INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2018

(Expressed in U.S.

dollars)

(Unaudited)

1 of 19

NOTICE TO READER

These interim condensed consolidated financial statements of Loncor Resources Inc. as at and for the three months ended March 31, 2018 have been prepared by management of Loncor Resources Inc. The auditors of Loncor Resources Inc. have not audited or reviewed these interim condensed consolidated financial statements.

2 of 19

CONTENTS

3 of 19

| Loncor Resources Inc. |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

| (Expressed in U.S. dollars - unaudited) |

| Notes | March 31, 2018 | December 31, 2017 | |||||

| $ | $ | ||||||

| Assets | |||||||

| Current Assets | |||||||

| Cash and cash equivalents | 9,771 | 20,162 | |||||

| Advances receivable | 5 | 191,765 | 175,501 | ||||

| Due from related parties | 6 | 4,787 | 4,518 | ||||

| Prepaid expenses and deposits | 68,143 | 68,263 | |||||

| Total Current Assets | 274,466 | 268,444 | |||||

| Non-Current Assets | |||||||

| Property, plant and equipment | 7 | 15,431 | 16,275 | ||||

| Exploration and evaluation assets | 8 | 27,653,541 | 27,633,564 | ||||

| Intangible assets | 9 | 1 | 1 | ||||

| Total Non-Current Assets | 27,668,973 | 27,649,840 | |||||

| Total Assets | 27,943,439 | 27,918,284 | |||||

| Liabilities and Shareholders' Equity | |||||||

| Current Liabilities | |||||||

| Accounts payable | 11 | 336,779 | 359,651 | ||||

| Accrued liabilities | 187,890 | 67,132 | |||||

| Due to related parties | 6 | 309,599 | 237,305 | ||||

| Employee retention allowance | 18 | 202,539 | 208,153 | ||||

| Loans | 12 | 160,807 | 122,753 | ||||

| Current Liabilities | 1,197,614 | 994,994 | |||||

| Common share purchase warrants | 13c | 23,443 | 67,305 | ||||

| Total Liabilities | 1,221,057 | 1,062,299 | |||||

| Commitments and contingencies | 15 | ||||||

| Shareholders' Equity | |||||||

| Share capital | 13 | 77,286,874 | 77,286,874 | ||||

| Reserves | 8,221,219 | 8,219,502 | |||||

| Deficit | (58,785,711 | ) | (58,650,391 | ) | |||

| Total Shareholders' Equity | 26,722,382 | 26,855,985 | |||||

| Total Liabilities and Shareholders' Equity | 27,943,439 | 27,918,284 |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

4 of 19

| Loncor Resources Inc. |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS |

| (Expressed in U.S. dollars - unaudited) |

| For the three months ended | |||||||

| Notes | |||||||

| March 31, 2018 | March 31, 2017 | ||||||

| $ | $ | ||||||

| Expenses | |||||||

| Consulting, management and professional fees | 5,965 | 23,313 | |||||

| Employee benefits | 35,353 | 58,061 | |||||

| Office and sundry | 143,207 | 13,769 | |||||

| Compensation expense-share-based payment | 14 | 1,717 | 9,020 | ||||

| Travel and promotion | 26,885 | 35,695 | |||||

| Depreciation | 783 | 846 | |||||

| Interest and bank expenses | 3,134 | 144 | |||||

| (Gain)/loss on derivative instruments | 13c | (43,862 | ) | 27,019 | |||

| Foreign exchange loss/(gain) | (37,831 | ) | 12,777 | ||||

| Loss before other items | (135,351 | ) | (180,644 | ) | |||

| Interest income | 31 | 59 | |||||

| Loss | (135,320 | ) | (180,585 | ) | |||

| Comprehensive loss for the period | (135,320 | ) | (180,585 | ) | |||

| Loss per share, basic and diluted | 13d | (0.00 | ) | (0.00 | ) | ||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

5 of 19

| Loncor Resources Inc. |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| (Expressed in U.S. dollars - unaudited) |

| Common shares | Total | |||||||||||||||

| Notes | Number of | Reserves | Deficit | shareholders' | ||||||||||||

| shares | Amount | equity | ||||||||||||||

| Balance at January 1, 2017 | 153,189,732 | $ | 77,048,991 | $ | 8,197,193 | $ | (58,589,104 | ) | $ | 26,657,082 | ||||||

| Loss for the period | - | - | - | (180,585 | ) | (180,585 | ) | |||||||||

| Share-based payments | - | - | 9,020 | - | 9,020 | |||||||||||

| Common shares and warrants issued | 5,500,000 | 237,883 | - | - | 237,883 | |||||||||||

| Balance at March 31, 2017 | 158,689,732 | $ | 77,286,874 | $ | 8,206,213 | $ | (58,769,689 | ) | $ | 26,723,400 | ||||||

| Loss for the period | - | - | - | 119,298 | 119,298 | |||||||||||

| Share-based payments | - | - | 13,289 | - | 13,289 | |||||||||||

| Balance at December 31, 2017 | 158,689,732 | $ | 77,286,874 | $ | 8,219,502 | $ | (58,650,391 | ) | $ | 26,855,985 | ||||||

| Loss for the period | - | - | - | (135,320 | ) | (135,320 | ) | |||||||||

| Share-based payments | - | - | 1,717 | - | 1,717 | |||||||||||

| Balance at March 31, 2018 | 158,689,732 | $ | 77,286,874 | $ | 8,221,219 | $ | (58,785,711 | ) | $ | 26,722,382 | ||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

