UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

[X] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the quarterly period ended |

March 31, 2018 |

OR

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from |

to |

|

Commission file number |

0-53713 |

|

OTTER TAIL CORPORATION |

|

(Exact name of registrant as specified in its charter) |

|

Minnesota |

27-0383995 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

|

215 South Cascade Street, Box 496, Fergus Falls, Minnesota |

56538-0496 |

|

(Address of principal executive offices) |

(Zip Code) |

|

866-410-8780 |

|

(Registrant's telephone number, including area code) |

|

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ☑ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

| (Do not check if a smaller reporting company) | ||

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Yes ☑ No ☐

Indicate the number of shares outstanding of each of the issuer's classes of Common Stock, as of the latest practicable date:

April 30, 2018 – 39,651,236 Common Shares ($5 par value)

OTTER TAIL CORPORATION

|

Page No. |

||

|

Item 1. |

||

|

Consolidated Balance Sheets – March 31, 2018 and December 31, 2017 (not audited) |

2 & 3 |

|

|

Consolidated Statements of Income - Three Months Ended March 31, 2018 and 2017 (not audited) |

4 |

|

|

5 |

||

|

Consolidated Statements of Cash Flows - Three Months Ended March 31, 2018 and 2017 (not audited) |

6 |

|

|

Condensed Notes to Consolidated Financial Statements (not audited) |

7-32 |

|

|

Item 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

33-46 |

|

Item 3. |

46 |

|

|

Item 4. |

46 |

|

|

Item 1. |

47 |

|

|

Item 1A. |

47 |

|

|

Item 2. |

47 |

|

|

Item 6. |

47 |

|

|

48 |

||

|

Otter Tail Corporation |

||

|

(not audited) |

|

(in thousands) |

March 31, 2018 |

December 31, 2017 |

||||||

|

Assets |

||||||||

|

Current Assets |

||||||||

|

Cash and Cash Equivalents |

$ | 1,121 | $ | 16,216 | ||||

|

Accounts Receivable: |

||||||||

|

Trade—Net |

94,265 | 68,466 | ||||||

|

Other |

7,109 | 7,761 | ||||||

|

Inventories |

87,999 | 88,034 | ||||||

|

Unbilled Receivables |

18,692 | 22,427 | ||||||

|

Income Taxes Receivable |

-- | 1,181 | ||||||

|

Regulatory Assets |

19,736 | 22,551 | ||||||

|

Other |

11,210 | 12,491 | ||||||

|

Total Current Assets |

240,132 | 239,127 | ||||||

|

Investments |

8,648 | 8,629 | ||||||

|

Other Assets |

35,763 | 36,006 | ||||||

|

Goodwill |

37,572 | 37,572 | ||||||

|

Other Intangibles—Net |

13,420 | 13,765 | ||||||

|

Regulatory Assets |

125,667 | 129,576 | ||||||

|

Plant |

||||||||

|

Electric Plant in Service |

1,986,385 | 1,981,018 | ||||||

|

Nonelectric Operations |

219,942 | 216,937 | ||||||

|

Construction Work in Progress |

153,963 | 141,067 | ||||||

|

Total Gross Plant |

2,360,290 | 2,339,022 | ||||||

|

Less Accumulated Depreciation and Amortization |

814,074 | 799,419 | ||||||

|

Net Plant |

1,546,216 | 1,539,603 | ||||||

|

Total Assets |

$ | 2,007,418 | $ | 2,004,278 | ||||

See accompanying condensed notes to consolidated financial statements.

|

Otter Tail Corporation |

||

|

Consolidated Balance Sheets |

||

|

(not audited) |

|

(in thousands, except share data) |

March 31, 2018 |

December 31, 2017 |

||||||

|

Liabilities and Equity |

||||||||

|

Current Liabilities |

||||||||

|

Short-Term Debt |

$ | 30,319 | $ | 112,371 | ||||

|

Current Maturities of Long-Term Debt |

171 | 186 | ||||||

|

Accounts Payable |

87,179 | 84,185 | ||||||

|

Accrued Salaries and Wages |

14,806 | 21,534 | ||||||

|

Accrued Federal and State Income Taxes |

984 | -- | ||||||

|

Accrued Taxes |

17,585 | 16,808 | ||||||

|

Regulatory Liabilities |

5,119 | 9,688 | ||||||

|

Other Accrued Liabilities |

9,940 | 11,389 | ||||||

|

Liabilities of Discontinued Operations |

-- | 492 | ||||||

|

Total Current Liabilities |

166,103 | 256,653 | ||||||

|

Pensions Benefit Liability |

89,552 | 109,708 | ||||||

|

Other Postretirement Benefits Liability |

70,040 | 69,774 | ||||||

|

Other Noncurrent Liabilities |

23,482 | 22,769 | ||||||

|

Commitments and Contingencies (note 8) |

||||||||

|

Deferred Credits |

||||||||

|

Deferred Income Taxes |

103,009 | 100,501 | ||||||

|

Deferred Tax Credits |

21,025 | 21,379 | ||||||

|

Regulatory Liabilities |

233,279 | 232,893 | ||||||

|

Other |

2,935 | 3,329 | ||||||

|

Total Deferred Credits |

360,248 | 358,102 | ||||||

|

Capitalization |

||||||||

|

Long-Term Debt—Net |

589,943 | 490,380 | ||||||

|

Cumulative Preferred Shares – Authorized 1,500,000 Shares Without Par Value; Outstanding – None |

-- | -- | ||||||

|

Cumulative Preference Shares – Authorized 1,000,000 Shares Without Par Value; Outstanding – None |

-- | -- | ||||||

|

Common Shares, Par Value $5 Per Share—Authorized, 50,000,000 Shares; Outstanding, 2018—39,626,594 Shares; 2017—39,557,491 Shares |

198,133 | 197,787 | ||||||

|

Premium on Common Shares |

341,841 | 343,450 | ||||||

|

Retained Earnings |

174,209 | 161,286 | ||||||

|

Accumulated Other Comprehensive Loss |

(6,133 | ) | (5,631 | ) | ||||

|

Total Common Equity |

708,050 | 696,892 | ||||||

|

Total Capitalization |

1,297,993 | 1,187,272 | ||||||

|

Total Liabilities and Equity |

$ | 2,007,418 | $ | 2,004,278 | ||||

See accompanying condensed notes to consolidated financial statements.

