Table of Contents

As filed with the Securities and Exchange Commission on September 4, 2019

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

FOR REGISTRATION UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN

REAL ESTATE COMPANIES

Resource Real Estate Opportunity REIT, Inc.

(Exact name of Registrant as specified in its charter)

1845 Walnut Street, 18th Floor

Philadelphia, PA 19103

(215) 231-7050

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Alan F. Feldman

Chief Executive Officer

Resource Real Estate Opportunity REIT, Inc.

1845 Walnut Street, 18th Floor

Philadelphia, Pennsylvania 19103

(215) 231-7050

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt, Esq.

Laura K. Sirianni, Esq.

DLA Piper LLP (US)

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Aggregate Offering Price Per Share (1) |

Proposed Maximum Offering Price (2) |

Amount of Registration Fee | ||||

| Common stock, par value $0.01 per share |

711,274 | $10.5322 | $7,491,280 | $908 | ||||

|

| ||||||||

|

| ||||||||

| (1) | The average price of the 711,274 shares of the common stock being registered is $10.53 per share. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o) promulgated under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this document is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This document is not an offer to sell these securities and we are not soliciting any offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Prospectus (Subject to Completion)

September 4, 2019

711,274 Shares Common Stock

Resource Real Estate Opportunity REIT, Inc.

RESCISSION OFFER

| • | We are offering to repurchase 711,274 shares of our common stock from persons who are or were residents of California and purchased shares of our common stock between June 8, 2017 and June 30, 2019 pursuant to our distribution reinvestment plan. |

| • | If you accept our rescission offer and surrender your shares, you will receive your purchase price for the shares (which ranges from $10.26 to $10.94), plus 7% interest based on the initial purchase price, less any distributions you have received on those shares. Interest and distributions will be determined from the date you purchased the shares through the date that the rescission offer expires. |

| • | The rescission offer will expire on [30 days from receipt of offer], 2019. |

| • | There is no current established public market for our shares and we currently have no plans to list our shares on a national securities exchange. Our board of directors has approved a share redemption program, but may amend, suspend or terminate our share redemption program upon 30 days’ notice and without stockholder approval. Our board of directors may reject any request for redemption of shares. Further, there are many limitations on your ability to sell your shares pursuant to the share redemption program. |

| • | There are restrictions on the ownership and transferability of our shares of common stock. See “Description of Shares.” |

See “Risk Factors” beginning on page 18 to read about certain factors you should consider before accepting or rejecting the rescission offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THIS OFFER OF REPURCHASE HAS BEEN APPROVED BY THE CALIFORNIA COMMISSIONER OF CORPORATIONS IN ACCORDANCE WITH SECTION 25507(b) OF THE CALIFORNIA CORPORATE SECURITIES LAW OF 1968 ONLY AS TO ITS FORM. SUCH APPROVAL DOES NOT IMPLY A FINDING BY THE COMMISSIONER THAT ANY STATEMENTS MADE HEREIN OR IN ACCOMPANYING DOCUMENTS ARE TRUE OR COMPLETE; NOR DOES IT IMPLY A FINDING THAT THE AMOUNT OFFERED BY RESOURCE REAL ESTATE OPPORTUNITY REIT, INC. IS EQUAL TO THE AMOUNT RECOVERABLE BY THE BUYER OF THE SECURITY IN ACCORDANCE WITH SECTION 25503 IN A SUIT AGAINST RESOURCE REAL ESTATE OPPORTUNITY REIT, INC., AND THE COMMISSIONER DOES NOT ENDORSE THE OFFER AND MAKES NO RECOMMENDATION AS TO ITS ACCEPTANCE OR REJECTION.

Table of Contents

| 1 | ||||

| 5 | ||||

| 9 | ||||

| 13 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

You should rely only on the information contained in this document. We have not authorized anyone to provide you with information that is different from that contained in this document. We are offering to repurchase shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this document is complete and accurate only as of the date of the front cover regardless of the time of delivery of this document or of any sale of shares. Except where the context requires otherwise, in this document, the “Company,” “we,” “us” and “our” refer to Resource Real Estate Opportunity REIT, Inc., a Maryland corporation, and, where appropriate, its subsidiaries.

Only residents of the United States are eligible to participate in the rescission offer.

i

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE RESCISSION OFFER

You should read the following questions and answers, together with the more detailed information regarding the rescission offer and the risk factors set forth elsewhere in this document, before deciding whether to accept or reject the rescission offer.

General

Q: Why are we making the rescission offer?

A: Certain shares of common stock issued pursuant to our distribution reinvestment plan during the period from June 8, 2017 through June 30, 2019 were inadvertently not registered under California state securities laws nor exempt from the registration requirements. Consequently, these stock issuances may have violated the state securities laws of California. The rescission offer is intended to address this state securities law compliance issue by allowing the holders of the shares covered by the rescission offer to rescind the underlying stock transactions and sell those shares of common stock back to us.

Q: Were the shares subject to this rescission offer validly issued and registered under the federal securities laws?

A: Yes. The shares subject to this rescission offer were validly issued under corporate law and the sale of shares under our distribution reinvestment plan have at all times been registered under the federal securities laws, most recently pursuant to a Form S-3 filed with the SEC on May 31, 2016.

Q: Which shares of common stock are included in the rescission offer?

A: We are offering, upon the terms and conditions described in this document, to rescind the sale of 711,274 shares of common stock sold between June 8, 2017 and June 30, 2019 pursuant to our distribution reinvestment plan at the purchase prices and on the specific dates set forth below.

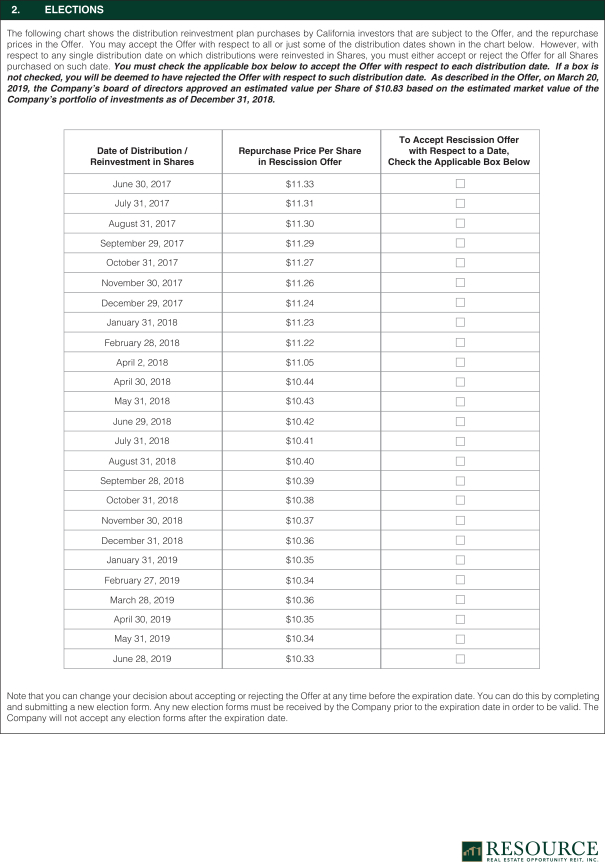

The following chart shows the distribution reinvestment plan purchases by California investors that are subject to this rescission offer, and the repurchase prices in this offering.

| Date of Distribution /

Reinvestment in |

Original Purchase Price |

Repurchase Price Per Share in Rescission Offer |

||||||

| June 30, 2017 |

$ | 10.94 | $ | 11.33 | ||||

| July 31, 2017 |

$ | 10.94 | $ | 11.31 | ||||

| August 31, 2017 |

$ | 10.94 | $ | 11.30 | ||||

| September 29, 2017 |

$ | 10.94 | $ | 11.29 | ||||

| October 31, 2017 |

$ | 10.94 | $ | 11.27 | ||||

| November 30, 2017 |

$ | 10.94 | $ | 11.26 | ||||

| December 29, 2017 |

$ | 10.94 | $ | 11.24 | ||||

| January 31, 2018 |

$ | 10.94 | $ | 11.23 | ||||

| February 28, 2018 |

$ | 10.94 | $ | 11.22 | ||||

| April 2, 2018 |

$ | 10.80 | $ | 11.05 | ||||

| April 30, 2018 |

$ | 10.26 | $ | 10.44 | ||||

| May 31, 2018 |

$ | 10.26 | $ | 10.43 | ||||

| June 29, 2018 |

$ | 10.26 | $ | 10.42 | ||||

| July 31, 2018 |

$ | 10.26 | $ | 10.41 | ||||

| August 31, 2018 |

$ | 10.26 | $ | 10.40 | ||||

| September 28, 2018 |

$ | 10.26 | $ | 10.39 | ||||

| October 31, 2018 |

$ | 10.26 | $ | 10.38 | ||||

| November 30, 2018 |

$ | 10.26 | $ | 10.37 | ||||

| December 31, 2018 |

$ | 10.26 | $ | 10.36 | ||||

| January 31, 2019 |

$ | 10.26 | $ | 10.35 | ||||

| February 27, 2019 |

$ | 10.26 | $ | 10.34 | ||||

1

Table of Contents

| Date of Distribution /

Reinvestment in |

Original Purchase Price |

Repurchase Price Per Share in Rescission Offer |

||||||

| March 28, 2019 |

$ | 10.29 | $ | 10.36 | ||||

| April 30, 2019 |

$ | 10.29 | $ | 10.35 | ||||

| May 31, 2019 |

$ | 10.29 | $ | 10.34 | ||||

| June 28, 2019 |

$ | 10.29 | $ | 10.33 | ||||

Q: When does the rescission offer expire?

A: Our rescission offer will expire on [thirty days from receipt of offer] , 2019.

Q: What will I receive if I accept the rescission offer?

A: If you accept our rescission offer, we will repurchase the shares you hold that are subject to the rescission offer at the price per share you paid, plus interest at 7% per year, less any distributions you have received on those shares.

We believe that your acceptance of the rescission offer will preclude you from later seeking similar relief under general theories of estoppel, and we are unaware of any federal or state case law to the contrary. However, we urge you to consult with an attorney regarding all of your legal rights and remedies before deciding whether or not to accept the rescission offer.

Q: What is the most recent estimated value per share of common stock?

A: On March 20, 2019, our board of directors approved an estimated value per share of our common stock of $10.83 based on the estimated market value of the Company’s portfolio of investments as of December 31, 2018. There have been no material changes between December 31, 2018 and the date of this filing that would impact the overall estimated value per share.

Q: If I do not accept the offer now, can I sell my shares?

A: There is no current established public market for our shares and we currently have no plans to list our shares on a national securities exchange. Our board of directors has approved a share redemption program, but may amend, suspend or terminate our share redemption program upon 30 days’ notice and without stockholder approval. Our board of directors may reject any request for redemption of shares. Further, there are many limitations on your ability to sell your shares pursuant to the share redemption program. As of December 31, 2018, other than redemptions following the death or qualifying disability of a stockholder or redemptions sought upon a stockholder’s confinement to a long-term care facility, the purchase price for such shares we repurchase under our redemption program equaled 95% of the current estimated value per share, or $10.29.

Q: Have any officers, directors or 5% stockholders advised us whether they will participate in the rescission offer?

A: We have no 5% stockholders, and no officer or director is eligible to participate in the rescission offer.

Q: What do I need to do now to accept or reject the rescission offer?

A: To accept or reject the rescission offer, you must complete and sign the accompanying election form (see Appendix A) according to its instructions and deliver it, together with any required signature guarantees and any other documents required by the election form, to our transfer agent, DST Systems, Inc. (“DST”) at the appropriate address shown on the “Important Instructions and Information” page accompanying the election form. The completed and executed election form must be received before the expiration date of our rescission offer.

2

Table of Contents

Q: Can I accept the rescission offer in part?

A: You may accept this rescission offer with respect to all or just some of the distribution dates shown in the chart above. However, with respect to any single distribution date on which distributions were reinvested in shares, you must either accept or reject the rescission offer for all shares purchased on such date.

Q: The rescission offer only applies to a small fraction of the shares that I own. Can I rescind the purchase of additional shares?

A: No. Only the shares purchased by California residents pursuant to our distribution reinvestment plan during the period from June 8, 2017 through June 30, 2019 are eligible to participate in the rescission offer.

Q: What if I was not a California resident for some or all of the period from June 8, 2017 through June 30, 2019?

A: You are not eligible to rescind the purchase of any shares acquired during any period in which you were not a California resident.

Q: What happens if I do not return my rescission offer election form?

A: If you do not return your election form before the expiration date of our rescission offer, you will be deemed to have rejected our offer.

Q: What remedies or rights do I have now that I will not have after the rescission offer?

A: The following is a summary of the statutes of limitations and the effect of the rescission offer for California. This summary is not complete. For a more detailed description of the California rescission laws, see “Rescission Offer—Effect of Rescission Offer.”

In June 2010, pursuant to an application for qualification of securities pursuant to Section 25113 of the California Corporate Securities Law, the California Department of Corporations issued us a permit that qualified us to offer and sell shares of our common stock in our initial public offering. Following the termination of our primary public offering in December 2013, we continued to sell shares under our distribution reinvestment plan and we timely renewed our California permit in connection with the distribution reinvestment plan through June 8, 2017. However, following the expiration of the June 2017 permit, we inadvertently did not timely renew our permit. Consequently, certain shares issued pursuant to our distribution reinvestment plan from June 30, 2017 through June 28, 2019 may have been issued in violation of the California Corporate Securities Act. Generally, the California statute of limitations for noncompliance with the requirement to register or qualify securities under the California Corporate Securities Law is the earlier of two years after the noncompliance occurred, or one year after discovery of the facts constituting such noncompliance. Regardless, you will no longer have any right of rescission or repurchase with respect to these securities under Section 25503 of the California Corporate Securities Law after the expiration of our rescission offer.

Regardless of whether you accept the rescission offer, we believe that any remedies you may have after the rescission offer expires would not be greater than an amount you would receive in the rescission offer.

Q: How will the rescission offer be funded?

A: The rescission offer will be funded from our existing cash balances. If all persons eligible to participate in the rescission offer accept our offer to the full extent, our results of operations, cash balances or financial condition will not be affected materially.

3

Table of Contents

Q: Can I change my mind after I have mailed my signed election form?

A: Yes. You can change your decision about accepting or rejecting our rescission offer at any time before the expiration date. You can do this by completing and submitting a new election form. Any new election forms must be received by us prior to the expiration date in order to be valid. We will not accept any election forms after the expiration date.

Q: Who can help answer my questions?

A: You can call Resource Operations Team at 866-469-0129 or e-mail Resourceoperations@resourcerei.com with questions about the rescission offer.

Q: Where can I get more information about Resource Real Estate Opportunity REIT, Inc.?

A: We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement, Current Reports on Form 8-K and all amendments to those reports with the United States Securities and Exchange Commission (“SEC”). The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available free of charge, the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement, Current Reports on Form 8-K and all amendments to those reports on our website, www.resourcereit.com, or by responding to requests addressed to our investor relations group. These reports are available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC.

4

Table of Contents

This summary highlights information contained elsewhere in this document and does not contain all of the information you should consider in deciding whether to accept or reject the rescission offer. You should read this summary together with the more detailed information, including our financial statements and the related notes, elsewhere in this document. You should carefully consider, among other things, the matters discussed in “Risk Factors.”

General

Resource Real Estate Opportunity REIT, Inc. is a Maryland corporation that was formed on June 3, 2009 with its principal executive offices at 1845 Walnut Street, 18th Floor, Philadelphia, Pennsylvania 19103. As used herein, the terms “we,” “our” and “us” refer to Resource Real Estate Opportunity REIT, Inc., a Maryland corporation, and Resource Real Estate Opportunity OP, LP, a Delaware limited partnership, and its subsidiaries. We have elected to be taxed as a real estate investment trust, or REIT, and to operate as a REIT beginning with our taxable year ended December 31, 2010. Our objectives are to preserve stockholder capital, realize growth in the value of our investments, increase cash distributions through increased cash flow from operations or asset sales, and enable stockholders to realize a return on their investments. As of December 31, 2018, we owned 30 multifamily properties, as described further in “Item 2. Properties” below, and one performing loan.

We are externally managed by Resource Real Estate Opportunity Advisor, LLC, which we refer to as our Advisor, an indirect wholly owned subsidiary of Resource America, Inc. (“RAI”). RAI is a wholly-owned subsidiary of C-III Capital Partners LLC (“C-III”), a leading commercial real estate services company engaged in a broad range of activities. C-III controls both our Advisor and Resource Real Estate Opportunity Manager, LLC, our property manager. C-III also controls all of the shares of our common stock held by our Advisor. To provide its services, the Advisor draws upon RAI, C-III, their management teams and their collective investment experience.

Our Offerings

On September 15, 2009, we commenced a private placement offering to accredited investors for the sale of up to 5,000,000 shares of common stock at a price of $10 per share, with discounts available to certain categories of purchasers. The offering, which closed on June 9, 2010, resulted in aggregate gross proceeds of $12.8 million, ($11.3 million, net of syndication costs) and resulted in the issuance of 1,283,727 common shares, including 20,000 shares purchased by our Advisor. Also, in conjunction with the private offering, we offered 5,000 shares of convertible stock at a price of $1 per share. Investors acquired 937 shares of the convertible stock; the Advisor purchased the remaining 4,063 shares.

On June 16, 2010, we commenced our initial primary public offering of up to 75,000,000 shares and a public offering of up to an additional 7,500,000 shares pursuant to our distribution reinvestment plan. An affiliate of our Advisor, Resource Securities LLC, or Resource Securities (formerly known as Resource Securities, Inc.), served as the dealer manager. We offered shares of our common stock in our primary offering for $10 per share, with discounts available to certain categories of investors.

The primary portion of our initial public offering closed on December 13, 2013, having raised aggregate gross proceeds of $633.1 million through the issuance of 63,647,084 shares of our common stock, including 276,056 shares purchased by our Advisor and 1,161,623 shares sold pursuant to our distribution reinvestment plan. On December 26, 2013, the unsold primary offering shares were deregistered and, on December 30, 2013, the registration of the shares issuable pursuant to the distribution reinvestment plan was continued pursuant to a Registration Statement on Form S-3. A new Registration Statement on Form S-3 was filed in May 2016 to

5

Table of Contents

continue the distribution reinvestment plan offering. We continue to offer shares pursuant to our distribution reinvestment plan at a purchase price equal to 95% of our current estimated value per share. During the years ended December 31, 2018, 2017, and 2016, we issued, in total, an additional 7.6 million shares through our distribution reinvestment plan for gross proceeds of $81.5 million.

Our Business Strategy

Our business strategy has a particular focus on multifamily assets. Our targeted portfolio consists of commercial real estate assets, principally (i) multifamily rental properties purchased as non-performing or distressed loans or as real estate owned by financial institutions and (ii) multifamily rental properties to which we have added value with a capital infusion (referred to as “value add properties”). However, we are not limited in the types of real estate and real estate-related assets in which we may invest or whether we may invest in equity or debt secured by real estate and, accordingly, we may invest in other real estate assets or debt secured by real estate assets. We continually monitor the portfolio of optimized, renovated properties seeking sales opportunities that will maximize our return. We generally expect to distribute gains from such sales to our stockholders in the form of distributions.

We anticipate providing our stockholders with a liquidity event or events by some combination of the following: (i) liquidating all, or substantially all, of our assets and distributing the net proceeds to stockholders, or (ii) listing our shares for trading on a national securities exchange. Our Board of Directors anticipates evaluating a liquidity event no later than six years after the termination of our primary offering (which occurred in December 2013), subject to prevailing market conditions. In making the decision to liquidate or apply for listing of our shares, our directors will determine whether liquidating our assets or listing our shares will result in a greater value for our stockholders. If we do not begin the process of liquidating our assets or listing our shares by December 2019, or otherwise determine a future date for such action, upon the request of stockholders holding 10% or more of our outstanding shares of common stock, our charter requires that we hold a stockholders meeting to vote on a proposal for our orderly liquidation.

Our Operating Policies and Strategies

Our Advisor has the primary responsibility for the selection of investments, the negotiation of the acquisition of these investments, and financing, asset-management and disposition decisions. A majority of our Board of Directors and a majority of the Conflicts Committee, which includes only our three independent directors, approve all proposed real estate property investments and certain significant real estate-related debt investments. Our Board of Directors meets regularly to monitor the execution of our investment strategies and our progress in achieving our investment objectives.

We may use leverage for our acquisitions in the form of both REIT level financing and individual investment financing. Such financing, both at the REIT level and at the individual investment level, may also be obtained from the seller of an investment. Although there is no limit on the amount we can borrow to acquire a single real estate investment, we may not leverage our assets with debt financing such that our total liabilities exceed 75% of the aggregate value of our assets unless a majority of our independent directors finds substantial justification for borrowing a greater amount.

