UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

| (Mark One) | ||||||||

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

| For the fiscal year ended: December 31, 2019 | ||||||||

| or | ||||||||

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

| For the transition period from to | ||||||||

| Commission file number: | 001-34516 |

Cowen Inc.

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

27-0423711 (I.R.S. Employer Identification No.) |

599 Lexington Avenue

New York, New York 10022

(212) 845-7900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Exchange on Which Registered | ||

| Class A Common Stock, par value $0.01 per share | COWN | The Nasdaq Global Market | ||

| 7.35% Senior Notes due 2027 | COWNZ | The Nasdaq Global Market | ||

| 7.75% Senior Notes due 2033 | COWNL | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ |

Accelerated filer x |

Non-accelerated filer ¨ |

Smaller reporting company ¨ | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of Class A common stock held by non-affiliates of the registrant on June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price of the Class A common stock on the NASDAQ Global Market on that date was $488,181,217.

As of April 28, 2020 there were 27,688,071 shares of the registrant’s Class A common stock outstanding.

Explanatory Note

Cowen Inc. (the “Company”) is filing this Amendment No. 2 on Form 10-K/A to its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “Form 10-K”) to provide additional information required by Part III, because the definitive proxy statement for our 2020 Annual Meeting of Stockholders will not be filed within 120 days after the end of our 2019 fiscal year. This Amendment No. 2 on Form 10-K/A does not change the previously reported financial statements or any of the other disclosure contained in Part I or Part II. Part IV is being amended solely to add new certifications in accordance with Rule 13a-14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

DIRECTORS OF THE COMPANY

The number of directors currently serving on our Board of Directors is ten. The members of our Board of Directors are elected to serve a one-year term.

Set forth below is biographical information for each of the members of our Board of Directors. All ages are as of April 28, 2020.

Jeffrey M. Solomon. Age 54. Jeffrey Solomon is Chairman of the Board and Chief Executive Officer of the Company and Chief Executive Officer of Cowen and Company, LLC (“Cowen and Company”), and was appointed a director of Cowen in December 2011. Mr. Solomon served as President of the Company prior to his appointment as Chief Executive Officer on December 27, 2017. Mr. Solomon serves as a member of the Management Committee of Cowen. Previously, Mr. Solomon served as Cowen’s Chief Operating Officer and Head of Investment Banking at Cowen and Company. Mr. Solomon joined Ramius, Cowen’s investment management division, when it was founded in 1994 and was responsible for the development, management and oversight of a number of the investment strategies employed by Ramius. From 1991 to 1994, Mr. Solomon was at Republic New York Securities Corporation, or Republic, the brokerage affiliate of Republic National Bank, now part of the HSBC Group, where he was the firm’s Chief Administrative Officer. Prior to Republic, Mr. Solomon was in the Mergers and Acquisitions Group at Shearson Lehman Brothers. Currently, Mr. Solomon is a Director of NuGo Nutrition, the manufacturer of NuGo Nutrition Bars. Mr. Solomon is also co-chair of the Equity Capital Formation Task Force, a group composed of individuals from across the country’s startup and small-capitalization company ecosystems advocating for market structure reform to encourage job creation and growth. Mr. Solomon graduated from the University of Pennsylvania in 1988 with a B.A. in Economics. Mr. Solomon provides the board with institutional knowledge of all aspects of the Company’s businesses and, as Chief Executive Officer, he is able to provide in-depth knowledge of the Company’s business and affairs, management’s perspective on those matters and an avenue of communication between the Board and senior management.

Brett H. Barth. Age 48. Mr. Barth was elected to our Board on June 26, 2018. Mr. Barth co-founded BBR Partners in 2000 and is a Managing Partner, co-managing the firm and overseeing BBR’s investment approach and implementation. He has extensive experience vetting investment opportunities across the asset class spectrum and through a range of market environments, working with both traditional and alternative investment managers. Mr. Barth is also a member of BBR’s Executive Committee and Investment Committee. Prior to founding BBR, Mr. Barth was in the Equities Division of Goldman Sachs. Previously, he served in Goldman’s Equity Capital Markets groups in New York and Hong Kong. He began his career in Goldman Sachs’ Corporate Finance Department. Mr. Barth is a trustee of the University of Pennsylvania as well as a member of the Board of Overseers of the Graduate School of Education. He previously served as both the Chair of the Penn Fund, the University of Pennsylvania’s undergraduate annual giving program, and as the Inaugural Chair of the Undergraduate Financial Aid Leadership Council. Mr. Barth is a member of the board and executive committee of the UJA-Federation of New York, he co-chairs the Annual Campaign and he serves on the endowment’s Investment Committee. Mr. Barth was awarded the Alan C. Greenberg Young Leadership Award by UJA-Federation of New York, Wall Street & Financial Services Division. Mr. Barth graduated summa cum laude with concentrations in Finance and Accounting from the Wharton School of the University of Pennsylvania. Mr. Barth provides the Board with extensive investment and wealth management expertise.

| - 2 - |

Katherine E. Dietze. Age 62. Ms. Dietze was appointed to our Board in June 2011 upon the completion of Cowen’s acquisition of LaBranche & Co., Inc., or LaBranche. Ms. Dietze was a member of LaBranche’s board of directors since January 2007. Ms. Dietze served as the Audit Committee Chair at LaBranche. Ms. Dietze spent over 20 years in the financial services industry prior to her retirement in 2005. From 2003 to 2005, Ms. Dietze was Global Chief Operating Officer for the Investment Banking Division of Credit Suisse First Boston. From 1996 to 2003, she was a Managing Director in Credit Suisse First Boston’s Telecommunications Group. Prior to that, Ms. Dietze was a Managing Director and Co-Head of the Telecommunications Group in Salomon Brothers Inc’s Investment Banking Division. Ms. Dietze began her career at Merrill Lynch Money Markets after which she moved to Salomon Brothers Inc. to work on money market products and later became a member of the Investment Banking Division. Ms. Dietze is a director, a member of the Governance Committee and Chair of the Finance Committee of Matthews International Corporation (MATW), a designer, manufacturer and marketer of memorialization products and brand solutions. Ms. Dietze was a member of the Board of Trustees for Liberty Property Trust, which was purchased this past February by Prologis. Ms. Dietze holds a B.A. from Brown University and an M.B.A. from Columbia Graduate School of Business. Ms. Dietze provides the Board with extensive experience in Investment Banking management and corporate governance expertise as a public company director.

Gregg A. Gonsalves. Age 52. Mr. Gonsalves was appointed to our Board in April 2020. Mr. Gonsalves has been an advisory partner with Integrated Capital LLC, a leading, hotel-focused, private real estate advisory and investment firm since 2013. Prior to joining Integrated Capital, Mr. Gonsalves was a managing director at Goldman Sachs and was the partner responsible for the Real Estate Mergers & Acquisition business. In his 20-year career at Goldman Sachs, Mr. Gonsalves completed over 50 M&A transactions worth approximately $100 billion in deal value, working with a variety of companies in a wide range of industries. Mr. Gonsalves serves on the Board of Directors of Cedar Realty Trust, a publicly-traded retail REIT, and is on the Board of POP Tracker LLC, a private company focused on providing proof of performance to the out-of-home advertising industry. He began his career as a sales engineer at Mobil Oil Corporation from 1989 to 1991. Mr. Gonsalves received a B.S. from Columbia University and received an M.B.A. from Harvard Business School. Mr. Gonsalves is presently chairman of the board of directors of the Jackie Robinson Foundation, where he has served as a board member for approximately the past ten years. Mr. Gonsalves provides the Board with extensive investment banking and real estate investment experience.

