| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| FORM N-CSR | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED | |

| MANAGEMENT INVESTMENT COMPANIES | |

| Investment Company Act file number 811- 22303 | |

| John Hancock Collateral Investment Trust | |

| (Exact name of registrant as specified in charter) | |

| 601 Congress Street, Boston, Massachusetts 02210 | |

| (Address of principal executive offices) (Zip code) | |

| Michael J. Leary | |

| Treasurer | |

| 601 Congress Street | |

| Boston, Massachusetts 02210 | |

| (Name and address of agent for service) | |

| Registrant's telephone number, including area code: 617-663-4490 | |

| Date of fiscal year end: | December 31 |

| Date of reporting period: | December 31, 2010 |

ITEM1. REPORTS TO STOCKHOLDERS.

| John Hancock Collateral Investment Trust | ||

| Table of Contents | ||

| Management’s discussion of Fund performance | Page 3 | |

| A look at performance | Page 4 | |

| Your expenses | Page 5 | |

| Portfolio summary | Page 6 | |

| Portfolio of investments | Page 7 | |

| Financial statements | Page 12 | |

| Financial highlights | Page 15 | |

| Notes to financial statements | Page 16 | |

| Auditors’ report | Page 19 | |

| Trustees and Officers | Page 20 | |

| More information | Page 22 | |

| 2 |

Fund performance

by Manulife Asset Management (US) LLC

During 2010, the U.S. economy continued to slowly recover from the recession. However, low growth estimates, high unemployment and European sovereign debt worries kept global equities volatile for the majority of the year. The three-month rates for the London Interbank Offered Rate (LIBOR), a rate used to determine yields in various short-term investments, continued along historically low levels, despite a brief summer spike due to European debt worries. Over the course of the year, the Federal Reserve maintained its federal funds rate (the rate banks charge each other for overnight loans) at its historical low range of 0.00% to 0.25%. After various quantitative easing actions by the Federal Reserve, aimed at stimulating the economy, it became increasingly evident that the Fed was fully committed to maintaining “exceptionally low interest rates for an extended period.”

Fund Results & Strategy:

For the year ended December 31, 2010, the Fund returned 0.27% at net asset value. In addition, as of December 31, 2010, the seven-day net yield was 0.29%. As it became evident that the Federal Reserve would maintain the fed funds rate at the 0.00% to 0.25% level for an extended period of time, we took advantage of higher incremental yield further out on the yield curve, increasing the Fund’s average maturity. We ended the year with a weighted average maturity of 70 days, which was up from 55 days at the year’s midpoint and 64 at the beginning of the fourth quarter. The longer average maturity provided us with increased yield in the last quarter and enabled us to maintain the Fund’s overall yield at a steady rate in a falling rate environment. We continued to invest primarily in a mix of short-term commercial bonds, commercial paper and agency securities. Additionally, we ended the year with approximately 32% of the Fund in floating debt to protect performance in the event of rising rates. Despite buying securities further out on the yield curve, we believe the Fund maintains ample investment liquidity and quality.

This commentary reflects the view of the Fund’s portfolio management team through the end of the Fund’s period discussed in this report. The team’s statements reflect its own opinions. As such, they are in no way guarantees of future events or results and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

| 3 |

A look at performance

For the period ended December 31, 2010

| Average annual total returns (%) | Cumulative total returns (%) | |||||||

| Since | Since | |||||||

| 1-year | 5-year | 10-year | inception 1 | 1-year | 5-year | 10-year | inception 1 | |

|

| ||||||||

| John Hancock Collateral | ||||||||

| Investment Trust | 0.27 | — | — | 0.35 | 0.27 | — | — | 0.55 |

|

| ||||||||

Performance figures assume all distributions are reinvested.

The expense ratios of the Fund are set forth according to the most recent publicly available registration statement for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The net expenses equal the gross expenses of 0.09%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown.

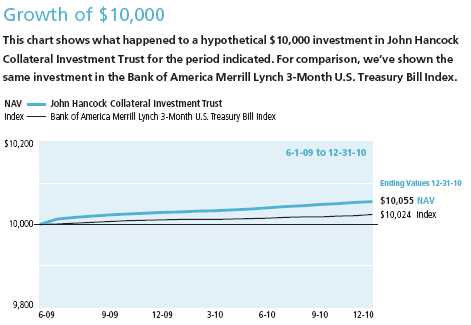

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

1 From 6-1-09.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would have resulted in lower values if they did.

| Annual report | Collateral Investment Trust |

| 4 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding your fund expenses

As a shareholder of the Fund, you incur two types of costs:

• Transaction costs which include sales charges (loads) on purchases or redemptions (if applicable), minimum account fee charge, etc.

• Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on July 1, 2010 with the same investment held until December 31, 2010.

| Account value | Ending value | Expenses paid during | |

| on 7-1-10 | on 12-31-10 | period ended 12-31-101 | |

|

| |||

| Common Shares | $1,000.00 | $1,001.50 | $0.30 |

|

| |||

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at December 31, 2010, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Example