Our Advisor and our Property Manager

Our Advisor manages our day-to-day operations and our portfolio of real estate investments, and provides asset management, marketing, investor relations, and other administrative services on our behalf, all subject to the supervision of our Board of Directors. Our Advisor has invested approximately $2.5 million in us and as of December 31, 2018, it owned 276,056 shares of our common stock and 30,886 shares of our convertible stock.

6

Table of Contents

Under certain circumstances, the convertible shares may be converted into shares of our common stock. As of December 31, 2018, our Advisor has granted 21,210 shares of its convertible stock to employees of RAI and its subsidiaries and affiliates. Of these shares, 2,421 have been forfeited and returned to the Advisor as of December 31, 2018. The outstanding shares vest ratably over three years, and 18,789 of these shares have vested as of December 31, 2018.

We have a management agreement with Resource Real Estate Opportunity Manager, LLC, an affiliate of our Advisor, or our Manager, to provide property management services, as applicable, for most of the properties or other real estate related assets, in each case where our Advisor is able to control the operational management of such properties. Our Manager may subcontract with an affiliate or third party to provide day-to-day property management, construction management and/or other property specific functions as applicable for the properties it manages. Our Manager also manages our real estate-related debt investments.

Competition

We believe that the current market for properties that meet our investment objectives is extremely competitive and many of our competitors have greater resources than we do. We believe that our multifamily communities are suitable for their intended purposes and adequately covered by insurance. There are a number of comparable properties located in the same submarkets that might compete with our properties. We compete with numerous other entities engaged in real estate investment activities, including individuals, corporations, banks and insurance company investment accounts, other REITs, real estate limited partnerships, the U.S. government and other entities, to acquire, manage and sell real estate properties and real estate related assets. Many of our expected competitors enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. In addition, the number of entities and the amount of funds competing for suitable investments may increase.

Environmental

As an owner of real estate, we are subject to various environmental laws of federal, state and local governments. Compliance with existing laws has not had a material adverse effect on our financial condition or results of operations, and management does not believe it will have such an impact in the future. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed laws or regulations on properties in which we hold an interest, or on properties that may be acquired directly or indirectly in the future.

Employees and Economic Dependency

We have no paid employees. The employees of our Advisor and its affiliates provide management, acquisition, advisory and certain administrative services for us. We are dependent on our Advisor and its affiliates for certain services that are essential to us, including the identification, evaluation, negotiation, purchase and disposition of properties and other investments; management of the daily operations of our portfolio; and other general and administrative responsibilities. In the event that these affiliated companies are unable to provide the respective services, we will be required to obtain such services from other sources.

Access to Company Information

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement, Current Reports on Form 8-K and all amendments to those reports with the SEC. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

7

Table of Contents

We make available free of charge, the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement, Current Reports on Form 8-K and all amendments to those reports on our website, www.resourcereit.com, or by responding to requests addressed to our investor relations group. These reports are available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC.

The Rescission Offer

| • | We are offering to repurchase 711,274 shares of our common stock from persons who are or were residents of California and purchased shares of our common stock between June 8, 2017 and June 30, 2019 pursuant to our distribution reinvestment plan. |

| • | If you accept our rescission offer and surrender your shares, you will receive your purchase price for the shares (which ranges from $10.26 to $10.94), plus 7% interest based on the initial purchase price, less any distributions you have received on those shares. Interest and distributions will be determined from the date you purchased the shares through the date that the rescission offer expires. |

| • | The rescission offer will expire on [30 days from receipt] , 2019. |

8

Table of Contents

Background

Certain shares of common stock issued pursuant to our distribution reinvestment plan during the period from June 8, 2017 through June 30, 2019 were inadvertently not registered under California state securities laws nor exempt from the registration requirements. Consequently, these stock issuances may have violated the state securities laws of California. The rescission offer is intended to address these state securities laws compliance issues by allowing the holders of the shares covered by the rescission offer to rescind the underlying stock transactions and sell those shares of common stock back to us.

In order to address this issue, we are offering to repurchase 711,274 shares of our common stock from persons who are or were residents of California and purchased shares of our common stock between June 8, 2017 and June 30, 2019 pursuant to our distribution reinvestment plan. If our rescission offer is accepted by all offerees, we will be required to make an aggregate payment to the holders of these shares of up to approximately $7.6 million, which includes statutory interest.

The rescission offer will be kept open for 30 days from receipt of this offer and will be registered under the Securities Act of 1933 and qualified in each state where such qualification is required under applicable state securities laws.

| • | We are offering to repurchase 711,274 shares of our common stock from persons who are or were residents of California and purchased shares of our common stock between June 8, 2017 and June 30, 2019 pursuant to our distribution reinvestment plan. |

| • | If you accept our rescission offer and surrender your shares, you will receive your purchase price for the shares (which ranges from $10.26 to $10.94), plus 7% interest based on the initial purchase price, less any distributions you have received on those shares. Interest and distributions will be determined from the date you purchased the shares through the date that the rescission offer expires. |

| • | The rescission offer will expire on [30 days from receipt] , 2019. |

Rescission Offer and Price

We are offering to rescind certain stock issuances pursuant to our distribution reinvestment plan. By making this rescission offer, we are not waiving any applicable statutes of limitations.

More specifically, we are offering to rescind the sale of 711,724 shares of our common stock sold to approximately 1,200 persons who are or were residents of California and purchased shares of our common stock between June 8, 2017 and June 30, 2019 pursuant to our distribution reinvestment plan. If you accept our rescission offer and surrender your shares, you will receive your purchase price for the shares (which ranges from $10.26 to $10.94), plus 7% interest based on the initial purchase price, less any distributions you have received on those shares. Interest and distributions will be determined from the date you purchased the shares through the date that the rescission offer expires.

The following chart shows the distribution reinvestment plan purchases by California investors that are subject to this rescission offer, and the repurchase prices in this offering.