6 of 19

| Loncor Resources Inc. |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Expressed in U.S. dollars - unaudited) |

| For the three months ended | |||||||

| Notes | March 31, 2018 | March 31, 2017 | |||||

| Cash flows from operating activities | |||||||

| Loss for the period | $ | (135,320 | ) | $ | (180,585 | ) | |

| Adjustments to reconcile loss to net cash used in operating activities | |||||||

| Depreciation | 783 | 846 | |||||

| Share-based payments - employee compensation | 14 | 1,717 | 9,020 | ||||

| Loss/(gain) on derivative instruments | (43,862 | ) | 27,019 | ||||

| Employee retention allowance | 18 | (5,614 | ) | 2,032 | |||

| Changes in non-cash working capital | |||||||

| Advances receivable | (16,264 | ) | (51,761 | ) | |||

| Prepaid expenses and deposits | 120 | (32,627 | ) | ||||

| Due from related parties | (269 | ) | (440 | ) | |||

| Accounts payable | (26,089 | ) | 11,619 | ||||

| Accrued liabilities | 120,758 | (30,964 | ) | ||||

| Net cash used in operating activities | (104,040 | ) | (245,841 | ) | |||

| Cash flows from investing activities | |||||||

| Expenditures on exploration and evaluation assets | (522,044 | ) | (91,234 | ) | |||

| Net cash used in investing activities | (522,044 | ) | (91,234 | ) | |||

| Cash flows from financing activities | |||||||

| Proceeds from share and warrant issuance, net of issuance costs | - | 512,085 | |||||

| Loan | 12 | 38,054 | - | ||||

| Due to related parties | 72,294 | (34,254 | ) | ||||

| Funds received from Randgold | 505,345 | - | |||||

| Net cash provided from financing activities | 615,693 | 477,831 | |||||

| Net increase/(decrease) in cash and cash equivalent during the year | (10,391 | ) | 140,756 | ||||

| Cash and cash equivalents, beginning of the period | 20,162 | 21,520 | |||||

| Cash and cash equivalents, end of the period | 9,771 | 162,276 | |||||

Supplemental cash flow information (Note 17)

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

7 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

1. CORPORATE INFORMATION

Loncor Resources Inc. (the "Company" or “Loncor”) is a corporation governed by the Ontario Business Corporations Act. The principal business of the Company is the acquisition and exploration of mineral properties.

These interim condensed consolidated financial statements as at and for the three months ended March 31, 2018 include the accounts of the Company and of its wholly owned subsidiaries in the Democratic Republic of the Congo (the “Congo”), Loncor Resources Congo SARL, and in the U.S., Nevada Bob’s Franchising, Inc., respectively.

The Company is a publicly traded company whose outstanding common shares are listed for trading on the Toronto Stock Exchange. The head office of the Company is located at 1 First Canadian Place, 100 King St. West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada.

2. BASIS OF PREPARATION

| a) |

Statement of compliance |

|

These interim condensed consolidated financial statements as at and for the three month period ended March 31, 2018 have been prepared in accordance with International Accounting Standard (“IAS”) 34 ‘Interim Financial Reporting’ (“IAS 34”) using accounting policies consistent with the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The disclosure contained in these interim condensed consolidated financial statements does not include all the requirements in IAS 1 Presentation of Financial Statements (“IAS 1”). Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements as at and for the year ended December 31, 2017, which include information necessary to understand the Company’s business and financial statement presentation. | |

| b) |

Continuation of Business |

|

The Company incurred a net loss of $135,320 for the three months ended March 31, 2018 (three months ended March 31, 2017 - $180,585) and as at March 31, 2018 had a working capital deficit of $923,148 (December 31, 2017: $726,550). The Company’s ability to continue operations in the normal course of business is dependent on several factors, including its ability to secure additional funding. Management is exploring all available options to secure additional funding, including equity financing and strategic partnerships. In addition, the recoverability of the amount shown for exploration and evaluation assets is dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain financing to continue to perform exploration activity or complete the development of the properties where necessary, or alternatively, upon the Company’s ability to recover its incurred costs through a disposition of its interests, all of which are uncertain. | |

|

In the event the Company is unable to identify recoverable resources, receive the necessary permitting, or arrange appropriate financing, the carrying value of the Company’s assets and liabilities could be subject to material adjustment. These matters create material uncertainties that cast significant and substantial doubt upon the validity of the going concern assumption. | |

|

These interim condensed consolidated financial statements do not include any additional adjustments to the recoverability and classification of certain recorded asset amounts, classification of certain liabilities and changes to the statements of loss and comprehensive loss that might be necessary if the Company was unable to continue as a going concern. |

