UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[ X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended |

March 31, 2019 |

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from |

to |

|

Commission file number |

0-53713 |

|

OTTER TAIL CORPORATION |

|

(Exact name of registrant as specified in its charter) |

|

Minnesota |

27-0383995 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

|

215 South Cascade Street, Box 496, Fergus Falls, Minnesota |

56538-0496 |

|

(Address of principal executive offices) |

(Zip Code) |

|

866-410-8780 |

|

(Registrant's telephone number, including area code) |

|

(Former name, former address and former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Shares, par value $5.00 per share |

OTTR |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ☑ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer's classes of Common Stock, as of the latest practicable date:

April 30, 2019 – 39,754,652 Common Shares ($5 par value)

INDEX

|

Page No. |

||

|

Item 1. |

||

|

Consolidated Balance Sheets – March 31, 2019 and December 31, 2018 (not audited) |

2 & 3 |

|

|

Consolidated Statements of Income – Three Months Ended March 31, 2019 and 2018 (not audited) |

4 |

|

|

5 |

||

|

6 |

||

|

Consolidated Statements of Cash Flows – Three Months Ended March 31, 2019 and 2018 (not audited) |

7 |

|

|

Condensed Notes to Consolidated Financial Statements (not audited) |

8-34 |

|

|

Item 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

35-47 |

|

Item 3. |

47-48 |

|

|

Item 4. |

48 |

|

|

Item 1. |

48 |

|

|

Item 1A. |

48 |

|

|

Item 2. |

48 |

|

|

Item 6. |

49 |

|

|

49 |

||

|

Consolidated Balance Sheets |

||||||||

|

(not audited) |

||||||||

|

(in thousands) |

March 31, 2019 |

December 31, 2018 |

||||||

|

Assets |

||||||||

|

Current Assets |

||||||||

|

Cash and Cash Equivalents |

$ | 891 | $ | 861 | ||||

|

Accounts Receivable: |

||||||||

|

Trade—Net |

113,144 | 75,144 | ||||||

|

Other |

8,827 | 9,741 | ||||||

|

Inventories |

106,732 | 106,270 | ||||||

|

Unbilled Receivables |

18,928 | 23,626 | ||||||

|

Income Taxes Receivable |

-- | 2,439 | ||||||

|

Regulatory Assets |

15,193 | 17,225 | ||||||

|

Other |

9,986 | 6,114 | ||||||

|

Total Current Assets |

273,701 | 241,420 | ||||||

|

Investments |

9,220 | 8,961 | ||||||

|

Other Assets |

38,653 | 35,759 | ||||||

|

Goodwill |

37,572 | 37,572 | ||||||

|

Other Intangibles—Net |

12,154 | 12,450 | ||||||

|

Regulatory Assets |

133,427 | 135,257 | ||||||

|

Right of Use Assets - Operating Leases |

20,712 | -- | ||||||

|

Plant |

||||||||

|

Electric Plant in Service |

2,160,321 | 2,019,721 | ||||||

|

Nonelectric Operations |

231,135 | 228,120 | ||||||

|

Construction Work in Progress |

49,054 | 181,626 | ||||||

|

Total Gross Plant |

2,440,510 | 2,429,467 | ||||||

|

Less Accumulated Depreciation and Amortization |

861,401 | 848,369 | ||||||

|

Net Plant |

1,579,109 | 1,581,098 | ||||||

|

Total Assets |

$ | 2,104,548 | $ | 2,052,517 | ||||

|

See accompanying condensed notes to consolidated financial statements. |

|

Otter Tail Corporation |

||||||||

|

Consolidated Balance Sheets |

||||||||

|

(not audited) |

||||||||

|

(in thousands, except share data) |

March 31, 2019 |

December 31, 2018 |

||||

|

Liabilities and Equity |

||||||

|

Current Liabilities |

||||||

|

Short-Term Debt |

$ | 43,601 | $ | 18,599 | ||

|

Current Maturities of Long-Term Debt |

174 | 172 | ||||

|

Accounts Payable |

100,496 | 96,291 | ||||

|

Accrued Salaries and Wages |

15,139 | 24,857 | ||||

|

Accrued Federal and State Income Taxes |

2,459 | -- | ||||

|

Other Accrued Taxes |

18,590 | 17,287 | ||||

|

Regulatory Liabilities |

7,787 | 738 | ||||

|

Current Operating Lease Liabilities |

3,900 | -- | ||||

|

Other Accrued Liabilities |

8,575 | 12,149 | ||||

|

Total Current Liabilities |

200,721 | 170,093 | ||||

|

Pensions Benefit Liability |

88,223 | 98,358 | ||||

|

Other Postretirement Benefits Liability |

72,456 | 71,561 | ||||

|

Long-Term Operating Lease Liabilities |

17,160 | -- | ||||

|

Other Noncurrent Liabilities |

26,354 | 24,326 | ||||

|

Commitments and Contingencies (note 9) |

||||||

|

Deferred Credits |

||||||

|

Deferred Income Taxes |

121,863 | 120,976 | ||||

|

Deferred Tax Credits |

19,637 | 19,974 | ||||

|

Regulatory Liabilities |

225,496 | 226,469 | ||||

|

Other |

2,117 | 1,895 | ||||

|

Total Deferred Credits |

369,113 | 369,314 | ||||

|

Capitalization |

||||||

|

Long-Term Debt—Net |

590,022 | 590,002 | ||||

|

Cumulative Preferred Shares – Authorized 1,500,000 Shares Without Par Value; Outstanding – None |

-- | -- | ||||

|

Cumulative Preference Shares – Authorized 1,000,000 Shares Without Par Value; Outstanding – None |

-- | -- | ||||

|

Common Shares, Par Value $5 Per Share—Authorized, 50,000,000 Shares; Outstanding, 2019—39,729,708 Shares; 2018—39,664,884 Shares |

198,649 | 198,324 | ||||

|

Premium on Common Shares |

342,991 | 344,250 | ||||

|

Retained Earnings |

203,619 | 190,433 | ||||

|

Accumulated Other Comprehensive Loss |

(4,760 | ) | (4,144 | ) | ||

|

Total Common Equity |

740,499 | 728,863 | ||||

|

Total Capitalization |

1,330,521 | 1,318,865 | ||||

|

Total Liabilities and Equity |

$ | 2,104,548 | $ | 2,052,517 | ||

|

See accompanying condensed notes to consolidated financial statements. |

|

Consolidated Statements of Income |

||

|

(not audited) |

|

Three Months Ended March 31, |

||||||||

|

(in thousands, except share and per-share amounts) |

2019 |

2018 |

||||||

|

Operating Revenues |

||||||||

|

Electric: |

||||||||

|

Revenues from Contracts with Customers |

$ | 129,144 | $ | 123,825 | ||||

|

Changes in Accrued Revenues under Alternative Revenue Programs |

(1,049 | ) | (875 | ) | ||||

|

Total Electric Revenues |

128,095 | 122,950 | ||||||

|

Product Sales under Contracts with Customers |

117,877 | 118,316 | ||||||

|

Total Operating Revenues |

245,972 | 241,266 | ||||||

|

Operating Expenses |

||||||||

|

Production Fuel – Electric |

18,920 | 18,706 | ||||||

|

Purchased Power – Electric System Use |

21,952 | 21,593 | ||||||

|

Electric Operation and Maintenance Expenses |

38,382 | 39,475 | ||||||

|

Cost of Products Sold (depreciation included below) |

90,582 | 88,785 | ||||||

|

Other Nonelectric Expenses |

13,477 | 12,494 | ||||||

|

Depreciation and Amortization |

19,131 | 18,763 | ||||||

|

Property Taxes – Electric |

3,959 | 3,835 | ||||||

|

Total Operating Expenses |

206,403 | 203,651 | ||||||

|

Operating Income |

39,569 | 37,615 | ||||||

|

Interest Charges |

7,826 | 7,372 | ||||||

|

Nonservice Cost Components of Postretirement Benefits |

1,035 | 1,417 | ||||||

|

Other Income |

1,244 | 1,183 | ||||||

|

Income Before Income Taxes |

31,952 | 30,009 | ||||||

|

Income Tax Expense |

5,628 | 3,794 | ||||||

|

Net Income |

$ | 26,324 | $ | 26,215 | ||||

|

Average Number of Common Shares Outstanding—Basic |

39,657,321 | 39,550,874 | ||||||

|

Average Number of Common Shares Outstanding—Diluted |

39,903,165 | 39,863,682 | ||||||

|

Basic Earnings Per Common Share |

$ | 0.66 | $ | 0.66 | ||||

|

Diluted Earnings Per Common Share |

$ | 0.66 | $ | 0.66 | ||||

|

See accompanying condensed notes to consolidated financial statements. |

|

Consolidated Statements of Comprehensive Income |

||

|

(not audited) |

|

Three Months Ended March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Net Income |

