity Plan are shares of our common stock that are authorized but unissued or reacquired common stock, including shares repurchased by the Company as treasury shares. The total aggregate shares of common stock authorized for issuance during the term of the Equity Plan is limited to 800,000 shares. The Committee must equitably adjust awards and the number of shares available under the Equity Plan in the event of a recapitalization, stock split, stock dividend, extraordinary cash dividend, split-up, spin-off, reclassification, combination or other exchange of shares.

Types of Awards and Eligibility. The Equity Plan provides for five types of awards. The Eligible Persons under the Equity Plan include Employees, Outside Directors, Consultants and New Hires of the Company or its subsidiaries, as selected by our Board or the designated committee thereof. As of July 5, 2023, 27 individuals (consisting of 3 executive officers, 3 directors who are not executive officers, and 21 employees who are not executive officers) are eligible to receive awards under the Equity Plan. The closing price of Company’s common stock on the NASDAQ Capital Market was $2.02 per share as of July 5, 2023.

Stock Options. Incentive Stock Options (“ISOs”) are options that are intended to qualify as, and that satisfy the requirements applicable to, an “incentive stock option” described in Code § 422(b). NSO shall mean an Option that is not intended to be, or does not qualify as, an Incentive Stock Option and is commonly referred to as a “Non-Statutory Stock Option”.

Option Grant: The grant of an Option entitles the Participant to purchase the number of Shares designated in the Award Agreement for such Option at an Exercise Price established by the Committee. Options may be either Incentive Stock Options or Non-Statutory Stock Options, as determined in the discretion of the Committee. Each Option shall be evidenced by and conditional on an Award Agreement in the form approved by the Committee, which Award Agreement shall specify whether the Option is an ISO or NSO. No ISO may be granted to any person more than ten (10) years after the Effective Date of the Equity Plan. Award Agreements need not be identical, but shall include the terms specified in and be subject to the provisions of the Equity Plan applicable to such Options. To the extent that the aggregate Fair Market Value of the Shares (determined as of the respective date or dates of grant), subject to ISOs granted to any Participant under the Equity Plan and any other option plan of the Corporation or any Related Corporation that first become exercisable in any calendar year, including any ISOs which become exercisable on an accelerated basis during such year, exceeds the sum of One Hundred Thousand Dollars ($100,000), such excess Options shall be treated as NSOs.

Exercise of Options: The Exercise Price shall be fixed by the Committee, provided that the Exercise Price for any Option shall never be less than one hundred percent (100%) (or, in the case of a 10% Stockholder receiving an ISO, 110%) of the Fair Market Value per share of Stock on the Option grant date. Fair Market Value shall be determined in a manner compliant with Code Section 409A.

Payment of Exercise Price: The exercise price is payable in cash; by tendering shares of our common stock owned by the participant; by withholding shares that would be acquired on exercise; by broker-assisted cashless exercise; or by any other form of legal consideration acceptable by the Committee (so long as it does not result in deferral of compensation within the meaning of Code Section 409A). Options are subject to the conditions, restrictions and contingencies specified by the Committee.

Option Term: The maximum term of any option is ten years from the date of grant and, with respect to ISOs granted to an individual who owns 10% of the voting power of our stock, the maximum term is five years from the date of grant.

Stock Appreciation Rights. A Stock Appreciation Right (“SAR”) entitles the Participant to receive, with respect to each Share subject to the SAR, the appreciation in the Fair Market Value over a base price established by the Committee, payable in cash or Stock, or a combination of both, as determined by the Committee at the time of payment. Each SAR shall be evidenced by an Award Agreement in the form approved by the Committee. Award Agreements evidencing SARs need not be identical, but shall include the terms specified below and be subject to the provisions of the Equity Plan applicable to such SARs.

SARs Grant: Each award of SARs will be evidenced by an award agreement that will specify the base price, the term of the SAR, and such other provisions as the Committee determines, and which are not inconsistent with the terms of the Equity Plan (which need not be the same for each award for each recipient).

Base Price of SAR: The base price of each SAR granted under the Equity Plan will be at least equal to the fair market value of a share of our common stock on the date of grant.

Settlement of SARs: The Participant may exercise the SAR by delivering a written notice of exercise to the Corporation, in the form and manner designated by the Committee. To the extent the Committee determines that the Participant will receive cash upon exercise of a SAR, the Corporation shall deliver the cash amount which becomes due upon exercise of a SAR as soon as administratively practicable after the Corporation’s receipt of the Participant’s properly completed notice of exercise. To the extent the Committee determines that Shares will be delivered to the Participant upon exercise of a SAR, the Shares shall be subject to such conditions, restrictions and contingencies as the Committee may establish, except that such conditions may not cause the deferral of recognition of income.

