Table of Contents

As filed with the Securities and Exchange Commission on December 30, 2013

Registration No. 333-160463

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

POST-EFFECTIVE AMENDMENT NO. 15 TO

FORM S-11

on

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Resource Real Estate Opportunity REIT, Inc.

(Exact name of registrant as specified in its charter)

Maryland

(State or other jurisdiction of

incorporation or organization)

27-0331816

(I.R.S. employer

identification number)

1845 Walnut Street, 18th Floor

Philadelphia, Pennsylvania 19103

(215) 231-7050

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Alan F. Feldman

Chief Executive Officer

Resource Real Estate Opportunity REIT, Inc.

1845 Walnut Street, 18th Floor

Philadelphia, Pennsylvania 19103

(215) 231-7050

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt, Esq.

DLA Piper LLP (US)

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2000

Approximate date of commencement of proposed sale to public: From time to time after effectiveness of the registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: x

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if smaller reporting company) | Smaller Reporting Company | x | |||

Explanatory note: This registration statement (reg. no. 333-160463) for the issuer’s primary offering and distribution reinvestment plan offering was first declared effective by the Staff on June 16, 2010. On December 26, 2013, the issuer filed post-effective amendment no. 14 to de-register the unsold shares in the primary offering. This post-effective amendment no. 15 to Form S-11 on Form S-3 amends the issuer’s registration statement to make it a distribution reinvestment plan only registration statement.

Table of Contents

RESOURCE REAL ESTATE OPPORTUNITY REIT, INC.

Distribution Reinvestment Plan

Maximum Offering of 7,500,000 Shares of Common Stock

Resource Real Estate Opportunity REIT, Inc. is a Maryland corporation that has purchased and intends to continue to purchase a diversified portfolio of U.S. commercial real estate and real estate-related debt that has been significantly discounted due to the effects of recent economic events and high levels of leverage on U.S. commercial real estate, as well as properties that may benefit from extensive renovations intended to increase their long-term values. We have a particular focus on operating multifamily assets, and we have targeted this asset class while also considering interests in other types of commercial property assets consistent with our investment objectives. As of December 27, 2013, we owned three performing first mortgage loans and 24 multifamily properties.

We are offering up to 7,500,000 shares of our common stock to our existing stockholders pursuant to our distribution reinvestment plan. Some of the significant features of the plan are:

| • | Stockholders who elect to participate in the plan may choose to invest all or a portion of their cash distributions in shares of our common stock. |

| • | We are offering the shares at a purchase price of $9.50. |

| • | We may offer shares of common stock under our distribution reinvestment plan until we have sold all 7,500,000 shares. |

| • | We may amend or terminate the distribution reinvestment plan for any reason at any time upon 10 days’ notice to participants. |

| • | Participants may terminate participation in the plan at any time upon written notice to us. For your termination to be effective for a particular distribution, we must have received your notice of termination at least 10 business days prior to the last day of the fiscal period to which the distribution relates. |

| • | If you elect to participate in our distribution reinvestment plan, you will be deemed to have received, and for income tax purposes will be taxed on, the amount reinvested in shares of our common stock to the extent the amount reinvested was not a tax-free return of capital. In addition, you will be treated for tax purposes as having received an additional distribution to the extent the shares are purchased at a discount to fair market value, if any. |

You may elect to participate in our distribution reinvestment plan by completing the enrollment form or other company-approved authorization form available from our dealer manager or a participating broker-dealer.

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the specific risks set forth under the caption “Risk Factors” under Item 1A of Part I of our most recent Annual Report on Form 10-K, under Item 1A of Part II of our most recent Quarterly Reports on Form 10-Q, and in our Current Report on Form 8-K dated December 30, 2013, as applicable, and as the same may be updated from time to time by future filings under the Securities and Exchange Act of 1934, as amended, which are incorporated by reference into this prospectus.

Neither the SEC, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment.

|

| ||||||

| Price to Public | Selling Commissions and Dealer Manager Fees |

Net Proceeds (Before Expenses) | ||||

| Distribution Reinvestment Plan |

||||||

| Per Share |

$9.50 | $0.00 | $9.50 | |||

| Total Maximum |

$71,250,000.00 | $0.00 | $71,250,000.00 | |||

|

| ||||||

|

| ||||||

The date of this prospectus is December 30, 2013.

Table of Contents

The shares we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. Because there is no public market for our shares, you will have difficulty selling your shares.

In consideration of these factors, we have established suitability standards for investors in this offering and subsequent purchasers of our shares. These general suitability standards require that a purchaser of shares have either:

| • | a net worth of at least $250,000; or |

| • | gross annual income of at least $70,000 and a net worth of at least $70,000. |

In addition, the states listed below have established suitability requirements that are more stringent than ours and investors in these states are directed to the following special suitability standards:

| • | Ohio – Investors must have a liquid net worth of at least 10 times the amount of their investment in us, our affiliates and any other non-traded real estate investment programs and meet one of the above general suitability standard. |

| • | Oregon – Investors must have a liquid net worth of at least 10 times their investment in us and meet one of the above general suitability standards. |

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. “Liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. In the case of sales to fiduciary accounts, these suitability standards must be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares if such person is the fiduciary or by the beneficiary of the account.

Our sponsor, those selling shares on our behalf and participating broker-dealers and registered investment advisors recommending the purchase of shares in this offering must make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment for each stockholder based on information provided by the stockholder regarding the stockholder’s financial situation and investment objectives. See “Plan of Distribution – Suitability Standards” in this prospectus for a detailed discussion of the determinations regarding suitability that we require.

i

Table of Contents

| i | ||||

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 11 | ||||

| 33 | ||||

| LIMITED LIABILITY AND INDEMNIFICATION OF DIRECTORS, OFFICERS, EMPLOYEES AND OTHER AGENTS |

34 | |||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 37 | ||||

| APPENDIX A – AMENDED AND RESTATED DISTRIBUTION REINVESTMENT PLAN |

A-1 | |||

| B-1 |

ii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in or incorporated by reference in this prospectus other than historical facts may be considered forward-looking statements. Such statements include, in particular, statements about our plans, strategies and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Any such forward-looking statements are subject to unknown risks, uncertainties and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered. Some of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition are as follows:

| • | We have a limited operating history. This inexperience makes our future performance difficult to predict. |

| • | Our executive officers and some of our directors are also officers, directors, managers or key professionals of our advisor, our dealer manager and other affiliated Resource Real Estate entities. As a result, they face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs sponsored by Resource Real Estate and conflicts in allocating time among us and these other programs. These conflicts could result in action or inaction that is not in the best interests of our stockholders. |

| • | We pay substantial fees to and expenses of our advisor and its affiliates and, in connection with our initial public offering, we paid substantial fees to participating broker-dealers. These payments increase the risk that our stockholders will not earn a profit on their investment in us and increase the risk of loss to our stockholders. |

| • | Our charter permits us to pay distributions from any source, including from offering proceeds, borrowings, the sale of assets and the waiver or deferral of fees otherwise owed to our advisor. We have not established limits on the amount of offering proceeds, borrowings or cash advances we may use to pay distributions. To date, we have paid distributions from cash flow from our operating activities and from borrowings. To the extent these distributions exceed our taxable income or net capital gain, a greater proportion of your distributions will generally represent a return of capital as opposed to current income or gain, as applicable. |

| • | Investments in non-performing real estate assets involve greater risks than investments in stabilized performing assets and make our future performance more difficult to predict. |

| • | Continued disruptions in the financial markets and uncertain economic conditions could adversely affect our ability to implement our business strategy and generate returns to stockholders. |

| • | Our failure to qualify as a REIT for federal income tax purposes would reduce the amount of income we have available for distribution and limit our ability to make distributions to our stockholders. |

