UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

¨REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2012

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ____________________________

For the transition period from_________________to______________

Commission File Number: 0-53646

EAGLEFORD ENERGY INC.

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Jurisdiction of incorporation or organization)

1 King Street West, Suite 1505

Toronto, Ontario, Canada, M5H 1A1

(Address of principal executive offices)

James Cassina, Telephone (416) 364-4039, Fax (416) 364-8244

1 King Street West, Suite 1505, Toronto, Ontario, Canada, M5H 1A1

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Stock, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

(Title of Class)

The number of outstanding shares of the issuer’s common stock as of August 31, 2012 was 96,707,667 shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or a transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ |

International Financial Reporting Standards by the International Accounting Standards Board x |

Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ‘

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

| GENERAL | 1 | |

| NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 | |

| PART I | 1 | |

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 1 |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 1 |

| B. | ADVISERS | 1 |

| C. | AUDITORS | 1 |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 2 |

| A. | OFFER STATISTICS | 2 |

| B. | METHOD AND EXPECTED TIMETABLE | 2 |

| ITEM 3 | KEY INFORMATION | 2 |

| A. | SELECTED FINANCIAL DATA | 2 |

| B. | CAPITALIZATION AND INDEBTEDNESS | 4 |

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS | 4 |

| D. | RISK FACTORS | 4 |

| ITEM 4 | INFORMATION ON THE COMPANY | 10 |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY | 11 |

| B. | BUSINESS OVERVIEW | 14 |

| C. | ORGANIZATIONAL STRUCTURE | 16 |

| D. | PROPERTY, PLANTS AND EQUIPMENT | 16 |

| ITEM 4A | UNRESOLVED STAFF COMMENTS | 23 |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 23 |

| A. | OPERATING RESULTS | |

| B. | LIQUIDITY AND CAPITAL RESOURCES | 45 |

| C. | RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC. | 46 |

| D. | TREND INFORMATION | 46 |

| E. | OFF-BALANCE SHEET ARRANGEMENTS | 47 |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS | 47 |

| G. | SAFE HARBOR | 51 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 51 |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 51 |

| B. | COMPENSATION | 52 |

| C. | BOARD PRACTICES | 55 |

| D. | EMPLOYEES | 62 |

| E. | SHARE OWNERSHIP | 62 |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 64 |

| A. | MAJOR SHAREHOLDERS | 64 |

| B. | RELATED PARTY TRANSACTIONS | 65 |

| C. | INTERESTS OF EXPERTS AND COUNSEL | 66 |

| ITEM 8 | FINANCIAL INFORMATION | 66 |

| A. | CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION | 66 |

| B. | SIGNIFICANT CHANGES | 68 |

| ITEM 9 | THE OFFER AND LISTING | 68 |

| A. | OFFER AND LISTING DETAILS | 68 |

| B. | PLAN OF DISTRIBUTION | 69 |

| i |

| C. | MARKETS | 69 |

| D. | SELLING SHAREHOLDERS | 69 |

| E. | DILUTION | 69 |

| F. | EXPENSES OF THE ISSUE | 69 |

| ITEM 10 | ADDITIONAL INFORMATION | 69 |

| A. | SHARE CAPITAL | 69 |

| B. | MEMORANDUM AND ARTICLES OF ASSOCIATION | 69 |

| C. | MATERIAL CONTRACTS | 72 |

| D. | EXCHANGE CONTROLS | 74 |

| E. | TAXATION | 75 |

| F. | DIVIDENDS AND PAYING AGENTS | 78 |

| G. | STATEMENT BY EXPERTS | 78 |

| H. | DOCUMENTS ON DISPLAY | 78 |

| I. | SUBSIDIARY INFORMATION | 78 |

| ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 78 |

| ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 82 |

| A. | DEBT SECURITIES | 82 |

| B. | WARRANTS AND RIGHTS | 82 |

| C. | OTHER SECURITIES | 82 |

| D. | AMERICAN DEPOSITORY SHARES | 82 |

| PART II | 82 | |

| ITEM 13 | DEFAULTS, DIVIDENDS ARREARAGES AND DELINQUENCIES | 82 |

| ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 83 |

| ITEM 15 | CONTROLS AND PROCEDURES | 83 |

| ITEM 16 | [RESERVED] | 84 |

| ITEM 16A | AUDIT COMMITTEE FINANCIAL EXPERT | 84 |

| ITEM 16B | CODE OF ETHICS | 84 |

| ITEM 16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 85 |

| ITEM 16D | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 85 |

| ITEM 16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 85 |

| ITEM 16F | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 85 |

| ITEM 16G | CORPORATE GOVERNANCE | 86 |

| ITEM 16H | MINE SAFETY DISCLOSURE | 86 |

| PART III | 86 | |

| ITEM 17 | FINANCIAL STATEMENTS | 86 |

| ITEM 18 | FINANCIAL STATEMENTS | 86 |

| ITEM 19 | EXHIBITS | 86 |

| ii |

GENERAL

In this Annual Report, references to “we”, “us”, “our”, the “Company”, and “Eagleford” mean Eagleford Energy Inc., and its subsidiaries, unless the context requires otherwise.

We use the Canadian dollar as our reporting and presentation currency and our consolidated financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). Note 18 to our consolidated financial statements provides a reconciliation of our August 31, 2011 consolidated financial statements to IFRS from the previous Canadian generally accepted accounting principles. All monetary references in this document are to Canadian dollars, unless otherwise indicated. All references in this document to “dollars” or “$” or “CDN$” mean Canadian dollars, unless otherwise indicated, and references to “US$” mean United States dollars.

Except as noted, the information set forth in this Annual Report is as of November 30, 2012 and all information included in this document should only be considered accurate as of such date. Our business, financial condition or results of operations may have changed since that date.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Much of the information included in this Annual Report is based upon estimates, projections or other “forward-looking statements”. Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. These statements relate to future events or our future financial performance. In some cases you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of those terms or other comparable terminology. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Such estimates, projections or other forward-looking statements involve various risks and uncertainties and other factors, including the risks in the section titled “Risk Factors” below, which may cause our actual results, levels of activities, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform those statements to actual results.

The statements contained in Item 4 – “Information on the Company”, Item 5 – “Operating and Financial Review and Prospects” and Item 11 – “Quantitative and Qualitative Disclosures About Market Risk” are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly.

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

| A. | DIRECTORS AND SENIOR MANAGEMENT |

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| B. | ADVISERS |

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| C. | AUDITORS |

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| 1 |

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

| A. | OFFER STATISTICS |

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| B. | METHOD AND EXPECTED TIMETABLE |

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

ITEM 3 KEY INFORMATION

| A. | SELECTED FINANCIAL DATA |

The following table presents selected financial data derived from our Audited Consolidated Financial Statements for the fiscal years ended August 31, 2012 and 2011. You should read this information in conjunction with our Audited Consolidated Financial Statements and related notes (Item 18), as well as Item 4: “Information on the Company” and Item 5: “Operating and Financial Review and Prospects” of this Annual Report.

Our consolidated financial statements have been prepared in accordance International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). Note 18 to our consolidated financial statements provides a reconciliation of our August 31, 2011 consolidated financial statements to IFRS from the previous Canadian generally accepted accounting principles. The selected consolidated statement of operations data set forth below for the years ended August 31, 2012 and 2011 and the selected consolidated statement of financial position information set forth below as of August 31, 2012 and 2011 is derived from our consolidated financial statements, which have been audited by Schwartz Levitsky Feldman LLP, Chartered Accountants, Toronto, Canada all of which are attached to and forming part of this Annual Report under Item 18 – Financial Statements.

| 2 |

EAGLEFORD ENERGY INC.

Prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”)

(STATED IN CANADIAN DOLLARS)

Except share and per share data

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION INFORMATION | YEARS ENDED AUGUST 31, | |||||||

| 2012 | 2011 | |||||||

| Cash and cash equivalents | $ | 330,003 | $ | 165,266 | ||||

| Total assets | $ | 8,998,016 | $ | 9,575,976 | ||||

| Total liabilities | $ | 6,047,663 | $ | 6,848,676 | ||||

| Total shareholders’ equity | $ | 2,950,353 | $ | 2,727,300 | ||||

| CONSOLIDATED STATEMENT OF OPERATIONS INFORMATION | YEARS ENDED AUGUST 31, | |||||||

| 2012 | 2011 | |||||||

| Revenue | ||||||||

| Natural gas sales, net of royalties | $ | 39,218 | $ | 56,916 | ||||

| Expenses | ||||||||

| Operating costs | 28,471 | 52,190 | ||||||

| Depletion and accretion | 20,509 | 23,912 | ||||||

| General and administrative | 705,591 | 502,474 | ||||||

| Marketing and public relations | 46,272 | 88,569 | ||||||

| Impairment loss on property and equipment | 50,774 | 48,249 | ||||||

| Interest expense | 88,789 | 68,199 | ||||||

| Loss (gain) loss on derivative warrant liabilities | 46,655 | (126,410 | ) | |||||

| Loss on settlement of debt | 1,465,465 | - | ||||||

| Stock based compensation | 95,910 | - | ||||||

| Stock based compensation-non employees | 75,062 | - | ||||||

| Compensation expense on re-pricing of units | 188,625 | - | ||||||

| Loss (gain) on foreign exchange | 36,283 | (161,340 | ) | |||||

| Gain on disposal of marketable securities | - | (8,000 | ) | |||||

| 2,848,406 | 487,843 | |||||||

| Net loss | $ | (2,809,188 | ) | $ | (430,927 | ) | ||

| Foreign currency translation | (160 | ) | (109,303 | ) | ||||

| Comprehensive loss | $ | (2, 809,348) | $ | (540,230 | ) | |||

| Loss per share, basic and diluted | $ | (0.034 | ) | $ | (0.007 | ) | ||

| Weighted average shares outstanding, basic and diluted * | 81,769,733 | 63,854,456 | ||||||

*Reflects March 16, 2012 two-for-one stock split

| 3 |

Exchange Rate Information

The exchange rate between the Canadian dollar and the U.S. dollar was CDN$1.00 per US$0.9931 (or US$1.00 per CDN$1.0069) as of November 30, 2012.

The average exchange rates for the periods indicated below (based on the daily noon buying rate for cable transfers in New York City certified for customs purposes by the Federal Reserve Bank of New York) are as follows:

| YEARS ENDED AUGUST 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Average exchange rate CDN$ per US$1.00 | 0.9925 | 0.9783 | 1.0640 | 1.0967 | 1.0631 | |||||||||||||||

| Average exchange rate US$ per CDN$1.00 | 1.0075 | 1.0217 | 0.9360 | 0.9033 | 0.9369 | |||||||||||||||

The high and low exchange rates between the Canadian dollar and the U.S. dollar for each of the six months ended November 30, 2012 are as follows:

| Exchange rate CDN$ per US$1.00 | ||||||||

| Month | Low | High | ||||||

| November 2012 | 0.9927 | 1.0029 | ||||||

| October 2012 | 0.9763 | 1.0003 | ||||||

| September 2012 | 0.9723 | 0.9901 | ||||||

| August 2012 | 0.9862 | 1.0061 | ||||||

| July 2012 | 1.0014 | 1.0207 | ||||||

| June 2012 | 1.0190 | 1.0417 | ||||||

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not Applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not Applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| D. | RISK FACTORS |

Our securities are highly speculative and subject to a number of risks. You should not consider an investment in our securities unless you are capable of sustaining an economic loss of the entire investment. In addition to the other information presented in this Annual Report, the following risk factors should be given special consideration when evaluating an investment in our securities.

