Pampa Energía S.A. (‘Pampa’ or the ‘Company’), the largest independent energy integrated company in Argentina, with active participation in the country’s electricity and gas value chain, announces the results for the quarter ended on March 31, 2019.

Buenos Aires, May 10, 2019

1 Under the IFRS, Greenwind, OldelVal, Refinor, Transener and TGS are not consolidated in Pampa’s FS, being its equity income shown as ‘Results for participation in associates/joint businesses’.

2 Consolidated adjusted EBITDA represents the results before net financial results, income tax and minimum notional income tax, depreciations and amortizations, non-recurring and non-cash income and expense, equity income and other adjustments from the IFRS implementation, and includes affiliates’ EBITDA at ownership. For more information, see section 3 of this Earnings Release.

Pampa Energía • Q1 19 Earning Release • 1

Information about the Conference Call

There will be a conference call to discuss Pampa’s Q1 19 results on Tuesday May 14, 2019 at 10:00 a.m. Eastern Standard Time / 11:00 a.m. Buenos Aires Time.

The host will be Lida Wang, Investor Relations Manager at Pampa. For those interested in participating, please dial +54 (11) 3984-5677 in Argentina, +1 (844) 717-6837 in the United States or +1 (412) 317-6394 from any other country. Participants of the conference call should use the identification password ‘Pampa Energía’ and dial in five minutes before the scheduled time. Please download the Q1 19 Conference Call Presentation from our IR website. There will also be a live audio webcast of the conference at http://bit.ly/PampaQ119Call.

You may find additional information on the Company at:

ü ri.pampaenergia.com/en

ü www.cnv.gov.ar

ü www.sec.gov

ü www.bolsar.com

|

2 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 2

Table of Contents

|

Main Results for the Q1 19 |

1 | ||

|

Information about the Conference Call |

2 | ||

|

Table of Contents |

3 | ||

|

1. |

Relevant Events |

4 | |

|

1.1 |

Generation Segment: Commissioning of Two New Wind Farms |

4 | |

|

1.2 |

Oil and Gas Segment |

4 | |

|

1.3 |

TGS |

6 | |

|

1.4 |

Edenor: Modification of the Wholesale Electricity Market ('WEM') Seasonal Programming |

7 | |

|

1.5 |

Transener |

7 | |

|

1.6 |

Strategic Divestments: Closing of Dock Sud Sale |

7 | |

|

1.7 |

Tax Reform |

7 | |

|

1.8 |

Buyback of Own Financial Securities |

8 | |

|

1.9 |

Appointment of Board and Audit Committee Members at Pampa |

9 | |

|

2. |

Financial Highlights |

10 | |

|

2.1 |

Consolidated Balance Sheet |

10 | |

|

2.2 |

Consolidated Income Statement |

11 | |

|

2.3 |

Cash and Financial Borrowings |

12 | |

|

3. |

Analysis of the Q1 19 Results |

14 | |

|

3.1 |

Analysis of the Power Generation Segment |

15 | |

|

3.2 |

Analysis of the Electricity Distribution Segment |

18 | |

|

3.3 |

Analysis of the Oil and Gas Segment |

21 | |

|

3.4 |

Analysis of the Refining and Distribution Segment |

24 | |

|

3.5 |

Analysis of the Petrochemicals Segment |

25 | |

|

3.6 |

Analysis of the Holding and Others Segment |

27 | |

|

3.7 |

Analysis of the Quarter, by Subsidiary |

29 | |

|

3 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 3

1. Relevant Events

1.1 Generation Segment: Commissioning of Two New Wind Farms

On May 10, 2019, the Wholesale Electricity Market Clearing Company (‘CAMMESA’) granted the commercial commissioning of Pampa Energía Wind Farms (‘PEPE’) II and III, each 53 MW of installed capacity. It is worth highlighting that the commissioning of PEPE II and III was achieved within the scheduled timeframe set forth in the awarding of priority dispatch.

The PEPE II was inaugurated on last March 20 before the Crown Prince and heir to the throne Frederik of Denmark; Hector Gay, Mayor of the City of Bahía Blanca; Sebastian Kind, Undersecretary of Renewable Energies, as well as Pampa officers and other authorities and special guests. The PEPE II is located in the area known as Corti, 20 kilometers away from the City of Bahía Blanca, in the Province of Buenos Aires, nearby Engineer Mario Cebreiro Wind Farm (‘PEMC’), whereas the PEPE III is located in the City of Coronel Rosales, 25 kilometers away from the City of Bahía Blanca.

Both wind farms consist of 14 wind turbines each, by which each turbine is made up of four tower sections, a nacelle and three blades driving the turbine with a total diameter of 136 meters. As in the previous PEMC project, the installation of these wind turbines required the construction of sophisticated works on the platforms and foundations, similar to the existing ones in different wind farms of this type around the world. Furthermore, the PEPE II and III were awarded under Res. No. 281-E/2017 passed by the former Ministry of Energy and Mining (‘MEyM’) for the Renewable Energy Term Market (‘MAT ER’), and will be destined to meet the demand by large electricity consumption users through power purchase agreements (‘PPAs’) between private parties.

The wind farms demanded a final estimated investment of US$130 million. Thus, as of today with these new additions, 206 MW of renewable energy is developed by Pampa, operating 14 power plants with 4.0 GW of installed capacity, and once the remaining committed expansion projects for 398 MW3 are commissioned, Pampa’s total capacity will reach 4.4 GW.

New Tariff Schemes for Natural Gas End-Users in Distribution

Following the public hearings held in late February 2019, on April 1, 3 and 5, 2019 Res. No. 193-199, 201-202 and 205-207/2019 issued by the National Gas Regulatory Entity (‘ENARGAS’) were published in the Public Gazette (‘BO’), which established, effective as from April 1, 2019, new natural gas final tariffs for residential, commercial and compressed natural gas (‘CNG’) users considering Transportation System Entry Point (‘PIST’) prices for natural gas as a raw material for the following 6 months ranging between AR$3.24/m3 (equivalent to US$2.14/MBTU) and AR$7.09/m3 (equivalent to US$4.69/MBTU), including the differential tariff4. These prices differ based on the distribution company and the geographical location.

Furthermore, pursuant to Resolution No. 148/2019 issued by the Government Secretariat of Energy (‘SGE’) on March 29, 2019, 27% and 12% discounts in the price of natural gas within the PIST were set for the months of April and May 2019, respectively, which will be borne by the Federal Government in the form of a subsidy. Additionally, on April 17, 2019, the Federal Government provided for a 22% reduction in the price of natural gas within the PIST for residential users during the winter season, which users will have to pay it back in their summer season bills, when there is usually a lower consumption on account of seasonality. In this way, final bills will be evened out throughout the year. The financial cost of deferring these payments would be borne by the Federal Government. However, to date the applicable resolutions have neither been formalized nor issued yet.

|

4 |

|

<BCLPAGE>8</BCLPAGE> |

3 This figure considers 383 MW from the closing to combined cycle at Genelba thermal power plant (‘CTGEBA’) and 15 MW from MAN engines at Loma de la Lata thermal power plant (‘CTLL’).

4 The resolutions with the new tariff schemes contemplate an exchange rate of AR$41.003/US$ corresponding to average rate quoted by the Banco de la Nación Argentina’s between March 1 and 15, 2019.

Pampa Energía • Q1 19 Earning Release • 4

Exploration Licenses

The extension of the exploration license for Parva Negra Este, a block located in the Province of Neuquén granted under concession to Gas y Petróleo de Neuquén S.A.P.E.M. (‘GyP’) and operated by Pampa since April 2014, in which the Company has a 42.5% stake, expired in April 2019. On March 29, 2019, GyP requested that the whole Parva Negra Este block should be classified as an evaluation lot for a 3-year period.

On February 22, 2019 Salta’s Provincial Executive Order No. 249/19 was passed, which granted a 12-month term extension for the third exploratory period of Chirete, a block located in the Province of Salta and operated by High Luck Group Limited, effective as from November 18, 2018. Since the discovered field turned out to be commercially exploitable, on April 26, 2019 an application was filed for the granting of a hydrocarbon exploitation concession for the 95-km2 exploitation lot known as ‘Los Blancos’. Additionally, on April 30, 2019 a three-year extension of the third exploratory period for the permit’s remaining area was requested on considering that the exploratory potential will require additional surveys after the discovery of oil in late 2018. Pampa has a 50% interest in the Chirete block.

