UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2018

Commission File Number 000-55627

US ALLIANCE CORPORATION

|

Kansas |

26-4824142 |

|||

|

State of Incorporation |

IRS Employer Identification Number |

|||

|

4123 SW Gage Center Drive, Suite 240 Topeka, Kansas 66604 |

(785) 228-0200 |

|||

|

Address, including zip code, of principal executive offices |

Registrant's telephone number, including area code |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.10 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☑ |

||||

|

Emerging growth company |

☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

[As of February 4, 2019 the aggregate market value of voting and non-voting common equity held by non-affiliates of US Alliance could not be calculated as no established public trading market for our equity exists.]

Applicable only to registrants involved in bankruptcy proceedings during the preceding five years

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

No established public trading market for our common stock currently exists. As of February 4, 2019, 7,677,252 shares of our common stock were outstanding.

Documents Incorporated By Reference

[Information required by Part III of this Annual Report on Form 10-K is incorporated by reference to portions of our definitive proxy statement for our 2018 annual meeting of stockholders which we will file with the Securities and Exchange Commission within 120 days after the end of our fiscal year ended December 31, 2018.]

|

Item 1. |

1 |

|

|

Item 1A. |

7 |

|

|

Item 1B. |

11 |

|

|

Item 2. |

11 |

|

|

Item 3. |

11 |

|

|

Item 4. |

11 |

|

|

Item 5. |

12 |

|

|

Item 6. |

12 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

13 |

|

Item 7A. |

24 |

|

|

Item 8. |

24 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

24 |

|

Item 9A. |

24 |

|

|

Item 9B. |

24 |

|

|

Item 10. |

24 |

|

|

Item 11. |

24 |

|

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

25 |

|

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

25 |

|

Item 14. |

25 |

|

|

Item 15. |

26 |

|

|

26 |

||

|

29 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report, and the Annual Report to Shareholders of which this report is a part, contain forward-looking statements within the meaning of the U.S. federal securities laws. You can identify forward-looking statements by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “projects,” “may,” “will” or “should,” or the negative or other variation of these or similar words, or by discussions of strategy or risks and uncertainties, and similar references to future periods.

We base these and other forward-looking statements on our current expectations and assumptions regarding our business, the economy and other future conditions; however, our actual results may differ materially from those contemplated by the forward-looking statements. We caution you, therefore, that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of future performance. Forward-looking statements, which by their nature relate to the future, are subject to inherent uncertainties, risks and changes in circumstances which we cannot easily predict. Important factors that could cause actual results to differ materially and adversely from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions.

Any forward-looking statement made by us in this report speaks only as of the date of this report. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.

|

BUSINESS. |

Overview and History - US Alliance Corporation ("USAC") was formed as a Kansas corporation on April 24, 2009 to raise capital to form a new Kansas-based life insurance company. Our offices are located at 4123 SW Gage Center Drive, Suite 240, Topeka, Kansas 66604. Our telephone number is 785-228-0200 and our website address is www.usalliancecorporation.com.

USAC has five wholly-owned operating subsidiaries. US Alliance Life and Security Company ("USALSC") was formed June 9, 2011, to serve as our life insurance company. US Alliance Marketing Corporation ("USAMC") was formed April 23, 2012, to serve as a marketing resource. US Alliance Investment Corporation ("USAIC") was formed April 23, 2012 to serve as investment manager for USAC. Dakota Capital Life Insurance Company (“DCLIC”), was acquired on August 1, 2017 when USAC merged with Northern Plains Capital Corporation (“NPCC”). US Alliance Life and Security Company - Montana (USALSC-Montana) was acquired December 14, 2018. Both DCLIC and USALSC-Montana are wholly-owned subsidiaries of USALSC. Unless the context otherwise indicates, references in this registration statement to "we", "us", "our", or the "Company" refer collectively to USAC and its subsidiaries.

We initially capitalized our subsidiaries with proceeds from intrastate public offering(s) registered by qualification with the office of Kansas Securities Commissioner.

USALSC received a Certificate of Authority from the Kansas Insurance Department ("KID") effective January 2, 2012, and sold its first insurance product on May 1, 2013. USALSC currently offers the following eight product categories:

|

Solid Solutions Term Life Series®, Registered Trademark No 4,740,828. This simplified issue term life insurance product is designed to provide coverage with a face value of $250,000 or less. This product features limited underwriting and is offered with 10, 20, 25, and 30 year terms. |

|

Sound Solutions Term Life Series®, Registered Trademark No, 4,740,827. This is a fully underwritten term life insurance product designed to provide coverage for higher face amounts. This product features multiple risk classifications and is offered with 15, 20, 25 and 30 year terms. |

|

Pioneer Whole Life. This is a traditional whole life insurance product designed to provide permanent coverage with a limited premium paying period. This product is sold with death benefits typically ranging from $25,000 to $100,000. |

|

Legacy Juvenile Series®, Registered Trademark No. 4,577,835. This product is term life insurance to age 25 available for purchase on children up to the age of 16 in an amount of $10,000 or $20,000 with a one-time premium payment. |

|

American Annuity Series®, Registered Trademark No. 4,582,074. This product is a flexible premium deferred annuity with initial rates guaranteed for five years by company practice. |

|

Thoughtful Pre-Need Series®, Registered Trademark No 4,620,073. This series of products includes a single or multiple pay premium pre-need whole life insurance policy sold by funeral directors who are licensed by the KID in conjunction with a preplanned funeral. This product is typically sold with smaller death benefits than our traditional Pioneer Whole Life. |

|

Group Products. This is a series of group non-medical insurance products developed for the small group marketplace. These products are sold to employers and provide benefits for their employees. Our group suite of products includes group term life insurance, group long term disability, and group short term disability. |

|

Critical Illness. This individual policy provides cash benefits to the insured should certain defined illnesses or injuries occur. |

DCLIC received a Certificate of Authority from the North Dakota Insurance Department ("NDID") effective January 24, 2012. DCLIC currently offers the following eight product categories:

|

Prarie Term Life Series®, Registered Trademark No 5,266,633. This series of products include a simplified issue term life insurance product is designed to provide coverage with a face value of $250,000 or less and a fully underwritten term life insurance product designed to provide coverage for higher face amounts. |

|

Accumulator Whole Life. This is a hybrid product featuring a limited pay whole life insurance policy and a flexible premium deferred annuity rider. |

|

Frontier Whole Life. This is a traditional whole life insurance product designed to provide permanent coverage with a limited premium paying period. This product is sold with death benefits typically ranging from $25,000 to $100,000. |

|

Little Missouri Juvenile Series®, Registered Trademark No. 5,271,811. This product is term life insurance to age 25 available for purchase on children up to the age of 16 in an amount of $10,000 or $20,000 with a one-time premium payment. |

|

Badlands Annuity Series®, Registered Trademark No. 5,266,632. This product is a flexible premium deferred annuity with initial rates guaranteed for five years by company practice. |

|

Peace Garden Pre-Need Series®, Registered Trademark No. 5,271,810. This series of products includes a single or multiple pay premium pre-need whole life insurance policy sold by funeral directors who are licensed by the NDID in conjunction with a preplanned funeral. This product is typically sold with smaller death benefits than our traditional Frontier Whole Life. |

|

Dakota Group Series®, Registered Trademark No. 5,402,079. This is a series of group non-medical insurance products developed for the small group marketplace. These products are sold to employers and provide benefits for their employees. Our group suite of products includes group term life insurance, group long term disability, and group short term disability. |

|

Critical Illness. This individual policy provides cash benefits to the insured should certain defined illnesses or injuries occur. |

USALSC-Montana is not marketing products at this time.

