0001467373DEF 14AFalse00014673732022-09-012023-08-31iso4217:USD00014673732021-09-012022-08-3100014673732020-09-012021-08-310001467373acn:PEOMinusReportedValueOfEquityAwardsMember2022-09-012023-08-310001467373acn:PEOPlusEquityAwardAdjustmentsMember2022-09-012023-08-310001467373acn:PEOMinusReportedValueOfEquityAwardsMember2021-09-012022-08-310001467373acn:PEOPlusEquityAwardAdjustmentsMember2021-09-012022-08-310001467373acn:PEOMinusReportedValueOfEquityAwardsMember2020-09-012021-08-310001467373acn:PEOPlusEquityAwardAdjustmentsMember2020-09-012021-08-310001467373acn:PEOYearEndFairValueOfEquityAwardsGrantedDuringYearMember2022-09-012023-08-310001467373acn:PEOYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsAsOfYearEndMember2022-09-012023-08-310001467373acn:PEOFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheYearMember2022-09-012023-08-310001467373acn:PEOChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2022-09-012023-08-310001467373acn:PEOTotalEquityAwardAdjustmentsMember2022-09-012023-08-310001467373acn:PEOYearEndFairValueOfEquityAwardsGrantedDuringYearMember2021-09-012022-08-310001467373acn:PEOYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsAsOfYearEndMember2021-09-012022-08-310001467373acn:PEOFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheYearMember2021-09-012022-08-310001467373acn:PEOChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2021-09-012022-08-310001467373acn:PEOTotalEquityAwardAdjustmentsMember2021-09-012022-08-310001467373acn:PEOYearEndFairValueOfEquityAwardsGrantedDuringYearMember2020-09-012021-08-310001467373acn:PEOYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsAsOfYearEndMember2020-09-012021-08-310001467373acn:PEOFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheYearMember2020-09-012021-08-310001467373acn:PEOChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2020-09-012021-08-310001467373acn:PEOTotalEquityAwardAdjustmentsMember2020-09-012021-08-310001467373acn:NonNEOPEOMinusAverageReportedValueOfEquityAwardsMember2022-09-012023-08-310001467373acn:NonNEOPEOPlusAverageEquityAwardAdjustmentsMember2022-09-012023-08-310001467373acn:NonNEOPEOMinusAverageReportedValueOfEquityAwardsMember2021-09-012022-08-310001467373acn:NonNEOPEOPlusAverageEquityAwardAdjustmentsMember2021-09-012022-08-310001467373acn:NonNEOPEOMinusAverageReportedValueOfEquityAwardsMember2020-09-012021-08-310001467373acn:NonNEOPEOPlusAverageEquityAwardAdjustmentsMember2020-09-012021-08-310001467373acn:NonNEOPEOAverageYearEndFairValueOfEquityAwardsGrantedDuringYearMember2022-09-012023-08-310001467373acn:NonNEOPEOYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsAsOfYearEndMember2022-09-012023-08-310001467373acn:NonNEOPEOAverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheYearMember2022-09-012023-08-310001467373acn:NonNEOPEOAverageChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2022-09-012023-08-310001467373acn:NonNEOPEOTotalAverageEquityAwardAdjustmentsMember2022-09-012023-08-310001467373acn:NonNEOPEOAverageYearEndFairValueOfEquityAwardsGrantedDuringYearMember2021-09-012022-08-310001467373acn:NonNEOPEOYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsAsOfYearEndMember2021-09-012022-08-310001467373acn:NonNEOPEOAverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheYearMember2021-09-012022-08-310001467373acn:NonNEOPEOAverageChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2021-09-012022-08-310001467373acn:NonNEOPEOTotalAverageEquityAwardAdjustmentsMember2021-09-012022-08-310001467373acn:NonNEOPEOAverageYearEndFairValueOfEquityAwardsGrantedDuringYearMember2020-09-012021-08-310001467373acn:NonNEOPEOYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsAsOfYearEndMember2020-09-012021-08-310001467373acn:NonNEOPEOAverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheYearMember2020-09-012021-08-310001467373acn:NonNEOPEOAverageChangeInFairValueFromPriorYearEndToVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2020-09-012021-08-310001467373acn:NonNEOPEOTotalAverageEquityAwardAdjustmentsMember2020-09-012021-08-31000146737312022-09-012023-08-31000146737322022-09-012023-08-31000146737332022-09-012023-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

____________________

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Accenture plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | |

| x | | No fee required. |

| | | |

| ¨ | | Fee paid previously with preliminary materials. |

¨

| | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of Annual General Meeting of Shareholders

| | | | | | | | |

Date Wednesday, January 31, 2024 Time 12:00 pm local time | Record Date December 4, 2023 Place The Dock, 7 Hanover Quay Grand Canal Dock, Dublin 2, Ireland | Availability of Materials The proxy statement, our Annual Report for the fiscal year ended August 31, 2023, and our Irish financial statements are available at www.proxyvote.com |

Items of Business

| | | | | | | | |

| 1 | By separate resolutions appoint the eleven director nominees described in the proxy statement | The Board recommends that you vote “FOR” each director nominee included in Proposal 1 and “FOR” each of the other proposals. The full text of these proposals is set forth in the accompanying proxy statement. Registered shareholders of the Company at the close of business on the record date are eligible to vote at the meeting. During the meeting, management will also present, and the auditors will report to shareholders on, our Irish financial statements for the fiscal year ended August 31, 2023. We recommend that you review the further information on the process for, and deadlines applicable to, voting, attending the meeting and appointing a proxy under “Questions and Answers About the Annual Meeting.” By order of the Board of Directors, Joel Unruch General Counsel and Corporate Secretary December 13, 2023 |

| |

| 2 | Approve, in a non-binding vote, the compensation of our named executive officers |

| |

| 3 | Approve the Amended and Restated Accenture plc 2010 Share Incentive Plan |

| |

| 4 | Approve the Amended and Restated Accenture plc 2010 Employee Share Purchase Plan |

| |

| 5 | Ratify, in a non-binding vote, the appointment of KPMG LLP (“KPMG”) as independent auditor of Accenture plc (the “Company”) and authorize, in a binding vote, the Audit Committee of the Board of Directors (the “Board”) to determine KPMG’s remuneration |

| |

| Annual Irish Law Proposals: |

| |

| 6 | Grant the Board the authority to issue shares under Irish law |

| |

| 7 | Grant the Board the authority to opt-out of pre-emption rights under Irish law |

| |

| 8 | Determine the price range at which the Company can re-allot shares that it acquires as treasury shares under Irish law |

| | | | | | | | | | | |

| | | |

Your vote is important To make sure your shares are represented, please cast your vote as soon as possible in one of the following ways: |

| | | |

| | | |

Internet Online at www.proxyvote.com | Telephone Call 1 (800) 690-6903 | Mail Mark, sign and date your proxy card or voting instruction form and return it in the postage-paid envelope | QR Code Scan this QR code. Additional software may be required for scanning |

| | | |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

| |

|

|

| |

| |

|

|

| |

| |

|

|

| |

| |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

| |

| |

| |

| |

| |

| |

|

|

| |

| |

|

|

| |

| |

| |

| We use the terms “Accenture,” the “Company,” “we,” “our” and “us” in this proxy statement to refer to Accenture plc and its subsidiaries. All references to “years,” unless otherwise noted, refer to our fiscal year, which ends on August 31. |

Our Company

Accenture (the “Company”) is a leading global professional services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth and enhance citizen services—creating tangible value at speed and scale.

We are a talent- and innovation-led company with approximately 733,000 people serving clients in more than 120 countries.

Technology is at the core of change today, and we are one of the world’s leaders in helping drive that change, with strong ecosystem relationships.

We combine our strength in technology and leadership in cloud, data and AI with unmatched industry experience, functional expertise and global delivery capability.

We are uniquely able to deliver tangible outcomes because of our broad range of services, solutions and assets across Strategy & Consulting, Technology, Operations, Industry X and Song.

These capabilities, together with our culture of shared success and commitment to creating 360° value, enable us to help our clients reinvent and build trusted, lasting relationships.

We measure our success by the 360° value we create for our clients, each other, our shareholders, partners and communities.

| | | | | |

Accenture 2023 Proxy Statement | 1 |

Our Strategy

The core of our strategy is delivering 360° value to our clients, people, shareholders, partners and communities by helping them continuously reinvent. Our strategy defines the areas in which we will drive growth, build differentiation via 360° value and enable our clients to transform their organizations through technology, data and AI to create value every day. We aspire to be at the center of our clients’ business and help them reach new levels of performance and to set themselves apart as leaders in their industries. We define 360° value as delivering the financial business case and unique value a client may be seeking, and striving to partner with our clients to achieve greater progress on inclusion and diversity, reskill and upskill our clients’ employees, help our clients achieve their sustainability goals, and create meaningful experiences, both with Accenture and for the customers and employees of our clients.

We bring industry specific solutions and services as well as cross industry expertise and leverage our scale and global footprint, innovation capabilities, and strong ecosystem partnerships together with our assets and platforms including myWizard, myNav, SynOps and AI Navigator for Enterprise to deliver tangible value for our clients.

