UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2020

__________________

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X |

Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

EXPLANATORY NOTE

Geopark Limited is filing this Amendment No. 1 (the “Form 6-K/A”) to its Form 6-K containing the Consolidated Financial Statements as of and for the year ended December 31, 2019 (the “Annual Financial Statements”), which was originally furnished to the Securities and Exchange Commission on March 4, 2020, solely to correct a typographical error in the name of the engagement partner included in the Report of Independent Registered Public Accounting Firm at December 31, 2019 and 2018, and for each of the three years in the period ended December 31, 2019 (the “Audit Report”). As noted in the new Audit Report furnished herewith, the name of the engagement partner included in the Audit Report is revised to state his full name, Hernan Pablo Rodriguez Cancelo Araujo, instead of only Hernan Rodriguez Cancelo.

Except as set forth above, this Form 6-K/A does not modify or update any of the disclosures in the Annual Financial Statements, which includes the Audit Report. No other changes were made to the previously filed Form 6-K. This Form 6-K/A does not reflect events that may have occurred subsequent to such filing, and does not modify or update information and disclosures made in the previously filed Form 6-K.

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM | |

| 1. | GeoPark Limited Consolidated Financial Statements as of and for the year ended December 31, 2019 |

Item 1

GEOPARK LIMITED

CONSOLIDATED

FINANCIAL STATEMENTS

As of and for the year ended December 31, 2019

GEOPARK LIMITED

DECEMBER 31, 2019

Contents

| 2 | Report of Independent Registered Public Accounting Firm | |

| 5 | Consolidated Statement of Income | |

| 6 | Consolidated Statement of Comprehensive Income | |

| 7 | Consolidated Statement of Financial Position | |

| 8 | Consolidated Statement of Changes in Equity | |

| 9 | Consolidated Statement of Cash Flow | |

| 10 | Notes to the Consolidated Financial Statements |

GEOPARK LIMITED

DECEMBER 31, 2019

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of GeoPark Limited

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of financial position of GeoPark Limited and its subsidiaries (the "Company") as of December 31, 2019 and 2018, and the related consolidated statements of income and of comprehensive income, changes in equity and cash flows, for each of the three years in the period ended December 31, 2019, including the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2019 in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our

audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether

due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis,

evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the

accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the

consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

2

Critical Audit Matters

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that (i) relates to accounts or disclosures that are material to the consolidated financial statements and (ii) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

The Impact of estimates of proven and probable Oil and Natural Gas Reserves on Property, Plant and Equipment, net

As described in Note 2, 4 and 20 to the consolidated financial statements, the Company’s consolidated property, plant & equipment, net was $567.8 million at December 31, 2019, depreciation expense and impairment loss for non-financial assets for the year ended December 31, 2019 was $102.9 million and $7.6 million, respectively. The Company follows the successful efforts method of accounting for its oil and gas activities. Under this method, all capitalized costs of proved oil and gas properties are amortized by the units-of-production method using proven and probable reserves and incorporating the estimated future cost of developing and extracting those reserves. Periodic revisions to the estimated oil and natural gas reserves and related future net cash flows may be necessary as a result of a number of factors, including expected reservoir characteristics based on geological, geophysical and engineering assessments; future production rates based on historical performance and expected future operating and investment activities; future oil and natural gas prices and quality differentials; assumed effects of regulation by governmental agencies; and future development and operating costs. The Company’s estimates of oil and natural gas reserves have been developed by specialists, specifically petroleum engineers, and certified by independent specialist engaged by the Company.

The

principal considerations for our determination that performing procedures relating to the impact of estimates of proven and probable

oil and natural gas reserves on property, plant and equipment, net is a critical audit matter are there was significant judgment

by management, including the use of specialists, when developing the estimates of proven and probable oil and natural gas reserves.

This in turn led to a high degree of auditor judgment, subjectivity and effort in performing procedures and evaluating the significant

assumptions used in developing those estimates, including future production rates, future oil and natural gas prices and quality

differentials, and future development and operating costs. In addition, the audit effort involved the use of professionals with

specialized skill and knowledge to assist in performing these procedures and evaluating the audit evidence obtained.

3

Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls relating to management’s estimates of proven and probable oil and natural gas reserves, the calculation of depreciation expense, and the impairment assessment of property, plant and equipment. These procedures also included, among others, evaluating the methods and significant assumptions used by management in developing these estimates, including future production rates, future oil and natural gas prices and quality differentials, and future development and operating costs, and testing the unit-of production rate used to calculate depreciation expense. The work of management’s specialists was used in performing the procedures to evaluate the reasonableness of these estimates of proven and probable oil and natural gas reserves. As a basis for using this work, the specialists’ qualifications and objectivity were understood, as well as the methods and assumptions used by the specialists. The procedures performed also included tests of the data used by the specialists and an evaluation of their findings. Evaluating the significant assumptions relating to the estimates of proven and probable oil and natural gas reserves also involved obtaining evidence to support the reasonableness of the assumptions, including whether the assumptions used were reasonable considering the past and current performance of the Company, and whether they were consistent with evidence obtained in other areas of the audit. In addition, for impairment tests, the audit effort involved the use of professionals with specialized skill and knowledge to assist in performing these procedures and evaluating the audit evidence obtained, comprising the Company’s discounted cash flow model and certain significant assumptions, including the discount.

/s/ PRICE WATERHOUSE & CO. S.R.L.

(Partner) |

|

/s/ Hernan Pablo Rodriguez Cancelo Araujo |

Autonomous

City of Buenos Aires, Argentina

March 4, 2020

We have served as the Company's auditor since 2009.

4

| CONSOLIDATED STATEMENT OF INCOME | ||||

| Amounts in US$ ´000 | Note | 2019 | 2018 | 2017 |

| REVENUE | 7 | 628,907 | 601,161 | 330,122 |

| Commodity risk management contracts | 8 | (22,523) | 16,173 | (15,448) |

| Production and operating costs | 9 | (168,964) | (174,260) | (98,987) |

| Geological and geophysical expenses | 12 | (18,593) | (13,951) | (7,694) |

| Administrative expenses | 13 | (60,818) | (52,074) | (42,054) |

| Selling expenses | 14 | (14,113) | (4,023) | (1,136) |

| Depreciation | (105,532) | (92,240) | (74,885) | |

| Write-off of unsuccessful exploration efforts | 20 | (18,290) | (26,389) | (5,834) |

| Impairment loss (recognized) reversed for non-financial assets | 20-37 | (7,559) | 4,982 | - |

| Other expenses | (1,840) | (2,887) | (5,088) | |

| OPERATING PROFIT | 210,675 | 256,492 | 78,996 | |

| Financial expenses | 15 | (41,070) | (39,321) | (53,511) |

| Financial income | 15 | 2,360 | 3,059 | 2,016 |

| Foreign exchange loss | 15 | (2,446) | (11,323) | (2,193) |

| PROFIT BEFORE INCOME TAX | 169,519 | 208,907 | 25,308 | |

| Income tax expense | 17 | (111,762) | (106,240) | (43,145) |

| PROFIT (LOSS) FOR THE YEAR | 57,757 | 102,667 | (17,837) | |

| Attributable to: | ||||

| Owners of the Company | 57,757 | 72,415 | (24,228) | |

| Non-controlling interest | - | 30,252 | 6,391 | |

| Earnings (Losses) per share (in US$) for profit (loss) attributable to owners of the Company. Basic | 19 | 0.96 | 1.19 | (0.40) |

| Earnings (Losses) per share (in US$) for profit (loss) attributable to owners of the Company. Diluted | 19 | 0.92 | 1.11 | (0.40) |

The notes on pages 10 to 89 are an integral part of these Consolidated Financial Statements.

