PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

(PAMPA ENERGY INC.)

Building #4

C1425DSR

Buenos Aires

Argentina

Form 20-F ___X___ Form 40-F ______

(Indicate by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

registrant in connection with Rule 12g3-2(b): 82- .)

2014 Annual Report

Contents

| 1. |

2014 Results and Future Outlook |

3 |

|

| ||

| 2. |

Corporate Governance |

9 |

| 3. |

Our Shareholders / Stock Performance |

15 |

| 4. |

Macroeconomic Context |

17 |

| 5. |

The Argentine Electricity Market |

18 |

| 6. |

Fiscal Year Relevant Events |

36 |

| 7. |

Description of Our Assets |

42 |

| 8. |

Human Resources |

69 |

| 9. |

Corporate Responsibility |

70 |

| 10. |

Information Technology |

74 |

| 11. |

Environmental Management |

75 |

| 12. |

Results for the Fiscal Year 2014 |

77 |

| 13. |

Dividend Policy |

95 |

| 14. |

Board of Directors’ Proposal |

96 |

|

Appendix I: Corporate Governance Report |

97 | |

|

2014 Annual Report

To the Shareholders of Pampa Energía S.A. (‘Pampa’ or the ‘Company’),

Pursuant to the statutory rules and bylaws currently in force, we submit to your consideration the Annual Report and Financial Statements for the 71st fiscal year ended December 31, 2014.

|

2014 Annual Report | 2 |

|

1. 2014 Results and Future Outlook

In 2014, Pampa recorded a profit of AR$530 million, of which AR$743 million are attributable to the Company’s shareholders, compared to a profit of AR$615 million in 2013, of which AR$286 are attributable to the Company’s shareholders. The AR$530 million profit is explained by profits of AR$633 million in Pampa’s Generation segment, AR$34 million in the Transmission segment and AR$964 million in the Holding and Others segment, partly offset by a loss of AR$1,101 million in the Distribution segment.

It is important to highlight that the profit incurred in 2014 corresponds in a large degree to (i) the increase in the recoverable value of credits that our generation units maintain with CAMMESA, which had an impact of AR$362 million on Pampa’s net income as a consequence of the signing of the agreements that could allow the use of these credits to expand in 115 MW our Central Térmica Loma de la Lata’s (‘CTLL’) capacity, and (ii) a profit for the valuation at market value of Pampa’s 40% participation in CIESA, TGS’s holding company, and holding of TGS’s ADRs, by which Pampa had a net profit of AR$602 million. Moreover, the 2014 results include higher costs recognitions by the Secretariat of Energy (‘SE’) to Edenor through Resolution No. 250/13 and subsequent Notes for AR$2,272 million, which however was not enough to compensate the distribution segments losses; and Transener and Transba also had higher costs recognitions for AR$1,131 million including interests, which nevertheless were not recognized in the mentioned companies’ tariffs.

In 2014, the widespread cost increase affecting our subsidiaries’ operations continued while their revenues, which are mostly regulated, did not increase at the same pace. This has given rise to a situation of growing operational deficit, which has long been affecting Edenor, Transener, Transba, and the generation subsidiaries that neither operate in the energy plus market, nor are bound by contracts under SE Resolution No. 220/07, such as Central Térmica Piedra Buena or the hydroelectric power plants Los Nihuiles and Diamante.

Regarding our subsidiary Edenor, 2014 was characterized by a deepening of the serious economic and financial difficulties we have been warning for years, which come from the tariff freeze and the continuous growth in costs that continue to affect its activity. Thus, Edenor recorded an accounting loss of AR$780 million for the fiscal year, an operating deficit before recognition of higher costs that reached the impressive amount of AR$2,525 million and financing needs for more than AR$3,450 million.

Since May 2013, the SE has arranged the recognition of a smaller increase (about one third of the real cost increase due to Edenor) resulting from the partial application of the Cost Monitoring Mechanism provided in the Memorandum of Understanding for Contract Renegotiation of 2007, and which was not properly transferred to tariffs. This measure was carried out through the issuance of Resolution No. 250/13 and subsequent Notes which compensated such recognition with debts Edenor has generated in concept of PUREE and with CAMMESA regarding energy purchases. This recognition, which in 2014 amounted to AR$2,272 million, prevented Edenor from losing its net worth and enter a dissolution stage with consequences difficult to predict given its severity. However, it did not prevent the losses from the fiscal year ended December 31 from consuming the totality of reserves and more than fifty percent of Edenor’s capital. In view of this, the next General Shareholders' Meeting of Edenor shall provide, in extraordinary session, the mandatory reduction of capital, pursuant to the provisions of section 206 of the Companies law No. 19,550.

As a result of Edenor’s prolonged operating deficit, the worsening divergence between income and expenses resulting from tariff freeze and the increasing operating and investing costs, since October 2012 Edenor has been forced to defer payments to CAMMESA for the energy purchases in the wholesale electricity market, a situation that continued to grow during the year 2014 and has led Edenor to postpone payments to CAMMESA almost entirely. As a result, as of December 31, 2014, the debt of Edenor with CAMMESA amounted to AR$2,257 million, including interest and compensations for the higher costs recognition mentioned above. However, this extreme measure has not been sufficient to cover Edenor’s financial deficit.

|

2014 Annual Report | 3 |

|

For this reason and to address the significant impact of wage increases, the SE instructed CAMMESA to grant Edenor financing in order to cover its funding needs by entering into a loan with no established due date, in which CAMMESA charges interest at market rates and whose source of repayment is uncertain, increasing debts, losses and affecting the performance of Edenor’s net worth. Also, in September 2014 the SE issued Resolution No. 65/14, by which it decided that Edenor’s temporary lack of funds from the Fund for Electricity Distribution Works Consolidation and Expansion (‘FOCEDE’) will be covered by CAMMESA on behalf of the Unified Fund. To achieve this, the SE ordered the granting of a loan that as of December 31, 2014, amounts to AR$1,700 million to partially cover the 2014-2017 investment plan, of which only AR$200 million have been disbursed. To date, Edenor cannot guarantee it will count with the means to repay these debts, or the continuity and sufficiency of the sources of financing to fund its financial deficit.

Continuing with the decision taken by the Board of Directors of Edenor in 2012, during the year 2014 and despite the serious situation being experienced, the distributor continued to prioritize the execution of the works necessary to preserve the quality of the concessioned public service and the security of the network, despite the contingencies of the activity and meeting the increased demand. In that sense, investments made during the year 2014 amounted AR$1,702 million, higher than the carried out during 2013, which were AR$1,092 million. This 56% growth responds to the implementation of the investment plan established by Edenor, partially funded through the FOCEDE funds. Most of the funds were destined to increase infrastructure, strengthen existing facilities, connect new power supplies and to make important investments in environmental protection and public safety, being the end users the main beneficiaries. However, the pace and progress of the works is conditioned by the certainty and availability of funds, which depend on obtaining the relevant approvals from the regulator, the Commission of Financial & Administration Implementation of the FOCEDE trust created under Resolution No. 347/12 and the SE, and the subsequent signing of the loans extensions with CAMMESA. Knowing that the concept may be repetitive, finance charges and the uncertain possibility of payback given the lack of genuine resources, will continue to impact on Edenor’s results and net worth in the near future. Moreover, in the absence of new solutions from the National Authority, Edenor’s net worth could become negative in the coming quarters, a situation that could have consequences difficult to predict, risking service continuity and Edenor’s presence in the Buenos Aires and New York stock markets.

However, the precarious situation described for Edenor and its ability to cope with the rising costs of the service is not reflected, as could be thought, in service quality indicators. This is thanks to the constant attention of all of Edenor’s employees, that beyond the uncertainties mentioned, make an extraordinary effort every day to operate in an unpredictable and changing context, while maintaining the level of service and customer satisfaction among the best utility companies in the country. Yet, we are aware that although indicators are at reasonable levels there is a gradual deterioration. This analysis cannot be separated from the fact that in absence of price signals, with residential demand growing, there are consequences on Edenor facilities, which eventually will raise the level of failures and complaints.

To sum, currently Edenor has genuine financing from its tariff revenue to cover less than a quarter of its real financial needs to maintain the concessioned public service and carry out the necessary works to preserve the quality and safety of the facilities, as well as meeting the increasing demand. The rest depends on the willingness of the authorities to allow and enable CAMMESA to make available for Edenor the necessary funds, either via the delay of payments for energy purchases and / or subscribing loans to pay investments and wages. The situation is precarious but to date we have been able to get the funds, although in some cases not the total amounts requested.

|

2014 Annual Report | 4 |

|

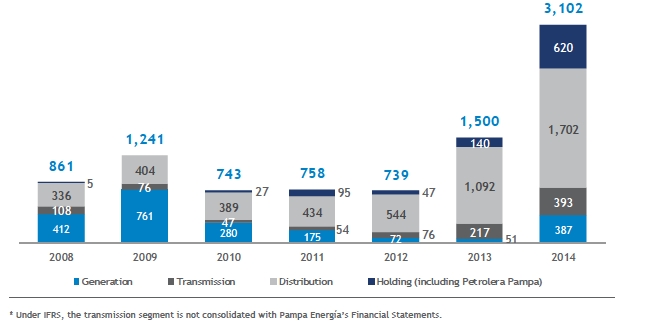

Despite the above-mentioned difficult economic and financial situation, we would like to highlight the effort we have been making as an integral part of the electricity sector to contribute in delivering energy on a safe and sound basis in order to meet the sustained electric power demand growth in the last years. In this sense, in 2014 and for twelve consecutive years, the Argentine electricity grid recorded a historical peak power demand of 24,034 MW, 71% above the figure recorded in 2001. In 2014, through Pampa’s controlled and co-controlled subsidiaries we have strengthen our commitment by investing AR$3.1 billion, 107% above AR$1.5 billion invested in 2013.