|

Otter Tail Corporation |

||

|

(not audited) |

|

Three Months Ended March 31, |

||||||||

|

(in thousands, except share and per-share amounts) |

2018 |

2017 |

||||||

|

Operating Revenues |

||||||||

|

Electric: |

||||||||

|

Revenues from Contracts with Customers |

$ | 123,825 | $ | 119,782 | ||||

|

Changes in Accrued Revenues under Alternative Revenue Programs |

(875 | ) | (1,239 | ) | ||||

|

Total Electric Revenues |

122,950 | 118,543 | ||||||

|

Product Sales under Contracts with Customers |

118,316 | 95,574 | ||||||

|

Total Operating Revenues |

241,266 | 214,117 | ||||||

|

Operating Expenses |

||||||||

|

Production Fuel – Electric |

18,706 | 16,382 | ||||||

|

Purchased Power - Electric |

21,593 | 19,188 | ||||||

|

Electric Operation and Maintenance Expenses |

39,475 | 37,277 | ||||||

|

Cost of Products Sold (depreciation included below) |

88,785 | 75,277 | ||||||

|

Other Nonelectric Expenses |

12,494 | 10,135 | ||||||

|

Depreciation and Amortization |

18,763 | 17,854 | ||||||

|

Property Taxes – Electric |

3,835 | 3,798 | ||||||

|

Total Operating Expenses |

203,651 | 179,911 | ||||||

|

Operating Income |

37,615 | 34,206 | ||||||

|

Interest Charges |

7,372 | 7,462 | ||||||

|

Nonservice Cost Components of Postretirement Benefits |

1,417 | 1,405 | ||||||

|

Other Income |

1,183 | 553 | ||||||

|

Income Before Income Taxes – Continuing Operations |

30,009 | 25,892 | ||||||

|

Income Tax Expense – Continuing Operations |

3,794 | 6,363 | ||||||

|

Net Income from Continuing Operations |

26,215 | 19,529 | ||||||

|

Income from Discontinued Operations – net of Income Tax Expense of $38 in 2017 |

-- | 56 | ||||||

|

Net Income |

$ | 26,215 | $ | 19,585 | ||||

|

Average Number of Common Shares Outstanding—Basic |

39,550,874 | 39,350,802 | ||||||

|

Average Number of Common Shares Outstanding—Diluted |

39,863,682 | 39,640,725 | ||||||

|

Basic Earnings Per Common Share: |

||||||||

|

Continuing Operations |

$ | 0.66 | $ | 0.50 | ||||

|

Discontinued Operations |

-- | -- | ||||||

| $ | 0.66 | $ | 0.50 | |||||

|

Diluted Earnings Per Common Share: |

||||||||

|

Continuing Operations |

$ | 0.66 | $ | 0.49 | ||||

|

Discontinued Operations |

-- | -- | ||||||

| $ | 0.66 | $ | 0.49 | |||||

|

Dividends Declared Per Common Share |

$ | 0.335 | $ | 0.320 | ||||

See accompanying condensed notes to consolidated financial statements.

|

Otter Tail Corporation |

||

|

(not audited) |

|

Three Months Ended March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Net Income |

$ | 26,215 | $ | 19,585 | ||||

|

Other Comprehensive (Loss) Income: |

||||||||

|

Unrealized Gains on Available-for-Sale Securities: |

||||||||

|

Reversal of Previously Recognized Gains on Available for Sale Securities Included in Other Income During Period |

(110 | ) | -- | |||||

|

Unrealized (Losses) Gains Arising During Period |

(66 | ) | 17 | |||||

|

Income Tax Benefit (Expense) |

37 | (6 | ) | |||||

|

Change in Unrealized Gains on Available-for-Sale Securities – net-of-tax |

(139 | ) | 11 | |||||

|

Pension and Postretirement Benefit Plans: |

||||||||

|

Amortization of Unrecognized Postretirement Benefit Losses and Costs (note 10) |

227 | 157 | ||||||

|

Income Tax Expense |

(59 | ) | (63 | ) | ||||

|

Adjustment to Income Tax Expense Related to 2017 Tax Cuts and Jobs Act |

(531 | ) | -- | |||||

|

Pension and Postretirement Benefit Plans – net-of-tax |

(363 | ) | 94 | |||||

|

Total Other Comprehensive (Loss) Income |

(502 | ) | 105 | |||||

|

Total Comprehensive Income |

$ | 25,713 | $ | 19,690 | ||||

See accompanying condensed notes to consolidated financial statements.

|

Otter Tail Corporation |

||

|

(not audited) |

|

Three Months Ended March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Cash Flows from Operating Activities |

||||||||

|

Net Income |

$ | 26,215 | $ | 19,585 | ||||

|

Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: |

||||||||

|

Net Income from Discontinued Operations |

-- | (56 | ) | |||||

|

Depreciation and Amortization |

18,763 | 17,854 | ||||||

|

Deferred Tax Credits |

(354 | ) | (366 | ) | ||||

|

Deferred Income Taxes |

2,901 | 4,512 | ||||||

|

Change in Deferred Debits and Other Assets |

6,295 | 5,005 | ||||||

|

Discretionary Contribution to Pension Plan |

(20,000 | ) | -- | |||||

|

Change in Noncurrent Liabilities and Deferred Credits |

(5,091 | ) | 1,314 | |||||

|

Allowance for Equity/Other Funds Used During Construction |

(638 | ) | (170 | ) | ||||

|

Stock Compensation Expense—Equity Awards |

1,146 | 1,150 | ||||||

|

Other—Net |

(284 | ) | (5 | ) | ||||

|

Cash (Used for) Provided by Current Assets and Current Liabilities: |

||||||||

|

Change in Receivables |

(25,047 | ) | (15,521 | ) | ||||

|

Change in Inventories |

35 | 2,267 | ||||||

|

Change in Other Current Assets |

2,334 | (22 | ) | |||||

|

Change in Payables and Other Current Liabilities |

(2,598 | ) | (13,986 | ) | ||||

|

Change in Interest and Income Taxes Receivable/Payable |

1,163 | (321 | ) | |||||

|

Net Cash Provided by Continuing Operations |

4,840 | 21,240 | ||||||

|

Net Cash Used in Discontinued Operations |

(200 | ) | (39 | ) | ||||

|

Net Cash Provided by Operating Activities |

4,640 | 21,201 | ||||||

|

Cash Flows from Investing Activities |

||||||||

|

Capital Expenditures |

(23,618 | ) | (30,113 | ) | ||||

|

Net Proceeds from Disposal of Noncurrent Assets |

510 | 612 | ||||||

|

Cash Used for Investments and Other Assets |

(719 | ) | (508 | ) | ||||

|

Net Cash Used in Investing Activities |

(23,827 | ) | (30,009 | ) | ||||

|

Cash Flows from Financing Activities |

||||||||

|

Change in Checks Written in Excess of Cash |

2,338 | 7,999 | ||||||

|

Net Short-Term (Repayments) Borrowings |

(82,052 | ) | 16,293 | |||||

|

Proceeds from Issuance of Common Stock – net of Issuance Expenses |

-- | 1,958 | ||||||

|

Payments for Retirement of Capital Stock |

(2,409 | ) | (1,759 | ) | ||||

|

Proceeds from Issuance of Long-Term Debt |

100,000 | -- | ||||||

|

Short-Term and Long-Term Debt Issuance Expenses |

(433 | ) | -- | |||||

|

Payments for Retirement of Long-Term Debt |

(60 | ) | (3,057 | ) | ||||

|

Dividends Paid |

(13,292 | ) | (12,626 | ) | ||||

|

Net Cash Provided by Financing Activities |

4,092 | 8,808 | ||||||

|

Net Change in Cash and Cash Equivalents |

(15,095 | ) | -- | |||||

|

Cash and Cash Equivalents at Beginning of Period |

16,216 | -- | ||||||

|

Cash and Cash Equivalents at End of Period |

$ | 1,121 | $ | -- | ||||

See accompanying condensed notes to consolidated financial statements.

OTTER TAIL CORPORATION

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(not audited)

In the opinion of management, Otter Tail Corporation (the Company) has included all adjustments (including normal recurring accruals) necessary for a fair presentation of the consolidated financial statements for the periods presented. The consolidated financial statements and condensed notes thereto should be read in conjunction with the consolidated financial statements and notes included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2017. Because of seasonal and other factors, the earnings for the three months ended March 31, 2018 should not be taken as an indication of earnings for all or any part of the balance of the year.

The following condensed notes are numbered to correspond to numbers of the notes included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

1. Summary of Significant Accounting Policies

Revenue Recognition

In May 2014 the Financial Accounting Standards Board (FASB) issued a major update to the Accounting Standards Codification (ASC), Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (ASC 606). The Company adopted the updates in ASC 606 effective January 1, 2018 on a modified retrospective basis but did not record a cumulative effect adjustment to retained earnings on application of the updates because the adoption of the updates in ASC 606 had no material impact on the timing of revenue recognition for the Company or its subsidiaries. ASC 606 is a comprehensive, principles-based accounting standard which amends current revenue recognition guidance with the objective of improving revenue recognition requirements by providing a single comprehensive model to determine the measurement of revenue and the timing of revenue recognition. ASC 606 also requires expanded disclosures to enable users of financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

Due to the diverse business operations of the Company, recognition of revenue from contracts with customers depends on the product produced and sold or service performed. The Company recognizes revenue from contracts with customers, at prices that are fixed or determinable as evidenced by an agreement with the customer, when the Company has met its performance obligation under the contract and it is probable that the Company will collect the amount to which it is entitled in exchange for the goods or services transferred or to be transferred to the customer. Depending on the product produced and sold or service performed and the terms of the agreement with the customer, the Company recognizes revenue either over time, in the case of delivery or transmission of electricity or related services or the production and storage of certain custom-made products, or at a point in time for the delivery of standardized products and other products made to the customers specifications where the terms of the contract require transfer of the completed product. Based on review of the Company’s revenue streams, the Company has not identified any contracts where the timing of revenue recognition will change as a result of the adoption of the updates in ASC 606. Provisions for sales returns, early payment terms discounts, volume-based variable pricing incentives and warranty costs are recorded as reductions to revenue at the time revenue is recognized based on customer history, historical information and current trends.

