MainStay Funds Trust

|

|

|

|

|

|

|

|

|

OMB APPROVAL |

|

|

|

|

OMB Number: 3235-0570 |

|

|

|

|

Expires: January 31, 2017 |

|

|

|

|

Estimated average burden hours |

|

|

|

|

per response. . . ..20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna

Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: November 30

(MainStay Cushing MLP

Premier Fund, MainStay Cushing Renaissance Advantage Fund and MainStay Cushing Royalty Energy Income Fund only)

Date of reporting period:

November 30, 2014

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Cushing MLP Premier Fund, MainStay Cushing Renaissance Advantage Fund and MainStay

Cushing Royalty Energy Income Fund, each a series of the Registrant.

Item 1. Reports to Stockholders.

MainStay Cushing® Funds

Message from the President,

Cushing® Asset Management, LP Commentary and Annual

Report

November 30, 2014

MainStay Cushing® MLP Premier Fund

MainStay Cushing® Renaissance Advantage

Fund

MainStay Cushing® Royalty Energy Income Fund

This page intentionally left blank

Message from the President

Whether you are new to the MainStay family or have invested with us for many years, we are pleased to have you as a

shareholder of the MainStay Cushing Funds.

All MainStay Cushing Funds continue to provide the portfolio management capability and market insight of

Cushing Asset Management, LP. Their consistent use of time-tested investment principles and risk-management techniques can be comforting in light of the volatility that the energy markets have experienced in recent months.

The Cushing Asset Management, LP, Fiscal Year-End Commentary that follows contains detailed information about up-stream, midstream and downstream energy companies.

It looks at the U.S. Energy Renaissance and explains how various energy providers have dealt with recent market volatility. Most importantly, it shows why an optimistic outlook may be warranted.

The annual report for the MainStay Cushing Funds for the 12 months ended November 30, 2014, also follows. The report contains more detailed information about

the market forces,

investment decisions and specific holdings that affected your MainStay Cushing Fund investment(s) during the reporting period.

We encourage you to read this information carefully and use it as you evaluate the progress of your investment portfolio. We welcome Cushing Asset Management, LP, to the MainStay family, and we thank you for

choosing MainStay Funds.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of

this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no

guarantee of future results.

Not part of the

Annual Report

Cushing Asset Management, LP Fiscal Year-End Commentary

Midstream MLPs

For the bulk of the 12-month reporting period ending November 30, 2014, fundamentals were quite favorable for the midstream master limited partnership

(“MLP”) space. Key themes driving positive fundamentals included: 1) good earnings results, particularly for natural gas pipeline companies with capacity available to take advantage of extreme winter weather in late 2013 and early 2014; 2)

continuing supply takeaway announcements, such as new long-haul Bakken crude pipelines, a significant ethane export terminal project and numerous sizable natural gas pipeline project proposals related to the Marcellus/Utica takeaway; 3) merger and

acquisition activity and strategic restructurings spurred by the pursuit of growth, including several “drop-down” transactions and proposals for MLP consolidation; 4) numerous initial public offerings and the ongoing

“MLP-ification” trend (assets moving into MLP structures), including an important announcement by an energy “major” to form an MLP; and 5) positive fund flows into MLP-focused investment products. Continuing the trend of the past

few years, the rapid and dramatically shifting dynamics related to midstream infrastructure has created both challenges and opportunities for individual MLPs.

The vast majority of energy infrastructure needed to support continued shale development is being built and developed by MLPs. In addition to the significant capex backlogs of existing MLPs, we believe the numerous

announcements and filings for new MLPs in the past year alone highlight the positive attributes of the MLP structure (assets moving into the MLP structure is a trend we have historically referred to as the “MLP-ification” of the energy

space). Noteworthy examples of “MLP-ification” this year included IPOs from large sponsors such as Royal Dutch Shell PLC (NYSE: RDS), Antero Resources Corp. (AM), Dominion Resources, Inc. (NYSE: D), CONSOL Energy Inc. (NYSE: CNX), Noble

Energy, Inc. (NYSE: NBL), Transocean Ltd. (NYSE: RIG), Westlake Chemical Corp. (NYSE: WLKP), CenterPoint Energy, Inc. (NYSEL CNP) and OGE Energy Corp. (NYSE: OGE). We believe the MLP structure remains a preferred vehicle to house midstream assets as

well as a means to unlock value, via the general partner and associated incentive distribution rights (“IDRs”), at the parent/sponsor level.

IPO activity was robust, with 16 MLP public offerings launched and priced in the six months ending November 2014, as compared to a total of six IPOs for the prior

six-month period ending May 2014. In addition, there were 14 planned MLP IPOs on file with the SEC with plans for potential launch in the future.

Asset

flows into MLP-focused pooled products and general demand for equity capital from MLPs were supportive of the IPOs launched during the period. According to U.S. Capital Advisors, total assets for U.S. MLP-focused open-end mutual funds, closed-end

funds, exchange traded products and exchange traded notes increased by $23 billion during the

period from December 2013 to November 2014, representing a 42% year-over-year increase and resulting in a total asset size for MLP products of approximately $78 billion.1 We continue to closely monitor these inflows as we believe this has been a significant

contributor to MLP performance.

Merger and acquisition activity was also elevated, including MLP consolidation, as larger MLPs focused on M&A to

further diversify and integrate their assets into new business areas as well as gain access to new production regions. There were numerous acquisition/merger announcements this year, including Williams Companies, Inc. (NYSE: WMB)/Williams Partners,

L.P. (NYSE:WPZ) acquiring Access Midstream Partners, L.P. (NYSE:ACMP), NGL Energy Partners, LP (NYSE: NGL) acquiring Transmontaigne Partners, L.P. (NYSE: TLP), Kinder Morgan, Inc. (NYSE: KMI) acquiring Kinder Morgan Energy Partners, LP (NYSE:

KMP)/Kinder Morgan Management, LLC (NYSE: KMR)/El Paso Pipeline Partners, LP (NYSE: EPB) and Targa Resources Corp. (NYSE:TRGP)/Targa Resources Partners, LP (NYSE:NGLS) acquiring Atlas Energy, LP (NYSE:ATLS)/Atlas Pipeline Partners, LP (NYSE:APL).

However, the positive fundamental landscape and investor sentiment changed significantly with the precipitous decline in crude and natural gas liquids

(“NGL”) prices beginning in the summer of 2014, and prices were further aggravated by the OPEC (Organization of the Petroleum Exporting Countries) decision in November 2014 to maintain its targeted crude production ceiling. Crude prices

fell sharply towards the end of the fiscal year in large part, we believe, due to robust production, global growth concerns, geopolitical issues and dollar strength.

