MainStay Funds Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson

Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: April 30

(MainStay CBRE Global

Infrastructure Fund, MainStay CBRE Real Estate Fund, MainStay MacKay Intermediate Tax Free Bond Fund and MainStay MacKay Short Term Municipal Fund)

Date

of reporting period: April 30, 2020

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay CBRE Global Infrastructure Fund, MainStay CBRE Real Estate Fund, MainStay MacKay Intermediate

Tax Free Bond Fund and MainStay MacKay Short Term Municipal Fund,

each a series of the Registrant.

| Item 1. |

Reports to Stockholders. |

MainStay CBRE Global Infrastructure Fund

Message from the President and Annual Report

April 30, 2020

Beginning on January 1, 2021, paper copies of each MainStay Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically

request paper copies of the reports from MainStay Funds or from your financial intermediary. Instead, the reports will be made available on the MainStay Funds’ website. You will be notified by mail and provided with a website address to access

the report each time a new report is posted to the website.

If you already elected to receive shareholder reports electronically, you will not be affected by this

change and you need not take any action. At any time, you may elect to receive reports and other communications from MainStay Funds electronically by calling toll-free 800-624-6782, by sending an e-mail to MainStayShareholderServices@nylim.com, or

by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper form free of charge. If you hold shares of a MainStay

Fund directly, you can inform MainStay Funds that you wish to receive paper copies of reports by calling toll-free 800-624-6782 or by sending an e-mail to MainStayShareholderServices@nylim.com. If you hold shares of a MainStay Fund through a

financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper form will apply to all MainStay Funds in which you are invested and may apply to all funds held with your financial

intermediary.

|

|

|

|

|

|

|

|

|

| Not FDIC/NCUA Insured |

|

Not a Deposit |

|

May Lose Value |

|

No Bank Guarantee |

|

Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Financial markets experienced high levels of volatility in response to the spread of the novel coronavirus and a

sharpening decline in global economic activity from November 1, 2019, through April 30, 2020.

After gaining ground during the first three and a half

months of the reporting period, most broad stock and bond indices began to dip in late February, as growing numbers of COVID-19 cases were seen in hotspots around the world. On March 11, 2020, the World

Health Organization acknowledged that the disease had reached pandemic proportions, with over 80,000 identified cases in China; thousands in Italy, South Korea and the United States; and more cases in dozens of additional countries. Governments and

central banks pledged trillions of dollars to address the mounting economic and public health crises; however, “stay-at-home” orders and other restrictions on non-essential activities caused global economic activity to slow. Most stocks and bonds lost significant ground in this challenging environment.

With the number of reported COVID-19 cases in the United States continuing to rise, the Federal Reserve (“Fed”) twice

cut interest rates and announced unlimited quantitative easing. In late March, the federal government declared a national emergency, and Congress passed—and the President signed—a $2 trillion stimulus package, with the promise of further

aid to come for consumers and businesses. Investors generally responded positively to the government’s fiscal and monetary measures, as well as to prospects for a gradual lessening of restrictions on

non-essential businesses. Accordingly, despite mounting signs of recession and rapidly rising unemployment levels, markets regained some of the ground in April, that they had lost in the previous month.

For the reporting period as a whole, U.S. equity indices produced broadly negative performance. Traditionally more volatile small- and

mid-cap stocks were particularly hard hit, and value stocks tended to underperform their growth-oriented counterparts. The energy sector suffered the steepest declines due to weakening demand and an escalating

petroleum price war between Saudi Arabia and Russia, the world’s second and third largest petroleum producers after the United States. Most other

sectors sustained substantial, though milder, losses. The health care and information technology sectors, both of which rebounded strongly in April, generally, ended the reporting period in

positive territory. International equities followed patterns similar to those seen in the United States, with a decline in March followed by a partial recovery in April. Overall, however, U.S. stocks ended the reporting period with milder losses

than those of most other developed and developing economies. With few exceptions, emerging markets tended to underperform by the greatest margins.

Infrastructure

stocks experienced a wide variation in performance, depending on the underlying industry’s vulnerability to the impacts of the pandemic and other key macroeconomic developments. For example, energy companies were hit particularly hard by the

sharp drop in oil prices and the slump in demand. Transportation-related industries, including airports and toll roads, suffered due to travel restrictions designed to limit the pandemic’s spread. On the other hand, industries leveraged to

increased communications traffic from stay-at-home workers, such as tower companies and data centers, saw business trends remain relatively intact, and in some cases

experienced growth.

Today, as we at New York Life Investments continue to track the curve of the ongoing health crisis and its financial ramifications, we are

particularly mindful of the people at the heart of our enterprise—our colleagues and valued clients. By taking appropriate steps to minimize community spread of COVID-19 within our organization, we strive

to safeguard the health of our investment professionals so that they can continue to provide you, as a MainStay investor, with world class investment solutions in this rapidly evolving environment.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this

report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee

of future results.

Not part of the Annual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and

expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of

charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to

MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at nylinvestments.com/funds. Please read the Summary Prospectus and/or Prospectus carefully before investing.