For a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition, you should carefully review the risk factors disclosed under the caption “Risk Factors” under Item 1A of Part I of our most recent Annual Report on Form 10-K, under Item 1A of Part II of our most recent Quarterly Reports on Form 10-Q, and in our Current Report on Form 8-K dated December 30, 2013, as applicable, and any updated risk factors contained in future filings we make under the Securities Exchange Act of 1934, as amended. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

Table of Contents

This summary highlights material information about this offering. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully before making a decision to participate in the distribution reinvestment plan. You should also review the section of this prospectus titled “Incorporation of Certain Information by Reference.”

What is Resource Real Estate Opportunity REIT, Inc.?

Resource Real Estate Opportunity REIT, Inc. is a Maryland corporation that has purchased and intends to continue to purchase a diversified portfolio of U.S. commercial real estate and real estate-related debt that has been discounted due to the effects of recent economic events and high levels of leverage on U.S. commercial real estate, as well as properties that may benefit from extensive renovations intended to increase their long-term values. We have a particular focus on operating multifamily assets, and we have targeted this asset class while also considering interests in other types of commercial property assets consistent with our investment objectives. Our targeted portfolio will consist of commercial real estate assets, principally: (i) non-performing or distressed loans, including but not limited to first- and second-priority mortgage loans, mezzanine loans, B-Notes and other loans; (ii) real estate owned by financial institutions (“REO”), usually as a result of foreclosure; (iii) value-add multifamily rental properties; (iv) discounted investment grade commercial mortgage-backed securities; and (v) and other real estate-related assets we purchase either directly or with a co-investor or joint venture partner. We anticipate holding approximately 45% of our total assets in categories (i) and (ii) listed above and 55% of our total assets in category (iii) listed above. Our mailing address is 1845 Walnut Street, 18th Floor, Philadelphia, Pennsylvania 19103. Our telephone number is (215) 231-7050, our fax number is (215) 640-6320 and our email address is info@resourcereit.com. We also maintain an Internet site at http://www.resourcereit.com at which there is additional information about us and our affiliates, but the contents of that site are not incorporated by reference in or otherwise a part of this prospectus.

We were incorporated in the State of Maryland on June 3, 2009. As of December 27, 2013, we owned 24 multifamily properties encompassing approximately 6.8 million rentable square feet. In addition, as of December 27, 2013, we owned three performing first mortgage loans.

Our external advisor, Resource Real Estate Opportunity Advisor, LLC, conducts our operations and manages our portfolio of real estate investments, all subject to the supervision of our board of directors. We have no paid employees.

What is the distribution reinvestment plan?

We are offering up to 7,500,000 shares of our common stock to our existing stockholders pursuant to our distribution reinvestment plan. The purchase price for shares purchased under the distribution reinvestment plan will initially be $9.50 per share. Once we establish an estimated value per share that is not based on the price to acquire a share in the primary portion of our initial public offering, shares issued pursuant to our distribution reinvestment plan will be priced at the estimated value per share of our common stock, as determined by our advisor or another firm chosen for that purpose. We expect to establish an estimated value per share not based on the price to acquire a share in the primary portion of our initial public offering after the completion of our offering stage; however, the time frame before which we establish an estimated value per share may be different depending on regulatory requirements. We will consider our offering stage complete when 18 months have passed since our last sale of shares in a public offering of equity securities, whether that last sale was in the primary portion of our initial public offering or a public follow-on offering. (For purposes of this definition, we do not consider “public equity offerings” to include offerings on behalf of selling stockholders or offerings related to any distribution reinvestment plan, employee benefit plan or the redemption of interests in our operating partnership.)

We may offer shares of common stock under our distribution reinvestment plan until we have sold all 7,500,000 shares. As of December 27, 2013, we had sold approximately 1,161,371 shares of common stock under our distribution reinvestment plan.

No selling commissions or dealer manager fees are payable on shares sold under our distribution reinvestment plan. We may amend or terminate the distribution reinvestment plan for any reason at any time upon 10 days’ written notice to participants.

2

Table of Contents

Who may participate in the distribution reinvestment plan?

All of our stockholders are eligible to participate in our distribution reinvestment plan; however, we may elect to deny your participation in the distribution reinvestment plan if you reside in a jurisdiction or foreign country where, in our judgment, the burden or expense of compliance with applicable securities laws makes your participation impracticable or inadvisable.

At any time prior to the listing of our shares on a national stock exchange, you must cease participation in our distribution reinvestment plan if you no longer meet the net income and net worth standards set forth in our charter or the then-current prospectus. Participants must agree to notify us promptly when they no longer meet these standards. See the “Suitability Standards” section of this prospectus (immediately following the cover page).

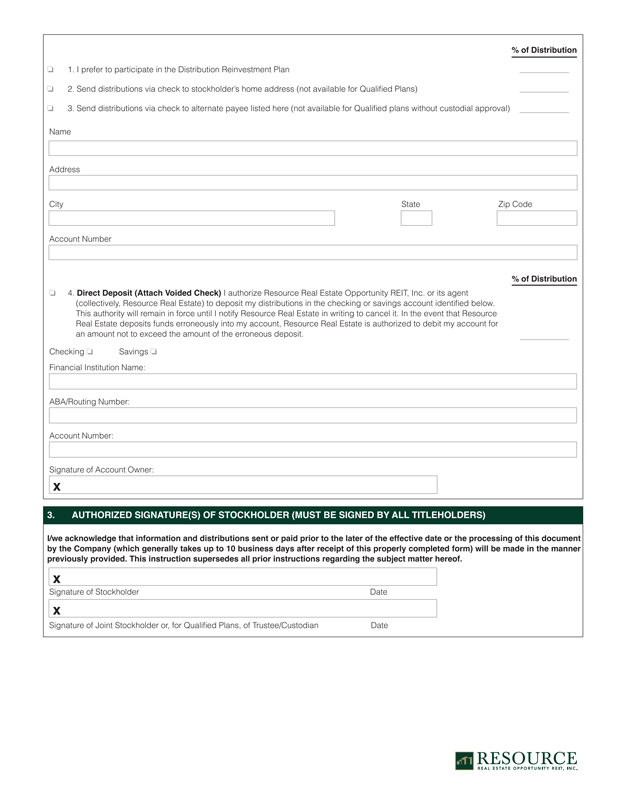

If you choose to participate in our distribution reinvestment plan you will need to fill out an enrollment form, like the one contained in this prospectus as Appendix B, that we will provide to you at your request. Your participation in the distribution reinvestment plan will begin with the next distribution made after receipt of your enrollment form in good order. You can choose to have all or a portion of your distributions reinvested through the distribution reinvestment plan; however, the distribution reinvestment plan requires you to designate at least 20% of your distributions for the purchase of additional shares of common stock. You may also change the percentage of your distributions that will be reinvested at any time by completing a new enrollment form or other form provided for that purpose. You must make any election to increase your level of participation through your participating broker-dealer or the dealer manager, as applicable.