8 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

| c) |

Basis of measurement |

These interim condensed consolidated financial statements have been prepared on the historical cost basis, except for certain financial assets and liabilities which are presented at fair value. These interim condensed consolidated financial statements have also been prepared on an accrual basis, except for cash flow information.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accounting policies set out below have been applied consistently by all group entities and to all periods presented in these interim condensed consolidated financial statements, unless otherwise indicated.

| a) |

Basis of Consolidation |

| i. |

Subsidiaries |

|

Subsidiaries consist of entities over which the Company is exposed to, or has rights to, variable returns as well as ability to offset these returns through the power to direct the relevant activities of the entity. This control is generally evidenced through owning more than 50% of the voting rights or currently exercisable potential voting rights of a company’s share capital. The financial statements of subsidiaries are included in the consolidated financial statements of the Company from the date that control commences until the date that control ceases. Consolidation accounting is applied for all of the Company’s wholly-owned subsidiaries (see note 4). | |

| ii. |

Transactions eliminated on consolidation |

|

Inter-company balances, transactions, and any unrealized income and expenses, are eliminated in preparing the consolidated financial statements. | |

|

Unrealized gains arising from transactions with associates are eliminated against the investment to the extent of the Company’s interest in the investee. Unrealized losses are eliminated in the same way as unrealized gains, but only to the extent that there is no evidence of impairment. |

| b) |

Use of Estimates and Judgments |

The preparation of these interim condensed consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

| c) |

Newly Applied Accounting Standards |

|

The following amended standard was adopted as of January 1, 2018: |

| • | IFRS 9, “Financial instruments”. |

|

The adoption of this standard did not have a significant impact on the Company’s interim condensed consolidated financial statements. | |

| d) |

Accounting Standards Issued But Not Yet Effective |

|

The Company has reviewed new and revised accounting pronouncements that have been issued but are not yet effective and determined that the following may have an impact on the Company: | |

|

IFRS 16, Leases (“IFRS 16”) was issued by the IASB in January 2016 and will replace IAS 17 Leases. IFRS 16 specifies the methodology to recognize, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognize assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value. The mandatory effective date is for annual periods beginning on or after January 1, 2019. The Company is evaluating the impact of this standard on its consolidated financial statements. |

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

4. SUBSIDIARIES

The following table lists the Company’s subsidiaries:

| Name of Subsidiary | Place of Incorporation | Proportion of Ownership Interest | Principal Activity |

| Loncor Resources Congo SARL | Democratic Republic of the Congo | 100% | Mineral Exploration |

| Nevada Bob's Franchising, Inc. | Delaware, USA | 100% | Dormant |

5. ADVANCES RECEIVABLE

The balance of $191,765 pertains to advances to employees and suppliers (December 31, 2017 - $175,501). The balances are non-interest bearing, unsecured and due on demand.

6. RELATED PARTY TRANSACTIONS

Balances and transactions between the Company and its subsidiaries, which are related parties of the Company, have been eliminated on consolidation, and are not disclosed in this note.

a) Key Management Remuneration

Key management includes directors (executive and non-executive), the Chief Executive Officer (“CEO”), the Chief Financial Officer, and the senior executives reporting directly to the CEO. The remuneration of the key management of the Company as defined above, during the three months ended March 31, 2018 and March 31, 2017 was as follows:

| For the three months ended | ||||||

| March 31, 2018 | March 31, 2017 | |||||

| Salaries | $ | 31,615 | $ | 34,666 | ||

| Employee retention allowance | $ | - | $ | 2,889 | ||

| Compensation expense-share-based payments | $ | 1,717 | $ | 9,020 | ||

| $ | 33,332 | $ | 46,575 | |||

b) Other Related Party Transactions

As at March 31, 2018, an amount of $4,787 was due from Kuuhubb Inc. (formerly Delrand Resources Limited), a company with common directors, incurred in connection with common expenses (December 31, 2017 - $4,518).

As at March 31, 2018, an amount of $139,312 relating to consulting fees and advances provided to the Company was due to Arnold Kondrat, a director and officer of the Company (December 31, 2017 - $75,670).

As at March 31, 2018, an amount of $170,287 was due to Gentor Resources Inc. (a company with common directors) related to common expenses (December 31, 2016 - $161,635).

The amounts included in due from/to related parties are unsecured, non-interest bearing and are payable on demand.

10 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

7. PROPERTY, PLANT AND EQUIPMENT

The Company’s property, plant and equipment are summarized as follows:

| Furniture & fixtures |

Office & Communication equipment |

Vehicles | Field camps and equipment |

Leasehold improvements |

Total | |||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||

| Cost | ||||||||||||||||||

| Balance at January 1, 2017 | 151,786 | 102,692 | 11,707 | 425,003 | 84,906 | 776,094 | ||||||||||||

| Additions | - | 1,510 | - | - | - | 1,510 | ||||||||||||

| Disposals | - | - | - | - | - | - | ||||||||||||

| Balance at December 31, 2017 | 151,786 | 104,202 | 11,707 | 425,003 | 84,906 | 777,604 | ||||||||||||

