As filed with the Securities and Exchange Commission on

File No. 333-264639

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Amendment No. 3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Capstone Technologies Group, Inc.

| Nevada | 3357 | |||

(State or jurisdiction of Incorporation or organization) |

(Primary

Standard Industrial Classification Code) |

(I.R.S. Employer Identification No.) |

7529

Red Oak Lane

Charlotte, NC 28226

702-578-2238

(Address, including zip code, and telephone number, including area code,

of registrant’s principle executive offices)

Matheau

J. W. Stout, Esq.

201 International Circle, Suite 230

Hunt Valley, Maryland 21030

(410)

429-7076

(Name, address, including zip code, and telephone number, including area code,

of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS

Capstone Technologies Group, Inc.

5,000,000 Shares of Common Stock Offered by the Company

$3.00 per share

This is a public offering of our common stock, par value $0.001 per share. We are selling up to 5,000,000 shares of our common stock.

This offering will terminate on the date which is 180 days from the effective date of this prospectus, although we may close the offering on any date prior if the offering is fully subscribed or upon the vote of our board of directors.

We are offering a Maximum Offering of up to 5,000,000 in Shares of our Common Stock for a fixed price of $3.00 per share for the duration of the offering.

The Company is quoted on the OTC Pink market and there is a limited established market for our stock. The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our capital structure and the amount of money we would need to implement our business plans. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

Investing in our common stock involves a high degree of risk. See “Risk Factors” for certain risks you should consider before purchasing any shares in this offering. This prospectus is not an offer to sell these securities and it is not the solicitation of an offer to buy these securities in any state where the offer or sale is not permitted.

The offering is being conducted on a self-underwritten, best efforts basis, which means our management will attempt to sell the shares being offered hereby on behalf of the Company. There is no underwriter for this offering.

The minimum investment in this Offering is $25,000.00. We do not have an arrangement to place the proceeds from this offering in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our immediate use.

Any purchaser of common stock investing $25,000.00 in the offering may be the only purchaser.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Company does not plan to use this offering prospectus before the effective date.

Proceeds to Company in Offering

Number of Shares |

Offering Price (1) |

Underwriting Discounts & Commissions |

Gross Proceeds |

|||||||||||||

| Per Share | ||||||||||||||||

| 25% of Offering Sold | 1,250,000 | $ | 3.00 | $ | 0 | $ | 3,750,000 | |||||||||

| 50% of Offering sold | 2,500,000 | $ | 3.00 | $ | 0 | $ | 7,500,000 | |||||||||

| 75% of Offering Sold | 3,750,000 | $ | 3.00 | $ | 0 | $ | 11,250,000 | |||||||||

| Maximum Offering sold | 5,000,000 | $ | 3.00 | $ | 0 | $ | 15,000,000 | |||||||||

| (1) | Assuming a public offering price of $3.00 per share, as set forth on the cover page of this prospectus. |

TABLE OF CONTENTS

| -3- |

ABOUT THIS PROSPECTUS

In making your investment decision, you should only rely on the information contained in this prospectus. We have not authorized anyone to provide you with any other or different information. If anyone provides you with information that is different from, or inconsistent with, the information in this prospectus, you should not rely on it. We believe the information in this prospectus is materially complete and correct as of the date on the front cover. We cannot, however, guarantee that the information will remain correct after that date. For that reason, you should assume that the information in this prospectus is accurate only as of the date on the front cover and that it may not still be accurate on a later date. This document may only be used where it is legal to sell these securities. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sales of our shares of common stock.

You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

This prospectus does not offer to sell, or ask for offers to buy, any shares of our common stock in any state or other jurisdiction in which such offer or solicitation would be unlawful or where the person making the offer is not qualified to do so.

No action is being taken in any jurisdictions outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in those jurisdictions. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions that apply in those jurisdictions to this offering or the distribution of this prospectus. In this prospectus, unless the context otherwise denotes, references to “we,” “us,” “our,” and the “Company” refer to Capstone Technologies Group, Inc.

| -4- |

OFFERING SUMMARY, PERKS AND RISK FACTORS

SUMMARY

Company Overview and Plan of Operation

Management Experience

The Company’s CEO, Michael Pruitt, has a wide range of experience in both operating and serving on the boards of public companies. Our CEO has proven capabilities of identifying quality growth businesses, and leadership teams. The Company intends to operate as a holding company and over time expects to acquire both minority and majority interests in several businesses, some of which will become operating subsidiaries. The primary functions of the Company’s role as a holding company will be to allocate capital, choose subsidiary management, advise subsidiary management in areas in which we have specific knowledge and to provide management with support and capital through our access to institutional investors with whom the Company has existing relationships. .

Target Market

Our initial target market for strategic acquisitions is the Customer Data Platform Market. While this market typically consists of first, second- and third-party data, the Company is aggregating multiple sources of first party data and utilizing sophisticated proprietary algorithms to enhance the customer experience.

Acquisition of an Interest in DrivenIQ Corporation

Our first transaction in the Customer Data Platform Market space was our acquisition of a minority interest in DrivenIQ on October 12, 2021. As of this date, as a minority shareholder owning 45% of the outstanding equity in DrivenIQ, the Company does not have a controlling interest in DrivenIQ. DrivenIQ was an operating company when the Company purchased its 45% stake and continues to operate as a marketing data company.

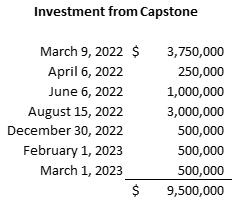

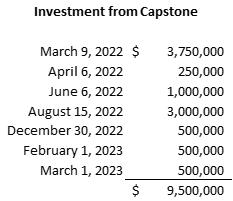

On March 9, 2022, we providedDrivenIQ’s management with strategic advice and capital for their acquisition of Visitor Data , The Company supported DrivenIQ in its acquisition of Visitor Data with additional capital, valuation modeling,due diligence and deal structuring advice.

Since the Company’s acquisition of a minority interest in DrivenIQ, the Company has been involved with further software design,development and buildout of DrivenIQ’s business model and capabilities. These are some of the typical functions that we will provide to companies that we bring under our holding company structure.

