Filed Pursuant to Rule 424(b)(3)

Registration No. 333-197396

PROSPECTUS SUPPLEMENT NO. 5

12,600,000 Shares of Common Stock

XCELMOBILITY, INC.

Common Stock

This Prospectus Supplement No. 5 supplements and amends our Prospectus dated July 31, 2014. This Prospectus Supplement No. 5 includes our attached Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2015, as filed with the Securities and Exchange Commission on August 14, 2015.

The Prospectus, any prospectus supplements filed before the date hereof, and this Prospectus Supplement No. 5 relate to the resale of 12,600,000 shares of our common stock, par value $0.001 per share, by Hanover Holdings I, LLC (“Hanover”), including (i) 10,769,230 shares of the Company’s common stock issuable upon conversion of the principal of the senior convertible promissory note issued to Hanover as of May 30, 2014 (the “Convertible Note”); (ii) 71,508 shares of the Company’s common stock issuable upon conversion of the accrued interest under the Convertible Note; and (iii) 1,759,262 shares of our common stock issuable upon exercise of a warrant issued to Hanover as of May 30, 2014 (the “Warrant”).

We will not receive any proceeds from the sale of the shares of common stock offered by Hanover. We may receive proceeds of up to $150,000 if the Warrant is exercised for cash. Any proceeds received from the exercise of the Warrant will be used for working capital or general corporate purposes.

This Prospectus Supplement No. 5 should be read in conjunction with the Prospectus and any prospectus supplements filed before the date hereof. Any statement contained in the Prospectus and any prospectus supplements filed before the date hereof shall be deemed to be modified or superseded to the extent that information in this Prospectus Supplement No. 5 modifies or supersedes such statement. Any statement that is modified or superseded shall not be deemed to constitute a part of the Prospectus except as modified or superseded by this Prospectus Supplement No. 5.

Our common stock is quoted on the OTCQB marketplace, operated by OTC Market Group, Inc., under the symbol “XCLL.” The shares of our common stock registered hereunder are being offered for sale by Hanover at prices established on the OTCQB during the term of this offering. On August 13, 2015, the closing bid price of our common stock was $0.004 per share. These prices will fluctuate based on the demand for our common stock.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 5 OF THE PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THE PROSPECTUS OR THIS PROSPECTUS SUPPLEMENT NO. 5 IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement No. 5 is August 17, 2015.

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to _________

Commission File Number 000-54333

XCELMOBILITY

INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0561888 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification Number) |

2225 East Bayshore Road, Suite 200,

Palo Alto, CA 94303

(Address of principal executive offices) (Zip Code)

(650) 632-4210

(Registrant’s telephone number, including area code)

N/A

(Former address, if changed since last report)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files)

xYes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| ¨ Large accelerated filer | ¨ Accelerated filer | ¨ Non-accelerated filer | x Smaller reporting |

| (Do not check if smaller | company | ||

| reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding as of August 10, 2015 |

| Common stock, $.001 par value | 289,820,346 |

XCELMOBILITY INC. FORM 10-Q

INDEX

| 2 |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Reference is made in particular to the description of our plans and objectives for future operations, assumptions underlying such plans and objectives, and other forward-looking statements included in this report. Such statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management’s current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning, among others, capital expenditures, earnings, litigation, regulatory matters, liquidity and capital resources, and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, changes in consumer demand, legislative, regulatory and competitive developments in markets in which we operate, results of litigation, and other circumstances affecting anticipated revenues and costs, and the risk factors set forth in our Annual Report on Form 10-K filed on April 8, 2015.

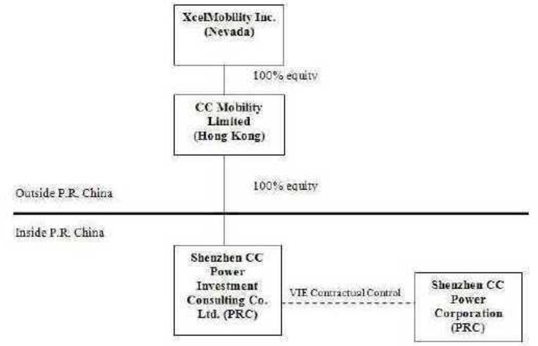

As used in this Quarterly Report on Form 10-Q, references to “dollars” and “$” are to United States dollars and, unless otherwise indicated, references to “we,” “our,” “us,” “Xcel,” “XCLL,” the “Company” or the “Registrant” refer to XcelMobility Inc., a Nevada corporation and its wholly owned subsidiaries, CC Mobility Limited (“CC Mobility”), a company organized under the laws of Hong Kong, Shenzhen CC Power Investment Consulting Co. Ltd. (“CC Investment”), a company organized under the laws of the People’s Republic of China, and a wholly-owned subsidiary of CC Mobility, and Shenzhen CC Power Corporation (“CC Power”), a company organized under the laws of the People’s Republic of China.

YOU SHOULD NOT PLACE UNDUE RELIANCE ON THESE FORWARD LOOKING STATEMENTS

The forward-looking statements made in this report on Form 10-Q relate only to events or information as of the date on which the statements are made in this report on Form 10-Q. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this report and the documents that we reference in this report, including documents referenced by incorporation, completely and with the understanding that our actual future results may be materially different from what we expect or hope.

| 3 |

XCELMOBILITY INC. AND SUBSIDIARIES

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2015 AND 2014

INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 4 |

XCELMOBILITY INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30 | December 31 | |||||||

| 2015 | 2014 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 190,589 | $ | 159,628 | ||||

| Trade accounts receivable | 40,338 | 40,144 | ||||||

| Other receivables, net of 3,578 and 3,500 allowance for doubtful accounts | 295,616 | 95,412 | ||||||

| Inventory | 36,635 | 357 | ||||||

| Advances to suppliers | 18,513 | - | ||||||

| Prepaid VAT | 3,189 | - | ||||||

| Total Current Assets | $ | 584,880 | $ | 295,541 | ||||

| Property, Plant and Equipment, net of accumulated depreciation of $108,407 and $119,328, respectively | 73,876 | 49,226 | ||||||

| TOTAL ASSETS | $ | 658,756 | $ | 344,767 | ||||

| LIABILITIES AND SHAREHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | - | $ | - | ||||

| Other payables and accrued expenses | 1,166,561 | 510,762 | ||||||

| Other taxes payable | - | 9,254 | ||||||

| Deferred revenue | - | 19,135 | ||||||

| Convertible notes, net of debt discount | - | 48,875 | ||||||

| Derivative liability | 69,800 | 693,303 | ||||||

| Accrued interest | 5,223 | 5,223 | ||||||

| Total Current Liabilities | $ | 1,241,584 | $ | 1,286,552 | ||||

| Convertible notes, net of debt discount | 970,336 | 974,142 | ||||||

| Accrued interest | 350,426 | 330,426 | ||||||

| Total Liabilities | $ | 2,562,346 | $ | 2,591,120 | ||||

| Shareholders’ Equity: | ||||||||

| Preferred stock, $0.001 par value, 20,000,000 shares authorized; no shares issued and outstanding at June 30, 2015 and December 31, 2014 | - | - | ||||||

| Common stock, $0.001 par value, 400,000,000 shares authorized; 270,561,731 and 207,414,781 shares issued and outstanding at June 30, 2015 and December 31, 2014 | 270,562 | 207,415 | ||||||

| Shares unissued | 549,000 | 1,049,000 | ||||||

| Additional paid in capital | 2,463,572 | 1,810,965 | ||||||

| Accumulated deficit | (5,112,043 | ) | (5,264,385 | ) | ||||

| Accumulated other comprehensive loss | (74,681 | ) | (49,348 | ) | ||||

| Total Shareholders’ Equity | (1,903,590 | ) | (2,246,353 | ) | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 658,756 | $ | 344,767 | ||||