Our single pay life products (which include our Juvenile and Pre-Need products) accounted for 62% of 2018 direct premium revenue. Our individual life and Critical Illness products (which include Term Life and Whole Life products) accounted for 24% of 2018 direct premium revenue. Our group products accounted for 14% of 2018 direct written premiums.

USALSC and DCLIC seek opportunities to develop and market additional products.

Our business model also seeks the acquisition by USAC and/or it’s subsidiaries of other insurance and insurance related companies, including third-party administrators, marketing organizations, and rights to blocks of insurance business through reinsurance or other transactions.

Material Agreements and Partners - Effective January 1, 2013, USALSC entered into a reinsurance agreement with Unified Life Insurance Company (“ULIC”) to assume 20% of a certain block of health insurance policies. This agreement renews annually unless either party provides written notice of its intent not to renew at least 120 days prior to the expiration of the then-current term. The agreement provides for monthly settlement. For the year ended December 31, 2018, USALSC assumed premiums of $3,770,426.

On September 1, 2015, USALSC entered into an agreement to provide certain insurance administrative functions, data processing systems, daily operational services, management consulting, and marketing development to Dakota Capital Life Insurance Company. This agreement has an initial term of 60 months (beginning on September 1, 2015), and requires 90-day advance written notice to terminate. In addition, the agreement requires that certain products will be exclusively administered by USALSC and administrative services with respect to such products may not be transferred without our consent. The agreement provides for monthly settlement. On August 1, 2017, DCLIC became a wholly-owned subsidiary of USALSC as described below. Subsequent to the acquisition of DCLIC, this agreement became an inter-company agreement and is eliminated as a part of the consolidation of the financial statements of the companies.

On August 1, 2017 the Company acquired NPCC pursuant to a Plan and Agreement of Merger dated May 23, 2017, under which Alliance Merger Sub, Inc. (“Acquisition”), a wholly owned subsidiary of the Company, merged with and into Northern Plains (“Merger”) with Acquisition being the surviving company. Pursuant to the agreement, the Company exchanged .5841 shares of the Company’s common stock for each share of Northern Plains common stock, or 1,644,458 shares. Subsequent to the merger, Acquisition was merged into the Company and DCLIC was contributed to USALSC.

On September 30, 2017, USALSC entered into a coinsurance agreement with American Life and Security Corporation (“ALSC”) to assume 100% of a certain block of life insurance policies. USALSC is also the servicer of this block of policies. USALSC paid a ceding commission of $1,850,000 and received $7,153,663 from ALSC. The agreement will remain in effect until all liabilities associated with this block of policies have been satisfied.

On December 14, 2018, USALSC acquired Great Western Life Insurance Company ("GWLIC") pursuant to a Stock Purchase agreement entered into on October 11, 2018 with Great Western Insurance Company, a wholly-owned subsidiary of American Enterprise Group, Inc. USALSC paid $500,000 to acquire all outstanding shares of GWLIC. Subsequent to the acquisition, GWLIC was renamed US Alliance Life and Security Company – Montana.

USAC uses the actuarial firm of Miller & Newberg to provide valuation, pricing and illustration actuarial services for USALSC and DCLIC.

Investments – USAC and USAIC contracted in 2013 with New England Asset Management (NEAM), a Berkshire Hathaway subsidiary, to manage the investments of USALSC and a portion of the investments of USAC. USALSC, DCLIC and USALSC-Montana have investment management agreements with USAIC, who has a sub-advisory agreement with NEAM. DCLIC was added to this agreement on August 1, 2017 and USALSC-Montana was added to this agreement on December 14, 2018. The investment parameters are determined by Kansas law, the KID, the North Dakota Insurance Department, and the Montana Insurance Department, as well as the internal investment policies of USALSC, DCLIC, USALSC-Montana and USAC.

USAC internally manages a portfolio of equities within its investment policy guidelines (as modified from time to time, "Investment Policy"), which consider type of investments and investment instruments, and establishes diversification benchmarks to help manage investment risk. USAC's investment in its subsidiaries is managed outside of its Investment Policy.

The USAC Investment Policy may be modified by USAC's Board of Directors (the "Board" or "Board of Directors") in compliance with applicable law.

The following summarizes USAC’s Investment Policy, effective September 13, 2018 as amended:

|

Approved Investment Instruments. We may invest in the following approved investment classes in accordance with the restrictions and subject to the benchmark ranges set forth in our Investment Policy and described below: |

|

United States Government Securities — bonds or other evidences of indebtedness that are fully guaranteed or insured by the U.S. Government or any agency or instrumentality thereof. |

|

Securities of the District of Columbia, State, Insular or Territorial Possession Government of the United States —bonds or other evidences of indebtedness, without limitation, of the District of Columbia, State, or any political subdivision of such, or Insular or Territorial Possession of the United States. |

|

Canadian Government, Provincial and Municipal Obligations —bonds or other evidences of indebtedness issued by the Dominion of Canada, or by any Province thereof, or by any municipality, agency or instrumentality thereof. |

|

Fixed Income Obligations — bonds or other evidence of indebtedness issued, assumed or guaranteed by a corporation. |

|

Equity Interests - preferred stocks, common stocks, mutual funds, exchange traded funds, master limited partnerships and other securities representing equity ownership interests in a corporation, provided that we may not own more than 2% of any corporation, mutual fund, exchange traded fund, master limited partnership or other equity security. |

|

Real Estate - real estate for use in the operations of the Company, which we refer to as "Home Office Real Estate," or for the production of income. We may also invest in shares of beneficial interest in or obligations issued by a Real Estate Investment Trust qualified under pertinent sections of the United States Internal Revenue Code. |

|

Mortgage Loans - first-lien mortgage loans on commercial or residential property with loan to value of no greater than 80% at the time of purchase. |

|

Mortgage - Backed Securities - mortgage-backed securities issued by the Federal Home Loan Mortgage Corporation (Freddie Mac), Federal National Mortgage Association (Fannie Mae), or a private entity. Any such securities must be rated investment grade by Moody's, S&P or Fitch. |

|

Asset-Backed Securities - asset-backed securities designated as investment grade by Moody's, S&P or Fitch or the equivalent rating by another nationally recognized statistical rating organization. |

|

Certificates of Deposit, Time Deposits, Overnight Bank Deposits, Banker's Acceptances and Repurchase Agreements - certificates of deposit, time deposits, overnight bank deposits, banker's acceptances issued by federally insured banks with maturities of 270 days or less from the date of acquisition, repurchase agreements with acceptable collateral and maturities of 270 days or less from date of acquisition. |

|

Commercial Paper - commercial paper of US corporations that are rated at least "A-2" by S&P or "P-2" by Moody's or the equivalent rating of another nationally recognized statistical rating organization if S&P or Moody's cease publishing ratings of these securities, and have maturities of 270 days or less from the date of acquisition.

