false

6-K

Q2

2024-06-30

--12-31

2024

0001470683

CN

P5Y

P5Y

P5Y

0001470683

2024-01-01

2024-06-30

0001470683

2024-06-30

0001470683

2023-12-31

0001470683

2023-01-01

2023-06-30

0001470683

ifrs-full:SharePremiumMember

2023-12-31

0001470683

AEHL:ReverseRecapitalizationReserveMember

2023-12-31

0001470683

ifrs-full:MergerReserveMember

2023-12-31

0001470683

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-12-31

0001470683

ifrs-full:StatutoryReserveMember

2023-12-31

0001470683

ifrs-full:CapitalReserveMember

2023-12-31

0001470683

ifrs-full:RetainedEarningsMember

2023-12-31

0001470683

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-12-31

0001470683

ifrs-full:EquityAttributableToOwnersOfParentMember

2023-12-31

0001470683

ifrs-full:NoncontrollingInterestsMember

2023-12-31

0001470683

AEHL:TotalEquityMember

2023-12-31

0001470683

ifrs-full:SharePremiumMember

2022-12-31

0001470683

AEHL:ReverseRecapitalizationReserveMember

2022-12-31

0001470683

ifrs-full:MergerReserveMember

2022-12-31

0001470683

ifrs-full:ReserveOfSharebasedPaymentsMember

2022-12-31

0001470683

ifrs-full:StatutoryReserveMember

2022-12-31

0001470683

ifrs-full:CapitalReserveMember

2022-12-31

0001470683

ifrs-full:RetainedEarningsMember

2022-12-31

0001470683

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2022-12-31

0001470683

ifrs-full:EquityAttributableToOwnersOfParentMember

2022-12-31

0001470683

ifrs-full:NoncontrollingInterestsMember

2022-12-31

0001470683

AEHL:TotalEquityMember

2022-12-31

0001470683

ifrs-full:SharePremiumMember

2024-01-01

2024-06-30

0001470683

AEHL:ReverseRecapitalizationReserveMember

2024-01-01

2024-06-30

0001470683

ifrs-full:MergerReserveMember

2024-01-01

2024-06-30

0001470683

ifrs-full:ReserveOfSharebasedPaymentsMember

2024-01-01

2024-06-30

0001470683

ifrs-full:StatutoryReserveMember

2024-01-01

2024-06-30

0001470683

ifrs-full:CapitalReserveMember

2024-01-01

2024-06-30

0001470683

ifrs-full:RetainedEarningsMember

2024-01-01

2024-06-30

0001470683

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2024-01-01

2024-06-30

0001470683

ifrs-full:EquityAttributableToOwnersOfParentMember

2024-01-01

2024-06-30

0001470683

ifrs-full:NoncontrollingInterestsMember

2024-01-01

2024-06-30

0001470683

AEHL:TotalEquityMember

2024-01-01

2024-06-30

0001470683

ifrs-full:SharePremiumMember

2023-01-01

2023-06-30

0001470683

AEHL:ReverseRecapitalizationReserveMember

2023-01-01

2023-06-30

0001470683

ifrs-full:MergerReserveMember

2023-01-01

2023-06-30

0001470683

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-01-01

2023-06-30

0001470683

ifrs-full:StatutoryReserveMember

2023-01-01

2023-06-30

0001470683

ifrs-full:CapitalReserveMember

2023-01-01

2023-06-30

0001470683

ifrs-full:RetainedEarningsMember

2023-01-01

2023-06-30

0001470683

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-01-01

2023-06-30

0001470683

ifrs-full:EquityAttributableToOwnersOfParentMember

2023-01-01

2023-06-30

0001470683

ifrs-full:NoncontrollingInterestsMember

2023-01-01

2023-06-30

0001470683

AEHL:TotalEquityMember

2023-01-01

2023-06-30

0001470683

ifrs-full:SharePremiumMember

2024-06-30

0001470683

AEHL:ReverseRecapitalizationReserveMember

2024-06-30

0001470683

ifrs-full:MergerReserveMember

2024-06-30

0001470683

ifrs-full:ReserveOfSharebasedPaymentsMember

2024-06-30

0001470683

ifrs-full:StatutoryReserveMember

2024-06-30

0001470683

ifrs-full:CapitalReserveMember

2024-06-30

0001470683

ifrs-full:RetainedEarningsMember

2024-06-30

0001470683

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2024-06-30

0001470683

ifrs-full:EquityAttributableToOwnersOfParentMember

2024-06-30

0001470683

ifrs-full:NoncontrollingInterestsMember

2024-06-30

0001470683

AEHL:TotalEquityMember

2024-06-30

0001470683

ifrs-full:SharePremiumMember

2023-06-30

0001470683

AEHL:ReverseRecapitalizationReserveMember

2023-06-30

0001470683

ifrs-full:MergerReserveMember

2023-06-30

0001470683

ifrs-full:ReserveOfSharebasedPaymentsMember

2023-06-30

0001470683

ifrs-full:StatutoryReserveMember

2023-06-30

0001470683

ifrs-full:CapitalReserveMember

2023-06-30

0001470683

ifrs-full:RetainedEarningsMember

2023-06-30

0001470683

ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember

2023-06-30

0001470683

ifrs-full:EquityAttributableToOwnersOfParentMember

2023-06-30

0001470683

ifrs-full:NoncontrollingInterestsMember

2023-06-30

0001470683

AEHL:TotalEquityMember

2023-06-30

0001470683

2022-12-31

0001470683

2023-06-30

0001470683

AEHL:BusinessManagementAndConsultingServicesSegmentMember

2024-01-01

2024-06-30

0001470683

AEHL:BusinessManagementAndConsultingServicesSegmentMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:RevenuesMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:CostOfRevenuesMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:OperatingCostsAndExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:BadDebtExpenseReversalMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:OtherExpensesMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2023-01-01

2023-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2024-01-01

2024-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:OtherIncomesMember

2023-01-01

2023-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2024-01-01

2024-06-30

0001470683

AEHL:SaleOfTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2023-01-01

2023-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultingIncomeAndSoftwareMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2023-01-01

2023-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2024-01-01

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2023-01-01

2023-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2024-01-01

2024-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2023-01-01

2023-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2024-01-01

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:IncomeLossFromOperationsMember

2023-01-01

2023-06-30

0001470683

AEHL:CeramicTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2024-06-30

0001470683

AEHL:CeramicTileProductsMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2023-12-31

0001470683

AEHL:BusinessManagementAndConsultingServicesSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2024-06-30

0001470683

AEHL:BusinessManagementAndConsultingServicesSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2023-12-31

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2024-06-30

0001470683

AEHL:LiveStreamingecommerceMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2023-12-31

