SECURITIES AND EXCHANGE COMMISSION

Commission File Number: 001-34476

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

|

SUMMARY |

|

|

|

Pages |

Individual and Consolidated Financial Statements - June 30, 2019

|

(Free Translation into English from the Original Previously Issued in Portuguese) | |

|

|

BANCO SANTANDER (BRASIL) S.A. AND SUBSIDIARIES |

|

MANAGEMENT REPORT | |

|

In thousands of Brazilian Real - R$, unless otherwise stated | |

Dear Stockholders:

We present the Management Report to Individual and Consolidated Financial Statements of Banco Santander (Brasil) S.A. (Banco Santander or Bank) related to the period ended June 30, 2019, prepared in accordance with accounting practices set by Brazilian Corporate Law, the standards of the National Monetary Council (CMN), the Central Bank of Brazil (Bacen) and document template provided by the Accounting National Financial System Institutions (Cosif) and the Brazilian Exchange Commission (CVM), that does not conflict with the rules issued by Bacen.

The Interim Condensed Consolidated Financial Statements in accordance with the International Accounting Standards Board (IASB) for the period ended June 30, 2019, will be disclosed simultaneously, on the website www.santander.com.br/ri.

1) Macroeconomic Environment

In the second quarter, despite a relatively volatile trajectory, prices of Brazilian financial assets closed the period with prices more favorable than those observed at the end of the first quarter of the year. Santander estimates that both domestic and international factors were responsible for this volatile performance with good performance at the end of the period. The exchange rate reversed the devaluation observed in the first quarter when it fell from R$3.92/US$ at the end of March 2019 to R$3.84/US$ at the end of June 2019 - also lower than the R$3.88/US$ registered at the end of last year. By the end of 2019, we currently project the exchange rate to return to the level of R$3.90/US$. This movement was followed by the sovereign risk indicator, as the Brazilian CDS for the 5 year period fell from 180bps to 150bps between March 2019 and June 2019, signaling a greater appetite on the part of foreign investors with assets of the country. The Bovespa index has risen from the approximate level of 95,400 points in March, 2019 to a level above 100,000 points, breaking a symbolic barrier that is very important for the Brazilian stock market. Last but not least, prices of fixed income instruments also registered a rise in the period, which translated into a fall in the implicit interest rate over all the terms of the term structure of the interest rate - for example, the future interest rate with maturity on January 1, 2020 fell from approximately 6.5% per year in March 2019 to 6.0% pa. in June 2019. As mentioned before, although all financial assets recorded price improvement at the end of the second quarter of the year, the Bank points out that such performance did not follow a smooth path in some moments, both by domestic factors and outside.

From the international point of view, Santander understands that there was an increase in the tensions arising from the so-called "Trade War" between China and the United States, which continued to weigh on the perception of economic agents around the globe as to the magnitude of the negative impact that such situation may have on world economic performance. Moreover, the appearance of more concrete signs of a slowdown in the economic growth of the American and Chinese economies has raised even more caution, and even led the US monetary authority to substantially change the signage regarding the next actions to be implemented in the conduct of the monetary policy in the USA. At the same time, there have been comments from Chinese officials that further stimulus measures could be adopted later this year to sustain the expansion of the economy. If, at the beginning of the year, there were still those who thought that the FOMC (Federal Open Market Committee – a division of the Federal Reserve) could raise the base interest rate in the US this year, there seems to be a conviction that it will need to be reduced sometime within the next six months - a shared vision, including , by members of the FOMC. This is to say that, rather than anticipating the continuity of a robust growth rate in the US, the US monetary authority has come to fear that there will be a substantial loss in the country's pace of economic expansion. Despite the anxiety generated by the uncertainty regarding the robustness of the world economic expansion, the fact that the other major global economies signaled a similar position to the FOMC, raised the attractiveness of assets of other countries considered to be higher risk, which benefited Brazilian financial assets between March 2019 and June 2019.

In the domestic environment, the second quarter of 2019 was marked by progress in the process of the structural reform agenda, especially the progress in the analysis of the constitutional amendment referring to the reformulation of the Brazilian social security system, which was approved in the first round by the House of Representatives. Deputies in mid-July 2019. The fact is important, since it signaled the possibility of containing the process of worsening public accounts. That is, the perception that the transformations necessary for fiscal balance are on the way to being implemented ended up improving the mood for increased exposure to Brazilian financial assets. However, the process was also not linear, with comings and goings, meetings and disagreements between congressmen aligned with the government and members of the federal administration bringing volatility to asset prices - mainly to the stock market, the exchange rate and the sovereign risk.

In addition to the observed political environment, the Bank noted a new round of frustration with the performance of indicators of economic activity, which generated a wave of revisions and reductions in GDP growth projections for 2019. Santander revised its projection for performance of the Brazilian economy this year and, instead of working with an expectation of expansion of 2.3% for the GDP of 2019, now considers that the country's economy is likely to advance 0.8% this year. Maintaining a more gradual pace of growth has reinforced the favorable dynamics of price indices, with underlying inflation measures signaling broad comfort to meet the targets set by the National Monetary Council for the coming years. In view of this situation, the Bank understands that there has been an expansion of space so that the Central Bank of Brazil can reduce the basic interest rate of the current level of 6.50% pa. to a level of 5.50% a.a. still in 2019, without prejudice to its mission to keep the inflationary dynamics compatible with the convergence of current inflation to the targets. In this way, Santander began to consider that after reaching 5.50% pa. in 2019, the Selic rate target should remain unchanged by the end of 2020 - previously, the indication was that it would remain stable at 6.50% a.a. both this year and next.

Individual and Consolidated Financial Statements - June 30, 2019 1

These low projections for growth, inflation and interest rates made by Banco Santander are based on the continuity of the reform agenda in the Brazilian economy, especially in the fiscal field. Santander reiterates its assessment that the willingness and commitment of the current government to seek stabilization of the public debt as well as to maintain a sustainable economic policy will be fundamental for the country to achieve long-term economic and social development.

2) Performance

2.1) Corporate Net Income

|

CONSOLIDATED INCOME STATEMENTS |

1S19 |

1S18 |

annual changes% |

2Q19 |

1Q19 |

quarter changes % |

|

Financial Income |

38,580.6 |

39,604.9 |

-2.6 |

18,030.0 |

20,550.5 |

-12.3 |

|

Financial Expenses |

(21,530.2) |

(30,239.9) |

-28.8 |

(8,973.5) |

(12,556.6) |

-28.5 |

|

Gross Profit From Financial Operations (a) |

17,050.4 |

9,365.0 |

82.1 |

9,056.5 |

7,993.9 |

13.3 |

|

Other Operating (Expenses) Income (b) |

(5,671.0) |

(4,462.9) |

27.1 |

(3,028.6) |

(2,642.4) |

14.6 |

|

Operating Income |

11,379.4 |

4,902.1 |

132.1 |

6,027.9 |

5,351.5 |

12.6 |

|

Non-Operating Income |

(111.4) |

27.3 |

-508.4 |

(111.9) |

0.5 |

-23356.3 |

|

Income Before Taxes on Income and Profit Sharing |

11,268.0 |

4,929.4 |

128.6 |

5,916.0 |

5,352.0 |

10.5 |

|

Income Tax and Social Contribution (a) |

(3,336.4) |

1,936.1 |

-272.3 |

(1,960.3) |

(1,376.1) |

42.5 |

|

Profit Sharing |

(925.3) |

(900.1) |

2.8 |

(456.8) |

(468.4) |

-2.5 |

|

Non-Controlling Interest |

(181.2) |

(173.4) |

4.5 |

(89.1) |

(92.0) |

-3.2 |

|

Consolidated Net Income |

6,825.2 |

5,791.9 |

17.8 |

3,409.8 |

3,415.4 |

-0.2 |

For a better understanding of the results in BRGAAP, below is the Gross Profit from Financial Operations, disregarding the hedge effect (according to item 1):

|

ADJUSTED GROSS PROFIT FROM FINANCIAL OPERATIONS |

1S19 |

1S18 |

annual changes% |

2Q19 |

1Q19 |

quarter changes % |

|

Gross Profit From Financial Operations |

17,050.4 |

9,365.0 |

82.1 |

9,056.5 |

7,993.9 |

13.3 |

|

Income Tax and Social Contribution (hedge) |

(367.7) |

5,420.4 |

-106.8 |

(520.5) |

152.8 |

-440.6 |

|

Adjusted Gross Profit From Financial Operations |

16,682.7 |

14,785.4 |

12.8 |

8,536.0 |

8,146.7 |

4.8 |

|

INCOME TAX AND SOCIAL CONTRIBUITION |

1S19 |

1S18 |

annual changes% |

2Q19 |

1Q19 |

quarter changes % |

|

Income Tax and Social Contribution |

(3,336.4) |

1,936.1 |

-272.3 |

(1,960.3) |

(1,376.1) |

42.5 |

|

Income Tax and Social Contribution (hedge) |

367.7 |

(5,420.4) |

-106.8 |

520.5 |

(152.8) |

-440.6 |

|

Adjusted Income Tax and Social Contribution |

(2,968.7) |

(3,484.3) |

-14.8 |

(1,439.8) |

(1,528.9) |

-5.8 |

(1) The variation, after the effects of the hedge, refers mainly to the higher volume of Interest on Own Capital deliberated and the change in the CSLL rate from 20% to 15%.

