acn-20200831FALSEFALSE2020FY00014673738/31115,077,476,776658,883,029527,509Portions of the definitive proxy statement to be filed with the Securities

and Exchange Commission pursuant to Regulation 14A relating to the

registrant’s Annual General Meeting of Shareholders, to be held on

February 3, 2021, will be incorporated by reference in this Form 10-K in

response to Items 10, 11, 12, 13 and 14 of Part III. The definitive proxy

statement will be filed with the SEC not later than 120 days after the

registrant’s fiscal year ended August 31, 2020.110.00002250.00002250.00002250.000022540,00040,00020,000,000,00020,000,000,0001,000,000,0001,000,000,00040,00040,000658,548,895654,739,267527,509609,404527,509609,40440,00040,00024,383,36918,964,8632710275101116one yeartwelve years2740,0001.00500014673732019-09-012020-08-31iso4217:USD00014673732020-02-28xbrli:shares0001467373us-gaap:CommonClassAMember2020-10-080001467373acn:CommonClassXMember2020-10-0800014673732020-08-3100014673732019-08-310001467373acn:OrdinarySharesMember2020-08-310001467373acn:OrdinarySharesMember2019-08-310001467373us-gaap:CommonClassAMember2020-08-310001467373us-gaap:CommonClassAMember2019-08-310001467373acn:CommonClassXMember2020-08-310001467373acn:CommonClassXMember2019-08-31iso4217:EURxbrli:sharesiso4217:USDxbrli:shares00014673732018-09-012019-08-3100014673732017-09-012018-08-310001467373acn:OrdinarySharesMember2017-08-310001467373us-gaap:CommonClassAMember2017-08-310001467373acn:CommonClassXMember2017-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2017-08-310001467373us-gaap:AdditionalPaidInCapitalMember2017-08-310001467373us-gaap:TreasuryStockMember2017-08-310001467373us-gaap:RetainedEarningsMember2017-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-08-310001467373us-gaap:ParentMember2017-08-310001467373us-gaap:NoncontrollingInterestMember2017-08-3100014673732017-08-310001467373us-gaap:RetainedEarningsMember2017-09-012018-08-310001467373us-gaap:ParentMember2017-09-012018-08-310001467373us-gaap:NoncontrollingInterestMember2017-09-012018-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-09-012018-08-310001467373us-gaap:AdditionalPaidInCapitalMember2017-09-012018-08-310001467373us-gaap:TreasuryStockMember2017-09-012018-08-310001467373us-gaap:CommonClassAMember2017-09-012018-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2017-09-012018-08-310001467373acn:CommonClassXMember2017-09-012018-08-310001467373acn:OrdinarySharesMember2018-08-310001467373us-gaap:CommonClassAMember2018-08-310001467373acn:CommonClassXMember2018-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2018-08-310001467373us-gaap:AdditionalPaidInCapitalMember2018-08-310001467373us-gaap:TreasuryStockMember2018-08-310001467373us-gaap:RetainedEarningsMember2018-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-08-310001467373us-gaap:ParentMember2018-08-310001467373us-gaap:NoncontrollingInterestMember2018-08-3100014673732018-08-310001467373us-gaap:RetainedEarningsMember2019-08-310001467373us-gaap:RetainedEarningsMember2018-09-012019-08-310001467373us-gaap:ParentMember2018-09-012019-08-310001467373us-gaap:NoncontrollingInterestMember2018-09-012019-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-09-012019-08-310001467373us-gaap:AdditionalPaidInCapitalMember2018-09-012019-08-310001467373us-gaap:TreasuryStockMember2018-09-012019-08-310001467373us-gaap:CommonClassAMember2018-09-012019-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2018-09-012019-08-310001467373acn:CommonClassXMember2018-09-012019-08-310001467373us-gaap:TreasuryStockValue2018-09-012019-08-310001467373acn:OrdinarySharesMember2019-08-310001467373us-gaap:CommonClassAMember2019-08-310001467373acn:CommonClassXMember2019-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2019-08-310001467373us-gaap:AdditionalPaidInCapitalMember2019-08-310001467373us-gaap:TreasuryStockMember2019-08-310001467373us-gaap:RetainedEarningsMember2019-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-08-310001467373us-gaap:ParentMember2019-08-310001467373us-gaap:NoncontrollingInterestMember2019-08-310001467373us-gaap:RetainedEarningsMember2019-09-012020-08-310001467373us-gaap:ParentMember2019-09-012020-08-310001467373us-gaap:NoncontrollingInterestMember2019-09-012020-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-012020-08-310001467373us-gaap:AdditionalPaidInCapitalMember2019-09-012020-08-310001467373us-gaap:TreasuryStockMember2019-09-012020-08-310001467373us-gaap:CommonClassAMember2019-09-012020-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2019-09-012020-08-310001467373acn:CommonClassXMember2019-09-012020-08-310001467373acn:OrdinarySharesMember2020-08-310001467373us-gaap:CommonClassAMember2020-08-310001467373acn:CommonClassXMember2020-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2020-08-310001467373us-gaap:AdditionalPaidInCapitalMember2020-08-310001467373us-gaap:TreasuryStockMember2020-08-310001467373us-gaap:RetainedEarningsMember2020-08-310001467373us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-08-310001467373us-gaap:ParentMember2020-08-310001467373us-gaap:NoncontrollingInterestMember2020-08-31xbrli:pure0001467373srt:SubsidiariesMember2020-08-310001467373acn:Acn_DuckCreekEquityMethodInvestmentMember2020-08-310001467373acn:Acn_DuckCreekEquityMethodInvestmentMember2020-08-310001467373us-gaap:LeaseholdImprovementsMember2019-09-012020-08-310001467373us-gaap:AccountingStandardsUpdate201602Member2019-09-0100014673732019-09-010001467373srt:MinimumMemberacn:TechnologyIntegrationConsultingServicesMember2019-09-012020-08-310001467373srt:MaximumMemberacn:TechnologyIntegrationConsultingServicesMember2019-09-012020-08-310001467373acn:NonTechnologyIntegrationConsultingServicesMembersrt:MaximumMember2019-09-012020-08-310001467373us-gaap:TechnologyEquipmentMembersrt:MinimumMember2019-09-012020-08-310001467373us-gaap:TechnologyEquipmentMembersrt:MaximumMember2019-09-012020-08-310001467373srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2019-09-012020-08-310001467373us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2019-09-012020-08-310001467373srt:MinimumMember2019-09-012020-08-310001467373srt:MaximumMember2019-09-012020-08-310001467373srt:ScenarioForecastMember2021-08-310001467373srt:ScenarioForecastMember2022-08-3100014673732018-09-010001467373us-gaap:LandAndBuildingMember2020-08-310001467373us-gaap:LandAndBuildingMember2019-08-310001467373us-gaap:TechnologyEquipmentMember2020-08-310001467373us-gaap:TechnologyEquipmentMember2019-08-310001467373us-gaap:FurnitureAndFixturesMember2020-08-310001467373us-gaap:FurnitureAndFixturesMember2019-08-310001467373us-gaap:LeaseholdImprovementsMember2020-08-310001467373us-gaap:LeaseholdImprovementsMember2019-08-310001467373us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-09-012020-08-310001467373us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2018-09-012019-08-310001467373us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2017-09-012018-08-310001467373us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-08-310001467373us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-08-310001467373us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2018-08-310001467373srt:MinimumMemberus-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-09-012020-08-310001467373srt:MaximumMemberus-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-09-012020-08-310001467373srt:NorthAmericaMember2018-08-310001467373srt:NorthAmericaMember2018-09-012019-08-310001467373srt:NorthAmericaMember2019-08-310001467373srt:NorthAmericaMember2019-09-012020-08-310001467373srt:NorthAmericaMember2020-08-310001467373srt:EuropeMember2018-08-310001467373srt:EuropeMember2018-09-012019-08-310001467373srt:EuropeMember2019-08-310001467373srt:EuropeMember2019-09-012020-08-310001467373srt:EuropeMember2020-08-310001467373acn:GrowthMarketsMember2018-08-310001467373acn:GrowthMarketsMember2018-09-012019-08-310001467373acn:GrowthMarketsMember2019-08-310001467373acn:GrowthMarketsMember2019-09-012020-08-310001467373acn:GrowthMarketsMember2020-08-310001467373us-gaap:CustomerRelatedIntangibleAssetsMember2019-08-310001467373us-gaap:CustomerRelatedIntangibleAssetsMember2020-08-310001467373us-gaap:TechnologyBasedIntangibleAssetsMember2019-08-310001467373us-gaap:TechnologyBasedIntangibleAssetsMember2020-08-310001467373us-gaap:PatentsMember2019-08-310001467373us-gaap:PatentsMember2020-08-310001467373us-gaap:OtherIntangibleAssetsMember2019-08-310001467373us-gaap:OtherIntangibleAssetsMember2020-08-310001467373us-gaap:OtherCurrentAssetsMemberus-gaap:CashFlowHedgingMember2020-08-310001467373us-gaap:OtherCurrentAssetsMemberus-gaap:CashFlowHedgingMember2019-08-310001467373us-gaap:OtherAssetsMemberus-gaap:CashFlowHedgingMember2020-08-310001467373us-gaap:OtherAssetsMemberus-gaap:CashFlowHedgingMember2019-08-310001467373us-gaap:OtherCurrentAssetsMemberacn:OtherDerivativeInstrumentsMember2020-08-310001467373us-gaap:OtherCurrentAssetsMemberacn:OtherDerivativeInstrumentsMember2019-08-310001467373us-gaap:OtherCurrentLiabilitiesMemberus-gaap:CashFlowHedgingMember2020-08-310001467373us-gaap:OtherCurrentLiabilitiesMemberus-gaap:CashFlowHedgingMember2019-08-310001467373us-gaap:OtherLiabilitiesMemberus-gaap:CashFlowHedgingMember2020-08-310001467373us-gaap:OtherLiabilitiesMemberus-gaap:CashFlowHedgingMember2019-08-310001467373us-gaap:OtherCurrentLiabilitiesMemberacn:OtherDerivativeInstrumentsMember2020-08-310001467373us-gaap:OtherCurrentLiabilitiesMemberacn:OtherDerivativeInstrumentsMember2019-08-310001467373acn:SyndicatedLoanFacilityDueDecember102024Member2020-08-310001467373acn:SyndicatedLoanFacilityDueDecember222020Member2020-08-310001467373acn:SyndicatedLoanFacilityDueJune162021Member2020-08-310001467373acn:SeparateUncommittedUnsecuredMultiCurrencyRevolvingCreditFacilitiesMember2020-08-310001467373acn:LocalGuaranteedAndNonGuaranteedLinesOfCreditMember2020-08-310001467373acn:LocalGuaranteedAndNonGuaranteedLinesOfCreditMember2019-08-3100014673732017-12-312017-12-3100014673732018-01-012018-01-010001467373acn:TaxCreditCarryForwardsExpiringBetween2018And2027Member2020-08-310001467373acn:TaxCreditCarryForwardsExpiringBetween2028And2037Member2020-08-310001467373acn:TaxCreditCarryforwardsWithIndefiniteCarryforwardPeriodMember2020-08-310001467373acn:NetOperatingLossCarryforwardsExpiringBetween2018and2027Member2020-08-310001467373acn:NetOperatingLossCarryforwardsExpiringBetween2028and2037Member2020-08-310001467373acn:NetOperatingLossCarryforwardsWithIndefiniteCarryforwardPeriodMember2020-08-310001467373us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-08-310001467373us-gaap:PensionPlansDefinedBenefitMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-08-310001467373us-gaap:PensionPlansDefinedBenefitMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-08-310001467373us-gaap:PensionPlansDefinedBenefitMemberacn:NonUSPensionPlanMember2018-08-310001467373us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-08-310001467373us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-08-310001467373us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-08-310001467373us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-09-012020-08-310001467373us-gaap:PensionPlansDefinedBenefitMemberacn:NonUSPensionPlanMember2019-09-012020-08-310001467373us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-09-012019-08-310001467373us-gaap:PensionPlansDefinedBenefitMemberacn:NonUSPensionPlanMember2018-09-012019-08-310001467373us-gaap:PensionPlansDefinedBenefitMembercountry:US2017-09-012018-08-310001467373us-gaap:PensionPlansDefinedBenefitMemberacn:NonUSPensionPlanMember2017-09-012018-08-310001467373us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-09-012020-08-310001467373us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-09-012019-08-310001467373us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-09-012018-08-310001467373acn:NonUSPensionPlanMember2019-08-310001467373acn:NonUSPensionPlanMember2018-08-310001467373acn:NonUSPensionPlanMember2019-09-012020-08-310001467373acn:NonUSPensionPlanMember2018-09-012019-08-310001467373acn:NonUSPensionPlanMember2020-08-310001467373country:US2020-08-310001467373country:US2019-08-310001467373country:USus-gaap:EquitySecuritiesMember2020-08-310001467373us-gaap:EquitySecuritiesMemberacn:NonUSPensionPlanMember2020-08-310001467373country:USus-gaap:EquitySecuritiesMember2019-08-310001467373us-gaap:EquitySecuritiesMemberacn:NonUSPensionPlanMember2019-08-310001467373country:USus-gaap:DebtSecuritiesMember2020-08-310001467373us-gaap:DebtSecuritiesMemberacn:NonUSPensionPlanMember2020-08-310001467373country:USus-gaap:DebtSecuritiesMember2019-08-310001467373us-gaap:DebtSecuritiesMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMembercountry:US2020-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMembercountry:US2019-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberacn:NonUSPensionPlanMember2019-08-310001467373country:USacn:InsuranceContractsMember2020-08-310001467373acn:NonUSPensionPlanMemberacn:InsuranceContractsMember2020-08-310001467373country:USacn:InsuranceContractsMember2019-08-310001467373acn:NonUSPensionPlanMemberacn:InsuranceContractsMember2019-08-310001467373country:USus-gaap:OtherAssetsMember2020-08-310001467373us-gaap:OtherAssetsMemberacn:NonUSPensionPlanMember2020-08-310001467373country:USus-gaap:OtherAssetsMember2019-08-310001467373us-gaap:OtherAssetsMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:EquityFundsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:EquityFundsMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:EquityFundsMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:ForeignCorporateDebtSecuritiesMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignCorporateDebtSecuritiesMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:ForeignCorporateDebtSecuritiesMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:FixedIncomeFundsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:FixedIncomeFundsMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2020-08-310001467373acn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Memberacn:InsuranceContractsMember2020-08-310001467373us-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMemberacn:InsuranceContractsMember2020-08-310001467373us-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMemberacn:InsuranceContractsMember2020-08-310001467373us-gaap:OtherAssetsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMemberacn:NonUSPensionPlanMember2020-08-310001467373acn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2020-08-310001467373us-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2020-08-310001467373us-gaap:FairValueInputsLevel2Membercountry:US2020-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMembercountry:US2020-08-310001467373us-gaap:FairValueInputsLevel2Memberacn:USGovernmentStateAndLocalDebtSecuritiesMembercountry:US2020-08-310001467373us-gaap:EquityFundsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:EquityFundsMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:EquityFundsMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:ForeignGovernmentDebtSecuritiesMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:ForeignCorporateDebtSecuritiesMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignCorporateDebtSecuritiesMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:ForeignCorporateDebtSecuritiesMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:FixedIncomeFundsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:FixedIncomeFundsMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2019-08-310001467373acn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Memberacn:InsuranceContractsMember2019-08-310001467373us-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMemberacn:InsuranceContractsMember2019-08-310001467373us-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMemberacn:InsuranceContractsMember2019-08-310001467373us-gaap:OtherAssetsMemberacn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMemberacn:NonUSPensionPlanMember2019-08-310001467373acn:NonUSPensionPlanMemberus-gaap:FairValueInputsLevel1Member2019-08-310001467373us-gaap:FairValueInputsLevel2Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:FairValueInputsLevel3Memberacn:NonUSPensionPlanMember2019-08-310001467373us-gaap:FairValueInputsLevel2Membercountry:US2019-08-310001467373us-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMembercountry:US2019-08-310001467373us-gaap:FairValueInputsLevel2Memberacn:USGovernmentStateAndLocalDebtSecuritiesMembercountry:US2019-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2020-08-310001467373us-gaap:RestrictedStockUnitsRSUMember2019-09-012020-08-310001467373srt:MinimumMemberacn:Espp2010Member2019-09-012020-08-310001467373acn:Espp2010Membersrt:MaximumMember2019-09-012020-08-310001467373acn:Espp2010Member2019-09-012020-08-310001467373acn:Espp2010Member2020-08-310001467373acn:Espp2010Member2018-09-012019-08-310001467373acn:Espp2010Member2017-09-012018-08-310001467373srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2019-09-012020-08-310001467373srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2019-09-012020-08-310001467373us-gaap:CommonClassAMember2019-09-012020-08-310001467373acn:CommonClassXMember2019-09-012020-08-310001467373acn:OpenMarketSharePurchasesMember2019-09-012020-08-310001467373acn:OtherSharePurchaseProgramsMember2019-09-012020-08-310001467373acn:OtherPurchasesMember2019-09-012020-08-310001467373acn:DividendPaymentNovember2019Member2019-11-152019-11-150001467373acn:DividendPaymentNovember2019Member2019-09-012020-08-310001467373acn:DividendPaymentNovember2019Memberus-gaap:CommonClassAMember2019-09-012020-08-310001467373acn:DividendPaymentNovember2019Memberacn:AccentureHoldingsplcordinarySharesandAccentureCanadaHoldingsIncExchangeableSharesMember2019-09-012020-08-310001467373acn:DividendPaymentFebruary2020Member2019-09-012020-08-310001467373acn:DividendPaymentFebruary2020Memberus-gaap:CommonClassAMember2019-09-012020-08-310001467373acn:DividendPaymentFebruary2020Memberacn:AccentureHoldingsplcordinarySharesandAccentureCanadaHoldingsIncExchangeableSharesMember2019-09-012020-08-310001467373acn:DividendPaymentMay2020Member2019-09-012020-08-310001467373acn:DividendPaymentMay2020Memberus-gaap:CommonClassAMember2019-09-012020-08-310001467373acn:DividendPaymentMay2020Memberacn:AccentureHoldingsplcordinarySharesandAccentureCanadaHoldingsIncExchangeableSharesMember2019-09-012020-08-310001467373acn:DividendPaymentAugust2020Member2019-09-012020-08-310001467373acn:DividendPaymentAugust2020Memberus-gaap:CommonClassAMember2019-09-012020-08-310001467373acn:AccentureHoldingsplcordinarySharesandAccentureCanadaHoldingsIncExchangeableSharesMemberacn:DividendPaymentAugust2020Member2019-09-012020-08-310001467373acn:AccentureHoldingsplcordinarySharesandAccentureCanadaHoldingsIncExchangeableSharesMember2019-09-012020-08-310001467373us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2020-09-232020-09-230001467373us-gaap:SubsequentEventMember2020-09-230001467373us-gaap:SubsequentEventMember2020-10-132020-10-130001467373us-gaap:SubsequentEventMember2020-11-132020-11-1300014673732020-09-202020-09-20acn:reportableSegments0001467373srt:NorthAmericaMember2019-09-012020-08-310001467373srt:EuropeMember2019-09-012020-08-310001467373acn:GrowthMarketsMember2019-09-012020-08-310001467373srt:EuropeMember2019-09-012020-08-310001467373srt:NorthAmericaMember2020-08-310001467373srt:EuropeMember2020-08-310001467373acn:GrowthMarketsMember2020-08-310001467373srt:NorthAmericaMember2018-09-012019-08-310001467373srt:EuropeMember2018-09-012019-08-310001467373acn:GrowthMarketsMember2018-09-012019-08-310001467373srt:NorthAmericaMember2018-09-012019-08-310001467373acn:GrowthMarketsMember2018-09-012019-08-310001467373srt:NorthAmericaMember2019-08-310001467373srt:EuropeMember2019-08-310001467373acn:GrowthMarketsMember2019-08-310001467373srt:NorthAmericaMember2017-09-012018-08-310001467373srt:EuropeMember2017-09-012018-08-310001467373acn:GrowthMarketsMember2017-09-012018-08-310001467373srt:NorthAmericaMember2018-08-310001467373srt:EuropeMember2018-08-310001467373acn:GrowthMarketsMember2018-08-310001467373country:US2019-09-012020-08-310001467373country:US2018-09-012019-08-310001467373country:US2017-09-012018-08-310001467373country:IE2019-09-012020-08-310001467373country:IN2020-08-310001467373country:IN2019-08-310001467373country:IN2018-08-310001467373country:US2020-08-310001467373country:US2019-08-310001467373country:US2018-08-310001467373country:IE2020-08-310001467373country:IE2019-08-310001467373country:IE2018-08-310001467373acn:CommunicationsMediaandTechnologyMember2019-09-012020-08-310001467373acn:CommunicationsMediaandTechnologyMember2018-09-012019-08-310001467373acn:CommunicationsMediaandTechnologyMember2017-09-012018-08-310001467373acn:FinancialServicesSegmentMember2019-09-012020-08-310001467373acn:FinancialServicesSegmentMember2018-09-012019-08-310001467373acn:FinancialServicesSegmentMember2017-09-012018-08-310001467373acn:HealthAndPublicServiceSegmentMember2019-09-012020-08-310001467373acn:HealthAndPublicServiceSegmentMember2018-09-012019-08-310001467373acn:HealthAndPublicServiceSegmentMember2017-09-012018-08-310001467373acn:ProductsSegmentMember2019-09-012020-08-310001467373acn:ProductsSegmentMember2018-09-012019-08-310001467373acn:ProductsSegmentMember2017-09-012018-08-310001467373acn:ResourcesSegmentMember2019-09-012020-08-310001467373acn:ResourcesSegmentMember2018-09-012019-08-310001467373acn:ResourcesSegmentMember2017-09-012018-08-310001467373us-gaap:AllOtherSegmentsMember2019-09-012020-08-310001467373us-gaap:AllOtherSegmentsMember2018-09-012019-08-310001467373us-gaap:AllOtherSegmentsMember2017-09-012018-08-310001467373acn:ConsultingRevenueMember2019-09-012020-08-310001467373acn:ConsultingRevenueMember2018-09-012019-08-310001467373acn:ConsultingRevenueMember2017-09-012018-08-310001467373acn:OutsourcingRevenueMember2019-09-012020-08-310001467373acn:OutsourcingRevenueMember2018-09-012019-08-310001467373acn:OutsourcingRevenueMember2017-09-012018-08-3100014673732019-09-012019-11-3000014673732019-12-012020-02-2900014673732020-03-012020-05-3100014673732020-06-012020-08-3100014673732018-09-012018-11-3000014673732018-12-012019-02-2800014673732019-03-012019-05-3100014673732019-06-012019-08-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☑ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended August 31, 2020

