UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

SCHEDULE 14A

______________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant: X

Filed by a Party other than the Registrant:

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

X

Definitive Additional Materials

Soliciting Material Pursuant to Rule 14a-12

TOWERS WATSON & CO.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

X

No fee required

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

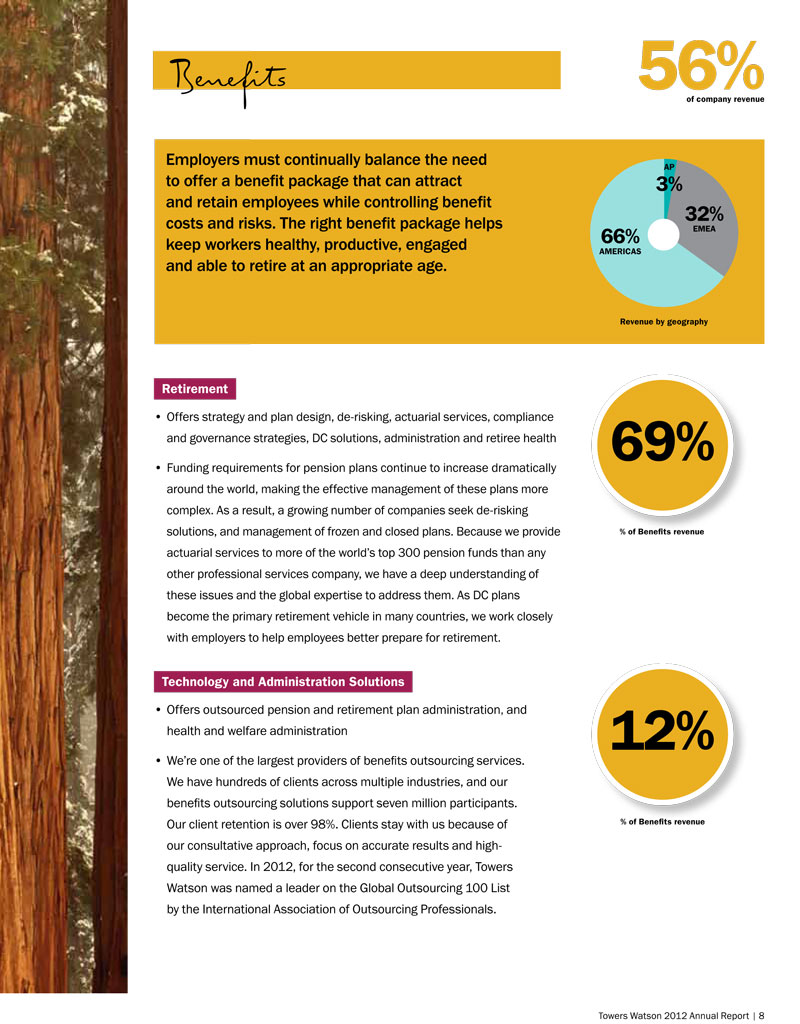

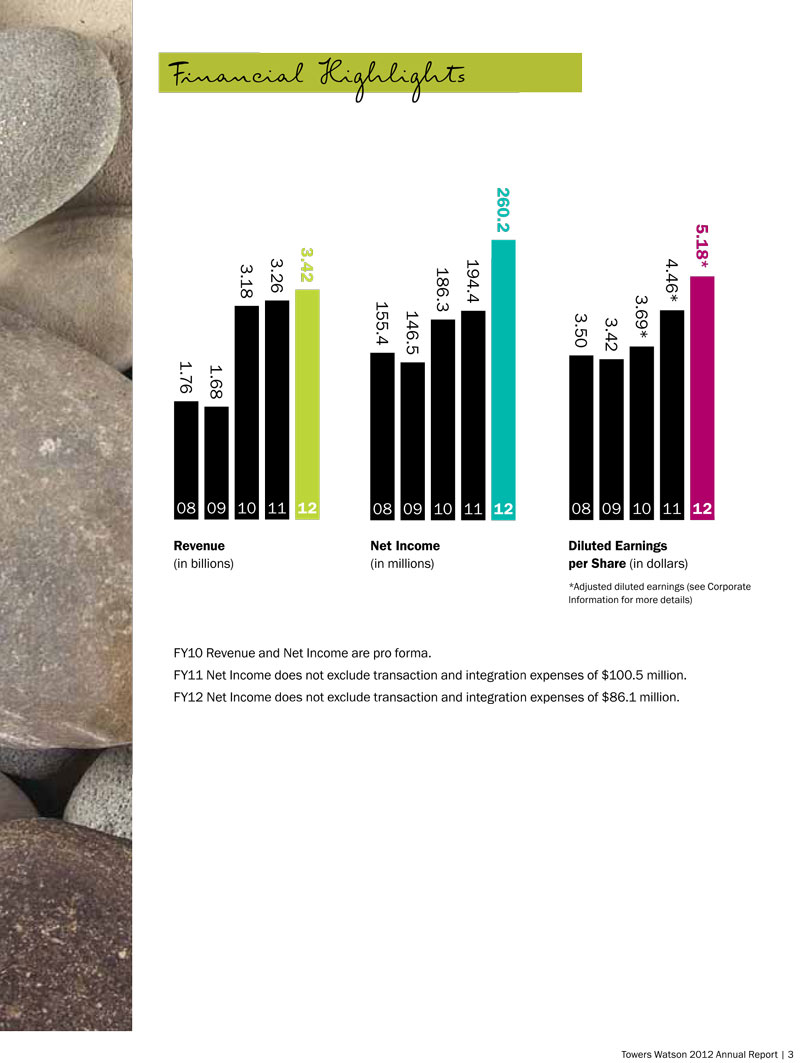

Revenues in our Benefits segment grew 4% this year on a constant currency basis. Organizations sought our help with ongoing benefit cost and risk pressures driven by a volatile economy, coupled with a persistent low interest rate environment and changing benefit regulations in many countries.

In Retirement, we benefited from steady, recurring work with long-term clients. This included consulting on pension de-risking, lump sum distribution and management, and other strategies as companies shifted from defined benefit (DB) to defined contribution (DC) retirement plans for their employees. Many clients needed help managing their DC plans, and we saw more clients begin to bundle administration, outsourcing and actuarial services.