The Company is now contemplating creating wholly owned operating subsidiaries in vertical markets where we see opportunities to exploit our first party data platform. We also are evaluating additional acquisitions and joint venture opportunities that we believe would bring value to our shareholders. DrivenIQ provides an example of the qualities we will look for in future acquisition or joint venture candidates:

Overview of DrivenIQ

DrivenIQ is an omni-data technology solutions company that builds custom 1st party data, location geo-device, AI & CRM-based custom micro-audiences for brands, enterprises and retailers. The company make custom precision audiences, from audience curation to ad and media delivery. With a precision-data-driven focus, the goal and vision are to identify the “persona” and “in-market” audience profile first, develop geo-zoning precision technology to target only the household, and then determine when and where the “media” messaging should be delivered. 1st Party Data and in-market intelligence allows the customer to eliminate ad waste, achieve higher ROI, and ultimately provide real traffic and measurability because they start and end with the DATA first. With strategic data, AI partnerships & DSP-based relationships, and a niche-based automotive clientele, DrivenIQ is poised to flip how current marketing and advertising are done digitally today.

DrivenIQ’s entire technology stack was built and developed around zero and 1st party data. Since the company has strategic 1st party multi-use relationships, they can provide exclusive in-market partnerships and the client 1st party DATA as a market differential. By positioning themselves around data, and data independence, they align themselves with their clientele to be ahead of Google FLoC and the “cookieless” future. This technology and concept will apply to enterprises, big box retailers, SaaS, or any organization looking to find ways to become more innovative and more refined in their audience and ad attack strategy.

| -5- |

Third party data is data that is collected by a company without the direct relationship to the person that the data is being collected from. An example is data purchased using online cookies. Second party data is data shared between two companies for a mutual benefit, for example company A and company B share data that will help both of their efforts. First party data is data that a company collects and owns about their customers, an example would be CRM Data or website visitor data. Zero Part data is data that a customer shares with the company proactively.

Services

| ● | Consumer Radar |

| ○ | Consumer radar is a platform built to ingest, target, optimize and report on unstructured individual data elements. It empowers business owners to deliver data-centric marketing campaigns to reach specific people within specific parameters with specific messaging about the products or services they are in the market to buy. Direct access to data such as behavioral data, mobile GPS and offline data variables enables highly differentiated capabilities and industry-leading performance compared to segment dependent platforms. |

| ● | VisitIQ+ |

| ○ | The acquisition of Visitor Data Inc. has allowed DrivenIQ to own and use its proprietary pixel technology to enable business owners to “pull back the curtain on their website and see who is visiting.” Once the pixel is downloaded onto the client’s website, their traffic is scrubbed against 27 different data aggregators and over 500 million double-opted customers. | |

| ○ | DrivenIQ has invested in their DrivenID Identity Graph, an updated version of their owned data, with over 300 categories of intender data. They now own over 2 billion records classifying an IP address as residential, commercial, or mobile. DrivenIQ recently participated in a blind study with 15 other data suppliers and DrivenIQ’s combination of age and gender data outperformed all other suppliers in terms of accuracy. This gives DrivenIQ a distinct competitive advantage due to its records being more accurate than other suppliers in the industry. | |

| ○ | DrivenIQ believes in the future of building an ecosystem between Customer Data Platforms™ (CDP), Customer Experience Management™ (CXM), Customer Relationship Management tools (CRM), and Data Management Platforms™ (DMP). DrivenIQ also sees a future in Audience Experience Platforms™ (AXP) and Audience Management. Brands need a way to unify, collect, normalize, and ingest data to use in an easy and seamless way. Additionally, Data Platforms are missing some key integral components that DrivenIQ will solve with its VisitIQ™ data-as-a-service (DaaS) platform. | |

| ○ | VisitIQ 2.0 is using this data to show a fully functioning DaaS (Data-as-a-service) based platform that will allow businesses to log on and find the audience they are looking for. Consumers will be able to soon go onto this dashboard, sign-up, and begin to curate their own micro custom audiences based on their needs. DrivenIQ’s development team has been working on an easily navigated user interface, allowing customers to tap into the data they need. These data records include first name, last name, physical addresses, email and IP addresses, phone numbers, online behaviors, social media handles, mobile ad IDs (MAIDs), and 496 total selections used to construct audiences. These comprehensive selections include occupation, interests, donor behavior, political reading, and more. | |

| ○ | Since DrivenIQ owns over 500 million first-party data records through the acquisition of VDI, DrivenIQ can better serve other companies that are looking for accurate and reliable data on consumers visiting their websites. With this first-party data, companies can adjust their marketing campaigns in real-time to see the impact it has on the end user. DrivenIQ is working towards a zero-party and first-party data world, while most firms are still using unreliable third-party data when it comes to genuinely identifying an individual. After screening the information through the identity graph, companies can be sure of their audience and how they can better serve them. |

| -6- |

| ● | Geo-Zoning |

| ○ | Geo-Zoning refers to the technology that allows DrivenIQ to capture shopper’s mobile device ID’s and Persistent ID’s during in-person visits or after online visits to follow and target them across all of their connected devices. Polygon mapping allows DrivenIQ to draw a digital line around the audience members’ homes and the advertiser’s competitor location in order to deliver targeted ads at the household level. Mobile Device IDs are captured inside every polygon and matched to other linked devices using WIFI as a link. This enables DrivenIQ to serve ads to customers inside highly targeted individual households and follow them no matter what device. |

| ● | TextIQ |

| ○ | TextIQ bridges the gap between traditional direct mail and email marketing with the modern consumer’s preference for texting. The mission is to upgrade direct mailing pieces by adding a digital marketing component to the content. Recipients will be able to text for information about a company, which then will allow clients to collect a mobile opted-in database for future use and to digitize mailing pieces. |

| ● | Social Radar |

| ○ | DrivenIQ delivers a turnkey, scalable social media solution including Oracle Audience Data for Facebook and Instagram. Social media campaigns managed by DrivenIQ will have the unique benefit of leveraging both in-market first party audiences and Oracle Audience targeting capabilities. This helps clients build custom audiences that will improve campaign effectiveness to drive both website and physical traffic to stores. |

| ● | DriveBid |

| ○ | DriveBid is a patent-pending consumer-facing app built by DrivenIQ. DriveBid will serve as a live-virtual auction site where consumers can list their used vehicles for local dealers to bid on. The app will seamlessly connect consumers “who want the best offer for their trade-in with dealers who need inventory in a real-time, easy-to-use online platform.” After all, in a world where banks compete for your mortgage, so should dealers when purchasing used car inventory. With more than 18,000 dealerships located in the United States, DriveBid has ample opportunity in a fragmented market. While DriveBid is thought of as a separate business internally, the patent-pending technology captures data throughout the bidding process, ultimately enhancing DrivenIQ’s primary focus, the collection and ability to draw first-party data insights for their clients. | |

| ○ | The BID MY TRADE function on DriveBid puts consumers in a position of strength while dealers actively bid on their cars. Once an auction has ended, the consumer can decide which offer they would like to accept- based on price, location, or the dealer’s availability of cars for a trade. |

Marketing

DrivenIQ markets their various products through digital marketing, sales channels and resellers rights. The digital marketing includes search engine marketing and display. Their sales channels consist of in-house sellers and contractors. The sellers target enterprises, mostly in the automotive space, and target up-sells throughout campaigns. Their resellers do the same thing as their in-house sellers but market the VisitIQ pixel as an add on product to their own company services.