Commission File Number: 001-34448

Accenture plc

(Exact name of registrant as specified in its charter)

| | | | | |

| Ireland | 98-0627530 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer Identification No.) |

1 Grand Canal Square,

Grand Canal Harbour,

Dublin 2, Ireland

(Address of principal executive offices)

(353) (1) 646-2000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A ordinary shares, par value $0.0000225 per share | ACN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the common equity of the registrant held by non-affiliates of the registrant on February 28, 2020 was approximately $115,077,476,776 based on the closing price of the registrant’s Class A ordinary shares, par value $0.0000225 per share, reported on the New York Stock Exchange on such date of $180.59 per share and on the par value of the registrant’s Class X ordinary shares, par value $0.0000225 per share.

The number of shares of the registrant’s Class A ordinary shares, par value $0.0000225 per share, outstanding as of October 8, 2020 was 658,883,029 (which number includes 25,317,084 issued shares held by the registrant). The number of shares of the registrant’s Class X ordinary shares, par value $0.0000225 per share, outstanding as of October 8, 2020 was 527,509.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A relating to the registrant’s Annual General Meeting of Shareholders, to be held on February 3, 2021, will be incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III. The definitive proxy statement will be filed with the SEC not later than 120 days after the registrant’s fiscal year ended August 31, 2020.

Table of Contents

| | | | | | | | |

| | |

| | | Page |

| Part I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Part II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Part III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| Part IV | | |

| Item 15. | | |

| Item 16. | | |

| | |

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Part I | 1 |

Part I

Disclosure Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) relating to our operations, results of operations and other matters that are based on our current expectations, estimates, assumptions and projections. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “positioned,” “outlook” and similar expressions are used to identify these forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed or forecast in these forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to, the factors discussed below under the section entitled “Risk Factors.” Our forward-looking statements speak only as of the date of this report or as of the date they are made, and we undertake no obligation to update them.

Available Information

Our website address is www.accenture.com. We use our website as a channel of distribution for company information. We make available free of charge on the Investor Relations section of our website (http://investor.accenture.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(a) or 15(d) of the Exchange Act. We also make available through our website other reports filed with or furnished to the SEC under the Exchange Act, including our proxy statements and reports filed by officers and directors under Section 16(a) of the Exchange Act, as well as our Code of Business Ethics. Financial and other material information regarding us is routinely posted on and accessible at http://investor.accenture.com. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Any materials we file with the SEC are available on such Internet site.

In this Annual Report on Form 10-K, we use the terms “Accenture,” “we,” the “Company,” “our” and “us” to refer to Accenture plc and its subsidiaries. All references to years, unless otherwise noted, refer to our fiscal year, which ends on August 31.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 2 |

Item 1. Business

Overview

Accenture is a leading global professional services company, providing a broad range of services in strategy and consulting, interactive, technology and operations, with digital capabilities across all of these services. We combine unmatched experience and specialized capabilities across more than 40 industries, which are organized across our five industry groups, together with our culture of innovation. Our approximately 506,000 people serve clients in more than 120 countries to help clients build their digital core, transform their operations, and accelerate revenue growth — creating tangible value across their enterprises at speed and scale.

| | | | | |

Accenture serves clients in three geographic markets: North America, Europe and Growth Markets (Asia Pacific, Latin America, Africa and the Middle East). Our geographic markets bring together capabilities from across the organization in Strategy & Consulting, Interactive, Technology and Operations—infusing digital skills and industry and functional expertise throughout—to deliver value to our clients. | Our revenues for fiscal 2020 were $44.3 billion, and we employed approximately 506,000 people as of August 31, 2020. Our revenues are derived primarily from Forbes Global 2000 companies, governments and government agencies. We have long-term relationships and have partnered with 97 of our top 100 clients in fiscal 2020 for > 10 years. |

Effective March 1, 2020, we began managing our business under a new growth model through the three geographic markets, which also became our reportable segments in the third quarter of fiscal 2020. The change was designed to help us better serve our clients and continue to scale our business. Prior to this change, our reportable segments were our five operating groups, Communications, Media & Technology, Financial Services, Health & Public Service, Products and Resources, which we now refer to as our industry groups. | |

Under the new growth model, we continue to go to market primarily by industry, leveraging our deep expertise across more than 40 industries. The new model simplified our organizational structure and increased our agility to form multi-service teams to meet client needs rapidly and at scale. It is also accelerating innovation by enabling our teams to move seamlessly between global and local, leveraging our network of more than 100 innovation hubs, our technology expertise and ecosystem relationships, and our global delivery capabilities to drive value for clients. | |

During fiscal 2020, we continued to make significant investments—in strategic acquisitions, in research and development in our assets, platforms and solutions, and in attracting and developing talent—to further enhance our differentiation and competitiveness in the marketplace. At year-end, we had more than 7,900 patents and pending patent applications worldwide. Our disciplined acquisition strategy, which is an engine to fuel organic growth, is focused on scaling our business in high-growth areas; adding skills and capabilities in new areas; and deepening our industry and functional expertise. In fiscal 2020, we invested more than $1.5 billion across 34 strategic acquisitions. | |

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 3 |

| | | | | | | | |

Our Strategy | | |

Our growth strategy begins with a focus on what our clients need. Regardless of industry, our clients must transform every aspect of their business to meet the needs of today’s digital world. We are helping our clients use technology to build their digital core to drive enterprise-wide transformation—such as moving them to the cloud and embedding security across the enterprise, by transforming their operations—such as replatforming their ERP systems and through our Operations services and Industry X, and by accelerating their growth—such as through creating omni-channel experiences through Interactive. | | |

We are uniquely able to deliver this transformation because of our ability to bring applied innovation and deliver 360-degree value for our clients. We define 360-degree value as delivering the financial business case and unique value a client may be seeking, and striving where possible to partner with our clients to achieve greater progress on inclusion and diversity with our diverse teams, reskill our clients’ employees, help our clients achieve their sustainability goals, and create meaningful experiences, both with Accenture and for the customers and employees of our clients. | | |

We are able to leverage our scale and global footprint, and seamlessly move between global and local, embedding responsible business by design in everything we do. Our strong ecosystem partnerships, together with our assets and platforms, including MyWizard, MyNav and Synops, position Accenture to consistently deliver tangible value for our clients. | | |