$ | 26,324 | $ | 26,215 | ||||

|

Other Comprehensive Income (Loss): |

||||||||

|

Unrealized Gains (Losses) on Available-for-Sale Securities: |

||||||||

|

Reversal of Previously Recognized Gains on Available for Sale Securities Included in Other Income During Period |

-- | (110 | ) | |||||

|

Unrealized Gains (Losses) Arising During Period |

91 | (66 | ) | |||||

|

Income Tax (Expense) Benefit |

(19 | ) | 37 | |||||

|

Change in Unrealized Losses/Gains on Available-for-Sale Securities – net-of-tax |

72 | (139 | ) | |||||

|

Pension and Postretirement Benefit Plans: |

||||||||

|

Amortization of Unrecognized Postretirement Benefit Losses and Costs (note 11) |

130 | 227 | ||||||

|

Income Tax Expense |

(34 | ) | (59 | ) | ||||

|

Adjustment to Income Tax Expense Related to 2017 Tax Cuts and Jobs Act |

-- | (531 | ) | |||||

|

Pension and Postretirement Benefit Plans – net-of-tax |

96 | (363 | ) | |||||

|

Total Other Comprehensive Income (Loss) |

168 | (502 | ) | |||||

|

Total Comprehensive Income |

$ | 26,492 | $ | 25,713 | ||||

|

See accompanying condensed notes to consolidated financial statements. |

| Otter Tail Corporation |

|

Consolidated Statements of Common Shareholders’ Equity |

|

For the Three-Month Periods Ended March 31, 2019 and 2018 |

|

(not audited) |

|

(in thousands, except common shares outstanding) |

Common Shares Outstanding |

Par Value, Common Shares |

Premium on Common Shares |

Retained Earnings |

Accumulated Other Comprehensive Income/(Loss) |

Total Common Equity |

||||||||||||||||||

|

Balance, December 31, 2018 |

39,664,884 | $ | 198,324 | $ | 344,250 | $ | 190,433 | $ | (4,144 | ) | $ | 728,863 | ||||||||||||

|

Common Stock Issuances, Net of Expenses |

120,048 | 601 | (601 | ) | -- | |||||||||||||||||||

|

Common Stock Retirements |

(55,224 | ) | (276 | ) | (2,454 | ) | (2,730 | ) | ||||||||||||||||

|

Net Income |

26,324 | 26,324 | ||||||||||||||||||||||

|

Other Comprehensive Income |

168 | 168 | ||||||||||||||||||||||

|

ASU 2018-02 2017 TCJA Stranded Tax Transfer |

784 | (784 | ) | -- | ||||||||||||||||||||

|

Employee Stock Incentive Plan Expense |

1,796 | 1,796 | ||||||||||||||||||||||

|

Common Dividends ($0.35 per share) |

(13,922 | ) | (13,922 | ) | ||||||||||||||||||||

|

Balance, March 31, 2019 |

39,729,708 | $ | 198,649 | 342,991 | $ | 203,619 | $ | (4,760 | ) | $ | 740,499 | |||||||||||||

|

Balance, December 31, 2017 |

39,557,491 | $ | 197,787 | $ | 343,450 | $ | 161,286 | $ | (5,631 | ) | $ | 696,892 | ||||||||||||

|

Common Stock Issuances, Net of Expenses |

127,598 | 638 | (638 | ) | -- | |||||||||||||||||||

|

Common Stock Retirements |

(58,495 | ) | (292 | ) | (2,117 | ) | (2,409 | ) | ||||||||||||||||

|

Net Income |

26,215 | 26,215 | ||||||||||||||||||||||

|

Other Comprehensive Loss |

(502 | ) | (502 | ) | ||||||||||||||||||||

|

Employee Stock Incentive Plan Expense |

1,146 | 1,146 | ||||||||||||||||||||||

|

Common Dividends ($0.335 per share) |

(13,292 | ) | (13,292 | ) | ||||||||||||||||||||

|

Balance, March 31, 2018 |

39,626,594 | $ | 198,133 | 341,841 | $ | 174,209 | $ | (6,133 | ) | $ | 708,050 | |||||||||||||

|

Consolidated Statements of Cash Flows |

||

|

(not audited) |

|

Three Months Ended March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Cash Flows from Operating Activities |

||||||||

|

Net Income |

$ | 26,324 | $ | 26,215 | ||||

|

Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: |

||||||||

|

Depreciation and Amortization |

19,131 | 18,763 | ||||||

|

Deferred Tax Credits |

(337 | ) | (354 | ) | ||||

|

Deferred Income Taxes |

835 | 2,901 | ||||||

|

Change in Deferred Debits and Other Assets |

1,464 | 6,295 | ||||||

|

Discretionary Contribution to Pension Plan |

(10,000 | ) | (20,000 | ) | ||||

|

Change in Noncurrent Liabilities and Deferred Credits |

8,787 | (5,091 | ) | |||||

|

Allowance for Equity/Other Funds Used During Construction |

(330 | ) | (638 | ) | ||||

|

Stock Compensation Expense—Equity Awards |

1,796 | 1,146 | ||||||

|

Other—Net |

375 | (284 | ) | |||||

|

Cash (Used for) Provided by Current Assets and Current Liabilities: |

||||||||

|

Change in Receivables |

(37,086 | ) | (25,047 | ) | ||||

|

Change in Inventories |

(462 | ) | 35 | |||||

|

Change in Other Current Assets |

128 | 2,334 | ||||||

|

Change in Payables and Other Current Liabilities |

4,088 | (2,798 | ) | |||||

|

Change in Interest and Income Taxes Receivable/Payable |

2,437 | 1,163 | ||||||

|

Net Cash Provided by Operating Activities |

17,150 | 4,640 | ||||||

|

Cash Flows from Investing Activities |

||||||||

|

Capital Expenditures |

(24,687 | ) | (23,618 | ) | ||||

|

Net Proceeds from Disposal of Noncurrent Assets |

509 | 510 | ||||||

|

Cash Used for Investments and Other Assets |

(1,258 | ) | (719 | ) | ||||

|

Net Cash Used in Investing Activities |

(25,436 | ) | (23,827 | ) | ||||

|

Cash Flows from Financing Activities |

||||||||

|

Change in Checks Written in Excess of Cash |

8 | 2,338 | ||||||

|

Net Short-Term Borrowings (Repayments) |

25,002 | (82,052 | ) | |||||

|

Payments for Retirement of Capital Stock |

(2,730 | ) | (2,409 | ) | ||||

|

Proceeds from Issuance of Long-Term Debt |

-- | 100,000 | ||||||

|

Short-Term and Long-Term Debt Issuance Expenses |

-- | (433 | ) | |||||

|

Payments for Retirement of Long-Term Debt |

(42 | ) | (60 | ) | ||||

|

Dividends Paid |

(13,922 | ) | (13,292 | ) | ||||

|

Net Cash Provided by Financing Activities |

8,316 | 4,092 | ||||||

|

Net Change in Cash and Cash Equivalents |

30 | (15,095 | ) | |||||

|

Cash and Cash Equivalents at Beginning of Period |

861 | 16,216 | ||||||

|

Cash and Cash Equivalents at End of Period |

$ | 891 | $ | 1,121 | ||||

|

See accompanying condensed notes to consolidated financial statements. |

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(not audited)

In the opinion of management, Otter Tail Corporation (the Company) has included all adjustments (including normal recurring accruals) necessary for a fair presentation of the consolidated financial statements for the periods presented. The consolidated financial statements and condensed notes thereto should be read in conjunction with the consolidated financial statements and notes included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2018. Because of seasonal and other factors, the earnings for the three months ended March 31, 2019 should not be taken as an indication of earnings for all or any part of the balance of the year.