Collateral Loans - loans secured by collateral consisting of a pledge of bonds, mortgages, securities, stock or other indebtedness. |

|

|

|

Money Market Accounts or Funds - money market accounts or funds that meet the following criteria: |

|

■ |

A substantial portion of the assets of the money market account or fund must be comprised of certain qualifying investments instruments; |

|

■ |

Issuers of the fund or account's investments must have a combined capital and surplus in excess of $500,000,000; |

|

■ |

Maturities of 270 days or less from the date of acquisition; |

|

■ |

Have net assets of not less than $500,000,000; and |

|

■ |

Have the highest rating available of S&P, Moody's, or Fitch, or carry an equivalent rating by a nationally recognized statistical rating organization if the named rating agencies cease publishing ratings of investments. |

|

Diversification. Our portfolio is constructed to diversify risk with respect to asset class, geographical location, quality, maturity, business sector and individual issuer and issue concentrations. |

|

Benchmarks. We benchmark the allocation of our investments based on the criteria set forth in the table below to help assure our investments are appropriately diversified. The benchmarks may change to respond to market conditions. Based on market conditions and other considerations, investments in the approved investment instruments described are maintained in the following ranges: |

|

|

% of Portfolio Cost Value | |||||||

|

Asset Class |

Minimum |

Maximum |

||||||

|

Cash/Short Term |

0% | 100% | ||||||

|

Investment Grade Fixed Income |

20% | 100% | ||||||

|

High Yield Fixed Income |

0% | 15% | ||||||

|

Equity |

0% | 50% | ||||||

|

Mortgage and Mortgage related |

0% | 50% | ||||||

|

Real Estate (including REITs) |

0% | 20% | ||||||

The Executive Committee of our Board of Directors may modify the above benchmark ranges at any time deemed appropriate based on current conditions. Any such modifications will be subject to approval by the full Board of Directors at its next regularly scheduled meeting. USALSC's investment policy, as a regulated insurance entity, contains additional investment limitations as required by law.

|

Reporting. The President, CEO, or their respective designees shall provide monthly reports to the Board of Directors reflecting the securities purchased and sold during the quarter, securities held at the end of the quarter, current benchmarks and an overall evaluation of the portfolio's investment performance. |

Marketing and Distribution - USALSC and DCLIC use independent consultants, shareholders, and referrals to market its products and build distribution channels among funeral homes, banks, accountants, independent insurance agencies, agents, insurance brokerage firms, business owners and other distribution channels as opportunities arise. USALSC and DCLIC workswith other insurance companies who have captive or non-captive agents to broaden their product offerings.

Employees - As of December 31, 2018, USAC and its subsidiaries have fourteen full-time employees and one part-time employee.

Reports to Security Holders - We provide reports to our stockholders, along with our audited year-end financial statements. In addition, all periodic reports and other information we file with the U.S. Securities and Exchange Commission (the “SEC”) are available for inspection and copying at the public reference facilities of the Securities and Exchange Commission located at 100 F Street N E, Washington, D C 20549.

Copies of such material may be obtained by mail from the Public Reference Section of the Securities and Exchange Commission, 100 F Street, N E, Washington, D.C. 20549, at prescribed rates.

Information on the operation of the Public Reference Room may be obtained by calling the SEC at l-800-SEC-0330. In addition, the Commission maintains a World Wide Website on the Internet at: http://www.sec.gov that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. You may also find this information on our website (http://www.usalliancecorporation.com).

Implications of Emerging Growth Company Status - As a company with less than $1 billion in revenue in our last fiscal year, we are defined as an “emerging growth company” under the Jumpstart Our Business Startups (“JOBS”) Act. We will retain “emerging growth company” status until the earliest of:

• The last day of the fiscal year during which our annual revenues are equal to or exceed $1 billion;

• The last day of the fiscal year following the fifth anniversary of our first sale of common stock pursuant to a registration statement filed under the Securities Act of 1933, as amended (the “Securities Act”);

• The date on which we have issued more than $1 billion in nonconvertible debt in a previous three-year period; or

• The date on which we qualify as a large accelerated filer under Rule 12b-2 adopted under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (i.e., an issuer with a public float of $700 million that has been filing reports with the SEC under the Exchange Act for at least 12 months).

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to SEC reporting companies. For so long as we remain an emerging growth company we will not be required to:

• Comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

• Submit certain executive compensation matters to stockholder non-binding advisory votes;

• Submit for stockholder approval golden parachute payments not previously approved;

• Disclose certain executive compensation related items, as we will be subject to the scaled disclosure requirements of a smaller reporting company with respect to executive compensation disclosure.

Pursuant to Section 107(b) of the JOBS Act, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of The JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates. Section 107 of the JOBS Act provides that our decision to opt into the extended transition period for complying with new or revised accounting standards is irrevocable.

Because the worldwide market value of our common stock held by non-affiliates, or public float, is below $75 million, we are also a “smaller reporting company” as defined under the Exchange Act. Some of the foregoing reduced disclosure and other requirements are also available to us because we are a smaller reporting company and may continue to be available to us even after we are no longer an emerging growth company under the JOBS Act but remain a smaller reporting company under the Exchange Act. As a smaller reporting company we are not required to:

• Have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; and

• Present more than two years of audited financial statements in our registration statements and annual reports on Form 10-K and present any selected financial data in such registration statements and annual reports.

|

RISK FACTORS. |

Risks Associated with an Investment in USAC Stock

We face many significant risks in the operating of our business and may face significant unforeseen risks as well. Our significant material risks are set forth below:

SHARE OWNERSHIP RISK - An investment in our voting common stock is speculative. Shares of our voting common stock constitute a high-risk investment in a developing business that has incurred losses to date and expects to continue to incur losses for several years. No assurance or guaranty can be given that any of the potential benefits envisioned by our business plan will prove to be available to our stockholders, nor can any assurance or guaranty be given as to the actual amount of financial return, if any, which may result from ownership of our voting Common Stock. The entire value of the shares of USAC Common Stock may be lost.

OPERATING RISK - We face all of the risks inherent in establishing a new business, including limited capital, challenging product markets, lack of significant revenues, as well as competition from better capitalized and more seasoned companies. We have no control over general economic conditions, competitors’ products or their pricing, customer demand and costs of marketing or advertising. There can be no assurance that our life insurance operations will be successful. The likelihood of any success must be considered in light of our history of operations and operating losses incurred to date. These risks make it difficult to accurately predict our future revenues or results of operations. As a result, our financial results may fluctuate. The Company evaluates the financial condition of its reinsurers to minimize its exposure to losses from reinsurer insolvencies. Management believes that any liabilities arising from this contingency would not be material to the Company’s financial position.

LIQUIDITY RISK – Although USAC is a public company, there is no public market for USAC Common Stock, and there is no assurance that one will develop or be sustained, or that USAC Common Stock will become publicly traded. It may be difficult to sell shares your shares USAC Common Stock. Our securities are not listed for trading on any national securities exchange nor are bid or asked quotations reported in any over-the-counter quotation service and we do not intend to seek any such listing in the foreseeable future.

PROFITABILITY - As is common among young life insurance companies, we have and will incur significant losses for a number of years. As of December 31, 2018 we had a consolidated accumulated deficit of $8.9 million. These losses were attributable primarily to costs of administration, the substantial nonrecurring costs of writing new life insurance (which are deferred and amortized in accordance with our deferred acquisition policy) and include first year commissions payable to insurance agents, medical and investigation expenses as well as other expenses incidental to the issuance of new policies as well as with the reserves required to be established for each policy.

DIVIDENDS - We have not paid a cash dividend on USAC Common Stock and we do not anticipate paying a cash dividend in the foreseeable future. We intend to retain available funds to be used in the expansion of operations. The success of any investment in USAC Common Stock will depend upon any future appreciation in its value which depends upon the success of our life insurance subsidiaries. We cannot guarantee that our common stock will appreciate in value or achieve or maintain a value equal to the price at which shares were purchased. Further, a market may never develop to sell shares of USAC Common Stock.