Pampa Energía’s Investment by Segment

(AR$ Million)

Argentine Electricity System: Evolution of Maximum Demand of Power Capacity

2001 – 2014, in MW

|

2014 Annual Report | 5 |

|

Regarding the Generation segment, in May 2014 the SE issued Resolution No. 529/14 applying retroactively, since February 2014, the remuneration scheme implemented under the Resolution No. 95/13. This update enabled Pampa’s generation units to receive an additional revenue of approximately AR$290 million in 2014, compared to the remuneration scheme previously in force. However, Pampa’s results were negatively affected by the continuous increase in operating costs, among those to be emphasized that labor costs increased about 40% in 2014.

This has particularly impacted generators not operating in the Energy Plus market or with contracts under Resolution No. 220/07, as in the case of Central Piedra Buena (‘CPB’) and our hydroelectric plants Los Nihuiles and Diamante. Hydroelectric plants have been further affected by low water levels, being 2014 a dry year with a water flow 50% below the historical average. Moreover, both SE Resolution No. 95/13 and No. 529/14 allocate a large share of the proceeds to the MWh generated, leaving hydroelectric plants to depend largely on the level of water flow (meteorology) to cover their fixed costs.

At consolidated level, the generation segment could offset part of the cost increases thanks to the 308 MW of installed capacity that are remunerated by private schemes such as Energy Plus and Resolution No. 220/07. This power corresponds to the MW’s installed by the company since 2008 and represent 14% of the total capacity of the Generation segment.

Despite the tight economic situation in the generation segment the excellent performance and availability of all our plants during 2014 is noteworthy. This metric stands significantly above the industry average and exceeds its own historical average, which speaks of the professionalism and commitment of all personnel involved.

In relation to the maintenance of our plants, during 2014 CPB obtained a loan with CAMMESA for US$83 million plus nationalization costs and VAT, to be used for major maintenance works in its units and therefore improve and sustain their availability. This loan will be repaid with the remuneration of the non-recurring maintenance charge established in Resolution No. 529/14 previously mentioned and, if not sufficient, and to the extent that a target availability is met, with up to 50% of the free cash flow generated by CPB. Moreover, in December 2014 the SE approved the funding request from CTLL and Central Térmica Güemes (‘CTG’) for approximately US$13 million plus VAT and US$10 million plus VAT, respectively, for conducting major maintenance works in its units, to be repaid with the remuneration of the non-recurring maintenance charge mentioned above.

Finally, a fact of great importance for Pampa’s generation units was the signing of agreements with the SE and CAMMESA to expand the installed capacity of CTLL by 115 MW. This expansion will be done by installing a high efficiency gas turbine LMS-100 GE (100 MW) and two MAN engines (15 MW), which involves an estimated investment of AR$930 million. The financing of the expansion project will be made substantially by a loan from CAMMESA whose repayment at maturity may be done through offsetting sales credits that generators have with CAMMESA, or by cash, at Pampa’s option. As of the date of this annual report, we have received from CAMMESA the disbursement of AR$435 million that were applied to the expansion project.

Regarding the Transmission segment, in December 2010 and May 2011, we entered into agreements with the SE and ENRE, respectively, referred to as ‘Instrumental Agreement to the Memorandum of Understanding with UNIREN’, which recognized amounts owed to Transener and Transba for higher operating costs between 2005 and 2010, calculated on the basis of the Cost Variation Index (‘IVC’). Such agreements were extended through an amendment in September 2014 of the ‘Renewal Agreement of the Instrumental Agreement’ signed in May 2013, recognizing the amounts owed to Transener and Transba for higher costs between January 2013 and May 2014. The total amount subject to recognition between both agreements amounted to AR$863 million for Transener and Transba, of which as of December 31, 2014, there was an amount due of AR$187 million, plus AR$87 million in interest. As of today, both companies have not been authorized to include recognized cost increases in their current tariffs.

|

2014 Annual Report | 6 |

|

It is worth noting that the financial position of Transener and Transba largely depends on the pace of CAMMESA’s payment of such credits. Although the execution of the Renewal Agreement and its amendment is a step forward in the recognition of higher costs, the delay in obtaining a tariff scheme resulting from a Full Tariff Review (‘RTI’) raises uncertainty about the ability of such companies to generate the necessary revenues to meet its liabilities and short-term operations.

In 2014, through our subsidiary Petrolera Pampa, we continued with the exploration and exploitation of natural gas reserves under the agreements with YPF, Petrobras and Apache. Such projects fall within the scope of both Gas Plus and the Natural Gas Excess Injection Encouragement Program, under which a price of US$7.5 per million BTU shall be received for all the volume exceeding the adjusted base injection. To date, these projects have enabled us to drill 45 productive wells, with a gas production of 2.2 million cubic meters per day, of which 870 thousand cubic meters per day correspond to the proportional interest of Petrolera Pampa. A major milestone for the company has been the execution of an agreement with YPF in November 2013, whereby Petrolera Pampa agreed to invest US$151.5 million in exchange for 50% of the stake in the hydrocarbon production from certain wells in the Rincón del Mangrullo block, located in the province of Neuquén, pertaining to the Mulichinco formation. During 2014, Petrolera Pampa invested in the productive development of the area, having drilled and completed the 17 wells agreed, of which 14 were in production as of December 2014. During 2015, Petrolera Pampa will continue investing in the second phase of said project, which includes the drilling of 15 additional wells with an investment of up to US$70 million. Moreover, the possibility of extending the investment objectives in this area is being analyzed along with YPF.

Another significant event for Petrolera Pampa was the listing of its shares on the Buenos Aires Stock Exchange, together with a capital increase of AR$100 million, wholly subscribed by Pampa’s shareholders. Said capital increase, together with new debt issuances, financed the company’s investment plan, which contributes to increase the supply of locally produced gas, helping to replace costly gas imports.

Regarding the transportation and processing of natural gas, TGS continues to be affected by the tariff freeze it suffers since 1999. This freeze was only interrupted by an almost imperceptible 20% increase granted by the regulator in the middle of this year, compared to an increase in wage costs of 1,190% in a 15-year period. Additionally, in relation to the production and commercialization of the liquid hydrocarbons, it is important to note the impact of the fall in international prices in the last quarter of 2014 correlated with the fall in the crude oil price, of around 50%, and marking the lowest prices in the last six years. This situation, combined with the increasing cost of natural gas purchased by TGS, significantly affects the operating margins of the liquids segment, which until now allowed TGS to balance its results, offsetting the negative effect from the natural gas transportation segment’s lack of tariff update. Consequently, the need for an answer by the authorities regarding the tariff adjustment is deepened.

In relation to the acquisition of TGS’s co-control timely notified to the National Antitrust Commission (‘CNDC’) it is currently, at the discretion of the Company, tacitly approved given that as of December 2011 there is a positive ruling from the referred CNDC recommending Mr. Secretary of Interior Commerce to approve the purchase of 40% of the capital and votes in CIESA by the Company, being no administrative acts in contrary since. For this reason, and in accordance with CIESA's provisions on the Debt Restructuring Agreement, the Company believes it would be in a legal and factual position to assume the right to co-control CIESA, and indirectly TGS, and thus contribute our effort and know-how in the development of such companies business. Nonetheless, as of today, the board of directors of the Company is evaluating the legal and factual implications of this and other courses of action without having yet taken a decision on this matter.

|

2014 Annual Report | 7 |

|

Finally, Pampa’s Board of Directors would like to seize this opportunity to thank all of the Company’s employees, who help us overcome the challenges of our business on a daily basis. We would also like to express our gratitude to our suppliers, financial institutions and investors who have shown their support and continuous trust placed in us.

|

2014 Annual Report | 8 |

|

2. Corporate Governance

At Pampa we believe that the best way of preserving and protecting our investors is to adopt and implement the best corporate governance practices that may consolidate us as one of the most trustworthy and transparent companies on the market.

For such purpose, we constantly work to incorporate those practices by taking into account international market trends, as well as domestic and foreign applicable corporate governance standards and rules.

Beyond the information contained in this presentation, further information on Pampa’s Corporate Governance practices may be found in Appendix I to this Annual Report containing the Corporate Governance Report required by the Corporate Governance Code (the ‘Code’) pursuant to National Securities Commission (‘CNV’) General Resolution No. 606/12 issued on March 23, 2012, which supersedes prior CNV General Resolution No. 516/07.