This dramatic price decline sent shockwaves through the energy industry. For example, many exploration and production (“E&P”) companies materially lowered their 2015 cap-ex budgets (i.e. reducing

planned drilling and expected production growth) and indicated an intent to focus spending on higher return areas within their respective footprint. According to Bentek’s internal rate of return (“IRR”) estimates, most of the major

oil plays in the U.S. yield IRRs between 20% and 30% at a wellhead price as low as $60/bbl.2

It is important to note that this is an ongoing development affecting plays and companies/partnerships in different

ways and to different degrees (for example, depending on the type of business, the location of the asset, the customer, the type of contract, etc.). For the time being, many midstream MLP management teams have stated they have yet to see volumetric

impacts for their systems or anticipate significant reductions in their backlog of organic growth projects. However, MLP investors have apparently re-priced MLP equities based not only on direct commodity price impacts (for those contracts with

commodity price sensitivity) but on anticipated throughput and/or project backlog reductions as well. Subsectors that have performed worse on a relative basis over the past few months

| 1. |

“USCA MLP Weekly” US Capital Advisors., 12/8/14. |

| 2. |

“Production Junction, What’s That Price Function?” Bentek Energy LLC., 11/4/14. |

Not part of the Annual

Report

are generally more commodity price sensitive and include natural gas gatherers & processors, shipping, coal, upstream MLPs, variable distribution MLPs and general partners. We expect

continued volatility in MLP trading until we get additional clarity into E&P cap-ex plans and commodity prices stabilize.

Despite the increased

volatility in unit prices, there are numerous examples of MLPs whose earnings and growth attributes have been thus far largely unaffected by the current commodity price environment. For example, select “dropdown” MLPs have predominately

fee-based cash flow and multi-year growth opportunities supported by visible (sometimes guaranteed) acquisitions from their parent sponsor. These partnerships typically have minimum volume commitments (“MVCs”) which, along with visible

dropdown acquisitions, generally allow the partnership to maintain earnings growth through any commodity price weakness. As an example and despite the current crude market weakness, management of the recently formed Shell Midstream Partners, LP

(NYSE: SHLX) is guiding towards approximately 20% annual distribution growth for at least the next 10 years. Additionally, MPLX, LP (the MLP formed by Marathon Petroleum Corp.) recently updated their guidance to mid-20% annual distribution growth

for at least the next five years. Although lower yielding, we continue to believe these dropdown MLPs offer investors a very attractive risk-adjusted combination of yield and growth.

In the midst of the current market turmoil, we continue to monitor relevant credit spreads, which have historically been an early warning signal for trouble ahead in the MLP space. While these spreads have widened,

they remain below longer-term averages and below recent peaks experienced during 2011 and 2008-2009.

We believe interest rates have taken a back seat to

the focus on crude oil and related NGL dynamics. Nonetheless, while there have been bouts of heightened market anxiety surrounding monetary policy and the timing/trajectory of interest rate “lift-off,” interest rates continue to remain low

and currently provide a favorable backdrop for midstream MLPs. We believe the market generally expects the Federal Reserve to begin increasing the Fed Funds rate as early as June 2015, and we shall see if we get a “rate tantrum” as we

approach that point in time.

While we remain confident in the long-term need for infrastructure and positive return potential for MLPs, the rapid

decline in crude oil prices has created significant near-term headwinds and uncertainty for the space. This is an ongoing and rapidly changing development and the industry is currently assessing and working through the implications of a lower crude

price environment. A prolonged period of low crude oil prices is likely to reduce drilling activity, which would result in a lower production growth trajectory. Although this could result in fewer future organic growth opportunities for MLPs, we do

not believe this will have an impact on current projects under development, most all of which are supported by long term commitments.

Nonetheless, we have stress tested our models to better understand the cash flow impact for midstream companies from the recent oil price fluctuations.

We believe the midstream energy sector continues to provide a compelling long term risk-adjusted total return potential through a combination of current yield with

growth. In the near term, we expect continued equity volatility until commodity prices stabilize and we gain a better understanding of expected E&P spending plans. Importantly, we do not invest in the asset class as a whole; we continue to seek

attractive investment opportunities based upon our fundamental and bottom-up research process.

Upstream MLPs & Royalty Trusts

While there were multiple macro-economic factors that impacted equity markets during the fiscal period, particularly in October of 2014, including the International

Monetary Fund’s cut to its global growth forecasts, the spread of the Ebola outbreak to Europe and the U.S., concerns of a recession in Germany, and further decreases in China’s growth outlook, the U.S. equity market continued to perform

reasonably well. Furthermore, U.S. economic data continued to be on the positive side, but global growth concerns and a strengthening U.S. dollar were factors that the Federal Reserve cited for its decision not to increase short-term interest rates

for the time being. The most significant event that impacted upstream master limited partnerships (“upstream MLPs”) and U.S. and Canadian royalty trusts and energy companies (“energy trusts”) during the period was the decline in

crude oil prices resulting primarily from OPEC’s November 2014 announcement that it would maintain current production quotas in the face of a widely projected oversupplied global crude oil market in the first half of 2015. Adding to the

weakness in crude oil prices were Saudi Arabia’s comments that it would defend its market share to existing customers and would not decrease production in order to support crude oil prices.

The upstream MLP and energy trust subsectors have each continued to grow, mature and evolve. Deal flow and acquisition activity by upstream MLPs continued to be

robust until the recent dramatic fall in crude oil prices. Clearly, it will take time for buyers and sellers of oil and natural gas assets to adjust to this new crude oil price environment and the subsequent changes in their cost of capital,

liquidity and the conditions of their balance sheets. We anticipate deal flow and acquisitions by upstream MLPs will continue, but it will likely take time to recover to the pace we witnessed over the last several quarters. Furthermore, if current

lower crude oil prices persist for a prolonged period of time, some upstream MLPs may need to reduce distribution levels to a sustainable level commensurate with a lower commodity price environment. On the other hand, in this lower crude oil price

environment we believe many E&P companies may be forced to sell attractive and/or mature oil and natural gas assets in order to fill funding gaps for their drilling development programs or de-lever their balance sheets.

Not part of the Annual

Report

We remain focused on the favorable long-term fundamental attributes of upstream MLPs and energy trusts and the

potential for attractive total returns based on current yield and expected distributions. We will continue to seek out stocks with attractive valuations and long-term growth opportunities, as well as those with near-term catalysts.

U.S. Energy Renaissance

For a majority of 2014, the U.S.