a) Foreign Exchange Hedge of the Grand Cayman and Luxembourg Branches and the Subsidiary Santander Brasil EFC

Banco Santander operates branches in the Cayman Islands and Luxembourg and the subsidiary Santander Brasil Establecimiento Financiero de Credito, EFC, or “Santander Brasil EFC” which are used, mainly, to raise funds in the capital and financial foreign markets, providing credit lines that are extended to clients for trade-related financings and working capital. To protect the exposures to foreign exchange rate variations, the Bank uses derivatives. According to Brazilian tax rules, the gains or losses resulting from the impact of appreciation or depreciation of the local currency (Real) in foreign investments are nontaxable to PIS/Cofins/IR/CSLL, while gains or losses from derivatives used as hedges are taxable or deductible. The purpose of these derivatives is to protect the after-tax net income.

The different tax treatment of such foreign exchange rate differences results in a volatility on the operational earnings or losses and on the gross revenue tax expense (PIS/Cofins) and income taxes (IR/CSLL), considering the negative exchange variation of 1% and 1.8% for Dollar and Euro, respectively (2018 - 17% and 15%), as demonstrated below:

|

FOREIGN EXCHANGE HEDGE OF THE GRAND CAYMAN AND LUXEMBOURG BRANCHS |

1S19 |

1S18 |

annual changes% |

2Q19 |

1Q19 |

quarter changes % |

|

Exchange Variation - Profit From Financial Operations |

(554.5) |

6,566.1 |

-108.4 |

(780.0) |

225.5 |

-445.9 |

|

Derivative Financial Instruments - Profit From Financial Operations |

967.1 |

(12,462.9) |

-107.8 |

1,363.9 |

(396.8) |

-443.7 |

|

Income Tax and Social Contribution |

(367.7) |

5,420.4 |

-106.8 |

(520.5) |

152.8 |

-440.6 |

|

PIS/Cofins - Tax Expenses |

(45.0) |

476.4 |

-109.4 |

(63.4) |

18.4 |

-444.6 |

Individual and Consolidated Financial Statements - June 30, 2019 2

b) Other Operating (Expenses) Income

Income from Services Rendered and Banking Fees - The highlights are: (a) credit/debit card commission and Acquiring Services, with growth of 13,4% in relation to the same period of the previous year, mainly due to the increase in both card; (b) Current Account Services, an increase of 16,5% in relation to the same period of the previous year, influenced by the increase in the number of active account holders, which grew 49 consecutive months; (c) Insurance Commissions, with an increase of 13,2% in relation to the same period of the previous year, following the credit dynamics; and (d) Placement of Securities, Custody and Brokerage, an increase of 35.2% in relation to the same period of the previous year, mainly due to the increase of activities with the capital market.

Revenues from commissions on credit operations and guarantees provided fell by comparison with the same period of the previous year, mainly in accordance with the revision of some fee policies, in line with the market guidelines.

|

Fees |

1S19 |

1S18 |

annual changes% |

2Q19 |

1Q19 |

quarter changes % |

|

Asset Management |

516.4 |

509.8 |

1.3 |

265.6 |

250.8 |

5.9 |

|

Checking Account Services |

1,892.8 |

1,624.0 |

16.5 |

983.3 |

909.5 |

8.1 |

|

Lending Operations and Income from Guarantees Provided |

665.6 |

784.5 |

-15.2 |

341.3 |

324.3 |

5.2 |

|

Lending Operations |

390.9 |

465.3 |

-16.0 |

201.3 |

189.6 |

6.2 |

|

Income Guarantees Provided |

274.7 |

319.2 |

-13.9 |

140.0 |

134.7 |

3.9 |

|

Insurance Fees |

1,514.2 |

1,337.8 |

13.2 |

775.0 |

739.2 |

4.8 |

|

Cards (Debit and Credit) and Acquiring Services |

3,086.4 |

2,722.6 |

13.4 |

1,477.5 |

1,608.9 |

-8.2 |

|

Collection |

752.6 |

752.5 |

0.0 |

377.2 |

375.4 |

0.5 |

|

Brokerage, Custody and Placement of Securities |

477.4 |

353.1 |

35.2 |

285.6 |

191.8 |

48.9 |

|

Others |

278.4 |

324.4 |

-14.2 |

149.4 |

129.0 |

15.8 |

|

Total |

9,183.8 |

8,408.8 |

9.2 |

4,654.9 |

4,528.9 |

2.8 |

General Expenses - Total expenses, which include expenses with personnel, other administrative expenses and expenses with profit sharing, excluding the effects of goodwill amortization, increased by 6,7%, and personnel expenses and profit sharing, increased by 0,8% and other administrative expenses increased by 12,0%. Changes in administrative expenses are mainly due to the increase in expenses with data processing, associated with greater transactionality and growth in the customer base and expenses with specialized technical services and third parties, mainly through the contracting of technology services.

|

General Expenses |

1S19 |

1S18 |

annual changes% |

2Q19 |

1Q19 |

quarter changes % |

|

Personnel Expenses |

(4,631.1) |

(4,594.9) |

0.8 |

(2,312.1) |

(2,319.0) |

-0.3 |

|

Other Administrative Expenses, excluding the effects of goodwill amortization |

(5,685.1) |

(5,077.2) |

12.0 |

(2,901.6) |

(2,783.5) |

4.2 |

|

General Expenses, excluding the effects of goodwill amortization |

(10,316.2) |

(9,672.1) |

6.7 |

(5,213.7) |

(5,102.5) |

2.2 |

2.2) Assets and Liabilities

|

CONSOLIDATED BALANCE SHEETS |

Jun/19 |

Jun/18 |

jun/19 vs. jun/18 changes % | ||

|

Current and Long-Term Assets |

823,718.0 |

728,300.3 |

13.1 | ||

|

Permanent Assets |

12,539.6 |

10,770.8 |

16.4 | ||

|

TOTAL ASSETS |

836,257.6 |

739,071.1 |

13.1 | ||

|

Current and Long-Term Liabilities |

763,715.9 |

673,247.6 |

13.4 | ||

|

Deferred Income |

279.8 |

423.0 |

-33.9 | ||

|

Non-Controlling Interest |

1,760.1 |

2,075.8 |

-15.2 | ||

|

Stockholders' Equity |

70,501.8 |

63,324.8 |

11.3 | ||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

836,257.6 |

739,071.1 |

13.1 |

Total assets are mainly represented:

|

(R$ Millions) |

Jun/19 |

Jun/18 |

jun/19 vs. jun/18 changes % | ||

|

Loan Portfolio |

317,624.8 |

290,478.6 |

9.3 | ||

|

Securities and Derivative Financial Instruments (1) |

202,990.9 |

187,416.6 |

8.3 | ||

|

Interbank Investments |

38,898.7 |

53,294.6 |

-27.0 | ||

|

Interbank Accounts |

94,849.5 |

90,695.2 |

4.6 |

(1) Given the provisions of Circular Bacen 3,068/2001, Banco Santander has the financial capacity and intention to hold to maturity, securities classified as held-to-maturity, in the amount of R$10.721,1 million on June 30, 2019 (06/30/2018 - R$11.226,7 million).).

