Exhibit 10.1

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Coinsurance Agreement

between

American Life & Security Corporation

Lincoln, Nebraska

(hereinafter referred to as “Ceding Company”)

and

US Alliance Life and Security Company

Topeka, Kansas

(hereinafter referred to as “Reinsurer”)

effective September 30, 2017

Treaty Number 1

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

|

Table of Contents |

||

|

Article 1 — COINSURANCE AGREEMENT |

1 | |

|

1.1 |

Parties to the Agreement |

1 |

|

1.2 |

Effective Date |

1 |

|

Article 2 – DEFINITIONS |

2 | |

|

2.1 |

Defined Terms |

2 |

|

2.2 |

Other Definitional Provisions |

5 |

|

Article 3 — COVERAGE |

7 | |

|

3.1 |

Scope |

7 |

|

3.2 |

Basis of Reinsurance |

7 |

|

3.3 |

Retention |

7 |

|

3.4 |

Existing Reinsurance |

7 |

|

3.5 |

Reinstatement |

7 |

|

3.6 |

Misstatement of Fact |

8 |

|

3.7 |

Credited Rates and Nonguaranteed Elements |

8 |

|

3.8 |

Internal Replacements |

8 |

|

3.9 |

Recapture |

8 |

|

Article 4 – REINSURANCE PREMIUMS |

9 | |

|

4.1 |

Reinsurance Premiums |

9 |

|

4.2 |

Initial Consideration |

9 |

|

4.3 |

Ceding Commission |

9 |

|

4.4 |

Premium Taxes |

9 |

|

Article 5 – REINSURANCE BENEFITS AND EXPENSES |

10 | |

|

5.1 |

Policy Claims |

10 |

|

5.2 |

Commissions |

10 |

|

5.3 |

Expenses |

10 |

|

Article 6 – ADMINISTRATION |

11 | |

|

6.1 |

Administrator |

11 |

|

6.2 |

Record Keeping |

11 |

|

Article 7 – REPORTING AND SETTLEMENTS |

12 | |

|

7.1 |

Initial and Monthly Reporting |

12 |

|

7.2 |

Quarterly and Annual Reporting |

12 |

|

7.3 |

Settlements |

12 |

|

Article 8 – CREDIT FOR REINSURANCE |

13 | |

|

8.1 |

Reserves |

13 |

|

8.2 |

Form of Security |

13 |

|

Article 9 – TERM AND TERMINATION |

14 | |

|

9.1 |

Duration of Agreement |

14 |

|

9.2 |

Termination for Non-Payment |

14 |

|

9.3 |

Termination for Material Breach |

14 |

|

9.4 |

Termination for Insolvency of Reinsurer |

14 |

|

9.5 |

Termination Payment |

14 |

|

9.6 |

Rescission |

15 |

|

9.7 |

Survival |

15 |

|

Article 10 – ERRORS AND OMISSIONS |

16 | |

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

|

Article 11 – DISPUTE RESOLUTION |

17 | |

|

11.1 |

Negotiation |

17 |

|

11.2 |

Arbitration |

17 |

|

11.3 |

Waiver of Trial by Jury |

18 |

|

Article 12 – INSOLVENCY |

20 | |

|

Article 13 – REPRESENTATIONS, WARRANTIES AND COVENANTS |

21 | |

|

13.1 |

Representations and Warranties of Ceding Company |

21 |

|

13.2 |

Covenants of Ceding Company |

22 |

|

13.3 |

Representations and Warranties of Reinsurer |

22 |

|

Article 14 – MISCELLANEOUS |

24 | |

|

14.1 |

Currency |

24 |

|

14.2 |

Interest |

24 |

|

14.3 |

Right of Setoff and Recoupment |

24 |

|

14.4 |

No Third Party Beneficiaries |

24 |

|

14.5 |

Amendment |

24 |

|

14.6 |

Notices |

24 |

|

14.7 |

Consent to Jurisdiction |

25 |

|

14.8 |

Service of Process |

26 |

|

14.9 |

Inspection of Records |

26 |

|

14.10 |

Confidentiality |

26 |

|

14.11 |

Indemnification |

26 |

|

14.12 |

Reinsurance Brokers |

27 |

|

14.13 |

Successors |

27 |

|

14.14 |

Entire Agreement |

27 |

|

14.15 |

Severability |

27 |

|

14.16 |

Construction |

27 |

|

14.17 |

Non-Waiver |

27 |

|

14.18 |

Further Assurances |

28 |

|

14.19 |

Governing Law |

28 |

|

14.20 |

Counterparts |

28 |

Schedules

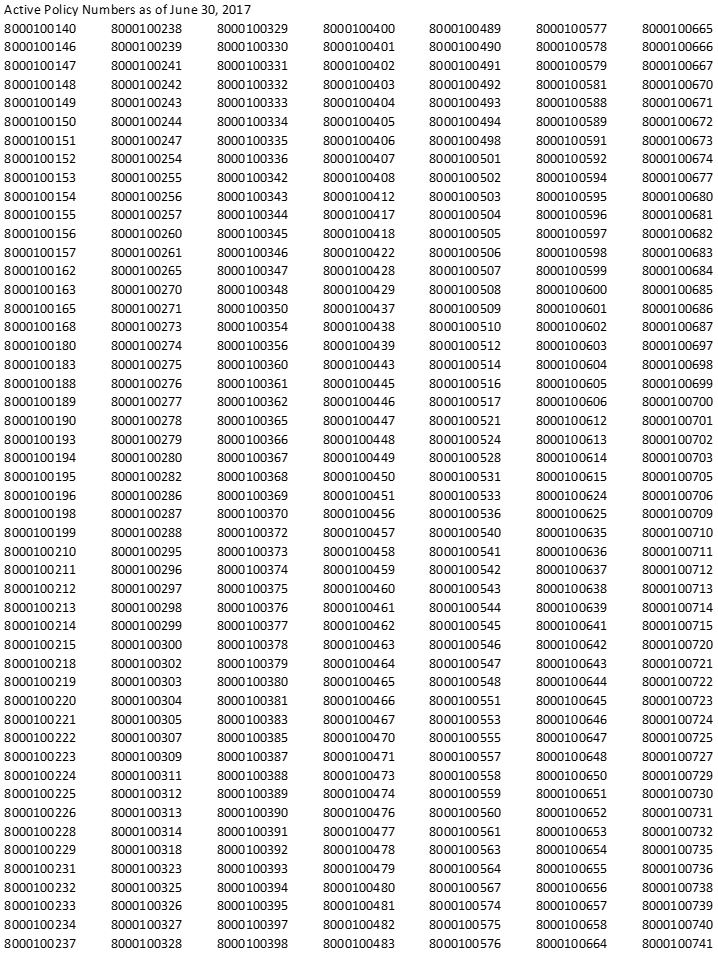

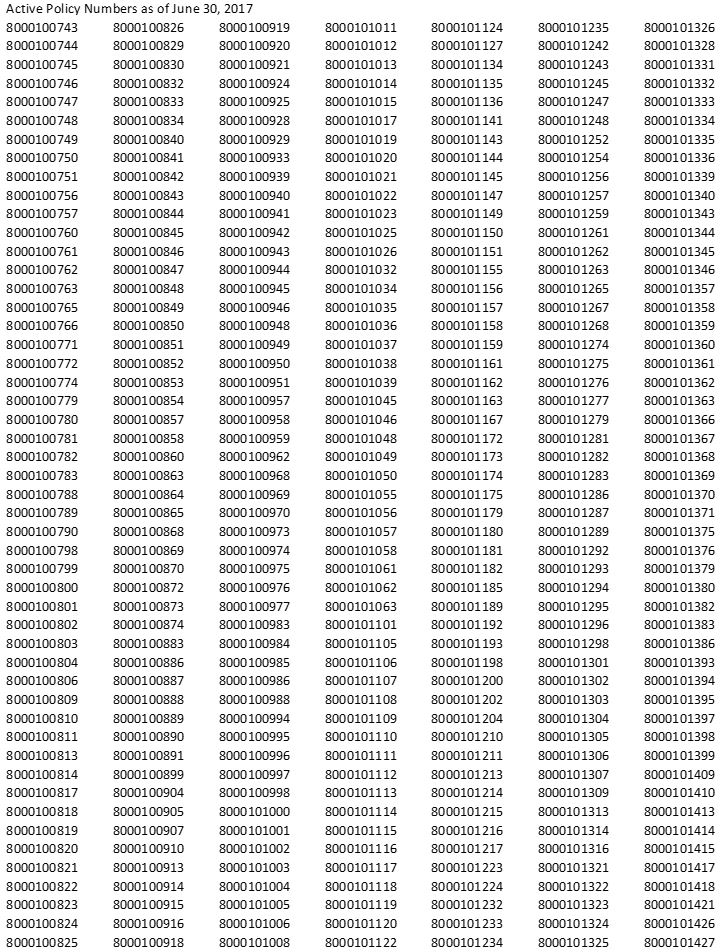

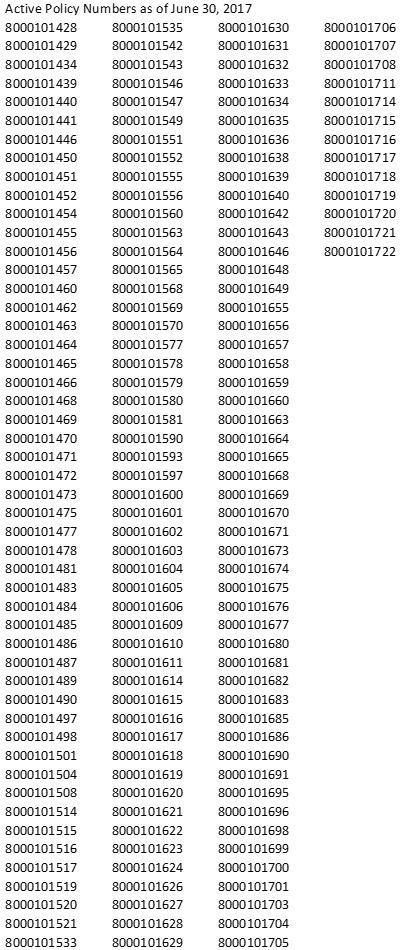

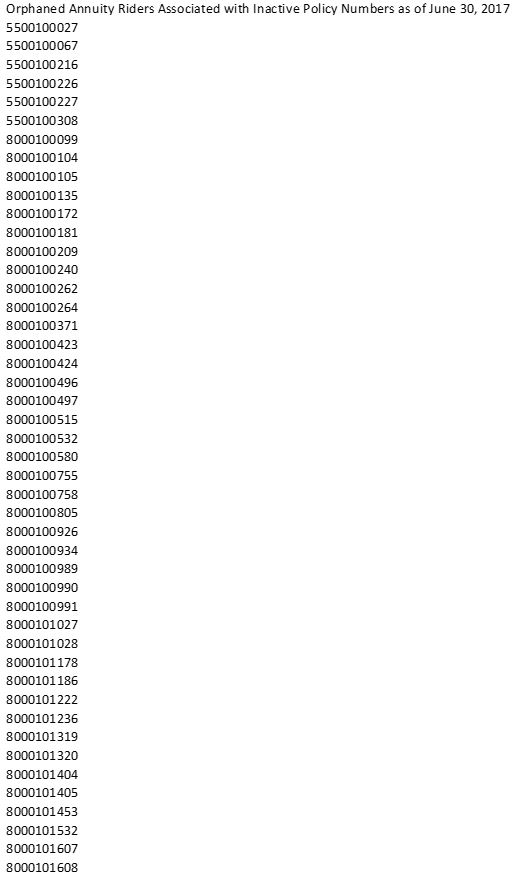

Schedule A – Reinsured Policies

Exhibits

Exhibit A – Monthly Accounting Report

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 1 — COINSURANCE AGREEMENT

1.1 Parties to the Agreement

This coinsurance agreement for indemnity reinsurance (the “Agreement”) is entered into on the ______ day of September, 2017 (the “Agreement Date”) by and between American Life & Security Corporation, a Nebraska domiciled insurance company with executive offices in Lincoln, Nebraska (“Ceding Company”), and US Alliance Life and Security Company (“Reinsurer”), a Kansas domiciled insurance company with executive offices in Topeka, Kansas, collectively referred to as the “parties”.