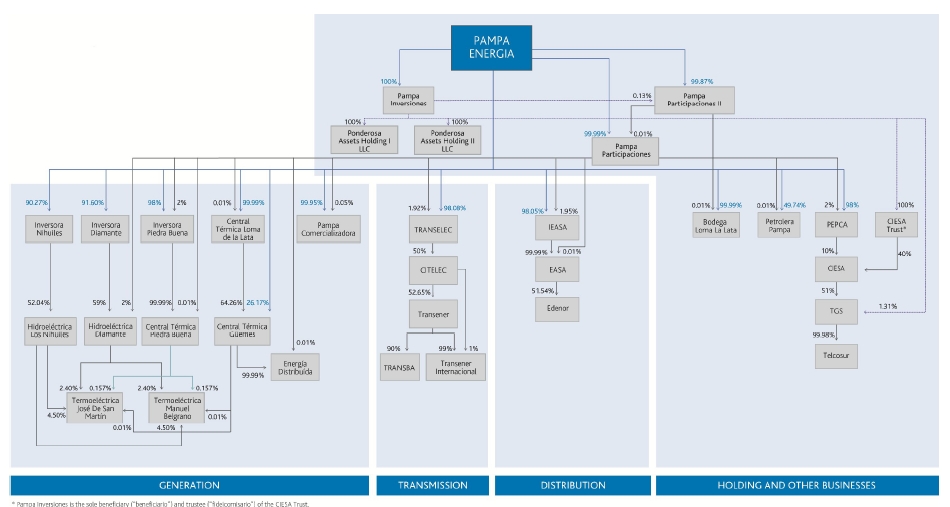

2.1 | Pampa’s Corporate Structure

Board of Directors

Pursuant to Business Companies’ Act No. 19,550 (the ‘BCA’), Capital Markets’ Act No. 26,831 (the ‘CMA’) and Pampa’s bylaws, decision-making within the Company is in charge of the Board of Directors. The Board consists of ten regular directors and an equal or smaller number of alternate directors1, half of which will be independent according to the independence standards set out in the CNV rules. All of our directors are elected for a term of three years and they may be re-elected indefinitely, except for independent directors, who may not be re-elected for consecutive periods. The expiration and further renewal of terms of office is made on a partial and staggered basis every year, with the election of three directors for two years, and four directors on the third year.

1 As of the date of this Annual Report, Pampa’s Board of Directors has 9 alternate directors following the renunciation submitted by Mr. David Kary, which was accepted by Pampa’s Board of Directors on January 27, 2015.

|

2014 Annual Report | 9 |

|

At present, Pampa’s Board of Directors is composed as follows:

|

Name |

Position |

Independence |

Term expiration* |

|

Gustavo Mariani |

Chairman |

Non-Independent |

12/31/2016 |

|

Ricardo Alejandro Torres |

Vice-Chairman |

Non-Independent |

12/31/2016 |

|

Damián Miguel Mindlin |

Director |

Non-Independent |

12/31/2014 |

|

Marcos Marcelo Mindlin |

Director |

Non-Independent |

12/31/2014 |

|

Diego Martín Salaverri |

Director |

Non-Independent |

12/31/2015 |

|

Marcelo Blanco |

Director |

Independent |

12/31/2015 |

|

Emmanuel Antonio Álvarez Agis |

Director |

Independent |

12/31/2014 |

|

Lucía Belén Gutierrez |

Director |

Independent |

12/31/2016 |

|

Héctor Mochón |

Director |

Independent |

12/31/2015 |

|

Eduardo Setti |

Director |

Independent |

12/31/2015 |

|

Mariano Batistella |

Alternate Director |

Non-Independent |

12/31/2015 |

|

Carlos Tovagliari |

Alternate Director |

Independent |

12/31/2015 |

|

Pablo Díaz |

Alternate Director |

Non-Independent |

12/31/2015 |

|

Alejandro Mindlin |

Alternate Director |

Non-Independent |

12/31/2015 |

|

Brian Henderson |

Alternate Director |

Non-Independent |

12/31/2014 |

|

Gabriel Cohen |

Alternate Director |

Non-Independent |

12/31/2015 |

|

Carlos Pérez Bello |

Alternate Director |

Independent |

12/31/2015 |

|

Gerardo Carlos Paz |

Alternate Director |

Non-Independent |

12/31/2016 |

|

Juan Cuattromo |

Alternate Director |

Independent |

12/31/2016 |

*They will be in office until the election of their substitutes

Senior Management

The following table includes information on our Senior Management:

|

Name |

Position |

|

Marcos Marcelo Mindlin |

Chief Executive Officer |

|

Gustavo Mariani |

President, co-CEO, and generation &new business director |

|

Ricardo Alejandro Torres |

Vice-President, co-CEO, and distribution director |

|

Damián Miguel Mindlin |

Investment director |

|

Gabriel Cohen |

Corporate finance director |

|

Horacio Jorge Tomás Turri |

Oil &gas director |

|

Orlando Escudero |

Operations &maintenance co-director |

|

Ruben Turienzo |

Commercial director |

|

Mario Ricardo Cebreiro |

Human resources director & operations & maintenance co-director |

|

2014 Annual Report | 10 |

|

Supervisory Committee

Our corporate bylaws provide that the oversight of Pampa will be in charge of a Supervisory Committee consisting of three regular members and three alternate members appointed by our shareholders pursuant to the legal provisions in force. The Supervisory Committee will be composed of duly registered lawyers and/or accountants admitted to practice in Argentina, who will serve for a term of three fiscal years.

The primary function of the Supervisory Committee is to exercise statutory control over the Board of Directors complying with the provisions set forth in the Business Company Act, the bylaws, its regulations, if any, and the Shareholders’ Meeting decisions. In the accomplishment of these duties, the Supervisory Committee will neither monitor our operations nor assess the merits of decisions made by board members.

At present, the Pampa Supervisory Committee is composed as follows:

|

Name |

Position |

Term expiration* |

|

José Daniel Abelovich |

Statutory Auditor* |

12/31/2014 |

|

Walter Antonio Pardi |

Statutory Auditor |

12/31/2014 |

|

Germán Wetzler Malbrán |

Statutory Auditor |

12/31/2014 |

|

Marcelo Héctor Fuxman |

Alternate Statutory Auditor |

12/31/2015 |

|

Silvia Alejandra Rodríguez |

Alternate Statutory Auditor |

12/31/2016 |

|

Santiago Dellatorre |

Alternate Statutory Auditor |

12/31/2014 |

|

* Chairman of the Supervisory Board (Statutory Auditors) *They will be in office until the election of their substitutes | ||

Pursuant to Section 109 of the CMA (previously regulated by Section 15 of abrogated Executive Order No. 677/01), Pampa has an Audit Committee consisting of three regular members, who will all be independent according to the independence standards set out in the CNV rules. The Audit Committee members have professional expertise in financial, accounting, legal, and/or business matters.

Pursuant to the applicable legislation and its own Internal Regulations, the Audit Committee is responsible for compliance with, inter alia, the following duties:

· Supervising the operation of internal control systems and the administrative/accounting system, as well as the reliability of the latter and of all financial information or any other significant facts that may be disclosed to the authorities in compliance with the applicable reporting system.

· Advising the Board of Directors on the nomination of candidate independent directors to be members of the Audit Committee.

· Expressing their opinion on any proposal by the Board of Directors to designate external auditors to be hired by the Company, and ensuring their independence.

· Reviewing the plans submitted by external auditors, supervising and assessing their performance, and issuing a relevant opinion upon the presentation and disclosure of annual financial statements.

|

2014 Annual Report | 11 |

|

· Reporting on external audit fees and other services provided by the auditing firm and other firms rendering auditing, accounting, IT systems, internal control and financial and administrative counseling services.

· Supervising the implementation of risk management information policies within the Company.

· Providing the market with full information on transactions where there may be a conflict of interest with members of corporate bodies or controlling shareholders.

· Approving any proposal for compensation of Pampa’s senior management to be submitted by the Board of Directors to the Shareholders’ Meeting for consideration.

· Rendering its opinion on the compliance with legal requirements and the reasonableness of the issuance of shares or convertible securities in capital increases with the exclusion or limitation of preemptive rights.

· Authorizing related-party transactions in the cases provided by law, as well as issuing an informed decision and disclosing it in compliance with the law whenever there is or may be an alleged conflict of interest within Pampa.

· Checking compliance with applicable standards of ethical conduct.

· Drawing up an annual action plan.

At present, Pampa’s Audit Committee is composed as follows:

|

Name |

Position |

|

Marcelo Blanco |

President |

|

Lucía Belén Gutierrez |

Vice-President |

|

Héctor Mochón |

Regular Member |

Board Committees

Within the Board of Directors there is a Management Committee, which is in charge of implementing every technical and administrative matter that is part of Pampa’s day-to-day management.

Additionally, there are other committees hierarchically reporting to the Management Committee, such as: (i) the Disclosure Committee, which is in charge of receiving, classifying and analyzing all the corporate information in order to determine which information should be relayed to the market, in what way and terms, and within the scope set forth by the local and/or foreign statutory regulations applicable to Pampa; (ii) the Ethics Committee, which has a mission to oversee cases and make decisions on action to be taken regarding any behavior, acts or events which, after being examined according to the procedures prescribed by each one of Pampa’s corporate governance policies in force, imply a severe policy violation; (iii) the Cash Flow Committee, which has the purpose of reviewing, analyzing and monitoring Pampa’s cash flow; and (iv) the Finance Committee, which is responsible for implementing Pampa’s general investment and indebtedness guidelines as established by the Management Committee.

|

2014 Annual Report | 12 |

|

2.2 | Minority Shareholder Protection

Pampa’s by-laws include significant safeguards aimed at the protection of Pampa’s minority shareholders, such as:

· Only one class of shares granting equal economic and political rights.