Individual and Consolidated Financial Statements - June 30, 2019 3

2.3) Loan Portfolio

|

MANAGEMENT DISCLOSURE OF LOAN PORTFOLIO BY SEGMENT |

Jun/19 |

Jun/18 |

jun/19 vs. jun/18 changes % | ||

|

Individuals (1) |

141,431.5 |

119,836.7 |

18.0 | ||

|

Consumer Finance |

53,156.2 |

45,368.6 |

17.2 | ||

|

Individuals (1) |

46,512.2 |

40,338.8 |

15.3 | ||

|

Corporate |

6,644.0 |

5,029.8 |

32.1 | ||

|

Small and Medium-sized Entities |

37,131.3 |

33,757.4 |

10.0 | ||

|

Large-sized Entity |

85,905.8 |

91,515.9 |

-6.1 | ||

|

Total Loan portfolio (gross) |

317,624.8 |

290,478.6 |

9.3 | ||

|

Other Operations with Credit Risk |

76,507.1 |

77,766.1 |

-1.6 | ||

|

Total Extended Portfolio (gross) |

394,131.9 |

368,244.7 |

6.9 | ||

|

Allowance for Loan Losses (2) |

(18,491.1) |

(18,096.1) |

2.2 | ||

|

Total Loan portfolio (net) |

375,640.8 |

350,148.6 |

7.3 |

(1) Including the loans to individual in the consumer finance segment, the individual portfolio reached R$187.943,7 on June 30, 2019 (06/30/2018 - R$160.175,5).

(2) Includes debentures, FIDC, CRI, promissory notes, promissory notes for placement abroad, assets related to acquiring activities and sureties and sureties.

On June 30, 2019, the main highlights were the following segments: (a) "Individuals", which presented growth in both comparison periods, 18,0% compared to December 31, 2018, influenced mainly by the payroll growth, due to the good adherence of the digital channels by the customers and strong commercial dynamics of the network; (b) "Consumer Finance", also with growth in both periods, being 17,2% compared to June 2018. (c) "Small and Medium Enterprises (SMEs)", with a reduction of 5.1% compared to June 2018.

Delinquency

The over-90 delinquency ratio reached 3.0% of the total credit portfolio on June 30, 2019, 0.2% above in relation to June 30, 2018 (2.8%). The ratio remains at a controlled level, as a result of the risk management and assertive models of Banco Santander.

Allowance for loan losses represents 5,8% of the loan portfolio on June 30, 2019, 6.4% on June 30, 2018.

The allowance for loan losses expenses, net of revenues with recovery of loans previously written off for the period ended on June 30, 2019 is R$ R$5.313,3 million and R$ R$5.361,3 million in 2018, increasing 0,9%.

2.4) Funding by Customers

|

FUNDING BY CUSTOMERS |

Jun/19 |

Jun/18 |

jun/19 vs. jun/18 changes % | ||

|

Demand Deposits |

20,521.5 |

17,369.3 |

18.1 | ||

|

Saving Deposits |

46,574.5 |

42,571.0 |

9.4 | ||

|

Time Deposits |

197,300.8 |

177,610.7 |

11.1 | ||

|

Debentures/LCI/LCA/LIG (1) |

50,477.2 |

53,979.6 |

-6.5 | ||

|

Treasury Bills/Structured Operations Certificates |

36,635.7 |

33,348.3 |

9.9 | ||

|

Total Funding |

351,509.7 |

324,878.9 |

8.2 |

(1) Debentures repurchase agreement, Real Estate Credit Notes (LCI), Agribusiness Credit Notes (LCA) and Guaranteed Real State Credit Notes (LIG).

The total funding resources increased 8.2%, compared to December, 2018, with steady and more pronounced Time Deposit growth in Debentures.

2.5) Issuance of Debt Instruments Eligible to Compose Capital

On November 5, 2018, the Board of Directors approved the redemption of Level I and Level II Notes issued on January 29, 2014, in the total amount of US $ 2.5 billion. The repurchase was approved by the Central Bank on December 18, 2018.

In conjunction with the approval of the redemption of the previous notes, the Board of Directors approved the issuance of the equity instruments, which was held on November 8, 2018. Such issuance took the form of notes issued abroad, in US dollars, in the amount of US $ 2.5 billion, for payment in Level I and Level II of Reference Equity. The offering of these Notes was made outside of Brazil and the United States of America, for non-US Persons, based on Regulation S under the Securities Act, and was fully paid in by Santander España, controlling shareholder of Banco Santander Brasil.

On December 18, 2018, the Bank issued an approval for the Notes to comprise Level I and Level II of Banco Santander's Reference Equity as of such date. This approval led to the reclassification of these instruments from the line of Eligible Debt Instruments to Capital for Subordinated Debts.

Details of the balance of Debt Instruments Eligible to Compose Capital referred to the issuance of equity instruments for the composition of Tier I and Tier II of Regulatory Capital due to the Capital Optimization Plan, are as follows:

|

Debt Instruments Eligible to Compose Capital |

jun-19 |

|

jun-18 | |

|

Specific features |

Tier I (1) |

Tier II (1) |

Tier I (1) |

Tier II (1) |

|

Issuance |

nov/18 |

nov/18 |

jan/14 |

jan/14 |

|

Amount (Million) |

US$1.250 |

US$1.250 |

R$3.000 |

R$3.000 |

|

Interest Rate (p.a.) (2) |

7,250% |

6,125% |

7,375% |

6,000% |

|

Maturity |

No Maturity (Perpetual) |

nov/28 |

No Maturity (Perpetual) |

jan/24 |

|

Periodicity of |

semiannually, as of May 8, 2019 |

semiannually, as of May 8, 2019 |

quarterly, as of April 29, 2014 |

semiannually, as of July 29, 2014 |

Individual and Consolidated Financial Statements - June 30, 2019 4

(1) Notes repurchased in 2019; As authorized by Bacen on December 17, 2018, as of the date of their issuance, Level I and II of PR must be excluded.

(2) The debts of January 2014 were made by Banco Santander in Brazil, therefore, as Income Tax at source assumed by the issuer, in the form of a corresponding exchange rate, is 8.676% and 7.059% for the instruments Level I and Level II, respectively. The emissions generated from November 2018 were made through the Cayman Agency and, consequently, there is no incidence of Income Tax at Source.

Notes have the following common characteristics:

(a) Unit value of at least US$150 thousand and in integral multiples of US$1 thousand in excess of such minimum value

(b) The Notes may be repurchased or redeemed by Banco Santander after the fifth anniversary as of the date of issue of the Notes, at the sole discretion of the Bank or as a result of changes in the tax legislation applicable to the Notes; or at any time, due to the occurrence of certain regulatory events.

2.6) Stockholders’ Equity

On June 30, 2019, Banco Santander consolidated stockholders’ equity presented an increase of 11.3% compared to June 30, 2018.

The variation in the Stockholders' Equity balance between June 30, 2019 and 2018 was, mainly, due to the negative variation of the asset valuation adjustment (securities and derivative financial instruments) in the amount of R$1,424.5 million and the net income for the period in the amount of R$6,825.2 million and reduced, mainly, by the established of Interest on Capital in the amount of R$2 billion.

Treasury Shares

In the meeting held on November 1, 2018, the Bank’s Board of Directors approved, in continuation of the buyback program that expired on November 1, 2017, the buyback program of its Units and ADRs, by the Bank or its agency in Cayman, to be held in treasury or subsequently sold.

The Buyback Program will cover the acquisition up to 37,753,760 Units, representing 37,753,760 common shares and 37,753,760 preferred shares, or the ADRs, which, on December 31, 2018, corresponded to approximately 1% of the Bank’s share capital. On December 31, 2018, the Bank held 362,227,661 common shares and 390,032,076 preferred shares being traded.

