zen-ex991_7.htm

Exhibit 99.1

ZENDESK ANNOUNCES FOURTH QUARTER AND FULL FISCAL YEAR 2015 RESULTS

Highlights:

|

|

· |

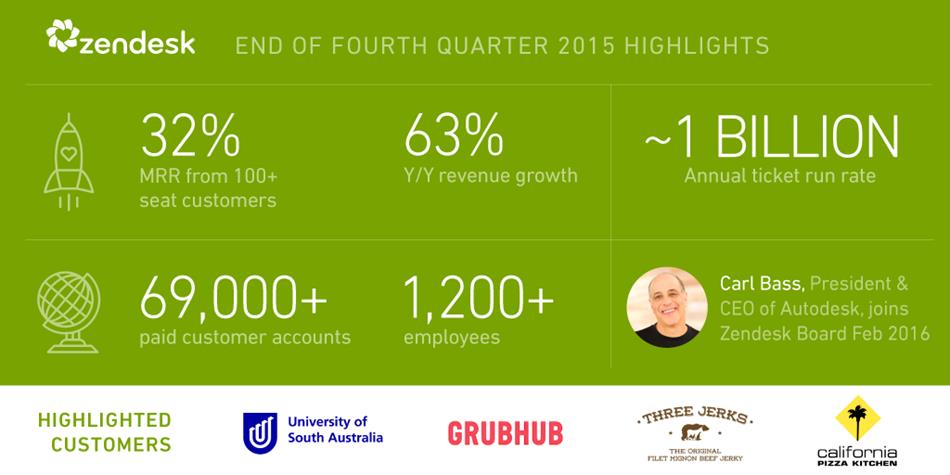

Fourth quarter revenue increased 63% year-over-year to $62.6 million |

|

|

· |

Fourth quarter GAAP operating loss of $24.4 million and non-GAAP operating loss of $6.6 million |

|

|

· |

Autodesk President and CEO Carl Bass appointed to the Board of Directors |

SAN FRANCISCO – February 16, 2016 – Zendesk, Inc. (NYSE: ZEN) today reported financial results for the fiscal quarter and full fiscal year ended December 31, 2015, and announced the appointment of Autodesk President and CEO Carl Bass to the Board of Directors.

“2015 was a breakout year for the growth of our enterprise business and solidified our leadership with emerging and small businesses,” said Mikkel Svane, Zendesk Founder, CEO and Chair of the Board of Directors. “Building on strong momentum across our business, we’ve set an ambitious goal to reach $1 billion in revenue in 2020. We are aggressively developing products and markets that move us beyond our core in customer support and into emerging opportunities around customer relationships.”

Results for the Fourth Quarter 2015

Revenue was $62.6 million for the quarter ended December 31, 2015, an increase of 63% over the prior year period. GAAP net loss for the quarter ended December 31, 2015 was $24.5 million, and GAAP net loss per share was $0.27. Non-GAAP net loss was $6.7 million, and non-GAAP net loss per share was $0.07. Non-GAAP net loss excludes approximately $16.2 million in share-based compensation related expenses (including $0.4 million of employer tax related to employee stock transactions and $0.3 million of amortized share-based compensation capitalized in internal-use software), $0.9 million of amortization of purchased intangibles and $0.7 million of transaction costs related to the acquisition of We Are Cloud SAS completed in October 2015. GAAP and non-GAAP net loss per share for the quarter ended December 31, 2015 were based on 89.1 million weighted average shares outstanding.

Results for the Full Fiscal Year 2015

Revenue was $208.8 million for the year ended December 31, 2015, an increase of 64% over the prior year period. GAAP net loss for the year ended December 31, 2015 was $84.1 million, and GAAP net loss per share was $0.99. Non-GAAP net loss was $25.7 million, and non-GAAP net loss per share was $0.30. Non-GAAP net loss excludes approximately $55.2 million in share-based compensation related expenses (including $1.6 million of employer tax related to employee stock transactions and $1.1 million of amortized share-based compensation capitalized in internal-use software), $2.2 million of amortization of purchased intangibles and $1.0 million of transaction costs related to the acquisition of We Are Cloud SAS completed in October 2015. GAAP and non-GAAP net loss per share for the year ended December 31, 2015 were based on 84.9 million weighted average shares outstanding.

Board of Directors Appointment

Carl Bass, President and CEO of Autodesk, Inc., was appointed to the Zendesk Board of Directors effective February 9, 2016. Bass brings to the board his deep experience in building and leading a multi-product company with billions in revenue that serves both enterprises and small organizations.

“Carl is a maker and tinkerer at heart, and shares our belief in the importance of the product experience and a robust developer platform,” Svane said. “His product passion and proven business leadership will serve us well.”