Key enablers of our growth strategy include: | | |

| | |

| Our People – As a talent- and innovation-led organization, across our entire business our people have highly specialized skills that drive our differentiation and competitiveness. We are deeply committed to investing in our people to ensure they have opportunities to learn and grow in their careers through their work experience and continued development, training and reskilling, and we have an unwavering commitment to inclusion and diversity; | |

| Our Commitment – We are a purpose driven company, committed to delivering on the promise of technology and human ingenuity. Our culture is underpinned by our core values and Code of Business Ethics which are key drivers of the trust our clients and partners place in us to deliver tangible value and outcomes for them; and | |

| Our Foundation – The new growth model and our enduring shareholder value creation model are key elements of the foundation that enable us to execute on our growth strategy. | |

Geographic Markets

The geographic markets, North America, Europe and Growth Markets, assemble integrated, multi-service client teams, which typically consist of industry experts, capability specialists and professionals with local market knowledge and experience. The geographic markets have primary responsibility for building and sustaining long-term client relationships; bringing together our expertise and collaborating with the other parts of our business to sell and deliver the full range of our services and capabilities; ensuring client satisfaction; and achieving revenue and profitability objectives.

While we serve clients in locally relevant ways, our global footprint and scale in every major country give us the ability to leverage our experience and talent from around the world to accelerate outcomes for our clients.

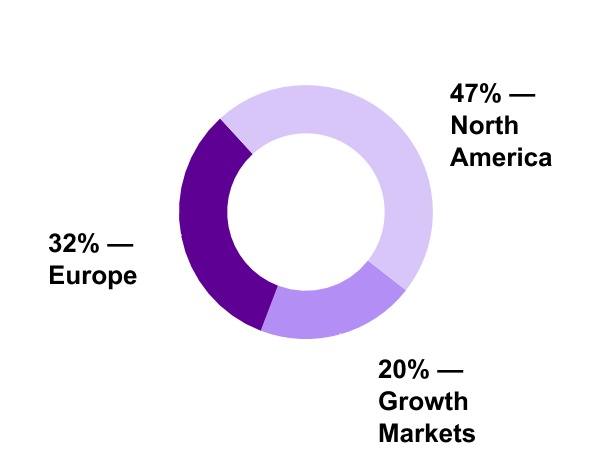

Our three geographic markets are Accenture’s reporting segments. The percent of our revenues represented by each market is shown at right.

Percent of Fiscal 2020 Revenue

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 4 |

Services

Strategy & Consulting

Strategy & Consulting works with C-suite executives and boards of the world’s leading organizations, helping them accelerate their digital transformation to enhance competitiveness, grow profitability and deliver sustainable stakeholder value. We use our deep industry and functional expertise underpinned by data, analytics, artificial intelligence, and innovation to help clients solve a diverse set of business challenges, including identifying and developing new markets, products and services; optimizing cost structures; maximizing human performance; harnessing data to improve decision-making; mitigating risk and enhancing security; implementing modern change management programs; shaping and delivering value from large-scale cloud migrations; building more resilient supply chains; and reinventing manufacturing and operations with smart, connected products and platforms.

Interactive

Interactive combines creativity and technology in service of meaningful experiences that drive sustainable growth and value for our clients. Our capabilities span ideation to execution: growth, product and culture design; technology and experience platforms; creative, media and marketing strategy; and campaign, content and channel orchestration. With strong client relationships and deep industry expertise, we are uniquely positioned to design, build, communicate and run experiences, reimagining the entire journey for customers, employees, patients and citizens alike. We embed this focus on experience across our services.

Technology

Technology provides innovative and comprehensive services and solutions that span cloud; systems integration and application management; security; intelligent platform services; infrastructure services; software engineering services; data and artificial intelligence; and global delivery through our Advanced Technology Centers. We continuously innovate our services, capabilities and platforms through early adoption of new technologies such as blockchain, robotics, 5G, quantum computing and Edge computing. Accenture provides a powerful range of capabilities that addresses the challenges faced by organizations today, including how to manage change and develop new growth opportunities.

Technology also includes the innovation and R&D activities in our Labs and our investments in emerging technologies through Accenture Ventures. Our innovation hubs around the world help clients innovate at unmatched speed, scope and scale. We have strong relationships with the world’s leading technology companies, as well as emerging start-ups, which enable us to enhance our service offerings, augment our capabilities and deliver distinctive business value to our clients. Our strong ecosystem relationships provide a significant competitive advantage, and we are a key partner of a broad range of technology providers, including Adobe, Alibaba, Amazon Web Services, Blue Yonder, Cisco, Dell, Google, HPE, IBM RedHat, Microsoft, Oracle, Pegasystems, Salesforce, SAP, ServiceNow, VMWare, Workday and many others. We push the boundaries of what technology can enable and help clients get the most value and best capabilities out of platforms.

Operations

We operate business processes on behalf of clients for specific enterprise functions, including finance and accounting, sourcing and procurement, supply chain, marketing and sales, as well as industry-specific services, such as platform trust and safety, banking, insurance and health services. We help organizations to reinvent themselves through intelligent operations, enabled by SynOps, our human-machine platform, powered by data and analytics, artificial intelligence, digital technology, and exceptional people to provide tangible business outcomes at speed and scale, including improved productivity and customer experiences as well as sustained long-term growth.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 5 |

Industry Groups

One of our competitive advantages is the depth and breadth of our industry expertise. Our industry focus gives us an understanding of industry evolution, business issues and new and emerging technologies, enabling us to deliver innovative solutions tailored to each client. It also allows us to bring cross-industry insights to our clients to accelerate value creation. Our capabilities across more than 40 industries are organized in the following five industry groups.

Communications, Media & Technology

| | | | | | | | |

| Communications & Media | High Tech | Software & Platforms |

Clients Served | | |

| Wireline, wireless, broadcast, entertainment, print, publishing, cable and satellite communications service providers | Enterprise technology, network equipment, semiconductor, consumer technology, aerospace & defense, and medical equipment companies | Cloud-based enterprise and consumer software companies; and social, e-commerce, retail, content, advertising and gaming platform companies |

| Percent of Group’s FY20 Revenue | | |

| 45% | 21% | 34% |

Financial Services

| | | | | |

| Banking & Capital Markets | Insurance |

Clients Served | |

| Retail and commercial banks, mortgage lenders, payment providers, investment banks, wealth and asset management firms, broker/dealers, depositories, exchanges, clearing and settlement organizations, and other diversified financial enterprises | Property and casualty insurers, life insurers, reinsurance firms and insurance brokers |

| Percent of Group’s FY20 Revenue | |

| 69% | 31% |

Health & Public Service

| | | | | |

| Health | Public Service |

Clients Served | |

| Healthcare providers, such as hospitals, public health systems, policy-making authorities, health insurers (payers), and industry organizations and associations | Defense departments and military forces; public safety authorities; justice departments; human and social services agencies; educational institutions; non-profit organizations; cities; and postal, customs, revenue and tax agencies |

| Percent of Group’s FY20 Revenue | |

| 36% | 64% |

Our work with clients in the U.S. federal government is delivered through Accenture Federal Services, a U.S. company and a wholly owned subsidiary of Accenture LLP, and represented approximately 35% of our Health & Public Service industry group’s revenues and 14% of our North America revenues in fiscal 2020.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 6 |

Products

| | | | | | | | |

| Consumer Goods, Retail & Travel Services | Industrial | Life Sciences |

Clients Served | | |

| Food and beverage, household goods, personal care, tobacco, fashion/apparel, agribusiness and consumer health companies; supermarkets, hardline retailers, mass-merchandise discounters, department stores and specialty retailers; airlines; and hospitality and travel services companies | Industrial & electrical equipment manufacturers and suppliers; and construction, heavy equipment, consumer durables, engineering services, real estate business services, freight & logistics, and automotive and public transportation companies | Biopharmaceutical, medical technology, and biotechnology companies and distributors |

| Percent of Group’s FY20 Revenue | | |

| 52% | 25% | 24% |

Amounts do not total due to rounding.