[ My account value $8,600.00 / $1,000.00 = 8.6 ] x $[ “expenses paid” from table ] = My actual expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on July 1, 2010, with the same investment held until December 31, 2010. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| Account value | Ending value | Expenses paid during | |

| on 7-1-10 | on 12-31-10 | period ended 12-31-101 | |

|

| |||

| Common Shares | $1,000.00 | $1,024.90 | $0.31 |

|

| |||

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund's annualized expense ratio of 0.06%, for the Fund's shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| 5 |

| Portfolio Summary | ||

| Top 10 Issuers1 | Yield* | Percentage of Net |

| Assets | ||

| Morgan Stanley | ||

| 01/18/11 to 06/20/12 | 0.539 to 6.750% | 6.0% |

| Federal Home Loan Bank | ||

| 11/15/11 to 12/29/11 | 0.340 to 0.500% | 5.8% |

| General Electric Capital Corp. | ||

| 01/26/11 to 03/12/12 | 0.338 to 6.125% | 5.4% |

| Toyota Motor Credit Corp. | ||

| 01/10/11 to 12/14/11 | 0.240 to 5.450% | 5.2% |

| CAFCO LLC | ||

| 01/04/11 to 02/07/11 | 0.280 to 0.300% | 5.0% |

| Bank of Nova Scotia | ||

| 01/03/11 to 12/08/11 | 0.090 to 0.450% | 4.8% |

| JPMorgan Chase & Company | ||

| 01/17/11 to 12/26/12 | 0.364 to 5.600% | 4.6% |

| Societe Generale North America, Inc. | ||

| 01/03/11 to 08/05/11 | 0.250 to 0.500% | 4.4% |

| Govco LLC | ||

| 01/05/11 to 05/12/11 | 0.250 to 0.370% | 3.8% |

| The Goldman Sachs Group, Inc. | ||

| 01/05/11 to 03/15/12 | 0.502 to 6.875% | 3.6% |

| Sector Composition1,2 | |||

| Financials | |||

| Commercial Banks | 28% | ||

| Diversified Financial Services | 27% | ||

| Capital Markets | 17% | ||

| Consumer Finance | 4% | ||

| U.S. Government & Agency Obligations | 12% | ||

| Industrials | 6% | ||

| Consumer Staples | 2% | ||

| Consumer Discretionary | 2% | ||

| Telecommunication Services | 1% | ||

| Health Care | 1% | ||

| Portfolio Composition1,2 | |||

| Corporate Interest-Bearing Obligations | 44% | ||

| Commercial Paper | 41% | ||

| U.S. Government & Agency Obligations | 12% | ||

| Asset Backed Securities | 3% | ||

1 As a percentage of net assets on 12-31-10.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

* Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end.

