zmtp_s1.htm

As filed with the Securities and Exchange Commission on May 29, 2013

Registration No. ____________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Zoom Telephonics, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

3661

|

|

04-2621506

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

207 South Street

Boston, MA 02111

(617) 423-1072

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Frank Manning

President, Chief Executive Officer,

Chairman of the Board and Acting Chief Financial Officer

207 South Street

Boston, MA 02111

(617) 423-1072

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Daniele Ouellette Levy, Esq.

Morse, Barnes-Brown & Pendleton, PC

CityPoint

230 Third Avenue, 4th Floor

Waltham, MA 02451

(781) 622-5930

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: þ

If this Form is filed to register additional shares for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

|

|

|

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company)

|

Smaller reporting company

|

þ

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

|

Amount

to be

registered

|

|

|

Proposed

maximum

offering price

per share

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount of

registration fee (2)

|

|

|

Subscription Rights (1)

|

|

|

6,973,704 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Common Stock

|

|

6,973,704 shares

|

|

|

$ |

0.28 |

|

|

$ |

1,952,637 |

|

|

$ |

266.34 |

|

|

Total

|

|

|

|

|

|

|

|

|

|

$ |

1,952,637 |

|

|

$ |

266.34 |

|

|

(1)

|

We are granting for no consideration to our stockholders subscription rights to purchase shares of our common stock. Our common stockholders will receive one subscription right for each share of common stock owned of record at the close of business on June 14, 2013.

|

|

(2)

|

Pursuant to Rule 457(g), no separate registration fee is required for the subscription rights since we are registering the subscription rights in the same registration statement as the underlying securities offered pursuant to such rights.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED MAY 29, 2013

Prospectus

ZOOM TELEPHONICS, INC.

UP TO 6,973,704 SHARES OF COMMON STOCK ISSUABLE UPON EXERCISE OF THE SUBSCRIPTION RIGHTS

Zoom Telephonics, Inc. is distributing at no charge to the holders of our common stock who own shares on June 14, 2013, which we refer to as the record date, subscription rights to purchase shares of our common stock at a subscription price equal to $0.28 per share. The maximum amount of shares sold in this rights offering to all our shareholders as a group is 6,973,704 shares.

You will receive one subscription right for each share of our common stock that you owned as of 5:00 p.m., New York City time, on June 14, 2013. Each subscription right will entitle you to purchase one share at $0.28 per share, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. Subscribers who exercise their rights in full may over-subscribe for additional shares, subject to certain limitations for shareholders attempting to own 5% or more of our shares, to the extent shares are available.

The subscription rights are exercisable beginning on the date of this prospectus and continuing until 5:00 p.m., New York City time on August 9, 2013. The subscription rights will expire and will have no value if they are not exercised prior to this time. We may extend the period for exercising subscription rights in our sole discretion. Any subscription rights not exercised by the expiration date will expire worthless without any payment to the holders of those unexercised subscription rights. There is no minimum subscription amount required for consummation of this rights offering.

If you timely exercise your basic subscription right and some other stockholders do not exercise their basic subscription rights, then you will be entitled to exercise an over-subscription privilege, subject to certain limitations and subject to allotment, to purchase unsubscribed shares at the same subscription price of $0.28 per share. To the extent that you properly exercise your over-subscription privilege for a number of shares that exceeds the number of unsubscribed shares that may be available to you, any excess subscription payments received by the subscription agent, Broadridge Corporate Issuer Solutions, Inc. (the “Subscription Agent” or “Broadridge”), will be returned to you, without interest, as soon as practicable following the expiration of the rights offering. Funds received from subscribers in the rights offering will be held in escrow by the Subscription Agent until the rights offering is completed or canceled.

We may cancel the rights offering at any time and for any reason prior to August 9, 2013, the expiration of the rights offering. In the event that we cancel the rights offering, all subscription payments received by the Subscription Agent will be returned, without interest or deduction, as soon as practicable.

You should carefully consider whether to exercise your subscription rights prior to August 9, 2013, the expiration of the rights offering. All exercises of subscription rights are irrevocable. Shareholders who do not participate in the rights offering will continue to own the same number of shares, but will own a smaller percentage of the total shares outstanding to the extent that other shareholders participate in the rights offering. Our board of directors is making no recommendation regarding your exercise of the subscription rights.

Our common stock is quoted on the National Association of Securities Dealers Over-the-Counter Bulletin Board under the symbol “ZMTP.”. The last reported sales price of our shares of common stock on May 28, 2013 is $0.19 per share. The shares of our common stock issued in connection with this rights offering will continue to be quoted on the Over-the-Counter Bulletin Board under the ticker symbol “ZMTP.”

The purpose of this rights offering is to raise equity capital in a cost-effective manner that allows all shareholders to participate, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. Net proceeds from this rights offering (up to approximately $1.9 million after deducting estimated offering expenses) are expected to be used for working capital needs, development and marketing of a line of sensor and control products, and for general corporate purposes. We may also use a portion, if available, of the net proceeds to acquire or invest in businesses, products and technologies that we believe are complementary to our own. However, we have no definitive agreements nor are we engaged in any preliminary discussions to acquire or invest in any business, product or technology, nor have we identified any specific transaction to pursue. See “Use of Proceeds.”

We reserve the right to limit the exercise of rights by certain shareholders in order to protect against an unexpected “ownership change” for federal income tax purposes. This may affect our ability to receive proceeds in the rights offering.

|

|

|

Per Share

|

|

|

Total

|

|

|

Purchase Price

|

|

$ |

0.28 |

|

|

$ |

1,952,637 |

|

|

Estimated Expenses

|

|

|

|

|

|

|

30,000 |

|

|

Net Proceeds to Us

|

|

|

|

|

|

$ |

1,922,637 |

|

This is not an underwritten offering. The securities are being offered directly by us without the services of an underwriter or selling agent.

Our principal executive office is located at 207 South Street, Boston, MA 02111. Our telephone number at that address is (617) 423-1072. Our website is located at http://www.zoomtel.com.

INVESTING IN OUR COMMON STOCK INVOLVES SIGNIFICANT RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISK FACTORS BEGINNING ON PAGE 10 OF THIS PROSPECTUS BEFORE EXERCISING YOUR RIGHTS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Our securities are not being offered in any jurisdiction where the offer is not permitted under applicable local laws.

The date of this prospectus is May 29, 2013.