Moreover, in compliance with the respective partnership agreements, the Company had timely informed to the partners of the Enarsa 1 and Enarsa 3 blocks of its decision not to take part in their reconversion into exploration permits pursuant to Law No. 27.007. On April 15, 2019, SGE Res. No. 195/19 and 196/19 were published in the BO informing of the relinquishment and transfer back to the Federal Government of the Enarsa 3 block, as well as the partial reconversion of the Enarsa 1 block into an exploration permit granted to YPF and the relinquishment and transfer back to the Federal Government of Enarsa 1 block’s remaining surface. Therefore, Pampa no longer holds any interests in these areas.

Collection of 2017 Plan Gas’ Compensations

As regards compensations pending settlement under the Natural Gas Surplus Injection Promotion Programs, Res. No. 1/2013 of the former Secretariat of Energy (‘SE’), and for Companies with Reduced Natural Gas Injection, SE Res. No. 60/2013 (‘Plan Gas’) and pursuant to SGE Res. No. 54/19, on April 17, 2019 the Company was credited the Natural Gas Program Bond for a face value of US$88.5 million and maturing on June 28, 2021, corresponding to former Petrolera Pampa (a company absorbed by Pampa). As of the issuance hereof, 4 installments, equivalent to US$11.8 million, have already been collected.

As regards the outstanding receivable, estimated at US$54 million, the Company is conducting the necessary actions before the corresponding authorities to collect the bond and the owed repayments.

Investment in Oleoductos de Crudos Pesados (‘OCP’)

Pursuant to the agreement entered into on December 5, 2018 with Agip Oleoducto de Crudos Pesados BV for the purchase of shares representing 4.49% of OCP’s capital stock and the subordinated debt issued by such company, on March 19, 2019 OCP was notified that on March 8, 2019 the Ecuadorian Government had granted the required authorization, which was a precedent condition for the transaction’s closing. As of the issuance hereof, the parties are working on the requirements for the closing of the transaction.

|

5 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 5

1.3 TGS

Semiannual Remuneration Update

On March 29, 2019 ENARGAS issued Res. No. 192/19, which established a 26.0% increase in tariff schemes applicable to the natural gas transportation utility service by TGS, effective as from April 1, 2019, which represents a 3% increase for end-users. This increase was determined by ENARGAS using the non-automatic adjustment mechanism based on the Wholesale Domestic Price Index (‘IPIM’)’s semiannual variation between August 2018 and February 2019.

Midstream Project – Vaca Muerta

On April 30, 2019, the project completed the assembly works for the surface facilities located in the Vaca Muerta Gas Pipeline in connection with Neuba II and the partial commissioning of the conditioning plant in the town of Tratayén. Thus, the first stage of this project was commissioned, which as from May 2019 will generate revenues from firm contracts for 0.8 million m3/d.

Tender for the Construction and/or Extension of Gas Pipeline

Under SGE Res. No. 82/19, which was published in the BO on March 8, 2019, the private sector was called to submit bids for the construction of a new gas pipeline connecting the Neuquina Basin with Greater Buenos Aires and the eastern area, and/or for the extension of existing gas pipeline systems to replace imported natural gas liquids (‘NGL’) and the use of diesel oil.

Last April 8, TGS submitted its project for the construction of a gas pipeline with an extension of more than 1,000 kilometers in two stages: Tratayén-Salliqueló and Salliqueló-San Nicolás, plus the expansion of the final tranches. As of the date of this Report, the SGE has not issued any resolutions in this respect.

Legal Proceeding Challenging the Charge on Natural Gas Processing Companies

On March 26, 2019, TGS was served notice of the first-instance ruling rendered by the National First-Instance Administrative Litigation Court No. 1 upholding the claim for unconstitutionality and nullity of Executive Order No. 2,067/08, Res. No. 1451/08 of the former Ministry of Federal Planning, Public Investment and Services (‘MPFIP’) and ENARGAS Res. No. I-1.982/11 and I-1.991/11, as well as of any other act or provision issued or to be issued based on the above-mentioned provisions.

It should be pointed out that the Executive Order No. 2067/08 created a charge payable by: (i) users of the natural gas transportation and/or distribution regulated services, (ii) natural gas consumers directly receiving it from producers without the use of transportation or distribution systems, and (iii) natural gas processing companies. This charge’s main purpose was to finance natural gas imports by the Federal Government, and it made up the variable costs for the processing of natural gas by TGS.

Distribution of Cash Dividends

On April 11, 2019 TGS held the General Ordinary Shareholders' Meeting, which approved, among other measures, the payment of cash dividends in the amount of AR$6,942 million. Furthermore, TGS’s Board of Directors resolved to pay an additional cash dividend in the amount of AR$240.5 million from the partial release of the Reserve for Future Investments and Other Specific Purposes, totalizing AR$7,182.5 million, which were placed at the shareholders’ disposal as from April 23, 2019.

|

6 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 6

1.4 Edenor: Modification of the WEM Seasonal Programming

On April 29, 2019, the Secretariat of Renewable Resources and Electricity Market (‘SRRYME’) issued Res. N° 14/19, which partially amended SGE Res. No. 366/18, maintaining in effect the power capacity reference price of AR$80,000 per MW-month, effective since February 2019, until October 2019. Energy reference prices for the May-July 2019 and August-October 2019 periods were set at AR$2,902/MWh and AR$3,042/MWh for Large Users at Distribution (‘GUDI’), and at AR$1,985/MWh and AR$2,122/MWh for the rest of non-residential users. However, energy reference prices for residential users effective since February 2019 remained unchanged.

Furthermore, the stabilized price for transmission in the extra high voltage system and the distributor-based main distribution price established by Provision No. 75/18 of the former Under Secretariat of Electric Power (‘SEE’) remained unchanged.

Semiannual Remuneration Update

On March 22, 2019, the National Electricity Regulatory Entity (‘ENRE’) issued Res. No. 67/19 and No. 68/19 updating Transener and Transba’s remunerations by 25.15% and 26.53%, respectively (both including a 0.4% X-Factor adjustment stimulating efficiency), for the June 2018 – December 2018 period, applicable on the remuneration scheme effective as from February 1, 2019.

Distribution of Cash Dividends

On April 25, 2019 Transener held the General Ordinary Shareholders’ Meeting, which approved, among other measures, the payment of cash dividends to shareholders in the amount of AR$3,300 million, delegating to Transener's Board of Directors the payment terms set out in the regulations.

1.6 Strategic Divestments: Closing of Dock Sud Sale

Under the sale of the Dock Sud storage facility to Raízen Argentina, a licensee of the Shell brand, on March 30, 2019, the Dock Sud Terminal was transferred to the purchaser at a price of US$19.5 million and US$2.0 million on account of inventory. The transaction resulted in profit before income tax in the amount of AR$81.2 million.

Optional Tax Revaluation

Based on an assessment of the domestic context and the evolution of financial variables (including the inflation rate), on March 27, 2019, Pampa and Central Piedra Buena (‘CPB’) exercised their option to adhere to the tax revaluation regime on property, plant and equipment existing as of December 31, 2017 pursuant to Law No. 27,430, the tax cost of such property thus increasing to AR$15,311 million. On exercising this option, Pampa and CPB have to pay the special tax for a principal amount of AR$1,495 million, plus interest for AR$45 million, under a 5 monthly installments’ plan. As of issuance of this Report, the first 2 installments have already been paid.

Additionally, Pampa and CPB had to waive all proceedings and rights invoked in any previously brought judicial or administrative proceedings seeking the application of updating mechanisms on the income tax. Furthermore, Pampa and CPB have waived their rights to initiate any judicial or administrative proceeding seeking the application of such updating mechanisms regarding fiscal years ended before December 31, 2017.

|

7 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 7

Tax Inflation Adjustment

The Law No. 27,430 stipulates the application of the tax inflation adjustment set forth by the Income Tax Law for the first, second and third fiscal year as from its effective date (in 2018) in the event the Consumer Price Index (‘IPC’) cumulative variation, calculated from the beginning to the end of each fiscal year, exceeds 55%, 30% and 15% for fiscal years 2018, 2019 and 2020, respectively.

Even though in fiscal year 2018 the IPC cumulative variation did not exceed 55%, based on the assessment of the domestic context, the evolution of financial variables and an average of inflation forecasts from the market expectations survey report as of March 2019 issued by the Central Bank of the Argentine Republic (‘BCRA’), the Company estimates that as of the closing of fiscal year 2019 the IPC cumulative variation will exceed the foreseen 30% condition for the tax inflation adjustment’s second transition year and, for this reason, has applied the tax inflation adjustment in the current and deferred income tax provision.