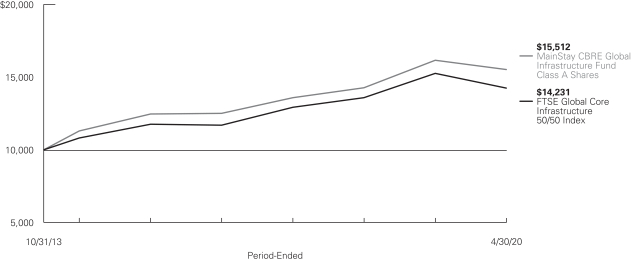

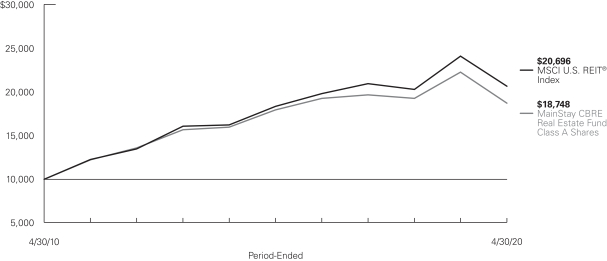

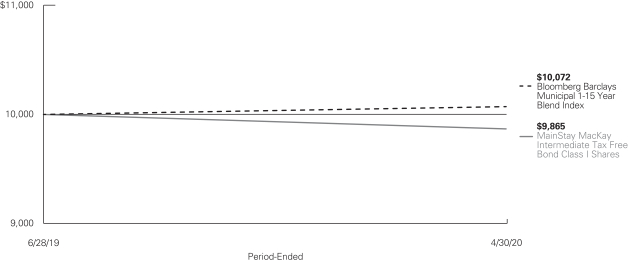

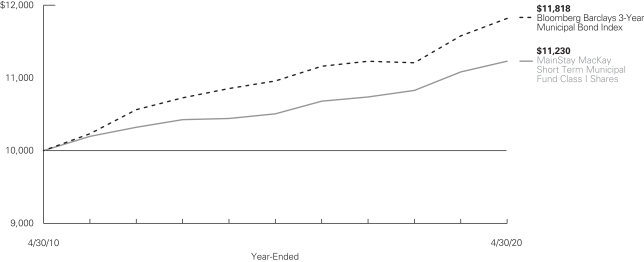

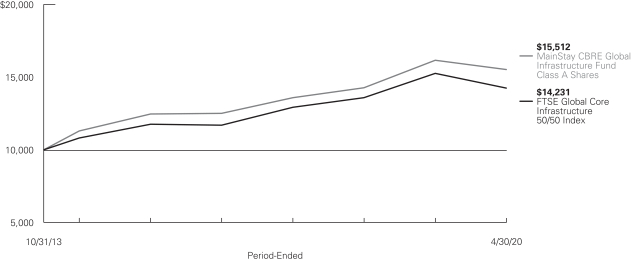

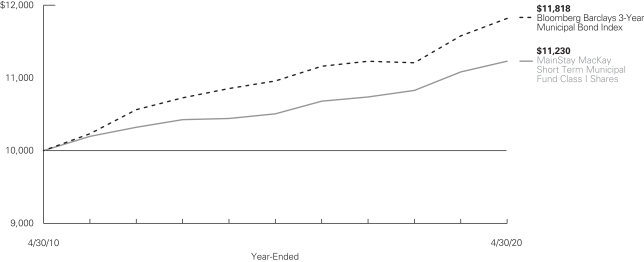

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past

performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a

result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class A shares of the Fund. Performance will vary from class to class based on differences in

class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit nylinvestments.com/funds.

Average Annual Total Returns for the Period-Ended April 30, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Class |

|

Sales Charge |

|

|

|

Inception

Date |

|

|

Six

Months* |

|

|

One Year |

|

|

Five

Years |

|

|

Since

Inception |

|

|

Gross

Expense

Ratio2 |

|

|

|

|

|

|

|

|

|

|

| Class A Shares3 |

|

Maximum 5.5% Initial Sales Charge |

|

With sales charges

Excluding sales charges |

|

|

10/16/2013 |

|

|

|

–15.71

–10.57 |

%

|

|

|

–9.50

–3.97 |

%

|

|

|

3.27

4.50 |

%

|

|

|

5.98

6.94 |

%

|

|

|

1.27

1.27 |

%

|

| Investor Class Shares |

|

Maximum 5.5% Initial Sales Charge |

|

With sales charges

Excluding sales charges |

|

|

2/24/2020 |

|

|

|

N/A

N/A |

|

|

|

N/A

N/A |

|

|

|

N/A

N/A |

|

|

|

–21.25

–16.66 |

|

|

|

1.46

1.46 |

|

| Class C Shares3 |

|

Maximum 1% CDSC

if Redeemed Within One Year of Purchase |

|

With sales charges

Excluding sales charges |

|

|

2/28/2019 |

|

|

|

–11.76

–10.89 |

|

|

|

–5.62

–4.70 |

|

|

|

N/A

N/A |

|

|

|

–0.43

–0.43 |

|

|

|

2.21

2.21 |

|

| Class I Shares3 |

|

No Sales Charge |

|

|

|

|

6/28/2013 |

|

|

|

–10.46 |

|

|

|

–3.75 |

|

|

|

4.79 |

|

|

|

8.08 |

|

|

|

1.02 |

|

| Class R6 Shares |

|

No Sales Charge |

|

|

|

|

2/24/2020 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

–16.65 |

|

|

|

0.96 |

|

| * |

Effective at the close of business on February 21, 2020, the Fund changed its fiscal and tax year end from October 31 to

April 30. |

| 1. |

The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or

Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment

amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower.

For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements.

|

| 2. |

The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most

recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. |

Performance figures for Class A shares, Class C shares and Class I shares reflect the historical performance of the

then-existing Class A shares, Class C shares and Class I shares, respectively, of the Voya CBRE Global Infrastructure Fund (the predecessor to the Fund, which was subject to a different fee structure) for periods prior to February 21, 2020. The

MainStay CBRE Global Infrastructure Fund commenced operations on February 24, 2020. |

The footnotes on the next page are an integral

part of the table and graph and should be carefully read in conjunction with them.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benchmark Performance |

|

Six

Months |

|

|

One

Year |

|

|

Five

Years |

|

|

Since

Inception |

|

|

|

|

|

|

| FTSE Global Core Infrastructure 50/50 Index4 |

|

|

–12.60 |

% |

|

|

–6.65 |

% |

|

|

3.91 |

% |

|

|

5.54 |

% |

| Morningstar Infrastructure Category Average5 |

|

|

–12.45 |

|

|

|

–7.23 |

|

|

|

2.26 |

|

|

|

5.13 |

|

| 4. |

The FTSE Global Core Infrastructure 50/50 Index is the Fund’s primary broad-based securities market index for

comparison purposes. The FTSE Global Core Infrastructure 50/50 Index gives participants an industry-defined interpretation of infrastructure and adjusts the exposure to certain infrastructure sub-sectors. Results assume reinvestment of all dividends

and capital gains. An investment cannot be made directly in an index.

|

| 5. |

The Morningstar Infrastructure Category Average is representative of funds that invest more than 60% of their assets in

stocks of companies engaged in infrastructure activities. Industries considered to be part of the infrastructure sector include: oil & gas midstream; waste management; airports; integrated shipping; railroads; shipping & ports; trucking;

engineering & construction; infrastructure operations; and the utilities sector. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested.

|

The footnotes on the preceding page are an

integral part of the table and graph and should be carefully read in conjunction with them.

|

|

|

| 6 |

|

MainStay CBRE Global Infrastructure Fund |

Cost in Dollars of a $1,000 Investment in MainStay CBRE Global Infrastructure Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from November 1, 2019, to April 30, 2020, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as

applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your

ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the

six-month period and held for the entire period from November 1, 2019, to April 30, 2020.