| Additions | - | - | - | - | - | - | ||||||||||||

| Disposals | - | - | - | - | - | - | ||||||||||||

| Balance at March 31, 2018 | 151,786 | 104,202 | 11,707 | 425,003 | 84,906 | 777,604 | ||||||||||||

| Accumulated Depreciation | ||||||||||||||||||

| Balance at January 1, 2017 | 133,429 | 102,691 | 11,707 | 407,957 | 84,906 | 740,691 | ||||||||||||

| Additions | 3,404 | 188 | - | 17,046 | - | 20,638 | ||||||||||||

| Disposals | - | - | - | - | - | - | ||||||||||||

| Balance at December 31, 2017 | 136,833 | 102,879 | 11,707 | 425,003 | 84,906 | 761,329 | ||||||||||||

| Additions | 750 | 96 | - | - | 846 | |||||||||||||

| Disposals | - | - | - | - | - | - | ||||||||||||

| Balance at March 31, 2018 | 137,583 | 102,975 | 11,707 | 425,003 | 84,906 | 762,173 | ||||||||||||

| Carrying amounts | ||||||||||||||||||

| Balance at December 31, 2017 | 14,953 | - | - | - | - | 16,275 | ||||||||||||

| Balance at March 31, 2018 | 14,203 | 1,227 | - | - | - | 15,431 |

During the three months ended ended March 31, 2018, depreciation in the amount of $59 (three months ended March 31, 2017 - $8,926) was capitalized to exploration and evaluation assets.

8. EXPLORATION AND EVALUATION ASSETS

| North Kivu | Ngayu | Total | |||||||

| Cost | |||||||||

| Balance as at January 1, 2017 | $ | 9,955,415 | $ | 17,752,354 | $ | 27,707,769 | |||

| Additions | 203,541 | 1,236,098 | 1,439,639 | ||||||

| Adjustments | - | (412,549 | ) | (412,549 | ) | ||||

| Earn-in Randgold payment | - | (1,251,296 | ) | (1,251,296 | ) | ||||

| Balance as at December 31, 2017 | $ | 10,158,956 | $ | 17,324,607 | $ | 27,483,563 | |||

| Additions | 127 | 530,184 | 530,311 | ||||||

| Earn-in Randgold payment | - | (510,333 | ) | (510,333 | ) | ||||

| Balance as at March 31, 2018 | $ | 10,159,083 | $ | 17,344,458 | $ | 27,503,541 |

11 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

There is $150,000 of intangible exploration and evaluation expenditures as at March 31, 2018. The intangibles have not been included in the table above. There have not been any additions or disposals of intangible assets since January 1, 2014.

The Company’s exploration and evaluation assets are subject to renewal of the underlying permits and rights and other government royalties.

a. North Kivu

The North Kivu project is situated in the North Kivu Province in eastern Congo to the northwest of Lake Edward and consists of various exploration permits. All of these exploration permits are currently under force majeure due to the poor security situation, affecting the Company’s ability to carry out the desired exploration activities. The duration of the event of force majeure is added to the time limit for execution of obligations under the permits. Exploration estimates to date have not advanced to the stage of being able to identify the quantity of possible resources available for potential mining. Under force majeure, the Company has no tax payment obligations and does not lose tenure of mining titles until force majeure is lifted.

b. Ngayu

The Ngayu project consists of various exploration permits and is found within the Tshopo Province in the northeast of the Congo, approximately 270 kilometers northeast of Kisangani. The Ngayu project covers part of the Ngayu Archaean greenstone belt which is one of a number of greenstone belts in the north-east Congo Archaeancraton that includes the Kilo and Moto greenstone belts. These Archaean greenstone belts are the northwestern extensions of the Lake Victoria greenstone belt terrain that hosts a number of world class gold deposits including Geita and Bulyanhulu.

In 2015, due to a decrease in gold prices coupled with the reduction of the exploration budget, the Company conducted an impairment analysis whereby the carrying value of the Ngayu exploration and evaluation asset as at December 31, 2015 was assessed for possible impairment. The asset’s recoverable amount was calculated applying a fair value of $15 per ounce of gold in the ground, which was provided by a valuation analysis of an independent report on similar African exploration companies, to the Ngayu project’s Makapela estimated mineral resource. Since the carrying value of the asset was determined to be higher than its recoverable amount, an impairment loss of $2,300,000 was recorded during the year ended December 31, 2015. As at December 31, 2016 and 2017, the Company conducted an analysis of various factors and determined that there was no further impairment recognized by IFRS 6, and no evidence to support an impairment reversal. As at March 31, 2018, the Company determined that no impairment charge or gain was required.

Randgold Agreement

In January 2016, the Company’s Congo subsidiary (“Loncor Congo”) entered into an agreement with Randgold Resources (DRC) Limited ("Randgold") with respect to a portion of the Company’s Ngayu project. This agreement provides for the potential future establishment of a joint venture special purpose company (“Mining Company”) between Loncor Congo and Randgold. The Mining Company will be established only if exploration activities undertaken by Randgold at the Ngayu project result in an approved completed pre-feasibility study on any gold discovery meeting the investment criteria of Randgold. The agreement does not include certain parcels of land surrounding and including the Makapela and Yindi prospects which are retained by Loncor Congo and do not form part of the agreement.

