ottr-202012310001466593falseFY2020us-gaap:OtherAssetsus-gaap:OtherAssetsus-gaap:LiabilitiesCurrentAbstractus-gaap:LiabilitiesCurrentAbstractus-gaap:LiabilitiesNoncurrentAbstractus-gaap:LiabilitiesNoncurrentAbstractP5YP5YP3Y00014665932020-01-012020-12-31iso4217:USD00014665932020-06-30xbrli:shares00014665932021-02-1600014665932020-12-3100014665932019-12-31iso4217:USDxbrli:shares0001466593ottr:ElectricMember2020-01-012020-12-310001466593ottr:ElectricMember2019-01-012019-12-310001466593ottr:ElectricMember2018-01-012018-12-310001466593ottr:ProductSalesMember2020-01-012020-12-310001466593ottr:ProductSalesMember2019-01-012019-12-310001466593ottr:ProductSalesMember2018-01-012018-12-3100014665932019-01-012019-12-3100014665932018-01-012018-12-310001466593us-gaap:CommonStockMember2017-12-310001466593us-gaap:AdditionalPaidInCapitalMember2017-12-310001466593us-gaap:RetainedEarningsMember2017-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-3100014665932017-12-310001466593us-gaap:CommonStockMember2018-01-012018-12-310001466593us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001466593us-gaap:RetainedEarningsMember2018-01-012018-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001466593us-gaap:CommonStockMember2018-12-310001466593us-gaap:AdditionalPaidInCapitalMember2018-12-310001466593us-gaap:RetainedEarningsMember2018-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-3100014665932018-12-310001466593us-gaap:CommonStockMember2019-01-012019-12-310001466593us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001466593us-gaap:RetainedEarningsMember2019-01-012019-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001466593us-gaap:CommonStockMember2019-12-310001466593us-gaap:AdditionalPaidInCapitalMember2019-12-310001466593us-gaap:RetainedEarningsMember2019-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001466593us-gaap:CommonStockMember2020-01-012020-12-310001466593us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001466593us-gaap:RetainedEarningsMember2020-01-012020-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001466593us-gaap:CommonStockMember2020-12-310001466593us-gaap:AdditionalPaidInCapitalMember2020-12-310001466593us-gaap:RetainedEarningsMember2020-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2018-12-31ottr:segment0001466593ottr:ElectricPlantMember2020-01-012020-12-310001466593ottr:ElectricPlantMember2019-01-012019-12-310001466593ottr:ElectricPlantMember2018-01-012018-12-310001466593ottr:ElectricPlantMembersrt:MinimumMemberus-gaap:EquipmentMember2020-01-012020-12-310001466593srt:MaximumMemberottr:ElectricPlantMemberus-gaap:EquipmentMember2020-01-012020-12-310001466593srt:MinimumMemberus-gaap:EquipmentMemberottr:NonelectricPlantMember2020-01-012020-12-310001466593srt:MaximumMemberus-gaap:EquipmentMemberottr:NonelectricPlantMember2020-01-012020-12-310001466593ottr:BuildingAndLeaseholdImprovementsMembersrt:MinimumMemberottr:NonelectricPlantMember2020-01-012020-12-310001466593srt:MaximumMemberottr:BuildingAndLeaseholdImprovementsMemberottr:NonelectricPlantMember2020-01-012020-12-31ottr:plant0001466593srt:MinimumMember2020-01-012020-12-310001466593srt:MaximumMember2020-01-012020-12-310001466593srt:MinimumMember2020-12-310001466593srt:MaximumMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:LigniteSalesAgreementMemberottr:CoyoteCreekMiningCompanyLLCCCMCMember2020-12-31xbrli:pure0001466593ottr:OtterTailPowerCompanyMemberottr:LigniteSalesAgreementMemberottr:CoyoteCreekMiningCompanyLLCCCMCMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2020-01-012020-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2019-01-012019-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2018-01-012018-12-310001466593us-gaap:OperatingSegmentsMemberottr:PlasticsMember2020-01-012020-12-310001466593us-gaap:OperatingSegmentsMemberottr:PlasticsMember2019-01-012019-12-310001466593us-gaap:OperatingSegmentsMemberottr:PlasticsMember2018-01-012018-12-310001466593us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001466593us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001466593us-gaap:CorporateNonSegmentMember2018-01-012018-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMember2020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMember2019-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2020-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2019-12-310001466593us-gaap:OperatingSegmentsMemberottr:PlasticsMember2020-12-310001466593us-gaap:OperatingSegmentsMemberottr:PlasticsMember2019-12-310001466593us-gaap:CorporateNonSegmentMember2020-12-310001466593us-gaap:CorporateNonSegmentMember2019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailResidentialMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailResidentialMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailResidentialMember2018-01-012018-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailCommercialAndIndustrialMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailCommercialAndIndustrialMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailCommercialAndIndustrialMember2018-01-012018-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailOtherMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailOtherMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:RetailOtherMember2018-01-012018-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:ElectronicProductRetailMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:ElectronicProductRetailMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:ElectronicProductRetailMember2018-01-012018-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberus-gaap:ElectricTransmissionMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberus-gaap:ElectricTransmissionMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberus-gaap:ElectricTransmissionMember2018-01-012018-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:WholesaleMember2020-01-012020-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:WholesaleMember2019-01-012019-12-310001466593ottr:ElectricMemberus-gaap:OperatingSegmentsMemberottr:WholesaleMember2018-01-012018-12-310001466593ottr:ElectricMemberottr:ElectricProductOtherMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001466593ottr:ElectricMemberottr:ElectricProductOtherMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001466593ottr:ElectricMemberottr:ElectricProductOtherMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001466593us-gaap:OperatingSegmentsMemberottr:MetalPartsAndToolingMemberottr:ManufacturingMember2020-01-012020-12-310001466593us-gaap:OperatingSegmentsMemberottr:MetalPartsAndToolingMemberottr:ManufacturingMember2019-01-012019-12-310001466593us-gaap:OperatingSegmentsMemberottr:MetalPartsAndToolingMemberottr:ManufacturingMember2018-01-012018-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMemberottr:PlasticProductsMember2020-01-012020-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMemberottr:PlasticProductsMember2019-01-012019-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMemberottr:PlasticProductsMember2018-01-012018-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMemberus-gaap:ManufacturedProductOtherMember2020-01-012020-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMemberus-gaap:ManufacturedProductOtherMember2019-01-012019-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMemberus-gaap:ManufacturedProductOtherMember2018-01-012018-12-310001466593us-gaap:OperatingSegmentsMember2020-01-012020-12-310001466593us-gaap:OperatingSegmentsMember2019-01-012019-12-310001466593us-gaap:OperatingSegmentsMember2018-01-012018-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2020-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2019-12-310001466593ottr:AlternativeRevenueProgramRidersMember2020-01-012020-12-310001466593ottr:AlternativeRevenueProgramRidersMember2020-12-310001466593ottr:AlternativeRevenueProgramRidersMember2019-12-310001466593ottr:AssetRetirementObligationsMember2020-12-310001466593ottr:AssetRetirementObligationsMember2019-12-310001466593ottr:ISOCostRecoveryTrackersMember2020-01-012020-12-310001466593ottr:ISOCostRecoveryTrackersMember2020-12-310001466593ottr:ISOCostRecoveryTrackersMember2019-12-310001466593ottr:UnrecoveredProjectCostsMember2020-01-012020-12-310001466593ottr:UnrecoveredProjectCostsMember2020-12-310001466593ottr:UnrecoveredProjectCostsMember2019-12-310001466593ottr:DeferredRateCaseExpensesMember2020-12-310001466593ottr:DeferredRateCaseExpensesMember2019-12-310001466593ottr:DebtReacquisitionPremiumsMember2020-01-012020-12-310001466593ottr:DebtReacquisitionPremiumsMember2020-12-310001466593ottr:DebtReacquisitionPremiumsMember2019-12-310001466593ottr:OtherRegulatoryAssetsMember2020-12-310001466593ottr:OtherRegulatoryAssetsMember2019-12-310001466593ottr:DeferredIncomeTaxesMember2020-12-310001466593ottr:DeferredIncomeTaxesMember