SAR Term: The maximum term of any SAR is ten years from the date of grant.

Unrestricted Stock. The Committee may, in its sole discretion, award unrestricted stock to any participant as a stock bonus or otherwise pursuant to which such participant may receive shares of stock free of restrictions or limitations.

Restricted Stock. A Restricted Stock Award is a grant of Shares subject to conditions and restrictions as determined by the Committee. Each Restricted Stock Award shall be evidenced by an Award Agreement in the form approved by the Committee. Award Agreements evidencing Restricted Stock Awards need not be identical, but shall include the terms specified in and be subject to the provisions of the Equity Plan applicable to such Restricted Stock Awards. Each Restricted Stock Award shall be, for the applicable Period of Restriction determined by the Committee, subject to such conditions, restrictions and contingencies as the Committee shall determine. Lapse of restrictions may be conditioned on the continued performance of Service or the achievement of performance conditions measured on an individual, corporate or other basis, or any combination thereof.

Restricted Stock Units. A Restricted Stock Unit Award entitles the Participant to receive Shares upon the vesting of the Award. Each Restricted Stock Unit Award shall be evidenced by an Award Agreement in the form approved by the Committee. Subject to the terms of the Equity Plan, Restricted Stock Units may be granted to Participants in such amounts and upon such terms and at any time and from time to time, as shall be determined by the Committee. Award Agreements evidencing Restricted Stock Unit Awards need not be identical, but shall include the terms specified in and be subject to the provisions of the Equity Plan applicable to Restricted Stock Unit Awards. As soon as practicable following the date each Restricted Stock Unit vests, the Corporation shall deliver to the Participant the Share underlying such Restricted Stock Unit, subject to such conditions, restrictions and contingencies as the Committee may establish.

Performance-Based Compensation. At its discretion, the Committee may make Awards to Participants intended to be the performance-based compensation. In such event, the number of shares becoming exercisable or transferable or amounts payable with respect to grants of Options, Stock Appreciation Rights, and/or awards of Restricted Stock, Unrestricted Stock or Restricted Stock Units may be determined based on the attainment of written performance goals based on the performance measures set forth in Article 7 of the Equity Plan and which have been approved by the Committee for a specified performance period. The performance goals shall state, in terms of an objective formula or standard, the method of computing the amount of compensation payable to the Participant if the goal is attained.

Limitations on Awards. The maximum aggregate cash amount payable under the Equity Plan for any Awards intended to constitute performance-based compensation to any Participant in any single calendar year shall not exceed $1,000,000. Subject to adjustment as provided in the Equity Plan, the maximum aggregate number of Shares (including Options, SARs, Restricted Stock, and RSUs) that may be granted to any Participant in any calendar year shall be 1,000,000 Shares.

Vesting and Forfeiture. The Committee determines the time and conditions under which the award will vest or the period of time after which the restriction shall lapse as part of making an award. Vesting or the lapse of the period of restriction may, in the Committee’s discretion, be based solely upon continued employment or service for a specified period of time, or may be based upon the achievement of specific performance goals (individual, corporation or other basis), or both. Vesting means the time at which an option, SAR or RSU holder may exercise his or her award at the end of the period of restriction that applies to Restricted Stock. Vesting or lapse provisions need not be uniform among awards granted at the same time or to persons similarly-situated. Vesting and lapse requirements will be set forth in the applicable award agreement. The Committee, in its discretion, may accelerate vesting of any award at any time. Unless otherwise determined by the Committee and included in the Participant’s Award Agreement, in the event that a Participant’s Service with the Corporation and all Related Corporations is terminated for any reason, all Awards held by the Participant which are unexercised or have not yet vested as of such date shall expire, terminate, and become unexercisable as of such termination date, provided, however, that if the Participant’s Service terminates for reasons other than Cause, all outstanding vested Options and SARs held by the Participant as of his or her termination date shall continue to be exercisable until the earlier of the expiration of their term or the date that is three months after such termination date.

Extension Exercise Period. The Committee, in its discretion, may extend the period of time for which an Option or SAR is to remain exercisable following a termination of service, but in no event beyond the expiration of the Option or SAR.

Prohibition on Repricing. Except as required or permitted pursuant to a corporate transaction (including, without limitation, any recapitalization or reorganization), in no event will an Option or SAR be amended to reduce the exercise or base price or be canceled in exchange for cash, other awards or Options or SARs with an exercise price or base price less than the exercise price of the original Option or base price of the original SAR without shareholder approval.