Table of Contents

|

|

|

Page

|

|

|

ABOUT THIS PROSPECTUS

|

|

|

1 |

|

|

|

|

|

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

1 |

|

|

|

|

|

|

|

|

PROSPECTUS SUMMARY

|

|

|

1 |

|

|

|

|

|

|

|

|

QUESTIONS AND ANSWERS ABOUT THE RIGHTS OFFERING

|

|

|

5 |

|

|

|

|

|

|

|

|

RISK FACTORS

|

|

|

10 |

|

|

|

|

|

|

|

|

THE RIGHTS OFFERING

|

|

|

20 |

|

|

|

|

|

|

|

|

USE OF PROCEEDS

|

|

|

30 |

|

|

|

|

|

|

|

|

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON STOCK

|

|

|

30 |

|

|

|

|

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

32 |

|

|

|

|

|

|

|

|

BUSINESS

|

|

|

42 |

|

|

|

|

|

|

|

|

PROPERTIES

|

|

|

52 |

|

|

|

|

|

|

|

|

LEGAL PROCEEDINGS

|

|

|

53 |

|

|

|

|

|

|

|

|

BOARD OF DIRECTORS AND MANAGEMENT

|

|

|

53 |

|

|

|

|

|

|

|

|

EXECUTIVE COMPENSATION

|

|

|

55 |

|

|

|

|

|

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

|

|

58 |

|

|

|

|

|

|

|

|

DIRECTOR INDEPENDENCE

|

|

|

58 |

|

|

|

|

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

|

58 |

|

|

|

|

|

|

|

|

DESCRIPTION OF CAPITAL STOCK

|

|

|

60 |

|

|

|

|

|

|

|

|

SUMMARY OF UNITED STATES FEDERAL INCOME TAX CONSEQUENCES

|

|

|

60 |

|

|

|

|

|

|

|

|

CAPITALIZATION

|

|

|

62 |

|

|

|

|

|

|

|

|

PLAN OF DISTRIBUTION

|

|

|

63 |

|

|

|

|

|

|

|

|

LEGAL MATTERS

|

|

|

63 |

|

|

|

|

|

|

|

|

EXPERTS

|

|

|

63 |

|

|

|

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

64 |

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

|

|

64 |

|

|

|

|

|

|

|

|

INDEX TO FINANCIAL STATEMENTS AND SCHEDULES

|

|

|

F-1 |

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not provided, and we have not authorized anyone else, to provide you with different or additional information. We are not making an offer of securities in any state or other jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus regardless of its time of delivery, and you should not consider any information in this prospectus or in the documents incorporated by reference herein to be investment, legal or tax advice. We encourage you to consult your own counsel, accountant and other advisors for legal, tax, business, financial and related advice regarding an investment in our securities.

As used in this prospectus, “Zoom Telephonics,” “Zoom,” “Company,” “we,” “our” and “us” refer to Zoom Telephonics, Inc. unless stated otherwise or the context requires otherwise.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Throughout this prospectus we make “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include the words “may,” “would,” “could,” “likely,” “estimate,” “intend,” “plan,” “continue,” “believe,” “expect” or “anticipate” and similar words as well as our acquisition, development and expansion plans, objectives or expectations and our liquidity projections. These forward-looking statements generally relate to our plans, objectives, prospects and expectations for future operations and results and are based upon what we consider to be reasonable future estimates. Although we believe that our plans, objectives, prospects and expectations reflected in, or suggested by, such forward-looking statements are reasonable at the present time, we may not achieve or we may modify them from time to time. Furthermore, there is no assurance that any positive trends suggested or referred to in such statements will continue. Any forward-looking statements made in this prospectus are made as of the date of this prospectus and we assume no obligation to update the forward-looking statements. You should read this prospectus thoroughly, including the factors described in the “Risk Factors” section of this prospectus for information regarding risk factors that could affect our results with the understanding that actual future results may be materially different from what we expect. You should understand that it is not possible to predict or identify all such risks and uncertainties. Consequently, you should not consider these risks and uncertainties to be a complete discussion of all potential risks and uncertainties associated with an investment in us or our securities. We will not update forward-looking statements even though our situation or plans may change in the future, unless applicable law requires us to do so.

The following summary provides an overview of certain information about Zoom and this offering and may not contain all the information that is important to you. This summary is qualified in its entirety by, and should be read together with, the information contained in other parts of this prospectus and the documents we incorporate by reference. You should carefully review this entire prospectus, including the matters discussed in “Risk Factors” beginning on page 10, in our Annual Report on Form 10-K, and our most recent Quarterly Report on Form 10-Q before making a decision about whether to invest in our securities.

Our Company

Zoom Telephonics, Inc. was incorporated as a New York corporation in 1977 and was reincorporated as a Delaware corporation on March 25, 1993. Zoom was formerly the operating subsidiary of Zoom Technologies, Inc. With Zoom Technologies, Inc., Zoom initially designed, produced, and sold telephone products. Zoom grew its business primarily based on the sale of dial-up modems, reaching peak sales of approximately $100 million in the late nineties. As computers began to include dial-up modems and as broadband modems began to compete with dial-up modems, Zoom’s sales shrank even though Zoom introduced broadband modems. One reason was the fact that broadband modems are typically supplied by the broadband service provider, whereas dial-up modems were not. Very recently Zoom’s year-over-year sales rose in the fourth quarter of 2011 through the third quarter of 2012 as Zoom broadened its product line to include cable modems and routers, ADSL modems and routers, mobile broadband modems and routers, and Bluetooth and WiFi compatible wireless products. However, Zoom’s year-over-year sales were down in the fourth quarter of 2012 and the first quarter of 2013.

On January 28, 2009, Zoom Technologies, Inc. entered into a Share Exchange Agreement (the “Agreement”) with Tianjin Tong Guang Group Digital Communication Co., Ltd (“TCB Digital”), TCB Digital’s majority shareholder, Gold Lion Holding Limited (“Gold Lion”) and Lei Gu, a shareholder of Gold Lion. On May 12, 2009, the parties amended the Agreement to, among other actions, add Songtao Du, a shareholder of Gold Lion, as a party to the Agreement. On September 22, 2009, pursuant to the Agreement, Zoom Technologies acquired all the outstanding shares of Gold Lion. In addition, as part of the transaction, Zoom Technologies spun off its then-current business, which consisted of its ownership of Zoom Telephonics, (the “Communications Business”) to its stockholders, by distributing and transferring its assets and liabilities to Zoom Telephonics and issuing a dividend of the Zoom Telephonics’ shares to its stockholders.

Upon the completion of the spin-off, Zoom Telephonics became a separate publicly-traded company listed on the Over-the-Counter Bulletin Board (the “OTCBB”).

We describe in this prospectus the Communications Business transferred to Zoom Telephonics by Zoom Technologies in connection with the spin-off as though the Communications Business were our business for all historical periods described. References in this prospectus to the historical assets, liabilities, products, business or activities of our business are intended to refer to the historical assets, liabilities, products, business or activities of the Communications Business as those were conducted as part of Zoom Technologies prior to the date of the spin-off.

Our common stock is traded in the over-the-counter market with the symbol ZMTP.

Our principal executive offices are located at 207 South Street, Boston, MA 02111. Our telephone number is (617) 423-1072. Our web site is http://www.zoomtel.com. Information contained on our web site does not constitute a part of this prospectus.

The Rights Offering

For a more complete description of the terms of this rights offering, see “The Rights Offering” beginning on page 20.

|

Subscription Rights

|

|

We will distribute to each stockholder of record on June 14, 2013 at no charge, one non-transferable subscription right for each share of our common stock then owned. The rights will be evidenced by subscription rights certificates.