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2024-06-30

0001470683

AEHL:OtherSegmentMember

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2023-12-31

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2024-06-30

0001470683

ifrs-full:OperatingSegmentsMember

AEHL:SegmentAssetsMember

2023-12-31

0001470683

AEHL:HKMember

2024-01-01

2024-06-30

0001470683

ifrs-full:BottomOfRangeMember

2024-06-30

0001470683

ifrs-full:TopOfRangeMember

2024-06-30

0001470683

AEHL:PurchaseOfOrdinarySharesMember

2024-06-30

0001470683

AEHL:PurchaseOfOrdinarySharesMember

2023-06-30

0001470683

AEHL:AnhuiZhongjunEnterpriseManagementMember

2023-03-31

2024-06-30

0001470683

AEHL:NewStonehengeLimitedMember

2023-04-28

0001470683

AEHL:NewStonehengeLimitedMember

2024-01-01

2024-06-30

0001470683

AEHL:NewStonehengeLimitedMember

2023-01-01

2023-06-30

0001470683

AEHL:NewStonehengeLimitedMember

2024-06-30

0001470683

ifrs-full:RightofuseAssetsMember

2024-01-01

0001470683

ifrs-full:RightofuseAssetsMember

2024-06-30

0001470683

ifrs-full:RightofuseAssetsMember

2023-01-01

0001470683

ifrs-full:RightofuseAssetsMember

2023-12-31

0001470683

ifrs-full:LaterThanOneYearMember

2023-12-31

0001470683

AEHL:LaterThanOneYearsAndNotLaterThanFiveYearsMember

2023-12-31

0001470683

ifrs-full:RightofuseAssetsMember

2024-01-01

2024-06-30

0001470683

ifrs-full:RightofuseAssetsMember

2023-01-01

2023-06-30

0001470683

ifrs-full:RightofuseAssetsMember

ifrs-full:DiscontinuedOperationsMember

2023-01-01

2023-06-30

0001470683

ifrs-full:DiscontinuedOperationsMember

2024-01-01

2024-06-30

0001470683

ifrs-full:DiscontinuedOperationsMember

2023-01-01

2023-06-30

0001470683

AEHL:NotePurchaseAgreementMember

2022-12-12

0001470683

AEHL:NotePurchaseAgreementMember

2022-12-11

2022-12-12

0001470683

AEHL:NotePurchaseAgreementMember

2024-01-01

2024-06-30

0001470683

AEHL:NotePurchaseAgreementMember

2023-01-01

2023-06-30

0001470683

AEHL:NotePurchaseAgreementMember

2023-01-01

2023-12-31

0001470683

AEHL:NotePurchaseAgreementOneMember

2023-07-26

0001470683

AEHL:NotePurchaseAgreementOneMember

2023-07-26

2023-07-26

0001470683

AEHL:NotePurchaseAgreementMember

2023-07-26

2023-07-26

0001470683

AEHL:NotePurchaseAgreementOneMember

2024-01-01

2024-06-30

0001470683

AEHL:NotePurchaseAgreementOneMember

2023-01-01

2023-12-31

0001470683

AEHL:NotePurchaseAgreementTwoMember

2024-01-25

0001470683

AEHL:NotePurchaseAgreementTwoMember

2024-01-25

2024-01-25

0001470683

2024-01-25

2024-01-25

0001470683

AEHL:ClassAOrdinarySharesMember

2024-01-25

0001470683

AEHL:ClassAOrdinarySharesMember

2024-01-25

2024-01-25

0001470683

AEHL:ClassAOrdinarySharesMember

2024-02-02

0001470683

AEHL:NotePurchaseAgreementTwoMember

2024-01-01

2024-06-30

0001470683

AEHL:ClassAOrdinarySharesMember

2024-06-30

0001470683

AEHL:ClassAOrdinarySharesMember

2023-12-31

0001470683

AEHL:ClassBOrdinarySharesMember

2024-06-30

0001470683

AEHL:ClassBOrdinarySharesMember

2023-12-31

0001470683

2021-02-12

2021-02-12

0001470683

2021-02-12

0001470683

2021-06-10

2021-06-10

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2021-06-10

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2021-06-10

2021-06-10

0001470683

AEHL:SecuritiesPurchaseAgreementMember

AEHL:InvestorWarrantsMember

2021-06-10

2021-06-10

0001470683

AEHL:InvestorWarrantsMember

2021-06-10

0001470683

AEHL:InvestorWarrantsMember

2021-06-10

2021-06-10

0001470683

AEHL:PlacementAgentWarrantsMember

2021-06-10

2021-06-10

0001470683

AEHL:PlacementAgentWarrantsMember

2021-06-10

0001470683

2021-06-14

2021-06-14

0001470683

ifrs-full:BottomOfRangeMember

2021-06-14

2021-06-14

0001470683

ifrs-full:TopOfRangeMember

2021-06-14

2021-06-14

0001470683

2021-06-14

0001470683

2022-09-30

2022-09-30

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2022-09-30

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2022-09-30

2022-09-30

0001470683

AEHL:InvestorWarrantsMember

2022-09-30

0001470683

AEHL:InvestorWarrantsMember

2022-09-30

2022-09-30

0001470683

AEHL:PlacementAgentWarrantsMember

2022-09-30

2022-09-30

0001470683

AEHL:PlacementAgentWarrantsMember

2022-09-30

0001470683

2022-10-04

2022-10-04

0001470683

ifrs-full:BottomOfRangeMember

2022-10-04

2022-10-04

0001470683

ifrs-full:TopOfRangeMember

2022-10-04

2022-10-04

0001470683

2022-10-04

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-02-23

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-02-23

2024-02-23

0001470683

2023-01-10

0001470683

2023-01-10

2023-01-10

0001470683

2023-01-13

0001470683

2023-01-13

2023-01-13

0001470683

2023-03-30

0001470683

2023-03-30

2023-03-30

0001470683

2023-08-02

0001470683

2023-08-02

2023-08-02

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-06-28

2024-06-28

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-03-15

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-03-15

2024-03-15

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-05-28

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-05-28

2024-05-28

0001470683

AEHL:SecuritiesPurchaseAgreementMember

2024-06-28

0001470683

srt:ChiefFinancialOfficerMember

2024-06-30

0001470683

srt:ChiefFinancialOfficerMember

2024-01-01

2024-06-30

0001470683

srt:ChiefExecutiveOfficerMember

AEHL:ClassBOrdinarySharesMember

2024-06-30

0001470683

srt:ChiefExecutiveOfficerMember

AEHL:ClassBOrdinarySharesMember

2024-01-01

2024-06-30

0001470683

srt:DirectorMember

2024-06-30

0001470683

srt:DirectorMember

2024-01-01

2024-06-30

0001470683

AEHL:EmployeesMember

2024-06-30

0001470683

AEHL:EmployeesMember

2024-01-01

2024-06-30

0001470683

AEHL:ConsultantsMember

2024-01-01

2024-06-30

0001470683

2021-02-17

2021-02-17

0001470683

ifrs-full:BottomOfRangeMember

2021-02-17

2021-02-17

0001470683

ifrs-full:TopOfRangeMember

2021-02-17

2021-02-17

0001470683

2021-02-17

0001470683

2023-01-01

2023-12-31

0001470683

AEHL:LipingHuangMember

2024-06-30

0001470683

AEHL:LipingHuangMember

2023-12-31

0001470683

AEHL:LeiDengMember

2024-06-30

0001470683

AEHL:LeiDengMember

2023-12-31

0001470683

AEHL:XiaorongYangMember

2024-06-30

0001470683

AEHL:XiaorongYangMember

2023-12-31

0001470683

srt:ChiefExecutiveOfficerMember

2024-06-30

0001470683

srt:ChiefExecutiveOfficerMember

2023-12-31

0001470683

AEHL:ChengduFutureTalentedManagementAndConsultingCoLtdMember

2024-06-30

0001470683

AEHL:ChengduFutureTalentedManagementAndConsultingCoLtdMember

2023-12-31

0001470683

AEHL:AntelopeHoldingsChengduCo.LtdMember

2024-06-30

0001470683

AEHL:AntelopeHoldingsChengduCo.LtdMember

2023-12-31

0001470683

AEHL:HainanAntelopeHoldingMember

2024-06-30

0001470683

AEHL:HainanAntelopeHoldingMember

2023-12-31

0001470683

AEHL:AntelopeFutureYangpuMember

2024-06-30

0001470683

AEHL:AntelopeFutureYangpuMember

2023-12-31

0001470683

AEHL:AntelopeInvestmentHainanMember

2024-06-30

0001470683

AEHL:AntelopeInvestmentHainanMember

2023-12-31

0001470683

AEHL:AntelopeRuichengInvestmentMember

2024-06-30

0001470683

AEHL:AntelopeRuichengInvestmentMember

2023-12-31

0001470683

AEHL:HubeiKylinCloudServiceTechnologyMember

2024-06-30

0001470683

AEHL:HubeiKylinCloudServiceTechnologyMember

2023-12-31

0001470683

AEHL:WenzhouKylinCloudServiceTechnologyMember

2024-06-30

0001470683

AEHL:WenzhouKylinCloudServiceTechnologyMember

