Mr. Dave Irving and Ms. Sharon Blume

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

|

Re:

|

COWEN INC.

|

|

Form 10-K for the Fiscal Year Ended December 31, 2019

|

|

|

Filed March 4, 2020

|

|

|

Form 10-Q for the Quarter Ended June 30, 2020

|

|

|

Filed July 30, 2020

|

|

|

Form 8-K Filed July 28, 2020

|

|

|

File No. 001-34516

|

We are writing in response to your letter dated September 23, 2020 with respect to the review, by the staff of the Division of Corporation Finance (the

“Staff”) of the U.S. Securities and Exchange Commission (the “Commission”), of Cowen Inc.’s (the “Company”) above-referenced Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the

Commission on March 4, 2020, Form 10-Q for the quarter ended June 30, 2020, which was filed on July 30, 2020, and the Form 8-K containing the Company’s

earnings release for the three-month period ended June 30, 2020, which was filed with the Commission on July 28, 2020. Our responses to your comments are provided below. For your convenience, we have restated the text of your comments.

Because of the confidential nature of information contained herein, this submission is accompanied by a request for confidential treatment

for selected portions of this letter. We have filed a separate letter with the Office of Freedom of Information and Privacy Act (the “FOIA Office”) in connection with the confidential treatment request, pursuant to Rule 83 of the Commission’s Rules

on Information and Requests 17 C.F.R. § 200.83 (“Rule 83”). For the Staff’s reference, we have enclosed a copy of our letter to the FOIA Office (the “Request”) with this copy of the correspondence marked to show the portions redacted from the

version filed via EDGAR and for which the Company is requesting confidential treatment.

In accordance with Rule 83, the Company requests confidential treatment of (a) the marked portions (the “Confidential Information”) of this

response letter (this “Letter”) and (b) the accompanying Request letter (collectively, the “Confidential Material”). Please promptly inform the Company of any request for disclosure of the Confidential Material made pursuant to the Freedom of

Information and Privacy Act or otherwise so that the undersigned may substantiate the foregoing request for confidential treatment in accordance with Rule 83.

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 1

|

In accordance with Rule 83, this Letter has also been clearly marked with the legend “CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.” and

each page is marked for the record with the identifying numbers and code “COWEN INC. 1” through “COWEN INC. 7.”

Form 8-K Filed July 28, 2020

Exhibit 99.1

Non-GAAP Financial Measures, page 8

1. We note your response to prior comment 2. We continue to evaluate your response and may have further comments.

Response:

The Company appreciates that the Staff is still evaluating the response to our prior comment 2 to the Staff’s last comment letter. Please let us know if there

are any points of clarification that the Company can assist with.

2. We note your response to prior comment 3. In future period filings where you provide the reconciliation from Net income attributable to Cowen Inc. Common Stockholders to Economic Income (Loss), please remove the

adjustments pertaining to prior periods to conform to your current presentation. Refer to Question 100.02 of the Division’s Non-GAAP Financial Measures Compliance & Disclosure Interpretations.

Response:

[***]

Form 10-Q for the Quarter Ended June 30, 2020

Notes to Unaudited Condensed Consolidated Financial Statements

Note 22 - Segment Reporting, page 59

3. We note you reclassify certain amounts to and make certain adjustments to the amounts you disclose as revenue for each of your reportable segments. Please tell us how the amounts you disclosed as revenue for each

reportable segment complies with ASC 280-10-50-22(a). Please also explain to us your basis for disclosing other amounts for each of your reportable segments that reflect adjustments and reclassifications, such as various expense amounts disclosed

on page 60, citing the applicable authoritative guidance. Refer to ASC 280-10-50.