The following condensed notes are numbered to correspond to numbers of the notes included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

1. Summary of Significant Accounting Policies

Revenue Recognition

Due to the diverse business operations of the Company, recognition of revenue from contracts with customers depends on the product produced and sold or service performed. The Company recognizes revenue from contracts with customers, at prices that are fixed or determinable as evidenced by an agreement with the customer, when the Company has met its performance obligation under the contract and it is probable that the Company will collect the amount to which it is entitled in exchange for the goods or services transferred or to be transferred to the customer. Depending on the product produced and sold or service performed and the terms of the agreement with the customer, the Company recognizes revenue either over time, in the case of delivery or transmission of electricity or related services or the production and storage of certain custom-made products, or at a point in time for the delivery of standardized products and other products made to the customers specifications where the terms of the contract require transfer of the completed product. Provisions for sales returns, early payment terms discounts, volume-based variable pricing incentives and warranty costs are recorded as reductions to revenue at the time revenue is recognized based on customer history, historical information and current trends.

In addition to recognizing revenue from contracts with customers under Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (ASC 606), the Company also records adjustments to Electric segment revenues for amounts subject to future collection under alternative revenue programs (ARPs) as defined in ASC Topic 980, Regulated Operations (ASC 980). The ARP revenue adjustments are recorded on the basis of recoverable costs incurred and returns earned under rate riders on a separate line on the face of the Company’s consolidated statements of income as they do not meet the criteria to be classified as revenue from contracts with customers.

Electric Segment Revenues—In the Electric segment, the Company recognizes revenue in two categories: (1) revenues from contracts with customers and (2) adjustments to revenues for amounts collectible under ARPs.

Most Electric segment revenues are earned from the generation, transmission and sale of electricity to retail customers at rates approved by regulatory commissions in the states where Otter Tail Power Company (OTP) provides service. OTP also earns revenue from the transmission of electricity for others over the transmission assets it owns separately, or jointly with other transmission service providers, under rate tariffs established by the independent transmission system operator and approved by the Federal Energy Regulatory Commission (FERC). These revenues account for over 80% of other electric revenues reported in the table of disaggregated revenues in note 2. A third source of revenue for OTP comes from the generation and sale of electricity to wholesale customers at contract or market rates. Revenues from all these sources meet the criteria to be classified as revenue from contracts with customers and are recognized over time as energy is delivered or transmitted. Revenue is recognized based on the metered quantity of electricity delivered or transmitted at the applicable rates. For electricity delivered and consumed after a meter is read but prior to the end of the reporting period, OTP records revenue and an unbilled receivable based on estimates of the kilowatt-hours (kwh) of energy delivered to the customer.

ARPs provide for adjustments to rates outside of a general rate case proceeding, usually as a surcharge applied to future billings typically through the use of rate riders subject to periodic adjustments, to encourage or incentivize investments in certain areas such as conservation, renewable energy, pollution reduction or control, improved infrastructure of the transmission grid or other programs that provide benefits to the general public under public policy, laws or regulations. ARP riders generally provide for the recovery of specified costs and investments and include an incentive component to provide the regulated utility with a return on amounts invested.

OTP has recovered costs and earned incentives or returns on investments subject to recovery under several ARP rate riders, including:

|

● |

In Minnesota: Transmission Cost Recovery (TCR), Environmental Cost Recovery (ECR), Renewable Resource Adjustment (RRA) and Conservation Improvement Program riders. |

|

● |

In North Dakota: TCR, ECR, RRA and Generation Cost Recovery (GCR) riders. |

|

● |

In South Dakota: TCR, ECR and Energy Efficiency Plan (conservation) riders. |

OTP accrues ARP revenue on the basis of costs incurred, investments made and returns on those investments that qualify for recovery through established riders. Amounts billed under riders in effect at the time of the billing are included in revenues from contracts with customers net of amounts billed that are subject to refund through future rider adjustments. Amounts accrued and subject to recovery through future rider rate updates and adjustments are reported as ARP revenue adjustments on a separate line in the revenue section of the Company’s consolidated statement of income. See table in note 3 for total revenues billed and accrued under ARP riders for the three-month periods ended March 31, 2019, and 2018.

Manufacturing Segment Revenues—Companies in the Manufacturing segment, BTD Manufacturing, Inc. (BTD) and T.O. Plastics, Inc. (T.O. Plastics), earn revenue predominantly from the production and delivery of custom-made or standardized parts to customers across several industries. BTD also earns revenue from the production and sale of tools and dies to other manufacturers. For the production and delivery of standardized products and other products made to customer specifications where the terms of the contract require transfer of the completed product, the operating company has met its performance obligation and recognizes revenue at the point in time when the product is shipped. For revenue recognized on products when shipped, the operating companies have no further obligation to provide services related to such products. The shipping terms used in these instances are FOB shipping point.

Plastics Segment Revenues—Companies in our Plastics segment earn revenue predominantly from the sale and delivery of standardized polyvinyl chloride (PVC) pipe products produced at their manufacturing facilities. Revenue from the sale of these products is recognized at the point in time when the product is shipped based on prices agreed to in a purchase order. For revenue recognized on shipped products, there is no further obligation to provide services related to such product. The shipping terms used in these instances are FOB shipping point. The Plastics segment has one customer for which it produces and stores a product made to the customer’s specifications and design under a build and hold agreement. For sales to this customer, the operating company recognizes revenue as the custom-made product is produced, adjusting the amount of revenue for volume rebate variable pricing considerations the operating company expects the customer will earn and applicable early payment discounts the company expects the customer will take. Ownership of the pipe transfers to the customer prior to delivery and the operating company is paid a negotiated fee for storage of the pipe. Revenue for storage of the pipe is also recognized over time as the pipe is stored.

See operating revenue table in note 2 for a disaggregation of the Company’s revenues by business segment for the three-month periods ended March 31, 2019 and 2018.

Agreements Subject to Legally Enforceable Netting Arrangements

OTP has certain derivative contracts that are designated as normal purchases. Individual counterparty exposures for these contracts can be offset according to legally enforceable netting arrangements. The Company does not offset assets and liabilities under legally enforceable netting arrangements on the face of its consolidated balance sheet.

Fair Value Measurements

The Company follows ASC Topic 820, Fair Value Measurements and Disclosures (ASC 820), for recurring fair value measurements. ASC 820 provides a single definition of fair value, requires enhanced disclosures about assets and liabilities measured at fair value and establishes a hierarchical framework for disclosing the observability of the inputs utilized in measuring assets and liabilities at fair value. The three levels defined by the hierarchy and examples of each level are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities as of the reported date. The types of assets and liabilities included in Level 1 are highly liquid and actively traded instruments with quoted prices, such as equities listed by the New York Stock Exchange and commodity derivative contracts listed on the New York Mercantile Exchange.

Level 2 – Pricing inputs are other than quoted prices in active markets but are either directly or indirectly observable as of the reported date. The types of assets and liabilities included in Level 2 are typically either comparable to actively traded securities or contracts, such as treasury securities with pricing interpolated from recent trades of similar securities, or priced with models using highly observable inputs, such as commodity options priced using observable forward prices and volatilities.

Level 3 – Significant inputs to pricing have little or no observability as of the reporting date. The types of assets and liabilities included in Level 3 are those with inputs requiring significant management judgment or estimation and may include complex and subjective models and forecasts.