2023-12-31

0001470683

AEHL:JiangxiKylinCloudServiceTechnologyMember

2024-06-30

0001470683

AEHL:JiangxiKylinCloudServiceTechnologyMember

2023-12-31

0001470683

AEHL:AnhuiKylinCloudServiceTechnologyMember

2024-06-30

0001470683

AEHL:AnhuiKylinCloudServiceTechnologyMember

2023-12-31

0001470683

AEHL:SuccessWinnerLimitedMember

2023-04-28

2023-04-28

0001470683

ifrs-full:DebtSecuritiesMember

2022-12-30

0001470683

ifrs-full:NetAssetValueMember

2023-01-01

2023-12-31

0001470683

ifrs-full:DisposalGroupsClassifiedAsHeldForSaleMember

2023-04-28

0001470683

AEHL:FinancialPerformanceMember

2024-01-01

2024-06-30

0001470683

AEHL:NonadjustingEventMember

AEHL:SecuritiesPurchaseAgreementMember

2024-07-31

0001470683

AEHL:NonadjustingEventMember

AEHL:SecuritiesPurchaseAgreementMember

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:CNY

iso4217:HKD

iso4217:HKD

xbrli:shares

AEHL:Integer

iso4217:CNY

xbrli:shares

AEHL:Investors

Exhibit

99.1

ANTELOPE

ENTERPRISE HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

| | |

Notes | | |

(Unaudited) | | |

USD’000 | |

| | |

| | |

As of June

30, 2024 | | |

| |

| | |

| | |

USD’000 | | |

As of December 31,

2023 | |

| | |

Notes | | |

(Unaudited) | | |

USD’000 | |

| | |

| | |

| | |

| |

| ASSETS AND LIABILITIES | |

| | | |

| | | |

| | |

| NONCURRENT ASSETS | |

| | | |

| | | |

| | |

| Property and

equipment, net | |

| | | |

| 1,946 | | |

| 161 | |

| Intangible assets, net | |

| | | |

| 1 | | |

| 1 | |

| Right-of-use assets, net | |

| 13 | | |

| 310 | | |

| - | |

| Security deposit | |

| | | |

| 166 | | |

| - | |

| Loan receivable | |

| 9 | | |

| 10,768 | | |

| 5,181 | |

| Note Receivable | |

| 20 | | |

| 5,490 | | |

| 6,949 | |

| Total noncurrent assets | |

| | | |

| 18,681 | | |

| 12,292 | |

| | |

| | | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | | |

| | |

| Trade receivable | |

| | | |

| 1,508 | | |

| - | |

| Other receivables and prepayments | |

| | | |

| 4,367 | | |

| 2,871 | |

| Available-for-sale financial

assets | |

| | | |

| - | | |

| 99 | |

| Due from related parties | |

| 16 | | |

| 1,286 | | |

| 1,316 | |

| Cash and bank balances | |

| | | |

| 2,322 | | |

| 536 | |

| Total current assets | |

| | | |

| 9,483 | | |

| 4,822 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| | | |

| 28,164 | | |

| 17,114 | |

| | |

| | | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | | |

| | |

| Trade payables | |

| 11 | | |

| 639 | | |

| - | |

| Accrued liabilities and

other payables | |

| 12 | | |

| 1,077 | | |

| 216 | |

| Unearned revenue | |

| | | |

| 1,009 | | |

| 27 | |

| Amounts owed to related

parties | |

| 16 | | |

| 53 | | |

| 78 | |

| Lease liabilities | |

| 13 | | |

| 117 | | |

| - | |

| Taxes payable | |

| | | |

| 763 | | |

| 281 | |

| Total current liabilities | |

| | | |

| 3,658 | | |

| 602 | |

| | |

| | | |

| | | |

| | |

| NET CURRENT ASSETS | |

| | | |

| 5,825 | | |

| 4,220 | |

| | |

| | | |

| | | |

| | |

| NONCURRENT LIABILITIES | |

| | | |

| | | |

| | |

| Lease liabilities | |

| 13 | | |

| 227 | | |

| - | |

| Note payable | |

| 14 | | |

| 6,245 | | |

| 2,111 | |

| Total noncurrent liabilities | |

| | | |

| 6,472 | | |

| 2,111 | |

| |

| | | |

| | | |

| | |

| Total liabilities | |

| | | |

| 10,130 | | |

| 2,713 | |

| | |

| | | |

| | | |

| | |

| NET ASSETS | |

| | | |

| 18,034 | | |

| 14,401 | |

| | |

| | | |

| | | |

| | |

| EQUITY | |

| | | |

| | | |

| | |

| Reserves | |

| 15 | | |

| 17,145 | | |

| 13,985 | |

| Noncontrolling interest | |

| | | |

| 889 | | |

| 416 | |

| | |

| | | |

| | | |

| | |

| Total equity | |

| | | |

| 18,034 | | |

| 14,401 | |

The

accompanying notes are an integral part of these consolidated financial statements.

ANTELOPE

ENTERPRISE HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| | |

Notes | | |

USD’000 | | |

USD’000 | |

| | |

| | |

SIX MONTHS

ENDED JUNE 30, | |

| | |

| | |

2024 | | |

2023 | |

| | |

Notes | | |

USD’000 | | |

USD’000 | |

| | |

| | |

| | |

| |

| Net sales | |

| 5 | | |

| 43,462 | | |

| 44,636 | |

| | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| | | |

| 39,969 | | |

| 37,824 | |

| | |

| | | |

| | | |

| | |

| Gross profit | |

| | | |

| 3,493 | | |

| 6,812 | |

| | |

| | | |

| | | |

| | |

| Other income | |

| 5 | | |

| 651 | | |

| 409 | |

| Selling and distribution expenses | |

| | | |

| (3,130 | ) | |

| (7,100 | ) |

| Administrative expenses | |

| | | |

| (6,863 | ) | |

| (5,588 | ) |

| Finance costs | |

| | | |

| (537 | ) | |

| - | |

| Other expenses | |

| | | |

| (139 | ) | |

| - | |

| | |

| | | |

| | | |

| | |

| Loss before taxation | |

| 6 | | |

| (6,525 | ) | |

| (5,467 | ) |

| | |

| | | |

| | | |

| | |

| Income tax expense | |

| 7 | | |

| 2 | | |

| - | |

| | |

| | | |

| | | |

| | |

| Net loss for the period from continuing operations | |

| | | |

| (6,527 | ) | |

| (5,467 | ) |

| | |

| | | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | | |

| | |

| Gain on disposal of discontinued

operations | |

| | | |

| - | | |

| 10,659 | |

| Loss from discontinued

operations | |

| 18 | | |

| - | | |

| (200 | ) |

| Net income (loss) | |

| | | |

| (6,527 | ) | |

| 4,992 | |

| | |

| | | |

| | | |

| | |

| Net income (loss) attributable to : | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| | | |

| (6,635 | ) | |

| 4,997 | |

| Non-controlling interest | |

| | | |

| 108 | | |

| (5 | ) |

| Net income (loss) | |

| | | |

| (6,527 | ) | |

| 4,992 | |

| | |

| | | |

| | | |

| | |

| Net loss attributable to the equity holders

of the Company arising from: | |

| | | |

| | | |

| | |

| Continuing operations | |

| | | |

| (6,635 | ) | |

| (5,462 | ) |

| Discontinued operations | |

| | | |

| - | | |

| 10,459 | |

| | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | |

| Exchange differences on

translation of financial statements of foreign operations | |

| | | |

| (913 | ) | |

| (598 | ) |

| | |

| | | |

| | | |

| | |

| Total comprehensive income (loss) | |

| | | |

| (7,440 | ) | |

| 4,394 | |

| | |

| | | |

| | | |

| | |

| Total comprehensive income (loss) attributable

to: | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| | | |

| (7,548 | ) | |

| 4,399 | |

| Non-controlling interest | |

| | | |

| 108 | | |

| (5 | ) |

| Total comprehensive income (loss) | |

| | | |

| (7,440 | ) | |

| 4,394 | |

| | |

| | | |

| | | |

| | |

| Total comprehensive income (loss) arising from: | |

| | | |

| | | |

| | |

| Continuing operations | |

| | | |

| (7,440 | ) | |

| (6,065 | ) |

| Discontinued operations | |

| | | |

| - | | |

| 10,459 | |

| | |

| | | |

| | | |

| | |

| Income (loss) per share attributable to the

equity holders of the Company | |

| | | |

| | | |

| | |

| Basic (USD) | |

| 8 | | |

| | | |

| | |

| — from continuing

operations | |

| | | |

| (0.96 | ) | |

| (3.38 | ) |

| — from discontinued

operations | |

| | | |

| - | | |

| 6.48 | |

| Diluted (USD) | |

| 8 | | |

| | | |

| | |

| — from continuing

operations | |

| | | |

| (0.96 | ) | |

| (3.38 | ) |

| — from discontinued

operations | |

| | | |

| - | | |

| 5.27 | |

The

accompanying notes are an integral part of these consolidated financial statements.