Competition

In the case of audience identity solutions, VisitIQ will compete with other data aggregation services, first- and zero-party audience identity services, geozone companies, and other Audience Experience platforms. We believe that VisitIQ’s ability to compete effectively in this space will depend primarily upon:

| ● | Its continued ability to ensure clean, accurate data for marketing teams; | |

| ● | Its ability to monetize data records in a cost-effective manner; | |

| ● | Its ability to remain compliant with regulations regarding data privacy of individuals; | |

| ● | Seller’s ability to sell all other solutions by explaining how the data is the forefront of all products |

In the case of automotive marketplace solutions, DriveBid will compete against other longtime competitors that offer the ability for consumers to sell and trade their cars to buyers online. We believe that DriveBid’s ability to compete effectively in this space will depend primarily upon:

| ● | Its ability to attract new dealers to the platform | |

| ● | Its ability to attract consumers to the platform | |

| ● | Its ability to hold off other platforms allowing dealers to bid on consumer’s inventory through their patent | |

| ● | Its ability to collect “BidLock” fees from transactions between dealers and consumers on the App | |

| ● | Its ability to demonstrate the ease and savings that consumers will have while using DriveBid for their automotive transactions |

| -7- |

Revenue

DrivenIQ revenue is primarily derived from customers using the platform as a Software as a Service (SaaS), which comprises monthly fees paid for access that vary according to the amount of data the customer requires. The company plans on offering an additional revenue stream that is based on Data as a Service (DaaS) in its VisitIQ 2.0 dashboard product.

The company does not plan on having any full-time employees. Planned operating expenses for the next twelve months consist of a total of $655,000. The majority of these expenses ($580,000) are for consultants, legal fees and audit fees. The remainder of the expenses are for office related expenses.

The company plans on investing the amount raised in excess of $655,000 in target company investments.

Company History

Capstone Technologies Group, Inc. (the “Company,” “we,” “us,” “our,” or “CATG”) was incorporated in the State of Nevada on March 31, 2009 under the name Designer Export, Inc. On June 30, 2010, the Company effected a stock split whereby each stockholder of record of the Company as of July 14, 2010 was issued 2.582781 shares of common stock for each 1 share of common stock which they hold as of the record date.

On June 30, 2010, the Company entered into an Agreement and Plan of Merger with China Bilingual Education Acquisition Inc., a Nevada corporation (“Acquisition Corp”), Kahibah Limited, a limited liability company organized under the laws of the British Virgin Islands (“Kahibah”), Ren Zhiqing, Pan Mingxiao, Ren Shudong, Ren Junnan, Kong Jianwei and Xu Yunxian (collectively, the “Kahibah Shareholders”), Taiyuan Taiji Industry Development Co., Ltd., an equity joint venture company organized under the laws of the PRC (“Taiyuan Taiji”), Shanxi Taiji Industrial Development Co. Ltd., a limited liability company organized under the laws of the PRC (“Shanxi Taiji”), the shareholders of Shanxi Taiji and its subsidiaries and the beneficiaries to the Agreement (collectively, the “Sellers”)., pursuant to which the Acquisition Corp. acquired 100% of the issued and outstanding capital of Kahibah in exchange for 26,100,000 shares of the Company’s common stock, par value $0.001 (the “Merger”). Kahibah was a holding company whose only asset, held through Taiyuan Taiji, a wholly-foreign owned enterprise (“WOFE”) under the laws of the PRC is 95% of the registered capital of Shanxi Taiji an equity joint venture company organized under the laws of the PRC. On November 25, 2009, Kahibah entered into a share exchange agreement to sell the remaining 5% ownership to Ms. Ren Baiv. Ms. Ren Baiv is the sister of Mr. Ren Zhiqing, the Company’s Chief Executive Officer. At December 31, 2010 Ms. Ren Baiv paid 1 million Renminbi (“RMB”) as part of the capital contribution. The 5% ownership was held by Ms. Ren Baiv on behalf of the Taiyuan Taiji in accordance with local Chinese regulations, therefore no non-controlling interest is recognized. Shanxi Taiji owned all of the registered capital of Shanxi Modern Bilingual School, a private non-enterprise entity incorporated under the laws of the PRC and Sichuan Guangan Experimental High School.

Immediately following the Merger, pursuant to an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Liabilities, we transferred all of our pre-Merger assets and liabilities to our wholly-owned subsidiary, Designer Export Holdings, Inc. (“SplitCo”) to certain of our shareholders. Thereafter, pursuant to a Stock Purchase Agreement (the “Stock Purchase Agreement”), we transferred all of the outstanding capital stock of SplitCo to certain of our stockholders in exchange for the cancellation of 3,000,000 shares of our common stock (the “Split Off Transaction”), with 1,510,000 shares of common stock held by persons who were stockholders of ours prior to the Merger remaining outstanding. These 1,510,000 shares constitute our “public float” and are our only shares of registered common stock and accordingly are our only shares available for resale without further registration.

| -8- |

As part of the Merger, the Company’s name was changed from “Designer Export, Inc.” to “China Bilingual Technology & Education Group, Inc.” As a result of these transactions, persons affiliated with Kahibah at the time of the merger owned securities that in the aggregate represented approximately 87% of the equity in the Company.

On June 30, 2010, the Company entered into a Share Exchange Agreement (“Agreement”) with Kahibah Limited (“KL”), a British Virgin Islands (“BVI”) corporation and its shareholders. According to this Agreement, the Company acquired all the issued and outstanding shares of KL. The Company issued 26,100,076 shares of its common stock, after giving effect to the cancellation of 7,748,343 shares on June 30, 2010, to KL’s shareholders in exchange for 100% of the shares of KL. After the closing of the transaction, the Company had a total of 30,000,005 shares of common stock issued and outstanding, with KL’s shareholders owning 87% of the total issued and outstanding shares of the Company’s common stock, and the balance held by those who held shares of the Company’s common stock prior to the closing of the exchange. This transaction resulted in KL’s shareholders obtaining a majority voting interest in the Company.

