UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

¨ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended July 31, 2014

Commission File No. 000-52735

XIANGTIAN (USA) AIR POWER CO., LTD.

(Exact Name of Small Business Issuer as specified in its charter)

| Delaware | 98-0632932 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.) |

c/o Luck Sky International Investment Holdings Limited

Unit 602 Causeway Bay Comm Bldg 1

Sugar Street, Causeway Bay

Hong Kong, People’s Republic of China

(Address of principal executive offices)

+86 10 859 10 261

(Registrant's telephone number including area code)

Securities Registered Under Section 12(b) of the Exchange Act: None

Securities Registered Under Section 12(g) of the Exchange Act: Common Stock, $0.001 par value (Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer as defined by Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Rule 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the reporting requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates, as of the last business day of the registrant’s most recently completed second fiscal quarter was $49,054,163, based on 98,108,325 common shares at $0.50 on January 31, 2014, which is the quotation posted on the OTCQB Market (“OTCQB” under the symbol “GOAS”)

The number of shares of common stock outstanding as of November 10, 2014 was 531,042,000.

DOCUMENTS INCORPORATED BY REFERENCE

None

Xiangtian (USA) Air Power Co., Ltd.

FORM 10-K

For the Year Ended July 31, 2014

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty.

A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made in this report. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as “may”, “will”, “should”, “plans”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" beginning on page 7, that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The cautions outlined made in this statement and elsewhere in this document should not be construed as complete or exhaustive. In many cases, we cannot predict factors which could cause results to differ materially from those indicated by the forward-looking statements. Additionally, many items or factors that could cause actual results to differ materially from forward-looking statements are beyond our ability to control. The Company will not undertake an obligation to further update or change any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. References to common shares refer to common shares in our capital stock.

In this annual report, “Goa Tours”, “the Company,” “we,” “us,” and “our,” refer to Xiangtian (USA) Air Power Co., Ltd., unless the context otherwise requires. Unless otherwise indicated, the term “fiscal year” refers to our fiscal year ending July 31. Unless otherwise indicated, the term “common stock” refers to shares of the Company’s common stock, par value $0.001 per share.

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to:

| ● | “Xiangtian US,” “Goa Tours,” “Company,” “we,” “us” or “our” are references to the combined business of Xiangtian (USA) Air Power Co., Ltd. and its direct and indirect subsidiaries. |

| ● | “fiscal year” refers to our fiscal year ending July 31. |

| 3 |

| ● | “Xiangtian US,” “Company,” “we,” “us” or “our” do not include the selling stockholders. |

| ● | “U.S. Dollar,” “$” and “US$” means the legal currency of the United States of America. |

| ● | “RMB” means Renminbi, the legal currency of China. |

| ● | “common stock” refers to shares of the Company’s common stock, par value $0.001 per share. |

| ● | “China” or the “PRC” are references to the People’s Republic of China. |

Business Overview

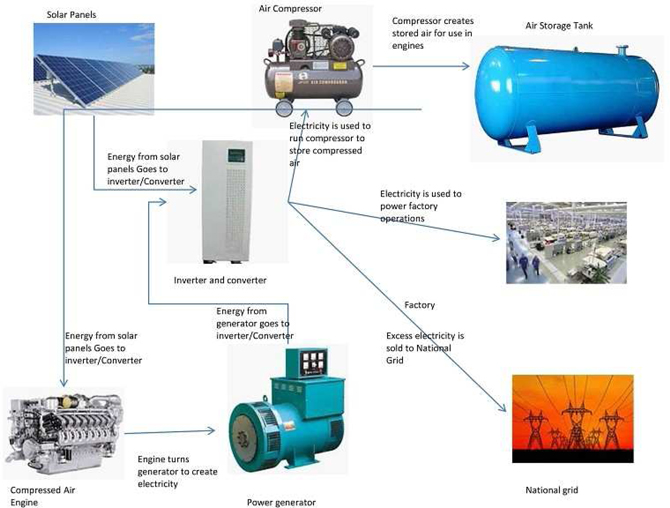

We utilize a proprietary compressed air energy storage power generation technology that can operate in conjunction with electricity produced by other alternative energy sources, such as solar, wind, geothermal, and tidal as raw power to generate additional electricity without the use of fossil fuels. When the alternative energy source is intermittent or unavailable, we believe that our novel approach of releasing the compressed air to operate a compressed air engine linked with a generator and thereby creating electricity provides customers with an advanced power generation capability with no carbon or toxic emissions. The resulting power can either be used for the customer’s operations or for sale to the State Grid Corporation of China (“National Grid”).

Our initial focus is on industrial users. Our first two projects include an installation of photovoltaic solar panels (“PV panels”) in conjunction with our compressed air energy storage technology and consist of an installation at a factory in Shandong Province with a capacity of nine megawatts and a power plant in Hubei Province with a capacity of six megawatts. The installation in Shandong Province commenced production of electricity from the solar panel installation in June 2014, and is currently in the testing stage. The installation in Shandong Province is expected to be completed by December 15, 2014. Completion of the project has been delayed due to the need to change certain equipment and solar panels that did not meet our requirements. The installation in Hubei Province is expected to be completed in January 2015. The delay was due to the bad weather conditions. Sanhe also signed a contract in February 2014 for the design and construction of a generation system for a factory in Sichuan Province but construction has not yet commenced. We are also developing smaller compressed air energy storage power generation equipment for use with PV that will be appropriate for smaller commercial buildings and private homes.

We produce our systems in China primarily for Chinese customers and are also exploring foreign markets. We benefit from the Chinese government’s incentives for the production of green energy. We operate a factory in Hebei province to produce components for the compressed air energy storage power generation systems, but also purchase certain components, such as PV panels and diesel engines from third party suppliers, which we modify to operate with compressed air. We have a distribution network of 60 distributors and sales agencies in 24 provinces in China

Our Business History and Background

Xiangtian (USA) Air Power Co., Ltd. was originally incorporated as Goa Sweet Tours Ltd. in the State of Delaware on September 2, 2008. We were originally formed to provide personalized concierge tour packages to tourists who visit the State of Goa, India. On April 17, 2012, Goa Sweet Tours, Ltd. entered into Share Purchase Agreements (the “Purchase Agreements”), with Luck Sky International Investment Holdings Limited, an entity owned and controlled by Zhou Deng Rong, and certain of our former stockholders who owned, in the aggregate, 7,200,000 shares of our common stock (90% of the then outstanding shares). Luck Sky International Investment Holdings Limited purchased such shares for an aggregate consideration of $235,000. The sale of such shares closed on May 15, 2012.

On May 25, 2012, Goa Sweet Tours, Ltd. formed a corporation under the laws of the State of Delaware called Xiangtian (USA) Air Power Co., Ltd. ("Merger Sub") for the purpose of changing its name. On the same day, we acquired one hundred percent of the total outstanding shares of Merger Sub's common stock for cash. As such, Merger Sub became our wholly-owned subsidiary. Effective as of May 29, 2012, Merger Sub was merged with and into the Company. As a result of the merger, the Company’s corporate name was changed to “Xiangtian (USA) Air Power Co., Ltd.” Prior to the merger, Merger Sub had no liabilities and nominal assets and, as a result of the merger, the separate existence of the Merger Sub ceased. The Company was the surviving corporation in the merger and, except for the name change provided for in the Agreement and Plan of Merger, there was no change in the directors, officers, capital structure or business of the Company.