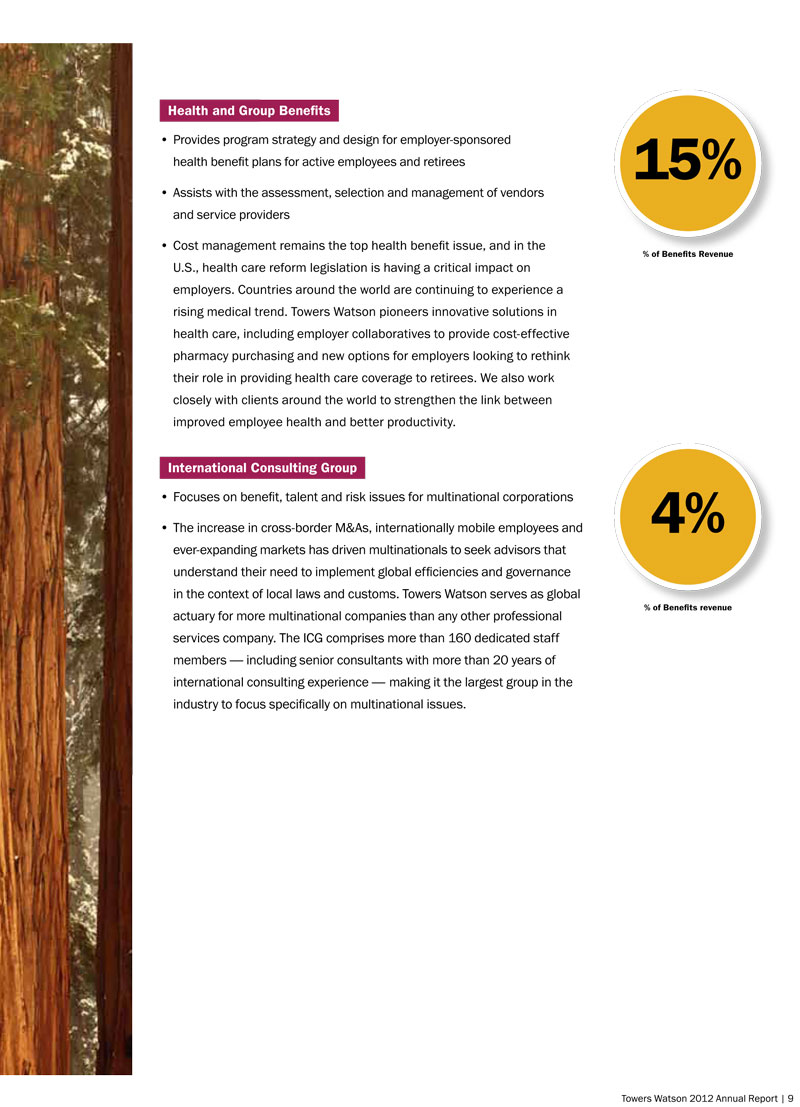

Clients asked our Health and Group Benefits experts to help them manage their health plans more cost efficiently. We also responded to multinational companies’ sharpened focus on global health and productivity. And we helped U.S. clients reshape their total rewards programs and make other changes in response to the Patient Protection and Affordable Care Act. This major piece of legislation requires virtually all our U.S. clients to make decisions that will significantly affect their employees and bottom line.

Our International Consulting Group (ICG) grew revenues by helping clients with merger and acquisition (M&A) transactions and integration, and through ongoing work for multinationals.

Revenues increased for our Technology and Administration Solutions (TAS) line of business. TAS completed a number of full outsourcing agreements this year and continued to benefit from our January 2011 acquisition of Aliquant, a U.S. outsourcing and administration company.