Energy Renaissance continued to strengthen as the natural gas export theme and infrastructure build-out associated with the U.S. shale revolution moved forward. The beneficiaries of the Renaissance theme continued to be dynamic, shifting

significantly during the last half of the year with the dramatic decline in crude oil prices. Industries which may not have been as compelling in a high crude oil price environment became favorable as the price of West Texas Intermediate

(“WTI”) crude oil dropped from approximately $108 per barrel in late June to approximately $66 per barrel at the end of November.

Throughout

the first half of the year, the discount of U.S. natural gas prices to global natural gas prices created a competitive advantage in several industries. The incentive to take advantage of the price arbitrage through exporting natural gas as liquefied

natural gas (“LNG”) was a large driving force behind multiple companies filing for permits to build LNG export facilities along the coasts (primarily the Gulf Coast). Projects sponsored by ConocoPhillips (NYSE: COP), Energy Transfer

Partners, L.P. (NYSE: ETP) and Sempra Energy (NYSE: SRE) received approval to begin construction in 2014, joining the project by Cheniere Energy, Inc. (NYSE: LNG) already under construction. On the same note, U.S. industries that have a high energy

input cost, such as the manufacturing, industrials and chemicals industries, were able to realize a significant competitive advantage through a reduction in operating expense as U.S. natural gas prices remained at a significant discount to natural

gas prices around the world. This advantage not only drove higher margins for companies currently operating domestically, but also drove jobs back to the U.S. that had largely moved overseas for the past 20 years. The competitive price advantage

incentivized domestic companies to increase their production capacity, which led to a significant expansion in manufacturing

and chemical plants. This expansion created heightened demand for industrial companies involved with design, construction and supply. In addition to the impact from the natural gas price dynamic,

the increased production of crude oil and natural gas drove infrastructure build-out and a need for alternative means of transporting crude oil, which benefitted multiple industries. Production across the U.S. was growing at a faster pace than the

midstream sector was able to accommodate, which provided an opportunity for companies within the rail, trucking and barge sectors to transport a portion of the additional volumes. This benefit transcended into ancillary industries including rail car

manufacturers, rail car component manufacturers and inland barge manufacturers as the demand for their products and services increased.

As oil prices

steadily declined during the latter half of the year, the beneficiaries within the scope of the U.S. Energy Renaissance shifted to those who benefitted from a lower price environment. The reduced price of crude oil ultimately resulted in

significantly lower gasoline prices, which had a positive impact on operating expense for companies with fuel expense as a high input cost in their operations, similar to the dynamic mentioned previously with natural gas. Beneficiaries of low oil

prices within the Renaissance universe include trucking companies, auto and auto part manufacturers, retail gas companies and airlines. Although the decrease in crude oil prices created a new dynamic within the Renaissance theme, the drop in natural

gas prices only served as further support to the theme. The industries which gained a competitive price advantage versus global pricing were able to further reduce their operating costs with respect to natural gas and natural gas liquids

(“NGLs”). Additionally, a low crude oil price environment has historically been a positive driver for domestic gross domestic product, which ultimately drives additional growth opportunities for a majority of the industries within the

scope of the Renaissance universe. Due to the dynamic theme and broad scope of the U.S. Energy Renaissance, the industries and companies which see the greatest benefit can vary in different macroeconomic environments. Through active management, we

believe portfolio holdings can be adapted to capitalize on the opportunities created by the U.S. Energy Renaissance as it plays out over the next several years.

The information provided herein

represents the opinion of the Portfolio Manager and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Not part of the Annual

Report

Table of Contents

Investors

should refer to each Fund’s Summary Prospectus and/or Prospectus and consider each Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and

other information about each Fund. You may obtain copies of each Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free

800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by

sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read each Summary Prospectus

and/or Prospectus carefully before investing.

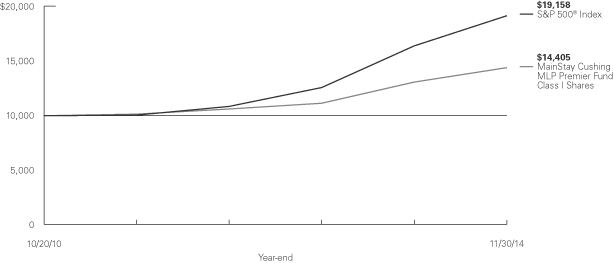

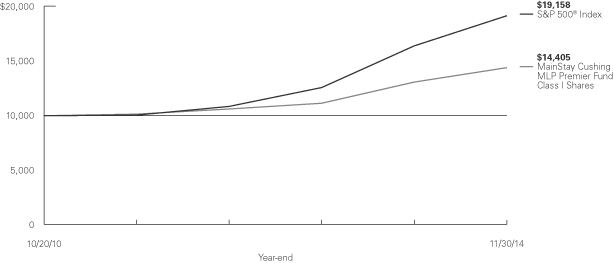

MainStay Cushing MLP Premier Fund

Investment and Performance Comparison1

(Unaudited)

Performance data quoted represents past

performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are

redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales

charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Year Ended November 30, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Class |

|

Sales Charge |

|

|

|

One Year |

|

|

Since

Inception

(10/20/10) |

|

|

Gross

Expense

Ratio2 |

|

| Class A Shares4 |

|

Maximum 5.5% Initial Sales Charge |

|

With sales charge Excluding sales charge |

|

|

3.67

10.00 |

%

|

|

|

7.45

9.01 |

%

|

|

|

9.42

9.42 |

%

|

| Investor Class Shares3 |

|

Maximum 5.5% Initial Sales Charge |

|

With sales charge Excluding sales charge |

|

|

3.67

10.00 |

|

|

|

7.45

9.01 |

|

|

|

9.42

9.42 |

|

| Class C Shares4 |

|

Maximum 1% CDSC if Redeemed Within One Year of Purchase |

|

With sales charge Excluding sales charge |

|

|

8.19

9.19 |

|

|

|

8.18

8.18 |

|

|

|

10.17

10.17 |

|

| Class I Shares4 |

|

No Sales Charge |

|

|

|

|

10.25 |

|

|

|

9.28 |

|

|

|

9.17 |

|

| 1. |

The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum

applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales

charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers

and/or expense limitations, please refer to the notes to the financial statements. |

| 2. |

The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense

ratios disclosed in this report. |

| 3. |

Performance figures for Investor Class shares, first offered on July 11, 2014, include the historical performance of Class A shares through July 10, 2014, adjusted for

differences in certain expenses and fees. Unadjusted, the performance shown for Investor Class shares would likely have been different. |

| 4. |

Performance figures for Class A shares, Class C shares and Class I shares reflect the historical performance of the then-existing Class A shares, Class C

shares and Class I shares, respectively, of the Cushing® MLP Premier Fund (the predecessor to the Fund, which was subject to a different fee structure) for periods prior

to July 11, 2014. The Cushing® MLP Premier Fund commenced operations on October 20, 2010. |