CAPITAL RISK - We are required by law to have adequate capital and surplus calculated in accordance with statutory accounting principles prescribed by state insurance regulatory authorities to meet regulatory requirements in the states in which we operate. The amount of capital and surplus required is based on certain “risk-based capital” standards established by statute and regulation and administered by regulators. The “risk-based capital” system establishes a framework for evaluating the adequacy of the minimum amount of capital and surplus, calculated in accordance with statutory accounting principles, necessary for an insurance company to support its overall business operations. If we fail to maintain required capital levels, our ability to conduct business would be compromised absent an infusion of capital.

DILUTION RISK - We intend to conduct additional offerings of our securities to raise additional capital to fund our growth. In February, 2010, we filed a prospectus with the Kansas Securities Commission to register shares of USAC Common Stock and warrants to purchase USAC Common Stock. In February 2015, we filed a Prospectus with the Kansas Securities Commission to register the common stock to be issued upon the exercise of the warrants, and in January, 2016, filed a Supplement to the Prospectus to register an additional 1,500,000 shares of USAC Common Stock. We also commenced a private placement of USAC Common Stock in North Dakota in 2017. Any additional offerings of USAC securities that we may conduct in the future will reduce the ownership interests and be accretive to existing stockholder book value.

KEY EXECUTIVE RISK - Our ability to operate is dependent primarily upon the efforts of our Chairman and Chief Executive Officer, Jack H. Brier, and Chief Operating Officer of USALSC, Jeff Brown. The loss of the services of these officers could have a material adverse effect on our ability to execute our business plan. We do not have an employment agreement with Mr. Brier. On June 4, 2018, the Company entered into an employment agreement with Mr. Brown retroactively effective as of February 1, 2018 for a term of three years. Annually, the agreement may be extended for an additional year if agreed upon by both parties.

SEC REGISTRATION - USAC is a public company. As a public company, we incur significant legal, accounting and other expenses under the Exchange Act and the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC. These rules impose various requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and appropriate corporate governance practices. Our management and other personnel are required to devote a substantial amount of time to these compliance requirements. Moreover, these rules and regulations increase our legal and financial compliance and are costly.

EMERGING GROWTH COMPANY - We are an “emerging growth company,” as defined in the JOBS Act. We will remain an “emerging growth company” for up to five years. However, if our non-convertible debt issued within a three-year period or revenues exceeds $1 billion, or the market value of our ordinary shares that are held by non-affiliates exceeds $700 million on the last day of the second fiscal quarter of any given fiscal year, we would cease to be an emerging growth company as of the following fiscal year. As an emerging growth company, we are not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, we have reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and we are exempt from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, will not adopt the new or revised standard until the time private companies are required to adopt the new or revised standard. This may make comparison of our financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult because of the potential differences in accounting standards used.

POTENTIAL ACQUISITION RISK - In addition to our organic growth plans, we plan to pursue strategic acquisitions of insurance related companies that meet our acquisition criteria. However, suitable acquisition candidates may not be available on terms and conditions that are economic to us. In pursuing acquisitions, we compete with other companies, who may have greater financial and other resources than us. Further, if we succeed in consummating acquisitions, our business, financial condition and results of operations may be negatively affected.

| ● | An acquired business may not achieve anticipated revenues, earnings or cash flows; | |

|

● |

We may assume liabilities that were not disclosed or exceed estimates; |

|

● |

We may be unable to integrate acquired businesses successfully and realize anticipated economic, operational and other benefits in a timely manner; |

|

● |

Acquisitions could disrupt our on-going business, distract our management and divert our financial and human resources; |

|

● |

We may experience difficulties operating in markets in which we have no or only limited direct experience; and |

|

● |

There is the potential for loss of customers and key employees of any acquired company. |

MARKETING STRATEGY RISK - We market our products through several different distribution channels which require licensed insurance agents. These distribution channels include funeral directors, bankers, brokerages, accountants, and independent agents. The premium written will depend primarily on our products, product pricing and ability to choose and timely and adequately train and motivate agents, producers and brokers to sell our products.

Independent agents are not required to sell the Company’s products and are free to sell products from other licensed companies. We are committed to working to educate and incentivize independent agents to sell our products.

THE COMPANY’S INVESTMENTS ARE SUBJECT TO MARKET AND CREDIT RISKS - Our invested assets, primarily including fixed maturity securities, are subject to customary risks of credit defaults and changes in fair value. Factors that may affect the overall default rate on and fair value of the Company’s invested assets include interest rate levels and changes, availability and cost of liquidity, financial market performance, and general economic conditions.

RATINGS RISK - We do not anticipate that USALSC, DCLIC, or USALSC-Montana will be rated by rating agencies for several years. This may have a negative impact on its ability to complete with rated insurance companies.

Insurance ratings reflect the rating agencies’ opinion of an insurance company’s history, financial strength, operating performance and ability to meet its obligations to policyholders. There can be no assurance that USALSC, DCLIC, or USALSC-Montana will be rated by a rating agency or that any rating, if and when received, will be favorable.

Risks Associated with Companies in the Life Insurance Industry, including USAC and its subsidiaries

GENERAL REGULATORY RISK -All insurance operations are subject to government regulation in each of the states in which they conduct business. Such regulatory authority is vested in state agencies having broad administrative power dealing with all aspects of the insurance business, including premium rates, policy forms, and capital adequacy, and is concerned with the protection of policyholders rather than stockholders. Among other things, the regulations require prior approval of acquisitions of insurance companies, solvency standards, licensing of insurers and their agents, investment restrictions, deposits of securities for the benefit of policyholders, approval of policy forms and rates, periodic examinations, and reserves for unearned premiums, losses and other matters.

Compliance with insurance regulation is costly and time consuming, requiring the filing of detailed annual reports, and the business and accounts are subject to examination by the applicable state insurance regulator.

Increased scrutiny has been placed upon the insurance regulatory framework during the past several years, and certain state legislatures have considered or enacted laws that alter, and in many cases increase, state authority to regulate insurance companies and insurance holding company systems. The National Association of Insurance Commissioners (“NAIC”) and state insurance regulators reexamine existing laws and regulations on an ongoing basis, and focus on insurance company investments and solvency issues, risk-based capital guidelines, interpretations of existing laws, the development of new laws, the implementation of non-statutory guidelines and the circumstances under which dividends may be paid. Future NAIC initiatives, and other regulatory changes, could have a material adverse impact on the insurance industry. There is no assurance the regulatory requirements of the departments of insurance of their respective state of domicile or a similar department in any other state in which they may wish to transact business can be satisfied.

Individual state guaranty associations assess insurance companies to pay benefits to policyholders of insolvent or failed insurance companies. The amount of any future assessments to be made from known insolvencies cannot be predicted.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”) reshaped financial regulations in the United States by creating new regulators, regulating new markets and firms, and providing new enforcement powers to regulators. Virtually all major areas of the Reform Act continue to be subject to regulatory interpretation and implementation rules requiring rulemaking that may take several years to complete. The ultimate outcome of the regulatory rulemaking proceedings cannot be predicted. The regulations promulgated could have a material impact on consolidated financial results or financial condition.

COMPETITION RISK - The operating results of life insurance companies are subject to significant fluctuations due to competition, economic conditions, interest rates, investment performance, maintenance of insurance ratings from rating agencies, the ability to choose and timely and adequately train agents, and other factors. Each company encounters significant competition from other insurance companies, as well as competition from other available investment alternatives.

Large life insurance companies who have greater financial resources, longer business histories, and who may have more products present significant competition to smaller insurance companies. These larger companies also generally have large distribution opportunities.