1.8 Buyback of Own Financial Securities

Pampa and TGS

Given that there is still a gap between the value of assets and the shares’ quotation price in stock exchanges, and that the latter does not reflect either the value or the economic reality they currently or potentially have, thus being detrimental to shareholders’ interests, and taking into consideration the current strong cash position and fund availability, on March 27, 2019 Pampa and TGS’s Board of Directors approved programs for the repurchase of own shares under the following terms and conditions:

|

|

Pampa |

TGS |

|

|

Repurchase Program III | |

|

Maximum amount for repurchase |

US$100 million |

AR$1.5 billion |

|

Maximum price |

US$1.04/ordinary share or US$26/ADR |

AR$135/ordinary share or US$15/ADR |

|

Period in force |

120 days since Mar 28, 2019 |

180 days since Mar 28, 2019 |

|

Repurchases to date |

1,998,235 ADRs @ US$22.97/ADR |

1,200,329 ADRs @ US$10.65/ADR |

|

Progress |

46% - In process |

34% - In process |

Note: Repurchases are deemed to be effected transactions.

As of the date hereof, Pampa and TGS have repurchased 70.1 million and 19.6 million ordinary shares that are held in treasury, which equal 2.8 million and 3.9 million American Depositary Receipts (‘ADRs’), respectively.

Edenor

After completing the second share buyback program on April 5, 2019, on April 9, 2019, Edenor’s Board of Directors approved a third program pursuant to the following terms and conditions:

|

|

Edenor | |

|

|

Repurchase Program II |

Repurchase Program III |

|

Maximum amount for repurchase |

AR$800 million |

AR$800 million |

|

Maximum price |

US$1,5/ordinary share or US$30/ADR |

AR$60/ordinary share or US$55/ADR |

|

Period in force |

120 days since Dec 6, 2018 |

120 days since May 11, 2018 |

|

Repurchases to date |

449,676 ADRs @ US$26.48/ADR |

97,463 ADRs @ US$17.33/ADR |

|

Progress |

57% - Complete |

9% - In process |

Note: Repurchases are deemed to be effected transactions.

|

8 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 8

As of the date hereof, Edenor has repurchased 23.9 million common shares that are held in treasury, which equal 1.2 million ADR.

Acquisition of Edenor’s Shares

In the month of April 2019, the Company acquired a total number of 6,804 Edenor’s ADRs at an average acquisition cost of US$17.6 per ADR and, considering Edenor’s ADRs acquired in 2018, Pampa’s equity interest in Edenor amounts to 51.779% of its issued capital stock.

Pampa’s Compensation Plan

Under the stock compensation plan for the Company’s key staff approved on February 10, 2017 by the Company’s Board of Directors, during March 2019 a total of 290,363 common shares were granted to employees benefitted by the stock compensation plan. The Company currently holds 5 million ordinary shares in treasury, representing 0.3% of the issued capital stock, available to fund such compensation plan.

1.9 Appointment of Board and Audit Committee Members at Pampa

On April 29, 2019, Pampa’s Ordinary and Extraordinary Shareholders’ Meeting approved the renewal of the terms of office of Gabriel Cohen as non-independent director; Pablo Díaz, Mariano Batistella and Nicolás Mindlin as non-independent alternate directors, and Santiago Alberdi as independent director. Moreover, it approved the appointment of Carolina Sigwald, which previously served as Pampa’s alternate director, as non-independent director; Carlos Correa Urquiza and Darío Epstein as independent directors to replace Diana Mondino and Carlos Tovagliari; Horacio Turri and Gerardo Paz as non-independent alternate directors, and Silvana Wasersztrom and Catalina Lappas as independent alternate directors.

The Audit Committee was finally made up of Miguel Bein as chairman; Carlos Correa Urquiza as vice-chairman; Darío Epstein as member and Silvana Wasersztrom as alternate member.