The footnotes on the next page are an

integral part of the table and graph and should be carefully read in conjunction with them.

|

|

|

| 8 |

|

MainStay Cushing MLP Premier Fund |

|

|

|

|

|

|

|

|

|

| Benchmark Performance |

|

One

Year |

|

|

Since

Inception |

|

| S&P 500® Index5 |

|

|

16.86 |

% |

|

|

17.13 |

% |

| Average Lipper Energy MLP

Fund6 |

|

|

11.65 |

|

|

|

11.36 |

|

| 5. |

“S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. The

S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The S&P 500® Index is the Fund’s primary benchmark. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index.

|

| 6. |

The average Lipper Energy MLP Fund is representative of funds that invest primarily in Master Limited Partnerships (MLPs) engaged in the

|

| |

transportation, storage and processing of minerals and natural resources. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based

on total returns with all dividend and capital gain distributions reinvested. |

The footnotes on the preceding page

are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Cushing MLP Premier Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period

from June 1, 2014, to November 30, 2014, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as

applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in

the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from June 1, 2014, to

November 30, 2014.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values

and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended November 30, 2014. Simply divide your account value by $1,000 (for

example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth

data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the

Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this

information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the

other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs,

such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if

these transactional costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share Class |

|

Beginning

Account Value

(6/1/2014)1 |

|

|

Ending Account Value (Based

on Actual

Returns and

Expenses)

11/30/2014 |

|

|

Expenses

Paid During

Period2 |

|

|

Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

11/30/2014 |

|

|

Expenses

Paid During

Period2 |

|

|

|

|

|

|

|

| Class A Shares4 |

|

$ |

1,000.00 |

|

|

$ |

991.30 |

|

|

$ |

35.34 |

|

|

$ |

989.57 |

|

|

$ |

35.31 |

|

|

|

|

|

|

|

| Investor Class Shares1,3 |

|

$ |

1,000.00 |

|

|

$ |

948.80 |

|

|

$ |

20.93 |

|

|

$ |

997.98 |

|

|

$ |

21.45 |

|

|

|

|

|

|

|

| Class C Shares4 |

|

$ |

1,000.00 |

|

|

$ |

987.80 |

|

|

$ |

32.19 |

|

|

$ |

992.68 |

|

|

$ |

32.27 |

|

|

|

|

|

|

|

| Class I Shares4 |

|

$ |

1,000.00 |

|

|

$ |

992.70 |

|

|

$ |

18.03 |

|

|

$ |

1,006.97 |

|

|

$ |

18.16 |

|

| 1. |

Investor Class shares were first offered as of the close of business on July 11, 2014. |

| 2. |

Expenses are equal to the Fund’s annualized expense ratio of each class (7.08% for Class A, 5.52% for Investor Class, 6.46% for Class C and 3.61% for Class I)

multiplied by the average account value over the period, divided by 365 and multiplied by 183 for Class A, Class C, and Class I and 142 days for Investor Class (to reflect the six-month period). The table above represents the actual

expenses incurred during the six-month period. |

| 3. |

Expenses paid during the period reflect ongoing costs for the period from inception through November 30, 2014. Had these shares been offered for the full six-month period

ended November 30, 2014, and had the Fund provided a hypothetical 5% annualized return, expenses paid during the period would have been $27.64 for Investor Class shares and the ending account value would have been $997.39 for Investor Class

shares. |

| 4. |

For the period from June 1, 2014 through July 11, 2014, expenses were from Predecessor Fund. |

|

|

|

| 10 |

|

MainStay Cushing MLP Premier Fund |

Portfolio Composition as of November 30, 2014(1) (Unaudited)

(Expressed as a Percentage of Total Investments)

See Portfolio of Investments beginning on page 14 for specific holdings within these categories.

Top Ten Holdings as of November 30, 2014 (excluding

short-term investment) (Unaudited)

| 2. |

Energy Transfer Equity, L.P. |

| 3. |

Williams Companies, Inc. |

| 4. |

Energy Transfer Partners, L.P. |

| 6. |

Enbridge Energy Partners, L.P. |

| 7. |

Regency Energy Partners, L.P. |

| 8. |

Equitable Midstream Partners, L.P. |

| 9. |

Atlas Pipeline Partners, L.P. |

| 10. |

Access Midstream Partners, L.P. |

| (1) |

Fund holdings and sector allocations are subject to change, and there is no assurance that the Fund will continue to hold any particular security. |

| (2) |

Master Limited Partnerships and Related Companies |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Jerry V. Swank, Daniel L. Spears and Kevin P. Gallagher, CFA, of Cushing

Asset Management, LP, the Fund’s Subadvisor.

How did MainStay Cushing MLP Premier Fund perform relative to its primary benchmark and peers for the

12 months ended November 30, 2014?

Excluding all sales charges, MainStay Cushing MLP Premier Fund returned 10.00% for

Class A shares and Investor Class shares and 9.19% for Class C shares for the 12 months ended November 30, 2014. Over the same period, Class I shares returned 10.25%. For the 12 months ended November 30, 2014, all share classes

underperformed the 16.86% return of the S&P 500® Index,1 which is the Fund’s primary broad-based securities-market index. Over the same period, all share classes underperformed the

11.65% return of the average Lipper2 Energy MLP Fund. See page 8 for Fund

returns with applicable sales charges.

What factors affected the Fund’s performance relative to the S&P 500® Index during the reporting period?

The Fund is subject to fees and expenses and is taxed as a regular corporation, or “C” corporation, for federal income tax purposes. The S&P 500® Index, on the other hand, does not incur taxes, fees or expenses. During the reporting period, these were the primary factors that led the Fund to underperform the

S&P 500® Index.

Which subsectors were the strongest contributors to the Fund’s absolute performance and which subsectors were particularly weak?

The top contributors to the Fund’s absolute performance dur- ing the reporting period were general partnerships, large cap diversified, and natural gas

gatherers & processors. (Contribu- tions take weightings and total returns into account.) On average, these subsectors represented the highest Fund weightings during the reporting period, and each provided positive performance. The general

partnerships subsector provided the strongest positive contribution given the actual and estimated distribution growth for its constituents relative to other MLPs. The subsectors with the weakest absolute performance were upstream MLPs, natural gas

transportation & storage, and shipping. Although each of these sectors had negative performance, each also had a relatively modest weighting, which lessened the impact on the Fund. The upstream MLPs and shipping subsectors were particularly

affected by the deteriorating commodity-price environment during the reporting period.