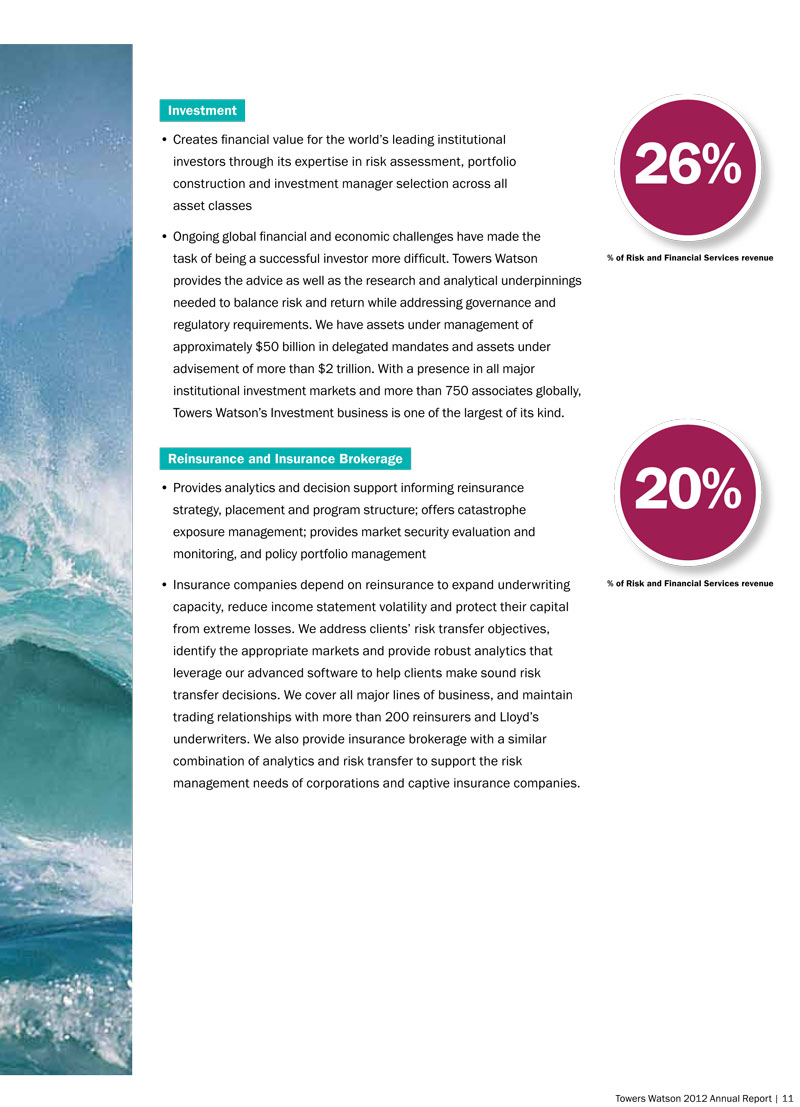

Our Risk and Financial Services (RFS) segment had 10% revenue growth on a constant currency basis as we helped clients tackle a host of challenges: regulatory changes, the Eurozone crisis and continued low interest rate environment, and M&A activity. To further strengthen RFS, we acquired WellsCanning, an insurance investment firm operating primarily in North America. WellsCanning’s investment expertise significantly broadens our service offering to the insurance industry. The acquisition also creates a more holistic solution set through collaboration between our Investment consultants and our Risk Consulting and Software business.

Clients came to our Risk Consulting and Software experts for help with financial and regulatory reporting — especially preparing for Solvency II in Europe, enterprise risk and capital management, and M&A transactions. And we continued to benefit from our fiscal year 2011 acquisition of property & casualty consulting and software firm EMB.