Lucksky Holding (Group) Co. Ltd (“LuckSky Group”), formerly named Xiangtian Kelitai Air Powered Machinery Co., Ltd.,(“Xiangtian Kelitai”) was established in 2000 by Zhou Deng Rong after he obtained a series of patents and developed the compressed air energy storage and related technology. In 2012, LuckSky Group received proceeds of an offering to Chinese investors by Xiangtian (Beijing) Equity Investment Fund Management Co. Ltd., an unaffiliated entity, which proceeds were used to develop the technologies related to the compressed air energy storage technology and PV panel installations and for operations. The investors received the right to receive equity that was to be exchanged for stock in a United States entity that would own rights to the compressed air energy storage technology. Common equity in Luck Sky (Hong Kong) Shares Limited was issued and upon the merger of Luck Sky (Hong Kong) Shares Limited into the Company in September 2013, the investors became the beneficial holders of 150,000,000 shares of common stock of the Company. On September 24, 2013, the Company acquired all of the shares of common stock of Luck Sky (Hong Kong) Shares Limited for 250,000,000 shares of common stock of the Company.

On May 30, 2014, the Company entered into the Stock Purchase Agreement with Zhou Jian, the sole shareholder of Luck Sky HK. Effective May 30, 2014 the Company purchased 100% of the issued and outstanding shares of common stock of Luck Sky HK, and the Company paid Zhou Jian a purchase price in the amount of HKD $10,000.00 (approximately USD$1,289.98) in cash. Luck Sky HK and Luck Sky Shen Zhen, its subsidiary organized in the PRC, had no operating business, no liabilities and nominal assets as of the date of the acquisition. As a result of the acquisition, Luck Sky HK became our wholly owned subsidiary and Luck Sky Shen Zhen became our indirect subsidiary through Luck Sky HK.

Sanhe was established in July 2013 and was under common control with LuckSky Group. Sanhe had no operating business and no liabilities. On July 18, 2013, Sanhe borrowed RMB7,722,000, pursuant to a loan agreement with Xiangtian Kelitai, a division of LuckSky Group.

During the three months ended June 30, 2014, LuckSky Group provided Sanhe with additional working capital and transferred to Sanhe its assets and liabilities related to the compressed air energy storage power generation technology and PV panel installations, but retained its other assets. On April 1, 2014, LuckSky Group loaned Sanhe RMB3,000,000. In April and May 2014, Sanhe purchased the inventory, the equipment, including machinery, and office equipment from Xiangtian Kelitai at their book or historical values. Sanhe entered into leases with Lucksky Group for a portion of the factory, office space and dormitory located in Sanhe City and a lease with Dong Yi Glass Machine Company Limited, which is owned by Zhou Deng Rong, our former CEO, for a second factory and office space, on May 1, 2014 and April 1, 2014, respectively. Also, 48 employees have transferred from LuckSky Group to Sanhe, including all personnel related to the projects under construction and development and administrative and finance personnel. See “Business-Properties” and “Certain Relationships and Related Party Transactions.”

The Company also owns all of the outstanding stock of LuckSky Holdings Limited, a corporation organized in the British West Indies, which is dormant.

| 4 |

Acquisition of Sanhe

On July 25, 2014, prior to the Acquisition, Sanhe and Luck Sky Shen Zhen and Sanhe’s current shareholders entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Sanhe became Luck Sky Shen Zhen’s contractually controlled affiliate. The purpose and effect of the VIE Agreements is to provide Luck Sky Shen Zhen (our indirect wholly-owned subsidiary) with all of the management, control and net profits of Sanhe. While Luck Sky Shen Zhen does not actually own any of the equity and shares in Sanhe, the purpose and effect of the VIE Agreements is to instill in Luck Sky Shen Zhen total management and voting control of Sanhe for all material purposes. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government.

The VIE Agreements include:

| (1) | Framework Agreement on Business Cooperation, entered between Luck Sky Shen Zhen and Sanhe, pursuant to which Luck Sky Shen Zhen and Sanhe have agreed to enter into a series of VIE agreements and to cooperate in all prospective of Sanhe’s business operation and management; |

| (2) | Exclusive Management, Consulting and Training and Technical Service Agreement, entered between Luck Sky Shen Zhen and Sanhe, pursuant to which Luck Sky Shen Zhen has agreed to provide Sanhe with complete business support and technical support and related management, training and consulting services. In consideration for such services, Luck Sky Shen Zhen is entitled to receive an amount equal to 100% of Sanhe’s net income. |

| (3) | Exclusive Option Agreement, entered among Luck Sky HK, Luck Sky Shen Zhen, Zhou Deng Rong, Zhou Jian and Sanhe, pursuant to which Zhou Deng Rong and Zhou Jian, the owners of Sanhe, have granted to Luck Sky Shen Zhen and Luck Sky HK the irrevocable right and option to acquire all of their equity interests in Sanhe; |

| (4) | Equity Pledge Agreement, entered among Luck Sky Shen Zhen, Zhou Deng Rong, Zhou Jian, and Sanhe, pursuant to which Zhou Deng Rong and Zhou Jian, the owners of Sanhe, have pledged all of their rights, titles and interests in Sanhe to Luck Sky Shen Zhen to guarantee Sanhe’s performance of its obligations under all the other VIE Agreements; |

| (5) | Know-How Sub-License Agreement, entered between Luck Sky Shen Zhen and Sanhe, pursuant to which Luck Sky Shen Zhen has granted Sanhe an exclusive right to use and develop a series of aerodynamics related patents and technologies with respect to electrical generation for commercial and residential structures, not including automobile and wind towers. Luck Sky Shen Zhen possesses the rights licensed under this agreement through two license agreements dated July 25, 2014 with Zhou Deng Rong, Zhou Jian and LuckSky Group, the owners of the aforesaid patents and technologies. For the sublicense contemplated under this Agreement, Sanhe will pay Luck Sky Shen Zhen an annual royalty fee of five percent of revenue; and |

| (6) | Power of Attorney. Pursuant to a power of attorney, each of the Sanhe stockholders agreed to irrevocably entrust Luck Sky Shen Zhen with his stockholder voting rights and other stockholder rights for representing him to exercise such rights at the stockholders’ meeting of Sanhe in accordance with applicable laws and its Article of Association, including, but not limited to, the right to sell or transfer all or any of his equity interest in Sanhe, and appoint and vote for the directors and Chairman of Sanhe as the authorized representative of the Sanhe stockholders. The term of each proxy and voting agreement is as long as each of the Sanhe stockholders is a shareholder of Sanhe and is binding on any transferee. |

The foregoing description of the terms of the Framework Agreement on Business Cooperation, the Exclusive Management Agreement, Consulting and Training and Technical Service Agreement, the Exclusive Option Agreement, the Equity Pledge Agreement, the Know-How Sub-License Agreement and the Power-of- Attorney is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, and 10.6 to this report, respectively, which are incorporated by reference herein.

On July 25, 2014, we agreed to issue 264,850,740 shares and 8,191,260 shares of our common stock to Zhou Jian and Zhou Deng Rong, respectively, the sole shareholders of Sanhe, in consideration for the execution of the VIE Agreements and the Acquisition of Sanhe.