What are the tax consequences of participation in the distribution reinvestment plan?

If you elect to participate in the distribution reinvestment plan and are subject to federal income taxation, you will incur a tax liability for distributions allocated to you even though you have elected not to receive the distributions in cash but rather to have the distributions withheld and reinvested pursuant to the distribution reinvestment plan. Specifically, you will be treated as if you have received the distribution from us in cash and then applied such distribution to the purchase of additional shares. In addition, to the extent you purchase shares through our distribution reinvestment plan at a discount to their fair market value, you will be treated for tax purposes as receiving an additional distribution equal to the amount of the discount.

You will be taxed on the amount of such distribution as a dividend to the extent such distribution is from current or accumulated earnings and profits, unless we have designated all or a portion of the distribution as a capital gain distribution. See “Federal Income Tax Considerations—Taxation of Stockholders.” We will withhold 28% of the amount of dividends or distributions paid if you fail to furnish a valid taxpayer identification number, fail to properly report interest or distributions or fail to certify that you are not subject to withholding.

How will you use the proceeds raised in this offering?

We expect to use the net proceeds from the sale of shares under our distribution reinvestment plan for general corporate purposes, including, but not limited to, the following:

| • | the repurchase of shares under our share redemption program; |

| • | capital expenditures, tenant improvement costs and leasing costs related to our investments in real estate properties; |

| • | reserves required by any financings of our investments; |

| • | future funding obligations under any real estate loan receivable we acquire; |

| • | acquisition of assets, which would include payment of acquisition fees to our advisor; and |

| • | the repayment of debt. |

3

Table of Contents

We cannot predict with any certainty how much, if any, distribution reinvestment plan proceeds will be available for specific purposes. No selling commissions or dealer manager fees will be payable on shares sold under the distribution reinvestment plan.

What are your investment objectives?

Our principal investment objectives are to:

| • | preserve, protect and return your capital contribution; |

| • | realize growth in the value of our investments; |

| • | increase cash distributions to you through increased cash flow from operations or targeted asset sales; and |

| • | enable you to realize a return of your investment by either liquidating our assets or listing our shares on a national securities exchange within three to six years after the termination of the primary portion of our initial public offering. |

Who is your advisor and what does the advisor do?

Resource Real Estate Opportunity Advisor, LLC is our advisor. Our advisor is a limited liability company that was formed in the State of Delaware on June 8, 2009 and has a limited operating history and limited experience managing a public company. Our advisor is supported by our sponsor, Resource Real Estate, Inc., and its personnel in providing advisory services to us.

Our advisor manages our day-to-day operations and our portfolio of real estate investments, and provides asset-management, marketing, investor relations and other administrative services on our behalf, pursuant to an advisory agreement and subject to the supervision of our board of directors. We have entered into a management agreement with Resource Real Estate Opportunity Manager, our affiliate, to provide property management services for most, if not all, of the properties or other real estate-related assets we acquire, provided our advisor is able to control the operational management of such acquisitions. Resource Real Estate Opportunity Manager may subcontract with an affiliate or third party to provide day-to-day property management, construction management or other property specific functions, as applicable, for the properties it manages.

Resource Real Estate and its team of real estate professionals, including Jonathan Z. Cohen, Alan F. Feldman and Kevin M. Finkel, acting through our advisor, make most of the decisions regarding the selection, negotiation, financing and disposition of real estate investments. A majority of our board of directors and a majority of the conflicts committee approves all proposed real estate property investments and certain significant real estate-related debt investments.

Are there any special restrictions on the ownership or transfer of shares?

Yes. Our charter contains restrictions on the ownership of our shares that prevent any one person from owning more than 9.8% of our aggregate outstanding shares unless exempted by our board of directors. These restrictions are designed to enable us to comply with ownership restrictions imposed on REITs by the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). Our charter also limits your ability to sell your shares unless (i) the prospective purchaser meets the suitability standards in our charter regarding income or net worth and (ii) unless you are transferring all of your shares and the transfer complies with the minimum purchase requirements.

When will the company seek to list its shares of common stock or liquidate its assets?

We anticipate providing our stockholders with a liquidity event or events by some combination of the following: (i) liquidating all, or substantially all, of our assets and distributing the net proceeds to our stockholders; or (ii) listing of our shares for trading on an exchange. Our board anticipates evaluating a liquidity event within three to six years after the termination of the primary portion of our initial public offering (which occurred in December 2013), subject to then

4

Table of Contents

prevailing market conditions; however, our board could accelerate this timing. If we do not begin the process of liquidating our assets or listing our shares within six years of the termination of the primary portion of our initial public offering and a majority of our board of directors and a majority of our independent directors have not voted to defer the liquidation or listing beyond such sixth anniversary, upon the request of stockholders holding 10% or more of our outstanding shares of common stock, our charter requires that we hold a stockholder meeting to vote on a proposal for our orderly liquidation. Prior to any stockholder meeting, our directors would evaluate whether to recommend the proposal to our stockholders and, if they so determine, would recommend the proposal and their reasons for doing so. The proposal would include information regarding appraisals of our portfolio. If our stockholders did not approve the proposal, we would obtain new appraisals and resubmit the proposal to our stockholders up to once every two years upon the written request of stockholders owning 10% of our outstanding common stock.

If we commence liquidation, we would begin an orderly sale of our properties and other assets. The precise timing of such sales will depend on the prevailing real estate and financial markets, the economic conditions in the areas where our properties are located and the federal income tax consequences to our stockholders. In making the decision to liquidate or apply for listing of our shares, our directors will try to determine whether liquidating our assets or listing our shares will result in greater value for stockholders.

Will I be notified of how my investment is doing?

Yes, we will provide you with periodic updates on the performance of your investment in us, including:

| • | detailed quarterly dividend reports; |

| • | an annual report; and |

| • | three quarterly financial reports. |

We will provide this information to you via one or more of the following methods, in our discretion and with your consent, if necessary:

| • | U.S. mail or other courier; |

| • | facsimile; |

| • | electronic delivery; or |

| • | posting on our web site at www.resourcereit.com. |

When will I get my detailed tax information?

Your Form 1099-DIV tax information, if required, will be mailed by January 31 of each year.

Who can help answer my questions about the offering?