The following tables present, for each of the hierarchy levels, the Company’s assets and liabilities that are measured at fair value on a recurring basis as of March 31, 2019 and December 31, 2018:

|

March 31, 2019 (in thousands) |

Level 1 |

Level 2 |

Level 3 |

|||||||||

|

Assets: |

||||||||||||

|

Investments: |

||||||||||||

|

Equity Funds – Held by Captive Insurance Company |

$ | 1,444 | ||||||||||

|

Corporate Debt Securities – Held by Captive Insurance Company |

$ | 5,975 | ||||||||||

|

Government-Backed and Government-Sponsored Enterprises’ Debt Securities – Held by Captive Insurance Company |

1,644 | |||||||||||

|

Other Assets: |

||||||||||||

|

Money Market and Mutual Funds – Nonqualified Retirement Savings Plan |

1,396 | |||||||||||

|

Total Assets |

$ | 2,840 | $ | 7,619 | ||||||||

|

December 31, 2018 (in thousands) |

Level 1 |

Level 2 |

Level 3 |

|||||||||

|

Assets: |

||||||||||||

|

Investments: |

||||||||||||

|

Equity Funds – Held by Captive Insurance Company |

$ | 1,294 | ||||||||||

|

Corporate Debt Securities – Held by Captive Insurance Company |

$ | 5,898 | ||||||||||

|

Government-Backed and Government-Sponsored Enterprises’ Debt Securities – Held by Captive Insurance Company |

1,586 | |||||||||||

|

Other Assets: |

||||||||||||

|

Money Market and Mutual Funds – Nonqualified Retirement Savings Plan |

838 | |||||||||||

|

Total Assets |

$ | 2,132 | $ | 7,484 | ||||||||

The level 2 fair values for Government-Backed and Government-Sponsored Enterprises’ and Corporate Debt Securities Held by the Company’s Captive Insurance Company are determined on the basis of valuations provided by a third-party pricing service which utilizes industry accepted valuation models and observable market inputs to determine valuation. Some valuations or model inputs used by the pricing service may be based on broker quotes.

Coyote Station Lignite Supply Agreement – Variable Interest Entity

In October 2012 the Coyote Station owners, including OTP, entered into a lignite sales agreement (LSA) with Coyote Creek Mining Company, L.L.C. (CCMC), a subsidiary of The North American Coal Corporation, for the purchase of lignite coal to meet the coal supply requirements of Coyote Station for the period beginning in May 2016 and ending in December 2040. The price per ton paid by the Coyote Station owners under the LSA reflects the cost of production, along with an agreed profit and capital charge. CCMC was formed for the purpose of mining coal to meet the coal fuel supply requirements of Coyote Station from May 2016 through December 2040 and, based on the terms of the LSA, is considered a variable interest entity (VIE) due to the transfer of all operating and economic risk to the Coyote Station owners, as the agreement is structured so that the price of the coal would cover all costs of operations as well as future reclamation costs. The Coyote Station owners are also providing a guarantee of the value of the assets of CCMC as they would be required to buy certain assets at book value should they terminate the contract prior to the end of the contract term and are providing a guarantee of the value of the equity of CCMC in that they are required to buy the entity at the end of the contract term at equity value. Under current accounting standards, the primary beneficiary of a VIE is required to include the assets, liabilities, results of operations and cash flows of the VIE in its consolidated financial statements. No single owner of Coyote Station owns a majority interest in Coyote Station and none, individually, has the power to direct the activities that most significantly impact CCMC. Therefore, none of the owners individually, including OTP, is considered a primary beneficiary of the VIE and the Company is not required to include CCMC in its consolidated financial statements.

If the LSA terminates prior to the expiration of its term or the production period terminates prior to December 31, 2040 and the Coyote Station owners purchase all of the outstanding membership interests of CCMC as required by the LSA, the owners will satisfy, or (if permitted by CCMC’s applicable lender) assume, all of CCMC’s obligations owed to CCMC’s lenders under its loans and leases. The Coyote Station owners have limited rights to assign their rights and obligations under the LSA without the consent of CCMC’s lenders during any period in which CCMC’s obligations to its lenders remain outstanding. In the event the contract is terminated because regulations or legislation render the burning of coal cost prohibitive and the assets worthless, OTP’s maximum exposure to loss as a result of its involvement with CCMC as of March 31, 2019 could be as high as $53.1 million, OTP’s 35% share of unrecovered costs.

Inventories

Inventories, valued at the lower of cost or net realizable value, consist of the following:

|

March 31, |

December 31, |

|||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Finished Goods |

$ | 35,771 | $ | 37,130 | ||||

|

Work in Process |

20,503 | 20,393 | ||||||

|

Raw Material, Fuel and Supplies |

50,458 | 48,747 | ||||||

|

Total Inventories |

$ | 106,732 | $ | 106,270 | ||||

Goodwill and Other Intangible Assets

An assessment of the carrying amounts of goodwill of the Company’s operating units as of December 31, 2018 indicated the fair values are substantially in excess of their respective book values and not impaired.

The following table indicates there were no changes to goodwill by business segment during the first three months of 2019:

|

(in thousands) |

Gross Balance December 31, 2018 |

Accumulated Impairments |

Balance (net of impairments) December 31, 2018 |

Adjustments to Goodwill in 2019 |

Balance (net of impairments) March 31, 2019 |

|||||||||||||||

|

Manufacturing |

$ | 18,270 | $ | -- | $ | 18,270 | $ | -- | $ | 18,270 | ||||||||||

|

Plastics |

19,302 | -- | 19,302 | -- | 19,302 | |||||||||||||||

|

Total |

$ | 37,572 | $ | -- | $ | 37,572 | $ | -- | $ | 37,572 | ||||||||||

Intangible assets with finite lives are amortized over their estimated useful lives and reviewed for impairment in accordance with requirements under ASC Topic 360-10-35, Property, Plant, and Equipment—Overall—Subsequent Measurement.

The following table summarizes the components of the Company’s intangible assets at March 31, 2019 and December 31, 2018:

|

March 31, 2019 (in thousands) |

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

Remaining Amortization Periods (months) |

|||||||||||||

|

Amortizable Intangible Assets: |

|||||||||||||||||

|

Customer Relationships |

$ | 22,491 | $ | 10,410 | $ | 12,081 | 9 | - | 197 | ||||||||

|

Other |

154 | 81 | 73 | 17 | |||||||||||||

|

Total |

$ | 22,645 | $ | 10,491 | $ | 12,154 | |||||||||||

|

December 31, 2018 (in thousands) |

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

Remaining Amortization Periods (months) |

|||||||||||||

|

Amortizable Intangible Assets: |

|||||||||||||||||

|

Customer Relationships |

$ | 22,491 | $ | 10,127 | $ | 12,364 | 12 | - | 200 | ||||||||

|

Other |

154 | 68 | 86 | 20 | |||||||||||||

|

Total |

$ | 22,645 | $ | 10,195 | $ | 12,450 | |||||||||||

The amortization expense for these intangible assets was:

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Amortization Expense – Intangible Assets |

$ | 296 | $ | 345 | ||||

The estimated annual amortization expense for these intangible assets for the next five years is:

|

(in thousands) |

2019 |

2020 |

2021 |

2022 |

2023 |

|||||||||||||||

|

Estimated Amortization Expense – Intangible Assets |

$ | 1,184 | $ | 1,133 | $ | 1,099 | $ | 1,099 | $ | 1,099 | ||||||||||

Supplemental Disclosures of Cash Flow Information

|

As of March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Noncash Investing Activities: |

||||||||

|

Transactions Related to Capital Additions not Settled in Cash |

$ | 4,338 | $ | 10,451 | ||||

New Accounting Standards Adopted

ASU 2016-02—In February 2016 the FASB issued ASU No. 2016-02, Leases (Topic 842) (ASU 2016-02). ASU 2016-02 is a comprehensive amendment of the ASC, creating Topic 842, which supersedes the requirements under ASC Topic 840 on leases and requires the recognition of lease assets and lease liabilities on the balance sheet and the disclosure of key information about leasing arrangements. The amendments in ASU 2016-02 are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The main difference between previous Generally Accepted Accounting Principles in the United States (GAAP) and Topic 842 is the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous GAAP. The Company adopted the amendments in ASU 2016-02 to its consolidated financial statements effective January 1, 2019. See note 8 for further information on leases and the Company’s elections for applying the new standard.

ASU 2018-02—In February 2018 the FASB issued ASU No. 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (ASU 2018-02). The amendments in ASU 2018-02, which are narrow in scope, allow a reclassification from accumulated other comprehensive income/(loss) (AOCI/(L)) to retained earnings for the stranded tax effects resulting from the Tax Cuts and Jobs Act (TCJA). Consequently, the amendments eliminate the stranded tax effects resulting from the TCJA and will improve the usefulness of information reported to financial statement users. The amendments in ASU 2018-02 also require certain disclosures about stranded tax effects and are effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. The amendments in ASU 2018-02 can be applied either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the TCJA is recognized.

The Company adopted the updates in ASU 2018-02 effective January 1, 2019, applying them in the period of adoption and not retrospectively. On adoption, the Company reclassified $784,000 of income tax effects of the TCJA on the gross deferred tax amounts reflected in AOCI/(L) at the date of enactment of the TCJA from AOCI/(L) to retained earnings so the remaining gross deferred tax amounts related to items in AOCI/(L) will reflect current effective tax rates.

Support for the determination of the stranded tax effects resulting from the enactment of the TCJA in AOCI/(L) is provided in the table below.

|

(in thousands) |

Unrealized Gains on Available-for- Sale Securities |

Unamortized Actuarial Losses and Prior Service Costs on Pension and Other Postretirement Benefits |

AOCI/(L) |

|||||||||

|

Balance on December 22, 2017 – Pre-tax |

$ | 71 | $ | (5,672 | ) | $ | (5,601 | ) | ||||

|

Effect of TCJA 14% Federal Tax Rate Reduction on Gross Deferred Tax Amounts |

$ | 10 | $ | (794 | ) | $ | (784 | ) | ||||

ASU 2017-04—In January 2017 the FASB issued ASU No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (ASU 2017-04), which simplifies how an entity is required to test goodwill for impairment by eliminating Step 2 from the goodwill impairment test. Step 2 measures a goodwill impairment loss by comparing the implied fair value of a reporting unit’s goodwill with the carrying amount of that goodwill. In computing the implied fair value of goodwill under Step 2, an entity must perform procedures to determine the fair value at the impairment testing date of its assets and liabilities (including unrecognized assets and liabilities) following the procedure that would be required in determining the fair value of assets acquired and liabilities assumed in a business combination. Under the amendments in ASU 2017-04, an entity will perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. An entity will recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value; however, the loss recognized will not exceed the total amount of goodwill allocated to that reporting unit. Additionally, an entity will consider income tax effects from any tax-deductible goodwill on the carrying amount of the reporting unit when measuring the goodwill impairment loss, if applicable.

The amendments in ASU 2017-04 modify the concept of impairment from the condition that exists when the carrying amount of goodwill exceeds its implied fair value to the condition that exists when the carrying amount of a reporting unit exceeds its fair value. An entity no longer will determine goodwill impairment by calculating the implied fair value of goodwill by assigning the fair value of a reporting unit to all of its assets and liabilities as if that reporting unit had been acquired in a business combination. Because these amendments eliminate Step 2 from the goodwill impairment test, they should reduce the cost and complexity of evaluating goodwill for impairment. The amendments in ASU 2017-04 are effective for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company early adopted the amendments in ASU 2017-04 in the first quarter of 2019. The Company had no indication that any of its goodwill was impaired, therefore, the adoption of the updated standard had no impact on the Company’s consolidated financial statements.

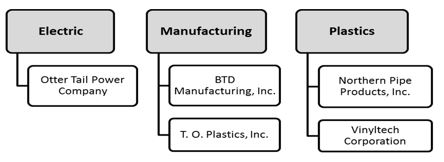

2. Segment Information

The accounting policies of the segments are described under note 1 – Summary of Significant Accounting Policies. The Company's businesses have been classified into three segments to be consistent with its business strategy and the reporting and review process used by the Company’s chief operating decision maker. These businesses sell products and provide services to customers primarily in the United States. The Company’s business structure currently includes the following three segments: Electric, Manufacturing and Plastics. The chart below indicates the companies included in each segment.

Electric includes the production, transmission, distribution and sale of electric energy in Minnesota, North Dakota and South Dakota by OTP. In addition, OTP is a participant in the Midcontinent Independent System Operator, Inc. (MISO) markets. OTP’s operations have been the Company’s primary business since 1907.

Manufacturing consists of businesses in the following manufacturing activities: contract machining, metal parts stamping, fabrication and painting, and production of plastic thermoformed horticultural containers, life science and industrial packaging, material handling components and extruded raw material stock. These businesses have manufacturing facilities in Georgia, Illinois and Minnesota and sell products primarily in the United States.

Plastics consists of businesses producing PVC pipe at plants in North Dakota and Arizona. The PVC pipe is sold primarily in the upper Midwest and Southwest regions of the United States.

OTP is a wholly owned subsidiary of the Company. All of the Company’s other businesses are owned by its wholly owned subsidiary, Varistar Corporation. The Company’s Corporate operating costs include items such as corporate staff and overhead costs, the results of the Company’s captive insurance company and other items excluded from the measurement of operating segment performance. Corporate assets consist primarily of cash, prepaid expenses, investments and fixed assets. Corporate is not an operating segment. Rather, it is added to operating segment totals to reconcile to totals on the Company’s consolidated financial statements.

While no single customer accounted for over 10% of the Company’s consolidated revenue in 2018, certain customers provided a significant portion of each business segment’s 2018 revenue. The Electric segment has one customer that provided 11.2% of 2018 segment revenues. The Manufacturing segment has one customer that manufactures and sells recreational vehicles that provided 22.2% of 2018 segment revenues and one customer that manufactures and sells lawn and garden equipment that provided 11.2% of 2018 segment revenues. The Manufacturing segment’s top five revenue-generating customers provided over 52% of 2018 segment revenues. The Plastics segment has two customers that together provided 39.1% of 2018 segment revenues. The loss of any one of these customers would have a significant negative impact on the financial position and results of operations of the respective business segment and the Company.

All of the Company’s long-lived assets are within the United States and 99.0% and 98.3% of its operating revenues for the respective three-month periods ended March 31, 2019 and 2018 came from sales within the United States.

The Company evaluates the performance of its business segments and allocates resources to them based on earnings contribution and return on total invested capital. Information for the business segments for the three months ended March 31, 2019 and 2018 and total assets by business segment as of March 31, 2019 and December 31, 2018 are presented in the following tables:

Operating Revenue

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Electric Segment: |

||||||||

|

Retail Sales Revenue from Contracts with Customers |

$ | 114,955 | $ | 109,180 | ||||

|

Changes in Accrued ARP Revenues |

(1,049 | ) | (875 | ) | ||||

|

Total Retail Sales Revenue |

113,906 | 108,305 | ||||||

|

Transmission Services Revenue |

10,862 | 11,903 | ||||||

|

Wholesale Revenues – Company Generation |

1,527 | 1,015 | ||||||

|

Other Revenues |

1,814 | 1,742 | ||||||

|

Total Electric Segment Revenues |

128,109 | 122,965 | ||||||

|

Manufacturing Segment: |

||||||||

|

Metal Parts and Tooling |

66,724 | 56,927 | ||||||

|

Plastic Products and Tooling |

9,045 | 10,235 | ||||||

|

Other |

2,053 | 1,500 | ||||||

|

Total Manufacturing Segment Revenues |

77,822 | 68,662 | ||||||

|

Plastics Segment – Sale of PVC Pipe Products |

40,058 | 49,653 | ||||||

|

Intersegment Eliminations |

(17 | ) | (14 | ) | ||||

|

Total |

$ | 245,972 | $ | 241,266 | ||||

Interest Charges

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Electric |

$ | 6,641 | $ | 6,390 | ||||

|

Manufacturing |

584 | 554 | ||||||

|

Plastics |

149 | 150 | ||||||

|

Corporate and Intersegment Eliminations |

452 | 278 | ||||||

|

Total |

$ | 7,826 | $ | 7,372 | ||||

Income Taxes

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Electric |

$ | 4,771 | $ | 2,098 | ||||

|

Manufacturing |

1,454 | 1,223 | ||||||

|

Plastics |

1,329 | 2,414 | ||||||

|

Corporate |

(1,926 | ) | (1,941 | ) | ||||

|

Total |

$ | 5,628 | $ | 3,794 | ||||

Net Income (Loss)