The acquisition of KL and the operations of its subsidiaries were accounted for as a reverse merger, whereby KL was the continuing entity for financial reporting purposes and was deemed, for accounting purposes, to be the acquirer of the Company. In accordance with the applicable accounting guidance for accounting for the business combination as a reverse merger, KL was deemed to have undergone a recapitalization, whereby KL was deemed to have issued common stock to the Company’s common equity holders. Accordingly, although the Company, as KL’s parent company, was deemed to have legally acquired KL, in accordance with the applicable accounting guidance for accounting for the transaction as a reverse merger and re-capitalization, KL was the surviving entity for accounting purposes and its assets and liabilities are recorded at their historical carrying amounts with no goodwill or other intangible assets recorded as a result of the accounting merger with the Company. As part of the acquisition, the Company changed its name to China Bilingual Technology & Education Group Inc. Since the ownership of KL and its Subsidiaries was substantially the same, the merger with each was accounted for as a transfer of equity interests between entities under common control, whereby the acquirer recognized the assets and liabilities of each Subsidiary transferred at their carrying amounts. The reorganization was treated similar to the pooling of interest method with carry over basis.

On August 31, 2011, the Company’s entered into an Equity Transfer Agreement and purchased all of the outstanding equity of Shanxi Rising Education Investment Company Limited (the “Investment Company”) from the equity holders (the “Sellers”) for a total purchase consideration of RMB 690,000,000 (approximately $108,226,806). The acquisition of the Investment Company was accounted for as a business combination under Accounting Standards Codification Topic 805, Business Combinations (“ASC 805”).

Prior to closing the Equity Transfer Agreement, the Company became involved in the operations of the Shanxi South Campus in the spring of 2011. With the consent of the Investment Company, the Company assisted in the operations, accounting and promotion of the school to attract more and better students for the 2011-2012 school year. Some of these responsibilities included collecting prepaid tuition, room & board and other school fees (“School Fees”) in advance of the school year, which combined with better operations, higher tuition rates and an increase in enrollment led to an increase in deferred revenue at August 31, 2011. The Company’s involvement at the Shanxi South Campus was under the direction of Investment Company management until it assumed control of the Investment Company on August 31, 2011, in accordance with the Equity Transfer Agreement.

The Company ceased filing reports with the SEC in 2012 and appears to have ceased operations at that time. Its corporate charter was revoked. This resulted in a Nevada Court Custodianship Proceeding from May 19, 2016 through April 4, 2018. While the Company was reinstated with the Nevada Secretary of State (NVSOS) on September 26, 2016, it did not file the Annual List the NVSOS that was due on March 13, 2018. This again resulted in revocation of the Company’s corporate charter a year later. Other than these facts, no information is available concerning the Company’s former business after the 11/30/2012 Form 10Q.

Bauman & Associates Law Firm (“Bauman”) was appointed custodian of the Company on March 31, 2020.

| -9- |

As disclosed in the Company’s final 11/30/2012 Form 10-Q, filed January 14, 2013, the Company, as of November 30, 2012, reported approximately $87 million of liabilities (as well as $142 million of assets). As reported in the 10-Q , all of the Company’ s operations were in the Peoples Republic of China and, hence, were through the above-referenced subsidiaries. The Company owed approximately $41 million in remaining payments for acquisition indebtedness of the China Rising School, with the last payment due August 31, 2014.

On August 31, 2020, Bauman & Associates Law Firm (“Bauman”) provided a debt extinguishment opinion to the Company on August 31, 2020 opining that, based on a reading of the Company’ s SEC filings, the above-referenced liabilities (as well as the reported offsetting assets) carried on the Company’s November 30, 2012 balance sheet, were not liabilities (or assets) of the Company in a legal sense, but were liabilities (or assets) of the various Chinese subsidiaries. These liabilities (and assets) were consolidated onto the balance sheet of the Company as required by GAAP. Bauman was informed that these are discontinued operations and, therefore, were no longer consolidated with the Company’ s liabilities and assets as of March 31, 2018. Bauman further advised that an additional payable for acquisition of China Rising School was time- barred under the six-year Nevada statute of limitations for written contracts.

During the quarter ended November 30, 2020, Barbara McIntyre Bauman, the Company’s President, Secretary and Treasurer, paid expenses on behalf of the Company totaling $3,225 to revive the Company’s operations. On September 3, 2020, the Company issued 250,000,000 shares of common stock to Barbara McIntyre Bauman for repayment of this related party debt totaling $3,225.

Pursuant to a term sheet dated January 26, 2021, Sky Direct LLC purchased 250,000,000 shares of common stock from Barbara McIntyre Bauman, triggering a change in control.

On February 1, 2021, Barbara McIntyre Bauman resigned from all positions as an officer and director of the Company and appointed Michael D. Pruitt as CEO, CFO, President, Secretary, Treasurer and sole Director.

On February 26, 2021, the Company entered into an unsecured convertible promissory note with Sky Direct LLC, an entity controlled by the Company’s majority shareholder, Sky Direct LLC. The Company funded $1.000,000 under this note as of November 1,, 2021.

On August 5, 2021, the Company entered a reverse 1 for 75 stock split.

On October 5, 2021, the Company entered into an unsecured convertible promissory note with Seacor Capital, Inc. The Company funded $550,000 under this note as of November 1, 2021.

Between September 30, 2021 and October 12, 2021, the Company entered a series of transactions related to DrivenIQ Corporation and one of its primary shareholders. The Company acquired 45% of the common stock of DrivenIQ from one of the founders for $460,000 and has loaned DrivenIQ $790,000 on a 3 year secured note that has an interest rate of 5%. Interest is paid quarterly. It is anticipated that the $790,000 note will be converted into DrivenIQ preferred stock as part of a later round of Capstone’s investment in DrivenIQ.

Early in March 2022, the Company entered into secured convertible notes with NY Farms Group, LLC and Seacor Capital, Inc. Each lender funded the Company $2,000,000. The terms of the notes include an Original Issue discount of 7.5%, an interest rate of 7.5% and warrants to purchase shares of Company common stock equivalent to 50% of the value of the Note and with an exercise price $1.00 per share. An additional $250,000 has been received under the same terms in early April 2022 from EROP Enterprises, LLC. An additional $5,000,000 was raised from Arena Investors, LP during May 2022, under the same terms.

In addition, the Company sold $5,000,000 of preferred stock during May 2022 to Arena Investors, LP. The preferred stock is convertible into 5,375,000 common shares, has a dividend of 7.5% per year and has warrants to purchase 2,687,500 shares of company common stock at an exercise price of $1.00 per share.