Resources

| | | | | | | | |

| Chemicals & Natural Resources | Energy | Utilities |

Clients Served | | |

| Petrochemicals, specialty chemicals, polymers and plastics, gases and agricultural chemicals companies, as well as the metals, mining, forest products and building materials industries | Companies in the oil and gas industry, including upstream, midstream, downstream, oilfield services, clean energy and energy trading companies | Electric, gas and water utilities; new energy providers |

| Percent of Group’s FY20 Revenue | | |

| 30% | 28% | 42% |

Global Delivery Capability

A key differentiator is our global delivery capability, powered by the world’s largest network of Advanced Technology and Intelligent Operations Centers. This allows us to bring the right talent at the right time to our clients from anywhere in the world—both in physical and virtual working environments—a capability that is particularly crucial as business needs and conditions change rapidly. Our global approach provides scalable innovation; standardized processes, methods and tools; automation and artificial intelligence; industry expertise and specialized capabilities; cost advantages; foreign language fluency; proximity to clients; and time zone advantages—to deliver high-quality solutions. Emphasizing quality, productivity, reduced risk, speed to market and predictability, our global delivery model supports all parts of our business to provide clients with price-competitive services and solutions.

Innovation and Intellectual Property

We are committed to developing leading-edge ideas and technologies and see innovation as a source of competitive advantage. We use our investment in research and development—on which we spent $871 million, $800 million, and $791 million in fiscal 2020, 2019 and 2018 respectively—to help clients address new realities in the marketplace and to face the future with confidence.

Our innovation experts work with clients across the world to imagine their future, build and co-create innovative business strategies and technology solutions, and then scale those solutions to sustain innovation. We harness our unique intellectual property to deliver these innovation services.

We leverage patent, trade secret and copyright laws as well as contractual arrangements and confidentiality procedures to protect the intellectual property in our innovative services and solutions. These include our proprietary platforms, software, reusable knowledge capital, and other innovations. We also have policies to respect the intellectual property rights of third parties, such as our clients, partners, vendors and others. As of August 31, 2020, we had a portfolio of more than 7,900 patents and pending patent applications worldwide.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 7 |

Underpinning our innovation services and our global strength in intellectual property is the Accenture Innovation Architecture, which brings together the diverse capabilities from Accenture Research, Accenture Ventures and Accenture Labs to our Studios, Innovation Centers and Delivery Centers.

Our research and thought leadership teams help identify market, technology and industry trends. Accenture Ventures partners with and invests in growth-stage companies that create innovative enterprise technologies. Accenture Labs incubate and prototype new concepts through applied research and development projects. The new Technology Incubation Group incubates and applies emerging technology innovation to business architectures, including blockchain, extended reality and quantum. Our network of more than 100 innovation hubs uses those insights and technologies to help clients imagine, build and scale for the future. We believe this combination of talent, assets and capabilities makes Accenture one of the leading strategic innovation partners for our clients.

To protect Accenture’s brands, we rely on intellectual property laws and trademark registrations held around the world. Trademarks appearing in this report are the trademarks or registered trademarks of Accenture Global Services Limited, Accenture Global Solutions Limited, or third parties, as applicable.

Competition

Accenture operates in a highly competitive and rapidly changing global marketplace. We compete with a variety of organizations that offer services and solutions competitive with those we offer—but we believe no other company offers the full range of services at scale that Accenture does, which uniquely positions us in a highly competitive market. Our clients typically retain us on a non-exclusive basis.

Our competitors include large multinational IT service providers, including the services arms of large global technology providers; off-shore IT service providers in lower-cost locations, particularly in India; accounting firms that provide consulting and other IT services and solutions; solution or service providers that compete with us in a specific geographic market, industry or service area, including advertising agencies and technology start-ups; and in-house IT departments of large corporations that use their own resources rather than engage an outside firm.

We believe Accenture competes successfully in the marketplace because:

•We are a trusted partner with long-term client relationships and a proven track record for delivering on large, complex programs that drive tangible value;

•We provide a broad range of services with our unique approach to bring integrated multi-service teams at scale and have a significant presence in every major geographic market, enabling us to leverage our global expertise in a local context and deliver tangible value;

•We have deep industry and cross-industry expertise, which enable us to accelerate value as clients transform their products, customer experiences and business operations;

•The breadth and scale of our technology capabilities, combined with our strong relationships with our technology ecosystem partners, enable us to help clients transform and re-platform in a sustainable way at speed; and

•Our goal is to recruit the most talented people in our markets, and we have an unwavering commitment to inclusion and diversity, which creates an environment that unleashes innovation, and a world-class learning organization that helps us continuously invest in the development of our people.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 8 |

Information About Our Executive Officers

Our executive officers as of October 22, 2020 are as follows:

| | | | | |

| Gianfranco Casati, 61, became our chief executive officer—Growth Markets in January 2014. From September 2006 to January 2014, he served as our group chief executive—Products. From April 2002 to September 2006, Mr. Casati was managing director of the Products Europe operating unit. He also served as our country managing director for Italy and as chairman of our geographic council in its IGEM (Italy, Greece, emerging markets) region, supervising our offices in Italy, Greece and several Eastern European countries. Mr. Casati has been with Accenture for 36 years. |

| Richard P. Clark, 59, became our chief accounting officer in September 2013 and has served as our corporate controller since September 2010. Prior to that, Mr. Clark served as our senior managing director of investor relations from September 2006 to September 2010. Previously he served as our finance director—Communications, Media & Technology from July 2001 to September 2006 and as our finance director—Resources from 1998 to July 2001. Mr. Clark has been with Accenture for 37 years. |

| Jo Deblaere, 58, became our chief operating officer in September 2009. Mr. Deblaere also served as our chief executive—Europe from January 2014 to February 2020. From September 2006 to September 2009, Mr. Deblaere served as our chief operating officer—Outsourcing. Prior to that, from September 2005 to September 2006, he led our global network of business process outsourcing delivery centers. From September 2000 to September 2005, he had overall responsibility for work with public-sector clients in Western Europe. Mr. Deblaere has been with Accenture for 35 years. |

| Jimmy Etheredge, 57, became our chief executive officer—North America in September 2019. From December 2016 to September 2019, Mr. Etheredge served as senior managing director—US Southeast, responsible for our business in 10 states, including the key markets of Atlanta, Charlotte and Washington, D.C. Previously, he served as senior managing director—Products in North America from 2011 until December 2016. Mr. Etheredge has been with Accenture for 35 years. |

| KC McClure, 55, became our chief financial officer in January 2019. From June 2018 to January 2019, she served as managing director—Finance Operations, where she led our finance operations across the entirety of our businesses. From December 2016 to May 2018, she served as our finance director—Communications, Media & Technology. Prior to assuming that role, she served as our head of investor relations from September 2010 to November 2016, and from March 2002 to August 2010, she served as our finance director—Health & Public Service. Ms. McClure has been with Accenture for 32 years. |

| Jean-Marc Ollagnier, 58, became our chief executive officer—Europe in March 2020. From March 2011 to March 2020, Mr. Ollagnier served as our group chief executive—Resources. From September 2006 to March 2011, Mr. Ollagnier led Resources in Europe, Latin America, the Middle East and Africa. Previously, he served as our global managing director—Financial Services Solutions group and as our geographic unit managing director—Gallia. Mr. Ollagnier has been with Accenture for 34 years. |