5

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

| Amounts in US$ ´000 | 2019 | 2018 | 2017 | |

| Profit (Loss) for the year | 57,757 | 102,667 | (17,837) | |

| Other comprehensive income: | ||||

| Items that may be subsequently reclassified to profit or loss | ||||

| Currency translation differences | (1,498) | (4,401) | (512) | |

| Gains on cash flow hedges | 6,770 | - | - | |

| Income tax relating to gains on cash flow hedges | (2,166) | - | - | |

| Other comprehensive profit (loss) for the year | 3,106 | (4,401) | (512) | |

| Total comprehensive profit (loss) for the year | 60,863 | 98,266 | (18,349) | |

| Attributable to: | ||||

| Owners of the Company | 60,863 | 68,014 | (24,740) | |

| Non-controlling interest | - | 30,252 | 6,391 |

The notes on pages 10 to 89 are an integral part of these Consolidated Financial Statements.

6

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| Amounts in US$ ´000 | Note | 2019 | 2018 |

| ASSETS | |||

| NON-CURRENT ASSETS | |||

| Property, plant and equipment | 20 | 567,788 | 557,170 |

| Right-of-use assets | 28 | 13,462 | - |

| Prepayments and other receivables | 22 | 7,031 | 3,494 |

| Other financial assets | 25 | 10,985 | 10,570 |

| Deferred income tax asset | 18 | 26,934 | 31,793 |

| TOTAL NON-CURRENT ASSETS | 626,200 | 603,027 | |

| CURRENT ASSETS | |||

| Inventories | 23 | 11,447 | 9,309 |

| Trade receivables | 24 | 44,178 | 16,215 |

| Prepayments and other receivables | 22 | 51,016 | 54,659 |

| Derivative financial instrument assets | 25 | 8,097 | 27,539 |

| Other financial assets | 25 | 14 | 898 |

| Cash and cash equivalents | 25 | 111,180 | 127,727 |

| Assets held for sale | 36.2 | - | 23,286 |

| TOTAL CURRENT ASSETS | 225,932 | 259,633 | |

| TOTAL ASSETS | 852,132 | 862,660 | |

| EQUITY | |||

| Equity attributable to owners of the Company | |||

| Share capital | 26.1 | 59 | 60 |

| Share premium | 173,716 | 237,840 | |

| Reserves | 112,471 | 111,809 | |

| Accumulated losses | (153,361) | (206,688) | |

| Attributable to owners of the Company | 132,885 | 143,021 | |

| TOTAL EQUITY | 132,885 | 143,021 | |

| LIABILITIES | |||

| NON-CURRENT LIABILITIES | |||

| Borrowings | 27 | 420,138 | 429,027 |

| Lease liabilities | 28 | 5,801 | - |

| Provisions and other long-term liabilities | 29 | 62,062 | 42,577 |

| Deferred income tax liability | 18 | 10,850 | 14,801 |

| Trade and other payables | 30 | 5,475 | 14,789 |

| TOTAL NON-CURRENT LIABILITIES | 504,326 | 501,194 | |

| CURRENT LIABILITIES | |||

| Borrowings | 27 | 17,281 | 17,975 |

| Lease liabilities | 28 | 7,442 | - |

| Derivative financial instrument liabilities | 25 | 952 | - |

| Current income tax liabilities | 57,901 | 58,776 | |

| Trade and other payables | 30 | 131,345 | 131,420 |

| Liabilities associated with assets held for sale | 36.2 | - | 10,274 |

| TOTAL CURRENT LIABILITIES | 214,921 | 218,445 | |

| TOTAL LIABILITIES | 719,247 | 719,639 | |

| TOTAL EQUITY AND LIABILITIES | 852,132 | 862,660 | |

The notes

on pages 10 to 89 are an integral part of these Consolidated Financial Statements.

7

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Attributable to owners of the Company | |||||||

| Amount in US$ '000 |

Share Capital |

Share Premium |

Other Reserve |

Translation Reserve |

(Accumulated Losses) Retained Earnings |

Non-controlling Interest | Total |

| Equity at January 1, 2017 | 60 | 236,046 | 127,527 | 2,591 | (260,459) | 35,828 | 141,593 |

| Comprehensive income: | |||||||

| (Loss) Profit for the year | - | - | - | - | (24,228) | 6,391 | (17,837) |

| Other comprehensive loss for the year | - | - | - | (512) | - | - | (512) |

| Total Comprehensive (loss) profit for the year 2017 | - | - | - | (512) | (24,228) | 6,391 | (18,349) |

| Transactions with owners: | |||||||

| Share-based payment (Note 31) | 1 | 3,145 | - | - | 754 | 175 | 4,075 |

| Dividends distribution to non-controlling interest | - | - | - | - | - | (479) | (479) |

| Total 2017 | 1 | 3,145 | - | - | 754 | (304) | 3,596 |

| Balances at December 31, 2017 | 61 | 239,191 | 127,527 | 2,079 | (283,933) | 41,915 | 126,840 |

| Comprehensive income: | |||||||

| Profit for the year | - | - | - | - | 72,415 | 30,252 | 102,667 |

| Other comprehensive loss for the year | - | - | - | (4,401) | - | - | (4,401) |

| Total Comprehensive (loss) profit for the year 2018 | - | - | - | (4,401) | 72,415 | 30,252 | 98,266 |

| Transactions with owners: | |||||||

| Share-based payment (Note 31) | - | 449 | - | - | 4,830 | 167 | 5,446 |

| Repurchase of shares (Note 26.1) | (1) | (1,800) | - | - | - | - | (1,801) |

| Dividends distribution to non-controlling interest | - | - | - | - | - | (8,089) | (8,089) |

| Transactions with non-controlling interest (Note 36.1) | - | - | (13,396) | - | - | (64,245) | (77,641) |

| Total 2018 | (1) | (1,351) | (13,396) | - | 4,830 | (72,167) | (82,085) |

| Balances at December 31, 2018 | 60 | 237,840 | 114,131 | (2,322) | (206,688) | - | 143,021 |

| Comprehensive income: | |||||||

| Profit for the year | - | - | - | - | 57,757 | - | 57,757 |

| Other comprehensive income (loss) for the year | - | - | 4,604 | (1,498) | - | - | 3,106 |

| Total Comprehensive profit (loss) for the year 2019 | - | - | 4,604 | (1,498) | 57,757 | - | 60,863 |

| Transactions with owners: | |||||||

| Share-based payment (Note 31) | 3 | 7,144 | - | - | (4,430) | - | 2,717 |

| Repurchase of shares (Note 26.1) | (4) | (71,268) | - | - | - | - | (71,272) |

| Cash distribution (Note 26.2) | - | - | (2,444) | - | - | - | (2,444) |

| Total 2019 | (1) | (64,124) | (2,444) | - | (4,430) | - | (70,999) |

| Balances at December 31, 2019 | 59 | 173,716 | 116,291 | (3,820) | (153,361) | - | 132,885 |

The notes

on pages 10 to 89 are an integral part of these Consolidated Financial Statements.