The ability to compete is dependent upon, among other things, the ability to develop competitive and profitable products, market the insurance products, and achieve efficient costs of placing policies.

ASSUMPTION RISK - In the life insurance business, assumptions as to expected mortality, lapse rates and other factors in developing the pricing and other terms of life insurance products are made. These assumptions are based on industry experience and are reviewed and revised regularly by an outside actuary to reflect actual experience on a current basis. Variation of actual experience from that assumed in developing such terms may affect a product’s profitability or sales volume and in turn adversely impact revenues.

LIABILITY RISK - Underestimating future policy benefits results in incurring additional expenses at the time a company becomes aware of the inadequacy. As a result, the ability to achieve profits would suffer as a result of such underestimates.

INTEREST RATE RISK - Spread is the difference between the amounts that the insurance company is required to pay under the contracts and the amounts the insurance company is able to earn on its investments intended to support its obligations under the contracts. Interest rate fluctuations could impair an insurance company’s ability to pay policyholder benefits with operating and investment cash flows, cash on hand and other cash sources. Annuity products expose the risk that changes in interest rates will reduce any spread. Spread is a key component of revenues.

To the extent that interest rates credited are less than those generally available in the marketplace, policyholder lapses, policy loans and surrenders, and withdrawals of life insurance policies and annuity contracts may increase as contract holders seek to purchase products with higher returns. This process may result in cash outflows requiring that an insurance subsidiary sell investments as a time when the prices of those investments are adversely affected by the increase in market interest rates, which may result in realized investment losses.

Increases in market interest rates may negatively affect profitability in periods of rising interest rates. The ability to replace invested assets with higher yielding assets needed to fund higher crediting rates that may be necessary to keep interest sensitive products competitive.

LAPSE AND WITHDRAWAL RISK - Policy lapses in excess of those actuarially anticipated would have a negative impact on financial performance. Profitability could be reduced if lapse and surrender rates exceed the assumptions upon which the insurance policies were priced. Policy sales costs are deferred and recognized over the life of a policy. Excess policy lapses, however, cause the immediate expensing or amortizing of deferred policy sales costs. In addition, some of our policies allow holders to withdraw all or some of the policy’s value, and withdrawals beyond those anticipated could impact our business.

OPERATIONAL RISK - In the insurance industry, successful incorporation and functionality of the internal audit function, the evolution of financial and administrative internal controls to safeguard human, facility and financial assets electronically including anti-fraud initiatives and compliance with anti-money laundering requirements as well as an effective disaster recovery program and effective business continuity programs are necessary.

TAX LAW RISK - Congress has considered legislation that would eliminate the deferral of taxation on the accretion of value within certain annuities and life insurance products. This and similar legislation, including a simplified “flat tax” income tax structure with an exemption from taxation for investment income, could adversely affect the sale of life insurance products compared with other financial products. There can be no assurance as to whether such legislation will be enacted or, if enacted, whether such legislation would contain provisions with possible adverse effects on any annuity and life insurance products that we and our operating subsidiaries develop.

Under the Internal Revenue Code, income taxes payable by policyholders on investment earnings is deferred during the accumulation period of certain life insurance and annuity products. This favorable tax treatment may give certain insurance products a competitive advantage over other non-insurance products. To the extent that the Internal Revenue Code may be revised to reduce the tax-deferred status of life insurance and annuity products, or to increase the tax-deferred status of competing products, insurance companies would be adversely affected with respect to their ability to sell products. Also, depending on grandfathering provisions, the surrenders of existing annuity contracts and life insurance policies might increase. In addition, life insurance products are often used to fund estate tax obligations. We cannot predict what future tax initiatives may be proposed with respect to the estate tax or other taxes which may adversely affect us.

REINSURANCE RISK -In order to manage the risk of financial exposure to adverse underwriting results, reinsurers accept a portion of the risk of other insurance companies. However, the direct insurer remains liable with respect to ceded insurance should any reinsurer fail to meet the obligations assumed by the reinsurer.

|

UNRESOLVED STAFF COMMENTS. |

Not applicable.

|

PROPERTIES. |

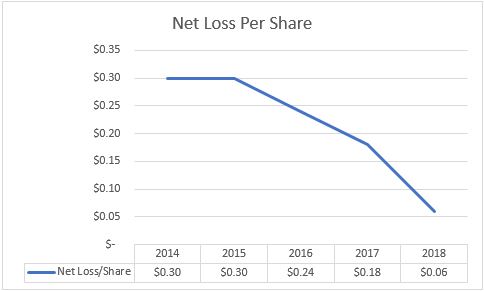

USAC and its subsidiaries share offices located at 4123 SW Gage Center Drive, Suite 240, Topeka, Kansas 66604. Effective January 1, 2015, the lease amount was $2,250 per month for three years with a one-year option under the same rate, terms, and conditions. Effective January 1, 2019 the company extended its lease for up to three additional years at a lease amount of $3,152 per month. Total rent expense was $27,000 and $27,000 for the years ended December 31, 2018 and 2017.

DCLIC also maintains an office at 107 W. Main Avenue, Suite 325, Bismarck, North Dakota, 58501. The lease for the Bismarck office expired on September 30, 2018 and was renewed for an additional two year term. The lease rate for this location is $920 per month for the first year of the renewal. The Company paid $12,166 and $4,684 in rent for this location in 2018 and 2017.

|

LEGAL PROCEEDINGS |

Neither the Company nor any of its principals are presently engaged in any material pending litigation which might have an adverse impact on its net assets.

|

MINE SAFETY DISCLOSURES |

Not applicable.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

|

(a) |

Market Information |

There is no established trading market for our voting common stock. Our securities are not listed for trading or quoted on any national securities exchange nor are bid or asked quotations reported in any over-the-counter quotation system.

As of December 31, 2018, we had issued and outstanding 7,650,551 shares of our voting common stock. No other equity securities of the company have been issued.

|

(b) |

Holders of Record |

As of February 4, 2019 there are approximately 3,475 holders of record of our voting common stock.

|

(c) |

Dividends |

We have not paid dividends on USAC Common Stock and do not anticipate paying dividends in the foreseeable future. We intend to retain any future earnings for reinvestment into our business.

|

(d) |

Securities Authorized for Issuance Under Equity Compensation Plans |

We have not established any equity compensation plans or granted any equity awards under such plans. As a result, there are no securities authorized for issuance under such plans.

|

(e) |

Recent Sales of Unregistered Securities |

During the year ended December 31, 2018, the Company issued 202,939 shares of common stock, for aggregate consideration of $1,420,573, pursuant to an offering to residents of the state of Kansas that was registered with the Kansas Securities Commissioner.

The offering of shares in the above–described transaction was self-underwritten and sold through agents of the Company licensed to sell securities in Kansas. Proceeds from the sale of common stock were used to finance the growth of the Company’s life insurance subsidiary and to provide working capital for the Company. The offer and sale of common stock was exempt from registration under Section 3(a)11 of the Securities Act of 1933 for securities offered and sold on a wholly intrastate basis. The shares of common stock were sold only to bona fide residents of the state of Kansas.