| 6 |

John Hancock Collateral Investment Trust

As of 12-31-10

Portfolio of Investments

| Description | Yield* | Par value | Value |

| Asset Backed Securities 2.78% | $188,056,360 | ||

|

| |||

| (Cost $188,009,812) | |||

| Bank of America Auto Trust, Series 2010-2, Class A1 | |||

| 07/15/11 | 0.619% | $5,182,162 | 5,184,121 |

| BMW Vehicle Lease Trust, Series 2010-1, Class A1 | |||

| 10/17/11 | 0.298 | 10,784,582 | 10,788,672 |

| CNH Equipment Trust, Series 2010-B, Class A1 | |||

| 09/02/11 | 0.576 | 21,253,440 | 21,260,620 |

| CNH Equipment Trust, Series 2010-C, Class A1 | |||

| 12/09/11 | 0.427 | 23,339,153 | 23,339,255 |

| Ford Credit Auto Owner Trust, Series 2010-B, Class A1 (S) | |||

| 08/15/11 | 0.506 | 10,851,238 | 10,855,358 |

| Honda Auto Receivables Owner Trust, Series 2010-3, Class | |||

| A1 | |||

| 10/21/11 | 0.310 | 54,525,534 | 54,526,199 |

| Hyundai Auto Receivables Trust, Series 2010-A, Class A1 | |||

| 05/16/11 | 0.398 | 801,654 | 801,710 |

| Hyundai Auto Receivables Trust, Series 2010-B, Class A1 | |||

| 09/15/11 | 0.371 | 15,051,264 | 15,056,830 |

| John Deere Owner Trust, Series 2010-A, Class A1 | |||

| 05/16/11 | 0.344 | 5,668,144 | 5,668,305 |

| Mercedes-Benz Auto Receivables Trust, Series 2010-1, | |||

| Class A1 | |||

| 05/13/11 | 0.309 | 868,341 | 868,384 |

| Nissan Auto Lease Trust, Series 2010-A, Class A1 | |||

| 06/15/11 | 0.561 | 22,386 | 22,390 |

| Nissan Auto Lease Trust, Series 2010-B, Class A1 | |||

| 11/15/11 | 0.317 | 26,641,828 | 26,656,657 |

| Nissan Auto Receivables Owner Trust, Series 2010-A, Class | |||

| A1 | |||

| 10/17/11 | 0.356 | 13,020,086 | 13,027,859 |

| Commercial Paper 41.09% | $2,775,489,330 | ||

|

| |||

| (Cost $2,775,422,617) | |||

| American Honda Finance Corp. | |||

| 01/19/11 | 0.260% | $25,000,000 | 24,996,750 |

| ANZ National International Ltd. | |||

| 06/02/11 | 0.360 | 75,000,000 | 74,916,750 |

| Australia & New Zealand Banking Group, Ltd. | |||

| 05/09/11 to 11/08/11 | 0.306 to 0.330 | 141,555,000 | 141,488,940 |

| Bank of Nova Scotia | |||

| 01/03/11 | 0.090 | 225,000,000 | 224,998,875 |

| Barclays US Funding LLC | |||

| 01/04/11 | 0.230 | 10,000,000 | 9,999,800 |

| CAFCO LLC | |||

| 01/04/11 to 02/07/11 | 0.280 to 0.300 | 335,000,000 | 334,952,400 |

| Cargill Global Funding PLC | |||

| 01/04/11 | 0.210 | 40,000,000 | 39,999,200 |

| 7 |

John Hancock Collateral Investment Trust

As of 12-31-10

Portfolio of Investments

| Description | Yield* | Par value | Value |

| Commercial Paper (continued) | |||

|

| |||

| Cargill, Inc. | |||

| 01/10/11 to 02/09/11 | 0.250% | $90,000,000 | $89,984,600 |

| Deutsche Bank Financial LLC | |||

| 08/05/11 | 0.390 | 50,000,000 | 49,855,500 |

| Falcon Asset Securitization Company LLC | |||

| 01/06/11 to 01/18/11 | 0.230 to 0.270 | 173,000,000 | 172,991,050 |

| Govco LLC | |||

| 01/05/11 to 05/12/11 | 0.250 to 0.370 | 256,778,000 | 256,657,494 |

| Jupiter Securitization Company LLC | |||

| 03/08/11 | 0.260 | 75,000,000 | 74,955,750 |

| Old Line Funding LLC | |||

| 01/04/11 to 03/02/11 | 0.230 to 0.270 | 234,361,000 | 234,322,491 |

| Societe Generale North America, Inc. | |||

| 01/03/11 to 08/05/11 | 0.250 to 0.500 | 350,000,000 | 299,815,400 |

| State Street Corp. | |||

| 01/05/11 to 04/25/11 | 0.250 to 0.320 | 225,000,000 | 224,903,750 |

| Toyota Motor Credit Corp. | |||

| 01/25/11 to 07/05/11 | 0.240 to 0.380 | 275,000,000 | 274,657,500 |

| UBS Finance (Delaware) LLC | |||

| 01/06/11 | 0.190 | 200,000,000 | 199,994,000 |

| Westpac Securities NZ, Ltd. | |||

| 01/21/11 | 0.341 | 46,000,000 | 45,999,080 |

| Corporate Interest-Bearing Obligations 44.03% | $2,974,505,824 | ||

|

| |||

| (Cost $2,975,391,782) | |||

| American Honda Finance Corp. (P)(S) | |||

| 06/20/11 to 06/29/11 | 1.054 to 2.653% | $111,700,000 | 112,080,408 |

| AT&T Mobility LLC | |||

| 12/15/11 | 6.500 | 43,855,000 | 46,280,182 |

| AT&T, Inc. | |||

| 03/15/11 | 6.250 | 39,565,000 | 40,006,822 |

| Australia & New Zealand Banking Group, Ltd. (P)(S) | |||

| 10/21/11 | 0.589 | 13,500,000 | 13,519,494 |

| Bank of America Corp. | |||

| 08/15/11 | 5.375 | 7,800,000 | 8,018,119 |

| Bank of America NA (P) | |||

| 01/27/11 | 0.361 | 135,000,000 | 135,001,755 |

| Bank of Montreal (P) | |||

| 10/27/11 | 0.351 | 75,000,000 | 74,999,589 |

| Bank of Montreal | |||

| 02/02/11 | 0.250 | 50,000,000 | 49,997,500 |

| Bank of Nova Scotia (P) | |||

| 12/08/11 | 0.450 | 100,000,000 | 99,954,000 |

| Bank of Tokyo-Mitsubishi UFJ, Ltd. | |||

| 01/10/11 | 0.250 | 25,000,000 | 24,999,750 |

| 8 |

John Hancock Collateral Investment Trust

As of 12-31-10

Portfolio of Investments

| Description | Yield* | Par value | Value |

| Corporate Interest-Bearing Obligations (continued) | |||

|

| |||

| Bellsouth Corp. | |||

| 10/15/11 | 6.000% | $3,966,000 | $4,134,472 |

| BNP Paribas Finance, Inc. | |||

| 01/04/11 | 0.010 | 177,400,000 | 177,400,000 |

| Caterpillar Financial Services Corp. | |||

| 06/24/11 to 10/12/11 | 1.053 to 5.125 | 43,840,000 | 44,216,938 |

| Credit Suisse USA, Inc. | |||

| 03/02/11 to 11/15/11 | 5.250 to 6.125 | 42,304,000 | 43,944,048 |

| Credit Suisse USA, Inc. (P) | |||

| 03/02/11 to 08/16/11 | 0.484 to 0.490 | 67,005,000 | 67,055,973 |

| General Electric Capital Corp. (P) | |||

| 01/26/11 to 11/21/11 | 0.338 to 0.737 | 272,914,000 | 273,049,012 |

| General Electric Capital Corp., Series A | |||

| 02/22/11 | 6.125 | 69,926,000 | 70,438,348 |

| International Business Machines Corp. (P) | |||

| 07/28/11 to 11/04/11 | 0.326 to 0.868 | 8,600,000 | 8,619,220 |

| John Deere Capital Corp. (P) | |||

| 06/10/11 | 1.052 | 48,220,000 | 48,379,367 |

| JPMorgan Chase & Company | |||

| 01/17/11 to 06/16/11 | 4.600 to 5.600 | 70,039,000 | 71,110,660 |

| JPMorgan Chase & Company (P) | |||

| 01/17/11 to 05/16/11 | 0.394 to 0.459 | 181,644,000 | 181,671,461 |

| Merrill Lynch & Company, Inc. (P) | |||

| 07/25/11 | 0.488 | 39,510,000 | 39,488,072 |

| Morgan Stanley | |||

| 01/21/11 to 04/15/11 | 5.050 to 6.750 | 298,036,000 | 300,182,510 |

| Morgan Stanley (P) | |||

| 01/18/11 | 0.539 | 49,970,000 | 49,974,347 |

| National Australia Bank, Ltd. (P) | |||

| 12/01/11 | 0.320 | 45,000,000 | 44,979,525 |

| PepsiCo, Inc. (P) | |||

| 07/15/11 | 0.319 | 20,000,000 | 19,998,120 |

| Pfizer, Inc. (P) | |||

| 03/15/11 | 2.252 | 27,100,000 | 27,208,671 |

| Procter & Gamble International Funding SCA | |||

| 08/26/11 | 1.350 | 10,000,000 | 10,077,530 |

| Royal Bank of Canada (P) | |||

| 12/02/11 | 0.440 | 80,000,000 | 79,964,000 |

| The Bank of New York Mellon Corp. | |||

| 01/14/11 | 4.950 | 7,385,000 | 7,392,481 |

| The Goldman Sachs Group, Inc. | |||

| 01/15/11 to 01/15/11 | 5.000 to 6.875 | 158,310,000 | 158,561,458 |

| The Goldman Sachs Group, Inc. (P) | |||

| 08/05/11 to 10/07/11 | 0.506 to 0.703 | 50,950,000 | 51,066,426 |

| Toyota Motor Credit Corp. | |||

| 05/18/11 | 5.450 | 8,240,000 | 8,400,425 |

| 9 |

John Hancock Collateral Investment Trust

As of 12-31-10

Portfolio of Investments

| Description | Yield* | Par value | Value |

| Corporate Interest-Bearing Obligations (continued) | |||

|

| |||

| Toyota Motor Credit Corp. (P) | |||

| 01/10/11 to 12/14/11 | 0.263 to 0.440% | $70,000,000 | $69,976,460 |

| Wachovia Corp. | |||

| 03/15/11 | 5.350 | 7,550,000 | 7,622,246 |

| Wachovia Corp. (S) | |||

| 03/15/11 to 10/15/11 | 0.419 to 0.422 | 126,387,000 | 126,431,416 |

| Wells Fargo & Company | |||

| 01/12/11 | 4.875 | 16,000,000 | 16,011,984 |

| Wells Fargo & Company (P) | |||

| 01/12/11 to 01/24/11 | 0.389 to 0.738 | 159,800,000 | 159,834,297 |

| Wells Fargo Bank NA | |||

| 02/01/11 | 6.450 | 17,500,000 | 17,571,978 |

| Westpac Banking Corp. (P)(S) | |||

| 10/21/11 | 0.589 | 84,855,000 | 84,928,060 |

| Westpac Banking Corp. (P) | |||

| 11/03/11 | 0.370 | 100,000,000 | 99,958,700 |

| U.S. Government & Agency Obligations 11.87% | $802,054,829 | ||

|

| |||

| (Cost $801,431,602) | |||

| Bank of America Corp. (J)(P) | |||

| 06/22/12 | 0.503% | $41,000,000 | 41,154,570 |

| Citibank NA (J)(P) | |||

| 07/12/11 to 11/15/12 | 0.286 to 0.316 | 86,000,000 | 86,058,707 |

| Citigroup Funding, Inc. (J)(P) | |||

| 03/30/12 | 0.603 | 13,000,000 | 13,075,049 |

| Citigroup, Inc. (J)(P) | |||

| 12/09/11 | 1.064 | 22,340,000 | 22,505,562 |

| Federal Home Loan Bank | |||

| 11/15/11 to 12/29/11 | 0.340 to 0.500 | 392,775,000 | 392,496,936 |

| General Electric Capital Corp. (J)(P) | |||

| 03/11/11 to 03/12/12 | 0.382 to 0.502 | 18,000,000 | 18,038,226 |

| JPMorgan Chase & Company (J)(P) | |||

| 02/23/11 to 12/26/12 | 0.364 to 0.553 | 60,000,000 | 60,224,993 |

| Morgan Stanley (J)(P) | |||

| 02/10/12 to 06/20/12 | 0.502 to 0.654 | 55,000,000 | 55,219,555 |

| PNC Funding Corp. (J)(P) | |||

| 04/01/12 | 0.503 | 10,000,000 | 10,029,680 |

| State Street Bank & Trust Company (J)(P) | |||

| 09/15/11 | 0.502 | 10,000,000 | 10,017,110 |

| The Goldman Sachs Group, Inc. (J)(P) | |||

| 11/09/11 to 03/15/12 | 0.502 to 0.536 | 36,000,000 | 36,086,664 |

| The Huntington National Bank (J)(P) | |||

| 06/01/12 | 0.696 | 18,000,000 | 18,097,146 |

| Union Bank NA (J)(P) | |||

| 03/16/12 | 0.502 | 6,000,000 | 6,015,666 |

| US Central Federal Credit Union (P) | |||

| 10/19/11 | 0.289 | 23,000,000 | 22,999,075 |

| 10 |

John Hancock Collateral Investment Trust

As of 12-31-10

Portfolio of Investments

| Description | Yield* | Par value | Value |

| U.S. Government & Agency Obligations (continued) | |||

|

| |||

| Wells Fargo & Company (J)(P) | |||

| 06/15/12 | 0.522% | $10,000,000 | $10,035,890 |

| Total investments (Cost $6,740,255,813)† 99.77% | $6,740,106,343 | ||

|

| |||

| Other assets and liabilities, net 0.23% | $15,473,386 | ||

|

| |||

| Total net assets 100.00% | $6,755,579,729 | ||

|

| |||

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

* Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end.