8

CONSOLIDATED STATEMENT OF CASH FLOW

| Amounts in US$ '000 | Note | 2019 | 2018 | 2017 |

| Cash flows from operating activities | ||||

| Profit (Loss) for the year | 57,757 | 102,667 | (17,837) | |

| Adjustments for: | ||||

| Income tax expense | 17 | 111,762 | 106,240 | 43,145 |

| Depreciation | 105,532 | 92,240 | 74,885 | |

| Loss on disposal of property, plant and equipment | 143 | 272 | 190 | |

| Impairment loss for non-financial assets | 20-37 | 7,559 | (4,982) | - |

| Write-off of unsuccessful exploration efforts | 20 | 18,290 | 26,389 | 5,834 |

| Accrual of borrowing’s interests | 29,573 | 30,444 | 28,879 | |

| Borrowings cancellation costs | 15 | - | - | 17,575 |

| Amortization of other long-term liabilities | 29 | (429) | (1,005) | (657) |

| Unwinding of long-term liabilities | 15 | 4,560 | 3,505 | 2,779 |

| Accrual of share-based payment | 2,717 | 5,446 | 4,075 | |

| Foreign exchange loss | 15 | 2,446 | 11,323 | 2,193 |

| Unrealized loss (gain) on commodity risk management contracts | 8 | 26,411 | (42,271) | 13,300 |

| Income tax paid | (88,638) | (67,704) | (6,925) | |

| Changes in working capital | 5 | (42,254) | (6,358) | (25,278) |

| Cash flows from operating activities – net | 235,429 | 256,206 | 142,158 | |

| Cash flows from investing activities | ||||

| Purchase of property, plant and equipment | (126,316) | (124,744) | (105,604) | |

| Acquisition of business | 36.4 | - | (48,850) | - |

| Proceeds from disposal of long-term assets | 36.2 | 7,066 | 9,000 | - |

| Cash flows used in investing activities – net | (119,250) | (164,594) | (105,604) | |

| Cash flows from financing activities | ||||

| Proceeds from borrowings | - | 36,017 | 425,000 | |

| Debt issuance costs paid | - | - | (6,683) | |

| Principal paid | (9,790) | (15,073) | (355,022) | |

| Interest paid | (29,099) | (27,695) | (27,688) | |

| Borrowings cancellation costs paid | - | - | (12,315) | |

| Lease payments | (4,855) | - | - | |

| Repurchase of shares | 26.1 | (71,272) | (1,801) | - |

| Proceeds from cash calls from related parties | - | - | 1,155 | |

| Dividends distribution to non-controlling interest | - | (8,089) | (479) | |

| Cash distribution | 26.2 | (2,444) | - | - |

| Payments for transactions with non-controlling interest | 36.1 | (15,000) | (81,000) | - |

| Cash flows (used in) from financing activities - net | (132,460) | (97,641) | 23,968 | |

| Net (decrease) increase in cash and cash equivalents | (16,281) | (6,029) | 60,522 | |

| Cash and cash equivalents at January 1 | 127,727 | 134,755 | 73,563 | |

| Currency translation differences | (266) | (999) | 670 | |

| Cash and cash equivalents at the end of the year | 111,180 | 127,727 | 134,755 | |

| Ending Cash and cash equivalents are specified as follows: | ||||

| Cash in bank and bank deposits | 111,159 | 127,707 | 134,734 | |

| Cash in hand | 21 | 20 | 21 | |

| Cash and cash equivalents | 111,180 | 127,727 | 134,755 |

The notes on pages 10 to 89 are an integral part of these Consolidated Financial Statements.

9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note

| 1 | General Information |

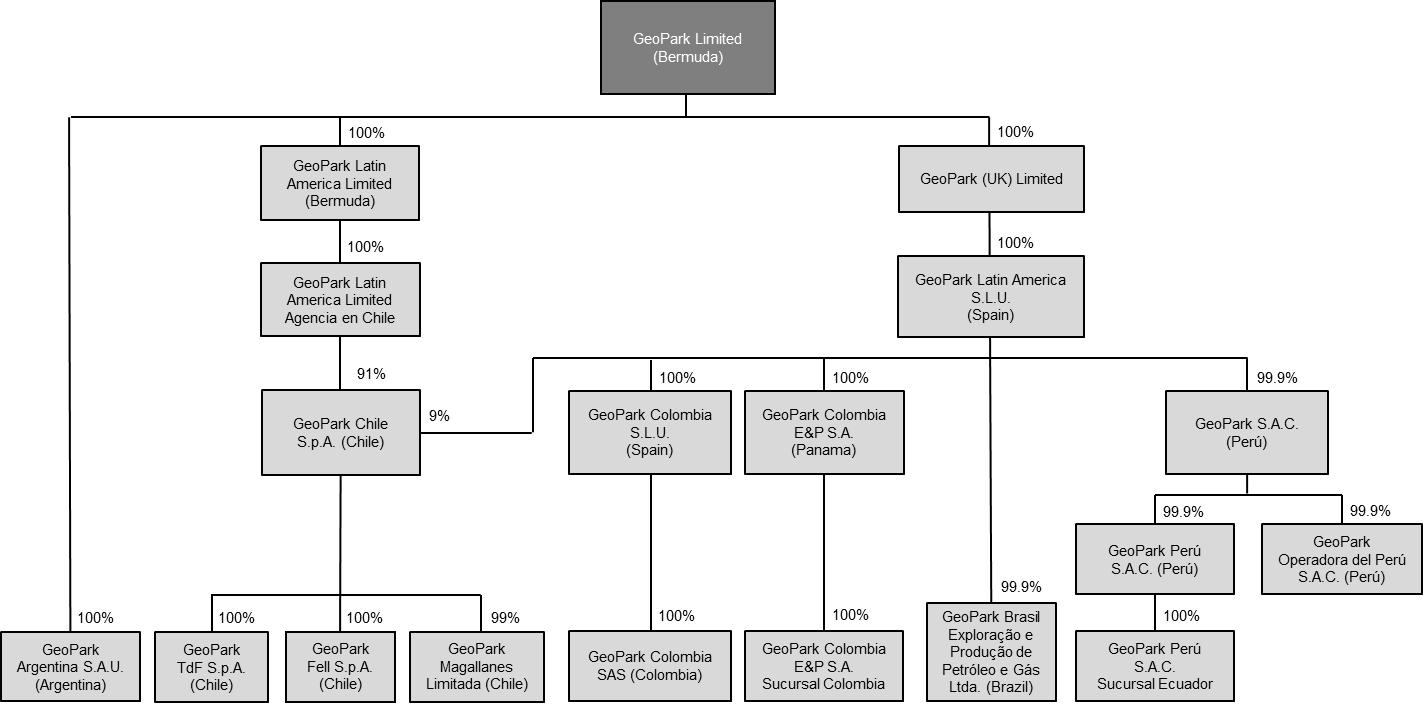

GeoPark Limited (the “Company”) is a company incorporated under the law of Bermuda. The Registered Office address is Clarendon House, 2 Church Street, Hamilton HM11, Bermuda.

The principal activities of the Company and its subsidiaries (the “Group” or “GeoPark”) are exploration, development and production for oil and gas reserves in Colombia, Chile, Brazil, Argentina, Peru and Ecuador.

These Consolidated Financial Statements were authorized for issue by the Board of Directors on March 4, 2020.

Note

| 2 | Summary of significant accounting policies |

The principal accounting policies applied in the preparation of these Consolidated Financial Statements are set out below. These policies have been consistently applied to the years presented, unless otherwise stated.

| 2.1 | Basis of preparation |

The Consolidated Financial Statements of GeoPark Limited have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), under the historical cost basis, except for the following: certain financial assets and liabilities (including derivative instruments) measured at fair value, and assets held for sale – measured at fair value less costs to sell.

The Consolidated Financial Statements are presented in thousands of United States Dollars (US$'000) and all values are rounded to the nearest thousand (US$'000), except in the footnotes and where otherwise indicated.

The preparation of financial statements in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group’s accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the Consolidated Financial Statements are disclosed in this note under the title “Accounting estimates and assumptions”.

All the information included in these Consolidated Financial Statements corresponds to the Group, except where otherwise indicated.

During the year ended December 31, 2019, the Group income tax expense included an out of period adjustment related to prior periods that increased the income tax expense for US$ 9,910,000. The adjustment is related to the increase in deferred tax liabilities as a result of computing as temporary differences originally considered permanent, generated between the tax and book basis of Property, plant and equipment. The Group concluded that this adjustment was not material to the current year or to any previously reported Consolidated Financial Statements.