|

9 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 9

2. Financial Highlights

2.1 Consolidated Balance Sheet

|

In AR$ million |

As of 3.31.19 |

As of 12.31.18 |

|

ASSETS |

||

|

Property, plant and equipment |

141,673 |

138,554 |

|

Intangible assets |

6,659 |

6,739 |

|

Deferred tax credits |

81 |

89 |

|

Participation in joint businesses and associates |

16,534 |

16,995 |

|

Financial assets at fair value with changing results |

468 |

468 |

|

Right-of-use assets |

36 |

37 |

|

Other assets |

306 |

- |

|

Trade receivable and other credits |

10,064 |

10,553 |

|

Total non-current assets |

175,821 |

173,435 |

|

Inventories |

6,061 |

5,729 |

|

Investments at amortized cost |

1,822 |

1,474 |

|

Financial assets at fair value with changing results |

17,596 |

16,928 |

|

Financial derivatives |

166 |

3 |

|

Trade receivable and other credits |

31,709 |

29,360 |

|

Cash and cash equivalents |

4,281 |

10,083 |

|

Total current assets |

61,635 |

63,577 |

|

Total assets |

237,456 |

237,012 |

|

EQUITY |

||

|

Share capital |

1,875 |

1,874 |

|

Adjustment to share capital |

11,094 |

11,094 |

|

Share premium |

20,503 |

20,504 |

|

Repurchased shares |

25 |

25 |

|

Cost of repurchased shares |

(1,630) |

(1,652) |

|

Adjustment to share capital in treasury |

151 |

151 |

|

Statutory reserve |

1,002 |

1,002 |

|

Voluntary reserve |

8,152 |

8,152 |

|

Other reserves |

(725) |

(535) |

|

Retained earnings |

23,215 |

16,840 |

|

Other comprehensive result |

(239) |

(348) |

|

Equity attributable to owners of the parent |

63,423 |

57,107 |

|

Non-controlling interests |

17,927 |

17,912 |

|

Total equity |

81,350 |

75,019 |

|

LIABILITIES |

||

|

Investments in joint ventures and associates |

204 |

170 |

|

Provisions |

6,598 |

6,095 |

|

Income tax and minimum expected profit tax liability |

447 |

1,146 |

|

Deferred revenues |

274 |

305 |

|

Tax payable |

561 |

601 |

|

Deferred tax liabilities |

12,277 |

17,018 |

|

Defined benefit plan obligations |

1,262 |

1,303 |

|

Salaries and social security payable |

176 |

181 |

|

Borrowings |

79,077 |

76,688 |

|

Accounts payable and other liabilities |

9,095 |

9,047 |

|

Total non-current liabilities |

109,971 |

112,554 |

|

Provisions |

892 |

965 |

|

Deferred income |

5 |

6 |

|

Income tax and minimum expected profit tax liability |

1,740 |

1,201 |

|

Tax payable |

3,511 |

2,274 |

|

Defined benefit plan obligations |

157 |

180 |

|

Salaries and social security payable |

2,020 |

3,021 |

|

Financial derivatives |

12 |

54 |

|

Borrowings |

8,263 |

14,299 |

|

Accounts payable and other liabilities |

29,535 |

27,439 |

|

Total current liabilities |

46,135 |

49,439 |

|

Total liabilities |

156,106 |

161,993 |

|

Total liabilities and equity |

237,456 |

237,012 |

|

10 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 10

2.2 Consolidated Income Statement

|

|

First Quarter | ||

|

In AR$ million |

2019 |

|

2018 |

|

Sales revenue |

29,908 |

30,728 | |

|

Cost of sales |

(21,925) |

(19,422) | |

|

|

|||

|

Gross profit |

7,983 |

|

11,306 |

|

|

|||

|

Selling expenses |

(1,829) |

(1,590) | |

|

Administrative expenses |

(1,900) |

(2,076) | |

|

Exploration expenses |

(44) |

(3) | |

|

Other operating income |

515 |

5,527 | |

|

Other operating expenses |

(1,038) |

(3,851) | |

|

Results for participation in joint businesses and associates |

756 |

841 | |

|

|

|||

|

Operating income |

4,443 |

|

10,154 |

|

|

|||

|

RECPAM - Results from net monetary position |

8,080 |

3,977 | |

|

Financial income |

1,342 |

678 | |

|

Financial costs |

(3,683) |

(2,667) | |

|

Other financial results |

(6,381) |

(3,389) | |

|

Financial results, net |

(642) |

(1,401) | |

|

|

|||

|

Profit before tax |

3,801 |

|

8,753 |

|

|

|||

|

Income tax |

2,764 |

(2,565) | |

|

|

|||

|

Net income for continuing operations |

6,565 |

|

6,188 |

|

|

|||

|

Net income from discontinued operations |

- |

842 | |

|

|

|||

|

Net income for the period |

6,565 |

|

7,030 |

|

|

|||

|

Attributable to: |

|||

|

Owners of the Company |

6,375 |

5,640 | |

|

Continuing operations |

6,375 |

4,896 | |

|

Discontinued operations |

- |

744 | |

|

Non-controlling interests |

190 |

1,390 | |

|

|

|||

|

Net income per share attributable to the owners of the Company |

3.4000 |

2.7141 | |

|

Basic and diluted income per share of continuing operations |

3.4000 |

2.3561 | |

|

Basic and diluted income per share of discontinued operations |

- |

0.3580 | |

|

|

|

|

|

|

11 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 11

2.3 Cash and Financial Borrowings

|

As of March 31, 2019, |

Cash(1) |

|

Financial Debt | ||

|

Consolidated |

Ownership Adjusted |

|

Consolidated |

Ownership Adjusted | |

|

Power generation(2) |

1,918 |

1,137 |

24,358 |

24,358 | |

|

Electricity distribution |

3,384 |

1,752 |

9,615 |

4,977 | |

|

Refining & distribution |

- |

- |

- |

- | |

|

Petrochemicals |

- |

- |

- |

- | |

|

Holding and others |

10,664 |

10,664 |

- |

- | |

|

Oil and gas |

7,734 |

7,728 |

48,490 |

48,490 | |

|

Total |

23,699 |

21,280 |

|

82,463 |

77,825 |

Note: (1) It includes cash and cash equivalents, financial assets at fair value with changing results and investments at amortized cost.

(2) It does not include regulatory liability held against CAMMESA for AR$4,877 million.

2.3.1 Summary of Listed Debt Securities

|

Company |

Security |

Maturity |

Amount Issued |

Amount Outstanding |

Coupon |

|

In US$ |

|

|

|

|

|

|

Transener1 |

ON Series 2 |

2021 |

101 |

97 |

9.75% |

|

Edenor |

ON par at fixed rate |

2022 |

300 |

164 |

9.75% |

|

TGS1 |

ON at discount at fixed rate |

2025 |

500 |

500 |

6.75% |

|

Pampa Energía |

ON Series 4 US$-Link2,3 |

2020 |

34 |

34 |

6.25% |

|

ON Series T at discount & fixed rate |

2023 |

500 |

500 |

7.375% | |

|

ON Series I at discount & fixed rate |

2027 |

750 |

740 |

7.5% | |

|

In AR$ |

|

|

|

|

|

|

Pampa Energía |

ON Series E3 |

2020 |

575 |

575 |

Badlar Privada |

Note: (1) Affiliates are not consolidated in Pampa’s FS, according to the IFRS standards. (2) CB dollar-link, with initial FX rate of AR$8.4917/US$. (3) Debt securities issued by CTLL, a power generation subsidiary merged by absorption to Pampa Energía.

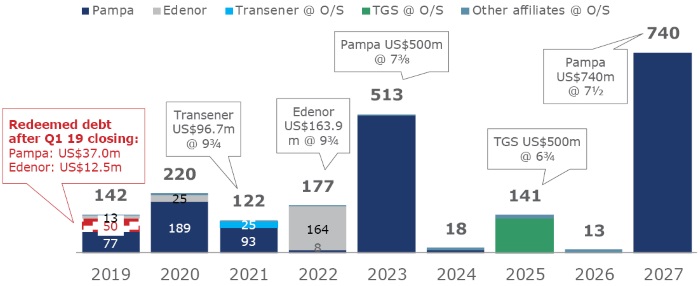

As of March 31, 2019, at consolidated level the average interest rate bearing US$ loans was 7.2%, currency in which 99% of gross debt is denominated and mostly at fixed rate. The average life of Pampa’s consolidated financial debt amounts to 5 years. The following chart shows the debt profile for Pampa and subsidiaries5, net of repurchases and redemptions, in US$ million:

|

12 |

|

<BCLPAGE>8</BCLPAGE> |

5 It does not include interests, it considers Pampa stand-alone and Edenor at 100%, and the affiliates TGS, OldelVal, Transener, Greenwind and Refinor at our equity participation.

Pampa Energía • Q1 19 Earning Release • 12

After the quarter’s closing, Pampa redeemed at maturity a total amount of US$37 million and Edenor redeemed at maturity the first amortization of the loan granted by the Industrial and Commercial Bank of China Dubai Branch (‘ICBC’) for US$12.5 million.

Moreover, as of the quarter’s closing at consolidated level, Pampa held in treasury Series I Corporate Bond (‘CB’) maturing in 2027 for a face value of US$9 million, repurchased between August and September 2018 at an average clean price of US$79.2 per face value of US$100. By the beginning of May 2019, Pampa repurchased a face value of US$1 million of this CB at a clean price of US$86 per face value of US$100.

In the case of Edenor, as of the quarter’s closing the outstanding CB’s principal, net of repurchases, reached US$163.9 million, which include US$2.3 million repurchased in Q1 19 at a clean price of US$98 per face value of US$100.

Finally, after the quarter’s closing, Transener repurchased US$1.9 million at face value of the 2021 CB at a clean price of US$98.5 per US$100. Thus as of the date hereof, the outstanding CB’s principal, net of repurchases, reached US$96.7 million.

2.3.3 Pampa Corporate Group’s CBs Ratings

As of the date hereof, Pampa Corporate Group’s CBs ratings remained unchanged since the publication of the Earnings Release as of the closing of 2018 fiscal year.

The following table shows the Pampa Group’s CBs ratings:

|

Company |

Agency |

Ratings | |

|

Global |

Local | ||

|

Pampa |

S&P |

B |

na |

|

Moody's |

B2 |

na | |

|

FitchRatings |

B |

AA- | |

|

Edenor |

S&P |

B |

raA |

|

Moody's |

B1 |

Aa3.ar | |

|

TGS |

S&P |

B |

na |

|

Moody's |

B1 |

Aa2.ar | |

|

Transener |

S&P |

B |

raAA- |

|

13 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 13

3. Analysis of the Q1 19 Results

Consolidated net revenues of AR$29,908 million, 3% lower than the AR$30,728 million for Q1 18, explained by decreases of 8% in electricity distribution, 7% in oil and gas, and 13% in holding and others, in addition to higher eliminations due to intersegment sales of AR$2,454 million, partially offset by increases of 64% in power generation and 4% in petrochemicals.

ð Power Generation of 3,913 GWh from 12 power plants

ð Electricity sales of 5,018 GWh to 3.1 million end-users

ð Production of 46.8 thousand barrels per day of hydrocarbons

ð Sales of 83 thousand tons of petrochemical products

Consolidated adjusted EBITDA for continuing operations of AR$8,037 million, 34% lower compared to the AR$12,237 million for Q1 18, mainly due to decreases of 79% in electricity distribution, 47% in oil and gas, AR$213 million in petrochemicals and 5% in holding and others, partially offset by increases of 25% in power generation and lower intersegment eliminations of AR$19 million.