*** - Information omitted and provided under separate cover to the Staff pursuant to Rule 83.

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 2

|

Response:

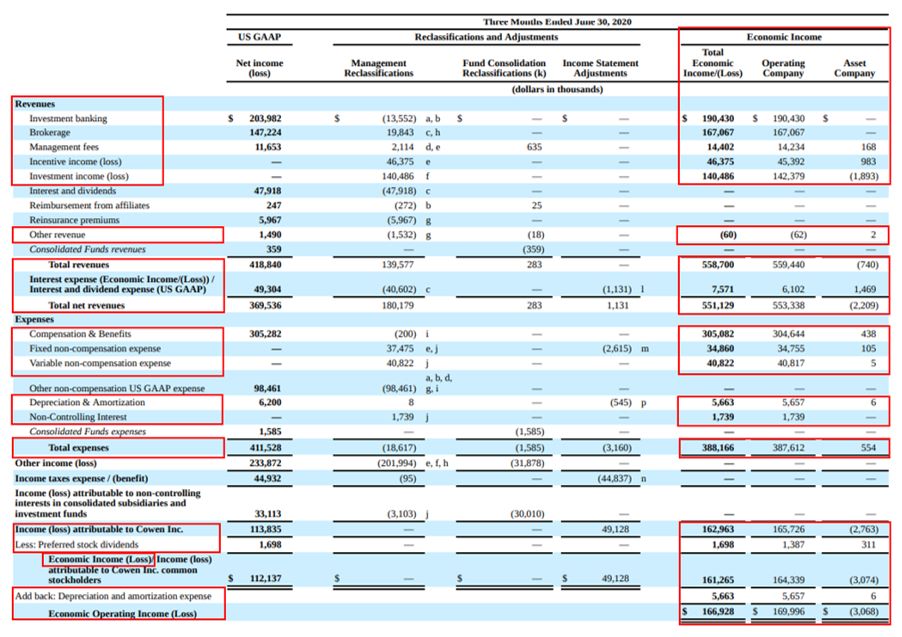

The goal of the quantitative disclosures in ASC 280-10-50

is, among others, to provide readers of the Company’s financial statements information on profit or loss for each segment using the same measurement basis that the Company’s Chief Operating Decision Maker (the “CODM”) regularly reviews and to

reconcile the segment information to required amounts in ASC 280-10-50-30. ASC 280-10-50, among others, breaks these requirements into three components, (i) information about profit or loss in ASC 280-10-50-22 through 26, (ii) measurement of the information provided in ASC 280-10-50-27 through 29 and (iii)

reconciliation requirements in ASC 280-10-50-30.

Specifically, ASC 280-10-50-22 requires that the

Company report a measure of profit or loss for each reportable segment as well as a requirement to disclose specified amounts described in ASC

280-10-50-22(a) through (j) if included in the segment measure of profit or loss reviewed or regularly provided to the CODM. ASC 280-10-50-27 clarifies

that the amount of each segment measure reported in accordance with ASC 280-10-50-22 shall be the measure reported to the CODM for purposes of

making decisions about allocating resources to the segment and assessing its performance. Further, ASC 280-10-50-30 requires several

reconciliations, including the reconciliation of the total of the reportable segment’s measures of profit or loss to the Company’s consolidated income (loss) before taxes and discontinued operations.

The table disclosed on page 60 under the “Performance measures” heading under Note 22 - Segment Reporting, is designed to meet the disclosure requirements

described above.

The Company’s main performance measure is Economic Income (Loss). As previously described to the Staff in the Company’s response to the prior Comment 1 filed

with the Commission on August 10, 2020, Economic Income (Loss), Economic Operating Income (Loss) and related per share amounts are the key financial performance indicators that are utilized by the Company’s CODM and other members of management to

assess the performance of the Company’s consolidated operations and business segments, to make decisions about capital allocation, compensation and recruiting as well as to set corporate strategy and assess the overall effectiveness of senior

management.

As disclosed on page 59 under the “Performance measures” heading under Note 22 - Segment Reporting, Economic Income (Loss) is, in general, a pre-tax measure

that (i) includes management reclassifications which the Company believes provides additional insight on the performance of the Company’s core businesses and divisions, (ii) eliminates the impact of consolidation for Consolidated Funds and excludes

(iii) goodwill and intangible impairment (iv) certain other transaction-related adjustments and/or reorganization expenses and (v) certain costs associated with debt. Economic Operating Income (Loss) is a similar measure but before depreciation and

amortization expenses.