Performance of the obligations of each party under this Agreement shall be rendered solely to the other party. The acceptance of risks under this Agreement will create no right or legal relationship between Reinsurer and the insured, owner, or beneficiary of any insurance policy or other contract of Ceding Company.

The Agreement will be binding upon Ceding Company and Reinsurer and their respective successors and assigns.

1.2 Effective Date

The Effective Date of this Agreement is September 30, 2017. Hereinafter, the Effective Date shall mean midnight Central Time on this date.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 2 – DEFINITIONS

2.1 Defined Terms

As used in this Agreement, the following terms shall have the following meanings:

“Adjusted Net Reserves” shall be calculated as Net Reserves, less Net Due and Deferred Premiums, less Net Policy Loans, plus Advanced Premiums.

“Administrator” shall mean the Ceding Company from the effective date to December 31, 2017 and after December 31, 2017 shall mean the Reinsurer.

“Advance Premiums” shall mean premiums received in advance calculated in accordance with SAP, net of Existing Reinsurance, which would have been or should have been reported by Ceding Company on its NAIC Convention Blank as of the date of calculation with respect to the Reinsured Policies as if this Agreement were not in effect.

“Affiliate” shall mean, with respect to any person, any other person that directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such specified person; provided, that “control” (including, with correlative meanings, “controlled by” and “under common control with”), as used with respect to any person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such person, whether through the ownership of voting securities, by agreement or otherwise.

“Agreement” shall have the meaning as specified in Article 1.1.

“Agreement Date” shall have the meaning as specified in Article 1.1.

“Basic Policy Data” shall mean, with respect to active Reinsured Policies, policy number, plan code, issue date, issue age, gender, risk class, policy units, face amount, in force amount, annual premium, modal premium, premium mode, paid-to date, policy status, expiry date (in the case of extended term insurance), amount of accidental death benefit, direct statutory reserve, direct statutory net valuation premium, direct accidental death benefit reserve, loan value, annuity fund value, annuity cash value, and annuity reserve. With respect to orphaned annuity riders associated with inactive Reinsured Policies, such data shall mean policy number, plan code, issue date, issue age, gender, risk class, policy status, annuity fund value, annuity cash value, and annuity reserve.

“Business Day” shall mean any day other than a Saturday, Sunday or any other day on which banking institutions are authorized or required by law or executive order to close in Lincoln, Nebraska or Topeka, Kansas.

“Ceded Reserves” shall have the meaning as specified in Article 8.2.

“Ceding Company” shall have the meaning as specified in Article 1.1.

“Ceding Commission” shall mean $1,850,000.00 payable as set forth in Article 4.3.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

“Claims” shall mean, with respect to the contractual provisions and obligations of the Reinsured Policies incurred on or after the Effective Date, all death benefits, maturity or endowment benefits, full surrender benefits, partial surrender or withdrawal benefits, loan proceeds, accrued interest, accrued credits or other nonguaranteed elements, annuitizations, benefits under Supplementary Contracts, and other contractual benefits, as further described in Article 5.1, net of Existing Reinsurance, where surrender or withdrawal benefits are net of applicable surrender or withdrawal charges, if any. Claims shall not include any Excluded Liabilities or any liabilities other than the Reinsured Liabilities.

“Contested Claim” shall have the meaning as specified in Article 5.1.

“Effective Date” shall have the meaning as specified in Article 1.2.