· Special majorities of up to 67% of the votes to amend certain clauses of the by-laws, such as those regarding the Audit Committee’s Internal Regulations.

· Possibility to call a Shareholders’ Meeting upon request of shareholders representing at least 5% of the capital stock.

2.3 | Corporate Governance Policies

Code of Business Conduct – Ethics Hotline

Pampa has a Code of Business Conduct in place that not only lays down the ethical principles that constitute the foundation of the relationships between Pampa, its employees and suppliers, but also offers the means and instruments that ensure transparency in the handling of matters and issues that may affect Pampa’s adequate management.

As part of the various corporate governance policies adopted in the course of 2010, Pampa’s Management Committee has approved the implementation of the Ethics Hotline as an exclusive channel to report, in the strict confidentiality, any suspected misconduct or breach of the Code of Business Conduct.

Policy on Best Stock Market Practices

This Policy has been implemented in order to avoid ‘insider trading’ practices by Pampa’s employees who, by reason of their duties and/or positions, may have access to material non-public information and use it either directly or indirectly to trade securities, thus gaining an unfair advantage for themselves or for others.

This Policy applies to Pampa’s staff and its subsidiaries, including directors, members of the Supervisory Committee and senior management lines.

Policy on Related-Party Transactions

Pursuant to the CMA, all high-value transactions made between Pampa and individuals and/or legal entities which, pursuant to the applicable regulations in force, are considered ‘related parties’ will be subject to a specific prior authorization and control procedure to be carried out under the supervision of Pampa’s Legal and Compliance Department and involving both Pampa’s Board of Directors and its Audit Committee (as applicable).

|

2014 Annual Report | 13 |

|

Board of Directors’ Self-Assessment Questionnaire

In line with the Code’s recommendations, in 2008 Pampa’s Board of Directors passed the implementation of a self-assessment questionnaire to annually examine and assess its own performance and management.

The Company’s Legal & Compliance Department is in charge of examining and filing each individual questionnaire; afterwards, based on the results, it will submit to Pampa’s Board of Directors all the proposed measures deemed useful to improve the performance of the Board of Directors’ duties.

Policy on Material Information Disclosure

In the year 2009, Pampa’s Management Committee approved the Relevant Information Disclosure Policy in order to regulate the basic principles that guide the operation of the processes to be followed when publishing information relevant to Pampa in accordance with the regulatory requirements imposed by the securities markets where Pampa’s securities are traded or those in which Pampa is a registered issuer.

Policy on Preliminary Approval for External Auditors’ Services

In the year 2009, Pampa’s Management Committee passed the Policy on Preliminary Approval for External Auditors’ Services, which standardizes an internal process for the Audit Committee to comply with its obligation to grant its prior approval to the hiring of External Auditors for the provision of any kind of authorized service to Pampa or any of its subsidiaries.

Fraudulent Practices Prevention Program

In the year 2010, in accordance with the provisions of the U.S. Foreign Corrupt Act and in addition to the Code of Business Conduct, Pampa adopted the Fraudulent Practices Prevention Program, which sets out the responsibilities, duties and methodology necessary to prevent and detect any misconduct and/or fraudulent behavior within Pampa and/or any Pampa Group company.

Anti-Money Laundering and Terrorist Financing Prevention Policy

In its capacity as agent of Mercado a Término de Rosario S.A., in the year 2011, Pampa became bound by Section 20, subsections 4 and 5, of Act No. 25,246 on Concealment and Laundering of Assets, its regulations and related provisions, and by Financial Intelligence Unit’s Resolution No. 33/11. Consequently, Pampa became a covered party and, in compliance with the regulations in force, its Board of Directors passed the Anti-Money Laundering and Terrorist Financing Prevention Policy, thus establishing the procedures for institutionally combating asset laundering and terrorist financing.

|

2014 Annual Report | 14 |

|

3. Our Shareholders / Stock Performance

As of December 31, 2014, Pampa held 1,314,310,895 outstanding common shares with a face value of one Argentine peso each. The following table shows information about Pampa’s ordinary shareholdings as of said date:

|

Name |

Number of Shares |

Percentage of Capital |

|

Management |

275,266,954 |

20.9% |

|

Other Shareholders |

1,039,043,941 |

79.1% |

|

Total |

1,314,310,895 |

100.0% |

Note: Warrants issued on behalf of some Pampa’s executives are excluded. ‘Management’ includes the interests held by Pampa Holdings LLC, Dolphin Fund Management S.A., Marcos Marcelo Mindlin, Gustavo Mariani and Ricardo Alejandro Torres.

Pampa is listed on the Buenos Aires Stock Exchange (‘BCBA’), and has an American Depositary Share program (1 ADS = 25 shares) admitted to listing on the New York Stock Exchange (‘NYSE’).

As of March 31, 2014, Standard & Poor’s International Ratings LLC’s office in Argentina maintained its ‘Global 3 Rating’ assigned to Pampa’s shares, with ‘Low’ capacity to generate profits and ‘High’ liquidity.

The following chart shows the price evolution per share and the traded volume on the BCBA from January 2006 to December 31, 2014:

|

2014 Annual Report | 15 |

|

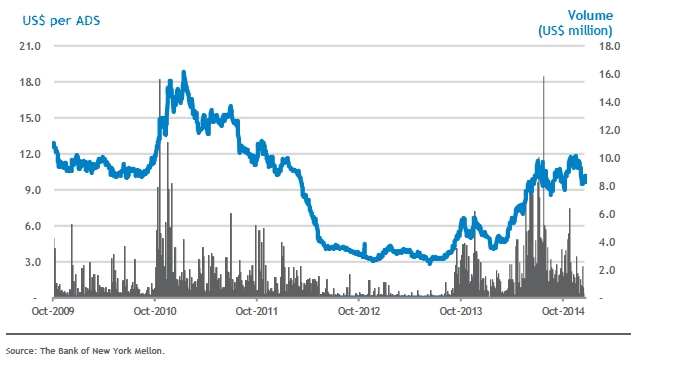

Finally, the following chart shows the price evolution per ADS and traded volume on the NYSE from October 9, 2009, to December 31, 2014:

|

2014 Annual Report | 16 |

|

4. Macroeconomic Context

4.1 | Economic Activity

Official estimates as of the third quarter of the year 2014 show an approximate variation of 0% for 2014, a lower figure compared to a 2.9% growth during 2013; this is mainly due to year-on-year decreases in wholesale and retail business (-3.1%), private households with domestic services (-2.6%), construction (-1.4%) and manufacturing industry (-1.0%), which were partially offset by an increase, compared to 2013, in financial intermediation (+12.8%), teaching (+2,7%), health and social services (+2.6%) and hotels and restaurants (+2,1%) sectors.

4.2 | Price Trends

According to the National Institute of Statistics and Censuses (‘INDEC’), in 2014 the general consumer price index (‘CPI’) accumulated a 23.9% increase. The general goods and services sector showed the most significant increase throughout the year, with a 31.6% variation as compared to 2013. The two most CPI-weighted sectors, which amount to 48% of the index, are represented by food and beverages, as well as recreation, which recorded a year-on-year 19.7% and 27.2% rise respectively.

4.3 | Fiscal Situation

By the end of 2014, fiscal revenues recorded a 36.2% increase compared to 2013, reaching an amount of AR$1,170 billion. This improvement in the fiscal situation was mainly due to an increase of AR$331,203 million in VAT revenue, AR$297,504 million in the social security system and AR$267,075 for income tax.

On the other hand, the status of public accounts showed a national public sector primary deficit of AR$38,290 million and AR$109,720 million after government debt interest payments.

4.4 | Financial System

In the exchange market, the US dollar closing price was AR$8.551/US$, showing a cumulative 31.1% increase compared to December 2013.

The stock of Central Bank foreign exchange reserves increased from US$30,599 million in December 2013 to US$31,443 million in December 2014.

4.5 | Trade Balance

According to INDEC data, in 2014 exports decreased less than imports, showing an 11.9% year-on-year variation and amounting to US$71,935 million; whereas imports declined by 12.8%, reaching US$65,249 million. This implied a 16.5% decline in the balance of trade surplus compared to 2013, totaling US$6,686 million.

|

2014 Annual Report | 17 |

|

5. The Argentine Electricity Market

5.1 | Generation

Evolution of Demand

During 2014, the demand for electricity experienced a 1.0% growth compared to 2013, with a total electricity demand volume of 127,396 GWh and 125,167 GWh for 2014 and 2013, respectively.

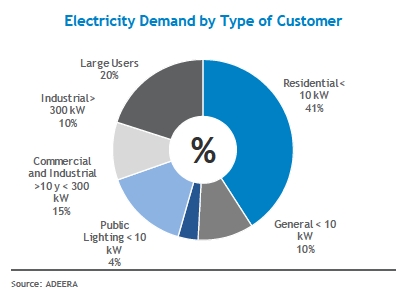

The following chart shows the breakdown of electricity demand in 2014 by type of customer:

Moreover, on January 20, 2014, there was a record-breaking demand for electricity, which reached 24,034 MW.