ANTELOPE

ENTERPRISE HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CHANGES IN EQUITY

(UNAUDITED)

| | |

Share premium | | |

Reverse recapitalization

reserve | | |

Merger reserve | | |

Share-based payment

reserves | | |

Statutory reserve | | |

Capital reserve | | |

Accumulated deficit | | |

Currency translation

reserve | | |

Total | | |

Noncontrolling

Interest | | |

Total Equity | |

| | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | | |

USD’000 | |

| Notes | |

| | | |

| | | |

| | | |

| 15 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at January 1, 2024 | |

| 121,768 | | |

| (79,596 | ) | |

| 9,257 | | |

| 27,229 | | |

| 21,238 | | |

| 9,614 | | |

| (98,097 | ) | |

| 2,208 | | |

| 13,621 | | |

| 780 | | |

| 14,401 | |

| Net loss

for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,635 | ) | |

| - | | |

| (6,635 | ) | |

| 108 | | |

| (6,527 | ) |

| Exchange

difference on transaction of financial statements of foreign operations | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (913 | ) | |

| (913 | ) | |

| - | | |

| (913 | ) |

| Total

comprehensive income for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,635 | ) | |

| (913 | ) | |

| (7,548 | ) | |

| 108 | | |

| (7,440 | ) |

| Issuance of new shares for

equity financing | |

| 4,297 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,297 | | |

| - | | |

| 4,297 | |

| Warrants exercised | |

| 1,228 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,228 | | |

| - | | |

| 1,228 | |

| Conversion of long-term notes

into common shares | |

| 106 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 106 | | |

| - | | |

| 106 | |

| Equity

compensation - employee share-based compensation | |

| - | | |

| - | | |

| - | | |

| 5,442 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,442 | | |

| - | | |

| 5,442 | |

| Balance

at June 30, 2024 | |

| 127,399 | | |

| (79,596 | ) | |

| 9,257 | | |

| 32,671 | | |

| 21,238 | | |

| 9,614 | | |

| (104,732 | ) | |

| 1,295 | | |

| 17,146 | | |

| 888 | | |

| 18,034 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at January 1, 2023 | |

| 112,821 | | |

| (79,596 | ) | |

| 9,257 | | |

| 20,348 | | |

| 21,238 | | |

| 9,614 | | |

| (96,072 | ) | |

| 2,468 | | |

| 78 | | |

| 797 | | |

| 875 | |

| Balance | |

| 112,821 | | |

| (79,596 | ) | |

| 9,257 | | |

| 20,348 | | |

| 21,238 | | |

| 9,614 | | |

| (96,072 | ) | |

| 2,468 | | |

| 78 | | |

| 797 | | |

| 875 | |

| Net loss

for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,997 | | |

| - | | |

| 4,997 | | |

| (5 | ) | |

| 4,992 | |

| Exchange

difference on transaction of financial statements of foreign operations | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (598 | ) | |

| (598 | ) | |

| - | | |

| (598 | ) |

| Total

comprehensive loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,997 | | |

| (598 | ) | |

| 4,399 | | |

| (5 | ) | |

| 4,394 | |

| Issuance of new shares for

equity financing | |

| 7,640 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,640 | | |

| - | | |

| 7,640 | |

| Conversion of long-term notes

into common shares | |

| 21 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 21 | | |

| - | | |

| 21 | |

| Equity

compensation - employee share-based compensation | |

| 109 | | |

| - | | |

| - | | |

| 4,006 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,115 | | |

| - | | |

| 4,115 | |

| Balance

at June 30, 2023 | |

| 120,591 | | |

| (79,596 | ) | |

| 9,257 | | |

| 24,354 | | |

| 21,238 | | |

| 9,614 | | |

| (91,075 | ) | |

| 1,870 | | |

| 16,253 | | |

| 792 | | |

| 17,045 | |

| Balance | |

| 120,591 | | |

| (79,596 | ) | |

| 9,257 | | |

| 24,354 | | |

| 21,238 | | |

| 9,614 | | |

| (91,075 | ) | |

| 1,870 | | |

| 16,253 | | |

| 792 | | |

| 17,045 | |

The

accompanying notes are an integral part of these consolidated financial statements.

ANTELOPE

ENTERPRISE HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Notes | | |

USD’000 | | |

USD’000 | |

| | |

| | |

Six Months

Ended June 30, | |

| | |

| | |

2024 | | |

2023 | |

| | |

Notes | | |

USD’000 | | |

USD’000 | |

| | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | | |

| | |

| Income (loss)