The accompanying notes are an integral part of the condensed consolidated financial statements

| 5 |

XCELMOBILITY INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenue | $ | 92,626 | $ | 629,448 | $ | 166,997 | $ | 1,473,976 | ||||||||

| Cost of Revenue | 75,321 | 93,445 | 75,620 | 228,297 | ||||||||||||

| Gross Profit | 17,305 | 536,003 | 91,377 | 1,245,679 | ||||||||||||

| Operating Expenses: | ||||||||||||||||

| Selling expense | 63,763 | 9,307 | 113,912 | 44,324 | ||||||||||||

| General and administrative expense | 138,184 | 386,837 | 313,577 | 905,958 | ||||||||||||

| Total Operating Expenses | 201,947 | 396,144 | 427,489 | 950,282 | ||||||||||||

| Income (loss) from Operations | (184,642 | ) | 139,859 | (336,112 | ) | 295,397 | ||||||||||

| Other Income (Expense): | ||||||||||||||||

| Interest income | 3 | 82 | 75 | 82 | ||||||||||||

| Interest expense | - | (5,550 | ) | - | (26,250 | ) | ||||||||||

| Gain (loss) on derivative | 381,029 | (129,411 | ) | 635,011 | (101,513 | ) | ||||||||||

| Amortization of debt discount | (9,545 | ) | (83,579 | ) | (143,528 | ) | (159,015 | ) | ||||||||

| Other income (expense) | (369 | ) | 43,699 | (369 | ) | 66,312 | ||||||||||

| Total Other Income (Expense) | 371,118 | (174,759 | ) | 491,189 | (220,384 | ) | ||||||||||

| Income (loss) Before Taxes | 186,476 | (34,900 | ) | 155,077 | 75,013 | |||||||||||

| Income tax expense | - | - | - | - | ||||||||||||

| Net Income (Loss) | 186,476 | (34,900 | ) | 155,077 | 75,013 | |||||||||||

| Foreign currency translation adjustment | (25,877 | ) | 2,742 | (25,333 | ) | 9,799 | ||||||||||

| Comprehensive (loss) income | 160,599 | (32,158 | ) | 129,744 | 84,812 | |||||||||||

| Basic income (loss) per share: | $ | 0.00 | $ | (0.00 | ) | $ | 0.00 | $ | 0.00 | |||||||

| Diluted income (loss) per share: | $ | 0.00 | $ | (0.00 | ) | $ | 0.00 | $ | 0.00 | |||||||

| Basic weighted average number of shares outstanding | 239,346,889 | 73,666,997 | 239,346,889 | 73,398,831 | ||||||||||||

| Diluted weighted average number of shares outstanding | 239,346,889 | 73,666,997 | 239,346,889 | 86,238,476 | ||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements

| 6 |

XCELMOBILITY INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Six Months Ended | ||||||||

| June 30, | ||||||||

| 2015 | 2014 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income (loss) | $ | 155,077 | $ | 75,013 | ||||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Depreciation | 12,014 | 10,675 | ||||||

| Amortization of debt discount | 143,528 | 159,015 | ||||||

| Fair value adjustment on derivative liability | (635,011 | ) | 101,513 | |||||

| Changes in assets and liabilities: | ||||||||

| Trade accounts receivable, net | (194 | ) | (565,330 | ) | ||||

| Other receivables and prepayment | (200,204 | ) | 74,581 | |||||

| Advances to suppliers | (8,185 | ) | 913 | |||||

| Inventory | (36,278 | ) | 1,167,334 | |||||

| Prepaid VAT | (3,189 | ) | - | |||||

| Prepayment | (10,328 | ) | - | |||||

| Accounts payable | - | (1,541,950 | ) | |||||

| Accrued interest | - | 80,597 | ||||||

| Other taxes payable | (9,254 | ) | (318 | ) | ||||

| Other payables and accrued expenses | 655,800 | (22,514 | ) | |||||

| Deferred revenue | (19,135 | ) | (140 | ) | ||||

| Net Cash Used In Operating Activities | 44,642 | (460,611 | ) | |||||

| Cash Flows from Investing Activities: | ||||||||

| Purchase of property, plant and equipment, net of value added tax refunds received | (36,671 | ) | (158 | ) | ||||

| Net Cash Used In Investing Activities | (36,671 | ) | (158 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from issuance of notes payable | - | 200,000 | ||||||

| Net Cash Provided By Financing Activities | - | 200,000 | ||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | 22,991 | 11,446 | ||||||

| Net Change in Cash and Cash Equivalents | 30,961 | (249,323 | ) | |||||

| Cash and Cash Equivalents at Beginning of Period | 159,628 | 431,707 | ||||||

| Cash and Cash Equivalents at End of Period | $ | 190,589 | $ | 182,384 | ||||

| Supplement Cash Flow Information | ||||||||

| Cash paid during the period for interest | $ | - | $ | 26,250 | ||||

| Cash paid during the period for income taxes | $ | - | $ | - | ||||

The accompanying notes are an integral part of the condensed consolidated financial statements

| 7 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. Organization and Nature of Business

XcelMobility Inc.

XcelMobility Inc. (“Xcel” or the “Company”) was incorporated under the laws of the State of Nevada on December 27, 2007. Initial operations have included organization and incorporation, target market identification, marketing plans, and capital formation. The Company was no longer a development stage company after the Company started to generate revenues from various application of mobile device.

Share Cancellation

On August 11, 2011, Moses Carlo Supera Paez, a director and shareholder of the Company, surrendered 17,700,000 shares of common stock for cancellation. Further, on August 30, 2011, Mr. Paez surrendered an additional 7,350,000 shares of our common stock for cancellation and Mr. Jaime Brodeth, one of our former directors and a shareholder, surrendered 22,950,000 shares of our common stock for cancellation. As such, immediately prior to the Exchange Transaction as further discussed in detail later and after giving effect to the foregoing cancellations, the Company had 29,700,000 shares of common stock issued and outstanding. Immediately after the Exchange Transaction, the Company had 60,000,000 shares of common stock issued and outstanding.

CC Mobility Limited

CC Mobility Limited (“CC Mobility”), a company organized under the laws of Hong Kong, was formed on May 3, 2011 and has authorized capital of 10,000 shares with registered capital of HK$1,000 at HK$1 per share. At formation, CC Mobility Limited has issued 560 shares to CC Wireless Limited, a company organized under the laws of Hong Kong, and 440 shares to Sheen Ventures Limited, a company organized under the laws of Hong Kong. The Company is a holding company formed for the purpose of acquiring a target company to effect a reverse merger with a U.S. reporting company. The reverse merger was completed on August 30, 2011.

CC Power Investment Consulting Co. Ltd.

Shenzhen CC Power Investment Consulting Co. Ltd. (“CC Investment”), a wholly-owned subsidiary of CC Mobility, was incorporated on July 27, 2011 under the laws of the People’s Republic of China (“PRC”) as a wholly foreign owned limited liability company. The required registered capital is $2,000,000 and as of December 31, 2013, $400,000 of the registered capital has been contributed.