| Date of Distribution /

Reinvestment in |

Original Purchase Price |

Repurchase Price Per Share in Rescission Offer |

||||||

| June 30, 2017 |

$ | 10.94 | $ | 11.33 | ||||

| July 31, 2017 |

$ | 10.94 | $ | 11.31 | ||||

| August 31, 2017 |

$ | 10.94 | $ | 11.30 | ||||

| September 29, 2017 |

$ | 10.94 | $ | 11.29 | ||||

| October 31, 2017 |

$ | 10.94 | $ | 11.27 | ||||

| November 30, 2017 |

$ | 10.94 | $ | 11.26 | ||||

9

Table of Contents

| Date of Distribution /

Reinvestment in |

Original Purchase Price |

Repurchase Price Per Share in Rescission Offer |

||||||

| December 29, 2017 |

$ | 10.94 | $ | 11.24 | ||||

| January 31, 2018 |

$ | 10.94 | $ | 11.23 | ||||

| February 28, 2018 |

$ | 10.94 | $ | 11.22 | ||||

| April 2, 2018 |

$ | 10.80 | $ | 11.05 | ||||

| April 30, 2018 |

$ | 10.26 | $ | 10.44 | ||||

| May 31, 2018 |

$ | 10.26 | $ | 10.43 | ||||

| June 29, 2018 |

$ | 10.26 | $ | 10.42 | ||||

| July 31, 2018 |

$ | 10.26 | $ | 10.41 | ||||

| August 31, 2018 |

$ | 10.26 | $ | 10.40 | ||||

| September 28, 2018 |

$ | 10.26 | $ | 10.39 | ||||

| October 31, 2018 |

$ | 10.26 | $ | 10.38 | ||||

| November 30, 2018 |

$ | 10.26 | $ | 10.37 | ||||

| December 31, 2018 |

$ | 10.26 | $ | 10.36 | ||||

| January 31, 2019 |

$ | 10.26 | $ | 10.35 | ||||

| February 27, 2019 |

$ | 10.26 | $ | 10.34 | ||||

| March 28, 2019 |

$ | 10.29 | $ | 10.36 | ||||

| April 30, 2019 |

$ | 10.29 | $ | 10.35 | ||||

| May 31, 2019 |

$ | 10.29 | $ | 10.34 | ||||

| June 28, 2019 |

$ | 10.29 | $ | 10.33 | ||||

Acceptance

To accept or reject the rescission offer, you must complete and sign the accompanying election form (see Appendix A) according to its instructions and deliver it, together with any required signature guarantees and any other documents required by the election form, to our transfer agent, DST Systems, Inc. (“DST”) at the appropriate address shown on the “Important Instructions and Information” page accompanying the election form. The completed and executed election form must be received before the expiration date of our rescission offer. Within fifteen business days after the expiration date, we will pay for any securities as to which the rescission offer has been validly accepted.

You may accept this rescission offer with respect to all or just some of the distribution dates shown in the chart above. However, with respect to any single distribution date on which distributions were reinvested in shares, you must either accept or reject the rescission offer for all shares purchased on such date.

The rescission offer will expire on [thirty days from receipt of offer], 2019. If you submit an election form after the expiration date, regardless of whether your form is otherwise complete, your election will not be accepted, and you will be deemed to have rejected our rescission offer.

Neither we nor our officers and directors make any recommendations to you with respect to the rescission offer contained herein. You are urged to read the rescission offer carefully and consult with counsel and to make an independent evaluation with respect to its terms.

Rejection or Failure to Affirmatively Accept

If you fail to accept, or if you affirmatively reject the rescission offer by so indicating on the enclosed election form, you will retain ownership of the shares and you will not receive any cash for those securities in connection with the rescission offer.

Solicitation

We have not retained, nor do we intend to retain, any person to make solicitations or recommendations to you in connection with the rescission offer.

10

Table of Contents

Effect of Rescission Offer

We believe that your acceptance of the rescission offer will preclude you from later seeking similar relief under general theories of estoppel, and we are unaware of any federal or state case law to the contrary. However, we urge you to consult with an attorney regarding all of your legal rights and remedies before deciding whether or not to accept the rescission offer.

Regardless of whether you accept the rescission offer, we believe that any remedies you may have after the rescission offer expires would not be greater than an amount you would receive in the rescission offer.

Below is a discussion of our contingent liability as a result of potential securities laws violations resulting from our issuance of the shares, covered by the rescission offer in California. California has different laws with respect to rights under common law and fraud and the following discussion of state law does not relate to the antifraud provisions of applicable securities laws or rights under common law or equity.

Under California law, an issuer is civilly liable to a purchaser of its securities sold in violation of the registration or qualification requirements of the California Corporate Securities Law of 1968. The purchaser may sue to recover the consideration paid for such securities with interest at 7% per year, less the amount of any income received from ownership of the securities, upon the tender of such securities at any time prior to the earlier of the two year anniversary of the noncompliance with the registration or qualification requirements or the one year anniversary of the discovery by the purchaser of the facts constituting such noncompliance.

However, we may terminate the rights of the purchasers to seek additional remedies under the California Corporate Securities Law of 1968 by making a written rescission offer before suit is commenced by the purchaser, approved as to form by the California Commissioner of Corporations where the offer:

| • | states the respect in which liability under the registration or qualification requirements may have arisen; |

| • | offers to repurchase the securities for a cash price payable upon delivery of the securities or offering to pay the purchaser an amount in cash equal in either case to the amount recoverable by the purchaser, or offering to rescind the transaction by putting the parties back in the same position as before the transaction; |

| • | provides that such offer may be accepted by the purchaser at any time within a specified period of not less than 30 days after the date of receipt of the offer unless rejected earlier during such periods by the purchaser; |

| • | sets forth the provisions of the rescission offer requirements under the California Corporate Securities Law of 1968; and |

| • | contains such other information as the California Commissioner of Corporations may require by rule or order. |

If the purchaser fails to accept such offer in writing within the specified time period of not less than 30 days after the date of receipt of the offer, that purchaser will no longer have any right of rescission under California law.

We must also file with the California Commissioner of Corporations, in such form as the California Commissioner of Corporations prescribes by rule, an irrevocable consent appointing the Commissioner of Corporations or its successor in office to be our attorney to receive services of any lawful process in any noncriminal suit, action or proceeding against us or our successor, which arises under California law after the consent has been filed with the same force and validity as if served personally on us.

We believe this rescission offer complies in all material respects with the rescission offer requirements of the California Corporate Securities Law of 1968.

11

Table of Contents

Funding the Rescission Offer

The rescission offer will be funded from our existing cash balances. If all persons eligible to participate accept our offer to repurchase common stock to the full extent, our results of operations, cash balances or financial condition will not be affected materially.

Directors, Officers and 5% Stockholders

We have no 5% stockholders, and no officer or director is eligible to participate in the rescission offer.

12

Table of Contents

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a discussion of material U.S. federal income tax consequences of the proposed rescission offer to (i) those of our stockholders whose stock is rescinded pursuant to the rescission offer and (ii) those of our stockholders that choose to reject the offer and retain their current ownership of our shares. Additional information regarding the material United States federal income tax consequences of continuing an investment in our common stock is incorporated herein by reference to our Current Report on Form 8-K, filed with the SEC on September 4, 2019 (the “Tax Considerations 8-K”). The law firm of DLA Piper LLP (US) has acted as our tax counsel and reviewed this summary and the information incorporated by reference to the Tax Considerations 8-K.