2019-12-310001466593ottr:PlantRemovalObligationsMember2020-12-310001466593ottr:PlantRemovalObligationsMember2019-12-310001466593ottr:FuelClauseAdjustmentMember2020-01-012020-12-310001466593ottr:FuelClauseAdjustmentMember2020-12-310001466593ottr:FuelClauseAdjustmentMember2019-12-310001466593ottr:AlternativeRevenueProgramRidersMember2020-01-012020-12-310001466593ottr:AlternativeRevenueProgramRidersMember2020-12-310001466593ottr:AlternativeRevenueProgramRidersMember2019-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2020-01-012020-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2020-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2019-12-310001466593ottr:DeferredRateCaseExpensesMember2020-12-310001466593ottr:DeferredRateCaseExpensesMember2019-12-310001466593ottr:ISOCostRecoveryTrackersMember2020-01-012020-12-310001466593ottr:ISOCostRecoveryTrackersMember2020-12-310001466593ottr:ISOCostRecoveryTrackersMember2019-12-310001466593ottr:OtherRegulatoryLiabilitiesMember2020-12-310001466593ottr:OtherRegulatoryLiabilitiesMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:AlternativeRevenueProgramRidersMember2020-01-012020-12-310001466593ottr:OtterTailPowerCompanyMember2020-12-310001466593us-gaap:ElectricGenerationEquipmentMemberottr:ElectricPlantMember2020-12-310001466593us-gaap:ElectricGenerationEquipmentMemberottr:ElectricPlantMember2019-12-310001466593ottr:TransmissionPlantMemberottr:ElectricPlantMember2020-12-310001466593ottr:TransmissionPlantMemberottr:ElectricPlantMember2019-12-310001466593ottr:DistributionPlantMemberottr:ElectricPlantMember2020-12-310001466593ottr:DistributionPlantMemberottr:ElectricPlantMember2019-12-310001466593ottr:GeneralPlantMemberottr:ElectricPlantMember2020-12-310001466593ottr:GeneralPlantMemberottr:ElectricPlantMember2019-12-310001466593ottr:ElectricPlantMemberottr:ElectricPlantInServiceMember2020-12-310001466593ottr:ElectricPlantMemberottr:ElectricPlantInServiceMember2019-12-310001466593us-gaap:ConstructionInProgressMemberottr:ElectricPlantMember2020-12-310001466593us-gaap:ConstructionInProgressMemberottr:ElectricPlantMember2019-12-310001466593ottr:ElectricPlantMember2020-12-310001466593ottr:ElectricPlantMember2019-12-310001466593us-gaap:EquipmentMemberottr:NonelectricPlantMember2020-12-310001466593us-gaap:EquipmentMemberottr:NonelectricPlantMember2019-12-310001466593ottr:BuildingsAndLeaseholdImprovementsMemberottr:NonelectricPlantMember2020-12-310001466593ottr:BuildingsAndLeaseholdImprovementsMemberottr:NonelectricPlantMember2019-12-310001466593us-gaap:LandMemberottr:NonelectricPlantMember2020-12-310001466593us-gaap:LandMemberottr:NonelectricPlantMember2019-12-310001466593ottr:NonelectricOperationsPlantMemberottr:NonelectricPlantMember2020-12-310001466593ottr:NonelectricOperationsPlantMemberottr:NonelectricPlantMember2019-12-310001466593us-gaap:ConstructionInProgressMemberottr:NonelectricPlantMember2020-12-310001466593us-gaap:ConstructionInProgressMemberottr:NonelectricPlantMember2019-12-310001466593ottr:NonelectricPlantMember2020-12-310001466593ottr:NonelectricPlantMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStonePlantMember2020-12-310001466593ottr:BigStonePlantMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:CoyoteStationMember2020-12-310001466593ottr:CoyoteStationMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStoneSouthEllendaleMultiValueProjectMember2020-12-310001466593ottr:BigStoneSouthEllendaleMultiValueProjectMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:FargoProjectMember2020-12-310001466593ottr:FargoProjectMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStoneSouthBrookingsMultiValueProjectMember2020-12-310001466593ottr:BigStoneSouthBrookingsMultiValueProjectMember2020-12-310001466593ottr:BrookingsProjectMemberottr:OtterTailPowerCompanyMember2020-12-310001466593ottr:BrookingsProjectMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BemidjiProjectMember2020-12-310001466593ottr:BemidjiProjectMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStonePlantMember2019-12-310001466593ottr:BigStonePlantMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:CoyoteStationMember2019-12-310001466593ottr:CoyoteStationMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStoneSouthEllendaleMultiValueProjectMember2019-12-310001466593ottr:BigStoneSouthEllendaleMultiValueProjectMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:FargoProjectMember2019-12-310001466593ottr:FargoProjectMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStoneSouthBrookingsMultiValueProjectMember2019-12-310001466593ottr:BigStoneSouthBrookingsMultiValueProjectMember2019-12-310001466593ottr:BrookingsProjectMemberottr:OtterTailPowerCompanyMember2019-12-310001466593ottr:BrookingsProjectMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BemidjiProjectMember2019-12-310001466593ottr:BemidjiProjectMember2019-12-310001466593ottr:ManufacturingMember2020-12-310001466593ottr:ManufacturingMember2019-12-310001466593ottr:PlasticsMember2020-12-310001466593ottr:PlasticsMember2019-12-310001466593us-gaap:CustomerRelationshipsMember2020-12-310001466593us-gaap:OtherIntangibleAssetsMember2020-12-310001466593us-gaap:CustomerRelationshipsMember2019-12-310001466593us-gaap:OtherIntangibleAssetsMember2019-12-310001466593srt:ParentCompanyMember2020-12-310001466593srt:ParentCompanyMember2019-12-310001466593ottr:OtterTailPowerCompanyMember2019-12-310001466593ottr:OtterTailCorporationCreditAgreementMember2020-12-310001466593ottr:OtterTailCorporationCreditAgreementMember2019-12-310001466593ottr:OTPCreditAgreementMember2020-12-310001466593ottr:OTPCreditAgreementMember2019-12-310001466593us-gaap:LetterOfCreditMemberottr:OtterTailCorporationCreditAgreementMember2020-12-310001466593us-gaap:LetterOfCreditMemberottr:OTPCreditAgreementMember2020-12-310001466593ottr:BenchmarkRateMembersrt:MinimumMember2020-01-012020-12-310001466593srt:MaximumMemberottr:BenchmarkRateMember2020-01-012020-12-310001466593us-gaap:LondonInterbankOfferedRateLIBORMemberottr:OtterTailCorporationCreditAgreementMember2020-01-012020-12-310001466593us-gaap:LondonInterbankOfferedRateLIBORMemberottr:OTPCreditAgreementMember2020-01-012020-12-310001466593ottr:The355GuaranteedSeniorNotesDueDecember152026Member2020-12-310001466593ottr:The355GuaranteedSeniorNotesDueDecember152026Member2019-12-310001466593ottr:SeniorUnsecuredNotes463SeriesADueDecember12021Member2020-12-310001466593ottr:SeniorUnsecuredNotes463SeriesADueDecember12021Member2019-12-310001466593ottr:SeniorUnsecuredNotes615SeriesBDueAugust202022Member2020-12-310001466593ottr:SeniorUnsecuredNotes615SeriesBDueAugust202022Member2019-12-310001466593ottr:SeniorUnsecuredNotes637SeriesCDueAugust202027Member2020-12-310001466593ottr:SeniorUnsecuredNotes637SeriesCDueAugust202027Member2019-12-310001466593ottr:SeniorUnsecuredNotes468SeriesADueFebruary272029Member2020-12-310001466593ottr:SeniorUnsecuredNotes468SeriesADueFebruary272029Member2019-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueOctober102029Member2020-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueOctober102029Member2019-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueFebruary252030Member2020-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueFebruary252030Member2019-12-310001466593ottr:SeniorUnsecuredNotes322SeriesBDueAugust202030Member2020-12-310001466593ottr:SeniorUnsecuredNotes322SeriesBDueAugust202030Member2019-12-310001466593ottr:SeniorUnsecuredNotes647SeriesDDueAugust202037Member2020-12-310001466593ottr:SeniorUnsecuredNotes647SeriesDDueAugust202037Member2019-12-310001466593ottr:SeniorUnsecuredNotes352SeriesBDueOctober102039Member2020-12-310001466593ottr:SeniorUnsecuredNotes352SeriesBDueOctober102039Member2019-12-310001466593ottr:SeniorUnsecuredNotes362SeriesCDueFebruary252040Member2020-12-310001466593ottr:SeniorUnsecuredNotes362SeriesCDueFebruary252040Member2019-12-310001466593ottr:SeniorUnsecuredNotes547SeriesBDueFebruary272044Member2020-12-310001466593ottr:SeniorUnsecuredNotes547SeriesBDueFebruary272044Member2019-12-310001466593ottr:SeniorUnsecuredNotes407SeriesADueFebruary72048Member2020-12-310001466593ottr:SeniorUnsecuredNotes407SeriesADueFebruary72048Member2019-12-310001466593ottr:SeniorUnsecuredNotes382SeriesCDueOctober102049Member2020-12-310001466593ottr:SeniorUnsecuredNotes382SeriesCDueOctober102049Member2019-12-310001466593ottr:SeniorUnsecuredNotes392SeriesDDueFebruary252050Member2020-12-310001466593ottr:SeniorUnsecuredNotes392SeriesDDueFebruary252050Member2019-12-310001466593ottr:PartnershipInAssistingCommunityExpansionPaceNote254DueMarch182021Member2020-12-310001466593ottr:PartnershipInAssistingCommunityExpansionPaceNote254DueMarch182021Member2019-12-310001466593ottr:The2019NotePurchaseAgreementMemberottr:OtterTailPowerCompanyMember2020-01-012020-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-31ottr:year0001466593us