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 3

|

The CODM receives and reviews Economic Income (Loss) information on a regular basis that depicts the profit and loss information for each of the Company’s

reportable segments, which is not presented to the CODM on a US GAAP basis. This information is depicted in the three Economic Income (Loss) columns disclosed in the table. The red squares below are meant to highlight what the CODM sees in the

information regularly received and reviewed and is presented on page 60 under the “Performance measures” heading under Note 22 - Segment Reporting, in the three Economic Income (Loss) columns and associated line item descriptions as depicted below to

meet the disclosure requirement in ASC 280-10-50-22.

The Company notes that the Staff is interested in how the amounts the Company discloses as revenue for each reportable segment complies with ASC 280-10-50-22(a), which requires the disclosure of revenues from external customers. Revenues from external customers required under ASC 280-10-50-22(a) are Total Revenues on a US

GAAP basis less interest revenue and revenues from transactions with other operating segments of the public entity.

While the Company does not explicitly report a measure entitled revenues from external customers for each reportable segment, the Company believes that

information provided to reconcile the segment profit and loss includes this information. The Company does not have revenues from transactions between the Company’s reportable segments, which ASC 280-10-50-22(b) indicates is excluded from revenue from external customers. Additionally, ASC

280-10-50-22(c) indicates that revenues from external customers excludes interest revenue. To meet the disclosure requirement in ASC

280-10-50-22(a) and distinguish from the requirement in ASC 280-10-50-22(c), the Company provides interest revenue information with the

reconciliation of segment profit and loss to discern the revenue from external customers. The Company’s Operating Company segment comprises the vast majority of the Company’s Total Revenues and due to materiality, the Company believes that the

readers of the financial statements can discern that interest revenue should be materially attributed to the Operating Company segment.

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 4

|

The Company additionally notes that the Staff would like to understand the basis for disclosing other amounts for each of our reportable segments that reflect

adjustments and reclassifications, such as various expense amounts disclosed on page 60 under the “Performance measures” heading under Note 22 - Segment Reporting. As the Company noted above, the table is meant to cover all quantitative disclosure

requirements in ASC 280-10-50. Additionally, as described and depicted above, the Economic Income (Loss) columns on the right side of the table

are meant to comply with ASC 280-10-50-22 and ASC

280-10-50-27. We disclosed the adjustments and reclassifications reported in the table, such as various expense amounts, to meet the reconciliation requirements in ASC 280-10-50-30. The Company notes that the inclusion of these amounts in revenue is not meant to depict US GAAP revenue. However, the adjustments are in line with the performance measure that the CODM utilizes

to review segment profit and loss and is reported as the per segment measure of profit and loss in accordance with ASC 280-10-50-27.

4. You disclose on page 59 that the performance measure for your segments is “Economic Income (Loss).” You appear to disclose measures of profit or loss for each reportable segment in addition to “Economic Income

(Loss),” including amounts in the “Income (Loss) attributable to Cowen Inc.,” line item, as well as “Economic Operating Income (Loss).” If your chief operating decision maker uses more than one measure in assessing segment performance and deciding

how to allocate resources, the reported measure shall be the measure that management believes is determined in accordance with the measurement principles most consistent with those used in measuring the corresponding amounts in your consolidated

financial statements. Please tell us how your disclosure complies with ASC 280-10-50-22 and 28.

Response:

Please refer to the Company’s response to Comment 3 for a discussion of how the Company’s disclosure complies with ASC 280-10-50-22. The Company notes that ASC 280-10-50-28 does require that when

a the CODM uses more than one measure in assessing performance, the Company must use the measure most consistent US GAAP. As such, the Company will no longer present Economic Operating Income (Loss) in its segment disclosures in future filings.