We help our clients use technology to drive enterprise-wide transformation, which includes:

•building their digital core—such as moving them to the cloud, leveraging data and AI, including generative AI, and embedding security across the enterprise;

•optimizing their operations—such as helping our clients digitize faster, access digital talent and reduce costs as well as through digitizing engineering and manufacturing; and

•accelerating their revenue growth—such as through using technology and creativity to create personalized connections, experiences and targeted sales at scale, leveraging data and AI, transforming content supply chains and marketing and commerce models and helping create new digital services and business models.

Our managed services are strategic for our clients as companies seek to move faster and leverage our digital platforms and talent as well as reduce costs.

We believe our strategy to deliver 360° value makes us an attractive destination for top talent, a trusted partner to our clients and ecosystem partners, and a respected member of our communities.

We believe that the companies that will lead in the next decade need to harness the five key forces of change we have identified—total enterprise reinvention, talent, sustainability, the metaverse continuum and the ongoing technology revolution. We are investing and co-creating with clients and partners to lead in helping our clients thrive across these forces, which we expect to have different time horizons. Today, the demand we continue to see across our geographic markets, services and industries is being primarily driven by the first two, as companies are in the early stages of harnessing these forces. We have summarized below each of the five key forces as we currently see them evolving.

•Total enterprise reinvention, as we believe every part of every business must be transformed by technology, data and AI, with new ways of working and engaging with customers, employees and partners, and new business models, products and services. We are helping clients build their digital core and use new technologies, like generative AI, to optimize operations and accelerate growth.

•Talent, as companies must be able to access great talent, be talent creators not just consumers, and unlock the potential of their people—from the ways they organize and work, to their culture, to their employee value proposition.

•Sustainability, as consumers, employees, business partners, regulators and investors are demanding companies move from commitment to action—we believe every business must be a sustainable business.

•The metaverse continuum, moving seamlessly between virtual and physical, which we believe will provide even greater possibilities in the next waves of digital transformation.

•The ongoing technology revolution, from the rich innovation to come in the powerful technologies, like generative AI, being used to transform companies today, to the new fields of the future, from quantum computing, to science and space technology.

We believe that helping clients navigate these five key forces of change will, in turn, drive our growth.

| | | | | |

2 | Accenture 2023 Proxy Statement |

We are Investing in Data & AI to Help Accelerate Our Clients’ Reinvention

In June 2023, we announced an industry-leading $3 billion investment in our Data & AI practice over the next three years to help our clients across all industries rapidly and responsibly advance and use AI to achieve greater growth, efficiency and resilience.

As part of this investment, we are doubling our AI talent to 80,000 people, and we are equipping more than 250,000 people with skills to use new AI tools equitably, sustainably and without bias.

The investment builds on our work in AI for more than 15 years, including more than 1,500 patents and pending patent applications.

Our AI Navigator for Enterprise is a generative AI-based platform designed to help our clients reinvent responsibly with AI, and the Accenture Center for Advanced AI is designed to give clients confidence to move their business forward into the AI era and better navigate extraordinarily rapid change and uncertainty.

In addition to bringing generative AI innovation to our clients, we are embedding it into how we deliver our services and in how we operate—all underpinned by our Responsible AI compliance program.

| | | | | |

Accenture 2023 Proxy Statement | 3 |

| | | | | |

4 | Accenture 2023 Proxy Statement |

Driving Reinvention, Delivering 360° Value

The core of our strategy is delivering 360° value to our clients, people, shareholders, partners and communities by helping them continuously reinvent.

We achieved another strong year of financial performance(1) in fiscal 2023, with record new bookings, continued adjusted operating margin expansion and adjusted EPS growth, and very strong cash flow, driving shareholder value creation. These results continue to enable us to deliver 360° value for all our stakeholders.

| | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | Diluted Earnings Per Share | | | Free Cash Flow |

| ¡ | | | ¡ | | | ¡ | |

| | | | |

| $64.1B An increase of 4% in U.S. dollars and 8% in local currency from fiscal 2022, including revenues of $30.3 billion from North America, $21.3 billion from Europe(2) and $12.5 billion from Growth Markets | | | $10.77 A 1% increase from fiscal 2022 EPS of $10.71; after excluding the impact of business optimization costs of $1.28 per share and an investment gain of $0.38 per share, adjusted fiscal 2023 EPS of $11.67 increased 9% | | | $9.0B Defined as operating cash flow of $9.5 billion net of property and equipment additions of $528 million, with a free cash flow to net income ratio of 1.3 |

| | | | | | | |

| New Bookings | | | Operating Margin | | | Cash Returned to Shareholders |

| ¡ | | | ¡ | | | ¡ | |

| | | | |

| $72.2B An increase of 1% in U.S. dollars and 5% in local currency from fiscal 2022 | | | 13.7% A decrease of 150 basis points from fiscal 2022 operating margin of 15.2%; after excluding business optimization costs of 170 basis points, adjusted operating margin was 15.4%, an expansion of 20 basis points | | | $7.2B Defined as cash dividends of $2.8 billion and share repurchases of $4.3 billion. In fiscal 2023, we paid dividends of $4.48 per share, a 15% increase over the prior year |

(1)See “Reconciliation of GAAP Measures to Non-GAAP Measures.”

(2)In the first quarter of fiscal 2024, our Middle East and Africa market units moved from Growth Markets to Europe, and the Europe market is now referred to as our Europe, Middle East and Africa (EMEA) geographic market.

| | | | | |

Accenture 2023 Proxy Statement | 5 |

For the three-year period from the end of fiscal 2020 through fiscal 2023, our performance reflects our consistent focus on creating 360° value for our clients and all our stakeholders.

| | | | | | | | | | | | | | |

| Broad-Based Revenue Growth

13% CAGR(2) in U.S. dollars and

15% in local currency(1) | | | Sustained Adjusted Margin Expansion

100 Basis Point Decrease (on a GAAP basis) 70 Basis Point Expansion (on an adjusted basis)(1)(3) |

| | | | |

| Revenues | | | Operating Margin |

| ¡ | | | ¡ | |

| | |

| | | | |

| | | | | | | | | | | | | | |

| Strong Earnings Growth

11% CAGR (on a GAAP basis) 16% CAGR (on an adjusted basis)(1)(4) | | | Significant Cash Returned to

Shareholders since Fiscal 2020

12% CAGR dividends per share $19.7 billion returned since Fiscal 2020 |

| | | | |

| Earnings Per Share | | | Cash Returned to Shareholders |

| ¡ | | | ¡ | |

| | |

| | | | |

| | | | | |

| Total Shareholder Return (TSR)(5) |

| ¡ | |

|

(1)See “Reconciliation of GAAP Measures to Non-GAAP Measures.”

(2)“CAGR” means Compound Annual Growth Rate.

(3)FY23 adjusted operating margin of 15.4% excludes business optimization costs of 170 basis points.

(4)FY20 adjusted diluted EPS of $7.46 were adjusted to exclude an investment gain of $0.43 per share. FY23 adjusted EPS of $11.67 were adjusted to exclude the $1.28 per share impact of business optimization costs and an investment gain of $0.38 per share.

(5)The cumulative TSR on our Class A shares for the period August 31, 2020 - August 31, 2023, compared with the cumulative TSR over the same period of the S&P 500 Stock Index and the S&P 500 Information Technology Sector Index, assuming that on August 31, 2019, $100 was invested in our Class A shares and in each of the two indices, with dividends reinvested on the ex-dividend date without payment of any commissions.

| | | | | |

6 | Accenture 2023 Proxy Statement |

We measure our success by the 360° value we create for our clients, each other, our shareholders, partners and communities, including in the following key areas during fiscal 2023:

| | | | | | | | | | | | | | |

| Investments in Acquisitions | | | Research and Development |

| ¡ | | | ¡ | |

| | |

| $2.5B 25 strategic acquisitions to scale our business in high-growth areas, add skills and capabilities in new areas and deepen our industry and functional expertise | | | $1.3B Investment in assets, platforms and industry and functional solutions and in patents and pending patents |

| | | | |

| Developing Our People | | | Promoting Our People |

| ¡ | | | ¡ | |

| | |

| $1.1B Investment in continuous learning and development. With our digital learning platform, we delivered approximately 40 million training hours, consistent with fiscal 2022 | | | 123,000 We celebrated approximately 123,000 promotions, demonstrating our continued commitment to creating vibrant careers and opportunities for our people |

| | | | |

| Strong Leadership | | | Gender Equality |

| ¡ | | | ¡ | |

| | |

| 10,000 Approximately 10,000 Accenture leaders, with an average of 16 years of Accenture experience, and a global management committee (our primary management and leadership team) with an average of 23 years of Accenture experience | | | 48% Of our global workforce are women, compared to our global goal of gender parity by 2025, and 30% of our managing directors are women, in line with our global goal of 30% women by 2025 |

| | | | |

| Commitment to Our Communities | | | Renewable Electricity |

| ¡ | | | ¡ | |

| | |

| 4.3M People equipped with skills toward employment or entrepreneurship reported by programs supported through our Skills to Succeed initiative | | | 100% We achieved our goal of 100% renewable electricity across our offices by the end of 2023 |

| | | | | |

Accenture 2023 Proxy Statement | 7 |

Proxy Summary

This proxy summary highlights information contained elsewhere in this proxy statement, which is first being sent or made available to shareholders on or about December 13, 2023. This summary does not contain all of the information you should consider, so please read the entire proxy statement carefully before voting.