(J) These securities are issued under the Temporary Liquidity Guarantee and are insured by the Federal Deposit Insurance Corporation. Securities reset coupon rates periodically, which allows the securities to qualify as short-term securities under the provisions of Rule 2a-7 of the Investment Company Act of 1940.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

† At 12-31-10, the aggregate cost of investment securities for federal income tax purposes was $6,740,255,813. Net unrealized depreciation aggregated $149,470, of which $1,166,584 related to appreciated investment securities and $1,316,054 related to depreciated investment securities.

| 11 |

John Hancock Collateral Investment Trust

Statement of Assets and Liabilities — December 31, 2010

| Assets | |||

|

|

|||

| Investments, at value (Cost $6,740,255,813) | $6,740,106,343 | ||

| Cash | 84,308 | ||

| Interest receivable | 17,401,834 | ||

| Other receivables and prepaid expenses | 26,704 | ||

| Total assets | 6,757,619,189 | ||

| Liabilities | |||

|

|

|||

| Distributions payable | 1,915,878 | ||

| Payable to affiliates (Note 4) | |||

| Chief compliance officer fees | 8,854 | ||

| Transfer agent fees | 8,628 | ||

| Trustees' fees | 13,970 | ||

| Other liabilities and accrued expenses | 92,130 | ||

| Total liabilities | 2,039,460 | ||

| Net assets | |||

|

|

|||

| Capital paid-in | $6,756,021,332 | ||

| Accumulated distributions in excess of net | |||

| investment income | (244,828) | ||

| Accumulated net realized loss on investments | (47,305) | ||

| Net unrealized appreciation (depreciation) on | |||

| investments | (149,470) | ||

| Net assets | $6,755,579,729 | ||

| Net asset value per share | |||

|

|

|||

| Based on 675,089,738 shares of beneficial | |||

| interest outstanding — unlimited number of | |||

| shares authorized with no par value | $10.01 | ||

| The accompanying notes are an integral part of the financial statements. |

| 12 |

John Hancock Collateral Investment Trust

Statement of Operations — For the Year Ended December 31, 2010

| Investment income | |||

|

|

|||

| Interest | $20,829,392 | ||

| Expenses | |||

|

|

|||

| Investment management fees (Note 4) | 2,230,240 | ||

| Accounting and legal services fees (Note 4) | 400,000 | ||

| Transfer agent fees (Note 4) | 100,000 | ||

| Trustees' fees (Note 4) | 50,501 | ||

| Professional fees | 181,248 | ||

| Custodian fees | 420,558 | ||

| Registration and filing fees | 9,418 | ||

| Chief compliance officer fees (Note 4) | 35,000 | ||

| Other | 118,731 | ||

| Total expenses | 3,545,696 | ||

| Net investment income | 17,283,696 | ||

| Realized and unrealized loss | |||

|

|

|||

| Net realized loss on investments | (47,305) | ||

| Change in net unrealized appreciation | |||

| (depreciation) on investments | (1,714,332) | ||

| Net realized and unrealized loss | (1,761,637) | ||

| Increase in net assets from operations | $15,522,059 | ||

| The accompanying notes are an integral part of the financial statements. |

| 13 |

John Hancock Collateral Investment Trust

Statements of Changes in Net Assets

| Year ended | Period ended | |||

| Increase (decrease) in net assets | 12/31/10 | 12/31/091 | ||

|

|

||||

| From operations | ||||

| Net investment income | $17,283,696 | $6,319,754 | ||

| Net realized loss | (47,305) | — | ||

| Change in net unrealized appreciation | ||||

| (depreciation) | (1,714,332) | 1,564,862 | ||

| Increase in net assets resulting from | ||||

| operations | 15,522,059 | 7,884,616 | ||

| Distributions to shareholders | ||||

| From net investment income | (17,391,310) | (6,464,575) | ||

| From Fund share transactions (Note 5) | 1,856,535,067 | 4,899,493,872 | ||

| Total increase | 1,854,665,816 | 4,900,913,913 | ||

| Net assets | ||||

|

|

||||

| Beginning of period | 4,900,913,913 | — | ||

| End of period | $6,755,579,729 | $4,900,913,913 | ||

| Accumulated distributions in excess of net | ||||

| investment income | ($244,828) | ($144,821) | ||

1 Period from 6-1-09 (inception date) to 12-31-09.

| The accompanying notes are an integral part of the financial statements. |

| 14 |

John Hancock Collateral Investment Trust

Financial Highlights (For a share outstanding throughout the period)

| Period ended | 12/31/10 | 12/31/091 | ||

| Per share operating performance | ||||

|

|

||||

| Net asset value, beginning of period | $10.01 | $10.00 | ||

| Net investment income 2 | 0.03 | 0.02 | ||

| Net realized and unrealized gain on | ||||

| investments | — 3 | 0.01 | ||

| Total from investment operations | 0.03 | 0.03 | ||

| Less distributions | ||||

| From net investment income | (0.03) | (0.02) | ||

| Net asset value, end of period | $10.01 | $10.01 | ||

| Total return (%) | 0.27 | 0.294 | ||

| Ratios and supplemental data | ||||

|

|

||||

| Net assets, end of period (in millions) | $6,756 | $4,901 | ||

| Ratio (as a percentage of average net assets) | ||||

| Expenses | 0.06 | 0.095 | ||

| Net investment income | 0.27 | 0.295 | ||

| Portfolio turnover (%)6 | 153 | 517 | ||

1 Period from 6-1-09 (inception date) to 12-31-09.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Not annualized.

5 All expenses have been annualized except organizational fees, which were 0.01% of average net assets and are non-recurring. This expense decreased the net investment income by less than $0.005 per share and the net investment income ratio by 0.01%.

6 The calculation of portfolio turnover excludes amounts from all securities whose maturities or expiration dates at the time of acquisition were one year or less, which represents a significant amount of the investments held by the Fund.

7 The 2009 Portfolio turnover rate has been revised from what was previously reported to exclude the effect of short-term securities owned by the Fund during the period ended 12-31-09.

| The accompanying notes are an integral part of the financial statements. |

| 15 |

John Hancock Collateral Investment Trust

Notes to financial statements

Note 1 - Organization

John Hancock Collateral Investment Trust (the Fund) is a Massachusetts business trust organized on May 19, 2009. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund is the successor to John Hancock Cash Investment Trust (CIT). The Fund acquired all the assets and liabilities of CIT in a non-taxable exchange for shares of the Fund. The Fund commenced operations on June 1, 2009 upon the completion of this transaction. Most of the current investors in the Fund are affiliated funds of John Hancock Mutual Funds family of funds. The Fund serves primarily as an investment vehicle for cash collateral received by such affiliated funds for securities lending.