See “Certain Relationships and Related Transactions” for further information on our contractual arrangements with these parties.

Because of the common control between us, LuckSky Shen Zhen and Sanhe, for accounting purposes, the acquisition of these entities has been treated as a combination between entities under common control with no adjustment to the historical basis of their assets and liabilities. Since there is a change of reporting entity after the acquisition takes place, the Company accounts for business combinations pursuant to Accounting Standard Codification (“ASC”) 805-50 which generally requires the entity that receives net assets or equity interests to recognize the carrying amounts of the net assets transferred in its accounting for the combination and to combine the financial statements of the entities under common control for all periods presented and to eliminate any intercompany balances and transactions

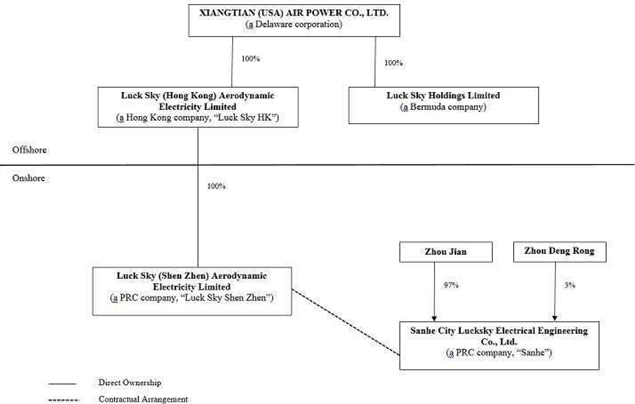

Our Corporate Structure

All of our business operations are conducted through our Hong Kong and Chinese subsidiaries and controlled affiliate. The chart below presents our corporate structure:

| 5 |

Industry Background

Consumption of electricity in China has grown from 3.63 trillion KWh in 2012 to 4.21 Trillion KWh in 2013. In 2011, 69 % of such electricity was produced by coal, 1% by nuclear reactors, 1% by solar energy and other alternative energy sources. Electric consumption is expected to grow to 11,595 KWh by 2040, according to the U.S. Energy Information Administration (http://www.eia.gov/countries/country-data.cfm?fips=CH). Electricity in China is distributed by the National Grid, which is required to purchase electricity

We can use solar energy, wind energy, geothermal energy, tidal energy, water hammer potential energy and all the available natural energy as a raw power in conjunction with our compressed air energy storage technology. The collected mechanical energy from the raw power source is converted into direct current power, and through our ultra-wide band and high-performance power inverter, we produce an output of stable power in compliance with the Chinese national interconnection standards. We are initially producing electricity generation systems that combine our compressed air storage technology with PV panels to achieve continuous supply of power, especially under extreme weather conditions.

We chose to initially utilize PV panels to produce the raw power because China has abundant solar energy resources as many parts of China have long durations of sunshine; and China has vast vacant spaces that are available for the installation of solar energy systems. In 2015, 35 Gigawatts of electricity will be produced by PV panels in China, an increase of 32 Gigawatts from 3 Gigawatts in 2012, according to the U.S. Energy Information Administration (http://www.eia.gov/countries/country-data.cfm?fips=CH). The solar panel industry in China is highly competitive, with around 20 to 30 companies providing installation service and 50 manufacturers. However, we believe that we are the only company that offers an electrical generation system that includes combines compressed air energy storage power generation technology.

The Chinese solar market has grown rapidly since 2012, driven largely by a favorable policy environment intended to meet a greater portion of the country’s growing energy needs from cleaner sources, while also driving demand for domestic solar panel manufacturers. China offers a feed-in-tariff for both utility-scale power plants as well as distributed generation installations. The feed in tariffs for large-scale ground mounted power plants are between 0.9 yuan ($0.14) and 1 yuan ($0.16) per kilowatt-hour (kWh) of energy generated, based on the radiation levels at the location of the plant. Distribution projects get a payment of between 0.62 yuan ($0.10) to 0.78 yuan ($ 0.12) per kWh. These subsidies will be valid for the next 20 years and this is likely to be a positive attribute for project developers such as ourselves, since the subsidies protect the rate of return on their PV projects. China also provides other incentives, including free grid connectivity for small and medium-scale distributed PV solar power producers.

Our Competitive Advantages

We believe that we possess the following competitive advantages that allow us to maintain our strong market position and will aid our profit growth in the future:

Environmental Protection: We believe that our compressed air energy storage power generation offers a unique approach to generating electricity without producing pollutants associated with burning fossil fuels and when alternative energy sources are intermittent or insufficient. When the alternate energy system, such as PV panels or wind, are unstable and fluctuate, the compressed air power generation system will start and ensure a stable power supply. In addition, a one megawatt system cleans air by compressing 200,000 square meters of air per hour thereby removing dust and other particles that can later be removed from the compressed air storage tank.

Patent Protection: Zhou Deng Rong, our former Chief Executive Officer, and Zhou Jian, our Chief Executive Officer and President, respectively, and LuckSky Group are the holders of 48 patents and 13 patent applications with respect to various aspects of the compressed air energy storage power generation technology, including improvements to the solar power generation system, the installation of solar energy systems, the inverters, and generators. The patents, patent applications and related know-how and trade secrets are subject to an exclusive license to Luck Sky Shen Zhen, our indirect wholly-owned subsidiary.

Government Incentives: The development of alternative sources of energy to reduce the amount of pollution in China caused by burning fossil fuels, particularly the use of coal to generate electric power, is a priority of the Chinese government. The Chinese government offers tax and rebate incentives for the construction of PV production facilities and has become stricter regarding the construction of power plants that rely on coal.

Technical Advantage Compared to Conventional Battery Technologies: The use of conventional batteries to store excess electricity produced by solar power or other alternative energy sources is less attractive than the compressed air energy storage power generation technology. The most important disadvantages to standard batteries are that industrial batteries lose their capacity to store electricity over time and also present environmental risks with respect to their production and disposal.

| 6 |

Technical Advantage Compare to Conventional Solar Panels and Inverter/Converters: Our patented technologies increase the efficiency of PV panels to generate DC current by enhancing their ability to operate at levels of lower sunlight and also increase the efficiency of the inverter/converter that converts the DC current to AC current by operating at a wider range of DC current than conventional inverter/converters.

Reduced Electrical Costs: Customers who generate electricity using alternate energy systems that is intermittent or subject to periods of low production need to be linked to the National Grid to meet their power requirements. Our compressed air energy storage power generation system allows consumers to limit or eliminate their reliance on the National Grid; by producing power during periods of peak pricing by the National Grid and storing the surplus energy produced by their alternate energy systems when prices charged by the National Grid are less expensive.

Scalability: The compressed air energy storage power generation system in conjunction with a PV panel installation is easily expanded thru the addition of additional solar panels, more storage tanks and/or bigger generators and engines.

Our Growth Strategy

Chinese demand for electricity is expected to increase by nearly 300 % between 2010 and 2040 according to the U.S. Energy Information Administration (http://www.eia.gov/countries/country-data.cfm?fips=CH). We believe demand for electricity and solar energy production will continue to grow domestically and globally, thus affording us opportunity to grow and expand our business operations

We intend to pursue the following strategies to achieve our goal:

| 1) | Sell systems to construct large-scale power plants that sell power to the National Grid or service zones that are off the grid and benefit from government subsidy policies. |

| 2) | Sell systems to industrial consumers with large electricity demand, in excess of one megawatt, to establish their own power generation facilities to benefit from government subsidy polices to reduce operating costs by either being off the National Grid, reducing their purchased from the grid during peak periods or being able to store energy when the grid is not purchasing power. |

| 3) | Sell systems to industrial and mining companies operating in remote locations which lack connections to the National Grid to create self- sufficient systems. |

| 4) | Complete development of prototypes and commercialize smaller air compression power generation systems designed for standalone homes and smaller factories and commercial structures. |

Products

Our principal product is a system that combines our air compression power generation systems with a PV installation that is custom designed for industrial users such as factories and power plants. We also offer PV systems without the air compression generation technology based on certain technological innovations that we believe increase the efficiency of our PV systems compared to those of competitors.

The air compression power generation systems can be used with multiple forms of natural energy production, including solar, wind, biomass, geothermal and tidal and the selection of the appropriate natural source depends on their relative availability at the customer’s location. Although use of any of these natural energy sources is feasible, we have initially focused on linking our air compression technology to PV installations The installation of the solar power systems generally requires the lowest investment and shortest building time, in part because the area for building the facility is flexible as solar installations can be used anywhere outdoors and take advantage of a customer’s room. Wind power is not stable as the turbines may be inoperable at low or high winds. Nuclear and hydropower facilities are only feasible for producing power for the National Grid and are not feasible for individual factories and homes

1. Basic PV Installation Our basic PV installation includes the solar panels installation and solar energy generation converter equipment with proprietary technology with the ability to convert the DC power produced by the solar panels into up to 30% more AC power than conventional converters because of its ability to operate in lower light environments. The product is designed for customers who do not need to store energy, because their facilities only operate in day time. The conversion advantage provides a higher capacity that allows the solar array to be used more effectively, thereby allowing us to sell larger systems measured in terms of the AC current capacity at a more competitive price.

2. Energy Storage Our air compression energy storage generation technology is designed for customers whose alternative energy source provides intermittent or unstable power. The systems are currently sold in conjunction with a PV installation. A portion of the electricity produced by the PV panels is used to compress air into the cylinders, which effectively store the energy until it is released. The system includes compression equipment, storage tanks and a modified engine that is linked to a generator. The surplus power generated by the air compression technology may either be used by the customer it its operations or sold to the National Grid.

The following chart illustrates an air compression power generation system that is linked with a PV installation, although the compression system can be linked to other alternative energy sources, such as wind farms, biomass, tidal or geothermal.

| 7 |

| 8 |

Electricity Generation Process

| 1. | Energy collection – photovoltaic power generation. |

We install PV systems on the clients’ roofs to generate the initial source of electricity. Our proprietary technology increases the efficiency of the PV panels. In a traditional system, weaker, more indirect sunlight reduced the pressure (voltage) and the PV panels become less efficient or stop working. Our installation of the PV panels in conjunction with the inverter/converter increases the utilization of the PV panels to increase the system’s efficiency. Our system allows the panels to function wither in series or in parallel to operate more efficiently in lower light, such as earlier or later in the day and on cloudy days. While the cost of our equipment is higher per watt than competitive products, our systems can work more efficiently for additional hours per day, and increasing the efficiency of the PV panels. Each one megawatt system utilizes 6700 square meters of PV panels.

The system offers double power selection by utilizing a backup switch to ensure that the power supply does not stop. Should the generation of the solar power become unstable or intermittent, the system is switch to operate using the air compression generation technology or, if available, to rely on the National Grid.

| 2. | Inverter/Converter |

The inverter/converter regulates the voltage so it is produced at a constant level and converts the DC current generated by the PV system to 110 or 220 volts of AC current. Our patented technology permits our inverter to run on a wider range DC current than commonly used inverter/converters. Under low light or diminished light due to cloud cover, most PV systems have reduced capabilities or are unable to convert the energy to electricity. Our product allows the system to convert electricity from AC to DC when there is low light or diminished light due to cloud cover or due to the time of day, thus providing an increase in usage of up to 30%.

| 3. | Compression Storage System |

A. Compressor – fills storage tanks with air.

B. Plasma Heater – heats air being stored into tanks to a temperature of 300 to 400 degrees Fahrenheit to increase the amount of stored energy.

C. Storage Tanks – stores compressed air. Our storage tanks are built with carbon steel to withstand higher pressures. Each one megawatt of generated electricity requires 2 tanks, each with an average capacity of 30 m3 of compressed air. The energy capacity per tank is dependent on the temperature and pressure of the air and the capacity of the e cylinder. The quality of the storage tanks are based on ISO standards.

D. Air Engine – we utilize our patented technology to modify diesel engines purchased from outside vendors to enable the engine to operate on compressed air. A pressure regulator within the air engine turns the generator. Unlike a conventional combustion engine that explodes fossil fuel to create energy, the compressed air engine utilizes the heat and compression of the air to release energy.

E. Generator – Our proprietary generator utilizes patented and other proprietary technology was developed in 2012 for our air compression storage generation system. The device affords stability by maintaining a consistent supply despite changes in the air pressure that may cause inefficiency in the engine (for example, a piston misfiring). Our tests indicated that the generator is more efficient that the industry standard in maintaining a stable flow of voltage.

The air compression technology is used to produce electricity primarily at night or at other times when the electricity produced by the PV panels is intermittent or unstable. At such times, the compressed air is sent first from the storage tanks to the thermal heater, then to the engine. The engine then spins a flywheel attached to the generator.

New Products

We have completed a prototype for a smaller generator suitable for smaller factories and standalone home. The product will be most appropriate for home in rural areas which are stand alone and have sufficient space for the installation of solar panels, as compared to urban multi-family buildings which have smaller roofs per resident and are more likely to have insufficient space for sufficient solar panels. We will focus on newer buildings as many existing structures cannot handle the weight of the PV installation. One market approach under consideration is to target customer will be local governments to attempt to get them to require the systems in new contraction. The product will come in three capacities: 20, 50 and 100 kilowatts. We believe that a 20 kilowatt generator is sufficient for a smaller home. We expect to commence marketing the product in 2015, initially utilizing the same sales agents as are currently marketing our products for larger industrial concerns.

Sales Contracts

We have two projects under construction and one project that is under contract but not otherwise commenced to sell compressed air energy storage power generation systems in conjunction with a PV panel installation. The contracts typically provide for payments in installments, with approximately 35% paid upon the commencement of construction, and the balance in two equal installments approximately 6 and 18 months later.

In Shandong Province, we are designing and installing a new power supply system with a capacity of nine megawatts (the “Haide Group Project”). Pursuant to an agreement executed by Sanhe with Bing Zhou Xin Tuo Natural Energy Electrical Engineering Limited (“Bing Zhou Xin Tuo”) on April 18, 2014, Sanhe will transfer the Haide Group Project in turn-key condition to Bing Zhou Xin Tuo after the completion of the installation and construction. The project began to produce electricity from the PV panels in June 2014 and the entire project is expected to be completed by December 15, 2014. The project has been delayed due to the need to change certain equipment and solar panels that did not meet our requirements. The sale price for the project is RMB126,000,000. For the Haide Group Project, we have executed a purchase contract for the PV panels with Shandong TD Solar Company Limited, who also installs the PV panels and equipment.