The Company invested $9,000,000 of the proceeds of these notes into DrivenIQ preferred stock. DrivenIQ used the proceeds of the investment to make an acquisition and for working capital.

| -10- |

| Type of Stock Offering: | Common Stock | |

| Price Per Share: | $3.00 | |

| Minimum Investment: | $25,000.00 per investor (8,333 Shares of Common Stock) | |

| Maximum Offering: | $15,000,000.00. The Company will not accept investments greater than the Maximum Offering amount. | |

| Maximum Shares Offered: | 5,000,000 Shares of Common Stock. | |

| Use of Proceeds: | See the description in section entitled “USE OF PROCEEDS TO ISSUER” on page 25 herein. | |

| Voting Rights: | The Shares have full voting rights. | |

| Length of Offering: | Shares will be offered on a continuous basis until either (1) the maximum number of Shares or sold; (2) 180 days from the date of registration by the Commission, (3) if Company in its sole discretion extends the offering beyond 180 days from the date of registration by the Commission, or (4) the Company in its sole discretion withdraws this Offering. |

| Common Stock Outstanding | 5,466,570 Shares | |||

| Common Stock in this Offering | 5,000,000 Shares | |||

| Stock to be outstanding after the offering (1) | 10,466,570 Shares |

| (1) | The total number of Shares of Common Stock assumes that the maximum number of Shares are sold in this offering. |

| -11- |

The Company may not be able to sell the Maximum Offering Amount.

The net proceeds of the Offering will be the gross proceeds of the Shares sold minus the expenses of the offering.

Our common stock is quoted on OTCMarkets.com under trading symbol “CATG.” We are not listed on any trading market or stock exchange, and our ability to list our stock in the future is uncertain. Investors should not assume that the Offered Shares will be listed. A consistent public trading market for the shares may not develop.

There is no assurance Capstone Technologies Group, Inc. will be profitable, or that management’s opinion of the Company’s future prospects will not be outweighed in the by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

The purchase of the Company’s Common Stock involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Shares offered by the Company constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the Shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company’s business and your investment in the Shares. An investment in the Company may not be suitable for all recipients of this Prospectus. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and the financial resources available to you.

The discussions and information in this Prospectus may contain both historical and forward- looking statements. To the extent that the Prospectus contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company in forward-looking statements. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results may differ from the Company’s current expectations.

Before investing, you should carefully read and carefully consider the following risk factors:

Risks Relating to the Company and Its Business

The Company Has A History of Losses

The Company has suffered losses since its inception and there can be no assurance that the Company’s proposed plan of business can be realized in the manner contemplated and, if it cannot be, shareholders may lose all or a substantial part of their investment. There is no guarantee that it will ever realize any significant operating revenues or that its operations will ever be profitable.

| -12- |

The Company Is Dependent Upon Its Management, Key Personnel and Consultants to Execute the Business Plan

The Company’s success is heavily dependent upon the continued active participation of the Company’s current executive officer, Michael D. Pruitt, as well as other key personnel and consultants. Loss of the services of one or more of these individuals could have a material adverse effect upon the Company’s business, financial condition or results of operations. Mr. Pruitt is currently an officer or director of other companies, including, Amergent Hospitality Group, Inc., and thus the amount of time he can devote to the management of the Company, and the execution of the Company’s business plan, may be limited. Such management roles in other companies, could present a potential conflict of interest. Further, the Company’s success and achievement of the Company’s growth plans depend on the Company’s ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in the healthy living, healthcare and online industries is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of the Company’s activities, could have a materially adverse effect on it. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on the Company’s business, financial condition or results of operations.

Although Dependent Upon Certain Key Personnel, The Company Does Not Have Any Key Man Life Insurance Policies On Any Such People

The Company is dependent upon management in order to conduct its operations and execute its business plan; however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, should any of these key personnel, management or founders die or become disabled, the Company will not receive any compensation that would assist with such person’s absence. The loss of such person could negatively affect the Company and its operations.

The Company Is Subject To Income Taxes As Well As Non-Income Based Taxes, Such As Payroll, Sales, Use, Property And Goods And Services Taxes.

Significant judgment is required in determining our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although the Company believes that our tax estimates will be reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions, expense amounts for non-income based taxes and accruals and (ii) any material differences could have an adverse effect on our consolidated financial position and results of operations in the period or periods for which determination is made.

The Company Is Not Subject To Sarbanes-Oxley Regulations And Lack The Financial Controls And Safeguards Required Of Public Companies.

The Company does not have the internal infrastructure necessary, and is not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial controls. The Company expects to incur additional expenses and diversion of management’s time if and when it becomes necessary to perform the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

The Company Has Engaged In Certain Transactions With Related Persons.

Please see the section of this Prospectus entitled “Interest of Management and Others in Certain Related-Party Transactions and Agreements”

Changes In Employment Laws Or Regulation Could Harm The Company’s Performance.

Various federal and state labor laws govern the Company’s relationship with our employees and affect operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

| -13- |

The Company’s Bank Accounts Will Not Be Fully Insured

The Company’s regular bank accounts and the checking account used for this Offering each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in each account may eventually exceed those limits at times. In the event that any of Company’s banks should fail, the Company may not be able to recover all amounts deposited in these bank accounts.

The Company’s Business Plan Is Speculative

The Company’s present business and planned business are speculative and subject to numerous risks and uncertainties. There is no assurance that the Company will generate significant revenues or profits.

The Company Will Likely Incur Debt

The Company has incurred debt and expects to incur future debt in order to fund operations. Complying with obligations under such indebtedness may have a material adverse effect on the Company and on your investment.

The Company’s Expenses Could Increase Without a Corresponding Increase in Revenues

The Company’s operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on the Company’s consolidated financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

The Company Will Be Reliant On Key Suppliers

The Company intends to enter into agreements with key suppliers and will be reliant on positive and continuing relationships with such suppliers. Termination of those agreements, variations in their terms or the failure of a key supplier to comply with its obligations under these agreements (including if a key supplier were to become insolvent) could have a material adverse effect on the Company’s consolidated financial results and on your investment.