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1. Business | 9 |

| | | | | |

| David P. Rowland, 59, became executive chairman of the Board of Directors in September 2019. From January 2019 to September 2019, he served as our interim chief executive officer. Mr. Rowland was our chief financial officer from July 2013 to January 2019. From October 2006 to July 2013, he was our senior vice president—Finance. Previously, Mr. Rowland was our managing director—Finance Operations from July 2001 to October 2006. Prior to assuming that role, he served as our finance director—Communications, Media & Technology and as our finance director—Products. Mr. Rowland has been with Accenture for 37 years and has served as a director since January 2019. Prior to its merger with and into Accenture plc in March 2018, Mr. Rowland also served on the board of Accenture Holdings plc. |

| Ellyn J. Shook, 57, became our chief leadership officer in December 2015 and has also served as our chief human resources officer since March 2014. From 2012 to March 2014, Ms. Shook was our senior managing director—Human Resources and head of our Human Resources Centers of Expertise. From 2004 to 2011, she served as the global human resources lead for career management, performance management, total rewards, employee engagement and mergers and acquisitions. Ms. Shook has been with Accenture for 32 years. |

| Julie Sweet, 53, became our chief executive officer in September 2019. From June 2015 to September 2019, she served as our chief executive officer—North America. From March 2010 to June 2015, she served as our general counsel, secretary and chief compliance officer. Prior to joining Accenture in 2010, Ms. Sweet was a partner for 10 years in the law firm Cravath, Swaine & Moore LLP, which she joined as an associate in 1992. Ms. Sweet has been with Accenture for 10 years and has served as a director since September 2019. |

| Joel Unruch, 42, became our general counsel in September 2019 and has served as our corporate secretary since June 2015. Mr. Unruch also served as our chief compliance officer from September 2019 to January 2020. Mr. Unruch joined Accenture in 2011 as our assistant general counsel and assistant secretary and also oversaw ventures & acquisitions and alliances & ecosystems practices for our legal group. Prior to joining Accenture, Mr. Unruch was corporate counsel at Amazon.com and previously an associate in the corporate department of the law firm Cravath, Swaine & Moore LLP. Mr. Unruch has been with Accenture for 9 years. |

Organizational Structure

Accenture plc was incorporated in Ireland on June 10, 2009 as a public limited company. We operate our business through subsidiaries of Accenture plc.

The Consolidated Financial Statements reflect the ownership interests in Accenture Holdings plc (for applicable periods) and Accenture Canada Holdings Inc. held by certain current and former members of Accenture Leadership as noncontrolling interests. The noncontrolling ownership interests percentage was less than 1% as of August 31, 2020. “Accenture Leadership” is comprised of members of our global management committee (our primary management and leadership team, which consists of approximately 40 of our most senior leaders), senior managing directors and managing directors.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1A. Risk Factors | 10 |

Item 1A. Risk Factors

In addition to the other information set forth in this report, you should carefully consider the following factors which could materially adversely affect our business, financial condition, results of operations (including revenues and profitability) and/or stock price. Our business is also subject to general risks and uncertainties that may broadly affect companies, including us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also could materially adversely affect our business, financial condition, results of operations and/or stock price.

Our results of operations have been significantly adversely affected and could in the future be materially adversely impacted by the COVID-19 pandemic.

The COVID-19 pandemic has created significant volatility, uncertainty and economic disruption. The pandemic has resulted in authorities around the world implementing numerous unprecedented measures such as travel restrictions, quarantines, shelter in place orders, social distancing measures and temporary business closures. The pandemic and the actions taken by governments, businesses and individuals in response to the pandemic have resulted in, and are expected to continue to result in, a substantial curtailment of business activities, weakened economic conditions, significant economic uncertainty and volatility. The pandemic is significantly adversely impacting and could in the future materially adversely impact our business, operations and financial results.

The extent to which the coronavirus pandemic will continue to impact our business, operations and financial results will depend on numerous evolving factors that are difficult to accurately predict, including: the duration and scope of the pandemic and the continuation of additional outbreaks; how quickly and to what extent normal economic and social activity can resume; the timing of the development and distribution of an effective vaccine or treatments for COVID-19; government, business and individuals’ actions in response to the pandemic; the prolonged effect on our clients and client demand for our services and solutions; the degree to which client demand normalizes in a remote work environment; the reprioritization, delay or termination of existing client engagements; the ability of our clients to pay for our services and solutions. The closures of our and our clients’ offices, and restrictions inhibiting our people’s ability to access those offices, have disrupted, and will continue to disrupt our ability to sell and provide our services and have resulted in, and may continue to result in, losses of revenue.

In response to governmental directives and recommended safety measures, we have enabled most of our employees to work remotely. As governments ease their restrictions, our employees will likely increase their social interactions, including in certain circumstances in our and our clients’ offices, which could increase the risk of infection and could result in increased illness among our employees and associated risks, including business interruption.

Any of these events could cause, contribute to or magnify the other risks and uncertainties enumerated below and could materially adversely affect our business, financial condition, results of operations and/or stock price.

Our results of operations have been, and may in the future be, adversely affected by volatile, negative or uncertain economic and political conditions and the effects of these conditions on our clients’ businesses and levels of business activity.

Global macroeconomic and geopolitical conditions affect our clients’ businesses and the markets they serve. Economic and political conditions have become increasingly volatile, negative and uncertain due to the coronavirus pandemic, among other reasons, and have undermined business confidence in our significant markets and other markets, which are increasingly interdependent, caused our clients to reduce or defer their spending on new initiatives and technologies, and resulted in clients reducing, delaying or eliminating spending under existing contracts with us, which has, and may continue to, negatively affect our business. Growth in the markets we serve could be at a slow rate, or could stagnate or contract, in each case, for an extended period of time. Because we operate globally and have significant businesses in many markets, an economic slowdown in any of those markets could adversely affect our results of operations.

Ongoing economic and political volatility and uncertainty and changing demand patterns affect our business in a number of other ways, including making it more difficult to accurately forecast client demand and effectively build our revenue and resource plans, particularly in consulting. Economic and political volatility and uncertainty is particularly challenging because it may take some time for the effects and changes in demand patterns resulting from these and other factors to manifest

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1A. Risk Factors | 11 |

themselves in our business and results of operations. Changing demand patterns from economic and political volatility and uncertainty, including as a result of the COVID-19 pandemic, changes in global trade policies, increasing geopolitical tensions and trends such as populism and economic nationalism, elections in our major markets and their impact on us, our clients and the industries we serve, could continue to have a significant negative impact on our results of operations.