Peak Power Capacity Records

|

|

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

|

Power Capacity(MW) |

19,566 |

20,843 |

21,564 |

21,949 |

23,794 |

24,034 |

|

Date |

07/24/2009 |

08/03/2010 |

08/01/2011 |

02/16/2012 |

12/23/2013 |

01/20/2014 |

|

Temperature (°C) |

5.1 |

1.6 |

3.5 |

34.2 |

35.4 |

29.6 |

|

Time |

19:59 |

19:45 |

20:18 |

15:10 |

14:20 |

15:05 |

Source: CAMMESA.

|

2014 Annual Report | 18 |

|

Evolution of Electricity Supply and Fuel Consumption

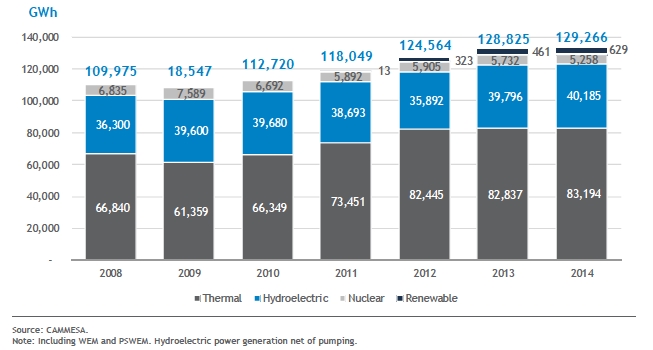

Similarly to what happened with the demand for electricity, during 2014 there was a 0.3% increase in power generation, with a generated volume of 129,266 GWh and 128,826 GWh for the years 2014 and 2013, respectively.

Thermal power generation remained as the main resource to meet electricity demand, supplying a power volume of 83,194 GWh (64%), followed by hydroelectric power generation, which contributed 40,185 GWh net of pumping (31%), nuclear power generation with 5,258 GWh (4%),as well as photovoltaic and wind power generation with 629 GWh. Additionally, there were imports for 1,390 GWh (306% higher than 2013), exports for 0.1 GWh (95% lower than 2013), and losses for 4,258 GWh (6.5% higher than 2013.)

Hydroelectric power generation was slightly higher than that recorded in 2013 (showing a 1% increase). Thermal power generation remained as the main source for electricity supply, both with natural gas and liquid fuels (gas oil and fuel oil), and mineral coal.

The following chart shows the evolution of electricity generation by type of power generation (thermal, hydroelectric, nuclear, and renewable):

Electricity Generation by Type of Power Plant

2008 - 2014

During 2014, power generation facilities have not recorded any relevant variations in their installed capacity compared to the previous year, totaling 31,405 MW, as compared to the 31,399 MW recorded as of December 2013.

|

2014 Annual Report | 19 |

|

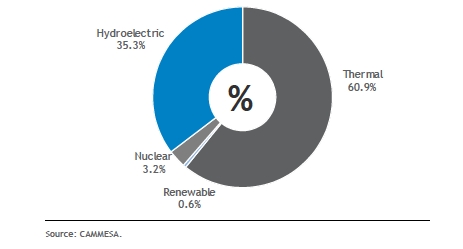

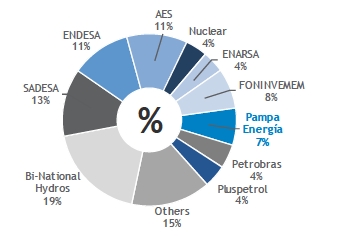

Finally, the following chart shows the composition of Argentine installed power capacity as of December 31, 2014:

Argentine Installed Power Capacity

100% = 31.4 GW

Regarding fuel supply for electricity generation, authorities have kept supply mechanisms in place, including the assignment of contracted natural gas volumes by electric power generation companies to CAMMESA for their administration aiming to optimize the consumption of natural gas in the most efficient generation units. Likewise, the Company continued purchasing liquefied natural gas and its re-gasification, as well as natural gas from the Republic of Bolivia. However, the natural gas supply remained insufficient to meet the electric power generation needs, and therefore authorities have continued to rely on the consumption of liquid fuels (fuel oil and gas oil) for electricity generation in order to meet the demand. In this line, through Resolution No. 95/13 the Secretariat of Energy (‘SE’) provided for the centralized management of commercial proceedings and the dispatch of fuels for electricity generation.

In 2014, consumption of natural gas for electric power generation remained at the same levels as the previous year (+2.7%, that is, 14.3 million cubic decameters.) The recovery of the technical availability of steam turbines resulted in a 21.8% increase in fuel oil consumption compared to 2013. This has caused a 30.7% decrease in gas oil consumption compared to 2013. In contrast, consumption of mineral coal has increased by 18% due to the higher availability of steam turbines using this type of fuel.

Price of Electric Power

The energy authority has continued with the policy started in the year 2003, whereby the spot price of the Wholesale Electricity Market (‘WEM’) is determined according to the variable cost of production with natural gas from available power generating units, even if said units are not generating electricity with such fuel (SE Resolution No. 240/03). The additional cost for consumption of liquid fuels is recognized outside the specified market price as a temporary dispatch surcharge.

Regarding the generation capacity remuneration, in March 2013 the SE issued Resolution No. 95/13 introducing a new capacity remuneration scheme, which was later amended pursuant to SE Resolution No. 529/14, applicable to power generating companies adhering to such mechanism.

For those power generation companies outside the scope of the scheme provided for in SE Resolution No. 95/13 and its amending provisions, the regulation in force continues to be the same as that applicable since January 2002, which limits the determination of the short-term marginal cost to AR$120 per MWh.

|

2014 Annual Report | 20 |

|

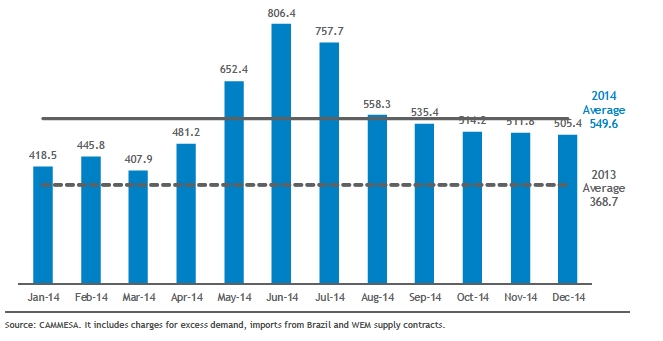

Evolution of WEM Prices

During 2014, the approved average monthly price for energy was AR$120/MWh, which is the maximum stipulated price.

On the other hand, the following chart shows the average monthly price that all electricity system users should pay so that the power grid would not run into a deficit. Such cost includes not only the energy price, but also the power capacity fee, the cost of generation with liquid fuels, such as fuel oil or gas oil, and other minor items.

Average Monthly Monomic Price

In AR$/MWh

SE Resolutions No. 95/13 and 529/14: New Remuneration Scheme and Other Changes to the WEM

SE Resolution No. 95/13, published in the Official Gazette on March 26, 2013, provided for a new general-scope system replacing the remuneration scheme applicable to all the power generation sector (power generation companies, self-generators and co-generators), with the following exceptions:

i. Bi-national hydroelectric power plants and nuclear power plants; and

ii. The electric power and/or energy traded under contracts regulated by the SE having a differential price, such as those set forth in SE Resolutions No. 1,193/05, 1,281/06, 220/07, 1,836/07, 200/09, 712/09, 762/09, 108/11 and 137/11, as well as any other kind of electric power supply contract under a differential remuneration scheme established by the SE (the ‘Covered Generators’).

|

2014 Annual Report | 21 |

|

The new remuneration scheme applies to economic transactions as from the month of February 2013. However, its effective application to each specific power generation agent required each generator to waive any and all administrative and/or judicial claims it may have brought against the National Government, the SE and/or CAMMESA regarding the 2008-2011 Generators’ Agreement and/or SE Resolution No. 406/03. Furthermore, each power generation agent had to commit to waive its right to file judicial and/or administrative claims against the National Government, the SE and/or CAMMESA regarding the above-mentioned Agreement and/or SE Resolution No. 95/13. Those Covered Generators not meeting this waiver requirement will not be eligible for the new scheme, and they will remain under the preexisting system.

Within such framework, the Group’s generation companies have waived all administrative and/or judicial claims against the National Government, the SE and/or CAMMESA regarding the 2008-2011 Agreement and/or SE Resolution No. 406/03, as well as their right to file new claims relating to said items and periods. The new remuneration scheme has been applied to Central Térmica Loma de la Lata S.A. (‘CTLL’), Central Térmica Güemes S.A. (‘CTG’) and Central Piedra Buena S.A. (‘CPB’) as from the relevant commercial transaction for the month of February 2013. In the case of Hidroeléctrica Diamante and Hidroeléctrica Los Nihuiles, the application of said remuneration scheme has started as from the relevant commercial transaction for the month of November 2013.

In May 2014, the SE issued Resolution No. 529/14 modifying the scheme set forth by SE Resolution No. 95/13, thus replacing Schedules I, II and III of SE Resolution No. 95/13, which provided for a retroactive updating —as from the economic transactions for the month of February, 2014— of the remuneration values contemplated in said schedules, and a modification of the fixed costs’ offsetting mechanism.