“Excluded Liabilities” shall mean

“Existing Reinsurance” shall mean, for FWL, reinsurance under an automatic reinsurance agreement with Optimum Re Insurance Company, Number 2537-12AY05, dated May 1, 2012, and subsequent amendments, and for GPL, reinsurance under an automatic reinsurance agreement with Optimum Re Insurance Company, Number 2516-10AY01, dated January 4, 2010, and subsequent amendments, and for both FWL and GPL, bulk reinsurance agreements with Optimum Re Insurance Company covering accidental death benefit riders associated with the Reinsured Policies.

“Extra-Contractual Obligations” shall mean any liabilities or obligations not arising under the express terms and conditions of, or in excess of the applicable policy limits of, the Reinsured Policies, which arise from the handling of any claim with respect to the Reinsured Policies, including liabilities or obligations for fines, penalties, fees, forfeitures, compensatory damages, and punitive, special, treble, bad faith, tort, exemplary or other forms of extracontractual damages awarded against or paid by Ceding Company, which liabilities or obligations arise from any act, error or omission committed by Ceding Company, relating to (a) the investigation, defense, trial, settlement or handling of claims, benefits or payments under the Reinsured Policies, or (b) the failure to pay, the delay in payment, or errors in calculating or administering the payment of benefits, claims or any other amounts due or alleged to be due under or in connection with the Reinsured Policies; however excluded from “Extra-Contractual Obligations” are any liabilities or obligations arising out of fraud or any act of a member of the Ceding Company’s officers or board of directors

“Factual Information” shall have the meaning as specified in Article 13.1.

“FWL” shall mean First Wyoming Life Insurance Company, NAIC Company Code 14086, prior to its merger into Ceding Company on September 1, 2016.

“GPL” shall mean Great Plains Life Assurance Company, NAIC Company Code 13561, prior to its merger into Ceding Company on December 1, 2016.

“Initial Consideration” shall have the meaning as specified in Article 4.2.

“Monthly Accounting Period” shall have the meaning as specified in Article 7.1.

“Monthly Accounting Report” shall have the meaning as specified in Article 7.1.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

“Net Due and Deferred Premiums” shall mean net due and deferred premiums calculated in accordance with SAP, net of Existing Reinsurance, which would have been or should have been reported by Ceding Company on its NAIC Convention Blank as of the date of calculation with respect to the Reinsured Policies as if this Agreement were not in effect.

“Net Policy Loans” shall mean contract loans originating under provisions contained in the Reinsured Policies calculated in accordance with SAP, net of Existing Reinsurance, which would have been or should have been reported by Ceding Company on its NAIC Convention Blank as of the date of calculation with respect to the Reinsured Policies as if this Agreement were not in effect.

“Net Reserves” shall be calculated as Statutory Reserves, net of Statutory Reserves for Existing Reinsurance, which would have been or should have been reported by Ceding Company on its NAIC Convention Blank as of the date of calculation with respect to the Reinsured Policies as if this Agreement were not in effect.

“Non-Payment Event” shall have the meaning as specified in Article 9.2.

“Non-Public Personal Information” shall mean personally identifiable medical, financial, and other personal information about proposed, current and former applicants, policy owners, contract holders, insureds, annuitants, claimants, and beneficiaries of Reinsured Policies or contracts issued by Ceding Company, and their representatives, that is not publicly available. Non-Public Personal Information does not include de-identified personal data, i.e., information that does not identify, or could not reasonably be associated with, an individual.

“Person” shall mean and include an individual, a corporation, a partnership, an association, a trust, an unincorporated organization or a government or political subdivision thereof.

“Proprietary Information” shall include, but not be limited to, underwriting manuals and guidelines, applications, contract forms, agent lists and premium rates and allowances of Reinsurer and Ceding Company, but shall not include the existence of this Agreement and the identity of the parties. Additionally, Proprietary Information may be shared by either party on a need-to-know basis with its officers, directors, employees, Affiliates, third party service providers, auditors, consultants or retrocessionaires, or in connection with the dispute process specified in this Agreement.

“Receiver” shall have the meaning as specified in Article 9.5.

“Reinsurance Premiums” shall have the meaning as specified in Article 4.1.

“Reinsured Liabilities” shall mean, with respect to the contractual provisions and obligations of the Reinsured Policies, the liabilities incurred or accrued by Ceding Company that relate to death benefits, maturity or endowment benefits, full surrender benefits, partial surrender or withdrawal benefits, accrued interest, accrued credits or other nonguaranteed elements, annuitizations, benefits under Supplementary Contracts, and other contractual benefits, net of Existing Reinsurance, provided that in no case shall Reinsured Liabilities include any Excluded Liabilities.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

“Reinsured Policies” shall mean all policies and riders, including any amendments or endorsements attached thereto, and all Supplementary Contracts in force as of the Effective Date originally issued by FWL, which through merger of FWL into Ceding Company became contracts of Ceding Company, and GPL, which through merger of GPL into Ceding Company became contracts of Ceding Company, and as listed by policy number in Schedule A, excluding policies and riders terminated subsequent to the listing date (June 30, 2017) and prior to the Effective Date. Any riders, amendments, or endorsements issued by Ceding Company on Reinsured Policies or increase in benefits on Reinsured Policies subsequent to the effective date shall be reinsured under the terms of this Agreement.

“Reinsured Policies Report” shall have the meaning as specified in Article 7.1.

“Reinsurer” shall have the meaning as specified in Article 1.1.

“Relevant Regulatory Authority” shall mean the insurance regulatory authority of Ceding Company’s state of domicile.

“SAP” shall mean the statutory accounting principles and practices prescribed or permitted for life insurance companies domiciled in Ceding Company’s state of domicile.

“Statutory Reserves” shall mean reserves and claim liabilities, including in course of settlement and incurred but not reported, calculated in accordance with SAP. Such reserves shall be calculated in good faith on a seriatim basis by Ceding Company (for calculation dates prior to December 31, 2017) or by Reinsurer (for calculation dates on or after December 31, 2017), but shall not include (a) additional actuarial reserves as used in connection with SAP, if any, established by Ceding Company as a result of its annual cash flow testing, (b) any asset valuation reserves as used in connection with SAP established by Ceding Company, or (c) any other reserve not directly attributable to the Reinsured Policies.

“Supplementary Contracts” shall mean all supplementary contracts or settlement options, whether with or without life contingencies, issued by Ceding Company in exchange for a Reinsured Policy.

“Termination Effective Date” shall have the meaning as specified in Article 9.5.

“Terminal Accounting Period” shall have the meaning as specified in Article 7.1.

“Third Party Administrative Services Agreement” shall have the meaning as specified in Article 6.1.

2.2 Other Definitional Provisions

For purposes of this Agreement, the words “hereof,” “herein,” “hereby” and other words of similar import refer to this Agreement as a whole, including all Schedules and Exhibits to this Agreement, unless otherwise indicated.

Whenever the singular is used herein, the same shall include the plural, and whenever the plural is used herein, the same shall include the singular, where appropriate.

The term “including” means “including but not limited to.”

Whenever used in this Agreement, the masculine gender shall include the feminine and neutral genders and vice versa.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

The Schedules and Exhibits hereto are hereby incorporated by reference into the body of this Agreement.

All references herein to Articles, Exhibits and Schedules shall be deemed references to Articles of and Exhibits and Schedules to this Agreement unless the context shall otherwise require.

All terms defined in this Agreement shall have the defined meaning when used in any Schedule, Exhibit, report or other documents attached hereto or made or delivered pursuant hereto unless otherwise defined therein.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 3 — COVERAGE

3.1 Scope

Ceding Company agrees to transfer to Reinsurer and Reinsurer agrees to accept and indemnify risk on all Reinsured Policies, subject in all respects to the terms, clauses, conditions, stipulations, waivers and modifications of the Reinsured Policies, provided, however, that Reinsurer acknowledges and agrees that Ceding Company shall submit this Agreement to the Nebraska Department of Insurance and the parties will negotiate in good faith any amendments to this Agreement requested thereby. In the event the parties are unable to so agree on any such amendments within ten (10) Business Days following notice to both parties of such request, this Agreement shall be rescinded according to the provisions set forth in Article 9.