Bass has held several executive positions, including chief technology officer and chief operations officer, during his time at Autodesk, a maker of professional 3D design software and consumer applications. He joined the company in 1993 after Autodesk acquired Ithaca Software, which he co-founded.

“I’m honored to be joining the board at a time when Zendesk is charting an ambitious future to be a multi-product company serving a wider market,” Bass said.

Outlook

As of February 16, 2016, Zendesk provided guidance for its expected revenue, GAAP operating loss and non-GAAP operating loss for the quarter ending March 31, 2016 and for the year ending December 31, 2016.

For the quarter ending March 31, 2016, Zendesk expects to report:

|

|

· |

Revenue in the range of $65.0 - 67.0 million |

|

|

· |

GAAP operating loss of $28.0 - 29.0 million, which includes share-based compensation and related expenses of approximately $19.0 million and amortization of intangibles of approximately $1.0 million |

|

|

· |

Non-GAAP operating loss of $8.0 - 9.0 million, which excludes share-based compensation and related expenses of approximately $19.0 million and amortization of intangibles of approximately $1.0 million |

For the full year 2016, Zendesk expects to report:

|

|

· |

Revenue to grow 40 - 45%, in the range of $290.0 - 300.0 million |

|

|

· |

GAAP operating loss of $120.0 - 122.0 million, which includes share-based compensation and related expenses of approximately $88.0 million and amortization of intangibles of approximately $4.0 million |

|

|

· |

Non-GAAP operating loss of $28.0 - 30.0 million, which excludes share-based compensation and related expenses of approximately $88.0 million and amortization of intangibles of approximately $4.0 million |

Zendesk’s estimates of share-based compensation and acquisition related expenses in future periods assume, among other things, the occurrence of no additional acquisitions, investments or restructurings and no further revisions to share-based compensation and related expenses.

Conference Call Information

Zendesk will host a conference call today, February 16, 2016, to discuss financial results at 2:00 p.m. Pacific Time, 5:00 p.m. Eastern Time. A live webcast of the conference call will be available at https://investor.zendesk.com. The conference call can also be accessed by dialing 877-201-0168, or +1 647-788-4901 (outside the U.S. and Canada). The conference ID is 21383226. A replay of the call via webcast will be available at https://investor.zendesk.com or by dialing 855-859-2056 or +1 404-537-3406 (outside the U.S. and Canada) and entering passcode 21383226. The dial-in replay will be available until the end of day February 18, 2016. The webcast replay will be available for 12 months.

About Zendesk

Zendesk provides a customer service platform designed to bring organizations and their customers closer together. With more than 69,000 paid customer accounts, Zendesk’s products are used by organizations in 150 countries and territories to provide support in more than 40 languages. Founded in 2007 and headquartered in San Francisco, Zendesk has operations in the United States, Europe, Asia, Australia and South America. Learn more at www.zendesk.com.

Forward-Looking Statements

This press release contains forward-looking statements, including, among other things, statements regarding Zendesk’s future financial performance, its continued investment to grow its business, and progress towards its long-term financial objectives. The words such as “may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases that denote future expectation or intent regarding Zendesk’s financial results, operations and other matters are intended to identify forward-looking statements. You should not rely upon forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual results, performance, or achievements to differ materially, including (i) adverse changes in general economic or market conditions; (ii) Zendesk’s ability to adapt its customer service platform to changing market dynamics and customer preferences or achieve increased market acceptance of its platform; (iii) Zendesk’s expectation that the future growth rate of its revenues will decline, and that as its costs increase, Zendesk may not be able to generate sufficient revenues to achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes it difficult to evaluate its prospects and future operating results; (v) Zendesk’s ability to effectively manage its growth and organizational change; (vi) the market in which Zendesk operates is intensely competitive, and Zendesk may not compete effectively; (vii) the development of the market for software as a service business software applications; (viii) Zendesk’s ability to sell its live chat software as a standalone service and more fully integrate its live chat software with its customer service platform; (ix) Zendesk’s ability to sell its analytics software as a standalone service and to integrate its analytics software with its customer service platform; (x) breaches in Zendesk’s security measures or unauthorized access to its customers’ data; (xi) service interruptions or performance problems associated with Zendesk’s technology and infrastructure; (xii) real or perceived errors, failures, or bugs in its products; (xiii) Zendesk’s substantial reliance on its customers renewing their subscriptions and purchasing additional subscriptions; and (xiv) Zendesk’s ability to effectively expand its sales capabilities.

The forward-looking statements contained in this press release are also subject to additional risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that Zendesk makes with the Securities and Exchange Commission from time to time, including its Annual Report on Form 10-K for the year ended December 31, 2015.

Forward-looking statements represent Zendesk’s management’s beliefs and assumptions only as of the date such statements are made. Zendesk undertakes no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

Condensed Consolidated Statements of Operations

(In thousands, except per share data; unaudited)

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

62,646 |

|

|

$ |

38,541 |

|

|

$ |

208,768 |

|

|

$ |

127,049 |

|

|

Cost of revenue |

|

19,693 |

|

|

|

13,637 |

|

|

|

67,184 |

|

|

|

46,047 |

|

|

Gross profit |

|

42,954 |

|

|

|

24,904 |

|

|

|

141,584 |

|

|

|

81,002 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

19,098 |

|

|

|

11,176 |

|

|

|

62,615 |

|

|

|

36,403 |

|

|

Sales and marketing |

|

34,328 |

|

|

|

21,701 |

|

|

|

114,052 |

|

|

|

77,875 |

|

|

General and administrative |

|

13,920 |

|

|

|

9,230 |

|

|

|

47,902 |

|

|

|

32,869 |

|

|

Total operating expenses |

|

67,346 |

|

|

|

42,107 |

|

|

|

224,569 |

|

|

|

147,147 |

|

|

Operating loss |

|

(24,393 |

) |

|

|

(17,203 |

) |

|

|

(82,985 |

) |

|

|

(66,145 |

) |

|

Other expense, net |

|

(302 |

) |

|

|

(282 |

) |

|

|

(729 |

) |

|

|

(1,533 |

) |

|

Loss before provision for (benefit from) income taxes |

|

(24,694 |

) |

|

|

(17,485 |

) |

|

|

(83,714 |

) |

|

|

(67,678 |

) |

|

Provision for (benefit from) income taxes |

|

(216 |

) |

|

|

9 |

|

|

|

338 |

|

|

|

(263 |

) |

|

Net loss |

|

(24,478 |

) |

|

|

(17,494 |

) |

|

|

(84,052 |

) |

|

|

(67,415 |

) |

|

Accretion of redeemable convertible preferred stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(18 |

) |

|

Net loss attributable to common stockholders |

$ |

(24,478 |

) |

|

$ |

(17,494 |

) |

|

$ |

(84,052 |

) |

|

$ |

(67,433 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders,

basic and diluted |

$ |

(0.27 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.99 |

) |

|

$ |

(1.26 |

) |

|

Weighted-average shares used to compute net loss per

share attributable to common stockholders, basic and

diluted |

|

89,073 |

|

|

|

73,295 |

|

|

|

84,926 |

|

|

|

53,571 |

|

Condensed Consolidated Balance Sheets

(In thousands, except par value; unaudited)

|

|

December 31, |

|

|

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

216,226 |

|

|

$ |

80,265 |

|

|

Marketable securities |

|

29,414 |

|

|

|

42,204 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $763 and $264, respectively |

|

26,168 |

|

|

|

11,523 |

|

|

Prepaid expenses and other current assets |

|

11,423 |

|

|

|

5,013 |

|

|

Total current assets |

|

283,231 |

|

|

|

139,005 |

|

|

Marketable securities, noncurrent |

|

22,336 |

|

|

|

9,205 |

|

|

Property and equipment, net |

|

56,540 |

|

|

|

41,895 |

|

|

Goodwill and intangible assets, net |

|

57,050 |

|

|

|

14,152 |

|

|

Other assets |

|

3,529 |

|

|

|

1,531 |

|

|

Total assets |

$ |

422,686 |

|

|

$ |

205,788 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

9,332 |

|

|

$ |

4,763 |

|

|

Accrued liabilities |

|

9,742 |

|

|

|

7,689 |

|

|

Accrued compensation and related benefits |

|

14,115 |

|

|

|

11,738 |

|

|

Deferred revenue |

|

84,210 |

|

|

|

50,908 |

|

|

Current portion of credit facility |

|

— |

|

|

|

3,041 |

|

|

Current portion of capital leases |

|

— |

|

|

|

10 |

|

|

Total current liabilities |

|

117,399 |

|

|

|

78,149 |

|

|

Deferred revenue, noncurrent |

|

1,405 |

|

|

|

823 |

|

|

Credit facility, noncurrent |

|

— |

|

|

|

3,911 |

|

|

Other liabilities |

|

10,592 |

|

|

|

9,199 |

|

|

Total liabilities |

|

129,396 |

|

|

|

92,082 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock, par value $0.01 per share |

|

905 |

|

|

|

755 |

|

|

Additional paid-in capital |

|

511,183 |

|

|

|

246,000 |

|

|

Accumulated other comprehensive loss |

|

(2,225 |

) |

|

|

(528 |

) |

|

Accumulated deficit |

|

(215,921 |

) |

|

|

(131,869 |

) |

|

Treasury stock at cost |

|

(652 |

) |

|

|

(652 |

) |

|

Total stockholders’ equity |

|

293,290 |

|

|

|

113,706 |

|

|

Total liabilities and stockholders’ equity |

$ |

422,686 |

|

|

$ |

205,788 |

|

Condensed Consolidated Statements of Cash Flows

(In thousands; unaudited)

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(24,478 |

) |

|

$ |

(17,494 |

) |

|

$ |

(84,052 |

) |

|

$ |

(67,415 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

6,072 |

|

|

|

3,783 |

|

|

|

19,744 |

|

|

|

11,456 |

|

|

Share-based compensation |

|

15,497 |

|

|

|

8,514 |

|

|

|

52,556 |

|

|

|

32,139 |

|

|

Excess tax benefit from share-based award activity |

|

(325 |

) |

|

|

(334 |

) |

|

|

(449 |

) |

|

|

(334 |

) |

|

Other |

|

932 |

|

|

|

6 |

|

|

|

1,457 |

|

|

|

337 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

(1,908 |

) |

|

|

1,258 |

|

|

|

(14,989 |

) |

|

|

(3,846 |

) |

|

Prepaid expenses and other current assets |

|

(1,349 |

) |

|

|

516 |

|

|

|

(5,510 |

) |

|

|

(1,444 |

) |

|

Other assets and liabilities |

|

(1,582 |

) |

|

|

421 |

|

|

|

(3,204 |

) |

|

|

1,742 |

|

|

Accounts payable |

|

3,936 |

|

|

|

356 |

|

|

|

2,017 |

|

|

|

947 |

|

|

Accrued liabilities |

|

(57 |

) |

|

|

(571 |

) |

|

|

2,204 |

|

|

|

351 |

|

|

Accrued compensation and related benefits |

|

4,061 |

|

|

|

552 |

|

|

|

1,706 |

|

|

|

5,767 |

|

|

Deferred revenue |

|

9,482 |

|

|

|

5,100 |

|

|

|

33,853 |

|

|

|

22,390 |

|

|

Net cash provided by operating activities |

|

10,281 |

|

|

|

2,107 |

|

|

|

5,333 |

|

|

|

2,090 |

|

|

Cash flows used in investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(8,758 |

) |

|

|

(2,544 |

) |

|

|

(22,989 |

) |

|

|

(21,665 |

) |

|

Internal-use software development costs |

|

(1,157 |

) |

|

|

(1,745 |

) |

|

|

(4,705 |

) |

|

|

(8,013 |

) |

|

Purchases of marketable securities |

|

(13,312 |

) |

|

|

(11,324 |

) |

|

|

(70,303 |

) |

|

|

(54,330 |

) |

|

Proceeds from maturities of marketable securities |

|

6,557 |

|

|

|

3,500 |

|

|

|

36,982 |

|

|

|

10,450 |

|

|

Proceeds from sale of marketable securities |

|

2,501 |

|

|

|

4,004 |

|

|

|

32,152 |

|

|

|

4,004 |

|

|

Cash paid for the acquisition of WAC, net of cash acquired |

|

(42,758 |

) |

|

|

— |

|

|

|

(42,758 |

) |

|

|

— |

|

|

Cash paid for the acquisition of Zopim, net of cash acquired |

|

— |

|

|

|

— |

|

|

|

(1,100 |

) |

|

|

(1,896 |

) |

|

Decrease to restricted cash |

|

— |

|

|

|

153 |

|

|

|

— |

|

|

|

153 |

|

|

Net cash used in investing activities |

|

(56,927 |

) |

|

|

(7,956 |

) |

|

|

(72,721 |

) |

|

|

(71,297 |

) |

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from initial public offering, net of issuance costs |

|

— |

|

|

|

(20 |

) |

|

|

— |

|

|

|

103,090 |

|

|

Proceeds from follow-on public offering, net of issuance costs |

|

(16 |

) |

|

|

— |

|

|

|

190,094 |

|

|

|

— |

|

|

Proceeds from exercise of employee stock options |

|

4,836 |

|

|

|

4,484 |

|

|

|

10,609 |

|

|

|

7,229 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(128 |

) |

|

|

(367 |

) |

|

|

(609 |

) |

|

|

(2,117 |

) |

|

Proceeds from employee stock purchase plan |

|

2,283 |

|

|

|

2,058 |

|

|

|

9,526 |

|

|

|

4,404 |

|

|

Excess tax benefit from share-based award activity |

|

325 |

|

|

|

334 |

|

|

|

449 |

|

|

|

334 |

|

|

Proceeds from issuance of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,940 |

|

|

Principal payments on debt |

|

— |

|

|

|

(748 |

) |

|

|

(6,952 |

) |

|

|

(20,748 |

) |

|

Principal payments on capital lease obligations |

|

— |

|

|

|

(93 |

) |

|

|

(10 |

) |

|

|

(364 |

) |

|

Net cash provided by financing activities |

|

7,300 |

|

|

|

5,648 |

|

|

|

203,107 |

|

|

|

95,768 |

|

|

Effect of exchange rates changes on cash and cash equivalents |

|

187 |

|

|

|

30 |

|

|

|

242 |

|

|

|

(21 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

(39,159 |

) |

|

|

(171 |

) |

|

|

135,961 |

|

|

|

26,540 |

|

|

Cash and cash equivalents at the beginning of period |

|

255,385 |

|

|

|

80,436 |

|

|

|

80,265 |

|

|

|

53,725 |

|

|

Cash and cash equivalents at the end of period |

$ |

216,226 |

|

|

$ |

80,265 |

|

|

$ |

216,226 |

|

|

$ |

80,265 |

|

Non-GAAP Results

(In thousands, except per share data)

The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this release.

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Reconciliation of gross profit and gross margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

$ |

42,954 |

|

|

$ |

24,904 |

|

|

$ |

141,584 |

|

|

$ |

81,002 |

|

|

Plus: Share-based compensation |

|

1,405 |

|

|

|

773 |

|

|

|

4,541 |

|

|

|

2,464 |

|

|

Plus: Employer tax related to employee stock transactions |

|

31 |

|

|

|

10 |

|

|

|

175 |

|

|

|

29 |

|

|

Plus: Amortization of share-based compensation capitalized in

internal-use software |

|

312 |

|

|

|

132 |

|

|

|

1,065 |

|

|

|

402 |

|

|

Plus: Amortization of purchased intangibles |

|

832 |

|

|

|

369 |

|

|

|

1,890 |

|

|

|

1,167 |

|

|

Non-GAAP gross profit |

$ |

45,534 |

|

|

$ |

26,188 |

|

|

$ |

149,255 |

|

|

$ |

85,064 |

|

|

GAAP gross margin |

|

69 |

% |

|

|

65 |

% |

|

|

68 |

% |

|

|

64 |

% |

|

Non-GAAP adjustments |

|

4 |

% |

|

|

3 |

% |

|

|

3 |

% |

|

|

3 |

% |

|

Non-GAAP gross margin |

|

73 |

% |

|

|

68 |

% |

|

|

71 |

% |

|

|

67 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP research and development |

$ |

19,098 |

|

|

$ |

11,176 |

|

|

$ |

62,615 |

|

|

$ |

36,403 |

|

|

Less: Share-based compensation |

|

(5,930 |

) |

|

|

(3,388 |

) |

|

|

(19,414 |

) |

|

|

(10,918 |

) |

|

Less: Employer tax related to employee stock transactions |

|

(69 |

) |

|

|

(28 |

) |

|

|

(415 |

) |

|

|

(129 |

) |

|

Non-GAAP research and development |

$ |

13,099 |

|

|

$ |

7,760 |

|

|

$ |

42,786 |

|

|

$ |

25,356 |

|

|

GAAP research and development as percentage of revenue |

|

30 |

% |

|

|

29 |

% |

|

|

30 |

% |

|

|

29 |

% |

|

Non-GAAP research and development as percentage of revenue |

|

21 |

% |

|

|

20 |

% |

|

|

20 |

% |

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP sales and marketing |

$ |

34,328 |

|

|

$ |

21,701 |

|

|

$ |

114,052 |

|

|

$ |

77,875 |

|

|

Less: Share-based compensation |

|

(4,604 |

) |

|

|

(2,045 |

) |

|

|

(14,759 |

) |

|

|

(10,680 |

) |

|

Less: Employer tax related to employee stock transactions |

|

(174 |

) |

|

|

(245 |

) |

|

|

(474 |

) |

|

|

(314 |

) |

|

Less: Amortization of purchased intangibles |

|

(103 |

) |

|

|

(96 |

) |

|

|

(346 |

) |

|

|

(303 |

) |

|

Non-GAAP sales and marketing |

$ |

29,447 |

|

|

$ |

19,315 |

|

|

$ |

98,473 |

|

|

$ |

66,578 |

|

|

GAAP sales and marketing as percentage of revenue |

|

55 |

% |

|

|

56 |

% |

|

|

55 |

% |

|

|

61 |

% |

|

Non-GAAP sales and marketing as percentage of revenue |

|

47 |

% |

|

|

50 |

% |

|

|

47 |

% |

|

|

52 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP general and administrative |

$ |

13,920 |

|

|

$ |

9,230 |

|

|

$ |

47,902 |

|

|

$ |

32,869 |

|

|

Less: Share-based compensation |

|

(3,559 |

) |

|

|

(2,308 |

) |

|

|

(13,842 |

) |

|

|

(8,077 |

) |

|

Less: Employer tax related to employee stock transactions |

|

(73 |

) |

|

|

(65 |

) |

|

|

(387 |

) |

|

|

(113 |

) |

|

Less: Transaction costs related to acquisition |

|

(708 |

) |

|

|

— |

|

|

|

(998 |

) |

|

|

(649 |

) |

|

Non-GAAP general and administrative |

$ |

9,580 |

|

|

$ |

6,857 |

|

|

$ |

32,675 |

|

|

$ |

24,030 |

|

|

GAAP general and administrative as percentage of revenue |

|

22 |

% |

|

|

24 |

% |

|

|

23 |

% |

|

|

26 |

% |

|

Non-GAAP general and administrative as percentage of revenue |

|

15 |

% |

|

|

18 |

% |

|

|

16 |

% |

|

|

19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of operating loss and operating margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating loss |

$ |

(24,393 |

) |

|

$ |

(17,203 |

) |

|

$ |

(82,985 |

) |

|

$ |

(66,145 |

) |

|

Plus: Share-based compensation |

|

15,498 |

|

|

|

8,514 |

|

|

|

52,556 |

|

|

|

32,139 |

|

|

Plus: Employer tax related to employee stock transactions |

|

347 |

|

|

|

348 |

|

|

|

1,451 |

|

|

|

585 |

|

|

Plus: Amortization of share-based compensation capitalized in

internal-use software |

|

312 |

|

|

|

132 |

|

|

|

1,065 |

|

|

|

402 |

|

|

Plus: Amortization of purchased intangibles |

|

935 |

|

|

|

465 |

|

|

|

2,236 |

|

|

|

1,470 |

|

|

Plus: Transaction costs related to acquisition |

|

708 |

|

|

|

— |

|

|

|

998 |

|

|

|

649 |

|

|

Non-GAAP operating loss |

$ |

(6,593 |

) |

|

$ |

(7,744 |

) |

|

$ |

(24,679 |

) |

|

$ |

(30,900 |

) |

|

GAAP operating margin |

|

(39 |

%) |

|

|

(45 |

%) |

|

|

(40 |

%) |

|

|

(52 |

%) |

|

Non-GAAP adjustments |

|

28 |

% |

|

|

25 |

% |

|

|

28 |

% |

|

|

28 |

% |

|

Non-GAAP operating margin |

|

(11 |

%) |

|

|

(20 |

%) |

|

|

(12 |

%) |

|

|

(24 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net loss attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss attributable to common stockholders |

$ |

(24,478 |

) |

|

$ |

(17,494 |

) |

|

$ |

(84,052 |

) |

|

$ |

(67,433 |

) |

|

Plus: Share-based compensation |

|

15,498 |

|

|

|

8,514 |

|

|

|

52,556 |

|

|

|

32,139 |

|

|

Plus: Employer tax related to employee stock transactions |

|

347 |

|

|

|

348 |

|

|

|

1,451 |

|

|

|

585 |

|

|

Plus: Amortization of share-based compensation capitalized in

internal-use software |

|

312 |

|

|

|

132 |

|

|

|

1,065 |

|

|

|

402 |

|

|

Plus: Amortization of purchased intangibles |

|

935 |

|

|

|

465 |

|

|

|

2,236 |

|

|

|

1,470 |

|

|

Plus: Transaction costs related to acquisition |

|

708 |

|

|

|

— |

|

|

|

998 |

|

|

|

649 |

|

|

Non-GAAP net loss attributable to common stockholders |

$ |

(6,678 |

) |

|

$ |

(8,035 |

) |

|

$ |

(25,746 |

) |

|

$ |

(32,188 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net loss per share attributable to common

stockholders, basic and diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss per share attributable to common stockholders,

basic and diluted |

$ |

(0.27 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.99 |

) |

|

$ |

(1.26 |

) |

|

Non-GAAP adjustments to net loss |

|

0.20 |

|

|

|

0.13 |

|

|

|

0.69 |

|

|

|

0.66 |

|

|

Non-GAAP adjustment to weighted-average shares used to

compute net loss per share |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.12 |

|

|

Non-GAAP net loss per share attributable to common

stockholders, basic and diluted |

$ |

(0.07 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.48 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of weighted-average shares used to compute net

loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP weighted-average shares used to compute net loss per

share attributable to common stockholders, basic and diluted |

|

89,073 |

|

|

|

73,295 |

|

|

|

84,926 |

|

|

|

53,571 |

|

|

Conversion of preferred stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,071 |

|

|

Non-GAAP weighted-average shares used to compute net loss per

share attributable to common stockholders, basic and diluted |

|

89,073 |

|

|

|

73,295 |

|

|

|

84,926 |

|

|

|

66,642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Computation of free cash flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

10,281 |

|

|

$ |

2,107 |

|

|

$ |

5,333 |

|

|

$ |

2,090 |

|

|

Less: purchases of property and equipment |

|

(8,758 |

) |

|

|

(2,544 |

) |

|

|

(22,989 |

) |

|

|

(21,665 |

) |

|

Less: internal-use software development costs |

|

(1,157 |

) |

|

|

(1,745 |

) |

|

|

(4,705 |

) |

|

|

(8,013 |

) |

|

Free cash flow |

$ |

366 |

|

|

$ |

(2,182 |

) |

|

$ |

(22,361 |

) |

|

$ |

(27,588 |

) |

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Zendesk’s results, the following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross margin, non-GAAP operating expenses, non-GAAP operating loss and operating margin, non-GAAP net loss attributable to common stockholders, non-GAAP net loss per share attributable to common stockholders, basic and diluted, non-GAAP weighted-average shares used to compute net loss per share attributable to common stockholders, basic and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-GAAP financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation Capitalized in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain employees. It is principally aimed at aligning their interests with those of its stockholders and at long-term retention, rather than to address operational performance for any particular period. As a result, share-based compensation expenses vary for reasons that are generally unrelated to financial and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of employer taxes related to its employee stock transactions as an expense that is dependent on its stock price, employee exercise and other award disposition activity, and other factors that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock transactions vary for reasons that are generally unrelated to financial and operational performance in any particular period.

Amortization of Purchased Intangibles and Acquisition Related Expenses: Zendesk views amortization of purchased intangible assets, including the amortization of the cost associated with an acquired entity’s developed technology, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are evaluated for impairment regularly, amortization of the cost of purchased intangibles is an expense that is not typically affected by operations during any particular period. Zendesk views acquisition related expenses as events that are not necessarily reflective of operational performance during a period. In particular, Zendesk believes the consideration of measures that exclude such expenses can assist in the comparison of operational performance in different periods which may or may not include such expenses.

Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from operating activities, less purchases of property and equipment and internal-use software development costs. Zendesk uses free cash flow, among other measures, to evaluate the ability of its operations to generate cash that is available for purposes other than capital expenditures and capitalized software development costs. Zendesk believes that information regarding free cash flow provides investors with an important perspective on the cash available to fund ongoing operations.

As a result of Zendesk’s initial public offering, all outstanding shares of redeemable convertible preferred stock were automatically converted into shares of common stock. Consequently, the non-GAAP weighted-average shares outstanding used to compute non-GAAP net loss per share assumes that the conversion of Zendesk's redeemable convertible preferred stock that occurred in connection with its initial public offering occurred at the beginning of the relevant period. Zendesk believes this facilitates comparison with prior periods.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for internal planning and forecasting purposes. Zendesk's management does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk presents such non-GAAP financial measures in reporting its financial results to provide investors with an additional tool to evaluate Zendesk's operating results. Zendesk believes these non-GAAP financial measures are useful because they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making. This allows investors and others to better understand and evaluate Zendesk’s operating results and future prospects in the same manner as management.

Zendesk's management believes it is useful for itself and investors to review, as applicable, both GAAP information that may include items such as share-based compensation expense, amortization of share-based compensation capitalized in internal-use software, amortization of purchased intangibles, transaction costs related to acquisitions, and the non-GAAP measures that exclude such information in order to assess the performance of Zendesk's business and for planning and forecasting in subsequent periods. When Zendesk uses such a non-GAAP financial measure, it provides, when determinable without unreasonable effort, a reconciliation of the non-GAAP financial measure to the most closely comparable GAAP financial measure. When such reconciliation is not determinable without unreasonable effort, Zendesk provides the reconciling information that is determinable without unreasonable effort and identifies the information that would need to be added or subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP measure. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure as detailed above.

About Operating Metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure performance, identify trends, formulate business plans, and make strategic decisions. These include the number of paid customer accounts for its customer service platform and live chat software, dollar-based net expansion rate, monthly recurring revenue represented by its churned customers, and the percentage of its monthly recurring revenue originating from customers with more than 100 agents.

Zendesk defines the number of paid customer accounts at the end of any particular period as the sum of the number of accounts on its customer service platform, exclusive of its Starter plan, free trials or other free services, and the number of accounts using its live chat software, exclusive of free trials or other free services, each as of the end of the period and as identified by a unique account identifier. Use of Zendesk’s customer service platform and live chat software requires separate subscriptions and each of these accounts are treated as a separate paid customer account. A single consolidated organization or customers may have multiple accounts across each of Zendesk’s customer service platform and live chat software to service separate subsidiaries, divisions, or work processes. Each of these accounts is also treated as a separate paid customer account.

In the quarter ended December 31, 2015, Zendesk introduced the Essential plan for its customer service platform. This plan replaced Zendesk’s Starter plan as the least expensive plan on Zendesk’s customer service platform. Following the introduction of the Essential plan, Zendesk no longer made its Starter plan available for new accounts. Accounts that subscribe to the Essential plan are included in the determination of the number of paid customer accounts.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase revenue across its existing customer base through expansion of authorized agents associated with a paid customer account, and upgrades in subscription plan, as offset by churn, contraction in authorized agents associated with a paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net expansion rate is based upon “monthly recurring revenue” for a set of paid customer accounts. Monthly recurring revenue or “MRR” for a paid customer account is a legal and contractual determination made by assessing the contractual terms of each paid customer account, as of the date of determination, as to the revenue Zendesk expects to generate in the next monthly period for that paid customer account, assuming no changes to the subscription and without taking into account any one-time discounts or any platform usage above the subscription base, if any, that may be applicable to such subscription. Monthly recurring revenue is not determined by reference to historical revenue, deferred revenue or any other United States generally accepted accounting principles, or GAAP, financial measure over any period. It is forward-looking and contractually derived as of the date of determination.

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue as the aggregate monthly recurring revenue of the paid customer accounts on Zendesk’s customer service platform as of the date one year prior to the date of calculation. Zendesk defines the retained revenue net of contraction and churn as the aggregate monthly recurring revenue of the same customer base included in the measure of base revenue at the end of the annual period being measured. The dollar-based net expansion rate is also adjusted to eliminate the effect of certain activities that we identify involving the transfer of agents between paid customer accounts, consolidation of customer accounts, or the split of a single paid customer account into multiple paid customer accounts. In addition, the dollar-based net expansion rate is adjusted to include paid customer accounts in the customer base used to determine retained revenue net of contraction and churn that share common corporate information with customers in the customer base that is used to determine the base revenue. Giving effect to this consolidation results in Zendesk’s dollar-based net expansion rate being calculated across approximately 32,300 customers, as compared to the approximately 35,700 total paid customer accounts as of December 31, 2015. To the extent that Zendesk can determine that the underlying customers do not share common corporate information, Zendesk does not aggregate paid customer accounts associated with reseller and other similar channel arrangements for the purposes of determining its dollar-based net expansion rate. While not material, Zendesk believes the failure to account for these activities would otherwise skew the dollar-based net expansion metrics associated with customers that maintain multiple paid customer accounts on its customer service platform and paid customer accounts associated with reseller and other similar channel arrangements.

For a more detailed description of how Zendesk calculates its dollar-based net expansion rate, please refer to Zendesk’s periodic reports as filed with the Securities and Exchange Commission.

Zendesk calculates its monthly recurring revenue represented by its churned customers on an annualized basis by dividing base revenue associated with paid customer accounts on Zendesk’s customer service platform that churn, either by termination of the subscription or failure to renew, during the annual period being measured, by Zendesk’s base revenue. Zendesk’s monthly recurring revenue represented by its churned customers excludes expansion or contraction associated with paid customer accounts on Zendesk’s customer service platform and the effect of upgrades or downgrades in subscription plan. The monthly recurring revenue represented by its churned customers is adjusted to exclude paid customer accounts that churned from the customer base used that share common corporate information with customer accounts that did not churn from the customer base during the annual period being measured. While not material, Zendesk believes the failure to make this adjustment could otherwise skew the monthly recurring revenue represented by its churned customers as a result of customers that maintain multiple paid customer accounts on its customer service platform.

Zendesk’s percentage of monthly recurring revenue that is generated by customers with 100 or more agents is determined by dividing the monthly recurring revenue for paid customer accounts with more than 100 agents on its customer service platform as of the measurement date by the monthly recurring revenue for all paid customer accounts on its customer service platform as of the measurement date. Zendesk determines the customers with 100 or more agents as of the measurement date based on the number of activated agents at the measurement date and includes adjustments to aggregate paid customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly recurring revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with its live chat software, analytics software, or advanced voice software into its measurement of dollar-based net expansion rate, monthly recurring revenue represented by its churned customers, or percentage of monthly recurring revenue that is generated by customers with 100 or more agents.

Zendesk’s freemium plans include its Starter plan for its customer service platform, its Lite plan for its live chat software, and its Inbox service for facilitating and simplifying email collaboration on group email aliases. Zendesk believes these services provide exposure to its brand and establish a relationship that can facilitate further adoption of its customer service platform and live chat software as organizations grow in size and their service needs grow more complex. A customer account on Zendesk’s freemium plans is considered active based on whether functionality of the service has been utilized within the 90-day period preceding the measurement date. A single consolidated organization or customer may have multiple freemium customer accounts across each of Zendesk’s customer service platform, live chat software, Inbox service. Each of these accounts is treated as a separate customer account on Zendesk’s freemium products.

Source: Zendesk, Inc.

Contact:

Zendesk, Inc.

Investor Contact:

Marc Cabi, +1 415-852-3877

ir@zendesk.com

or

Media Contact:

Matt Hicks, +1 415-529-5606

press@zendesk.com