The Buyback has the purpose to (1) maximize the value creation to stockholders by means of an efficient capital structure management; and (2) enable the payment of officers, management level employees and others Bank’s employees and companies under its control, according to the Long Term Incentive Plans. The term of the Buyback Program is 12 months counted from November 6, 2018, and will expire on November 5, 2019.

|

Jun/19 |

Jun/18 | ||||

|

Quantity |

Quantity | ||||

|

Units |

Units | ||||

|

Treasury shares at beginning of the fiscal year |

13,316 |

1,773 | |||

|

Shares Acquisitions |

4,975 |

13,478 | |||

|

Payment - Share-based compensation |

(3,065) |

(4,336) | |||

|

Treasury shares at end of the fiscal year |

15,226 |

10,915 | |||

|

Subtotal - Treasury Shares in thousands of reais |

R$ 612,398 |

R$ 356,672 | |||

|

|

R$ 2,410 |

R$ 219 | |||

|

Balance of Treasury Shares in thousands of reais |

R$ 614,808 |

R$ 356,891 | |||

|

Cost/Share price |

Units |

Units | |||

|

Minimum cost |

R$ 7.55 |

R$ 7.55 | |||

|

Weighted average cost |

R$ 31.51 |

R$ 27.51 | |||

|

Maximum cost |

R$ 49.55 |

R$ 36.98 | |||

|

Share price |

R$ 45.46 |

R$ 27.64 |

In the periods ended June 30, 2019 and 2018, there were highlights of Dividends and Interest on Capital, as below:

|

DIVIDENDS AND INTEREST ON CAPITAL |

Jun/19 |

Mar/18 | |||

|

Interest on capital |

2,000.0 |

600.0 | |||

|

Dividends |

0.0 |

600.0 | |||

|

Total |

2,000.0 |

1,200.0 |

Individual and Consolidated Financial Statements - June 30, 2019 5

2.7) Basel Index

Financial institutions are required by Bacen to maintain Regulatory Capital (PR), Tier I and Principal Capital consistent with their risk activities, higher than the minimum requirement of the Regulatory Capital Requirement, represented by the sum of the partial credit risk, market risk and operational risk.

As required by Resolution CMN 4,193/2013, the requirement for PR in 2018 was 11.0%, composed of 8.625% of Reference Equity Minimum plus 1.875% of Capital Conservation Additional. Considering this additional, PR Level I increased to 8.375% and Minimum Principal Capital to 6.875%.

For the base year 2019, the PR requirement remains at 10.5% (since January, 2019), including 8.0% of Minimum of Reference Equity and a further 2.5% of Capital Conservation Additional. The PR Level I reaches 8.5% and the Principal Capital Minimum 7.0%.

The Basel ratio is determined in accordance with the Financial Statements of the Prudential Conglomerate prepared in accordance with accounting practices adopted in Brazil, applicable to institutions authorized to operate by Bacen, as shown bellow:

|

BASEL INDEX % |

Jun/19 |

Jun/18 | |||

|

Tier I Regulatory Capital |

67,550.0 |

57,152.8 | |||

|

Principal Capital |

62,709.6 |

52,271.1 | |||

|

Supplementary Capital |

4,840.4 |

4,881.7 | |||

|

Tier II Regulatory Capital |

4,832.6 |

4,953.4 | |||

|

Regulatory Capital (Tier I and II) |

72,382.6 |

62,106.2 | |||

|

Credit Risk |

371,140.8 |

354,413.8 | |||

|

Market Risk |

29,463.7 |

28,802.2 | |||

|

Operational Risk |

46,527.0 |

37,372.3 | |||

|

Total RWA |

447,131.5 |

420,588.3 | |||

|

Basel I Ratio |

15.1 |

13.6 | |||

|

Basel Principal Capital |

14.0 |

12.4 | |||

|

Basel Regulatory Capital |

16.2 |

14.8 |

2.8) Main Subsidiaries

The table below presents the balances of total assets, net assets, net income and credit operations for the period ended June 30, 2019 for the main subsidiaries of Banco Santander portfolio:

|

SUBSIDIARIES |

Total Assets |

Stockholders' Equity |

Net |

Loan |

Ownership / Interest (%) |

|

Aymoré Crédito, Financiamento e Investimento S.A. |

45,670.7 |

2,098.7 |

617.7 |

41,194.4 |

100.00% |

|

Getnet Adquirência e Serviços para Meios de Pagamento S.A. |

24,448.9 |

2,466.2 |

301.1 |

0.0 |

100.00% |

|

Santander Leasing S.A. Arrendamento Mercantil |

7,042.7 |

5,739.4 |

3.1 |

1,872.2 |

99.99% |

|

Banco Bandepe S.A. |

6,300.4 |

4,185.6 |

146.2 |

0.0 |

100.00% |

|

Santander Brasil, Establecimiento Financiero de Credito, S.A. |

3,561.5 |

3,423.2 |

3.1 |

777.4 |

100.00% |

|

Santander Corretora de Seguros, Investimento e Serviços S.A. |

3,187.0 |

2,765.6 |

203.5 |

0.0 |

100.00% |

|

Santander Corretora de Câmbio e Valores Mobiliários S.A. |

3,994.2 |

638.4 |

41.8 |

0.0 |

100.00% |

(1) Includes Leasing portfolio and other loans.

Balances reported above are in accordance with accounting practices established by Brazilian Corporate Law and standards established by the CMN, the Bacen and document template provided in the Accounting National Financial System Institutions (Cosif) and the CVM, that does not conflict with the rules issued by Bacen.

3) Other Events

3.1) Post-employment Benefit Plan

On June 30, 2018, there was an increase in the cost contribution established in the Post-Employment Benefit Plan, which is calculated as a percentage of the total monthly compensation of members. The increase in the contribution resulted in a decrease in the past service cost, due to changes in the plan. The changes proposed in the Post-Employment Benefit imply a reduction in the present value of the obligations of the defined benefit plan, which is supported by actuarial valuations.

3.2) Recoverable Value Assessment

In the first half of 2018, Banco Santander recognized impairment losses in the amount of R$341 million on intangible assets in the acquisition and development of systems. The loss was recorded based on the performance of technical analysis, which demonstrated a significant reduction in expected future economic benefits on these assets, without material effects as of June 30, 2019.

Individual and Consolidated Financial Statements - June 30, 2019 6

3.3) Opening of the branch in Luxembourg

On June 9, 2017, Banco Santander obtained authorization from the Central Bank to set up an agency in Luxembourg with a capital of US$1 billion, with the objective of complementing the foreign trade strategy for corporate clients (large Brazilian companies and their operations abroad) and offer financial products and services through an offshore entity that is not established in a jurisdiction with favored taxation and that allows for the increase of funding capacity. The opening of the agency was authorized by the Luxembourg Minister of Finance on March 5, 2018. On April 3, 2018, after the reduction of the capital of the Cayman agency in the equivalent amount, the value of US$1 billion was allocated to capital of the Luxembourg branch.

3.4) Corporate Restructuring

Several social movements were implemented in order to reorganize the operations and activities of entities according to the business plan of the Conglomerate Santander.

a) Acquisition of Summer Empreendimentos Ltda.

On May 14, 2019, Banco Santander and its wholly owned subsidiary Santander Holding Imobiliária S.A. executed a binding agreement with the partners of Summer Empreendimentos Ltda. defining the negotiation terms for the purchase and sale of shares fully representing the capital of Summer Empreendimentos. The operation closing is subject to accomplishment of conditions precedent usual to this type of transaction, including the previous authorization by the Bacen.

b) Put option of equity interest in Banco Olé Bonsucesso Consignado S.A.

On March 14, 2019, the minority shareholder of Banco Olé Bonsucesso Consignado S.A. (Olé Consignado) formalized its interest to exercise the put option right provided in the Investment Agreement, executed on July 30, 2014, to sell its 40% equity interest in the capital stock of Olé Consignado to Aymoré CFI. The closing of the transaction is conditioned to implementation of the proceedings set forth in the Investment Agreement.

c) Acquisition of residual equity interest in Getnet S.A.

On December 19, 2018, Banco Santander and the Minority shareholders of Getnet S.A. executed an amendment to the Shares’ Sale and Purchase Agreement and Other Covenants of Getnet S.A., in which Banco Santander commits to acquire all of the Minority shareholders’ shares, corresponding to 11.5% of Getnet S.A. capital stock, per the amount of R$1,431,000. The acquisition was approved by Bacen on February 18, 2019 and closed on February 25, 2019, as a consequence Santander Brasil has become the holder of 100% of the shares representatives of the capital stock of Getnet S.A.

d) Formation of Esfera Fidelidade S.A.

