x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Delaware | 20-1480589 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

71 South Wacker Drive 12th Floor, Chicago, Illinois | 60606 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Large accelerated filer | x | Accelerated filer | ¨ | ||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | ||

Emerging growth company | ¨ | ||||

PART I – FINANCIAL INFORMATION | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II – OTHER INFORMATION | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, 2017 | June 30, 2016 | June 30, 2017 | June 30, 2016 | ||||||||||||

REVENUES: | |||||||||||||||

Owned and leased hotels | $ | 577 | $ | 559 | $ | 1,149 | $ | 1,075 | |||||||

Management and franchise fees | 130 | 115 | 252 | 222 | |||||||||||

Other revenues | 15 | 11 | 37 | 20 | |||||||||||

Other revenues from managed properties | 473 | 480 | 944 | 937 | |||||||||||

Total revenues | 1,195 | 1,165 | 2,382 | 2,254 | |||||||||||

DIRECT AND SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES: | |||||||||||||||

Owned and leased hotels | 430 | 413 | 857 | 802 | |||||||||||

Depreciation and amortization | 91 | 86 | 182 | 167 | |||||||||||

Other direct costs | 6 | 9 | 25 | 15 | |||||||||||

Selling, general, and administrative | 90 | 75 | 189 | 163 | |||||||||||

Other costs from managed properties | 473 | 480 | 944 | 937 | |||||||||||

Direct and selling, general, and administrative expenses | 1,090 | 1,063 | 2,197 | 2,084 | |||||||||||

Net gains and interest income from marketable securities held to fund operating programs | 10 | 7 | 25 | 8 | |||||||||||

Equity earnings (losses) from unconsolidated hospitality ventures | 1 | 19 | (2 | ) | 21 | ||||||||||

Interest expense | (20 | ) | (20 | ) | (41 | ) | (37 | ) | |||||||

Gains (losses) on sales of real estate | 34 | (21 | ) | 34 | (21 | ) | |||||||||

Other income (loss), net | 2 | 1 | 42 | (3 | ) | ||||||||||

INCOME BEFORE INCOME TAXES | 132 | 88 | 243 | 138 | |||||||||||

PROVISION FOR INCOME TAXES | (45 | ) | (21 | ) | (86 | ) | (37 | ) | |||||||

NET INCOME | 87 | 67 | 157 | 101 | |||||||||||

NET INCOME AND ACCRETION ATTRIBUTABLE TO NONCONTROLLING INTERESTS | — | — | — | — | |||||||||||

NET INCOME ATTRIBUTABLE TO HYATT HOTELS CORPORATION | $ | 87 | $ | 67 | $ | 157 | $ | 101 | |||||||

EARNINGS PER SHARE—Basic | |||||||||||||||

Net income | $ | 0.69 | $ | 0.50 | $ | 1.23 | $ | 0.75 | |||||||

Net income attributable to Hyatt Hotels Corporation | $ | 0.69 | $ | 0.50 | $ | 1.23 | $ | 0.75 | |||||||

EARNINGS PER SHARE—Diluted | |||||||||||||||

Net income | $ | 0.68 | $ | 0.49 | $ | 1.22 | $ | 0.74 | |||||||

Net income attributable to Hyatt Hotels Corporation | $ | 0.68 | $ | 0.49 | $ | 1.22 | $ | 0.74 | |||||||

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, 2017 | June 30, 2016 | June 30, 2017 | June 30, 2016 | ||||||||||||

Net income | $ | 87 | $ | 67 | $ | 157 | $ | 101 | |||||||

Other comprehensive income (loss), net of taxes: | |||||||||||||||

Foreign currency translation adjustments, net of tax expense of $- for the three and six months ended June 30, 2017 and June 30, 2016 | 19 | (9 | ) | 60 | 15 | ||||||||||

Unrealized gains on available-for-sale securities, net of tax expense of $7 and $28 for the three and six months ended June 30, 2017, respectively, and $8 and $5 for the three and six months ended June 30, 2016, respectively | 11 | 12 | 45 | 8 | |||||||||||

Other comprehensive income | 30 | 3 | 105 | 23 | |||||||||||

COMPREHENSIVE INCOME | 117 | 70 | 262 | 124 | |||||||||||

COMPREHENSIVE INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | — | — | — | — | |||||||||||

COMPREHENSIVE INCOME ATTRIBUTABLE TO HYATT HOTELS CORPORATION | $ | 117 | $ | 70 | $ | 262 | $ | 124 | |||||||

June 30, 2017 | December 31, 2016 | ||||||

ASSETS | |||||||

CURRENT ASSETS: | |||||||

Cash and cash equivalents | $ | 400 | $ | 482 | |||

Restricted cash | 340 | 76 | |||||

Short-term investments | 51 | 56 | |||||

Receivables, net of allowances of $21 at June 30, 2017 and $18 at December 31, 2016 | 368 | 304 | |||||

Inventories | 15 | 28 | |||||

Prepaids and other assets | 153 | 153 | |||||

Prepaid income taxes | 36 | 40 | |||||

Total current assets | 1,363 | 1,139 | |||||

Investments | 181 | 186 | |||||

Property and equipment, net | 4,239 | 4,270 | |||||

Financing receivables, net of allowances | 19 | 19 | |||||

Goodwill | 145 | 125 | |||||

Intangibles, net | 671 | 599 | |||||

Deferred tax assets | 290 | 313 | |||||

Other assets | 993 | 1,098 | |||||

TOTAL ASSETS | $ | 7,901 | $ | 7,749 | |||

LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND EQUITY | |||||||

CURRENT LIABILITIES: | |||||||

Current maturities of long-term debt | $ | 241 | $ | 119 | |||

Accounts payable | 159 | 162 | |||||

Accrued expenses and other current liabilities | 550 | 514 | |||||

Accrued compensation and benefits | 123 | 129 | |||||

Total current liabilities | 1,073 | 924 | |||||

Long-term debt | 1,446 | 1,445 | |||||

Other long-term liabilities | 1,530 | 1,472 | |||||

Total liabilities | 4,049 | 3,841 | |||||

Commitments and contingencies (see Note 11) | |||||||

Redeemable noncontrolling interest in preferred shares of a subsidiary | 9 | — | |||||

EQUITY: | |||||||

Preferred stock, $0.01 par value per share, 10,000,000 shares authorized and none outstanding at June 30, 2017 and December 31, 2016 | — | — | |||||

Class A common stock, $0.01 par value per share, 1,000,000,000 shares authorized, 39,422,221 issued and outstanding at June 30, 2017, and Class B common stock, $0.01 par value per share, 422,318,251 shares authorized, 86,090,839 shares issued and outstanding at June 30, 2017. Class A common stock, $0.01 par value per share, 1,000,000,000 shares authorized, 39,952,061 issued and outstanding at December 31, 2016, and Class B common stock, $0.01 par value per share, 422,857,621 shares authorized, 90,863,209 shares issued and outstanding at December 31, 2016 | 1 | 1 | |||||

Additional paid-in capital | 1,358 | 1,686 | |||||

Retained earnings | 2,650 | 2,493 | |||||

Accumulated other comprehensive loss | (172 | ) | (277 | ) | |||

Total stockholders’ equity | 3,837 | 3,903 | |||||

Noncontrolling interests in consolidated subsidiaries | 6 | 5 | |||||

Total equity | 3,843 | 3,908 | |||||

TOTAL LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND EQUITY | $ | 7,901 | $ | 7,749 | |||

Six Months Ended | |||||||

June 30, 2017 | June 30, 2016 | ||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||

Net income | $ | 157 | $ | 101 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 182 | 167 | |||||

(Gains) losses on sales of real estate | (34 | ) | 21 | ||||

Realized losses from marketable securities | 40 | — | |||||

Working capital changes and other | (26 | ) | (50 | ) | |||

Net cash provided by operating activities | 319 | 239 | |||||

CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||

Purchases of marketable securities and short-term investments | (251 | ) | (226 | ) | |||

Proceeds from marketable securities and short-term investments | 252 | 232 | |||||