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Electric |

$ | 18,700 | $ | 16,668 | ||||

|

Manufacturing |

4,842 | 4,164 | ||||||

|

Plastics |

3,729 | 6,844 | ||||||

|

Corporate |

(947 | ) | (1,461 | ) | ||||

|

Total |

$ | 26,324 | $ | 26,215 | ||||

Identifiable Assets

|

March 31, |

December 31, |

|||||||

|

(in thousands) |

2019 |

2018 |

||||||

|

Electric |

$ | 1,737,278 | $ | 1,728,534 | ||||

|

Manufacturing |

217,390 | 187,556 | ||||||

|

Plastics |

104,544 | 91,630 | ||||||

|

Corporate |

45,336 | 44,797 | ||||||

|

Total |

$ | 2,104,548 | $ | 2,052,517 | ||||

3. Rate and Regulatory Matters

Below are descriptions of OTP’s major capital expenditure projects that have had, or are expected to have, a significant impact on OTP’s revenue requirements, rates and alternative revenue recovery mechanisms, followed by summaries of specific electric rate or rider proceedings with the Minnesota Public Utilities Commission (MPUC), the North Dakota Public Service Commission (NDPSC), the South Dakota Public Utilities Commission (SDPUC) and the FERC, impacting OTP’s revenues in 2019 and 2018.

Major Capital Expenditure Projects

Astoria Station—OTP is constructing this 245-megawatt (MW) simple-cycle natural gas-fired combustion turbine generation facility near Astoria, South Dakota as part of its plan to reliably meet customers’ electric needs, replace expiring capacity purchase agreements and prepare for the planned retirement of its Hoot Lake Plant in 2021. A final order granting an Advance Determination of Prudence (ADP) for Astoria Station was issued by the NDPSC on November 3, 2017, subject to certain qualifications and compliance obligations. On August 3, 2018 the SDPUC issued an order granting a site permit for Astoria Station. In a September 26, 2018 hearing the NDPSC established a GCR rider for future recovery of costs incurred for Astoria Station. The interconnection agreement for Astoria Station was executed by MISO in December 2018 and accepted by the FERC in January 2019. As of March 31, 2019, OTP had capitalized approximately $7.7 million in development and other costs associated with Astoria Station.

Merricourt Project—On November 16, 2016 OTP entered into an Asset Purchase Agreement (the Purchase Agreement) with EDF Renewable Development, Inc. and certain of its affiliated companies (EDF) to purchase and assume the development assets and certain specified liabilities associated with a 150-MW wind farm in southeastern North Dakota (the Merricourt Project) for a purchase price of approximately $34.7 million, subject to adjustments for interconnection costs. The Purchase Agreement will close on satisfaction of various closing conditions (including regulatory approvals). Also on November 16, 2016, OTP entered into a Turnkey Engineering, Procurement and Construction Services Agreement with EDF pursuant to which EDF will develop, design, procure, construct, interconnect, test and commission the wind farm with a targeted completion date in 2020 for consideration of approximately $200.5 million, subject to certain adjustments, payable following the closing of the Purchase Agreement in installments in connection with certain project construction milestones. The agreements contain customary representations, warranties, covenants and indemnities for this type of transaction. On October 26, 2017 the MPUC approved the facility under the Renewable Energy Standard making the Merricourt Project eligible for cost recovery under the Minnesota Renewable Resource Recovery rider, subject to qualifications and reporting obligations. The MPUC’s final written order was issued on January 10, 2018. A final order for an ADP, subject to qualifications and compliance obligations, and a Certificate of Public Convenience and Necessity were issued by the NDPSC on November 3, 2017. The Merricourt generation interconnection agreement with MISO was approved by the FERC in April 2019. Construction of the Merricourt Project will begin after closing on the Purchase Agreement, anticipated to occur in the last half of 2019. As of March 31, 2019, OTP had capitalized approximately $5.3 million in development costs associated with the Merricourt Project.

Big Stone South–Ellendale Multi-Value Transmission Project (MVP)—This 345-kilovolt transmission line, energized on February 6, 2019, extends 163 miles between a substation near Big Stone City, South Dakota and a substation near Ellendale, North Dakota. OTP jointly developed this project with Montana-Dakota Utilities Co., and the parties have equal ownership interest in the transmission line portion of the project. The MISO approved this project as an MVP under the MISO Open Access Transmission, Energy and Operating Reserve Markets Tariff (MISO Tariff) in December 2011. MVPs are designed to enable the MISO region to comply with energy policy mandates and to address reliability and economic issues affecting multiple areas within the MISO region. The cost allocation is designed to ensure the costs of transmission projects with regional benefits are properly assigned to those who benefit. OTP’s capitalized costs on this project as of March 31, 2019 were approximately $106 million, which includes assets that are 100% owned by OTP.

Recovery of OTP’s major transmission investments is through the MISO Tariff and, currently, Minnesota, North Dakota and South Dakota base rates and TCR riders.

Minnesota

General Rates—The MPUC rendered its final decision in OTP’s 2016 general rate case in March 2017 and issued its written order on May 1, 2017. Pursuant to the order, OTP’s allowed rate of return on rate base is 8.61% and its allowed rate of return on equity (ROE) is 10.74%.

The MPUC’s order also included: (1) the determination that all costs (including FERC allocated costs and revenues) of the Big Stone South–Brookings and Big Stone South–Ellendale MVPs will be included in the Minnesota TCR rider and jurisdictionally allocated to OTP’s Minnesota customers (see discussion under Minnesota Transmission Cost Recovery Rider below), and (2) approval of OTP’s proposal to transition rate base, expenses and revenues from ECR and TCR riders to base rate recovery, which occurred when final rates were implemented on November 1, 2017. Certain MISO expenses and revenues remain in the TCR rider to allow for the ongoing refund or recovery of these variable revenues and costs.

Minnesota Conservation Improvement Programs (MNCIP)—OTP recovers conservation related costs not included in base rates under the MNCIP through the use of an annual recovery mechanism approved by the MPUC. On May 25, 2016 the MPUC adopted changes to the MNCIP financial incentive. The model included incentives for utilities of 13.5% of 2017 net benefits, 12% of 2018 net benefits and 10% of 2019 net benefits, assuming the utility achieves 1.7% savings compared to retail sales. The financial incentive was also limited to 40% of 2017 MNCIP spending and 35% of 2018 spending and will be limited to 30% of 2019 spending. The new model reduces the MNCIP financial incentive by approximately 50% compared to the previous incentive mechanism. The Minnesota Department of Commerce (MNDOC) issued a proposed decision on March 20, 2019 to extend all utilities 2017-2019 CIP plans one year, through 2020.

On April 1, 2019 OTP filed a request for approval of its 2018 energy savings, recovery of $3.0 million in accrued financial incentives and recovery of 2018 program costs not included in base rates.

Transmission Cost Recovery Rider—The Minnesota Public Utilities Act provides a mechanism for automatic adjustment outside of a general rate proceeding to recover the costs of new transmission facilities that meet certain criteria, plus a return on investment at the level approved in a utility’s last general rate case. Additionally, following approval of the rate schedule, the MPUC may approve annual rate adjustments filed pursuant to the rate schedule.

In OTP’s 2016 general rate case order issued on May 1, 2017, the MPUC ordered OTP to include, in the TCR rider retail rate base, Minnesota’s jurisdictional share of OTP’s investment in the Big Stone South–Brookings and Big Stone South–Ellendale MVPs and all revenues received from other utilities under MISO’s tariffed rates as a credit in its TCR revenue requirement calculations. In doing so, the MPUC’s order diverted interstate wholesale revenues that have been approved by the FERC to offset FERC-approved expenses, effectively reducing OTP’s recovery of those FERC-approved expense levels. The MPUC-ordered treatment resulted in the projects being treated as retail investments for Minnesota retail ratemaking purposes. Because the FERC’s revenue requirements and authorized returns vary from the MPUC revenue requirements and authorized returns for the project investments over the lives of the projects, the impact of this decision would vary over time and be dependent on the differences between the revenue requirements and returns in the two jurisdictions at any given time. On August 18, 2017 OTP filed an appeal of the MPUC order with the Minnesota Court of Appeals to contest the portion of the order requiring OTP to jurisdictionally allocate costs of the FERC MVP transmission projects in the TCR rider.