The investment objective of the Fund is to maximize income, while maintaining adequate liquidity, safeguarding the return of principal and minimizing risk of default. The Fund invests only in U.S. dollar denominated securities rated within the two highest short-term credit categories and their unrated equivalents. The Fund is a floating net asset value (NAV) fund and its NAV may fluctuate.

Note 2 - Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. As of December 31, 2010, all investments are categorized as Level 2 under the hierarchy described above. During the year ended December 31, 2010, there were no significant transfers in or out of Level 2 assets.

In order to value the securities, the Fund uses the following valuation techniques. Debt obligations, including short-term debt investments, are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied quotes and electronic data processing techniques, taking into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Debt obligations, for which there are no prices available from an independent pricing service, are valued based on broker quotes or fair valued as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

| 16 |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful.

Expenses. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of December 31, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years. Net capital losses of $57,984, that are a result of security transactions occurring after October 31, 2010, are treated as occurring on January 1, 2011, the first day of the Fund’s next taxable year.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares dividends daily and pays them monthly. Capital gain distributions net of fee paid to the fund security lending agent, if any, are distributed annually. The tax character of distributions for the periods ended December 31, 2010 and December 31, 2009 was as follows: ordinary income of $17,391,310 and $6,464,575, respectively.

As of December 31, 2010, the components of distributable earnings on a tax basis included $203,997 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. The Fund had no material book-tax differences at December 31, 2010.

Note 3 - Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 - Fees and transactions with affiliates

Manulife Asset Management (US) LLC (formerly MFC Global Investment Management (U.S.), LLC) (the Adviser) serves as investment adviser for the Fund. John Hancock Funds, LLC (the Placement Agent) performs services related to the

| 17 |

offering and sale of shares of the Fund. The Adviser and the Placement Agent are indirect wholly owned subsidiaries of Manulife Financial Corporation.

Management fee. The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.05% of the first $1,500,000,000 of the Fund’s average daily net assets and (b) 0.03% of the Fund’s average daily net assets in excess of $1,500,000,000.

The investment management fees incurred for the year ended December 31, 2010, were equivalent to an annual effective rate of 0.035% of the Fund’s average daily net assets.

Administrative services. The Fund has an agreement with an affiliate of the Adviser to perform necessary tax, accounting, compliance and other administrative services of the Fund. As of December 31, 2010, the Fund pays such affiliate monthly in arrears for these services at a rate of 0.02% of the Fund’s average daily net assets, up to a maximum of $400,000 annually. The administrative service fees incurred for the year ended December 31, 2010 were equivalent to an annual effective rate of 0.01% of the Fund’s average daily net assets.

Effective January 1, 2011, the annual maximum amount has been reduced to $300,000.

Chief Compliance Officer services. The Fund, as of December 31, 2010, has contracted with the Adviser’s Chief Compliance Officer (CCO) to provide certain services, including on-going evaluation of the Fund’s Federal Security Law policies and procedures. In addition, the CCO will provide annual reporting to the Board of Trustees detailing the results of this review. The Fund pays an annual flat rate of $35,000 to the Adviser, paid monthly in arrears, for these services.

Trustee expenses. The Fund compensates each Trustee who is not an employee of the Adviser or its affiliates.

Transfer agent fees. The Fund, as of December 31, 2010, has a transfer agent agreement with John Hancock Signature Services, Inc. (Transfer Agent), an affiliate of the Adviser. The Fund pays the Transfer Agent monthly a fee which is based on an annual rate of $100,000. The Fund also pays certain out-of-pocket expenses.

Note 5 - Fund share transactions

Transactions in Fund shares for the year ended December 31, 2010 and the period ended December 31, 2009 were as follows:

| Year ended | Period ended | |||

| 12/31/10 | 12/31/091 | |||

|

| ||||

| Shares | Amount | Shares | Amount | |

|

| ||||

| Common shares | ||||

| Sold | 3,572,336,077 | $35,754,481,630 | 1,617,448,284 | $16,190,461,263 |

| Issued in acquisition of CIT | - | - | 175,181,953 | 1,751,819,527 |

| Repurchased | (3,386,873,227) | (33,897,946,563) | (1,303,003,349) | (13,042,786,918) |

|

| ||||

| Net increase | 185,462,850 | $1,856,535,067 | 489,626,888 | $4,899,493,872 |

1 Period from 6-1-09 (inception date) to 12-31-09.

Note 6 - Purchase and sale of securities

Purchases and proceeds from sales or maturities of securities, other than short-term securities, during the year ended December 31, 2010, aggregated to $2,074,820,390 and $1,687,728,853, respectively.

| 18 |

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of John Hancock Collateral Investment Trust:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Collateral Investment Trust (the “Fund”) at December 31, 2010, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 24, 2011

| 19 |

Trustees and Officers

This chart provides information about the Trustees and Officers of John Hancock Collateral Investment Trust. Officers elected by the Trustees manage the day-to-day operations of the Portfolio and execute policies formulated by the Trustees.