Steven Kotler. Age 73. Mr. Kotler was elected to our Board on June 7, 2010. Mr. Kotler currently serves as Vice Chairman of the private equity firm Gilbert Global Equity Partners, which he joined in 2000. Prior to joining Gilbert Global, Mr. Kotler, for 25 years, was with the investment banking firm of Schroder & Co. and its predecessor firm, Wertheim & Co., where he served in various executive capacities including President & Chief Executive Officer, and Group Managing Director and Global Head of Investment and Merchant Banking. Mr. Kotler is a director of CPM Holdings, an international agricultural process equipment company; and Co-Chairman of Birch Grove Capital, an asset management firm. Mr. Kotler is a member of the Council on Foreign Relations; and, from 1999 to 2002, was Council President of The Woodrow Wilson International Center for Scholars. Mr. Kotler has previously served as a Governor of the American Stock Exchange, The New York City Partnership and Chamber of Commerce’s Infrastructure and Housing Task Force, The Board of Trustees of Columbia Preparatory School; and, the Board of Overseers of the California Institute of the Arts. Mr. Kotler also previously served as a director of Cowen Holdings from September 2006 until June 2007. Mr. Kotler provides the Board with extensive experience in leading an international financial institution and expertise in private equity.

| - 3 - |

Lawrence E. Leibowitz. Age 60. Mr. Leibowitz was elected to our Board on June 26, 2018. Mr. Leibowitz is the President and board member of Crux Informatics, a data operations service that adopts data supply chains, ensuring they mature into cohesive, stable, and performant systems. Mr. Leibowitz has served as Crux’s President and a member of its board since October 2017. Crux’s features include data management platforms, professional services, and a global data supplier network. Mr. Leibowitz formerly served as Interim CEO of Incapture Technologies from September 2014 to October 2017. Mr. Leibowitz has thirty years of experience as a finance and technology entrepreneur. Most recently, Mr. Leibowitz served as Chief Operating Officer, Head of Global Equities Listing & Trading and as a Member of the board of directors of NYSE Euronext, holding such positions from 2007 to 2013. Prior to that, Mr. Leibowitz served as Chief Operating Officer of Americas Equities at UBS, Co-Head of Schwab Soundview Capital Markets, and Chief Executive Officer of Redibook. Mr. Leibowitz was a founding partner at Bunker Capital and Head of Quantitative Trading and Equities technology at CS First Boston. Mr. Leibowitz provides the Board with extensive capital markets knowledge, including trading microstructure, regulation, asset management and quantitative methods.

Jerome S. Markowitz. Age 80. Mr. Markowitz serves as Lead Director and has served as a member of our Board since November 2009. Mr. Markowitz was a Senior Partner at Conifer Securities LLC, a boutique servicing the operational needs of investment managers, from 2006 through May 2011. From 1998 to 2006, Mr. Markowitz was actively involved in managing a private investment portfolio. Prior to 1998, Mr. Markowitz was Managing Director and a member of the executive committee at Montgomery Securities and was responsible for starting their private client, high yield, equity derivatives and prime brokerage divisions. Prior to joining Montgomery, Mr. Markowitz was a Managing Director of L.F. Rothschild’s Institutional Equity Department. Mr. Markowitz is a director and serves on the investment committee of Market Axess Inc., and also formerly served on the advisory board of Thomas Weisel Partners Group, Inc. Mr. Markowitz provides the Board with extensive experience in asset management and investment banking, as well as experience as a public company director.

Jack H. Nusbaum. Age 79. Mr. Nusbaum has served as a member of our Board since November 2009. Mr. Nusbaum is a Senior Partner of the New York law firm of Willkie Farr & Gallagher LLP. Mr. Nusbaum served as the firm’s Chairman from 1987 through 2009 and has been a partner in that firm for more than forty-five years. Willkie Farr & Gallagher LLP is outside counsel to Cowen. Mr. Nusbaum is also a director of W. R. Berkley Corporation. Mr. Nusbaum provides the Board with experience as senior management of an international law firm and provides extensive legal and corporate governance expertise.

Margaret L. Poster. Age 68. Ms. Poster was appointed to our Board in April 2019. Ms. Poster served as Chief Operating Officer and Managing Director of Willkie Far & Gallagher LLP from 1991 through 2018. Ms. Poster is a Director of Generation Citizen, serves as the Chair of the Finance Committee and Audit Committee and has served as a member of the Generation Citizen’s Executive Committee and Strategic Planning Committee. Ms. Poster previously served as President of Workbench, Inc., Chief Financial Officer of Barnes & Noble Bookstores Inc. and Chief Financial Officer of the Jewelry & Sporting Good Division at W.R. Grace & Co. Ms. Poster began her career as an auditor at PricewaterhouseCoopers LLP. Ms. Poster is a certified public accountant and received a Masters of Business Administration from Harvard Business School. Ms. Poster provides the Board with comprehensive operating and public accounting experience.

Douglas A. Rediker. Age 60. Mr. Rediker was appointed to our Board in April 2015. Mr. Rediker is the Executive Chairman of International Capital Strategies, LLC, a policy and markets advisory boutique based in Washington, D.C. Until 2012, he was a member of the Executive Board of the International Monetary Fund representing the United States. He has held senior and visiting fellowships at Brookings, the Peterson Institute for International Economics and at the New America Foundation. He has written extensively and testified before Congress on the subject of state capitalism, global finance, Sovereign Wealth Funds and other issues surrounding the relationship between international economic policy, financial markets, global capital flows and foreign policy. Mr. Rediker previously served as a senior investment banker and private equity investor for a number of investment banks, including Salomon Brothers, Merrill Lynch and Lehman Brothers. Mr. Rediker began his career as an attorney with Skadden Arps in New York and Washington, D.C. Mr. Rediker’s experience on global macro issues provides the Board with expertise relating to capital markets, the economy and global governance.

| - 4 - |

EXECUTIVE OFFICERS OF THE COMPANY

Biographies of the current executive officers of the Company are set forth below, excluding Mr. Solomon’s biography, which is included under “Directors of the Company” above. Each executive officer serves at the discretion of the Board.

John Holmes. Age 56. Mr. Holmes serves as Chief Operating Officer and serves as a member of the Management Committee of Cowen. Mr. Holmes previously served as the Company’s Chief Administrative Officer and was appointed an executive officer in May 2013. Mr. Holmes was the Head of Technology and Operations at Cowen following the merger between Cowen and Company and Ramius. Mr. Holmes joined Ramius in June 2006 as Global Head of Operations. Prior to joining Ramius, Mr. Holmes was Global Head of the Equity Product Team at Bank of America Securities. Mr. Holmes has also held senior operations management positions at Deutsche Bank, Credit Lyonnais and Kidder Peabody. His experience includes treasury, foreign exchange, equity, fixed income & derivative operations. Mr. Holmes is NASD licensed as a General Securities Representative, General Securities Principal and a Financial & Operations Principal.

Stephen A. Lasota. Age 57. Mr. Lasota serves as Chief Financial Officer of Cowen and serves as a member of the Management Committee of Cowen. Mr. Lasota was appointed Chief Financial Officer in November 2009. Prior to the consummation of the business combination of Cowen Holdings and Ramius in November 2009, Mr. Lasota was the Chief Financial Officer of Ramius LLC and a Managing Director of the Company. Mr. Lasota began working at Ramius in November 2004 as the Director of Tax and was appointed Chief Financial Officer in May 2007. Prior to joining Ramius, Mr. Lasota was a Senior Manager at PricewaterhouseCoopers LLP.