If you have more questions about the offering, or if you would like additional copies of this prospectus, you should contact your registered representative or contact:

Resource Securities, Inc.

1845 Walnut Street, 17th Floor

Philadelphia, Pennsylvania 19103

Telephone: (866) 469-0129

Fax: (866) 545-7693

5

Table of Contents

Where can I find more information about Resource Real Estate Opportunity REIT, Inc?

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. SEC rules allow us to incorporate by reference information into this prospectus. By incorporating by reference, we are disclosing important information to you by referring you to another document that we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus. Further, any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of the securities by means of this prospectus is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus. See “Incorporation of Certain Information by Reference” and “Where You Can Find More Information” in this prospectus.

6

Table of Contents

An investment in our common stock involves various risks and uncertainties. For a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition, you should carefully review the risk factors disclosed under Item 1A of Part I of our most recent Annual Report on Form 10-K and under Item 1A of Part II of our most recent Quarterly Reports on Form 10-Q, in our Current Report on Form 8-K dated December 30, 2013, as applicable, and any updated risk factors contained in future filings we make under the Securities Exchange Act of 1934, as amended, which are incorporated by reference into this prospectus, as amended and supplemented. These risks can adversely affect our business, operating results, prospects and financial condition. This could cause the value of our common stock to decline and could cause you to lose all or part of your investment.

7

Table of Contents

We expect to use the net proceeds from the sale of shares under our distribution reinvestment plan for general corporate purposes, including, but not limited to, the following:

| • | the repurchase of shares under our share redemption program; |

| • | capital expenditures, tenant improvement costs and leasing costs related to our investments in real estate properties; |

| • | reserves required by any financings of our investments; |

| • | future funding obligations under any real estate loan receivable we acquire; |

| • | acquisition of assets, which would include payment of acquisition fees to our advisor; and |

| • | the repayment of debt. |

We cannot predict with any certainty how much, if any, distribution reinvestment plan proceeds will be available for specific purposes. No selling commissions or dealer manager fees will be payable on shares sold under the distribution reinvestment plan.

DESCRIPTION OF DISTRIBUTION REINVESTMENT PLAN

Pursuant to our amended and restated distribution reinvestment plan, you may elect to have your distributions reinvested in additional shares of our common stock. The following discussion summarizes the principal terms of this plan. Appendix A to this prospectus contains the full text of our amended and restated distribution reinvestment plan as is currently in effect.

Eligibility

All of our common stockholders are eligible to participate in our distribution reinvestment plan; however, we may elect to deny your participation in the distribution reinvestment plan if you reside in a jurisdiction or foreign country where, in our judgment, the burden or expense of compliance with applicable securities laws makes your participation impracticable or inadvisable.

At any time prior to the listing of our shares on a national stock exchange, you must cease participation in our distribution reinvestment plan if you no longer meet the net income and net worth standards set forth in our charter or the then-current prospectus. Participants must agree to notify us promptly when they no longer meet these standards. See the “Suitability Standards” section of this prospectus (immediately following the cover page) and the form of enrollment form attached hereto as Appendix B.

Election to Participate

Assuming you are eligible, you may elect to participate in our distribution reinvestment plan by completing the enrollment form or other company-approved authorization form available from the dealer manager or a participating broker-dealer. Your participation in the distribution reinvestment plan will begin with the next distribution made after receipt of your enrollment form. You can choose to have all or a portion of your distributions reinvested through the distribution reinvestment plan; however, the distribution reinvestment plan requires you to designate at least 20% of your distributions for the purchase of additional shares of common stock. You may also change the percentage of your distributions that will be reinvested at any time by completing a new enrollment form or other form provided for that purpose. You must make any election to increase your level of participation through your participating broker-dealer or the dealer manager.

8

Table of Contents

Stock Purchases

Shares will be purchased under the distribution reinvestment plan on the distribution payment dates. The purchase of fractional shares is a permissible, and likely, result of the reinvestment of distributions under the distribution reinvestment plan.

The purchase price for shares purchased under the distribution reinvestment plan will initially be $9.50 per share. Once we establish an estimated value per share that is not based on the price to acquire a share in the primary portion of our initial public offering, shares issued pursuant to our distribution reinvestment plan will be priced at the estimated value per share of our common stock, as determined by our advisor or another firm chosen for that purpose. We expect to establish an estimated value per share not based on the price to acquire a share in the primary portion of our initial public offering after the completion of our offering stage; however, the time frame before which we establish an estimated value per share may be different depending on regulatory requirements. We will consider our offering stage complete when 18 months have passed since our last sale of shares in a public offering of equity securities, whether that last sale was in the primary portion of our initial public offering or a public follow-on offering. (For purposes of this definition, we do not consider “public equity offerings” to include offerings on behalf of selling stockholders or offerings related to any distribution reinvestment plan, employee benefit plan or the redemption of interests in our operating partnership.)

Account Statements

You or your designee will receive a confirmation of your purchases under the distribution reinvestment plan no less than quarterly. Your confirmation will disclose the following information:

| • | each distribution reinvested for your account during the period; |

| • | the date of the reinvestment; |

| • | the number and price of the shares purchased by you; and |

| • | the total number of shares in your account. |

In addition, within 90 days after the end of each calendar year, we will provide you with an individualized report on your investment, including the purchase dates, purchase price, number of shares owned and the amount of distributions made in the prior year. We will also provide to all participants in the plan, without charge, any updated versions of this prospectus, as required under applicable securities laws.

Notice to Participants

With respect to material changes, we may provide notice by including such information (a) in a Current Report on Form 8-K or in our annual or quarterly reports filed with the SEC and (b) in a separate mailing to the participants. With respect to immaterial changes, we may provide notice by including such information (a) in a Current Report on Form 8-K or in our annual or quarterly reports filed with the SEC, (b) in a separate mailing to the participants, or (c) on our web site.

Fees and Commissions

No selling commissions or dealer manager fees are payable on shares sold under the distribution reinvestment plan, and our sponsor, advisor, directors or any affiliates will not receive a fee for selling shares under the distribution reinvestment plan.

Voting

You may vote all shares, including fractional shares that you acquire through the distribution reinvestment plan.

Tax Consequences of Participation

If you elect to participate in the distribution reinvestment plan and are subject to federal income taxation, you will incur a tax liability for distributions allocated to you even though you have elected not to receive the distributions in cash but rather to have the distributions withheld and reinvested pursuant to the distribution reinvestment plan. Specifically, you will be treated as if you have received the distribution from us in cash and then applied such distribution to the purchase of additional shares. In addition, to the extent you purchase shares through our distribution reinvestment plan at a discount to their fair market value, you will be treated for tax purposes as receiving an additional distribution equal to the amount of the discount.

9

Table of Contents

You will be taxed on the amount of such distribution as a dividend to the extent such distribution is from current or accumulated earnings and profits, unless we have designated all or a portion of the distribution as a capital gain distribution. See “Federal Income Tax Considerations—Taxation of Stockholders—Taxation of Taxable Domestic Stockholders.” We will withhold 28% of the amount of dividends or distributions paid if you fail to furnish a valid taxpayer identification number, fail to properly report interest or distributions or fail to certify that you are not subject to withholding.

Termination of Participation

Once enrolled, you may continue to purchase shares under our distribution reinvestment plan until we have sold all of the shares registered in this offering, have terminated this offering or have terminated the distribution reinvestment plan. You may terminate your participation in the distribution reinvestment plan at any time by providing us with written notice. For your termination to be effective for a particular distribution, we must have received your notice of termination at least 10 business days prior to the last day of the fiscal period to which the distribution relates. If you participate in our share redemption program, you will not be terminated from participating in the distribution reinvestment plan to the extent that you do not redeem all of the shares you own. Any transfer of your shares will effect a termination of the participation of those shares in the distribution reinvestment plan. We will terminate your participation in the distribution reinvestment plan to the extent that a reinvestment of your distributions would cause you to violate the ownership limit contained in our charter, unless you have obtained an exemption from the ownership limit from our board of directors.

Amendment or Termination of Plan

We may amend or terminate the distribution reinvestment plan for any reason at any time upon 10 days’ written notice to the participants, except we may not amend the distribution reinvestment plan to remove the right of a stockholder to terminate participation in the plan. We may provide notice by including such information (a) in a Current Report on Form 8-K or in our annual or quarterly reports, all publicly filed with the SEC, or (b) in a separate mailing to the participants.

10

Table of Contents

FEDERAL INCOME TAX CONSIDERATIONS

The following is a summary of the material U.S. federal income tax consequences of an investment in our common stock. The law firm of DLA Piper LLP (US) has acted as our tax counsel and reviewed this summary. For purposes of this section under the heading “Federal Income Tax Considerations,” references to “Resource Real Estate Opportunity REIT, Inc.,” “we,” “our” and “us” mean only Resource Real Estate Opportunity REIT, Inc. and not its subsidiaries or other lower-tier entities, except as otherwise indicated. This summary is based upon the Internal Revenue Code, the regulations promulgated by the U.S. Treasury Department, rulings and other administrative pronouncements issued by the Internal Revenue Service, or IRS, and judicial decisions, all as currently in effect, and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described below. We have not sought and do not currently expect to seek an advance ruling from the IRS regarding any matter discussed in this prospectus. The summary is also based upon the assumption that we and our subsidiaries and affiliates will operate in accordance with their applicable organizational documents. This summary is for general information only and does not purport to discuss all aspects of U.S. federal income taxation that may be important to a particular investor in light of its investment or tax circumstances or to investors subject to special tax rules, such as:

| • | financial institutions; |

| • | insurance companies; |

| • | broker-dealers; |

| • | regulated investment companies; |

| • | partnerships and trusts; |

| • | persons who hold our stock on behalf of other persons as nominees; |

| • | persons who receive our stock through the exercise of employee stock options (if we ever have employees) or otherwise as compensation; |

| • | persons holding our stock as part of a “straddle,” “hedge,” “conversion transaction,” “constructive ownership transaction,” “synthetic security” or other integrated investment; |

| • | “S” corporations; |

and, except to the extent discussed below:

| • | tax-exempt organizations; and |

| • | foreign investors. |

This summary assumes that investors will hold their common stock as a capital asset, which generally means as property held for investment.

The federal income tax treatment of holders of our common stock depends in some instances on determinations of fact and interpretations of complex provisions of U.S. federal income tax law for which no clear precedent or authority may be available. In addition, the tax consequences to any particular stockholder of holding our common stock will depend on the stockholder’s particular tax circumstances. For example, a stockholder that is a partnership or trust that has issued an equity interest to certain types of tax-exempt organizations may be subject to a special entity-level tax if we make distributions attributable to “excess inclusion income.” See “—Taxation of Resource Real Estate Opportunity REIT, Inc.—Taxable Mortgage Pools and Excess Inclusion Income.” A similar tax may be payable by persons who hold our stock as nominees on behalf of tax-exempt organizations. You are urged to consult your tax advisor regarding the federal, state, local and foreign income and other tax consequences to you in light of your particular investment or tax circumstances of acquiring, holding, exchanging, or otherwise disposing of our common stock.

11

Table of Contents

Taxation of Resource Real Estate Opportunity REIT, Inc.

We made an election to be taxed as a REIT under Section 856 of the Internal Revenue Code, effective for our taxable year ended December 31, 2010. We believe that we have been organized and operate in such a manner as to qualify for taxation as a REIT.

The law firm of DLA Piper LLP (US), acting as our tax counsel in connection with this offering, has rendered an opinion dated February 9, 2010, assuming that the actions described in this section are completed on a timely basis and we timely file the requisite elections, that we were organized in conformity with the requirements for qualification and taxation as a REIT under the Internal Revenue Code, and that our proposed method of operation would enable us to continue to meet the requirements for qualification and taxation as a REIT. It must be emphasized that the opinion of DLA Piper LLP (US) was based on various assumptions relating to our organization and operation and was conditioned upon fact-based representations and covenants made by our management regarding our organization, assets, and income, and the past, present and future conduct of our business operations. While we intend to operate so that we will qualify as a REIT, given the highly complex nature of the rules governing REITs, the ongoing importance of factual determinations, and the possibility of future changes in our circumstances, no assurance can be given by DLA Piper LLP (US) or by us that we will qualify as a REIT for any particular year. The opinion was expressed as of the date issued and does not cover subsequent periods. Counsel has no obligation to advise us or our stockholders of any subsequent change in the matters stated, represented or assumed, or of any subsequent change in the applicable law. You should be aware that opinions of counsel are not binding on the IRS, and no assurance can be given that the IRS will not challenge the conclusions set forth in such opinions.

Qualification and taxation as a REIT depends on our ability to meet on a continuing basis, through actual operating results, distribution levels, and diversity of stock and asset ownership, various qualification requirements imposed upon REITs by the Internal Revenue Code, the compliance with which will not be reviewed by DLA Piper LLP (US). Our ability to qualify as a REIT also requires that we satisfy certain asset tests, some of which depend upon the fair market values of assets that we own directly or indirectly. Such values may not be susceptible to a precise determination. Accordingly, no assurance can be given that the actual results of our operations for any taxable year will satisfy such requirements for qualification and taxation as a REIT.

Taxation of REITs in General

As indicated above, our qualification and taxation as a REIT depends upon our ability to meet, on a continuing basis, various qualification requirements imposed upon REITs by the Internal Revenue Code. The material qualification requirements are summarized below under “—Requirements for Qualification—General.” While we intend to operate so that we qualify as a REIT, no assurance can be given that the IRS will not challenge our qualification, or that we will be able to operate in accordance with the REIT requirements in the future. See “—Failure to Qualify.”

Provided that we qualify as a REIT, generally we will be entitled to a deduction for distributions that we pay to our stockholders and therefore will not be subject to federal corporate income tax on our taxable income that is currently distributed to our stockholders. This treatment substantially eliminates the “double taxation” at the corporate and stockholder levels that generally results from investment in a corporation. In general, the income that we generate is taxed only at the stockholder level upon distribution to our stockholders.

Certain domestic stockholders that are individuals, trusts or estates are generally taxed on corporate distributions at a maximum rate of 20%. With limited exceptions, however, distributions from us or from other entities that are taxed as REITs are generally not eligible for this rate and will continue to be taxed at rates applicable to ordinary income. See “—Taxation of Stockholders—Taxation of Taxable Domestic Stockholders—Distributions.”

Any net operating losses and other tax attributes generally do not pass through to our stockholders, subject to special rules for certain items such as the capital gains that we recognize. See “—Taxation of Stockholders.”

If we qualify as a REIT, we will nonetheless be subject to federal tax in the following circumstances:

| • | We will be taxed at regular corporate rates on any undistributed taxable income, including undistributed net capital gains. |

12

Table of Contents

| • | We may be subject to the “alternative minimum tax” on our items of tax preference, including any deductions of net operating losses. |

| • | If we have net income from prohibited transactions, which are, in general, sales or other dispositions of inventory or property held primarily for sale to customers in the ordinary course of business, other than foreclosure property, such income will be subject to a 100% tax. See “—Prohibited Transactions” and “—Foreclosure Property” below. |

| • | If we elect to treat property that we acquire in connection with a foreclosure of a mortgage loan or certain leasehold terminations as “foreclosure property,” we may thereby avoid the 100% tax on gain from a resale of that property (if the sale would otherwise constitute a prohibited transaction), but the income from the sale or operation of the property may be subject to corporate income tax at the highest applicable rate (currently 35%). |

| • | If we derive “excess inclusion income” from an interest in certain mortgage loan securitization structures (i.e., a “taxable mortgage pool” or a residual interest in a REMIC), we could be subject to corporate level federal income tax at a 35% rate to the extent that such income is allocable to specified types of tax-exempt stockholders known as “disqualified organizations” that are not subject to unrelated business income tax. See “—Taxable Mortgage Pools and Excess Inclusion Income” below. “Disqualified organizations” are any organization described in Section 860E(e)(5) of the Internal Revenue Code, including: (i) the United States; (ii) any state or political subdivision of the United States; (iii) any foreign government; and (iv) certain other organizations. |

| • | If we should fail to satisfy the 75% gross income test or the 95% gross income test, as discussed below, but nonetheless maintain our qualification as a REIT because we satisfy other requirements, we will be subject to a 100% tax on an amount based on the magnitude of the failure, as adjusted to reflect the profit margin associated with our gross income. |

| • | If we should violate the asset tests (other than certain de minimis violations) or other requirements applicable to REITs, as described below, and yet maintain our qualification as a REIT because there is reasonable cause for the failure and other applicable requirements are met, we may be subject to an excise tax. In that case, the amount of the excise tax will be at least $50,000 per failure, and, in the case of certain asset test failures, will be determined as the amount of net income generated by the assets in question multiplied by the highest corporate tax rate (currently 35%) if that amount exceeds $50,000 per failure. |

| • | If we should fail to distribute during each calendar year at least the sum of (a) 85% of our REIT ordinary income for such year, (b) 95% of our REIT capital gain net income for such year, and (c) any undistributed taxable income from prior periods, we would be subject to a nondeductible 4% excise tax on the excess of the required distribution over the sum of (i) the amounts that we actually distributed and (ii) the amounts we retained and upon which we paid income tax at the corporate level. |

| • | We may be required to pay monetary penalties to the IRS in certain circumstances, including if we fail to meet record keeping requirements intended to monitor our compliance with rules relating to the composition of a REIT’s stockholders, as described below in “—Requirements for Qualification—General.” |

| • | A 100% tax may be imposed on transactions between us and a TRS (as described below) that do not reflect arm’s-length terms. |

| • | If we acquire appreciated assets from a corporation that is not a REIT (i.e., a corporation taxable under subchapter C of the Internal Revenue Code) in a transaction in which the adjusted tax basis of the assets in our hands is determined by reference to the adjusted tax basis of the assets in the hands of the subchapter C corporation, we may be subject to tax on such appreciation at the highest corporate income tax rate then applicable if we subsequently recognize gain on a disposition of any such assets during the 10-year period following their acquisition from the subchapter C corporation. |

| • | The earnings of our subsidiaries, including any subsidiary we may elect to treat as a TRS, are subject to federal corporate income tax to the extent that such subsidiaries are subchapter C corporations. |

13

Table of Contents

In addition, we and our subsidiaries may be subject to a variety of taxes, including payroll taxes and state and local and foreign income, property and other taxes on our assets and operations. We could also be subject to tax in situations and on transactions not presently contemplated.

Requirements for Qualification—General

The Internal Revenue Code defines a REIT as a corporation, trust or association:

| (1) | that is managed by one or more trustees or directors; |

| (2) | the beneficial ownership of which is evidenced by transferable shares, or by transferable certificates of beneficial interest; |

| (3) | that would be taxable as a domestic corporation but for its election to be subject to tax as a REIT; |

| (4) | that is neither a financial institution nor an insurance company subject to specific provisions of the Internal Revenue Code; |

| (5) | the beneficial ownership of which is held by 100 or more persons; |

| (6) | in which, during the last half of each taxable year, not more than 50% in value of the outstanding stock is owned, directly or indirectly, by five or fewer “individuals” (as defined in the Internal Revenue Code to include specified tax-exempt entities); |

| (7) | that elects to be taxed as a REIT, or has made such election for a previous taxable year, and satisfies all relevant filing and other administrative requirements that must be met to elect and maintain REIT qualification; and |

| (8) | that meets other tests described below, including with respect to the nature of its income and assets. |

The Internal Revenue Code provides that conditions (1) through (4) must be met during the entire taxable year, and that condition (5) must be met during at least 335 days of a taxable year of 12 months, or during a proportionate part of a shorter taxable year. Conditions (5) and (6) need not be met during a corporation’s initial tax year as a REIT (which, in our case, was 2010). Our charter provides restrictions regarding the ownership and transfer of our shares, which are intended to assist us in satisfying the share ownership requirements described in conditions (5) and (6) above.

We believe that we have issued common stock with sufficient diversity of ownership to satisfy requirements 5 and 6. In addition, our charter restricts the ownership and transfer of our stock so that we should continue to satisfy these requirements.

To monitor compliance with the share ownership requirements, we generally are required to maintain records regarding the actual ownership of our shares. To do so, we must demand written statements each year from the record holders of significant percentages of our stock pursuant to which the record holders must disclose the actual owners of the shares (i.e., the persons required to include our distributions in their gross income). We must maintain a list of those persons failing or refusing to comply with this demand as part of our records. We could be subject to monetary penalties if we fail to comply with these record-keeping requirements. If you fail or refuse to comply with the demands, you will be required by Treasury regulations to submit a statement with your tax return disclosing your actual ownership of our shares and other information.