In Hubei province, construction was expected to commence in August 2014 on a six megawatt project at a new power plant (the “Hubei Xianning Project”). Because of weather conditions, the construction has been delayed but is expected to be completed by January 2015. Sanhe executed a contract with Xianning Xiangtian Air Energy Electric Company on April 25, 2014, pursuant to which Sanhe will be responsible for designing, installing and constructing the project and such project will be transferred to Xianning Xiangtian Air Energy Electric Limited Liability Company in turn-key condition. The project is anticipated to begin producing electricity two months after the commencement of the construction. The sale price for the project is RMB84, 000,000. For the Hubei Xianning Project, we have executed a contract with, Zhejiang Bowei Industrial and Trading Co., Ltd., a supplier of PV panels and such supplier has engaged a third-party contractor to provide the installation service. The facility has room for expansion should the parties agree to increase the power plant’s capacity.

Sanhe also signed a contract with Deyang Zhenlin Technology Co., Ltd. for the design and construction of a compressed air energy storage power generation system in conjunction with a PV panel installation for a factory in Sichuan province on February 28, 2014. The capacity of the project is 3.5 megawatts. The purchase price is RMB25, 500,000. We are now in the process of the approval procedures, and the construction has not commenced. The contract provides for construction to be completed by August 1, 2014, but also provides that Deyang Zhenlin Technology Co., Ltd. has waived any and all claims against Sanhe if the construction is not completed by such date. We are uncertain as to when the construction will be commenced as it depends on how soon the government approvals will be obtained, however we anticipate commencing construction in the first quarter of 2015.

| 9 |

Marketing

We market our products through approximately 60 distributors in 24 Provinces and through a team of employees for direct sales. The agents exclusively sell our products and receive commissions based on the value of the contracts. We utilize three classes of agents based on the size of their territory – provincial, city and town. The agents target both factories and power plants, but also local governments which may encourage local industry to utilize alternate energy sources. Our marketing focus is on:

| 1) | Large scale power plants that sell power to the National Grid or service zones that are off the grid and benefit from government subsidy policies. |

| 2) | Industrial concerns with large electricity demand, in excess of one megawatt, to establish their own power generation facilities to benefit from government subsidy police to reduce operating costs by either being off the National Grid, reducing their purchased from the grid during peak periods or being able to store energy when the grid is not purchasing power. |

| 3) | Industrial and mining companies operating in remote locations which lack connections to the National Grid to create self-sufficient systems. |

In 2015, we intend to commence marketing a smaller air energy compression generation and PV system to smaller commercial structures and stand- alone homes using the same distribution network.

Manufacturing

We produce and assemble our PV installations and air energy compression generation systems at our factory in Sanhe. We produce many components, including the brackets and supports for the PV panels, an ultra-wideband voltage power inverter and converter, parts to modify the engines to operate using air compression, low-speed aerodynamic generators, and isothermal air compressor and thermal heaters. Other parts, such as solar panels, power cords, engines, carbon fiber tanks and generators and compressors are purchased from third parties and used to assemble our systems.

Our factory is based in Hebei Province Sanhe City, Yanjiao Economic Development Zone, with a production workshop of 7500 square meters for our core-technology equipment that can supply solar energy systems. We produce the engine generators and related components, but not the PV panels. The factory has a total capacity of up to 7 megawatts each month, based on one –eight hour shift working six days per week. Capacity can readily be expanded by adding additional shifts or building up to three more production lines at our facility.

Suppliers

We are not dependent on any single supplier for any important product. We purchase our solar panels, engines, and carbon fiber storage tanks, each from at least one supplier for each product. We have a good relationship with each supplier. We believe that many suitable alternate producers of these products are available should we need an alternate supplier. We also purchase electrical components to the inverter/converters, generators, compressors and control panels that we manufacture and believe that alternate suppliers of such components are also readily available.

Patents and Technology

LuckSky Shen Zhen has an exclusive, worldwide, royalty free license from Zhou Deng Rong, Zhou Jian and LuckSky Group to 48 Chinese patents and 13 patent applications and related know how and trade secrets, including the technology underlying the patent applications for power stations, commercial structures and residences, but not for other uses, including wind towers, vehicles and trains. (the “Technology”) that was executed in July 2014. The Technology represents all of the patents, patent applications and related know how and trade secrets owned by the licensors with respect to PV installations and the air energy storage power generation technology. Of the 48 Chinese Patents, we are in the process of applying for international patents for three patents with pending applications in six foreign countries. Luck Sky Shen Zhen has granted Sanhe an exclusive, sub-license in July 2014 with respect to the use of the Technology. The sublicense provides for a royalty payment of five percent of Sanhe’s revenues.

Research and Development

Our Technology was developed principally by Zhou Deng Rong over 10 years. Sanhe has no research and development staff. Sanhe obtains the legal right to use and develop the Technology through entering into an Agreement on Know-How Sub-Licensing on July 25, 2014 with Luck Sky Shen Zhen, and Luck Sky Shen Zhen was granted a license to use and sublease the Technology through licensing agreements with Zhou Deng Rong, Zhou Jian, and LuckSky Group, owners of the Technology. LuckSky Group has approximately 10 employees performing research and development and we had relied on LuckSky Group for research and development. We recently established a research and development department with 11 employees.

Warranty

We provide a five year limited warranty on all models of compressed air energy generators produced by us, and on the parts we manufacture, such as the inverter/converter and plasma heater. Components that we purchase from third party suppliers, such as the PV panels, storage tanks and the unmodified portions of the engines, are governed by the suppliers’ warranties.

Competition

We compete against larger, better capitalized and better known competitors that have become, or are becoming, vertically integrated in the PV industry value chain, from module manufacturing to PV system sales and installation, such as Yingli Green Energy, one of the largest vertically integrated PV module suppliers in the world. The ability of the vertically integrated competitors to produce modules and sometimes also be polysilicon manufacturers gives them a cost advantage with respect to the price of PV modules, which we purchase, and which could erode our competitive advantage resulting from our PV installation and air compression technologies. Furthermore, we face competition from conventional energy and non-solar renewable energy providers.

With respect to large integrated PV system projects, we compete primarily in terms of price, design and construction experience, aesthetics and conversion efficiency. We face competition from other providers of renewable energy solutions, including developers of PV, solar thermal and concentrated solar power systems, and developers of other forms of renewable energy projects, including wind, hydropower, geothermal, biomass, and tidal. We also face competition from other EPC companies and joint venture type arrangements between EPC companies and solar companies. While the decline in PV modules prices over the last several years has increased demand in solar electricity worldwide, competition at the systems level can be intense, thereby exerting downward pressure on systems level profit margins industry-wide, to the extent competitors are willing and able to bid aggressively low prices for new projects and power purchase agreements, or PPAs, using low cost assumptions for modules, components, installation, maintenance and other costs. We face intense competition in the PV system markets and our PV and compressed air energy generation systems compete with different solar energy systems as well as other renewable energy sources in the alternative energy market.”