On August 14, 2018, Esfera Fidelidade was incorporated, with equity fully owned by Banco Santander. Esfera Fidelidade will act in the development and management of customer loyalty programs. On November 26, 2018, Esfera Fidelidade had its capital stock increased in the amount of R$10,000, amounting the full share capital of R$10,000, divided into 10,001,000 (ten million and one thousand) nominative common shares without par value, entirely held by Banco Santander. The company started its operation in November 2018.

e) Investment in Loop Gestão de Pátios S.A.

On June 26, 2018, Webmotors S.A., company with 70% interest indirectly owned by Banco Santander, signed an investment agreement with Allpark Empreendimentos, Participações e Serviços S.A. and Celta LA Participações S.A., in order to acquire an equity interest corresponding to 51% of the capital stock of Loop Gestão de Pátios S.A., through capital increase and issuance of new shares of Loop to be fully subscribed and paid-in by Webmotors. Loop operates in the segment of commercialization and physical and virtual auction of motor vehicles. On September 25, 2018, the transaction was completed with increase of the capital stock, in the amount of R$23,900, through issuance of shares representing 51% of equity interest in Loop, which were fully subscribed and paid-in by Webmotors.

f) Formation of BEN Benefícios e Serviços S.A.

On June 11, 2018, BEN Benefícios, with equity fully owned by Banco Santander, was incorporated, to act in the supply and administration of meal, food, transportation, cultural and similar vouchers, via printed or electronic and magnetic cards.

In the EGM held on August 1, 2018, BEN Benefícios had its capital increased in R$ 45,000, passing the capital stock to the amount of R$ 45,001, divided into 45,001,000 (forty-five million and one hundred thousand) registered common shares without par value, fully owned by Banco Santander.

Individual and Consolidated Financial Statements - June 30, 2019 7

In the EGM held on March 27, 2019, Santander Brasil approved the capital increase in the amount of R$44,999, totalizing R$90,000 of capital stock distributed into 90,000,000 (ninety million) common shares without par value, fully held by Banco Santander.

BEN Benefícios started its activities in the first quarter of 2019.

g) Acquisition of Isban Brasil S.A. and Produban Serviços de Informática S.A.

On February 19 and 28, 2018, Banco Santander purchased, respectively, the totality of shares of Isban Brasil, formerly held by Ingeniería de Software Bancário, S.L., and of Produban Serviços de Informática, formerly held by Produban Servicios Informáticos Generales, S.L., for the amount of R$61,078 and R$42,731, respectively. The parties involved in the transactions had Banco Santander, S.A. (Santander Spain) as common indirect controller, being such transactions carried-out under market conditions. At the EGM held on February 19, 2018, was approved the capital increase of Isban Brasil in the amount of R$33,000, through the issuance of 11,783,900 (eleven million, seven hundred and eighty-three thousand and nine hundred) shares, without par value, entirely subscribed and paid in by Banco Santander. On February 28, 2018, the company Isban Brasil was merged into Produban Serviços de Informática S.A. and on the same date, Produban Serviços de Informática had its corporate name changed to Santander Brasil Tecnologia S.A. In continuity, on February 28, 2018, Produban Servicios Informáticos Generales, S.L. (currently named Santander Global Technology, S.L.) approved the merger of the spin-off share of Produban Serviços de Informática into Produban Brasil Tecnologia e Serviços de Informática Ltda. (currently named Santander Global Technology Brasil Ltda.).

h) Formation of Santander Auto S.A.

On December 20, 2017, Banco Santander and HDI Seguros S.A. (HDI Seguros), executed documents to form a partnership for the issuance, offering and sale of auto insurance, in a 100% digital way, through creation of a new insurance company - Santander Auto, to be held 50% by Sancap, a company controlled by Banco Santander, and 50% by HDI Seguros. On February 2, 2018 the partnership was approved by the Administrative Council of Economic Defense (Conselho Administrativo de Defesa Econômica – CADE), on April, 30, 2018, was approved by the Brazilian Central Bank and, on May, 15, 2018, SUSEP's prior approval was obtained. On October 9, 2018, through transformation of the corporate vehicle L.G.J.S.P.E. Investments and Participations S.A., Sancap and HDI Seguros formed Santander Auto S.A., with capital of R$15,000. On January 9, 2019, Susep granted to Santander Auto the authorization to operate insurance throughout national territory.

i) Formation of Gestora de Inteligência de Crédito S.A.

On April 14, 2017, the definitive documents necessary for the creation of a new credit bureau, Gestora de Inteligência de Crédito, were signed by the stockholders, whose control will be shared among the stockholders who will hold 20% of the its share capital each. In the EGM held on October 5, 2017, the capital increase of Gestora de Crédito was approved in the total amount of R$285,205, so that the capital stock increased from R$65,823 to R$351,028. The Company will develop a database with the objective of aggregating, reconciling and processing registration and credit information of individuals and legal entities, in accordance with the applicable standards, providing a significant improvement in the processes of granting, pricing and directing credit lines. The Company began operations in 2019 on a partial basis (negative and positive), and the Bank estimates that it will be fully operational by the end of 2019.

j) Formation of Banco Hyundai Capital Brasil S.A.

On April 28, 2016, Aymoré CFI and Banco Santander executed with Hyundai Capital Services, Inc. (Hyundai Capital) the necessary documents for the formation of Banco Hyundai and an insurance brokerage company with the purpose to provide, respectively, auto finance and financial and insurance brokerage services to clients and dealers of Hyundai in Brazil.

On April 11, 2018, the parties incorporated, with an equity interest of 50% held by Aymoré CFI and 50% held by Hyundai Capital, a non-operational entity named BHJV Assessoria e Consultoria em Gestão Empresarial Ltda. On May 8, 2018, Aymoré CFI and Hyundai Capital took resolution on the conversion of BHJV Assessoria into the non-operational joint-stock corporation named Banco Hyundai Capital Brasil S.A., as well as the capital stock increase in R$99,995, passing to the amount of R$100,000, divided into 100,000,000 (one hundred million) nominative common shares without par value. On December 13, 2018, the incorporation procedure of Banco Hyundai Capital Brasil S.A. was concluded.

In the EGM held on February 19, 2019, the shareholders of Banco Hyundai approved the capital increase in the amount of R$200,000, summing the total value of R$300,000 distributed into 300,000,000 (three hundred million) common shares without par value, held in the proportion of 50% by Aymoré CFI and 50% by Hyundai Capital.

On February 21, 2019, the authorization to operate granted by Bacen for the functioning of Banco Hyundai was published in the Federal Official Gazette. The Banco Hyundai starts operating on April, 2019.

On May 13, 2019, the Central Bank authorized Banco Santander to hold an indirect interest in a company to be incorporated under the name Hyundai Corretora de Seguros Ltda. Hyundai Corretora was incorporated on July 22, 2019, with the beginning of its operations subject to registration of the company as insurance brokerage with SUSEP.

k) Creation of PI Distribuidora de Títulos e Valores Mobiliários S.A.

On May 3, 2018, Santander Finance Arrendamento Mercantil S.A., an indirectly controlled subsidiary of Banco Santander, was converted into a distribution company of bonds and securities and had its corporate name changed to SI Distribuidora de Títulos e Valores Mobiliários S.A. The conversion process of approved by Bacen on November 21, 2018. On December 17, 2018, SI Distribuidora de Títulos e Valores Mobiliários S.A. had its corporate name changed to PI Distribuidora de Títulos e Valores Mobiliários S.A., being the corporate name change process approved by Bacen on January 22, 2019. The company started its operations on March 14, 2019.

Individual and Consolidated Financial Statements - June 30, 2019 8

3.5) Subsequent Event

On July 22, 2019, was legally incorporated the limited liability company Hyundai Corretora de Seguros Ltda. (Hyundai Insurance Brokerage). Hyundai Insurance Brokerage has a capital stock in the amount of R$2,000 divided into 2,000,000 (two million) quotas, with individual par value of R$1.00, fully subscribed and pending of payment, divided between its quotaholders Santander Corretora de Seguros, Investimentos e Serviços S.A. and Hyundai Capital Services, Inc. in the proportion of 50% to each.