before taxation | |

| | | |

| (6,525 | ) | |

| 5,192 | |

| Adjustments for | |

| | | |

| | | |

| | |

| Operating lease charge | |

| | | |

| 33 | | |

| - | |

| Depreciation of property,

plant and equipment | |

| | | |

| 40 | | |

| 26 | |

| Gain on disposal of subsidiaries | |

| 18 | | |

| - | | |

| (10,659 | ) |

| Loan forgiveness by related

party | |

| | | |

| - | | |

| (167 | ) |

| Loss on convertible note | |

| 14 | | |

| 6 | | |

| 5 | |

| Standstill fee on note

payable | |

| | | |

| 125 | | |

| - | |

| Share based compensation | |

| 15 | | |

| 5,442 | | |

| 4,115 | |

| Interest expense on lease

liability | |

| 13 | | |

| 13 | | |

| - | |

| Amortization of OID of

convertible note | |

| 13 | | |

| 28 | | |

| 22 | |

| Operating cash flows before

working capital changes | |

| | | |

| (838 | ) | |

| (1,466 | ) |

| Increase in trade receivables | |

| | | |

| (1,508 | ) | |

| - | |

| Increase in other receivables

and prepayments | |

| | | |

| (2,190 | ) | |

| (1,325 | ) |

| Increase in loan receivable | |

| | | |

| (5,587 | ) | |

| (4,688 | ) |

| Increase (Decrease) in

trade payables | |

| | | |

| 639 | | |

| (70 | ) |

| Increase in unearned revenue | |

| | | |

| 982 | | |

| 56 | |

| Increase (Decrease) in

taxes payable | |

| | | |

| 480 | | |

| (106 | ) |

| Increase in accrued liabilities

and other payables | |

| | | |

| 862 | | |

| 8 | |

| Cash used in operations | |

| | | |

| (7,160 | ) | |

| (7,591 | ) |

| Interest paid | |

| | | |

| - | | |

| - | |

| Income tax paid | |

| | | |

| - | | |

| (14 | ) |

| Net cash generated from

operating activities from discontinued operations | |

| | | |

| - | | |

| 2,038 | |

| | |

| | | |

| | | |

| | |

| Net cash used in operating

activities | |

| | | |

| (7,160 | ) | |

| (5,567 | ) |

| |

| | | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | | |

| | |

| Acquisition of fixed assets | |

| | | |

| (1,825 | ) | |

| (72 | ) |

| Decrease in notes receivable | |

| | | |

| 1,460 | | |

| - | |

| Decrease in available-for-sale

financial asset | |

| | | |

| 99 | | |

| 126 | |

| Decrease in restricted

cash | |

| | | |

| - | | |

| 299 | |

| Cash disposed as a result

of disposal of subsidiaries | |

| | | |

| - | | |

| (37 | ) |

| Net cash used in investing

activities from discontinued operations | |

| | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Net cash generated from

(used in) investing activities | |

| | | |

| (266 | ) | |

| 316 | |

| |

| | | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | | |

| | |

| Payment for lease liabilities | |

| | | |

| (13 | ) | |

| - | |

| Insurance of share capital

for equity financing | |

| 15 | | |

| 4,297 | | |

| 7,661 | |

| Warrants exercised | |

| | | |

| 1,228 | | |

| - | |

| Proceeds from promissory

note | |

| | | |

| 4,630 | | |

| - | |

| Repayment of promissory

note | |

| | | |

| (550 | ) | |

| - | |

| Advance from related parties | |

| 16 | | |

| 533 | | |

| 55 | |

| Net cash used in financing

activities from discontinued operations | |

| | | |

| - | | |

| (2,064 | ) |

| | |

| | | |

| | | |

| | |

| Net cash generated from

financing activities | |

| | | |

| 10,125 | | |

| 5,652 | |

| | |

| | | |

| | | |

| | |

| NET INCREASE IN CASH & EQUIVALENTS | |

| | | |

| 2,699 | | |

| 401 | |

| CASH & EQUIVALENTS, BEGINNING OF PERIOD | |

| | | |

| 536 | | |

| 612 | |

| EFFECT OF FOREIGN EXCHANGE RATE DIFFERENCES | |

| | | |

| (913 | ) | |

| (560 | ) |

| | |

| | | |

| | | |

| | |

| CASH & EQUIVALENTS, END OF PERIOD | |

| | | |

| 2,322 | | |

| 453 | |

The

accompanying notes are an integral part of these consolidated financial statements.

ANTELOPE

ENTERPRISE HOLDINGS LIMITED AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE SIX MONTHS ENDED JUNE 30, 2024

(UNAUDITED)

1.