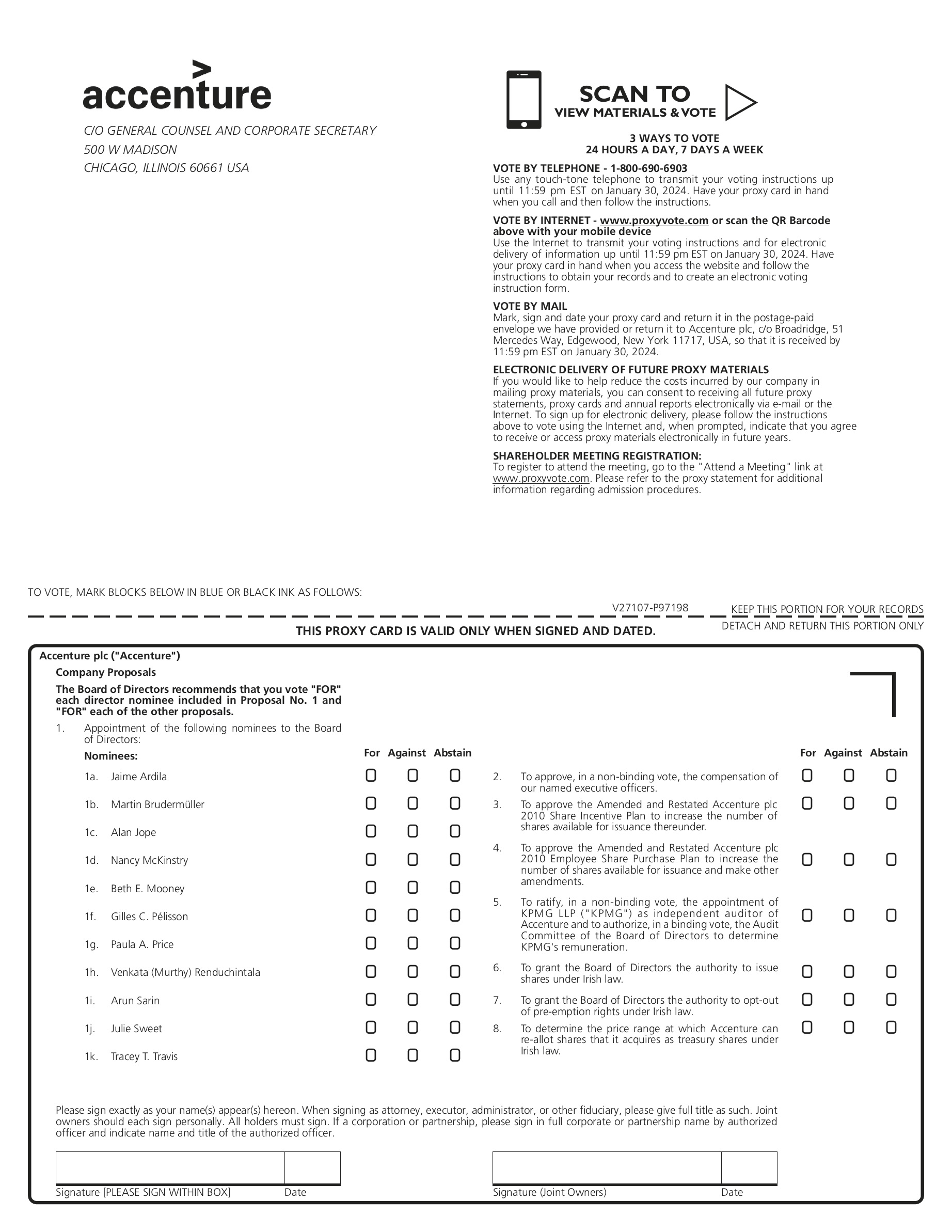

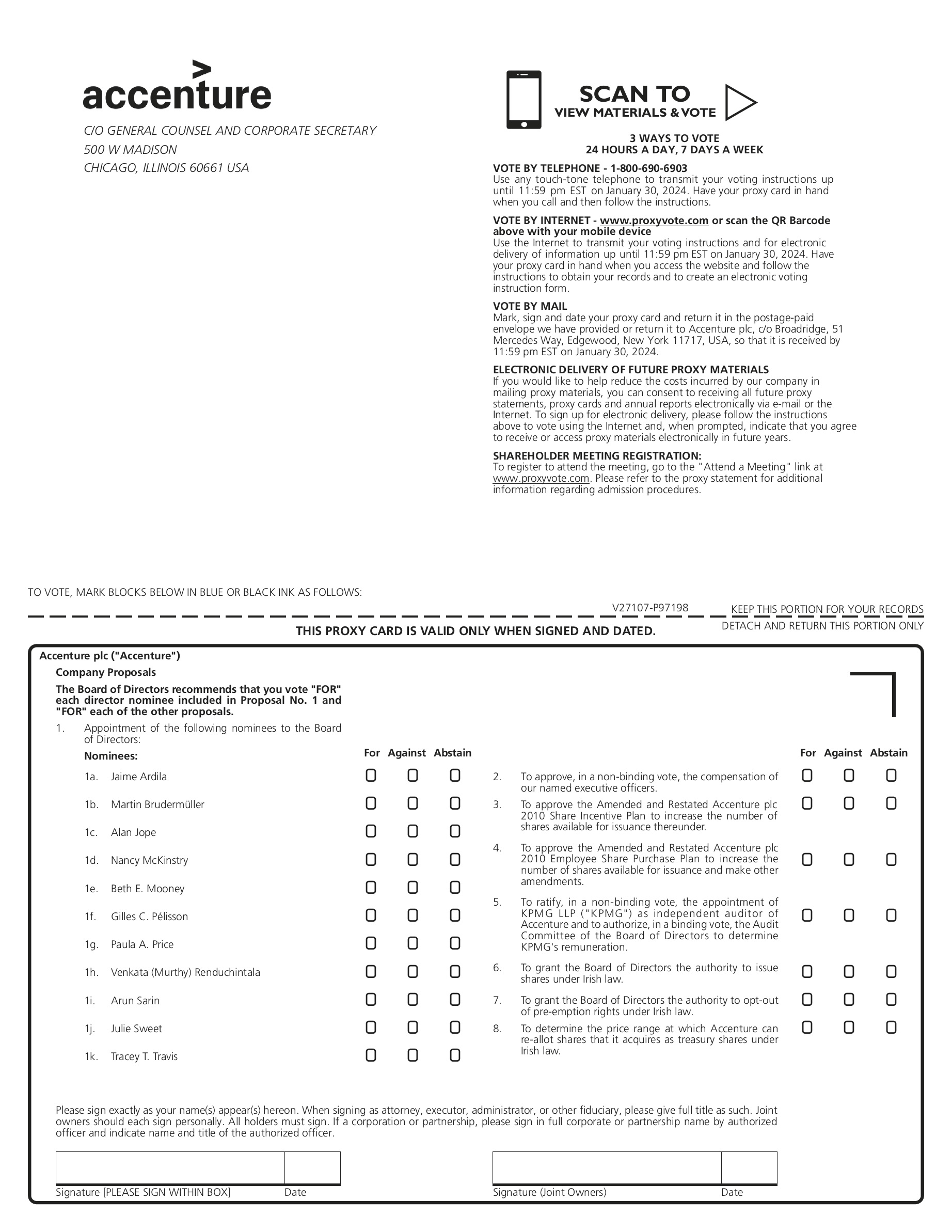

Items of Business

The following table summarizes the proposals to be voted upon at the 2024 Annual General Meeting of Shareholders to be held on January 31, 2024 (the “Annual Meeting”), and the Board’s voting recommendations with respect to each proposal. The required approval is a majority of votes cast for Proposals 1-6 and 75% of votes cast for Proposals 7 and 8.