Shenzhen CC Power Corporation

Shenzhen CC Power Corporation (“CC Power”) is a Chinese enterprise organized in the PRC on March 13, 2003 in accordance with the Laws of the People’s Republic of China. The required registered capital of CC Power was approximately $1,547,000 (RMB 10,000,000) and as of December 31, 2013, CC Power has paid up approximately $346,000 (RMB2,526,000). In March 2011, Mr. Ryan Ge sold his 5% ownership in CC Power to the other shareholder, Xili Wang (“CC Power Shareholder”). Ms. Wang holds 100% ownership interest in CC Power at the end of the financial period.

CC Power is primarily engaged in the research, development and commercialization of applications for mobile devices that access the Internet utilizing mobile phone networks. CC Power’s principal activity is the design, testing sale and support of software to support mobile internet applications on cellular phones, smart phones, tablets and mobile computers in China. The principal product designed and built by CC Power is its Mach 5 Accelerator. This product has been independently tested by all 3 mobile phone carriers in China and accesses the internet 5 times faster than with other mobile browsers. The speed of the Mach 5 browser enables CC Power to develop other mobile software that can leverage off the Mach 5 products speed of processing. In order to support CC Power products the Company has built a series of server locations throughout China. CC Power sells its products to corporations directly, to individual users via the company’s website and retail locations, through distribution agents and through all three mobile phone carriers in China.

| 8 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

As noted above, the primary purpose of CC Power is to develop software that allows user faster access to the Internet. CC Power’s primary focus is in the mobile Internet market, with a focus on providing software that significantly increases the speed that users of smartphones, tablets and laptops can access the Internet over cellular phone networks. CC Power also uses their technology to increase the speed at which users of Virtual Private Networks can access data from their networks.

On September 22, 2014, XcelMobility Inc. entered into an Asset Purchase Agreement with CC Power, Xianjiang Silvercreek Digital Technology Co., Ltd. (“Silvercreek”) and the shareholders of Silvercreek (the “Selling Shareholders”). Pursuant to the terms of the Agreement, CC Power will acquire certain assets of Silvercreek relating to its online sports lottery business unit in exchange for the issuance of up to 80,000,000 shares of common stock of the Company to the Selling Shareholders. No Shares will be issued upon the closing date of the transaction. The Shares will be issued to the Selling Shareholders on a pro rata basis and upon achievement of the following milestones: (i) 10,000,000 Shares to be issued in the event that CC Power derives initial online lottery sales revenue (“Lottery Revenue”) of over 10,000 RMB per month from the business developed in connection with the Assets on or before October 1, 2014; (ii) 10,000,000 Shares to be issued in the event that CC Power derives Lottery Revenue of over 3,000,000 RMB per month from the business developed in connection with the Assets on or before March 31, 2015; (iii) 10,000,000 Shares to be issued in the event that CC Power derives initial online lottery sales revenue of over 20,000,000 RMB per month from the business developed in connection with the Assets on or before December 31, 2015; (iv) 40,000,000 Shares to be issued in the event that CC power obtains a lottery gaming license from the People’s Republic of China; and (v) 10,000,000 Shares to be issued based on the achievement of certain incentives as determined by the board of directors of the Company.

| 9 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Share Exchange Agreement

On August 30, 2011, the Company completed a voluntary share exchange transaction with Shenzhen CC Power Corporation, CC Mobility Limited and the shareholders of CC Mobility (“Selling Shareholders”) pursuant to a Share Exchange Agreement dated July 5, 2011 (the “Exchange Agreement”). In accordance with the terms of Exchange Agreement, on the Closing Date, Xcel issued 30,300,000 shares of its common stock to the Selling Shareholders in exchange for 100% of the issued and outstanding capital stock of CC Mobility (the “Exchange Transaction”). As a result of the Exchange Transaction, there was a change of control in the Company as the Selling Shareholders of CC Mobility acquired 50.5% of Xcel’s issued and outstanding common stock, CC Mobility became Xcel’s wholly-owned subsidiary, and Xcel acquired the business and operations of CC Mobility and CC Power.

For accounting purposes, the merger transaction is being accounted for as a reverse merger. The transaction has been treated as a recapitalization of CC Mobility and its subsidiaries, with Xcel (the legal acquirer of CC Mobility and its subsidiaries) considered the accounting acquiree and CC Mobility whose management took control of Xcel (the legal acquire of CC Mobility) considered the accounting acquirer.

CC Power is owned by an individual but controlled by CC Investment through a series of contractual arrangements that transferred all of the benefits and responsibilities for the operations of CC Power to CC Investment. CC Investment accounts for CC Power as a Variable Interest Entity (“VIE”) under ASC 810 “Consolidation.” Accordingly, CC Investment consolidates CC Power’s results, assets and liabilities.

Shenzhen Jifu Communication Technology Co., Ltd.

Shenzhen Jifu Communication Technology Co., Ltd (“Jifu”), was incorporated on April 16, 2001 under the laws of the People’s Republic of China (“PRC”) as a limited liability company. The required registered capital is RMB3,000,000 and all of the required registered capital has been contributed.

Jifu is primarily engaged in develops and distributes optical transmitters and receivers, electronic surveillance equipment, and other communications equipment. Jifu also engages in the purchase and sale of electronic products, network products, and communications equipment. In order to bolster its business, Jifu also engages in software research and development.

On May 7, 2013, the Company entered into and consummated a Stock Purchase Agreement (the “Agreement”) with Shenzhen CC Power Investment Consulting Co., Ltd., a company organized under the laws of the People’s Republic of China and an indirect wholly-owned subsidiary of the Company (“CC Power”), Shenzhen Jifu Communication Technology Co., Ltd. a company organized under the laws of the People’s Republic of China (“Jifu”) the shareholders of Jifu set forth in the signature page to the Agreement (the “Jifu Shareholders”) and Hui Luo.

Pursuant to the terms and conditions of the Agreement, the Company will issue an aggregate of 27,000,000 shares of the Company’s common stock (the “Purchase Shares”) to the Jifu Shareholders as consideration for Jifu entering into certain controlling agreements (the “VIE Agreement”) with CC Power. CC Power will effectively own Jifu through the various conditions prescribed in the VIE Agreements. The Company will also grant 3,000,000 shares (the “Luo Shares”, together with the Purchase Shares, the “Shares’”) to Mr. Luo.

The Shares will be released to the Jifu Shareholders and Mr. Luo after the Company has reviewed Jifu’s audited financial statements for the year ended December 31, 2013. If Jifu has achieved net revenue of $4,000,000 for the year ended December 31, 2013 (the “Target”), then the Company will release the Shares to the Jifu Shareholders and Mr. Luo in their full respective amounts. If Jifu has not achieved the Target by the end of the calendar year, the Company will decrease the amount of shares of common stock issued to the Jifu Shareholders and Mr. Luo in accordance with a formula set forth in the Agreement and release the Shares to the Jifu Shareholders and Mr. Luo in their respective decreased amounts. The Agreement has been approved by the boards of directors of the Company, CC Power, and Jifu, and the Jifu Shareholders.

On October 1, 2014, we entered into a Settlement Agreement, Waiver and Mutual Release with Jifu. Pursuant to the Release, the parties cancelled the Stock Purchase Agreement. We have completely transferred back the ownership of shares of Jifu to Jifu Shareholders without any further disputation and mutual accountability. In exchange, we have agreed to deliver 1,000,000 newly issued shares of our common stock to Jifu Shareholders.

| 10 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

The organizational structure of the Company is as follows:

| 11 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies

Basis of presentation

The accompanying unaudited condensed consolidated financial statements of the Company and its subsidiaries at June 30, 2015 and for the six months ended June 30, 2015 and 2014 reflect all adjustments (consisting only of normal recurring adjustments) that, in the opinion of management, are necessary to present fairly the financial position and results of operations of the Company for the periods presented. Operating results for the six months ended June 30, 2015 are not necessarily indicative of the results that may be expected for the year ending December 31, 2015. The accompanying condensed consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto for the year ended December 31, 2014. The Company follows the same accounting policies in the preparation of interim reports. The Company’s accounting policies used in the preparation of the accompanying financial statements conform to accounting principles generally accepted in the United States of America ("US GAAP")

The functional currency is the Chinese Renminbi, however the accompanying condensed consolidated financial statements have been translated and presented in United States Dollars ($). All significant inter-company balances and transactions have been eliminated in consolidation.

All dollars are rounded to nearest hundred except for share data.

| 12 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies - Continued

Use of estimates

In preparing financial statements in conformity with US GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported periods. Actual results could differ from those estimates.

Significant Estimates

These financial statements include some amounts that are based on management’s best estimates and judgments. The most significant estimates relate to depreciation of property, plant and equipment, the valuation allowance for deferred taxes. It is reasonably possible that the above-mentioned estimates and others may be adjusted as more current information becomes available, and any adjustment could be significant in future reporting periods.

Variable Interest Entity

The accounts of CC Power have been consolidated with the accounts of the Company because CC Power is a variable interest entity with respect to CC Investment, which is a wholly-owned subsidiary of the Company. CC Investment entered into five agreements dated August 22, 2011 with CC Power Shareholder and with CC Power pursuant to which CC Investment provides CC Power with exclusive technology consulting and management services. In summary, the five agreements contain the following terms:

Entrusted Management Agreement. This agreement provides that CC Investment will provide exclusive management services to CC Power. Such management services include but are not limited to financial management, business management, marketing management, human resource management and internal control of CC Power. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of CC Power by CC Investment is complete (as more fully described in the Exclusive Purchase Option Agreement below).

Technical Services Agreement. This agreement provides that CC Investment will provide exclusive technical services to CC Power. Such technical services include but are not limited to software, computer system, data analysis, training and other technical services. CC Investment shall be entitled to charge CC Power service fees equivalent to CC Power’s total net income. The Technical Service Agreement will remain in effect until the acquisition of all assets or equity of CC Power by CC Investment is complete (as more fully described in the Exclusive Purchase Option Agreement below).

Exclusive Purchase Option Agreement. Under the Exclusive Purchase Option Agreement, the CC Power Shareholder granted CC Investment an irrevocable and exclusive purchase option to acquire CC Power’s equity and/or assets at a nominal consideration. CC Investment may exercise the purchase option at any time.

Loan Agreement. Under the Loan Agreement, CC Investment agreed to lend RMB 10,000,000 to the CC Power Shareholder, to be used solely for the operations of CC Power.

Equity Pledge Agreement. Under the Equity Pledge Agreement, the CC Power Shareholder pledged all of its equity interests in CC Power, including the proceeds thereof, to guarantee all of CC Investment’s rights and benefits under the Entrusted Management Agreement, the Technical Service Agreement, the Exclusive Purchase Option Agreement and the Loan Agreement. Prior to termination of this Equity Pledge Agreement, the pledged equity interests cannot be transferred without CC Investment’s prior consent. The CC Power Shareholder covenants to CC Investment that among other things, it will only appoint/elect the candidates for the directors of CC Power nominated by CC Investment.

| 13 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies - Continued

In sum, the agreements transfer to CC Investment all of the benefits and all of the risk arising from the operations of CC Power, as well as complete managerial authority over the operations of CC Power. Through these contractual arrangements, the Company has the ability to substantially influence CC Power’s daily operations and financial affairs, appoint its directors and senior executives, and approve all matters requiring board and/or shareholder approval. These contractual arrangements enable the Company to control CC Power and operate our business in the PRC through CC Investment. By reason of the relationship described in these agreements, CC Power is a variable interest entity with respect to CC Investment and CC Investment is considered the primary beneficiary of CC Power because the following characteristics identified in ASC 810-10-15-14 are present:

| - | The holder of the equity investment in CC Power lacks the direct or indirect ability to make decisions about the entity’s activities that have a significant effect on the success of CC Power, having assigned their voting rights and all managerial authority to CC Investment. (ASC 810-10-15-14(b)(1)). | |

| - | The holder of the equity investment in CC Power lacks the obligation to absorb the expected losses of CC Power, having assigned to CC Investment all revenue and responsibility for all payables. (ASC 810-10-15-14(b)(2). | |

| - | The holder of the equity investment in CC Power lacks the right to receive the expected residual returns of CC Power, having granted to CC Investment all revenue as well as an option to purchase the equity interests at a fixed price. (ASC 810-10-15-14(b)(3)). |

Accordingly, the Company’s condensed consolidated financial statements reflect the results of operations, assets and liabilities of CC Power. The carrying amount and classification of CC Power’s assets and liabilities included in the Condensed Consolidated Balance Sheets are as follows:

| June 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Total current assets | $ | 394,029 | $ | 188,942 | ||||

| Total assets | 467,737 | 236,166 | ||||||

| Total current liabilities | 897,924 | 801,511 | ||||||

| Total liabilities | 897,924 | 801,511 | ||||||

Jifu

The accounts of Jifu have been consolidated with the accounts of the Company because Jifu is a variable interest entity with respect to CC Investment, which is a wholly-owned subsidiary of the Company. CC Investment entered into five agreements dated May 7, 2013 with Jifu Shareholder and with Jifu pursuant to which CC Investment provides Jifu with exclusive technology consulting and management services. In summary, the five agreements contain the following terms:

Entrusted Management Agreement. Effective on May 7, 2013, CC Investment entered into an Entrusted Management Agreement with Jifu and the Jifu Shareholders, pursuant to which CC Investment agreed to provide, and Jifu agreed to accept, exclusive management services provided by CC Investment. Such management services include but are not limited to financial management, business management, marketing management, human resource management and internal control of Jifu. Jifu will pay a service fee to CC Investment on a quarterly basis, which fee will be a percentage of Jifu’s total operational income. The Entrusted Management Agreement will remain in effect until the acquisition of all the assets or equity of Jifu by CC Investment.

Technical Services Agreement. Effective on May 7, 2013, CC Investment entered into a Technical Services Agreement with Jifu and the Jifu Shareholders, pursuant to which CC Investment agreed to provide, and Jifu agreed to accept, exclusive technical services provided by CC Investment. Such technical services include but are not limited to software services, computer systems services, data analysis, training and other technical services. Jifu will pay a service fee to CC Investment on a quarterly basis, which fee shall be a percentage of Jifu’s total operational income. The Technical Service Agreement will remain in effect until the acquisition of all the assets or equity of Jifu by CC Investment.

| 14 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Exclusive Purchase Option Agreement. Effective on May 7, 2013, CC Investment entered into an Exclusive Purchase Option Agreement with Jifu and the Jifu Shareholders, pursuant to which the Jifu Shareholders granted CC Investment an irrevocable and exclusive purchase option to acquire all of Jifu’s equity and/or assets at a nominal consideration. CC Investment may exercise the purchase option at any time. Until CC Investment has exercised its purchase option, Jifu is required to conduct its business in accordance with certain covenants as further described in the Exclusive Purchase Option Agreement.

Loan Agreement

Effective on May 7, 2013, CC Investment entered into a Loan Agreement with the Jifu Shareholders, pursuant to which CC Investment agreed to lend RMB 3,000,000 to the Jifu Shareholders, to be used solely for the operations of Jifu. The loan is interest free, unless the deemed value of the consideration for the equity purchase of Jifu or asset purchase of Jifu under the Exclusive Purchase Option Agreement is higher than the principal amount of the loan, in which case the excess will be deemed to be interest on the loan.

Equity Pledge Agreement

Effective on May 7, 2013, CC Investment entered into an Equity Pledge Agreement with Jifu and the Jifu Shareholders, pursuant to which the Jifu Shareholders pledged all of their equity interests in Jifu, including the proceeds thereof, to guarantee all of CC Investment’s rights and benefits under the Entrusted Management Agreement, the Technical Service Agreement, the Exclusive Purchase Option Agreement and the Loan Agreement. Prior to termination of the Equity Pledge Agreement, the pledged equity interests cannot be transferred without CC Investment’s prior consent. The Jifu Shareholders covenant to CC Investment that among other things, they will only appoint/elect candidates for the board of directors of Jifu and supervisor office of Jifu that were nominated by CC Investment.

In sum, the agreements transfer to CC Investment all of the benefits and all of the risk arising from the operations of Jifu, as well as complete managerial authority over the operations of Jifu. Through these contractual arrangements, the Company has the ability to substantially influence Jifu’s daily operations and financial affairs, appoint its directors and senior executives, and approve all matters requiring board and/or shareholder approval. These contractual arrangements enable the Company to control Jifu and operate our business in the PRC through CC Investment. By reason of the relationship described in these agreements, Jifu is a variable interest entity with respect to CC Investment and CC Investment is considered the primary beneficiary of Jifu because the following characteristics identified in ASC 810-10-15-14 are present:

|

|

The holder of the equity investment in Jifu lacks the direct or indirect ability to make decisions about the entity’s activities that have a significant effect on the success of Jifu, having assigned their voting rights and all managerial authority to CC Investment. (ASC 810-10-15-14(b)(1)). | |

|

|

The holder of the equity investment in Jifu lacks the obligation to absorb the expected losses of Jifu, having assigned to CC Investment all revenue and responsibility for all payables. (ASC 810-10-15-14(b)(2). | |

|

|

The holder of the equity investment in Jifu lacks the right to receive the expected residual returns of Jifu, having granted to CC Investment all revenue as well as an option to purchase the equity interests at a fixed price. (ASC 810-10-15-14(b)(3)). |

On October 1, 2014, we entered into a Settlement Agreement, Waiver and Mutual Release with Jifu. Pursuant to the Release, the parties cancelled the Stock Purchase Agreement. We have completely transferred bac k the ownership of shares of Jifu to Jifu Shareholders without any further disputation and mutual accountability. In exchange, we have agreed to deliver 1,000,000 newly issued shares of our common stock to Jifu Shareholders.

Revenue recognition

Our source of revenues is from internet accelerator software, which includes new software license revenues and software plus hardware and maintenance arrangements, and the source of revenue of Jifu is from developing and distributing optical transmitters and receivers, electronic surveillance equipment, and other communications equipment; and trading of electronic products, network products, and communications equipment. We also engage in software research and development, GPS system development and website development projects along with maintenance arrangements.

We evaluate revenue recognition based on the criteria set forth in FASB ASC 985-605, Software: Revenue Recognition and Staff Accounting Bulletin (“SAB”) No. 101, Revenue Recognition in Financial Statements, as revised by SAB No. 104, Revenue Recognition.

| 15 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies - Continued

Revenue Recognition for Software Products (Software Elements)

New software license revenues represent fees earned from granting customers licenses to download our software products that aim at improving the internet connection speed of the mobile phone, computers or servers. The basis for software license revenue recognition is substantially governed by the accounting guidance contained in ASC 985-605, Software-Revenue Recognition. For software license that do not require significant modification or customization of the underlying software, we recognize new software license revenues when: (1) we enter into a legally binding arrangement with a customer for the license of software; (2) we deliver the products; (3) the sale price is fixed or determinable and free of contingencies or significant uncertainties; and (4) collection is probable. Revenues that are not recognized at the time of sale because the foregoing conditions are not met are recognized when those conditions are subsequently met.

Our software license arrangements do not include acceptance provisions, software license updates or product support contracts.

Revenue Recognition for Multiple-Element Arrangements - Software Products and Software Related Services(Software Arrangements)

We enter into arrangements with customers that purchase software related products that include one to three year product support service and a short training session (referred to as software related multiple-element arrangements). Such software related multiple-element arrangements include the sale of our software products, and product support contracts whereby software license delivery is followed by the subsequent delivery of the other elements. Our software license arrangements include acceptance provisions. We recognize revenue upon the receipt of written customer acceptance. The vast majority of our software license arrangements include software license updates and product support contracts. Software license updates provide customers with rights to unspecified software product upgrades during the term of the support period. Product support includes telephone access to technical support personnel or on-site support. For those software related multiple-element arrangements, we recognized revenue pursuant to ASC 985-605. Since we are unable to determine the fair value of the selling price for the undelivered elements in a multiple-element arrangement, which is the product support service and training, the entire arrangement consideration is deferred and is recognized ratably over the term of the arrangement, typically one year to three years.

Revenue Recognition for Multiple-Element Arrangements - Arrangements with Software and Hardware Elements

We also enter into multiple-element arrangements that may include a combination of our software installed in the hardware products we purchased from third parties and service offerings including purchased hardware , new software licenses, installation of the software in the hardware and one to three years product support. We adopted Accounting Standards Update (“ASU”) 2009-13, Revenue Recognition (Topic 605) : Multiple-Deliverable Revenue Arrangements . This guidance modifies the fair value requirements of FASB ASC subtopic 605-25, Revenue Recognition-Multiple Element Arrangements , by allowing the use of the “best estimate of selling price” in addition to vendor-specific objective evidence and third-party evidence for determining the selling price of a deliverable for non-software arrangements. This guidance establishes a selling price hierarchy for determining the selling price of a deliverable, which is based on: (a) vendor-specific objective evidence, (b) third-party evidence, or (c) estimated selling price. In addition, the residual method of allocating arrangement consideration is no longer permitted. In such arrangements, we first allocate the total arrangement consideration based on the relative selling prices of the software group of elements as a whole and to the hardware elements. We recognize the hardware element considerations upon delivery of the hardware. The consideration allocated to the software group which includes the software element and the product support is recognized in according to the software arrangements policy as described above.

Revenue Recognition for Lottery Revenue

Commission income is recognized when the lottery ticket is sold through its online system. Other service income is recognized when the service is provided.

Cost of Revenue

Cost of revenue primarily consists of direct costs of products, direct labor of technical staff, depreciation of computer equipment, and overhead associated with the technical department.

| 16 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies - Continued

Economic and political risks

The Company’s operations are mainly conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations in the PRC may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC.

The Company’s major operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in government administration, governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

Credit risk

The Company may be exposed to credit risk from its cash and fixed deposits at bank. No allowance has been made for estimated irrecoverable amounts determined by reference to past default experience and the current economic environment.

Property and equipment

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using the straight-line method. Estimated useful lives of the plant and equipment are as follows:

| Equipment | 5 years |

| Office equipment | 5 years |

| Leasehold improvements | Over the lease terms |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to income as incurred, whereas significant renewals and betterments are capitalized.

Accounting for the impairment of long-lived assets

Impairment of Long-Lived Assets is evaluated for impairment at a minimum on an annual basis whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable in accordance with ASC 360-10 “Impairments of Long-Lived Assets”. An asset is considered impaired if its carrying amount exceeds the future net cash flow the asset is expected to generate. If an asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair market value. The recoverability of long-lived assets is assessed by determining whether the unamortized balances can be recovered through undiscounted future net cash flows of the related assets. The amount of impairment, if any, is measured based on projected discounted future net cash flows using a discount rate reflecting the Company's average cost of capital.

Inventories

Inventories are stated at the lower of cost or market value. Substantially all inventory costs are determined using the weighted average basis. The management regularly evaluates the composition of its inventory to identify slow-moving and obsolete inventories to determine if additional write-downs are required.

Accounts receivable

Accounts receivable consists of amounts due from customers. An allowance for doubtful accounts is established and determined based on management’s assessment of known requirements, aging of receivables, payment history, the customer’s current credit worthiness and the economic environment. As of June 30, 2015 and 2014, no allowance for doubtful accounts was deemed necessary based on management’s assessment.

| 17 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Fair Value of Financial Instruments

FASB accounting standards require disclosing fair value to the extent practicable for financial instruments that are recognized or unrecognized in the balance sheet. The fair value of the financial instruments disclosed herein is not necessarily representative of the amount that could be realized or settled, nor does the fair value amount consider the tax consequences of realization or settlement.

For certain financial instruments, including cash, accounts payable, accruals and other payables, the carrying amounts approximate fair value because of the near term maturities of such obligations.

Patents

The Company has three patents as listed in the table below relating to its internet accelerator software products. Fees related to registering these patents were insignificant and have been expensed as incurred.

| Patent | Register Number | Issued By | ||

| Mach5 Internet Acceleration Software V.6.0 | 2007SR09253 | National Copyright Administration of PRC | ||

| Mach5 Enterprise Acceleration Software V.3.3 | 2009SR058767 | National Copyright Administration of PRC | ||

| Mach5 Web Browser Software | 2010SR001089 | National Copyright Administration of PRC |

Research and development and Software Development Costs

All research and development costs are expensed as incurred. Software development costs eligible for capitalization under ASC 985-20, Software-Costs of Software to be Sold, Leased or Marketed, were not material to our consolidated financial statements for the six months ended June 30, 2015 and 2014. Research and development expenses amounted to $36,480 and $193,795 for the six months ended June 30, 2015 and 2014, respectively, and were included in general and administrative expense.

Comprehensive income

Comprehensive income is defined as the change in equity of a company during a period from transactions and other events and circumstances excluding transactions resulting from investments from owners and distributions to owners. For the Company, comprehensive income for the periods presented includes net income and foreign currency translation adjustments.

Income taxes

Income taxes are provided on an asset and liability approach for financial accounting and reporting of income taxes. Current tax is based on the profit or loss from ordinary activities adjusted for items that are non-assessable or disallowable for income tax purpose and is calculated using tax rates that have been enacted or substantively enacted at the balance sheet date. Deferred income tax liabilities or assets are recorded to reflect the tax consequences in future differences between the tax basis of assets and liabilities and the financial reporting amounts at each year end. A valuation allowance is recognized if it is more likely than not that some portion, or all, of a deferred tax asset will not be realized.

| 18 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies - Continued

Foreign currency translation

Assets and liabilities of the Company’s subsidiaries with a functional currency other than US$ are translated into US$ using period end exchange rates. Income and expense items are translated at the average exchange rates in effect during the period. Foreign currency translation differences are included as a component of Accumulated Other Comprehensive Income in Shareholders’ Equity.

The exchange rates used to translate amounts in RMB into USD for the purposes of preparing the financial statements were as follows:

| June 30, 2015 | ||

| Balance sheet | RMB 6.1088 to US $1.00 | |

| Statement of income and other comprehensive income | RMB 6.1254 to US $1.00 |

| June 30, 2014 | ||

| Balance sheet | RMB 6.1552 to US $1.00 | |

| Statement of income and other comprehensive income | RMB 6.1397 to US $1.00 |

| December 31, 2014 | ||

| Balance sheet | RMB 6.1384 to US $1.00 | |

| Statement of income and other comprehensive income | RMB 6.1438 to US $1.00 |

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into USD at the rates used in translation.

| 19 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

2. Summary of Significant Accounting Policies - Continued

Post-retirement and post-employment benefits

The Company contributes to a state pension plan in respect of its PRC employees. Other than the state pension plan, the Company does not provide any other post-retirement or post-employment benefits.

Recently Issued Accounting Pronouncements

The FASB has issued an Accounting Standards Update (ASU) No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis, which is intended to improve targeted areas of consolidation guidance for legal entities such as limited partnerships, limited liability corporations, and securitization structures (collateralized debt obligations, collateralized loan obligations, and mortgage-backed security transactions).

The ASU focuses on the consolidation evaluation for reporting organizations (public and private companies and not-for-profit organizations) that are required to evaluate whether they should consolidate certain legal entities.

In addition to reducing the number of consolidation models from four to two, the new standard simplifies the FASB Accounting Standards Codification™ and improves current GAAP by:

-Placing more emphasis on risk of loss when determining a controlling financial interest. A reporting organization may no longer have to consolidate a legal entity in certain circumstances based solely on its fee arrangement, when certain criteria are met.

-Reducing the frequency of the application of related-party guidance when determining a controlling financial interest in a variable interest entity (VIE).

-Changing consolidation conclusions for public and private companies in several industries that typically make use of limited partnerships or VIEs.

The ASU will be effective for periods beginning after December 15, 2015, for public companies. For private companies and not-for-profit organizations, the ASU will be effective for annual periods beginning after December 15, 2016; and for interim periods, beginning after December 15, 2017. Early adoption is permitted, including adoption in an interim period.

The FASB has issued Accounting Standards Update

(ASU) No. 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. The

amendments in this ASU require that debt issuance costs related to a recognized debt liability be presented in the balance sheet

as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The recognition and measurement

guidance for debt issuance costs are not affected by the amendments in this ASU.

For public business entities, the amendments are effective for financial statements issued for fiscal years beginning after December

15, 2015, and interim periods within those fiscal years. For all other entities, the amendments are effective for financial statements

issued for fiscal years beginning after December 15, 2015, and interim periods within fiscal years beginning after December 15,

2016.

Early adoption of the amendments is permitted for financial statements that have not been previously issued.

The amendments should be applied on a retrospective basis, wherein the balance sheet of each individual period presented should

be adjusted to reflect the period-specific effects of applying the new guidance. Upon transition, an entity is required to comply

with the applicable disclosures for a change in an accounting principle. These disclosures include the nature of and reason for

the change in accounting principle, the transition method, a description of the prior-period information that has been retrospectively

adjusted, and the effect of the change on the financial statement line items (i.e., debt issuance cost asset and the debt liability).

| 20 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

The FASB has issued Accounting Standards Update (ASU) No, 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory.

Topic 330, Inventory, currently requires an entity to measure inventory at the lower of cost or market. Market could be replacement cost, net realizable value, or net realizable value less an approximately normal profit margin.

The amendments do not apply to inventory that is measured using last-in, first-out (LIFO) or the retail inventory method. The amendments apply to all other inventory, which includes inventory that is measured using first-in, first-out (FIFO) or average cost.

An entity should measure in scope inventory at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. Subsequent measurement is unchanged for inventory measured using LIFO or the retail inventory method.