Loncor Congo shall only be called upon to contribute to the future costs of the Mining Company after the approval of the completed pre-feasibility study. The parties will then (a) contribute to the funding required pro rata to their participating interests (65% for Randgold and 35% for Loncor Congo, less the free carried interest attributable to Congo authorities under applicable law, determined at the time of establishment) once the Mining Company has been established and any mining rights with respect to the area of discovery are transferred to the Mining Company, or (b) be diluted. The decision-making committee of the Mining Company will determine whether the funding is contributed (for the purpose of funding the Mining Company) by way of equity or shareholder loans.

9. INTANGIBLE ASSETS

The Company’s intangible assets include licenses and rights. Based on management’s assessment, these intangible assets have been valued at $1 as their fair value is nominal.

12 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

10. SEGMENTED REPORTING

The Company has one operating segment: the acquisition, exploration and development of precious metal projects located in the Congo. The operations of the Company are located in two geographic locations, Canada and the Congo. Geographic segmentation of non-current assets is as follows:

March 31, 2018

| Property, plant and | Exploration and | ||||||||

| equipment | Intangible assets | evaluation | |||||||

| Congo | $ | 1,115 | - | $ | 27,653,541 | ||||

| Canada | $ | 14,316 | $ | 1 | - | ||||

| $ | 15,431 | $ | 1 | $ | 27,653,541 |

| December 31, 2017 | |||||||||

| Property, plant and | Exploration and | ||||||||

| equipment | Intangible assets | evaluation | |||||||

| Congo | $ | 1,174 | - | $ | 27,633,564 | ||||

| Canada | $ | 15,101 | $ | 1 | - | ||||

| $ | 16,275 | $ | 1 | $ | 27,633,564 |

11. ACCOUNTS PAYABLE

The following table summarizes the Company’s accounts payable:

| March 31, 2018 | December 31, 2017 | |||||

| Exploration and evaluation expenditures | $ | 230,753 | $ | 227,537 | ||

| Non-exploration and evaluation expenditures | $ | 106,026 | $ | 132,114 | ||

| Total Accounts Payable | $ | 336,779 | $ | 359,651 |

12. LOANS

In February 2018, the Company received a loan from an arm’s length party in the amount of $41,242 ($50,000 CDN) that is payable on demand, unsecured and bears interest at 8% per annum. In September 2017, the Company received a loan from an arm’s length party in the amount of $119,565 ($150,000 CDN) that is unsecured and bears interest at 8% per annum and is payable within one year. Total interest accrued on the loans as at March 31, 2018 is $5,687 (December 31, 2017 - $3,188).

13. SHARE CAPITAL

| a) |

Authorized |

|

The authorized share capital of the Company consists of unlimited number of common shares and unlimited number of preference shares, issuable in series, with no par value. All shares issued are fully paid. | |

|

The holders of common shares are entitled to receive notice of and to attend all meetings of the shareholders of the Company and shall have one vote for each common share held at all meetings of shareholders of the Company, except for meetings at which only holders of another specified class or series of shares are entitled to vote separately as a class or series. Subject to the prior rights of the holders of the preference shares or any other share ranking senior to the common shares, the holders of the common shares are entitled to (a) receive any dividend as and when declared by the board of directors, out of the assets of the Company properly applicable to payment of dividends, in such amount and in such form as the board of directors may from time to time determine, and (b) receive the remaining property of the Company in the event of any liquidation, dissolution or winding up of the Company. |

13 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

|

The Company may issue preference shares at any time and from time to time in one or more series with designations, rights, privileges, restrictions and conditions fixed by the board of directors. The preference shares of each series are ranked on parity with the preference shares of every series and are entitled to priority over the common shares and any other shares of the Company ranking junior to the preference shares, with respect to priority in payment of dividends and the return of capital and the distribution of assets of the Company in the event of liquidation, dissolution or winding up of the Company. | |

| b) |

Issued share capital |

|

In February 2017, the Company closed a non-brokered private placement of 4,000,000 units of the Company at a price of Cdn$0.12 per unit for gross proceeds of Cdn$480,000. Each such unit was comprised of one common share of the Company and one-half of one warrant of the Company, with each full warrant entitling the holder to purchase one common share of the Company at a price of Cdn$0.18 for a period of two years. Also in February 2017, the Company closed a second non- brokered private placement of 1,500,000 units of the Company at a price of Cdn$0.13 per unit for gross proceeds of Cdn$195,000. Each such unit was comprised of one common share of the Company and one-half of one warrant of the Company, with each full warrant entitling the holder to purchase one common share of the Company at a price of Cdn$0.18 for a period of two years. | |

|

As of March 31, 2018, the Company had issued and outstanding 158,689,732 common shares (December 31, 2017 – 158,689,732) and no preference shares are issued and outstanding. | |

| c) |

Common share purchase warrants |

|

As at March 31, 2018, the Company had outstanding 3,625,000 (December 31, 2017 – 3,625,000) common share purchase warrants. No warrants were forfeited or cancelled during the the three months ended March 31, 2018 (year ended December 31, 2017 – nil). The common share purchase warrants are classified as a liability because they are a derivative financial instrument due to their exercise price differing from the functional currency of the Company. The common share purchase warrants are re-valued at year and period end, with a gain or loss reported on the interim condensed consolidated statement of loss and comprehensive loss. For the three months ended March 31, 2018, the Company recognized a gain of $43,862 in the interim condensed consolidated statement of loss and comprehensive loss representing the change in fair value on this derivative financial instrument (three months ended March 31, 2017 – loss of $27,019). The following table summarizes the Company’s common share purchase warrants outstanding as at March 31, 2018: |

| Granted | Exercise | Remaining | |||||||||||||||||||||||||

| Date of | Opening | during | Closing | Exercise | period | Expiry | contractual | ||||||||||||||||||||

| Grant | Balance | period | Exercised | Expired | Balance | Price | (months) | Date | life (months) | ||||||||||||||||||

| 2016-06-29 | 875,000 | - | - | - | 875,000 | $ | 0.18 | 24 | 2018-06-29 | 3 | |||||||||||||||||

| 2017-02-03 | 2,000,000 | - | - | - | 2,000,000 | $ | 0.18 | 24 | 2019-02-03 | 10 | |||||||||||||||||

| 2017-02-28 | 750,000 | - | - | - | 750,000 | $ | 0.18 | 24 | 2019-02-28 | 11 | |||||||||||||||||

| 3,625,000 | - | - | - | 3,625,000 |

The value of the warrants was calculated using the Black-Scholes model and the assumptions at grant date and period end date were as follows:

| (i) |

Risk-free interest rate: 0.48% - 1.95%, which is based on the Bank of Canada benchmark bonds yield 2 year rate in effect at the time of grant for bonds with maturity dates at the estimated term of the warrants | |

| (ii) |

Expected volatility: 49.8% - 179.41%, which is based on the Company’s historical stock prices | |

| (iii) |

Expected life: 1 - 2 years | |

| (iv) |

Expected dividends: $Nil |

| d) |

Loss per share |

|

Loss per share was calculated on the basis of the weighted average number of common shares outstanding for the three months ended March 31, 2018 amounting to 158,689,732 (three months ended March 31, 2017 – 156,195,288) common shares. The diluted weighted average number of common shares outstanding for the three months ended March 31, 2018 amounted to 158,689,732 (three months ended March 31, 2017 - 156,195,288) common shares. As at March 31, 2018, fully diluted earnings per share calculated by adding 342,857 common shares related to stock options were the same as the basic earnings per share because they were anti-dilutive. |

14 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

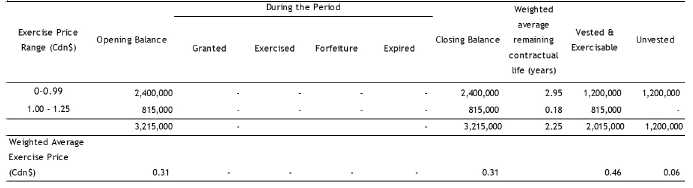

14. SHARE-BASED PAYMENTS

The Company has an incentive Stock Option Plan under which non-transferable options to purchase common shares of the Company may be granted to directors, officers, employees or consultants of the Company or any of its subsidiaries. No amounts are paid or payable by the recipient on receipt of the option, and the exercise of the options granted is not dependent on any performance-based criteria. In accordance with these programs, options are exercisable at a price not less than the last closing price of the shares at the grant date.

Under this Stock Option Plan, 25% of options granted vest on each of the 6 month, 12 month, 18 month and 24 month anniversaries of the grant date.

The following tables summarize information about stock options:

| For the three months ended March 31, 2018: | |||||||||

| During the Period | |||||||||

| Exercise Price Range (Cdn$) |

Opening Balance | Granted | Exercised | Forfeiture | Expired | Closing Balance | Weighted average remaining contractual life (years) |

Vested & Exercisable |

Unvested |

| 0-0.99 | 2,400,000 | - | - | - | - | 2,400,000 | 2.95 | 2,400,000 | - |

| Weighted Average Exercise Price (Cdn$) |

0.06 |

- |

- |

- |

- |

0.06 |

0.05 |

0.06 | |

For the three months ended March 31, 2017:

There were no stock options granted during the three months ended March 31, 2018. The weighted average grant date fair value of stock options as at March 31, 2018 was estimated at Cdn$0.04 per stock option (year ended December 31, 2017 – Cdn$0.04) .

During the three months ended March 31, 2018, the Company recognized in the statement of loss and comprehensive loss as an expense $1,717 (three months ended March 31, 2017 – $9,020) representing the vesting of the fair value at the date of grant of stock options previously granted to employees, directors and officers under the Company’s Stock Option Plan.

15 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

15. COMMITMENTS AND CONTINGENCIES

Environmental

The Company’s exploration and evaluation activities are subject to laws and regulations governing the protection of the environment. These laws and regulations are continually changing and generally becoming more restrictive. The Company believs its activities are materially in compliance with all applicable laws and regulations. The Company has made, and expects to make in the future expenditures to comply with such laws and regulations.

Lease Commitments

The Company has in place a lease agreement for the head office location in Toronto, Canada (with a monthly obligation of U.S. dollar equivalent of Cdn $18,442) to August 2019.

16. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

| a) |

Fair value of financial assets and liabilities |

|

The interim condensed consolidated statements of financial position carrying amounts for cash and cash equivalents, advances receivable, balances due from and due to related parties, accounts payable, accrued liabilities and the employee retention allowance approximate fair value due to their short-term nature. | |

|

Fair value hierarchy | |

|

The following table provides an analysis of financial instruments that are measured subsequent to initial recognition at fair value, grouped into Levels 1 to 3 based on the degree to which the fair value is observable: |

| • |

Level 1 fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets or liabilities; | |

| • |

Level 2 fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices); | |

| • |

Level 3 fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are not based on observable market data (unobservable inputs). |

There were no transfers between Level 1, 2 and 3 during the reporting period. Cash and cash equivalents are ranked Level 1 as the market value is readily observable. The carrying value of cash and cash equivalents approximates fair value, as maturities are less than three months.

The fair value of warrants (note 13c) would be included in the hierarchy as follows:

| 31-Mar-18 | |||

| Liabilities: | Level 1 | Level 2 | Level 3 |

| Canadian dollar common

share purchase warrants |

- | $23,443 | - |

| 31-Dec-17 | |||

| Liabilities: | Level 1 | Level 2 | Level 3 |

| Canadian dollar common

share purchase warrants |

- | $67,305 | - |

16 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

| b) |

Risk Management Policies |

|

The Company is sensitive to changes in commodity prices and foreign-exchange. The Company’s Board of Directors has overall responsibility for the establishment and oversight of the Company’s risk management framework. Although the Company has the ability to address its price-related exposures through the use of options, futures and forward contracts, it does not generally enter into such arrangements. | |

| c) |

Foreign Currency Risk |

|

Foreign currency risk is the risk that a variation in exchange rates between the United States dollar and Canadian dollar or other foreign currencies will affect the Company’s operations and financial results. A portion of the Company’s transactions are denominated in Canadian dollars. The Company is also exposed to the impact of currency fluctuations on its monetary assets and liabilities. Significant foreign exchange gains or losses are reflected as a separate item in the interim condensed consolidated statement of loss and comprehensive loss. The Company does not use derivative instruments to reduce its exposure to foreign currency risk. | |

|

The following table indicates the impact of foreign currency exchange risk on net working capital as at March 31, 2018. The table below also provides a sensitivity analysis of a 10 percent strengthening of the US dollar against the Canadian dollar which would have increased (decreased) the Company’s net loss by the amounts shown in the table below. A 10 percent weakening of the US dollar against the Canadian dollar would have had the equal but opposite effect as at March 31, 2018. |

| Canadian dollar | |||

| Cash and cash equivalents | 1,913 | ||

| Accounts payable and accrued liabilities | (243,014 | ) | |

| Employee retention allowance | (261,138 | ) | |

| Total foreign currency financial assets and liabilities | (502,239 | ) | |

| Foreign exchange rate at March 31, 2018 | 0.7971 | ||

| Total foreign currency financial assets and liabilities in US $ | (400,335 | ) | |

| Impact of a 10% strengthening of the US $ on net loss | (40,033 | ) |

| d) |

Credit Risk |

|

Financial instruments which are potentially subject to credit risk for the Company consist primarily of cash and cash equivalents, advances receivable, and due from related parties. Cash and cash equivalents are maintained with several financial institutions of reputable credit and may be redeemed upon demand. It is therefore the Company’s opinion that such credit risk is subject to normal industry risks and is considered minimal. The credit risk of advances receivable is, in management opinion, normal given ongoing relationships with those debtors. | |

|

The Company limits its exposure to credit risk on any investments by investing only in securities rated R1 (the highest rating) by credit rating agencies such as the DBRS (Dominion Bond Rating Service). Management continuously monitors the fair value of any investments to determine potential credit exposures. Short-term excess cash is invested in R1 rated investments including money market funds and other highly rated short-term investment instruments. Any credit risk exposure on cash balances is considered negligible as the Company places deposits only with major established banks in the countries in which it carries on operations. | |

|

The carrying amount of financial assets represents the maximum credit exposure. The Company’s gross credit exposure at March, 31, 2018 and December 31, 2017 was as follows: |