GENERAL INFORMATION

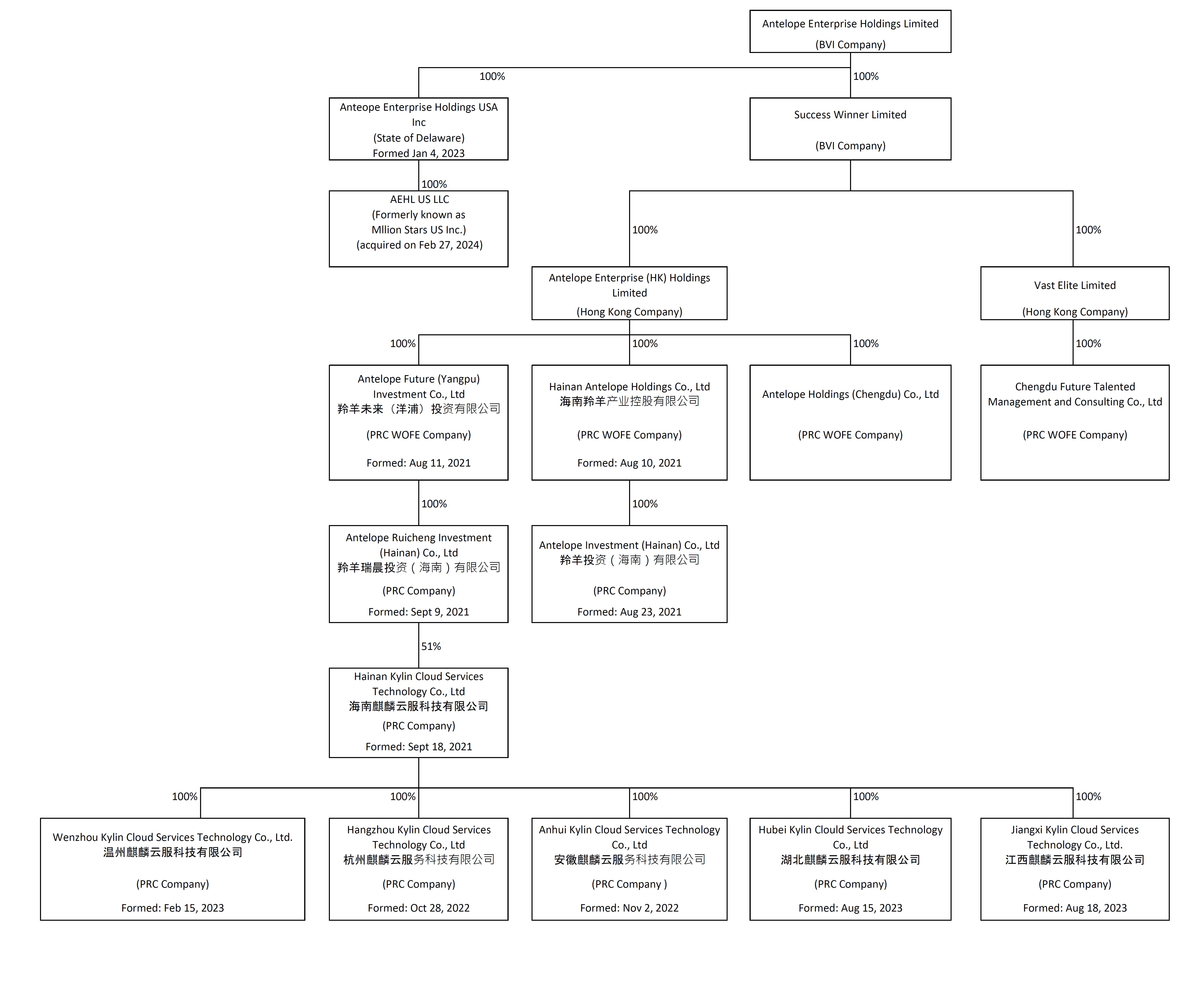

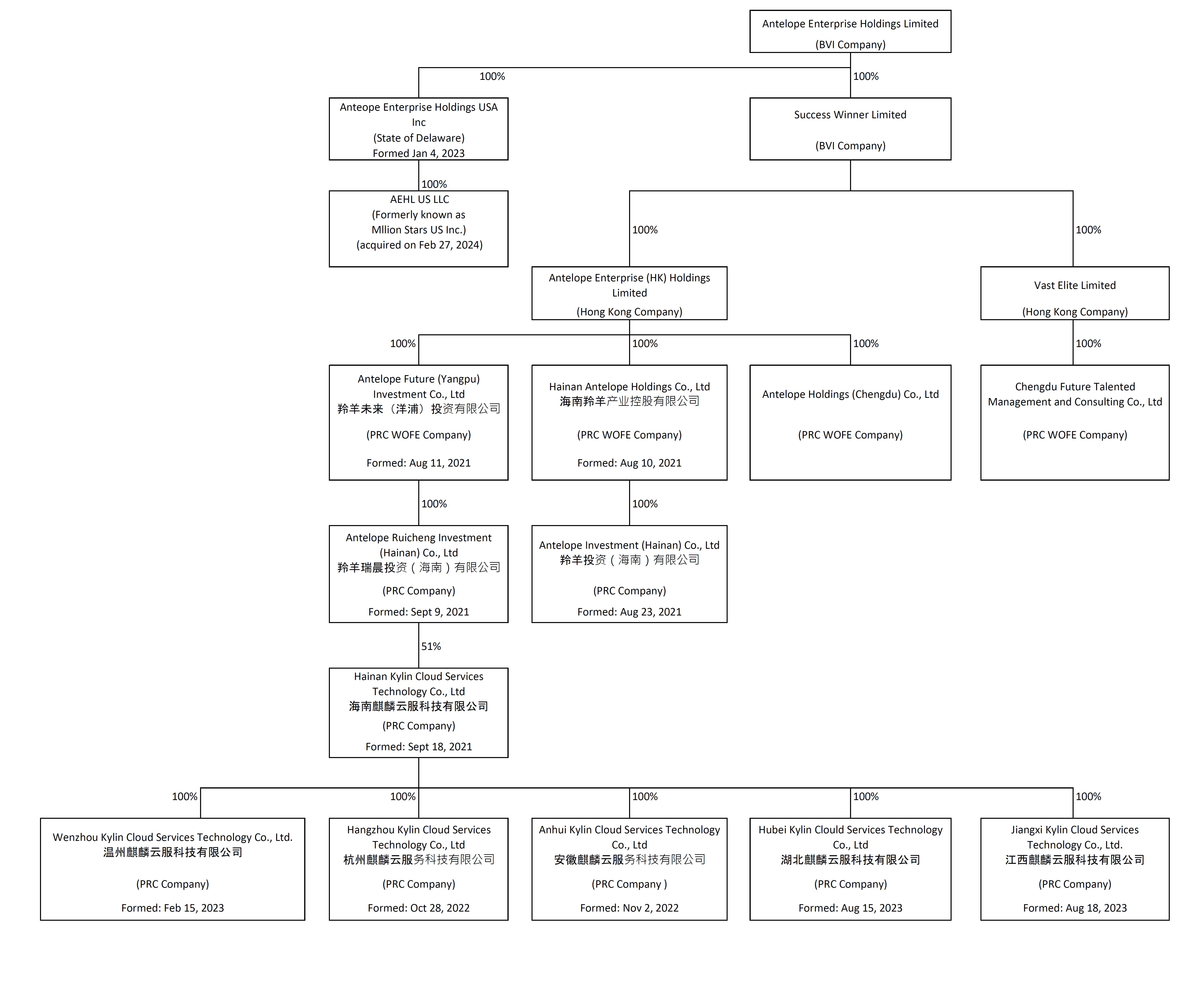

Antelope

Enterprise Holdings Limited (“Antelope Enterprise” or the “Company”), formerly known as China Ceramics Co., Ltd

(“CCCL”), is a British Virgin Islands company operating under the BVI Business Companies Act (2004) with its shares listed

on the NASDAQ Stock Market (Ticker: AEHL). The head office of the Company is located at Room 1802, Block D, Zhonghai International

Center, Hi-Tech Zone, Chengdu, Sichuan Province, the People’s Republic of China (“PRC”).

On

September 18, 2023, the Company effected a one-for-ten reverse split of its issued and outstanding Class A ordinary shares.

On February 27, 2024, the Company entered into a stock transfer agreement with Right Fortress Limited, through which Right Fortress

Limited transferred all its equity in Million Stars US Inc (“Million Star”) to Antelope Enterprise Holdings USA Inc. Million

Star is mainly engaged in the computing power activities.

Antelope

Enterprise and its subsidiaries’ corporate structure as of June 30, 2024 was as follows:

2.

BASIS OF PREPARATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The

accompanying unaudited condensed consolidated interim financial statements have been prepared in accordance with International Accounting

Standard (“IAS”) 34 Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”).

They do not include all of the information required in annual financial statements in accordance with International Financial Reporting

Standards (“IFRS”), and should be read in conjunction with the audited consolidated financial statements and related footnotes

on Form 20-F for the year ended December 31, 2023 as filed with the Securities and Exchange Commission. The accompanying unaudited condensed

consolidated interim financial statements reflect all normal recurring adjustments which, in the opinion of management, are necessary

for a fair statement of the results for the interim periods presented. Results for the six months ended June 30, 2024 are not necessarily

indicative of the results expected for the full fiscal year or for any future period.

Effective

January 1, 2024, the Company changed its financial statements presentation of its reporting currency from RMB to USD. Financial

information for all periods presented in the filing were recast into the new reporting currency using a methodology consistent with IAS

21. Accordingly, the interim consolidated financial statements as of June 30, 2024 and December 31, 2023, and for the six months ended

June 30, 2024 and 2023 were presented in USD, unless otherwise stated. They were approved for issue by the Audit Committee of the Board

of Directors and the Board of Directors on September 30, 2024.

These

interim financial statements have been prepared in accordance with the same accounting policies adopted in the 2023 annual financial

statements, except for the change of reporting currency and accounting policy changes that are expected to be reflected in the 2024 annual

financial statements. Details of any changes in accounting policies are set out in note 3.

These

interim financial statements contain condensed consolidated financial statements and selected explanatory notes. The notes include an

explanation of events and transactions that are significant to an understanding of the changes in financial position and performance

of the Group since the 2023 annual financial statements.

3.

CHANGES IN ACCOUNTING POLICIES AND DISCLOSURES

Effective

January 1, 2024, the Company changed its presentation currency from RMB to USD to be more relevant to users.

Prior

to January 1, 2024, the Company reported its annual and interim consolidated financial statements in RMB. In making this change in presentation

currency, the Company followed the recommendations set out in IAS 21, the Effects of Change in Foreign Exchange Rates. In accordance

with IAS 21, comparable financial statements for the six months ended June 30, 2023 have been restated retrospectively in the new presentation

currency of USD using the current rate method.

The

consolidated financial statements as of December 31, 2023 of the Company have been prepared in RMB and translated into the new presentation

currency of USD using the current rate method.

The

procedure under the current rate method as applied in these interim condensed unaudited consolidated financial statements is outlined

as below:

| |

● |

balances

for the six months ended June 30, 2023 reported in the Interim Condensed Unaudited Consolidated Statement of Comprehensive Income

(Loss) and Interim Condensed Unaudited Consolidated Statements of Cash Flows have been translated into USD using average foreign

currency rates prevailing for the period; |

| |

● |

balances

as at and for the six months ended June 30, 2023 reported in the Interim Condensed Unaudited Consolidated Statement of Change in

Equity, including share-based payment reserve, foreign currency translation reserve, deficit and share capital, have been translated

into USD using historical rates; and |

| |

● |

basic

and diluted loss per share for the six months ended June 30, 2023 have been restated to USD to reflect the change in presentation

currency. |

All

resulting exchange differences arising from the translation are included as separate component of other comprehensive income (loss).

The

effect of the change in functional currency to USD was applied prospectively in the financial statements effective January 1, 2024. The

financial position of the Company as at January 1, 2024 has been translated from RMB to USD at an exchange rate of 7.10.

All

transactions for the Company are recorded in USD from January 1, 2024 and onwards. Transactions denominated in currencies other than

USD are considered foreign currency transactions. Foreign currency transactions are translated into USD using the foreign currency rates

prevailing at the date of the transaction. Period-end balances of monetary assets and liabilities in foreign currency are translated

to USD using period-end foreign currency rates. Foreign currency gains and losses arising from the settlement of foreign currency transactions

are recognized in profit or loss.

At

the date of authorization of these financial statements, the IASB has issued a number of amendments, new standards and interpretations

which are not yet effective for the six months ended June 30, 2024 and which have not been adopted in these financial statements. These

include the following which may be relevant to the Group :

| Amendments

to IFRS 10 and IAS 28 |

|

Sale

or Contribution of Assets between an Investor and its Associate or Joint Venture |

The

management of the Company anticipate that the application of all the new and amendments to IFRSs will have no material impact on the

consolidated financial statements in the foreseeable future.

4.

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The

preparation of interim financial statements in conformity with IAS 34 requires management to make judgments, estimates and assumptions

that affect the application of policies and reported amounts of assets and liabilities, income and expenses on a year to date basis.

Actual results may differ from these estimates.

5.

REVENUE AND OTHER INCOME

| |

a)

|

Revenue

comprises the fair value of the consideration received or receivable for the sale of goods. |

| |

|

|

| |

|

An

analysis of the Company’s revenue and other income is as follows: |

SCHEDULE OF ANALYSIS ABOUT COMPANY'S REVENUE AND OTHER INCOME

| | |

USD’000 | | |

USD’000 | |

| | |

For

the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Revenues | |

| | | |

| | |

| Continuing operations | |

| | | |

| | |

| Business management

and consulting | |

| - | | |

| 477 | |

| Livestreaming ecommerce | |

| 43,462 | | |

| 44,159 | |

| | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sale of tiles (Note 18) | |

| - | | |

| 390 | |

| | |

| | | |

| | |

| Total revenues | |

| 43,462 | | |

| 45,026 | |

| Total revenues | |

| 43,462 | | |

| 45,026 | |

| | |

| | | |

| | |

| Other income | |

| | | |

| | |

| Continuing operations | |

| | | |

| | |

| Interest income | |

| 213 | | |

| 77 | |

| Government grant | |

| - | | |

| 45 | |

| Tax subsidy | |

| 438 | | |

| 120 | |

| Loan forgiveness | |

| - | | |

| 167 | |

| | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Other income (Note 18) | |

| - | | |

| 825 | |

| Total other income | |

| 651 | | |

| 1,234 | |

The

Company identifies operating segments and prepares segment information based on the regular internal financial information reported to

the Chief Executive Officer and executive directors, who are the Company’s chief operating decision makers for their decisions

about the allocation of resources to the Company’s business components and for their review of the performance of those components.