Contributions to investments | (23 | ) | (17 | ) | |||

Return of investments | 200 | 52 | |||||

Acquisitions, net of cash acquired | (243 | ) | (238 | ) | |||

Capital expenditures | (133 | ) | (85 | ) | |||

Proceeds from sales of real estate, net of cash disposed | 296 | 240 | |||||

Sales proceeds transferred to escrow as restricted cash | (267 | ) | — | ||||

Other investing activities | (13 | ) | 19 | ||||

Net cash used in investing activities | (182 | ) | (23 | ) | |||

CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

Proceeds from debt, net of issuance costs of $- and $4, respectively | 420 | 519 | |||||

Repayments of debt | (295 | ) | (428 | ) | |||

Repurchase of common stock | (348 | ) | (131 | ) | |||

Proceeds from redeemable noncontrolling interest in preferred shares of a subsidiary | 9 | — | |||||

Other financing activities | (7 | ) | (7 | ) | |||

Net cash used in financing activities | (221 | ) | (47 | ) | |||

EFFECT OF EXCHANGE RATE CHANGES ON CASH | 2 | 16 | |||||

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | (82 | ) | 185 | ||||

CASH AND CASH EQUIVALENTS—BEGINNING OF YEAR | 482 | 457 | |||||

CASH AND CASH EQUIVALENTS—END OF PERIOD | $ | 400 | $ | 642 | |||

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||||

Cash paid during the period for interest | $ | 40 | $ | 37 | |||

Cash paid during the period for income taxes | $ | 63 | $ | 28 | |||

Non-cash investing and financing activities are as follows: | |||||||

Change in accrued capital expenditures | $ | 23 | $ | 6 | |||

June 30, 2017 | December 31, 2016 | ||||||

Equity method investments | $ | 175 | $ | 180 | |||

Cost method investments | 6 | 6 | |||||

Total investments | $ | 181 | $ | 186 | |||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Total revenues | $ | 179 | $ | 342 | $ | 453 | $ | 626 | |||||||

Gross operating profit | 67 | 132 | 145 | 202 | |||||||||||

Income (loss) from continuing operations | 16 | 58 | (2 | ) | 78 | ||||||||||

Net income (loss) | 16 | 58 | (2 | ) | 78 | ||||||||||

June 30, 2017 | December 31, 2016 | ||||||

Loyalty program | $ | 400 | $ | 394 | |||

Deferred compensation plans held in rabbi trusts (Note 9) | 377 | 352 | |||||

Captive insurance companies | 72 | 65 | |||||

Total marketable securities held to fund operating programs | $ | 849 | $ | 811 | |||

Less current portion of marketable securities held to fund operating programs included in cash and cash equivalents, short-term investments, and prepaids and other assets | (116 | ) | (109 | ) | |||

Marketable securities held to fund operating programs included in other assets | $ | 733 | $ | 702 | |||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Loyalty program | $ | 1 | $ | 2 | $ | 1 | $ | 3 | |||||||

Deferred compensation plans held in rabbi trusts | 9 | 5 | 24 | 5 | |||||||||||

Total net gains and interest income from marketable securities held to fund operating programs | $ | 10 | $ | 7 | $ | 25 | $ | 8 | |||||||

June 30, 2017 | December 31, 2016 | ||||||

Interest bearing money market funds | $ | 57 | $ | 106 | |||

Time deposits | 45 | 45 | |||||

Preferred shares | — | 290 | |||||

Common shares | 145 | — | |||||

Total marketable securities held for investment purposes | $ | 247 | $ | 441 | |||

Less current portion of marketable securities held for investment purposes included in cash and cash equivalents and short-term investments | (102 | ) | (151 | ) | |||

Marketable securities held for investment purposes included in other assets | $ | 145 | $ | 290 | |||

June 30, 2017 | Cash and cash equivalents | Short-term investments | Prepaids and other assets | Other assets | |||||||||||||||

Level One - Quoted Prices in Active Markets for Identical Assets | |||||||||||||||||||

Interest bearing money market funds | $ | 67 | $ | 67 | $ | — | $ | — | $ | — | |||||||||

Mutual funds | 377 | — | — | — | 377 | ||||||||||||||

Common shares | 145 | — | — | — | 145 | ||||||||||||||

Level Two - Significant Other Observable Inputs | |||||||||||||||||||

Time deposits | 58 | — | 46 | — | 12 | ||||||||||||||

U.S. government obligations | 150 | — | — | 38 | 112 | ||||||||||||||

U.S. government agencies | 48 | — | 1 | 8 | 39 | ||||||||||||||

Corporate debt securities | 190 | — | 4 | 38 | 148 | ||||||||||||||

Mortgage-backed securities | 18 | — | — | 5 | 13 | ||||||||||||||

Asset-backed securities | 40 | — | — | 10 | 30 | ||||||||||||||

Municipal and provincial notes and bonds | 3 | — | — | 1 | 2 | ||||||||||||||

Total | $ | 1,096 | $ | 67 | $ | 51 | $ | 100 | $ | 878 | |||||||||

December 31, 2016 | Cash and cash equivalents | Short-term investments | Prepaids and other assets | Other assets | |||||||||||||||

Level One - Quoted Prices in Active Markets for Identical Assets | |||||||||||||||||||

Interest bearing money market funds | $ | 114 | $ | 114 | $ | — | $ | — | $ | — | |||||||||

Mutual funds | 352 | — | — | — | 352 | ||||||||||||||

Level Two - Significant Other Observable Inputs | |||||||||||||||||||

Time deposits | 59 | — | 46 | — | 13 | ||||||||||||||

U.S. government obligations | 142 | — | — | 33 | 109 | ||||||||||||||

U.S. government agencies | 53 | — | 9 | 8 | 36 | ||||||||||||||

Corporate debt securities | 181 | — | 1 | 35 | 145 | ||||||||||||||

Mortgage-backed securities | 22 | — | — | 5 | 17 | ||||||||||||||

Asset-backed securities | 34 | — | — | 8 | 26 | ||||||||||||||

Municipal and provincial notes and bonds | 5 | — | — | 1 | 4 | ||||||||||||||

Level Three - Significant Unobservable Inputs | |||||||||||||||||||

Preferred shares | 290 | — | — | — | 290 | ||||||||||||||

Total | $ | 1,252 | $ | 114 | $ | 56 | $ | 90 | $ | 992 | |||||||||

2017 | 2016 | ||||||

Fair value at January 1 | $ | 290 | $ | 335 | |||

Gross unrealized losses | (54 | ) | (7 | ) | |||

Realized losses | (40 | ) | — | ||||

Interest income | 94 | — | |||||

Cash redemption | (290 | ) | — | ||||

Fair value at March 31 | $ | — | $ | 328 | |||

Gross unrealized gains | — | 19 | |||||

Fair value at June 30 | $ | — | $ | 347 | |||

June 30, 2017 | December 31, 2016 | ||||||

Unsecured financing to hotel owners | $ | 124 | $ | 119 | |||

Less allowance for losses | (105 | ) | (100 | ) | |||

Total long-term financing receivables, net | $ | 19 | $ | 19 | |||

2017 | 2016 | ||||||

Allowance at January 1 | $ | 100 | $ | 98 | |||

Provisions | 2 | 1 | |||||

Other adjustments | 1 | 1 | |||||

Allowance at March 31 | $ | 103 | $ | 100 | |||

Provisions | 2 | 3 | |||||

Allowance at June 30 | $ | 105 | $ | 103 | |||

June 30, 2017 | |||||||||||||||

Gross loan balance (principal and interest) | Related allowance | Net financing receivables | Gross receivables on non-accrual status | ||||||||||||

Loans | $ | 13 | $ | — | $ | 13 | $ | — | |||||||

Impaired loans (1) | 59 | (59 | ) | — | 59 | ||||||||||

Total loans | 72 | (59 | ) | 13 | 59 | ||||||||||

Other financing arrangements | 52 | (46 | ) | 6 | 46 | ||||||||||

Total unsecured financing receivables | $ | 124 | $ | (105 | ) | $ | 19 | $ | 105 | ||||||

December 31, 2016 | |||||||||||||||

Gross loan balance (principal and interest) | Related allowance | Net financing receivables | Gross receivables on non-accrual status | ||||||||||||

Loans | $ | 13 | $ | — | $ | 13 | $ | — | |||||||

Impaired loans (2) | 56 | (56 | ) | — | 56 | ||||||||||

Total loans | 69 | (56 | ) | 13 | 56 | ||||||||||

Other financing arrangements | 50 | (44 | ) | 6 | 44 | ||||||||||

Total unsecured financing receivables | $ | 119 | $ | (100 | ) | $ | 19 | $ | 100 | ||||||