| | | | | | | | | | | |

| | | |

| Proposals | Board Recommendation | Page |

| | | |

| | | |

| 1 | Appointment of Directors | FOR

each nominee | 42 |

| | | |

| | | |

| 2 | Advisory Vote to Approve Executive Compensation | FOR | 60 |

| | | |

| | | |

| 3 | Approve Amended and Restated Accenture plc 2010 Share Incentive Plan | FOR | 99 |

| | | |

| | | |

| 4 | Approve Amended and Restated Accenture plc 2010 Employee Share Purchase Plan | FOR | 108 |

| | | |

| | | |

| 5 | Ratify the Appointment and Approve Remuneration of Auditor | FOR | 117 |

| | | |

| | | |

| 6 | Grant Board Authority to Issue Shares | FOR | 120 |

| | | |

| | | |

| 7 | Grant Board Authority to Opt-Out of Pre-emption Rights | FOR | 121 |

| | | |

| | | |

| 8 | Determine Price Range for the Re-Allotment of Treasury Shares | FOR | 123 |

| | | |

| | | | | |

Accenture 2023 Proxy Statement | 9 |

Our Director Nominees

Our director nominees exhibit a mix of skills, experience, diversity and perspectives:

| | | | | | | | | | | | | | | | | | | | |

| | Principal Occupation | Age | Director since | Committee Memberships | Other Public Company Boards(1) |

| Jaime Ardila | Former EVP and President, South America, General Motors Company | 68 | 2013 | Audit, Finance (C), Nominating, Governance & Sustainability | 2 |

| Martin Brudermüller(2) | CEO & Chairman of the Executive Board, BASF SE | 62 | Nominee | Audit | 1 |

| Alan Jope | Former CEO, Unilever plc | 59 | 2023 | Nominating, Governance & Sustainability | 0 |

| Nancy McKinstry | CEO & Chairman of the Executive Board, Wolters Kluwer N.V. | 64 | 2016 | Compensation, Culture & People (C), Nominating, Governance & Sustainability | 1 |

| Beth E. Mooney | Former Chairman & CEO, KeyCorp | 68 | 2021 | Compensation, Culture & People, Finance | 2 |

| Gilles C. Pélisson Independent Lead Director | Former Chairman & CEO, TF1 Group | 66 | 2012 | Nominating, Governance & Sustainability | 0 |

| Paula A. Price | Former CFO, Macy’s, Inc. | 62 | 2014 | Audit (C), Compensation, Culture & People | 2 |

| Venkata (Murthy) Renduchintala | Former Chief Engineering Officer, Intel Corporation | 58 | 2018 | Audit, Finance | 0 |

| Arun Sarin | Former CEO, Vodafone Group plc | 69 | 2015 | Compensation, Culture & People, Nominating, Governance & Sustainability (C) | 2 |

| Julie Sweet Chair | Chair & CEO, Accenture plc | 56 | 2019 | — | 0 |

| Tracey T. Travis | CFO, The Estée Lauder Companies Inc. | 61 | 2017 | Audit, Finance | 1 |

(1)All director nominees are in compliance with the Company’s Director Overboarding Policy. See “Proposal 1: Appointment of Directors—Process for Selecting New Outside Directors—Director Overboarding Policy.” (2)Subject to appointment at the Annual Meeting, Dr. Brudermüller will be appointed to the Audit Committee. Dr. Brudermüller is expected to step down from his roles at BASF SE in April 2024.

| | | | | |

10 | Accenture 2023 Proxy Statement |

Director Nominee Highlights

| | | | | | | | | | | | | | | | | |

| Nominee Diversity | | | |

| ¡ | | | | | |

| | | | |

| 5 of 11 are racially and

ethnically diverse | |

5 of 11 are women | |

| | |

| | | | | |

| 45% | Directors are Women | | |

| | | | | |

| | | | | |

| 45% | Racially and Ethnically

Diverse Directors | | |

| | | | | |

| | | | | |

| 50% | Board Committees

Chaired by Women | | |

| | | | | |

| | | | | |

| 75% | Board Committees Chaired

by Racially and Ethnically

Diverse Directors | | |

| | | | | |

| | | | | |

| | | | | | | | | | | |

| | Nominee Experience |

| ¡ | | |

| | |

| | |

| | 11/11

Senior Leadership Experience |

| | | |

| | |

| | 9/11

Public Company Board Experience |

| | | |

| | |

| | 10/11

Global Expertise |

| | | |

| | |

| | 10/11

Finance, Accounting and Risk Management |

| | | |

| | |

| | 10/11

Innovation and Technology |

| | | |

| | |

| | 11/11

Investment Expertise |

| | | |

| | |

| | 9/11

Government and Regulatory |

| | | |

| | Range of Tenure | |

| ¡ | | |

| | |

| | | 6.1 years

average tenure |

| | | | | |

Accenture 2023 Proxy Statement | 11 |

Corporate Governance Highlights

Accenture has a history of strong corporate governance. The Company believes good governance is critical to achieving long-term shareholder value. We are committed to governance practices and

policies that serve the long-term interests of the Company and its stakeholders. The following table summarizes certain highlights of our corporate governance practices and policies:

| | | | | |

| |

Our Practices and Policies |

| |

| Board Structure and Independence | Other Strong Governance Practices |

| |

ü100% independent Board committees ü10 of our 11 director nominees are independent üStrong independent Lead Director, elected by the independent directors üRegular executive sessions, where independent directors meet without management present üRobust director selection process resulting in a diverse and international Board in terms of gender, race, ethnicity, experience, perspectives, skills and tenure üBoard takes active role in Board succession planning and is committed to Board refreshment | üBoard diversity policy to actively seek out women and underrepresented candidates üDirector overboarding policy limiting service to 3 other public company boards or 2 other public company boards if the director is a public company chief executive officer üAnnual Board, committee and individual director evaluations and self-assessments üActive shareholder engagement üPolicy on political contributions and lobbying |

| |

| Board Oversight | Shareholder Rights |

| |

üActive Board oversight of strategy, risk management and environmental, social and governance (“ESG”) matters üCommittee oversight of ESG performance, disclosure, strategies, goals, objectives, risks and opportunities, as well as strategies related to the Company’s people, including pay equity, inclusion and diversity, leadership succession and risks | üAnnual election of directors üShareholders holding 10% or more of our outstanding share capital have the right to convene a special meeting üNo shareholder rights plan (“poison pill”) üProxy access right |

| |

| | | | | |

12 | Accenture 2023 Proxy Statement |

| | |

Compensation Highlights Consistent with our pay-for-performance philosophy, 2023 compensation decisions were aligned with our strong financial performance in fiscal 2023, as described further under “Executive Compensation—Compensation Discussion and Analysis—Fiscal 2023 Compensation Decisions.” |

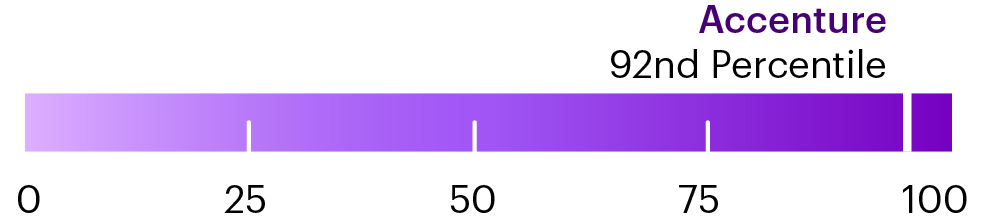

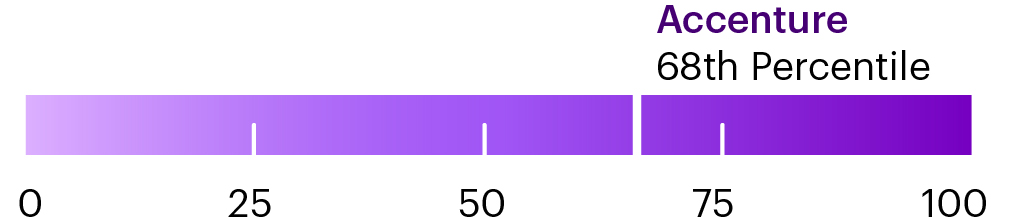

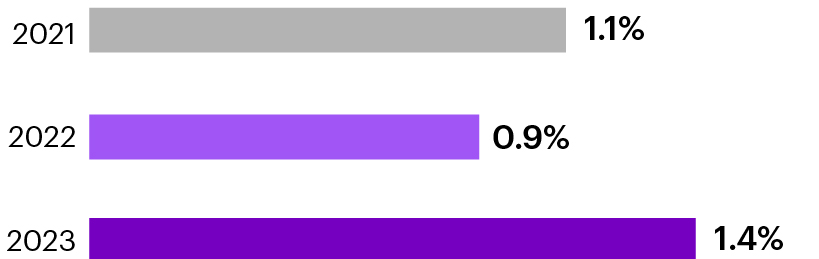

Pay-for-Performance

The Company’s performance with respect to total shareholder return over a three-year period was at the 45th percentile among the companies in our peer group. The realizable total direct compensation for the chair and chief executive officer role over this

same period was at the 34th percentile, which indicates that our relative Company performance ranked higher than relative realizable pay, as compared to our peer group.

See page 67 for a definition of realizable total direct compensation.

| | | | | |

Accenture 2023 Proxy Statement | 13 |

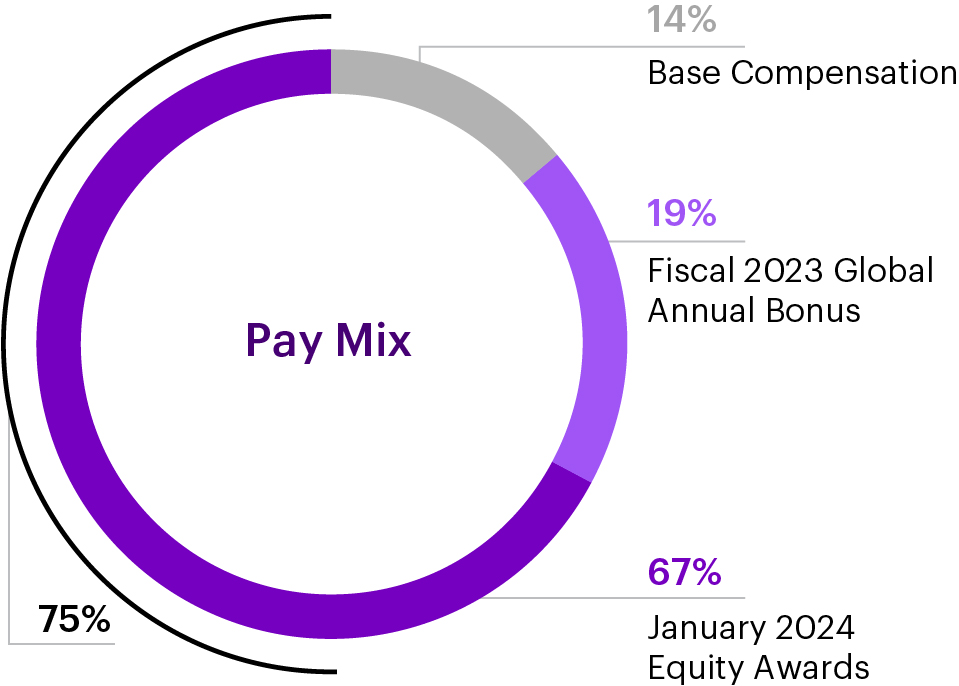

Pay Elements for Named Executive Officers

The Compensation, Culture & People Committee believes that total compensation for the Company’s named executive officers should closely align with the Company’s performance and each individual’s performance.