For purposes of this section under the heading “Material U.S. Federal Income Tax Considerations,” references to “Resource Real Estate Opportunity REIT, Inc.,” “we,” “our,” and “us” mean only Resource Real Estate Opportunity REIT, Inc. and not its subsidiaries or other lower-tier entities, except as otherwise indicated. This summary is based upon the Internal Revenue Code, the regulations promulgated by the United States Treasury Department, rulings and other administrative pronouncements issued by the Internal Revenue Service, and judicial decisions, all as currently in effect, and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the Internal Revenue Service would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described below. We have not sought and do not currently expect to seek an advance ruling from the Internal Revenue Service regarding any matter discussed in this prospectus. The summary is also based upon the assumption that we will operate Resource Real Estate Opportunity REIT, Inc. and its subsidiaries and affiliated entities in accordance with their applicable organizational documents. This summary is for general information only and does not purport to discuss all aspects of United States federal income taxation that may be important to a particular investor in light of its investment or tax circumstances or to investors subject to special tax rules, such as:

| • | financial institutions; |

| • | insurance companies; |

| • | broker-dealers; |

| • | regulated investment companies and REITs; |

| • | partnerships and trusts; |

| • | persons who hold our stock on behalf of other persons as nominees; |

| • | persons who receive our stock through the exercise of employee stock options (if we ever have employees) or otherwise as compensation; |

| • | U.S. stockholders whose “functional currency” is not the U.S. dollar; |

| • | persons holding our stock as part of a “straddle,” “hedge,” “conversion transaction,” “constructive ownership transaction,” “synthetic security,” or other integrated investment; |

| • | “S” corporations; |

and, except to the extent discussed below:

| • | tax-exempt organizations; |

| • | persons that are not U.S. stockholders; and |

| • | persons subject to the alternative minimum tax. |

A “U.S. stockholder” is a beneficial owner of shares that for federal income tax purposes is:

| • | a citizen or resident of the United States; |

13

Table of Contents

| • | a corporation (including an entity treated as a corporation for federal tax purposes) created or organized in or under the laws of the United States, any of its states or the District of Columbia; |

| • | an estate, the income of which is subject to federal income taxation regardless of its source; or |

| • | a trust if either a U.S. court is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or it has a valid election in place to be treated as a U.S. person. |

If a partnership, including any entity that is treated as a partnership for federal tax purposes, holds shares, the federal income tax treatment of the partner in the partnership will generally depend on the status of the partner and the activities of the partnership. If you are a partner in a partnership that holds shares, you should consult your tax advisor regarding the tax consequences of accepting the rescission offer with respect to shares held by the partnership.

This summary assumes that investors will hold their common stock as a capital asset, which generally means as property held for investment.

The federal income tax treatment of holders of our common stock depends in some instances on determinations of fact and interpretations of complex provisions of United States federal income tax law for which no clear precedent or authority may be available. In addition, the tax consequences to any particular shareholder of holding our common stock will depend on the shareholder’s particular tax circumstances. YOU ARE URGED TO CONSULT YOUR TAX ADVISOR REGARDING THE FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES TO YOU IN LIGHT OF YOUR PARTICULAR INVESTMENT OR TAX CIRCUMSTANCES OF ACQUIRING, HOLDING, EXCHANGING, OR OTHERWISE DISPOSING OF OUR COMMON STOCK.

Material Federal Income Tax Consequences of Accepting the Rescission Offer

Redemption of Shares

For United States federal income tax purposes, the rescission offer with respect to shares of our common stock is intended to constitute a taxable redemption of shares for cash, with the redemption price equal to the amount paid for such shares (and including in the redemption price the interest on the original purchase price of such shares). However, the law applicable to the rescission offer is unclear, and we have not received a ruling from the Internal Revenue Service, or IRS, to that effect. Thus, the IRS is not precluded from successfully asserting a contrary position or otherwise recharacterizing the transaction in whole or in part. For example, the IRS may characterize our rescission offer as the return of the original purchase price, which would be nontaxable, plus the payment of interest, which would be taxable as ordinary income.

The summary below describes the tax consequences of accepting the rescission offer assuming that for United States federal income tax purposes, the rescission offer with respect to shares of our common stock constitutes a taxable redemption of shares for cash, with the redemption price equal to the amount paid for such shares (and including in the redemption price the interest on the original purchase price of such shares).

Generally. If the redemption qualifies as a sale of shares by a U.S. stockholder under Section 302 of the Code, the U.S. stockholder will recognize gain or loss equal to the difference between (i) the cash received pursuant to the rescission offer and (ii) the U.S. stockholder’s adjusted tax basis in the shares surrendered pursuant to the rescission offer. If the redemption does not qualify as a sale of shares under Section 302 of the Code, the U.S. stockholder will not be treated as having sold shares but will be treated as having received a distribution from us in an amount up to the amount of the cash received pursuant to the rescission offer. If a U.S. stockholder is treated as receiving a distribution from us, the U.S. stockholder will generally be taken into account as ordinary income dividend to the extent of our current or accumulated earnings and profits, unless we designate the dividend as a capital gain dividend.

14

Table of Contents

As described below, whether a redemption qualifies for sale treatment will depend largely on the relationship between (i) the total number of the U.S. stockholder’s shares (including any shares constructively owned by the U.S. stockholder) before any shares are purchased in the rescission offer and (ii) the total number of the U.S. stockholder’s shares (including any shares constructively owned by the U.S. stockholder) after the purchase of shares pursuant to the rescission offer is completed, taking into account any shares acquired or disposed of in a transaction that, for federal income tax purposes, is integrated with the rescission offer.

Sale Treatment. Under Section 302 of the Code, a redemption of shares pursuant to the rescission offer will be treated as a sale of such shares for federal income tax purposes if such redemption (i) results in a “complete redemption” of all of the U.S. stockholder’s stock in us, (ii) is “substantially disproportionate” with respect to the U.S. stockholder, or (iii) is “not essentially equivalent to a dividend” with respect to the stockholder. For purposes of these tests, shares shall be deemed to include all common stock of the Company. In determining whether any of these three tests under Section 302 of the Code is satisfied, a U.S. stockholder must take into account not only stock that the U.S. stockholder actually owns, but also any stock that the U.S. stockholder is treated as owning pursuant to the constructive ownership rules of Section 318 of the Code. Under those rules, a U.S. stockholder generally is treated as owning (i) shares owned by the U.S. stockholder’s spouse, children, grandchildren and parents; (ii) shares owned by certain trusts of which the U.S. stockholder is a beneficiary, in proportion to the U.S. stockholder’s interest; (iii) shares owned by any estate of which the U.S. stockholder is a beneficiary, in proportion to the U.S. stockholder’s interest; (iv) shares owned by any partnership or S corporation in which the U.S. stockholder is a partner or stockholder, in proportion to the U.S. stockholder’s interest; (v) shares owned by any C corporation of which the stockholder owns at least 50% in value of the stock; and (vi) shares that the U.S. stockholder has an option or similar right to acquire. A U.S. stockholder that is a partnership or S corporation, estate, trust or non-S corporation is treated as owning stock owned (as the case may be) by partners or S corporation stockholders, by estate beneficiaries, by certain trust beneficiaries, A U.S. stockholder that is a C corporation is treated as owning stock owned by 50% stockholders of a non-S corporation. Shares constructively owned by a person generally are treated as being owned by that person for the purpose of attributing ownership to another person.

A redemption of shares from a U.S. stockholder pursuant to the rescission offer will result in a “complete redemption” of all the U.S. stockholder’s shares in us if either (i) we purchase all of the shares actually and constructively owned by the U.S. stockholder, or (ii) the U.S. stockholder actually owns no shares after all transfers of shares pursuant to the rescission offer, constructively owns only shares owned by certain family members, and the U.S. stockholder is eligible for a waiver from, and does waive (pursuant to Section 302(c)(2) of the Code), constructive ownership of shares owned by family members. Any U.S. stockholder desiring to waive such constructive ownership of shares should consult a tax advisor about the applicability of Section 302(c)(2) of the Code.