Current assets, net of cash acquired | $ | 2 | |

Property and equipment | 173 | ||

Indefinite-lived intangibles (1) | 37 | ||

Management agreement intangibles (2) | 14 | ||

Goodwill (3) | 17 | ||

Other definite-lived intangibles (4) | 7 | ||

Total assets | $ | 250 | |

Current liabilities | $ | 11 | |

Deferred tax liabilities | 3 | ||

Total liabilities | 14 | ||

Total net assets acquired attributable to Hyatt Hotels Corporation | 236 | ||

Total net assets acquired attributable to noncontrolling interests | 1 | ||

Total net assets acquired | $ | 237 | |

June 30, 2017 | Weighted- average useful lives in years | December 31, 2016 | ||||||||

Management and franchise agreement intangibles | $ | 630 | 25 | $ | 589 | |||||

Lease related intangibles | 121 | 111 | 115 | |||||||

Brand and other indefinite-lived intangibles | 53 | — | 16 | |||||||

Advanced bookings intangibles | 12 | 6 | 11 | |||||||

Other definite-lived intangibles | 9 | 11 | 6 | |||||||

825 | 737 | |||||||||

Accumulated amortization | (154 | ) | (138 | ) | ||||||

Intangibles, net | $ | 671 | $ | 599 | ||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Amortization expense | $ | 8 | $ | 6 | $ | 15 | $ | 13 | |||||||

June 30, 2017 | |||||||||||||||||||

Carrying value | Fair value | Quoted prices in active markets for identical assets (level one) | Significant other observable inputs (level two) | Significant unobservable inputs (level three) | |||||||||||||||

Debt (1) | $ | 1,688 | $ | 1,794 | $ | — | $ | 1,473 | $ | 321 | |||||||||

December 31, 2016 | |||||||||||||||||||

Carrying value | Fair value | Quoted prices in active markets for identical assets (level one) | Significant other observable inputs (level two) | Significant unobservable inputs (level three) | |||||||||||||||

Debt (2) | $ | 1,565 | $ | 1,642 | $ | — | $ | 1,450 | $ | 192 | |||||||||

June 30, 2017 | December 31, 2016 | ||||||

Deferred gains on sales of hotel properties | $ | 378 | $ | 363 | |||

Deferred compensation plans (Note 4) | 377 | 352 | |||||

Loyalty program liability | 292 | 296 | |||||

Guarantee liabilities (Note 11) | 118 | 124 | |||||

Other | 365 | 337 | |||||

Total other long-term liabilities | $ | 1,530 | $ | 1,472 | |||

The four managed hotels in France | Other performance guarantees | All performance guarantees | ||||||||||||||||||||||

2017 | 2016 | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||

Beginning balance, January 1 | $ | 66 | $ | 93 | $ | 13 | $ | 4 | $ | 79 | $ | 97 | ||||||||||||

Amortization of initial guarantee obligation liability into income | (3 | ) | (8 | ) | (1 | ) | — | (4 | ) | (8 | ) | |||||||||||||

Performance guarantee expense, net | 26 | 19 | — | — | 26 | 19 | ||||||||||||||||||

Net payments during the period | (22 | ) | (14 | ) | (4 | ) | (1 | ) | (26 | ) | (15 | ) | ||||||||||||

Foreign currency exchange, net | 2 | 4 | — | — | 2 | 4 | ||||||||||||||||||

Ending balance, March 31 | $ | 69 | $ | 94 | $ | 8 | $ | 3 | $ | 77 | $ | 97 | ||||||||||||

Initial guarantee obligation liability upon inception | — | — | 3 | — | 3 | — | ||||||||||||||||||

Amortization of initial guarantee obligation liability into income | (4 | ) | (9 | ) | (1 | ) | — | (5 | ) | (9 | ) | |||||||||||||

Performance guarantee expense (income), net | 15 | 10 | (1 | ) | (2 | ) | 14 | 8 | ||||||||||||||||

Net (payments) receipts during the period | (27 | ) | (20 | ) | 3 | 1 | (24 | ) | (19 | ) | ||||||||||||||

Foreign currency exchange, net | 4 | (1 | ) | — | — | 4 | (1 | ) | ||||||||||||||||

Ending balance, June 30 | $ | 57 | $ | 74 | $ | 12 | $ | 2 | $ | 69 | $ | 76 | ||||||||||||

Property Description | Maximum potential future payments | Maximum exposure net of recoverability from third parties | Other long-term liabilities recorded at June 30, 2017 | Other long-term liabilities recorded at December 31, 2016 | Year of guarantee expiration | |||||||||||||

Hotel property in Washington State (1), (3), (4), (5) | $ | 215 | $ | — | $ | 30 | $ | 35 | 2020 | |||||||||

Hotel properties in India (2), (3) | 186 | 186 | 19 | 21 | 2020 | |||||||||||||

Hotel property in Brazil (1) | 80 | 40 | 3 | 3 | 2020 | |||||||||||||

Hotel property in Minnesota | 25 | 25 | 2 | 2 | 2021 | |||||||||||||

Hotel property in Arizona (1), (4) | 25 | — | 2 | 2 | 2019 | |||||||||||||

Hotel properties in California (1) | 31 | 13 | 6 | 6 | various, through 2021 | |||||||||||||

Other (1) | 36 | 14 | 3 | — | various, through 2021 | |||||||||||||

Total | $ | 598 | $ | 278 | $ | 65 | $ | 69 | ||||||||||

Stockholders' equity | Noncontrolling interests in consolidated subsidiaries | Total equity | |||||||||

Balance at January 1, 2017 | $ | 3,903 | $ | 5 | $ | 3,908 | |||||

Net income | 157 | — | 157 | ||||||||

Other comprehensive income | 105 | — | 105 | ||||||||

Contributions from noncontrolling interests | — | 1 | 1 | ||||||||

Repurchase of common stock | (348 | ) | — | (348 | ) | ||||||

Directors compensation | 2 | — | 2 | ||||||||

Employee stock plan issuance | 2 | — | 2 | ||||||||

Share-based payment activity | 16 | — | 16 | ||||||||

Balance at June 30, 2017 | $ | 3,837 | $ | 6 | $ | 3,843 | |||||

Stockholders' equity | Noncontrolling interests in consolidated subsidiaries | Total equity | |||||||||

Balance at January 1, 2016 | $ | 3,991 | $ | 4 | $ | 3,995 | |||||

Net income | 101 | — | 101 | ||||||||

Other comprehensive income | 23 | — | 23 | ||||||||

Repurchase of common stock | (131 | ) | — | (131 | ) | ||||||

Directors compensation | 2 | — | 2 | ||||||||

Employee stock plan issuance | 2 | — | 2 | ||||||||

Share-based payment activity | 16 | — | 16 | ||||||||

Balance at June 30, 2016 | $ | 4,004 | $ | 4 | $ | 4,008 | |||||

Balance at April 1, 2017 | Current period other comprehensive income before reclassification | Amount reclassified from accumulated other comprehensive loss | Balance at June 30, 2017 | ||||||||||||

Foreign currency translation adjustments | $ | (258 | ) | $ | 19 | $ | — | $ | (239 | ) | |||||

Unrealized gains on AFS securities | 67 | 11 | — | 78 | |||||||||||

Unrecognized pension cost | (7 | ) | — | — | (7 | ) | |||||||||

Unrealized losses on derivative instruments | (4 | ) | — | — | (4 | ) | |||||||||

Accumulated other comprehensive income (loss) | $ | (202 | ) | $ | 30 | $ | — | $ | (172 | ) | |||||

Balance at January 1, 2017 | Current period other comprehensive income before reclassification | Amount reclassified from accumulated other comprehensive loss | Balance at June 30, 2017 | ||||||||||||

Foreign currency translation adjustments | $ | (299 | ) | $ | 60 | $ | — | $ | (239 | ) | |||||

Unrealized gains on AFS securities | 33 | 45 | — | 78 | |||||||||||

Unrecognized pension cost | (7 | ) | — | — | (7 | ) | |||||||||

Unrealized losses on derivative instruments | (4 | ) | — | — | (4 | ) | |||||||||

Accumulated other comprehensive income (loss) | $ | (277 | ) | $ | 105 | $ | — | $ | (172 | ) | |||||