Owen S. Littman. Age 47. Mr. Littman serves as General Counsel and Secretary of Cowen and serves as a member of the Management Committee of Cowen. Mr. Littman was appointed General Counsel and Secretary in July 2010. Following the consummation of the business combination of Cowen Holdings and Ramius in November 2009, Mr. Littman was appointed Deputy General Counsel, Assistant Secretary and Managing Director of Cowen and General Counsel and Secretary of Ramius LLC. Mr. Littman began working at Ramius in October 2005 as its senior transactional attorney and was appointed General Counsel in February 2009. Prior to joining Ramius, Mr. Littman was an associate in the Business and Finance Department of Morgan, Lewis & Bockius LLP.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted a current copy of the code on our website, www.cowen.com. In addition, we intend to post on our website all disclosures that are required by law or NASDAQ Stock Market listing standards concerning any amendments to, or waivers from, any provision of the code. You may also request a copy of the code by writing to Cowen Inc., Attn: Secretary, 599 Lexington Avenue, New York, NY 10022.

AUDIT COMMITTEE

Our Board has established a separately-designated standing Audit Committee which operates under a charter that has been approved by our Board.

Our Board has determined that all of the members of the Audit Committee are independent as defined under the rules of the Nasdaq Stock Market, and the independence requirements contemplated by Rule 10A-3 under the Exchange Act.

The current members of our Audit Committee are Ms. Dietze (Chairperson), Mr. Kotler and Ms. Poster. The Board has determined that Ms. Poster is an “audit committee financial expert” as defined by applicable SEC rules.

| - 5 - |

Item 11: Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

In addition to performing the roles and responsibilities described under “Committees of the Board — Compensation Committee” above, our Compensation Committee, which is composed entirely of independent directors, determined the 2019 compensation of our named executive officers:

| · | Jeffrey M. Solomon, Chairman of the Board and Chief Executive Officer |

| · | Stephen A. Lasota, Chief Financial Officer |

| · | John Holmes, Chief Operating Officer |

| · | Owen S. Littman, General Counsel and Secretary |

Executive Summary

The following is an executive summary of our executive officer compensation program.

Business Overview

Cowen Inc., a Delaware corporation formed in 2009, is a diversified financial services firm that, together with its consolidated subsidiaries (collectively, “Cowen” or the “Company”), provides investment banking, research, sales and trading, prime brokerage, global clearing, commission management services and investment management through its two business segments: the Operating Company (“Op Co”) and the Asset Company (“Asset Co”).

Operating Company

The Op Co segment consists of four divisions: the Cowen Investment Management (“CIM”) division, the Investment Banking division, the Markets division and the Research division. The Company refers to the Investment Banking division, the Markets division and the Research division collectively as its investment banking businesses. Op Co’s CIM division includes advisers to investment funds (including private equity structures and privately placed hedge funds), and registered funds. Op Co’s investment banking businesses offer industry focused investment banking for growth-oriented companies including advisory and global capital markets origination, domain knowledge-driven research, sales and trading platforms for institutional investors, global clearing, commission management services and also a comprehensive suite of prime brokerage services.

The CIM division is the Company’s investment management business, which operates primarily under the Cowen Investment Management name. CIM offers innovative investment products and solutions across the liquidity spectrum to institutional and private clients. The predecessor to this business was founded in 1994 and, through one of its subsidiaries, has been registered with the United States (“U.S.”) Securities and Exchange Commission (“SEC”) as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”) since 1997. The Company’s investment management business offers investors access to a number of strategies to meet their specific needs including private healthcare investing, private sustainable investing, healthcare royalties, activism and merger arbitrage. A portion of the Company’s capital is invested alongside the Company’s investment management clients. The Company has also invested some of its capital in its reinsurance businesses.

| - 6 - |

Op Co’s investment banking businesses include investment banking, research, sales and trading, prime brokerage, global clearing and commission management services provided primarily to companies and institutional investor clients. Sectors covered by Op Co’s investment banking business include healthcare, technology, media and telecommunications, consumer, industrials, information and technology services, and energy. We provide research and brokerage services to over 6,000 domestic and international clients seeking to trade securities and other financial instruments, principally in our sectors. The investment banking businesses also offer a full-service suite of introduced prime brokerage services targeting emerging private fund managers. Historically, we have focused our investment banking efforts on small to mid-capitalization public companies as well as private companies. From time to time, the Company invests in private capital raising transactions of its investment banking clients.

Asset Company

The Asset Co segment consists of the Company’s private investments, private real estate investments and other legacy investment strategies. The focus of Asset Co is to drive future monetization of the invested capital of the segment.

2019 Performance Overview

| • | 2019 Economic Income revenue increased 4% to a record $944.8 million compared to $909.5 million in 2018. |

| • | Record 2019 investment banking revenues of $352.2 million were up 7% due to higher equities and debt capital markets activity. |

| • | 2019 brokerage revenues were down 3% compared to a market-wide trading drop of 4%. Securities finance, derivatives and special situations trading all posted strong year-over-year revenue growth. |

| • | 2019 management fees of $45.7 million were down 7% year-over-year due to exits from non-core investment strategies during 2019. |

| • | Incentive income rose 95% to $46.2 million in 2019 due to higher performance fees in the healthcare and activist investment strategies. |

| • | 2019 compensation and benefits costs were $537.5 million compared to $509.6 million in 2018. The increase was due to higher 2019 revenues as well as additional hires, which resulted in a higher compensation and benefits accrual. The 2019 compensation-to-revenue ratio was 56.9%, up from 56.0% in the prior year. |

| • | Economic Operating Income, which represents Economic Income attributable to common stockholders before depreciation and amortization, was $69.1 million in 2019 versus $80.9 million in 2018. |

| • | As of December 31, 2019, the Company had assets under management of $11.4 billion, an increase of $1.0 billion from December 31, 2018. |

| • | On January 3, 2019, the Company completed the acquisition of Quarton International, a leading middle-market financial advisory firm, expanding the Company’s advisory business and creating a global, cross-border investment banking platform with significant scale. |

Please refer to the Company’s Segment Reporting Note in its financial statements included on pages F-72 to F-77 of its Form 10-K for the year ended December 31, 2019, as filed with the SEC, for reconciliations of the non-GAAP financial measures above to their most directly comparable GAAP measures.

| - 7 - |

Advisory Vote on Executive Compensation and Stockholder Engagement

The Compensation Committee believes that our executive compensation programs are effective in driving our pay-for-performance philosophy. At our 2019 annual meeting of stockholders, over 90% of shares voted (excluding broker non-votes) were in favor of the compensation of our named executive officers as disclosed in the proxy statement for the 2019 annual meeting of stockholders. The Compensation Committee considered the results of the vote to be an endorsement of the Company’s response to its continued stockholder outreach and evolving compensation practices, as described in more detail below.

Stockholder Outreach

Since 2014, we have engaged in stockholder outreach efforts regarding our compensation program. In an effort to continue to better understand our investors’ perspective and thoughts regarding our executive compensation program, a team of our senior management, including our Chief Financial Officer and General Counsel, engaged in a stockholder outreach initiative in early 2020. As part of our 2020 outreach, we contacted 18 stockholders, including some of our largest stockholders, who we believe collectively hold approximately 60% of our outstanding Class A common stock, which represents in excess of 80% of our outside stockholder base.

Starting in 2015, some of our stockholders raised concerns over the evergreen nature of our 2010 Equity and Incentive Plan (the “2010 Plan”). We have continued to hear that concern from stockholders during our subsequent stockholder outreach efforts. In 2020, stockholders have expressed support for compensation decisions being reflective of the market environment and being based upon financial metrics including earnings and return on equity. The 2010 Plan expires in June 2020. The Company plans to present a new equity and incentive plan for approval by our stockholders at the 2020 Annual Meeting of Stockholders. Our stockholders have generally expressed support for our compensation philosophy and the components of our compensation, in particular, including the fact that a significant portion of named executive officer compensation is stock-based and that our stock-based awards have significant vesting periods.