In addition to recognizing revenue from contracts with customers under ASC 606, the Company also records adjustments to Electric segment revenues for amounts subject to future collection or refund under alternative revenue programs (ARPs) as defined in ASC Topic 980, Regulated Operations (ASC 980). The ARP revenue adjustments are recorded on the basis of recoverable costs incurred and returns earned under rate riders on a separate line on the face of the Company’s consolidated statements of income as they do not meet the criteria to be classified as revenue from contracts with customers.

Electric Segment Revenues—In the Electric segment, the Company recognizes revenue in two categories: (1) revenues from contracts with customers and (2) adjustments to revenues for amounts collectible or refundable under ARPs.

Most Electric segment revenues are earned from the generation, transmission and sale of electricity to retail customers at rates approved by regulatory commissions in the states where Otter Tail Power Company (OTP) provides service. OTP also earns revenue from the transmission of electricity for others over the transmission assets it owns separately or jointly with other transmission service providers under rate tariffs established by the independent transmission system operator and approved by the Federal Energy Regulatory Commission (FERC). A third source of revenue for OTP comes from the generation and sale of electricity to wholesale customers at contract or market rates. Revenues from all these sources meet the criteria to be classified as revenue from contracts with customers and are recognized over time as energy is delivered or transmitted. Revenue is recognized based on the metered quantity of electricity delivered or transmitted at the applicable rates. For electricity delivered and consumed after a meter is read but prior to the end of the reporting period, OTP records revenue and an unbilled receivable based on estimates of the kilowatt-hours (kwh) of energy delivered to the customer.

ARPs provide for adjustments to rates outside of a general rate case proceeding, usually as a surcharge applied to future billings typically through the use of rate riders subject to periodic adjustments, to encourage or incentivize investments in certain areas such as conservation, renewable energy, pollution reduction or control, improved infrastructure of the transmission grid or other programs that provide benefits to the general public under public policy, laws or regulations. ARP riders generally provide for the recovery of specified costs and investments and include an incentive component to provide the regulated utility with a return on amounts invested. OTP currently is recovering costs and earning incentives or returns on investments subject to recovery under several ARP rate riders, including:

|

● |

In Minnesota: Transmission Cost Recovery (TCR), Environmental Cost Recovery (ECR), Renewable Resource Adjustment (RRA) and Conservation Improvement Program (CIP) riders. |

|

● |

In North Dakota: TCR, ECR and RRA riders |

|

● |

In South Dakota: TCR, ECR and Energy Efficiency Plan (conservation) riders. |

OTP accrues ARP revenue on the basis of costs incurred, investments made and returns on those investments that qualify for recovery through established riders. Amounts billed under riders in effect at the time of the billing are included in revenues from contracts with customers. Amounts accrued and subject to future recovery, or amounts billed that are subject to refund, through future rider rate updates and adjustments are reported as ARP revenue adjustments on a separate line in the revenue section of the Company’s consolidated statement of income. See table in note 3 for total revenues billed and accrued under ARP riders for the three-month periods ended March 31, 2018 and 2017.

Manufacturing Segment Revenues—Companies in the Manufacturing segment, BTD Manufacturing, Inc. (BTD) and T.O. Plastics, Inc. (T.O. Plastics), earn revenue predominantly from the production and delivery of custom-made or standardized parts to customers across several industries. BTD also earns revenue from the production and sale of tools and dies to other manufacturers. For the production and delivery of standardized products and other products made to the customers specifications where the terms of the contract require transfer of the completed product, the operating company has met its performance obligation and recognizes revenue at the point in time when the product is shipped and adjusts the revenue for volume rebate variable pricing considerations the company expects the customer will earn and applicable early payment discounts the company expects the customer will take. For revenue recognized on products when shipped, the operating companies have no further obligation to provide services related to such product. The shipping terms used in these instances are FOB shipping point.

Plastics Segment Revenues—Companies in our Plastics segment earn revenue predominantly from the sale and delivery of standardized polyvinyl-chloride (PVC) pipe products produced at their manufacturing facilities. Revenue from the sale of these products is recognized at the point in time when the product is shipped based on prices agreed to in a purchase order. Billed amounts of revenue recognized are adjusted for volume rebate variable pricing considerations the operating company expects the customer will earn and applicable early payment discounts the company expects the customer will take. For revenue recognized on shipped products, there is no further obligation to provide services related to such product. The shipping terms used in these instances are FOB shipping point. The Plastics segment has one customer for which it produces and stores a product made to the customer’s specifications and design under a build and hold agreement. For sales to this customer, the operating company recognizes revenue as the custom-made product is produced, adjusting the amount of revenue for volume rebate variable pricing considerations the operating company expects the customer will earn and applicable early payment discounts the company expects the customer will take. Ownership of the pipe transfers to the customer prior to delivery and the operating company is paid a negotiated fee for storage of the pipe. Revenue for storage of the pipe is also recognized over time as the pipe is stored.

See operating revenue table in note 2 to consolidated financial statements for a disaggregation of the Company’s revenues by business segment for the three-month periods ended March 31, 2018 and 2017.

Agreements Subject to Legally Enforceable Netting Arrangements

OTP has certain derivative contracts that are designated as normal purchases and carried at historical cost in the accompanying balance sheet. Individual counterparty exposures for these contracts can be offset according to legally enforceable netting arrangements. The Company does not offset assets and liabilities under legally enforceable netting arrangements on the face of its consolidated balance sheet.

Fair Value Measurements

The Company follows ASC Topic 820, Fair Value Measurements and Disclosures (ASC 820), for recurring fair value measurements. ASC 820 provides a single definition of fair value, requires enhanced disclosures about assets and liabilities measured at fair value and establishes a hierarchical framework for disclosing the observability of the inputs utilized in measuring assets and liabilities at fair value. The three levels defined by the hierarchy and examples of each level are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities as of the reported date. The types of assets and liabilities included in Level 1 are highly liquid and actively traded instruments with quoted prices, such as equities listed by the New York Stock Exchange and commodity derivative contracts listed on the New York Mercantile Exchange.

Level 2 – Pricing inputs are other than quoted prices in active markets but are either directly or indirectly observable as of the reported date. The types of assets and liabilities included in Level 2 are typically either comparable to actively traded securities or contracts, such as treasury securities with pricing interpolated from recent trades of similar securities, or priced with models using highly observable inputs, such as commodity options priced using observable forward prices and volatilities.

Level 3 – Significant inputs to pricing have little or no observability as of the reporting date. The types of assets and liabilities included in Level 3 are those with inputs requiring significant management judgment or estimation and may include complex and subjective models and forecasts.