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593ottr:CostsIncludedInOTPCapitalExpendituresMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:CostsIncludedInOTPCapitalExpendituresMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:CostsIncludedInOTPCapitalExpendituresMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593ottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593ottr:CostsIncludedInOtherNonelectricExpensesMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:CostsIncludedInOtherNonelectricExpensesMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:CostsIncludedInOtherNonelectricExpensesMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593ottr:NonserviceCostsCapitalizedAsRegulatoryAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:NonserviceCostsCapitalizedAsRegulatoryAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:NonserviceCostsCapitalizedAsRegulatoryAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2020-01-012020-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2019-01-012019-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2018-01-012018-12-310001466593ottr:ParticipantsToAge39Memberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:ParticipantsToAge39Memberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:ParticipantsToAge39Memberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593ottr:ParticipantsAge40To49Memberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:ParticipantsAge40To49Memberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:ParticipantsAge40To49Memberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593ottr:ParticipantsAge50AndOlderMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001466593ottr:ParticipantsAge50AndOlderMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001466593ottr:ParticipantsAge50AndOlderMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2018-12-310001466593ottr:ParticipantsToAge39Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:ParticipantsToAge39Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:ParticipantsAge40To49Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:ParticipantsAge40To49Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:ParticipantsAge50AndOlderMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:ParticipantsAge50AndOlderMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:SubsequentEventMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-01-310001466593ottr:PermittedRangeLessThan85PercentPBOMembersrt:MinimumMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMembersrt:MaximumMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMembersrt:MinimumMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MinimumMemberus-gaap:EquitySecuritiesMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberus-gaap:EquitySecuritiesMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MinimumMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593srt:MaximumMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593ottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMembersrt:MinimumMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMemberus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMemberottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMemberottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMemberottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MinimumMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMemberottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InvestmentGradeFixedIncomeSecuritiesMembersrt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMembersrt:MinimumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMembersrt:MaximumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMembersrt:MinimumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MinimumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MinimumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593srt:MaximumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593ottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMembersrt:MinimumMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMemberottr:BelowInvestmentGradeFixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMemberottr:OtherAssetCategoriesMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:PermittedRangeLessThan85PercentPBOMembersrt:MaximumMemberottr:OtherAssetCategoriesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:OtherAssetCategoriesMemberottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:OtherAssetCategoriesMemberottr:PermittedRangeEqualToOrGreaterThan85PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:OtherAssetCategoriesMembersrt:MinimumMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:OtherAssetCategoriesMemberottr:PermittedRangeEqualToOrGreaterThan90PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:OtherAssetCategoriesMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593srt:MaximumMemberottr:OtherAssetCategoriesMemberus-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRangeEqualToOrGreaterThan95PBOMember2020-12-310001466593ottr:OtherAssetCategoriesMemberottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593srt:MaximumMemberottr:OtherAssetCategoriesMemberottr:PermittedRangeEqualToOrGreaterThan100PercentPBOMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:MixedEquitiesFundMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:MixedEquitiesFundMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:LargeCapitalizationEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:LargeCapitalizationEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:InternationalEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:InternationalEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:EmergingMarketsEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:EmergingMarketsEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:SmallAndMidCapitalizationEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:SmallAndMidCapitalizationEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:SEIDynamicAssetAllocationFundMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:SEIDynamicAssetAllocationFundMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMember2020-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMember2019-12-310001466593ottr:FixedIncomeSecuritiesAndCashMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:FixedIncomeSecuritiesAndCashMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:OtherSEIEnergyDebtCollectiveFundMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:OtherSEIEnergyDebtCollectiveFundMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:MixedEquitiesFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:MixedEquitiesFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:LargeCapitalizationEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:LargeCapitalizationEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:InternationalEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:InternationalEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:SmallAndMidCapitalizationEquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:SmallAndMidCapitalizationEquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:SEIDynamicAssetAllocationFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:SEIDynamicAssetAllocationFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:EmergingMarketsEquityFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:EmergingMarketsEquityFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2020-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2019-12-310001466593ottr:CashManagementMoneyMarketFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001466593ottr:CashManagementMoneyMarketFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2020-01-012020-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2019-01-012019-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2018-01-012018-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMember2020-01-012020-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMember2019-01-012019-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMember2018-01-012018-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:CostsIncludedInOtherNonelectricExpensesMember2020-01-012020-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:CostsIncludedInOtherNonelectricExpensesMember2019-01-012019-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:CostsIncludedInOtherNonelectricExpensesMember2018-01-012018-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2020-01-012020-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2019-01-012019-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2018-01-012018-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2020-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