Each subscription right will entitle the holder to purchase one share of our common stock at a price equal to $0.28 per share, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. The subscription price shall be paid in cash.

|

|

|

|

|

Shares

|

|

If the rights offering is fully subscribed, we will issue a total of 6,973,704 shares of our common stock and the gross proceeds from the offering would be $1,952,637.

|

|

|

|

|

Subscription Price

|

|

$0.28 per share, which shall be paid in cash.

|

|

|

|

|

Record Date

|

|

June 14, 2013

|

|

|

|

|

Expiration Date

|

|

5:00 p.m., New York City time, on August 9, 2013, subject to extension or earlier termination, but in no event shall such extension extend beyond *!*absolute last date*!*, and if the rights offering is extended all subscriptions received prior to such extension shall be irrevocable. After the expiration date, the subscription rights will expire and will have no value.

|

|

|

|

|

Basic Subscription Right

|

|

For each subscription right you own, you will have the basic subscription right to purchase one share of our common stock at the subscription price, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. You may exercise some or all of your basic subscription rights, or you may choose not to exercise any of your basic subscription rights. The Company may limit the rights which you may exercise in order not to endanger the availability of the Company’s net operating loss carry-forwards under Section 382 of the Internal Revenue Code. The subscription agent will return any excess payments by mail without interest or deduction promptly after the expiration of the subscription period.

|

|

Over-subscription Right

|

|

If you elect to fully exercise your basic subscription right, you may also subscribe for additional shares of our common stock at the same subscription price per share. If there are insufficient shares available to fully satisfy all over-subscription right requests, the available shares will be distributed proportionately among rights holders who exercise their over-subscription right based on the number of shares each rights holder subscribed for under the basic subscription right. In addition, the Company may limit the rights which you may exercise in order not to endanger the availability of the Company’s net operating loss carry-forwards under Section 382 of the Internal Revenue Code. The subscription agent will return any excess payments by mail without interest or deduction promptly after the expiration of the subscription period.

|

|

Amendment, Extension and Termination

|

|

We may extend the expiration date at any time after the record date, but in no event shall such extension extend beyond *!*absolute last date*!* and if the rights offering is extended all subscriptions received prior to such extension shall be irrevocable. We may amend or modify the terms of the rights offering at any time prior to the expiration date, including if we extend the rights offering up until *!*absolute last date*!*. We also reserve the right to terminate the rights offering at any time prior to the expiration date for any reason, in which event all funds received in connection with the rights offering will be returned without interest or deduction to those persons who exercised their subscription rights. We will extend the duration of the rights offering as required by applicable law, and may choose to extend the rights offering if we decide that changes in the market price of our common stock warrant an extension or if we decide that the degree of participation in this rights offering by holders of our common stock is less than the level we desire.

|

|

|

|

|

Fractional Shares

|

|

We will not issue fractional shares, but rather will round down the aggregate number of shares you are entitled to receive to the nearest whole number.

|

|

|

|

|

Procedure for Exercising Rights

|

|

You may exercise your subscription rights by properly completing and executing your rights certificate or an equivalent thereof, and delivering it, together with the subscription price for each share for which you subscribe, to the subscription agent on or prior to the expiration date. If you use the mail, we recommend that you use insured, registered mail, return receipt requested. If you cannot deliver your rights certificate to the subscription agent on time, you may follow the guaranteed delivery procedures described under “The Rights Offering — Guaranteed Delivery Procedures” beginning on page 24.

|

|

|

|

|

No Revocation

|

|

Once you submit the form of rights certificate to exercise any subscription rights, you may not revoke or change your exercise or request a refund of monies paid. All exercises of rights are irrevocable, even if you subsequently learn information about us that you consider to be unfavorable.

|

|

|

|

|

Payment Adjustments

|

|

If you send a payment that is insufficient to purchase the number of shares requested, or if the number of shares requested is not specified in the rights certificate, the payment received will be applied to exercise your subscription rights to the extent of the payment. If the payment exceeds the amount necessary for the full exercise of your subscription rights, including any over-subscription rights exercised and permitted, the excess will be returned to you as soon as practicable in cash. You will not receive interest or a deduction on any payments refunded to you under the rights offering.

|

|

|

|

|

Limitation on Ability to Exercise Rights

|

|

We have implemented certain protection mechanisms and reserve the right to limit the exercise of over-subscription rights by certain shareholders in order to protect against an unexpected “ownership change” for federal income tax purposes. See “The Rights Offering—Protection Mechanics.” By signing the subscription certificate and exercising your right, you are agreeing that:

● the following protection mechanics are valid, binding and enforceable against such shareholder:

¡ if purchasing shares of common stock, each subscriber will inform us through the subscription agent if they will be, after giving effect to the purchase of the common stock, an owner, either direct or indirect, record or beneficial, or by application of Section 382 attribution provisions summarized above, of more than 348,685 shares of our common stock;

¡ if an exercise would result in the subscriber owning more than 348,685 shares of our common stock, the subscriber must notify the subscription agent at the telephone number set forth under the heading “Subscription Agent”;

¡ if requested, each subscriber will be required to provide us with additional information regarding the amount of common stock that the subscriber owns;

¡ we have the right to instruct the subscription agent to refuse to honor any exercise of rights by a subscriber to the extent an exercise might, in our sole and absolute discretion, result in the subscriber owing 5% or more of our common stock. We will exercise this discretion if such exercise of rights would endanger our Net Operating Loss, ie NOL’s, or tax credit carry forwards against future taxable income.

● any purported exercise of rights in violation of the protection mechanics section will be void and of no force and effect; and

● we have the right to void and cancel (and treat as if never exercised) any exercise of rights, and shares issued pursuant to an exercise of rights, if any of the agreements, representations or warranties of a subscriber in the subscription documents are false.

In order to participate in the rights offering you must execute an applicable subscription agreement. The protection mechanisms described above are binding and enforceable solely against those shareholders who properly execute the subscription agreement and the protection mechanisms relate solely to the exercise by shareholders of rights in this offering and do not restrict a shareholders’ ability to purchase shares other than in this offering.

|

|

How Rights Holders Can Exercise Rights Through Others

|

|

If you hold our common stock through a broker, custodian bank or other nominee, we will ask your broker, custodian bank or other nominee to notify you of the rights offering. If you wish to exercise your rights, you will need to have your broker, custodian bank or other nominee act for you. To indicate your decision, you should complete and return to your broker, custodian bank or other nominee the form entitled “Beneficial Owners Election Form” or an equivalent method of informing your broker, custodian bank, or other nominee. You should receive this form or its equivalent from your broker, custodian bank or other nominee with the other rights offering materials. You should contact your broker, custodian bank or other nominee if you believe you are entitled to participate in the rights offering but you have not received this form or its equivalent.

|

|

|

|

|

How Foreign Stockholders and Other Stockholders Can Exercise Rights

|

|

The subscription agent will not mail rights certificates to you if you are a stockholder whose address is outside the United States or if you have an Army Post Office or a Fleet Post Office address. Instead, we will have the subscription agent hold the subscription rights certificates for your account. To exercise your rights, you must notify the subscription agent prior to 11:00 a.m., New York City time, at least three business days prior to the expiration date, and establish to the satisfaction of the subscription agent that it is permitted to exercise your subscription rights under applicable law. If you do not follow these procedures by such time, your rights will expire and will have no value.

|

|

|

|

|

Material United States Federal Income Tax Consequences

|

|

A holder will not recognize income or loss for United States Federal income tax purposes in connection with the receipt or exercise of subscription rights in the rights offering. For a detailed discussion, see “Material United States Federal Income Tax Consequences” beginning on page 60. You should consult your tax advisor as to the particular consequences to you of the rights offering.