All

of the Company’s operations are considered by the chief operating decision makers to be aggregated into three reportable operating

segments: 1) the provision of livestreaming ecommerce industry which was acquired as part of a strategic transformation towards trending

technology businesses in China to mitigate the challenging conditions in the real estate market in China, and associated industries like

the Company’s legacy ceramic tile business, (2) business management and consulting; and (3) the manufacture and sale of standard

to high-end ceramic tiles, which was disposed by the Company in April 2023. Operating segments are defined as components of an enterprise

for which separate financial information is available and evaluated regularly by the Company’s chief operating decision makers

in deciding how to allocate resources and in assessing performance.

The

business of the Company is engaged entirely in the PRC. The Chief Executive Officer and executive directors regularly review the Company’s

business as one geographical segment.

The

following table shows the Company’s operations by business segment for the six months ended June 30, 2024 and 2023.

SCHEDULE OF OPERATIONS BY BUSINESS SEGMENT

| | |

USD’000 | | |

USD’000 | |

| | |

For

the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Revenues | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sales of tile

products | |

| - | | |

| 390 | |

| Continuing operations | |

| | | |

| | |

| Consulting income / software | |

| - | | |

| 477 | |

| Livestreaming ecommerce | |

| 43,462 | | |

| 44,159 | |

| Total revenues | |

| 43,462 | | |

| 45,026 | |

| | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sales of tile products | |

| - | | |

| 1,091 | |

| Continuing operations | |

| | | |

| | |

| Consulting income / software | |

| 65 | | |

| 1,177 | |

| Livestreaming ecommerce | |

| 39,904 | | |

| 36,647 | |

| Total cost of revenues | |

| 39,969 | | |

| 38,915 | |

| | |

| | | |

| | |

| Operating costs and expenses | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sales of tile products | |

| - | | |

| 468 | |

| Continuing operations | |

| | | |

| | |

| Consulting income / software | |

| 139 | | |

| 373 | |

| Livestreaming ecommerce | |

| 3,641 | | |

| 7,676 | |

| Other | |

| 6,750 | | |

| 4,639 | |

| Total operating costs and expenses | |

| 10,530 | | |

| 13,156 | |

| | |

| | | |

| | |

| Bad debt expense (reversal) | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sales of tile products | |

| - | | |

| 144 | |

| Continuing operations | |

| | | |

| | |

| Consulting income / software | |

| - | | |

| - | |

| Livestreaming ecommerce | |

| - | | |

| - | |

| Total bad debt expense | |

| - | | |

| 144 | |

| | |

| | | |

| | |

| Other expenses | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sales of tile products | |

| - | | |

| - | |

| Continuing operations | |

| | | |

| | |

| Consulting income / software | |

| - | | |

| - | |

| Livestreaming ecommerce | |

| 139 | | |

| - | |

| Total other expenses | |

| 139 | | |

| - | |

| | |

| | | |

| | |

| Other income | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Sales of tile products | |

| - | | |

| 825 | |

| Continuing operations | |

| | | |

| | |

| Consulting income / software | |

| - | | |

| 11 | |

| Livestreaming ecommerce | |

| 446 | | |

| 154 | |

| Other | |

| 205 | | |

| 244 | |

| Total other income | |

| 651 | | |

| 1,234 | |

| | |

| | | |

| | |

| Loss from operations | |

| | | |

| | |

| Sales of tile products | |

| - | | |

| (200 | ) |

| Consulting income / software | |

| (212 | ) | |

| (1,062 | ) |

| Livestreaming ecommerce | |

| 224 | | |

| (11 | ) |

| Other | |

| (6,537 | ) | |

| (4,394 | ) |

| Loss from operations | |

| (6,525 | ) | |

| (5,667 | ) |

| | |

As

of June 30,

2024 | | |

As

of December 31,

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Segment assets | |

| | | |

| | |

| Ceramic tile products | |

| - | | |

| - | |

| Consulting income/software | |

| 13,535 | | |

| 7,231 | |

| Livestreaming ecommerce | |

| 3,692 | | |

| 1,903 | |

| Others | |

| 10,937 | | |

| 7,980 | |

| Total assets | |

| 28,164 | | |

| 17,114 | |

6.

LOSS BEFORE TAXATION

SCHEDULE

OF LOSS BEFORE TAXATION

| | |

USD’000 | | |

USD’000 | |

| | |

For

the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Finance costs | |

| | | |

| | |

| Interest expense

on lease liability | |

| 13 | | |

| 42 | |

| Interest expense on note

payable | |

| 524 | | |

| | |

| Cost of inventories recognized as an expense

(including depreciation charge of right-of-use assets for leases) | |

| - | | |

| 1,091 | |

| Depreciation of fixed assets | |

| 40 | | |

| 26 | |

| Depreciation charge of right-of-use assets

for leases (included in the administrative expenses) | |

| 33 | | |

| - | |

| Marketing and promotion

expense | |

| 2,958 | | |

| 6,431 | |

7.

INCOME TAX

SCHEDULE

OF INFORMATION ABOUT INCOME TAX EXPENSES

| | |

USD’000 | | |

USD’000 | |

| | |

For

the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Continuing operations | |

| | | |

| | |

| Current Tax: | |

| | | |

| | |

| PRC Income

Tax Expense | |

| 1 | | |

| - | |

| US Income Tax Expense | |

| 1 | | |

| - | |

| Deferred tax expense | |

| - | | |

| - | |

| Tax

per financial statements | |

| 2 | | |

| - | |

Discontinued

operations did not incur any income tax expense for the six months ended June 30, 2024.

British

Virgin Islands Profits Tax

The

Company has not been subject to any taxation in this jurisdiction for the six months ended June 30, 2024 and 2023.

Hong

Kong Profits Tax

The

subsidiaries in Hong Kong are subject to tax charged on Hong Kong sourced income, the corporate tax rate in Hong Kong is a two-tier one

starting with the year of assessment 2018/2019 (from April 1, 2018): the tax is 8.25% (7.5% for unincorporated companies) on the first

2 million HKD of taxable profits and 16.5% (15% for unincorporated companies) for the rest of the profits. No Hong Kong profits tax has

been provided as the Company has no assessable profit arising in Hong Kong for the six months ended June 30, 2024 and 2023.

US

Income Tax

The

Company’s U.S. subsidiaries are subject to U.S. federal income tax rate of 21%, and New York state corporate income tax with rates

ranging from 6.5% to 7.25%.

PRC

Income Tax

Most

subsidiaries of the Company in the PRC are subject to the enterprise income tax in accordance with “PRC Enterprise Income Tax Law”,

and the applicable income tax rate for the six months ended June 30, 2024 and 2023 is 25%.

Both Antelope Holdings (Chengdu) Co., Ltd (“Antelope Chengdu”) and Chengdu Future Talented Management and Consulting Co,

Ltd (“Chengdu Future”) are subject to 2.5%

preferential income tax rate for the six months ended June 30, 2024 and 2023.

8.

LOSS PER SHARE

SCHEDULE

OF LOSS PER SHARE

| | |

USD’000 | | |

USD’000 | |

| | |

For

the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Loss attributable to holders of ordinary shares

(USD’000): | |

| | | |

| | |

| Net loss from

continuing operations | |

| (6,635 | ) | |

| (5,462 | ) |

| Net income from discontinued

operations | |

| - | | |

| 10,459 | |

| Weighted average number

of ordinary shares outstanding used in computing basic earnings per share * | |

| 6,923,985 | | |

| 1,614,471 | |

| Weighted average number

of ordinary shares outstanding used in computing diluted earnings per share * | |

| 6,923,985 | | |

| 1,984,646 | |

| Income (loss) per share - basic (USD) | |

| | | |

| | |

| From

continuing operations | |

| (0.96 | ) | |

| (3.38 | ) |

| From

discontinued operations | |

| - | | |

| 6.48 | |

| Income (loss) per share - diluted (USD) ** | |

| | | |

| | |

| From

continuing operations** | |

| (0.96 | ) | |

| (3.38 | ) |

| From

discontinued operations** | |

| - | | |

| 5.27 | |

9.