2019-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInOTPCapitalExpendituresMember2020-01-012020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInOTPCapitalExpendituresMember2019-01-012019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInOTPCapitalExpendituresMember2018-01-012018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMember2020-01-012020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMember2019-01-012019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInElectricOperationAndMaintenanceExpensesMember2018-01-012018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInOtherNonelectricExpensesMember2020-01-012020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInOtherNonelectricExpensesMember2019-01-012019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:CostsIncludedInOtherNonelectricExpensesMember2018-01-012018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:NonserviceCostsCapitalizedAsRegulatoryAssetsMember2020-01-012020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:NonserviceCostsCapitalizedAsRegulatoryAssetsMember2019-01-012019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:NonserviceCostsCapitalizedAsRegulatoryAssetsMember2018-01-012018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2020-01-012020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2019-01-012019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberottr:NonserviceCostsIncludedInNonserviceCostComponentsOfPostretirementBenefitsMember2018-01-012018-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-12-310001466593us-gaap:DomesticCountryMember2020-12-310001466593ottr:TaxYears2022To2032Memberus-gaap:DomesticCountryMember2020-12-310001466593ottr:TaxYears2033To2038Memberus-gaap:DomesticCountryMember2020-12-310001466593us-gaap:DomesticCountryMemberottr:TaxYears2039To2043Member2020-12-310001466593us-gaap:StateAndLocalJurisdictionMember2020-12-310001466593ottr:TaxYears2022To2032Memberus-gaap:StateAndLocalJurisdictionMember2020-12-310001466593ottr:TaxYears2033To2038Memberus-gaap:StateAndLocalJurisdictionMember2020-12-310001466593us-gaap:StateAndLocalJurisdictionMemberottr:TaxYears2039To2043Member2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:ConstructionProgramsMember2020-01-012020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:ConstructionProgramsMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:ConstructionProgramsMember2019-12-310001466593ottr:OtterTailPowerCompanyMemberottr:ConstructionProgramsMember2018-12-310001466593ottr:SupplyAgreementMemberottr:TOPlasticsMember2019-10-012019-10-010001466593ottr:OtterTailPowerCompanyMemberottr:OTPLandEasementsMember2020-01-012020-12-310001466593srt:SubsidiariesMemberottr:ConstructionProgramAndOtherCommitmentsMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:CapacityAndEnergyRequirementsMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:CoalPurchaseCommitmentsMember2020-12-310001466593ottr:OtterTailPowerCompanyMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:FederalEnergyRegulatoryCommissionMember2020-12-310001466593us-gaap:CumulativePreferredStockMember2020-12-310001466593ottr:CumulativePreferenceSharesMember2020-12-310001466593us-gaap:CumulativePreferredStockMember2019-12-310001466593ottr:DistributionAgreementWithKeybancMember2019-11-080001466593ottr:DistributionAgreementWithKeybancMember2020-01-012020-12-310001466593ottr:DistributionAgreementWithKeybancMember2019-11-082020-12-310001466593ottr:SecondShelfRegistrationMember2018-05-032018-05-030001466593ottr:SecondShelfRegistrationMember2020-01-012020-12-310001466593ottr:SecondShelfRegistrationMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:MinnesotaPublicUtilitiesCommissionMembersrt:MinimumMember2020-07-152020-07-150001466593ottr:OtterTailPowerCompanyMembersrt:MaximumMemberottr:MinnesotaPublicUtilitiesCommissionMember2020-07-152020-07-150001466593ottr:OtterTailPowerCompanyMember2020-01-012020-12-310001466593ottr:OtterTailPowerCompanyMembersrt:MaximumMember2020-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2020-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2020-01-012020-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2018-01-012019-06-300001466593ottr:The1999EmployeeStockPurchasePlanMember2019-07-012020-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2019-01-012019-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2018-01-012018-12-310001466593ottr:The2014StockIncentivePlanMember2020-12-310001466593ottr:The2014StockIncentivePlanMember2020-01-012020-12-310001466593ottr:The2014StockIncentivePlanMember2019-01-012019-12-310001466593ottr:The2014StockIncentivePlanMember2018-01-012018-12-310001466593srt:MinimumMemberus-gaap:RestrictedStockMember2020-01-012020-12-310001466593srt:MaximumMemberus-gaap:RestrictedStockMember2020-01-012020-12-310001466593us-gaap:RestrictedStockMember2020-01-012020-12-310001466593us-gaap:RestrictedStockMember2019-12-310001466593us-gaap:RestrictedStockMember2020-12-310001466593us-gaap:RestrictedStockMember2019-01-012019-12-310001466593us-gaap:RestrictedStockMember2018-01-012018-12-310001466593us-gaap:PerformanceSharesMember2020-01-012020-12-310001466593srt:MinimumMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310001466593srt:MaximumMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310001466593us-gaap:PerformanceSharesMember2019-01-012019-12-310001466593us-gaap:PerformanceSharesMember2018-01-012018-12-310001466593us-gaap:PerformanceSharesMember2019-12-310001466593us-gaap:PerformanceSharesMember2020-12-310001466593us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001466593us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001466593us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001466593us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001466593us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001466593us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001466593ottr:GovernmentBackedAndGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001466593ottr:GovernmentBackedAndGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001466593ottr:GovernmentBackedAndGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001466593us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001466593us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001466593us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001466593ottr:GovernmentBackedAndGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001466593ottr:GovernmentBackedAndGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001466593ottr:GovernmentBackedAndGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001466593us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001466593us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001466593us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001466593us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001466593srt:ParentCompanyMember2020-01-012020-12-310001466593srt:ParentCompanyMember2019-01-012019-12-310001466593srt:ParentCompanyMember2018-01-012018-12-310001466593srt:ParentCompanyMember2018-12-310001466593srt:ParentCompanyMember2017-12-310001466593ottr:OtterTailPowerCompanyMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:NorthernPipeProductsIncMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:VinyltechCorporationMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:BTDManufacturingIncMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:TOPlasticsIncMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:VaristarCorporationMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:OtterTailAssuranceLimitedMemberottr:OtterTailCorporationMember2020-12-310001466593ottr:OtterTailCorporationMember2020-12-310001466593ottr:OtterTailPowerCompanyMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:NorthernPipeProductsIncMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:VinyltechCorporationMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:BTDManufacturingIncMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:TOPlasticsIncMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:VaristarCorporationMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:OtterTailAssuranceLimitedMemberottr:OtterTailCorporationMember2019-12-310001466593ottr:OtterTailCorporationMember2019-12-310001466593us-gaap:AllowanceForCreditLossMember2019-12-310001466593us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001466593us-gaap:AllowanceForCreditLossMember2020-12-310001466593us-gaap:AllowanceForCreditLossMember2018-12-310001466593us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310001466593us-gaap:AllowanceForCreditLossMember2017-12-310001466593us-gaap:AllowanceForCreditLossMember2018-01-012018-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-01-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2020 or

