Use these links to rapidly review the document

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-177492

PROSPECTUS

24,053,393 Shares

COWEN GROUP, INC.

Class A common stock

This prospectus covers up to 24,053,393 shares of Class A common stock of Cowen Group, Inc. held by RCG Holdings LLC (our largest shareholder) which holds 32,616,294 shares of our Class A common stock in the aggregate and that may be sold, transferred, distributed or otherwise disposed of from time to time by the selling stockholders named herein, or their transferees. The shares held by RCG Holdings LLC are attributable to its members and may be distributed to them or sold on their behalf, as described in this prospectus. We will not receive any of the proceeds from any of such sales or distributions. The selling stockholders will bear all sales commissions and similar expenses. Of the 24,053,393 shares covered by this prospectus, 5,763,994 are attributable to certain members of RCG Holdings LLC named herein (who we refer to as the individual selling stockholders) who are directors and/or executive officers of Cowen Group, Inc. This prospectus covers both the distribution of shares to those individual selling stockholders and the subsequent resale by those individual selling stockholders of such shares.

The selling stockholders, which may include certain of our directors and/or executive officers as transferees of RCG Holdings LLC, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

Our Class A common stock is presently traded on the NASDAQ Global Market under the symbol "COWN". On November 1, 2011, the last reported sale price of our Class A common stock was $2.68 per share.

An investment in our Class A common stock involves a high degree of risk. See "Risk Factors" beginning on page 5 of this prospectus to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 2, 2011.

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission pursuant to which the selling stockholders may sell, transfer, distribute or otherwise dispose of up to 24,053,393 shares of our Class A common stock from time to time. You should read both this prospectus and any prospectus supplement together with the additional information described in the sections titled "Where You Can Find More Information" and "Incorporation By Reference" below.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. Neither we nor the selling stockholders have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The selling stockholders will not make an offer of these securities in any jurisdiction where it is unlawful. You should assume that the information in this prospectus or any prospectus supplement, as well as the information we have previously filed with the SEC and incorporated by reference in this prospectus, is accurate only as of the date of the documents containing the information. Our business, financial condition, results of operations and prospects may have subsequently changed.

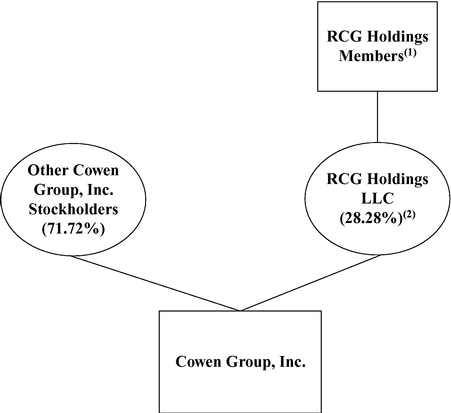

In this prospectus, references to "the Company," "Cowen Group," "we," "our" and "us" are to Cowen Group, Inc. and, except as the context otherwise requires, its consolidated subsidiaries. In this prospectus, references to "Ramius" refer to Ramius LLC, a wholly owned subsidiary of the Company, references to "Cowen Holdings" refer to Cowen Holdings, Inc., a wholly owned subsidiary of the Company, and references to "RCG" refer to RCG Holdings LLC, an entity which holds approximately 28.28% of our Class A common stock as of the date of this prospectus, in each case unless the context indicates otherwise.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain a number of forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that are not limited to historical facts, but our current beliefs, expectations or intentions regarding future events. In some cases, you can identify these statements by forward-looking terms such as "may," "will," "could," "should," "expect," "plan," "project," "intend," "anticipate," "believe," "estimate," "predict," "potential," "possible," "pursue," "seek," "target," "continue," the negative of those terms and other comparable terminology or similar expressions.

The forward-looking statements involve particular risks and uncertainties. The ability of the Company to predict results or the actual effects of its plans and strategies is subject to inherent uncertainty. Factors that may cause actual results or earnings to differ materially from such forward-looking statements include those set forth in the section titled "Risk Factors," as well as, among others, the following:

- •

- Difficult market conditions, market disruptions and volatility have adversely affected and may in the future continue to

adversely affect the Company's businesses, results of operations and financial condition; and

- •

- The Company's alternative investment management and investment banking businesses have incurred losses in recent periods and may incur losses in the future.