10

Note

| 2 | Summary of significant accounting policies (continued) |

| 2.1 | Basis of preparation (continued) |

2.1.1 Changes in accounting policy and disclosure

New and amended standards adopted by the Group

The following standards have been adopted by the Group for the first time for the financial year beginning on or after January 1, 2019:

| · | IFRS 16 Leases |

| · | Prepayment Features with Negative Compensation – Amendments to IFRS 9 |

| · | Long-term Interests in Associates and Joint Ventures – Amendments to IAS 28 |

| · | Annual Improvements to IFRS Standards 2015 – 2017 Cycle |

| · | Plan Amendment, Curtailment or Settlement – Amendments to IAS 19 |

| · | Interpretation 23 Uncertainty over Income Tax Treatments. |

The Group also elected to adopt the following amendments early:

| · | Definition of Material – Amendments to IAS 1 and IAS 8. |

IFRS 16 - Leases

The Group has adopted IFRS 16 following the simplified approach, and has not restated comparative figures for previous reporting periods, as permitted under the specific transitional provisions in the standard. The impacts arising from the new leasing rules are therefore recognized in the opening balance sheet on January 1, 2019.

On adoption of IFRS 16, the Group recognized lease liabilities in relation to leases which had previously been classified as ‘operating leases’ under the principles of IAS 17 Leases. These liabilities were measured at the present value of the remaining lease payments, discounted using the lessee’s incremental borrowing rate as of January 1, 2019. The weighted average lessee’s incremental borrowing rate applied to the lease liabilities on January 1, 2019 was 9.4%.

The table below summarizes the initial measurement of lease liabilities:

| Amounts in US$ '000 | Total |

| Operating lease commitments disclosed as at December 31, 2018 (Note 33.3) | 69,938 |

| (Less) Contracts reassessed as not being lease contracts in accordance with IFRS 16 | (34,239) |

| (Less) Short-term leases not recognized as a liability | (17,537) |

| (Less) Low-value leases not recognized as a liability | (341) |

| Lease liabilities recognized as at January 1, 2019 (at nominal value) | 17,821 |

| Lease liabilities recognized as at January 1, 2019 (at present value) | 14,610 |

| Classified as follows: | |

| Current | 7,967 |

| Non-current | 6,643 |

11

Note

| 2 | Summary of significant accounting policies (continued) |

| 2.1 | Basis of preparation (continued) |

2.1.1 Changes in accounting policy and disclosure (continued)

The table below summarizes the recognition of assets related to the adoption of IFRS 16:

| Amounts in US$ '000 | Total |

| Right-of-use assets at January 1, 2019 | 14,610 |

| Additions | 2,496 |

| Depreciation during the period | (3,644) |

| Right-of-use assets at December 31, 2019 | 13,462 |

Impact on segment information

As a result of the change in the accounting policy, segment assets as of December 31, 2019 increased for the amount of the Right-of-use assets. Nevertheless, there is no impact on Adjusted EBITDA as a consequence of the adoption of this new standard, as specified in the indenture governing the Notes issued by the Company which considers IFRS in effect as of September 21, 2017.

Practical expedients applied

In applying IFRS 16 for the first time, the Group has used the following practical expedients permitted by the standard:

| · | the use of a single discount rate to a portfolio of leases with reasonably similar characteristics, |

| · | reliance on previous assessments on whether leases are onerous, |

| · | the accounting for operating leases with a remaining lease term of less than 12 months as at January 1, 2019 as short-term leases, |

| · | the exclusion of initial direct costs for the measurement of the right-of-use asset at the date of initial application, and |

| · | the use of hindsight in determining the lease term where the contract contains options to extend or terminate the lease. |

Accounting for the Group’s leasing activities

The Group leases various offices, facilities, machinery and equipment. Lease contracts are typically made for fixed periods of 1 to 7 years but may have extension options. Lease terms are negotiated on an individual basis and contain a wide range of different terms and conditions. The lease agreements do not impose any covenants, but leased assets may not be used as security for borrowing purposes.

Until the 2018 financial year, leases of property, plant and equipment were classified as either finance or operating leases. Payments made under operating leases (net of any incentives received from the lessor) were charged to profit or loss on a straight-line basis over the period of the lease.

12

Note

| 2 | Summary of significant accounting policies (continued) |

| 2.1 | Basis of preparation (continued) |

2.1.1 Changes in accounting policy and disclosure (continued)

From January 1, 2019, leases are recognized as a right-of-use asset and a corresponding liability at the date at which the leased asset is available for use by the Group. Each lease payment is allocated between the liability and finance expenses. The finance expense is charged to the Condensed Consolidated Statement of Income over the lease period so as to produce a constant periodic rate of interest on the remaining balance of the liability for each period. The right-of-use asset is depreciated over the shorter of the asset's useful life and the lease term on a straight-line basis.

Assets and liabilities arising from a lease are initially measured on a present value basis. Lease liabilities include the net present value of the following lease payments:

| · | fixed payments, less any lease incentives receivable, |

| · | variable lease payments that are based on an index or a rate, |

| · | amounts expected to be payable by the lessee under residual value guarantees, |

| · | the exercise price of a purchase option if the lessee is reasonably certain to exercise that option, and |

| · | payments of penalties for terminating the lease, if the lease term reflects the lessee exercising that option. |

The lease payments are discounted using the interest rate implicit in the lease. If that rate cannot be determined, the lessee’s incremental borrowing rate is used, being the rate that the lessee would have to pay to borrow the funds necessary to obtain an asset of similar value in a similar economic environment with similar terms and conditions.

Right-of-use assets are measured at cost comprising the following:

| · | the amount of the initial measurement of lease liability, |

| · | any lease payments made at or before the commencement date less any lease incentives received, |

| · | any initial direct costs, and |

| · | restoration costs. |

Payments associated with short-term leases and leases of low-value assets are recognized on a straight-line basis as an expense in the Condensed Consolidated Statement of Income. Short-term leases are leases with a lease term of 12 months or less. Low-value asses comprise IT equipment and small items of office furniture.

The adoption of the other amendments listed above did not have any impact on the amounts recognized in prior and current periods and are not expected to significantly affect future periods.

New standards, amendments and interpretations issued but not effective for the financial year beginning January 1, 2019 and not early adopted.

Certain new accounting standards and interpretations have been published that are not mandatory for December 31, 2019 reporting periods and have not been early adopted by the Group. These standards are not expected to have a material impact on the entity in the current or future reporting periods and on foreseeable future transactions.

13

Note

| 2 | Summary of significant accounting policies (continued) |

| 2.2 | Going concern |

The Directors regularly monitor the Group's cash position and liquidity risks throughout the year to ensure that it has sufficient funds to meet forecast operational and investment funding requirements. Sensitivities are run to reflect latest expectations of expenditures, oil and gas prices and other factors to enable the Group to manage the risk of any funding short falls and/or potential debt covenant breaches.

Considering macroeconomic environment conditions, the performance of the operations, the US$ 425,000,000 and US$ 350,000,000 debt fundraisings completed in September 2017 and January 2020, respectively (see Notes 27 and 38.2), the Group’s cash position, and the fact that over 96% of its total indebtedness as of December 31, 2019 matures in 2024, the Directors have formed a judgement, at the time of approving the financial statements, that there is a reasonable expectation that the Group has adequate resources to meet all its obligations for the foreseeable future. For this reason, the Directors have continued to adopt the going concern basis in preparing the Consolidated Financial Statements.

| 2.3 | Consolidation |

Subsidiaries are all entities (including structured entities) over which the Group has control. The Group controls an entity when the Group is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are deconsolidated from the date that control ceases.

The Group applies the acquisition method to account for business combinations. The consideration transferred for the acquisition of a subsidiary is the fair value of the assets transferred, the liabilities incurred by the former owners of the acquiree and the equity interests issued by the Group. The consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Identifiable assets acquired, and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. Acquisition-related costs are expensed as incurred.