Balance at April 1, 2016 | Current period other comprehensive income (loss) before reclassification | Amount reclassified from accumulated other comprehensive loss | Balance at June 30, 2016 | ||||||||||||

Foreign currency translation adjustments | $ | (233 | ) | $ | (9 | ) | $ | — | $ | (242 | ) | ||||

Unrealized gains on AFS securities | 35 | 12 | — | 47 | |||||||||||

Unrecognized pension cost | (7 | ) | — | — | (7 | ) | |||||||||

Unrealized losses on derivative instruments | (5 | ) | — | — | (5 | ) | |||||||||

Accumulated other comprehensive income (loss) | $ | (210 | ) | $ | 3 | $ | — | $ | (207 | ) | |||||

Balance at January 1, 2016 | Current period other comprehensive income before reclassification | Amount reclassified from accumulated other comprehensive loss | Balance at June 30, 2016 | ||||||||||||

Foreign currency translation adjustments | $ | (257 | ) | $ | 15 | $ | — | $ | (242 | ) | |||||

Unrealized gains on AFS securities | 39 | 8 | — | 47 | |||||||||||

Unrecognized pension cost | (7 | ) | — | — | (7 | ) | |||||||||

Unrealized losses on derivative instruments | (5 | ) | — | — | (5 | ) | |||||||||

Accumulated other comprehensive income (loss) | $ | (230 | ) | $ | 23 | $ | — | $ | (207 | ) | |||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

SARs | $ | 1 | $ | 1 | $ | 9 | $ | 8 | |||||||

RSUs | 3 | 3 | 11 | 11 | |||||||||||

PSUs and PSs | 1 | — | 1 | 1 | |||||||||||

Total stock-based compensation recorded within selling, general, and administrative expenses | $ | 5 | $ | 4 | $ | 21 | $ | 20 | |||||||

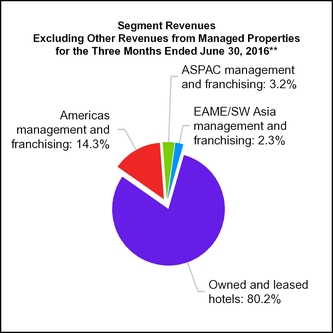

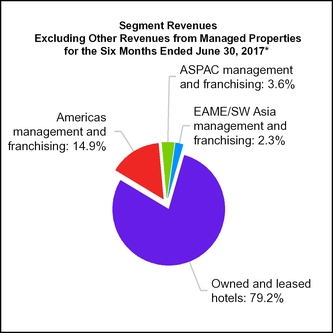

• | Owned and leased hotels—This segment derives its earnings from owned and leased hotel properties located predominantly in the United States but also in certain international locations and for purposes of segment Adjusted EBITDA, includes our pro rata share of the Adjusted EBITDA of our unconsolidated hospitality ventures, based on our ownership percentage of each venture. Adjusted EBITDA includes intercompany expenses related to management fees paid to the Company's management and franchising segments, which are eliminated in consolidation. Intersegment revenues relate to promotional award redemptions at our owned and leased hotels related to our co-branded credit card, which are eliminated in consolidation. |

• | Americas management and franchising—This segment derives its earnings primarily from a combination of hotel management and licensing of our portfolio of brands to franchisees located in the United States, Latin America, Canada and the Caribbean. This segment's revenues also include the reimbursement of costs incurred on behalf of managed hotel property owners and franchisees with no added margin. These costs relate primarily to payroll costs at managed properties where the Company is the employer. These revenues and costs are recorded within other revenues from managed properties and other costs from managed properties, respectively. The intersegment revenues relate to management fees earned from the Company's owned hotels, which are eliminated in consolidation. |

• | ASPAC management and franchising—This segment derives its earnings primarily from a combination of hotel management and licensing of our portfolio of brands to franchisees located in Southeast Asia, as well as Greater China, Australia, South Korea, Japan and Micronesia. This segment's revenues also include the reimbursement of costs incurred on behalf of managed hotel property owners and franchisees with no added margin. These costs relate primarily to reservations, marketing and technology costs. These revenues and costs are recorded within other revenues from managed properties and other costs from managed properties, respectively. The intersegment revenues relate to management fees earned from the Company's owned hotels, which are eliminated in consolidation. |

• | EAME/SW Asia management and franchising—This segment derives its earnings primarily from a combination of hotel management and licensing of our portfolio of brands to franchisees located in Europe, Africa, the Middle East, India, Central Asia and Nepal. This segment's revenues also include the reimbursement of costs incurred on behalf of managed hotel property owners and franchisees with no added margin. These costs relate primarily to reservations, marketing and technology costs. These revenues and costs are recorded within other revenues from managed properties and other costs from managed properties, respectively. The intersegment revenues relate to management fees earned from the Company's owned hotels, which are eliminated in consolidation. |

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Owned and leased hotels | |||||||||||||||

Owned and leased hotels revenues | $ | 562 | $ | 559 | $ | 1,120 | $ | 1,075 | |||||||

Other revenues | — | — | 13 | — | |||||||||||

Intersegment revenues (a) | 2 | — | 4 | — | |||||||||||

Adjusted EBITDA | 136 | 149 | 279 | 280 | |||||||||||

Depreciation and amortization | 73 | 72 | 147 | 140 | |||||||||||

Americas management and franchising | |||||||||||||||

Management and franchise fees revenues | 109 | 100 | 213 | 191 | |||||||||||

Other revenues from managed properties | 431 | 436 | 859 | 857 | |||||||||||

Intersegment revenues (a) | 21 | 21 | 43 | 41 | |||||||||||

Adjusted EBITDA | 97 | 89 | 187 | 165 | |||||||||||

Depreciation and amortization | 4 | 4 | 9 | 9 | |||||||||||

ASPAC management and franchising | |||||||||||||||

Management and franchise fees revenues | 27 | 22 | 52 | 44 | |||||||||||

Other revenues from managed properties | 26 | 27 | 52 | 48 | |||||||||||

Intersegment revenues (a) | 1 | — | 1 | — | |||||||||||

Adjusted EBITDA | 16 | 12 | 31 | 24 | |||||||||||

Depreciation and amortization | 1 | 1 | 1 | 1 | |||||||||||

EAME/SW Asia management and franchising | |||||||||||||||

Management and franchise fees revenues | 17 | 16 | 33 | 32 | |||||||||||

Other revenues from managed properties | 16 | 17 | 33 | 32 | |||||||||||

Intersegment revenues (a) | 2 | 4 | 4 | 6 | |||||||||||

Adjusted EBITDA | 9 | 8 | 17 | 16 | |||||||||||

Depreciation and amortization | 2 | 2 | 3 | 3 | |||||||||||

Corporate and other | |||||||||||||||

Revenues | 33 | 13 | 59 | 22 | |||||||||||

Adjusted EBITDA | (29 | ) | (31 | ) | (58 | ) | (64 | ) | |||||||

Depreciation and amortization | 11 | 7 | 22 | 14 | |||||||||||

Eliminations | |||||||||||||||

Revenues (a) | (26 | ) | (25 | ) | (52 | ) | (47 | ) | |||||||

Adjusted EBITDA (b) | — | — | 1 | — | |||||||||||

Depreciation and amortization | — | — | — | — | |||||||||||

TOTAL | |||||||||||||||

Revenues | $ | 1,195 | $ | 1,165 | $ | 2,382 | $ | 2,254 | |||||||

Adjusted EBITDA | 229 | 227 | 457 | 421 | |||||||||||

Depreciation and amortization | 91 | 86 | 182 | 167 | |||||||||||

(a) | Intersegment revenues are included in the management and franchise fees revenues and owned and leased hotels revenues and are eliminated in Eliminations. |

(b) | Includes expenses recorded by our owned and leased hotels related to billings for depreciation of technology-related capital assets. |

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Net income attributable to Hyatt Hotels Corporation | $ | 87 | $ | 67 | $ | 157 | $ | 101 | |||||||

Interest expense | 20 | 20 | 41 | 37 | |||||||||||

Provision for income taxes | 45 | 21 | 86 | 37 | |||||||||||

Depreciation and amortization | 91 | 86 | 182 | 167 | |||||||||||

EBITDA | 243 | 194 | 466 | 342 | |||||||||||

Equity (earnings) losses from unconsolidated hospitality ventures | (1 | ) | (19 | ) | 2 | (21 | ) | ||||||||