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number 0-53713

OTTER TAIL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | |

Minnesota (State or other jurisdiction of incorporation or organization) | 27-0383995 (I.R.S. Employer Identification No.) |

| |

215 South Cascade Street, Box 496, Fergus Falls, Minnesota (Address of principal executive offices) | 56538-0496 (Zip Code) |

Registrant's telephone number, including area code: 866-410-8780

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $5.00 per share | OTTR | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | |

| | Large Accelerated Filer ☑ | | Accelerated Filer ☐ | | |

| | Non-Accelerated Filer ☐ | | Smaller Reporting Company ☐ | | Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued

its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of common stock held by non-affiliates, computed by reference to the last sales price on June 30, 2020 was $1,546,518,975.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date:

41,510,455 Common Shares ($5 par value) as of February 16, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant's definitive Proxy Statement for its 2021 Annual Meeting of Shareholders is incorporated by reference into Part III of this Form 10-K.

| | | | | | | | |

| | Description | Page |

| | |

| | | |

| | |

| | |

| | |

| ITEM 1. | | |

| ITEM 1A. | | |

| ITEM 1B. | | |

| ITEM 2. | | |

| ITEM 3. | | |

| ITEM 3A. | | |

| ITEM 4. | | |

| | |

| ITEM 5. | | |

| | |

| ITEM 7. | | |

| ITEM 7A. | | |

| ITEM 8. | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| ITEM 9. | | |

| ITEM 9A. | | |

| ITEM 9B. | | |

| | |

| ITEM 10. | | |

| ITEM 11. | | |

| ITEM 12. | | |

| ITEM 13. | | |

| ITEM 14. | | |

| | |

| ITEM 15. | | |

| ITEM 16. | | |

| | |

The following abbreviations or acronyms are used in the text. | | | | | | | | | | | | | | |

| ACE | Affordable Clean Energy | | MNDOC | Minnesota Department of Commerce |

| AFUDC | Allowance for Funds Used During Construction | | MPCA | Minnesota Pollution Control Agency |

| ARO | Asset Retirement Obligation | | MPUC | Minnesota Public Utilities Commission |

| BTD | BTD Manufacturing, Inc. | | MVP | Multi-Value Project |

| CCMC | Coyote Creek Mining Company, L.L.C. | | MW | megawatts |

CO2 | carbon dioxide | | NDDEQ | North Dakota Department of Environmental Quality |

| ECR | Environmental Cost Recovery | | NDPSC | North Dakota Public Service Commission |

| EEI | Edison Electric Institute | | NERC | North American Electric Reliability Corporation |

| EEP | Energy Efficiency Plan | | Northern Pipe | Northern Pipe Products, Inc. |

| EPA | Environmental Protection Agency | | OTP | Otter Tail Power Company |

| ESSRP | Executive Survivor and Supplemental Retirement Plan | | PACE | Partnership in Assisting Community Expansion |

| FERC | Federal Energy Regulatory Commission | | PTCs | Production tax credits |

| GCR | Generation Cost Recovery | | PVC | Polyvinyl chloride |

| GHG | Greenhouse Gas | | RHR | Regional Haze Rule |

| IRP | Integrated Resource Plan | | ROE | Return on equity |

| kV | kiloVolt | | SDPUC | South Dakota Public Utilities Commission |

| kW | kiloWatt | | SRECs | Solar renewable energy credits |

| kwh | kilowatt-hour | | T.O. Plastics | T.O. Plastics, Inc. |

| LSA | Lignite Sales Agreement | | TCR | Transmission Cost Recovery |

| Merricourt | Merricourt Wind Energy Center | | Varistar | Varistar Corporation |

| MISO | Midcontinent Independent System Operator, Inc. | | Vinyltech | Vinyltech Corporation |

| MNCIP | Minnesota Conservation Improvement Program | | | |

| | | | |

| | | | | | | | |

| WHERE TO FIND MORE INFORMATION | | |

We make available free of charge at our website (www.ottertail.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements, Forms 3, 4 and 5 filed on behalf of directors and executive officers and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (SEC). These reports are also available on the SEC's website (www.sec.gov). Information on our and the SEC's websites is not deemed to be incorporated by reference into this report on Form 10-K. | | |

| FORWARD-LOOKING INFORMATION |

This report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the Act). When used in this Form 10-K and in future filings by the Company with the SEC, in the Company’s press releases and in oral statements, words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “possible,” “potential,” “should,” “will,” “would” or similar expressions are intended to identify forward-looking statements within the meaning of the Act. Such statements are based on current expectations and assumptions and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements. Such risks and uncertainties include the various factors set forth in Item 1A. Risk Factors of this report on Form 10-K and in our other SEC filings.

PART I

Otter Tail Corporation has interests in diversified operations that include an electric utility and manufacturing and plastic pipe businesses with corporate offices located in Fergus Falls, Minnesota and Fargo, North Dakota.

We classify our five operating companies into three segments consistent with our business strategy and management. The following depicts our three segments and the subsidiary entities included within each segment:

| | | | | | | | | | | | | | |

| ELECTRIC SEGMENT | | MANUFACTURING SEGMENT | | PLASTICS SEGMENT |

| Otter Tail Power Company (OTP) | | BTD Manufacturing, Inc. (BTD) | | Northern Pipe Products, Inc. (Northern Pipe) |

| | T.O. Plastics, Inc. (T.O. Plastics) | | Vinyltech Corporation (Vinyltech) |

Electric includes the generation, purchase, transmission, distribution and sale of electric energy in western Minnesota, eastern North Dakota and northeastern South Dakota. OTP, our largest operating subsidiary and primary business since 1907, serves more than 133,000 customers in 422 communities across a predominantly rural and agricultural service territory.