The excess of the consideration transferred over the fair value of the identifiable net assets acquired is recorded as goodwill. If the total of consideration transferred is less than the fair value of the net assets of the subsidiary acquired in the case of a bargain purchase, the difference is recognized directly in the income statement.

Intercompany transactions, balances and unrealized gains on transactions between the Group and its subsidiaries are eliminated. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred. Amounts reported in the financial statements of subsidiaries have been adjusted where necessary to ensure consistency with the accounting policies adopted by the Group.

14

Note

| 2 | Summary of significant accounting policies (continued) |

| 2.4 | Segment reporting |

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing performance of the operating segments, has been identified as the Executive Committee. This committee is integrated by the CEO, COO, CFO and managers in charge of the Geoscience, Operations, Corporate Governance, Finance and People departments. This committee reviews the Group’s internal reporting in order to assess performance and allocate resources. Management has determined the operating segments based on these reports.

| 2.5 | Foreign currency translation |

2.5.1 Functional and presentation currency

The Consolidated Financial Statements are presented in US Dollars, which is the Group’s presentation currency.

Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The functional currency of Group companies incorporated in Colombia, Chile, Argentina, Peru and Ecuador is the US Dollar, meanwhile for the Group´s Brazilian company the functional currency is the local currency, which is the Brazilian Real.

2.5.2 Transactions and balances

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at period-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in the Consolidated Statement of Income.

The results and financial position of foreign operations that have a functional currency different from the presentation currency are translated into the presentation currency as follows: assets and liabilities are translated at the closing rate, and income and expenses are translated at average exchange rates. All resulting exchange differences are recognized in Other comprehensive income.

| 2.6 | Joint arrangements |

Under IFRS 11 investments in joint arrangements are classified as either joint operations or joint ventures depending on the contractual rights and obligations of each investor.

The Group has assessed the nature of its joint arrangements and determined them to be joint operations. The Group combines its share in the joint operations individual assets, liabilities, results and cash flows on a line-by-line basis with similar items in its financial statements.

15

Note

| 2 | Summary of significant accounting policies (continued) |

| 2.7 | Revenue recognition |

Revenue from the sale of crude oil and gas is recognized in the Consolidated Statement of Income when control is transferred to the purchaser, and if the revenue can be measured reliably and is expected to be received. Revenue is shown net of VAT, discounts related to the sale and overriding royalties due to the ex-owners of oil and gas properties where the royalty arrangements represent a retained working interest in the property. See Note 33.1.

| 2.8 | Production and operating costs |

Production and operating costs are recognized in the Consolidated Statement of Income on the accrual basis of accounting. These costs include wages and salaries incurred to achieve the revenue for the year. Direct and indirect costs of raw materials and consumables, rentals, and royalties are also included within this account.

| 2.9 | Financial results |

Financial results include interest expenses, interest income, bank charges, the amortization of financial assets and liabilities, and foreign exchange gains and losses. The Group has capitalized the borrowing cost directly attributable to wells and facilities identified as qualifying assets. Qualifying assets are assets that necessarily take a substantial period of time to get ready for their intended use or sale. The capitalization rate used to determine the amount of borrowing costs to be capitalized is the weighted average interest rate applicable to the Group’s general borrowings during the year, which was 6.90% at year-end 2019 (6.90% at year-end 2018 and 6.90% in 2017). Amounts capitalized during the year amounted to US$ 366,561 (US$ 257,507 in 2018 and US$ 610,841 in 2017).

2.10 Property, plant and equipment

Property, plant and equipment are stated at historical cost less depreciation and impairment charges, if applicable. Historical cost includes expenditure that is directly attributable to the acquisition of the items; including provisions for asset retirement obligation.

Oil and gas exploration and production activities are accounted for in accordance with the successful efforts method on a field by field basis. The Group accounts for exploration and evaluation activities in accordance with IFRS 6, Exploration for and Evaluation of Mineral Resources, capitalizing exploration and evaluation costs until such time as the economic viability of producing the underlying resources is determined. Costs incurred prior to obtaining legal rights to explore are expensed immediately to the Consolidated Statement of Income.

Exploration and evaluation costs may include: license acquisition, geological and geophysical studies (i.e.: seismic), direct labour costs and drilling costs of exploratory wells. No depreciation and/or amortization are charged during the exploration and evaluation phase. Upon completion of the evaluation phase, the prospects are either transferred to oil and gas properties or charged to expense (exploration costs) in the period in which the determination is made, depending whether they have discovered reserves or not. If not developed, exploration and evaluation assets are written off after three years, unless it can be clearly demonstrated that the carrying value of the investment is recoverable.

16

Note

| 2 | Summary of significant accounting policies (continued) |

2.10 Property, plant and equipment (continued)

A charge of US$ 18,290,000 has been recognized in the Consolidated Statement of Income within Write-off of unsuccessful exploration efforts (US$ 26,389,000 in 2018 and US$ 5,834,000 in 2017). See Note 20.

All field development costs are considered construction in progress until they are finished and capitalized within oil and gas properties, and are subject to depreciation once completed. Such costs may include the acquisition and installation of production facilities, development drilling costs (including dry holes, service wells and seismic surveys for development purposes), project-related engineering and the acquisition costs of rights and concessions related to proved properties.

Workovers of wells made to develop reserves and/or increase production are capitalized as development costs. Maintenance costs are charged to the Consolidated Statement of Income when incurred.

Capitalized costs of proved oil and gas properties and production facilities and machinery are depreciated on a licensed area by the licensed area basis, using the unit of production method, based on commercial proved and probable reserves. The calculation of the “unit of production” depreciation takes into account estimated future finding and development costs and is based on current year-end unescalated price levels. Changes in reserves and cost estimates are recognized prospectively. Reserves are converted to equivalent units on the basis of approximate relative energy content.

Depreciation of the remaining property, plant and equipment assets (i.e. furniture and vehicles) not directly associated with oil and gas activities has been calculated by means of the straight-line method by applying such annual rates as required to write-off their value at the end of their estimated useful lives. The useful lives range between 3 years and 10 years.

Depreciation is allocated in the Consolidated Statement of Income as a separate line to better follow the performance of the business.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount (see Impairment of non-financial assets in Note 2.12).

2.11 Provisions and other long-term liabilities

Provisions for asset retirement obligations and other environmental liabilities, deferred income, restructuring obligations and legal claims are recognized when the Group has a present legal or constructive obligation as a result of past events; it is probable that an outflow of resources will be required to settle the obligation; and the amount has been reliably estimated. Restructuring provisions, if any, comprise lease termination penalties and employee termination payments.

Provisions are measured at the present value of the expenditures expected to be required to settle the obligation using a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the obligation. The increase in the provision due to the passage of time is recognized as financial expense.

17

Note

| 2 | Summary of significant accounting policies (continued) |

2.11 Provisions and other long-term liabilities (continued)

2.11.1 Asset Retirement Obligation

The Group records the fair value of the liability for asset retirement obligations in the period in which the wells are drilled. When the liability is initially recorded, the Group capitalizes the cost by increasing the carrying amount of the related long-lived asset. Over time, the liability is accreted to its present value at each reporting period, and the capitalized cost is depreciated over the estimated useful life of the related asset. According to interpretations and the application of current legislation, and on the basis of the changes in technology and the variations in the costs of restoration necessary to protect the environment, the Group has considered it appropriate to periodically re-evaluate future costs of well-capping. The effects of this recalculation are included in the financial statements in the period in which this recalculation is determined and reflected as an adjustment to the provision and the corresponding property, plant and equipment asset.

2.11.2 Deferred Income

Government grants relating to the purchase of property, plant and equipment and contributions received in cash from the Group’s clients to improve the project economics of gas wells are included in non-current liabilities as deferred income and they are credited to the Consolidated Statement of Income over the expected lives of the related assets. Grants from the government are recognized at their fair value where there is a reasonable assurance that the grant will be received and the Group will comply with all attached conditions.