The following tables present, for each of the hierarchy levels, the Company’s assets and liabilities that are measured at fair value on a recurring basis as of March 31, 2018 and December 31, 2017:

|

March 31, 2018 (in thousands) |

Level 1 |

Level 2 |

Level 3 |

|||||||||

|

Assets: |

||||||||||||

|

Investments: |

||||||||||||

|

Equity Funds – Held by Captive Insurance Company |

$ | 1,220 | ||||||||||

|

Corporate Debt Securities – Held by Captive Insurance Company |

$ | 5,341 | ||||||||||

|

Government-Backed and Government-Sponsored Enterprises’ Debt Securities – Held by Captive Insurance Company |

1,779 | |||||||||||

|

Other Assets: |

||||||||||||

|

Money Market and Mutual Funds – Nonqualified Retirement Savings Plan |

870 | |||||||||||

|

Total Assets |

$ | 2,090 | $ | 7,120 | ||||||||

|

December 31, 2017 (in thousands) |

Level 1 |

Level 2 |

Level 3 |

|||||||||

|

Assets: |

||||||||||||

|

Investments: |

||||||||||||

|

Equity Funds – Held by Captive Insurance Company |

$ | 1,285 | ||||||||||

|

Corporate Debt Securities – Held by Captive Insurance Company |

$ | 5,373 | ||||||||||

|

Government-Backed and Government-Sponsored Enterprises’ Debt Securities – Held by Captive Insurance Company |

1,787 | |||||||||||

|

Other Assets: |

||||||||||||

|

Money Market and Mutual Funds – Nonqualified Retirement Savings Plan |

823 | |||||||||||

|

Total Assets |

$ | 2,108 | $ | 7,160 | ||||||||

The valuation techniques and inputs used for the Level 2 fair value measurements in the table above are as follows:

Government-Backed and Government-Sponsored Enterprises’ and Corporate Debt Securities Held by the Company’s Captive Insurance Company – Fair values are determined on the basis of valuations provided by a third-party pricing service which utilizes industry accepted valuation models and observable market inputs to determine valuation. Some valuations or model inputs used by the pricing service may be based on broker quotes.

Coyote Station Lignite Supply Agreement – Variable Interest Entity—In October 2012 the Coyote Station owners, including OTP, entered into a lignite sales agreement (LSA) with Coyote Creek Mining Company, L.L.C. (CCMC), a subsidiary of The North American Coal Corporation, for the purchase of lignite coal to meet the coal supply requirements of Coyote Station for the period beginning in May 2016 and ending in December 2040. The price per ton paid by the Coyote Station owners under the LSA reflects the cost of production, along with an agreed profit and capital charge. CCMC was formed for the purpose of mining coal to meet the coal fuel supply requirements of Coyote Station from May 2016 through December 2040 and, based on the terms of the LSA, is considered a variable interest entity (VIE) due to the transfer of all operating and economic risk to the Coyote Station owners, as the agreement is structured so that the price of the coal would cover all costs of operations as well as future reclamation costs. The Coyote Station owners are also providing a guarantee of the value of the assets of CCMC as they would be required to buy certain assets at book value should they terminate the contract prior to the end of the contract term and are providing a guarantee of the value of the equity of CCMC in that they are required to buy the entity at the end of the contract term at equity value. Under current accounting standards, the primary beneficiary of a VIE is required to include the assets, liabilities, results of operations and cash flows of the VIE in its consolidated financial statements. No single owner of Coyote Station owns a majority interest in Coyote Station and none, individually, has the power to direct the activities that most significantly impact CCMC. Therefore, none of the owners individually, including OTP, is considered a primary beneficiary of the VIE and the Company is not required to include CCMC in its consolidated financial statements.

If the LSA terminates prior to the expiration of its term or the production period terminates prior to December 31, 2040 and the Coyote Station owners purchase all of the outstanding membership interests of CCMC as required by the LSA, the owners will satisfy, or (if permitted by CCMC’s applicable lender) assume, all of CCMC’s obligations owed to CCMC’s lenders under its loans and leases. The Coyote Station owners have limited rights to assign their rights and obligations under the LSA without the consent of CCMC’s lenders during any period in which CCMC’s obligations to its lenders remain outstanding. In the event the contract is terminated because regulations or legislation render the burning of coal cost prohibitive and the assets worthless, OTP’s maximum exposure to loss as a result of its involvement with CCMC as of March 31, 2018 could be as high as $56.5 million, OTP’s 35% share of unrecovered costs.

Inventories

Inventories, valued at the lower of cost or net realizable value, consist of the following:

|

March 31, |

December 31, |

|||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Finished Goods |

$ | 25,341 | $ | 26,605 | ||||

|

Work in Process |

17,224 | 14,222 | ||||||

|

Raw Material, Fuel and Supplies |

45,434 | 47,207 | ||||||

|

Total Inventories |

$ | 87,999 | $ | 88,034 | ||||

Goodwill and Other Intangible Assets

An assessment of the carrying amounts of goodwill of the Company’s operating units as of December 31, 2017 indicated the fair values are substantially in excess of their respective book values and not impaired.

The following table indicates there were no changes to goodwill by business segment during the first three months of 2018:

|

(in thousands) |

Gross Balance December 31, 2017 |

Accumulated Impairments |

Balance (net of impairments) December 31, 2017 |

Adjustments to Goodwill in 2018 |

Balance (net of impairments) March 31, 2018 |

|||||||||||||||

|

Manufacturing |

$ | 18,270 | $ | -- | $ | 18,270 | $ | -- | $ | 18,270 | ||||||||||

|

Plastics |

19,302 | -- | 19,302 | -- | 19,302 | |||||||||||||||

|

Total |

$ | 37,572 | $ | -- | $ | 37,572 | $ | -- | $ | 37,572 | ||||||||||

Intangible assets with finite lives are amortized over their estimated useful lives and reviewed for impairment in accordance with requirements under ASC Topic 360-10-35, Property, Plant, and Equipment—Overall—Subsequent Measurement.

The following table summarizes the components of the Company’s intangible assets at March 31, 2018 and December 31, 2017:

|

March 31, 2018 (in thousands) |

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

Remaining Amortization Periods (months) |

|||||||||||||

|

Amortizable Intangible Assets: |

|||||||||||||||||

|

Customer Relationships |

$ | 22,491 | $ | 9,277 | $ | 13,214 | 21 | - | 209 | ||||||||

|

Covenant not to Compete |

590 | 508 | 82 | 5 | |||||||||||||

|

Other |

154 | 30 | 124 | 29 | |||||||||||||

|

Total |

$ | 23,235 | $ | 9,815 | $ | 13,420 | |||||||||||

|

December 31, 2017 (in thousands) |

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

Remaining Amortization Periods (months) |

|||||||||||||

|

Amortizable Intangible Assets: |

|||||||||||||||||

|

Customer Relationships |

$ | 22,491 | $ | 8,994 | $ | 13,497 | 24 | - | 212 | ||||||||

|

Covenant not to Compete |

590 | 459 | 131 | 8 | |||||||||||||

|

Other |

154 | 17 | 137 | 32 | |||||||||||||

|

Total |

$ | 23,235 | $ | 9,470 | $ | 13,765 | |||||||||||

The amortization expense for these intangible assets was:

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Amortization Expense – Intangible Assets |

$ | 345 | $ | 332 | ||||

The estimated annual amortization expense for these intangible assets for the next five years is:

|

(in thousands) |

2018 |

2019 |

2020 |

2021 |

2022 |

|||||||||||||||

|

Estimated Amortization Expense – Intangible Assets |

$ | 1,315 | $ | 1,184 | $ | 1,133 | $ | 1,099 | $ | 1,099 | ||||||||||

Supplemental Disclosures of Cash Flow Information

|

As of March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Noncash Investing Activities: |

||||||||

|

Transactions Related to Capital Additions not Settled in Cash |

$ | 10,451 | $ | 10,811 | ||||

New Accounting Standards Adopted

ASU 2014-09—In May 2014 the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). The Company adopted the updates in ASC 606 effective January 1, 2018 on a modified retrospective basis. See disclosures above under Revenue Recognition.

ASU 2016-01—In January 2016 the FASB issued ASU No. 2016-01, Financial Instruments—Overall (Subtopic 825-10) (ASU 2016-01). The amendments in ASU 2016-01 address certain aspects of recognition, measurement, presentation, and disclosure of financial instruments and require equity investments (except those accounted for under the equity method of accounting or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income. For the Company, the amendments in ASU 2016-01are effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The Company adopted the updates in ASU 2016-01 in the first quarter of 2018, which resulted in changes in the fair value of equity instruments held as investments by the Company’s captive insurance company being classified in net income. The fair value of equity instruments held by the Company’s captive insurance company on March 31, 2018 were $1,220,000 and the amount of unrealized gains on those investments recorded in net income in the first quarter of 2018 was $87,000.

ASU 2017-07—In March 2017 the FASB issued ASU No. 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost (ASU 2017-07), with the intent of improving the presentation of net periodic pension cost and net periodic postretirement benefit cost. ASC Topic 715, Compensation—Retirement Benefits (ASC 715), does not prescribe where the amount of net benefit cost should be presented in an employer’s income statement and does not require entities to disclose by line item the amount of net benefit cost that is included in the income statement or capitalized in assets. The amendments in ASU 2017-07 require that an employer report the service cost component of periodic benefit costs in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period, which the Company has provided in the electric operation and maintenance and other nonelectric expense lines on its income statement. The other components of net benefit cost as defined in ASC 715 are required to be presented in the income statement separately from the service cost component and outside a subtotal of income from operations. The Company has provided the amount of the non-service cost components of net periodic postretirement benefit costs in a separate line below interest expense on the face of its consolidated income statement. The amendments in ASU 2017-07 also allow only the service cost component to be eligible for capitalization when applicable (for example, as a cost of internally manufactured inventory or a self-constructed asset). The amendments in ASU 2017-07 are effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods. The amendments have been applied retrospectively for the presentation of the service cost component and the other components of net periodic pension cost and net periodic postretirement benefit cost in the Company’s consolidated income statements and prospectively, on and after the effective date, for the capitalization of the service cost component of net periodic pension cost and net periodic postretirement benefit cost in assets.

The majority of the Company’s benefit costs to which the amendments in ASU 2017-07 apply are related to benefit plans in place at OTP, the Company’s regulated provider of electric utility services. The amendments in ASU 2017-07 deviate significantly from current prescribed ratemaking and regulatory accounting treatment of postretirement benefit costs applicable to OTP, which require the capitalization of a portion of all the components of net periodic benefit costs be included in rate base additions and provide for rate recovery of the non-capitalized portion of all the components of net periodic pension costs as recoverable operating expenses. The Company has assessed the impact adoption of the amendments in ASU 2017-07 will have on its consolidated financial statements, financial position and results of operations and OTP has established regulatory assets to reflect the effect of the required regulatory accounting treatment of the non-service cost components that cannot be capitalized to plant in service under ASU 2017-07.

The Company’s non-service cost components of net periodic post-retirement benefit costs that were capitalized to plant in service in 2017 that would have been recorded as regulatory assets if the amendments in ASU 2017-07 were applicable in 2017 were $0.8 million. The Company’s non-service costs components of net periodic postretirement benefit costs included in operating expense in 2017 and 2016 that will be reported in other income and deductions in the Company's 2018 annual report on Form 10-K after adoption of ASU 2017-07 were $5.6 million for 2017 and $5.1 million for 2016. Additional information on the allocation of postretirement benefit costs for the three-month periods ended March 31, 2018 and 2017 is provided in note 10 to these consolidated financial statements for the Company’s major benefit programs presented.

New Accounting Standards Pending Adoption

ASU 2016-02—In February 2016 the FASB issued ASU No. 2016-02, Leases (Topic 842) (ASU 2016-02). ASU 2016-02 is a comprehensive amendment of the ASC, creating Topic 842, which will supersede the current requirements under ASC Topic 840 on leases and require the recognition of lease assets and lease liabilities on the balance sheet and the disclosure of key information about leasing arrangements. Topic 842 affects any entity that enters into a lease, with some specified scope exemptions. The main difference between previous Generally Accepted Accounting Principles in the United States (GAAP) and Topic 842 is the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous GAAP. Topic 842 retains a distinction between finance leases and operating leases. The classification criteria for distinguishing between finance leases and operating leases are substantially similar to the classification criteria for distinguishing between capital leases and operating leases in the previous guidance. Topic 842 also requires qualitative and specific quantitative disclosures by lessees and lessors to meet the objective of enabling users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. The amendments in ASU 2016-02 are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early application of the amendments in ASU 2016-02 is permitted. The Company has developed a list of all current leases outstanding and continues to review ASU 2016-02, identifying key impacts to its businesses to determine areas where the amendments in ASU 2016-02 will be applicable and is evaluating transition options. The Company does not currently plan to apply the amendments in ASU 2016-02 to its consolidated financial statements prior to 2019.

ASU 2017-04—In January 2017 the FASB issued ASU No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (ASU 2017-04), which simplifies how an entity is required to test goodwill for impairment by eliminating Step 2 from the goodwill impairment test. Step 2 measures a goodwill impairment loss by comparing the implied fair value of a reporting unit’s goodwill with the carrying amount of that goodwill. In computing the implied fair value of goodwill under Step 2, an entity must perform procedures to determine the fair value at the impairment testing date of its assets and liabilities (including unrecognized assets and liabilities) following the procedure that would be required in determining the fair value of assets acquired and liabilities assumed in a business combination. Under the amendments in ASU 2017-04, an entity will perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. An entity will recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value; however, the loss recognized will not exceed the total amount of goodwill allocated to that reporting unit. Additionally, an entity will consider income tax effects from any tax-deductible goodwill on the carrying amount of the reporting unit when measuring the goodwill impairment loss, if applicable.

The amendments in ASU 2017-04 modify the concept of impairment from the condition that exists when the carrying amount of goodwill exceeds its implied fair value to the condition that exists when the carrying amount of a reporting unit exceeds its fair value. An entity no longer will determine goodwill impairment by calculating the implied fair value of goodwill by assigning the fair value of a reporting unit to all of its assets and liabilities as if that reporting unit had been acquired in a business combination. Because these amendments eliminate Step 2 from the goodwill impairment test, they should reduce the cost and complexity of evaluating goodwill for impairment. The amendments in ASU 2017-04 are effective for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017.

ASU 2018-02—In February 2018 the FASB issued ASU No. 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (ASU 2018-02). The amendments in ASU 2018-02, which are narrow in scope, allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act. Consequently, the amendments eliminate the stranded tax effects resulting from the 2017 Tax Cuts and Jobs Act (TCJA) and will improve the usefulness of information reported to financial statement users. The amendments in ASU 2018-02 also require certain disclosures about stranded tax effects and are effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption of the amendments in ASU 2018-02 is permitted. The amendments in ASU 2018-02 can be applied either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the TCJA is recognized. The Company does not plan to adopt the amendments in ASU 2018-02 until the first quarter of 2019. On adoption, the Company will reclassify the $784,000 of income tax effects of the TCJA on the gross deferred tax amounts at the date of enactment of the TCJA related to items remaining in accumulated other comprehensive income from other comprehensive income to retained earnings so that the remaining gross deferred tax amounts related to items in other comprehensive income will reflect current effective tax rates.

2. Segment Information

Segment Information

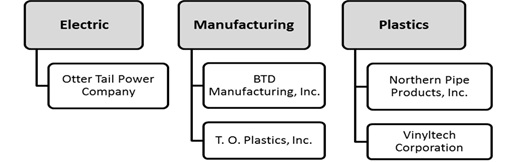

The accounting policies of the segments are described under note 1 – Summary of Significant Accounting Policies. The Company's businesses have been classified into three segments to be consistent with its business strategy and the reporting and review process used by the Company’s chief operating decision makers. These businesses sell products and provide services to customers primarily in the United States. The Company’s business structure currently includes the following three segments: Electric, Manufacturing and Plastics. The chart below indicates the companies included in each segment.

Electric includes the production, transmission, distribution and sale of electric energy in Minnesota, North Dakota and South Dakota by OTP. In addition, OTP is a participant in the Midcontinent Independent System Operator, Inc. (MISO) markets. OTP’s operations have been the Company’s primary business since 1907.

Manufacturing consists of businesses in the following manufacturing activities: contract machining, metal parts stamping, fabrication and painting, and production of plastic thermoformed horticultural containers, life science and industrial packaging, and material handling components. These businesses have manufacturing facilities in Georgia, Illinois and Minnesota and sell products primarily in the United States.

Plastics consists of businesses producing PVC pipe at plants in North Dakota and Arizona. The PVC pipe is sold primarily in the upper Midwest and Southwest regions of the United States.

OTP is a wholly owned subsidiary of the Company. All of the Company’s other businesses are owned by its wholly owned subsidiary, Varistar Corporation (Varistar). The Company’s Corporate operating costs include items such as corporate staff and overhead costs, the results of the Company’s captive insurance company and other items excluded from the measurement of operating segment performance. Corporate assets consist primarily of cash, prepaid expenses, investments and fixed assets. Corporate is not an operating segment. Rather, it is added to operating segment totals to reconcile to totals on the Company’s consolidated financial statements.

No single customer accounted for over 10% of the Company’s consolidated revenues in 2017. The Electric segment has one customer that provided 11.7% of 2017 Electric segment revenues. The Manufacturing segment has one customer that manufactures and sells recreational vehicles that provided 24.3% of 2017 Manufacturing segment revenues and one customer that manufactures and sells lawn and garden equipment that provided 12.0% of 2017 Manufacturing segment revenues. The Plastics segment has two customers that individually provided 20.6% and 17.8% of 2017 Plastics segment revenues. The loss of any one of these customers would have a significant negative impact on the financial position and results of operations of the respective business segment and the Company.

All of the Company’s long-lived assets are within the United States and 98.3% and 98.4% of its operating revenues for the respective three-month periods ended March 31, 2018 and 2017 came from sales within the United States.

The Company evaluates the performance of its business segments and allocates resources to them based on earnings contribution and return on total invested capital. Information for the business segments for the three months ended March 31, 2018 and 2017 and total assets by business segment as of March 31, 2018 and December 31, 2017 are presented in the following tables:

Operating Revenue

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Electric Segment: |

||||||||

|

Retail Sales Revenue from Contracts with Customers |

$ | 109,180 | $ | 106,454 | ||||

|

Changes in Accrued ARP Revenues |

(875 | ) | (1,239 | ) | ||||

|

Total Retail Sales Revenue |

108,305 | 105,215 | ||||||

|

Wholesale Revenues – Company Generation |

1,015 | 867 | ||||||

|

Other Revenues |

13,645 | 12,469 | ||||||

|

Total Electric Segment Revenues |

$ | 122,965 | $ | 118,551 | ||||

|

Manufacturing Segment: |

||||||||

| Metal Parts and Tooling | $ | 56,927 | $ | 48,078 | ||||

| Plastic Products | 10,235 | 9,552 | ||||||

| Other | 1,500 | 787 | ||||||

| Total Manufacturing Segment Revenues | $ | 68,662 | $ | 58,417 | ||||

|

Plastics Segment – Sale of PVC Pipe Products |

$ | 49,653 | $ | 37,157 | ||||

|

Intersegment Eliminations |

$ | (14 | ) | $ | (8 | ) | ||

|

Total |

$ | 241,266 | $ | 214,117 | ||||

Interest Charges

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Electric |

$ | 6,390 | $ | 6,386 | ||||

|

Manufacturing |

554 | 554 | ||||||

|

Plastics |

150 | 153 | ||||||

|

Corporate and Intersegment Eliminations |

278 | 369 | ||||||

|

Total |

$ | 7,372 | $ | 7,462 | ||||

Income Taxes

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Electric |

$ | 2,098 | $ | 6,062 | ||||

|

Manufacturing |

1,223 | 1,055 | ||||||

|

Plastics |

2,414 | 1,390 | ||||||

|

Corporate |

(1,941 | ) | (2,144 | ) | ||||

|

Total |

$ | 3,794 | $ | 6,363 | ||||

Net Income (Loss)

|

Three Months Ended |

||||||||

|

March 31, |

||||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Electric |

$ | 16,668 | $ | 15,560 | ||||

|

Manufacturing |

4,164 | 2,172 | ||||||

|

Plastics |

6,844 | 2,437 | ||||||

|

Corporate |

(1,461 | ) | (640 | ) | ||||

|

Discontinued Operations |

-- | 56 | ||||||

|

Total |

$ | 26,215 | $ | 19,585 | ||||

Identifiable Assets

|

March 31, |

December 31, |

|||||||

|

(in thousands) |

2018 |

2017 |

||||||

|

Electric |

$ | 1,686,255 | $ | 1,690,224 | ||||

|

Manufacturing |

180,319 | 167,023 | ||||||

|

Plastics |

97,953 | 87,230 | ||||||

|

Corporate |

42,891 | 59,801 | ||||||

|

Total |

$ | 2,007,418 | $ | 2,004,278 | ||||

3. Rate and Regulatory Matters

Below are descriptions of OTP’s major capital expenditure projects that have had, or will have, a significant impact on OTP’s revenue requirements, rates and alternative revenue recovery mechanisms, followed by summaries of specific electric rate or rider proceedings with the Minnesota Public Utilities Commission (MPUC), the North Dakota Public Service Commission (NDPSC), the South Dakota Public Utilities Commission (SDPUC) and the FERC, impacting OTP’s revenues in 2018 and 2017.

Major Capital Expenditure Projects

Big Stone South–Ellendale Multi-Value Transmission Project (MVP)—This is a 345-kiloVolt (kV) transmission line that will extend 163 miles between a substation near Big Stone City, South Dakota and a substation near Ellendale, North Dakota. OTP jointly developed this project with Montana-Dakota Utilities Co., a division of MDU Resources Group, Inc., and the parties will have equal ownership interest in the transmission line portion of the project. MISO approved this project as an MVP under the MISO Open Access Transmission, Energy and Operating Reserve Markets Tariff (MISO Tariff) in December 2011. MVPs are designed to enable the region to comply with energy policy mandates and to address reliability and economic issues affecting multiple areas within the MISO region. The cost allocation is designed to ensure the costs of transmission projects with regional benefits are properly assigned to those who benefit. Construction began on this line in the second quarter of 2016 and is expected to be completed in 2019. OTP’s capitalized costs on this project as of March 31, 2018 were approximately $96.5 million, which includes assets that are 100% owned by OTP.

Big Stone South–Brookings MVP—This 345-kV transmission line extends approximately 70 miles between a substation near Big Stone City, South Dakota and the Brookings County Substation near Brookings, South Dakota. OTP and Northern States Power–Minnesota, a subsidiary of Xcel Energy Inc., jointly developed this project and the parties have equal ownership interest in the transmission line portion of the project. MISO approved this project as an MVP under the MISO Tariff in December 2011. Construction began on this line in the third quarter of 2015 and the line was energized on September 8, 2017. OTP’s capitalized costs on this project as of March 31, 2018 were approximately $72.4 million, which includes assets that are 100% owned by OTP.

Recovery of OTP’s major transmission investments is through the MISO Tariff (several as MVPs) and, currently, Minnesota, North Dakota and South Dakota Transmission Cost Recovery (TCR) Riders.

Minnesota

General Rates—The MPUC rendered its final decision in OTP’s 2016 general rate case in March 2017 and issued its written order on May 1, 2017. Pursuant to the order, OTP’s allowed rate of return on rate base decreased from 8.61% to 7.5056% and its allowed rate of return on equity decreased from 10.74% to 9.41%.

The MPUC’s order also included: (1) the determination that all costs (including FERC allocated costs and revenues) of the Big Stone South–Brookings and Big Stone South–Ellendale MVPs will be included in the Minnesota TCR rider and jurisdictionally allocated to OTP’s Minnesota customers, and (2) approval of OTP’s proposal to transition rate base, expenses and revenues from ECR and TCR riders to base rate recovery, with the transition occurring when final rates are implemented. The rate base balances, expense levels and revenue levels existing in the riders at the time of implementation of final rates will be used to establish the amounts transitioned to base rates. Certain MISO expenses and revenues will remain in the TCR rider to allow for the ongoing refund or recovery of these variable revenues and costs.