Stock-based compensation expense (Note 13) | 5 | 4 | 21 | 20 | |||||||||||

(Gains) losses on sales of real estate (Note 6) | (34 | ) | 21 | (34 | ) | 21 | |||||||||

Other (income) loss, net (Note 17) | (2 | ) | (1 | ) | (42 | ) | 3 | ||||||||

Pro rata share of unconsolidated hospitality ventures Adjusted EBITDA | 18 | 28 | 44 | 56 | |||||||||||

Adjusted EBITDA | $ | 229 | $ | 227 | $ | 457 | $ | 421 | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Numerator: | |||||||||||||||

Net income | $ | 87 | $ | 67 | $ | 157 | $ | 101 | |||||||

Net income and accretion attributable to noncontrolling interests | — | — | — | — | |||||||||||

Net income attributable to Hyatt Hotels Corporation | $ | 87 | $ | 67 | $ | 157 | $ | 101 | |||||||

Denominator: | |||||||||||||||

Basic weighted average shares outstanding | 125,504,276 | 133,991,118 | 127,614,404 | 134,560,660 | |||||||||||

Share-based compensation and equity-classified forward contract under the 2017 ASR | 1,300,290 | 904,836 | 1,279,859 | 848,400 | |||||||||||

Diluted weighted average shares outstanding | 126,804,566 | 134,895,954 | 128,894,263 | 135,409,060 | |||||||||||

Basic Earnings Per Share: | |||||||||||||||

Net income | $ | 0.69 | $ | 0.50 | $ | 1.23 | $ | 0.75 | |||||||

Net income and accretion attributable to noncontrolling interests | — | — | — | — | |||||||||||

Net income attributable to Hyatt Hotels Corporation | $ | 0.69 | $ | 0.50 | $ | 1.23 | $ | 0.75 | |||||||

Diluted Earnings Per Share: | |||||||||||||||

Net income | $ | 0.68 | $ | 0.49 | $ | 1.22 | $ | 0.74 | |||||||

Net income and accretion attributable to noncontrolling interests | — | — | — | — | |||||||||||

Net income attributable to Hyatt Hotels Corporation | $ | 0.68 | $ | 0.49 | $ | 1.22 | $ | 0.74 | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||

SARs | 49,900 | 117,930 | 41,100 | 4,501 | |||||||

RSUs | — | 14,089 | — | 10,946 | |||||||

Equity-classified forward contract under the 2017 ASR | 16,200 | — | — | — | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Interest income (Note 4) | $ | 2 | $ | 2 | $ | 97 | $ | 3 | |||||||

Depreciation recovery | 6 | 6 | 12 | 11 | |||||||||||

Performance guarantee liability amortization (Note 11) | 5 | 9 | 9 | 17 | |||||||||||

Foreign currency gains, net | — | 3 | — | 3 | |||||||||||

Performance guarantee expense, net (Note 11) | (14 | ) | (8 | ) | (40 | ) | (27 | ) | |||||||

Realized losses (Note 4) | — | — | (40 | ) | — | ||||||||||

Debt settlement costs (Note 8) | — | (3 | ) | — | (3 | ) | |||||||||

Other | 3 | (8 | ) | 4 | (7 | ) | |||||||||

Other income (loss), net | $ | 2 | $ | 1 | $ | 42 | $ | (3 | ) | ||||||

• | 290 managed properties (94,382 rooms), all of which we operate under management agreements with third-party property owners; |

• | 326 franchised properties (53,629 rooms), all of which are owned by third parties that have franchise agreements with us and are operated by third parties; |

• | 33 owned properties (16,802 rooms) (including 1 consolidated hospitality venture), 1 capital leased property (171 rooms), and 7 operating leased properties (2,411 rooms), all of which we manage; and |

• | 23 managed properties and 6 franchised properties owned or leased by unconsolidated hospitality ventures (8,231 rooms). |

• | 3 destination wellness resorts (421 rooms), all of which we own and operate (including 1 consolidated hospitality venture); |

• | 6 all inclusive resorts (2,401 rooms), all of which are owned by a third party in which we hold a common share investment and which operates the resorts under franchise agreements with us; |

• | 16 vacation ownership properties (1,038 units), all of which are licensed by Interval Leisure Group ("ILG") under the Hyatt Residence Club brand and operated by third parties, including ILG and its affiliates; and |

• | 20 residential properties (2,562 units), which consist of branded residences and serviced apartments. We manage all of the serviced apartments and those branded residential units that participate in a rental program with an adjacent Hyatt-branded hotel. |

• | Owned and leased hotels, which consists of our owned and leased full service and select service hotels and, for purposes of segment Adjusted EBITDA, our pro rata share of the Adjusted EBITDA of our unconsolidated hospitality ventures, based on our ownership percentage of each venture; |

• | Americas management and franchising, which consists of our management and franchising of properties located in the United States, Latin America, Canada and the Caribbean; |

• | ASPAC management and franchising, which consists of our management and franchising of properties located in Southeast Asia, as well as Greater China, Australia, South Korea, Japan and Micronesia; and |

• | EAME/SW Asia management and franchising, which consists of our management and franchising of properties located in Europe, Africa, the Middle East, India, Central Asia and Nepal. |

• | sold Hyatt Regency Grand Cypress for a net sales price of $202 million and entered into a long-term management agreement with the purchaser of the hotel; and |

• | sold Hyatt Regency Louisville for a net sales price of $65 million and entered into a long-term franchise agreement with the purchaser of the hotel. |

RevPAR | ||||||||||||||||

Three Months Ended June 30, | ||||||||||||||||

(Comparable Locations) | Number of Comparable Hotels (1) | 2017 | 2016 | Change | Change (in constant $) | |||||||||||

Systemwide hotels | 595 | $ | 143 | $ | 140 | 2.4 | % | 2.9 | % | |||||||

Owned and leased hotels | 37 | $ | 179 | $ | 182 | (1.7 | )% | (1.2 | )% | |||||||

Americas full service hotels | 153 | $ | 165 | $ | 163 | 1.4 | % | 1.6 | % | |||||||

Americas select service hotels | 298 | $ | 115 | $ | 113 | 1.8 | % | 1.8 | % | |||||||

ASPAC full service hotels | 70 | $ | 143 | $ | 136 | 5.4 | % | 7.2 | % | |||||||

EAME/SW Asia full service hotels | 63 | $ | 123 | $ | 119 | 3.3 | % | 5.1 | % | |||||||

EAME/SW Asia select service hotels | 10 | $ | 67 | $ | 58 | 16.9 | % | 17.2 | % | |||||||

Three Months Ended June 30, | ||||||||||||||||||

2017 | 2016 | Better / (Worse) | Currency Impact | |||||||||||||||

Comparable owned and leased hotels revenues | $ | 500 | $ | 512 | $ | (12 | ) | (2.4 | )% | $ | (2 | ) | ||||||

Non-comparable owned and leased hotels revenues | 77 | 47 | 30 | 63.6 | % | (1 | ) | |||||||||||

Total owned and leased hotels revenues | $ | 577 | $ | 559 | $ | 18 | 3.2 | % | $ | (3 | ) | |||||||

Six Months Ended June 30, | ||||||||||||||||||

2017 | 2016 | Better / (Worse) | Currency Impact | |||||||||||||||

Comparable owned and leased hotels revenues | $ | 982 | $ | 989 | $ | (7 | ) | (0.7 | )% | $ | (6 | ) | ||||||

Non-comparable owned and leased hotels revenues | 167 | 86 | 81 | 93.5 | % | (1 | ) | |||||||||||

Total owned and leased hotels revenues | $ | 1,149 | $ | 1,075 | $ | 74 | 6.9 | % | $ | (7 | ) | |||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Base management fees | $ | 52 | $ | 49 | $ | 3 | 5.4 | % | ||||||

Incentive management fees | 34 | 30 | 4 | 11.5 | % | |||||||||

Franchise fees | 29 | 27 | 2 | 8.3 | % | |||||||||

Other fee revenues | 15 | 9 | 6 | 60.2 | % | |||||||||

Total management and franchise fees | $ | 130 | $ | 115 | $ | 15 | 12.0 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Base management fees | $ | 99 | $ | 94 | $ | 5 | 5.1 | % | ||||||