2.12 Impairment of non-financial assets

Assets that are not subject to depreciation and/or amortization are tested annually for impairment. Assets that are subject to depreciation and/or amortization are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

An impairment loss is recognized for the excess of the asset’s carrying amount over its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (cash-generating units), generally a licensed area. Non-financial assets other than goodwill that suffered impairment are reviewed for possible reversal of the impairment at each reporting date.

No asset should be kept as an exploration and evaluation asset for a period of more than three years, except if it can be clearly demonstrated that the carrying value of the investment will be recoverable.

During 2019, impairment loss was recognized for US$ 7,559,000 (impairment loss reversed for US$ 4,982,000 in 2018 and no impairment loss recognized or reversed in 2017). See Note 37. The write-offs are detailed in Note 20.

18

Note

| 2 | Summary of significant accounting policies (continued) |

2.13 Lease contracts

The Group has changed its accounting policy for leases where the Group is the lessee. The new policy and the impact of the change are described in Note 2.1.1.

All current lease contracts are considered to be operating leases on the basis that the lessor retains substantially all the risks and rewards related to the ownership of the leased asset. Until December 31, 2018, payments related to operating leases and other rental agreements were recognized in the Consolidated Income Statement on a straight-line basis over the term of the contract. The Group's total commitment relating to operating leases and rental agreements is disclosed in Note 33.3.

Leases in which substantially all of the risks and rewards of ownership are transferred to the lessee are classified as finance leases. Finance leases has to be recognized, at the lease’s inception, at the fair value of the leased property or, if lower, the present value of the minimum lease payments.

2.14 Inventories

Inventories comprise crude oil and materials.

Crude oil is measured at the lower of cost and net realizable value. Materials are measured at the lower of cost and recoverable amount. The cost of materials and consumables is calculated at acquisition price with the addition of transportation and similar costs. Cost is determined using the first-in, first-out (FIFO) method.

2.15 Current and deferred income tax

The tax expense for the year comprises current and deferred tax. Tax is recognized in the Consolidated Statement of Income.

The current income tax charge is calculated on the basis of the tax laws enacted or substantially enacted at the balance sheet date in the countries where the Company’s subsidiaries operate and generate taxable income. The computation of the income tax expense involves the interpretation of applicable tax laws and regulations in many jurisdictions. The resolution of tax positions taken by the Group, through negotiations with relevant tax authorities or through litigation, can take several years to complete and, in some cases, it is difficult to predict the ultimate outcome.

Deferred income tax is recognized, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the Consolidated Financial Statements. Deferred income tax is determined using tax rates (and laws) that have been enacted or substantially enacted as of the balance sheet date and are expected to apply when the related deferred income tax asset is realized, or the deferred income tax liability is settled.

In addition, the Group has tax-loss carry-forwards in certain tax jurisdictions that are available to be offset against future taxable profit. However, deferred tax assets are recognized only to the extent that it is probable that taxable profit will be available against which the unused tax losses can be utilized. Management judgment is exercised in assessing whether this is the case. To the extent that actual outcomes differ from management’s estimates, taxation charges or credits may arise in future periods.

19

Note

| 2 | Summary of significant accounting policies (continued) |

2.15 Current and deferred income tax (continued)

Deferred income tax liabilities are provided on taxable temporary differences arising from investments in subsidiaries and joint arrangements, except for deferred income tax liability where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future. The Group is able to control the timing of dividends from its subsidiaries and hence does not expect taxable profit. Hence deferred tax is recognized in respect of the retained earnings of overseas subsidiaries only if at the date of the statements of financial position, dividends have been accrued as receivable or a binding agreement to distribute past earnings in future has been entered into by the subsidiary. As mentioned above the Group does not expect that the temporary differences will revert in the foreseeable future. In the event that these differences revert in total (e.g. dividends are declared and paid), the deferred tax liability which the Group would have to recognize amounts to approximately US$ 4,000,000.

Deferred tax balances are provided in full, with no discounting.

2.16 Non-current assets or disposal groups held for sale

Non-current assets or disposal groups are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use and a sale is considered highly probable. They are measured at the lower of their carrying amount and fair value less costs to sell, except for assets such as deferred tax assets, assets arising from employee benefits, financial assets and investment property that are carried at fair value and contractual rights under insurance contracts, which are specifically exempt from this requirement.

An impairment loss is recognized for any initial or subsequent write-down of the asset or disposal group to fair value less costs to sell. A gain is recognized for any subsequent increases in fair value less costs to sell of an asset or disposal group, but not in excess of any cumulative impairment loss previously recognized. A gain or loss not previously recognized by the date of the sale of the non-current asset or disposal group is recognized at the date of derecognition.

Non-current assets (including those that are part of a disposal group) are not depreciated or amortized while they are classified as held for sale. Interest and other expenses attributable to the liabilities of a disposal group classified as held for sale continue to be recognized.

Non-current assets classified as held for sale and the assets of a disposal group classified as held for sale are presented separately from the other assets in the Consolidated Statement of Financial Position. The liabilities of a disposal group classified as held for sale are presented separately from other liabilities in the Consolidated Statement of Financial Position.

20

Note

| 2 | Summary of significant accounting policies (continued) |

2.17 Financial assets

Financial assets are divided into the following categories: amortized cost, financial assets at fair value through profit or loss and fair value through other comprehensive income. The classification depends on the Group’s business model for managing the financial assets and the contractual terms of the cash flows. The Group reclassifies debt investments when and only when its business model for managing those assets changes.

All financial assets not at fair value through profit or loss are initially recognized at fair value, plus transaction costs. Transaction costs of financial assets carried at fair value through profit or loss, if any, are expensed to profit or loss.

Derecognition of financial assets occurs when the rights to receive cash flows from the investments expire or are transferred and substantially all of the risks and rewards of ownership have been transferred. An assessment for impairment is undertaken at each balance sheet date.

Interest and other cash flows resulting from holding financial assets are recognized in the Consolidated Statement of Income when receivable, regardless of how the related carrying amount of financial assets is measured.

Amortized cost are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are included in current assets, except for maturities greater than twelve months after the balance sheet date. These are classified as non-current assets. These financial assets comprise trade and other receivables and cash and cash equivalents in the Consolidated Statement of Financial Position. They arise when the Group provides money, goods or services directly to a debtor with no intention of trading the receivables. These financial assets are subsequently measured at amortized cost using the effective interest method, less provision for impairment, if applicable.

Any change in their value through impairment or reversal of impairment is recognized in the Consolidated Statement of Income. All of the Group’s financial assets are classified as amortized cost.

2.18 Other financial assets

Non-current other financial assets include contributions made for environmental obligations according to a Colombian and Brazilian government request and are restricted for those purposes.

Current other financial assets include short-term investments with original maturities up to twelve months and over three months.

2.19 Impairment of financial assets

The Group assesses on a forward-looking basis the expected credit losses associated with its debt instruments. The impairment methodology applied depends on whether there has been a significant increase in credit risk. For trade receivables, the Group applies the simplified approach permitted by IFRS 9, which requires expected lifetime losses to be recognized from initial recognition of the receivables.

21

Note

| 2 | Summary of significant accounting policies (continued) |

2.20 Cash and cash equivalents

Cash and cash equivalents includes cash in hand, deposits held at call with banks, other short-term highly liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value, and bank overdrafts. Bank overdrafts, if any, are shown within borrowings in the current liabilities section of the Consolidated Statement of Financial Position.

2.21 Trade and other payables

Trade payables are obligations to pay for goods or services that have been acquired in the ordinary course of the business from suppliers. Accounts payable are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of the business if longer). If not, they are presented as non-current liabilities.

Trade payables are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method.