Compensation Practice Changes in Response to Stockholder Feedback

Following our stockholder outreach initiatives, senior management discussed the feedback received from our stockholders with the Compensation Committee. Additionally, the Compensation Committee obtained feedback, advice and recommendations on improvements to our compensation program from its independent compensation consultant, Pay Governance LLC. The Compensation Committee also reviewed the Company’s performance, the compensation practices of its peers and other materials regarding executive compensation. Since our 2014 annual meeting, the Compensation Committee has introduced the following changes to our executive compensation program, partially in response to feedback received from our stockholders:

| - 8 - |

| What We Heard from Stockholders | Action Taken by the Compensation Committee | ||

| • | Concerns over the evergreen nature of the 2010 Plan. | • | After careful review, decided to retain the evergreen provision of the 2010 Plan (expires in 2020) to support incentive and retention needs for the business. |

| • | The Company plans to present a new equity and incentive plan for stockholder approval at its 2020 Annual Meeting of Stockholders. The new equity and incentive plan will not have an evergreen provision. | ||

| • | A portion of executive compensation should be performance-based. | • | As of April 2015, eliminated minimum bonus guarantees for all named executive officers. |

| • | Approved the issuance of performance share awards, or PSAs, to our named executive officers in 2016 as a component of 2015 year-end compensation. Additional PSAs were awarded to our named executive officers in April of 2019 and we intend to award PSAs to our named executive officers in the second quarter of 2020. | ||

| • | No concern over the absolute amounts of compensation awarded to any of our named executive officers or the manner in which compensation is allocated. | • | Continued to deliver compensation consistent with our compensation philosophy, the Compensation Committee’s evaluation of Company and individual performance and industry norms. |

| • | Continued to deliver a significant portion of total compensation as stock-based awards subject to long-term vesting conditions. | ||

| • | Support for our compensation governance practices. | • | In March 2015, adopted stock ownership and retention guidelines for executive officers. |

| • | In March 2015, implemented a clawback policy for executive officers with respect to cash and equity performance-based compensation and annual bonus compensation paid under the Company’s equity and incentive plans. | ||

| • | Adopted an annual (rather than triennial) say-on-pay vote in 2017. | ||

| - 9 - |

Key Features of Our Executive Compensation Program

| What We Do | What We Don’t Do | |||

| • | We pay for performance through a careful year-end review of financial results and individual performance | • | We do not pay dividend equivalents on unvested RSUs or PSAs | |

| • | We consider peer groups in establishing compensation | • | We do not pay tax gross-ups on our limited perquisites | |

| • | Meaningful annual equity awards are granted in lieu of — not in addition to — annual cash incentives | • | We do not provide “single-trigger” equity vesting in the event of a change in control | |

| • | We introduced PSAs as a component of executive officer compensation in 2016. | • | We do not provide golden parachute excise tax gross-ups | |

| • | We granted PSAs to executive officers in April 2019. The PSAs are earned based on forward-looking performance metrics that consider long-term performance from 2019 through 2021. | • | We do not provide minimum guaranteed bonuses to our executive officers | |

| • | We intend to grant PSAs to executive officers in the second quarter of 2020. | |||

| • | We have implemented stock ownership guidelines for our directors and executive officers | |||

| • | We have double-trigger equity vesting in the event of a change in control | |||

| • | We require our executive officers to comply with reasonable restrictive covenants | |||

| • | We subject our deferred bonus awards to executive officers to a clawback policy | |||

| • | We seek to maintain a conservative compensation risk profile | |||

| • | The Compensation Committee retains an independent compensation consultant | |||

| • | We have an anti-hedging policy, and, during 2019, all executive officers were in compliance with this policy | |||

| - 10 - |

Compensation Philosophy and Objectives

Our compensation programs, including compensation of our named executive officers, are designed to achieve three objectives:

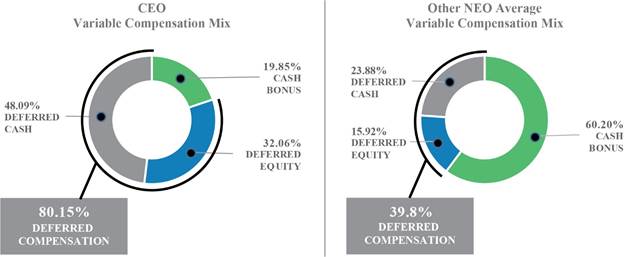

| • | Pay for Performance. A significant portion of the total compensation paid to each named executive officer is variable. Approximately 70% of our Chief Executive Officer’s compensation, approximately 30% of our Chief Financial Officer, Chief Operating Officer, and General Counsel’s compensation, in respect of 2019, was paid in deferred cash and equity, excluding long-term incentive compensation awards. The amount of compensation paid is determined based on: (i) the performance of the Company on an absolute basis through a comparison of our results to competitor firms; (ii) an evaluation of each named executive officer’s contribution to the Company; and (iii) his performance against individualized qualitative goals. |

| • | Annual Compensation Reflects an Informed Review of Annual Results and Judgment of the Committee. The Committee considers a number of factors in its pay determinations. Given the volatility and constantly changing dynamics of the markets, we believe that it makes more sense for our business to primarily determine compensation after year-end by making a careful evaluation of the business rather than establishing formulaic pre-set goals at the start of the year. An after-the-fact review of performance allows the Company and Compensation Committee to consider the quality of earnings, the combination of absolute and relative performance, organic versus non-organic sources of revenues and profits, and collaboration between our various lines of business. A pre-set formula would not allow us to fully evaluate performance and might result in negative unintended consequences for the business and the stockholders. Final compensation determinations are made at the discretion of the Committee. We believe this discretionary approach to compensation is consistent with common market practice in the financial services sector for these same reasons. Further, although the size of the incentive compensation award is based on current fiscal year results, a portion of it is delivered in the form of RSUs that vest over time to encourage retention and further link executive pay with longer-term stock performance. |

| • | Align Executive Officers’ Interests with Stockholders’ Interests. Our Compensation Committee reviews each executive officer’s performance as well as the Company’s financial results in the context of the market environment when determining year-end, performance-related compensation. In addition, our Compensation Committee evaluated the Company’s performance compared to the performance of its peers and also considered an analysis of competitive compensation levels of executive officers at the Company’s peer firms that was conducted by Pay Governance LLC, the independent compensation consultant to the Compensation Committee. Our Compensation Committee believes year-end, performance-related compensation should be delivered in a combination of short-term and long-term instruments. We believe that deferred cash, equity and equity-related instruments align the interests of our executive officers with those of our stockholders and ensure that our executive officers are focused on the long-term performance of the Company. In connection with fiscal 2019 bonus payments, Messrs. Solomon, Lasota, Holmes and Littman received a portion of their bonus in cash, a portion in deferred equity and a portion in deferred cash, in each case subject to service-based vesting requirements of approximately 4.5 years. The Compensation Committee believes that the payment of a significant portion of an employee’s compensation in the form of equity and deferred cash properly aligns the employee’s interests with those of the Company’s stockholders and effectively mitigates any risks associated with the Company’s compensation practices. Excluding long-term incentive compensation awards, approximately 70% of our Chief Executive Officer’s compensation, approximately 30% of our Chief Financial Officer, Chief Operating Officer, and General Counsel’s compensation, in all cases in respect of 2019, was paid in deferred cash and equity. |

| • | Recruiting and Retention. We operate in an intensely competitive industry, and we believe that our success is closely related to our recruiting and retention of highly talented employees and a strong management team. We try to keep our compensation program generally competitive with industry practices so that we can continue to recruit and retain talented executive officers and employees. |