Consolidated gain attributable to the owners of the Company of AR$6,375 million, 13% higher than the AR$5,640 million gain in Q1 18, which includes a higher profit of AR$4,103 million due to RECPAM, as a result of our passive net monetary position, in addition to a higher gain from lower deferred tax liabilities, partially offset by higher losses of AR$3.143 million due to 15% of AR$ depreciation against US$ in Q1 19, currency in which most of the Company’s financial liabilities are denominated.

|

Consolidated Adjusted EBITDA Calculation, in AR$ million |

Q1 19 |

Q1 18 |

|

Consolidated operating income |

4,443 |

10,154 |

|

Consolidated depreciations and amortizations |

2,547 |

2,570 |

|

Consolidated EBITDA under IFRS standards |

6,990 |

12,724 |

|

Adjustments from generation segment |

137 |

7 |

|

Deletion of equity income from Greenwind |

35 |

28 |

|

Greenwind's EBITDA adjusted by ownership |

102 |

(2) |

|

Increases in materials from other periods at CTGEBA and HPPL |

- |

(19) |

|

Adjustments from distribution segment |

64 |

38 |

|

Retroactive adjustments to extraordinary penalties from the RTI |

- |

(44) |

|

Late payment interests |

64 |

82 |

|

Adjustments from oil and gas segment |

(31) |

(1,246) |

|

Deletion of equity income from OldelVal and OCP |

(40) |

(16) |

|

OldelVal's EBITDA adjusted by ownership |

9 |

46 |

|

Deletion of net gain from settlement agreement for subsidiary in Ecuador |

- |

(4,256) |

|

Tax contingencies in Ecuador |

- |

2,980 |

|

Adjustments from petrochemicals segment |

- |

(54) |

|

Deletion of gained penalties |

- |

(54) |

|

Adjustments from holding and others segment |

878 |

768 |

|

Deletion of equity income from TGS, Transener and Refinor |

(751) |

(853) |

|

TGS's EBITDA adjusted by ownership |

1,151 |

1,087 |

|

Transener's EBITDA adjusted by ownership |

449 |

491 |

|

Refinor's EBITDA adjusted by ownership |

29 |

43 |

|

Consolidated adjusted EBITDA for continuing operations |

8,037 |

12,237 |

|

Consolidated adjusted EBITDA for continuing and discontinued operations |

8,037 |

13,735 |

|

14 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 14

3.1 Analysis of the Power Generation Segment

|

Power Generation Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

8,545 |

5,220 |

+64% |

|

Cost of sales |

(4,746) |

(2,389) |

+99% |

|

Gross profit |

3,799 |

2,831 |

+34% |

|

Selling expenses |

(20) |

(40) |

-50% |

|

Administrative expenses |

(314) |

(307) |

+2% |

|

Other operating income |

70 |

38 |

+84% |

|

Other operating expenses |

(92) |

(58) |

+59% |

|

Results for participation in joint businesses |

(35) |

(28) |

+25% |

|

Operating income |

3,408 |

2,436 |

+40% |

|

RECPAM - Results from net monetary position |

3,942 |

1,546 |

+155% |

|

Finance income |

640 |

407 |

+57% |

|

Finance costs |

(961) |

(922) |

+4% |

|

Other financial results |

(3,098) |

(1,537) |

+102% |

|

Profit before tax |

3,931 |

1,930 |

+104% |

|

Income tax |

(958) |

(1,037) |

-8% |

|

Net income for the period |

2,973 |

893 |

+233% |

|

Attributable to: |

|||

|

Owners of the Company |

2,847 |

859 |

+231% |

|

Non-controlling interests |

126 |

34 |

+271% |

|

Adjusted EBITDA |

4,230 |

3,382 |

+25% |

|

Increases in prop., plant, equipment and intangible assets |

2,610 |

952 |

+174% |

|

Depreciation and amortization |

685 |

939 |

-27% |

In Q1 19, gross margin at power generation recorded AR$3,799 million, a 34% higher than the same period in 2018, mainly due to the 98% year-on-year peso devaluation in the average nominal exchange rate, which was higher than the 53% year-on-year inflation, with impact on our US$-nominated sales, not only on our new energy’s PPAs (Energía Plus, SE Res. No. 220/2007, MEyM Res. No. 21/2017 and RenovAr) but also on our legacy energy’s remuneration (SEE Res. No. 19/2017 and SRRyM Res. No. 1/20191). Moreover, the increase in gross margin is explained by the addition of PEMC, commissioned in June 2018. On the other hand, since the second week of November 2018, Pampa opted to make use of the fuel self-procurement capacity for its thermal generation units and therefore, higher revenues were recorded due to the recognition of gas cost as a pass-through in the Variable Production Cost (‘CVP’), but also higher costs due to the purchase of such gas. These effects were partially offset by the update in legacy energy remuneration scheme as from March 2019, which, among other measures, reduced the thermal power plants’ remuneration not only for the capacity with the availability commitment statement (‘DIGO’) but also for the operation and maintenance, in addition to the application of an average utilization factor during the last twelve months per unit, which can diminish power capacity remuneration up to 30%. During the months of January and February 2019 and the whole Q1 18, our legacy energy was billed under the SEE Res. No. 19/2017, whereas during the month of March 2019, it was applied a reduced capacity remuneration of US$5,500/MW-month and adjusted by average dispatch, with a negative impact of AR$138 million in Q1 19.

|

15 |

|

<BCLPAGE>8</BCLPAGE> |

6 Effective as from March 1, 2019.

Pampa Energía • Q1 19 Earning Release • 15

In operating terms, Pampa’s power generation during Q1 19 decreased by 9% compared to Q1 18, mainly due to the lower dispatch at Güemes thermal power plant (‘CTG’) and Piquirenda thermal power plant (‘CTP’) as a result of the partial recognition of imported gas costs by the WEM since October 2018, pursuant to SGE Res. No. 25/18 (-377 GWh), a slightly lower dispatch rate due to lower electricity demand at CTLL, CPB and CTGEBA (-99 GWh) and a lower level of water at the dams in Mendoza, especially at Diamante hydro power plant (‘HIDISA’) (-35 GWh). These variations were partially offset by the commissioning of PEMC (+89 GWh) and a better availability at Ingeniero White thermal power plant (‘CTIW’) (+35 GWh). The availability rate of all Pampa’s power plants reached 95.5% in Q1 19 in comparison with 97.3% in Q1 18.

|

Summary of |

Hydroelectric |

Wind |

Thermal |

Total | |||||||||

|

HINISA |

HIDISA |

HPPL |

PEMC |

CTLL |

CTG |

CTP |

CPB |

CTPP |

CTIW |

CTGEBA |

Eco- | ||

|

Installed Capacity (MW) |

265 |

388 |

285 |

100 |

765 |

361 |

30 |

620 |

100 |

100 |

843 |

14 |

3,871 |

|

New Capacity (MW) |

- |

- |

- |

100 |

364 |

100 |

30 |

- |

100 |

100 |

169 |

14 |

977 |

|

Market Share |

0.7% |

1.0% |

0.7% |

0.3% |

2.0% |

0.9% |

0.1% |

1.6% |

0.3% |

0.3% |

2.2% |

0.04% |

10.0% |

|

First Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Generation Q1 19 (GWh) |

190 |

119 |

175 |

89 |

1,213 |

282 |

13 |

400 |

39 |

90 |

1,279 |

25 |

3,913 |

|

Market Share |

0.6% |

0.4% |

0.5% |

0.3% |

3.8% |

0.9% |

0.0% |

1.3% |

0.1% |

0.3% |

4.0% |

0.1% |

12.3% |

|

Sales Q1 19 (GWh) |

190 |

119 |

175 |

89 |

1,213 |

381 |

13 |

400 |

39 |

90 |

1,385 |

25 |

4,118 |

|

Net Generation Q1 18 (GWh) |

198 |

146 |

167 |

- |

1,251 |

623 |

49 |

430 |

34 |

55 |

1,310 |

28 |

4,289 |

|

Variation Q1 19 vs. Q1 18 |

-4% |

-18% |

+5% |

na |

-3% |

-55% |

-73% |

-7% |

+16% |

+65% |

-2% |

-9% |

-9% |

|

Sales Q1 18 (GWh) |

198 |

146 |

167 |

- |

1,251 |

785 |

49 |

430 |

34 |

55 |

1,488 |

28 |

4,630 |

|

Avg. Price Q1 19 (US$/MWh) |

25 |

40 |

25 |

70 |

59 |

43 |

132 |

57 |

243 |

102 |

46 |

27 |

53 |

|

Avg. Price Q1 18 (US$/MWh) |

25 |

34 |

26 |

na |

35 |

34 |

44 |

38 |

268 |

91 |

32 |

71 |

36 |

|

Avg. Gross Margin Q1 19 (US$/MWh) |

12 |

29 |

16 |

59 |

35 |

27 |

na |

21 |

192 |

73 |

19 |

(14) |

28 |

|

Avg. Gross Margin Q1 18 (US$/MWh) |

16 |

20 |

15 |

na |

33 |

20 |

na |

19 |

230 |

72 |

20 |

32 |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Gross margin before amortization and depreciation. FX rate of AR$/US$: Q1 19 – 39.01; Q1 18 – 19.68.

Net operating costs, excluding depreciations and amortizations, increased by 143% compared to Q1 18, mainly due to higher gas purchases for the fuel self-procurement, which represents 64% of the segment’s operating costs. During Q1 19, AR$97 million was recorded as a recognition of own fuel, net of purchases supplied by our E&P segment. This negative variation was partially offset by lower costs of energy purchases to cover Plus contracts.