In Brokerage, a strong renewal season and favorable pricing conditions contributed to revenue growth in the Americas and EMEA. And by creating a brokerage operation in Germany and signing on new talent in France, we expanded this group’s operations in Europe.

Low interest rates and elevated market volatility continued to drive companies to our Investment consulting services, and our revenues grew as clients sought new ways to increase investment returns. Demand increased for delegated investment services (investment outsourcing), mostly among smaller investors, and for our alternative investment offerings. Also, we expanded our hedge fund business to include the U.S. and grew our wealth management business in Asia Pacific.

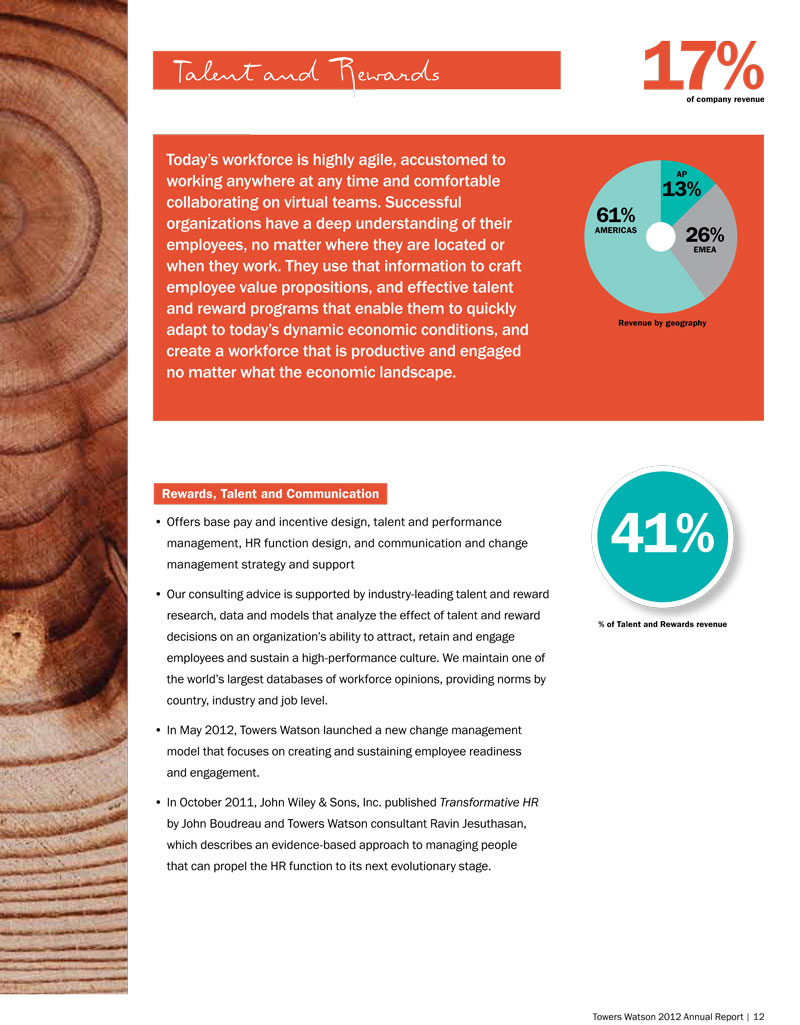

Revenues in our Talent and Rewards segment grew 5% on a constant currency basis. While concerns about the economy influenced spending decisions in Europe, clients in that region sought our expertise to help strike the right balance between managing talent and controlling costs.