Limits on Transfers of Awards/Beneficiary Designation. All awards are exercisable only by the participant during the participant’s lifetime, and are transferable only by will or by the laws of descent and distribution; provided, however, that the Committee may permit a transfer of an award, other than an ISO, to a family member of an individual, subject to such restrictions as the Committee may provide. Participants may designate a beneficiary or beneficiaries to receive their benefits under the Equity Plan if they die before receiving any or all of such benefit.

Recapitalization. Upon a recapitalization, the Committee must adjust the number and kind of shares issuable and maximum limits for each type of award, adjust the number and kind of shares subject to outstanding awards, adjust the exercise or base price of outstanding Options or SARs, and make any other equitable adjustments.

Reorganization. Upon a reorganization, the Committee may decide that: (i) awards will apply to securities of the resulting corporation (with appropriate adjustment as determined by the Committee); (ii) any or all outstanding Options and SARs will be immediately exercisable (to the extent permitted under federal or state securities laws) and shall remain exercisable for the remaining term of the Options or SARs under the terms of the Equity Plan; (iii) any or all Options and SARs will be immediately exercisable (to the extent permitted under federal or state securities laws) and shall be terminated after giving at least 30 days’ notice to the Participants to whom such Options or SARs have been granted, and/or (iv) any or all unvested Restricted Stock Units and Restricted Stock on which restrictions have not yet lapsed shall become immediately fully vested, nonforfeitable and payable.

Amendment and Termination. Our Board of Directors may amend, suspend or terminate the Equity Plan, without consent of stockholders or participants, provided, however, that amendments must be submitted to the stockholders for approval if shareholder approval is required by applicable law, and any amendment or termination that may adversely affect the rights of participants with outstanding awards requires the consent of such participants. The Committee may amend any award agreement, provided the amendment is not to re-price or constructively re-price any award.

Term. The Equity Plan is effective immediately upon the adoption by our Board of Directors, subject to shareholder approval, and will terminate on the earliest to occur of (i) the 10th anniversary of the Equity Plan’s effective date, or (ii) the date on which all shares available for issuance under the Equity Plan shall have been issued as fully-vested shares. Options may be granted at any time on or after the date the Board of Directors adopt the Equity Plan, however, until the stockholders approve the Equity Plan, no Options or SARs may be exercised, no restricted stock may be issued, and no award may be settled in stock. If shareholder approval is not obtained within 12 months after the adoption by our Board of Directors, all awards will be null and void.

U.S. Federal Income Tax Consequences

The following summary of the U.S. federal income tax consequences of awards under the Equity Plan is based on current U.S. federal income tax laws and regulations and is designed to provide a general understanding of the consequences as of the date of this proxy statement. Laws and regulations may change in the future and affect the income tax consequences of your award under the Equity Plan. In addition, the impact of the laws and regulations may vary based on your individual circumstances. This summary does not constitute tax advice and does not address taxation of your award under the laws of any municipality, state or foreign country. You are urged to consult your own tax advisor as to the specific tax impact of any award to you.

Incentive Stock Options. An employee participant will generally have no tax consequences when he or she receives the grant of an ISO. In most cases, an employee participant also will not have income tax consequences when he or she exercises an ISO. An employee participant may have income tax consequences when exercising an ISO if the aggregate fair market value (determined at the time of grant) of the shares of the common stock subject to the ISO that first become exercisable in any one calendar year exceeds $100,000. If this occurs, the excess shares (the number of shares the fair market value of which exceeds $100,000 in the year first exercisable) will be treated as though they are NQSOs instead of ISOs. Additionally, subject to certain exceptions for death or disability, if an employee participant exercises an ISO more than three months after termination of employment, the exercise of the option will be taxed as the exercise of a NQSO. Any shares recharacterized as NQSOs will have the tax consequences described below with respect to the exercise of NQSOs.

An employee participant recognizes income when selling or exchanging the shares acquired from the exercise of an ISO in the amount of the difference between the fair market value at the time of the sale or exchange and the exercise price the participant paid for those shares. This income will be taxed at the applicable capital gains rate if the sale or exchange occurs after the expiration of the requisite holding periods. Generally, the required holding periods expire two years after the date of grant of the ISO and one year after the date the common stock is acquired by the exercise of the ISO. Further, the amount by which the fair market value of a share of the common stock at the time of exercise of the ISO exceeds the exercise price will likely be included in determining a participant’s alternative minimum taxable income and may cause the participant to incur an alternative minimum tax liability in the year of exercise.