This example illustrates

your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third

data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months

ended April 30, 2020. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the

table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The

hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing

costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales

charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were

included, your costs would have been higher.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share Class |

|

Beginning

Account

Value

11/1/19 |

|

|

Ending Account

Value (Based

on Actual

Returns and

Expenses)

4/30/20 |

|

|

Expenses

Paid

During

Period1 |

|

|

Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

4/30/20 |

|

|

Expenses

Paid

During

Period1 |

|

|

Net Expense

Ratio

During

Period2 |

|

|

|

|

|

|

|

| Class A Shares |

|

$ |

1,000.00 |

|

|

$ |

894.30 |

|

|

$ |

6.22 |

|

|

$ |

1,018.30 |

|

|

$ |

6.62 |

|

|

1.32% |

|

|

|

|

|

|

|

| Investor Class Shares3,4 |

|

$ |

1,000.00 |

|

|

$ |

833.40 |

|

|

$ |

2.51 |

|

|

$ |

1,006.69 |

|

|

$ |

2.74 |

|

|

1.45% |

|

|

|

|

|

|

|

| Class C Shares |

|

$ |

1,000.00 |

|

|

$ |

891.10 |

|

|

$ |

9.83 |

|

|

$ |

1,014.47 |

|

|

$ |

10.47 |

|

|

2.09% |

|

|

|

|

|

|

|

| Class I Shares |

|

$ |

1,000.00 |

|

|

$ |

895.40 |

|

|

$ |

4.95 |

|

|

$ |

1,019.64 |

|

|

$ |

5.27 |

|

|

1.05% |

|

|

|

|

|

|

|

| Class R6 Shares3,4 |

|

$ |

1,000.00 |

|

|

$ |

833.50 |

|

|

$ |

1.64 |

|

|

$ |

1,007.64 |

|

|

$ |

1.80 |

|

|

0.95% |

| 1. |

Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over

the period, divided by 366 and multiplied by 182 (to reflect the six-month period) and 69 days for Investor Class and Class R6 shares (to reflect the since-inception period). The table above

represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro rata share of the fees and expenses of

the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. |

Expenses are equal to the Fund’s annualized expense ratio to reflect the

six-month period. |

| 3. |

The inception date was February 24, 2020. |

| 4. |

Expenses paid during the period reflect ongoing costs for the period from inception through April 30, 2020. Had these

shares been offered for the full six-month period ended April 30, 2020, and had the Fund provided a hypothetical 5% annualized return, expenses paid during the period would have been $7.32 and $4.97 for

Investor Class and Class R6 shares, respectively, and the ending account value would have been $1,017.60 and $1,019.94 for Investor Class and Class R6 shares, respectively. |

Country

Composition as of April 30, 2020 (Unaudited)

|

|

|

|

|

|

|

| United States |

|

|

50.7 |

% |

|

|

| Italy |

|

|

7.1 |

|

|

|

| Spain |

|

|

7.1 |

|

|

|

| Australia |

|

|

6.0 |

|

|

|

| United Kingdom |

|

|

5.9 |

|

|

|

| Canada |

|

|

5.5 |

|

|

|

| France |

|

|

4.0 |

|

|

|

| Hong Kong |

|

|

2.6 |

|

|

|

| Portugal |

|

|

2.0 |

|

|

|

|

|

|

|

|

| Japan |

|

|

1.7 |

% |

|

|

| Germany |

|

|

1.4 |

|

|

|

| Mexico |

|

|

1.4 |

|

|

|

| Singapore |

|

|

1.2 |

|

|

|

| Belgium |

|

|

1.0 |

|

|

|

| Other Assets, Less Liabilities |

|

|

2.4 |

|

|

|

|

|

|

|

|

|

|

|

100.0 |

% |

|

|

|

|

|

See Portfolio of Investments beginning on page 11 for

specific holdings within these categories. The Fund’s holdings are subject to change.

Top Ten Holdings as of April 30, 2020 (excluding

short-term investments) (Unaudited)

| 1. |

Crown Castle International Corp. |

| 2. |

American Electric Power Co., Inc. |

|

|

|

| 8 |

|

MainStay CBRE Global Infrastructure Fund |

Portfolio Management Discussion and Analysis

(Unaudited)

Questions answered by portfolio

managers T. Ritson Ferguson, CFA, Jeremy Anagnos, CFA, Daniel Foley, CFA, and Hinds Howard of CBRE Clarion Securities LLC, the Fund’s Subadvisor.

How did MainStay CBRE Global Infrastructure Fund perform relative to its benchmark and peer group from November 1,

2019, through April 30, 2020?

From November 1, 2019, through April 30, 2020, Class I shares of MainStay CBRE Global Infrastructure Fund

returned –10.46%, outperforming the –12.60% return of the Fund’s primary benchmark, the FTSE Global Core Infrastructure 50/50 Index. Over the same period, Class I shares outperformed the –12.45% return of the Morningstar

Infrastructure Category Average.1

Were there any changes to the Fund during the reporting period?

At the close of business on February 21, 2020, Voya CBRE Global Infrastructure Fund merged into the Fund and the Fund assumed the historical performance and accounting

information of Voya CBRE Global Infrastructure Fund.

What factors affected the Fund’s relative performance during the reporting period?

Strong performance relative to the FTSE Global Core Infrastructure 50/50 Index was driven by positive stock selection and sector allocation. In particular, the

Fund’s thematic emphasis on communications infrastructure stocks and renewable-focused utilities positively contributed to relative performance. (Contributions take weightings and total returns into account.) Moreover, the Fund increased its

exposure to both those areas during the reporting period, further enhancing relative performance.

During the reporting period, which sectors and subsectors were

the strongest positive contributors to the Fund’s relative performance and which sectors and subsectors were particularly weak?