The Q1 19 registered a positive variation in net financial results of AR$1,029 million, amounting to a net gain of AR$523 million, mainly due to the increase of RECPAM as a result of passive net monetary position allocated to the segment and higher recognition of commercial interests charged to CAMMESA due to delayed payments. These effects were partially offset by higher loss from net FX differences, as a result of a higher devaluation of the AR$ against the US$, currency in which most of the financial liabilities allocated to the segment are denominated, and to a lesser extent by lower gains from the holding of financial instruments and higher losses resulting from the impairment of credits.

Adjusted EBITDA increased by 25% in constant currency over Q1 18, registering a gain of AR$4,230 million, mainly due to the AR$ devaluation on our sales denominated in US$, the new PPA commissioning at PEMC and the recognition of the fuel self-procurement, partially offset by higher costs of gas purchase and operating and maintenance of the increasing number of units and lower thermal dispatch. The adjusted EBITDA considers the proportional EBITDA of PEMC (Greenwind), in which Pampa holds a direct participation of 50%, for a gain of AR$102 million in Q1 19 and a loss of AR$2 million in Q1 18.

|

16 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 16

The following table shows the status summary of the committed expansion projects:

|

Project |

MW |

Equipment Provider |

Marketing |

Awarded Price |

|

Estimated Capex in |

Date of | |||

|

Capacity |

Variable |

Total |

|

Budget |

% Executed | |||||

|

Thermal |

|

|

|

|

|

|

|

|

|

|

|

Loma de la Lata |

15 |

MAN |

Res. SEE No. 19/17 |

5,500 - 7,000 |

5.4 |

14 |

20 |

87% |

Q3 2019 | |

|

105 |

GE |

US$ PPA for 10 years |

23,000 |

7.5 |

39 |

|

90 |

100% |

August 5, 2017 | |

|

Parque Ind. Pilar |

100 |

Wärtsilä |

US$ PPA for 10 years |

26,900 |

15 - 16 |

52 |

|

103 |

100% |

August 29, 2017 |

|

Ing. White |

100 |

Wärtsilä |

US$ PPA for 10 years |

21,800 |

12 - 15 |

42 - 45 |

|

92 |

100% |

December 22, 2017 |

|

Closing Genelba Plus |

383 |

Siemens |

US$ PPA for 15 years |

20,500 |

6 |

34 |

350 |

60% |

GT: Q2 2019 / | |

|

Renewable |

|

|

|

|

|

|

|

|

|

|

|

Mario Cebreiro2 |

100 |

Vestas |

US$ PPA for 20 years |

na |

na |

58(3) |

|

139 |

96% |

June 8, 2018 |

|

Pampa Energía II |

53 |

Vestas |

MAT ER |

na |

na |

69(4) |

|

64 |

79% |

May 10, 2019 |

|

Pampa Energía III |

53 |

Vestas |

MAT ER |

na |

na |

69(4) |

73 |

74% |

May 10, 2019 | |

|

| ||||||||||

|

Total |

909 |

|

|

|

|

|

|

931 |

81% |

|

Note: (1) Amounts without VAT. (2) Pampa holds 50% of stake. (3) Awarded price does not consider incentive and adjustment factors.

(4) Weighted average of the PPAs.

Supplementary Information

|

Power Generation Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

8,223 |

3,296 |

+149% |

|

Cost of sales |

(4,170) |

(1,248) |

+234% |

|

Gross profit |

4,053 |

2,048 |

+98% |

|

Selling expenses |

(19) |

(25) |

-24% |

|

Administrative expenses |

(289) |

(194) |

+49% |

|

Other operating income |

69 |

24 |

+188% |

|

Other operating expenses |

(86) |

(37) |

+132% |

|

Depreciation and amortization |

248 |

272 |

-9% |

|

Adjusted EBITDA |

4,073 |

2,075 |

+96% |

|

Increases in prop., plant, equipment and intangible assets |

2,485 |

608 |

NA |

|

17 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 17

3.2 Analysis of the Electricity Distribution Segment

|

Electricity Distribution Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

15,987 |

17,439 |

-8% |

|

Cost of sales |

(13,562) |

(11,623) |

+17% |

|

Gross profit |

2,425 |

5,816 |

-58% |

|

Selling expenses |

(1,498) |

(1,195) |

+25% |

|

Administrative expenses |

(674) |

(700) |

-4% |

|

Other operating income |

128 |

81 |

+58% |

|

Other operating expenses |

(403) |

(411) |

-2% |

|

Operating income |

(22) |

3,591 |

NA |

|

RECPAM - Results from net monetary position |

3,308 |

1,679 |

+97% |

|

Finance income |

180 |

146 |

+23% |

|

Finance costs |

(1,636) |

(1,020) |

+60% |

|

Other financial results |

(610) |

(216) |

+182% |

|

Profit before tax |

1,220 |

4,180 |

-71% |

|

Income tax |

(1,071) |

(1,344) |

-20% |

|

Net income for the period |

149 |

2,836 |

-95% |

|

Attributable to: |

|||

|

Owners of the Company |

85 |

1,475 |

-94% |

|

Non-controlling interests |

64 |

1,361 |

-95% |

|

Adjusted EBITDA |

889 |

4,324 |

-79% |

|

Increases in prop., plant, equipment and intangible assets |

2,315 |

1,318 |

+76% |

|

Depreciation and amortization |

847 |

695 |

+22% |

In Q1 19, net sales decreased 8% compared to Q1 18, mainly due to the lower energy volume sales as a result of lower average temperature, in addition to the impact of economic recession and tariff increases. Moreover, the time lag between the measuring of Own Distribution Costs (‘CPD’) and its granting, which in an inflationary scenario has a negative impact on the Distribution Added Value (‘VAD’), as well as the composition of the CPD formula (which replicates Edenor’s costs structure) is overweight in the salary index, therefore CPD formula was outpaced by the IPC and IPIM indexes. These effects were partially offset by higher billing due to increases of electricity prices as a raw material. Moreover, the 48 monthly installments are being invoiced since February 2018 due to the gradual implementation of the tariff increase during February 2017 and January 2018 (AR$407 million in Q1 19 and AR$473 million in Q1 18).

In operating terms, energy volume sales decreased 10% in comparison to Q1 18, mainly explained by lower consumption in the residential segment related to average lower temperatures, the impact of economic recession and the tariff increase (-11% vs. Q1 18), in addition to lower demand from industries and SMEs in line with economic activity downturn (-7% vs. Q1 18). On the other hand, the number of Edenor’s clients increased by 4%, mainly due to regularization of residential clients as a result of the market disciplinary actions and normalization of clandestine connections, which included the installation of approximately 100 thousand energy integrated measuring units during 2018. This effect was partially offset by lower number of commercial clients due to the economic downturn.

|

18 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 18

|

Edenor's Sales |

2019 |

2018 |

Variation | |||||

|

In GWh |

Part. % |

Clients |

In GWh |

Part. % |

Clients |

% GWh |

% Clients | |

|

First Quarter |

|

|

|

|

|

|

|

|

|

Residential1 |

2,081 |

41% |

2,704,169 |

2,341 |

42% |

2,593,347 |

-11% |

+4% |

|

Commercial |

847 |

17% |

355,379 |

951 |

17% |

360,982 |

-11% |

-2% |

|

Industrial |

894 |

18% |

6,881 |

966 |

17% |

6,874 |

-8% |

+0% |

|

Wheeling System |

920 |

18% |

692 |

1,018 |

18% |

702 |

-10% |

-1% |

|

Others |

||||||||

|

Public Lighting |

161 |

3% |

21 |

161 |

3% |

21 |

-0% |

- |

|

Shantytowns and Others |

115 |

2% |

466 |

113 |

2% |

428 |

+2% |

+9% |

|

|

|

|

|

|

|

|

|

|

|

Total |

5,018 |

100% |

3,067,608 |

5,550 |

100% |

2,962,354 |

-10% |

+4% |

Note: (1) It includes 612,380 and 654,086 clients categorized under Social Tariff as of March 31, 2019 and 2018, respectively.

Energy purchases increased by 19% in Q1 19 compared to Q1 18, due to increase in electricity cost as a raw material as subsidies are being gradually removed, in addition to increase in electricity losses in terms of rate and cost (losses rate of 17.4% over demanded electricity in Q1 19 in comparison with 16.3% in Q1 18), mainly due to electricity theft, frauds incentivized by economic recession and tariff increase impact. These effects were partially offset by lower volume of energy demand.