Ceding Company and Reinsurer acknowledge the existence of a signed letter of intent dated August 31, 2017, which set forth the general terms and conditions leading to the execution of this Agreement, and agree that such letter of intent is both generally consistent with and fully replaced by this Agreement.

3.2 Basis of Reinsurance

Reinsurer shall accept, on a first dollar quota share coinsurance basis, one hundred percent (100%) of all risks and liabilities associated with the Reinsured Policies, subject in all respects to the terms, clauses, conditions, stipulations, waivers, modifications, and cancellations of the Reinsured Policies, and Extra-Contractual Obligations arising therefrom, but in no event shall Reinsurer be liable for Extra-Contractual Obligations unless Reinsurer shall have received notice in writing of and concurred with the actions taken or not taken by Ceding Company which led to its liability. Subject to the terms, conditions and limits of this Agreement, Reinsurer shall follow the fortunes and settlements of Ceding Company, and to that end, Reinsurer’s liability for the Reinsured Policies shall be identical to that of Ceding Company and shall be subject to the same risks, terms, conditions, interpretations, waivers, modifications, alterations and cancellations as the respective insurances of Ceding Company, subject in each case to Ceding Company’s duty to adhere to its obligations pursuant to Article 6 and to Reinsurer’s duty to adhere to its obligations pursuant to the same Article 6.

3.3 Retention

Ceding Company shall retain zero percent (0%) of the liabilities with respect to each of the Reinsured Policies.

3.4 Existing Reinsurance

Reinsurance under this Agreement shall be subject to Existing Reinsurance associated with the Reinsured Policies. The total reinsurance recoverable under Existing Reinsurance and reinsurance under this Agreement shall not exceed Ceding Company’s total contractual liability on any Reinsured Policy less Ceding Company’s retention under the respective reinsurance agreements.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

3.5 Reinstatement

If a Reinsured Policy that has lapsed or surrendered is reinstated in accordance with its terms and in accordance with Ceding Company’s rules and procedures for reinstatement, Reinsurer will, upon notification, reinstate reinsurance coverage for such Reinsured Policy. Upon reinstatement of reinsurance coverage, Ceding Company shall pay to Reinsurer all applicable Reinsurance Premiums, if any, plus accrued interest for the period and at the interest rate for which it receives premiums in arrears.

3.6 Misstatement of Fact

In the event of a change in the amount payable under a Reinsured Policy due to an applicant’s or policy owner’s misstatement in fact on the application for the Reinsured Policy, Reinsurer’s liability with respect to such Reinsured Policy will change proportionately to the change in amount payable under the Reinsured Policy. If the Ceding Company has misstated facts otherwise correct on the application which results in the incorrect amount of premium being collected, the Ceding Company will reimburse the Reinsurer for the correct amount of premium. Should this misstatement result in the over collection of premium, the Ceding Company will work the the Reinsurer to refund the excess premium to the policyowner.

3.7 Credited Rates and Nonguaranteed Elements

Subsequent to the Effective Date, Reinsurer shall have ultimate discretion and control for determining credited interest rates and other nonguaranteed elements of the Reinsured Policies, provided that Reinsurer shall consider in good faith any recommendations provided by Ceding Company regarding credited interest rates and other nonguaranteed elements of the Reinsured Policies for a period of ten (10) years subsequent to the Effective Date.

3.8 Internal Replacements

Ceding Company shall not solicit, directly or indirectly, contract holders of the Reinsured Policies in connection with the replacement of a Reinsured Policy with any other policy not reinsured by the Reinsurer.

3.9 Recapture

Reinsurance under this Agreement is not eligible for recapture by Ceding Company unless mutually agreed by the parties.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 4 – REINSURANCE PREMIUMS

4.1 Reinsurance Premiums

Reinsurer shall be entitled to 100% of all premiums due and collected subsequent to the Effective Date under the terms of all Reinsured Policies, including modal loadings and policy fees, less agent commissions and premium taxes. Reinsurance premiums are on the same mode as direct premiums.

4.2 Initial Consideration

On the Effective Date, Ceding Company shall pay to Reinsurer the Initial Consideration in an amount equal the Adjusted Net Reserves calculated immediately prior to the application of this Agreement and as of the Effective Date, less the Ceding Commission.

4.3 Ceding Commission

The Ceding Commission due Ceding Company on the Effective Date shall be paid to Ceding Company by Reinsurer by means of Ceding Company retaining said amount from the Adjusted Net Reserves transferred to Reinsurer as set forth in Article 4.2.

4.4 Premium Taxes

Premium taxes that first become due to state or local taxing authorities on or after the Effective Date with respect to the Reinsured Policies shall be paid or reimbursed by Reinsurer.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 5 – REINSURANCE BENEFITS AND EXPENSES

5.1 Policy Claims

Reinsurer shall pay or reimburse Ceding Company for all Claims incurred on or after the Effective Date in accordance with the terms and conditions of the Reinsured Policies, applicable law, and Article 7.3.

Reinsurer may request that Ceding Company investigate, contest, compromise or litigate any Claim involving a Reinsured Policy (any such claim, a “Contested Claim”), consent thereto shall not be unreasonably withheld, conditioned or delayed. Ceding Company may authorize Reinsurer to act on its behalf in such matter. Administrator shall provide to the other party all relevant information and documents, as such become available, pertaining to Contested Claim and will promptly report any developments during the review. Subject to limitations relating to Excluded Liabilities, Reinsurer shall bear the expenses, or reimburse Ceding Company for the reasonable expenses, of any contest or compromise of a Claim, and will be entitled to any reduction of liability.

If Reinsurer so elects, it may discharge its liability with respect to any Contested Claim by paying to Ceding Company its share of such Claim as originally presented to Ceding Company and, thereafter, will have no obligation to Ceding Company for reimbursement of expenses related to the contest of such Claim and will not share in any subsequent reduction in liability relating to such Claim.

5.2 Commissions

Commissions due on or after the Effective Date under the terms of valid agents’ contracts existing as of the Effective Date shall be paid or reimbursed by Reinsurer. Reinsurer shall not be responsible for any uncollectible agent debit balances.

5.3 Expenses

Expenses associated with the administration and reporting of the Reinsured Policies on or after the Effective Date shall be paid or reimbursed by Reinsurer after December 31, 2017. Ceding Company agrees to administer the Reinsured Policies through December 31, 2017 at no cost to Reinsurer. Provided, however, if Ceding Company is requested to provide administrative services after December 31, 2017, Reinsurer agrees to pay for those services at $100 per policy per annum, prorated for the period during which such administrative services are are provided.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 6 – ADMINISTRATION

6.1 Administrator

Administrator shall perform all appropriate administrative, claims and other services customarily performed by a direct company in the life insurance industry, including reporting under Article 7, as well as duties customarily performed by an assuming company in the reinsurance industry, such services to include all required and necessary policyholder service, premium billing and collection, commission processing, claim adjudication, insurance accounting, valuation of statutory reserves and other liabilities, and valuation of assets (Administrative Services). Administrator agrees to use reasonable care in its administration, conform with law, and use all reasonable efforts to preserve the value of the Reinsured Policies.

Neither party shall outsource any administrative functions or claims administration with respect to the Reinsured Policies without the consent of the other party, such consent not to be unreasonably withheld. Prior to any such outsourcing, the right to audit and inspect the party performing such outsourced services shall be secured.

All monetary considerations for such Administrative Services are explicitly reflected in the Ceding Commission or Reinsurance Premiums with no further monetary considerations owed to Ceding Company or Reinsurer.

6.2 Record Keeping

Administrator shall maintain all records and correspondence for services performed under Article 6.1 in

accordance with industry standards of insurance record keeping. In addition, such records shall be made available for examination, audit, and inspection by the department of insurance of any state within whose jurisdiction Ceding Company or Reinsurer operates. Administrator further agrees that in the event of the termination of this Agreement, any such records in the possession of the Administrator shall promptly be duplicated and forwarded to the other party unless otherwise instructed.