Underweight exposure to

lagging emerging markets stocks provided the strongest positive contribution to the Fund’s performance relative to the FTSE Global Core Infrastructure 50/50 Index during the reporting period. Relative performance also benefited from the

Fund’s overweight exposure to communications infrastructure companies, which are expected to experience increased demand this year as the COVID-19 response leads to more remote working and greater

investments in network connectivity and data growth. The Fund’s overweight exposure to the transportation infrastructure in continental Europe was the largest detractor from relative performance, with airports and toll roads experiencing

significant declines in demand due to quarantine measures and travel restrictions during the first four months of 2020.

During the reporting period, which individual stocks made the strongest positive contributions to the Fund’s

absolute performance and which stocks detracted the most?

The largest positive contributors to absolute performance included holdings in Cellnex, a Spain-based

telecommunications infrastructure operator, and Equinix, a U.S.-based owner of global data centers. Cellnex gained ground as it continued to acquire telecommunications tower assets in Europe from mobile operators, positioning the company to become a

regional leader. Equinix saw share prices rise in response to robust demand as data storage requirements increased with growing cloud-based storage activity.

The

most significant detractors from absolute performance during the reporting period included positions in German airport operator Fraport and French toll road concession operator Vinci, both of which were hurt by open-ended COVID-19-related restrictions on European travel in 2020. The Fund retained a position in Fraport, reflecting our positive assessment of the company’s liquidity along

with our belief that the sharp sell-off in the stock was overdone. Similarly, the Fund retained its position in Vinci in light of the high operating margins and the strong cash flow levels generated by toll

roads. We expect road travel to resume quickly after the pandemic recedes, when people may well choose to travel by car over other forms of transport.

What were

some of the Fund’s largest purchases and sales during the reporting period?

During the reporting period, the Fund’s largest purchases included shares

of American Tower, a leading owner of global telecommunications infrastructure real estate; and NextEra Energy, a Florida-based electric utility that is a major renewable energy developer in the United States. We see American Tower benefiting from

increased data transmission growth, while NextEra Energy is well positioned to continue to deliver renewable generation projects due to its scale. The Fund’s largest sales during the reporting period included its entire position in The Williams

Companies, a midstream oil & gas company owning natural gas assets; and Public Services Enterprises Group (PSEG), a New Jersey-based utility with significant power generation assets. The sales reflected our view that The Williams Companies

may see decreased volumes in gas in its pipelines due to reduced producer activity and that PSEG faces lower power prices due to commodity price declines.

How

did the Fund’s sector and subsector weightings change during the reporting period?

The Fund increased its exposure to utilities during the reporting period

with an emphasis on companies poised to benefit from

| 1. |

See page 5 for other share class returns, which may be higher or lower than Class I share returns. See page 6 for more

information on benchmark and peer group returns. |

global trends to reduce carbon emissions through investment in renewable generation assets. The Fund also increased its exposure to communications infrastructure, an area positioned to gain

ground as the stay-at-home work environment forced by COVID-19 accelerates the secular growth in data transmission. During the

same period, the Fund reduced its exposure to midstream oil & gas assets, particularly those exposed to oil and natural gas liquids, which are likely to experience challenges due to decreased production and producer bankruptcies. The Fund

also reduced its exposure to airports, which are coming under significant pressure at a time of severe travel restrictions and heightened uncertainty as to when either business or leisure air travel will resume.

How was the Fund positioned at the end of the reporting period?

As of

April 30, 2020, the Fund held overweight exposure to communications companies and utilities relative to the FTSE

Global Core Infrastructure 50/50 Index. We believe both areas are positioned to benefit from the secular themes described earlier. Communications infrastructure provides the necessary assets to

support secular data growth, while select utilities are facilitating the world’s transition to cleaner energy and decarbonization through renewable generation. As of the same date, the Fund held relatively underweight exposure to airports,

which are directly exposed to the COVID-19 travel restrictions; and midstream oil & gas infrastructure, which faces the financial consequences of constrained global energy demand.