During the reporting period, which individual holdings made

the strongest contributions to the Fund’s absolute performance and which holdings detracted the most?

The top contributors to the Fund’s

absolute performance during the reporting period were Energy Transfer Equity L.P., a general

partnership; Kinder Morgan Management LLC, a large cap diversified MLP; and The Williams Companies, Inc., a general partnership. Both Energy Transfer Equity and The Williams Companies are general

partners with projected double-digit multiyear distribution/dividend growth percentages at the end of the reporting period, driven by acquisitions and a healthy backlog of organic projects across a diverse asset base. Kin- der Morgan

Management’s performance benefited from the announced consolidation acquisition by its parent company, Kinder Morgan, Inc. Major detractors from the Fund’s absolute performance during the reporting period included BreitBurn Energy

Partners, L.P., an upstream MLP; Linn Energy, LLC, an upstream MLP; and Navios Maritime Partners L.P., a drybulk shipping MLP. Each of these detractors had negative absolute performance driven by the deteriorating commodity-price environment. As of

December 9, 2014, which was shortly after the reporting period, the Fund had a reduced position in BreitBurn Energy Partners and no longer held Linn Energy, LLC.

Did the Fund make any significant purchases or sales during the reporting period?

During the reporting period,

the Fund’s largest purchases were EQT Midstream Partners, L.P., a natural gas transportation & storage MLP, and Kinder Morgan, Inc., a general partnership with large, diversified underlying businesses. (On November 26, 2014,

Kinder Morgan, Inc., completed the acquisition of its affiliate MLPs.) The Fund purchased EQT Midstream Partners because of its attractive visible distribution growth. This growth was driven by the parent’s inventory of assets available for

“drop down” acquisitions and a strong position in the natural gas infrastructure build-out related to the growth of the Marcellus shale. The Fund purchased Kinder Morgan, Inc., because of an estimated underpricing of growth fueled by a

sizable backlog of organic projects across several geographic areas and businesses along the energy midstream value chain. During the reporting period, the Fund’s largest sales were Williams Partners, L.P., a large cap diversified MLP, and

Targa Resources Partners, L.P., a natural gas gatherer & processor. Both MLPs are involved with pending transactions to merge with other MLPs held by the Fund, and both sales were made to reduce combined exposure to the pro forma

merged entities.

On December 1, 2014, which was immediately after the reporting period, the deteriorating commodity-price environment led the Fund to

reduce positions in general partnerships, natural gas gatherers & processors, and upstream MLPs. These post-reporting-period sales represented just under 10% of the Fund’s exposure at that time.

| 1. |

See footnote on page 9 for more information on the S&P 500® Index.

|

| 2. |

See footnote on page 9 for more information on Lipper Inc. |

|

|

|

| 12 |

|

MainStay Cushing MLP Premier Fund |

How did the Fund’s subsector weightings change during the reporting period?

During the reporting period, the Fund increased exposure to the shipping, natural gas gatherers & processors, and general partnerships subsectors. The Fund

decreased exposure to the crude oil & refined products, large cap diversified, and propane subsectors.

How was the Fund positioned at the

end of the reporting period?

As of November 30, 2014, the Fund’s largest subsector position was natural gas gatherers &

processors, followed by general

partnerships and large-cap diversified. As previously noted, the extraordinarily weak commodity-price environment led the Fund to reduce its positions in general partnerships, natural gas

gatherers & processors, and upstream MLPs on December 1, 2014. These sales represented just under 10% of the Fund’s exposure at that time.

The opinions expressed are those of the

portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific

investment.