Administrator shall establish and maintain an adequate system of internal controls and procedures for financial reporting relating to the Reinsured Policies, including associated documentation and shall make such documentation available for examination and inspection by the other party. All reports provided by the Administrator pursuant to Article 7 shall be prepared in accordance with such system and procedures and shall be consistent with the Administrator’s books and records.

6.3 Administrative Account

Administrator shall maintain with sufficient funds, at its own expense, and Ceding Company shall cooperate in the establishment and maintenance of a checking account in the name of Ceding Company in a bank insured by the Federal Deposit Insurance Corporation for the purpose of facilitating Administrator’s performance of Administrative Services, including receiving premium and paying claims (“Administrative Account”).

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 7 – REPORTING AND SETTLEMENTS

7.1 Initial and Monthly Reporting

Within ten (10) Business Days following the Effective date and within ten (10) Business Days following the end of each Monthly Accounting Period thereafter, Administrator shall deliver to the other party a report of the Reinsured Policies (a “Reinsured Policies Report”) similar in form to the report set forth on Schedule A, along with seriatim information in electronic format containing Basic Policy Data with respect to each of the Reinsured Policies.

Within ten (10) Business Days following the end of each calendar month, the Administrator shall deliver to the other party an accounting report (a “Monthly Accounting Report”) prepared in accordance with SAP and substantially in the form set forth in Exhibit A for the immediately preceding calendar month (a “Monthly Accounting Period”) or, in the case of termination, the period from the end of the immediately preceding Monthly Accounting Period to the date on which this Agreement is terminated (the “Terminal Accounting Period”), as applicable.

7.2 Quarterly and Annual Reporting

Ceding Company shall deliver to Reinsurer and Reinsurer shall deliver to Ceding Company (a) a copy of its unaudited annual statement (Blue Book) within five (5) Business Days following the filing thereof with the Relevant Regulatory Authority but no later than March 5 of each year, (b) a copy of its audited annual statutory financial statements within five (5) Business Days following the filing thereof with the Relevant Regulatory Authority but no later than June 5 of each year and (c) a copy of its unaudited quarterly statutory financial statements within five (5) Business Days following the filing thereof with the Relevant Regulatory Authority but no later than fifty (50) calendar days after the end of each calendar quarter.

Upon request, Administrator shall promptly provide the other party with any additional information related to the Reinsured Policies that the other party reasonably requires to complete its financial statements.

Administrator acknowledges that timely and correct compliance with the reporting requirements of this Agreement are material elements of the Administrator’s responsibilities hereunder and an important basis of the other party’s ability to assess the risks hereunder. Material noncompliance with reporting requirements, including extended delays, will constitute a material breach of the terms of this Agreement.

7.3 Settlements

Administrator shall calculate a Monthly Settlement Amount on the first Business Day of each calendar month on the basis of Reinsurance Premiums received during the previous calendar month and Claims paid during the previous calendar month. On the first Business Day of each month, Administrator shall effectuate the payment of the Settlement Amount by paying Reinsurance Premiums to Reinsurer and collecting amounts paid for Claims from Reinsurer, consistent with Article 14.3.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 8 – CREDIT FOR REINSURANCE

8.1 Admitted Reinsurer

Reinsurer represents that it is an admitted insurance company licensed in the state of Nebraska, Ceding Company’s state of domicile.

8.2 Reserves

Reinsurer shall establish reserves in respect to the Reinsured Policies (“Ceded Reserves”) in an amount equal to Adjusted Net Reserves.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 9 – TERM AND TERMINATION

9.1 Duration of Agreement

Subject to Article 9.2, this Agreement shall be in effect until all assumed liabilities have been fully satisfied. Subject to Articles 4.1 and 9.2, all Reinsured Policies in force as of the Effective Date will remain Reinsured Policies until the expiration thereof and Reinsurer shall remain liable thereon.

9.2 Termination for Non-Payment

Either party may terminate this Agreement as to all Reinsured Policies if the other party fails to pay any amounts due under this Agreement within thirty (30) calendar days following written notice of non-payment from the non-defaulting party (a “Non-Payment Event”); provided, that reinsurance that is terminated due to non-payment by Ceding Company may be reinstated by Ceding Company, subject to Reinsurer’s approval, within sixty (60) calendar days of the date of termination, and upon payment of all amounts in arrears including any interest accrued thereon; provided, further, that Reinsurer shall have no liability for the payment of any Claims under the Reinsured Policies that are incurred between the date of termination and the date of the reinstatement of the reinsurance.

9.3 Termination for Material Breach

In addition to all other rights and remedies available under this Agreement, either party may terminate this Agreement as to all Reinsurance Policies by providing the other party with a minimum of thirty (30) calendar days prior written notice (except in the case of a Non-Payment Event, in which case notice may be given immediately) in the event the other party commits a material breach of any provision of this Agreement (including any failure by Reinsurer, within Reinsurer’s control, that causes Ceding Company not to receive full credit for the reinsurance effected hereunder on its statutory financial statements filed in Ceding Company’s state of domicile), which notice shall specify the nature of such material breach. The breaching party shall have twenty (20) calendar days from the date of the breaching party's receipt of the foregoing notice to cure such material breach to the reasonable satisfaction of the non-breaching party. If the breach is cured, the other party shall provide written notice to the curing party that the breach has been adequately cured. In the event the breaching party fails to cure the material breach within such twenty (20) calendar day period, then, at the option of the non-breaching party and upon notice, this Agreement will terminate upon expiration of the thirty (30) calendar day notice period. Notwithstanding the foregoing, the parties shall cooperate with each other to effect a cure of any breach of the terms of this Agreement.

9.4 Termination for Insolvency of Reinsurer

Ceding Company may terminate this Agreement as to all Reinsured Policies in the event that Reinsurer becomes insolvent (as set forth in Article 12) by promptly providing Reinsurer or its Authorized Representative with written notice of termination, to be effective as of the date on which Reinsurer’s insolvency is established by the authority responsible for such determination. Any requirement for a notification period prior to the termination of this Agreement shall not apply under such circumstances.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

9.5 Termination Payment

In the event that this Agreement is terminated as to all Reinsured Policies, including if this Agreement is rejected by any liquidator, receiver, rehabilitator, trustee or similar person acting on behalf of Ceding Company (a “Receiver”), a net accounting and settlement as to any balance due under this Agreement will be undertaken by Ceding Company in accordance with Article 7. In addition, on the date of delivery of the Monthly Accounting Report related to such termination, Reinsurer shall transfer to Ceding Company, within fifteen (15) Business Days after receipt of the Monthly Accounting Report, an amount equal to the Ceded Reserves as of the Termination Effective Date.

Reinsurer’s right to terminate the reinsurance provided hereunder will not prejudice its right to collect Reinsurance Premiums, if any, and applicable interest as specified in Article 14.2, for the period during which such reinsurance was in force, through and including any notice period.

9.6 Rescission

If this Agreement is rescinded pursuant to Article 3.1, the parties agree to cooperate in good faith and use all reasonable efforts to return each party to an economic position that is substantially similar to the economic position it was in immediately prior to the date of this Agreement, after the satisfaction of which this Agreement shall be extinguished and neither party shall have any further liability to the other party hereunder.

9.7 Survival

All provisions of this Agreement will survive any termination of this Agreement to the extent necessary to carry out its purpose.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 10 – ERRORS AND OMISSIONS

Any unintentional or accidental failure to comply with the terms of this Agreement that can be shown to be the result of an oversight or clerical error relating to the administration of reinsurance by either party will not constitute a breach of this Agreement. Upon discovery, the error will be promptly corrected so that both parties are restored to the position they would have occupied had the oversight or clerical error not occurred. In the event a payment is corrected, the party receiving the payment shall be entitled to interest in accordance with Article 14.2. Should it not be possible to restore both parties to this position, the party responsible for the oversight or clerical error will be responsible for any resulting liabilities and expenses.