Increased Costs Could Affect The Company

An increase in the cost of raw materials or energy could affect the Company’s profitability. Commodity and other price changes may result in unexpected increases in the cost of raw materials, and packaging materials used by the Company. The Company may also be adversely affected by shortages of raw materials or packaging materials. In addition, energy cost increases could result in higher transportation, freight and other operating costs. The Company may not be able to increase its prices to offset these increased costs without suffering reduced volume, sales and operating profit, and this could have an adverse effect on your investment.

| -14- |

If We Are Unable To Protect Effectively Our Intellectual Property, We May Not Be Able To Operate Our Business, Which Would Impair Our Ability To Compete

Our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual property. The names and/or logos of Company brands (whether owned by the Company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Such challenges could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

Computer, Website or Information System Breakdown Could Affect The Company’s Business

Computer, website and/or information system breakdowns as well as cyber security attacks could impair the Company’s ability to service its customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

Changes In The Economy Could Have a Detrimental Impact On The Company

Changes in the general economic climate could have a detrimental impact on consumer expenditure and therefore on the Company’s revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on the Company’s consolidated financial results and on your investment.

The Amount Of Capital The Company Is Attempting To Raise In This Offering Is Not Enough To Sustain The Company’s Current Business Plan

In order to achieve the Company’s near and long-term goals, the Company will need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause you to lose all or a portion of your investment.

| -15- |

Additional Financing May Be Necessary For The Implementation Of Our Growth Strategy

The Company may require additional debt and/or equity financing to pursue our growth and business strategies. These include, but are not limited to enhancing our operating infrastructure and otherwise respond to competitive pressures. Given our limited operating history and existing losses, there can be no assurance that additional financing will be available, or, if available, that the terms will be acceptable to us. Lack of additional funding could force us to curtail substantially our growth plans. Furthermore, the issuance by us of any additional securities pursuant to any future fundraising activities undertaken by us would dilute the ownership of existing shareholders and may reduce the price of our Shares.

Our Employees, Executive Officers, Directors And Insider Shareholders Beneficially Own Or Control A Substantial Portion Of Our Outstanding Shares

Our employees, executive officers, directors and insider shareholders beneficially own or control a substantial portion of our outstanding type of stock, which may limit your ability and the ability of our other shareholders, whether acting alone or together, to propose or direct the management or overall direction of our Company. Additionally, this concentration of ownership could discourage or prevent a potential takeover of our Company that might otherwise result in an investor receiving a premium over the market price for his Shares. The majority of our currently outstanding Shares of stock is beneficially owned and controlled by a group of insiders, including our employees, directors, executive officers and inside shareholders. Accordingly, our employees, directors, executive officers and insider shareholders may have the power to control the election of our directors and the approval of actions for which the approval of our shareholders is required. If you acquire our Shares, you will have no effective voice in the management of our Company. Such concentrated control of our Company may adversely affect the price of our Shares. Our principal shareholders may be able to control matters requiring approval by our shareholders, including the election of directors, mergers or other business combinations. Such concentrated control may also make it difficult for our shareholders to receive a premium for their Shares in the event that we merge with a third party or enter into different transactions, which require shareholder approval. These provisions could also limit the price that investors might be willing to pay in the future for our Shares.

Our Operating Plan Relies In Large Part Upon Assumptions And Analyses Developed By The Company. If These Assumptions Or Analyses Prove To Be Incorrect, The Company’s Actual Operating Results May Be Materially Different From Our Forecasted Results

Whether actual operating results and business developments will be consistent with the Company’s expectations and assumptions as reflected in its forecast depends on a number of factors, many of which are outside the Company’s control, including, but not limited to:

| ● | whether the Company can obtain sufficient capital to sustain and grow its business |

| ● | our ability to manage the Company’s growth |

| ● | whether the Company can manage relationships with key vendors and advertisers |

| ● | demand for the Company’s products and services |

| ● | the timing and costs of new and existing marketing and promotional efforts |

| ● | Competition |

| ● | the Company’s ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel |

| ● | the overall strength and stability of domestic and international economies |

| ● | consumer spending habits |

Unfavorable changes in any of these or other factors, most of which are beyond the Company’s control, could materially and adversely affect its business, consolidated results of operations and consolidated financial condition.

| -16- |

To Date, The Company Has Had Operating Losses And May Not Be Initially Profitable For At Least The Foreseeable Future, And Cannot Accurately Predict When It Might Become Profitable

The Company has been operating at a loss since the Company’s inception. The Company may not be able to generate significant revenues in the future. In addition, the Company expects to incur substantial operating expenses in order to fund the expansion of the Company’s business. As a result, the Company expects to continue to experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if, the Company might become profitable.

The Company May Be Unable To Manage Its Growth Or Implement Its Expansion Strategy

The Company may not be able to expand the Company’s product and service offerings, the Company’s markets, or implement the other features of the Company’s business strategy at the rate or to the extent presently planned. The Company’s projected growth will place a significant strain on the Company’s administrative, operational and financial resources. If the Company is unable to successfully manage the Company’s future growth, establish and continue to upgrade the Company’s operating and financial control systems, recruit and hire necessary personnel or effectively manage unexpected expansion difficulties, the Company’s consolidated financial condition and consolidated results of operations could be materially and adversely affected.

The Company Relies Upon Trade Secret Protection To Protect Its Intellectual Property; It May Be Difficult And Costly To Protect The Company’s Proprietary Rights And The Company May Not Be Able To Ensure Their Protection

The Company currently relies on trade secrets. While the Company uses reasonable efforts to protect these trade secrets, the Company cannot assure that its employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose the Company’s trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, the Company’s competitors may independently develop equivalent knowledge, methods and know-how. If the Company is unable to defend the Company’s trade secrets from others use, or if the Company’s competitors develop equivalent knowledge, it could have a material adverse effect on the Company’s business. Any infringement of the Company’s proprietary rights could result in significant litigation costs, and any failure to adequately protect the Company’s proprietary rights could result in the Company’s competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenue. Existing patent, copyright, trademark and trade secret laws afford only limited protection. In addition, the laws of some foreign countries do not protect the Company’s proprietary rights to the same extent as do the laws of the United States. Therefore, the Company may not be able to protect the Company’s proprietary rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using the Company’s trade secrets could be expensive and time consuming, and the outcome of such a claim is unpredictable. Litigation may be necessary in the future to enforce the Company’s intellectual property rights, to protect the Company’s trade secrets or to determine the validity and scope of the proprietary rights of others. This litigation could result in substantial costs and diversion of resources and could materially adversely affect the Company’s future operating results.