OTP accrued interim and rider rate refunds until final rates became effective. The final interim rate refund, including interest, of $9.0 million was applied as a credit to Minnesota customers’ electric bills beginning November 17, 2017. In addition to the interim rate refund, OTP will refund the difference between (1) amounts collected under its Minnesota ECR and TCR riders based on the return on equity (ROE) approved in its most recent rider update and (2) amounts that would have been collected based on the lower 9.41% ROE approved in its 2016 general rate case going back to April 16, 2016, the date interim rates were implemented. As of October 31, 2017, the revenues collected under the Minnesota ECR and TCR riders subject to refund due to the lower ROE rate and other adjustments were $0.9 million and $1.4 million, respectively. These amounts are being refunded to Minnesota customers over a 12-month period through reductions in the Minnesota ECR and TCR rider rates in effect November 1, 2017, as approved by the MPUC. The TCR rate is provisional and subject to revision under a separate docket.

Minnesota Conservation Improvement Programs (MNCIP)—OTP recovers conservation related costs not included in base rates under the MNCIP through the use of an annual recovery mechanism approved by the MPUC. On May 25, 2016 the MPUC adopted the Minnesota Department of Commerce’s (MNDOC’s) proposed changes to the MNCIP financial incentive. The model provides utilities an incentive of 13.5% of 2017 net benefits, 12% of 2018 net benefits and 10% of 2019 net benefits, assuming the utility achieves 1.7% savings compared to retail sales. The financial incentive is also limited to 40% of 2017 MNCIP spending, 35% of 2018 spending and 30% of 2019 spending.

Based on results from the 2017 MNCIP program year, OTP recognized a financial incentive of $2.6 million in 2017. The 2017 program resulted in an approximate 10% decrease in energy savings compared to 2016 program results. OTP requested approval for recovery of its 2017 MNCIP program costs not included in base rates, a $2.6 million financial incentive and an update to the MNCIP surcharge from the MPUC on March 31, 2018.

Transmission Cost Recovery Rider—The Minnesota Public Utilities Act provides a mechanism for automatic adjustment outside of a general rate proceeding to recover the costs of new transmission facilities that meet certain criteria, plus a return on investment at the level approved in a utility’s last general rate case. Additionally, following approval of the rate schedule, the MPUC may approve annual rate adjustments filed pursuant to the rate schedule.

In OTP’s 2016 general rate case order issued on May 1, 2017, the MPUC ordered OTP to include, in the TCR rider retail rate base, Minnesota’s jurisdictional share of OTP’s investment in the Big Stone South–Brookings and Big Stone South–Ellendale MVP Projects and all revenues received from other utilities under MISO’s tariffed rates as a credit in its TCR revenue requirement calculations. In doing so, the MPUC’s order diverts interstate wholesale revenues that have been approved by the FERC to offset FERC-approved expenses, effectively reducing OTP’s recovery of those FERC-approved expense levels. The MPUC-ordered treatment will result in the projects being treated as retail investments for Minnesota retail ratemaking purposes. Because the FERC’s revenue requirements and authorized returns will vary from the MPUC revenue requirements and authorized returns for the project investments over the lives of the projects, the impact of this decision will vary over time and be dependent on the differences between the revenue requirements and returns in the two jurisdictions at any given time. On August 18, 2017 OTP filed an appeal of the MPUC order with the Minnesota Court of Appeals to contest the portion of the order requiring OTP to jurisdictionally allocate costs of the FERC MVP transmission projects in the TCR rider. On March 22, 2018 oral arguments were made before the Minnesota Court of Appeals. A decision is anticipated by the end of the second quarter 2018. OTP believes the MPUC-ordered treatment conflicts with federal authority over interstate transmission of electricity in and with FERC electric transmission rates as set forth in the Federal Power Act of 1935, as amended (Federal Power Act).

Environmental Cost Recovery Rider— OTP had an ECR rider for recovery of OTP’s Minnesota jurisdictional share of the revenue requirements of its investment in the Big Stone Plant Air Quality Control System (AQCS). The ECR rider provided for a return on the project’s construction work in progress (CWIP) balance at the level approved in OTP’s 2010 general rate case. In its 2016 general rate case order, the MPUC approved OTP’s proposal to transition eligible rate base and expense recovery from the ECR rider to base rate recovery, effective with implementation of final rates in November 2017.

Renewable Resource Adjustment— Effective November 1, 2017, with the implementation of final rates in Minnesota, new rates were put into effect for the Minnesota RRA rider to address recovery of federal Production Tax Credits (PTCs) expiring on OTP’s wind farms in 2017 and 2018.

North Dakota

General Rates—On November 2, 2017 OTP filed a request with the NDPSC for a rate review and an effective increase in annual revenues from non-fuel base rates of $13.1 million or 8.72%. The $13.1 million increase is net of reductions in North Dakota RRA, TCR and ECR rider revenues that will result from a lower allowed rate of return on equity and changes in allocation factors in the general rate case. In the request, OTP proposed an allowed return on rate base of 7.97% and an allowed rate of return on equity of 10.30%. On December 20, 2017 the NDPSC approved OTP’s request for interim rates to increase annual revenue collections by $12.8 million, effective January 1, 2018. OTP used the same rate of return on equity in the calculation of interim rates as the rate of return on equity used in its 2018 test-year rate request. In response to the reduction in the federal corporate tax rate under the TCJA, the NDPSC issued an order on February 27, 2018 reducing OTP’s annual revenue requirement for interim rates by $4.5 million to $8.3 million, effective March 1, 2018. On March 23, 2018 OTP made a supplemental filing to its initial request for a rate review, reducing its request for an annual revenue increase from $13.1 million to $7.1 million, a 4.8% annual increase. The $6.0 million decrease includes $4.8 million related to tax reform and $1.2 million related to other updates. OTP will continue to address the impacts of the TJCA in its current general rate case.

OTP’s most recently approved general rate increase in North Dakota of $3.6 million, or approximately 3.0%, was granted by the NDPSC in an order issued on November 25, 2009 and effective December 2009. Pursuant to the order, OTP’s allowed rate of return on rate base was set at 8.62%, and its allowed rate of return on equity was set at 10.75%.

Renewable Resource Adjustment—OTP has a North Dakota Renewable Resource Adjustment which enables OTP to recover its North Dakota jurisdictional share of investments in renewable energy facilities. This rider allows OTP to recover costs associated with new renewable energy projects as they are completed, along with a return on investment.

Transmission Cost Recovery Rider—North Dakota law provides a mechanism for automatic adjustment outside of a general rate proceeding to recover jurisdictional capital and operating costs incurred by a public utility for new or modified electric transmission facilities. For qualifying projects, the law authorizes a current return on CWIP and a return on investment at the level approved in the utility's most recent general rate case.

Environmental Cost Recovery Rider—OTP has an ECR rider in North Dakota to recover its North Dakota jurisdictional share of the revenue requirements associated with its investment in the Big Stone Plant AQCS and Hoot Lake Plant Mercury and Air Toxic Standards (MATS) projects. The ECR rider provides for a return on investment at the level approved in OTP’s most recent general rate case and for recovery of OTP’s North Dakota share of reagent and emission allowance costs.

South Dakota

General Rates—On April 20, 2018 OTP filed a request with the SDPUC to increase non-fuel rates in South Dakota by approximately $3.3 million annually, or 10.1%, as the first step in a two-step request. OTP requested an interim rate increase effective May 21, 2018 while the SDPUC considers OTP’s overall request. The SDPUC is scheduled to review the application and act on the request for interim rates on May 15, 2018. The full effects of the TCJA on South Dakota revenue requirements will be addressed in OTP’s current general rate case and incorporated into final rates at the conclusion of that case. The second step in the request is an additional 1.7% increase to be effective January 1, 2020 to recover costs for a wind generation facility scheduled to be in service by the end of 2019.