The opinions expressed are those of the portfolio

managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

|

|

|

| 10 |

|

MainStay CBRE Global Infrastructure Fund |

Portfolio of Investments April 30, 2020

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value |

|

| Common Stocks 97.4%† |

|

| Australia 6.0% |

|

| APA Group (Utilities) |

|

|

469,799 |

|

|

$ |

3,343,099 |

|

| Atlas Arteria, Ltd. (Transportation) |

|

|

1,669,065 |

|

|

|

6,797,789 |

|

| Sydney Airport (Transportation) |

|

|

313,184 |

|

|

|

1,285,744 |

|

| Transurban Group (Transportation) |

|

|

205,107 |

|

|

|

1,844,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,271,112 |

|

|

|

|

|

|

|

|

|

|

| Belgium 1.0% |

|

| Elia Group S.A. (Utilities) (a) |

|

|

19,745 |

|

|

|

2,271,943 |

|

|

|

|

|

|

|

|

|

|

|

| Canada 5.5% |

|

| Enbridge, Inc. (Midstream / Pipelines) |

|

|

194,500 |

|

|

|

5,959,571 |

|

| Fortis, Inc. (Utilities) |

|

|

157,500 |

|

|

|

6,103,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,062,915 |

|

|

|

|

|

|

|

|

|

|

| France 4.0% |

|

| Vinci S.A. (Transportation) |

|

|

108,149 |

|

|

|

8,853,073 |

|

|

|

|

|

|

|

|

|

|

|

| Germany 1.4% |

|

| Fraport A.G. Frankfurt Airport Services Worldwide (Transportation) (a) |

|

|

68,630 |

|

|

|

3,011,335 |

|

|

|

|

|

|

|

|

|

|

|

| Hong Kong 2.6% |

|

| CLP Holdings, Ltd. (Utilities) |

|

|

536,655 |

|

|

|

5,731,704 |

|

|

|

|

|

|

|

|

|

|

|

| Italy 7.1% |

|

| Atlantia S.p.A. (Transportation) |

|

|

188,275 |

|

|

|

3,064,900 |

|

| Enel S.p.A. (Utilities) |

|

|

1,277,877 |

|

|

|

8,732,651 |

|

| Terna Rete Elettrica Nazionale S.p.A. (Utilities) |

|

|

608,823 |

|

|

|

3,816,260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,613,811 |

|

|

|

|

|

|

|

|

|

|

| Japan 1.7% |

|

| Chubu Electric Power Co., Inc. (Utilities) |

|

|

277,934 |

|

|

|

3,777,354 |

|

|

|

|

|

|

|

|

|

|

|

| Mexico 1.4% |

|

| Promotora Y Operadora de Infraestructura S.A.B. de C.V. (Transportation) |

|

|

441,995 |

|

|

|

3,063,027 |

|

|

|

|

|

|

|

|

|

|

|

| Portugal 2.0% |

|

| EDP—Energias de Portugal S.A. (Utilities) |

|

|

1,049,966 |

|

|

|

4,429,828 |

|

|

|

|

|

|

|

|

|

|

|

| Singapore 1.2% |

|

| NetLink NBN Trust (Communications) |

|

|

3,852,987 |

|

|

|

2,732,324 |

|

|

|

|

|

|

|

|

|

|

|

| Spain 7.1% |

|

| Cellnex Telecom S.A. (Communications) |

|

|

153,509 |

|

|

|

8,041,049 |

|

| Ferrovial S.A. (Transportation) |

|

|

114,010 |

|

|

|

2,848,582 |

|

| Iberdrola S.A. (Utilities) |

|

|

321,417 |

|

|

|

3,219,334 |

|

| Red Electrica Corp. S.A. (Utilities) |

|

|

92,074 |

|

|

|

1,619,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,728,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value |

|

| United Kingdom 5.9% |

|

| National Grid PLC (Utilities) |

|

|

736,993 |

|

|

$ |

8,667,928 |

|

| United Utilities Group PLC (Utilities) |

|

|

384,320 |

|

|

|

4,367,108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,035,036 |

|

|

|

|

|

|

|

|

|

|

| United States 50.5% |

|

| AES Corp. (Utilities) |

|

|

161,100 |

|

|

|

2,134,575 |

|

| Ameren Corp. (Utilities) |

|

|

76,900 |

|

|

|

5,594,475 |

|

| American Electric Power Co., Inc. (Utilities) |

|

|

114,300 |

|

|

|

9,499,473 |

|

| American Tower Corp. (Communications) |

|

|

34,632 |

|

|

|

8,242,416 |

|

| Atmos Energy Corp. (Utilities) |

|

|

55,000 |

|

|

|

5,608,350 |

|

| Cheniere Energy, Inc. (Midstream /Pipelines) (b) |

|

|

146,237 |

|

|

|

6,827,806 |

|

| CMS Energy Corp. (Utilities) |

|

|

67,910 |

|

|

|

3,876,982 |

|

| Crown Castle International Corp. (Communications) |

|

|

66,212 |

|

|

|

10,556,179 |

|

| Edison International (Utilities) |

|

|

108,400 |

|

|

|

6,364,164 |

|

| Equinix, Inc. (Communications) |

|

|

11,376 |

|

|

|

7,681,075 |

|

| Essential Utilities, Inc. (Utilities) |

|

|

121,450 |

|

|

|

5,075,395 |

|

| Exelon Corp. (Utilities) |

|

|

173,507 |

|

|

|

6,433,640 |

|

| FirstEnergy Corp. (Utilities) |

|

|

195,600 |

|

|

|

8,072,412 |

|

| Kinder Morgan, Inc. (Midstream / Pipelines) |

|

|

110,900 |

|

|

|

1,689,007 |

|

| NextEra Energy, Inc. (Utilities) |

|

|

36,970 |

|

|

|

8,544,506 |

|

| NiSource, Inc. (Utilities) |

|

|

100,800 |

|

|

|

2,531,088 |

|

| Norfolk Southern Corp. (Transportation) |

|

|

32,000 |

|

|

|

5,475,200 |

|

| Sempra Energy (Utilities) |

|

|

27,000 |

|

|

|

3,343,950 |

|

| Union Pacific Corp. (Transportation) |

|

|

23,800 |

|

|

|

3,803,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

111,353,696 |

|

|

|

|

|

|

|

|

|

|

| Total Common Stocks

(Cost $214,742,549) |

|

|

|

214,936,060 |

|

|

|

|

|

|

|

|

|

|

|

| Short-Term Investments 0.2% |

|

| Affiliated Investment Company 0.2% |

|

|

|

|

|

|

|

|

| United States 0.2% |

|

|

|

|

|

|

|

|

| MainStay U.S. Government Liquidity Fund, 0.01% (c) |

|

|

376,013 |

|

|

|

376,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unaffiliated Investment Company 0.0%‡ |

|

|

|

|

|

|

|

|

| United States 0.0%‡ |

|

|

|

|

|

|

|

|

| State Street Navigator Securities Lending Government Money Market Portfolio, 0.19% (c)(d) |

|

|

22,062 |

|

|

|

22,062 |

|

|

|

|

|

|

|

|

|

|

| Total Short-Term Investments

(Cost $398,075) |

|

|

|

|

|

|

398,075 |

|

|

|

|

|

|

|

|

|

|

| Total Investments

(Cost $215,140,624) |

|

|

97.6 |

% |

|

|

215,334,135 |

|

| Other Assets, Less Liabilities |

|

|

2.4 |

|

|

|

5,312,922 |

|

| Net Assets |

|

|

100.0 |

% |

|

$ |

220,647,057 |

|

| † |

Percentages indicated are based on Fund net assets. |

| ‡ |

Less than one-tenth of a percent.

|

|

|

|

|

|

|

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

|

|

|

|

11 |

|

Portfolio of Investments April 30, 2020 (continued)

| (a) |

All or a portion of this security was held on loan. As of April 30, 2020, the aggregate market value of securities on

loan was $2,979,451; the total market value of collateral held by the Fund was $3,140,726. The market value of the collateral held included non-cash collateral in the form of U.S. Treasury securities with a

value of $3,118,664 (See Note 2(J)). |

| (b) |

Non-income producing security. |

| (c) |

Current yield as of April 30, 2020. |

| (d) |

Represents a security purchased with cash collateral received for securities on loan.

|

The following is a summary of the fair valuations

according to the inputs used as of April 30, 2020, for valuing the Fund’s assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Quoted

Prices in Active

Markets for Identical

Assets (Level 1) |

|

|

Significant

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

|

|

|

|

|

| Asset Valuation Inputs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments in Securities (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks |

|

$ |

214,936,060 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

214,936,060 |

|

| Short-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Affiliated Investment Company |

|

|

376,013 |

|

|

|

— |

|

|

|

— |

|

|

|

376,013 |

|

| Unaffiliated Investment Company |

|

|

22,062 |

|

|

|

— |

|

|

|

— |

|

|

|

22,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Short-Term Investments |

|

|

398,075 |

|

|

|

— |

|

|

|

— |

|

|

|

398,075 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities |

|

$ |

215,334,135 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

215,334,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

For a complete listing of investments and their industries, see the Portfolio of Investments. |

The table below sets forth the diversification of the Fund’s investments by sector.