Manufacturing consists of businesses in the following manufacturing activities: contract machining; metal parts stamping, fabrication and painting; and production of plastic thermoformed horticultural containers, life science and industrial packaging, material handling components, and extruded raw material stock. These businesses have manufacturing facilities in Georgia, Illinois and Minnesota and sell products primarily in the United States.

Plastics consists of businesses producing polyvinyl chloride (PVC) pipe at plants in North Dakota and Arizona. The PVC pipe is sold primarily in the western half of the United States and Canada.

Throughout the remainder of this report, we use the terms "Company", "us", "our", or "we" to refer to Otter Tail Corporation and its subsidiaries collectively. We will also refer to our Electric, Manufacturing and Plastics segments and our individual subsidiaries as indicated above.

INVESTMENT AND GROWTH STRATEGY

We maintain a moderate risk profile by investing in rate base growth opportunities in our Electric segment and organic growth opportunities in our Manufacturing and Plastics segments. This strategy and risk profile are designed to provide a more predictable earnings stream, maintain our credit quality and preserve our ability to fund our dividend. Our goal is to deliver annual growth in earnings per share between five and seven percent over the next several years, using 2020 diluted earnings per share as the base for measurement. We expect our earnings growth to come from rate base investments in our Electric segment and from planned earnings growth arising from existing capacities within our Manufacturing and Plastics segments.

We will continue to review our business portfolio to identify additional opportunities to improve our risk profile, enhance our credit metrics and generate additional sources of cash to support the growth opportunities in our electric utility. We will also evaluate opportunities to allocate capital to potential acquisitions within our Manufacturing and Plastics segments.

We maintain a set of criteria used in evaluating the strategic fit of our operating businesses. The operating company should:

•Maintain a minimum level of net earnings and a return on invested capital in excess of the Company’s weighted average cost of capital,

•Have a strategic differentiation from competitors and a sustainable cost advantage,

•Operate within a stable and growing industry and be able to quickly adapt to changing economic cycles, and

•Have a strong management team committed to operational and commercial excellence.

Over time, we expect our Electric segment will provide approximately 75% of our overall earnings and our Manufacturing and Plastics segments will collectively provide approximately 25% of our overall earnings and continue to be a fundamental part of our strategy.

Our actual mix of earnings in 2020, 2019, 2018and the average for the five-year period ended December 31, 2020 is as follows:

HUMAN CAPITAL

Our employees are a critical resource and an integral part of our success. We strive to provide an environment of opportunity and accountability where people are valued and empowered to do their best work. We are focused on the health and safety of our employees and creating a culture of inclusion, excellence and learning. Our human capital management efforts include monitoring various metrics and objectives associated with i) employee safety, ii) workforce stability, iii) management and workforce demographics, including gender, racial and ethnic diversity, iv) leadership development and succession planning, and v) productivity. We have established the following programs in furtherance of these efforts:

•Safety is one of our core values. We engage a third party to conduct conformity assessments annually. We continually monitor the Occupational Safety and Health Administration Total Recordable Incident Rate and Lost Time Incident Rate. New cases are reported and evaluated for corrective action during monthly safety calls attended by safety professionals at all locations.

•We extend leadership development into the organization to build enterprise-wide understanding of our culture, strategy and processes. Annual succession planning, individual development planning, mentoring, and supervisory and leadership development programs all play a role in ensuring a capable leadership team now and in the future. Our skill progression and technical training programs help ensure we have a skilled and stable workforce.

•To enhance productivity and employee engagement, and to help our companies continue to be places where our employees choose to work and thrive, we have undertaken a multi-year series of employee engagement surveys. We use the feedback to help shape the future of our organization.

•We communicate annually to all employees on our Code of Conduct to help ensure understanding of the common principles that guide who we are and how we do business.

Across our operating companies and including our corporate team as of December 31, 2020, we employed 2,074 full-time employees:

| | | | | |

| Segment/Organization | Employees |

| |

| Electric Segment | |

| OTP | 647 | |

| Manufacturing Segment | |

| BTD | 1,047 | |

| T.O. Plastics | 163 | |

| Segment Total | 1,210 | |

| Plastics Segment | |

| Northern Pipe | 100 | |

| Vinyltech | 79 | |

| Segment Total | 179 | |

| Corporate | 38 | |

| Total | 2,074 | |

At December 31, 2020, 372 employees of OTP are represented by local unions of the International Brotherhood of Electrical Workers under two separate collective bargaining agreements expiring on August 31, 2023 and October 31, 2023. OTP has not experienced any strike, work stoppage or strike vote, and considers its present relations with employees to be good.

| | | | | |

| ELECTRIC | Contribution to Operating Revenues: 50% (2020), 50% (2019), 49% (2018) |

OTP, headquartered in Fergus Falls, Minnesota, is a vertically integrated, regulated utility with generation, transmission and distribution facilities to serve its more than 133,000 residential, industrial and commercial customers in a service area encompassing approximately 70,000 square miles of western Minnesota, eastern North Dakota and northeastern South Dakota.

CUSTOMERS

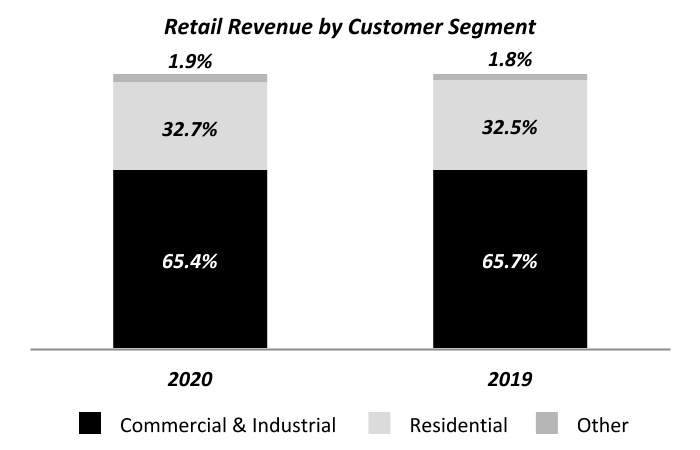

Our service territory is predominantly rural and agricultural and includes over 400 communities, most of which have populations of less than 10,000. While our customer base includes relatively few large customers, sales to commercial and industrial customers are significant, with one industrial customer accounting for 11% of segment operating revenues for the year ended December 31, 2020.

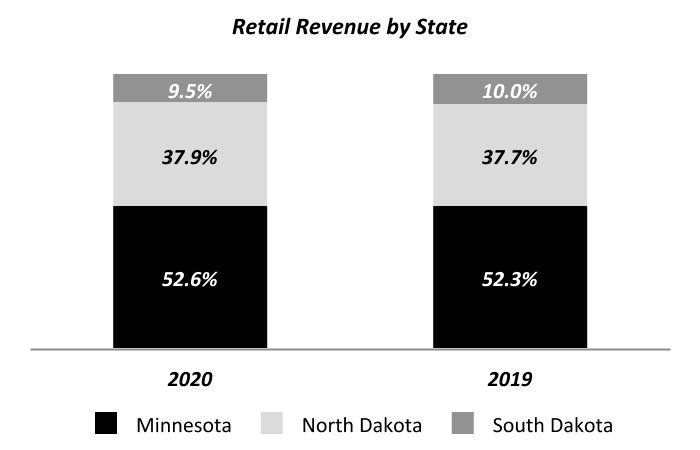

The following summarizes our retail electric revenues by state and by customer segment for the years ended December 31, 2020 and 2019:

In addition to retail revenue, our Electric segment also earns operating revenues from the transmission of electricity for others over the transmission assets we wholly or jointly own with other transmission service providers, and from the sale of electricity we generate and sell into the wholesale electricity market.