4) Strategy

Banco Santander Brasil is the only international bank with scale in the country. The Banco Santander are convinced that the best way to grow in a profitable, recurring and sustainable manner is by providing excellent services to enhance customer satisfaction levels and attract more customers, making them more loyal. The actions are based on establishing close and long-lasting relationships with customers, suppliers and shareholders. To accomplish that goal, the purpose is to help people and businesses prosper by being a Simple, Personal and Fair Bank, guided by the following strategic priorities:

|

|

· |

Increase customer preference and loyalty by offering targeted, simple, digital, innovative and high value-added products and services through a multi-channel platform. |

|

|

· |

Generate results in a sustainable and profitable manner, with greater revenue diversification, aiming to strike a balance between loans, funding and services, while maintaining a preemptive risk management approach and rigorous cost control. |

|

|

· |

Be disciplined with capital and liquidity to preserve the solidity, face regulatory changes and seize growth opportunities. |

|

|

· |

Achieve profitable market share gains through the robust portfolio, optimize the ecosystem and launch new ventures, consistently improving the customer experience. |

Thebusiness model focused on enhancing customer service and strengthening loyalty continues to provide recurring earnings generation, with an outstanding level of profitability. In the first half of the year, the Banco Santander enjoyed consistent growth in thecustomer base, accompanied by profitable market share gains. These factors, allied to the strong capital and liquidity base, place in a prime position to capture market opportunities. The Banco Santander highlight the following accomplishments:

Named Best Bank in Brazil and Best Bank in Latin America in Euromoney’s 2019 Awards for Excellence.

Retail

|

|

· |

Cards: themarket share reached 13.4% (+0.9 p.p. YoY, Source: Brazilian Central Bank, as of May/19.), while thetotal turnover expanded by 22% YoY in this quarter. The Banco Santander partnered with one of the leading online travel agencies in the nation to issue cards providing services and benefits to travelers. Regarding Santander’s credit plan for card customers, the Banco Santander are carrying out several actions to raise consumer awareness about this new alternative for installment payment purchases. Additionally, the Santander Way app totaled more than 6.9 million active customers and continues to receive high ratings in app stores. Moreover, it is worth noting that travel stores. Moreover, it is worth noting that travel insurance can now be purchased directly through the app, allowing for greater convenience. The AAdvantage® card continues to experience good customer acceptance and is running a campaign that offers extra miles when purchasing this product. All these initiatives stimulate turnover and customer loyalty. |

|

|

· |

Payroll Loans: the market share in the loan portfolio came to 10.5% (+1.2 p.p. YoY, Source: Brazilian Central Bank, as of May/19.). Digital channels, which saw a 78% rise in the number of contracts generated in twelve months, along with new agreements and differentiated offers, contribute to the customers’ financial management and are levers that support the growth. |

|

|

· |

Real Estate: the Banco Santander partnered with the biggest group of real estate portals in the country, offering a pioneering online property purchase experience, supporting customers from property selection to payment. Furthermore, the Banco Santander launched a joint campaign with a large retailer to present an appealing offer for mortgage loans, at competitive terms. As a result, the number of simulations has doubled over the previous month. |

Agro

During the quarter, the Banco Santander participated in several industry fairs, including the biggest of them, Agrishow, where the Banco Santander put forward exclusive offers. In addition, the Banco Santander also continued to expand the agro-oriented stores, which saw the opening of another unit in the South region of Brazil. Thus, the Banco Santander now have a total of 24 stores in the country. Customer proximity is one of the factors that contributes to increasing the customer base and generating sustainable growth in the loan portfolio. In the issuance of agribusiness credit notes (“LCA”), the market share hit 9.2% (+2.7 p.p. YoY, Source: Brazilian Central Bank, as of May/19.).

Getnet

SuperGet’s offering, geared towards individuals and micro entrepreneurs, is already reflecting in a customer base increase, with 200 thousand new customers in the segment. This offer gives greater transparency to the customer relationships and puts in a competitive position to further expand the presence in this market niche. In the period, the Banco Santander launched split payments on Getnet’s digital platform, with the goal of improving payment management. The market share reached 11.5% (Source: ABECS - Acquirer Monitor, as of 1Q19, new criterion), while total revenue climbed by 11.2% YoY in 1S19.

SMEs

The Banco Santander announced a new service model with a differentiated offer for small entrepreneurs, Santander DUO, which unifies the individual and business accounts, putting it in the hands of just one manager with a single fee, including the 10-day interest-free benefit provided by Santander Master. Also, as a cross-sell opportunity, when opening a “MEI” (individual micro entrepreneur) account, the customer receives advantages in the acquisition of SuperGet. Themarket share in the loan portfolio came to 8.3% (+0.3 p.p. YoY, Source: Brazilian Central Bank, as of May/19.), leveraged by customer base growth and greater loyalty.

Strengthening leading businesses

Consumer Finance: the Banco Santander maintained the leadership in the sector, with a market share of 25.3% among individuals (+0.3 p.p. in twelve months, Source: Brazilian Central Bank, as of May/19. Market share in vehicles considering only individuals). This evolution is sustained by the innovative offers, partnerships and the quality of the commercial service.

Webmotors: the Cockpit tool allows the Banco Santander to be present throughout the value chain, potentiating the Webmotors, Consumer Finance and Bank offers. This quarter, the Banco Santander finished the implementation of this platform in 100% of the customer base, featuring CRM Smart as one of its functionalities, which is already enjoying good adherence among dealerships. It should be noted that this CRM brings the end customer closer, improving the possibility of sealing the deal, besides enabling after-sales management.

Santander Corporate & Investment Banking (SCIB)

Holds the leadership in:

Financial advisory for financing and concession auctions and finance structuring, according to ANBIMA (Financial Advisory - leadership since 2008, ANBIMA 2018).

Project Finance Advisory (MLA) in the Americas and Latam, according to Dealogic (Dealogic, as of 2018)

The FX market, according to the Brazilian Central Bank (Cumulative figures from January to June of 2019).

Innovation

My Pocket: a new functionality available in the Santander On in the Santander app, which helps customers better manage their financial lives, displaying monthly income and expenses by category. This is yet another initiative that reinforces the commitment to financial education and transparency with the customers.

New ventures

Ben, a company that operates in the benefits industry, continues to make strides in partnering with food merchants, now totaling 143,000 commercial establishments. In addition to that, the Banco Santander also underscore the volume of active cards, which exceeded 77,000 in June 2019.

Pi, the digital investment platform, continues to grow its product portfolio and currently offers around 180 fixed-income products. Moreover, this quarter the Banco Santander started distributing investment funds..

Customer loyalty

All the aforementioned initiatives contribute to improving theservice and experience. Customer recognition can be confirmed by the Net Promoter Score (NPS), which is already recording high levels: 59 points in this quarter, rising 8 points YoY.

The customer base keeps expanding at a solid pace, highlighted by the number of active customers, who have been growing for the last 49 consecutive months.

Sustainability

The Banco Santander are committed to eradicating the single-use plastic consumption by 2020. This quarter, the Bank initiated a gradual move to phase-out this material from its units, starting with administrative buildings.

Furthermore, the Bank took on the challenge of consuming renewable energy in 100% of its operations by 2025. This commitment will reach the service units throughout the country by the end of 2021 and all administrative buildings and data processing center by 2025.

Through the Prospera microcredit program, the Banco Santander have positioned ourselves as the market leader among private banks in this segment. The Banco Santander launched 47 PROSPERA units in the first half of the year, contributing to financial inclusion in the nation. In June 2019, its loan portfolio totaled R$ 929 million, advancing 83% YoY.

In Higher Education, considered an important lever for the customer base, besides the financial offer, the Banco Santander have a non-financial offer based on training, employment and entrepreneurship. The Banco Santander have awarded more than 15,100 scholarships in Brazil since 2015.

With the purpose of fostering financial education in the communities where the Banco Santander operate, the Banco Santander opened some branches on Saturdays during a six-week period to offer free financial guidance to the population.

5) Rating Agencies

Banco Santander is rated by international ratings agencies and the ratings assigned reflect many factors including management quality, operating performance and financial strength, as well as other factors related to the financial sector and economic environment in which the Bank is inserted, having the long-term foreign currency rating limited to the sovereign rating. The table below presents the ratings assigned by the rating agencies Standard & Poor's and Moody's:

1) Last updated May 31, 2019.