If Ceding Company has failed to cede reinsurance as provided under this Agreement or has failed to comply with reporting requirements with respect to business ceded hereunder, Reinsurer may require Ceding Company to audit its records for similar errors and take reasonable actions necessary to correct errors and avoid similar errors. Failing prompt correction, Reinsurer may limit its liability to the correctly reported Reinsured Policies.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 11 – DISPUTE RESOLUTION

11.1 Negotiation

Within fifteen (15) calendar days after Reinsurer or Ceding Company has given the other party written notification of a specific dispute arising out of or relating to this Agreement, each party will appoint a designated officer of its company to attempt to resolve such dispute. The officers will meet at a mutually agreeable location as soon as reasonably possible and as often as reasonably necessary in order to gather and furnish the other with all appropriate and relevant information concerning the dispute. The officers will discuss the matter in dispute and will negotiate in good faith without the necessity of formal arbitration proceedings. During the negotiation process, all reasonable requests made by one officer to the other for information will be honored. The specific format for such discussions will be decided by the designated officers.

If the officers cannot resolve the dispute within thirty (30) calendar days of their first meeting, the dispute will be submitted to formal arbitration pursuant to Article 11.2, unless the parties agree in writing to extend the negotiation period for an additional thirty (30) calendar days.

11.2 Arbitration

It is the intention of Reinsurer and Ceding Company that the customs and practices of the insurance and reinsurance industry will be given full effect in the operation and interpretation of this Agreement. The parties agree to act in all matters with the utmost good faith. However, if Reinsurer and Ceding Company cannot mutually resolve a dispute that arises out of or relates to this Agreement, including, without limitation, the rights and obligations arising under, formation, interpretation, and/or validity of this Agreement, and the dispute cannot be resolved through the negotiation process, then, the dispute shall be submitted to arbitration in accordance with the provisions of this Article 11.2.

To initiate arbitration, either Ceding Company or Reinsurer will notify the other party by certified mail of its desire to arbitrate, stating the nature of the dispute and the remedy sought. Each party shall select an arbitrator within thirty (30) days of the written request for arbitration. If either party refuses or neglects to appoint an arbitrator withing thirty (30) days of the written request for arbitration, the other party may appoint the second arbitrator. The two arbitrators shall select an umpire within thirty (30) days of the appointment of the second arbitrator. If the two arbitrators fail to agree on the selection of the umpire withing thirty (30) days of the appointment of the second arbitrator, each arbitrator shall submit to the other a list of three umpire candidates, each arbitrator shall select one name from the list submitted by the other and the umpire shall be selected from the two names chosen by a lot drawing procedure to be agreed upon by the arbitrators.

The arbitratrors and umpire shall all be disinterested, ARIAS-certified arbitrators, who are current or former executive officers of a life insurance or life reinsurance company other than the parties to this Agreement, their Affiliates or subsidiaries. The arbitrator shall be familiar with the prevailing customs and practices for reinsurance in the life insurance and life reinsurance industry in the United States.

Each arbitration hearing under this Agreement will be held on the dates set by the umpire in Topeka, Kansas or other mutually agreed upon location. As soon as possible, the arbitrator shall establish arbitration procedures as warranted by the facts and issues of the particular case. Notwithstanding Article 14.19, the arbitration and this Article 11.2 shall be governed by Title 9 (Arbitration) of the United States Code.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

The arbitration panel shall interpret this Agreement as an honorable engagement rather than merely as a legal obligation and shall make its decision considering the terms and conditions of this Agreement and the customs and practices of the insurance and reinsurance industries with a view to effecting the general purpose of the Agreement. The arbitration panel is released from judicial formalities and shall not be bound by strict interpretation of the law.

The decision of a majority of the arbitration panel shall be final and binding on both parties, except to the extent otherwise provided in the Federal Arbitration Act. The arbitration panel shall render its award in writing. Judgment upon the award may be entered in any court having jurisdiction, pursuant to the Federal Arbitration Act.

The parties agree that the federal courts in either party’s state of domicile have jurisdiction to hear any matter relating to compelling arbitration or enforcing the judgment of an arbitral panel, and the parties hereby consent to such jurisdiction. Each party hereby waives, to the fullest extent permitted by law, any objection it may have to such venue, or any claim that a proceeding brought in federal court in either party’s state of domicile has been brought in an inconvenient forum. In addition, Ceding Company and Reinsurer hereby consent to service of process out of such courts at the addresses set forth in Article 14.6.

Unless the arbitration panel decides otherwise, each party will bear the expense of its own arbitration activities, including the fees and expenses of its own arbitrator, and any outside attorney and witness fees. The parties will jointly bear an equal share of the fees and expenses of the umpire and of the other expenses of the arbitration.

11.3 Waiver of Trial by Jury

Reinsurer and Ceding Company hereby waive any and all rights to trial by jury in any matter arising out of or relating to this Agreement.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 12 – INSOLVENCY

A party to this Agreement will be deemed “insolvent” when: (a) a receiver, rehabilitator, conservator, liquidator or statutory successor is appointed; (b) it is adjudicated as bankrupt or insolvent; (c) it files or consents to the filing of a petition in bankruptcy, seeks reorganization or an arrangement with creditors or takes advantage of any bankruptcy, dissolution, liquidation, rehabilitation, conservation or similar law or statute; or (d) it becomes the subject of an order of rehabilitation or an order of liquidation as defined by the insurance code of the jurisdiction of the party’s domicile.

In the event of the insolvency of either party, the rights or remedies of this Agreement will remain in full force and effect.

In the event of the insolvency of Ceding Company, the following three paragraphs shall apply:

The reinsurance provided under this Agreement will be payable by Reinsurer directly to Ceding Company or to its liquidator, receiver, conservator, statutory successor, or other authorized representative on the basis of the reported claims allowed against Ceding Company by any court of competent jurisdiction or by the liquidator, receiver, conservator, statutory successor, or other authorized representative having authority to allow such claims, without diminution because of such insolvency, or because the liquidator, receiver, conservator, statutory successor, or other authorized representative failed to pay all or a portion of any claims. It is agreed, however, that the liquidator, receiver, conservator, statutory successor, or other authorized representative shall give prompt written notice to Reinsurer of the pendency of a claim against Ceding Company within a reasonable time after such claim is filed in the receivership, conservation, insolvency or liquidation proceeding and that during the lendency of such claim, Reinsurer may investigate such Claim and interpose, at its own expense, in the proceedings where the Claim is to be adjudicated, any defense or defenses which it may deem available to Ceding Company or its Authorized Representative. Under no circumstances shall Reinsurer have any obligation to the policy owner of any Reinsured Policy.

Reinsurer will be liable only for benefits reinsured as benefits become due under the terms of the Reinsured Policies and will not be or become liable for any amounts or reserves to be held by Ceding Company as to the Reinsured Policies or for any damages or payments resulting from the termination or restructuring of the Reinsured Policies that are not otherwise expressly covered by this Agreement.