COMPETITIVE CONDITIONS

Retail electric sales are made to customers in assigned service territories. As a result, most retail customers do not have the ability to choose their electric supplier. Competition is present in some areas from municipally owned systems, rural electric cooperatives and, in certain respects, from on-site generators and co-generators. Electricity also competes with other forms of energy.

The degree of competition may vary from time to time depending on relative costs and supplies of other forms of energy and advances in technology; however, we believe OTP is well positioned to be successful in a competitive environment. A comparison of OTP's electric retail rates to the rates of other investor-owned utilities, cooperatives and municipals in the states OTP serves indicates OTP's rates are competitive.

Competition also arises from distributed generation, which is the generation of electricity on-site or close to where it is needed in small facilities designed to meet local needs. Distributed energy resources are utility- or customer-owned resources on the distribution grid that can include combined heat and power, solar photovoltaic, wind, battery storage, thermal storage, and demand-response technologies.

Wholesale electricity markets are competitive under the FERC's open access transmission tariffs, which require utilities to provide nondiscriminatory access to all wholesale users. In addition, the FERC has established a competitive process for the construction and operation of certain new electric transmission facilities whereby electric transmission providers, including the Midcontinent Independent System Operator, Inc. (MISO), of which OTP is a member, are required to remove from their tariffs a federal right of first refusal to construct transmission facilities selected in a regional transmission plan for purposes of cost allocation.

Franchises

OTP has franchises to operate as an electric utility in substantially all of the incorporated municipalities it serves. Franchise rights generally require periodic renewal. No franchises are required to serve unincorporated communities in any of the three states that OTP serves.

GENERATION AND PURCHASED POWER

OTP primarily relies on company-owned generation, supplemented by purchase power agreements, to supply the energy to meet our customer needs. Wholesale market purchases and sales of electricity are used as necessary to balance supply and demand as seasonal or other variations occur.

As of December 31, 2020, OTP’s wholly or jointly owned plants and facilities and their dependable kilowatt (kW) capacity was: | | | | | | | | |

| | Capacity in kW |

| | |

| Baseload Plants | | |

Big Stone Plant(1) | | 256,000 | |

Coyote Station(2) | | 149,000 | |

| Hoot Lake Plant | | 143,100 | |

| Total Baseload Net Plant | | 548,100 | |

| Combustion Turbine and Small Diesel Units | | 107,900 | |

| Hydroelectric Facilities | | 2,500 | |

| Owned Wind Facilities (rated at nameplate) | | |

| Merricourt Wind Energy Center (75 turbines) | | 150,000 | |

| Luverne Wind Farm (33 turbines) | | 49,500 | |

| Ashtabula Wind Center (32 turbines) | | 48,000 | |

| Langdon Wind Center (27 turbines) | | 40,500 | |

| Total Owned Wind Facilities | | 288,000 | |

| Total | | 946,500 | |

(1) Reflects OTP's 53.9% ownership percentage of jointly-owned facility | | |

(2) Reflects OTP's 35.0% ownership percentage of jointly-owned facility | | |

In addition to the owned facilities described above, OTP had the following purchased power agreements in place on December 31, 2020:

| | | | | |

| Purchased Power

in kW |

| |

| Purchased Wind Power (rated at nameplate and greater than 2,000 kW) | |

| Ashtabula Wind III | 62,400 | |

| Edgeley | 21,000 | |

| Langdon | 19,500 | |

| Total Purchased Wind | 102,900 | |

| Purchase of Capacity (in excess of 1 year and 500 kW) | |

Great River Energy (through May 2021) | 50,000 | |

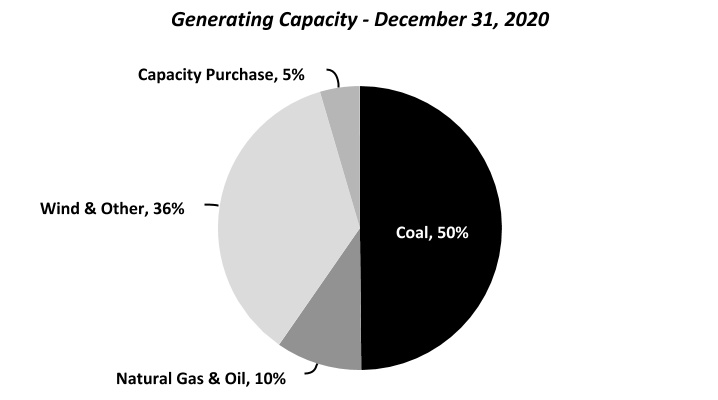

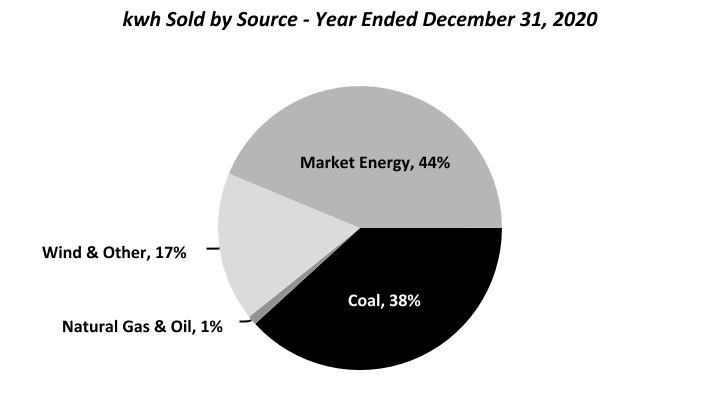

The following summarizes the percentage of our generating capacity by source, including owned and jointly-owned facilities and through power and capacity purchase arrangements, as of December 31, 2020, and the percentage of retail kilowatt-hours (kwh) sold by source during the year ended December 31, 2020:

Under MISO requirements, OTP is required to have sufficient capacity through wholly or jointly-owned generating capacity or purchased power agreements to meet its monthly weather-normalized forecast demand, plus a reserve obligation. OTP met its obligation for the 2019-2020 planning year and anticipates meeting this obligation prospectively.

Capacity Retirements and Additions

Hoot Lake Plant, our 142-meagwatt coal-fired power plant in Fergus Falls, Minnesota is approved for retirement in mid-2021.

As part of our investment plan to meet our future energy needs, we have the following projects at various stages of planning and construction or have been recently completed:

Merricourt Wind Energy Center (Merricourt) is a 150-megawatt wind farm located in southeastern North Dakota. Construction of the wind farm commenced in 2019 and the facility was in commercial operation in December 2020 at a cost of approximately $260.0 million.