Net operating costs, excluding energy purchases, depreciations and amortizations, increased by 11% in Q1 19 compared to Q1 18, mainly due to higher charges from penalties, explained by change in ENRE’s criteria, setting the penalty in AR$/kWh at the moment the regulator effectively fines, higher Unsupplied Energy Costs (‘CENS’) and tighter benchmark paths, in addition to a higher consumption of materials. These increases were partially offset by lower labor costs because inflation outpaced salary bargaining, and lower provisions for commercial receivables as a result of lower bad debt balance.

During Q1 19 net financial results increased by AR$653 million amounting to a gain of AR$1,242 million, mainly explained by the increase of RECPAM as a result of passive net monetary position allocated to the segment, in addition to financial income from the holding of bonds in portfolio and other bonds until maturity. These effects were partially offset by higher losses from commercial interests due to increased payable stock held against CAMMESA, FX difference as a result of a larger devaluation of the AR$ against the US$, currency in which Edenor’s financial liabilities are denominated, in addition to lower gains from the holding of financial instruments.

The adjusted EBITDA in Q1 19 for our electricity distribution segment posted a gain of AR$889 million compared to AR$4,324 million in Q1 18, mainly because tariff increases in CPD were outpaced by the inflation rate, the decline in electricity demand and the increasing operating costs and electricity theft. Moreover, the adjusted EBITDA includes income from late payment penalties charged to end-users of AR$64 million in Q1 19 and AR$82 million in Q1 18. The adjusted EBITDA in Q1 18 does not consider penalties implemented post Comprehensive Tariff Review (‘RTI’) corresponding to other periods for AR$44 million.

|

19 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 19

Supplementary Information

|

Electricity Distribution Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

15,377 |

11,010 |

+40% |

|

Cost of sales |

(12,396) |

(7,092) |

+75% |

|

Gross profit |

2,981 |

3,918 |

-24% |

|

Selling expenses |

(1,393) |

(718) |

+94% |

|

Administrative expenses |

(562) |

(411) |

+37% |

|

Other operating income |

122 |

52 |

+135% |

|

Other operating expenses |

(387) |

(262) |

+48% |

|

Depreciation and amortization |

164 |

136 |

+21% |

|

Adjusted EBITDA |

986 |

2,741 |

-64% |

|

Increases in prop., plant, equipment and intangible assets |

2,117 |

859 |

+146% |

|

20 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 20

3.3 Analysis of the Oil and Gas Segment7

|

Oil & Gas Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

4,639 |

4,968 |

-7% |

|

Cost of sales |

(3,274) |

(2,929) |

+12% |

|

Gross profit |

1,365 |

2,039 |

-33% |

|

Selling expenses |

(152) |

(243) |

-37% |

|

Administrative expenses |

(522) |

(538) |

-3% |

|

Exploration expenses |

(44) |

(3) |

NA |

|

Other operating income |

78 |

5,255 |

-99% |

|

Other operating expenses |

(203) |

(3,243) |

-94% |

|

Results for participation in associates |

40 |

16 |

+150% |

|

Operating income |

562 |

3,283 |

-83% |

|

RECPAM - Results from net monetary position |

2,421 |

864 |

+180% |

|

Finance income |

390 |

35 |

NA |

|

Finance costs |

(851) |

(594) |

+43% |

|

Other financial results |

(4,543) |

(1,738) |

+161% |

|

Profit before tax |

(2,021) |

1,850 |

NA |

|

Income tax |

608 |

(392) |

NA |

|

Net income for continuing operations |

(1,413) |

1,458 |

NA |

|

Net income from discontinued operations |

- |

746 |

-100% |

|

Net income for the period |

(1,413) |

2,204 |

NA |

|

Attributable to: |

|||

|

Owners of the Company |

(1,413) |

2,209 |

NA |

|

Non-controlling interests |

- |

(5) |

-100% |

|

Adjusted EBITDA for continuing operations |

1,527 |

2,858 |

-47% |

|

Adjusted EBITDA for cont. and discontinued operations |

1,527 |

4,108 |

-63% |

|

Increases in prop., plant, equipment and intangible assets |

1,427 |

916 |

+56% |

|

Depreciation and amortization |

996 |

821 |

+21% |

In Q1 19 the gross margin for continuing operations from our oil and gas segment decreased by AR$674 million compared to Q1 18, mainly due to a drop of 35% and 7% in the sale price accrued to the demand of gas and oil in US$, respectively; as well as 6% year-on-year lower gas sales resulting from a lesser acquisition from third-parties, because trading margins are getting tighter due to the aforementioned collapse of prices, although intersegment gas sales increased substantially due to fuel self-procurement at our thermal power plants. Moreover, higher gas treatment and transportation costs, and higher depreciations at El Mangrullo block due to higher level of investments contributed to the drop at gross income. These effects were partially offset by the nominal FX devaluation that outpaced inflation, positively impacting our oil and gas sale prices that are denominated in US$ and expressed in AR$, in addition to a higher production and sale of crude oil (increase of 24% in Q1 19 vs. Q1 18), and to a lesser extent, lower royalties and labor costs.

|

21 |

|

<BCLPAGE>8</BCLPAGE> |

7 The oil and gas segment only consolidates the continuing operations, because in January 2018 we agreed to divest certain assets that are mainly related to crude oil production, therefore because of reporting standards, this divestment is shown as discontinued operations as from the fourth quarter of 2017 not only the current but also the comparative period.

8 Encouragement Program for the Investment in Development of Natural Gas Production from Unconventional Reservoirs Program, MEyM Res. No. 46, 419, 447 /2017 and 12/2018.

Pampa Energía • Q1 19 Earning Release • 21

In operating terms, the production of our oil and gas segment for continuing operations in Q1 19 registered 46.8 kboe/day, 0.9 boe/day higher than Q1 18. Production of gas reached 249 mcf/day, slightly higher than Q1 18, mainly because of the production increase at El Mangrullo (+415 mcf/day), a block in which an early production facility (EPF) was installed and also it was interconnected by a gas pipeline to Rincón del Mangrullo to take advantage of this block’s processing plant, therefore increasing production to approximately 148 mcf/day as of March 2019, in line with fuel self-procurement for power generation. These effects were partially offset by a lower production as a result of excess of domestic supply due to the disruption of shale gas, which is mainly sustained by projects approved under the Unconventional Plan Gas1, and to a lesser extent, due to economic recession. These factors affected Rincón del Mangrullo block (-37 mcf/day) due to a lower drilling rate and natural decline, in addition to a minor decrease at Aguaragüe block (2 mcf/day). Additionally, oil production increased from 4.7 kbbl/day in Q1 18 to 5.4 kbbl/day in Q1 19, mainly due to the beginning of crude oil production at Chirete (+0.5 kbbl/day) and a slight increase in crude oil production at El Tordillo (+0.3 kbbl/day).

As of March 31, 2019, we accounted 869 productive wells in Argentina for continuing operations, in comparison to 892 as of December 31, 2018.

|

Oil & Gas Production |

Continuing Operations |

Discontinued Operations |

Total | |||||

|

Oil |

Gas |

Subtotal |

Oil |

Gas |

LPG |

Subtotal | ||

|

First Quarter |

|

|

|

|

|

|

|

|

|

Volume Q1 19 |

|

|

|

|

|

|

|

|

|

In thousand m3/day |

0.9 |

7,044 |

||||||

|

In thousand boe/day |

5.4 |

41.5 |

46.8 |

46.8 | ||||

|

In million cubic feet/day |

249 |

|||||||

|

Volume Q1 18 |

|

|

|

|

|

|

|

|

|

In thousand m3/day |

0.7 |

7,005 |

2.0 |

1,112 |

0.1 |

|||

|

In thousand boe/day |

4.7 |

41.2 |

45.9 |

12.7 |

6.5 |

0.6 |

19.8 |

65.7 |

|

In million cubic feet/day |

247 |

39 |

||||||

|

Variation Q1 19 v. Q1 18 |

+15% |

+1% |

+2% |

-29% | ||||

|

Avg. Price Q1 19 |

|

|

|

|

|

|

|

|

|

In US$/bbl |

54.4 |

|||||||

|

In US$/MBTU |

3.1 |

|||||||

|

Avg. Price Q1 18 |

|

|

|

|

|

|

|

|

|

In US$/bbl |

58.5 |

61.7 |

||||||

|

In US$/MBTU |

6.3 |

4.4 |

||||||

|

In US$/ton |

415.3 |

|||||||

|

Variation Q1 19 v. Q1 18 |

-7% |

-50% |

||||||

|

|

|

|

|

|

|

|

|

|

Note: The production does not consider foreign production of 0.2 kbbl/day in Q1 19 and 0.4 kbbl/day in Q1 18. FX rate of AR$/US$: Q1 19 – 39.01; Q1 18 – 19.68.