The expense incurred by Reinsurer will be chargeable, subject to court approval, against Ceding Company as part of the expense of its insolvency proceedings to the extent of a proportionate share of the benefit which may accrue to Ceding Company solely as a result of the defense undertaken by Reinsurer. Where two or more reinsurers are involved in the same Claim and a majority in interest elect to interpose a defense to such Claim, the expense will be apportioned in accordance with the terms of this Agreement as though such expense had been incurred by Ceding Company.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 13 – REPRESENTATIONS, WARRANTIES AND COVENANTS

13.1 Representations and Warranties of Ceding Company

Ceding Company hereby represents and warrants to Reinsurer as follows:

|

(a) |

Organization and Qualification. Ceding Company is a corporation duly incorporated, validly existing and in good standing under the laws of Ceding Company’s state of domicile and has all requisite corporate power and authority to operate its business as now conducted, and is duly qualified as a foreign corporation to do business, and, to the extent legally applicable, is in good standing, in each jurisdiction where the character of its owned, operated or leased properties or the nature of its activities makes such qualification necessary, except for failures to be so qualified or be in good standing that, individually or in the aggregate, do not have, and would not reasonably be expected to have, a material adverse effect on Ceding Company’s ability to perform its obligations under this Agreement. |

|

(b) |

Authorization. Ceding Company has all requisite corporate power to enter into, consummate the transactions contemplated by and carry out its obligations under, this Agreement. The execution and delivery by Ceding Company of this Agreement, and the consummation by Ceding Company of the transactions contemplated by, and the performance by Ceding Company of its obligations under, this Agreement have been duly authorized by all requisite corporate action on the part of Ceding Company. This Agreement has been duly executed and delivered by Ceding Company, and (assuming due authorization, execution and delivery by Reinsurer) this Agreement constitutes the legal, valid and binding obligation of Ceding Company, enforceable against it in accordance with its terms, subject to the effect of any applicable bankruptcy, reorganization, insolvency, moratorium, or similar laws relating to or affecting creditors’ rights generally. |

|

(c) |

No Conflict. The execution, delivery and performance by Ceding Company of, and the consummation by Ceding Company of the transactions contemplated by, this Agreement do not and will not (i) violate or conflict with the organizational documents of Ceding Company, (ii) conflict with or violate any statute, law, ordinance, rule, regulation, judgment, decree, order, injunction, writ, permit or license of any governmental authority applicable to Ceding Company or by which it or its properties or assets is bound or subject, or (iii) result in any breach of, or constitute a default (or event which, with the giving of notice or lapse of time, or both, would become a default) under, or give to any Person any rights of termination, acceleration or cancellation of, any agreement, lease, note, bond, loan or credit agreement, mortgage, indenture or other instrument, obligation or contract of any kind to which Ceding Company or any of its subsidiaries is a party or by which Ceding Company or any of its subsidiaries or any of their respective properties or assets is bound or affected, except, in the case of clause (iii), any such conflicts, violations, breaches, loss of contractual benefits, defaults or rights that, individually or in the aggregate, do not have, and would not reasonably be expected to have, a material adverse effect on Ceding Company’s ability to perform its obligations under this Agreement. |

|

(d) |

Factual Information Relating to the Reinsured Policies. The information relating to the business reinsured under this Agreement that was supplied by or on behalf of Ceding Company to Reinsurer or any of Reinsurer’s representatives in connection with this Agreement (such information, the “Factual Information”), as of the date supplied (or if later corrected or supplemented prior to the date hereof, as of the date corrected or supplemented), was true and correct in all material respects. |

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

13.2 Covenants of Ceding Company

|

(a) |

Investigations. To the extent permitted by applicable law or regulation, Ceding Company will notify Reinsurer within five (5) Business Days after notice thereof, in writing, of any and all investigations of Ceding Company conducted by any federal or state governmental authority commencing after the date hereof, which relates in any way whatsoever to the business reinsured under this Agreement. |

|

(b) |

Governmental Notices. Ceding Company shall provide Reinsurer, within five (5) Business Days after receipt thereof, copies of any written notice or report from any governmental authority that relates in any way whatsoever to the business reinsured under this Agreement and a written summary of any material oral communication with any governmental authority that relates in any way whatsoever to the business reinsured under this Agreement. |

13.3 Representations and Warranties of Reinsurer

Reinsurer hereby represents and warrants to Ceding Company as follows:

|

(a) |

Organization and Qualification. Reinsurer is a corporation duly incorporated, validly existing and in good standing under the laws of Reinsurer’s state of domicile and has all requisite corporate power and authority to operate its business as now conducted, and is duly qualified as a foreign corporation to do business, and, to the extent legally applicable, is in good standing, in each jurisdiction where the character of its owned, operated or leased properties or the nature of its activities makes such qualification necessary, except for failures to be so qualified or be in good standing that, individually or in the aggregate, do not have, and would not reasonably be expected to have, a material adverse effect on Reinsurer’s ability to perform its obligations under this Agreement. |

|

(b) |

Authorization. Reinsurer has all requisite corporate power to enter into, consummate the transactions contemplated by and carry out its obligations under, this Agreement. The execution and delivery by Reinsurer of this Agreement, and the consummation by Reinsurer of the transactions contemplated by, and the performance by Reinsurer of its obligations under, this Agreement have been duly authorized by all requisite corporate action on the part of Reinsurer. This Agreement has been duly executed and delivered by Reinsurer, and (assuming due authorization, execution and delivery by Ceding Company) this Agreement constitutes the legal, valid and binding obligation of Reinsurer, enforceable against it in accordance with its terms, subject to the effect of any applicable bankruptcy, reorganization, insolvency, moratorium, or similar laws relating to or affecting creditors’ rights generally. |

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

|

(c) |

No Conflict. The execution, delivery and performance by Reinsurer of, and the consummation by Reinsurer of the transactions contemplated by, this Agreement do not and will not (i) violate or conflict with the organizational documents of Reinsurer, (ii) conflict with or violate any statute, law, ordinance, rule, regulation, judgment, decree, order, injunction, writ, permit or license of any governmental authority applicable to Reinsurer or by which it or its properties or assets is bound or subject, or (iii) result in any breach of, or constitute a default (or event which, with the giving of notice or lapse of time, or both, would become a default) under, or give to any Person any rights of termination, acceleration or cancellation of, any agreement, lease, note, bond, loan or credit agreement, mortgage, indenture or other instrument, obligation or contract of any kind to which Reinsurer or any of its subsidiaries is a party or by which Reinsurer or any of its subsidiaries or any of their respective properties or assets is bound or affected, except, in the case of clause (iii), any such conflicts, violations, breaches, loss of contractual benefits, defaults or rights that, individually or in the aggregate, do not have, and would not reasonably be expected to have, a material adverse effect on Reinsurer’s ability to perform its obligations under this Agreement. |

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Article 14 – MISCELLANEOUS

14.1 Currency

All payments due under this Agreement will be made in U.S. Dollars.

14.2 Interest

All amounts due and payable by Ceding Company or Reinsurer under this Agreement that remain unpaid for more than fifteen (15) calendar days from the date due hereunder will incur interest from the date due hereunder. Except as otherwise set forth in this Agreement, such interest shall accrue at a rate equal to the greater of six percent (6%) or 300 basis points over LIBOR, calculated on a 30/360 basis.

14.3 Right of Setoff and Recoupment

Each of Ceding Company and Reinsurer shall have, and may exercise at any time and from time to time, the right to setoff or recoup any undisputed balance or balances, whether on account of Reinsurance Premiums, allowances, credits, Claims or otherwise, due from one party to the other under this Agreement and may setoff or recoup such balance or balances against any balance or balances due to the former from the latter under this Agreement.

The rights provided under this Article 14.3 are in addition to any rights of setoff that may exist at common law. The parties’ setoff rights may be enforced notwithstanding any other provision of this Agreement including, without limitation, the provisions of Article 12.

14.4 No Third Party Beneficiaries

This Agreement is an indemnity reinsurance agreement solely between Ceding Company and Reinsurer. The acceptance of risks under this Agreement by Reinsurer will create no right or legal relation between Reinsurer and the insured, owner, beneficiary, or assignee of any insurance policy of Ceding Company. In addition, nothing in this Agreement is intended to relieve or discharge the obligation or liability of any third party to any party to this Agreement.