During the year ended December 31, 2018, the Company issued 136,673 shares of common stock, for aggregate consideration of $956,711, pursuant to a private placement offering to accredited investor residents of the state of North Dakota (the “North Dakota Offering”). Proceeds from the sale of shares in the North Dakota Offering were used to finance the growth of DCLIC and to provide working capital for the Company. The North Dakota Offering and sales of shares thereunder were not registered with the SEC in reliance on an exemption for registration under Rule 506(b) of Regulation D under this Securities Act of 1933 (“Reg D”). Shares were sold only to “accredited investors”, as that term is defined in Rule 501 of Reg D, and were not sold by any means of general advertisement or solicitation.

|

SELECTED FINANCIAL DATA. |

As a “smaller reporting company”, the Company is not required to provide disclosure pursuant to this item.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included in this Form 10-K. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

Overview

USAC was formed as a Kansas corporation on April 24, 2009 for the purpose of raising capital to form a new Kansas-based life insurance company. We presently conduct our business through our five wholly-owned subsidiaries: USALSC, a life insurance corporation; DCLIC, a life insurance corporation; USALSC-Montana, a life insurance corporation; USAMC, an insurance marketing corporation; and USAIC, an investment management corporation

On January 2, 2012, USALSC was issued a Certificate of Authority to conduct life insurance business in the State of Kansas. We began third party administrative services in 2015.

On August 1, 2017, the Company merged with Northern Plains Capital Corporation with the Company being the ultimate surviving entity. As a result of this merger, the Company acquired Dakota Capital Life Insurance Company which became a wholly owned subsidiary of USALSC.

On December 14, 2018, the Company acquired Great Western Life Insurance Company. Great Western Life Insurance Company was renamed US Alliance Life and Security Company – Montana and is a subsidiary of USALSC.

The Company assumes business under two reinsurance treaties. On January 1, 2013, the Company entered into an agreement to assume 20% of a certain block of health insurance policies from Unified Life Insurance Company. On September 30, 2018, the Company entered into a coinsurance agreement to assume 100% of a certain block of life insurance policies from American Life and Security Company.

Critical Accounting Policies and Estimates

Our accounting and reporting policies are in accordance with GAAP. Preparation of the consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. The following is an explanation of our accounting policies and the estimates considered most significant by management. These accounting policies inherently require significant judgment and assumptions and actual operating results could differ significantly from management’s estimates determined using these policies. We believe the following accounting policies, judgments and estimates are the most critical to the understanding of our results of operations and financial position. A detailed discussion of significant accounting policies is provided in this report in the Notes to Consolidated Financial Statements included with this annual report.

Valuation of Investments

The Company's principal investments are in fixed maturity and equity securities. Fixed maturity and equity securities, classified as available for sale, are carried at their fair value in the consolidated balance sheets, with unrealized gains or losses recorded in comprehensive income (loss). Our fixed income investment manager utilizes external independent third-party pricing services to determine the fair values of investment securities available for sale.

We have a policy and process in place to identify securities that could potentially have an impairment that is other-than-temporary. The assessment of whether impairments have occurred is based on a case-by-case evaluation of underlying reasons for the decline in fair value. We consider severity of impairment, duration of impairment, forecasted recovery period, industry outlook, financial condition of the issuer, issuer credit ratings and whether we intend to sell a security, or it is more likely than not that we would be required to sell a security, prior to the recovery of the amortized cost. New England Asset Management, our investment manager, provides support to the Company in making these determinations.

The recognition of other-than-temporary impairment losses on debt securities is dependent on the facts and circumstances related to the specific security. If we intend to sell a security or it is more likely than not that we would be required to sell a security prior to recovery of the amortized cost, the difference between amortized cost and fair value is recognized in the income statement as an other-than-temporary impairment. Our membership in the Federal Home Loan Bank provides additional liquidity which further reduces the likelihood that we would be required to sell a security prior to recovery. As it relates to debt securities, if we do not expect to recover the amortized basis, do not plan to sell the security and if it is not more likely than not that we would be required to sell a security before the recovery of its amortized cost, the other-than-temporary impairment would be recognized. We would recognize the credit loss portion through earnings in the income statement and the noncredit loss portion in accumulated other comprehensive loss.

Deferred Acquisition Costs

Incremental direct costs, net of amounts ceded to reinsurers, that result directly from and are essential to a product sale and would not have been incurred by us had the sale not occurred, are capitalized, to the extent recoverable, and amortized over the life of the premiums produced. Recoverability of deferred acquisition costs is evaluated periodically by comparing the current estimate of the present value of expected pretax future profits to the unamortized asset balance. If this current estimate is less than the existing balance, the difference is charged to expense.

Value of Business Acquired

Value of business acquired (VOBA) represents the estimated value assigned to purchased companies or insurance in- force of the assumed policy obligations at the date of acquisition of a block of policies. At least annually, a review is performed of the models and the assumptions used to develop expected future profits, based upon management’s current view of future events. VOBA is reviewed on an ongoing basis to determine that the unamortized portion does not exceed the expected recoverable amounts. Management’s view primarily reflects our experience but can also reflect emerging trends within the industry. Short-term deviations in experience affect the amortization of VOBA in the period, but do not necessarily indicate that a change to the long-term assumptions of future experience is warranted. If it is determined that it is appropriate to change the assumptions related to future experience, then an unlocking adjustment is recognized for the block of business being evaluated. Certain assumptions, such as interest spreads and surrender rates, may be interrelated. As such, unlocking adjustments often reflect revisions to multiple assumptions. The VOBA balance is immediately impacted by any assumption changes, with the change reflected through the statements of comprehensive income as an unlocking adjustment in the amount of VOBA amortized. These adjustments can be positive or negative with adjustments reducing amortization limited to amounts previously deferred plus interest accrued through the date of the adjustment.

In addition, we may consider refinements in estimates due to improved capabilities resulting from administrative or actuarial system upgrades. We consider such enhancements to determine whether and to what extent they are associated with prior periods or simply improvements in the projection of future expected gross profits due to improved functionality. To the extent they represent such improvements, these items are applied to the appropriate financial statement line items in a manner similar to unlocking adjustments.

VOBA is also reviewed on an ongoing basis to determine that the unamortized portion does not exceed the expected recoverable amounts. If it is determined from emerging experience that the premium margins or gross profits are less than the unamortized value of business acquired, then the asset will be adjusted downward with the adjustment recorded as an expense in the current period.

Goodwill

Goodwill represents the excess of the amounts paid to acquire subsidiaries and other businesses over the fair value of their net assets at the date of acquisition. Goodwill is tested for impairment at least annually in the fourth quarter or more frequently if events or circumstances change that would indicate that a triggering event has occurred.

We assess the recoverability of indefinite-lived intangible assets at least annually or whenever events or circumstances suggest that the carrying value of an identifiable indefinite-lived intangible asset may exceed the sum of the future discounted cash flows expected to result from its use and eventual disposition. If the asset is considered to be impaired, the amount of any impairment is measured as the difference between the carrying value and the fair value of the impaired asset.

Reinsurance

In the normal course of business, we seek to limit aggregate and single exposure to losses on risk by purchasing reinsurance. The amounts reported in the consolidated balance sheets as reinsurance recoverable include amounts billed to reinsurers on losses paid as well as estimates of amounts expected to be recovered from reinsurers on insurance liabilities that have not yet been paid. Reinsurance recoverable on unpaid losses are estimated based upon assumptions consistent with those used in establishing the liabilities related to the underlying reinsured contracts. Insurance liabilities are reported gross of reinsurance recoverable. Management believes the recoverables are appropriately established. We diversify our credit risks related to reinsurance ceded. Reinsurance premiums are generally reflected in income in a manner consistent with the recognition of premiums on the reinsured contracts. Reinsurance does not extinguish our primary liability under the policies written. We regularly evaluate the financial condition of our reinsurers including their activities with respect to claim settlement practices and commutations, and establish allowances for uncollectible reinsurance recoverable as appropriate.