However, Income (Loss) attributable to Cowen Inc. is not a metric utilized or provided to the CODM, but a discrete line item on the Company’s Condensed Consolidated Statement of Operations and is included as part of the reconciliation described in

Comment 3.

5. Please tell us how your disclosure complies with the requirement to reconcile from the total of your reportable segments’ measures of profit or loss to consolidated income before income taxes and discontinued

operations. Refer to ASC 280-10-50-30(b).

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 5

|

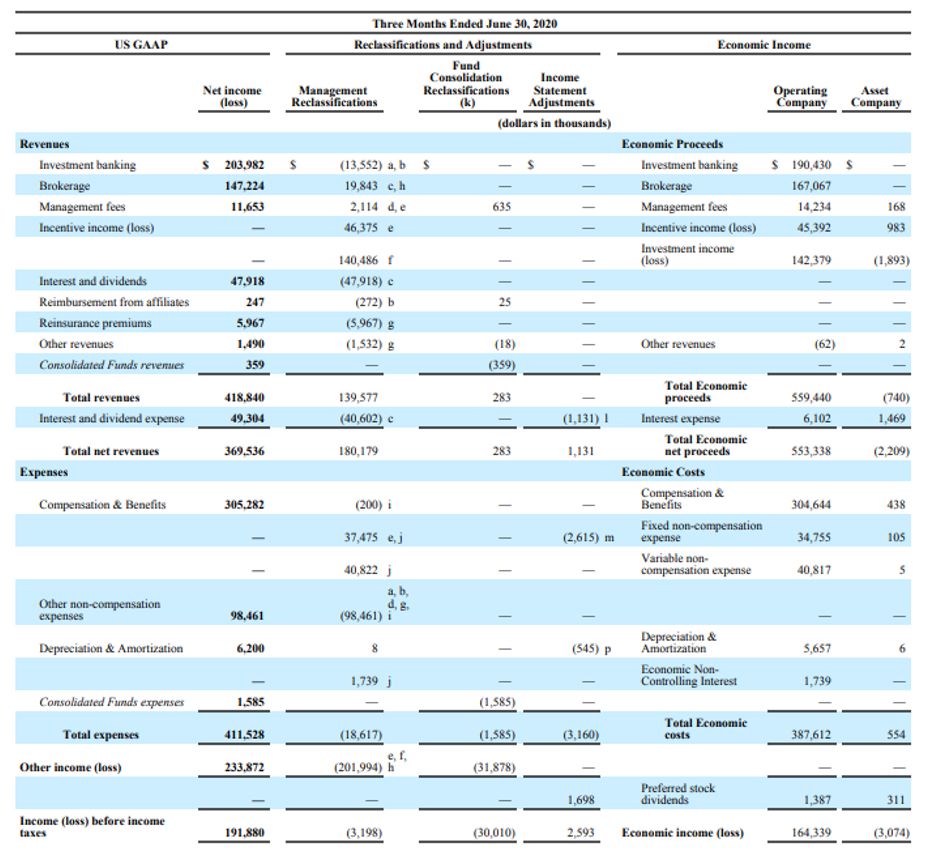

Response:

The Company will provide a reconciliation for profit or loss to consolidated income before income taxes and discontinued operations in future filings. Please

see below for a representation of the reconciliation for the three months ended June 30, 2020.

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 6

|

We appreciate the Staff’s attention to the Company’s filings and the opportunity to provide the foregoing responses to the Staff’s comments. Should you have

any questions concerning the foregoing, please do not hesitate to call me at (212) 845-7919.

Sincerely,

/s/ Stephen Lasota

Stephen Lasota

Chief Financial Officer

Cowen Inc.

|

Cowen Inc.

|

||

|

599 Lexington Avenue, 20th Floor

|

||

|

New York, NY 10022

|

||

|

T 646 562 1010

|

CONFIDENTIAL TREATMENT REQUESTED BY COWEN INC.

|

|

|

www.cowen.com

|

COWEN INC. 7

|