Fixed Costs Remuneration Scheme

Based on their technology and production scale, generating agents will receive the following as fixed costs remuneration.

|

Technology and Scale |

AR$ / MW-Hrp |

|

Gas Turbine Units (TG) with Capacity < 50 MW |

70.00 |

|

Gas Turbine Units (TG) with Capacity > 50 MW |

50.00 |

|

Steam Turbine Units (TV) with Capacity < 100 MW |

83.20 |

|

Steam Turbine Units (TV) with Capacity > 100 MW |

59.40 |

|

Combined Cycle Units (CC) with Capacity < 150 MW |

46.50 |

|

Combined Cycle Units (CC) with Capacity > 150 MW |

38.80 |

|

Hydroelectric Units (HI) with Capacity < 120 MW |

76.50 |

|

Hydroelectric Units (HI) with Capacity Between 120 MW and 300 MW |

29.80 |

|

Hydroelectric Units (HI) with Capacity > 300 MW |

21.30 |

The method for calculating the fixed costs remuneration for conventional thermal generation equipment (TG, TV and CC) will be variable based on the Actual Availability (AA), the Historical Availability (HA) and the time of the year.

|

2014 Annual Report | 22 |

|

A base percentage is defined, which is applied to the Fixed Costs Remuneration in accordance with the following values:

|

CC |

June through August December through February |

March through May September through November |

|

AA> 95% |

110% |

100% |

|

85% < AA ≤ 95% |

105% |

100% |

|

75% < AA ≤ 85% |

85% |

85% |

|

AA ≤ 75% |

70% |

70% |

|

TV/TG |

June through August December through February |

March through May September through November |

|

AA> 90% |

110% |

100% |

|

80% < AA≤ 90% |

105% |

100% |

|

70% < AA≤ 80% |

85% |

85% |

|

AA≤ 70% |

70% |

70% |

50% of the percentage difference between the generator's AA and HA will be added to or subtracted from the base percentage; that is, for each percentage point variation in the generator’s AA as compared with its HA, half a percentage point will be applied to the Fixed Costs remuneration.

For availability control purposes, the criteria set forth in SE Note No. 2053/13 will remain in force. HA values for each thermal group will be determined based on its availability recorded during the 2010-2013 period. At the end of each year, the result will be added to the base until reaching 5 rolling years.

Variable Costs Remuneration

The new scheme establishes new values replacing the remuneration of Maintenance Variable Costs and Other Non-Fuel Variable Costs. It is calculated on a monthly basis based on the power generated by each type of fuel:

|

2014 Annual Report | 23 |

|

|

Thermal Power Units |

Operating with (AR$ / MWh): | |||

|

Natural Gas |

Liquid Fuels |

Carbon |

Biofuel | |

|

TG Units with Capacity < 50 MW |

26.80 |

46.90 |

- |

89.20 |

|

TG Units with Capacity > 50 MW |

26.80 |

46.90 |

- |

89.20 |

|

TV Units with Capacity < 100 MW |

26.80 |

46.90 |

80.40 |

89.20 |

|

TV Units with Capacity > 100 MW |

26.80 |

46.90 |

80.40 |

89.20 |

|

CC Units with Capacity < 150 MW |

26.80 |

46.90 |

- |

89.20 |

|

CC Units with Capacity > 150 MW |

26.80 |

46.90 |

- |

89.20 |

|

Hydroelectric Power Units |

AR$ / MW-Hrp |

|

HI Units with Capacity < 120 MW |

21.30 |

|

HI Units with Capacity Between 120 MW and 300 MW |

21.30 |

|

HI Units with Capacity > 300 MW |

21.30 |

Additional Remuneration

One portion of the Additional Remuneration will be paid directly to the generator, whereas another will be allocated to ‘new infrastructure projects within the electric sectors’ to be defined by the SE under a trust agreement.

|

Classification |

Destined to: | |

|

Generator AR$ / MWh |

Trust AR$ / MWh | |

|

TG Units with Capacity < 50 MW |

10.90 |

4.70 |

|

TG Units with Capacity > 50 MW |

9.40 |

6.20 |

|

TV Units with Capacity < 100 MW |

10.90 |

4.70 |

|

TV Units with Capacity > 100 MW |

9.40 |

6.20 |

|

CC Units with Capacity < 150 MW |

10.90 |

4.70 |

|

CC Units with Capacity > 150 MW |

9.40 |

6.20 |

|

HI Units with Capacity < 120 MW |

76.50 |

13.50 |

|

HI Units with Capacity Between 120 MW and 300 MW |

54.00 |

36.00 |

|

TG Units with Capacity < 50 MW |

54.00 |

36.00 |

|

2014 Annual Report | 24 |

|

Remuneration for Non-Recurring Maintenance Works

Besides the previously stated remuneration items, SE Resolution No. 529/14 incorporates a new concept of ‘Remuneration for Non-Recurring Maintenance Works’ (‘Maintenance Remuneration’) applicable as from the economic transaction corresponding to February 2014 and calculated monthly based on the total generated energy. Such remuneration will be implemented through Sales Settlements with Maturity Date to be Defined instruments (‘LVFVDs’) and will be destined exclusively to the financing of major maintenance works, subject to the SE approval.

|

Technology and Scale |

AR$/MW-Hrp |

|

Gas Turbine Units (TG) with Capacity < 50 MW |

24 |

|

Gas Turbine Units (TG) with Capacity > 50 MW |

24 |

|

Steam Turbine Units (TV) with Capacity < 100 MW |

24 |

|

Steam Turbine Units (TV) with Capacity > 100 MW |

24 |

|

Combined Cycle Units (CC) with Capacity < 150 MW |

21 |

|

Combined Cycle Units (CC) with Capacity > 150 MW |

21 |

Payment Priority

SE Resolution No. 95/13 provides for two different payment priorities, to such effect excluding the application of SE Resolution No. 406/03: (i) in the first place, payment of the Fixed Costs Remuneration, the recognition of fuel costs and the Variable Costs Remuneration; (ii) secondly, payment of the remuneration of frequency regulation and short-term reserve services; and (iii) thirdly, payment of the Additional Remuneration.

Through SE Note No. 4,858/13, the SE instructed CAMMESA to implement a payment priority mechanism in favor of generators adhering to the Resolution in order to keep a liquidity level similar to that prior to the passing of such Resolution. For such purposes, CAMMESA will:

i. Account for the amounts directly received from Large Users;

ii. Allocate such amounts to cover the remuneration due to Generators, by distributing such funds to cover: first, fixed costs; secondly, variable costs; and lastly, direct additional remuneration. Distribution will be made proportionally to each Generator’s relative share in each of said items.

Recognition of Fuel Costs

SE Resolution No. 95/13 provides that the commercial management and dispatch of fuels for power generation purposes will be centralized in CAMMESA. Generators may not renew or extend their contracts with suppliers, with the exception of those trading electric energy under supply agreements having a differential remuneration scheme, in which case they may continue entering into fuel agreements to provide firm support to their supply commitments. Notwithstanding that, until the termination of the contracts currently in force between generators and their suppliers, costs associated with the reference price, acknowledged freight costs, costs associated with the transportation and distribution of natural gas, as well as their related taxes and rates, will be recognized. For the recognition of said costs, two conditions should be met: (i) that such costs be recognized by CAMMESA as of SE Resolution No. 95’s effective date; and (ii) that such costs result from contractual relationships taken on before SE Resolution No. 95/13’s effective date.

|

2014 Annual Report | 25 |

|

Moreover, with the purpose of optimizing and minimizing fuel supply costs to WEM plants, SE Resolution No. 529/14 provided for an extended centralization of the commercial management and the dispatch of fuels to generating, co-generating and self-generating agents the energy and power of which have been committed under SE Resolution No. 1,193/05 (FONINVEMEM), the WEM Supply Commitment under SE Resolution No. 220/07 and SE Resolution No. 1836/07, as well as under any other kind of energy supply agreement subject to a differential remuneration system, except for agreements under the Energy Plus Service passed by SE Resolution No. 1,281/06. Thus, as these generators’ supply agreements terminate, the supply of such fuel will become centralized in CAMMESA, and the generator will not be entitled to renew them.

It should be pointed out that for transaction purposes and to provide for the coverage of the agreements now subject to this provision, the availability of the generating unit will be considered independently of fuel.

Trust for the Execution of Works in the Electricity Sector

As it has been previously explained, part of the Additional Remuneration will be allocated to a trust for the execution of works in the electricity sector. SE Resolution No. 95/13 provides that the SE will establish trust funding mechanisms.

Additionally, SE Resolution No. 95/13 provides that the SE will define the mechanism under which the LVFVDs issued by CAMMESA pursuant to SE Resolution No. 406/03 which fall outside the scope of general and/or specific agreements executed with the SE and/or SE regulations on the execution of investment and/or maintenance works in relation to existing equipment will be allocated for trust funding purposes.

As of December 31, 2014, the trust for the execution of works amounts to AR$145 million.

Suspension of Contracts in the Term Market (‘MAT’)

SE Resolution No. 95/13 provides for the temporary suspension of the inclusion of new contracts into the MAT (excluding those derived from resolutions fixing a differential remuneration scheme), as well as their extension or renewal. Notwithstanding the foregoing, contracts in force as at the effective date of SE Resolution No. 95/13 will continue being managed by CAMMESA until their termination. After their termination, Large Users should acquire their supplies directly from CAMMESA pursuant to the conditions established by the SE to such effect.

Implementation Criteria for SE Resolution No. 95/13

A description of notes issued by the SE after the passing of SE Resolution No. 95/13 with the purpose of regulating some of its aspects is included below.