Portfolio of Investments November 30, 2014

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value |

|

|

|

|

|

|

|

|

|

|

| Common Stock 24.0%† |

|

|

|

|

|

|

|

|

| General Partnership 12.3% |

|

|

|

|

|

|

|

|

| United States 12.3% |

|

|

|

|

|

| ¨Kinder Morgan, Inc. |

|

|

3,560,435 |

|

|

$ |

147,223,976 |

|

| ¨Targa Resources Corp. |

|

|

840,100 |

|

|

|

95,889,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

243,112,990 |

|

|

|

|

|

|

|

|

|

|

| Shipping 1.9% |

|

|

|

|

|

|

|

|

| Bermuda 1.9% |

|

|

|

|

|

|

|

|

| Golar LNG Ltd. |

|

|

895,000 |

|

|

|

37,160,400 |

|

|

|

|

|

|

|

|

|

|

|

| Large Cap Diversified 9.8% |

|

| United States 9.8% |

|

|

|

|

|

|

|

|

| ONEOK, Inc. |

|

|

1,424,800 |

|

|

|

77,167,168 |

|

| ¨Williams Companies, Inc. |

|

|

2,229,700 |

|

|

|

115,386,975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

192,554,143 |

|

|

|

|

|

|

|

|

|

|

| Total Common Stock

(Cost $365,999,498) |

|

|

|

|

|

|

472,827,533 |

|

|

|

|

|

|

|

|

|

|

|

| Master Limited Partnerships and Related Companies 79.4% |

|

| Crude Oil & Refined Products 15.6% |

|

| United States 15.6% |

|

| Blueknight Energy Partners, L.P. |

|

|

2,161,200 |

|

|

|

15,517,416 |

|

| ¨Enbridge Energy Partners, L.P. |

|

|

2,382,800 |

|

|

|

89,355,000 |

|

| Genesis Energy, L.P. |

|

|

860,000 |

|

|

|

37,865,800 |

|

| NuStar Energy, L.P. |

|

|

1,108,500 |

|

|

|

62,076,000 |

|

| Sunoco Logistics Partners, L.P. |

|

|

933,400 |

|

|

|

44,933,876 |

|

| Tesoro Logistics, L.P. |

|

|

1,020,600 |

|

|

|

58,449,762 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

308,197,854 |

|

|

|

|

|

|

|

|

|

|

| General Partnerships 8.1% |

|

|

|

|

|

|

|

|

| United States 8.1% |

|

|

|

|

|

|

|

|

| Crestwood Equity Partners, L.P. |

|

|

316,124 |

|

|

|

2,845,116 |

|

| ¨Energy Transfer Equity, L.P. |

|

|

1,948,600 |

|

|

|

115,727,354 |

|

| Plains GP Holdings L.P. |

|

|

1,555,000 |

|

|

|

40,398,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

158,971,370 |

|

|

|

|

|

|

|

|

|

|

| Large Cap Diversified 15.4% |

|

|

|

|

|

|

|

|

| United States 15.4% |

|

|

|

|

|

|

|

|

| ¨Energy Transfer Partners, L.P. |

|

|

1,515,312 |

|

|

|

98,752,883 |

|

| Enterprise Products Partners, L.P. |

|

|

1,694,250 |

|

|

|

63,263,295 |

|

| Magellan Midstream Partners, L.P. |

|

|

771,615 |

|

|

|

63,959,167 |

|

| ONEOK Partners, L.P. |

|

|

441,600 |

|

|

|

19,465,728 |

|

| Plains All American Pipeline, L.P. |

|

|

1,125,905 |

|

|

|

57,927,812 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

303,368,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value |

|

|

|

|

|

|

|

|

|

|

| Natural Gas Gatherers & Processors 27.2% |

|

| United States 27.2% |

|

|

|

|

|

|

|

|

| ¨Access Midstream Partners, L.P. |

|

|

1,240,300 |

|

|

$ |

77,742,004 |

|

| ¨Atlas Pipeline Partners, L.P. |

|

|

2,472,100 |

|

|

|

81,183,764 |

|

| DCP Midstream Partners, L.P. |

|

|

1,226,000 |

|

|

|

58,737,660 |

|

| Enable Midstream Partners, L.P. |

|

|

1,317,000 |

|

|

|

26,498,040 |

|

| EnLink Midstream Partners, L.P. |

|

|

2,701,700 |

|

|

|

75,350,413 |

|

| MarkWest Energy Partners, L.P. |

|

|

1,066,400 |

|

|

|

75,778,384 |

|

| ¨Regency Energy Partners, L.P. |

|

|

3,003,230 |

|

|

|

85,562,023 |

|

| Western Gas Partners, L.P. |

|

|

772,600 |

|

|

|

54,800,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

535,652,806 |

|

|

|

|

|

|

|

|

|

|

| Natural Gas Transportation & Storage 4.1% |

|

| United States 4.1% |

|

|

|

|

|

|

|

|

| ¨EQT Midstream Partners, L.P. |

|

|

975,000 |

|

|

|

81,549,000 |

|

|

|

|

|

|

|

|

|

|

|

| Propane 3.4% |

|

| United States 3.4% |

|

|

|

|

|

| NGL Energy Partners, L.P. |

|

|

1,918,652 |

|

|

|

66,960,955 |

|

|

|

|

|

|

|

|

|

|

|

|

| Shipping 2.6% |

|

|

|

|

|

| Republic of the Marshall Islands 2.6% |

|

|

|

|

|

| Capital Product Partners, L.P. |

|

|

3,310,576 |

|

|

|

25,888,704 |

|

| Navios Maritime Partners, L.P. |

|

|

1,916,000 |

|

|

|

24,831,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,720,064 |

|

|

|

|

|

|

|

|

|

|

| Upstream 3.0% |

|

|

|

|

|

|

|

|

| United States 3.0% |

|

|

|

|

|

|

|

|

| BreitBurn Energy Partners, L.P. |

|

|

2,662,500 |

|

|

|

35,171,625 |

|

| Linn Energy, LLC |

|

|

1,362,800 |

|

|

|

24,871,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60,042,725 |

|

|

|

|

|

|

|

|

|

|

| Total Master Limited Partnerships and Related Companies

(Cost $1,235,243,844) |

|

|

|

|

|

|

1,565,463,659 |

|

|

|

|

|

|

|

|

|

|

|

| Preferred Stock 0.8% |

|

| Crude Oil & Refined Products 0.8% |

|

| United States 0.8% |

|

| Blueknight Energy Partners, L.P. (a) |

|

|

1,902,541 |

|

|

|

16,742,361 |

|

|

|

|

|

|

|

|

|

|

| Total Preferred Stock

(Cost $14,718,722) |

|

|

|

|

|

|

16,742,361 |

|

|

|

|

|

|

|

|

|

|

| † |

Calculated as a percentage of net assets applicable to common shareholders. |

| ¨ |

|

Among the Portfolio’s 10 largest holdings or issuers held, as of November 30, 2014, excluding short-term investments. May be subject to change daily.

|

|

|

|

|

|

| 14 |

|

MainStay Cushing MLP Premier Fund |

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value |

|

|

|

|

|

|

|

|

|

|

Short-Term Investments—Investment

Companies 3.3% |

|

| United States 3.3% |

|

|

|

|

|

|

|

|

| AIM Short-Term Treasury Portfolio Fund—Institutional Class, 0.01% (b) |

|

|

13,039,583 |

|

|

$ |

13,039,583 |

|

| Fidelity Government Portfolio Fund—Institutional Class, 0.01% (b) |

|

|

13,039,583 |

|

|

|

13,039,583 |

|

| Fidelity Money Market Portfolio—Institutional Class, 0.05% (b) |

|

|

13,039,582 |

|

|

|

13,039,582 |

|

| First American Government Obligations Fund—Class Z, 0.01% (b) |

|

|

13,039,582 |

|

|

|

13,039,582 |

|

| Invesco STIC Prime Portfolio, 0.04% (b) |

|

|

13,039,583 |

|

|

|

13,039,583 |

|

|

|

|

|

|

|

|

|

|

| Total Short-Term Investments

(Cost $65,197,913) |

|

|

|

|

|

|

65,197,913 |

|

|

|

|

|

|

|

|

|

|

| Total Investments

(Cost $1,681,159,977) (c) |

|

|

107.5 |

% |

|

|

2,120,231,466 |

|

| Liabilities in Excess of Other Assets |

|

|

(7.5 |

) |

|

|

(148,575,321 |

) |

| Net Assets |

|

|

100.0 |

% |

|

$ |

1,971,656,145 |

|

| (a) |

Illiquid security – As of November 30, 2014, the total market value of this security was $16,742,361, which represented 0.08% of the Fund’s net assets.

|

| (b) |

Rate reported is the current yield as of November 30, 2014. |

| (c) |

As of November 30, 2014, cost was $1,630,374,525 for federal income tax purposes and net unrealized appreciation was as follows: |

|

|

|

|

|

| Gross unrealized appreciation |

|

$ |

489,857,223 |

|

| Gross unrealized depreciation |

|

|

(282 |

) |

|

|

|

|

|

| Net unrealized appreciation |

|

$ |

489,856,941 |

|

|

|

|

|

|

The following is a summary of the fair

valuations according to the inputs used as of November 30, 2014, for valuing the Fund’s assets and liabilities.