Our named executive officers are eligible to earn a cash bonus award under our Global Annual Bonus program, which is funded during the fiscal year based on Company financial performance compared to the earnings target for the year, and rewards them for Company and individual performance evaluated against performance objectives, as described below under “—Process for Determining Executive

Compensation—Performance Objectives Used in Evaluations.” We also use two primary equity compensation programs for our named executive officers: the Key Executive Performance Share Program, which rewards achievement over a prospective three-year performance period, and the Accenture Leadership Performance Equity Award Program, which rewards executives for performance in the preceding fiscal year. The following reflects compensation elements approved by the Compensation, Culture & People Committee in recognition of our named executive officers’ achievements during fiscal 2023.

| | | | | | | | |

| CEO and Other Named Executive Officer (“NEO”) Pay Mix |

| ¡ | | |

| |

| | |

(1)Does not include Mr. Etheredge, who is not eligible to receive certain pay elements included above. Mr. Etheredge, who served as our chief executive officer—North America through August 31, 2023, is retiring and currently serves as an advisor to the Company and is expected to continue in this position through his retirement from the Company on June 30, 2024.

| | | | | |

14 | Accenture 2023 Proxy Statement |

Compensation Practices

The Compensation, Culture & People Committee oversees the design and administration of the Company’s compensation programs. The Compensation, Culture & People Committee believes that a well-designed, consistently applied compensation program is fundamental to the long-term creation of shared success—our commitment to make a positive difference together with our clients, people, shareholders, partners and communities. The following table summarizes some highlights of our compensation practices that drive our named executive officer compensation programs:

| | | | | | | | | | | | | | |

| | | | |

| What we do | | | |

| | | | |

| üAlign our executive pay with performance üSet challenging performance objectives üProvide an appropriate mix of short- and

long-term incentives üAlign executive compensation with shareholder returns through performance-based vesting of equity incentive awards üUse appropriate peer groups when establishing compensation üMaintain meaningful equity ownership guidelines | üInclude caps on individual payouts in short- and long-term incentive plans üMaintain clawback policies applicable to cash and equity incentive awards (including both time- and performance-based) üMitigate potential dilutive effects of equity awards through our share repurchase programs üHold an annual “say-on-pay” advisory vote üConduct annual compensation risk review and assessment üRetain an independent compensation consultant | |

| | | | |

| What we don’t do | | | |

| | | | |

| ûNo contracts with multi-year guaranteed salary increases or non-performance bonus arrangements ûNo “golden parachutes,” change in control payments or excise tax gross-ups ûNo change in control “single trigger” equity acceleration provisions | ûNo dividends or dividend equivalents paid until vesting ûNo hedging or pledging of Company shares ûNo supplemental executive retirement plan | |

| | | | |

| | | | | |

Accenture 2023 Proxy Statement | 15 |

Corporate Governance

The Board is responsible for providing governance and oversight over the strategy, operations and management of Accenture. The primary mission of the Board is to represent and protect the interests of our shareholders. The Board oversees our senior management, to whom it has delegated the authority to manage the day-to-day operations of the Company. The Board has adopted Corporate Governance Guidelines, committee charters and a Code of Business Ethics which, together with our Memorandum and Articles of Association, form the governance framework for the Board and its committees. We believe good governance strengthens the Board and management’s

accountability. The Board regularly (and at least annually) reviews its Corporate Governance Guidelines and other corporate governance documents and from time to time revises them when it believes it serves the interests of the Company and its shareholders to do so and in response to feedback from shareholders, changing regulatory and governance requirements and best practices. The following sections provide an overview of our corporate governance structure, including director independence and other criteria we use in selecting director nominees, our Board leadership structure and the responsibilities of the Board and each of its committees.

| | | | | | | | |

| Key Corporate Governance Documents The following materials are accessible through the Governance Principles section of our website at www.accenture.com/us-en/about/governance/company-principles : |

•Corporate Governance Guidelines •Code of Business Ethics | •Committee Charters •Memorandum and Articles of Association |

| | |

Printed copies of all of these documents are also available free of charge upon written request to our Investor Relations Group at Accenture, Investor Relations, 395 Ninth Avenue, 60th Floor, New York, NY 10001, USA. Accenture’s Code of Business Ethics is applicable to all of our directors, officers and employees. If the Board grants any waivers from our Code of Business Ethics to any of our directors or executive officers, or if we amend our Code of Business Ethics, we will, if required, disclose these matters through our website on a timely basis.

| | | | | |

Accenture 2023 Proxy Statement | 17 |

Corporate Governance Practices

Accenture has a history of strong corporate governance. We are committed to governance policies and practices that serve the interests of the Company and its shareholders. Over the years, our Board has evolved our practices in the interests of Accenture’s shareholders. Our governance practices and policies include the following, among other things:

| | | | | | | | |

| | |

| Board Structure and Independence | Independent Board | All of our directors are independent except for our chair and chief executive officer. |

| | |

| 100% independent Board committees | Each of our four committees consists solely of independent directors. Each standing committee operates under a written charter, which is reviewed annually, that has been approved by the Board. |

| | |

| Strong independent Lead Director, elected by the independent directors | We have an independent Lead Director of the Board who has comprehensive duties that are set forth in the Company’s Corporate Governance Guidelines, including leading regular executive sessions of the Board, where independent directors meet without management present. |

| | |

| Commitment to Board refreshment | Our Board takes an active role in Board succession planning, is committed to Board refreshment and works towards creating a balanced Board with both fresh perspectives and deep experience. As a refreshment mechanism, we have a retirement age of 75. The current average tenure of our 11 director nominees is 6.1 years. |

| | |

| Director selection process | Our Board has a rigorous director selection process resulting in a diverse and international Board in terms of gender, race, ethnicity, experience, perspectives, skills and tenure. |

| | |

| | |

| Board Oversight | Board oversight of ESG | The Board has delegated ESG oversight responsibility to committees of the Board based on the expertise of those committees. The Nominating, Governance & Sustainability Committee oversees the Company’s overall ESG performance, disclosure, strategies, goals and objectives and monitors evolving ESG risks and opportunities. The Compensation, Culture & People Committee oversees the Company’s strategies related to the Company’s people, including matters such as pay equity, inclusion and diversity, leadership succession and culture and monitors related risks. The Audit Committee oversees our approach to the quality of ESG-related data and controls. |

| | |

| Board oversight of strategy and risk | Our Board provides active oversight of our strategy and enterprise risk management program (including cybersecurity, responsible AI and data privacy risks). The Audit Committee’s oversight responsibility includes information technology risk exposures, including cybersecurity, data privacy and data security. |

| | |

| | |

| Shareholder Rights | Annual election of directors | All of our directors are elected annually. |

| | |

| Authority to call special meetings | Shareholders holding 10% or more of our outstanding share capital have the right to convene a special meeting. |

| | |

| No shareholder rights plan (“poison pill”) | The Company does not have a poison pill. |

| | |

| Proxy access right | Eligible shareholders can (subject to certain requirements) include their own qualified director nominees in our proxy materials. |

| | |

| | | | | |

18 | Accenture 2023 Proxy Statement |

| | | | | | | | |

| | |

Other Strong Corporate

Governance Practices | Annual Board, committee and individual director evaluations and self-assessments | The Nominating, Governance & Sustainability Committee conducts a confidential survey of the Board and its committees each year. The independent Lead Director and chair of the Nominating, Governance & Sustainability Committee also conduct a self-assessment interview with each Board member that is designed to enhance his or her participation and role as a member of the Board, as well as to assess the competencies and skills each individual director is expected to bring to the Board. |

| | |

| Board diversity policy | As part of the search process for new director candidates, the Nominating, Governance & Sustainability Committee actively seeks out women and underrepresented candidates to include in the pool from which Board nominees are chosen (and instructs any search firm engaged for the search to do so). |

| | |

| Director overboarding policy | Our directors may not serve on the boards of more than three public companies, in addition to our Board, and directors who are chief executive officers of public companies may not serve on the boards of more than two other public companies, in addition to our Board. |