The Company’s Business Model Is Evolving

The Company’s business model is unproven and is likely to continue to evolve. Accordingly, the Company’s initial business model may not be successful and may need to be changed. The Company’s ability to generate significant revenues will depend, in large part, on the Company’s ability to successfully market the Company’s products to potential users who may not be convinced of the need for the Company’s products and services or who may be reluctant to rely upon third parties to develop and provide these products. The Company intends to continue to develop the Company’s business model as the Company’s market continues to evolve.

| -17- |

The Company Needs to Increase Brand Awareness

Due to a variety of factors, the Company’s opportunity to achieve and maintain a significant market share may be limited. Developing and maintaining awareness of the Company’s brand name, among other factors, is critical. Further, the importance of brand recognition will increase as competition in the Company’s market increases. Successfully promoting and positioning the Company’s brand, products and services will depend largely on the effectiveness of the Company’s marketing efforts. Therefore, the Company may need to increase the Company’s financial commitment to creating and maintaining brand awareness. If the Company fails to successfully promote the Company’s brand name or if the Company incurs significant expenses promoting and maintaining the Company’s brand name, it would have a material adverse effect on the Company’s consolidated results of operations.

The Company Faces Competition In The Company’s Markets From A Number Of Large And Small Companies, Some Of Which Have Greater Financial, Research And Development, Production And Other Resources Than Does The Company

In many cases, the Company’s competitors have longer operating histories, established ties to the market and consumers, greater brand awareness, and greater financial, technical and marketing resources. The Company’s ability to compete depends, in part, upon a number of factors outside the Company’s control, including the ability of the Company’s competitors to develop alternatives that are superior. If the Company fails to successfully compete in its markets, or if the Company incurs significant expenses in order to compete, it would have a material adverse effect on the Company’s consolidated results of operations.

A Data Security Breach Could Expose The Company To Liability And Protracted And Costly Litigation, And Could Adversely Affect The Company’s Reputation And Operating Revenues

To the extent that the Company’s activities involve the storage and transmission of confidential information, the Company and/or third-party processors will receive, transmit and store confidential customer and other information. Encryption software and the other technologies used to provide security for storage, processing and transmission of confidential customer and other information may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper access to the Company’s or these third parties’ systems or databases could result in the theft, publication, deletion or modification of confidential customer and other information. A data security breach of the systems on which sensitive account information is stored could lead to fraudulent activity involving the Company’s products and services, reputational damage, and claims or regulatory actions against us. If the Company is sued in connection with any data security breach, the Company could be involved in protracted and costly litigation. If unsuccessful in defending that litigation, the Company might be forced to pay damages and/or change the Company’s business practices or pricing structure, any of which could have a material adverse effect on the Company’s operating revenues and profitability. The Company would also likely have to pay fines, penalties and/or other assessments imposed as a result of any data security breach.

The Company Depends On Third-Party Providers For A Reliable Internet Infrastructure And The Failure Of These Third Parties, Or The Internet In General, For Any Reason Would Significantly Impair The Company’s Ability To Conduct Its Business

The Company will outsource some or all of its online presence and data management to third parties who host the actual servers and provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted access to the Internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency of a third-party provider, or malicious electronic intrusion into the data center, its business would be significantly damaged. As has occurred with many Internet-based businesses, the Company may be subject to ‘denial-of-service’ attacks in which unknown individuals bombard its computer servers with requests for data, thereby degrading the servers’ performance. The Company cannot be certain it will be successful in quickly identifying and neutralizing these attacks. If either a third-party facility failed, or the Company’s ability to access the Internet was interfered with because of the failure of Internet equipment in general or if the Company becomes subject to malicious attacks of computer intruders, its business and operating results will be materially adversely affected.

| -18- |

The Company’s Employees May Engage In Misconduct Or Improper Activities

The Company, like any business, is exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with laws or regulations, provide accurate information to regulators, comply with applicable standards, report financial information or data accurately or disclose unauthorized activities to the Company. In particular, sales, marketing and business arrangements are subject to extensive laws and regulations intended to prevent fraud, misconduct, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve improper or illegal activities which could result in regulatory sanctions and serious harm to the Company’s reputation.

Limitation On Director Liability

The Company may provide for the indemnification of directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors to the Company and its shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Risks Relating to This Offering and Investment

The Company May Undertake Additional Equity or Debt Financing That May Dilute The Shares In This Offering

The Company may undertake further equity or debt financing, which may be dilutive to existing shareholders, including you, or result in an issuance of securities whose rights, preferences and privileges are senior to those of existing shareholders, including you, and also reducing the value of Shares subscribed for under this Offering.

An Investment In The Shares Is Speculative And There Can Be No Assurance Of Any Return On Any Such Investment

An investment in the Company’s Shares is speculative, and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The Shares Are Offered On A “Best Efforts” Basis And The Company May Not Raise The Maximum Amount Being Offered

Since the Company is offering the Shares on a “best efforts” basis, there is no assurance that the Company will sell enough Shares to meet its capital needs. If you purchase Shares in this Offering, you will do so without any assurance that the Company will raise enough money to satisfy the full Use Of Proceeds To Issuer which the Company has outlined in this Prospectus or to meet the Company’s working capital needs.

| -19- |

If The Maximum Offering Is Not Raised, It May Increase The Amount Of Long-Term Debt Or The Amount Of Additional Equity It Needs To Raise

There is no assurance that the maximum amount of Shares in this offering will be sold. If the maximum Offering amount is not sold, we may need to incur additional debt or raise additional equity in order to finance our operations. Increasing the amount of debt will increase our debt service obligations and make less cash available for distribution to our shareholders. Increasing the amount of additional equity that we will have to seek in the future will further dilute those investors participating in this Offering.

We Have Not Paid Dividends In The Past And Do Not Expect To Pay Dividends In The Future, So Any Return On Investment May Be Limited To The Value Of Our Shares

We have never paid cash dividends on our Shares and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Shares will depend on earnings, financial condition and other business and economic factors affecting it at such time that management may consider relevant. If we do not pay dividends, our Shares may be less valuable because a return on your investment will only occur if its stock price appreciates.

The Company May Not Be Able To Obtain Additional Financing

Even if the Company is successful in selling the maximum number of Shares in the Offering, the Company may require additional funds to continue and grow its business. The Company may not be able to obtain additional financing as needed, on acceptable terms, or at all, which would force the Company to delay its plans for growth and implementation of its strategy which could seriously harm its business, financial condition and results of operations. If the Company needs additional funds, the Company may seek to obtain them primarily through additional equity or debt financings. Those additional financings could result in dilution to the Company’s current shareholders and to you if you invest in this Offering.

The Offering Price Has Been Arbitrarily Determined

The offering price of the Shares has been arbitrarily established by the Company based upon its present and anticipated financing needs and bears no relationship to the Company’s present financial condition, assets, book value, projected earnings, or any other generally accepted valuation criteria. The offering price of the Shares may not be indicative of the value of the Shares or the Company, now or in the future.