Asset Valuation Inputs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) |

|

|

Significant

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Investments in Securities (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock |

|

$ |

472,827,533 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

472,827,533 |

|

| Master Limited Partnerships and Related Companies |

|

|

1,565,463,659 |

|

|

|

— |

|

|

|

— |

|

|

|

1,565,463,659 |

|

| Preferred Stock |

|

|

16,742,361 |

|

|

|

— |

|

|

|

— |

|

|

|

16,742,361 |

|

| Short-Term Investments |

|

|

65,197,913 |

|

|

|

— |

|

|

|

— |

|

|

|

65,197,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities |

|

$ |

2,120,231,466 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

2,120,231,466 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

For a complete listing of investments and their industries, see the Portfolio of Investments. |

The Fund recognizes transfers between the levels as of the beginning of the period.

For the year ended

November 30, 2014, the Fund did not have any transfers between Level 1 and Level 2 fair value measurements.

As of November 30, 2014, the Fund

did not hold any investments with significant unobservable inputs (Level 3).

|

|

|

|

|

|

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

|

|

|

|

15 |

|

Statement of Assets and Liabilities as of November 30, 2014

|

|

|

|

|

| Assets |

|

| Investments, at value

(identified cost $1,681,159,977) |

|

$ |

2,120,231,466 |

|

| Receivables: |

|

|

|

|

| Fund shares sold |

|

|

11,146,043 |

|

| Dividends and interest |

|

|

1,323 |

|

| Prepaid expenses |

|

|

145,480 |

|

|

|

|

|

|

| Total assets |

|

|

2,131,524,312 |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| Payables: |

|

|

|

|

| Fund shares redeemed |

|

|

1,938,436 |

|

| Advisory fees (See Note 3) |

|

|

1,809,290 |

|

| NYLIFE Distributors (See Note 3) |

|

|

829,766 |

|

| Transfer agent (See Note 3) |

|

|

367,000 |

|

| Shareholder communication |

|

|

63,241 |

|

| Professional fees |

|

|

31,903 |

|

| Trustees |

|

|

15,428 |

|

| Custodian |

|

|

3,875 |

|

| Accrued expenses |

|

|

1,809 |

|

| Deferred tax liability |

|

|

154,807,419 |

|

|

|

|

|

|

| Total liabilities |

|

|

159,868,167 |

|

|

|

|

|

|

| Net assets |

|

$ |

1,971,656,145 |

|

|

|

|

|

|

|

|

| Composition of Net Assets |

|

|

|

|

| Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized |

|

$ |

90,169 |

|

| Additional paid-in capital |

|

|

1,735,830,303 |

|

|

|

|

|

|

|

|

|

1,735,920,472 |

|

| Accumulated net investment loss, net of income taxes |

|

|

(67,584,264 |

) |

| Accumulated net realized gain (loss) on investments, net of income taxes |

|

|

24,024,760 |

|

| Net unrealized appreciation (depreciation) on investments, net of income taxes |

|

|

279,295,177 |

|

|

|

|

|

|

| Net assets |

|

$ |

1,971,656,145 |

|

|

|

|

|

|

|

|

|

|

|

| Class A |

|

|

|

|

| Net assets applicable to outstanding shares |

|

$ |

531,606,641 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

24,003,190 |

|

|

|

|

|

|

| Net asset value per share outstanding |

|

$ |

22.15 |

|

| Maximum sales change (5.50% of offering price) |

|

|

1.22 |

|

|

|

|

|

|

| Maximum offering price per share outstanding |

|

$ |

23.37 |

|

|

|

|

|

|

| Investor Class |

|

|

|

|

| Net assets applicable to outstanding shares |

|

$ |

1,310,220 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

59,161 |

|

|

|

|

|

|

| Net asset value per share outstanding |

|

$ |

22.15 |

|

| Maximum sales change (5.50% of offering price) |

|

|

1.22 |

|

|

|

|

|

|

| Maximum offering price per share outstanding |

|

$ |

23.37 |

|

|

|

|

|

|

| Class C |

|

|

|

|

| Net assets applicable to outstanding shares |

|

$ |

859,193,117 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

40,233,668 |

|

|

|

|

|

|

| Net asset value per share outstanding |

|

$ |

21.36 |

|

|

|

|

|

|

| Class I |

|

|

|

|

| Net assets applicable to outstanding shares |

|

$ |

579,546,167 |

|

|

|

|

|

|

| Shares of beneficial interest outstanding |

|

|

25,872,914 |

|

|

|

|

|

|

| Net asset value per share outstanding |

|

$ |

22.40 |

|

|

|

|

|

|

|

|

|

|

|

| 16 |

|

MainStay Cushing MLP Premier Fund |

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Operations for the year ended November 30,