SE Note No. 1,807/13 established a system which allows Generating Agents to continue managing the collection of invoices issued by CAMMESA to WEM’s Large Users which had been customers of that generator, but which were forced to meet their demand directly from CAMMESA upon the termination of the contract. Generating Agents should formally declare their will to conduct such collection at their own risk.

Subsequently, SE Note No. 2,052/13 set forth that MAT contracts effective as from May 1, 2013, provided that the information for their administration in the MAT has been filed pursuant to the regulations in force and before the issuance of SE Resolution No. 95/13, may be administered by the Generators for a maximum term of three months as from their effective date.

|

2014 Annual Report | 26 |

|

SE Note No. 2,053/13 approved the criteria for the implementation of SE Resolution No. 95. Among its most relevant aspects, it provided that the application of the new remuneration scheme will be made on a case-by-case basis for each agent as from the reception of the waiver set forth in Section 12 of SE Resolution No. 95/13. CAMMESA will make adjustments to the economic transactions as from February 2013 or on the third month prior to the month on which the waiver was reported, whichever occurs later, unless there is an SE specific provision in this respect.

On the other hand, the SE instructed CAMMESA to classify the generating units of Covered Generators according to the scales set forth in SE Resolution No. 95/13, subject to review by the SE itself. This classification was made by CAMMESA under its Note No. B-80255-1, consistently with the following description:

|

Power Plant |

Generating Unit |

Technology |

Capacity |

|

Güemes |

GUEMTV11 |

TV |

<100 MW |

|

GUEMTV12 |

TV |

<100 MW | |

|

GUEMTV13 |

TV |

>100 MW | |

|

Piedra Buena |

BBLATV29 |

TV |

>100 MW |

|

BBLATV30 |

TV |

>100 MW | |

|

Loma de la Lata |

LDLATG01 |

TG |

>100 MW |

|

LDLATG02 |

TG |

>100 MW | |

|

LDLATG03 |

TG |

>100 MW | |

|

Hidroeléctrica Diamante |

ADTOHI |

HI |

between 120 MW and 300 MW |

|

LREYHB |

HI |

between 120 MW and 300 MW | |

|

ETIGHI |

HI |

< 120 MW | |

|

Hidroeléctrica Los Nihuiles |

NIH1HI |

HI |

between 120 MW and 300 MW |

|

NIH2HI |

HI |

between 120 MW and 300 MW | |

|

NIH3HI |

HI |

between 120 MW and 300 MW |

|

2014 Annual Report | 27 |

|

Procedure for Dispatching Natural Gas Intended for Electricity Generation

On October 7, 2009, under Note No. 6,866, the SE instructed CAMMESA to invite the WEM’s thermal power generators to formally state their decision to adhere to the ‘Procedure for Dispatching Natural Gas Intended for Electricity Generation’ (the ‘Procedure’).

The Procedure basically consists of agreeing that, in the event of operating restrictions in the natural gas system, CAMMESA will exercise its right to the Generators’ natural gas and transportation volumes, so as to maximize thermal power supply within the electricity generation sector. In exchange for such voluntary assignment of natural gas and transportation volumes, generators will receive the higher value resulting from the positive difference between the determined Spot Price and the Variable Production Cost (‘VPC’) with natural gas recognized by CAMMESA, plus US$2.50 per MWh.

On November 16, 2010, under Notes No. 7,584 and 7,585, the SE instructed CAMMESA to broaden the scope of application of the Procedure, requiring WEM’s thermal power generators to execute agreements in the Term Market and/or natural gas supply agreements under Gas Plus Program, and to assign their natural gas volumes to CAMMESA. The agreements in the Term Market and/or under the scope of SE Resolution No. 220/07 are not affected by the instructions given in such notes. To the extent that the SE considers the supply to be valid and CAMMESA effectively uses the above-mentioned mechanism by allocating the volumes assigned to another generator, such practice will not adversely affect the remuneration for power capacity, the recognition of such fuel costs and related surcharges under Schedule 33 of CAMMESA’s Proceedings, or the amounts set forth in subsection (c), Section 4 of SE Resolution No. 406/03, compared to those otherwise allocable to the assignor generator.

The Procedure’s original effective term covered the winter seasons between 2009 and 2011. However, following CAMMESA’s successive calls on Generators, instructions were given to extend the Procedure’s effective term until April 30, 2013 (SE Note No. 8,692/13, and SE Note No. 7,469/12.)

Subsequently, within the framework of SE Resolution No. 95/13, under SE Note No. 2,053/13, the SE provided for the extension of the effective period of the above-mentioned procedures and methodologies (Resolutions No. 6,866/09, 7,584/10, 7,585/10, and 922/11), excluding the application of paragraph 7 of the procedure set out in SE Note No. 6,866/09 regarding minimum remuneration.

Generation Dispatch and Fuels

Under SE Note No. 5,129/13, CAMMESA was instructed to optimize generation dispatch and fuels considering the value of representative real purchase costs consistently with the conditions described by CAMMESA in the analysis previously sent to the Secretariat of Energy. This modification will result in a change in the current dispatch conditions and the fuel mix used for power generation.

Agreement for an Increase in Thermal Generation Availability in 2014

In 2014, the National Government submitted a proposal to generators for the execution of a new thermal generation availability increase agreement through the application of LVFVDs and the generators’ own resources (the ‘2014 Agreement’). CTLL, CTG, CPB, HINISA and HIDISA entered into this agreement, which sets forth the conditions for the incorporation of new generation capacity in CTLL’s Power Plant through the installation of two engines (15 MW) and a high-efficiency gas turbine (100 MW) 2.

2 For further information, see item 6.3 of this Annual Report.

|

2014 Annual Report | 28 |

|

5.2 | Transmission

Evolution of the High-Voltage Transportation System

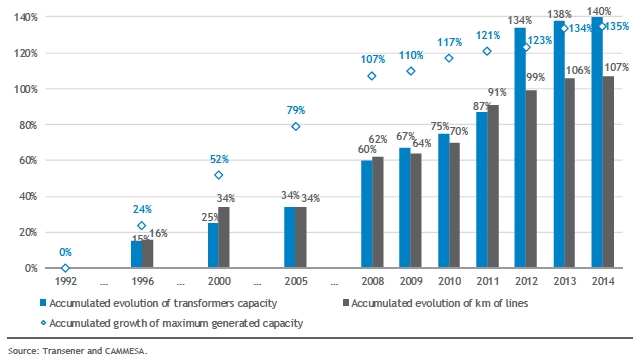

The following chart shows the evolution of the cumulative growth of transformation capacity and the cumulative growth of the number of kilometers of the high-voltage transmission system lines, compared to the percentage cumulative growth of peak demand since 1992.

Evolution of the Transmission System

Cumulative Growth (in %)

As illustrated in the chart above, the High-Voltage Transmission System has grown significantly since 2005, mainly due to the implementation of the 500 kV Transmission Federal Plan. The implementation of the Federal Plan has given Argentina’s National Interconnected System (the ‘Grid’) more stability and better conditions for meeting the rising demand.

Transener’s Tariff Situation

The Public Emergency and Exchange Rate Regime Reform Act No. 25,561 (the ‘Public Emergency Act’) imposed a duty on public utilities, such as Transener and its subsidiary Transba, to renegotiate their existing agreements with the Argentine Government while they continued with the supply of electricity services. This situation has significantly affected Transener and Transba’s economic and financial situation.

In May 2005, Transener and Transba signed the Memorandums of Understanding (‘MOUs’) with the Public Service Contract Renegotiation and Analysis Unit (‘UNIREN’) specifying the terms and conditions for adjustment of the Concession Agreements.

|

2014 Annual Report | 29 |

|

The MOUs provided for: (i) the performance of a Full Tariff Review (‘RTI’) before the ENRE to determine a new tariff regime for Transener and Transba, which should have come into force in the months of February 2006 and May 2006, respectively; and (ii) the recognition of increased operating costs occurring up until the RTI-based new tariff regime came into force.

Since 2006, Transener and Transba have requested the ENRE to address the need to standardize compliance with the provisions set forth in the MOU, expressing the ENRE’s failure to fulfill the commitments stipulated in this Agreement, the critical situation arising from such breach of duty, and its availability to continue with the RTI process insofar as the remaining commitments undertaken by the Parties remain in force and the competent authorities issue a resolution regulating the RTI-based new tariff regime.

Transener and Transba have timely filed their respective tariff claims pursuant to the provisions set forth in both MOUs, as well as in Section 45 and related sections of Act No. 24,065 with the purpose of transacting this business, holding the relevant Public Hearing, and defining the new tariff scheme within the framework of conducting the expected RTI process.

In order to begin rectifying the tariff scenario, in December 2010, Transener and Transba entered into a Supplementary Instrumental Agreement to the UNIREN MOU with the SE and the ENRE, which mainly provides for the acknowledgment of a credit claim to Transener and Transba for cost fluctuations recorded in the June 2005–November 2010 period calculated as per the MOU-Based Cost Variation Index (‘IVC’.)

Pursuant to the Instrumental Agreement, on May 2, 2011 Transener and Transba entered into new extensions to the financing agreements with CAMMESA (the ‘Addenda II’) granting Transba and Transener a new loan in the amount of AR$289.7 million and AR$134.1 million, respectively, pertaining to the positive balance for claims acknowledged by the SE and the ENRE for cost variations between June 2005 and November 2010.