Towers Watson 2012 Annual Report | 5

Organizations in Asia Pacific and Latin America looked to us for help on all aspects of human capital as a means of taking advantage of the potential in their markets. And in North America, clients engaged us to align their people programs with their efforts to return to a growth mode.

Our Rewards, Talent and Communication consultants designed workforce strategies, crafted employee value propositions, developed total rewards programs and helped clients transition through major organizational change.

A variety of factors combined to keep our Executive Compensation consultants involved with client work. As legislative issues around the world drove companies to reexamine their executive compensation programs, clients looked to us for help aligning pay and performance, mitigating risk, and preparing for and responding to shareholder opinions.

Our clients relied on Towers Watson’s Data, Surveys and Technology teams to implement technology to support HR processes; to gain access to essential benchmarking data on pay, practices and employee perspectives; and to apply our sustainable engagement model to unlock the full potential of their workers.

As the fiscal year neared its end, we created Exchange Solutions, our newest business segment, after acquiring Extend Health. The acquisition added the nation’s largest private Medicare exchange to the Towers Watson portfolio of services. Exchange Solutions allows employers to transition Medicare-eligible retirees from DB group health plans to DC individual health plans. Though Exchange Solutions’ market is limited to the U.S. at this point, the segment already serves over 30 Fortune 500 employers and works with more than 210,000 active members.

A Focus on Growth |

|

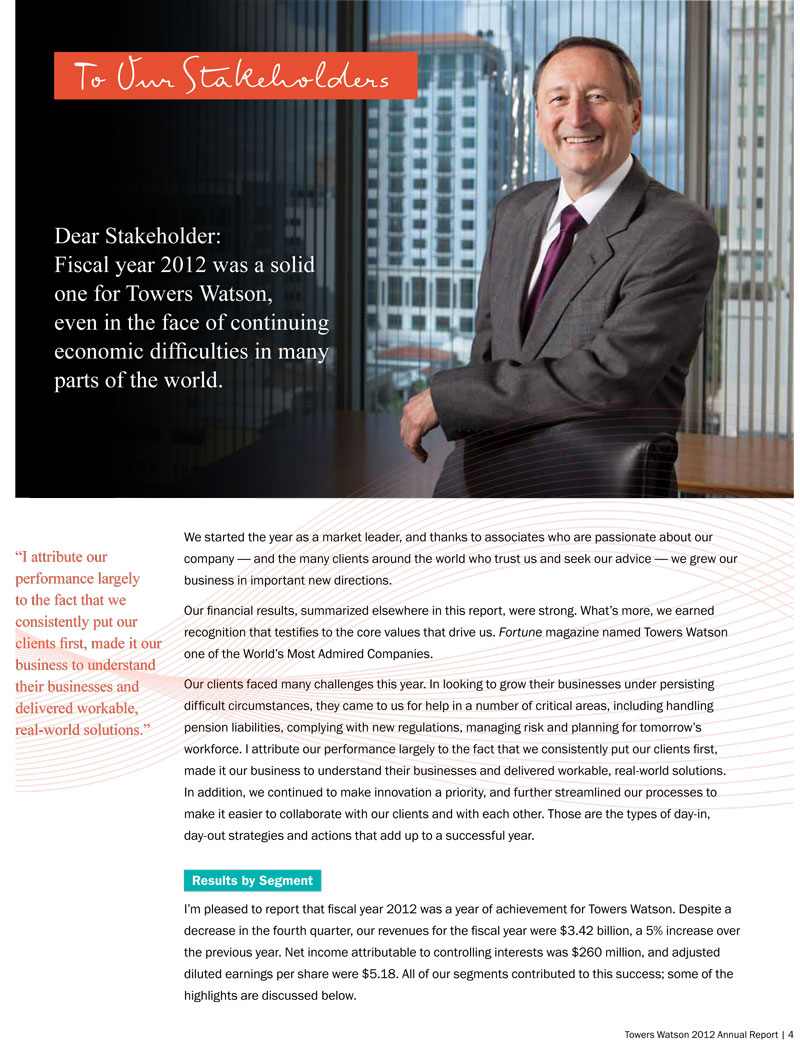

Throughout the year, our primary focus has been twofold: first, to respond to clients’ needs, and second, to implement a rational, successful growth strategy that incorporates organic growth, acquisitions and innovation.