| - 11 - |

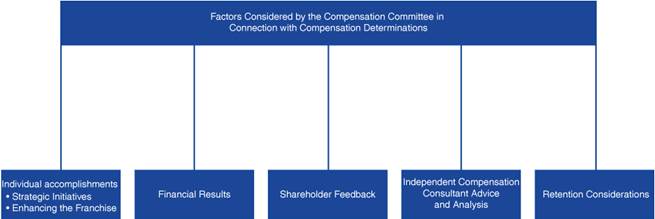

Determination of Named Executive Officer Compensation for 2019

At meetings held on December 16, 2019, January 16, 2020 and February 10, 2020 and numerous executive sessions following these meetings, the Compensation Committee considered and discussed management’s compensation recommendations for our named executive officers, and the Compensation Committee approved management’s recommendations. In determining the annual bonus compensation and long-term incentive compensation payable to each of our named executive officers for 2019, the Compensation Committee reviewed and considered the financial performance of the Company as a whole and each individual business unit compared to 2018 and the Company’s compensation to revenue ratio. For the year ended December 31, 2019, the Company’s compensation to revenue ratio was 56.9%, which the Compensation Committee viewed as reasonable given the performance of the Company during 2019. The Compensation Committee also considered each named executive officer’s contributions to the Company’s growth initiatives in 2019; historical compensation information for each named executive officer; the Company’s desire to retain and incentivize its named executive officers; the recommendations of Mr. Solomon, our Chief Executive Officer regarding total compensation of our named executive officers (other than the Chief Executive Officer); the financial performance of the Company during 2019 compared to comparable public companies and other companies in the securities industry; a review of public filings and other market data regarding total compensation paid by certain peer investment banks and asset management companies; and base salary, cash bonus, equity awards and all other compensation paid by the compensation peer group.

The Compensation Committee considered the following achievements in 2019 when making its determination of named executive officer compensation:

| · | 2019 Economic Income revenue increased 4% to a record $944.8 million compared to $909.5 million in 2018. |

| · | Record 2019 investment banking revenues of $352.2 million were up 7% due to higher equities and debt capital markets activity. |

| - 12 - |

| · | 2019 brokerage revenues were down 3% compared to a market-wide trading drop of 4%. Securities finance, derivatives and special situations trading all posted strong year-over-year revenue growth. |

| · | 2019 management fees of $45.7 million were down 7% year-over-year due to exits from non-core investment strategies during 2019. |

| · | Incentive income rose 95% to $46.2 million in 2019 due to higher performance fees in the healthcare and activist investment strategies. |

| · | The Company made significant progress integrating Quarton International, a leading middle-market financial advisory firm acquired in January 2019. |

| · | The Company continued to improve revenue diversification in its investment banking business. |

| · | The Company positioned the investment management platform towards strategies that are salable, scalable and reflect Cowen’s DNA, such as the private healthcare investment management strategy and the sustainable investments strategy. |

| · | The Company exited certain non-core investment strategies, included the real estate business and long/short strategies in the investment management business. |

Please refer to the Company’s Segment Reporting Note in its financial statements included on pages F-72 to F-77 of its Form 10-K for the year ended December 31, 2019, as filed with the SEC, for reconciliations of the non-GAAP financial measures above to their most directly comparable GAAP measures.

The Compensation Committee also considered the following individual factors in the determinations made for each named executive officer in 2019:

| • | Jeffrey Solomon. Mr. Solomon’s compensation reflected his significant contributions regarding the continued enhancement and growth of the Company’s business. Economic income revenue increased in 2019 compared to 2018 and Mr. Solomon played a leading role in diversifying the Company’s revenues through product and industry diversification. Mr. Solomon also played a key role in improving the Company’s capital allocation process and in managing the Company’s balance sheet investments to reduce volatility. |

| • | John Holmes. Mr. Holmes’s compensation reflected significant contributions related to the continued enhancement of the Company’s procedures relating to operational risk oversight and management of fixed and variable expenses across the Company. Mr. Holmes oversaw enhanced infrastructure implementation and upgrades. Mr. Holmes played a leading role in the integration of the Quarton International business. Mr. Holmes also played a significant role in managing the Company’s business operations. |

| • | Stephen Lasota. Mr. Lasota’s compensation reflected significant contributions related to the continued enhancement of the Company’s financial reporting. Mr. Lasota played a leading role in increasing the Company’s access to liquidity and obtaining the Company’s first investment grade credit rating. Mr. Lasota played a leading role in the financing transactions completed by the Company in 2019. Mr. Lasota also played a significant role in managing the Company’s business operations. |

| - 13 - |

| • | Owen Littman. Mr. Littman’s compensation reflected significant contributions related to the continued enhancement of the Company’s compliance structure, management of the Company’s outstanding litigation and regulatory matters as well as his focus on the Company’s legal disclosure and corporate governance procedures. Mr. Littman played a leading role in negotiating the terms of the transactions, including the financings completed by the Company in 2019. Mr. Littman also played a significant role in managing the Company’s business operations. |

The Compensation Committee approved discretionary annual bonuses for each of our named executive officers after review and consideration of the above factors.

After determining the aggregate cash values of annual bonuses payable to each of our named executive officers in respect of fiscal 2019, the Compensation Committee considered the percentage of the annual bonus compensation that each of our named executive officers would receive in the form of deferred awards. Jeffrey Solomon, our Chief Executive Officer, developed a proposal for the allocation of annual bonus compensation among the cash, deferred cash and equity components for Messrs. Holmes, Lasota and Littman. The Compensation Committee discussed and ultimately approved the proposal and established an allocation for Mr. Solomon. Excluding long-term incentive compensation awards, approximately 70% of our Chief Executive Officer’s compensation, approximately 30% of our Chief Financial Officer, Chief Operating Officer, General Counsel’s compensation, in all cases in respect of 2019, was paid in deferred cash and equity.

To eliminate the impact that a short-term significant price change in the market value of our Class A common stock may have on the number of RSUs that are intended to be delivered to an employee, the Compensation Committee approved valuing the RSUs using the volume-weighted average price for the 30 trading days ended January 17, 2020, which equaled $16.16 per share. Deferred cash and RSUs relating to fiscal 2019 annual bonuses were awarded to our named executive officers in February 2020. RSUs will vest with respect to 12.5% on December 1, 2020, 12.5% on September 1, 2021, 25% on September 1, 2022, 25% on September 1, 2023 and 25% on September 1, 2024. Deferred cash awards will vest with respect to 12.5% on November 15, 2020, 12.5% on August 15, 2021, 25% on August 15, 2022, 25% on August 15, 2023 and 25% on August 15, 2024.

The Company plans to grant PSA awards to the named executive officers in the second quarter of 2020.

Frequency of Say-on-Pay Vote

Consistent with the preference expressed by our stockholders at our 2017 Annual Meeting of Stockholders, the Board decided that the Company will include an advisory vote to approve the compensation of our named executive officers in our proxy materials every year until the next required advisory vote to approve the frequency of an advisory vote on executive compensation, which will occur no later than our 2023 annual meeting.

Compensation Program and Payments

The Company’s compensation program and payments for its executive officers includes base salary, annual bonus compensation and long term incentive compensation.

| - 14 - |

Base Salary

The purpose of base salary is to provide a set amount of cash compensation for each named executive officer that is not variable in nature and is generally competitive with market practices. We seek to limit the base salaries of our named executive officers such that a significant amount of their total compensation is contingent upon the performance of the Company and the named executive officer during the fiscal year. This was consistent with standard practice within the securities and asset management industries and we believe this allowed us to reward performance.

In 2019 Mr. Solomon received a base salary of $950,000 and each of Messrs. Lasota, Holmes and Littman received a base salary of $700,000. Mr. Solomon’s base salary was increased to $1,000,000 effective as of January 1, 2020.

Annual Bonus Compensation

A significant portion of total compensation our named executive officers are eligible to receive is in the form of an annual bonus. Annual bonuses are determined based on an informed judgment with final amounts determined at the discretion of the Committee. This is consistent with our view that a significant portion of compensation paid is to be based on the performance of the Company and of each named executive officer. Given the volatility and constantly changing dynamics of the markets, we believe that it makes more sense for our business to determine compensation after year-end by making a careful evaluation of the business rather than establishing formulaic pre-set goals at the start of the year. We also believe this discretionary approach to compensation is consistent with common market practice in the financial services sector. The annual bonus is paid partially in cash and partially in deferred cash and equity. The deferred components of the annual bonus are paid in lieu of, not in addition to, a cash payment and are subject to service-based vesting conditions of approximately 4.5 years. The Compensation Committee believes that the practice of paying a portion of each named executive officer’s annual bonus in the form of deferred awards is consistent with compensation practices at our peer companies and is a useful tool to continue aligning the long-term interests of our named executive officers with the interests of our stockholders.

| - 15 - |

In 2019, Mr. Solomon received an annual bonus of $6,550,000, consisting of a cash bonus of $1,300,000, a deferred equity award of $2,100,000 and a deferred cash award of $3,150,000. In 2019, Mr. Lasota received an annual bonus of $2,000,000, consisting of a cash bonus of $1,212,500, a deferred equity award of $315,000 and a deferred cash award of $472,500. In 2019, Mr. Holmes received an annual bonus of $2,100,000, consisting of a cash bonus of $1,247,500, a deferred equity award of $341,000 and a deferred cash award of $511,500. In 2019, Mr. Littman received an annual bonus of $2,000,000, consisting of a cash bonus of $1,212,500, a deferred equity award of $315,000 and a deferred cash award of $472,500.

Long-Term Incentive Compensation

Long-term incentive compensation includes PSAs granted in 2019 and expected to be granted in 2020. In 2019 the Company made long-term incentive grants of PSAs to the named executive officers, which cover performance periods through December 31, 2021.

2019 PSAs

In April 2019, the Company entered into a performance shares award agreement, or 2019 PSA Agreement, with each of our named executive officers. Under the terms of the 2019 PSA Agreement, each named executive officer was awarded PSAs, based on the attainment of certain performance metrics. Mr. Solomon received 56,000 2019 PSAs and each of Messrs. Lasota, Holmes and Littman received 35,000 2019 PSAs. With respect to Mr. Solomon, the Company provided Mr. Solomon with a letter of intent in 2019 committing to award 30,000 of the 2019 PSAs to Mr. Solomon in 2020. These 30,000 2019 PSAs were granted to Mr. Solomon in early 2020. The 2019 PSAs awarded are subject to a three-year performance period and are scheduled to vest on December 31, 2021. At the end of the performance period, the 2019 PSAs will be multiplied by an applicable percentage (set forth below) based on the Company’s AROCE.

2019 PSA Performance Metric Calculation

Economic Operating Income represents Economic Income before depreciation and amortization expenses. This allows us to measure performance of the business without the effects of depreciation and amortization expenses that can vary period to period as a result of acquisitions. As a result, we think this is a more appropriate measure to use for our performance share awards. We set the target AROCE level by looking at our historical performance and forecasted future performance with the objective of improving the overall performance of the business to achieve an AROCE at or above 10% on a consistent basis.

AROCE will be calculated by (i) taking the sum of the Company’s Adjusted Economic Operating Income less the payment of dividends on the Company’s outstanding preferred stock during each of the fiscal years during the Performance Period divided by the Average Common Equity of the Company during of the each such fiscal year (with the average Common Equity for each fiscal year calculated by adding the Common Equity at the beginning of such fiscal year and the Common Equity at end of such fiscal year and dividing by two) and (ii) dividing the sum by three. For the purposes of calculating AROCE, Economic Operating Income means, with respect to each fiscal year during a performance period, the Company’s Economic Operating Income (as reported in the Company’s Annual Report on Form 10-K) as adjusted for the following: (i) expenses greater than one million dollars associated with strategic initiatives undertaken by the Company shall be amortized over a five year period as opposed to being expensed in the period in which they are incurred, (ii) adjustments resulting from changes in an existing, or application of a new, accounting principle that is not applied on a fully retrospective basis shall be excluded and (iii) other extraordinary items of income or loss may be excluded at the discretion of the Compensation Committee of the Board. At the end of the performance period, the PSAs will be multiplied by the percentages set forth below based on the Company’s AROCE with respect to such performance period:

| - 16 - |

AROCE Performance Scale

| Performance Level* | AROCE | Payout Rate | ||

| Below Threshold | Below 8% | 0% Payout | ||

| Threshold | 8% | 50% Payout | ||

| Target | 10% | 100% Payout | ||

| Above Target | 12% | 150% Payout | ||

| Maximum (capped) | Greater than 15% | 200% Payout |

* Payout for performance between the Threshold and the Maximum will be interpolated

Setting Compensation

The Compensation Committee is responsible for approving the compensation paid to our named executive officers as well as certain other highly compensated employees. In making compensation determinations, the Compensation Committee reviews information presented to them by the Company’s management, compensation peer group information and the recommendations of an independent compensation consultant engaged by the Compensation Committee. The Compensation Committee also reviews our compensation-to-revenue ratio on a quarterly basis and may adjust the targeted compensation-to-revenue ratio in order to maintain the Company’s compensation philosophy of aligning the interests of our named executive officers and our stockholders.

Involvement of Executive Officers

Mr. Solomon, our Chief Executive Officer, in consultation with our Chief Financial Officer, our General Counsel, our Chief Operating Officer and employees in our Human Resources department, assists the Compensation Committee in making compensation determinations. These individuals prepare information that is provided to, and reviewed by, the Compensation Committee and the Chief Executive Officer makes recommendations to the Compensation Committee for their consideration. Such information and recommendations include, among other things, the compensation that should be received by the named executive officers (other than himself) and certain other highly compensated employees; financial information regarding the Company that should be reviewed in connection with compensation decisions; the firms to be included in a compensation peer group; and the evaluation and compensation process to be followed by the Compensation Committee. Our Chief Executive Officer is often invited to participate in Compensation Committee meetings; however, he recuses himself from all discussions regarding his own compensation.

Compensation Consultant

The Compensation Committee exercised its sole authority pursuant to its charter to directly engage Pay Governance LLC. Pay Governance LLC was retained by the Compensation Committee to provide advice, analysis, and assessment of alternatives related to the amount and form of executive compensation. Pay Governance LLC reviewed certain Compensation Committee presentation materials (including the peer group data described below) during November and December 2019 and early 2020 at the request of the Compensation Committee. The Compensation Committee meets with Pay Governance LLC from time to time without management present.

| - 17 - |

The Compensation Committee has assessed the independence of Pay Governance LLC pursuant to SEC and NASDAQ rules and concluded that no conflict of interest exists that would prevent Pay Governance LLC from independently representing the Compensation Committee. The Compensation Committee reviewed and was satisfied with Pay Governance LLC’s policies and procedures to prevent or mitigate conflicts of interest and that there were no business or personal relationships between members of the Compensation Committee and the individuals at Pay Governance LLC supporting the Compensation Committee.

Compensation Peer Group

The Compensation Committee, with the assistance of its independent compensation consultant, annually identifies a compensation peer group of firms with which we compete for executive talent. As a middle-market investment bank with material asset management operations, we believe there are few other companies that are directly comparable to Cowen. Our peer group includes investment banks with revenues and market capitalizations similar to ours as well as companies with significant asset management operations. In making compensation decisions for 2019, our Compensation Committee reviewed compensation information for similarly titled individuals at comparable companies gathered from public filings made in 2019 related to 2018 annual compensation and from subscriptions for other market data. In instances where an employee has responsibilities for both the investment banking and investment management businesses, both investment banking and investment management companies were utilized. At the request of the Compensation Committee, Pay Governance LLC provides the Compensation Committee with compensation data from other firms of similar size. For 2019, Pay Governance provided the Compensation Committee with peer group compensation data of B. Riley Financial, Evercore Partners Inc., Greenhill & Co., Inc., Houlihan Lokey, Inc., Jefferies Group, JMP Group, Lazard Ltd., Moelis & Company, Oppenheimer & Co. Inc., Piper Sandler Companies, PJT Partners, Raymond James Financial, and Stifel Financial Corp. The Compensation Committee believes that information regarding pay practices at comparable companies is useful in two respects. First, as discussed above, we recognize that our pay practices must be competitive in our marketplace. By understanding the compensation practices and levels of the Company’s peer group, we enhance our ability to attract and retain highly skilled and motivated executives, which is fundamental to the Company’s success. Second, this data is one of the many factors the Compensation Committee considers in assessing the reasonableness of compensation. Accordingly, the Compensation Committee reviewed trends among these peer firms and considered this data when determining named executive officers’ 2019 annual bonuses and other compensation, but did not utilize the peer firm compensation as a sole benchmark for determining executive compensation.

Relationship of Compensation Policies and Practices to Risk Management

The Board has discussed whether our compensation policies are reasonably likely to have a material adverse effect on our results. The Board noted that, consistent with our performance-based model, many of our employees receive a significant portion of their compensation through discretionary compensation tied to their individual or business unit performance, or a combination thereof. The Board noted that a lower portion of the Company’s revenues are derived from proprietary trading businesses and that a significant portion of many employees’ compensation is provided in the form of deferred compensation that vests over time, which has the effect of tying the individual employee’s long-term financial interest to the firm’s overall success. The Board believes that this helps mitigate the risks inherent in our business.

The Board noted that our risk management team continuously monitors our various business groups, the level of risk they are taking and the efficacy of potential risk mitigation strategies. Senior management also monitors risk and the Board is provided with data relating to risk at each of its regularly scheduled meetings. The Chief Risk Officer meets regularly with the Board to present his views and to respond to questions. For these reasons, the Board believes that our overall compensation policies and practices are not likely to have a material adverse effect on us.

Clawback Policy

In March 2015, the Company adopted a clawback policy that allows the Company to recover incentive compensation from any executive officer if that executive officer engages in intentional misconduct that caused or contributed to a restatement of the Company’s financial results. In the event of a restatement, a committee consisting of the non-management members of the Board (the “Independent Director Committee”) will review the performance-based compensation and annual bonus compensation paid in the form of both cash and equity under the Company’s equity and incentive plans to any such executive (the “Awarded Compensation”). If the Independent Director Committee determines, in good faith, that the amount of such performance-based compensation or annual bonus actually paid or awarded to any such executive officer would have been a lower amount had it been calculated based on such restated financial statements (the “Actual Compensation”) then the Independent Director Committee shall, subject to certain exceptions, seek to recover for the benefit of the Company the after-tax portion of the difference between the Awarded Compensation and the Actual Compensation. The clawback policy does not apply to equity-based compensation granted before March 16, 2015.

| - 18 - |

Executive Officer Stock Ownership Guidelines

The Company adopted stock ownership guidelines on March 18, 2015 that require the Company’s executive officers to hold Company stock or RSUs within the later of the adoption of the policy or five years of being designated as an executive officer. All named executive officers are in compliance with the stock ownership guidelines, which are set forth below.

| Chief Executive Officer | 8x Base Salary | $8,000,000 |

| Other Executive Officers | 3x Base Salary | $2,100,000 |

Anti-Hedging Policy

In order to support alignment between the interests of stockholders and employees, the Company maintains an anti-hedging policy that prohibits the “short sale” of Company securities. The policy prohibits employees from trading in options, warrants, puts and calls or similar instruments on Company securities. We allow directors and executive officers to hold up to 50% of their Company stock in a margin account. During 2019, all named executive officers were in compliance with this policy.

Perquisites

The Company provides certain perquisites, including reimbursement of group term life and long-term disability insurance and tax and financial planning expenses to certain members of senior management, including Messrs. Solomon, Lasota and Holmes.

Employment Agreements

Each of our named executive officers is party to an employment agreement with the Company. The Compensation Committee views the employment agreements as an important tool in achieving our compensation objective of recruiting and retaining talented employees and a strong management team. The severance and change-in-control arrangements provided by the employment agreements are intended to retain our named executive officers and to provide consideration for certain restrictive covenants that apply following a termination of employment. None of the Company’s executive officers have minimum guaranteed bonuses in their employment agreements.

Tax and Accounting Impact and Policy

The financial and income tax consequences to the Company of individual executive compensation elements are important considerations for the Compensation Committee when analyzing the overall design and mix of compensation. The Compensation Committee seeks to balance an effective compensation package for the executive officers with an appropriate impact on reported earnings and other financial measures.

In designing our compensation and benefit programs, we review and consider the accounting implications of our decisions, including the accounting treatment of amounts awarded or paid to our executives.

In general, Section 162(m) of the Code generally denies a publicly held corporation a deduction for federal income purposes for compensation in excess of $1 million per year paid to certain “covered employees.” As in prior years, the Compensation Committee will continue to take into account the tax and accounting implications (including with respect to the expected lack of deductibility under the revised Section 162(m)) when making compensation decisions, but reserves its right to make compensation decisions based on other factors as well if the Compensation Committee determines it is in its best interests to do so. The Compensation Committee may, from time to time, design programs that are intended to further our success, including by enabling us to continue to attract, retain, reward and motivate highly-qualified executives that may not be deductible as a result of the limitations on deductibility under Section 162(m).

| - 19 - |

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management and has recommended to the Board the inclusion of the Compensation Discussion and Analysis in the Form 10-K and in the definitive proxy statement for our 2020 Annual Meeting of Stockholders.

Compensation Committee of the Board of Directors of Cowen Inc.

Brett H. Barth, Chair

Lawrence E. Leibowitz

Jerome S. Markowitz

Summary Compensation Table

The following table sets forth compensation information for our named executive officers in 2019.

| Name & Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

| Jeffrey M. Solomon | 2019 | 950,000 | 1,300,000 | 3,588,250 | 1,640,563 | (3) | 7,478,814 | |||||||||||||||||

| Chief Executive Officer | 2018 | 950,000 | 1,875,000 | 1,053,481 | 1,210,376 | 5,088,857 | ||||||||||||||||||

| 2017 | 950,000 | 725,000 | 839,377 | 874,205 | 3,388,582 | |||||||||||||||||||

| Stephen A. Lasota | 2019 | 700,000 | 1,212,500 | 854,236 | 353,358 | (3) | 3,120,094 | |||||||||||||||||

| Chief Financial Officer | 2018 | 500,000 | 1,625,000 | 396,485 | 311,652 | 2,833,137 | ||||||||||||||||||

| 2017 | 500,000 | 725,000 | 411,800 | 257,472 | 1,894,272 | |||||||||||||||||||

| John Holmes | 2019 | 700,000 | 1,247,500 | 926,630 | 361,137 | (3) | 3,235,267 | |||||||||||||||||

| Chief Operating Officer | 2018 | 500,000 | 1,675,000 | 515,193 | 311,652 | 3,001,845 | ||||||||||||||||||

| 2017 | 500,000 | 725,000 | 411,800 | 257,472 | 1,894,272 | |||||||||||||||||||

| Owen S. Littman | 2019 | 700,000 | 1,212,500 | 890,424 | 351,955 | (3) | 3,154,879 | |||||||||||||||||

| General Counsel and | 2018 | 500,000 | 1,650,000 | 396,485 | 311,652 | 2,858,137 | ||||||||||||||||||

| Secretary | 2017 | 500,000 | 725,000 | 411,800 | 257,472 | 1,894,272 | ||||||||||||||||||

| (1) | The amounts in this column reflect cash bonuses paid to the named executive officers in 2020 in respect of performance during the 2019 year. |

| (2) | The entries in the stock awards column reflect the aggregate grant date value of the RSU (including the deferred equity component of the 2019 annual bonus) and PSA awards granted in 2019 in connection with 2018 performance in accordance with FASB ASC 718, disregarding for this purpose the estimate of forfeitures related to service-based vesting conditions. The value of the PSA awards reflects the grant date value of the awards based on the target level of performance, which is less than the maximum possible value. The grant date value of the PSA awards assuming that the highest level of the applicable performance conditions will be achieved is $1,710,240 for Mr. Solomon and $1,068,900 for Messrs. Lasota, Holmes and Littman, respectively. For information on the valuation assumptions with respect to awards made, refer to the Company’s Share-Based Compensation and Employee Ownership Plans Note in its financial statements included in its Form 10-K for the year ended December 31, 2019, as filed with the SEC. With respect to Mr. Solomon, the Company provided Mr. Solomon with a letter of intent in 2019 committing to award 30,000 of the 2019 PSAs to Mr. Solomon in 2020. These 30,000 2019 PSAs were granted to Mr. Solomon in early 2020 and are reflected in the Stock Awards column for 2019. |

| (3) | Other compensation includes: |

| Other Compensation ($) | Jeffrey M. Solomon | Stephen A. Lasota | John Holmes | Owen S. Littman | ||||||||||||

| Vested Deferred Cash Awards | 1,579,213 | 346,163 | 357,746 | 351,955 | ||||||||||||

| Tax and Financial Planning | 61,350 | 7,195 | 3,391 | — | ||||||||||||

| - 20 - |

Grants of Plan-Based Awards

The following table provides information regarding grants of compensation-related, plan-based awards made to the named executive officers during fiscal year 2019. These awards are also included in the Summary Compensation Table above.

| Estimated

Future Payouts Under Equity Incentive Plan Awards(1) | All

Other Stock Awards: Number | |||||||||||||||||||||||

| Grant Date | Corporate Action Date | Threshold (#) | Target (#) | Maximum (#) | of Shares of Stock or Units (#)(2) | Grant

Date Fair Value of Stock Awards ($)(3) | ||||||||||||||||||

| Jeffrey M. Solomon(4) | 2/20/2019 | 1/9/2019 | 160,867 | 2,733,130 | ||||||||||||||||||||

| 4/1/2019 | 2/12/2019 | 23,000 | 56,000 | 112,0000 | 855,120 | |||||||||||||||||||

| Stephen A. Lasota | 2/20/2019 | 1/9/2019 | 18,822 | 319,786 | ||||||||||||||||||||

| 4/1/2019 | 2/12/2019 | 17,500 | 35,000 | 70,000 | 534,450 | |||||||||||||||||||

| John Holmes | 2/20/2019 | 1/9/2019 | 23,083 | 392,180 | ||||||||||||||||||||

| 4/1/2019 | 2/12/2019 | 17,500 | 35,000 | 70,000 | 534,450 | |||||||||||||||||||

| Owen S. Littman | 2/20/2019 | 1/9/2019 | 20,952 | 355,974 | ||||||||||||||||||||

| 4/1/2019 | 2/12/2019 | 17,500 | 35,000 | 70,000 | 534,450 | |||||||||||||||||||

| (1) | The amounts reported in these columns represent Performance RSUs that are scheduled to vest in three tranches based on the attainment of AROE and relative TSR targets for the applicable performance period, subject to the named executive officer’s continued employment through the applicable vesting date. These columns represent the number of Performance RSUs that vest at threshold achievement, target achievement and maximum achievement of the performance metrics applicable to such awards. At or below the threshold performance level, no shares will be paid out. See “Compensation Discussion and Analysis—Long-Term Incentive Compensation” above for a detailed description of the Performance RSU program. |

| (2) | RSUs vest with respect to 12.5% on September 1, 2019, 12.5% on May 15, 2020, 25% on May 15, 2021, 25% on May 15, 2022 and 25% on May 15, 2023. |

| (3) | The entries in the “Grant Date Fair Value of Stock Awards” column reflect the aggregate grant date fair value of the awards granted in 2019 computed in accordance with FASB ASC 718, disregarding for this purpose the estimate of forfeitures related to service-based vesting conditions. The value of the PSA awards reflects the grant date value of the awards based on the target level of performance, which is less than the maximum possible value. The grant date value of the PSA awards assuming that the highest level of the applicable performance conditions will be achieved is $1,710,240 for Mr. Solomon and $1,068,900 for Messrs. Lasota, Holmes and Littman, respectively. For information on the valuation assumptions with respect to awards made, refer to the Company’s Share-Based Compensation and Employee Ownership Plans Note in its financial statements included in its Form 10-K for the year ended December 31, 2019, as filed with the SEC. |

| (4) | With respect to Mr. Solomon, the Company provided Mr. Solomon with a letter of intent in 2019 committing to award 30,000 of the 2019 PSAs to Mr. Solomon in 2020. These 30,000 2019 PSAs were granted to Mr. Solomon in early 2020 and were taken into account in the Stock Awards column of the Summary Compensation Table for 2019. |

| - 21 - |

Narrative Disclosure Relating to Summary Compensation Table and Grants of Plan-Based Awards Table

Employment Agreements

In 2019, the Company was party to an employment agreement with Mr. Solomon, dated as of May 31, 2012, as amended on November 30, 2017, and employment agreements with Messrs. Holmes, Lasota and Littman, dated as of August 2, 2012, each as amended on April 24, 2015 (the “2019 Employment Agreements”). The 2019 Employment Agreements provide for the following material terms:

| • | An initial term that expired April 30, 2016. Following the expiration of the initial term, the terms of the agreements automatically extend for successive one-year terms, unless either party elects not to extend the term. |

| • | A minimum annual base salary of $950,000 for Mr. Solomon and $450,000 for Messrs. Holmes, Lasota, and Littman. Each named executive officer is also eligible to receive an annual performance-based bonus as determined by the Compensation Committee. The 2019 Employment Agreements provide that the Company may pay all or a portion of any annual bonus in the form of restricted securities, other stock or security-based awards, deferred cash, or other deferred compensation. The 2019 Employment Agreements do not provide for a minimum annual bonus. |

| • | With respect to Mr. Solomon, his agreement provides that, if Mr. Solomon’s employment is terminated by us without cause (including a decision by us not to renew the employment agreement upon the expiration of the then-current term), by Mr. Solomon for good reason, or as a result of Mr. Solomon’s death or disability (as such terms are defined in the agreement), Mr. Solomon will, subject to his execution of a general release in our favor, be entitled to the following: (i) any unpaid annual bonus with respect to the previous completed fiscal year, (ii) a prorated annual bonus for the fiscal year of termination, calculated based on the average bonus paid for the two years immediately preceding the year of termination and the timing of such termination, (iii) in the case of a termination by us without cause or by Mr. Solomon for good reason only, a lump sum cash payment in an amount equal to two and one-half times the sum of his base salary and the average annual bonus paid for the two years immediately preceding his termination, provided that the payment under clause (iii) will not be less than $3,250,000 and not more than $5,000,000, (iv) immediate vesting of all equity awards and unvested deferred compensation, and (v) a cash payment equal to 24 months’ COBRA premiums. In the event that Mr. Solomon breaches the restrictive covenants described below following a termination of his employment, he will be required to repay any payments or benefits received in connection with such termination. |