A redemption of shares from a U.S. stockholder pursuant to the rescission offer will be “substantially disproportionate” with respect to the U.S. stockholder if (i) the percentage of shares actually and constructively owned by the U.S. stockholder compared to all shares outstanding immediately after all redemptions of shares pursuant to the rescission offer is less than (ii) 80% of the percentage of shares actually and constructively owned by the U.S. stockholder compared to all shares outstanding immediately before such redemptions.

A redemption of shares from a U.S. stockholder pursuant to the rescission offer will be “not essentially equivalent to a dividend” if, pursuant to the rescission offer, the U.S. stockholder experiences a “meaningful reduction” in his or her proportionate interest in us, including voting rights, participation in earnings and liquidation rights, arising from the actual and constructive ownership of shares. The fact that the redemption fails to qualify as a sale pursuant to the other two tests is not taken into account in determining whether the redemption is “not essentially equivalent to a dividend.” The IRS has indicated in Revenue Ruling 76-385 that a very small reduction in the proportionate interest of a small minority stockholder who does not exercise any control over corporate affairs generally constitutes a “meaningful reduction” in the stockholder’s interest in the company where the company’s stock is widely held and publicly traded. Although our shares are widely held, our

15

Table of Contents

shares are not publicly traded. U.S. stockholders are urged to consult their tax advisers about the applicability of that ruling to the rescission offer.

U.S. stockholders should be aware that an acquisition or disposition of shares as part of a plan that includes the U.S. stockholder’s acceptance of the rescission offer should be taken into account in determining whether any of the foregoing tests is satisfied. U.S. stockholders are urged to consult their own advisors with regard to whether acquisitions from or sales to third parties and acceptances of the rescission offer may be so integrated.

If any of the foregoing three tests is satisfied, the U.S. stockholder will recognize gain or loss equal to the difference between the amount of cash received pursuant to the rescission offer and the U.S. stockholder’s adjusted tax basis in the shares sold. Such gain or loss must be determined separately for each block of shares sold (i.e., shares that were acquired in a single transaction). Capital gain or loss generally will be long-term capital gain or loss if, at the time we accept the shares for payment, the U.S. stockholder held the shares for more than one year. Long-term capital gains of individuals, estates and trusts generally are subject to a maximum U.S. federal income tax rate of 20%. Short-term capital gains of individuals, estates, and trusts generally are subject to a maximum federal income tax rate of 37%. Capital gains of corporations generally are taxed at the federal income tax rates applicable to corporate ordinary income. In addition, a U.S. stockholder that is an individual, estate or trust many be subject to a 3.8 percent Medicare tax on capital gains recognized on the sale of shares pursuant to the rescission offer.

Dividend Treatment. If none of the foregoing three tests under Section 302 of the Code is satisfied, the U.S. stockholder generally will be treated as having received a distribution in an amount equal to the amount of cash received by the U.S. stockholder pursuant to the rescission offer. That distribution will be treated as ordinary dividend income to the extent our current or accumulated earnings and profits are allocated to the distribution, unless we designate the dividend as a capital gains dividend. Dividends paid to corporate U.S. stockholders will not qualify for the dividends received deduction generally available to corporations. In addition, our ordinary dividends generally will not qualify for the 20% tax rate on “qualified dividend income” received by taxpayers taxed as individuals. Our ordinary dividends, with limited exceptions, paid to taxpayers taxed as individuals are taxed at the higher federal income tax rate applicable to ordinary income, which is a maximum rate of 37%. However, under the Tax Cuts and Jobs Act, for taxable years beginning after December 31, 2017 and before January 1, 2026, stockholders that are individuals, trusts or estates generally may deduct up to 20% of certain qualified business income, including “qualified REIT dividends” (generally, dividends received by a REIT shareholder that are not designated as capital gain dividends or qualified dividend income), subject to certain limitations. In addition, a U.S. stockholder that is an individual, estate or trust many be subject to a 3.8 percent Medicare tax on any dividends treated as received as a result of the sale of shares pursuant to the rescission offer.

Information Reporting. Information returns will generally be filed with the IRS in connection with the gross proceeds payable to a U.S. stockholder pursuant to the rescission offer. We will rely on information previously provided by you in order to determine whether backup withholding is required. If we have not received this information from you, then unless an exemption exists and is proven in a manner satisfactory to the Depositary, a U.S. stockholder will be subject to backup withholding on these payments. If you have not previously provided this information or wish to change previously provided information, you must submit to the Depositary a completed Form W-9, which can be obtained from the Depositary or from www.irs.gov. Certain stockholders (including, among others, all corporations and certain non-U.S. foreign individuals who provide an IRS Form W-8BEN) are not subject to these backup withholding and reporting requirements. The amount of any backup withholding from a payment to a U.S. stockholder will be allowed as a credit against the U.S. stockholder’s U.S. federal income tax liability and may entitle the U.S. stockholder to a refund.

Federal income tax information reporting rules require “cost basis” for shares involved in certain transactions to be reported to stockholders and the IRS. More specifically, upon the transfer or redemption of any shares subject to those reporting requirements, a broker must report both the cost basis of the shares and the gain or loss recognized on the transfer or redemption of those shares to the stockholder and to the IRS on Form 1099-B.

16

Table of Contents

In connection with the purchase of shares pursuant to this rescission offer, U.S. stockholders may identify by lot the shares that are purchased, but U.S. stockholders who do not identify specific lots in a timely manner will be transferred on a “first in/first out” basis. U.S. stockholders should consult their tax advisors regarding the consequences of the “cost basis” information reporting rules.

Material Federal Income Tax Considerations with respect to Retaining Your Shares

If you reject the rescission offer, you will retain ownership of your shares subject to the rescission offer and you will not receive any cash for those securities in connection with the rescission offer.

Constructive Distributions. Provided that no U.S. stockholder accepting the rescission is treated as receiving a dividend as a result of the rescission offer, stockholders whose percentage ownership of the Company increases as a result of the rescission offer will not be treated as realizing taxable constructive distributions by virtue of that increase. In the event that any U.S. stockholder accepting the rescission offer is deemed to receive a dividend, it is possible that stockholders whose percentage ownership of the Company increases as a result of the rescission offer, including stockholders who do not accept the rescission offer, may be deemed to receive a constructive distribution in the amount of the increase in their percentage ownership of the Company as a result of the rescission offer. A constructive distribution will be treated as a dividend to the extent of our current or accumulated earnings and profits allocable to it. This dividend treatment will not apply if the purchase of shares pursuant to the rescission offer is treated as an “isolated redemption” within the meaning of the Treasury Regulations.

17

Table of Contents

You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making a decision to accept or reject our rescission offer. If any of the following risks actually occurs, our business, financial condition or operating results could be materially and adversely affected.

Risks Related to the Rescission Offer

We cannot predict whether the amounts you would receive in the rescission offer would be greater than the amounts you would receive if you retain your shares.

If you accept our rescission offer and surrender your shares, you will receive your purchase price for the shares (which ranges from $10.26 to $10.94), plus 7% interest based on the initial purchase price, less any distributions you have received on those shares. Interest and distributions will be determined from the date you purchased the shares through the date that the rescission offer expires.