2014

|

|

|

|

|

| Investment Income (Loss) |

|

| Income |

|

|

|

|

| Dividends and distributions

(Net of return of capital of $78,187,303) |

|

$ |

11,095,063 |

|

| Interest |

|

|

12,463 |

|

|

|

|

|

|

| Total income |

|

|

11,107,526 |

|

|

|

|

|

|

| Expenses |

|

|

|

|

| Manager (See Note 3) |

|

|

18,640,080 |

|

| Distribution/Service—Class A (See Note 3) |

|

|

1,381,048 |

|

| Distribution/Service—Investor Class (See Note 3) |

|

|

524 |

|

| Distribution/Service—Class C (See Note 3) |

|

|

7,533,655 |

|

| Transfer agent (See Note 3) |

|

|

1,106,083 |

|

| Administration and accounting (See Note 3) |

|

|

899,842 |

|

| Professional fees |

|

|

280,873 |

|

| Insurance |

|

|

262,248 |

|

| Registration |

|

|

254,008 |

|

| Shareholder communication |

|

|

205,527 |

|

| Trustees |

|

|

132,027 |

|

| Custodian |

|

|

52,547 |

|

| Franchise tax |

|

|

29,305 |

|

| Miscellaneous |

|

|

8,168 |

|

|

|

|

|

|

| Total expenses before recovery of previous waivers |

|

|

30,785,935 |

|

| Recoupment of previous waivers from Manager (See Note 3) |

|

|

801,594 |

|

|

|

|

|

|

| Net expenses |

|

|

31,587,529 |

|

|

|

|

|

|

| Net Investment Loss, before Income Taxes |

|

|

(20,480,003 |

) |

| Deferred tax benefit |

|

|

9,964,198 |

|

|

|

|

|

|

| Net Investment Income (Loss) |

|

|

(10,515,805 |

) |

|

|

|

|

|

|

| Realized and Unrealized Gain (Loss) on Investments |

|

| Net realized gain (loss) on: |

|

|

|

|

| Investments, before income taxes |

|

|

55,866,449 |

|

| Deferred tax expense |

|

|

(20,730,271 |

) |

|

|

|

|

|

| Net realized gain (loss) on investments |

|

|

35,136,178 |

|

|

|

|

|

|

| Net change in unrealized appreciation (depreciation) on: |

|

|

|

|

| Investments, before income taxes |

|

|

160,233,467 |

|

| Deferred tax expense |

|

|

(59,458,168 |

) |

|

|

|

|

|

| Net change in unrealized appreciation (depreciation) |

|

|

100,775,299 |

|

|

|

|

|

|

| Net realized and unrealized gain (loss) on investments |

|

|

135,911,477 |

|

|

|

|

|

|

| Net increase (decrease) in net assets resulting from operations |

|

$ |

125,395,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

|

|

|

|

17 |

|

Statements of Changes in Net Assets

|

|

|

|

|

|

|

|

|

| |

|

Year ended

November 30,

2014 |

|

|

Year ended

November 30,

2013* |

|

| Increase (Decrease) in Net Assets |

|

| Operations: |

|

|

|

|

|

|

|

|

| Net investment income (loss) |

|

$ |

(10,515,805 |

) |

|

$ |

(8,226,281 |

) |

| Net realized gain (loss) on investments |

|

|

35,136,178 |

|

|

|

6,064,272 |

|

| Net change in unrealized appreciation (depreciation) on investments |

|

|

100,775,299 |

|

|

|

143,419,606 |

|

|

|

|

|

|

| Net increase (decrease) in net assets resulting from operations |

|

|

125,395,672 |

|

|

|

141,257,597 |

|

|

|

|

|

|

| Dividends and distributions to shareholders: |

|

|

|

|

|

|

|

|

| From net investment income: |

|

|

|

|

|

|

|

|

| Class A |

|

|

(14,189,873 |

) |

|

|

— |

|

| Investor Class |

|

|

(6,008 |

) |

|

|

— |

|

| Class C |

|

|

(20,166,403 |

) |

|

|

— |

|

| Class I |

|

|

(10,131,458 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

(44,493,742 |

) |

|

|

— |

|

|

|

|

|

|

| From return of capital: |

|

|

|

|

|

|

|

|

| Class A |

|

|

(18,145,019 |

) |

|

|

(26,084,046 |

) |

| Investor Class |

|

|

(7,683 |

) |

|

|

— |

|

| Class C |

|

|

(25,787,389 |

) |

|

|

(27,804,978 |

) |

| Class I |

|

|

(12,955,400 |

) |

|

|

(9,945,506 |

) |

|

|

|

|

|

|

|

|

(56,895,491 |

) |

|

|

(63,834,530 |

) |

|

|

|

|

|

| Total dividends and distributions to shareholders |

|

|

(101,389,233 |

) |

|

|

(63,834,530 |

) |

|

|

|

|

|

| Capital share transactions: |

|

|

|

|

|

|

|

|

| Net proceeds from sale of shares |

|

|

1,058,742,376 |

|

|

|

727,380,349 |

|

| Net asset value of shares issued to shareholders in reinvestment of dividends and distributions |

|

|

86,845,034 |

|

|

|

42,036,389 |

|

| Cost of shares redeemed |

|

|

(475,289,126 |

) |

|

|

(220,119,043 |

) |

|

|

|

|

|

| Increase (decrease) in net assets derived from capital share transactions |

|

|

670,298,284 |

|

|

|

549,297,695 |

|

|

|

|

|

|

| Net increase (decrease) in net assets |

|

|

694,304,723 |

|

|

|

626,720,762 |

|

|

| Net Assets |

|

| Beginning of year |

|

|

1,277,351,422 |

|

|

|

650,630,660 |

|

|

|

|

|

|

| End of year |

|

$ |

1,971,656,145 |

|

|

$ |

1,277,351,422 |

|

|

|

|

|

|

| Undistributed (distributions in excess of) net investment income at end of year |

|

$ |

(67,584,264 |

) |

|

$ |

(12,574,717 |

) |

|

|

|

|

|

| * |

This year was audited by a predecessor audit firm whose opinion was unqualified.

|

|

|

|

|

|

| 18 |

|

MainStay Cushing MLP Premier Fund |

|

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended November 30, |

|

|

October 20,

2010**

through

November 30, |

|

| Class A |

|

2014 |

|

|

2013*** |

|

|

2012*** |

|

|

2011*** |

|

|

2010*** |

|

| Net asset value at beginning of period |

|

$ |

21.36 |

|

|

$ |

19.48 |

|

|

$ |

19.92 |

|

|

$ |

20.28 |

|

|

$ |

20.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (loss) (a) |

|

|

(0.09 |

) |

|

|

(0.12 |

) |

|

|

(0.13 |

) |

|

|

(0.14 |

) |

|

|

(0.02 |

) |

| Net realized and unrealized gain (loss) on investments |

|

|

2.21 |

|

|

|

3.34 |

|

|

|

1.02 |

|

|

|

1.07 |

|

|

|

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total from investment operations |

|

|

2.12 |

|

|

|

3.22 |

|

|

|

0.89 |

|

|

|

0.93 |

|

|

|

0.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less dividends and distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From net investment income |

|

|

(0.59 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| From return of capital |

|

|

(0.75 |

) |

|

|

(1.34 |

) |

|

|

(1.34 |

) |

|

|

(1.30 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total dividends and distributions |

|

|

(1.34 |

) |

|

|

(1.34 |

) |

|

|

(1.34 |

) |

|

|

(1.30 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Redemption fees retained (a)(b) |

|

|

0.01 |

|

|

|

0.00 |

‡ |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value at end of period |

|

$ |

22.15 |

|

|

$ |

21.36 |

|

|

$ |

19.48 |

|

|

$ |

19.92 |

|

|

$ |

20.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment return (c) |

|

|

10.00 |

% |

|

|

16.91 |

% |

|

|

4.56 |

% |

|

|

4.55 |

% |

|

|

1.40 |

% (d) |

| Ratios (to average net assets)/Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (loss) (including net deferred income tax benefit (expense)) (e) |

|

|

(6.46 |

%) |

|

|

(9.12 |

%) |

|

|

(2.95 |

%) |

|

|

(1.95 |

%) |

|

|

(5.32 |

%)†† |

| Net investment income (loss) (excluding net deferred income tax benefit (expense)) (e) |

|

|

(0.97 |

%) |

|

|

(1.18 |

%) |

|

|

(1.23 |

%) |

|

|

(1.29 |

%) |

|

|

(1.45 |

%)†† |

| Net expenses (including net deferred income tax (benefit) expense) (e)(f) |

|

|

7.08 |

% |

|

|

9.59 |

% |

|

|

3.37 |

% |

|

|

2.32 |

% |

|

|

5.52 |

% †† |