In addition, a corporation generally may not elect to become a REIT unless its taxable year is the calendar year. We have adopted December 31 as our year-end, and thereby satisfy this requirement.

14

Table of Contents

The Internal Revenue Code provides relief from violations of the REIT gross income requirements, as described below under “—Income Tests,” in cases where a violation is due to reasonable cause and not to willful neglect, and other requirements are met, including the payment of a penalty tax that is based upon the magnitude of the violation. In addition, certain provisions of the Internal Revenue Code extend similar relief in the case of certain violations of the REIT asset requirements (see “—Asset Tests” below) and other REIT requirements, again provided that the violation is due to reasonable cause and not willful neglect, and other conditions are met, including the payment of a penalty tax. If we fail to satisfy any of the various REIT requirements, there can be no assurance that these relief provisions would be available to enable us to maintain our qualification as a REIT, and, if such relief provisions are available, the amount of any resultant penalty tax could be substantial.

Effect of Subsidiary Entities

Ownership of Partnership Interests. An unincorporated domestic entity, such as a partnership, limited liability company, or trust that has a single owner generally is not treated as an entity separate from its parent for federal income tax purposes. An unincorporated domestic entity with two or more owners generally is treated as a partnership for federal income tax purposes. If we are a partner in an entity that is treated as a partnership for federal income tax purposes, Treasury regulations provide that we are deemed to own our proportionate share of the partnership’s assets, and to earn our proportionate share of the partnership’s income, for purposes of the asset and gross income tests applicable to REITs. Our proportionate share of a partnership’s assets and income is based on our capital interest in the partnership (except that for purposes of the 10% value test, our proportionate share of the partnership’s assets is based on our proportionate interest in the equity and certain debt securities issued by the partnership). In addition, the assets and gross income of the partnership are deemed to retain the same character in our hands. Thus, our proportionate share of the assets and items of income of any of our subsidiary partnerships will be treated as our assets and items of income for purposes of applying the REIT requirements. For any period of time that we own 100% of our operating partnership, all of our operating partnership’s assets and income will be deemed to be ours for federal income tax purposes.

Disregarded Subsidiaries. If we own a corporate subsidiary that is a “qualified REIT subsidiary,” that subsidiary is generally disregarded for federal income tax purposes, and all of the subsidiary’s assets, liabilities and items of income, deduction and credit are treated as our assets, liabilities and items of income, deduction and credit, including for purposes of the gross income and asset tests applicable to REITs. A qualified REIT subsidiary is any corporation, other than a TRS (as described below), that is directly or indirectly wholly owned by a REIT. Thus, in applying the requirements described herein, any qualified REIT subsidiary that we own will be ignored, and all assets, liabilities, and items of income, deduction and credit of such subsidiary will be treated as our assets, liabilities, and items of income, deduction and credit. If we own 100% of the equity interests in a CDO issuer or other securitization vehicle that is treated as a corporation for tax purposes, that CDO issuer or other securitization vehicle would be a qualified REIT subsidiary, unless we and the CDO issuer or other securitization vehicle jointly elect to treat the CDO issuer or other securitization vehicle as a TRS. It is anticipated that CDO financings we enter into, if any, will be treated as qualified REIT subsidiaries. Other entities that are wholly owned by us, including single member limited liability companies that have not elected to be taxed as corporations for federal income tax purposes, are also generally disregarded as separate entities for federal income tax purposes, including for purposes of the REIT income and asset tests. Disregarded subsidiaries, along with any partnerships in which we hold an equity interest, are sometimes referred to herein as “pass-through subsidiaries.”

In the event that a disregarded subsidiary of ours ceases to be wholly owned—for example, if any equity interest in the subsidiary is acquired by a person other than us or another disregarded subsidiary of ours—the subsidiary’s separate existence would no longer be disregarded for federal income tax purposes. Instead, the subsidiary would have multiple owners and would be treated as either a partnership or a taxable corporation. Such an event could, depending on the circumstances, adversely affect our ability to satisfy the various asset and gross income requirements applicable to REITs, including the requirement that REITs generally may not own, directly or indirectly, more than 10% of the securities of another corporation. See “—Asset Tests” and “—Income Tests.”

Taxable Corporate Subsidiaries. In the future we may jointly elect with any of our subsidiary corporations, whether or not wholly owned, to treat such subsidiary corporations as taxable REIT subsidiaries (“TRSs”). A REIT is permitted to own up to 100% of the stock of one or more TRSs. A TRS is a fully taxable corporation that may earn income that would not be qualifying income if earned directly by the parent REIT. The subsidiary and the REIT must jointly elect to treat the subsidiary as a TRS. A corporation with respect to which a TRS directly or indirectly owns more than 35% of the voting power or value of the stock will automatically be treated as a TRS. We generally may not own more than 10% of the securities of a taxable corporation, as measured by voting power or value, unless we and such corporation elect to treat such corporation as a TRS. Overall, no more than 25% of the value of a REIT’s assets may consist of stock or securities of one or more TRSs.

15

Table of Contents

The separate existence of a TRS or other taxable corporation is not ignored for federal income tax purposes. Accordingly, a TRS or other taxable corporation generally would be subject to corporate income tax on its earnings, which may reduce the cash flow that we and our subsidiaries generate in the aggregate, and may reduce our ability to make distributions to our stockholders.

We are not treated as holding the assets of a TRS or other taxable subsidiary corporation or as receiving any income that the subsidiary earns. Rather, the stock issued by a taxable subsidiary to us is an asset in our hands, and we treat the distributions paid to us from such taxable subsidiary, if any, as income. This treatment can affect our income and asset test calculations, as described below. Because we do not include the assets and income of TRSs or other taxable subsidiary corporations in determining our compliance with the REIT requirements, we may use such entities to undertake indirectly activities that the REIT rules might otherwise preclude us from doing directly or through pass-through subsidiaries. For example, we may use TRSs or other taxable subsidiary corporations to conduct activities that give rise to certain categories of income such as management fees or activities that would be treated in our hands as prohibited transactions.

Certain restrictions imposed on TRSs are intended to ensure that such entities will be subject to appropriate levels of U.S. federal income taxation. First, a TRS with a debt-equity ratio in excess of 1.5 to 1 may not deduct interest payments made in any year to an affiliated REIT to the extent that such payments exceed, generally, 50% of the TRS’s adjusted taxable income for that year (although the TRS may carry forward to, and deduct in, a succeeding year the disallowed interest amount if the 50% test is satisfied in that year). In addition, if amounts are paid to a REIT or deducted by a TRS due to transactions between the REIT and a TRS that exceed the amount that would be paid to or deducted by a party in an arm’s-length transaction, the REIT generally will be subject to an excise tax equal to 100% of such excess. We intend to scrutinize all of our transactions with any of our subsidiaries that are treated as a TRS in an effort to ensure that we do not become subject to this excise tax; however, we cannot assure you that we will be successful in avoiding this excise tax.