Astoria Station Natural Gas Plant (Astoria) is a 245-megawatt simple cycle natural gas combustion turbine generation facility near Astoria, South Dakota. Construction began in 2019 and we anticipate the facility will be substantially complete in the first quarter of 2021. We anticipate total project costs will be $152.5 million.

Hoot Lake Plant Solar (HLP Solar) is a 49-megawatt solar farm under development on land on and around our Hoot Lake Plant in Fergus Falls, Minnesota. The project will include up to 150,000 solar panels at an anticipated cost of $60.0 million. We anticipate, subject to permitting and regulatory approval, the facility will be in commercial operation no later than the end of 2023.

RESOURCE MATERIALS

Coal is the principal fuel burned at our Big Stone, Coyote and Hoot Lake generating plants. Coyote Station, a mine-mouth facility, burns North Dakota lignite coal. Hoot Lake Plant and Big Stone Plant burn western subbituminous coal transported by rail. We source coal for our coal-fired power plants through requirements contracts which do not include minimum purchase requirements but do require all coal necessary for the operation of the respective plant to be purchased from the counterparty. Our coal supply contracts for our Hoot Lake Plant, Big Stone Plant and Coyote Station have expiration dates in 2023, 2022 and 2040, respectively.

The supply agreement between the Coyote Station owners, including OTP, and the coal supplier includes provisions requiring the Coyote Station owners to purchase the membership interests of the coal supplier in the event of certain early termination events and at the expiration of the coal supply agreement in 2040. See Note 1 to our consolidated financial statements included in this report on Form 10-K for additional information.

Coal is transported to our non-mine-mouth facilities, Big Stone Plant and Hoot Lake Plant, by rail and is provided under a common carrier rate which includes a mileage-based fuel surcharge.

TRANSMISSION AND DISTRIBUTION

Our transmission and distribution assets deliver energy from energy generation sources to our customers. In addition, we earn revenue from the transmission of electricity over our wholly or jointly owned transmission assets for others under approved rate tariffs. As of December 31, 2020, we were the whole or partial owner of over 8,900 miles of transmission and distribution lines.

Midcontinent Independent System Operator, Inc. (MISO)

MISO is an independent, non-profit organization that operates the transmission facilities owned by other entities, including OTP, within its regional jurisdiction and administers energy and generation capacity markets. MISO has operational control of our transmission facilities above 100 kV. MISO seeks to optimize the efficiency of the interconnected system, provide solutions to regional planning needs and minimize risk to reliability through its security coordination, long-term regional planning, market monitoring, scheduling and tariff administration functions.

SEASONALITY

Electricity demand is affected by seasonal weather differences, with peak demand occurring in the summer and winter months. As a result, our Electric segment operating results may fluctuate on a seasonal basis. In addition, fluctuations in electricity demand within the same season but between years can impact our operating results. We monitor the level of heating and cooling degree days in a period to assess the impact of weather-related effects on our operating results between periods.

PUBLIC UTILITY REGULATION

OTP is subject to regulation of rates and other matters in each of the three states in which it operates and by the federal government for certain interstate operations. OTP operates under approved retail electric tariff rates in all three states it serves. Tariff rates are designed to recover plant investments, a return on those investments, and operating costs. In addition to determining rate tariffs, state regulatory commissions also authorize ROE, capital structure and depreciation rates of our plant investments. Decisions by our regulators can significantly impact our operating results, financial position and cash flows.

Below is a summary of the regulatory agencies with jurisdiction of electric rates over OTP along with the percentage of electric revenue for the year ended December 31, 2020 covered by each regulatory agency:

| | | | | | | | | | | | | | |

| Regulatory | | % of | | |

| Agency | | Revenue | | Areas of Regulation |

| | | | |

Minnesota Public Utilities Commission

(MPUC)

| | 47% | | Retail rates, issuance of securities, depreciation rates, capital structure, public utility services, construction of major facilities, establishment of exclusive assigned service areas, contracts with subsidiaries and other affiliated interests and other matters. Selection or designation of sites for new generating plants (50,000 kW or more) and routes for transmission lines (100 kV or more). Review and approval of fifteen-year Integrated Resource Plan. |

North Dakota Public Service Commission

(NDPSC) | | 34% | | Retail rates, certain issuances of securities, construction of major utility facilities and other matters. Approval of site and routes for new electric generating facilities (500 kW or more for wind generating facilities; 50,000 kW for non-wind generating facilities) and high voltage transmission lines (115 kV or more). Review and approval of ten-year facility plan. |

South Dakota Public Utilities Commission

(SDPUC) | | 9% | | Retail rates, public utility services, construction of major facilities, establishment of assigned service areas and other matters. Approval of sites and routes for new electric generating facilities (100,000 kW or more) and most transmission lines (115 kV or more). |

Federal Energy Regulatory Commission

(FERC) | | 10% | | Wholesale electricity sales, transmission and sale of electric energy in interstate commerce, interconnection of facilities, hyrdoelectric licensing and accounting policies and practices. Compliance with NERC reliability standards, including standards on cybersecurity and protection of critical infrastructure. |

In addition to base rates, there are other mechanisms for recovery of plant investments, including a return on investment, and operating expenses. The following is a summary of these recovery mechanisms:

| | | | | | | | | | | | | | |

| Recovery Mechanism | | Jurisdiction(s) | | Additional Information |

| | | | |

| Fuel Clause Adjustment (FCA) | | MN, ND, SD | | Provides for periodic billing adjustments for changes in prudently incurred costs of fuel and purchased power. In North and South Dakota, fuel and purchased power costs are generally adjusted on a monthly basis with over or under collections from the previous month applied to the next monthly billing. In Minnesota, fuel and purchased power costs are estimated on an annual basis and the accumulated difference between actual and estimated cost per kwh are refunded or recovered, subject to regulatory approval, in subsequent periods. |

| Transmission Cost Recovery Rider (TCR) | | MN, ND, SD | | Provides for recovery of costs outside of a general rate case for investments in new or modified electric transmission or distribution assets. |

| Environmental Cost Recovery Rider (ECR) | | MN, ND, SD | | Provides for recovery of costs outside of a general rate case for investments in certain environmental improvement projects. |

| Renewable Resource Rider (RRR) | | MN, ND | | Provides for recovery of costs outside of a general rate case for investments in certain new renewable energy projects. |

| Generation Cost Recovery Rider (GCR) | | ND | | Provides for the recovery of costs outside of a general rate case for investments in new generation facilities. |

| Phase-In Rider (PIR) | | SD | | Provides for the recovery of costs outside of a general rate case for investments in new generation facilities. |

| Conservation Improvement Program (CIP) | | MN | | Under Minnesota law, OTP is required to invest at least 1.5% of its gross operating revenues on energy conservation improvements. Recovery of these costs outside of a general rate case occurs through the CIP. |

| Energy Efficiency Plan (EEP) | | SD | | Provides for the recovery of costs from energy efficiency investments. |

Renewable Energy Standard