2.22 Derivatives and hedging activities

Derivative financial instruments are recognized in the statement of financial position as assets or liabilities and initially and subsequently measured at fair value. They are presented as current assets or liabilities if they are expected to be settled within 12 months after the end of the reporting period.

The mark-to-market fair value of the Group's outstanding derivative instruments is based on independently provided market rates and determined using standard valuation techniques, including the impact of counterparty credit risk and are within level 2 of the fair value hierarchy.

2.22.1 Cash flow hedges that qualify for hedge accounting

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is recognized in Other Reserve within Equity. The gain or loss relating to the ineffective portion is recognized immediately in the Consolidated Statement of Income.

When forward contracts are used to hedge forecast transactions, the Group designates the change in fair value of the forward contract as the hedging instrument. Gains or losses relating to the effective portion of the change in the fair value of the forward contracts are recognized in Other Reserve within Equity.

Where the hedged item subsequently results in the recognition of a non-financial asset, both the deferred hedging gains and losses and the deferred time value of the option contracts or deferred forward points, if any, are included within the initial cost of the asset.

22

Note

| 2 | Summary of significant accounting policies (continued) |

2.22 Derivatives and hedging activities (continued)

2.22.1 Cash flow hedges that qualify for hedge accounting (continued)

When a hedging instrument expires, or is sold or terminated, or when a hedge no longer meets the criteria for hedge accounting, any cumulative deferred gain or loss and deferred costs of hedging in Equity at that time remains in Equity until the forecast transaction occurs, resulting in the recognition of a non-financial asset. When the forecast transaction is no longer expected to occur, the cumulative gain or loss and deferred costs of hedging that were reported in Equity are immediately reclassified to the Consolidated Statement of Income.

For more information about derivatives designated as cash flow hedges please refer to Note 38.

2.22.2 Other Derivatives

Certain derivative instruments do not qualify for hedge accounting. Changes in the fair value of any derivative instrument that does not qualify for hedge accounting are recognized immediately in the Consolidated Statement of Income.

For more information about derivatives related to commodity risk management please refer to Note 8 and for more information about derivatives related to currency risk management please refer to Note 15.

2.23 Borrowings

Borrowings are obligations to pay cash and are recognized when the Group becomes a party to the contractual provisions of the instrument.

Borrowings are recognized initially at fair value, net of transaction costs incurred. Borrowings are subsequently stated at amortized cost; any difference between the proceeds (net of transaction costs) and the redemption value is recognized in the Consolidated Statement of Income over the period of the borrowings using the effective interest method.

Direct issue costs are charged to the Consolidated Statement of Income on an accrual basis using the effective interest method.

23

Note

| 2 | Summary of significant accounting policies (continued) |

2.24 Share capital

Equity comprises the following:

| · | "Share capital" representing the nominal value of equity shares. |

| · | "Share premium" representing the excess over nominal value of the fair value of consideration received for equity shares, net of expenses of the share issuance. |

| · | "Other reserve" representing: |

| - | the difference between the proceeds from the transaction with non-controlling interests received against the book value of the shares acquired in the Chilean and Colombian subsidiaries, and |

| - | the changes in the fair value of the effective portion of derivatives designated as cash flow hedges. |

| · | "Translation reserve" representing the differences arising from translation of investments in overseas subsidiaries. |

| · | "(Accumulated losses) Retained earnings" representing: |

| - | accumulated earnings and losses, and |

| - | the equity element attributable to shares granted according to IFRS 2 but not issued at year end. |

2.25 Share-based payment

The Group operates a number of equity-settled share-based compensation plans comprising share awards payments to employees and other third-party contractors. Share-based payment transactions are measured in accordance with IFRS 2.

Fair value of the stock option plan for employee or contractors services received in exchange for the grant of the options is recognized as an expense. The total amount to be expensed over the vesting period is determined by reference to the fair value of the options granted calculated using the Geometric Brownian Motion method.

Non-market vesting conditions are included in assumptions about the number of options that are expected to vest. At each balance sheet date, the entity revises its estimates of the number of options that are expected to vest. It recognizes the impact of the revision to original estimates, if any, in the Consolidated Statement of Income, with a corresponding adjustment to equity.

The fair value of the share awards payments is determined at the grant date by reference to the market value of the shares and recognized as an expense over the vesting period. When the awards are exercised, the Company issues new shares. The proceeds received net of any directly attributable transaction costs are credited to share capital (nominal value) and share premium when the options are exercised.

24

Note

| 3 | Financial Instruments-risk management |

The Group is exposed through its operations to the following financial risks:

| · | Currency risk |

| · | Price risk |

| · | Credit risk – concentration |

| · | Funding and liquidity risk |

| · | Interest rate risk |

| · | Capital risk management |

The policy for managing these risks is set by the Board of Directors. Certain risks are managed centrally, while others are managed locally following guidelines communicated from the corporate department. The policy for each of the above risks is described in more detail below.

Currency risk

In Colombia, Chile, Argentina, Peru and Ecuador the functional currency is the US Dollar. The fluctuation of the local currencies of these countries against the US Dollar, except for Ecuador where the local currency is the US Dollar, does not impact the loans, costs and revenue held in US Dollars; but it does impact the balances denominated in local currencies. Such is the case of the prepaid taxes.

In Colombian, Chilean, Argentinean and Peruvian subsidiaries most of the balances are denominated in US Dollars, and since it is the functional currency of the subsidiaries, there is no exposure to currency fluctuation except from receivables or payables originated in local currency mainly corresponding to VAT and income tax.

The Group minimises the local currency positions in Colombia, Chile, Argentina and Peru by seeking to balance local and foreign currency assets and liabilities. However, tax receivables (VAT) seldom match with local currency liabilities. Therefore, the Group maintains a net exposure to them, except for what it is described below.

Since December 2018, GeoPark decided to manage its future exposure to local currency fluctuation with respect to income tax balances in Colombia. Consequently, the Group entered into derivative financial instruments with local banks in Colombia, for an amount equivalent to US$ 83,700,000 as of December 31, 2019 (US$ 92,050,000 as of December 31, 2018), in order to anticipate any currency fluctuation with respect to income taxes to be paid during the first half of the following year. The Group’s derivatives are accounted for as non-hedge derivatives as of December 31, 2019 and 2018 and therefore all changes in the fair values of its derivative contracts are recognized as gains or losses in the results of the periods in which they occur. See the impact in the Consolidated Statement of Income in Note 15.

Most of the Group's assets held in those countries are associated with oil and gas productive assets. Those assets, even in the local markets, are generally settled in US Dollar equivalents.

During 2019, the Colombian Peso devalued by 1% (devalued by 9% in 2018 and revalued by 1% in 2017) against the US Dollar, the Chilean Peso devalued by 8% (devalued by 13% in 2018 and revalued by 8% in 2017), the Argentine Peso devalued by 59% (102% and 17% in 2018 and 2017) and the Peruvian Peso revalued by 2% (devalued by 4% in 2018 and revalued by 4% in 2017).

25

Note

| 3 | Financial Instruments-risk management (continued) |

Currency risk (continued)

If the Colombian Peso, the Chilean Peso, the Argentine Peso and the Peruvian Peso had each devalued an additional 10% against the US dollar, with all other variables held constant, post-tax profit for the year would have been lower by US$ 644,543 (post-tax profit lower by US$ 57,000 in 2018 and post-tax loss higher by US$ 1,538,000 in 2017).

In Brazil, the functional currency is the local currency, which is the Brazilian Real. The fluctuation of the US Dollars against the Brazilian Real does not impact the loans, costs and revenues held in Brazilian Real; but it does impact the balances denominated in US Dollars. Such is the case of the provision for asset retirement obligation and the lease liabilities. The intercompany loan that also used to be denominated in US Dollars was fully cancelled in October 2018, reducing significantly the exposure to foreign currency fluctuation. The exchange loss generated by the Brazilian subsidiary during 2019 amounted to US$ 664,000 (loss of US$ 5,862,000 in 2018 and loss of US$ 1,274,000 in 2017).