We may own TRSs that are organized outside of the United States. For example, we may hold certain investments and instruments through TRSs to the extent that direct ownership by us could jeopardize our compliance with the REIT qualification requirements, and we may make TRS elections with respect to certain offshore issuers of CDOs or other instruments to the extent that we do not own 100% of the offshore issuer’s equity. Special rules apply in the case of income earned by a taxable subsidiary corporation that is organized outside of the United States. Depending upon the nature of the subsidiary’s income, the parent REIT may be required to include in its taxable income an amount equal to its share of the subsidiary’s income, without regard to whether, or when, such income is distributed by the subsidiary. See “—Income Tests” below. A TRS that is organized outside of the United States may, depending upon the nature of its operations, be subject to little or no federal income tax. There is a specific exemption from federal income tax for non-U.S. corporations that restrict their activities in the United States to trading stock and securities (or any activity closely related thereto) for their own account, whether such trading (or such other activity) is conducted by the corporation or its employees through a resident broker, commission agent, custodian or other agent. We currently expect that any offshore TRSs will rely on that exemption or otherwise operate in a manner so that they will generally not be subject to federal income tax on their net income at the entity level.

Income Tests

In order to qualify as a REIT, we must satisfy two gross income requirements on an annual basis. First, at least 75% of our gross income for each taxable year, excluding gross income from sales of inventory or dealer property in “prohibited transactions,” generally must be derived from investments relating to real property or mortgages on real property, including interest income derived from mortgage loans secured by real property (including certain types of mortgage-backed securities), “rents from real property,” distributions received from other REITs, and gains from the sale of real estate assets, any amount includible in gross income with respect to a regular or residual interest in a REMIC, unless less than 95% of the REMIC’s assets are real estate assets, in which case only a proportionate amount of such income will qualify, as well as specified income from temporary investments. Second, at least 95% of our gross income in each taxable year, excluding gross income from prohibited transactions and certain hedging transactions, must be derived from some combination of such income from investments in real property (i.e., income that qualifies under the 75% income test described above), as well as other distributions, interest, and gain from the sale or disposition of stock or securities, which need not have any relation to real property.

16

Table of Contents

Gross income from the sale of inventory property is excluded from both the numerator and the denominator in both income tests. Income and gain from hedging transactions that we enter into to hedge indebtedness incurred or to be incurred to acquire or carry real estate assets will generally be excluded from both the numerator and the denominator for purposes of both gross income tests. We intend to monitor the amount of our non-qualifying income and manage our investment portfolio to comply at all times with the gross income tests but we cannot assure you that we will be successful in this effort.

The term “interest,” as defined for purposes of both gross income tests, generally excludes any amount that is based in whole or in part on the income or profits of any person. However, interest generally includes the following: (i) an amount that is based on a fixed percentage or percentages of gross receipts or sales and (ii) an amount that is based on the income or profits of a borrower where the borrower derives substantially all of its income from the real property securing the debt by leasing substantially all of its interest in the property, but only to the extent that the amounts received by the borrower would be qualifying “rents from real property” if received directly by a REIT.

If a loan contains a provision that entitles a REIT to a percentage of the borrower’s gain upon the sale of the real property securing the loan or a percentage of the appreciation in the property’s value as of a specific date, income attributable to that loan provision will be treated as gain from the sale of the property securing the loan, which generally is qualifying income for purposes of both gross income tests.

Interest on debt secured by a mortgage on real property or on interests in real property is generally qualifying income for purposes of the 75% gross income test. However, if the highest principal amount of a loan outstanding during a taxable year exceeds the fair market value of the real property securing the loan as of the date the REIT agreed to originate or acquire the loan, a portion of the interest income from such loan will not be qualifying income for purposes of the 75% gross income test, but will be qualifying income for purposes of the 95% gross income test. Note that a “significant modification” of a debt instrument will result in a new debt instrument which requires new tests of the value of the underlying real estate. The portion of the interest income that will not be qualifying income for purposes of the 75% gross income test will be equal to the portion of the principal amount of the loan that is not secured by real property (i.e., the amount by which the loan exceeds the value of the real estate that is security for the loan).

The IRS recently issued Revenue Procedure 2011-16, which addresses the treatment of modified mortgage loans and distressed debt for purposes of the REIT gross income and asset tests. Under existing Treasury Regulations, if a loan is secured by real property and other property and the highest principal amount of the loan outstanding during a taxable year exceeds the fair market value of the real property securing the loan as of (1) the date we agreed to acquire or originate the loan or (2) in the event of certain significant modifications, the date we modified the loan, then a portion of the interest income from such a loan will not be qualifying income for purposes of the 75% gross income test, but will be qualifying income for purposes of the 95% gross income test. Although the law is not entirely clear, a portion of the loan may not be treated as a qualifying “real estate asset” for purposes of the 75% asset test. The non-qualifying portion of such a loan would be subject to, among other requirements, the 10% value test.

Terms of debt obligations we may acquire may be modified to avoid foreclosure actions and for other reasons. If the terms of such loans are modified in a manner constituting a “significant modification,” such modification triggers a deemed exchange for tax purposes of the original loan for the modified loan. Revenue Procedure 2011-16 provides a safe harbor pursuant to which we will not be required to redetermine the fair market value of the real property securing certain of our loans for purposes of the REIT gross income and asset tests in connection with a loan modification that is (1) occasioned by a borrower default or (2) made at a time when we reasonably believe that the modification to the loan will substantially reduce a significant risk of default on the original loan. No assurance can be provided all of our loan modifications will qualify for the safe harbor in Revenue Procedure 2011-16. To the extent we significantly modify loans in a manner that does not qualify for that safe harbor, we will generally be required to redetermine the value of the real property securing the loan at the time it was significantly modified. In determining the value of the real property securing such a loan, we generally will not obtain third party appraisals, but rather will rely on internal valuations. No assurance can be provided that the IRS will not successfully challenge our internal valuations. If the terms of our debt instruments are significantly modified in a manner that does not qualify for the safe harbor in Revenue Procedure 2011-16 and the fair market value of the real property securing such loans has decreased significantly, we could fail the 75% gross income test, the 75% asset test and/or the 10% value test. Unless we qualified for relief under certain cure provisions in the Internal Revenue Code, such failures could cause us to fail to qualify as a REIT.

17

Table of Contents

As noted above, we and our subsidiaries may acquire distressed debt. Revenue Procedure 2011-16 provides that the IRS will treat a distressed mortgage loan acquired by a REIT that is secured by real property and other property as producing in part non-qualifying income for the 75% gross income test. Specifically, Revenue Procedure 2011-16 indicates that interest income on a loan will be treated as qualifying income based on the ratio of (1) the fair market value of the real property securing the loan determined as of the date the REIT committed to acquire the loan and (2) the face amount of the loan (and not the purchase price or current value of the loan). The face amount of a distressed mortgage loan and other distressed debt will typically exceed the fair market value of the real property securing the debt on the date the REIT commits to acquire the debt. We believe that we will continue to invest in distressed debt in a manner consistent with complying with the 75% gross income test and maintaining our qualification as a REIT.