Future Policy Benefits

We establish liabilities for amounts payable under insurance policies, including traditional life insurance and annuities. Generally, amounts are payable over an extended period of time. Liabilities for future policy benefits of traditional life insurance have been computed by using a net level premium method based upon estimates at the time of issue for investment yields, mortality and withdrawals. These estimates include provisions for experience less favorable than initially expected. Mortality assumptions are based on industry experience expressed as a percentage of standard mortality tables. Such liabilities are reviewed quarterly by an independent consulting actuary.

Income Taxes

Deferred tax assets are recorded based on the differences between the financial statement and tax basis of assets and liabilities at the enacted tax rates. The principal assets and liabilities giving rise to such differences are investments, insurance reserves, and deferred acquisition costs. A deferred tax asset valuation allowance is established when there is uncertainty that such assets would be realized. We have no uncertain tax positions we believe are more-likely-than-not that the benefit will not be realized.

Recognition of Revenues

Revenues on traditional life insurance products consist of direct and assumed premiums reported as earned when due.

Amounts received as payment for annuities are recognized as deposits to policyholder account balances and included in future insurance policy benefits. Revenues from these contracts are comprised of investment earnings of the deposits, which are recognized over the period of the contracts, and included in revenue. Deposits are shown as a financing activity in the Consolidated Statements of Cash Flows.

Mergers and Acquisitions

On May 23, 2017 the Company entered into a definitive merger agreement with Northern Plains Capital Corporation. The merger transaction closed on July 31, 2017. NPCC shareholders received .5841 shares of US Alliance Corporation stock for each share of NPCC stock owned. USAC issued 1,644,458 shares of common stock to holders of NPCC shares.

On October 11, 2018 the Company entered into a stock purchase agreement with Great Western Insurance Company to acquire Great Western Life Insurance Company. The transaction closed on December 14, 2018. USALSC paid $500,000 to acquire all of the outstanding shares of GWLIC.

New Accounting Standards

A detailed discussion of new accounting standards is provided in the Notes to Consolidated Financial Statements beginning on p. F-14 of this annual report.

Discussion of Consolidated Results of Operations

Revenues. Insurance revenues are primarily generated from premium revenues and investment income. Insurance revenues for the years ended December 31, 2018 and 2017 are summarized in the table below.

|

Years Ended December 31, |

||||||||

|

2018 |

2017 |

|||||||

|

Income: |

||||||||

|

Premium income |

$ | 8,807,779 | $ | 10,773,246 | ||||

|

Net investment income |

1,477,403 | 817,989 | ||||||

|

Net realized gain (loss) on sale of securities |

(4,499 | ) | 430,565 | |||||

|

Gain on bargain purchase |

1,140,996 | - | ||||||

|

Other income |

37,608 | 50,057 | ||||||

|

Total income |

$ | 11,459,287 | $ | 12,071,857 | ||||

USALSC entered into a coinsurance transaction with American Life and Security Corporation (“ALSC”) effective September 30, 2017. The agreement resulted in a one-time premium revenue of $3.9 million in the third quarter of 2017 which is the driver of the decrease in revenue. Absent this one-time revenue in 2017 and excluding our bargain purchase gain in 2018, our 2018 revenues increased by $2,101,336 or 26% as compared to 2017.

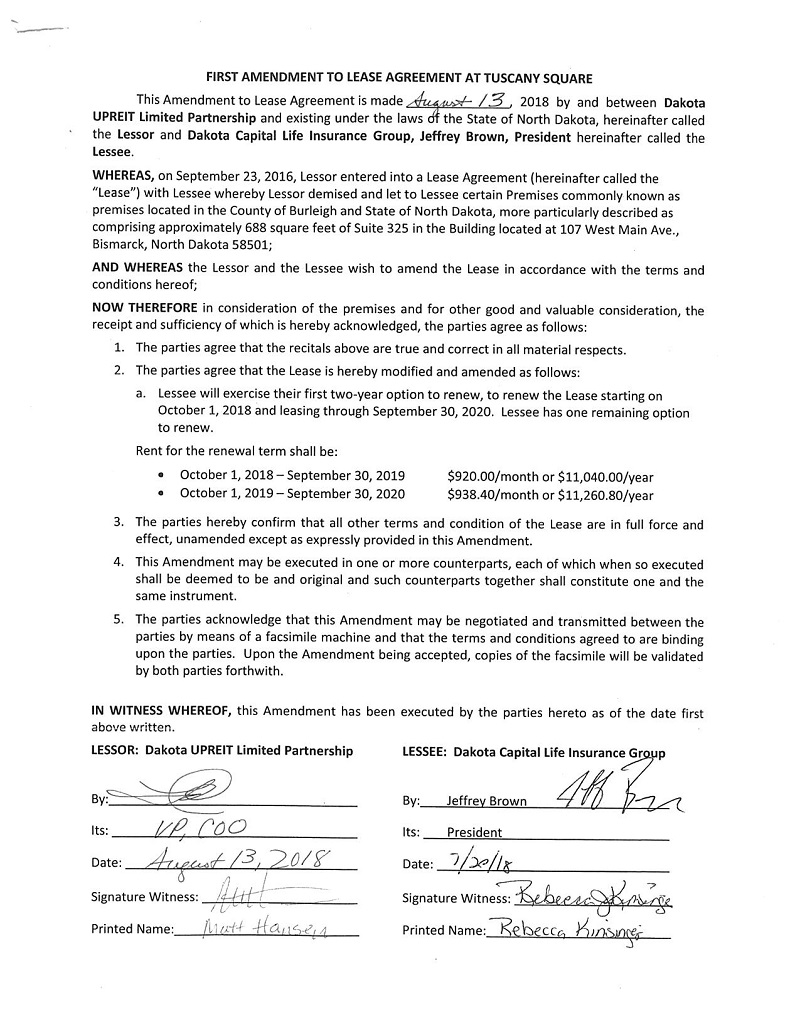

The following graph summarizes our five-year trend of GAAP revenues:

|

* 2017 revenue includes one-time revenue of $3.9 million from the ALSC reinsurance transaction. |

Premium revenue: Premium revenue for the year ended December 31, 2018 was $8,807,779 compared to $10,773,246 in 2017, a decrease of $1,965,467. The ALSC agreement resulted in a one-time premium revenue of $3.9 million in 2017 which is the driver of the decrease in revenue. The decrease is offset by the growth of our direct and on-going assumed premiums. Absent this one-time premium in 2017, our 2018 premiums increased by $1,889,435, or 27%, as compared to 2017.

Direct, assumed and ceded premiums for the years ended December 31, 2018 and 2017 are summarized in the following table.

|

Years Ended December 31, |

||||||||

|

2018 |

2017 |

|||||||

|

Direct |

$ | 4,573,748 | $ | 3,167,654 | ||||

|

Assumed |

4,863,227 | 7,826,619 | ||||||

|

Ceded |

(629,196 | ) | (221,027 | ) | ||||

|

Total |

$ | 8,807,779 | $ | 10,773,246 | ||||

The Company is pursuing new product and distribution opportunities to increase premium production. The acquisition of DCLIC and the reinsurance agreement with ALSC are designed to increase future premiums.