Sector Diversification

|

|

|

|

|

|

|

|

|

| |

|

Value |

|

|

Percent † |

|

| Communications |

|

$ |

37,253,043 |

|

|

|

16.9 |

% |

| Utilities |

|

|

123,159,500 |

|

|

|

55.8 |

|

| Midstream / Pipelines |

|

|

14,476,384 |

|

|

|

6.6 |

|

| Transportation |

|

|

40,047,133 |

|

|

|

18.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

214,936,060 |

|

|

|

97.4 |

|

| Short-Term Investment |

|

|

398,075 |

|

|

|

0.2 |

|

| Other Assets, Less Liabilities |

|

|

5,312,922 |

|

|

|

2.4 |

|

|

|

|

|

|

|

|

|

|

| Net Assets |

|

$ |

220,647,057 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

| † |

Percentages indicated are based on Fund net assets.

|

|

|

|

|

|

| 12 |

|

MainStay CBRE Global Infrastructure Fund |

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Assets and Liabilities as of

April 30, 2020

|

|

|

|

|

| Assets |

|

| Investment in unaffiliated securities, at value (identified cost $214,764,611) including securities

on loan of $2,979,451 |

|

$ |

214,958,122 |

|

| Investment in affiliated investment company, at value (identified cost $376,013) |

|

|

376,013 |

|

| Cash |

|

|

80,134 |

|

| Receivables: |

|

|

|

|

| Fund shares sold |

|

|

4,625,382 |

|

| Investment securities sold |

|

|

1,236,764 |

|

| Dividends and interest |

|

|

392,074 |

|

| Securities lending |

|

|

61 |

|

| Other assets |

|

|

71,590 |

|

|

|

|

|

|

| Total assets |

|

|

221,740,140 |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| Due to custodian |

|

|

103,891 |

|

| Cash collateral received for securities on loan |

|

|

22,062 |

|

| Payables: |

|

|

|

|

| Investment securities purchased |

|

|

693,140 |

|

| Manager (See Note 3) |

|

|

108,862 |

|

| Fund shares redeemed |

|

|

73,071 |

|

| Shareholder communication |

|

|

29,182 |

|

| Transfer agent (See Note 3) |

|

|

22,558 |

|

| Custodian |

|

|

9,892 |

|

| Professional fees |

|

|

5,255 |

|

| NYLIFE Distributors (See Note 3) |

|

|

3,121 |

|

| Accrued expenses |

|

|

22,049 |

|

|

|

|

|

|

| Total liabilities |

|

|

1,093,083 |

|

|

|

|

|

|

| Net assets |

|

$ |

220,647,057 |

|

|

|

|

|

|

|

|

| Composition of Net Assets |

|

|

|

|

| Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares

authorized |

|

$ |

21,235 |

|

| Additional paid-in capital |

|

|

233,269,329 |

|

|

|

|

|

|

|

|

|

233,290,564 |

|

| Total distributable earnings (loss) |

|

|

(12,643,507 |

) |

|

|

|

|

|

| Net assets |

|

$ |

220,647,057 |

|

|

|

|

|

|

|

|

|

|

|

| Class A |

|

|

|

|

| Net assets applicable to outstanding shares |

|

$ |

11,237,260 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

1,081,798 |

|

|

|

|

|

|

| Net asset value per share outstanding |

|

$ |

10.39 |

|

| Maximum sales charge (5.50% of offering price) |

|

|

0.60 |

|

|

|

|

|

|

| Maximum offering price per share outstanding |

|

$ |

10.99 |

|

|

|

|

|

|

| Investor Class |

|

| Net assets applicable to outstanding shares |

|

$ |

105,754 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

10,192 |

|

|

|

|

|

|

| Net asset value per share outstanding |

|

$ |

10.38 |

|

| Maximum sales charge (5.50% of offering price) |

|

|

0.60 |

|

|

|

|

|

|

| Maximum offering price per share outstanding |

|

$ |

10.98 |

|

|

|

|

|

|

| Class C |

|

| Net assets applicable to outstanding shares |

|

$ |

992,098 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

95,689 |

|

|

|

|

|

|

| Net asset value and offering price per share outstanding |

|

$ |

10.37 |

|

|

|

|

|

|

| Class I |

|

| Net assets applicable to outstanding shares |

|

$ |

208,291,098 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

20,045,351 |

|

|

|

|

|

|

| Net asset value and offering price per share outstanding |

|

$ |

10.39 |

|

|

|

|

|

|

| Class R6 |

|

| Net assets applicable to outstanding shares |

|

$ |

20,847 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

2,006 |

|

|

|

|

|

|

| Net asset value and offering price per share outstanding |

|

$ |

10.39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

|

|

|

|

13 |

|

Statement of Operations

for the period November 1, 2019 through April 30, 2020 and the year ended October 31, 2019