On June 11, 2018 the Minnesota Court of Appeals reversed the MPUC’s order related to the inclusion of Minnesota’s jurisdictional share of OTP’s investment in the Big Stone South–Brookings and Big Stone South–Ellendale MVPs and all revenues received from other utilities under MISO’s tariffed rates as a credit in OTP Minnesota TCR revenue requirement calculations. On July 11, 2018 the MPUC filed a petition for review of the MVP decision to the Minnesota Supreme Court, which granted review of the Minnesota Court of Appeals decision. Oral arguments were heard by the Minnesota Supreme Court on March 11, 2019.

On November 30, 2018 OTP filed its annual update and supplemental filing to the Minnesota TCR rider. In this filing two scenarios were submitted based on whether the Minnesota Supreme Court affirms the original decision by the Minnesota Court of Appeals to exclude the MVP projects from the TCR rider or overturns the Minnesota Court of Appeals decision and includes the two MVP projects in the TCR rider. Action by the Minnesota Supreme Court is expected later in 2019, increasing the likelihood the MPUC will delay its decision on the TCR rider update. In addition, on April 1, 2019, the MNDOC filed comments in OTP’s TCR rider docket, opposing OTP’s proposal for TCR rider recovery of these costs. The estimated amount credited to Minnesota customers through the TCR rider through March 31, 2019 is approximately $2.5 million.

Environmental Cost Recovery Rider—OTP had an ECR rider for recovery of OTP’s Minnesota jurisdictional share of the revenue requirements of its investment in the Big Stone Plant Air Quality Control System (AQCS). The ECR rider provided for a return on the project’s construction work in progress (CWIP) balance at the level approved in OTP’s 2010 general rate case. In its 2016 general rate case order, the MPUC approved OTP’s proposal to transition eligible rate base and expense recovery from the ECR rider to base rate recovery effective with implementation of final rates in November 2017. Accordingly, in its 2018 annual update filing OTP requested, and the MPUC approved, setting the Minnesota ECR rider rate to zero effective December 1, 2018. The remaining under-recovered balance was charged on customer billings in March and April 2019.

Renewable Resource Adjustment—Effective November 1, 2017, with the implementation of final rates in Minnesota, new rates were put into effect for the Minnesota RRA rider to address recovery of federal Production Tax Credits (PTCs) expiring on OTP’s wind farms in 2017 and 2018.

North Dakota

General Rates—On November 2, 2017 OTP filed a request with the NDPSC for a rate review and an effective increase in annual revenues from non-fuel base rates of $13.1 million or 8.72%. The requested $13.1 million increase was net of reductions in North Dakota RRA, TCR and ECR rider revenues that would have resulted from a lower allowed rate of ROE and changes in allocation factors in the general rate case. In the request, OTP proposed an allowed return on rate base of 7.97% and an allowed rate of ROE of 10.3%. On December 20, 2017 the NDPSC approved OTP’s request for interim rates to increase annual revenue collections by $12.8 million, effective January 1, 2018. In response to the reduction in the federal corporate tax rate under the TCJA, the NDPSC issued an order on February 27, 2018 reducing OTP’s annual revenue requirement for interim rates by $4.5 million to $8.3 million, effective March 1, 2018.

On March 23, 2018 OTP made a supplemental filing to its initial request for a rate review, reducing its request for an annual revenue increase from $13.1 million to $7.1 million, a 4.8% annual increase. The $6.0 million decrease included $4.8 million related to tax reform and $1.2 million related to other updates.

In a September 26, 2018 hearing the NDPSC approved an overall annual revenue increase of $4.6 million (3.1%) and a ROE of 9.77% on a 52.5% equity capital structure. This compares with OTP’s March 2018 adjusted annual revenue increase request of $7.1 million (4.8%) and a requested ROE of 10.3%. The NDPSC’s approval does not require any rate base adjustments from OTP’s original request and establishes a GCR rider for future recovery of costs incurred for Astoria Station. The net revenue increase reflects a reduction in income tax recovery requirements related to the TCJA and decreases in rider revenue recovery requirements. Final rates were effective February 1, 2019, with refunds of excess revenues collected under interim rates applied to customers’ April 2019 bills. OTP has accrued an interim rate refund of $3.4 million as of March 31, 2019, which includes interest and $0.8 million in excess revenue collected for income taxes under interim rates in effect in January and February 2018.

Renewable Resource Adjustment—OTP has a North Dakota RRA which enables OTP to recover its North Dakota jurisdictional share of investments in renewable energy facilities. This rider allows OTP to recover costs associated with new renewable energy projects as they are completed, along with a return on investment.

Effective in February 2019 with the implementation of general rates based on the results of OTP’s 2017 general rate case, recovery of renewable resource costs previously being recovered through the North Dakota RRA rider transitioned to recovery in base rates.

Transmission Cost Recovery Rider—North Dakota law provides a mechanism for automatic adjustment outside of a general rate proceeding to recover jurisdictional capital and operating costs incurred by a public utility for new or modified electric transmission facilities. For qualifying projects, the law authorizes a current return on CWIP and a return on investment at the level approved in the utility's most recent general rate case. Based on the order in the 2017 general rate case, only certain costs will remain subject to refund or recovery through this rider: Southwest Power Pool (SPP) costs and MISO Schedule 26 and 26A revenues and expenses and costs related to rider projects still under construction in the test year used in the 2017 general rate case. This rider will continue to be updated annually for new or modified electric transmission facilities and associated operating costs.

Environmental Cost Recovery Rider—OTP has an ECR rider in North Dakota. The ECR rider has provided for a return on investment at the level approved in OTP’s preceding general rate case and for recovery of OTP’s North Dakota share of environmental investments and costs approved for recovery under the rider. Prior to its 2017 general rate case reaching a final settlement and final rates going into effect on February 1, 2019, OTP’s North Dakota jurisdictional share of the revenue requirements associated with its investment in the Big Stone Plant AQCS and Hoot Lake Plant MATS projects were being recovered through the ECR rider. Effective February 1, 2019 these rate base investments are being recovered under general rates and the rider was zeroed out except for an overcollection balance that will be refunded to ratepayers through the rider.

Generation Cost Recovery Rider—On March 1, 2019 OTP filed a request with the NDPSC to establish an initial GCR rider rate for recovery of OTP’s North Dakota jurisdictional share of the revenue requirements of its investment in Astoria Station.

South Dakota

General Rates—On April 20, 2018 OTP filed a request with the SDPUC to increase non-fuel rates in South Dakota by approximately $3.3 million annually, or 10.1%, as the first step in a two-step request. Interim rates went into effect October 18, 2018. The second step in the request was an additional 1.7% revenue increase to recover costs for the proposed Merricourt wind generation facility when the facility goes into service.

The SDPUC approved a partial settlement on March 1, 2019 on all issues of the rate case except ROE. The settlement includes approval of a phase-in plan to provide for a return on amounts invested in Astoria Station and the Merricourt Project, which addresses the second step of the request for increased rates in South Dakota. The partial settlement also includes a moratorium on filing another general rate case in South Dakota until the new generation projects have been in service for a year. The settlement also allows OTP to retain the impact of lower tax rates related to the TCJA from January 1, 2018 through October 17, 2018 resulting in the reversal of an accrued refund liability and recognition of $1.0 million in revenue in the first quarter of 2019. OTP expects a final determination on its allowed rate of ROE sometime during the second quarter of 2019.

OTP’s previously approved general rate increase in South Dakota of approximately $643,000 or approximately 2.32% was granted by the SDPUC in an order issued in April 2011 and effective in June 2011. Pursuant to the order, OTP’s allowed rate of return on rate base was set at 8.50%.