17 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

| March 31, 2018 | December 31, 2017 | |||||

| Cash and cash equivalents | $ | 9,771 | $ | 20,162 | ||

| Advances receivable | $ | 191,765 | $ | 175,501 | ||

| Due from related parties | $ | 4,787 | $ | 4,518 | ||

| $ | 206,323 | $ | 200,181 |

| e) |

Liquidity Risk |

|

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they become due. The Company attempts to ensure that there is sufficient cash to meet its liabilities when they are due and manages this risk by regularly evaluating its liquid financial resources to fund current and long-term obligations and to meet its capital commitments in a cost-effective manner. Temporary surplus funds of the Company are invested in short-term investments. The Company arranges the portfolio so that securities mature approximately when funds are needed. The key to success in managing liquidity is the degree of certainty in the cash flow projections. If future cash flows are fairly uncertain, the liquidity risk increases. The Company’s liquidity requirements are met through a variety of sources, including cash and cash equivalents and equity capital markets. All financial obligations of the Company including accounts payable of $336,779, accrued liabilities of $187,890, due to related parties of $309,599, employee retention allowance of $202,539 and a loan of $160,807 are due within one year. | |

| f) |

Mineral Property Risk |

|

The Company’s operations in the Congo are exposed to various levels of political risk and uncertainties, including political and economic instability, government regulations relating to exploration and mining, military repression and civil disorder, all or any of which may have a material adverse impact on the Company’s activities or may result in impairment in or loss of part or all of the Company's assets. | |

| g) |

Capital Management |

|

The Company manages its common shares, warrants and stock options as capital. The Company’s policy is to maintain a sufficient capital base in order to meet its short term obligations and at the same time preserve investors’ confidence required to sustain future development of the business. |

| March 31, 2018 | December 31, 2017 | |||||

| Share capital | $ | 77,286,874 | $ | 77,286,874 | ||

| Reserves | $ | 8,221,219 | $ | 8,219,502 | ||

| Deficit | $ | (58,785,711 | ) | $ | (58,650,391 | ) |

| Common share purchase warrants | $ | 23,443 | $ | 67,305 | ||

| $ | 26,745,825 | $ | 26,923,290 |

The Company is not subject to any capital requirements imposed by a lending institution or regulatory body, other than the TSX which requires adequate working capital or financial resources to maintain operations and cover general and administrative expenses.

17. SUPPLEMENTAL CASH FLOW INFORMATION

During the periods indicated the Company undertook the following significant non-cash transactions:

18 of 19

| Loncor Resources Inc. |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| For the three months ended March 31, 2018 |

| (Expressed in U.S. dollars, except for per share amounts - unaudited) |

| For the three months ended | ||||||||

| Note | March 31, 2018 | March 31, 2017 | ||||||

| Depreciation included in exploration and evaluation assets | 8 | $ | 59 | $ | 8,926 | |||

| Employee retention allowance included in exploration and evaluation assets | 18 | $ | - | $ | - | |||

18. EMPLOYEE RETENTION ALLOWANCE

The Company has an incentive employee retention plan under which an amount equal to one month salary per year of service is accrued to each qualified employee up to a maximum of 10 months (or 10 years of service with the Company and/or a related company). To qualify for this retention allowance, an employee must complete two years of service with the Company and/or a related company. The full amount of retention allowance accumulated by a particular employee is paid out when the employee is no longer employed with the Company, unless other arrangements are made or unless there is a termination due to misconduct, in which case the retention allowance is forfeited. There is uncertainty about the timing and amount of these potential outflows. As at March 31, 2018, the Company estimated a total provision of $202,539 (December 31, 2017 - $208,153).

The following table summarizes information about changes to the Company’s employee retention provision during the three months ended March 31, 2018.

| $ | |||

| Balance at December 31, 2016 | 596,849 | ||

| Additions | 10,396 | ||

| Change in estimate | (412,549 | ) | |

| Foreign exchange loss | 13,457 | ||

| Balance at December 31, 2017 | 208,153 | ||

| Foreign exchange gain | (5,614 | ) | |

| Balance at March 31, 2018 | 202,539 |

19. SUBSEQUENT EVENT

On April 3, 2018, Loncor issued a press release announcing that it had entered into a binding term sheet with Resolute Mining Limited (“Resolute”) (ASX:RSG) whereby Resolute will acquire a total of 51,000,000 common shares of Loncor. As part of the series of transactions contemplated by the term sheet (the “Transactions”), (a) the Company will issue 26,000,000 common shares to Resolute at a price of Cdn$0.10 per share for gross proceeds of Cdn$2,600,000, (b) Resolute will purchase 25,000,000 common shares of Loncor held by Mr. Arnold Kondrat (“Kondrat”) in exchange for consideration of Cdn$2,500,000, to be paid by the issuance to Kondrat of ordinary shares of Resolute, and (c) Loncor will acquire a 100% interest in two DRC companies holding exploration permits in the Ngayu gold belt increasing Loncor’s holdings from 960 square kilometres to 1,696 square kilometres. The Company also intends to complete a further non-brokered private placement of 1,700,000 common shares of the Company at a price of Cdn$0.10 per share for gross proceeds of Cdn$170,000. Kondrat will purchase 700,000 shares of this placement. The term sheet also contemplates the entering into by Resolute and Kondrat of a shareholders’ agreement to pool their respective common share positions in Loncor, with a combined holding of approximately 54% of the outstanding common shares of the Company upon completion of the Transactions.

All Transactions are subject to completion of satisfactory due diligence, fulfilment of agreed conditions precedent, TSX and shareholder approvals and execution of the definitive agreements for the Transactions.

Loncor has called a special meeting of shareholders of the Company for May 22, 2018 to seek the requisite shareholder approval for the Transactions.

19 of 19