|

|

|

|

|

|

|

|

|

| |

|

2020(a) |

|

|

2019 |

|

| Investment Income (Loss) |

|

| Income |

|

| Dividends-unaffiliated (b) |

|

$ |

3,345,605 |

|

|

$ |

4,580,369 |

|

| Dividends-affiliated |

|

|

3,685 |

|

|

|

— |

|

| Securities lending |

|

|

61 |

|

|

|

— |

|

|

|

|

|

|

| Total income |

|

|

3,349,351 |

|

|

|

4,580,369 |

|

|

|

|

|

|

| Expenses |

|

| Manager (See Note 3) |

|

|

1,192,950 |

|

|

|

1,567,704 |

|

| Registration |

|

|

103,232 |

|

|

|

75,206 |

|

| Professional fees |

|

|

85,857 |

|

|

|

46,450 |

|

| Transfer agent (See Note 3) |

|

|

56,901 |

|

|

|

44,102 |

|

| Shareholder communication |

|

|

29,661 |

|

|

|

5,735 |

|

| Custodian |

|

|

21,192 |

|

|

|

56,995 |

|

| Distribution/Service—Class A (See Note 3) |

|

|

15,396 |

|

|

|

16,703 |

|

| Distribution/Service—Investor Class (See Note 3) |

|

|

27 |

|

|

|

— |

|

| Distribution/Service—Class C (See Note 3) |

|

|

5,343 |

|

|

|

2,963 |

|

| Trustees |

|

|

3,582 |

|

|

|

6,339 |

|

| Interest expense |

|

|

124 |

|

|

|

196 |

|

| Miscellaneous |

|

|

9,563 |

|

|

|

7,649 |

|

|

|

|

|

|

| Total expenses before waiver/reimbursement |

|

|

1,523,828 |

|

|

|

1,830,042 |

|

| Expense waiver/reimbursement from Manager (See Note 3) |

|

|

(172,117 |

) |

|

|

(82,747 |

) |

|

|

|

|

|

| Net expenses |

|

|

1,351,711 |

|

|

|

1,747,295 |

|

|

|

|

|

|

| Net investment income (loss) |

|

|

1,997,640 |

|

|

|

2,833,074 |

|

|

|

|

|

|

|

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions |

|

| Net realized gain (loss) on: |

|

| Unaffiliated investment transactions |

|

|

(12,208,632 |

) |

|

|

5,845,656 |

|

| Foreign currency forward transactions |

|

|

— |

|

|

|

6,100 |

|

| Foreign currency transactions |

|

|

(250,124 |

) |

|

|

(15,255 |

) |

|

|

|

|

|

| Net realized gain (loss) on investments and foreign currency transactions |

|

|

(12,458,756 |

) |

|

|

5,836,501 |

|

|

|

|

|

|

| Net change in unrealized appreciation (depreciation) on: |

|

|

|

|

|

|

|

|

| Unaffiliated investments |

|

|

(18,493,394 |

) |

|

|

21,244,139 |

|

| Translation of other assets and liabilities in foreign currencies |

|

|

(579 |

) |

|

|

(8,674 |

) |

|

|

|

|

|

| Net change in unrealized appreciation (depreciation) on investments and foreign currencies |

|

|

(18,493,973 |

) |

|

|

21,235,465 |

|

|

|

|

|

|

| Net realized and unrealized gain (loss) on investments and foreign currency transactions |

|

|

(30,952,729 |

) |

|

|

27,071,966 |

|

|

|

|

|

|

| Net increase (decrease) in net assets resulting from operations |

|

$ |

(28,955,089 |

) |

|

$ |

29,905,040 |

|

|

|

|

|

|

| (a) |

The Fund changed its fiscal year end from October 31 to April 30. |

| (b) |

Dividends recorded net of foreign withholding taxes in the amount of $328,589 and $245,050, respectively.

|

|

|

|

|

|

| 14 |

|

MainStay CBRE Global Infrastructure Fund |

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statements of Changes in Net Assets

for the period November 1, 2019 through April 30, 2020 and the years ended October 31, 2019 and October 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2020(a) |

|

|

2019 |

|

|

2018 |

|

| Increase (Decrease) in Net Assets |

|

| Operations: |

|

| Net investment income (loss) |

|

$ |

1,997,640 |

|

|

$ |

2,833,074 |

|

|

$ |

1,377,008 |

|

| Net realized gain (loss) on investments and foreign currency transactions |

|

|

(12,458,756 |

) |

|

|

5,836,501 |

|

|

|

1,221,896 |

|

| Net change in unrealized appreciation (depreciation) on investments and foreign currencies |

|

|

(18,493,973 |

) |

|

|

21,235,465 |

|

|

|

(5,637,401 |

) |

|

|

|

|

|

| Net increase (decrease) in net assets resulting from operations |

|

|

(28,955,089 |

) |

|

|

29,905,040 |

|

|

|

(3,038,497 |

) |

|

|

|

|

|

| Distributions to shareholders: |

|

| Class A |

|

|

(365,628 |

) |

|

|

(169,569 |

) |

|

|

(110,149 |

) |

| Investor Class |

|

|

(123 |

) |

|

|

— |

|

|

|

— |

|

| Class C |

|

|

(29,836 |

) |

|

|

(3,391 |

) |

|

|

— |

|

| Class I |

|

|

(7,127,573 |

) |

|

|

(3,968,511 |

) |

|

|

(4,118,454 |

) |

| Class W |

|

|

(282,475 |

) |

|

|

(68,056 |

) |

|

|

— |

|

| Class R6 |

|

|

(55 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

(7,805,690 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

| Distributions to shareholders from return of capital: |

|

| Class A |

|

|

(19,173 |

) |

|

|

— |

|

|

|

— |

|

| Investor Class |

|

|

(33 |

) |

|

|

— |

|

|

|

— |

|

| Class C |

|

|

(739 |

) |

|

|

— |

|

|

|

— |

|

| Class I |

|

|

(427,284 |

) |

|

|

— |

|

|

|

— |

|

| Class W |

|

|

(10,235 |

) |

|

|

— |

|

|

|

— |

|

| Class R6 |

|

|

(15 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

(457,479 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

| Total distributions to shareholders |

|

|

(8,263,169 |

) |

|

|

(4,209,527 |

) |

|

|

(4,228,603 |

) |

|

|

|

|

|

| Capital share transactions: |

|

| Net proceeds from sale of shares |

|

|

75,154,395 |

|

|

|

178,838,093 |

|

|

|

41,146,323 |

|

| Net asset value of shares issued to shareholders in reinvestment of distributions |

|

|

8,254,361 |

|

|

|

4,202,175 |

|

|

|

4,227,734 |

|

| Cost of shares redeemed |

|

|

(73,000,657 |

) |

|

|

(34,984,660 |

) |

|

|

(2,302,303 |

) |

|

|

|

|

|

| Increase (decrease) in net assets derived from capital share transactions |

|

|

10,408,099 |

|

|

|

148,055,608 |

|

|

|

43,071,754 |

|

|

|

|

|

|

| Net increase (decrease) in net assets |

|

|

(26,810,159 |

) |

|

|

173,751,121 |

|

|

|

35,804,654 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2020(a) |

|

|

2019 |

|

|

2018 |

|

|

| Net Assets |

|

| Beginning of period |

|

|

247,457,216 |

|

|

|

73,706,095 |

|

|

|

37,901,441 |

|

|

|

|

|

|

| End of period |

|

$ |

220,647,057 |

|

|

$ |

247,457,216 |

|

|

$ |

73,706,095 |

|

|

|

|

|

|

| (a) |

The Fund changed its fiscal year end from October 31 to April 30.