|

|

|

|

|

Issuance of Our Common Stock

|

|

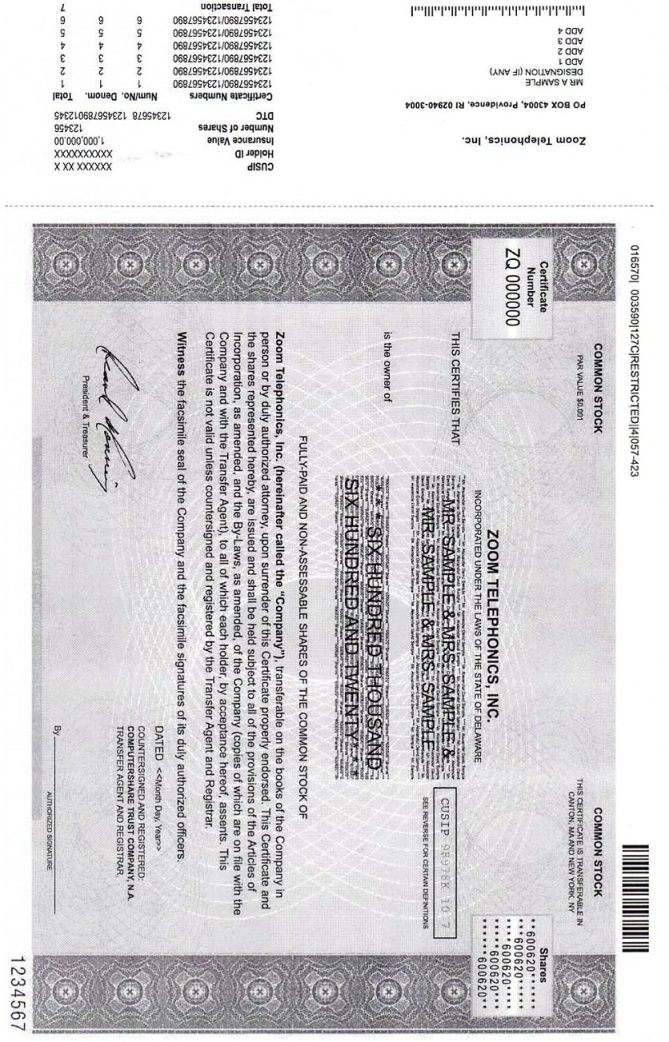

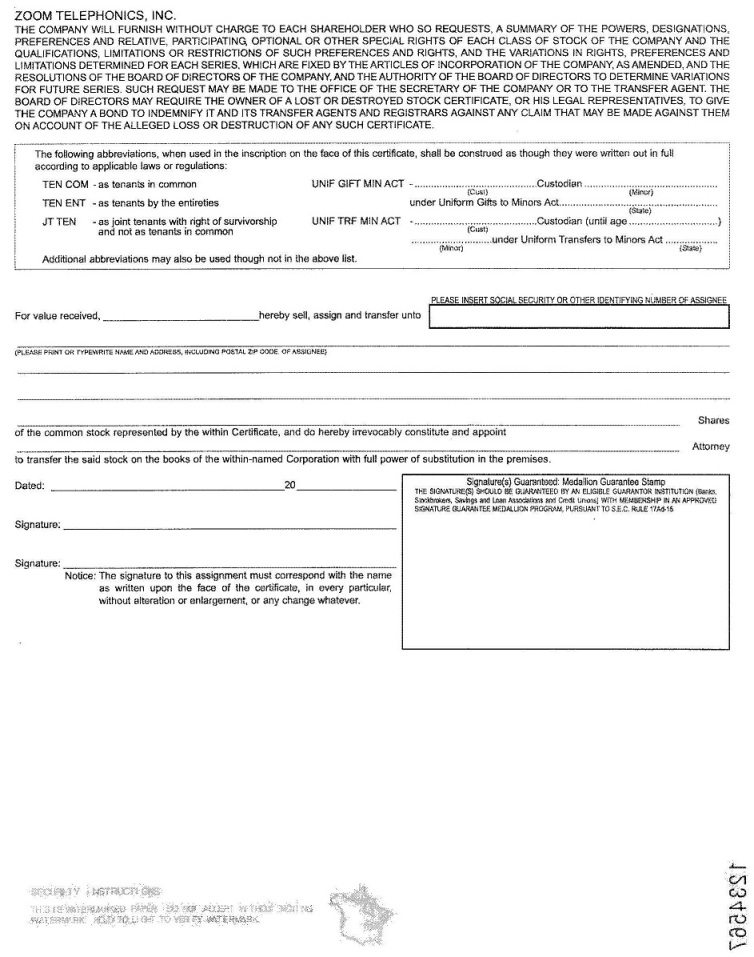

We will issue certificates representing common stock purchased in the rights offering as soon as practicable after the expiration of the rights offering.

|

|

|

|

|

Conditions

|

|

See “The Rights Offering—Conditions to the Rights Offering.”

|

|

|

|

|

No Board Recommendation

|

|

Our Board of Directors is making no recommendations regarding your exercise of the subscription rights. An investment in shares of our common stock must be made according to your evaluation of your own best interests and after considering all of the information herein, including the “Risk Factors” section of this prospectus.

|

|

|

|

|

Use of Proceeds

|

|

Net proceeds from this rights offering (up to approximately $1.9 million after deducting estimated offering expenses) are expected to be used for working capital needs, development and marketing of a line of sensor and control products, and for general corporate purposes.

|

|

|

|

|

Subscription Agent

|

|

Broadridge Corporate Issuer Solutions, Inc.

|

|

|

|

|

Shares of Common Stock Outstanding Before the Rights Offering

|

|

As of June 14, 2013, 6,973,704 shares of our common stock were outstanding.

|

|

|

|

|

Shares of Common Stock Outstanding After Completion of the Rights Offering

|

|

We will issue up to 6,973,704 shares of our common stock in the rights offering, depending on the number of subscription rights and over-subscription rights that are exercised. Assuming there are no changes in the number of outstanding shares of our common stock prior to the expiration of the rights offering period, and based on the number of shares of our common stock outstanding as of June 14, 2013, if we issue all 6,973,704 shares of our common stock available for the exercise of subscription rights in the rights offering, we would have 13,947,408 shares of our common stock outstanding following the completion of the rights offering.

|

|

Risk Factors

|

|

Stockholders considering making an investment by exercising subscription rights in the rights offering should carefully read and consider the information set forth in the section entitled “Risk Factors” beginning on page 11 of this prospectus, together with the other information contained in this prospectus, and information contained under the heading “Risk Factors” in our Annual Report on Form 10-K for our fiscal year ended December 31, 2012, filed with the SEC and any updates of those Risk Factors contained in our Quarterly Reports on Form 10-Q, before making a decision to invest in the rights offering.

|

|

For additional information concerning the rights offering, see “The Rights Offering,” beginning on page 20.

|

QUESTIONS AND ANSWERS ABOUT THE RIGHTS OFFERING

The following are questions that we anticipate you may have about this rights offering. The answers are based on selected information from this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about whether to exercise your subscription rights. We urge you to read the entire prospectus.

Exercising the rights and investing in our securities involves a high degree of risk. We urge you to carefully read the section entitled “Risk Factors” beginning on page 10 of this prospectus, as well as the other sections of this prospectus in their entirety before you decide whether to exercise your rights.

Q: What is the rights offering?

A: We are distributing, at no cost or charge to our stockholders, subscription rights, which we also refer to as rights, consisting of a basic subscription right to purchase shares of our common stock and an over-subscription right to purchase additional shares of our common stock. These rights are not transferable. Holders of our common stock will receive one basic subscription right for each share of common stock held of record as of 5:00 p.m., New York City time, on June 14, 2013, the record date of this rights offering. The subscription rights will be evidenced by subscription rights certificates. Each basic subscription right will entitle you to purchase one share of our common stock at a subscription price equal to $0.28 per share. You may exercise any number of your basic subscription rights, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares, or you may choose not to exercise any basic subscription rights. We will not distribute fractional subscription rights, but instead we will round down the aggregate number of shares you are entitled to receive to the nearest whole number.

A rights offering is an opportunity for you to purchase additional shares of common stock at a fixed price. If you exercise your basic subscription rights in full, you will then be entitled to exercise your over-subscription rights, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. This rights offering enables most shareholders to maintain or possibly increase their current percentage ownership of the Company.

Q: What is the basic subscription right?

A: Each subscription right evidences a right to purchase one share of our common stock at a subscription price of $0.28 per share, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. The subscription rights are not transferable.

Q: What is the over-subscription right?

A: We do not expect all of our shareholders to exercise all of their basic subscription rights. The over-subscription right provides shareholders that exercise all of their basic subscription rights the opportunity to subscribe for additional shares of our common stock at the same subscription price per share, if any shares are not purchased by other holders of subscription rights under the basic subscription rights as of the expiration date of the rights offering. If an insufficient number of shares are available to fully satisfy all over-subscription right requests, the available shares will be distributed proportionately among rights holders who exercise their over-subscription right based on the number of shares each rights holder subscribed for under the basic subscription right, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. The subscription agent will return any excess payments by mail without interest or deduction promptly after the expiration of the subscription period.

Q: Why are we engaging in a rights offering and how will we use the proceeds from the rights offering?

A: The purpose of this rights offering is to raise equity capital in a cost-effective manner that allows all shareholders to participate, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares. Net proceeds from this rights offering (up to approximately $1.9 million after deducting estimated offering expenses) are expected to be used for working capital needs, development and marketing of a line of sensor and control products, and for general corporate purposes. We may also use a portion, if available, of the net proceeds to acquire or invest in businesses, products and technologies that we believe are complementary to our own. However, we have no definitive agreements nor are we engaged in any preliminary discussions to acquire or invest in any business, product or technology nor have we identified any specific transaction to pursue.

Q: Am I required to subscribe in the rights offering?

A: No.

Q: How was the $0.28 per share subscription price established?

A: Our board of directors determined that the subscription price should be designed to, among other things, provide an incentive to our current shareholders to exercise their rights. Other factors considered in setting the subscription price included the amount of proceeds desired, our need for equity capital, alternatives available to us for raising equity capital, the historic and current market price and liquidity of our common stock, the pricing of similar transactions, the historic volatility of the market price of our common stock, the historic trading volume of our common stock, our business prospects, our recent and anticipated operating results and general conditions in the securities market.

The subscription price does not necessarily bear any relationship to the book value of our assets, net worth, past operations, cash flows, losses, financial condition, or any other established criteria for valuing the Company. Because the subscription price is a set price, it may be above the actual trading price of our common stock during the period the rights offering is effective and after such period if the trading price is above the subscription price, it may be advantageous for stockholders to purchase additional shares of our common stock on the OTC Bulletin Board (OTCBB) rather than pursuant to this rights offering. We cannot assure you that the trading price of our common stock will not decline during or after this rights offering. We also cannot assure you that you will be able to sell shares purchased in this offering at a price equal to or greater than the subscription price. We do not intend to change the subscription price in response to changes in the trading price of our common stock prior to the closing of this rights offering. You should not consider the subscription price as an indication of the value of the Company or our common stock.

Q: Who will receive subscription rights?

A: All holders of our common stock, including affiliates, will receive one subscription right for each share of common stock owned as of June 14, 2013, the record date.

Q: How many shares may I purchase if I exercise my subscription rights?

A: You will receive one subscription right for each share of our common stock that you owned on June 14, 2013, the record date. Each subscription right evidences a right to purchase one share of our common stock at a subscription price of $0.28 per share. You may exercise any number of your subscription rights, subject to potential purchase limits for shareholders attempting to own 5% or more of our shares.

Q: What happens if I choose not to exercise my subscription rights?

A: If you choose not to exercise your subscription rights you will retain your current number of shares of common stock of the Company. However, the percentage of the common stock of the Company that you own will decrease and your voting rights and other rights will be diluted if and to the extent that other shareholders exercise their subscription rights. Your subscription rights will expire and have no value if they are not exercised prior to 5:00 p.m., New York City time, on August 9, 2013, subject to extension, the expiration date.

Q: Does the company need to achieve a certain participation level in order to complete the rights offering?

A: No. We may choose to consummate, amend, extend or terminate the rights offering regardless of the number of shares actually purchased.

Q: Can the Company terminate the rights offering?

A: Yes. Our board of directors may decide to terminate the rights offering at any time prior to the expiration of the rights offering, for any reason. If we cancel the rights offering, any money received from subscribing shareholders will be refunded as soon as practicable, without interest or a deduction on any payments refunded to you under the rights offering. See “The Rights Offering—Expiration of the Rights Offering and Extensions, Amendments and Termination.”

Q: May I transfer my subscription rights if I do not want to purchase any shares?

A: No. Should you choose not to exercise your rights, you may not sell, give away or otherwise transfer your rights. However, rights will be transferable to affiliates of the recipient and by operation of law, for example, upon the death of the recipient.

Q: When will the rights offering expire?

A: The subscription rights will expire and will have no value, if not exercised prior thereto, at 5:00 p.m., New York City time, on August 9, 2013, unless we decide to extend the rights offering expiration date until some later time. In no event shall such extension extend beyond *!*absolute last date*!*. See “The Rights Offering—Expiration of the Rights Offering and Extensions, Amendments and Termination.” The subscription agent must actually receive all required documents and payments before the expiration date. There is no maximum duration for the rights offering.

Q: How do I exercise my subscription rights?

A: You may exercise your subscription rights by properly completing and executing your rights certificate and delivering it, together with the subscription price for each share of common stock you subscribe for, to the subscription agent on or prior to the expiration date. If you use the mail, we recommend that you use insured, registered mail, return receipt requested. If you cannot deliver your rights certificate to the subscription agent on time, you may follow the guaranteed delivery procedures described under “The Rights Offering—Guaranteed Delivery Procedures” beginning on page 24. If you hold shares of our common stock through a broker, custodian bank or other nominee, see “The Rights Offering—Beneficial Owners” beginning on page 25.

Q: What should I do if I want to participate in the rights offering but my shares are held in the name of my broker, custodian bank or other nominee?

A: If you hold our common stock through a broker, custodian bank or other nominee, we will ask your broker, custodian bank or other nominee to notify you of the rights offering. If you wish to exercise your rights, you will need to have your broker, custodian bank or other nominee act for you. To indicate your decision, you should complete and return to your broker, custodian bank or other nominee the form entitled “Beneficial Owners Election Form” or an equivalent method of informing your broker, custodian bank, or other nominee of your decision to exercise your rights. You should receive this form or its equivalent from your broker, custodian bank or other nominee with the other rights offering materials. You should contact your broker, custodian bank or other nominee if you believe you are entitled to participate in the rights offering but you have not received this form or its equivalent.

Q: What should I do if I want to participate in the rights offering, but I am a shareholder with a foreign address or a shareholder with an APO or FPO address?

A: The subscription agent will not mail rights certificates to you if you are a shareholder whose address is outside the United States or if you have an Army Post Office or a Fleet Post Office address. To exercise your rights, you must notify the subscription agent prior to 11:00 a.m., New York City time, at least three business days prior to the expiration date, and establish to the satisfaction of the subscription agent that it is permitted to exercise your subscription rights under applicable law. If you do not follow these procedures by such time, your rights will expire and will have no value.

Q: Will I be charged a sales commission or a fee if I exercise my subscription rights?

A: We will not charge a brokerage commission or a fee to rights holders for exercising their subscription rights. However, if you exercise your subscription rights through a broker, dealer or nominee, you will be responsible for any fees charged by your broker, dealer or nominee.

Q: Are there any conditions to my right to exercise my subscription rights?

A: Yes. The rights offering is subject to certain limited conditions. Please see “The Rights Offering—Conditions to the Rights Offering.”

Q: Has the board of directors made a recommendation regarding the rights offering?

A: Neither we, nor our board of directors is making any recommendation as to whether or not you should exercise your subscription rights. You are urged to make your decision based on your own assessment of the rights offering, after considering all of the information herein, including the “Risk Factors” section of this document, and of your best interests.

Q: Is exercising my subscription rights risky?

A: The exercise of your subscription rights involves significant risks. Exercising your rights means buying additional shares of our common stock and should be considered as carefully as you would consider any other equity investment. Among other things, you should carefully consider the risks described under the heading “Risk Factors,” beginning on page 10.

Q: How many shares will be outstanding after the rights offering?

A: The number of shares of common stock that will be outstanding after the rights offering will depend on the number of shares that are purchased in the rights offering. If all subscription rights are exercised, we will issue 6,973,704 shares of common stock and will have 13,947,408 shares of common stock outstanding after the rights offering.

Q: What will be the proceeds of the rights offering?

A: If all subscription rights are exercised, we will receive gross proceeds of $1,952,637. We are offering shares of our common stock in the rights offering with no minimum purchase requirement. As a result, there is no assurance we will be able to sell all or any of the shares being offered, and it is not likely that all of our shareholders will participate in the rights offering. We reserve the right to limit the exercise of rights by certain shareholders in order to protect against an unexpected “ownership change” for federal income tax purposes. This may affect our ability to receive gross proceeds of up to $1,952,637 in the rights offering.

Q: After I exercise my rights, can I change my mind and cancel my purchase?

A: No. Once you exercise and send in your subscription rights certificate and payment you cannot revoke the exercise of your subscription rights, even if you later learn information about the Company that you consider to be unfavorable and even if the market price of our common stock falls below the $0.28 per share subscription price. You should not exercise your subscription rights unless you are certain that you wish to purchase the shares of our common stock at a price of $0.28 per share. See “The Rights Offering—No Revocation or Change.”

Q: What are the material United States Federal Income Tax consequences of exercising my subscription rights?

A: A holder should not recognize income or loss for United States Federal income tax purposes in connection with the receipt or exercise of subscription rights in the rights offering. For a detailed discussion, see “Material United States Federal Income Tax Consequences.” You should consult your tax advisor as to the particular consequences to you of the rights offering.

Q: If the rights offering is not completed, for any reason, will my subscription payment be refunded to me?

A: Yes. If the rights offering is not completed, for any reason, any money received from subscribing shareholders will be refunded as soon as practicable, without interest or deduction.

Q: If I exercise my subscription rights, when will I receive the shares of common stock I purchased in the rights offering?

A: We will deliver certificates representing the shares of our common stock purchased in the rights offering as soon as practicable after the expiration of the rights offering and after all pro rata allocations and adjustments have been completed. We will not be able to calculate the number of shares to be issued to each exercising holder until 5:00 p.m., New York City time, on the third business day after the expiration date of the rights offering, which is the latest time by which subscription rights certificates may be delivered to the subscription agent under the guaranteed delivery procedures described under “The Rights Offering—Guaranteed Delivery Procedures.”

Q: To whom should I send my forms and payment?

A: If your shares are held in the name of a broker, dealer or other nominee, then you should send your subscription documents, rights certificate and payment to that record holder. If you are the record holder, then you should send your subscription documents, rights certificate and payment by hand delivery, first class mail or courier service to Broadridge Corporate Issuer Solutions, Inc., the subscription agent. The address for delivery to the subscription agent is as follows:

If delivering by Hand/Mail/Overnight Courier:

Broadridge Corporate Issuer Solutions, Inc.

Attn: Subscription Dept

44 West Lancaster Avenue

Ardmore, PA 19003

Checks should be made payable to: “Broadridge FBO Zoom Telephonics,”. Wires may be sent to: U.S. Bank, Minneapolis, MN. ABA 123000848, account# 153910722518, account name: Broadridge FBO Zoom Telephonics.

Your delivery other than in the manner or to the address listed above will not constitute valid delivery.

Q: What if I have other questions?

A: If you have other questions about the rights offering, please contact our President and CEO, Frank Manning by using the investor phone number at 617-753-0897.

FOR A MORE COMPLETE DESCRIPTION OF THE RIGHTS OFFERING, SEE “THE RIGHTS OFFERING” BEGINNING ON PAGE 20.

RISK FACTORS

An investment in our common stock involves a high degree of risk. Prospective investors should carefully consider the following risk factors, together with the other information contained in this Prospectus, including our financial statements and the notes thereto, in evaluating the Company and its business before purchasing our securities. In particular, prospective investors should note that this prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and that actual results could differ materially from those contemplated by such statements. The factors listed below represent certain important factors which we believe could cause such results to differ. These factors are not intended to represent a complete list of the general or specific risks that may affect us. Other risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. Many factors, including those described below, could cause actual results to differ materially from those discussed in forward-looking statements.

We may require additional funding, which may be difficult to obtain on favorable terms, if at all.

Over the next twelve months we may require additional funding. We currently have a line of credit of up to $1.75 million from which we can borrow, and this line is subject to covenants that must be met. It is not certain whether all or part of this line of credit will be available to us in the future; and other sources of financing may not be available to us on a timely basis if at all, or on terms acceptable to us. If we fail to obtain acceptable additional financing when needed, we may not have sufficient resources to fund our normal operations; and this would have a material adverse effect on our business.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

The audit report issued by our independent registered public accounting firm for our financial statements for the fiscal year ended December 31, 2012 states that the auditing firm has substantial doubt in our ability to continue as a going concern due to the risk that we may not have sufficient cash and liquid assets at December 31, 2012 to cover our operating and capital requirements for the next twelve-month period; and if in that case sufficient cash cannot be obtained, we would have to substantially alter, or possibly even discontinue, operations. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We may experience costs and senior management distractions due to patent-related matters.

We make many products and they typically use patented technology. We attempt to license appropriate patents either directly or through our integrated circuit suppliers. However, we are subject to costs and senior management distractions due to patent matters. On October 15, 2012 Telecomm Innovations LLC filed a complaint against Zoom Telephonics and at least 23 other companies including Dell Inc., various dial-up modem producers, and many fax machine producers. The only named Zoom product was Zoom’s Model 3095 dial-up modem, and we believe that this has a license through Conexant for the two patents mentioned in the complaint. However, other Zoom dial-up modem products may be subject to the complaint, and a small percentage of these did not use Conexant chipsets. On February 6, 2013 Voice Integration Technologies filed a complaint against Zoom Telephonics alleging infringement of U.S. Patent No. 7,127,048 (the “‘048 Patent”), entitled “Systems and Methods for Integrating Analog Voice Service and Derived POTS Voice Service in a Digital Subscriber Line Environment.” The products subject to the complaint include Zoom ADSL X6v models 5695 and 5697. Zoom has not sold many of this type of product during its entire history; so Zoom believes the risk from this complaint is likely to be small. It is impossible to assess the potential cost and senior management distraction associated with these complaints or with future complaints or suits that may occur.

Our cable modem sales may be significantly reduced due to competition.

Cable modems account for the majority of Zoom’s revenues. Zoom currently sells two Docsis 3.0 cable modems, one of which also includes a built-in wireless-N router. Our Docsis 3.0 cable modems are primarily sold through high-volume retailers. We continue to experience fierce competition from the Motorola cable modems brand, which in April 2013 was purchased by Arris. In addition, Netgear recently introduced a cable modem to USA retailers. It is impossible to predict the effect of theses competitors or others on our cable modem sales.

The market for Internet access products and services has many competing technologies, so the demand for certain of our products and services is declining.

Industry analysts believe that the market for our dial-up modems is likely to continue to decline. If we are unable to sustain or grow demand for and sales of our broadband modems, we may be unable to sustain or grow our business. The market for high-speed communications products and services has a number of competing technologies. For instance, Internet access can be achieved by using a standard telephone line with an appropriate modem and dial-up or DSL service; using a cable TV line with a cable modem and cable modem service; using a router and some type of modem to service the computers connected to a local area network; or other approaches, including mobile broadband links to the Internet.

We currently sell products that include all these technologies. The introduction of new products by competitors, market acceptance of competing products based on new or alternative technologies, or the emergence of new industry standards have in the past rendered and could continue to render our products less competitive or even obsolete. For example, these factors have caused the market for our dial-up modems to shrink dramatically. If we are unable to sustain or grow demand for our broadband modems, we may be unable to sustain or grow our business.

Our reliance on a small number of customers for a large portion of our revenues could materially harm our business and prospects.

Relatively few customers have accounted for a substantial portion of the Company’s revenues. In 2012 three customers accounted for 67% of our total net sales and 85% of our gross accounts receivable. During 2011 three customers accounted for 58% of the Company’s total net sales and 72% of gross accounts receivable. Our customers generally do not enter into long-term agreements obligating them to purchase our products. We may not continue to receive significant revenues from any of these or from other large customers. Because of our significant customer concentration, our net sales and operating income could fluctuate significantly due to changes in political or economic conditions or the loss of, reduction of business with, or less favorable terms for any of our significant customers. A reduction or delay in orders from any of our significant customers, or a delay or default in payment by any significant customer could materially harm our business, results of operation and liquidity.

We may be unable to produce sufficient quantities of our products because we obtain key components from, and depend on, sole or limited source suppliers.

We obtain certain key parts, components, and equipment from sole or limited sources of supply. For example, the vast majority of our broadband modems use Broadcom chipsets and the vast majority of our dial-up modems use Conexant chipsets. In the past we have experienced long lead-times and significant delays in receiving shipments of modem chipsets from our sole source suppliers. We may experience similar delays in the future. In addition, some products may have other components that are available from only one source. If we are unable to obtain a sufficient supply of components from our current sources, we would experience difficulties in obtaining alternative sources or in altering product designs to use alternative components. Resulting delays or reductions in product shipments could damage relationships with our customers, and our customers could decide to purchase products from our competitors. Inability to meet our customers’ demand or a decision by one or more of our customers to purchase products from our competitors could harm our operating results.

Fluctuations in the foreign currency exchange rates in relation to the U.S. dollar could have a material adverse effect on our operating results.

Changes in currency exchange rates that increase the relative value of the U.S. dollar may make it more difficult for us to compete with foreign manufacturers on price, may reduce our foreign currency denominated sales when expressed in dollars, or may otherwise have a material adverse effect on our sales and operating results. A significant increase in our foreign currency denominated sales would increase our risk associated with foreign currency fluctuations. A weakness in the U.S. dollar relative to the Mexican peso and various Asian currencies, especially the Chinese renminbi, could increase our product costs. Fluctuations in the currency exchange rates have, and may continue to, adversely affect our operating results.

The current uncertainty in global economic conditions could negatively affect our business, results of operations, and financial condition.

The current uncertainty in global economic conditions have resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in credit, equity and fixed income markets. There could be a number of follow-on effects from these economic developments on our business, including unavailability of credit, insolvency of key suppliers resulting in product delays; customer insolvencies; rapid changes to the foreign currency exchange rates; decreased customer confidence; and decreased customer demand. Any of these events, or any other events caused by the recent financial crisis, may have a material adverse effect on our business, operating results, and financial condition.

Capacity constraints in our Mexican operations could reduce our sales and revenues and hurt customer relationships.

We rely on our Mexican operations to finish and ship most of the products we sell. Since moving our manufacturing operations to our Mexican facility we have experienced and may continue to experience constraints on our manufacturing capacity as we address challenges related to operating our new facility, such as hiring and training workers, creating the facility’s infrastructure, developing new supplier relationships, complying with customs and border regulations, and resolving shipping and logistical issues. Our sales and revenues may be reduced and our customer relationships may be impaired if we continue to experience constraints on our manufacturing capacity. We are working to minimize capacity constraints in a cost-effective manner, but there can be no assurance that we will be able to adequately minimize capacity constraints.

Our reliance on a business processing outsourcing partner to conduct our operations in Mexico could materially harm our business and prospects.

In connection with the move of most of our North American manufacturing operations to Mexico, we rely on a business processing outsourcing partner to hire, subject to our oversight, the production team for our manufacturing operation, provide the selected facility described above, and coordinate many of the ongoing manufacturing logistics relating to our operations in Mexico. Our outsourcing partner’s related functions include acquiring the necessary Mexican permits, providing the appropriate Mexican operating entity, assisting in customs clearances, and providing other general assistance and administrative services in connection with the ongoing operation of the Mexican facility. Our outsourcing partner’s performance of these obligations efficiently and effectively is critical to the success of our operations in Mexico. Failure of our outsourcing partner to perform its obligations efficiently and effectively could result in delays, unanticipated costs or interruptions in production, delays in deliveries to our customers or other harm to our business, results of operation, and liquidity. Moreover, if our outsourcing arrangement is not successful, we cannot assure our ability to find an alternative production facility or outsourcing partner to assist in our operations in Mexico or our ability to operate successfully in Mexico without outsourcing or similar assistance.

Our net sales, operating results and liquidity have been and may in the future be adversely affected because of the decline in the retail market for dial-up modems.

The dial-up modem industry has been characterized by declining unit volumes due primarily to broadband as an alternative method for accessing the Internet. We expect that sales of dial-up modems will continue to decline. If we fail to replace declining revenue from the sales of dial-up modems with the sales of our other products, including our broadband modems, our business, results of operation and liquidity will be harmed.

We believe that our future success will depend in large part on our ability to more successfully penetrate the broadband modem markets, which have been challenging markets, with significant barriers to entry.

With the shrinking of the dial-up modem market, we believe that our future success will depend in large part on our ability to penetrate the broadband modem markets including cable, DSL, and mobile broadband. These markets have significant barriers to entry that have adversely affected our sales to these markets. Although some cable, DSL, and mobile broadband modems are sold at retail, the high volume purchasers of these modems are concentrated in a relatively few large cable, telephone, and mobile broadband service providers which offer broadband modem services to their customers. These customers, particularly cable and mobile broadband services providers, also have extensive and varied approval processes for modems to be approved for use on their network. These approvals are expensive, time consuming, and continue to evolve. Successfully penetrating the broadband modem market therefore presents a number of challenges including: the current limited retail market for broadband modems; the relatively small number of cable, telecommunications and Internet service provider customers that make up the bulk of the market for broadband modems in certain countries, including the United States; the significant bargaining power of these large volume purchasers; the time consuming, expensive, uncertain and varied approval process of the various cable service providers; and the strong relationships with cable service providers enjoyed by incumbent cable equipment providers like Motorola and Cisco.

If we fail to meet changing customer requirements and emerging industry standards, there would be an adverse impact on our ability to sell our products and services.

The market for Internet access products and services is characterized by aggressive pricing practices, continually changing customer demand patterns, rapid technological advances, emerging industry standards and short product life cycles. Some of our product and service developments and enhancements have taken longer than planned and have delayed the availability of our products and services, which adversely affected our sales and profitability in the past. Any significant delays in the future may adversely impact our ability to sell our products and services, and our results of operations and financial condition may be adversely affected. Our future success will depend in large part upon our ability to: identify and respond to emerging technological trends and industry standards in the market; develop and maintain competitive products that meet changing customer demands; enhance our products by adding innovative features that differentiate our products from those of our competitors; bring products to market on a timely basis; introduce products that have competitive prices; manage our product transitions, inventory levels and manufacturing processes efficiently; respond effectively to new technological changes or new product announcements by others; meet changing industry standards; distribute our products quickly in response to customer demand; and compete successfully in the markets for our new products. These factors could also have an adverse effective on our operating results.

Our product cycles tend to be short and we may incur significant non-recoverable expenses or devote significant resources to sales that do not occur when anticipated. Therefore, the resources we devote to product development, sales and marketing may not generate material net sales for us. In addition, short product cycles have resulted in and may in the future result in excess and obsolete inventory, which has had and may in the future have an adverse affect on our results of operations. In an effort to develop innovative products and technology, we have incurred and may in the future incur substantial development, sales, marketing, and inventory costs. If we are unable to recover these costs, our financial condition and operating results could be adversely affected. In addition, if we sell our products at reduced prices in anticipation of cost reductions and we still have higher cost products in inventory, our business would be harmed and our results of operations and financial condition would be adversely affected.

Our international operations are subject to a number of risks that could harm our business.

Currently our business is significantly dependent on our operations outside the United States, particularly sales and production of substantially all of our products. For the year 2012, sales outside North America were 9% of our net sales. In addition, almost all of our manufacturing operations are now located outside of the United States. The inherent risks of international operations could harm our business, results of operation, and liquidity. For instance, our manufacturing operations in Mexico are subject to the challenges and risks associated with international operations, including those related to integration of operations across different cultures and languages, currency risk, and economic, legal, political and regulatory risks. In addition, fluctuations in the currency exchange rates have had, and may continue to have, an adverse effect on our operating results. The types of risks faced in connection with international operations and sales include, among others: regulatory and communications requirements and policy changes; currency exchange rate fluctuations, including, as a result of the move of our manufacturing operations to Mexico, changes in value of the Mexican peso relative to the US dollar; favoritism toward local suppliers; delays in the rollout of broadband services by cable and DSL service providers outside of the United States; local language and technical support requirements; difficulties in inventory management, accounts receivable collection and the management of distributors or representatives; cultural differences; reduced control over staff and other difficulties in staffing and managing foreign operations; reduced protection for intellectual property rights in some countries; political and economic changes and disruptions; governmental currency controls; shipping costs; and import, export, and tariff regulations. Almost all of our products are built in mainland China or Taiwan, so these products are subject to numerous risks including currency risk and economic, legal, political and regulatory risks.

We may be subject to product returns resulting from defects or from overstocking of our products. Product returns could result in the failure to attain market acceptance of our products, which would harm our business.

If our products contain undetected defects, errors, or failures, we could face delays in the development of our products, numerous product returns, and other losses to us or to our customers or end users. Any of these occurrences could also result in the loss of or delay in market acceptance of our products, either of which would reduce our sales and harm our business. We are also exposed to the risk of product returns from our customers as a result of contractual stock rotation privileges and our practice of assisting some of our customers in balancing their inventories. Overstocking has in the past led and may in the future lead to higher than normal returns.

If we fail to effectively manage our inventory levels, there could be a material and adverse affect on our liquidity and our business.

Due to rapid technological change and changing markets we are required to manage our inventory levels carefully to both meet customer expectations regarding delivery times and to limit our excess inventory exposure. In the event we fail to effectively manage our inventory our liquidity may be adversely affected and we may face increased risk of inventory obsolescence, a decline in market value of the inventory, or losses from theft, fire, or other casualty.

We may be unable to produce sufficient quantities of our products because we depend on third party manufacturers. If these third party manufacturers fail to produce quality products in a timely manner, our ability to fulfill our customer orders would be adversely impacted.

We use contract manufacturers and original design manufacturers for electronics manufacturing of most of our products. We use these third party manufacturers to help ensure low costs, rapid market entry, and reliability. Any manufacturing disruption could impair our ability to fulfill orders, and failure to fulfill orders would adversely affect our sales. Although we currently use four electronics manufacturers for the bulk of our purchases, in some cases a given product is only provided by one of these companies. The loss of the services of any of our significant third party manufacturers or a material adverse change in the business of or our relationships with any of these manufacturers could harm our business. Since third parties manufacture our products and we expect this to continue in the future, our success will depend, in part, on the ability of third parties to manufacture our products cost effectively and in sufficient quantities to meet our customer demand.

We are subject to the following risks because of our reliance on third party manufacturers: reduced management and control of component purchases; reduced control over delivery schedules, quality assurance and manufacturing yields; lack of adequate capacity during periods of excess demand; limited warranties on products supplied to us; potential increases in prices; interruption of supplies from assemblers as a result of a fire, natural calamity, strike or other significant event; and misappropriation of our intellectual property.

Our cable modem sales may be significantly reduced due to long lead-times.