Also, air power technologies are being developed in Italy, Germany, the United Stated, and France.

| 10 |

Environmental Matters

We have installed various types of anti-pollution equipment in our facilities to reduce, treat, and where feasible, recycle the wastes generated in our manufacturing process. The most significant environmental contaminant we generate is waste water. We have built special facilities to filter and treat waste water generated in our production process and recycle the water back into our production process. The other major environmental contaminant we generate is gaseous waste. We treat such gas in our special facilities to reduce the contaminant level to below the applicable environmental protection standard before discharging the gas into the atmosphere. Our operations are subject to regulation and periodic monitoring by local environmental protection authorities. The Chinese national and local environmental laws and regulations impose fees for the discharge of waste substances above prescribed levels, impose fines for serious violations and provide that the Chinese national and local governments may at their own discretion close or suspend the operation of any facility that fails to comply with orders requiring it to cease or remedy operations causing environmental damage.

In May 2014, as required by PRC law, we obtained the Environmental Assessment Report on Construction Projects for the manufacturing space that we lease from Dong Yi Glass Machine Company Limited, which is used as our second factory and offices. This report was issued by an independent qualified evaluation company with a conclusion that the operations conducted by Sanhe comply with relevant environmental laws in China, which will not cause detrimental environmental impacts. However, since our primary manufacturing and office space leased from LuckSky Group in Sanhe City has a zoning restriction that only permits agricultural use, we are still in the process of obtaining the approval for the manufacturing use.

No penalties have been imposed on us or our subsidiaries, and we believe we are currently in compliance with present environmental protection requirements in all material respects, and have obtained or been in the process of obtaining all necessary environmental permits for our production facility. We are not aware of any pending or threatened environmental investigation proceeding or action by any governmental agency or third party.

Insurance

We do not maintain an insurance policy covering losses due to fire, earthquake, flood and a wide range of other natural disasters. We do not maintain product liability insurance coverage. We maintain insurance policy covering two vehicles owned by Sanhe for its business operations. See “Risk Factors – Risks Related to Lack of Product Liability Insurance.”

PRC Governmental Regulations

This section sets forth a summary of the most significant regulations or requirements that affect our business activities in China. Other regulations and requirements, such as those relating to foreign currency exchange, dividend distribution, regulation of foreign exchange in certain onshore and offshore transactions, and regulations of overseas listings, may affect our shareholders’ right to receive dividends and other distributions from us.

Renewable Energy Law and Other Government Directives

In February 2005, China enacted its Renewable Energy Law, which became effective on January 1, 2006, or the 2006 Renewable Energy Law. The 2006 Renewable Energy Law sets forth the national policy to encourage and support the use of solar and other renewable energy and the use of on-grid generation. On December 26, 2009, the Standing Committee of the National People’s Congress adopted an amendment to the 2006 Renewable Energy Law, or the Amended Renewable Energy Law, which became effective on April 1, 2010. While the 2006 Renewable Energy Law has laid the legal foundation for developing renewable energy in China, the Amended Renewable Energy Law has introduced practical implementing measures to enhance such development.

The Amended Renewable Energy Law details the principles, main content and key issues of the renewable energy development and utilization plans, further elaborates the requirements for grid companies to purchase the full amount of electricity generated from renewable energy by setting out the responsibilities and obligations of the government, the power companies and the grid companies, respectively, and also clarifies that the state will set up a special fund, referred to as the renewable energy development fund, to compensate the difference between the tariff for electricity generated from renewable energy and that generated from conventional energy sources. The proceeds of the renewable energy development fund may also be used to support renewable energy scientific research, finance rural clean energy projects, build independent power systems in remote areas and islands, and build information networks to exploit renewable energy. It is anticipated that China will publish more detailed implementing rules for the Amended Renewable Energy Law and make corresponding changes to those existing implementing rules relating to renewable energy.

The current rebates available for our customers include a rebate of 0.42 RMB per kilowatt for 20 years for factories and 1 RMB per kilowatt for 20 years for power plants.

China’s Ministry of Construction issued a directive in June of 2005, which seeks to expand the use of solar energy in residential and commercial buildings and encourages the increased application of solar energy in townships. In addition, China’s State Council promulgated a directive in June of 2005, which sets forth specific measures to conserve energy resources and encourage exploration, development and use of solar energy in China’s western areas, which are not fully connected to electricity transmission grids, and other rural areas. In July 2007, the PRC State Electricity Regulatory Commission issued the Supervision Regulations on the Purchase of All Renewable Energy by Power Grid Enterprises which became effective on September 1, 2007. To promote the use of renewable energy for power generation, the regulations require that electricity grid enterprises must in a timely manner set up connections between the grids and renewable power generation systems and purchase all the electricity generated by renewable power generation systems. The regulations also provide that power dispatch institutions shall give priority to renewable power generation companies in respect of power dispatch services provision.

On August 31, 2007, the NDRC implemented the National Medium- and Long-Term Programs for Renewable Energy, or MLPRE, which highlights the government’s long-term commitment to the development of renewable energy.

On April 1, 2008, the PRC Energy Conservation Law came into effect. Among other objectives, this law encourages the utilization and installation of solar power facilities in buildings for energy-efficiency purposes.

On March 23, 2009, the MOF, issued the Provisional Measures for Administration of Government Subsidy Funds for Application of Solar Photovoltaic Technology in Building Construction, which outline a subsidy program dedicated to rooftop PV systems with a minimum capacity of 50 kilowatt-peak.

In July 2010, the Ministry of Housing and Urban-Rural Development issued the “City Illumination Administration Provisions” or the Illumination Provision. The Illumination Provisions encourage the installation and use of renewable energy system such as PV systems in the process of construction and re- construction of city illumination projects.

On July 24, 2011, the NDRC issued the Notice on Improving the On-grid Tariff Policy for Photovoltaic Generation. Under this Notice, it is required that a uniform national benchmark on-grid tariff for solar energy photovoltaic generation be formulated. Furthermore, for PV projects that had been approved before July 1, 2011 and would be completed by December 31, 2011, the feed-in tariff would be RMB1.15/kWh, including value-added tax, or VAT. Except for PV projects that are constructed in Tibet, for PV projects that are approved after July 1, 2011 and PV projects that had been approved before July 1, 2011 but would not be completed by December 31, 2011, the feed-in tariff including VAT would be RMB1/kWh.

On March 14, 2012, the MOF, the NDRC and the National Energy Administration, or the NEA, jointly issued interim measures for the management of additional subsidies for renewable-energy power prices, according to which relevant renewable-energy power generation enterprises are entitled to apply for subsidies for their renewable power generation projects that satisfy relevant requirements set forth in the measures.

On January 1, 2013, the State Council adopted a Circular on the Twelfth Five-Year Plan for the Energy Development, which sets out key development objectives for the industry during the 12th Five-Year Plan. In accordance with this plan, to optimize the structure of energy consumption, the proportion of non- fossil energy consumption shall be increased to 11.4 percent of total energy consumption by 2015.