| Independent Trustees | ||

| Name, Year of Birth | Trustee | Number of |

| Position(s) held with Fund | of the | John Hancock |

| Principal occupation(s) and other | Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| Harlan D. Platt,2 Born: 1950 | 2009 | 1 |

|

| ||

| Chairman | ||

| Professor of Finance, Northeastern University College of Business Administration (since 1980); Director, | ||

| Republic Financial Corporation (since 2005); Advisory Board Member, Millennium Liquidation Fund, 2010– | ||

| Present; Director and Audit Committee Member, CypressTree Alternative Income Fund Inc. (2003–2004); | ||

| Director and Audit Committee Member, Prospect Street Debt Strategies Fund Inc. (1999–2003); Director | ||

| and Audit Committee Chairman, VSI Enterprises, Inc. (1998–2000); Director and Audit Committee | ||

| Member, Prospect Street High Income Portfolio Inc. (1988–2000). | ||

| John A. Frabotta,2 Born: 1942 | 2009 | 1 |

|

| ||

| Trustee | ||

| Retired. Former founding partner and Chief Investment Officer of Cypress Tree Investment | ||

| Management, LLC (1988–2009); Head of High Yield Research at Merrill Lynch, Pierce, Fenner & | ||

| Smith (1979–1988). | ||

| Non-Independent Trustee3 | ||

| Name, Year of Birth | Trustee | Number of |

| Position(s) held with Fund | of the | John Hancock |

| Principal occupation(s) and other | Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| Frank Saeli, Born: 1962 | 2009 | 1 |

|

| ||

| Head of Sales and Global Relationship Management for North America of MFC and member of | ||

| management committee and product steering committee, joined MFC in 2008. Prior to joining MFC | ||

| he was a Vice President and Principal at State Street Global Advisors. | ||

| Principal officers who are not Trustees | ||

| Name, Year of Birth | Officer | |

| Position(s) held with Fund | of the | |

| Principal occupation(s) and other | Trust | |

| directorships during past 5 years | since | |

| Barry H. Evans, Born: 1960 | 2009 | |

|

| ||

| President and Chief Executive Officer | ||

| Barry Evans is the Chief Investment Officer, Global Fixed Income & Country Head, US at Manulife Asset | ||

| Management and the President of Manulife Asset Management (US), LLC. Barry is responsible for all | ||

| US and international fixed income strategies managed by Manulife Asset Management, some of which | ||

| incorporate exposure to high yield and emerging market debt asset classes. He is a member of the firm’s | ||

| Senior Investment Policy Committee. Barry began his career in the financial industry in 1986 when he | ||

| joined John Hancock Advisers, the sister firm of Manulife Asset Management (US). | ||

| Collateral Investment Trust | Annual report |

| 20 |

| Principal officers who are not Trustees (continued) | |

| Name, Year of Birth | Officer |

| Position(s) held with Fund | of the |

| Principal occupation(s) and other | Trust |

| directorships during past 5 years | since |

| Carolyn M. Flanagan, Born: 1967 | 2009 |

|

| |

| Secretary and Chief Legal Officer | |

| Carolyn M. Flanagan is a vice president and the general counsel at Manulife Asset Management (US) | |

| LLC. She provides legal support for the firm’s mutual fund and institutional investment management | |

| business. Ms. Flanagan also serves as a member of the firm’s Senior Investment Policy Committee. | |

| Prior to joining the firm, Ms. Flanagan served as vice president and counsel at Wellington Management | |

| Company, LLP, and prior to that assistant vice president and counsel at State Street Bank and Trust | |

| Company. She is a member of the Massachusetts, Florida, and District of Columbia Bars. | |

| William E. Corson, Born: 1956 | 2009 |

|

| |

| Chief Compliance Officer | |

| William E. Corson is a vice president and the chief compliance officer at Manulife Asset Management | |

| (US) LLC, charged with oversight of all compliance related activities. Mr. Corson also serves as a member | |

| of the firm’s Senior Investment Policy Committee. Prior to joining the firm, Mr. Corson held chief | |

| compliance officer roles at Aladdin Capital Management, Pyramis Global Advisors (the institutional | |

| investment management firm of Fidelity Investments), and Lee Munder Capital Management. Earlier, he | |

| spent over 10 years at Investors Bank and Trust, where he was responsible for trust division operations | |

| and client service. He is a member of the Massachusetts Bar. | |

| Charles A. Rizzo, Born: 1957 | 2009 |

|

| |

| Chief Financial Officer | |

| Vice President, John Hancock Financial Services (since 2008); Chief Financial Officer, John Hancock retail | |

| funds, John Hancock Funds II and John Hancock Trust (since 2007); Senior Vice President, John Hancock | |

| Advisers, LLC and John Hancock Investment Management Services, LLC (since 2008); Assistant Treasurer, | |

| Goldman Sachs Mutual Fund Complex (2005–2007); Vice President, Goldman Sachs (2005–2007); | |

| Managing Director and Treasurer, Scudder Funds, Deutsche Asset Management (2003–2005). | |

| Michael J. Leary, Born: 1965 | 2009 |

|

| |

| Treasurer | |

| Assistant Vice President, John Hancock Financial Services (since 2007); Treasurer, John Hancock | |

| Funds II and John Hancock Trust (since 2009); Treasurer, John Hancock retail funds (2009–2010); Vice | |

| President, John Hancock Advisers, LLC and John Hancock Investment Management Services, LLC (since | |

| 2007); Assistant Treasurer, John Hancock retail funds (2007–2009 & 2010), John Hancock Funds II and | |

| John Hancock Trust (2007–2009) and John Hancock Funds III (since 2009); Vice President and Director | |

| of Fund Administration, JP Morgan (2004–2007). | |

The business address for Harlan D. Platt, John A. Frabotta, Frank Saeli, Barry H. Evans, Carolyn M. Flanagan and William E. Corson is 101 Huntington Avenue, Boston, Massachusetts 02199. The business address for Charles A. Rizzo and Michael J. Leary is 601 Congress Street, Boston, Massachusetts 02210.

The Statement of Additional Information of the Fund includes additional information about members of the Board of Trustees of the Fund and is available without charge, upon request, by calling 1-800-225-5291.