2) Last updated June 05, 2019.

6) Corporate Governance

The Board of Directors of Banco Santander has met and resolved:

On July 22, 2019, to approve the Individual and Consolidated Financial Statements of Banco Santander, prepared in accordance with accounting practices adopted in Brazil, applicable to institutions authorized to operate by Bacen and the Interim Condensed Consolidated Financial Statements of Banco Santander, prepared in accordance with the International Financial Reporting Standards (IFRS), respect to the period ended June 30, 2019.

On June 28, 2019, to approve the proposal for declaration and payment of interest on equity, in the gross amount of R$1 billion, for payment as of July 31, 2019, without any indexation.

On May 3, 2019, elect the members of the Audit Committee, for a one-year term, which shall extend until the investiture of the elected persons at the first meeting of the Board of Directors being held after the 2020 Ordinary Shareholders Meeting, the members of the Risk and Compliance Committee, the Sustainability Committee, the Nominating and Governance Committee and the Remuneration Committee for a new term of office entering in force until the investiture of the elected persons at the first meeting of the Board of Directors being held after the 2021 Ordinary Shareholders Meeting.

On May 3, 2019, know the resignation of Mr. Marcelo Malanga, Officer without specific designation of Banco Santander; and to elect the members of the Executive Board of Banco Santander for a new term of office entering in force until the investiture of the elected persons at the first meeting of the Board of Directors being held after the 2021 Ordinary Shareholders Meeting.

On April 30, 2019, approve the Annual Internal Audit Report for the year 2018 in compliance with Resolution 4588 of the Bacen.

On April 30, 2019, to approve the Individual and Consolidated Financial Statements of Banco Santander, prepared in accordance with accounting practices adopted in Brazil, applicable to institutions authorized to operate by Bacen and the Interim Condensed Consolidated Financial Statements of Banco Santander, prepared in accordance with the International Financial Reporting Standards (IFRS), respect to the period ended March 31, 2019.

On March 27, 2019, to approve the proposal for declaration and payment of interest on equity, in the gross amount of R$1 billion, for payment as of April 29, 2019, without any indexation.

Individual and Consolidated Financial Statements - June 30, 2019 9

On March 27, 2019, to acknowledge the resignation of Mr. Fernando Carvalho Botelho de Miranda to the position of Officer without specific designation, as well as to approve the appointment of the following member to be part of the Board of Officers, as Officers without specific designation: Mr. Daniel Fantoni Assa; Mrs. Elita Vechin Pastorelo Ariaz; Mr. Franco Luigi Fasoli; Mr. Jran Paulo Kambourakis and Mr. Roberto Alexandre Borges Fischetti.

On March 20, 2019, to approve the 20-F Form of Banco Santander referred to the fiscal year ended December 31, 2018.

On February 25, 2019, to approve the Consolidated Financial Statements of Banco Santander referred to the fiscal year ended December 31, 2018, prepared in accordance with the International Financial Reporting Standards (IFRS).

On January 29, 2019, to approve the Individual and Consolidated Financial Statements of Banco Santander, prepared in accordance with accounting practices adopted in Brazil, applicable to institutions authorized to operate by Bacen, respect to the fiscal year ended December 31, 2018.

7) Risk Management

On February 23, 2017, Bacen published CMN Resolution n° 4,557, which provides for the risk and capital management structure (GIRC) and entered into force 180 days from the date of its publication. The resolution highlights the need to implement an integrated risk and capital management framework, definition of integrated stress testing program and Risk Appetite Statement (RAS), constitution of Risk Committee and appointment of director for management and director of capital. Banco Santander is continuously and progressively developing necessary actions aiming at adherence to the resolution. We haven´t identified relevant impacts resulting from this standard up to the date of publication of this note.

For further information, see explanatory note nº 35 of this publication.

Structure of Capital Management

Banco Santander’s structure of capital management has a robust governance framework that supports the process related to this theme and establishes the attributions of each teams involved. Furthermore, there is a clear definition that should be adopted to effective capital management. More details can be consult in “Structure Capital and Risk Management”, available on Investor Relations website.

Internal Audit

Internal Audit reports directly to the Board of Directors, whose activities are supervised by the Audit Committee.

Internal Audit is a permanent function, independent of any other functions or units, whose objective is to provide the Management Body and the senior management with independent assurance on the quality and effectiveness of internal control, risk management (current or emerging) and governance processes and systems, thereby helping to protect the company’s value, solvency and reputation. The Internal Audit has quality certificate issued by the Institute of Internal Auditors (IIA).

In order to perform its duties and reduce coverage risks inherent to Banco Santander's activities, the Internal Audit area has internally developed tools that are updated when necessary. These include the risk matrix, used as a planning tool, prioritizing each unit’s risk level, considering, among others, its inherent risks, the last audit rating, level of compliance with recommendations and their size. The work programs, which describe the audit tests to be performed, are reviewed periodically.

The Audit Committee and the Board of Directors favorably reviewed and approved the work plan of the Internal Audit for the year 2019

In the first semester of 2019, internal control procedures and controls on the information systems of the selected units were evaluated according to the work plan for the year, considering the effectiveness of the design and its operation. The Internal Audit informed the Audit Committee and the Board of Directors about the conclusions of the works done during that period, according to its annual plan.

8) People

The people are an essential element in the Organization. After all, it is they who think, project, develop, interact and build what the Banco Santander wants to be. This is why we invest in each of the 48.912 employees here in Brazil.

For the development of these people, the Corporate Academy - Academia Santander, works for a strong, transversal culture, allowing everyone, online and in person, to improve what they already know and explore new possibilities.

The Banco Santander supports leaders and managers so they are close and available. This action is based on three pillars: Feedback, Open Chat and Personalized Recognition, making alignment among all through recurrent and frank conversations, career guidance and special moments to reward team growth.

The Banco Santander values a diverse environment, where each competence and each difference is valued. Example is the Affinity Group, created to promote diversity and inclusion of all based on 5 pillars: Women's Leadership; Racial Equity; Disabled people; Diversity of Formations, Experiences and Generations and the LGBT + pillar. Another good example is our Talent Show, which this year reaches its 2nd edition. In it, we open space to know the most different performances and to explore the universe of abilities that exist here, allowing interaction and fraternization between the colleagues.

The result of all these actions is the high rate of engagement, as evidenced by two surveys that we conducted annually and which brought us excellent indicators. One of them points out that at least 91% of employees say they want to stay here for a long time. The Banco Santander believes that this satisfaction reflects positively on the interactions with the Clients, generating greater linkage, sustainable growth and investments in the Company, which leads the Banco Snatnder to be the best bank for all stakeholders.

Individual and Consolidated Financial Statements - June 30, 2019 10

9) Sustainable Development

Santander Brasil's Sustainability strategy is based on three pillars: (i) efficient and strategic use of Natural Capital; (ii) Potential Development; and (iii) Resilient and Inclusive Economy. The Bank's vision of the future, through these pillars, is to support Brazilian society in its transformation to Brazil of the 21st Century, maintaining excellence and responsibility in internal management, with ethical values as the basis and technology at the service of people and Business.

Banco Santander remained for the 9th consecutive year in the B³ (ISE) Business Sustainability Index portfolio and in 2019 was recognized by the Diversity EXAME Guide as the company of the year and the financial institution with the best practices of inclusion and diversity of the national market. Still in 2019, it received an AA rating (on an AAA-CCC scale) in the MSCI ESG Ratings assessment.

In the second half, Banco Santander disbursed R$417.6 million in Socio-environmental Business, with Prospera Santander Microcredit generated around R$947 million in production (82% more than the same period in 2018).

Through Santander Universities, Santander awarded more than 660 study grants in the first half of the year, from the Santander University-Business Program, where it contributes with a scholarship of R$700 to help the student to pay tuition and/or related costs and own programs , carried out directly with the Universities.

The Friend of Value Program allows Banco Santander, as well as employees and customers, to direct part of the income tax directly to the Child and Adolescent Rights Funds. In 2018, this program raised funds totaling more than R$13 million, which were directed to 67 projects in Brazil.

Additionally, for six weeks, some agencies were opened on Saturdays to offer free financial guidance to the population.