The amendments more closely align the measurement of inventory in GAAP with the measurement of inventory in International Financial Reporting Standards.

For public business entities, the amendments are effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2016, and interim periods within fiscal years beginning after December 15, 2017. The amendments should be applied prospectively with earlier application permitted as of the beginning of an interim or annual reporting period.

| 21 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

3. Going Concern

The Company has incurred negative operating cash flows during the six months ended June 30, 2015 and has an accumulated deficit at June 30, 2015 and has relied on the Company’s registered capital and issuance of convertible notes to fund operations. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The financial statements have been prepared assuming that the Company will continue as a going concern and, accordingly, do not include any adjustments that might result from the outcome of this uncertainty. As of June 30, 2015, the Company had limited cash resources and management plans to continue its efforts to raise additional funds through debt or equity offerings which will be used to fund operations.

4. Property and Equipment, net

Property, plant and equipment, net consist of the following:

| June 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Equipment | $ | 135,114 | $ | 120,287 | ||||

| Office equipment | 47,963 | 39,633 | ||||||

| Leasehold improvements | - | 8,634 | ||||||

| Exchange rate difference | (794 | ) | - | |||||

| 182,283 | 168,554 | |||||||

| Less: Accumulated depreciation | (108,407 | ) | (119,328 | ) | ||||

| Property and equipment, net | $ | 73,876 | $ | 49,226 | ||||

During the six months ended June 30, 2015 and 2014, depreciation expense was approximately $12,014 and $10,317, respectively.

| 22 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

5. Deferred Revenue

Deferred revenue represents deferred internet accelerator license revenue over the maintenance period of one to three years for our multiple element arrangements (Note 2).

In addition, deferred revenue includes two government grants for use in research and development related. The portion of the grants that has not been spent is deferred and recognize as other income as the funds are spent on research and development related expenditures.

Deferred revenue included on the balance sheets as of June 30, 2015 and December 31, 2014 is as follow:

| June 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Deferred revenue: | ||||||||

| Current | $ | - | $ | 19,135 | ||||

| Non-current | - | - | ||||||

| Total | $ | - | $ | 19,135 | ||||

The table below sets forth the deferred revenue activities during the six months ended June 30, 2015 and 2014:

| For the six months ended June 30, | ||||||||

| 2015 | 2014 | |||||||

| Deferred revenue, balance at beginning of period | $ | 19,135 | $ | 19,223 | ||||

| Less: government grant earned during the period | - | - | ||||||

| Less: Revenue earned during the period | (19,135 | ) | - | |||||

| Exchange rate difference | - | (161 | ) | |||||

| Deferred revenue, balance at end of period | $ | - | $ | 19,062 | ||||

| 23 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

6. Convertible Promissory Notes

Outstanding balances for the four convertible promissory notes as of June 30, 2015 and December 31, 2014 are as follow:

| Lender | Date of Note | Maturity Date | Loan Amount | Interest Rate (p.a.) | Convertible Number of | June 30, 2015 | December 31, | |||||||||||||||||

| Vantage Associates SA | April 15, 2011 | April 15, 2016 | $ | 150,000 | 5 | % | 600,000 | $ | 150,000 | $ | 150,000 | |||||||||||||

| Empa Trading Ltd. | June 5, 2011 | June 5, 2016 | 100,000 | 5 | % | 400,000 | 100,000 | 100,000 | ||||||||||||||||

| First Capital A.G. | July 14, 2011 | July 14, 2016 | 150,000 | 5 | % | 600,000 | 150,000 | 150,000 | ||||||||||||||||

| First Capital A.G. | September 9, 2011 | September 9, 2016 | 200,000 | 5 | % | 800,000 | 200,000 | 200,000 | ||||||||||||||||

| Vantage Associates SA | September 9, 2011 | September 9, 2016 | 200,000 | 5 | % | 800,000 | 200,000 | 200,000 | ||||||||||||||||

| Vantage Associates SA | October 27, 2011 | October 27, 2016 | 50,000 | 5 | % | 200,000 | 50,000 | 50,000 | ||||||||||||||||

| First Capital A.G. | December 1, 2011 | December 1, 2016 | 50,000 | 5 | % | 200,000 | 50,000 | 50,000 | ||||||||||||||||

| First Capital A.G. | January 23, 2012 | January 23, 2017 | 50 000 | 5 | % | 200,000 | 50,000 | 50,000 | ||||||||||||||||

| Magna Equities II, LLC (f/k/a Hanover Holdings I, LLC) | May 30, 2014 | May 30, 2016 | 150,000 | 8 | % | 10,632,951 | - | 350,000 | ||||||||||||||||

| KBM Worldwide, Inc. | August 14, 2014 | August 21, 2015 | 70,000 | 8 | % | 4,319,104 | - | 110,000 | ||||||||||||||||

| KBM Worldwide, Inc. | November 17, 2014 | November 17, 2015 | 61,000 | 8 | % | 3,763,791 | - | 61,000 | ||||||||||||||||

| $ | $ | 950,000 | $ | 1,471,000 | ||||||||||||||||||||

| Less: | ||||||||||||||||||||||||

| Debt discount from beneficial conversion feature | (20,336 | ) | 447,983 | |||||||||||||||||||||

| 970,336 | 1,023,017 | |||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||

| Current portion | - | 48,875 | ||||||||||||||||||||||

| Non-current portion | $ | 970,336 | $ | 974,142 | ||||||||||||||||||||

| 24 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

6. Convertible Promissory Notes- Continued

The debt discount was the beneficial conversion feature of the notes. It is being accreted as additional interest expense ratably over the term of the convertible notes.

Interest expense for the three months ended June 30, 2015 and 2014 was $10,000 and $13,043, respectively. Interest expense for the six months ended June 30, 2015 and 2014 was $20,000 and $26,168, respectively.

Amortization of the beneficial conversion feature for the six months ended June 30, 2015 and 2014 were $143,528 and $159,015 respectively.

Except for the convertible promissory note of the $350,000 issued to Hanover Holdings I, LLC on May 30, 2014, and the $110,000 and $61,000 issued to KBM Worldwide, Inc. on August 14, 2014 and November 17, 2014 respectively, all the convertible promissory notes (the “Notes”) are convertible upon the occurrence of the following events:

(1) At any time, prior to the maturity date, the Company and the holder of the notes may mutually agree on a date to convert in whole or in part the notes into shares of common stock of the Company on the following terms: Holder of the note will be issued share units comprising of:

| (i) | one common share to be purchased at a price of $0.5, and |

| (ii) | one warrant that is convertible into one common share at a price of $1.00, and expires two years from the date of the Exchange Transaction is completed, and |

| (iii) | one warrant that is convertible into one common share at a price of $1.5, and expires three years from the date the Exchange Transaction is completed. |

(2) Unless earlier converted into common stock mentioned above, if within twelve months of the date hereof the Company completes a Qualified Financing, as defined by the respective convertible promissory notes, the holder agrees to exchange the notes simultaneously with the initial closing of such Qualified Financing as follows:

(a) In the event of a debt Qualified Financing (“Qualified Debt Financing”), the Holder may at its option exchange in whole or in part this Note for a promissory note (or other evidence of indebtedness) in the same form and with the same terms and conditions as those issued in such Qualified Debt Financing and in a principal amount equal to the then outstanding Debt.