In March 2013, NDRC issued the Notice on Improving the Pricing Scheme for Photovoltaic Power Generation. According to this notice, the NDRC proposed to reduce the feed-in tariff for utility scale PV projects from RMB 1/kWh to RMB 0.75/kWh, RMB 0.85/kWh and RMB 0.95/kWh, depending on the project’s location of construction. The feed-in tariff for PV projects constructed in specific regions would remain at RMB 1/kWh. In addition, the NDRC proposed a subsidy of RMB 0.35/kWh for distributed PV generation projects and the purchase price of electricity generated to be in line with the coal-electricity tariffs.

| 11 |

In March 2013, NDRC, the NEA and the MOF, jointly issued measures to standardize settlement of feed-in tariffs, which are believed to help address the delay in payment of solar subsidies and settlement of accounts payable experienced by solar project developers. In addition, pursuant to a July 2013 MOF notice, starting from August 2013, subsidies for distributed PV power generation stations (excluding distributed PV power generation projects) are required to be paid directly from the MOF to the State Grid Corporation of China and the China Southern Power Grid Co., Ltd., rather than through the MOF’s provincial counterparts. As a result of such measures, the collection period for feed-in-tariffs is expected to be significantly shortened.

The MOF has proposed to almost double the renewable energy surcharge for end-users of electricity from RMB0.008 per kWh to RMB0.015 per kWh, effective since September 25, 2013.

On August 26, 2013, the Department of Price of the NDRC released subsidy details for PV projects. Transmission-grid-connected projects will receive a feed-in-tariff of RMB0.90 to RMB1.00 per kWh, and distribution-grid-connected projects will receive a premium of RMB0.42 per kWh in addition to the desulphurized coal benchmark price. Distribution-grid-connected projects are expected to represent the majority of China’s new PV installation in the next few years. Unlike the rest of the world, capital expenditures for distribution-grid-connected projects are higher than transmission-grid-connected projects, since labor costs for scaffolding and work on rooftops are low in China and rooftop space is currently free. Meanwhile, the NDRC announced that the feed-in tariff will be valid, in principle, for 20 years.

On September 23, 2013, the MOF and the State Administration of Taxation jointly issued a notice that ordered a 50% refund of value-added tax on sales by PV manufacturers of their PV products. This VAT refund will be effective from October 1, 2013 through December 31, 2015.

On November 26, 2013, the MOF announced that the electricity generated by the distributed PV system for its own use is exempted from paying four governmental charges. On the same date, the NEA promulgated the “Interim Measures for the Administration of PV Power Generation.”, which clarify that the state department in charge of energy and its local counterparts are responsible for the supervision of PV projects.

On February 12, 2014, the NEA circulated the target of national solar installations for 2014 to be 14GW, 6GW of which would be targeted for utility scale, 8GW for distributed generation.

On the same day, the NEA released a list of 81 “New Energy Demonstration Cities” and eight “industrial demonstration parks” in 28 and 8 provinces respectively. These cities and zones are required to achieve their respective mandatory targets in terms of solar PV installations and the percentage of installed renewable energy power generation capacities by the end of 2015, or the end of the 12th Five-Year-Plan.

In February 2014, the Certification and Accreditation Administration and the NEA jointly issued the “Implementation Opinions on Strengthening the Testing and Certification of PV Products.” The implementation opinions provide that only certified PV products may be connected to the public grid or receive government subsidies. The institutions that certify PV products must be approved by the Certification and Accreditation Administration. According to the implementation opinions, PV products that are subject to certification include PV battery parts, inverters, control devices, confluence devices, energy storage devices and independent PV systems.

Environmental Regulations

We are subject to a variety of governmental regulations related to the storage, use and disposal of hazardous materials. The major environmental regulations applicable to us include the Environmental Protection Law of the PRC, the Law of the PRC on the Prevention and Control of Water Pollution and its implementation rules, the Law of the PRC on the Prevention and Control of Air Pollution and its implementation rules, the Law of PRC on the Prevention and Control of Solid Waste Pollution and the Law of the PRC on the Prevention and Control of Noise Pollution and the PRC Law on Appraising Environment Impacts.

In addition, under the Environmental Protection Law of the PRC, the Ministry of Environmental Protection sets national pollutant emission standards. However, provincial governments may set stricter local standards, which are required to be registered at the State Administration for Environmental Protection. Enterprises are required to comply with the stricter of the two standards.

The relevant laws and regulations generally impose discharge fees based on the level of emission of pollutants. These laws and regulations also impose fines for violations of laws, regulations or decrees and provide for possible closure by the central or local government of any enterprise which fails to comply with orders requiring it to rectify the activities causing environmental damage.

We have filed all documents required by the government in order to obtain the environmental certification related to our manufacturing process. We are permitted to continue production while we await the permit.

Product Quality Certification

Our air energy storage power generation products require certification by the National quality Supervision Department. As our air compression products are nonstandard, there is no ISO or other qualifying standard for the industry. The certification is therefore based on our design specifications. We have provided the government with our design specifications and begun discussions with the standard. We believe that there is no material risk that the government will not accept our product as the government is encouraging new technology in power generation.

Employees

We set out below the total number of our employees and the various functions which they serve as at July 31, 2014.

| Functions | ||||

| Sales, Purchasing and Marketing | 5 | |||

| Finance and Administration | 9 | |||

| Production, Research & Development and Quality Control | 68 | |||

| TOTAL | 82 |

All of our employees are based in the PRC. Our PRC permanent employees are not unionized. We have not experienced any strikes, labor disputes or work stoppages by our employees and believe our relationship with our employees is good.

Seasonality

Our business is not seasonal, except to the extent that construction projects in northern China are more likely to be delayed by weather.

Website Access to our SEC Reports

You may obtain a copy of the following reports, free of charge through the SEC’s website at www.sec.gov as soon as reasonably practicable after electronically filing them with, or furnishing them to, the SEC: our previous Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

The public may also read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The Public Reference Room may be contact at (800) SEC-0330. You may also access our other reports via that link to the SEC website.

| 12 |

You should carefully consider the risks described below, which constitute all of the material risks facing us. If any of the following risks actually occur, our business could be harmed. You should also refer to the other information about us contained in this Report including our financial statements and released notes.

Risks Related to our Business

We Have A Limited Operating History.

The Company has a limited history with respect to the manufacture, sale and distribution of air energy compression generation systems and PV installations. To date, we have commenced the installation of two systems and in the process of designing a third system. Our ability to achieve profitability and positive cash flow over time will be dependent upon, among other things, its ability to manufacture and market our products and maintain our technological competitiveness despite limited prior experience.

Our Products Have Not Been Proven Commercially.

While our air energy storage power generation technology has been thoroughly tested, we are currently constructing and installing our first two systems. We have not tested the technology on the scale of these systems. There can be no assurance that there will not be unexpected difficulties which will require additional resources to solve and delay our growth.

Our Business is Heavily Dependent on the Economic Growth of China.

Demand for our products substantially depends on the general economic conditions in China. Our projects generally require significant upfront capital expenditures, and our customers may rely on internally generated funds or on financing for the purchase of our systems. As a result of weakened macroeconomic conditions and in particular the adverse credit market conditions, our customers may experience difficulty in generating capital or in obtaining financing on attractive terms or at all. To the extent that any of the foregoing should occur, our revenues and our growth could be adversely affected.

We may be unable to maintain internal funds or obtain financing in the future.