If you reject the rescission offer, you may receive future distributions on your shares, you may receive consideration upon a liquidity event of our Company, or you may sell your shares pursuant to our redemption program. However, because all of the amounts you may receive with respect to your shares are uncertain, we cannot predict whether the amounts you would receive in the rescission offer would be greater than the amounts you would receive if you retain your shares.

Other Risks

For additional risks related to an investment in us, please refer to Part I, Item 1A, “Risk Factors” on pages 6-28, of our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 22, 2019, which is available on our website, www.resourcereit.com, and at www.sec.gov, and is incorporated herein by reference.

18

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Forward-looking statements we make in this prospectus are subject to various risks and uncertainties that could cause actual results to vary from our forward-looking statements, including:

| • | the factors described in this prospectus, including those set forth under the section captioned “Risk Factors” and incorporated herein by reference; |

| • | our future operating results; |

| • | our business prospects; |

| • | changes in our business strategy; |

| • | availability, terms and deployment of capital; |

| • | availability of qualified personnel; |

| • | changes in our industry, interest rates, the debt securities market or the general economy; |

| • | changes in governmental regulations, tax rates and similar matters; |

| • | actions and initiatives of the U.S. government relating to discounted or troubled assets, and the impact of these policies; |

| • | availability of investment opportunities in real estate and real estate-related assets; |

| • | the degree and nature of our competition; |

| • | the adequacy of our cash reserves and working capital; and |

| • | the timing of cash flows, if any, from our investments. |

Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

19

Table of Contents

For information about our management, management compensation and related party transactions, please refer to “Certain Information About Management” on pages 6-19, of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2019, which is available on our website, www.resourcereit.com, and at www.sec.gov, and is incorporated herein by reference.

For information about our stock ownership, please refer to “Stock Ownership” on page 20, of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2019, which is available on our website, www.resourcereit.com, and at www.sec.gov, and is incorporated herein by reference.

INVESTMENT OBJECTIVES AND POLICIES, INVESTMENT PORTFOLIO, SELECTED FINANCIAL INFORMATION AND RESULTS FROM OPERATIONS

For information about our investment objectives and policies, investment portfolio, selected financial information and results from operations, please refer to Part I, Item 1, on pages 4-6, Part I, Item 2 on pages 29-30, Part II, Item 6 on page 39, and Part II, Item 7 on pages 40-59, of our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 22, 2019, which is available on our website, www.resourcereit.com, and at www.sec.gov, and is incorporated herein by reference.

For a description of our shares of common stock, please refer to “Suitability Standards” on page i of our Registration Statement on Form S-3, filed with the SEC on May 31, 2016 and “Description of Shares” in our Post-Effective Amendment No. 2 to Registration Statement on Form S-11, on pages 167-184, filed with the SEC on March 3, 2011 (File No. 333-160463), which is available at www.sec.gov, and is incorporated herein by reference.

The audited consolidated financial statements and schedules of Resource Real Estate Opportunity REIT, Inc. incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing in giving said report.

20

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We have elected to “incorporate by reference” certain information into this prospectus. By incorporating by reference, we are disclosing important information to you by referring you to documents we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus. You can access documents that are incorporated by reference into this prospectus at our website at http://www.ResourceREIT.com (URL for documents: http://www.resourcereit.com/investor-relations.php). There is additional information about us and our advisor and its affiliates at the website, but unless specifically incorporated by reference herein as described in the paragraphs below, the contents of that site are not incorporated by reference in or otherwise a part of this prospectus.

The following documents filed with the SEC are incorporated by reference in this prospectus, except for any document or portion thereof deemed to be “furnished” and not filed in accordance with SEC rules:

| • | Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the SEC on March 22, 2019; |

| • | Quarterly Report on Form 10-Q for the period ended March 31, 2019 filed with the SEC on May 10, 2019; |

| • | Quarterly Report on Form 10-Q for the period ended June 30, 2019 filed with the SEC on August 9, 2019; |

| • | Definitive Proxy Statement on Schedule 14A filed with the SEC on April 29, 2019; |

| • | Registration Statement on Form 8-A12G (Reg. No. 000-54369) filed April 28, 2011; |

| • | Current Report on Form 8-K filed with the SEC on June 10, 2019; and |

| • | Current Report on Form 8-K filed with the SEC on July 22, 2019. |

| • | Current Report on Form 8-K filed with the SEC on September 4, 2019. |

We will provide to each person, including any beneficial owner, to whom this prospectus is delivered, upon request, a copy of any or all of the information that we have incorporated by reference into this prospectus but not delivered with this prospectus. To receive a free copy of any of the documents incorporated by reference in this prospectus, other than exhibits, unless they are specifically incorporated by reference in those documents, call or write us at:

Resource Securities, Inc.

1845 Walnut Street, 17th Floor

Philadelphia, PA 19103

Telephone: (215) 546-5005

The information relating to us contained in this prospectus does not purport to be comprehensive and should be read together with the information contained in the documents incorporated or deemed to be incorporated by reference in this prospectus.

21

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-11 with the SEC with respect to the rescission offer. This prospectus is a part of that registration statement and, as permitted by SEC rules, does not include all of the information you can find in the registration statement or the exhibits to the registration statement. For additional information relating to us, we refer you to the registration statement and the exhibits to the registration statement. Statements contained in this prospectus as to the contents of any contract or document are summaries of such contract or document and in each instance, if we have filed the contract or document as an exhibit to the registration statement, we refer you to the copy of the contract or document filed as an exhibit to the registration statement.

We file annual, quarterly and special reports, proxy statements and other information with the SEC. We intend to furnish our stockholders with annual reports containing consolidated financial statements certified by an independent public accounting firm. The registration statement and any of these other filings with the SEC is available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may read and copy any filed document at the SEC’s public reference room in Washington, D.C. at 100 F. Street, N.E., Room 1580, Washington, D.C. Please call the SEC at (800) SEC-0330 for further information about the public reference room.

There is additional information about us and our affiliates on our Internet site at http://www.resourcereit.com, but the contents of that site are not incorporated by reference in or otherwise a part of this prospectus.

22

Table of Contents

APPENDIX A

Form of Election

Table of Contents

RESCISSION OFFER ELECTION FORM THIS RESCISSION OFFER ELECTION FORM may be used by any current living investor(s) (an "investor") or the estate of a deceased Investor (a "Deceased Investor") in Resource Real Estate Opportunity REIT, Inc. (the "Company") that is eligible to have their Company shares (the "Shares") repurchased by the Company pursuant to the Company's rescission offer (the "Offer") described on the Company's prospectus dated September 4, 2019 (the "Prospectus"). Please refer to the description of the Offer contained in the Company's Prospectus. If you have questions regarding the Offer, you may contact the Company at (866) 469-0129 or via email at Resourceoperations@resourcerei.com. Please Send To: Resource Real Estate, Inc., PO Box 219169, Kansas City, MO 64121-9169. 1. INVESTOR INFORMATION Investor Name SSN/Tax ID Date of Birth Investor Name SSN/Tax ID Date of Birth Street Address City State Zip Code Mailing Address (if different than above) City State Zip Code Phone (day) Phone (evening) Email Account Number

Table of Contents