| | |

| Active shareholder engagement | We regularly engage with our shareholders to better understand their perspectives, and our independent Lead Director has participated when requested by major shareholders. |

| | |

| Code of Business Ethics | Our Code of Business Ethics, which applies to all employees as well as all members of the Board, reinforces our core values and helps drive our culture of compliance, ethical conduct and accountability. The contents of our Code of Business Ethics are organized by six fundamental behaviors: Make Your Conduct Count; Comply with Laws; Deliver for Our Clients; Protect People, Information and Our Business; Run Our Business Responsibly; and Be a Good Corporate Citizen. |

| | |

| Clawback policies | We maintain two clawback policies applicable to our current and former executive officers. Our Mandatory Clawback Policy complies with the requirements imposed pursuant to Exchange Act Rule 10D-1 and provides for clawback of excess incentive-based compensation in the event of a financial restatement. Our Senior Leadership Clawback policy applies to a broader group of individuals, including our current and former executive officers and other senior leaders, and provides for the recoupment of time- and performance-based cash and equity incentive compensation under specified circumstances as further described under “Executive Compensation—Compensation Discussion and Analysis—Additional Information.” |

| | |

| Director and executive officer equity ownership requirements | Each named executive officer is required to hold Accenture equity with a value equal to at least six times his or her base compensation by the fifth anniversary of becoming a named executive officer. Each director is required to hold Accenture equity having a fair market value equal to three times the value of the annual director equity grants within three years of joining the Board. |

| | |

| Prohibition on hedging or pledging of company stock | Our directors and all employees are prohibited from entering into hedging transactions, and our directors, our chair and chief executive officer, executive officers, members of our global management committee and other key employees are prohibited from entering into pledging transactions. |

| | |

| | | | | |

Accenture 2023 Proxy Statement | 19 |

Leadership Structure

We believe strong independent leadership is essential for the Board to effectively perform its functions and to help ensure independent oversight of management. Our Corporate Governance Guidelines provide the Board with the flexibility to choose the appropriate Board leadership structure for the Company based on what it believes is best for Accenture and its shareholders at a given point in time. Our Corporate Governance Guidelines also provide that if the same person holds the chair and chief executive officer roles, or if the chair is not independent, the independent directors of the Board will designate one of the independent directors to serve as the independent Lead Director.

Currently, our Board leadership structure consists of an independent Lead Director, a chair (who is also our chief executive officer) and strong independent committee chairs. The Board believes our structure provides independent Board leadership with the benefit of our chief executive officer serving as the chair at our regular board meetings. The Board regularly reviews its leadership structure and has determined that this structure is in the best interests of the Company and its shareholders at this time. Among other factors, the Board considered and evaluated: Ms. Sweet’s knowledge of Accenture and its industry, which has been built up over 13 years of experience with the Company; the strength of Ms. Sweet’s vision for the Company and the quality of her leadership; the importance of consistent, unified leadership to execute and oversee the Company’s strategy; the strong and highly independent composition of the Board; and the meaningful responsibilities of the independent Lead Director. In addition, the Board believes this leadership structure also enhances its oversight of material risks because

the chair and chief executive officer is uniquely positioned to identify and inform the Board of emerging risks while the independent Lead Director and committee chairs, as well as the other independent directors, provide independent oversight of the Company’s risk management programs.

Gilles Pélisson has served as our independent Lead Director since January 2020 and has been a director since 2012. The independent directors believe that Mr. Pélisson is well suited to serve as independent Lead Director given his significant managerial, operational and global experience, as well as his experience in corporate governance. As a result of his broad-based and relevant background, as well as his deep knowledge of Accenture’s business, Mr. Pélisson is well-positioned as independent Lead Director to provide constructive, independent and informed guidance and oversight to management. The Board believes that the presence of our independent Lead Director who, as described below, has meaningful oversight responsibilities, together with a combined chair and chief executive officer, provides the Company with the optimal leadership to drive the Company forward at this time.

We continue to believe it is important that the Board retain flexibility to determine whether these roles should be separate or combined based upon the Board’s assessment of the Company’s needs. The Board recognizes that no single leadership model is right for all companies and at all times, and will continue to evaluate whether to split or combine the chair and chief executive officer roles to ensure our leadership structure continues to be in the best interests of the Company and our shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Chair and Chief Executive Officer Julie Sweet | | Committee Chairs | |

| | | | | | |

| | Paula A. Price (Audit) | Nancy McKinstry (Compensation, Culture & People) | Jaime Ardila (Finance) | Arun Sarin (Nominating, Governance & Sustainability) | |

| | | | |

| | Independent Lead Director Gilles C. Pélisson | | |

| | | |

| | | |

| | All committee members are independent. | |

| | | | | |

| | | | | | | | |

| | | | | |

20 | Accenture 2023 Proxy Statement |

Independent Lead Director

| | | | | |

Independent Lead Director Gilles C. Pélisson | The independent Lead Director helps to ensure there is an appropriate balance between management and the independent directors and to keep the independent directors fully informed and able to discuss and debate the issues that they deem important. The responsibilities of the independent Lead Director, which are described in the Company’s Corporate Governance Guidelines, include, among others: |

| | | | | |

| Responsibility | Description |

| |

| Agendas | Providing input on issues for Board consideration, helping set and approve the Board agenda, ensuring that adequate information is provided to the Board, helping ensure that there is sufficient time for discussion of all agenda items and approving schedules for Board meetings. |

| |

| Board meetings | Presiding at all meetings of the Board at which the chair is not present. |

| |

| Executive sessions | Authority to call meetings of independent directors and presiding at all executive sessions of the independent directors. |

| |

| Communicating with directors | Acting as a liaison between the independent directors and the chair and chief executive officer. |

| |

| Communicating with shareholders | If requested by major shareholders, being available for consultation and direct communication. Serving as a liaison between the Board and shareholders on investor matters. |

| |

| Board evaluation process | Reviewing annual anonymous surveys and conducting in-person self-assessment interviews with each Board member, together with the chair of the Nominating, Governance & Sustainability Committee, in order to gain valuable insights on how to strengthen the performance of the Board, its committees and individual directors. |

| |

In addition to the above responsibilities, our independent Lead Director also has regular meetings with the chairs of the Board committees as well as our chair and chief executive officer, to discuss critical matters and other ongoing topics, including acquisitions and management decisions.

| | | | | |

Accenture 2023 Proxy Statement | 21 |

Director Independence

The Board has adopted categorical standards designed to assist the Board in assessing director independence (the “Independence Standards”), which are included in our Corporate Governance Guidelines. The Corporate Governance Guidelines and the Independence Standards have been designed to comply with the standards required by the New York Stock Exchange (“NYSE”). In accordance with the applicable NYSE rules and our Corporate Governance Guidelines, the Board performs an annual review of the independence of all directors and nominees. To be considered independent, a director must not have any direct or indirect material relationship with Accenture, as determined affirmatively by the Board. In addition, committee members are subject to any additional independence requirements that may be required by applicable law, regulations and NYSE listing standards.

In making its independence recommendations, the Nominating, Governance & Sustainability Committee evaluates the various commercial, charitable and employment transactions and relationships known to the committee that exist between us and our subsidiaries on the one hand, and the directors and the entities with which certain of our directors or members of their immediate families are, or have been, affiliated (including those identified through our annual director questionnaires) on the other. Furthermore, the Nominating, Governance & Sustainability Committee discusses other relevant facts and circumstances regarding the nature of these transactions and

relationships to determine whether other factors, regardless of the Independence Standards, might compromise a director’s independence.

Based on its analysis, the Nominating, Governance & Sustainability Committee recommended, and the Board determined that, other than Julie Sweet, each of our director nominees (Jaime Ardila, Martin Brudermüller, Alan Jope, Nancy McKinstry, Beth E. Mooney, Gilles C. Pélisson, Paula A. Price, Venkata (Murthy) Renduchintala, Arun Sarin and Tracey T. Travis) is independent under all applicable standards, including, with respect to members of the Audit and Compensation, Culture & People Committees, those applicable to such committee service. The Board concurred in these recommendations. In addition, the Board determined that Frank Tang, who was not subject to re-appointment at the 2023 Annual Meeting, was independent during the period he served on the Board during fiscal 2023. In reaching its determinations, the Nominating, Governance & Sustainability Committee and the Board considered that during fiscal 2023, Martin Brudermüller, Alan Jope, Nancy McKinstry, Gilles C. Pélisson and Tracey T. Travis were employed by organizations that do business with Accenture. The amount received by Accenture or such other organization in each of the last three fiscal years did not exceed the greater of $1 million or 1% of either Accenture’s or such organization’s consolidated gross revenues.

Board Oversight

Oversight of Strategy

The Board is responsible for providing governance and oversight over the strategy, operations and management of Accenture. Acting as a full Board and through the Board’s four standing committees, the Board is involved in the Company’s strategic planning process. Each year, the Board holds a strategy retreat during which members of the Accenture Leadership team present the Company’s overall corporate strategy and seek input from the Board. “Accenture Leadership” is comprised of members of our global management

committee, senior managing directors and managing directors. At subsequent meetings, the Board continues to review the Company’s progress against its strategic plan. In addition, throughout the year, the Board will review specific strategic initiatives where the Board will provide additional oversight. The Board is continuously engaged in providing oversight and independent business judgment on the strategic issues that are most important to the Company.

| | | | | |

22 | Accenture 2023 Proxy Statement |

Oversight of Risk

The full Board is responsible for overseeing the Company’s enterprise risk management (“ERM”) program. As described more fully below, the Board fulfills this responsibility both directly and through its standing committees, each of which assists the Board in overseeing a part of the Company’s overall risk management. Our ERM program and disclosure controls and procedures are designed to appropriately escalate key risks to the Board as well as to analyze potential risks for disclosure. The risks described in this section include those formally monitored at a Board or committee level as part of the ERM program, which includes the annual risk assessment process, program scope, status of priority and emerging risks and risk profile, among other things, or pursuant to committee charters. These risks do not represent a complete list of all enterprise risks that are considered and addressed from time to time by the Board and its committees. For more information on risks that affect our business, please see our most recent Annual Report on Form 10-K and other filings we make with the Securities & Exchange Commission (the “SEC”).

| | | | | |

| |

| Board Oversight of Risk |

| |

•Receives an annual review of the Company’s ERM program, which includes: –the annual risk assessment process, program scope, status of priority and emerging risks and associated mitigation activities –the Company’s approach to sustainability, people management, operational footprint, cybersecurity, responsible AI and data privacy and investment risks and strategies, among other things | •Receives interim updates as appropriate •Reviews reports from external advisors such as outside counsel and industry experts to further understand priority risk areas •Delegates specific risk oversight responsibility to committees based on expertise, as described below, and receives quarterly reports from the Board committee chairs, which include, when appropriate, updates with respect to risks overseen by the respective committees |

| |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Committee Oversight of Risk | |

| | | | | |

| Audit Committee | |

| | | | | |

| •Reviews our guidelines and policies with respect to risk assessment and management •Reviews major financial, contract and information technology risk exposures, including cybersecurity, data privacy and data security, along with the monitoring and mitigation of these exposures | •Receives quarterly updates on the ERM program and, in addition, reviews enterprise risks and risk management topics, as needed •Discusses with the chairs of the other committees the risk assessment process for the risks overseen by those committees, on at least an annual basis | |

| | | | | |

| | | | | |

| Compensation, Culture & People Committee | Finance Committee | Nominating, Governance & Sustainability Committee | |

| | | | | |

| •Reviews and discusses with management, management’s assessment of people and culture-related risks, including whether any risks arising from the Company’s compensation programs are reasonably likely to have a material adverse effect on the Company | •Reviews and discusses with management financial-related risks, including foreign exchange, counterparty and liquidity-related risks, major acquisitions and insurance exposure | •Evaluates the overall effectiveness of the Board and its committees, including the Board’s focus on the most critical issues and risks •Monitors evolving ESG risks | |

| | | | | |

| | | | | |

Accenture 2023 Proxy Statement | 23 |

| | | | | |

| |

| Enterprise Risk Management Program |

| |

ERM Program •An annual and ongoing process designed to identify, assess and manage the Company’s risk exposures over the short-, intermediate- and long-term •The general counsel, who reports to our chair and chief executive officer, oversees the Company’s ERM program •Priority risk areas are assigned to one or more members of our global management committee to manage •While the formal ERM assessment is conducted annually, the process provides the flexibility to make changes to the identified risks as needed and leaders engage with the ERM management team to escalate risks as appropriate | ERM Process •Members of Accenture Leadership representing all markets and services are surveyed each year to provide insight into changing risk levels •Based in part on the survey results and on other internal and external inputs, the Company: –identifies its material operational, strategic and financial risks –develops plans to monitor, manage and mitigate these risks –utilizes internal and external thought leadership to benchmark risk priorities on an annual basis –evaluates and prioritizes these risks by taking into account many factors, including the potential impact of risk events should they occur, the likelihood of occurrence and the effectiveness of existing risk mitigation strategies |

| |

Cybersecurity and Data Privacy Risks

As part of the Board’s role in overseeing the Company’s ERM program, the Board devotes time and attention to cybersecurity and data privacy-related risks, with the Audit Committee responsible for overseeing information technology risk exposures, including cybersecurity, data privacy and data security. The Audit Committee receives reports on cybersecurity and data privacy matters and related risk exposures from management, including our chief information security officer, at least twice a year and more frequently as applicable. The Audit Committee regularly updates the Board on such matters and the Board also periodically receives reports from management directly.

All Accenture people regularly participate in required and targeted data privacy trainings and annual information security trainings, in addition to completing at least one required level of our Information Security Advocate program, a self-paced training program designed to strengthen awareness and adoption of secure behaviors. We also assess the efficacy of our information security program through internal detection and monitoring systems, as well as through the engagement of external, third-party experts. Reflective of our commitment to cybersecurity and data privacy, we have received global certifications for Information Security (ISO 27001:2013) and Data Privacy (ISO 27701:2019).

| | | | | |

24 | Accenture 2023 Proxy Statement |

Oversight of ESG

The core of our strategy is delivering 360° value to our clients, people, shareholders, partners and communities by helping them continuously reinvent. To drive change for our clients, and for our business, we work across a spectrum of environmental, social and governance (ESG) priorities—and help our stakeholders do the same—contributing to the creation of a more sustainable world for all.

| | | | | | | | | | | |

| | |

| Board of Directors | |

| | | |

| At Accenture, responsibility for ESG matters starts at the top, with our Board actively overseeing our ESG strategies and progress in meeting our ESG-related commitments, and cascades throughout the business. | |

|

| | |

| Nominating, Governance & Sustainability Committee •The Nominating, Governance & Sustainability Committee is responsible for overseeing our overall ESG performance, disclosure, strategies, goals and objectives and monitoring evolving ESG risks. •In carrying out its responsibilities, the Nominating, Governance & Sustainability Committee receives periodic reports throughout the year from management on key ESG matters, including the sustainability services we provide to clients, our actions around being a responsible company and citizen, our progress in meeting our ESG-related commitments and our integrated reporting, which demonstrates our commitment to transparency and accountability of our goals and progress. | |

| | | |

| | | |

| Compensation, Culture & People Committee •The Compensation, Culture & People Committee is responsible for overseeing our strategies related to our people, including matters such as pay equity, inclusion and diversity, leadership succession and culture. | Audit Committee •The Audit Committee oversees our approach to the quality of ESG-related data and controls. | |

| | | |

| Global Management Committee •Our global management committee sponsors our responsible company strategies. These senior leaders, spanning multiple corporate functions, industries, services and geographies, engage on these topics and are responsible for implementing strategies, goals and policies. •Together, they make strategic recommendations and decisions on our ESG initiatives, including sponsorship of our non-financial goals. | ESG Executive Committee •Our ESG executive committee, made up of a subset of the global management committee, is accountable for approving strategic global decisions aligned with Accenture’s corporate sustainability commitments. •Our ESG executive committee and steering committee (which is comprised of leaders across the Company) meet regularly to monitor our sustainability performance, identify improvement areas and elevate matters to the Board as appropriate through the global management committee. | |

| | | |

For more information about our ESG initiatives and progress in meeting our ESG-related commitments, please see “Our People, Environment and Communities.”

| | | | | |

Accenture 2023 Proxy Statement | 25 |

Oversight of People and Culture

Accenture is a talent- and innovation-led organization, with a culture of shared success, which is defined as success for our clients, people, shareholders, partners and communities. This culture is built upon four tangible building blocks—our beliefs, our behaviors, the way we develop and reward our people and the way we do business. Our Board plays an integral role in the oversight of our people and our culture at Accenture, with the Compensation, Culture & People Committee responsible for overseeing the Company’s strategies related to the Company’s people, including matters such as pay equity, inclusion and diversity, leadership succession, culture and monitoring related risks. Throughout the year, the Board and the Compensation, Culture & People Committee receive reports from management on Accenture’s culture, talent development, retention and recruiting initiatives, inclusion and diversity strategy, pay equity, leadership and succession planning and employee conduct investigations. The Compensation, Culture and People Committee also receives updates on employee surveys. Moreover, our performance-based compensation program, which is reviewed and approved by the Compensation, Culture & People Committee, incorporates performance objectives, including specific gender, racial and ethnic diversity goals, as well as goals relating to professional development and retention. For additional information relating to such performance objectives, please see “Compensation Discussion and Analysis—Compensation Programs—Cash Compensation—Global Annual Bonus” and “Compensation Discussion and Analysis—Process for Determining Executive Compensation—Performance Objectives Used in Evaluations.”

Management Succession Planning

Succession planning is at the heart of the Company’s talent strategy. The Company seeks to identify candidates for succession with the experience and skills needed to serve our clients and to develop the strategy and manage the operations of the Company, and who also exemplify the Company’s leadership essentials, which are further described in “—Our People, Environment and Communities.” The Company conducts assessments to identify those with high potential for senior leadership positions, allowing us to assess leader skills, aspirations and readiness, enable the Company to plan for future role rotations and identify any talent gaps. The Company’s global management committee engages in discussions focused on succession plans with an emphasis on boundaryless and borderless opportunities. Ongoing conversations are conducted to understand the aspirations of high-potential leaders and their development focused on learning, experience and exposure. The Board also has meaningful opportunities to regularly engage with strong candidates for succession.