Incentive management fees | 69 | 60 | 9 | 14.3 | % | |||||||||

Franchise fees | 56 | 50 | 6 | 11.9 | % | |||||||||

Other fee revenues | 28 | 18 | 10 | 53.8 | % | |||||||||

Total management and franchise fees | $ | 252 | $ | 222 | $ | 30 | 13.1 | % | ||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Change | ||||||||||||

Other revenues from managed properties | $ | 473 | $ | 480 | $ | (7 | ) | (1.0 | )% | |||||

Less: rabbi trust impact | (4 | ) | (2 | ) | (2 | ) | (77.9 | )% | ||||||

Other revenues from managed properties excluding rabbi trust impact | $ | 469 | $ | 478 | $ | (9 | ) | (1.5 | )% | |||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Change | ||||||||||||

Other revenues from managed properties | $ | 944 | $ | 937 | $ | 7 | 0.9 | % | ||||||

Less: rabbi trust impact | (11 | ) | (2 | ) | (9 | ) | (415.4 | )% | ||||||

Other revenues from managed properties excluding rabbi trust impact | $ | 933 | $ | 935 | $ | (2 | ) | (0.1 | )% | |||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Comparable owned and leased hotels expense | $ | 369 | $ | 371 | $ | 2 | 0.7 | % | ||||||

Non-comparable owned and leased hotels expense | 60 | 41 | (19 | ) | (46.2 | )% | ||||||||

Rabbi trust impact | 1 | 1 | — | (77.9 | )% | |||||||||

Total owned and leased hotels expense | $ | 430 | $ | 413 | $ | (17 | ) | (4.1 | )% | |||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Comparable owned and leased hotels expense | $ | 730 | $ | 728 | $ | (2 | ) | (0.2 | )% | |||||

Non-comparable owned and leased hotels expense | 123 | 73 | (50 | ) | (70.0 | )% | ||||||||

Rabbi trust impact | 4 | 1 | (3 | ) | (415.4 | )% | ||||||||

Total owned and leased hotels expense | $ | 857 | $ | 802 | $ | (55 | ) | (6.9 | )% | |||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Change | ||||||||||||

Selling, general, and administrative expenses | $ | 90 | $ | 75 | $ | 15 | 20.8 | % | ||||||

Less: rabbi trust impact | (8 | ) | (4 | ) | (4 | ) | (80.3 | )% | ||||||

Less: stock-based compensation expense | (5 | ) | (4 | ) | (1 | ) | (43.3 | )% | ||||||

Adjusted selling, general, and administrative expenses | $ | 77 | $ | 67 | $ | 10 | 15.7 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Change | ||||||||||||

Selling, general, and administrative expenses | $ | 189 | $ | 163 | $ | 26 | 15.9 | % | ||||||

Less: rabbi trust impact | (20 | ) | (4 | ) | (16 | ) | (386.5 | )% | ||||||

Less: stock-based compensation expense | (21 | ) | (20 | ) | (1 | ) | (5.4 | )% | ||||||

Adjusted selling, general, and administrative expenses | $ | 148 | $ | 139 | $ | 9 | 6.4 | % | ||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Rabbi trust impact allocated to selling, general, and administrative expenses | $ | 8 | $ | 4 | $ | 4 | 80.3 | % | ||||||

Rabbi trust impact allocated to owned and leased hotels expense | 1 | 1 | — | 77.9 | % | |||||||||

Net gains and interest income from marketable securities held to fund our loyalty program allocated to owned and leased hotels revenues | 1 | 2 | (1 | ) | (47.2 | )% | ||||||||

Net gains and interest income from marketable securities held to fund operating programs | $ | 10 | $ | 7 | $ | 3 | 56.6 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Rabbi trust impact allocated to selling, general, and administrative expenses | $ | 20 | $ | 4 | $ | 16 | 386.5 | % | ||||||

Rabbi trust impact allocated to owned and leased hotels expense | 4 | 1 | 3 | 415.4 | % | |||||||||

Net gains and interest income from marketable securities held to fund our loyalty program allocated to owned and leased hotels revenues | 1 | 3 | (2 | ) | (60.4 | )% | ||||||||

Net gains and interest income from marketable securities held to fund operating programs | $ | 25 | $ | 8 | $ | 17 | 223.5 | % | ||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Equity earnings (losses) from unconsolidated hospitality ventures | $ | 1 | $ | 19 | $ | (18 | ) | (92.7 | )% | |||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Equity earnings (losses) from unconsolidated hospitality ventures | $ | (2 | ) | $ | 21 | $ | (23 | ) | (106.9 | )% | ||||

• | $7 million and $3 million decreases, respectively, as a result of the Playa business combination with Pace in March 2017 as discussed in Part I, Item 1 "Financial Statements—Note 4 to the Condensed Consolidated Financial Statements." Subsequent to the business combination, our investment ceased to be accounted for as an equity method investment, and we therefore no longer have equity earnings or losses related to our investment; |

• | $6 million decrease in both the three and six months ended June 30, 2017 as 2016 included equity earnings attributable to a distribution from one of our unconsolidated hospitality ventures primarily as a result of its debt refinancing; and |

• | $2 million and $3 million decreases, respectively, due to foreign currency volatility at one of our foreign unconsolidated hospitality ventures which holds loans denominated in a currency other than its functional currency. |

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Income before income taxes | $ | 132 | $ | 88 | $ | 44 | 49.6 | % | ||||||

Provision for income taxes | (45 | ) | (21 | ) | (24 | ) | (106.2 | )% | ||||||

Effective tax rate | 34.1 | % | 24.7 | % | (9.4 | )% | ||||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Income before income taxes | $ | 243 | $ | 138 | $ | 105 | 76.1 | % | ||||||

Provision for income taxes | (86 | ) | (37 | ) | (49 | ) | (128.3 | )% | ||||||

Effective tax rate | 35.3 | % | 27.2 | % | (8.1 | )% | ||||||||

Three Months Ended June 30, | ||||||||||||||||||

2017 | 2016 | Better / (Worse) | Currency Impact | |||||||||||||||

Comparable owned and leased hotels revenues | $ | 502 | $ | 512 | $ | (10 | ) | (1.9 | )% | $ | (2 | ) | ||||||

Non-comparable owned and leased hotels revenues | 60 | 47 | 13 | 26.8 | % | (1 | ) | |||||||||||

Total owned and leased hotels revenues | 562 | 559 | 3 | 0.5 | % | (3 | ) | |||||||||||

Other revenues | — | — | — | — | % | — | ||||||||||||

Total segment revenues | $ | 562 | $ | 559 | $ | 3 | 0.5 | % | $ | (3 | ) | |||||||

Six Months Ended June 30, | ||||||||||||||||||

2017 | 2016 | Better / (Worse) | Currency Impact | |||||||||||||||

Comparable owned and leased hotels revenues | $ | 986 | $ | 989 | $ | (3 | ) | (0.2 | )% | $ | (6 | ) | ||||||

Non-comparable owned and leased hotels revenues | 134 | 86 | 48 | 55.1 | % | (1 | ) | |||||||||||

Total owned and leased hotels revenues | 1,120 | 1,075 | 45 | 4.2 | % | (7 | ) | |||||||||||

Other revenues | 13 | — | 13 | NM | — | |||||||||||||

Total segment revenues | $ | 1,133 | $ | 1,075 | $ | 58 | 5.4 | % | $ | (7 | ) | |||||||

• | the acquisition of our partners' interests in Andaz Maui at Wailea Resort and villas in 2016; |

• | the acquisitions of Royal Palms Resort and Spa and The Confidante Miami Beach in 2016; and |

• | the opening of Grand Hyatt Rio de Janeiro in 2016. |

Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | ||||||||||||||||||||||||||

Comparable owned and leased hotels | $ | 179 | $ | 182 | (1.7 | )% | (1.2 | )% | 79.4 | % | 80.5 | % | (1.1 | )% | $ | 225 | $ | 226 | (0.3 | )% | 0.2 | % | ||||||||||||||

Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | ||||||||||||||||||||||||||

Comparable Owned and Leased Hotels | $ | 176 | $ | 176 | (0.1 | )% | 0.6 | % | 77.3 | % | 77.5 | % | (0.2 | )% | $ | 228 | $ | 227 | 0.2 | % | 0.9 | % | ||||||||||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Owned and leased hotels Adjusted EBITDA | $ | 118 | $ | 121 | $ | (3 | ) | (2.5 | )% | |||||