LOAN RECEIVABLE

From

March 31, 2023 to June 30, 2024, Anhui Zhongjun Enterprise Management Co., Ltd (“Anhui Zhongjun”) borrowed a total of $ 10,768,000

from Antelope Enterprise Holdings (Chengdu) Co., Ltd. This loan will be repaid in installments over a period of three years from the

date of disbursement.

10.

NOTE RECEIVABLE

On

April 28, 2023, the Company completed the sale of Stand Best Creation Limited and its subsidiaries, Hengda and Hengdali, to New Stonehenge

Limited for a total of USD $8,500,000.

New Stonehenge Limited has agreed to make the payment in four equal installments on a date that falls 48 months after the effective date

of the transaction, with an annual interest rate of 5%. For the six months ended June 30, 2024 and 2023, the Company recorded

interest income of $ 213,000

and $ 71,000.

As of June 30, 2024, total balance of note receivable was $ 5,490,000.

11.

TRADE PAYABLES

SCHEDULE OF INFORMATION ABOUT TRADE PAYABLES

| | |

As

of | |

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

USD’000 | | |

USD’000 | |

| Trade payables | |

| 639 | | |

| - | |

Trade

payables are denominated in Renminbi, non-interest bearing and generally settled within 120-day terms. All of the trade payables are

expected to be settled within one year. The carrying value of trade payables is considered to be a reasonable approximation of fair value.

12.

ACCRUED LIABILITIES AND OTHER PAYABLES

SCHEDULE OF INFORMATION ABOUT ACCRUED LIABILITIES AND OTHER PAYABLES

| | |

| | | |

| | |

| | |

As

of | |

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

USD’000 | | |

USD’000 | |

| Accrued salary | |

| 45 | | |

| 69 | |

| Accrued interest | |

| 542 | | |

| 144 | |

| Accrued liabilities -

others | |

| 490 | | |

| 3 | |

| Accrued liabilities and

other payables | |

| 1,077 | | |

| 216 | |

Accrued

liabilities consist mainly of accrued rental, wages and utility expenses.

The

carrying value of accrued liabilities and other payables is considered to be a reasonable approximation of fair value.

13.

RIGHT-OF-USE ASSETS AND LEASES LIABILITIES

(a)

Amounts recognized in the consolidated statement of financial position

The

carrying amounts of right-of-use assets for lease are as below:

SUMMARY OF CARRYING AMOUNTS OF RIGHT-OF-USE ASSETS FOR LEASE

| Net book amount at January 1, 2024 | |

$ | nil | |

| Net book amount at June 30, 2024 | |

$ | 310,000 | |

| | |

| | |

| Net book amount at January 1, 2023 | |

$ | 68,000 | |

| Net book amount at December 31, 2023 | |

$ | nil | |

The

lease liabilities for continuing operations are as below:

SCHEDULE OF LEASE LIABILITIES

| | |

June 30, 2024 | | |

December 31,

2023 | |

| | |

USD’000 | | |

USD’000 | |

| Lease liabilities - current | |

| 117 | | |

| - | |

| Lease liabilities –

noncurrent | |

| 227 | | |

| - | |

| Total

lease liabilities | |

| 344 | | |

| - | |

Contractual

undiscounted cash flows for the leases:

SCHEDULE OF CONTRACTUAL UNDISCOUNTED CASH FLOWS FOR THE LEASES

| | |

As

of December 31, 2023 | |

| | |

Within

one year | | |

One

to five years | | |

Total

contractual undiscounted cash flow | |

| | |

USD’000 | | |

USD’000 | | |

USD’000 | |

| | |

| 150 | | |

| 250 | | |

| 400 | |

(b)

Amounts recognized in the consolidated income statement

The

consolidated income statement shows the following amounts from continuing operations relating to leases:

SUMMARY OF CONSOLIDATED INCOME STATEMENT SHOWING THE AMOUNTS RELATING TO LEASES

| | |

Six Months

ended | |

| | |

June

30, 2024 | |

| | |

USD’000 | |

| Amortization charge of right-of-use

assets | |

| 33 | |

| Interest expense | |

| 13 | |

| |

|

Six

Months ended |

|

| |

|

June

30, 2023 |

|

| |

|

USD’000 |

|

| Amortization charge

of right-of-use assets |

|

|

- |

|

| Interest expense |

|

|

- |

|

The

consolidated income statement shows the following amounts from discontinued operations relating to leases:

| | |

Six Months

ended | |

| | |

June

30, 2023 | |

| Amortization charge of right-of-use

assets | |

| 616 | |

| Interest expense | |

| 42 | |

The

total cash outflow in financing activities for leases during the six months ended June 30, 2024 and 2023 was $ 13,000, and $ nil, respectively.

The

total cash outflow in financing activities from discontinued operations for leases during the six months ended June 30, 2024 and 2023

was $ nil and $ 2,064,000, respectively.

14.

NOTE PAYABLE

Unsecured

Promissory Note in December 2022

On

December 12, 2022, the Company entered into a note purchase agreement (the “2022 Note Purchase Agreement”)

with an investor, pursuant to which the Company issued to the investor an unsecured Promissory Note of $1,332,500,

for $1,250,000

in gross proceeds. The note included an

original issue discount, or OID, of $62,500

along with $20,000

for investor’s fees, costs and other transaction

expenses in connection with the issuance of the note. This OID was recognized as a debt discount is amortized over the life of

the note. The note bears interest at 8%

per annum compounding daily, and has a term of 18 months. Company may prepay all or a portion of the Note at any time by paying 120%

of the outstanding balance elected for pre-payment. The Investor has the right to redeem the Note at any time six (6) months after the

2022 note purchase price date (the “2022 Note Redemption Start Date”), subject to maximum monthly

redemption amount of $200,000.

The Company should pay the applicable redemption amount in cash to the Investor within three (3) Trading Days following the investor’s

delivery of a redemption notice. At the end of each month following the 2022 Note Redemption Start Date, if the Company has not

reduced the outstanding balance by at least $200,000,

then by the fifth (5th) day of the following month, the Company must pay in cash to the Investor the difference between $200,000

and the amount actually redeemed in such month

or the Outstanding Balance will automatically increase by one percent (1%)

as of such fifth (5th) day. Under the 2022 Note Purchase Agreement, while the Note is outstanding, the Company agreed to keep

adequate public information available and maintain its Nasdaq listing. Upon the occurrence of a Trigger Event (as defined in the note),

the

Investor shall have the right to increase the balance of the Note by fifteen percent (15%) for Major Trigger Event (as defined in the

Note) and five percent (5%) for Minor Trigger Event (as defined in the Note). In addition, the Note provides that upon occurrence of

an Event of Default (as defined in the note), the interest rate shall accrue on the outstanding balance at the rate equal to the

lesser of twenty-two percent (22%) per annum or the maximum rate permitted under applicable law.

During

the six months ended June 30, 2024, the Company amortized OID of $ 18,593

and recorded $ 37,046

interest expense on this note, and the

Company and Lender exchanged partitioned notes of $ 100,000

for the delivery of 68,913

Class A ordinary shares. The Company recorded

$ 6,126

loss on conversion of these notes in the six

months ended June 30, 2024 and made repayment of $ 450,000

by cash to this note.

During

the six months ended June 30, 2023, the Company amortized OID of $ 20,833

and recorded $ 52,376

interest expense on this note and the

Company and Lender exchanged Partitioned notes of $ 15,000

for the delivery of 22,751

Class A ordinary shares. The Company recorded

$ 4,955

loss on conversion of these notes in 2023. On

September 1, 2023, the Company and the investor entered into a standstill agreement with regard to the certain promissory note

issued to the investor dated December 12, 2022. Pursuant to the standstill agreement, the Investor agreed not to redeem any portion