Adequate financing is one of the major factors that can affect our ability to execute our business plan. We intend to finance our business mainly through internal funds, bank loans or raising equity funds. There is no guarantee that we will always have internal funds available for future developments or we will not experience difficulties in obtaining financing and obtaining credit facilities granted by financial institutions in the future. In addition, there may be a delay in equity fundraising activities. We may not be able to secure additional sources of financing on commercially acceptable terms, if at all. If we cannot raise additional capital on acceptable terms, we may not be able to develop or enhance our products, take advantage of future opportunities or respond to competitive pressures or unanticipated requirements. To fully realize our business objectives and potential, we may require additional financing. Additional financing may be debt, equity or a combination of debt and equity. If equity is used, it could result in significant dilution to our shareholders.

A Substantial Increase in the Cost of Solar Panels Could Adversely Affect our Growth.

We rely on third parties to supply our solar panels. Some of our competitors are vertically integrated and produce their own, giving them a cost advantage which limits the advantage of our solar installation and air energy storage power generation technologies. In addition, solar panels are in ample supply due to increased capacity, particularly in China, in recent years. A shortage of supply could result in increased costs and increase the cost advantage of our vertically integrated competitors.

There Is Doubt About Our Ability To Continue As A Going Concern Due To Recurring Losses From Operations, Accumulated Deficit And Insufficient Cash Resources To Meet Our Business Objectives, All Of Which Means That We May Not Be Able To Continue Operations.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. The Company has incurred losses since its inception resulting in an accumulated deficit of $862,221 as of July 31, 2014 and $556,788 in cash and $23,791 in receivables at July 31, 2014. F-further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due. The Company expects to finance operations primarily through cash flow from revenue and capital contributions from principal shareholders. In the event that we require additional funding to finance the growth of the Company’s current and expected future operations as well as to achieve our strategic objectives, our principal shareholders have indicated the intent and ability to provide additional equity financing.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s continuation as a going concern is dependent on our ability to meet obligations as they become due and to obtain additional equity or alternative financing required to fund operations until sufficient sources of recurring revenues can be generated. There can be no assurance that the Company will be successful in its plans described above or in attracting equity or alternative financing on acceptable terms, or if at all

We are dependent on our Executive Officers. Any loss in their services without suitable replacement may adversely affect our operations.

Our success has been largely due to the contribution of Zhou Deng Rong, the founder of our Company, however, Mr. Zhou resigned as our Chief Executive Officer, Chief Financial Officer and Chairman and as Sanhe’s General Manager and Director, in July 2014, Zhou Jian, his son, replaced him as Chairman. Zhiqi Zhang, the Company’s outside general counsel, replaced him as Chief Executive Officer. In July 2014, we also engaged Roy Thomas Philips as our Chief Operating Officer and Acting Chief Financial Officer. Our continued success is dependent, to a large extent, on our ability to retain their services.

The continued success of our business is also dependent on our key management and operational personnel. We rely on their experience in the alternate energy industry, product development, sales and marketing and on their relationships with our customers and suppliers.

The loss of the services of any of our executive directors or executive officers without suitable replacement or the inability to attract and retain qualified personnel will adversely affect our operations and hence, our revenue and profits.

If We Do Not Manage Our Growth, We May Not Be Able to Operate Our Business Effectively

We expect significant expansion will be required to address potential growth in our customer base, the breadth of our service offerings, and other opportunities. This expansion could strain our management, operations, systems and financial resources. To manage any future growth of our operations and personnel, we must improve and effectively utilize operational, management, marketing and financial systems and successfully recruit, hire, train and manage personnel and maintain close coordination among our technical, finance, marketing, sales and recruitment staffs. We also will need to manage an increasing number of complex relationships with customers, strategic partners, advertisers and other third parties. Our failure to manage growth could disrupt our operations and ultimately prevent us from generating the revenue we expect.

Risks Related to Protection and Infringement of Intellectual Property Rights

Our ability to compete depends, in part, on our ability to obtain and enforce intellectual property protection for our technology in China and internationally. We currently rely primarily on a combination of trade secrets, patents, copyrights, trademarks and licenses to protect our intellectually property. If we fail to enforce our intellectual property rights, our businesses may suffer. We, or our suppliers, may be subject to third-party claims of infringement on intellectual property rights. These claims, if successful, may require us to redesign affected products, enter into costly settlement or license agreements, pay damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our products.

| 13 |

Risks Related to Lack of Product Liability Insurance.

We may be held liable if any product we or our suppliers develop causes injury. We do not have product liability insurance. If we choose to obtain product liability insurance but cannot obtain sufficient insurance coverage at an acceptable cost or otherwise protect against potential product liability claims, the commercialization of products that we develop may be prevented or inhibited. If we are sued for any injury caused by its products, our liability could exceed our total assets.

If We Are Unable To Continue To Operate In Our Facilitates, Our Operations Could Be Adversely Affected

The land on which our factory, office and dormitory in Sanhe City are located is designated for agricultural use, and not for office, factory and dormitory space. We are in the process of applying for the land use approval. If we are not able to obtain the land use approval to use the land as our manufacturing facility, we will not be able to obtain the environmental assessment report and permits that are necessary for our operations. In the event that we are unable to use the space due to the failure of obtaining the land use approval and the environmental report and permits, we intend to move our operations to the facility currently leased from Sanhe Dong Yi Glass Machine Company Limited. In the event we are unable to use our principal factory and office space as a result of this usage issue, the lease provides that LuckSky Group will use every effort to complete and perfect the ownership and usage rights, or provide Sanhe with equivalent space. However, such a move would be potentially costly and disruptive.

Risks Related to our Securities

Our Common Stock Is A "Penny Stock" Which May Restrict The Ability Of Stockholders To Sell Our Common Stock In The Secondary Market.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be an equity security that has a market price, as defined, of less than $5.00 per share, or an exercise price of less than $5.00 per share, subject to certain exceptions, including an exception of an equity security that is quoted on a national securities exchange. Our Common Stock is not now quoted on a national exchange but is traded on the OTCQB of the OTC Markets (“OTCQB”). Thus, they are subject to rules that impose additional sales practice requirements on broker-dealers who sell these securities. For example, the broker-dealer must make a special suitability determination for the purchaser of such securities and have received the purchaser's written consent to the transactions prior to the purchase. Additionally, the rules require the delivery, prior to the transaction, of a disclosure schedule prepared by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered underwriter, and current quotations for the securities, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, among other requirements, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The "penny stock" rules, may restrict the ability of our stockholders to sell our Common Stock and warrants in the secondary market.

Allegations Have Been Made Regarding The Offering Of Securities Which Were Later Exchanged For Shares of Common Stock of the Company

Certain Chinese investors purchased the right to receive shares of common stock in a Hong Kong entity with were to be exchanged for stock in a United States entity that would /that would own rights to the compressed air storage technology. Shares in LuckSky (Hong Kong) Shares Limited, and then a total of 150,000,000 shares of common stock of the Company, were issued upon the merger of LuckSky (Hong Kong) Shares Limited into the Company in September 2013. Allegations have been made by journalists that certain misrepresentations were made by sales agents to such investors, including an alleged representation that they were receiving stock in the Company which owned the business of Sanhe and which shares would be listed on a national securities exchange. As a result of the Company’s acquisition of Sanhe, such investors now own stock in the Company, which controls the business of Sanhe through the VIE Agreements and is the licensee of the air compression energy technology. Allegations have also been made that sales agents improperly sold such securities.