Pro rata share of unconsolidated hospitality ventures Adjusted EBITDA | 18 | 28 | (10 | ) | (34.8 | )% | ||||||||

Segment Adjusted EBITDA | $ | 136 | $ | 149 | $ | (13 | ) | (8.5 | )% | |||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Owned and leased hotels Adjusted EBITDA | $ | 235 | $ | 224 | $ | 11 | 4.9 | % | ||||||

Pro rata share of unconsolidated hospitality ventures Adjusted EBITDA | 44 | 56 | (12 | ) | (21.5 | )% | ||||||||

Segment Adjusted EBITDA | $ | 279 | $ | 280 | $ | (1 | ) | (0.4 | )% | |||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment revenues | ||||||||||||||

Management, franchise and other fees | $ | 109 | $ | 100 | $ | 9 | 9.2 | % | ||||||

Other revenues from managed properties | 431 | 436 | (5 | ) | (1.0 | )% | ||||||||

Total segment revenues | $ | 540 | $ | 536 | $ | 4 | 0.9 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment revenues | ||||||||||||||

Management, franchise and other fees | $ | 213 | $ | 191 | $ | 22 | 11.5 | % | ||||||

Other revenues from managed properties | 859 | 857 | 2 | 0.3 | % | |||||||||

Total segment revenues | $ | 1,072 | $ | 1,048 | $ | 24 | 2.4 | % | ||||||

Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

(Comparable Systemwide Hotels) | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | |||||||||||||||||||||||||

Americas Full Service | $ | 165 | $ | 163 | 1.4 | % | 1.6 | % | 80.1 | % | 79.9 | % | 0.2 | % | $ | 206 | $ | 204 | 1.2 | % | 1.4 | % | ||||||||||||||

Americas Select Service | $ | 115 | $ | 113 | 1.8 | % | 1.8 | % | 82.3 | % | 81.6 | % | 0.7 | % | $ | 139 | $ | 138 | 1.0 | % | 1.0 | % | ||||||||||||||

Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

(Comparable Systemwide Hotels) | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | |||||||||||||||||||||||||

Americas Full Service | $ | 157 | $ | 152 | 3.2 | % | 3.3 | % | 76.1 | % | 75.6 | % | 0.5 | % | $ | 206 | $ | 202 | 2.4 | % | 2.5 | % | ||||||||||||||

Americas Select Service | $ | 108 | $ | 105 | 2.8 | % | 2.8 | % | 78.2 | % | 77.5 | % | 0.7 | % | $ | 138 | $ | 135 | 1.8 | % | 1.8 | % | ||||||||||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment Adjusted EBITDA | $ | 97 | $ | 89 | $ | 8 | 9.4 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment Adjusted EBITDA | $ | 187 | $ | 165 | $ | 22 | 13.4 | % | ||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment revenues | ||||||||||||||

Management, franchise and other fees | $ | 27 | $ | 22 | $ | 5 | 18.7 | % | ||||||

Other revenues from managed properties | 26 | 27 | (1 | ) | (2.6 | )% | ||||||||

Total segment revenues | $ | 53 | $ | 49 | $ | 4 | 7.1 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment revenues | ||||||||||||||

Management, franchise and other fees | $ | 52 | $ | 44 | $ | 8 | 17.4 | % | ||||||

Other revenues from managed properties | 52 | 48 | 4 | 7.4 | % | |||||||||

Total segment revenues | $ | 104 | $ | 92 | $ | 12 | 12.2 | % | ||||||

Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

(Comparable Systemwide Hotels) | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better (Worse) Constant $ | |||||||||||||||||||||||||

ASPAC Full Service | $ | 143 | $ | 136 | 5.4 | % | 7.2 | % | 72.2 | % | 66.3 | % | 5.9 | % | $ | 198 | $ | 205 | (3.2 | )% | (1.6 | )% | ||||||||||||||

Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

(Comparable Systemwide Hotels) | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better (Worse) Constant $ | |||||||||||||||||||||||||

ASPAC Full Service | $ | 141 | $ | 134 | 5.2 | % | 6.2 | % | 70.5 | % | 64.9 | % | 5.6 | % | $ | 200 | $ | 207 | (3.1 | )% | (2.2 | )% | ||||||||||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment Adjusted EBITDA | $ | 16 | $ | 12 | $ | 4 | 33.0 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment Adjusted EBITDA | $ | 31 | $ | 24 | $ | 7 | 30.3 | % | ||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment revenues | ||||||||||||||

Management, franchise and other fees | $ | 17 | $ | 16 | $ | 1 | 2.1 | % | ||||||

Other revenues from managed properties | 16 | 17 | (1 | ) | (0.2 | )% | ||||||||

Total segment revenues | $ | 33 | $ | 33 | $ | — | 0.9 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment revenues | ||||||||||||||

Management, franchise and other fees | $ | 33 | $ | 32 | $ | 1 | 2.1 | % | ||||||

Other revenues from managed properties | 33 | 32 | 1 | 4.7 | % | |||||||||

Total segment revenues | $ | 66 | $ | 64 | $ | 2 | 3.4 | % | ||||||

Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

(Comparable Systemwide Hotels) | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | |||||||||||||||||||||||||

EAME/SW Asia Full Service | $ | 123 | $ | 119 | 3.3 | % | 5.1 | % | 66.0 | % | 62.7 | % | 3.3 | % | $ | 186 | $ | 190 | (1.9 | )% | (0.1 | )% | ||||||||||||||

EAME/SW Asia Select Service | $ | 67 | $ | 58 | 16.9 | % | 17.2 | % | 72.2 | % | 63.5 | % | 8.7 | % | $ | 93 | $ | 91 | 2.8 | % | 3.0 | % | ||||||||||||||

Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

RevPAR | Occupancy | ADR | ||||||||||||||||||||||||||||||||||

(Comparable Systemwide Hotels) | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | 2017 | 2016 | Change in Occ % pts | 2017 | 2016 | Better / (Worse) | Better / (Worse) Constant $ | |||||||||||||||||||||||||

EAME/SW Asia Full Service | $ | 119 | $ | 116 | 2.2 | % | 4.1 | % | 66.1 | % | 62.6 | % | 3.5 | % | $ | 180 | $ | 185 | (3.1 | )% | (1.3 | )% | ||||||||||||||

EAME/SW Asia Select Service | $ | 68 | $ | 61 | 12.1 | % | 12.7 | % | 70.9 | % | 63.2 | % | 7.7 | % | $ | 97 | $ | 97 | — | % | 0.5 | % | ||||||||||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment Adjusted EBITDA | $ | 9 | $ | 8 | $ | 1 | 3.6 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Segment Adjusted EBITDA | $ | 17 | $ | 16 | $ | 1 | 3.7 | % | ||||||

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Corporate and other revenues | $ | 33 | $ | 13 | $ | 20 | 172.1 | % | ||||||

Corporate and other Adjusted EBITDA | $ | (29 | ) | $ | (31 | ) | $ | 2 | 2.3 | % | ||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Better / (Worse) | ||||||||||||

Corporate and other revenues | $ | 59 | $ | 22 | $ | 37 | 173.2 | % | ||||||

Corporate and other Adjusted EBITDA | $ | (58 | ) | $ | (64 | ) | $ | 6 | 8.6 | % | ||||

• | interest expense; |

• | provision for income taxes; |

• | depreciation and amortization; |

• | equity earnings (losses) from unconsolidated hospitality ventures; |

• | stock-based compensation expense; |

• | gains (losses) on sales of real estate; and |

• | other income (loss), net. |

Three Months Ended June 30, | ||||||||||||||

2017 | 2016 | Change | ||||||||||||

Net income attributable to Hyatt Hotels Corporation | $ | 87 | $ | 67 | $ | 20 | 30.5 | % | ||||||

Interest expense | 20 | 20 | — | (1.1 | )% | |||||||||

Provision for income taxes | 45 | 21 | 24 | 106.2 | % | |||||||||

Depreciation and amortization | 91 | 86 | 5 | 6.2 | % | |||||||||

EBITDA | 243 | 194 | 49 | 25.0 | % | |||||||||

Equity (earnings) losses from unconsolidated hospitality ventures | (1 | ) | (19 | ) | 18 | 92.7 | % | |||||||