The Subscription Agreement Contains an Exclusive Forum Provision for Disputes

The Subscription Agreement used for investors to purchase our Shares is governed by and construed solely in accordance with the internal laws of the State of Nevada with respect to contracts executed, delivered and to be fully performed therein, without regard to the conflicts of laws principles thereof. By entering into the Subscription Agreement, the subscriber expressly and irrevocably agrees that any suit or proceeding arising under Subscription Agreement or the consummation of the transactions contemplated hereby, (except those actions arising under the Securities Act of 1933 or the Securities Exchange Act of 1934), shall be brought solely in a federal or state court located in the State of Nevada.

The Management Of The Company Has Broad Discretion In Application of Proceeds

The management of the Company has broad discretion to adjust the application and allocation of the net proceeds of this offering in order to address changed circumstances and opportunities. As a result of the foregoing, the success of the Company will be substantially dependent upon the discretion and judgment of the management of the Company with respect to the application and allocation of the net proceeds hereof.

| -20- |

An Investment in the Company’s Shares Could Result In A Loss of Your Entire Investment

An investment in the Company’s Shares offered in this Offering involves a high degree of risk and you should not purchase the Shares if you cannot afford the loss of your entire investment. You may not be able to liquidate your investment for any reason in the near future.

There Is No Assurance The Company Will Be Able To Pay Distributions To Shareholders

While the Company may choose to pay distributions at some point in the future to its shareholders, there can be no assurance that cash flow and profits will allow such distributions to ever be made.

There a Limited Public Trading Market for the Company’s Shares

At present, the Company’s common stock is quoted on OTCMarkets.com. Our common stock experiences fluctuation in volume and trading prices. On the over-the-counter market, there will likely be no consistent and active trading market for the Company’s securities and the Company cannot assure that a consistent trading market will develop. OTCMarkets.com provides significantly less liquidity than a securities exchange such as the NASDAQ Stock Market. Prices for securities traded solely on OTCMarkets.com may be difficult to obtain and holders of the Shares and the Company’s securities may be unable to resell their securities at or near their original price or at any price. In any event, except to the extent that investors’ Shares may be registered on a Form S-1 Registration Statement with the Securities and Exchange Commission in the future, there is absolutely no assurance that Shares could be sold under Rule 144 or otherwise until the Company becomes a current public reporting company with the Securities and Exchange Commission and otherwise is current in the Company’s business, financial and management information reporting, and applicable holding periods have been satisfied.

Sales Of A Substantial Number Of Shares Of Our Type Of Stock May Cause The Price Of Our Type Of Stock To Decline

If our shareholders sell substantial amounts of our Shares in the public market, Shares sold may cause the price to decrease below the current offering price. These sales may also make it more difficult for us to sell equity or equity-related securities at a time and price that we deem reasonable or appropriate.

The Company Has Made Assumptions In Its Projections and In Forward-Looking Statements That May Not Be Accurate

The discussions and information in this Prospectus may contain both historical and “forward- looking statements” which can be identified by the use of forward-looking terminology including the terms “believes,” “anticipates,” “continues,” “expects,” “intends,” “may,” “will,” “would,” “should,” or, in each case, their negative or other variations or comparable terminology. You should not place undue reliance on forward-looking statements. These forward-looking statements include matters that are not historical facts. Forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. Forward-looking statements contained in this Prospectus, based on past trends or activities, should not be taken as a representation that such trends or activities will continue in the future. To the extent that the Prospectus contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results to differ from its current expectations. The differences may be caused by a variety of factors, including but not limited to adverse economic conditions, lack of market acceptance, reduction of consumer demand, unexpected costs and operating deficits, lower sales and revenues than forecast, default on leases or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure to obtain customers, loss of customers and failure to obtain new customers, the risk of litigation and administrative proceedings involving the Company or its employees, loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the possible fluctuation and volatility of the Company’s operating results and financial condition, adverse publicity and news coverage, inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other specific risks that may be referred to in this Prospectus or in other reports issued by us or by third-party publishers.

| -21- |

You Should Be Aware Of The Long-Term Nature Of This Investment

Because the Shares have not been registered under the Securities Act or under the securities laws of any state or non-United States jurisdiction, the Shares may have certain transfer restrictions. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Shares may also adversely affect the price that you might be able to obtain for the Shares in a private sale. You should be aware of the long-term nature of your investment in the Company. You will be required to represent that you are purchasing the Securities for your own account, for investment purposes and not with a view to resale or distribution thereof.

The Shares In This Offering Have No Protective Provisions.

The Shares in this Offering have no protective provisions. As such, you will not be afforded protection, by any provision of the Shares or as a Shareholder in the event of a transaction that may adversely affect you, including a reorganization, restructuring, merger or other similar transaction involving the Company. If there is a ‘liquidation event’ or ‘change of control’ the Shares being offered do not provide you with any protection. In addition, there are no provisions attached to the Shares in the Offering that would permit you to require the Company to repurchase the Shares in the event of a takeover, recapitalization or similar transaction.

You Will Not Have Significant Influence On The Management Of The Company

Substantially all decisions with respect to the management of the Company will be made exclusively by the officers, directors, managers or employees of the Company. You will have a very limited ability, if at all, to vote on issues of Company management and will not have the right or power to take part in the management of the Company and will not be represented on the board of directors or by managers of the Company. Accordingly, no person should purchase Shares unless he or she is willing to entrust all aspects of management to the Company.

No Guarantee of Return on Investment

There is no assurance that you will realize a return on your investment or that you will not lose your entire investment. For this reason, you should read this Form S-1, Prospectus and all exhibits and referenced materials carefully and should consult with your own attorney and business advisor prior to making any investment decision.

IN ADDITION TO THE RISKS LISTED ABOVE, BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY THE MANAGEMENT. IT IS NOT POSSIBLE TO FORESEE ALL RISKS THAT MAY AFFECT THE COMPANY. MOREOVER, THE COMPANY CANNOT PREDICT WHETHER THE COMPANY WILL SUCCESSFULLY EFFECTUATE THE COMPANY’S CURRENT BUSINESS PLAN. EACH PROSPECTIVE PURCHASER IS ENCOURAGED TO CAREFULLY ANALYZE THE RISKS AND MERITS OF AN INVESTMENT IN THE SECURITIES AND SHOULD TAKE INTO CONSIDERATION WHEN MAKING SUCH ANALYSIS, AMONG OTHER FACTORS, THE RISK FACTORS DISCUSSED ABOVE.