14.5 Amendment

This Agreement may not be changed or modified or in any way amended except by a written instrument duly executed by the proper officers of both parties to this Agreement and any change or modification to this Agreement will be null and void unless made by amendment to this Agreement and duly executed by the proper officers of both parties to this Agreement.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

14.6 Notices

All demands, notices, reports and other communications provided for herein shall be delivered by the following means: (i) hand delivery, (ii) overnight courier service (e.g., FedEx, Airborne Express, or DHL); (iii) registered or certified U.S. mail, postage prepaid and return receipt requested; or (iv) facsimile transmission or e-mail provided that the fax or e-mail is confirmed by delivery using one of the three methods identified in clauses (i) through (iii). All such demands, notices, reports and other communications shall be delivered to the parties as follows:

if to Ceding Company:

American Life & Security Corporation

2900 South 70th Street, Suite 400

Lincoln, NE 68506

Attention: Mark A. Oliver, Chairman and CEO

Phone: 402-489-8266

Email: _______________________________

with a copy to:

_____________________________________

_____________________________________

_____________________________________

Attention: ____________________________

Phone: _______________________________

Email: _______________________________

if to Reinsurer:

US Alliance Life and Security Company

4123 SW Gage Center Drive, Suite 240

Topeka, KS 66604

Attention: Jack H. Brier, Chairman and CEO

Phone: 785-228-0200

Email: _______________________________

with a copy to:

_____________________________________

_____________________________________

_____________________________________

Attention: ____________________________

Phone: _______________________________

Email: _______________________________

Either party hereto may change the names or addresses where notice is to be given by providing notice to the other party of such change in accordance with this Article 14.6.

If either party hereto becomes aware of any change in applicable law restricting the transmission of notices or other information in accordance with the foregoing, such party shall notify the other party hereto of such change in law and such resulting restriction.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

14.7 Consent to Jurisdiction

Subject to the terms and conditions of Article 11, Reinsurer (a) submits to the jurisdiction of any court of competent jurisdiction in the State of Nebraska for the adjudication of any issues arising out of this Agreement, (b) agrees to comply with all requirements necessary to give such court jurisdiction, and (c) will abide by the final decision of such court or of any appellate court in the event of an appeal. This

Article 14.7 is not intended to conflict with or override Article 11.

14.8 Service of Process

Reinsurer hereby designates the Insurance Commissioner of the State of Nebraska as its true and lawful attorney upon whom may be served any lawful process in any action, suit or proceeding instituted by or on behalf of Ceding Company. A copy of any such process shall be delivered to Reinsurer in accordance

with Article 14.6. This Article 14.8 is not intended to conflict with or override Article 7.

14.9 Inspection of Records

Provided that the requesting party is current on all amounts owing to the other party (other than amounts that are being disputed in accordance with the terms and conditions of this Agreement), upon giving at least five (5) Business Days’ prior written notice, the requesting party, or its duly authorized representatives, will have the right to audit, examine and copy, during regular business hours, at the home office of the other party, any and all books, records, statements, correspondence, reports, and other documents that relate to the Reinsured Policies or this Agreement, subject to the confidentiality provisions contained in this Agreement. In the event the requesting party exercises its inspection rights, the other party must provide a reasonable work space for such audit, examination or copying, cooperate fully and faithfully, and produce any and all materials reasonably requested to be produced, subject to confidentiality provisions contained in this Agreement. The administrative expenses, including expenses relating to copying, phone, fax and providing work space to the requesting party shall be borne by the requesting party; provided that if any material breach of this Agreement by the other party has occurred, the expenses relating to all such inspections shall be borne by the non-breaching party.

The requesting party’s right of access as specified above will survive until all of the requesting party’s obligations under this Agreement have terminated or been fully discharged.

14.10 Confidentiality

The parties agree to keep confidential and not disclose or make competitive use of any shared Proprietary Information, unless: (a) the information becomes publicly available or is obtained other than through unauthorized disclosure by the party seeking to disclose or use such information; (b) the information is independently developed by the recipient; (c) the disclosure is required by law, provided that, if applicable, the party required to make such disclosure will allow the other party to seek an appropriate protective order.

In addition, Reinsurer agrees to protect the confidentiality and security of Non-Public Personal Information by: (a) holding all Non-Public Personal Information in strict confidence; (b) maintaining appropriate measures that are designed to protect the security, integrity and confidentiality of Non-Public Personal Information; and (c) disclosing and using Non-Public Personal Information received under this Agreement for purposes of carrying out Reinsurer’s obligations under this Agreement, for purposes of retrocession, or as may be required or permitted by law.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

14.11 Indemnification

Reinsurer shall indemnify Ceding Company against the Reinsured Liabilities strictly in accordance with the terms and conditions set forth in this Agreement.

14.12 Reinsurance Brokers

The parties acknowledge that no broker or finder has acted directly or indirectly for Ceding Company or Reinsurer, nor has Ceding Company or Reinsurer incurred any obligation to pay any brokerage or finder’s fee or other commission, in connection with this Agreement and the transactions contemplated hereby.

14.13 Successors

This Agreement will be binding upon the parties hereto and their respective successors and assigns including any Authorized Representative of either party. Neither party may effect any novation of this Agreement without the other party’s prior written consent.

14.14 Entire Agreement

This Agreement and the Schedules and Exhibits hereto constitute the entire agreement between the parties with respect to the Reinsured Policies hereunder and supersede any and all prior representations, warranties, prior agreements or understandings between the parties pertaining to the subject matter of this Agreement. There are no understandings between the parties other than as expressed in this Agreement and the Schedules and Exhibits hereto. In the event of any express conflict between this Agreement and the Schedules and Exhibits hereto, the Schedules and Exhibits hereto will control.

14.15 Severability

Determination that any provision of this Agreement is invalid or unenforceable will not affect or impair the validity or the enforceability of the remaining provisions of this Agreement.

14.16 Construction

This Agreement will be construed and administered without regard to authorship and without any presumption or rule of construction in favor of either party. This Agreement is between sophisticated parties, each of which has reviewed this Agreement and is fully knowledgeable about its terms and conditions.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

14.17 Non-Waiver

Neither the failure nor any delay on the part of Ceding Company or Reinsurer to exercise any right, remedy, power, or privilege under this Agreement shall operate as a waiver thereof. No single or partial exercise of any right, remedy, power or privilege shall preclude the further exercise of that right, remedy, power or privilege or the exercise of any other right, remedy, power or privilege. No waiver of any right, remedy, power or privilege with respect to any occurrence shall be construed as a waiver of that right, remedy, power or privilege with respect to any other occurrence. No prior transaction or dealing between the parties will establish any custom, sage or precedent waiving or modifying any provision of this Agreement. No waiver shall be effective unless it is in writing and signed by the party granting the waiver.

14.18 Further Assurances

From time to time, as and when requested by a party hereto, the other party hereto shall execute and deliver all such documents and instruments and shall take all actions as may be reasonably necessary to consummate the transactions contemplated by this Agreement.

14.19 Governing Law

Subject to Article 11.2, this Agreement will be governed by and construed in accordance with the laws of the State of Nebraska without giving effect to any principles of conflicts of law thereof that are not mandatorily applicable by law and would permit or require the application of the laws of another jurisdiction.

14.20 Counterparts

This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one agreement, and any of the parties hereto may execute this Agreement by signing any such counterpart. When this Agreement has been fully executed by Ceding Company and Reinsurer, it will become effective as of the Effective Date.

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

The parties hereto have caused this Agreement to be executed effective as of the Effective Date.

|

American Life & Security Corporation |

US Alliance Life and Security Company |

|

|

By: /s/ Mark A. Oliver |

By: /s/ Jack H. Brier |

|

|

(signature) |

(signature) |

|

| Mark A. Oliver | Jack H. Brier | |

|

(print or type name) |

(print or type name) |

|

|

Title: CEO |

Title: President |

|

|

Date: 9-29-17 |

Date: 9-29-17 |

|

|

Location: Lincoln, NE |

Location: Topeka, Kansas |

|

|

Attest: /s/ Todd C. Boeve |

Attest: /s/ Jeff Brown |

|

|

(signature) |

(signature) |

|

|

Title: VP & COO |

Title: EVP & COO |

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Schedule A – Policies Reinsured

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

CONFIDENTIAL

ATTORNEY-CLIENT PRIVILEGE

Exhibit A – Monthly Accounting Report