Our organic growth is client-centered. By giving clients multidisciplinary teams with broad-based expertise, we can best understand their issues at both the macro- and micro-level, and provide solutions that address key business issues in a meaningful way. To help support this growth, we have further refined our global account management framework and provided cross-business training and account-planning training to key associates. We’re already seeing the benefits of this approach as our associates deepen their relationships with clients and further establish themselves as trusted business advisors.

As part of our growth strategy, we conducted a review of emerging markets throughout the world. We are focusing our immediate efforts on regions and countries with strong economic indicators and growing market opportunities, which also have a significant number of multinationals and large domestic firms, as well as a growing market for consulting services.

We also looked for inorganic growth opportunities. Through our acquisitions of Extend Health and WellsCanning, and our increased shareholding in Fifth Quadrant, a South African benefit consulting firm, to 51%, we broadened our service offerings in ways that should boost revenues in the long term.

Our work to create a Towers Watson culture of innovation was fueled by a meeting of forwardlooking minds from throughout the company and around the world. Together, they developed ideas for growth and innovation, and subjected them to rigorous challenge and assessment. Many of the ideas generated at the conference will be further explored, and the most promising will be launched.

Towers Watson 2012 Annual Report | 6

Meanwhile, our list of innovative products and services continued to grow this year. For example, we obtained two patents for Replicated Stratified Sampling™, which significantly speeds up run times for complex insurance calculations. We developed VERA, the world’s first automated narrative textprocessing tool designed specifically for employee survey comments, and we launched three new smartphone apps. And we developed new techniques for pension de-risking that recently received regulatory approval in the U.S. and are being implemented by two major corporations. By growing and innovating in these ways, we’re better able to help our clients meet their goals.

Building on Strength |

|

Maintaining our associates’ high level of technical quality and their commitment to client service is critical to our success. In fiscal year 2012, we strengthened our focus on associate and leadership development, and implemented a strategy to establish a more diverse and inclusive workplace. These steps help ensure that we’ll continue to attract the most talented, innovative people, and help them increase their knowledge and skills so they can better serve our clients. I’m pleased with the steps we have taken, and we look forward to more progress in these critical areas.

As we enter fiscal year 2013, our position is a good one: We have significant recurring revenues, consistent margins, solid cash flow, a solid balance sheet and a diverse client base. We’ve made strategic use of capital for M&As, share repurchases and dividend payments. With this foundation, we’ll have clear-cut opportunities for continued profitable growth that will reinforce our market leadership. For example, the economy and the business environment dictate that companies will need help with pension de-risking and M&A transactions. In the U.S., organizational needs pertaining to health care reform will only become larger and more complex. Our EMEA clients will continue to need our help to control their people costs and improve productivity. We’ll help clients with these and other challenges by conducting research to understand global forces and industry trends.

In closing, I want to acknowledge two of our Board members. First, I’d like to express my sincere gratitude to John Gabarro, who will retire from the Board this year. Starting in 1995, Jack has served on our Board with diligence and insight, and has been a key contributor to the company’s success. Second, I’d like to congratulate Linda Rabbitt, our Lead Director, who was recently named a 2012 Director of the Year by the National Association of Corporate Directors. This is a richly deserved honor, and all of us who know and work with Linda were delighted to see her recognized in this way.

Finally, I’m deeply appreciative of the work all of our associates have done this year. Their talent, energy and willingness to go above and beyond for our clients and our company are true differentiators for us.

The coming year holds great opportunities for Towers Watson, our clients and our associates. With our strong foundation, energy, ideas and a clear vision for our future, we’ll continue to thrive and to retain our position as a leader in our industry.

Sincerely,

![[text002.gif]](text002.gif)

John J. Haley

Chairman and Chief Executive Officer

Towers Watson 2012 Annual Report | 7