In Q1 19, our accrued gas average sale price was US$3.1/MBTU, 50% lower than the US$6.3/MBTU registered in Q1 18, mainly due to a 35% decline in end-users’ sale price in comparison with Q1 18 and 9% in comparison with Q4 18. Lower sale prices to end-users, which reflect the negative trend since August 2018, mainly respond to reduction of reference price for gas fired at power plants and the gas tenders on a non-firm basis conducted by CAMMESA, which reflected demand seasonality and excess in domestic supply, also negatively impacting the pricing in the industrial segment. These effects were partially offset by a slightly higher price accrual to residential demand compared to Q1 18. Moreover, the Q1 18 accrued sale price includes Plan Gas 2 compensation, which expired as from July 1, 2018 and its contribution to accrued sale price was US$1.4/MBTU.

|

22 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 22

In Q1 19, net financial losses increased by AR$1,150 million, to a loss of AR$2,583 million, mainly due to higher losses for net FX differences, as a result of AR$ devaluation against US$, currency in which most of financial liabilities allocated to the segment are denominated, and to a lesser extent to deterioration of receivables held against gas distributors, partially offset by the increase of RECPAM as a result of passive net monetary position allocated to the segment, and to a lesser extent a higher gain from the holding of financial instruments and financial interests charged to CAMMESA due to delayed payments for the gas supplied to our thermal power plants.

The adjusted EBITDA of our oil and gas segment for continuing operations decreased by 47%, posting AR$1,527 million in Q1 19, mainly due to lower hydrocarbon sale prices in US$, the expiration of Plan Gas 2, and to a lesser extent to export duties, pursuant to Executive Order No. 793 and 865/2018 effective since the beginning of September 2018, applicable to Escalante crude oil export at El Tordillo block during Q1 19. These effects were partially offset by the effect of devaluation in US$-denominated sales and to a lesser extent by a slight increase in production and sale of crude oil. The adjusted EBITDA considers the proportional of our 2.1% and 23.1% ownership at OldelVal, an oil pipeline company, for a gain of AR$9 million and AR$46 million in Q1 19 and Q1 18, respectively. Furthermore, the adjusted EBITDA in Q1 18 excludes the net gain of AR$1,276 million as a result of the agreement executed with the Republic of Ecuador for the Arbitration Award.

Supplementary Information

|

Oil & Gas Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

4,467 |

3,137 |

+42% |

|

Cost of sales |

(2,742) |

(1,768) |

+55% |

|

Gross profit |

1,725 |

1,369 |

+26% |

|

Selling expenses |

(146) |

(153) |

-5% |

|

Administrative expenses |

(492) |

(341) |

+44% |

|

Exploration expenses |

(41) |

(2) |

NA |

|

Other operating income |

76 |

3,317 |

-98% |

|

Other operating expenses |

(197) |

(2,047) |

-90% |

|

Depreciation and amortization |

531 |

426 |

+25% |

|

Adjusted EBITDA for continuing operations |

1,464 |

1,424 |

+3% |

|

Adjusted EBITDA for cont. and discontinued operations |

1,464 |

2,238 |

-35% |

|

Increases in prop., plant, equipment and intangible assets |

1,342 |

597 |

+125% |

|

23 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 23

3.4 Analysis of the Refining and Distribution Segment

|

Refining & Distribution Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Net income from discontinued operations |

- |

265 |

-100% |

|

Net income for the period |

- |

265 |

-100% |

|

Adjusted EBITDA for continuing operations |

- |

- |

NA |

|

Adjusted EBITDA for cont. and discontinued operations |

- |

248 |

-100% |

The refining and distribution segment only considers continuing operations, as in December 2017 we agreed to divest assets related to this segment, so for reporting purposes it is shown as discontinued operations since fourth quarter of 2017 not only for the current but also in the comparative periods. The adjusted EBITDA for our participation at Refinor and our Dock Sud’s facility was reclassified to holding and others segment.

The amounts corresponding to Pampa’s discontinued operations are shown below:

|

Refining & Distribution |

Products | |||||

|

Crude Oil |

Diesel Oil |

Gasolines |

Fuel Oil, IFOs & Asphalts |

Others |

Total | |

|

First Quarter |

|

|

|

|

|

|

|

Volume Q1 19 (thousand m3) |

na |

na |

na |

na |

na |

na |

|

Volume Q1 18 (thousand m3) |

3 |

190 |

118 |

79 |

62 |

452 |

|

Average Price Q1 19 (US$/m3) |

na |

na |

na |

na |

na |

na |

|

Average Price Q1 18 (US$/m3) |

342 |

609 |

662 |

430 |

476 |

571 |

|

|

|

|

|

|

|

|

Note: FX rate of AR$/US$: Q1 18 – 19.68.

|

24 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 24

3.5 Analysis of the Petrochemicals Segment

|

Petrochemicals Segment, Consolidated |

First Quarter | ||

|

2019 |

2018 |

∆ % | |

|

Sales revenue |

3,135 |

3,003 |

+4% |

|

Cost of sales |

(3,005) |

(2,667) |

+13% |

|

Gross profit |

130 |

336 |

-61% |

|

Selling expenses |

(72) |

(112) |

-36% |

|

Administrative expenses |

(45) |

(164) |

-73% |

|

Other operating income |

30 |

69 |

-57% |

|

Other operating expenses |

(189) |

(85) |

+122% |

|

Operating income |

(146) |

44 |

NA |

|

RECPAM - Results from net monetary position |

268 |

315 |

-15% |

|

Finance income |

11 |

12 |

-8% |

|

Finance costs |

(200) |

(129) |

+55% |

|

Other financial results |

(362) |

(220) |

+65% |

|

Profit before tax |

(429) |

22 |

NA |

|

Income tax |

129 |

68 |

+90% |

|

Net income for the period |

(300) |

90 |

NA |

|

Adjusted EBITDA |

(134) |

79 |

NA |

|

Increases in prop., plant, equipment and intangible assets |

14 |

15 |

-7% |

|

Depreciation and amortization |

12 |

89 |

-87% |

The gross margin in this segment during Q1 19 posted AR$130 million, 61% lower than Q1 18, mainly driven by lower international pricing references, denominated in US$, thus lower sale prices, combined with lower sales volume due to lesser domestic demand in products, export duties pursuant to Executive Order No. 793 and 865/2018, higher costs of imported virgin naphtha as a raw material for reforming plant and restructuring due to the closing of the ethylene plant in San Lorenzo. These effects were partially offset by the depreciation of the nominal FX, higher than inflation, on sale prices, incremental export sales, lower costs of gas purchases denominated in US$ and optimization of fixed costs by shutting down the BOPs plant in Zárate.

The amounts corresponding to Pampa are shown below:

|

Petrochemicals |

Products | |||

|

Styrene & Polystyrene1 |

SBR |

Others |

Total | |

|

First Quarter |

|

|

|

|

|

Volume Q1 19 (thousand ton) |

24 |

6 |

52 |

83 |

|

Volume Q1 18 (thousand ton) |

31 |

9 |

47 |

87 |

|

Volume Variation Q1 19 - Q1 18 |

-23% |

-30% |

+12% |

-5% |

|

Average Price Q1 19 (US$/ton) |

1,351 |

1,671 |

663 |

938 |

|

Average Price Q1 18 (US$/ton) |

1,604 |

1,773 |

653 |

1,109 |

|

Price Variation Q1 19 - Q1 18 |

-16% |

-6% |

+2% |

-15% |

|

|

|

|

|

|

Note: FX rate of AR$/US$: Q1 19 – 39.01; Q1 18 – 19.68. (1) Includes Propylene, Ethylene and BOPs.

Total sales volume of our petrochemicals segment decreased by 5% in Q1 19 vs. Q1 18, mainly due to lower domestic demand in addition to lower international sales of styrene products and synthetic rubber, as well as the shutdown of the BOPs plant in Zárate and the closing of ethylene plant in San Lorenzo, with impact on lower sales of BOPs, ethylene and propylene, partially offset by higher export of reforming products.

|

25 |

|

<BCLPAGE>8</BCLPAGE> |

Pampa Energía • Q1 19 Earning Release • 25