As described in the Company’s Corporate Governance Guidelines, the chair and chief executive officer reports annually to the Board regarding succession planning of the executive committee. The chair and chief executive officer and the chief leadership and human resources officer meet with the Compensation, Culture & People Committee and the Board regularly to discuss these succession plans and any recommendations they may have regarding the Company’s next generation of leaders. As set forth in their respective charters, the Compensation, Culture & People Committee oversees the Company’s general strategies related to leadership succession for the executive committee, and the Nominating, Governance & Sustainability Committee ensures that an effective chief executive officer succession plan is in place and, in the event of a vacancy, recommends to the Board a successor.

Board Meetings

During fiscal 2023, the Board met four times. In addition, per our committee charters, all of our Board members are ordinarily invited to and frequently attend the meetings of our four standing committees, except for a few specific sessions reserved to committee members only. Board members may only vote at meetings of the committees on which they serve. The Board expects that its members will prepare for, attend and participate in all Board and applicable committee meetings and each annual general meeting of shareholders. Directors are also expected to become familiar with Accenture’s organization, management team and operations in connection with discharging their oversight responsibilities.

| | |

|

| During fiscal 2023, all of our incumbent directors attended 100% of the meetings of the Board and the committees on which they served (during the periods when they served). |

|

| | | | | |

26 | Accenture 2023 Proxy Statement |

Executive Sessions

The Board believes that one of the key elements of effective, independent oversight is that the independent directors meet in executive session on a regular basis without the presence of management to discuss various matters related to the oversight of the Company, including the Board’s leadership structure and the chair and chief executive officer’s performance. Accordingly, our independent directors meet separately in executive session at each regularly scheduled Board meeting. Our independent directors held four executive sessions during fiscal 2023, all of which were led by the independent Lead Director.

Director Attendance at Annual Meetings

All nine of the Board members standing for re-appointment at our 2023 annual general meeting of shareholders attended the 2023 meeting. As set forth in our Corporate Governance Guidelines, the Board expects that its members will attend the annual general meeting of shareholders.

Committees of the Board

The Board currently has four standing committees: Audit; Compensation, Culture & People; Finance; and Nominating, Governance & Sustainability. From time to time, the Board may also create ad hoc or special committees for certain purposes in addition to these four standing committees. Each committee consists entirely of independent, non-employee directors. The table below lists the current membership of each committee and the number of meetings held in fiscal 2023.

During fiscal 2023, Mr. Jope, who has extensive sustainability experience from overseeing initiatives at Unilever, where he served as CEO from 2019 through June 2023, joined the Nominating, Governance & Sustainability Committee.

| | | | | | | | | | | | | | |

| Committees |

| Board Member | Audit | Compensation,

Culture &

People | Finance | Nominating,

Governance & Sustainability |

Jaime Ardila(1) | | | | |

Alan Jope(2) | | | | |

Martin Brudermüller(3) | | | | |

| Nancy McKinstry | | | | |

| Beth E. Mooney | | | | |

Gilles C. Pélisson(4) | | | | |

Paula A. Price(1) | | | | |

| Venkata (Murthy) Renduchintala | | | | |

| Arun Sarin | | | | |

Tracey T. Travis(1) | | | | |

| Number of Meetings in Fiscal 2023 | 9 | 5 | 5 | 5 |

(1)Audit Committee Financial Expert as defined under SEC rules.

(2)Joined the Nominating, Governance & Sustainability Committee on April 14, 2023.

(3)Subject to appointment at the Annual Meeting, will be appointed to the Audit Committee.

(4)Independent Lead Director of the Board.

| | | | | |

Accenture 2023 Proxy Statement | 27 |

| | | | | |

Audit Committee |

| |

| |

Members All Independent Paula A. Price (Chair) Jaime Ardila Martin Brudermüller(1) Venkata (Murthy) Renduchintala Tracey T. Travis | Oversees the Company’s accounting, financial reporting processes, audits of financial statements and internal controls, ERM program and information technology risk exposures. The Audit Committee’s primary responsibilities include oversight of the following: •the quality and integrity of the Company’s accounting and reporting practices and controls, and the financial statements and reports of the Company; •the Company’s compliance with legal and regulatory requirements; •the independent auditor’s qualifications and independence; •the performance of the Company’s internal audit function and independent auditors; and •the Company’s ERM program and information technology risk exposures, including cybersecurity, data privacy and data security and related risks. The Audit Committee also oversees our approach to the quality of ESG-related data and controls. In addition, the Board formalized the Audit Committee’s oversight of the Company’s tax policies and compliance. The Board has determined that each member of the Audit Committee meets the financial literacy, independence and accounting or auditing requirements of the SEC, the Companies Act of 2014 and the NYSE, as applicable to audit committee members, and that each of Jaime Ardila, Paula A. Price and Tracey T. Travis also qualifies as an “audit committee financial expert” for purposes of SEC rules. No member of the Audit Committee may serve on the audit committee of more than three public companies, including Accenture, unless the Board determines that such simultaneous service would not impair the ability of such member to effectively serve on the Audit Committee and discloses such determination in accordance with NYSE requirements. No member of the Audit Committee currently serves on the audit committees of more than three public companies, including Accenture. |

| |

(1)Subject to appointment at the Annual Meeting, will be appointed to the Audit Committee.

| | | | | |

Finance Committee |

| |

| |

Members All Independent Jaime Ardila (Chair) Beth E. Mooney Venkata (Murthy) Renduchintala Tracey T. Travis | Oversees the Company’s capital and treasury activities. The Finance Committee’s primary responsibilities include oversight of the Company’s: •capital structure and corporate finance strategy and activities; •dividends, share redemption and purchase activities; •treasury function, investment management and financial risk management; •major acquisitions, dispositions, joint ventures or similar transactions; and •insurance plans. |

| |

| | | | | |

28 | Accenture 2023 Proxy Statement |

| | | | | |

Nominating, Governance & Sustainability Committee |

| |

| |

Members All Independent Arun Sarin (Chair) Jaime Ardila Alan Jope Nancy McKinstry Gilles C. Pélisson | Oversees the Company’s corporate governance practices and processes, and ESG matters. The Nominating, Governance & Sustainability Committee’s primary responsibilities include oversight of the following: •assessing and selecting/nominating (or recommending to the Board for its selection/nomination) strong and capable candidates to serve on the Board; •making recommendations as to the size, composition, structure, operations, performance and effectiveness of the Board; •overseeing the Company’s chief executive officer succession process; •together with the Compensation, Culture & People Committee, conducting an annual review of the Company’s performance and the Company’s chair and chief executive officer’s performance; •developing and recommending to the Board a set of corporate governance principles, including independence standards; •overseeing ESG performance, disclosure, strategies, goals and objectives and monitoring evolving ESG risks and opportunities; •overseeing political, lobbying and other grassroots advocacy activities and the Company’s policies and practices regarding such activities; and •taking a leadership role in shaping the corporate governance of the Company. |

| |

| | | | | |

Compensation, Culture & People Committee |

| |

| |

Members All Independent Nancy McKinstry (Chair) Beth E. Mooney Paula A. Price Arun Sarin | Oversees the Company’s global compensation philosophy, policies and programs as well as the Company’s strategies related to the Company’s people and culture. The Compensation, Culture & People Committee’s primary responsibilities include oversight of the following: •together with the Nominating, Governance & Sustainability Committee, conducting an annual review of the Company’s performance and the Company’s chair and chief executive officer’s performance; •setting the compensation of the chair and chief executive officer, the executive officers and the members of our global management committee who also serve on the executive committee (the “executive committee”); •overseeing the Company’s equity-based plans; •reviewing and making recommendations to the full Board regarding Board compensation; and •overseeing the Company’s strategies related to the Company’s people, including matters such as pay equity, inclusion and diversity, leadership succession and culture, and monitor related risks. In addition, the Board formalized the Compensation, Culture & People Committee’s oversight of the administration of the Company’s clawback policies and the review of corporate investigations related to employee conduct. The Board has determined that each member of the Compensation, Culture & People Committee meets the independence requirements of the SEC and NYSE applicable to compensation committee members. |

| |

| | | | | |

Accenture 2023 Proxy Statement | 29 |

Compensation Oversight

A number of individuals and entities contribute to the process of reviewing and determining the compensation of the chair and chief executive officer, members of the executive committee and independent directors:

•Compensation, Culture & People Committee. Our Compensation, Culture & People Committee makes the final determination regarding the annual compensation of the chair and chief executive officer and members of the executive committee, taking into consideration, among other factors, an evaluation of each individual’s performance, the recommendations of the chair and chief executive officer regarding the compensation of the members of our executive committee and the advice of the Compensation, Culture & People Committee’s independent compensation consultant. In addition, our Compensation, Culture & People Committee reviews and, based in part on the advice of its independent consultant, makes recommendations to the Board with respect to the appropriateness of the compensation paid to our independent directors, and the full Board then reviews these recommendations and makes a final determination on the compensation of our independent directors. For a more detailed discussion regarding the role of compensation consultants with respect to executive and director compensation, see “Executive Compensation—Compensation Discussion and Analysis—Role of Compensation Consultants.”