|

|

|

|

|

|

|

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

|

|

|

|

15 |

|

Financial Highlights selected per share data and ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

November 1,

2019 through

April 30, |

|

|

|

|

|

Year ended October 31, |

|

|

|

|

|

|

|

|

|

| Class A |

|

2020# |

|

|

|

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

|

|

|

|

|

|

|

| Net asset value at beginning of period |

|

$ |

11.99 |

|

|

|

|

|

|

$ |

10.04 |

|

|

$ |

11.40 |

|

|

$ |

10.78 |

|

|

$ |

10.68 |

|

|

$ |

12.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (loss) |

|

|

0.07 |

(a) |

|

|

|

|

|

|

0.16 |

|

|

|

0.19 |

|

|

|

0.17 |

(a) |

|

|

0.15 |

(a) |

|

|

0.16 |

(a) |

|

|

|

|

|

|

|

|

| Net realized and unrealized gain (loss) on investments |

|

|

(1.29 |

) |

|

|

|

|

|

|

2.12 |

|

|

|

(0.51 |

) |

|

|

1.30 |

|

|

|

0.66 |

|

|

|

(0.59 |

) |

|

|

|

|

|

|

|

|

| Net realized and unrealized gain (loss) on foreign currency transactions |

|

|

(0.01 |

) |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total from investment operations |

|

|

(1.23 |

) |

|

|

|

|

|

|

2.28 |

|

|

|

(0.32 |

) |

|

|

1.47 |

|

|

|

0.81 |

|

|

|

(0.43 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From net investment income |

|

|

(0.06 |

) |

|

|

|

|

|

|

(0.17 |

) |

|

|

(0.25 |

) |

|

|

(0.12 |

) |

|

|

(0.20 |

) |

|

|

(0.13 |

) |

|

|

|

|

|

|

|

|

| From net realized gain on investments |

|

|

(0.29 |

) |

|

|

|

|

|

|

(0.16 |

) |

|

|

(0.79 |

) |

|

|

(0.73 |

) |

|

|

(0.51 |

) |

|

|

(1.49 |

) |

|

|

|

|

|

|

|

|

| Return of Capital |

|

|

(0.02 |

) |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total distributions |

|

|

(0.37 |

) |

|

|

|

|

|

|

(0.33 |

) |

|

|

(1.04 |

) |

|

|

(0.85 |

) |

|

|

(0.71 |

) |

|

|

(1.62 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Redemption fee |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value at end of period |

|

$ |

10.39 |

|

|

|

|

|

|

$ |

11.99 |

|

|

$ |

10.04 |

|

|

$ |

11.40 |

|

|

$ |

10.78 |

|

|

$ |

10.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment return (b) |

|

|

(10.57 |

%) |

|

|

|

|

|

|

23.24 |

% |

|

|

(3.16 |

%) |

|

|

14.96 |

% |

|

|

8.21 |

% |

|

|

(3.45 |

%) |

|

|

|

|

|

|

|

|

| Ratios (to average net assets)/Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (loss) |

|

|

1.32 |

% †† |

|

|

|

|

|

|

1.51 |

% |

|

|

1.89 |

% |

|

|

1.59 |

% |

|

|

1.44 |

% |

|

|

1.37 |

% |

|

|

|

|

|

|

|

|

| Net expenses |

|

|

1.32 |

% ††(c)(d) |

|

|

|

|

|

|

1.35 |

% |

|

|

1.35 |

% |

|

|

1.53 |

% |

|

|

1.60 |

% |

|

|

1.60 |

% |

|

|

|

|

|

|

|

|

| Expenses (before waiver/reimbursement) |

|

|

1.54 |

% ††(c)(d) |

|

|

|

|

|

|

1.56 |

% |

|

|

1.83 |

% |

|

|

2.36 |

% |

|

|

2.15 |

% |

|

|

1.76 |

% |

|

|

|

|

|

|

|

|

| Portfolio turnover rate |

|

|

49 |

% |

|

|

|

|

|

|

53 |

% |

|

|

61 |

% |

|

|

85 |

% |

|

|

88 |

% |

|

|

97 |

% |

|

|

|

|

|

|

|

|

| Net assets at end of period (in 000’s) |

|

$ |

11,237 |

|

|

|

|

|

|

$ |

11,700 |

|

|

$ |

1,787 |

|

|

$ |

1,146 |

|

|

$ |

526 |

|

|

$ |

178 |

|

| # |

The Fund changed its fiscal year end from October 31 to April 30. |

| (a) |

Per share data based on average shares outstanding during the period. |

| (b) |

Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and

distributions. For periods of less than one year, total return is not annualized. |

| (c) |

In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (d) |

Net of interest expense of less than 0.01%. (See Note 6) |

|

|

|

|

|

|

|

| Investor Class |

|

February 24,

2020^ through

April 30, 2020 |

|

|

|

| Net asset value at beginning of period |

|

$ |

12.50 |

|

|

|

|

|

|

|

|

| Net investment income (loss) (a)‡ |

|

|

(0.00 |

) |

|

|

| Net realized and unrealized gain (loss) on investments |

|

|

(2.06 |

) |

|

|

| Net realized and unrealized gain (loss) on foreign currency transactions |

|

|

(0.02 |

) |

|

|

|

|

|

|

|

| Total from investment operations |

|

|

(2.08 |

) |

|

|

|

|

|

|

| Less distributions: |

|

|

|

| From net investment income |

|

|

(0.03 |

) |

|

|

| Return of capital |

|

|

(0.01 |

) |

|

|

|

|

|

|

|

| Total distributions |

|

|

(0.04 |

) |

|

|

|

|

|

|

|

| Net asset value at end of period |

|

$ |

10.38 |

|

|

|

|

|

|

|

|

| Total investment return (b) |

|

|

(16.66 |

%) |

|

| Ratios (to average net assets)/Supplemental Data: |

|

|

|

| Net investment income (loss)†† |

|

|

(0.12 |

%) |

|

|

| Net expenses (c)†† |

|