The Bank assumed the goal of consuming renewable energy in 100% of its operations by the year 2025. The commitment will reach the service units throughout the country by the end of 2021 and all administrative buildings and data processing center until 2025.

Also launched was the Plastic Free project whose initial objective is to reduce the consumption of quick-use plastic (cups and bottles) in our administrative buildings and by 2020 to impact all agencies.

10) Independent Audit

Banco Santander's policy of including its subsidiaries in contracting services not related to the external audit of its independent auditors is based on Brazilian and international auditing standards that preserve the auditor's independence. This reasoning provides as follows: (i) the auditor should not audit his own work, (ii) the auditor should not perform managerial duties on his client, (iii) the auditor should not promote the interests of his client, and (iv) need for approval of any services by the Bank's Audit Committee.

In compliance with the Instruction of the Securities Commission 381/2003, Banco Santander informs that in the period ended June 30, 2019, PricewaterhouseCoopers did not provide services not related to the independent audit of the Financial Statements of Banco Santander and subsidiaries above 5% of total fees related to independent auditing services.

In addition, the Bank confirms that PricewaterhouseCoopers has procedures, policies and controls to ensure its independence, which include an evaluation of the work performed, covering any service that is not independent of the Financial Statements of Banco Santander and its subsidiaries. This evaluation is based on the applicable regulations and accepted principles that preserve the independence of the auditor. The acceptance and provision of professional services not related to the external audit in the period ended June 30, 2019 did not affect the independence and objectivity in conducting the external audits carried out in Banco Santander and other entities of the Group, since the above principles were observed.

The Board of Directors

The Executive

(Authorized at the Meeting of the Board of July 22, 2019).

Individual and Consolidated Financial Statements - June 30, 2019 11

(A free translation of the original in Portuguese)

www.pwc.com.br

|

|

|

Banco Santander (Brasil) S.A. Parent company and consolidated

|

BCOSANTANDER619RL-PAR.DOCX

Independent auditor's report

To the Board of Directors and Stockholders

Banco Santander (Brasil) S.A.

Opinion

We have audited the accompanying parent company financial statements of Banco Santander (Brasil) S.A. ("Bank"), which comprise the balance sheet as at June 30, 2019 and the income statements, statements of changes in stockholder’s equity and cash flows statements for the six-month period then ended, as well as the accompanying consolidated financial statements of Banco Santander (Brasil) S.A. and its subsidiaries ("Consolidated"), which comprise the consolidated balance sheets as at June 30, 2019 and the consolidated income statements, statements of changes in stockholder’s equity and cash flows statements for the six-month period then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the parent company and consolidated financial statements referred to above present fairly, in all material respects, the financial position of Banco Santander (Brasil) S.A. and of Banco Santander (Brasil) S.A. and its subsidiaries as at June 30, 2019, and the financial performance and the cash flows, as well as the consolidated financial performance and cash flows, for the six-month period then ended, in accordance with accounting practices adopted in Brazil applicable to institutions authorized to operate by the Brazilian Central Bank (BACEN).

Basis for opinion

We conducted our audit in accordance with Brazilian and International Standards on Auditing. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Parent Company and Consolidated Financial Statements section of our report. We are independent of the Bank and its subsidiaries in accordance with the ethical requirements established in the Code of Professional Ethics and Professional Standards issued by the Brazilian Federal Accounting Council, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

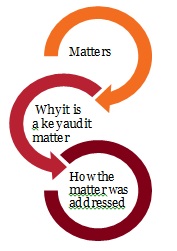

Key audit matters

|

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current six-month period. These matters were addressed in the context of our audit of the parent company and consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Our audit for the six-month period ended June 30, 2019 was planned and performed taking into consideration that the Bank and the Consolidated operations did not present significant changes compared to the prior year. In this context, the key audit matters and our audit approach remained mainly aligned with those of the prior year. |

|

|

Why it is a Key Audit Matter |

How the matter was addressed in the audit |

|

|

|

|

Allowance for loan losses (Note 3(i) and 8) |

|

|

|

|

|

The estimation of the allowance for loan losses involves a high level of judgment by management. The establishment of the allowance for loan losses involves the assessment of several assumptions and internal and external factors, including default levels and guarantees of the portfolios, renegotiation policy, and the current and prospective economic scenarios. Accordingly, we focused again on this area in our audit.

This judgment considers several assumptions in the determination of the allowances. The allowance for loan losses is recorded in accordance with the regulatory requirements of the National Monetary Council (CMN) and the Brazilian Central Bank (BACEN), especially CMN Resolution 2,682, and is based on the analyses of outstanding receivables (overdue and not yet due), according to the internal policies that consider the establishment of credit ratings (risk classification). Likewise, it considers the expectation of realization of the loan portfolio, in addition to the requirement of current legislation, based on past experience, current scenario and future expectations, specific portfolio risks, and management's assessment of risks in the recording of the allowance. |

We updated our understanding and tested the internal controls that are significant in the calculation and recognition of the allowance for loan losses, mainly including the following processes: (i) approval of the credit policy; (ii) credit analysis; (iii) credit granting and renegotiated transactions; (iv) attribution of rating considering the risk of the recoverable value of transactions; (v) processing and recording of provisions; (vi) reconciliation of accounting balances with the analytical position; and (vii) preparation of the notes to the financial statements.

We have also tested the integrity of the database used to calculate the allowance for loan losses, in addition to tests to verify the application of the calculation methodology for this allowance in relation to the ratings assigned, the assumptions consistency, as well as the comparison of the account balances with the analytical reports.

We consider that the criteria and assumptions that management adopted to determine and record the allowance for loan losses are consistent with those adopted in the prior year, and reasonable, in all material respects, in the context of the financial statements. |

|

|

|

|

|

|

|

|

|

|

Recognition and recoverable value of tax credits (Notes 3(s), and 11) |

|

|

|

|

|

The income tax and social contribution credits arising from temporary differences in the calculation bases of these taxes, as well as income tax and social contribution losses, are recognized in the books based on the expectation that future taxable profits will be available for their realization.

The expectation of tax credit realization is based on projections of future results that require judgment by management, including the use of assumptions.

Considering the subjectivity inherent to this process and the significance of the amounts involved, we focused again on this area in our audit. |

We updated our understanding and tested the significant internal controls over the calculation of these tax credits, as well as the estimates of their recoverable value, in accordance with the applicable standards of CMN and BACEN.

We obtained an understanding and assessed the reasonableness of the critical assumptions included in financial projections and compared them with both external and internal data. We also performed tests regarding the mathematical accuracy of the amounts estimated. In addition, we compared the historical results projected with those actually obtained.

We performed tests to confirm the nature and amounts of the temporary differences and income tax and social contribution losses that could be deducted from the future tax bases with the assistance of our experts in the tax area.

We discussed with Management and the Audit Committee and confirmed the approval of the technical study that supports the realization of the tax credits by the appropriate management bodies.

We consider that the criteria and assumptions that management used to determine and record the aforementioned tax credits are reasonable, in all material respects, in the context of the financial statements. |

|

|

|

|

Provisions for contingent liabilities |

|

|

|

|

|

The Bank and its subsidiaries are parties in legal and administrative tax, labor, and civil proceedings arising from the normal course of their business.

In general, these proceedings are terminated after a long period and involve not only discussions on merits, but also complex procedural aspects, in accordance with applicable legislation.

The decision to recognize a contingent liability and the measurement bases require the judgment of the Bank's management, which is periodically reassessed, including when preparing the financial statements, and considering new events. In these circumstances, we focused again on this area in our audit. |

We updated our understanding and we tested the relevant internal controls over the identification and recording of contingent liabilities (tax, civil, and labor) and the disclosures in accompanying notes, including, among others, the internal controls related to the calculation template used to account for the provisions for labor and civil contingencies that are carried out under the historical average loss criteria for actions that are considered as common and similar in nature.

We tested the application of the mathematical models of historical average loss calculation, when applicable, related to labor and civil contingencies. We also tested the ongoing proceedings at the base date of the financial statements.

We performed confirmation procedures with the law firms responsible for the most significant judicial and administrative proceedings to confirm the assessment of the prognosis, also considering the new events that occurred during the six-month period, the completeness of the information, and the correct amount of the provisions.