During 2019, the Brazilian Real devalued by 4% against the US Dollar (devalued by 17% in 2018 and devalued by 2% in 2017, respectively). If the Brazilian Real had devalued 10% against the US dollar, with all other variables held constant, post-tax profit for the year would have been lower by US$ 927,000 (post-tax profit lower by US$ 515,000 in 2018 and post-tax loss higher by US$ 3,100,000 in 2017).

As currency rate changes between the US Dollar and the local currencies, the Group recognizes gains and losses in the Consolidated Statement of Income.

In relation to the cash consideration payable for the acquisition of Amerisur Resources Plc, GeoPark was exposed to fluctuations of the British Pound Sterling (“GBP”) at year end. Consequently, the Group decided to manage this exposure by entering into a “Deal Contingent Forward” (DCF) with a UK Bank, in order to anticipate any currency fluctuation. This forward contract was accounted for as a cash flow hedge as of December 31, 2019 and therefore the effective portion of the changes in its fair value was recognized in Other Reserve within Equity. See Note 38.1.

Price risk

The realized oil price for the Group is linked to US dollar denominated crude oil international benchmarks. The market price of this commodity is subject to significant volatility and has historically fluctuated widely in response to relatively minor changes in the global supply and demand for oil, the geopolitical landscape, the economic conditions and a variety of additional factors. The main factors affecting realized prices for gas sales vary across countries with some closely linked to international references while others are more domestically driven.

In Colombia, the realized oil price is linked to the Vasconia crude reference price, a marker broadly used in the Llanos basin, adjusted for certain marketing and quality discounts based on, among other things, API, viscosity, sulphur content, water content, delivery point and transport costs.

26

Note

| 3 | Financial Instruments-risk management (continued) |

Price risk (continued)

In Chile, the oil price is based on Dated Brent minus certain marketing and quality discounts such as, API, sulphur content and others.

GeoPark has signed a long-term Gas Supply Contract with Methanex in Chile. The price of the gas sold under this contract is determined by a formula that considers a basket of international methanol prices, including US Gulf methanol spot barge prices, methanol spot Rotterdam prices and spot prices in Asia.

In Brazil, prices for gas produced in the Manati Field are based on a long-term off-take contract with Petrobras. The price of gas sold under this contract is denominated in Brazilian Real and is adjusted annually for inflation pursuant to the Brazilian General Market Price Index (Indice Geral de Preços do Mercado), or IGPM.

In Argentina, the realized oil prices for the production in the Neuquen Basin follows the “Medanito” blend oil price reference, which has traditionally been linked to ICE Brent adjusted by certain marketing and quality discounts based on API, delivery point and transport costs. Between August 16, 2019 and November 13, 2019, domestic crude oil prices were regulated industry-wide at a lower price than the international markets. After that, domestic prices have been deregulated and are agreed between sellers and buyers.

Gas sales in Argentina are carried out through annual contracts that go from May to April. The price of the gas sold under these contracts depends mainly on domestic supply and demand and regulation affecting the sector.

If oil and methanol prices had fallen by 10% compared to actual prices during the year, with all other variables held constant, considering the impact of the derivative contracts in place, post-tax profit for the year would have been lower by US$ 38,339,661 (post-tax profit lower by US$ 13,709,000 in 2018 and post-tax loss higher by US$ 10,423,000 in 2017).

GeoPark manages part of the exposure to crude oil price volatility using derivatives. The Group considers these derivative contracts to be an effective manner of properly managing commodity price risk. The price risk management activities mainly employ combinations of options and key parameters are based on forecasted production and budget price levels. GeoPark has also obtained credit lines from industry leading counterparties to minimize the potential cash exposure of the derivative contracts (see Note 8).

Credit risk – concentration

The Group’s credit risk relates mainly to accounts receivable where the credit risks correspond to the recognized values of commodities sold. GeoPark considers that there is no significant risk associated to the Group’s major customers and hedging counterparties.

27

Note

| 3 | Financial Instruments-risk management (continued) |

Credit risk – concentration (continued)

In Colombia, during 2019, the Colombian subsidiaries made 52% of the oil sales to Trafigura (one of the world’s leading independent commodity trading and logistics houses) and 38% to Ecopetrol (the State-owned oil and gas company), with these two clients accounting for 78% of the consolidated revenue for the same period. With the expiration of the long-term contract with Trafigura in December 2018, GeoPark begun diversifying its client base in Colombia, allocating sales on a competitive basis to industry leading participants including traders and other producers. The contracts extend through 2019 with no longer term delivery commitments in place. Delivery points include wellhead and other locations on the Colombian pipeline system. GeoPark manages its counterparty credit risk associated to sales contracts by including, in certain contracts, early payment conditions to minimize the exposure.

All the oil produced in Chile as well as the gas produced by TdF blocks until 2018 (5% of the consolidated revenue, 3% in 2018 and 5% in 2017) is sold to ENAP, the State-owned oil and gas company. In Chile, most of gas production is sold to the local subsidiary of Methanex, a Canadian public company (3% of the consolidated revenue, 3% in 2018 and 5% in 2017).

In Brazil, all the hydrocarbons from Manati Field are sold to Petrobras, the State-owned company, which is the operator of the Manati Field (4% of the consolidated revenue, 5% in 2018 and 10% in 2017). The crude oil production from the Reconcavo Basin since 2019 (representing less than a 1% of the consolidated revenue) is sold to local customers in the states of Bahia and Espirito Santo or also to Petrobras.

In Argentina, most of the gas produced is sold to Grupo Albanesi, a leading Argentine privately-held conglomerate focused on the energy market that offers natural gas, power supply and transport services to its customers. GeoPark has an annual agreement with this client in effect from May 2019 through April 2020. Gas sales in Argentina account for 1% of the consolidated revenues.

The oil sales in Argentina are diversified across clients and delivery points: i) 42% of the oil produced in Argentina (2% of the consolidated revenue) is sold locally in Neuquen, delivered at well-head; and ii) 58% of the oil produced in Argentina (3% of the consolidated revenue) is sold to major Argentinean refineries, delivered via pipeline. GeoPark manages the counterparty credit risk associated to sales contracts by limiting payment terms offered to minimize the exposure.

The forementioned companies all have a good credit standing and despite the concentration of the credit risk, the Directors do not consider there to be a significant collection risk.

GeoPark executes oil prices hedges via over-the-counter derivatives. Should oil prices drop, the Group could stand to collect from its counterparties under the derivative contracts. The Group’s hedging counterparties are leading financial institutions and trading companies, therefore the Directors do not consider there to be a significant collection risk.

See disclosure in Notes 8 and 25.

28

Note

| 3 | Financial Instruments-risk management (continued) |

Funding and Liquidity risk

In the past, the Group has been able to raise capital through different sources of funding including equity, strategic partnerships and financial debt.

The Group is positioned at the end of 2019 with a cash balance of US$ 111,180,000 and over 96% of its total indebtedness matures in 2024. In addition, the Group has a large portfolio of attractive and largely discretional projects - both oil and gas - in multiple countries with over 42,000 boepd in production at year end. This scale and positioning permit the Group to protect its financial condition and selectively allocate capital to the optimal projects subject to prevailing macroeconomic conditions.

The Indenture governing the Company Notes 2024 includes incurrence test covenants related to compliance with certain thresholds of Net Debt to Adjusted EBITDA ratio and Adjusted EBITDA to Interest ratio. Failure to comply with the incurrence test covenants does not trigger an event of default. However, this situation may limit the Group’s capacity to incur additional indebtedness, as specified in the indenture governing the Notes. As of the date of these Consolidated Financial Statements, the Group is in compliance with all the indenture’s provisions and covenants.

The most significant funding transactions executed during the last three years include: