Registration No. 333-266303 and 333-266303-03

PRELIMINARY PROSPECTUS DATED OCTOBER 11, 2023

|

$232,370,000(2)

|

0.00%

|

Class A-1 Asset Backed Notes(3)

|

|

|

$372,105,000(2)

|

____%

|

Class A-2 Asset Backed Notes

|

|

|

$372,105,000(2)

|

____%

|

Class A-3 Asset Backed Notes

|

|

|

$66,140,000(2)

|

____%

|

Class A-4 Asset Backed Notes

|

| (1) |

The determination regarding the initial principal amount of the Notes will be made no later than the day of pricing.

|

| (2) |

If the aggregate principal amount of Notes to be offered is (a) $810,350,000, the aggregate principal amount of the Notes to be issued will be $1,042,720,000, and the initial principal amount of each class of Notes will be as set forth

above or (b) $1,018,350,000, the aggregate principal amount of the Notes to be issued will be $1,310,360,000, and the initial principal amount of each class of Notes will be $292,010,000 of Class A-1 Notes (not offered hereby), $467,620,000

of Class A-2 Notes, $467,620,000 of Class A-3 Notes and $83,110,000 of Class A-4 Notes.

|

| (3) |

The Class A-1 Notes are not offered hereby and will be retained by the Depositor or one or more of its affiliates.

|

|

Mercedes-Benz Retail Receivables LLC

Depositor

(CIK: 0001463814)

|

Mercedes-Benz Financial Services USA LLC

Sponsor, Servicer and Administrator

(CIK: 0001540252)

|

|

Price to Public

|

Underwriting Discounts

and Commissions

|

Net Proceeds

to the Depositor(1)

|

||||||

|

Class A‑2 Asset Backed Notes

|

$__________

|

_____%

|

$__________

|

_____%

|

$__________

|

_____%

|

||

|

Class A‑3 Asset Backed Notes

|

$__________

|

_____%

|

$__________

|

_____%

|

$__________

|

_____%

|

||

|

Class A‑4 Asset Backed Notes

|

$__________

|

_____%

|

$__________

|

_____%

|

$__________

|

_____%

|

||

|

Total

|

$__________

|

$__________

|

$__________

|

|||||

| (1) |

The net proceeds to the Depositor exclude expenses, estimated at $1,000,000.

|

|

Joint Bookrunners

|

||

|

BofA Securities

|

BNP PARIBAS

|

SMBC Nikko

|

|

Co-Managers

|

|

HSBC

|

Wells Fargo Securities

|

| Page |

|

|

4

|

|

|

4

|

|

|

6

|

|

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

19

|

|

|

21

|

|

|

39

|

|

|

39

|

|

|

39

|

|

|

40

|

|

|

40

|

|

|

41

|

|

|

42

|

|

|

42

|

|

|

42

|

|

|

43

|

|

|

43

|

|

|

45

|

|

|

49

|

|

|

50

|

|

|

50

|

|

|

51

|

|

|

53

|

|

|

53

|

|

|

54

|

|

|

55

|

|

|

55

|

|

|

55

|

|

|

56

|

|

|

56

|

|

|

56

|

|

|

57

|

|

|

58

|

|

|

59

|

|

|

59

|

|

|

59

|

|

|

59

|

|

|

59

|

|

|

62

|

|

|

63

|

|

|

76

|

|

|

76

|

|

|

77

|

|

|

78

|

|

|

78

|

| Page | |

|

80

|

|

|

81

|

|

|

82

|

|

|

84

|

|

|

90

|

|

|

90

|

|

|

90

|

|

|

91

|

|

|

92

|

|

|

92

|

|

| 94 | |

| 94 | |

| 94 | |

| 95 | |

| 95 | |

| 97 | |

| 97 |

|

|

97

|

|

|

98

|

|

| 100 | |

| 100 | |

| 100 | |

| 102 | |

| 104 | |

|

104

|

|

| 105 | |

|

105

|

|

| 106 | |

| 106 | |

| 107 | |

|

107

|

|

| 108 | |

|

108

|

|

| 109 | |

| 110 | |

| 111 | |

| 111 | |

| 111 | |

| 112 | |

| 112 |

|

| 113 | |

| 115 |

|

|

| Page | |

| 117 | |

| 119 | |

| 119 | |

| 120 | |

| 122 | |

| 123 | |

|

123

|

|

| 127 | |

| 127 | |

| 128 | |

| 131 | |

| 132 | |

| 133 | |

|

134

|

|

| 134 | |

| 135 | |

| 136 | |

| 137 | |

| 137 | |

| 138 | |

| 138 | |

| 138 | |

| 139 | |

|

A-I-1

|

|

|

A-1

|

|

|

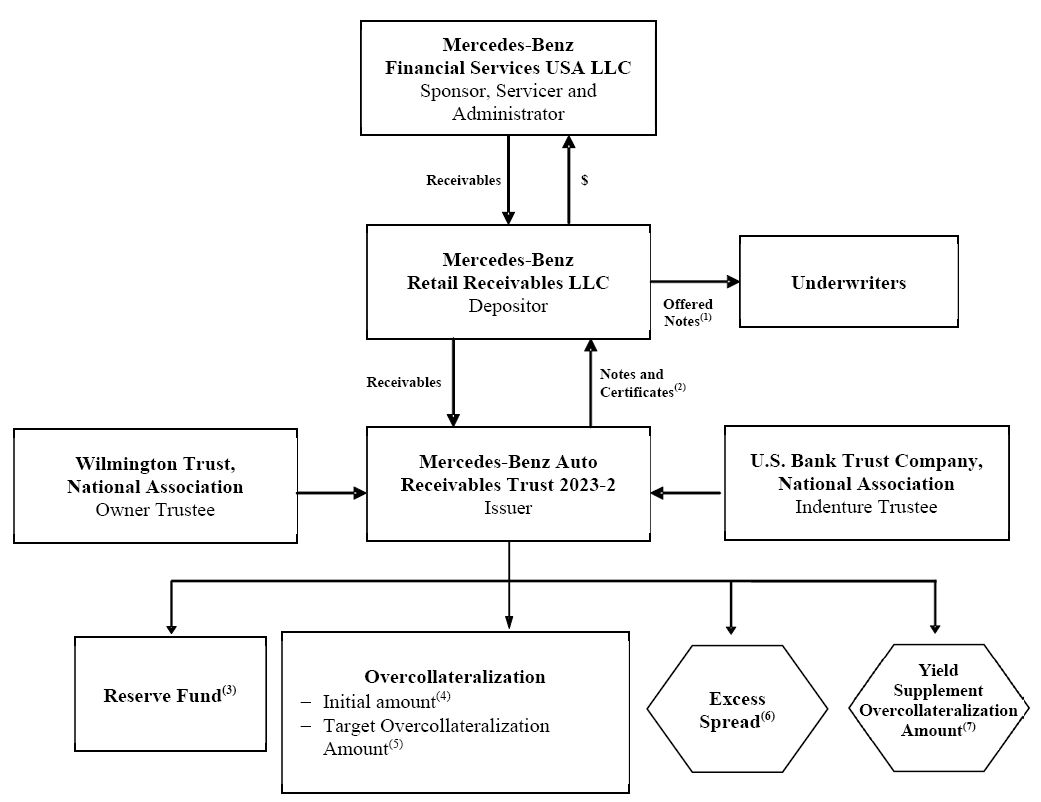

| (1) |

The Class A-1 Notes will be retained by the Depositor or one or more of its affiliates. Some or all of one or more of the other classes of Notes may be retained by the Depositor or its affiliates.

|

| (2) |

The Certificates will represent the residual interest that will be held initially by the Depositor and represent the right to all funds not needed to make monthly payments on the Notes, pay fees and expenses of the Issuer or make deposits

in the Reserve Fund. The Certificates are not being offered by this prospectus. The Depositor will hold the Certificates as described under “Credit Risk Retention.”

|

| (3) |

The Reserve Fund will be funded on the Closing Date in an amount at least equal to 0.25% of the Cutoff Date Adjusted Pool Balance.

|

| (4) |

Overcollateralization will be the amount by which the Adjusted Pool Balance exceeds the Note Balance of the Notes. Initially, the overcollateralization for the Notes will be approximately 2.50% of the Cutoff Date Adjusted Pool Balance.

|

| (5) |

The Target Overcollateralization Amount will be 2.50% of the Cutoff Date Adjusted Pool Balance and will be calculated as described under “Description of the Notes—Credit

Enhancement—Overcollateralization.”

|

| (6) |

Excess spread will be available, as a portion of Available Funds, to make required principal payments on the Notes and, as a result, will provide a source of funds to absorb losses on the Receivables and to maintain overcollateralization

at the Target Overcollateralization Amount, as further described under “Description of the Notes—Credit Enhancement—Excess Spread.”

|

| (7) |

Approximates the present value of the amount by which future scheduled payments on Receivables with Contract Rates less than the Required Rate are less than future payments would be on such Receivables if their Contract Rates were at least

equal to the Required Rate, as described under “Description of the Notes—Credit Enhancement—Yield Supplement Overcollateralization Amount.”

|

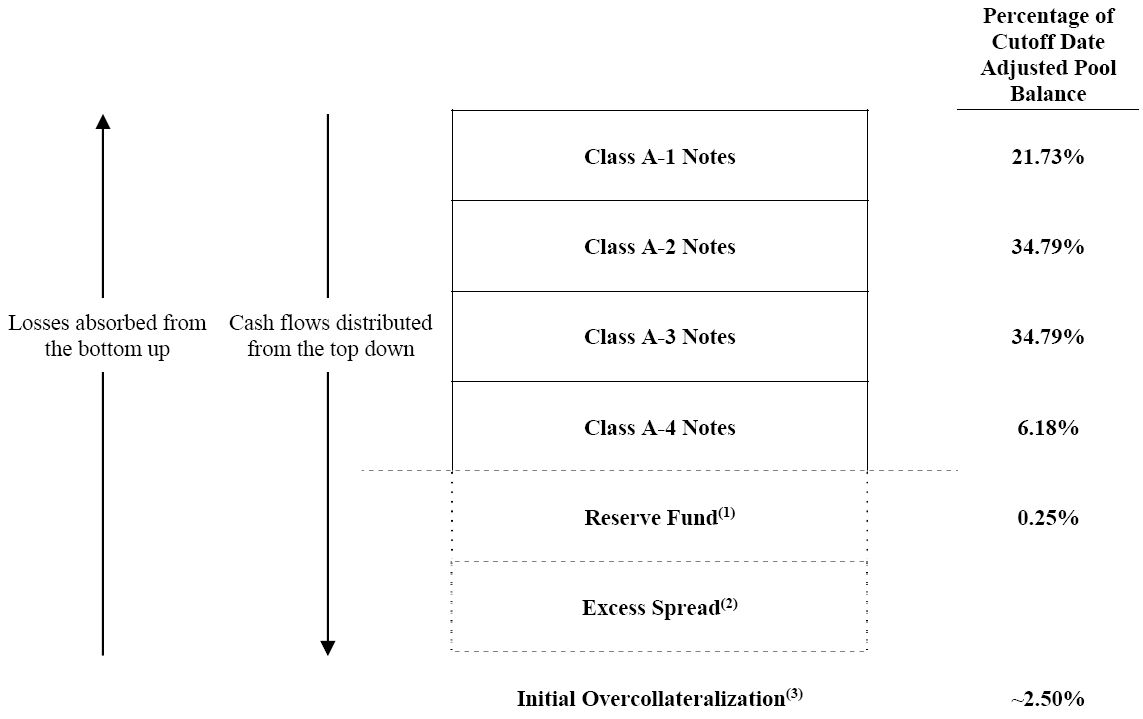

| (1) |

On the Closing Date, the Reserve Fund will be funded in an amount at least equal to 0.25% of the Cutoff Date Adjusted Pool Balance.

|

| (2) |

Excess spread will be available as a portion of Available Funds to make required principal payments on the Notes and, as a result, will provide a source of funds to absorb losses on the Receivables and to maintain overcollateralization at

the Target Overcollateralization Amount.

|

| (3) |

Overcollateralization will be the amount by which the Adjusted Pool Balance exceeds the Note Balance of the Notes. Initially, the overcollateralization for the Notes will be approximately 2.50% of the Cutoff Date Adjusted Pool Balance. The

Adjusted Pool Balance on any date will equal the Pool Balance minus the Yield Supplement Overcollateralization Amount for such date.

|

|

Note

Class

|

Initial Note

Balance(1)

|

Interest Rate

Per Annum

|

||

|

A-1

|

$232,370,000

|

0.00%

|

||

|

A-2

|

$372,105,000

|

____%

|

||

|

A-3

|

$372,105,000

|

____%

|

||

|

A-4

|

$66,140,000

|

____%

|

| (1) |

If the aggregate principal amount of the notes to be issued is (a) $1,042,720,000, the initial principal amount of each class of notes will be as set forth in this table or (b) $1,310,360,000, the initial principal amounts of each

class of notes will be $292,010,000 of class A-1 notes, $467,620,000 of class A-2 notes, $467,620,000 of class A-3 notes and $83,110,000 of class A-4 notes.

|

|

|

|

Note Class

|

Final Scheduled Payment Date

|

|

|

A-1

|

November 15, 2024

|

|

|

A-2

|

November 16, 2026

|

|

|

A-3

|

November 15, 2028

|

|

|

A-4

|

January 15, 2031

|

|

|

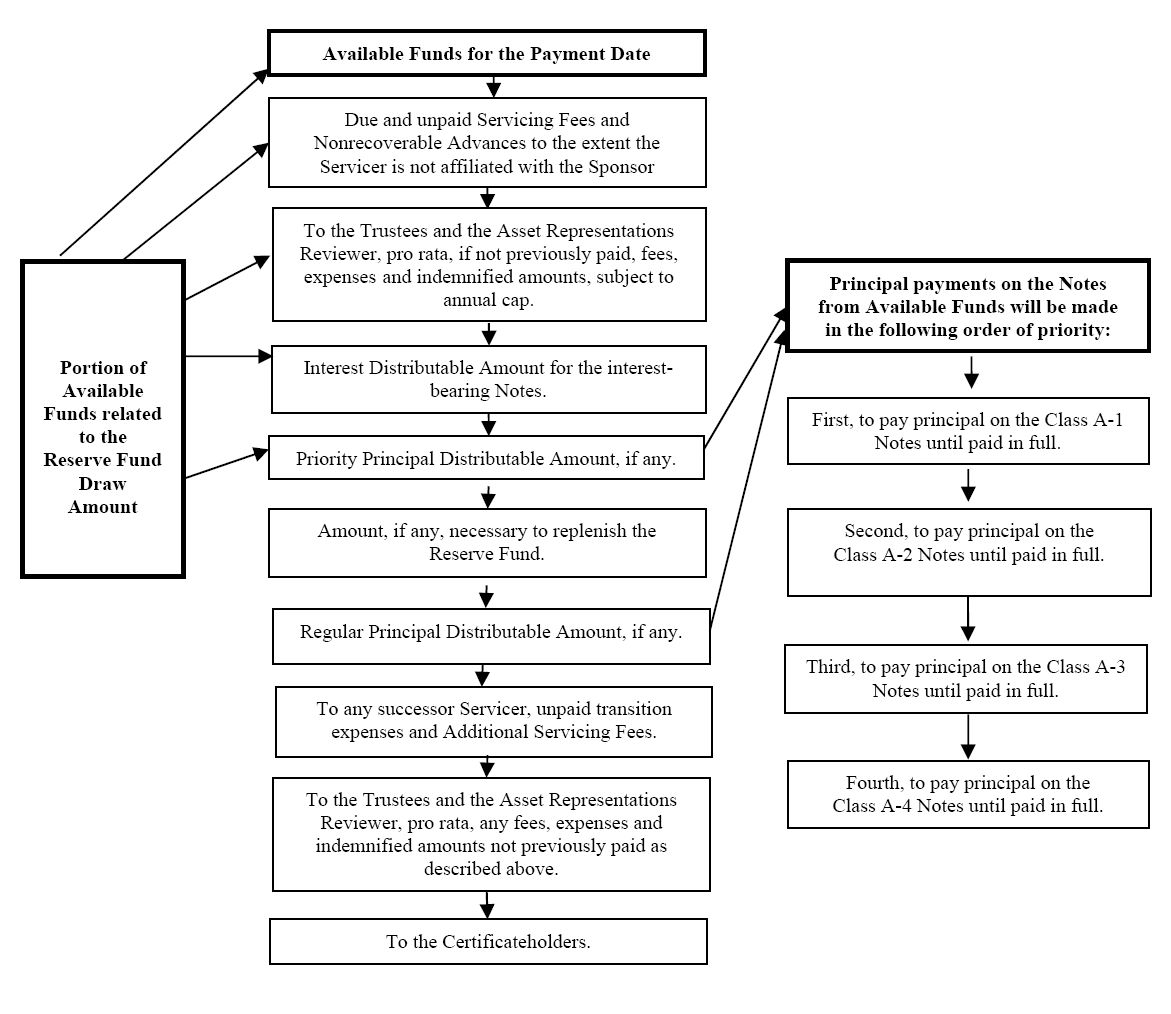

| (1) |

to the class A‑1 notes until they have been paid in full;

|

| (2) |

to the class A‑2 notes until they have been paid in full;

|

| (3) |

to the class A‑3 notes until they have been paid in full; and

|

| (4) |

to the class A‑4 notes until they have been paid in full.

|

| (1) |

the servicing fee for the related collection period plus any overdue servicing fees for one or more prior collection periods plus an amount equal to any nonrecoverable advances to the servicer;

|

| (2) |

if not previously paid, the fees, expenses and indemnified amounts of the trustees and the asset representations reviewer for the related collection period, plus any overdue fees, expenses or indemnified amounts for one or more prior

collection periods will be paid to such parties pro rata; provided, however, that such fees, expenses and indemnified amounts may not exceed, in the aggregate, $250,000 per annum;

|

| (3) |

the interest distributable amount for the interest-bearing notes, ratably to the holders of the interest-bearing notes;

|

| (4) |

principal of the notes in an amount equal to the excess, if any, of (a) the aggregate principal amount of the notes (before giving effect to any payments made to the holders of the notes on that payment date) over (b) the adjusted

pool balance (which equals the aggregate principal balance of the receivables as of the last day of the related collection period, less the yield supplement overcollateralization amount, described under “—Credit Enhancement—Overcollateralization”), to the holders of the notes; provided, that on and after the final scheduled payment date for any class of notes, the amount distributable under this clause shall be not

less than the amount necessary to reduce the outstanding principal balance of such class of notes to zero;

|

|

|

| (5) |

the amount, if any, necessary to fund the reserve fund up to the required amount, into the reserve fund;

|

| (6) |

principal of the notes in an amount equal to (i) the excess, if any, of (a) the aggregate principal amount of the notes (before giving effect to any payments made to the holders of the notes on that payment date) over (b) the

adjusted pool balance minus the target overcollateralization amount, described under “—Credit Enhancement—Overcollateralization,” less (ii) any amounts allocated to pay principal as described in

clause (4), to the holders of the notes;

|

| (7) |

if a successor servicer has replaced MBFS USA as the servicer, any unpaid transition expenses due in respect of the transfer of servicing and any additional servicing fees for the related collection period to the successor servicer;

|

| (8) |

any fees, expenses and indemnified amounts due to the trustees and the asset representations reviewer, pro rata, that have not been paid as described in clause (2); and

|

| (9) |

any remaining amounts to the certificateholders.

|

|

|

|

|

| (1) |

to the servicer, the servicing fee for the related collection period plus any overdue servicing fees for one or more prior collection periods plus an amount equal to any nonrecoverable advances;

|

| (2) |

to the trustees and the asset representations reviewer, all fees, expenses and indemnified amounts for the related collection period plus any overdue fees, expenses or indemnified amounts for one or more prior collection periods, so

long as the notes have not been accelerated following an event of default under the indenture, in an amount not to exceed $250,000 per annum;

|

| (3) |

to the noteholders, monthly interest and the amounts allocated to pay principal described in clause (4) under “Priority of Distributions,” if any, required to be paid on the interest-bearing

notes on that payment date plus any overdue monthly interest due to any class of notes for the previous payment date; and

|

| (4) |

to the noteholders, principal payments required to reduce the principal amount of a class of notes to zero on or after its final scheduled payment date.

|

| • |

a default in the payment of interest on the notes of any class for five or more days;

|

| • |

a default in the payment of the principal of any note on the related final scheduled payment date;

|

| • |

a default in the observance or performance of any other material covenant or agreement of the issuer made in the indenture and such default not having been cured for a period of 60 days after written notice thereof has been given to

the issuer by the depositor or the indenture trustee or to the issuer, the depositor and the indenture trustee by the holders of notes evidencing not less than 25% of the aggregate principal amount of the notes;

|

| • |

any representation or warranty made by the issuer in the indenture or in any certificate delivered pursuant thereto or in connection therewith having been incorrect in any material adverse respect as of the time made and such

incorrectness not having been cured for a period of 30 days after written notice thereof has been given to the issuer by the depositor or the indenture trustee or to the issuer, the depositor and the indenture trustee by the holders of

notes evidencing not less than 25% of the aggregate principal amount of the notes; and

|

|

|

| • |

certain events (which, if involuntary, remain unstayed for 60 days or more) of bankruptcy, insolvency, receivership or liquidation of the issuer or its property as specified in the indenture.

|

| • |

a pool of simple interest motor vehicle installment sales contracts and installment loans purchased by MBFS USA from motor vehicle dealers in the ordinary course of business in connection with the sale of new and pre-owned

Mercedes‑Benz automobiles or originated by MBFS USA in the ordinary course of business in connection with the purchase of Mercedes-Benz vehicles;

|

| • |

amounts received after the cutoff date on or in respect of the receivables;

|

| • |

security interests in the vehicles financed under the receivables;

|

| • |

any proceeds from claims on insurance policies relating to the financed vehicles or the related obligors;

|

| • |

the receivable files;

|

| • |

funds on deposit in the collection account, the note payment account and the reserve fund;

|

| • |

all rights under the receivables purchase agreement with MBFS USA, including the right to cause MBFS USA to repurchase from the depositor receivables affected materially and adversely by breaches of its representations and warranties

made in the receivables purchase agreement;

|

| • |

all rights under the sale and servicing agreement, including the right to cause the servicer to purchase receivables affected materially and adversely by breaches of certain of its servicing covenants made in the sale and servicing

agreement; and

|

| • |

any and all proceeds relating to the above.

|

|

Number of Receivables:

|

23,349

|

|

Average Principal Balance:

|

$48,396.02

|

|

Average Original Principal Balance:

|

$58,812.82

|

|

Weighted Average Contract Rate:

|

7.06%

|

|

Contract Rate (Range):

|

0.00% to 12.00%

|

|

Weighted Average Original Term(1):

|

68.25 months

|

|

Original Term (Range) (1):

|

24 months to 84 months

|

|

Weighted Average Remaining Term(2):

|

58.08 months

|

|

Remaining Term (Range)(2):

|

3 months to 83 months

|

|

Weighted Average FICO®(3) Score(4):

|

752.46

|

|

FICO®(3) Scores (Range)(4):

|

650 to 899

|

| (1) |

Based on the number of scheduled monthly payments at origination.

|

| (2) |

Based on the number of monthly payments remaining as of the cutoff date.

|

| (3) |

FICO® is a registered trademark of Fair Isaac & Co.

|

| (4) |

The FICO® score with respect to any receivable with co-obligors is the highest of each obligor’s FICO® score at the time of application.

|

|

Number of Receivables:

|

29,224

|

|

Average Principal Balance:

|

$48,590.17

|

|

Average Original Principal Balance:

|

$58,973.88

|

|

Weighted Average Contract Rate:

|

7.07%

|

|

Contract Rate (Range):

|

0.00% to 12.00%

|

|

Weighted Average Original Term(1):

|

68.23 months

|

|

Original Term (Range) (1):

|

24 months to 84 months

|

|

Weighted Average Remaining Term(2):

|

58.10 months

|

|

Remaining Term (Range)(2):

|

3 months to 83 months

|

|

Weighted Average FICO®(3) Score(4):

|

752.30

|

|

|

|

FICO®(3) Scores (Range)(4):

|

650 to 899

|

| (1) |

Based on the number of scheduled monthly payments at origination.

|

| (2) |

Based on the number of monthly payments remaining as of the cutoff date.

|

| (3) |

FICO® is a registered trademark of Fair Isaac & Co.

|

| (4) |

The FICO® score with respect to any receivable with co-obligors is the highest of each obligor’s FICO® score at the time of application.

|

| • |

any of its representations or warranties are breached with respect to that receivable;

|

| • |

the interests of the issuer or the noteholders in that receivable is materially and adversely affected by the breach; and

|

| • |

the breach has not been cured following the discovery by or notice to MBFS USA of the breach.

|

|

|

|

|

| • |

An adequate secondary market in the notes may not develop.

|

| • |

The notes are obligations solely of the issuer. Only the limited assets of the issuer will be available to make payments on the notes.

|

| • |

The principal amount of each class of notes will be one of the amounts set forth for that class on the cover page but will not be determined until pricing.

|

| • |

As asset backed securities, the rate of principal payments on the notes cannot be predicted.

|

| • |

The reserve fund provides credit enhancement for the notes but the amount on deposit in the reserve fund is limited and subject to depletion.

|

| • |

A failure to pay principal on a class of notes based on the funds available to the issuer will not be an event of default until the final scheduled payment date.

|

| • |

Principal on the notes will generally be paid sequentially and higher numerical class designations are generally expected to be outstanding longer and are therefore more exposed to risk of loss.

|

| • |

The hired rating agencies could lower, qualify or withdraw their ratings of the notes and unsolicited ratings could also be assigned. An evaluation of the notes, including the creditworthiness of the receivables and credit

enhancement, should be made independently of the ratings.

|

| • |

The depositor or one of its affiliates will retain the class A-1 notes and may retain some or all of one or more of the classes of offered notes which could adversely affect the market value or ability to resell those notes.

|

| • |

The performance of the receivables is dependent on a number of factors and cannot be predicted with accuracy.

|

| • |

Following an event of default, the liquidation of the issuer’s assets may not be sufficient to pay the notes in full.

|

| • |

Vehicle recalls could occur with regard to the models represented by the receivables which could adversely affect collections on those receivables.

|

| • |

The geographic concentration of the receivables means that the notes will be more sensitive to adverse economic changes in those states where concentration exists.

|

| • |

The proceeds from the sale after repossession of the financed vehicle securing a defaulted receivable may not be sufficient to pay the amounts owing under the related receivable.

|

| • |

Various factors could adversely affect the pricing of pre-owned vehicles and therefore the resale value of financed vehicles that are repossessed.

|

| • |

Excessive prepayments and defaults on receivables bearing interest at higher annual percentage rates could result in reduced available interest collections supporting the notes.

|

| • |

The total amount paid for servicing the receivables declines as the pool pays down which could make it more difficult to obtain a successor servicer should it become necessary to replace MBFS USA.

|

| • |

To the extent that collections on the receivables are commingled with the servicer’s own funds, noteholders could be adversely affected if the servicer is unable to make payments of those collections to the issuer on or before the

related payment date.

|

| • |

If a servicer default occurs, the replacement of MBFS USA with another servicer could create additional costs for the issuer and disrupt servicing.

|

| • |

Mercedes-Benz Group AG and its subsidiaries, including MBFS USA, are subject to legal proceedings, claims as well as government investigations and orders on a number of topics.

|

| • |

A bankruptcy of MBFS USA or the depositor could result in challenges to the issuer’s ownership of the receivables or its rights to collections on the receivables.

|

| • |

Liens or other interests in the receivables or financed vehicles in favor of third parties could adversely affect the servicer’s ability to realize on the financed vehicles securing the receivables.

|

| • |

The receivables must comply with numerous federal and state consumer protection and related laws and any failure to so could create liabilities for the issuer and defenses against enforcing the receivables.

|

| • |

Financial regulatory reforms can impose costs and constraints on MBFS USA’s servicing and other activities that affect the notes.

|

| • |

Future epidemics or pandemics could create significant uncertainty and could adversely affect the performance of the receivables as well as MBFS USA’s performance of its obligations under the transaction documents.

|

| • |

Economic downturns and financial market disruptions can adversely affect the notes

|

| • |

Armed conflicts and terrorist activities could have a material adverse impact on the notes.

|

|

Risks Relating to the Characteristics of the Notes and Transaction Structure

|

|

|

The notes are not suitable

investments for all investors

|

The notes are not a suitable investment for any investor that requires a regular or predictable schedule of payments or payment on specific dates. The notes are complex investments that should be considered only by sophisticated investors.

We suggest that only investors who, either alone or with their financial, tax and legal advisors, have the expertise to analyze the prepayment, reinvestment and default risks, the tax consequences of an investment and the interaction of these

factors should consider investing in the notes.

|

|

You may have difficulty selling

your notes and/or obtaining your

desired price

|

There may be no secondary market for the notes. The underwriters may participate in making a secondary market in the offered notes, but are under no obligation to do so. The underwriters and other brokers and dealers may also be unwilling

or unable to publish quotations for the offered notes or otherwise facilitate trading of the offered notes due to regulatory developments or other factors. Any secondary market maintained by an underwriter may be affected or terminated at any

time. We cannot assure you that a secondary market will develop or, if it does develop, that such market will provide noteholders with sufficient liquidity of investment at any time during the period for which your offered notes are

outstanding. Each investor in the offered notes must be prepared to hold its notes for an indefinite period of time or until the related final scheduled payment date or alternatively such investor may only be able to sell its notes at a

discount to its original purchase price of those notes.

There have been other times in the past where there have been very few buyers of asset backed notes and thus there has been a lack of liquidity in the secondary market. The COVID-19 pandemic caused disruptions and volatility in global

financial markets. Future epidemics and pandemics could result in a similar lack of liquidity in the secondary market in the future. As a result, you may not be able to sell your offered notes when you want to do so, or you may not be able to

obtain the price that you wish to receive.

|

|

The issuer’s assets are limited

and are the only assets available

to make payments on your notes

and you may experience a loss if

losses on the receivables exceed

the available credit enhancement

|

The notes represent indebtedness of the issuer and will not be insured or guaranteed by the depositor, MBFS USA, any of their respective affiliates or any other person or entity. The only source of payment on your notes will be payments

received on the receivables and the other credit enhancement described herein. The notes and the receivables will not be insured or guaranteed, in whole or in part, by the United States or any governmental entity. Therefore, you must rely

solely on the assets of the issuer for repayment of your notes. If these assets are insufficient, you may suffer losses on your notes.

|

|

Risks associated with unknown

aggregate initial principal

amount of the notes

|

Whether the issuer will issue notes with an aggregate initial principal amount of $1,042,720,000 or $1,310,360,000 is not expected to be known until the day of pricing. The determination regarding the aggregate initial principal amount of

the notes will be made based on, among other considerations, market conditions at the time of pricing. The size of a class of notes may affect liquidity of that class, with smaller classes being less liquid than a larger class may be. In

addition, if your class of notes is larger than you expected, then you will hold a smaller percentage of that class of notes and the voting power of your notes will be diluted.

|

|

Receivable prepayments may

adversely affect the average life

of and rate of return on your

notes

|

All receivables, by their terms, may be prepaid at any time. Prepayments include:

• prepayments in whole or in part by the obligor;

• liquidations due to default;

• partial payments with proceeds from amounts received as a result of rebates of extended warranty protection plan costs, insurance premiums and physical damage, theft, credit life and

disability insurance policies;

• required purchases of receivables by the servicer or repurchases of receivables by MBFS USA for specified breaches of their respective representations, warranties or covenants; and

• an optional purchase of the receivables by the servicer when their aggregate principal balance is 5% or less of the initial aggregate principal balance.

A variety of economic, social and other factors will influence the rate of receivable optional prepayments and defaults.

As a result of prepayments, the final payment of each class of notes is expected to occur prior to its final scheduled payment date. If sufficient funds are not available to pay any class of notes in full on its final scheduled payment

date, an event of default will occur and final payment of that class of notes may occur later than scheduled.

For more information regarding the timing of repayments of the notes, see “Maturity and Prepayment Considerations.”

|

|

Amounts on deposit in the

reserve fund will be limited and

subject to depletion

|

The amount on deposit in the reserve fund will be used to fund certain payments of monthly interest and certain distributions of principal to noteholders on each payment date if payments received on or in respect of the receivables,

including amounts recovered in connection with the repossession and sale of financed vehicles that secure defaulted receivables, are not sufficient to make such payments. There can be no assurances, however, that the amounts on deposit in the

reserve fund will be sufficient on any payment date to assure payment of your notes. If the receivables experience higher losses than were projected in determining the amount required to be on deposit in the reserve fund on the closing date,

the actual amount on deposit in the reserve fund on any payment date may be less than projected. If on any payment date, available collections and amounts in the reserve fund are not sufficient to pay in full the monthly interest and

distributions of principal due on the notes, you may experience payment delays with respect to your notes. If on subsequent payment dates the amount of that insufficiency is not offset by excess collections on or in respect of the receivables,

amounts recovered in connection with the repossession and sale of financed vehicles that secure defaulted receivables and any other available credit or cash flow enhancement for the issuer described in this prospectus and identified as applying

to the notes, you will experience losses with respect to your notes.

|

|

Failure to pay principal on your

notes will not constitute an event

of default until maturity

|

The amount of principal required to be paid to noteholders on any payment date will be limited to amounts available for that purpose in the collection account (and the reserve fund). Therefore, the failure to pay principal on your notes

generally will not result in the occurrence of an event of default until the final scheduled payment date for your notes.

|

|

Payment priorities increase risk

of loss or delay in payment to

certain classes of notes

|

Classes of notes that receive principal payments before other classes will be repaid more rapidly than the other classes. In addition, because the principal of each class of notes generally will be paid sequentially, classes of notes that

have higher numerical class designations generally are expected to be outstanding longer and therefore will be exposed to the risk of losses on the receivables during periods after other classes of notes have been receiving most or all amounts

payable on their notes, and after which a disproportionate amount of credit enhancement may have been applied and not replenished.

If an event of default under the indenture has occurred and the notes have been accelerated, available funds will be paid first to the class A-1 notes until they have been paid in full, then pro rata to the other classes of notes based upon

the outstanding principal amount of each such class. As a result, in relation to the class A-1 notes, the yields of the class A-2 notes, the class A-3 notes and the class A-4 notes will be relatively more sensitive to losses on the receivables

and the timing of such losses.

If the actual rate and amount of losses exceeds historical levels, and if the available credit enhancement is insufficient to cover the resulting shortfalls, the yield to maturity on your notes may be lower than anticipated and you could

suffer a loss.

For more information on interest and principal payments, see “Description of the Notes—Payments of Interest” and “—Payments of Principal.”

|

|

Prepayments and potential losses

following an indenture event of

default could adversely affect

your notes

|

If the notes have been accelerated following the occurrence of an event of default under the indenture, principal will then be paid first to the class A‑1 notes until they have been paid in full and then pro rata to the other classes of

notes based upon the outstanding principal amount of each such class.

If the maturity dates of the notes have been accelerated following the occurrence of an event of default arising from a payment default, the indenture trustee may, or acting at the direction of the holders of 51% of the aggregate principal

amount of the notes, shall, sell the receivables and prepay the notes. In addition, in the case of an event of default not arising from a payment default, the indenture trustee may sell the receivables and prepay the notes if (1) it obtains

the consent of the holders of 100% of the aggregate principal amount of notes, (2) the proceeds of such sale are sufficient to cover all outstanding principal and interest on the notes or (3) the indenture trustee determines that the future

collections on the receivables would be insufficient to make payments on the notes and obtains the consent of the holders of 66⅔% of the aggregate principal amount of the notes to the sale. If principal is repaid to any holder of notes earlier

than expected, such holder may not be able to reinvest the prepaid amount at a rate of return that is equal to or greater than the rate of return on such holder’s notes. A holder of notes also may not be paid the full principal amount of such

holder’s notes if the assets of the issuer are insufficient to pay the principal amount of such holder’s notes.

For more information on events of default, the rights of the noteholders following the occurrence of an event of default and payments after an acceleration of the notes following the occurrence of an event of default, see “Description of the Notes—Events of Default,” “—Rights Upon Event of Default,” and “—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default.”

|

|

Ratings of the offered notes are

limited and may be reduced or

withdrawn

|

The sponsor has hired two rating agencies and will pay them a fee to assign ratings on the offered notes. A rating is not a recommendation to purchase, hold or sell the related securities, and it does not comment as to market price or

suitability for a particular investor. The ratings of the offered notes address the assigning rating agency’s assessment of the likelihood of the payment of principal and interest on such notes according to their terms. We cannot assure you

that a rating will remain for any given period of time or that a rating agency will not lower, withdraw or qualify its rating if, in its judgment, circumstances in the future so warrant, or that one or more additional rating agencies, not hired

by the sponsor or the depositor to rate the offered notes, may nonetheless provide a rating for the offered notes that will be lower than any rating assigned by a hired rating agency. In addition, in the event that a rating with respect to any

notes is qualified, reduced or withdrawn, no person or entity will be obligated to provide any additional credit enhancement with respect to such notes. A reduction, withdrawal or qualification of a note’s rating would adversely affect its

value.

|

|

The sponsor will not hire any other nationally recognized statistical rating organization, or “NRSRO,” to assign ratings on the offered notes and is not aware that any other NRSRO has assigned ratings on the notes. However, under SEC rules,

information provided to a hired rating agency for the purpose of assigning or monitoring the ratings on the offered notes is required to be made available to each qualified NRSRO in order to make it possible for such non-hired NRSROs to assign

unsolicited ratings on such notes.

An unsolicited rating could be assigned at any time, including prior to the closing date, and none of the depositor, the sponsor, the underwriters or any of their respective affiliates will have any obligation to inform you of any

unsolicited ratings assigned on or after the date of this prospectus. NRSROs, including the hired rating agencies, have different methodologies, criteria, models and requirements. If any non-hired NRSRO assigns an unsolicited rating on the

notes, there can be no assurance that such rating will not be lower than the ratings provided by the hired rating agencies, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. In

addition, if the sponsor fails to make available to the non-hired NRSROs any information provided to any hired rating agency for the purpose of assigning or monitoring the ratings on the offered notes, a hired rating agency could withdraw its

ratings on the offered notes, which could adversely affect the market value of your notes and/or limit your ability to resell your notes.

None of the sponsor, the depositor, either trustee or any of their respective affiliates will be required to monitor any changes to the ratings on the offered notes. Potential investors are urged to make their own evaluation of the

creditworthiness of the receivables and the credit enhancement on the offered notes, and not to rely solely on the ratings on these notes.

Additionally, we note that it may be perceived that a rating agency has a conflict of interest where, as is the industry standard and the case with the ratings of the offered notes, the sponsor or the

issuer pays the fee charged by the rating agency for its rating services.

|

|

|

Retention of notes could

adversely affect the market value

of, and/or limit your ability to

resell, your notes

|

The depositor or its affiliates will retain the class A-1 notes and the certificates and may retain some or all of one or more of the offered classes of notes. As a result, the market for a retained class of notes may be less liquid than

would otherwise be the case and, if retained notes are later sold in the secondary market, it could reduce demand for notes of that class already in the market, which could adversely affect the market value of your notes and/or limit your

ability to resell your notes.

|

|

Risks Relating to the Receivables

|

|

|

Performance of the receivables is

uncertain

|

The performance of the receivables will depend on a number of factors, including general economic conditions, unemployment levels, the effects of future epidemics or pandemics, the circumstances of individual obligors, the underwriting

standards of MBFS USA at origination and the success of the servicer’s servicing and collection strategies. Consequently, the performance of the receivables cannot be predicted with accuracy based on FICO® scores or other similar

measures and may result in losses on your notes.

|

|

The sale of the financed vehicle

securing a defaulted receivable

may not result in complete

recovery of the amounts due

|

The servicer generally exercises its right to sell a vehicle securing a defaulted receivable after repossession. There is no assurance that the amount of proceeds received by the servicer from the sale of the financed vehicle will be equal

to or greater than the outstanding principal balance of the defaulted receivable. The rate at which the value of a financed vehicle depreciates cannot be predicted and may exceed the rate at which the principal balance of the receivable

amortizes. As a result, the amount owed on a receivable could exceed the amount that could be obtained by the servicer from the repossession and sale of the related financed vehicle following an event of default by the obligor. The risk is

increased because, as set forth under “MBFS USA—Underwriting,” the maximum advance rate guidelines used in originating the receivables may result in a receivable

having an initial principal balance in excess of the retail price or book value of the related financed vehicle. This increases the risk that, following a default by the obligor, the amount realized on the sale of the financed vehicle will be

less than the outstanding principal balance of the receivable. If financed vehicles are repossessed by the servicer at a time when auction markets are not functioning fully, or in the event of other factors such as the possible liquidation of

the rental fleet of one or more car rental companies, the resulting sale proceeds are likely to be lower than expected, which could result in increased losses on defaulted receivables. As a result, you may suffer losses on your notes if

available credit enhancement for losses on the receivables is insufficient.

|

|

Market factors may reduce the

value of pre-owned vehicles,

which could result in increased

losses on the receivables

|

Vehicles that are repossessed are typically sold at vehicle auctions as pre-owned vehicles. The pricing of pre-owned vehicles is affected by supply and demand for such vehicles, which in turn is affected by consumer tastes, economic

factors, fuel costs, the introduction and pricing of new car models and other factors, such as the introduction of new vehicle sales incentives, legislation relating to emissions and fuel efficiency, the possibility of vehicle recalls affecting

the related vehicle models or brands and other factors that are beyond the control of the issuer, the depositor or the servicer. Decisions by a manufacturer with respect to new vehicle production, pricing and incentives may affect pre-owned

vehicle prices, particularly those for the same or similar models. Adverse conditions affecting one or more automotive manufacturers, including any that could result from recalls or macro events, may negatively affect pre-owned vehicle prices

for vehicles manufactured by that company. In addition, the introduction of discount pricing incentives or other marketing incentive programs to encourage the purchase of new vehicles could result in reducing the demand for, and value of,

pre-owned vehicles.

Consumer preferences relating to pre-owned vehicles can change rapidly and can be influenced by a variety of economic and social factors, such as the current or anticipated future costs of gasoline. Perceptions of the increased severity of

the effects of climate change, particularly when combined with predictions that those effects may continue to grow and intensify in both the short and long term, could influence consumer efforts to mitigate or reduce climate change-related

events by purchasing or leasing vehicles that are viewed as more fuel efficient (including vehicles powered primarily or solely through electricity).

A decrease in demand for pre-owned vehicles may adversely affect the resale value of repossessed vehicles, which in turn could result in increased losses on the related receivables.

|

|

Excessive prepayments and defaults on receivables with higher annual percentage rates may adversely affect your notes

|

Interest collections that exceed required interest payments on the notes and required payments to the servicer, the asset representations reviewer and the trustees could be used to cover realized losses on defaulted receivables. Interest

collections depend among other things on the annual percentage rates of the receivables. The receivables have a range of annual percentage rates. Excessive prepayments and defaults on receivables with relatively higher annual percentage rates

may adversely affect your notes by reducing such available interest collections in the future.

|

|

Risks Relating to MBFS USA

|

|

|

Paying the servicer a fee based

on a percentage of the aggregate

principal balance of the

receivables may result in the

inability to obtain a successor

servicer

|

Because the servicer will be paid a base servicing fee based on a percentage of the aggregate principal balance of the receivables, the fee the servicer receives each month will be reduced as the size of the pool

decreases over time. At some point, if the need arises to obtain a successor servicer, the fee that such successor servicer would earn might not be sufficient to induce a potential successor servicer to agree to assume the duties of the

servicer with respect to the remaining receivables. If there is a delay in obtaining a successor servicer, it is possible that normal servicing activities could be disrupted during this period which could delay payments and reports to

noteholders, adversely affect collections and ultimately lead to losses or delays in payments on your notes.

|

|

You may suffer a loss on your

notes because the servicer may

commingle collections on the

receivables with its own funds

|

The servicer, so long as it continues to satisfy certain requirements, will be permitted to hold with its own funds collections it receives from obligors on the receivables and the purchase price of receivables required to be repurchased

from the issuer until the day prior to the date on which the related distributions are made on the notes. During this time, the servicer may invest those amounts at its own risk and for its own benefit and need not segregate them from its own

funds. If the servicer is unable to pay these amounts to the issuer on or before the related payment date, you might incur a delay in payment or a loss on your notes.

For more information about the servicer’s obligations regarding payments on the receivables, see “Description of the Transaction Documents—Collections.”

|

|

A servicer default may result in

additional costs or a diminution

in servicing performance, which

may have an adverse effect on

your notes

|

If a servicer default occurs, the servicer may be removed by the holders of a majority of the notes or the indenture trustee acting on their behalf. In the event of the removal of the servicer and an appointment of a successor servicer, we

cannot predict:

• the cost of the transfer of servicing to such successor or

• the ability of such successor to perform the obligations and duties of the servicer under the servicing agreement.

Furthermore, the indenture trustee or the noteholders may experience difficulties in appointing a successor servicer and during any transition phase it is possible that normal servicing activities could be disrupted.

|

|

Mercedes-Benz Group AG

and/or its subsidiaries are

subject to legal risks relating to

pending legal proceedings, claims

as well as governmental

investigations and orders

|

Mercedes-Benz Group AG and its subsidiaries (“Mercedes-Benz”), which include MBFS USA, are confronted with various legal proceedings, claims as well as government

investigations and orders on a large number of topics, including vehicle safety, emissions, fuel economy, financial services, dealer, supplier and other contractual relationships, intellectual property rights (especially patent infringement

lawsuits), warranty claims, environmental matters, antitrust matters (including actions for damages) as well as investor litigation.

The automotive industry is subject to extensive governmental regulations worldwide. Laws in various jurisdictions govern occupant safety and the environmental impact of

vehicles, including emissions levels, fuel economy and noise, as well as the emissions of the plants where vehicles or parts thereof are produced. In case regulations applicable in the different regions are not complied with, this could result

in significant penalties and reputational harm or the inability to certify vehicles in the relevant markets. The cost of compliance with these regulations is considerable, and in this context, Mercedes-Benz continues to expect a significant

level of costs.

Mercedes-Benz is continuously subject to governmental information requests, inquiries, investigations, administrative orders and proceedings relating to various laws and

regulations in connection with diesel exhaust emissions.

The corresponding activities of various authorities worldwide are ongoing, as described below. These activities particularly relate to test results, the emission control

systems used in Mercedes-Benz diesel vehicles and/or the interactions of Mercedes-Benz with the relevant authorities as well as related legal issues and implications, including, but not limited to, under applicable environmental, criminal,

consumer protection and antitrust laws.

|

|

In the United States, Mercedes-Benz Group AG and Mercedes-Benz USA, LLC (“MBUSA”) reached agreements in the third quarter of 2020 with various authorities to settle civil

environmental claims regarding the emission control systems of certain diesel vehicles. These agreements have become final and effective. The authorities take the position that Mercedes-Benz failed to disclose Auxiliary Emission Control Devices

(AECDs) in certain of its U.S. diesel vehicles and that several of these AECDs are illegal defeat devices.

As part of these settlements, Mercedes-Benz has denied the allegations by the authorities and does not admit liability, but has agreed to, among other things, pay civil

penalties, conduct an emission modification program for affected vehicles and take certain other measures. The failure to meet certain of those obligations may trigger additional stipulated penalties. In the first quarter of 2021, Mercedes-Benz

paid the civil penalties.

In April 2016, the U.S. Department of Justice (“DOJ”) requested that Mercedes-Benz conduct an internal investigation. Mercedes-Benz conducted such internal investigation

in cooperation with DOJ’s investigation; DOJ’s investigation remains open. In addition, further U.S. state authorities have opened investigations pursuant to both local environmental and consumer protection laws and have requested documents and

information.

In Canada, the Canadian environmental regulator Environment and Climate Change Canada (“ECCC”) is conducting an investigation in connection with diesel exhaust emissions

based on the suspicion of potential violations of, amongst others, the Canadian Environmental Protection Act as well as potential undisclosed AECDs and defeat devices. Mercedes-Benz continues to cooperate with the investigating authorities.

In Germany, the Stuttgart public prosecutor’s office issued a fine notice against Mercedes-Benz in September 2019 based on a negligent violation of supervisory duties,

thereby concluding the related administrative offense proceedings against Mercedes-Benz. The Stuttgart public prosecutor’s office is still conducting criminal investigation proceedings against Mercedes-Benz employees on the suspicion of,

amongst others, fraud. In July 2021, the local court of Böblingen issued penal orders against three Mercedes-Benz employees based on, amongst others, fraud, which have become final.

Between 2018 and 2020, the German Federal Motor Transport Authority (“KBA”) issued subsequent auxiliary provisions for the EC type approvals of certain Mercedes-Benz

diesel vehicles, and ordered mandatory recalls as well as, in some cases, stops of the first registration. In autumn 2022, the KBA issued further decisions regarding vehicles equipped with an OM607 EU6 or EU5 diesel engine. In each of those

cases, it held that certain calibrations of specified functionalities are to be qualified as impermissible defeat devices. Mercedes-Benz has a contrary legal opinion on this question and has filed timely objections against the KBA’s

administrative orders and determinations mentioned above. Insofar as the KBA has not remedied the objections, Mercedes-Benz has filed lawsuits with the competent administrative court to have the controversial questions at issue clarified in a

court of law. Irrespective of such objections and the lawsuits that are now pending, Mercedes-Benz continues to cooperate fully with the KBA. The new calibrations requested by the KBA were developed by Mercedes-Benz and assessed and approved by

the KBA; the related recalls were initiated. It cannot be ruled out that under certain circumstances, software updates may have to be reworked, or further delivery and registration stops may be ordered or resolved by Mercedes-Benz as a

precautionary measure, also with regard to the used-car, leasing and financing businesses. In the course of its regular market supervision, the KBA routinely conducts further reviews of Mercedes-Benz vehicles and asks questions about technical

elements of the vehicles. In addition, Mercedes-Benz continues to be in a dialogue with the German Ministry for Digital and Transport (BMDV) to conclude the analysis of the diesel-related emissions matter and to further the update of affected

customer vehicles. In light of the aforementioned administrative orders issued by the KBA, and continued discussions with the KBA and the BMDV, it cannot be ruled out completely that additional administrative orders may be issued in the course

of the ongoing and/or further investigations. Since September 1, 2020, this also applies to responsible authorities of other member states and the European Commission, which conduct market surveillance under the new European Type Approval

Regulation and can take measures upon assumed non-compliance, irrespective of the place of the original type approval, and also to the British market surveillance authority DVSA (Driver and Vehicle Standards Agency).

|

|

In addition to the aforementioned authorities, national cartel authorities and other authorities of various foreign States, including the South Korean Ministry of

Environment, the South Korean competition authority (Korea Fair Trade Commission) and the Seoul public prosecutor’s office (South Korea) are conducting various investigations and/or procedures in connection with diesel exhaust emissions. In

this context, South Korean authorities have made determinations and imposed sanctions against Mercedes-Benz. Mercedes-Benz has lodged an appeal against the determinations and the sanctions of the South Korean administrative authorities (the

Ministry of the Environment and the Korea Fair Trade Commission). The proceedings described in this paragraph are still ongoing.

Mercedes-Benz continues to fully cooperate with the authorities and institutions. Irrespective of such cooperation and in light of the past developments, it is possible

that further regulatory, criminal and administrative investigative and enforcement actions and measures relating to Mercedes-Benz and/or its employees will be taken or administrative orders will be issued. Additionally, further delays in

obtaining regulatory approvals necessary to introduce new or recertify existing vehicle models could occur.

Regarding the proceedings and processes still in progress, Mercedes-Benz cannot at this time make any statement to their outcome. In light of the legal positions taken by

U.S. regulatory authorities and the KBA as well as the South Korean Ministry of Environment, amongst others, it cannot be ruled out that, besides these authorities, one or more authorities worldwide will reach the conclusion that other

passenger cars and/or vans with the brand name Mercedes-Benz or other brand names of the Mercedes-Benz Group are equipped with impermissible defeat devices. Likewise, such authorities could take the view that certain functionalities and/or

calibrations are not proper and/or were not properly disclosed. It cannot be ruled out that Mercedes-Benz will become subject to, as the case may be, significant additional fines and other sanctions, measures and actions. The occurrence of the

aforementioned events in whole or in part could cause significant collateral damage including reputational harm. Further, due to negative allegations or findings with respect to technical or legal issues by one of the various governmental

agencies, other agencies – or also plaintiffs – could also adopt such allegations or findings. Thus, a negative allegation or finding in one proceeding carries the risk of being able to have an adverse effect on other proceedings, also

potentially leading to new or expanded investigations or proceedings, including lawsuits.

|

|

In addition, the ability of Mercedes-Benz to defend itself in proceedings could be impaired by concluded proceedings and their underlying allegations as well as by results

or developments in any of the information requests, inquiries, investigations, administrative or criminal orders, legal actions and/or proceedings discussed above.

In particular, any remediation requirements, recalls or delivery and registration stops of Mercedes-Benz diesel vehicles, or reputational harm to the Mercedes-Benz brand,

could adversely affect the sales prices of used Mercedes-Benz passenger cars and sport utility vehicles, including the values of the financed vehicles, and the residual values of Mercedes-Benz passenger cars and sport utility vehicles that are

leased. None of the financed vehicles will be diesel vehicles.

Notwithstanding the foregoing, MBFS USA does not believe that the outcome of any of the inquiries and investigations pertaining to Mercedes-Benz will have a material adverse effect on the financial condition

of MBFS USA or on the ability of MBFS USA to perform its obligations under the transaction documents relating to the issuance of the notes.

|

|

|

Legal and Regulatory Risks

|

|

|

An MBFS USA bankruptcy

could result in delays in payment

or losses on your notes

|

If MBFS USA were to become the subject of a bankruptcy proceeding, you could experience losses or delays in payment on your notes. MBFS USA will sell the receivables to the depositor, and the depositor will sell the receivables to the

issuer. However, if MBFS USA is the subject of a bankruptcy proceeding, the court in the bankruptcy proceeding could conclude that the sale of the receivables by MBFS USA to the depositor was not a true sale for bankruptcy purposes and that it

still owns the receivables. The court also could conclude that MBFS USA and the depositor should be consolidated for bankruptcy purposes. If the court were to reach either of these conclusions, you could experience losses or delays in

payments on your notes because:

• the indenture trustee will not be able to exercise remedies against MBFS USA on your behalf without permission from the court;

• the court may require the indenture trustee to accept property in exchange for the receivables that is of less value than the receivables;

• tax or other government liens on MBFS USA’s property that arose before the transfer of the receivables to the issuer will be paid from the collections on the receivables before the

collections are used to make payments on your notes; and

• the indenture trustee may not have a perfected security interest in one or more of the vehicles securing the receivables or cash collections held by MBFS USA at the time that a bankruptcy

proceeding begins.

MBFS USA and the depositor have taken steps in structuring the transactions described in this prospectus to minimize the risk that a court would conclude that the sale of the receivables to the depositor was not a “true sale” or that MBFS

USA and the depositor should be consolidated for bankruptcy purposes.

For more information regarding bankruptcy considerations, see “Material Legal Issues Relating to the Receivables—Certain Bankruptcy Considerations and Matters Relating to Bankruptcy.”

|

|

A depositor bankruptcy could

result in losses or payment delays

with respect to your notes

|

Mercedes-Benz Retail Receivables LLC, as depositor, intends that its transfer of the receivables to the issuer will be a valid sale and assignment of the receivables to the issuer for non-tax purposes. If the depositor were to become a

debtor in a bankruptcy case and a creditor or trustee-in-bankruptcy of the depositor or the depositor itself were to take the position that the sale of receivables by the depositor to the issuer for non-tax purposes should instead be treated as

a pledge of the receivables to secure a borrowing by it, delays in payments of collections on or in respect of the receivables to the noteholders could occur. If a court ruled in favor of any such debtor, creditor or trustee, reductions in the

amounts of those payments could result. A tax or governmental lien on the property of the depositor arising before the transfer of the receivables to the issuer may have priority over the issuer’s interest in those receivables even if the

transfer of the receivables to the issuer is characterized as a sale for non-tax purposes.

|

|

Interests of other persons in the

receivables or financed vehicles

could reduce the funds available

to make payments on your notes

|

UCC financing statements will be filed reflecting the sale of the receivables by MBFS USA to the depositor and by the depositor to the issuer. Each of MBFS USA and the depositor will mark its accounting records to reflect its sale of the

receivables. However, because the servicer will maintain possession of the physical installment sales contracts and installment loans evidencing the receivables and will not segregate or mark the contracts and loans as belonging to the issuer,

another person could acquire an interest in receivables evidenced by a physical installment sales contract or installment loan that is superior to the issuer’s interest in those receivables by obtaining physical possession of the installment

sales contracts or installment loans representing those receivables without knowledge of the assignment of the receivable to the issuer. In addition, another person could acquire an interest in a receivable that is superior to the issuer’s

interest in the receivable if the receivable is evidenced by an electronic contract and the servicer loses, or never obtains, control over the authoritative copy of the contract and another party purchases the receivable evidenced by the

contract without knowledge of the issuer’s interest. If another person acquires an interest in a receivable that is superior to the issuer’s interest, some or all of the collections on that receivable may not be available to make payments on

your notes.

Additionally, if another person acquires an interest in a vehicle financed by a receivable that is superior to the issuer’s security interest in the vehicle, some or all of the proceeds from the sale of the vehicle may not be available to

make payments on your notes.

The issuer’s security interest in the financed vehicles could be impaired for one or more of the following reasons:

|

|

• MBFS USA or the depositor might fail to perfect its security interest in a financed vehicle;

• another person may acquire an interest in a financed vehicle that is superior to the issuer’s security interest through fraud, forgery, negligence or error because the servicer will not

amend the certificate of title or ownership to identify the issuer as the new secured party;

• the issuer may not have a security interest in the financed vehicles in certain states because the certificates of title to the financed vehicles will not be amended to reflect assignment

of the security interest to the issuer;

• holders of some types of liens, such as tax liens or mechanics’ liens, may have priority over the issuer’s security interest; and

• the issuer may lose its security interest in vehicles confiscated by the government.

MBFS USA will be obligated to repurchase from the issuer any receivable sold by it to the issuer as to which a perfected security interest in the name of MBFS USA in the vehicle securing the receivable did not exist as of the date such

receivable was transferred to the issuer. However, MBFS USA will not be required to repurchase a receivable if a perfected security interest in its name in the vehicle securing a receivable has not been perfected in the issuer or if the

security interest in a related vehicle or the receivable becomes impaired after the receivable is sold to the issuer. If the issuer does not have a perfected security interest in a vehicle, its ability to realize on the vehicle following an

event of a default under the related receivable may be adversely affected and some or all of the collections on that vehicle may not be available to make payment on your notes.

|

|

|

Consumer protection laws may

reduce payments on your notes

|

Federal and state consumer protection laws impose requirements upon creditors in connection with extensions of credit and collections on motor vehicle installment sales contracts and installment loans. Some of these laws make an assignee of

the contract or loan, such as the issuer, liable to the obligor for any violation by the lender. Any liabilities of the issuer under these laws could reduce the funds that the issuer would otherwise have to make payments on your notes.

For more information about consumer protection laws, see “Material Legal Issues Relating to the Receivables—Consumer Protection Laws.”

|

|

Federal and state financial

regulatory reform and other

regulatory actions could have an

adverse effect on the sponsor, the

depositor or the issuer

|

The Dodd–Frank Wall Street Reform and Consumer Protection Act provides for enhanced regulation of financial institutions and non-bank financial companies, derivatives and asset-backed securities offerings and enhanced oversight of credit

rating agencies.

The Dodd-Frank Act also created the Consumer Financial Protection Bureau, an agency responsible for administering and enforcing the laws and regulations for consumer financial products and services. In 2015, MBFS USA became subject to the

CFPB’s supervisory authority when the CFPB’s final rule over “larger participants” in the auto finance industry took effect. Such supervisory authority allows the CFPB to conduct comprehensive and rigorous examinations to assess compliance

with consumer financial protection laws, which could result in enforcement actions, regulatory fines and mandated changes to MBFS USA’s business products, policies and procedures.

Compliance with the Dodd-Frank Act or the oversight of the SEC or CFPB may impose costs on, create operational constraints for, or place limits on pricing with respect to finance companies such as MBFS USA or its affiliates. No assurance

can be given that the new standards will not have an adverse effect on the marketability of asset-backed securities such as the notes, the servicing of the receivables, MBFS USA’s securitization program or the regulation or supervision of MBFS

USA.

In an ongoing federal court case, the CFPB has successfully asserted the power to investigate and bring enforcement actions directly against securitization vehicles. On December 13, 2021, in an action brought by the CFPB, the U.S. District

Court for the District of Delaware denied a motion to dismiss filed by a securitization trust by holding that the trust is a “covered person” under the Dodd-Frank Act because it engages in the servicing of loans, even if through servicers and

subservicers. CFPB v. Nat’l Collegiate Master Student Loan Trust, No. 1:17-cv-1323-SB (D. Del.). On February 11, 2022, the district court granted the defendant trusts’ motion to certify that order for an immediate appeal and stayed the case

pending resolution of any appeal. On April 29, 2022, the Third Circuit Court of Appeals granted the defendants trusts’ petition for permission to appeal. The Third Circuit Court of Appeals heard oral arguments in connection with this appeal

on May 17, 2023. Depending upon the outcome of the appeal, the CFPB may rely on this decision as precedent in investigating and bringing enforcement actions against other securitization vehicles, including the issuer, in the future.

In February 2022, the CFPB also issued a compliance bulletin regarding the repossession of motor vehicles in which it stated its position that automobile loan holders and servicers are responsible for ensuring that their repossession-related

practices, and the practices of their service providers, do not violate the law, and the CFPB also described its intention to hold loan holders and servicers liable for unfair, deceptive, or abusive acts or practices related to the repossession

of automobiles. It is possible that the CFPB may bring enforcement actions against securitization trusts holding automobile loans, such as the issuer, and servicers in the future.

In addition, the Federal Trade Commission and state attorneys general have recently increased their scrutiny of motor vehicle dealers and auto lending, particularly with respect to antidiscrimination and deception concerns related to the

prices of and fees charged in connection with automobile financing, including add-on products such as GAP insurance and extended warranties. Additionally, California recently enacted a law governing the sale, offering or administration of GAP

in connection with retail installments contracts.

|

|

The Dodd-Frank Act also creates a liquidation framework under which the FDIC may be appointed as receiver following a “systemic risk determination” by the Secretary of Treasury (in consultation with the President) for the resolution of

certain nonbank financial companies and other entities, defined as “covered financial companies” and commonly referred to as “systemically important entities,” in the event such a company is in default or in danger of default and the resolution

of such a company under other applicable law would have serious adverse effects on financial stability in the United States, and also for the resolution of certain of their subsidiaries. With respect to the new liquidation framework for

systemically important entities, no assurances can be given that such framework would not apply to the sponsor or its subsidiaries, including the issuer and the depositor, although the expectation embedded in the Dodd-Frank Act is that the

framework will be invoked only very rarely. Guidance from the FDIC indicates that such new framework will in certain cases be exercised in a manner consistent with the existing bankruptcy laws, which is the insolvency regime which would

otherwise apply to the sponsor, the depositor and the issuer. The provisions of the new framework, however, provide the FDIC with certain powers not possessed by a trustee in bankruptcy under existing bankruptcy laws. Under some applications

of these and other provisions of the new framework, payments on the notes could be reduced, delayed or otherwise negatively affected.

Further, changes to the regulatory framework in which MBFS USA operates, including, for example, laws or regulations enacted to address the potential impacts of climate change (including laws which may adversely impact the auto industry in

particular as a result of efforts to mitigate the factors contributing to climate change) or laws, regulations, executive orders or other guidance in response to the COVID-19 pandemic or other events could have a significant impact on the

servicer or the issuer and could adversely affect the timing and amount of payments on your notes.

|

|

|

General Risks

|

|

|

Adverse events arising from the

coronavirus pandemic could

result in payment delays and

losses on the notes

|

The coronavirus resulted in significant volatility worldwide. In its initial stages, the COVID-19 pandemic adversely affected sales of Mercedes-Benz vehicles in the United States and led to significant adverse effects on production, the

procurement market and the supply chain. Moreover, further adverse developments relating to future epidemics or pandemics, especially if restrictive measures are once again imposed, or in the event of continuing or additional waves of

infections and new variants, could not only affect sales of Mercedes-Benz vehicles in the United States, but could also more significantly affect production, the procurement market and the supply chain. In response to the COVID-19 pandemic,

certain governmental authorities, including United States federal, state or local governments, implemented or proposed regulations, executive orders or other guidance or took other actions, to permit obligors to forego making scheduled payments

for some period of time or required modification to the contracts and some states enacted executive orders to preclude creditors from exercising certain rights or taking certain actions with respect to the motor vehicles retail installment sale

contracts and loans, including repossession or liquidation of vehicles. For example, many physical vehicle auction sites were required to temporarily close as a result of the COVID-19 pandemic, and the auction prices for used vehicles

decreased. While the auction market subsequently experienced a recovery, the market and the ability to conduct auction sales could be adversely effected by a resurgence of the COVID-19 pandemic or other macro factors. If financed vehicles are

repossessed while the auction market is not fully functioning, the sale or disposition proceeds may be lower than expected which could negatively affect cashflows on the notes.

|

|

Moreover, in addition to the foregoing, a future epidemic or pandemic may also have the effect of heightening many of the other risks in this section, including those relating to receivables performance, geographic concentration of the

obligors, value of the financed vehicles, regulatory risks, credit ratings and secondary market liquidity of the notes.

|

|

|

Adverse economic conditions

could adversely affect the

performance of the receivables,

which could result in losses on

your notes

|

An economic downturn may adversely affect the performance of the receivables. High unemployment, declines in consumer confidence, price inflation and expectations of future inflation, rising interest rates and a

general reduction in the availability of credit may lead to increased delinquencies and default rates by obligors, as well as decreased consumer demand for pre-owned vehicles and reduced pre-owned vehicle prices, which could increase the amount

of losses on defaulted vehicle loans and contracts. No prediction can be given as to the degree of increases in the rates of delinquencies, defaults or losses on the receivables resulting from deteriorating economic conditions, but if not