Funds included in the Addenda II would be allocated to operation and maintenance, as well as to the 2011 investment plan, and would be advanced in partial payments depending on available cash held by CAMMESA as instructed by the SE.

The above-mentioned National Government’s commitments were delayed, and therefore, with the purpose of regularizing capacity remuneration adjustments since December 1, 2010, on May 13, 2013 and May 20, 2013, Transener and Transba, respectively, entered into a Renewal Agreement of the Instrumental Agreement (the ‘Renewal Agreement’) with the SE and the ENRE effective until December 31, 2015 and stipulating as follows:

i. The recognition of a credit claim in favor of Transener and Transba for cost fluctuations recorded in the December 2010- December 2012 period, calculated as per the Cost Variation Index (‘IVC’);

ii. A payment mechanism for pending positive balances of Addenda II, and balances specified in the above paragraph, in the course of 2013;

iii. A procedure for the automatic updating and payment of cost variations arising from the orderly sequence of six-month periods already elapsed between January 1, 2013 and December 31, 2015; and

iv. The signing of a new Addendum with CAMMESA, including the amount of resulting credit claims and relevant interest thereon up until their final settlement.

|

2014 Annual Report | 30 |

|

This Renewal Agreement provided for a Cash Flow and an Investment Plan to be executed by Transener and Transba during 2013 and 2014 based on the disbursements received pursuant to the Addenda and Transener and Transba’s income during each period.

The Investment Plan set forth in the Renewal Agreements estimates investments during 2013 and 2014 amounting to approximately AR$286 million and AR$207 million, respectively, for Transener; and to AR$113 million and AR$100 million, respectively, for Transba.

The Renewal Agreements provided that in case of non-renewal upon expiration of the effective term, as from January 1, 2016, CAMMESA will be required to consider as remuneration for services provided by Transener and Transba the amounts set forth by ENRE Resolutions No. 327/08 and 328/08, with the application of Section 4.2 of the MOUs, which have been specified by the ENRE in both Instrumental Agreements and Renewal Agreements.

In order to execute the Third Extension to the CAMMESA Loan, Transener and Transba have waived their filed legal actions regarding performance as at that date of the commitments undertaken in the MOUs and the Instrumental Agreements. In case of breach of the commitments undertaken under the MOUs, the Instrumental Agreements and the Renewal Agreements, Transener and Transba will be entitled to resume and/or reinitiate any actions deemed appropriate in furtherance thereof.

On October 25, 2013 and February 14, 2014, Transba and Transener, respectively, entered into an extension of the financing agreement with CAMMESA (the ‘Addenda III’) which provided as follows:

i. The granting of a new loan to Transba y Transener in the amount of AR$325 million and AR$786 million, respectively, pertaining to credit claims acknowledged by the SE and the ENRE for cost variations December 2010 through December 2012; and

ii. The assignment as security of credit claims for increased costs as of December 31, 2012 pursuant to the Renewal Agreement of the Instrumental Agreement with the purpose of paying off the amounts to be received within the scope of all the new extensions signed by the parties.

Furthermore, on September 2, 2014, Transener and Transba executed with CAMMESA the Loan Agreements for the implementation of the 2013 and 2014 Renewal Agreements (the ‘New Loan Agreements’), which stipulated as follows:

i. That the Loan Agreements, together with their Addenda I, II and III timely executed with CAMMESA, would be deemed duly performed;

ii. The granting to Transener and Transba of a new loan in the amount of AR$622 million and AR$241 million, respectively, pertaining to credit claims acknowledged by the SE and the ENRE for cost variations January 2013 through May 2014; and

iii. The assignment as security of credit claims for increased costs as of May 31, 2014 pursuant to the Renewal Agreement of the Instrumental Agreement with the purpose of paying off the amounts to be received within the scope of the executed New Loan Agreements.

|

2014 Annual Report | 31 |

|

|

Connection and Capacity Differential (In AR$ Million) |

Transba |

Transener |

Total | |

|

June 2005 – November 2010 |

Principal |

75.9 |

189.3 |

265.2 |

|

Interest |

35.2 |

111.8 |

147.0 | |

|

December 2010 – December 2012 |

Principal |

182.4 |

442.7 |

625.1 |

|

Interest |

17.5 |

52.2 |

69.7 | |

|

January 2013 – May 2014* |

Principal |

210.4 |

544.9 |

755.3 |

|

Interest |

30.3 |

77.2 |

107.5 | |

|

Total Amount Recognized as of 12/31/2014 |

|

551.7 |

1,418.1 |

1,969.8 |

|

|

|

|

|

|

|

Accrued interest |

|

25.1 |

61.5 |

86.6 |

|

|

|

|

|

|

|

Total Amount Recognized as of 12/31/2014 |

|

576.8 |

1,479.7 |

2,056.4 |

*Principal as of May 31, 2014, interest as of June 30, 2014.

These financial statements include the following income from recognition of cost variations by the SE and the ENRE, up to the amounts received under Addenda II and III:

|

Item (In AR$ Million) |

Transba |

Transener | ||

|

As of December 31, 2014 |

As of December 31, 2013 |

As of December 31, 2014 |

As of December 31, 2013 | |

|

Principal |

248.5 |

116.5 |

601.5 |

250.7 |

|

Interest |

80.5 |

64.5 |

200.9 |

149.3 |

|

Total |

329.0 |

181.0 |

802.4 |

400.0 |

Liabilities arising from total payments received have been written off through the assignment of acknowledged credit claims for increased costs pursuant to the Instrumental Agreement and the Renewal Agreement.

The above-mentioned execution of the Renewal Agreement constitutes a milestone towards achieving the future consolidation of Transener’s economic/financial equation. However, a delayed RTI-based tariff scheme raises uncertainty over Transener’s ability to generate the necessary revenues to meet its short-term liabilities and operations. Additionally, delays by CAMMESA in the payment of the current monthly remuneration for the electric power transportation service and the Fourth Line fee still persist. Therefore, it is still difficult to foresee the evolution of the tariff and economic/financial situation, as well as its potential impact on business and cash flow.

|

2014 Annual Report | 32 |

|

5.3 | Distribution

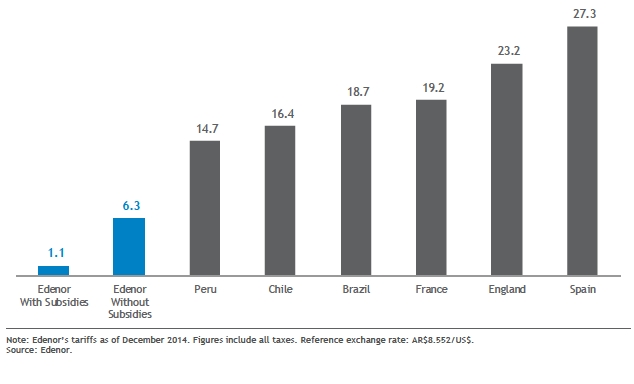

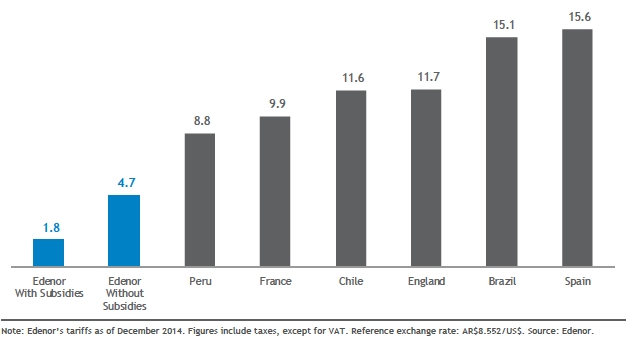

Edenor’s Tariff Situation

In 2014, Congress extended the application of the Public Emergency and Exchange Rate Regime Reform Act (Act No. 25,561) enacted on January 6, 2002, overriding the provisions for dollar-based and inflation-indexed adjustments set forth in Edenor’s Concession Agreement.

In 2014, the number of customers exempt from paying the tariff scheme provided for by ENRE Resolution No. 628/08 remained approximately at 281,000 on average. These beneficiaries were required to pay the immediately preceding tariff scheme, that is, the one set out in ENRE Resolution No. 324/08.

Throughout 2014, the Subsecretariat of Energy (‘SSEE’)’s Resolution No. 1,301/11 covered unsubsidized customers, who paid an average monomic price of AR$320 per MWh. The application of this Resolution did not affect Edenor’s Distribution Value Added (‘VAD’.)

In 2014 and continuing with the mechanism initiated through SE Resolution No. 250/13, SE Notes No, 4,012/14, 486/14 and 1,136/14 established the amounts owed to Edenor as Cost Monitoring Mechanism (‘MMC’) (including interest) and Edenor’s debts under the PUREE program (including interest), both until December 2014.

These notes instruct CAMMESA to issue LVFVDs for an amount equal to excess MMC credit less PUREE-related debt (including interest), and authorize CAMMESA to receive these LVFVDs as partial payment of Edenor’s debt with CAMMESA as of the issuance of these notes3.

On May 23, 2014, Edenor filed before the ENRE a request for approval of MMC No. 16 under MOU Appendix I for the period November 2013-April 2014, for an amount of 14.122%, which should have been applied since May 1, 2014.