Our business depends on generating and maintaining ongoing, profitable client demand for our services and solutions, including through the adaptation and expansion of our services and solutions in response to ongoing changes in technology and offerings, and a significant reduction in such demand or an inability to respond to the evolving technological environment could materially affect our results of operations.

Our revenue and profitability depend on the demand for our services and solutions with favorable margins, which could be negatively affected by numerous factors, many of which are beyond our control and unrelated to our work product. As described above, volatile, negative or uncertain global economic and political conditions and lower growth or contraction in the markets we serve have adversely affected and could in the future adversely affect client demand for our services and solutions. Our success depends, in part, on our ability to continue to develop and implement services and solutions that anticipate and respond to rapid and continuing changes in technology and offerings to serve the evolving needs of our clients. Examples of areas of significant change include digital-, cloud- and security-related offerings, which are continually evolving, as well as developments in areas such as artificial intelligence, augmented reality, automation, blockchain, Internet of Things, quantum and edge computing and as-a-service solutions. Technological developments may materially affect the cost and use of technology by our clients and, in the case of as-a-service solutions, could affect the nature of how we generate revenue. Some of these technological developments have reduced and replaced some of our historical services and solutions and may continue to do so in the future. This has caused, and may in the future cause, clients to delay spending under existing contracts and engagements and to delay entering into new contracts while they evaluate new technologies. Such technological developments and spending delays can negatively impact our results of operations if we are unable to introduce new pricing or commercial models that reflect the value of these technological developments or if the pace and level of spending on new technologies are not sufficient to make up any shortfall.

Developments in the industries we serve, which may be rapid, also could shift demand to new services and solutions. If, as a result of new technologies or changes in the industries we serve, our clients demand new services and solutions, we may be less competitive in these new areas or need to make significant investment to meet that demand. Our growth strategy focuses on responding to these types of developments by driving innovation that will enable us to expand our business into new growth areas. If we do not sufficiently invest in new technology and adapt to industry developments, or evolve and expand our business at sufficient speed and scale, or if we do not make the right strategic investments to respond to these developments and successfully drive innovation, our services and solutions, our results of operations, and our ability to develop and maintain a competitive advantage and to execute on our growth strategy could be adversely affected.

We operate in a rapidly evolving environment in which there currently are, and we expect will continue to be, new technology entrants. New services or technologies offered by competitors or new entrants may make our offerings less differentiated or less competitive when compared to other alternatives, which may adversely affect our results of operations. In addition, companies in the industries we serve sometimes seek to achieve economies of scale and other synergies by combining with or acquiring other companies. If one of our current clients merges or consolidates with a company that relies on another provider for the services and solutions we offer, we may lose work from that client or lose the opportunity to gain additional work if we are not successful in generating new opportunities from the merger or consolidation. In a particular geographic market, service or industry group, a small number of clients have contributed, or may, in the future contribute, a significant portion of the revenues of such geographic market, service or industry group, and any decision by such a client to delay, reduce, or eliminate spending on our services and solutions could have a disproportionate impact on the results of operations in the relevant geographic market, service or industry group.

Many of our consulting contracts are less than 12 months in duration, and these contracts typically permit a client to terminate the agreement with as little as 30 days’ notice. Longer-term, larger and more complex contracts, such as the majority of our outsourcing contracts, generally require a longer notice period for termination and often include an early termination charge to be paid to us, but this charge might not be sufficient to cover our costs or make up for anticipated ongoing revenues and profits lost upon termination of the contract. Many of our contracts allow clients to terminate, delay, reduce or eliminate spending on the services and solutions we provide. Additionally, a client could choose not to retain us for additional stages of a project, try to renegotiate the terms of its contract or cancel or delay additional planned work. When contracts are terminated or not renewed, we lose the anticipated revenues, and it may take significant time to replace the level of revenues lost. Consequently, our results of operations in subsequent periods could be materially lower than expected. The specific business or financial condition of a client, changes in management and changes in a client’s strategy are also all factors that can result in terminations, cancellations or delays.

| | | | | | | | | | | |

| | | |

ACCENTURE 2020 FORM 10-K | | Item 1A. Risk Factors | 12 |

If we are unable to keep our supply of skills and resources in balance with client demand around the world and attract and retain professionals with strong leadership skills, our business, the utilization rate of our professionals and our results of operations may be materially adversely affected.

Our success is dependent, in large part, on our ability to keep our supply of market-leading skills and capabilities in balance with client demand around the world and our ability to attract and retain personnel with the knowledge and skills to lead our business globally. We must hire or reskill, retain and motivate appropriate numbers of talented people with diverse skills in order to serve clients across the globe, respond quickly to rapid and ongoing changes in technology, industry and the macroeconomic environment, and continuously innovate to grow our business. For example, if we are unable to hire or retrain our employees to keep pace with the rapid and continuous changes in technology and the industries we serve, we may not be able to innovate and deliver new services and solutions to fulfill client demand. There is intense competition for scarce talent with market-leading skills and capabilities in new technologies, and our competitors have directly targeted our employees with these highly sought-after skills and will likely continue to do so. As a result, we may be unable to cost-effectively hire and retain employees with these market-leading skills, which may cause us to incur increased costs, or be unable to fulfill client demand for our services and solutions.

We are particularly dependent on retaining members of Accenture Leadership with critical capabilities. If we are unable to do so, our ability to innovate, generate new business opportunities and effectively lead large and complex transformations and client relationships could be jeopardized. We depend on identifying, developing and retaining top talent to innovate and lead our businesses. This includes developing talent and leadership capabilities in emerging markets, where the depth of skilled employees may be limited, and competition for these resources is intense. Our ability to expand in our key markets depends, in large part, on our ability to attract, develop, retain and integrate both leaders for the local business and people with critical capabilities.

Similarly, our profitability depends on our ability to effectively source and staff people with the right mix of skills and experience to perform services for our clients, including our ability to transition employees to new assignments on a timely basis. If we are unable to effectively deploy our employees globally and remotely on a timely basis to fulfill the needs of our clients, our profitability could suffer. For example, we have experienced reduced demand for strategy and consulting services during the COVID-19 pandemic and have staffed employees from these practices on projects where we are experiencing strong client demand. If we are unable to retain our top talent with these skills, we may experience difficulty staffing these engagements when demand for these services rebounds. If our utilization rate is too low, our profitability and the engagement of our employees could suffer. If the utilization rate of our professionals is too high, it could have an adverse effect on employee engagement and attrition, the quality of the work performed as well as our ability to staff projects. The costs associated with recruiting and training employees are significant. An important element of our global business model is the deployment of our employees around the world, which allows us to move talent as needed. Therefore, if we are not able to deploy the talent we need because of COVID-19 travel restrictions or increased regulation of immigration or work visas, including limitations placed on the number of visas granted, limitations on the type of work performed or location in which the work can be performed, and new or higher minimum salary requirements, it could be more difficult to staff our employees on client engagements and could increase our costs.

Our equity-based incentive compensation plans are designed to reward high-performing individuals for their contributions and provide incentives for them to remain with us. If the anticipated value of such incentives does not materialize because of volatility or lack of positive performance in our stock price, or if our total compensation package is not viewed as being competitive, our ability to attract and retain the personnel we need could be adversely affected. In addition, if we do not obtain the shareholder approval needed to continue granting equity awards under our share plans in the amounts we believe are necessary, our ability to attract and retain personnel could be negatively affected.