Transmission Cost Recovery Rider—South Dakota law provides a mechanism for automatic adjustment outside of a general rate proceeding to recover jurisdictional capital and operating costs incurred by a public utility for new or modified electric transmission facilities. OTP has a TCR rider in South Dakota. A supplemental filing to update the rider was made on January 29, 2018 to reflect updated costs and collections and incorporate the impact of the reduction in the federal corporate income tax rate under the TCJA. Effective October 18, 2018, with the implementation of interim rates under South Dakota general rate case proceedings, the TCR rate was decreased as a result of recovery of certain costs being shifted to recovery in interim rates and proposed for ongoing recoveries in final base rates at the end of the 2018 general rate case.

OTP made a supplemental filing for the South Dakota TCR rider on February 1, 2019. On February 8, 2019 the SDPUC approved the supplemental filing and rates effective March 1, 2019. Two new projects were approved for recovery under the rider: The Lake Norden area transmission upgrade project with a recovery date effective January 1, 2019 and The Big Stone South – Ellendale project with a recovery date effective January 2020.

Environmental Cost Recovery Rider—OTP has an ECR rider in South Dakota. The ECR rider provides for a return on investment at the level approved in OTP’s most recent general rate case and for recovery of OTP’s South Dakota share of environmental investments and costs approved for recovery under the rider. Prior to interim rates going into effect on October 18, 2018 pending a final decision on OTP’s South Dakota general rate increase request, OTP’s South Dakota jurisdictional share of the revenue requirements associated with its investment in the Big Stone Plant AQCS and Hoot Lake Plant Mercury and Air Toxics Standards projects were being recovered through the ECR rider. With the initiation of interim rates, recovery of the costs previously being recovered under the ECR rider was transitioned to recovery under interim rates and the South Dakota ECR rider rate was reset to provide a refund to customers while interim rates are in effect.

Rate Rider Updates

The following table provides summary information on the status of updates since January 1, 2017 for the rate riders described above:

|

Rate Rider |

R - Request Date A - Approval Date |

Effective Date Requested or Approved |

Annual Revenue ($000s) |

Rate |

|||

|

Minnesota |

|||||||

|

Conservation Improvement Program |

|||||||

|

2018 Incentive and Cost Recovery |

R – April 1, 2019 |

October 1, 2019 |

$ | 11,926 |

$0.00710/kwh |

||

|

2017 Incentive and Cost Recovery |

A – October 4, 2018 |

November 1, 2018 |

$ | 10,283 |

$0.00600/kwh |

||

|

2016 Incentive and Cost Recovery |

A – September 15, 2017 |

October 1, 2017 |

$ | 9,868 |

$0.00536/kwh |

||

|

Transmission Cost Recovery |

|||||||

|

2018 Annual Update–Scenario A |

R – November 30, 2018 |

June 1, 2019 |

$ | 6,475 |

Various |

||

|

–Scenario B |

$ | 2,708 |

Various |

||||

|

2017 Rate Reset |

A – October 30, 2017 |

November 1, 2017 |

$ | (3,311 | ) |

Various |

|

|

Environmental Cost Recovery |

|||||||

|

2018 Annual Update |

A – November 29, 2018 |

December 1, 2018 |

$ | -- |

0% of base |

||

|

2017 Rate Reset |

A – October 30, 2017 |

November 1, 2017 |

$ | (1,943 | ) |

-0.935% of base |

|

|

Renewable Resource Adjustment |

|||||||

|

2018 Annual Update |

A – August 29, 2018 |

November 1, 2018 |

$ | 5,886 |

$.00244/kwh |

||

|

2017 Rate Reset |

A – October 30, 2017 |

November 1, 2017 |

$ | 1,279 |

$.00049/kwh |

||

|

North Dakota |

|||||||

|

Renewable Resource Adjustment |

|||||||

|

2019 Annual Update |

A – May 1, 2019 |

June 1, 2019 |

$ | (235 | ) |

-0.224% of base |

|

|

2018 Rate Reset for effect of TCJA |

A – February 27, 2018 |

March 1, 2018 |

$ | 9,650 |

7.493% of base |

||

|

2017 Rate Reset |

A – December 20, 2017 |

January 1, 2018 |

$ | 9,989 |

7.756% of base |

||

|

Transmission Cost Recovery |

|||||||

|

2018 Supplemental Update |

A – December 6, 2018 |

February 1, 2019 |

$ | 4,801 |

Various |

||

|

2018 Rate Reset for effect of TCJA |

A – February 27, 2018 |

March 1, 2018 |

$ | 7,469 |

Various |

||

|

2017 Annual Update |

A – November 29, 2017 |

January 1, 2018 |

$ | 7,959 |

Various |

||

|

Environmental Cost Recovery |

|||||||

|

2018 Update |

A – December 19, 2018 |

February 1, 2019 |

$ | (378 | ) |

-0.310% of base |

|

|

2018 Rate Reset for effect of TCJA |

A – February 27, 2018 |

March 1, 2018 |

$ | 7,718 |

5.593% of base |

||

|

2017 Rate Reset |

A – December 20, 2017 |

January 1, 2018 |

$ | 8,537 |

6.629% of base |

||

|

Generation Cost Recovery |

|||||||

|

2019 Initial Request |

R – March 1, 2019 |

July 1, 2019 |

$ | 2,720 |

2.547% of base |

||

|

South Dakota |

|||||||

|

Transmission Cost Recovery |

|||||||

|

2019 Annual Update |

A – February 20, 2019 |

March 1, 2019 |

$ | 1,638 |

Various |

||

|

2018 Interim Rate Reset |

A – October 18, 2018 |

October 18, 2018 |

$ | 1,171 |

Various |

||

|

2017 Annual Update |

A – February 28, 2018 |

March 1, 2018 |

$ | 1,779 |

Various |

||

|

2016 Annual Update |

A – February 17, 2017 |

March 1, 2017 |

$ | 2,053 |

Various |

||

|

Environmental Cost Recovery |

|||||||

|

2018 Interim Rate Reset |

A – October 18, 2018 |

October 18, 2018 |

$ | (189 | ) |

-$0.00075/kwh |

|

|

2017 Annual Update |

A – October 13, 2017 |

November 1, 2017 |

$ | 2,082 |

$0.00483/kwh |

||

Revenues Recorded under Rate Riders

The following table presents revenue recorded by OTP under rate riders in place in Minnesota, North Dakota and South Dakota for the three-month periods ended March 31:

|

Rate Rider (in thousands) |

2019 |

2018 |

||||||

|

Minnesota |

||||||||

|

Conservation Improvement Program Costs and Incentives1 |

$ | 2,152 | $ | 2,516 | ||||

|

Renewable Resource Recovery |

1,316 | 525 | ||||||

|

Transmission Cost Recovery |

641 | (29 | ) | |||||

|

Environmental Cost Recovery |

(1 | ) | (31 | ) | ||||

|

North Dakota |

||||||||

|

Transmission Cost Recovery |

1,772 | 2,062 | ||||||

|

Renewable Resource Adjustment |

729 | 1,967 | ||||||

|

Environmental Cost Recovery |

575 | 1,821 | ||||||

|

Generation Cost Recovery |

248 | -- | ||||||

|

South Dakota |

||||||||

|

Transmission Cost Recovery |

473 | 536 | ||||||

|

Conservation Improvement Program Costs and Incentives |

244 | 229 | ||||||

|

Environmental Cost Recovery |

(4 | ) | 520 | |||||

|

Total |

$ | 8,145 | $ | 10,116 | ||||

|

1Includes MNCIP costs recovered in base rates. |

TCJA

The TCJA, passed in December 2017, reduced the federal corporate income tax rate from 35% to 21%, effective January 1, 2018. At the time of passage, OTP’s electric rates had been developed using a 35% tax rate. The MPUC, the NDPSC, the SDPUC and the FERC each initiated dockets or proceedings to begin working with utilities to assess the impact of the lower rates on electric rates, and to develop regulatory strategies to incorporate the tax reduction into future electric rates, if warranted.