OTP’s most recently approved general rate increase in South Dakota of approximately $643,000 or approximately 2.32% was granted by the SDPUC in an order issued on April 21, 2011 and effective with bills rendered on and after June 1, 2011. Pursuant to the order, OTP’s allowed rate of return on rate base was set at 8.50%.

Transmission Cost Recovery Rider—South Dakota law provides a mechanism for automatic adjustment outside of a general rate proceeding to recover jurisdictional capital and operating costs incurred by a public utility for new or modified electric transmission facilities.

Environmental Cost Recovery Rider—OTP has an ECR rider in South Dakota to recover its South Dakota jurisdictional share of revenue requirements associated with its investment in the Big Stone Plant AQCS and Hoot Lake Plant MATS projects.

Reagent Costs and Emission Allowances—The SDPUC has approved the recovery of reagent and emission allowance costs in OTP’s South Dakota Fuel Clause Adjustment rider.

Revenues Recorded under Rate Riders

The following table presents revenue recorded by OTP under rate riders in place in Minnesota, North Dakota and South Dakota for the three-month periods ended March 31:

|

Rate Rider (in thousands) |

2018 |

2017 |

||||||

|

Minnesota |

||||||||

|

Conservation Improvement Program Costs and Incentives1 |

$ | 2,516 | $ | 1,966 | ||||

|

Transmission Cost Recovery |

(29 | ) | 2,170 | |||||

|

Environmental Cost Recovery |

(31 | ) | 2,824 | |||||

|

Renewable Resource Recovery |

525 | -- | ||||||

|

North Dakota |

||||||||

|

Renewable Resource Adjustment |

1,967 | 1,770 | ||||||

|

Transmission Cost Recovery |

2,062 | 2,511 | ||||||

|

Environmental Cost Recovery |

1,821 | 2,488 | ||||||

|

South Dakota |

||||||||

|

Transmission Cost Recovery |

536 | 441 | ||||||

|

Environmental Cost Recovery |

520 | 597 | ||||||

|

Conservation Improvement Program Costs and Incentives |

229 | 240 | ||||||

|

Total |

$ | 10,116 | $ | 15,007 | ||||

|

1Includes MNCIP costs recovered in base rates. |

Rate Rider Updates

The following table provides summary information on the status of updates since January 1, 2016 for the rate riders described above:

|

Rate Rider |

R - Request Date A - Approval Date |

Effective Date Requested or Approved |

Annual Revenue ($000s) |

Rate |

|||

|

Minnesota |

|||||||

|

Conservation Improvement Program |

|||||||

|

2017 Incentive and Cost Recovery |

R – March 31, 2018 |

October 1, 2018 |

$ | 10,400 |

$0.00600/kwh |

||

|

2016 Incentive and Cost Recovery |

A – September 15, 2017 |

October 1, 2017 |

$ | 9,868 |

$0.00536/kwh |

||

|

2015 Incentive and Cost Recovery |

A – July 19, 2016 |

October 1, 2016 |

$ | 8,590 |

$0.00275/kwh |

||

|

Transmission Cost Recovery |

|||||||

|

2017 Rate Reset1 |

A – October 30, 2017 |

November 1, 2017 |

$ | (3,311 | ) |

Various |

|

|

2016 Annual Update |

A – July 5, 2016 |

September 1, 2016 |

$ | 4,736 |

Various |

||

|

2015 Annual Update |

A – March 9, 2016 |

April 1, 2016 |

$ | 7,203 |

Various |

||

|

Environmental Cost Recovery |

|||||||

|

2017 Rate Reset |

A – October 30, 2017 |

November 1, 2017 |

$ | (1,943 | ) |

-0.935% of base |

|

|

2016 Annual Update |

A – July 5, 2016 |

September 1, 2016 |

$ | 11,884 |

6.927% of base |

||

|

Renewable Resource Adjustment |

|||||||

|

2017 Rate Reset |

A – October 30, 2017 |

November 1, 2017 |

$ | 1,279 |

$.00049/kwh |

||

|

North Dakota |

|||||||

|

Renewable Resource Adjustment |

|||||||

|

2018 Rate Reset for effect of TCJA |

A – February 27, 2018 |

March 1, 2018 |

$ | 9,650 |

7.493% of base |

||

|

2017 Rate Reset |

A – December 20, 2017 |

January 1, 2018 |

$ | 9,989 |

7.756% of base |

||

|

2016 Annual Update |

A – March 15, 2017 |

April 1, 2017 |

$ | 9,156 |

7.005% of base |

||

|

2015 Annual Update |

A – June 22, 2016 |

July 1, 2016 |

$ | 9,262 |

7.573% of base |

||

|

Transmission Cost Recovery |

|||||||

|

2018 Rate Reset for effect of TCJA |

A – February 27, 2018 |

March 1, 2018 |

$ | 7,469 |

Various |

||

|

2017 Annual Update |

A – November 29, 2017 |

January 1, 2018 |

$ | 7,959 |

Various |

||

|

2016 Annual Update |

A – December 14, 2016 |

January 1, 2017 |

$ | 6,916 |

Various |

||

|

Environmental Cost Recovery |

|||||||

|

2018 Rate Reset for effect of TCJA |

A – February 27, 2018 |

March 1, 2018 |

$ | 7,718 |

5.593% of base |

||

|

2017 Rate Reset |

A – December 20, 2017 |

January 1, 2018 |

$ | 8,537 |

6.629% of base |

||

|

2017 Annual Update |

A – July 12, 2017 |

August 1, 2017 |

$ | 9,917 |

7.633% of base |

||

|

2016 Annual Update |

A – June 22, 2016 |

July 1, 2016 |

$ | 10,359 |

7.904% of base |

||

|

South Dakota |

|||||||

|

Transmission Cost Recovery |

|||||||

|

2017 Annual Update |

A – February 28, 2018 |

March 1, 2018 |

$ | 1,779 |

Various |

||

|

2016 Annual Update |

A – February 17, 2017 |

March 1, 2017 |

$ | 2,053 |

Various |

||

|

2015 Annual Update |

A – February 12, 2016 |

March 1, 2016 |

$ | 1,895 |

Various |

||

|

Environmental Cost Recovery |

|||||||

|

2017 Annual Update |

A – October 13, 2017 |

November 1, 2017 |

$ | 2,082 |

$0.00483/kwh |

||

|

2016 Annual Update |

A – October 26, 2016 |

November 1, 2016 |

$ | 2,238 |

$0.00536/kwh |

||

1Approved on a provisional basis in the Minnesota general rate case docket and subject to revision in a separate docket.

TCJA

The TCJA reduced the federal corporate income tax rate from 35% to 21%. Currently, all OTP rates have been developed using a 35% tax rate. The MPUC, the NDPSC, the SDPUC and the FERC have all initiated dockets or proceedings to assess the impact of the lower income tax rates under the TCJA on electric rates and develop regulatory strategies to incorporate the tax change into future rates, if warranted. The MPUC required regulated utilities providing service in Minnesota to make filings by February 15, 2018 but has not made a determination on rate treatment. The SDPUC required initial comments by February 1, 2018 and indicated that revenues collected after December 31, 2017 would be subject to refund, pending determination of the impacts of the TCJA. As described above, OTP’s pending general rate cases in North Dakota and South Dakota reflect the impact of the TCJA. OTP has accrued refund liabilities for revenues collected under rates set to recover higher levels of federal income taxes than OTP is currently incurring under the lower federal tax rates in the TCJA. The accrued refund liabilities as of March 31, 2018 related to the tax rate reduction were $1.9 million in Minnesota, $0.8 million in North Dakota and $0.5 million in South Dakota.

FERC

Wholesale power sales and transmission rates are subject to the jurisdiction of the FERC under the Federal Power Act. The FERC is an independent agency with jurisdiction over rates for wholesale electricity sales, transmission and sale of electric energy in interstate commerce, interconnection of facilities, and accounting policies and practices. Filed rates are effective after a one-day suspension period, subject to ultimate approval by the FERC.