(b) In the event of an equity Qualified Financing (“Qualified Equity Financing”), the Holder may at its option convert the Debt into shares of capital stock of the same class and series and with the same rights, preferences and privileges as those issued in such Qualified Equity Financing, at a price per share equal to the purchase price paid by investors in such Qualified Equity Financing.

| 25 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Convertible promissory note of $350,000 issued to Hanover Holdings I, LLC on May 30, 2014

On May 30, 2014, or the Closing Date, we entered into a securities purchase agreement dated as of the Closing Date (the “Purchase Agreement”) with Hanover Holdings I, LLC, a New York limited liability company (“Hanover”). Pursuant to the terms of the Purchase Agreement, Hanover purchased from us on the Closing Date (i) a senior convertible note with an initial principal amount of $350,000 (the “Convertible Note”) and (ii) a warrant to acquire up 3,716,091 shares of our common stock (the “Warrant”), for a total purchase price of $250,000. The Convertible Note was issued with an original issue discount of approximately 28.57%.

$40,000 of the outstanding principal amount of the Convertible Note (together with any accrued and unpaid interest with respect to such portion of the principal amount) shall be automatically extinguished (without any cash payment by us) if (i) we have properly filed a registration statement with the Securities and Exchange Commission, or SEC, on or prior to July 14, 2014, or the Filing Deadline, covering the resale by Hanover of the shares of common Stock issued or issuable upon conversion of the Convertible Note and (ii) no event of default or an event that with the passage of time or giving of notice would constitute an event of default has occurred on or prior to such date. Moreover, $60,000 of the outstanding principal amount of the Convertible Note (together with any accrued and unpaid interest with respect to such portion of the principal amount) shall be automatically extinguished (without any cash payment by us) if (i) the registration statement has been declared effective by the SEC on or prior to the earlier of (i) the 120th calendar day after the Closing Date and (ii) the fifth business day after the date we are notified by the SEC that such registration statement will not be reviewed or will not be subject to further review (the “Effectiveness Deadline”), and the prospectus contained therein is available for use by Hanover for the resale by Hanover of the shares of common stock issued or issuable upon conversion of the Convertible Note and (ii) no event of default or an event that with the passage of time or giving of notice would constitute an event of default has occurred on or prior to such date.

The Convertible Note matures on May 30, 2016 (subject to extension as provided in the Convertible Note) and, in addition to the approximately 28.57% original issue discount, accrues interest at the rate of 8.0% per annum. The Convertible Note is convertible at any time, in whole or in part, at Hanover’s option into shares of our common stock, par value $0.001 per share at a conversion price equal to the lesser of (i) the product of (x) the arithmetic average of the lowest three (3) trade prices of our common stock during the 10 consecutive trading days ending and including the trading day immediately preceding the applicable conversion date and (y) 65%, and (ii) $0.12 (as adjusted for stock splits, stock dividends, stock combinations or other similar transactions). The Warrant entitles Hanover to purchase up to 3,716,091 shares of our common stock (the “Share Amount”) at any time for a period of one year from the Closing Date at an exercise price equal to the lesser of (i) the product of (x) the arithmetic average of the lowest three (3) VWAPs of the common stock during preceding ten (10) consecutive trading days and (y) sixty-five percent (65%), and (B) $0.12 (as adjusted for any stock split, stock dividend, stock combination or other similar transaction) (the “Exercise Price”). The Warrant may only be exercised for cash and we have the right to accept or decline any exercise of the Warrant by Hanover. If at any time the Share Amount is less than the quotient of $150,000 and the Exercise Price (the “Required Share Amount”), then the number of shares issuable upon exercise of the warrant shall automatically be increased by such number of shares equal to the difference of the Required Share Amount less the Share Amount.

At no time will Hanover be entitled to convert any portion of the Convertible Note or exercise any portion of the Warrant to the extent that after such conversion or exercise, Hanover (together with its affiliates) would beneficially own more than 4.99% of the outstanding shares of our common stock as of such date (the “Maximum Percentage”). The Maximum Percentage may be raised to any other percentage not in excess of 9.99% at the option of Hanover upon at least 61 days’ prior notice to us, or lowered to any other percentage, at the option of Hanover, at any time.

The Convertible Note includes customary event of default provisions. Upon the occurrence of an event of default, Hanover may require us to pay in cash the greater of (i) the product of (A) the amount to be redeemed multiplied by (B) 135% (or 100% if an insolvency related event of default) and (ii) the product of (X) the conversion price in effect at that time multiplied by (Y) the product of (1) 135% (or 100% if an insolvency related event of default) multiplied by (2) the greatest closing sale price of our common stock on any trading day during the period commencing on the date immediately preceding such event of default and ending on the date we make the entire payment required to be made under this provision.

| 26 |

XCELMOBILITY INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

We have the right at any time to redeem all, but not less than all, of the total outstanding amount then remaining under the Convertible Note in cash at a price equal to 135% of the total amount of such Convertible Note then outstanding. If at any time after the Closing Date, (i) the closing bid price of our common stock is equal to or greater than 140% of the Exercise Price for a period of 30 consecutive trading days (the “Measuring Period”), (ii) no Equity Conditions Failure (as defined in the Warrant) shall have occurred, and (iii) the aggregate dollar trading volume of the Common Stock for each trading day during the Measuring Period exceeds $3,000 per day, then we shall have the right to require Hanover to exercise all, or any part, of the Warrant (up to the Maximum Forced Exercise Amount (defined below)) (the “Forced Exercise”) at the then applicable Exercise Price. We will not be permitted to effect a Forced Exercise if, after giving effect to such Forced Exercise, we have received more than $150,000 in cash, in the aggregate, from one or more exercises of the Warrant. “Maximum Forced Exercise Amount” means, as of any given date, the lesser of (x) the number of shares of our common stock issuable upon exercise of the Warrant as of such given date and (y) 500% of the average trading volume (as reported on Bloomberg) of our common stock on our principal market on each of the 10 consecutive trading days ending and including the trading day immediately prior to such given date.

Convertible promissory notes of $110,000 and $61,000 issued to KBM Worldwide, Inc. on August 14, 2014 and November 17, 2014

On August 14, 2014 and November 17, 2014, we and KBM Worldwide, Inc. (“KBM”) completed a financing pursuant to which the Company issued Convertible Promissory Notes in the original principal amounts of $110,000 and $61,000 respectively (the “Notes”). The Notes bear 8% interest and is due on August 21, 2015 and November 17, 2015 respectively. The Notes become convertible 180 days after the date of the Note. The principal amounts of the Notes and any accrued interest can then be converted into shares of the Company’s common stock at a rate of 75% multiplied by the market price, which is the average of the lowest three (3) trading prices for the common stock during the ten (10) trading day period ending on the latest complete trading day prior to the conversion date.

The fair value of the embedded conversion feature of these notes as at June 30, 2015 and December 31, 2014 was $635,011 and $693,303, respectively.

The fair value of the convertible notes was calculated using the Black-Scholes model with the following assumptions: expected life of 0.5-2 years, expected dividend rate of 0%, volatility of 246.8% and interest rate at 0.14%-0.26%.

Fair Value on a Recurring Basis

The following table sets forth, by level within the fair value hierarchy, the Company’s financial assets and liabilities that were accounted for at fair value on a recurring basis as of June 30, 2015:

| Fair Value Measurements at June 30, 2015 | ||||||||||||||||

| Quoted Prices In | Significant | |||||||||||||||

| Active Markets for | Significant Other | Unobservable | Total Carrying | |||||||||||||

| Identical Assets | Observable Inputs | Inputs | Value as of | |||||||||||||

| Descriptions | (Level 1) | (Level 2) | (Level 3) | June 30, 2015 | ||||||||||||