Stock-based compensation expense | 5 | 4 | 1 | 43.3 | % | |||||||||

(Gains) losses on sales of real estate | (34 | ) | 21 | (55 | ) | (260.0 | )% | |||||||

Other (income) loss, net | (2 | ) | (1 | ) | (1 | ) | (793.6 | )% | ||||||

Pro rata share of unconsolidated hospitality ventures Adjusted EBITDA | 18 | 28 | (10 | ) | (34.8 | )% | ||||||||

Adjusted EBITDA | $ | 229 | $ | 227 | $ | 2 | 0.6 | % | ||||||

Six Months Ended June 30, | ||||||||||||||

2017 | 2016 | Change | ||||||||||||

Net income attributable to Hyatt Hotels Corporation | $ | 157 | $ | 101 | $ | 56 | 55.8 | % | ||||||

Interest expense | 41 | 37 | 4 | 9.4 | % | |||||||||

Provision for income taxes | 86 | 37 | 49 | 128.3 | % | |||||||||

Depreciation and amortization | 182 | 167 | 15 | 9.3 | % | |||||||||

EBITDA | 466 | 342 | 124 | 36.1 | % | |||||||||

Equity (earnings) losses from unconsolidated hospitality ventures | 2 | (21 | ) | 23 | 106.9 | % | ||||||||

Stock-based compensation expense | 21 | 20 | 1 | 5.4 | % | |||||||||

(Gains) losses on sales of real estate | (34 | ) | 21 | (55 | ) | (260.5 | )% | |||||||

Other (income) loss, net | (42 | ) | 3 | (45 | ) | NM | ||||||||

Pro rata share of unconsolidated hospitality ventures Adjusted EBITDA | 44 | 56 | (12 | ) | (21.5 | )% | ||||||||

Adjusted EBITDA | $ | 457 | $ | 421 | $ | 36 | 8.5 | % | ||||||

Six Months Ended June 30, | |||||||

2017 | 2016 | ||||||

Cash provided by (used in): | |||||||

Operating activities | $ | 319 | $ | 239 | |||

Investing activities | (182 | ) | (23 | ) | |||

Financing activities | (221 | ) | (47 | ) | |||

Effect of exchange rate changes on cash | 2 | 16 | |||||

Net (decrease) increase in cash and cash equivalents | $ | (82 | ) | $ | 185 | ||

• | We acquired Miraval for approximately $237 million. |

• | We invested $133 million in capital expenditures (see "—Capital Expenditures"). |

• | We invested $23 million in unconsolidated hospitality ventures. |

• | We sold Hyatt Regency Grand Cypress for approximately $202 million of net cash proceeds, which was recorded as restricted cash. |

• | We received distributions of $196 million related to the redemption of our Playa preferred shares. |

• | We sold Hyatt Regency Louisville for approximately $65 million of net cash proceeds, which was recorded as restricted cash. |

• | We sold land and construction in progress to an unconsolidated hospitality venture, in which we have a 50%, ownership interest for approximately $29 million. |

• | We acquired Thompson Miami Beach for approximately $238 million. |

• | We invested $85 million in capital expenditures (see "—Capital Expenditures"). |

• | We invested $17 million in unconsolidated hospitality ventures. |

• | We sold Andaz 5th Avenue for approximately $240 million of net cash proceeds. |

• | We received distributions of $52 million from unconsolidated hospitality ventures. |

• | We released $29 million from restricted cash related to the finalization from the Canada Revenue Agency in connection with the 2014 disposition of Park Hyatt Toronto. |

June 30, 2017 | December 31, 2016 | ||||||

Consolidated debt (1) | $ | 1,687 | $ | 1,564 | |||

Stockholders’ equity | 3,837 | 3,903 | |||||

Total capital | 5,524 | 5,467 | |||||

Total debt to total capital | 30.5 | % | 28.6 | % | |||

Consolidated debt (1) | 1,687 | 1,564 | |||||

Less: Cash and cash equivalents and short-term investments | 451 | 538 | |||||

Net consolidated debt | $ | 1,236 | $ | 1,026 | |||

Net debt to total capital | 22.4 | % | 18.8 | % | |||

(1) | Excludes approximately $565 million and $745 million of our share of unconsolidated hospitality venture indebtedness at June 30, 2017 and December 31, 2016, respectively, substantially all of which is non-recourse to us and a portion of which we guarantee pursuant to separate agreements. The decrease from December 31, 2016 is primarily attributable to Playa, which is no longer an unconsolidated hospitality venture as discussed in Part I, Item 1 "Financial Statements—Note 4 to the Condensed Consolidated Financial Statements." |

June 30, 2017 | June 30, 2016 | ||||||

Maintenance | $ | 39 | $ | 26 | |||

Enhancements to existing properties | 63 | 24 | |||||

Investment in new properties under development or recently opened | 31 | 35 | |||||

Total capital expenditures | $ | 133 | $ | 85 | |||

Description | Principal Amount | ||

2019 Notes | $ | 196 | |

2021 Notes | 250 | ||

2023 Notes | 350 | ||

2026 Notes | 400 | ||

Total | $ | 1,196 | |

Maturities by Period | |||||||||||||||||||||||||||||||

2017 | 2018 | 2019 | 2020 | 2021 | Thereafter | Total Carrying Amount (1) | Total Fair Value | ||||||||||||||||||||||||

Fixed-rate debt | $ | 4 | $ | 4 | $ | 200 | $ | 5 | $ | 255 | $ | 918 | $ | 1,386 | $ | 1,473 | |||||||||||||||

Average interest rate (2) | 4.89 | % | |||||||||||||||||||||||||||||

Floating-rate debt (3) | $ | 233 | $ | 5 | $ | 5 | $ | 5 | $ | 5 | $ | 49 | $ | 302 | $ | 321 | |||||||||||||||

Average interest rate (2) | 3.58 | % | |||||||||||||||||||||||||||||

Total number of shares purchased | Weighted average price paid per share | Total number of shares purchased as part of publicly announced plans | Maximum number (or approximate dollar value) of shares that may yet be purchased under the program (1) | |||||||||||

April 1 to April 30, 2017 | — | $ | — | — | $ | 9,119,281 | ||||||||

May 1 to May 31, 2017 | — | $ | — | — | $ | 509,119,281 | ||||||||

June 1 to June 30, 2017 | — | $ | — | — | $ | 509,119,281 | ||||||||

Total | — | $ | — | — | ||||||||||

(1) | On each of December 13, 2016 and May 4, 2017, we announced approvals of expansions of our share repurchase program pursuant to which we are authorized to purchase up to an additional $250 million and $500 million, respectively, of Class A and Class B common stock in the open market, in privately negotiated transactions, or otherwise, including pursuant to a Rule 10b5-1 plan. The repurchase program does not have an expiration date. At June 30, 2017, we had approximately $509 million remaining under our current share repurchase authorization. During the first quarter, we entered into the 2017 ASR to repurchase $300 million of our Class A common stock. At June 30, 2017, there are $60 million of shares that had not yet settled. See Part I, Item 1 "Financial Statements—Note 12 to the Condensed Consolidated Financial Statements" for further details regarding the 2017 share repurchase plan. |

Exhibit Number | Exhibit Description |

3.1 | Amended and Restated Certificate of Incorporation of Hyatt Hotels Corporation |

3.2 | Amended and Restated Bylaws of Hyatt Hotels Corporation (incorporated by reference to Exhibit 3.2 to the Company's Current Report on Form 8-K (File No. 001-34521) filed with the Securities and Exchange Commission on September 11, 2014) |

31.1 | Certification of the Chief Executive Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

31.2 | Certification of the Chief Financial Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

32.1 | Certification of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

32.2 | Certification of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

101.INS | XBRL Instance Document |

101.SCH | XBRL Taxonomy Extension Schema Document |

101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

Hyatt Hotels Corporation | |||

Date: | August 3, 2017 | By: | /s/ Mark S. Hoplamazian |

Mark S. Hoplamazian | |||

President and Chief Executive Officer | |||

(Principal Executive Officer) | |||

Hyatt Hotels Corporation | |||

Date: | August 3, 2017 | By: | /s/ Patrick J. Grismer |

Patrick J. Grismer | |||

Executive Vice President, Chief Financial Officer | |||

(Principal Financial Officer) | |||