1 Each Trustee serves until resignation, retirement age or until his or her successor is elected.

2 Member of Audit Committee.

3 Non-Independent Trustees hold positions with the Fund’s investment adviser, underwriter and certain other affiliates.

| Annual report | Collateral Investment Trust |

| 21 |

More information

| Trustees | Investment adviser | |

| Harlan D. Platt* | John Hancock Asset Management | |

| John A. Frabotta* | a division of Manulife Asset Management (US) LLC | |

| Frank Saeli† | ||

| *Member of the Audit Committee | Placement agent | |

| †Non-Independent Trustee | John Hancock Funds, LLC | |

| Officers | Custodian | |

| Barry H. Evans | State Street Bank and Trust Company | |

| President and Chief Executive Officer | ||

| Carolyn M. Flanagan | Transfer agent | |

| Secretary and Chief Legal Officer | John Hancock Signature Services, Inc. | |

| William E. Corson | ||

| Chief Compliance Officer | Legal counsel | |

| Charles A. Rizzo | Skadden, Arps, Slate, Meagher & Flom LLP | |

| Chief Financial Officer | ||

| Michael J. Leary | Independent registered public accounting firm | |

| Treasurer | PricewaterhouseCoopers LLP | |

|

|

||

| The report is certified under the Sarbanes-Oxley Act, | ||

| which requires mutual funds and other public companies | ||

| to affirm that, to the best of their knowledge, the information | ||

| in their financial reports is fairly and accurately stated in | ||

| all material respects. | ||

|

|

||

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to receive information on the operation of the SEC's Public Reference Room.

| 22 |

ITEM 2. CODE OF ETHICS.

As of the end of the year, December 31, 2010, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its Chief Executive Officer, Chief Financial Officer and Treasurer (respectively, the principal executive officer, the principal financial officer and the principal accounting officer, the “Senior Financial Officers”). A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Trustees have determined that a member of the audit committee, Mr. John Frabotta, is an audit committee financial expert. Mr. Frabotta is an independent trustee by virtue of being not an "interested" person of the Trust (as defined under the Investment Company Act of 1940, as amended) whose sole compensation from the Trust is his Trustees' fees.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees billed for professional services rendered by the principal accountant(s) for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant(s) in connection with statutory and regulatory filings or engagements amounted to $50,226 for the fiscal year ended December 31, 2010 and $48,032 for the fiscal period ended December 31, 2009 for John Hancock Collateral Investment Trust. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(b) Audit-Related Services

Audit-related service fees amounted to $0 for the fiscal year ended December 31, 2010 and $0 for the fiscal period ended December 31, 2009 for John Hancock Collateral Investment Trust billed to the registrant or to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant ("control affiliates").

(c) Tax Fees

The aggregate fees billed for professional services rendered by the principal accountant(s) for the tax compliance, tax advice and tax planning (“tax fees”) amounted to $2,575 for the fiscal year ended December 31, 2010 and $1,561 for the fiscal period ended December 31, 2009 for John Hancock Collateral Investment Trust. The nature of the services comprising the tax fees was the review of the registrant’s income tax returns and tax distribution requirements. These fees were billed to the registrant and were approved by the registrant’s audit committee. There were no tax fees billed to the control affiliates.

(d) All Other Fees

Other fees amounted to $19 for the fiscal year ended December 31, 2010 and $0 for the fiscal period ended December 31, 2009 for John Hancock Collateral Investment Trust billed to the registrant or to the control affiliates.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by the independent registered public accounting firm (the “Auditor”) relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The trust’s Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of audit-related and non-audit services by the Auditor. The policies and procedures require that any audit-related and non-audit service provided by the Auditor and any non-audit service provided by the Auditor to a fund service provider that relates directly to the operations and financial reporting of a fund are subject to approval by the Audit Committee before such service is provided. Audit-related services provided by the Auditor that are expected to exceed $10,000 per instance/per fund are subject to specific pre-approval by the Audit Committee. Tax services provided by the Auditor that are expected to exceed $10,000 per instance/per fund are subject to specific pre-approval by the Audit Committee.

All audit services, as well as the audit-related and non-audit services that are expected to exceed the amounts stated above, must be approved in advance of provision of the service by formal resolution of the Audit Committee. At the regularly scheduled Audit Committee meetings, the Committee reviews a report summarizing the services, including fees, provided by the Auditor.

(e)(2) Services approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

Audit-Related Fees, Tax Fees and All Other Fees:

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

(f) According to the registrant’s principal accountant, for the fiscal year ended December 31, 2010, the percentage of hours spent on the audit of the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons who were not full-time, permanent employees of principal accountant was less than 50%.

(g) The aggregate non-audit fees billed by the registrant's accountant(s) for services rendered to the registrant and rendered to the registrant's control affiliates of the registrant was $2,690,164 for the fiscal year ended December 31, 2010 and $5,879,533 for the fiscal period ended December 31, 2009.

(h) The audit committee of the registrant has considered the non-audit services provided by the registrant’s principal accountant(s) to the control affiliates and has determined that the services that were not pre-approved are compatible with maintaining the principal accountant(s)' independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The registrant has a separately-designated standing audit committee comprised of independent trustees. The members of the audit committee are as follows:

Harlan D. Platt - Chairman

John A. Frabotta

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Not applicable.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not applicable.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) See attached Code of Ethics.

(a)(2) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c) Contact person at the registrant.

| SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Collateral Investment Trust

By: /s/ Barry H. Evans

________________

Barry H. Evans

President and Chief Executive Officer

Date: February 24, 2011

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Barry H. Evans

________________

Barry H. Evans

President and Chief Executive Officer

Date: February 24, 2011

By: /s/ Charles A. Rizzo

_________________

Charles A. Rizzo

Chief Financial Officer

Date: February 24, 2011