If an employee participant disposes of the common stock acquired by exercising an ISO before the holding periods expire, the participant will recognize ordinary income. The amount of income will equal the difference between the option exercise price and the lesser of (i) the fair market value of the shares on the date of exercise and (ii) the price at which the shares are sold. This amount will be taxed at ordinary income rates and be subject to employment taxes. If the sale price of the shares is greater than the fair market value on the date of exercise, the participant will recognize the difference as gain and will be taxed at the applicable capital gains rate. If the sale price of the shares is less than the exercise price, the participant will recognize a capital loss equal to the excess of the exercise price over the sale price.

Using shares acquired by exercising an ISO to pay the exercise price of another option (whether or not it is an ISO) will be considered a disposition of the shares for federal tax purposes. If this disposition occurs before the expiration of the required holding periods, the employee option-holder will have the same tax consequences as are described above in the preceding paragraph. If the option holder transfers any of these shares after holding them for the required holding periods or transfers shares acquired by exercising an NQSO or on the open market, he or she generally will not recognize any income upon exercise. Whether or not the transferred shares were acquired by exercising an ISO and regardless of how long the option holder has held those shares, the basis of the new shares received from the exercise will be calculated in two steps. In the first step, a number of new shares equal to the number of older shares tendered (in payment of the option’s exercise) is considered exchanged under Code Section 1036 and the related rulings; these new shares receive the same holding period and the same basis the option holder had in the old tendered shares, if any, plus the amount included in income from the deemed sale of the old shares and the amount of cash or other non-stock consideration paid for the new shares, if any. In the second step, the number of new shares received by the option holder in excess of the old tendered shares receives a basis of zero, and the option holder’s holding period with respect to such shares commences upon exercise.

There will be no tax consequences to the Company when it grants an ISO or, generally, when an employee participant exercises an ISO. However, to the extent that an option holder recognizes ordinary income when he or she exercises, as described above, the Company generally will have a tax deduction in the same amount and at the same time.

Nonqualified Stock Options. A participant generally has no income tax consequences from the grant of NQSOs. Generally, in the tax year when the participant exercises the NQSO, he or she recognizes ordinary income in the amount by which the fair market value of the shares at the time of exercise exceeds the exercise price for the shares, and that amount will be subject to withholding and employment taxes.

If a participant exercises a NQSO by paying the exercise price with previously acquired common stock, he or she will have federal income tax consequences (relative to the new shares received) in two steps. In the first step, a number of new shares equivalent to the number of older shares tendered (in payment of the NQSO exercised) is considered to have been exchanged in accordance with Code Section 1036 and related rulings, and no gain or loss is recognized. In the second step, with respect to the number of new shares acquired in excess of the number of old shares tendered, the participant recognizes income on those new shares equal to their fair market value less any non-stock consideration tendered. The new shares equal to the number of the old shares tendered will have the same basis the participant had in the old shares and the holding period with respect to the tendered older shares will apply to the new shares. The excess new shares received will have a basis equal to the amount of income recognized on exercise, increased by any non-stock consideration tendered. The holding period begins on the exercise of the option.

The gain, if any, realized at the later disposition of the common stock will either be short- or long-term capital gain, depending on the holding period.

There will be no tax consequences to the Company when granting a NQSO. The Company generally will have a tax deduction in the same amount and at the same time as the ordinary income recognized by the participant.

Stock Appreciation Rights. Neither the participant nor the Company has income tax consequences from the issuance of a SAR. The participant recognizes taxable income at the time the SAR is exercised in an amount equal to the amount by which the cash and/or the fair market value of the shares of the common stock received upon that exercise exceeds the base price. The income recognized on exercise of a SAR will be taxable at ordinary income tax rates and be subject to employment taxes. The Company generally will be entitled to a tax deduction with respect to the exercise of a SAR in the same amount and at the same time as the ordinary income recognized by the participant.

Restricted Stock. A holder of restricted stock will not recognize income at the time of the award, unless he or she specifically makes an election to do so under Code Section 83(b) within thirty days of such award. Unless the holder has made such an election, he or she will realize ordinary income and be subject to employment taxes in an amount equal to the fair market value of the shares on the date the restrictions on the shares lapse, reduced by the amount, if any, he or she paid for such stock. The Company will generally be entitled to a corresponding deduction in the same amount and at the same time as the holder recognizes ordinary income. Upon the otherwise taxable disposition of the shares awarded after ordinary income has been recognized, the holder will realize a capital gain or loss (which will be long-term or short-term depending upon how long the shares are held after the restrictions lapse).