Investment income, net of expenses: The components of net investment income for the years ended December 31, 2018 and 2017 are as follows:

|

Years Ended December 31, |

||||||||

|

2018 |

2017 |

|||||||

|

Fixed maturities |

$ | 967,959 | $ | 497,866 | ||||

|

Equity securities |

580,930 | 373,141 | ||||||

|

Cash and short term investments |

9,881 | 6,275 | ||||||

| 1,558,770 | 877,282 | |||||||

|

Less investment expenses |

(81,367 | ) | (59,293 | ) | ||||

| $ | 1,477,403 | $ | 817,989 | |||||

Net investment income for the years ended December 31, 2018 was $1,477,403, compared to $817,989 in 2017, an increase of $659,414 or 81%. This increase in investment income is primarily a result of increased invested assets as a result of our premium income, the Merger with Northern Plains, and our coinsurance agreement with ALSC, and an improvement in our book yield.

Net realized gains (losses) on investments: Net realized losses on investments for the years ended December 31, 2018 were $4,499, compared to gains of $430,565 in 2017, a decrease of $435,064. The decrease in realized gains is attributable to the repositioning of an equity portfolio from a market return focus to an income focus in 2017 as well as liquidating an equity portfolio to fund the ALSC transaction in 2017. There was not a similar activity in 2018. Realized gains and losses related to the sale of securities for the years ended December 31, 2018 and 2017 are summarized as follows:

|

Years Ended December 31, |

||||||||

|

2018 |

2017 |

|||||||

|

Gross gains |

$ | 530 | $ | 499,568 | ||||

|

Gross losses |

(5,029 | ) | (69,003 | ) | ||||

|

Net security gains (losses) |

$ | (4,499 | ) | $ | 430,565 | |||

Gain on bargain purchase: The Company acquired USALSC-Montana (formerly Great Western Life Insurance Company) on December 14, 2018. The total identifiable net assets of the purchase were $1,640,996 and the Company paid $500,000 for the acquisition. This resulted in a gain on bargain purchase of $1,140,996.

Other income: Other income for the year ended December 31, 2018 was $37,608 compared to $50,057 in 2017, a decrease of $12,449. This decrease is due to the acquisition of DCLIC which resulted in third party administration income from DCLIC being eliminated during consolidation for periods after the acquisition.

Expenses. Expenses for the year ended December 31, 2018 and 2017 are summarized in the table below.

|

Years Ended December 31, |

||||||||

|

2018 |

2017 |

|||||||

|

Expenses: |

||||||||

|

Death claims |

$ | 959,005 | $ | 823,545 | ||||

|

Policyholder benefits |

3,957,090 | 3,485,564 | ||||||

|

Increase in policyholder reserves |

2,766,169 | 5,654,476 | ||||||

|

Commissions, net of deferrals |

637,425 | 521,155 | ||||||

|

Amortization of deferred acquisition costs |

454,906 | 321,451 | ||||||

|

Amortization of value of business acquired |

20,304 | 8,460 | ||||||

|

Salaries & benefits |

1,152,728 | 990,076 | ||||||

|

Other operating expenses |

1,967,796 | 1,316,162 | ||||||

|

Total expense |

$ | 11,915,423 | $ | 13,120,889 | ||||

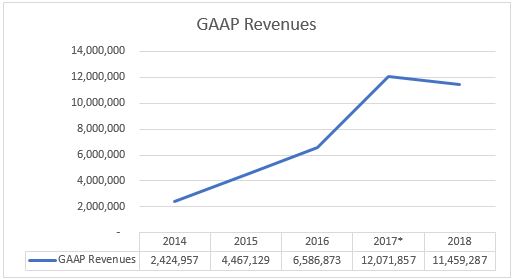

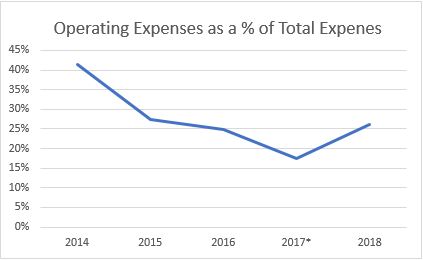

The following chart and graph summarizes our five-year expense trend:

|

Increase in |

Other |

% of Operating |

|||||||||||||||||||

|

Policyholder |

Policy-related |

Operating |

Total |

Expense to |

|||||||||||||||||

|

Year |

Reserves |

Expenses |

Expenses |

Expenses |

Total Expense |

||||||||||||||||

|

2014 |

$ | 928,483 | $ | 1,230,874 | $ | 1,527,670 | $ | 3,687,027 | 41% | ||||||||||||

|

2015 |

1,214,695 | 3,005,220 | 1,584,591 | 5,804,506 | 27% | ||||||||||||||||

|

2016 |

1,686,841 | 4,224,156 | 1,961,649 | 7,872,646 | 25% | ||||||||||||||||

| 2017* | 5,654,476 | 5,160,175 | 2,306,238 | 13,120,889 | 18% | ||||||||||||||||

|

2018 |

2,766,169 | 6,028,730 | 3,120,524 | 11,915,423 | 26% | ||||||||||||||||

|

* 2017 Increase in Reserves includes a one-time $3.9 million reserve increase from the ALSC transaction |

Increases in policyholder reserves represents funds that we maintain and invest for the future benefit of our policyholders. Other policy-related expenses represents the other expenses associated with fulfilling our obligations to our policyholders and producers. Operating expenses represent the costs to operate the company. It is important to note that our 2017 operating expense ratio is impacted by the one-time reserve increase which resulted from our transaction with ALSC. Absent this transaction, our 2017 ratio would have been 25%.

Death claims: Death benefits were $959,005 in the year ended December 31, 2018 compared to $823,545 in 2017, an increase of $135,460. This increase is attributable to the growth of our in-force block of life insurance policies. The majority of death claims paid from inception have been on pre-need policies. We expect these claims to grow as we continue to increase the size of our in-force pre-need business.

Policyholder benefits: Policyholder benefits were $3,957,090 in the year ended December 31, 2018 compared to $3,485,564 in 2017, an increase of $471,526. The primary driver of this increase is the growth of interest credited on annuities from ALSC and acquired with Dakota Capital Life.

Increase in policyholder reserves: Policyholder reserves increased $2,766,169 in the year ended December 31, 2018, compared to $5,654,476 in 2017, a decrease of $2,888,307. The decrease is driven by a one-time increase in reserves of $3.9 million in 2017 as a result of our ALSC coinsurance transaction and fully offset by the one-time assumed premium revenue associated with this transaction.

Commissions, net of deferrals: The Company pays commissions to the ceding company on a block of assumed policies as well as commissions to agents on directly written business. Commissions, net of deferrals, were $637,425 in the year ended December 31, 2018, compared to $521,155 in 2017, an increase of $116,270. This increase is due to an increase in premiums.

Amortization of deferred acquisition costs: The amortization of deferred acquisition costs was $454,906 in the year ended December 31, 2018, compared to $321,451 in 2017, an increase of $133,455. The amortization increase is attributable to the growth of our deferred acquisition cost asset related to our reinsurance transaction with ALSC.

Salaries and benefits: Salaries and benefits were $1,152,728 for the year ended December 31, 2018, compared to $990,076 in 2017, an increase of $162,652. Staffing costs increased due to additional staffing acquired with the Northern Plains Merger and the growth of our customer service team.

Other expenses: Other operating expenses were $1,967,796 in the year ended December 31, 2018, compared to $1,316,162 in 2017, an increase of $651,634. Operating costs have increased due to expenses associated with the DCLIC acquisition, including additional auditing and actuarial fees, increased information technology costs, and selling and marketing expenses. Additionally, updated interpretations of accounting guidance on leased software resulted in the full amortization of our software fixed assets.