Our forward-looking statements may include or relate to the following:

- •

- the extent and duration of continued economic and market disruptions and governmental regulatory proposals to address

these disruptions;

- •

- our plans to continue to grow our business through organic growth and integration of previous and any future acquisitions;

- •

- the risk of reduction in revenue from the elimination of existing and potential customers due to consolidation in the

banking, retail and financial services industries;

- •

- actions that may be taken by our competitors, customers and suppliers that may cause harm to the Company's businesses; and

- •

- decisions to restructure, divest or eliminate business units or otherwise change the Company's business mix.

Because these forward-looking statements are subject to assumptions and uncertainties, actual results may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this prospectus or such other date that may be specified herein. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change.

All subsequent written and oral forward-looking statements concerning the offering or other matters addressed in this prospectus and attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. Except to the extent required by applicable law or regulation, the Company does not undertake any obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

1

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you and is qualified in its entirety by, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus and our financial statements and the related notes appearing elsewhere in this prospectus before you decide to invest in our Class A common stock. This prospectus contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in "Risk Factors" and other sections of this prospectus.

Our Business

Cowen Group is a diversified financial services firm and, together with its consolidated subsidiaries, provides alternative investment management, investment banking, research, market-making and sales and trading services through its two business segments: alternative investment management and broker-dealer. The alternative investment management segment includes hedge funds, replication products, mutual funds, managed futures funds, fund of funds, real estate, healthcare royalty funds, cash management services and mortgage advisory services, offered primarily under the Ramius name. The broker-dealer segment offers industry focused investment banking for growth-oriented companies including advisory and global capital markets origination and domain knowledge-driven research, a sales and trading platform for institutional investors, primarily under the Cowen name and an ETF market-making business, both domestically and internationally.

On November 2, 2009, the Company consummated certain transactions (which we refer to collectively as the Transactions), including: (1) the merger with Cowen Holdings, pursuant to which each outstanding share of common stock of Cowen Holdings was converted into one share of our Class A common stock and (2) the transfer by RCG of substantially all of its assets and liabilities to Ramius in exchange for the Company's issuance to RCG of 37,536,826 shares of our Class A common stock. In connection with the Transactions, RCG awarded membership interests (which corresponded to an aggregate of 2,859,426 of the shares of Class A common stock RCG received in the Transactions) to certain key employees, which we refer to as the "Transaction REOP." The Transaction REOP was a one-time award which will vest over a three-year period, with 50% of the awards vesting on each of the second and third anniversaries of the closing of the Transactions.

2

The diagram below shows the structure of the Company:

- (1)

- Members

of our senior management control the managing member of RCG. RCG members also include certain of our directors, officers and other employees.

- (2)

- This prospectus covers up to (i) 20,493,858 shares of our Class A common stock held by RCG and attributable to certain of its members who may withdraw one-third of their capital in RCG in shares of our Class A common stock as of each of the first, second and third anniversaries of the closing of the Transactions, which were consummated on November 2, 2009, subject to certain additional distribution restrictions for certain of its members to whom 7,435,759 of such shares are attributable in the aggregate, as discussed in the section entitled "Selling Stockholders," (ii) 872,093 shares of our Class A common stock held by RCG and attributable to certain of its members who may withdraw one-third of their capital in RCG in cash as of the end of each calendar year, and who may request that RCG distribute the shares to them or sell the shares on their behalf and distribute the net proceeds of such sales to them and (iii) 2,687,442 shares of our Class A common stock which were granted in connection with the Transactions and which are held by RCG and attributable to Transaction REOP awards held by certain of its members who may withdraw 50% of their shares of our Class A common stock attributable to the Transaction REOP awards upon the vesting of such Transaction REOP as of each of November 2, 2011 and November 2, 2012, subject to certain additional distribution restrictions for certain of its members to whom 1,960,249 of such shares are attributable in the aggregate, as discussed in the section entitled "Selling Stockholders." Of the 24,053,393 shares covered by this prospectus, 5,763,994 are attributable to certain of our executive officers and directors. This prospectus covers any distribution of these shares to the individual selling stockholders and any subsequent resale by those individual selling stockholders of such shares.

3

Principal Executive Offices

Our principal executive offices are located at 599 Lexington Avenue, New York, New York 10022, and our telephone number is (212) 845-7900. Our website address is http://www.cowen.com. Our website and the information contained on, or that can be accessed through, the website are not part of this prospectus.

Shares Covered by this Prospectus

This prospectus covers up to (i) 20,493,858 shares of our Class A common stock held by RCG and attributable to certain of its members who may withdraw one-third of their capital in RCG in shares of our Class A common stock as of each of the first, second and third anniversaries of the closing of the Transactions, which were consummated on November 2, 2009, subject to certain additional distribution restrictions for certain of its members, to whom 7,435,759 of such shares are attributable in the aggregate, as discussed in the section entitled "Selling Stockholders," (ii) 872,093 shares of our Class A common stock held by RCG and attributable to certain of its members who may withdraw one-third of their capital in RCG in cash as of the end of each calendar year, and who may request that RCG distribute the shares to them or sell the shares on their behalf and distribute the net proceeds of such sales to them and (iii) 2,687,442 shares of our Class A common stock which were granted in connection with the Transactions and which are held by RCG and attributable to Transaction REOP awards held by certain of its members who may withdraw 50% of the shares of our Class A common stock attributable to their Transaction REOP awards upon the vesting of such Transaction REOP as of each of November 2, 2011 and November 2, 2012, subject to certain additional distribution restrictions for certain of its members to whom 1,960,249 of such shares are attributable in the aggregate, as discussed in the section entitled "Selling Stockholders." Of the 24,053,393 shares covered by this prospectus, 5,763,994 are attributable to certain of our executive officers and directors. This prospectus covers any distribution of these shares to the individual selling stockholders and any subsequent resale by those individual selling stockholders of such shares.

4

An investment in our Class A common stock involves a high degree of risk. You should carefully consider the following information, together with the other information in this prospectus, prior to making a decision to purchase shares of our Class A common stock. In addition to the following risk factors, you should carefully consider the risks, uncertainties and assumptions discussed in Item 1A. of our annual report on Form 10-K for the year ended December 31, 2010, our quarterly reports on Form 10-Q for the fiscal quarters ended March 31, 2011 and June 30, 2011, and in other documents that we subsequently file with the SEC that update, supplement or supersede such information, which documents are incorporated by reference into this prospectus supplement. See "Where You Can Find More Information."

This prospectus contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed herein. If any of the following risks occur or if any additional risks and uncertainties not presently known to us or not currently believed to be material occur, our business, results of operations, financial condition or prospects could be materially adversely affected.

The ability of RCG and some of the Company's employees to sell Class A common stock could cause the stock price to decrease.

The sale of a substantial number of shares of Class A common stock by RCG or the members of RCG who receive distributions of our Class A common stock from RCG within a short period of time, or the possibility of such sales, may adversely affect the price of the Company's Class A common stock and impede the Company's ability to raise capital through the issuance of equity securities.

Approximately 20,493,858 shares of our Class A common stock held by RCG underlie the capital in RCG of those members of RCG who may withdraw one-third of their capital in RCG in shares of our Class A common stock as of each of the first, second and third anniversaries of the closing of the Transactions, which were consummated on November 2, 2009, subject to certain additional distribution restrictions for certain of its members to whom 7,435,759 of such shares are attributable in the aggregate. In connection with the withdrawal of capital by certain of these members of RCG, this prospectus covers 20,493,858 shares of our Class A common stock attributable to such members who may request to withdraw such shares on the second and third anniversaries of the closing of the Transactions and which RCG will distribute to such requesting members as soon as practicable after each such anniversary or at such later date as may be requested.

Approximately 872,093 shares of our Class A common stock held by RCG underlie the capital in RCG of those members of RCG who may request to withdraw one-third of their capital in RCG in cash as of the end of each calendar year following the closing of the Transactions. In connection with the withdrawal of capital by certain of these non-affiliate members of RCG, RCG intends to sell 504,698 shares of our Class A common stock attributable to these members or distribute the shares to them. If RCG sells such shares, RCG will use the net proceeds of such sales to satisfy the withdrawal requests of these members in cash.

Approximately 2,687,442 shares of our Class A common stock held by RCG were granted in connection with the Transactions and are attributable to Transaction REOP awards held by certain of its members who may request to withdraw 50% of the shares of our Class A common stock attributable to their Transaction REOP awards upon the vesting of such Transaction REOP as of each of November 2, 2011 and November 2, 2012, subject to certain additional distribution restrictions for certain of its members to whom 1,960,249 of such shares are attributable in the aggregate, as discussed in the section entitled "Selling Stockholders." Additionally, certain shares of our Class A common stock may be sold by RCG on behalf of the members or by the members to whom such shares are

5

attributable prior to such dates in order to satisfy tax obligations with respect to such members. In connection with the withdrawal of capital by RCG and certain of these members of RCG, this prospectus covers 2,687,442 shares of our Class A common stock attributable to such members. If requested by the members, RCG will distribute these shares, other than those sold to satisfy tax obligations (if any), to the such requesting members as soon as practicable following the applicable vesting date or at such later date as may be requested.

RCG and the Company anticipate that, following November 2, 2012 and the vesting of certain Transaction REOP as of such date, there will be no distribution restrictions on any shares of Class A common stock held by RCG or the members of RCG who receive distributions of such shares of Class A common stock from RCG.

Of the 24,053,393 shares covered by this prospectus, approximately 6,825,783 are attributable to the individual selling stockholders. Following the distribution of these shares by RCG, to the individual selling stockholders, this prospectus will cover any subsequent resale of such shares by the individual selling stockholders.

The Company does not intend to pay dividends on shares of its Class A common stock for the foreseeable future.

The Company intends to use earnings in the future to fund and develop the Company's business and does not anticipate paying any cash dividends on Class A common stock. Your potential gain from your investment in Class A common stock, therefore, will be solely the capital appreciation, if any, of Class A common stock.

Under the amended and restated certificate of incorporation of the Company, the Company is able to issue more shares of common stock than are currently outstanding. As a result, such future issuances of common stock could have a dilutive effect on the earnings per share and voting power of the Company stockholders.

The amended and restated certificate of incorporation of the Company authorizes a greater number of shares of common stock than are currently outstanding. If the board of directors of the Company elects to issue additional shares of common stock in the future, whether in public offerings, in connection with mergers and acquisitions or otherwise, such additional issuances could dilute the earnings per share and voting power of the Company stockholders.

Certain provisions of the Company's amended and restated certificate of incorporation, amended and restated bylaws and Delaware law may have the effect of delaying or preventing an acquisition by a third party.

The Company's amended and restated certificate of incorporation and amended and restated bylaws contain several provisions that may make it more difficult for a third party to acquire control of the Company, even if such acquisition would be financially beneficial to the Company's stockholders. These provisions also may delay, prevent or deter a merger, acquisition, tender offer, proxy contest or other transaction that might otherwise result in the Company's stockholders receiving a premium over the then-current trading price of Class A common stock. For example, the Company's amended and restated certificate of incorporation authorizes its board of directors to issue up to 10,000,000 shares of "blank check" preferred stock. Without stockholder approval, the board of directors has the authority to attach special rights, including voting and dividend rights, to this preferred stock. With these rights, preferred stockholders could make it more difficult for a third party to acquire the Company. In addition, the Company's amended and restated bylaws provide for an advance notice procedure with regard to the nomination of candidates for election as directors and with regard to business to be brought before a meeting of stockholders. The Company is also subject to the anti-takeover provisions of Section 203 of the Delaware General Corporation Law, or DGCL. Under these provisions, if anyone becomes an "interested stockholder," the Company may not enter into a "business combination" with

6

that person for three years without special approval, which could discourage a third party from making a takeover offer and could delay or prevent a change of control. For the purposes of Section 203, "interested stockholder" means, generally, someone owning 15% or more of the Company's outstanding voting stock or an affiliate of the Company that owned 15% or more of our outstanding voting stock during the past three years, subject to certain exceptions as described in Section 203.

Any proceeds from the sale, transfer, distribution or other disposition of the shares of common stock covered hereby will be solely for the account of the selling stockholders. We will not receive any proceeds from the sale, transfer, distribution or other disposition of the shares by the selling stockholders.

This prospectus covers up to 24,053,393 shares of Class A common stock of Cowen Group, Inc. held by RCG (our largest shareholder, which holds 32,616,294 shares of our Class A common stock in the aggregate) that may be sold, transferred, distributed or otherwise disposed of from time to time by the selling stockholders named herein and their successors and assigns, including those selling stockholders who receive such shares after the date of this prospectus from a selling stockholder as a gift, pledge, distribution or other transfer. The shares held by RCG are attributable to its members and may be distributed to them or sold on their behalf, as described in this prospectus. We will not receive any of the proceeds from any of such sales or distributions. The selling stockholders will bear all sales commissions and similar expenses. This prospectus covers both the distribution of these shares by RCG to its members (or sales made by RCG on their behalf) and the resale, if any, of any shares distributed to any of our directors or executive officers who are members of RCG.

Approximately 20,493,558 shares of our Class A common stock held by RCG underlie the capital in RCG of those members of RCG who may request to withdraw one-third of their capital in RCG in shares of our Class A common stock as of each of the first, second and third anniversaries of the closing of the Transactions, which were consummated on November 2, 2009, subject to certain additional distribution restrictions for certain of its members to whom 7,435,759 of such shares are attributable in the aggregate, who are restricted from withdrawing (x) 50% of their capital in RCG in shares of our Class A common stock until the date that is thirty months after the closing of the Transactions and (y) 50% of their capital in RCG in shares of our Class A common stock until the third anniversary of the closing of the Transactions. In connection with the withdrawal of capital by certain of these members of RCG, this prospectus covers 20,493,558 shares of our Class A common stock attributable to these members. If requested by such members, RCG will distribute these shares to the members as soon as practicable following the second or third anniversaries of the closing of the Transactions, as applicable, or at such later date as may be requested.

Approximately 872,093 shares of our Class A common stock held by RCG underlie the capital in RCG of those members of RCG who may request to withdraw one-third of their capital in RCG in cash as of the end of each calendar year following the closing of the Transactions. In connection with the withdrawal of capital by certain of these non-affiliate members of RCG as of December 31, 2011, this prospectus covers and RCG intends to sell, on or prior to December 31, 2011, 504,698 shares of our Class A common stock attributable to these members or distribute the shares to them. If RCG sells such shares, RCG will use the net proceeds of such sales to satisfy the withdrawal requests of these members in cash.

Approximately 2,687,442 shares of our Class A common stock were granted in connection with the Transactions and are held by RCG and attributable to Transaction REOP awards held by certain of its members who may request to withdraw 50% of their capital in RCG with respect to the Class A

7

common stock attributable to their Transaction REOP awards upon the vesting of such Transaction REOP as of each of November 2, 2011 and November 2, 2012. Further, in addition to these vesting requirements, certain members of RCG, including the individual selling stockholders, are restricted from withdrawing (x) 50% of their capital in RCG in shares of our Class A common stock, until the date that is thirty months after the closing of the Transactions and (y) 50% of their capital in RCG shares of our Class A common stock on the third anniversary of the closing of the Transactions. However, such members are entitled to receive shares of our Class A common stock in, an amount necessary to satisfy tax obligations incurred with respect to the vesting of such Transaction REOP awards. Additionally, certain shares of our Class A common stock may be sold by RCG on behalf of the members or by the members to whom such shares are attributable in order to satisfy tax obligations with respect to such members. RCG has confirmed with the Company that it is its intention to distribute all shares of our Class A common stock attributable to Transaction REOP awards to the applicable members of RCG upon vesting of such Transaction REOP, except for those shares (excluding shares distributed or sold by RCG in order to satisfy tax obligations, if any) attributable to such members of RCG, including the individual selling stockholders, that are subject to further restrictions (as described above). In connection with the withdrawal of capital by certain of these members of RCG, this prospectus covers 2,687,442 shares of our Class A common stock attributable to these members. If requested by the members, RCG will distribute these shares, other than those sold to satisfy tax obligations (if any), to the such requesting members as soon as practicable following the applicable vesting date or at such later date as may be requested. This prospectus covers the distribution by RCG of these shares to the individual selling stockholders (or sales by RCG on their behalf) and the resale by the individual selling stockholders of such distributed shares.

The table below presents certain information as of October 28, 2011 regarding the beneficial ownership of our common stock by the selling stockholders.

| |

Shares owned Prior to any Offering under this Prospectus |

|

Shares Owned After the Completion of the Offering(s) under this Prospectus(1) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Maximum Number of Shares Being Sold Under this Prospectus |

|||||||||||||||

Selling Stockholder Name |

Number | Percentage(2) | Number | Percentage(2) | ||||||||||||

RCG Holdings LLC |

32,616,294 | (3) | 28.28 | % | 24,053,393 | (3) | 8,562,901 | (3) | 7.42 | % | ||||||

Peter A. Cohen |

32,701,083 | (4)(5) | 28.35 | % | 3,013,627 | (4)(5) | 8,647,690 | (4)(5) | 7.50 | % | ||||||

Stephen A. Lasota |

85,478 | (6) | 0.07 | % | 53,604 | (6) | 31,874 | (6) | 0.03 | % | ||||||

Jerome S. Markowitz |

260,061 | (7) | 0.23 | % | 216,243 | (7) | 43,818 | (7) | 0.04 | % | ||||||

Thomas W. Strauss |

32,649,022 | (4)(8) | 28.31 | % | 2,889,177 | (4)(8) | 8,595,629 | (4)(9) | 7.45 | % | ||||||

Jeffrey M. Solomon |

32,665,033 | (4)(9) | 28.32 | % | 590,969 | (4)(8) | 8,611,640 | (4)(9) | 7.47 | % | ||||||

Owen S. Littman |

94,129 | (10) | 0.08 | % | 62,163 | (10) | 31,966 | (10) | 0.03 | % | ||||||

- (1)

- Assumes that each selling stockholder sells, transfers, distributes or otherwise disposes of all the shares that it holds or are attributable to it covered hereby.

8

- (2)

- The

number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of

1934, as amended, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which each selling

stockholder has sole or shared voting power or investment power and also any shares that each selling stockholder has the right to acquire within 60 days after October 28, 2011, through

the exercise of any stock options or other rights. To our knowledge, the selling stockholders have sole voting and investment power with respect to the shares shown as beneficially owned. The

percentages of beneficial ownership are based on 115,344,186 shares of our common stock outstanding as of October 28, 2011 (assuming no exercise of outstanding stock options after that date).

We do not know when or in what amounts the selling stockholders may sell, transfer, distribute or otherwise dispose of the shares covered hereby. The selling stockholders might not sell, transfer,

distribute or otherwise dispose of any or all of the shares covered hereby. Because each selling stockholder may sell, transfer, distribute or otherwise dispose of none, some or all of the shares

covered by this prospectus, we cannot estimate the number of the shares that will be held by each selling stockholder after completion of any offering. For purposes of this table only, we have assumed

that, after completion of the offering, none of the shares covered by this prospectus will be held by any of the selling stockholders.

- (3)

- This

prospectus covers up to (i) 20,493,858 shares of our Class A common stock held by RCG Holdings LLC and attributable to certain of

its members who may request to withdraw one-third of their capital in RCG in shares of our Class A common stock as of each of the first, second and third anniversaries of the

closing of the Transactions, which were consummated on November 2, 2009, subject to certain additional restrictions for certain of its members to whom 7,435,759 of such shares are attributable

in the aggregate, and who have the right to request that RCG Holdings LLC distribute the shares to them, (ii) 872,093 shares of our Class A common stock held by RCG

Holdings LLC and attributable to certain of its members who may request to withdraw one-third of their capital in RCG Holdings LLC in cash as of the end of each calendar

year, and who may request that RCG Holdings LLC sell the shares on or prior to December 31, 2011 on their behalf and distribute the net proceeds to them or distribute the shares to them

and (iii) 2,687,442 shares of our Class A common stock which were granted in connection with the Transactions and which are held by RCG and attributable Transaction REOP awards held by

certain of its members who may request to withdraw 50% of the shares of our Class A common stock attributable to their Transaction REOP awards upon the vesting of such Transaction REOP as of

each of November 2, 2011 and November 2, 2012, subject to certain additional distribution restrictions for certain of its members to whom 1,960,249 of such shares are attributable in the

aggregate. Of the 24,053,393 shares covered by this prospectus, 6,825,783 are attributable to the individual selling stockholders. This prospectus covers both the distribution of these shares to the

individual selling stockholders (or sales by RCG on their behalf) and the resale by the individual selling stockholders of such shares.

- (4)

- The

number of shares of Class A common stock beneficially owned by Mr. Cohen, Mr. Solomon and Mr. Strauss consists of the

32,616,294 shares of Class A common stock held by RCG. C4S & Co., L.L.C. ("C4S") is the managing member of RCG and may be considered to be the beneficial owner of any securities

deemed to be beneficially owned by RCG. C4S disclaims beneficial ownership of these securities. Mr. Cohen, Mr. Solomon and Mr. Strauss are managing members of C4S and may be

considered beneficial owners of any securities deemed to be beneficially owned by C4S. Messrs. Cohen, Solomon and Strauss disclaim beneficial ownership of these securities, except as otherwise

expressly described below.

- (5)

- Mr. Cohen does not disclaim beneficial ownership with respect to the 3,013,627 shares of Class A common stock that are held by RCG and allocated to Mr. Cohen in connection with his ownership interest in RCG (including shares attributed to unvested Transaction REOP granted to Mr. Cohen

9

in connection with the Transactions). However, the distribution by RCG of those shares to Mr. Cohen is subject to certain restrictions, as described in this prospectus.

- (6)

- Mr. Lasota

has a pecuniary interest in the 53,604 shares of Class A common stock that are held by RCG and allocated to Mr. Lasota in

connection with his ownership interest in RCG (including shares attributed to unvested Transaction REOP granted to Mr. Lasota in connection with the Transactions), but is not deemed to be the

beneficial owner of these shares. The distribution by RCG of those shares to Mr. Lasota is subject to certain restrictions, as described in this prospectus.

- (7)

- Mr. Markowitz

has a pecuniary interest in 216,243 shares of Class A common stock that are held by RCG and allocated to Mr. Markowitz in

connection with his ownership interest in RCG, but is not deemed to be the beneficial owner of these shares. The distribution by RCG of those shares to Mr. Markowitz is subject to certain

restrictions, as described in this prospectus.

- (8)

- Mr. Strauss

does not disclaim beneficial ownership with respect to the 1,827,388 shares of Class A common stock that are held by RCG and

allocated to Mr. Strauss in connection with his ownership interest in RCG (including shares attributed to unvested Transaction REOP granted to Mr. Strauss in connection with the

Transactions) and the 1,061,789 shares of our Class A common stock that are held by RCG and allocated to an entity controlled by Mr. Strauss, in connection with its ownership interest in

RCG. However, the distribution by RCG of those shares to Mr. Strauss and the entity is subject to certain restrictions, as described in this prospectus.

- (9)

- Mr. Solomon

does not disclaim beneficial ownership with respect to the 590,969 shares of Class A common stock that are held by RCG and

allocated to Mr. Solomon in connection with his ownership interest in RCG (including shares attributed to unvested Transaction REOP granted to Mr. Solomon in connection with the

Transactions). However, the distribution by RCG of those shares to Mr. Solomon is subject to certain restrictions, as described in this prospectus.

- (10)

- Mr. Littman has a pecuniary interest in the 62,163 shares of Class A common stock that are held by RCG and allocated to Mr. Littman in connection with his ownership interest in RCG (including shares attributed to unvested Transaction REOP granted to Mr. Littman in connection with the Transactions), but is not deemed to be the beneficial owner of these shares. The distribution by RCG of those shares to Mr. Littman is subject to certain restrictions, as described in this prospectus.

Transactions with the Selling Stockholders

RCG is our largest shareholder and holds 32,616,294 shares of our Class A common stock in the aggregate. Under RCG's operating agreement, the members of RCG generally will not be entitled to receive any distributions of those shares of our Class A common stock or other capital attributable to them, and RCG's managing member has agreed in RCG's operating agreement not to make any distributions of shares of our Class A common stock or other capital to these members for specified periods of time.

10

We are registering 24,053,393 shares of Class A common stock on behalf of the selling stockholders. The selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, limited partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

Of these shares, 20,493,858 are held by RCG and are attributable to certain of its members who may request that RCG distribute the shares to them so that they may hold them directly, 872,092 are held by RCG and are attributable to certain of its members who may request that RCG sell the shares on their behalf and distribute the net proceeds to them and 2,687,442 are held by RCG and are attributable to certain of its members (i) who may request that RCG distribute shares to them so that they may hold them directly (and who may sell a portion of such shares to satisfy tax obligations) and/or (ii) who may request that RCG sell certain shares in order to satisfy tax obligations.

The selling stockholders may use any one or more of the following methods when disposing of shares:

- •

- ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

- •

- block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of

the block as principal to facilitate the transaction;

- •

- purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

- •

- an exchange distribution in accordance with the rules of the applicable exchange;

- •

- privately negotiated transactions;

- •

- short sales effected after the date the registration statement of which this prospectus is a part is declared effective by

the SEC;

- •

- through the writing or settlement of options or other hedging transactions, whether through an options exchange or

otherwise;

- •

- broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per

share; and

- •

- a combination of any such methods of sale.

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may

11

also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock may be "underwriters" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are "underwriters" within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify certain of the selling stockholders against liabilities, including liabilities of any violation by the Company of the Securities Act and the Exchange Act applicable to the Company and relating to the registration of the shares offered by this prospectus.

We have agreed with the selling stockholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier of such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement, provided that Rule 415 of the Securities Act, or any successor rule under the Securities Act, permits an offering on a continuous or delayed basis.

12

The validity of the issuance of the common stock offered by this prospectus and certain other legal matters are being passed upon for us by our counsel, Willkie Farr & Gallagher LLP, New York, New York.

The financial statements and management's assessment of the effectiveness of internal control over financial reporting (which is included in Management's Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. We have also filed with the SEC a registration statement on Form S-3 to register the common stock being offered pursuant to this prospectus. This prospectus, which forms part of the registration statement, does not contain all of the information included in the registration statement. For further information about us or the selling stockholders and the shares of common stock offered pursuant to this prospectus, you should refer to the registration statement and its exhibits.

Our annual reports on Form 10-K, along with all other reports and amendments filed with or furnished to the SEC, are publicly available free of charge on the investor relations section of our website as soon as reasonably practicable after we file such materials with, or furnish them to, the SEC. Our website is located at www.cowen.com. The information on our website is not part of this or any other report that we file with, or furnish to, the SEC. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. You may also read and copy any documents we file with the SEC at its Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring to those documents. The information incorporated by reference is an important part of this prospectus. Any statement contained in a document which is incorporated by reference in this prospectus is automatically updated and superseded if information contained in this prospectus, or information that we later file with the SEC, modifies or replaces this information. All documents we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the initial filing of this registration statement and prior to effectiveness of this registration statement and after the date of this prospectus and until we sell all the securities, shall be deemed to be incorporated by reference into this prospectus. We incorporate by reference the following previously filed documents:

- (1)

- Our Current Reports on Form 8-K (in all cases other than information furnished rather than filed pursuant to any Form 8-K) filed with the SEC on January 5, 2011, February 11, 2011, February 17, 2011, March 4, 2011, April 11, 2011, May 2, 2011, May 6, 2011, June 2, 2011, June 16, 2011, June 29, 2011, August 5, 2011, August 31, 2011, September 12, 2011 and October 7, 2011;

13

- (2)

- Our

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2011 and June 30, 2011;

- (3)

- Our

Annual Report on Form 10-K for the year ended December 31, 2010 as amended by the Form 10-K/A filed with the SEC on

May 2, 2011;

- (4)

- Our

Definitive Proxy Statement on Schedule 14A, filed with the SEC on August 3, 2011; and

- (5)

- The description of our common stock set forth in our registration statement filed under the Exchange Act on Form S-1 (File No. 333163372) as filed with the SEC on November 25, 2010, as amended, including any amendment or report for the purpose of updating such description.

To receive a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits) call or write us at the following address Cowen Group, Inc., 599 Lexington Avenue, New York, NY 10022, (212) 845-7900.

You should rely only on the information incorporated by reference or provided in this prospectus. Neither we nor the selling stockholders have authorized anyone else to provide you with different information. The selling stockholders are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of those documents.

14