General Risk Factors

We require additional capital which may not be available to us on acceptable terms, or at all. Both the exploration and development of oil and gas reserves can be capital-intensive businesses. We have accumulated significant losses and negative cash flows from operations in recent years which raises doubt as to the validity of the going concern assumption. As at August 31, 2012, we had a working capital deficiency of $3,819,056 and an accumulated deficit of $4,946,515. We do not have sufficient funds to meet our liabilities for the ensuing twelve months as they become due. In assessing whether the going concern assumption is appropriate, we take into account all available information about the future, which is at least, but not limited to, twelve months from August 31, 2012. Our ability to continue operations and fund our liabilities is dependent on our ability to secure additional financing and cash flow. We are pursuing such additional sources of financing and cash flow to fund our operations and obligations and while we have been successful in doing so in the past, there can be no assurance we will be able to do so in the future. We intend to satisfy any additional working capital requirements from cash flow and by raising capital through public or private sales of debt or equity securities, debt financing or short-term loans, or a combination of the foregoing. We have no current arrangements for obtaining additional capital, and may not be able to secure additional capital, or on terms which will not be objectionable to us or our shareholders. Under such circumstances, our failure or inability to obtain additional capital on acceptable terms or at all could have a material adverse effect on us.

| 4 |

We have a history of losses and a limited operating history as an oil and gas exploration and development company which makes it more difficult to evaluate our future prospects. To date, we have incurred significant losses. We have a limited operating history upon which any evaluation of us and our long-term prospects might be based. We are subject to the risks inherent in the oil and gas industry, as well as the more general risks inherent to the operation of an established business. We and our prospects must be considered in light of the risks, expenses and difficulties encountered by all companies engaged in the extremely volatile and competitive oil and gas markets. Any future success we might achieve will depend upon many factors, including factors, which may be beyond our control. These factors may include changes in technologies, price and product competition, developments and changes in the international oil and gas market, changes in our strategy, changes in expenses, fluctuations in foreign currency exchange rates, general economic conditions, and economic and regulatory conditions specific to the areas in which we compete. To address these risks, we must, among other things, comply with environmental regulations; expand our portfolio of proven oil and gas properties and negotiate additional working interests and prospect participations; and expand and replace depleting oil and gas reserves.

We have a pending litigation which could have a material effect on our financial condition or profitability. The lessors of the Matthews lease expressed their belief that the lease had terminated and filed a petition in the District Court, Zavala County, Texas, seeking a declaration that the lease has terminated. We disagree and believe that we are in compliance with the terms of the lease. We are defending the allegation and countersuing the lessors for repudiation of the lease and seeking damages. At August 31, 2012, we carry our investment in the Matthews lease at approximately $4,645,534 and the outcome of litigation is uncertain at this time. If the final outcome of such claim differs adversely from that expected, it would result in an impairment loss on the consolidated statement of operations and a reduction in exploration and evaluation assets, when determined (See Item 8.A Consolidated Financial Statements and Other Financial Information – Litigation).

We have significant debt which may make it more difficult for us to obtain future financing or engage in business combination transactions. We have significant debt obligations. The degree to which this indebtedness could have consequences on our future prospects includes the effect of such debts on our ability to obtain financing for working capital, capital expenditures or acquisitions. The portion of available cash flow that will need to be dedicated to repayment of indebtedness will reduce funds available for expansion. If we are unable to meet our debt obligations through cash flow from operations, we may be required to refinance or adopt alternative strategies to reduce or delay capital expenditures, or seek additional equity capital.

Our future operating results are subject to fluctuation based upon factors outside of our control. Our operating results may in the future fluctuate significantly depending upon a number of factors including industry conditions, oil and gas prices, rate of drilling success, rates of production from completed wells and the timing of capital expenditures. Such variability could have a material adverse effect on our business, financial condition and results of operations. In addition, any failure or delay in the realization of expected cash flows from operating activities could limit our future ability to participate in exploration or to participate in economically attractive oil and gas projects.

Our operating results will be affected by foreign exchange rates. Since energy commodity prices are primarily priced in US dollars, a portion of our revenue stream and a portion of our expenses are incurred in US dollars and they are affected by U.S./Canadian dollar exchange rates. We do not hedge this exposure. While to date this exposure has not been material, it may become so in the future.

Our inability to manage our expected growth could have a material adverse effect on our business operations and prospects. We may be subject to growth-related risks including capacity constraints and pressure on our internal systems and controls. The ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expend, train and manage our employee base. The inability to deal with this growth could have a material adverse impact on our business, operations and prospects.

To compete in our industry, we must attract and retain qualified personnel. Our ability to continue our business and to develop a competitive edge in the marketplace depends, in large part, on our ability to attract and retain qualified management and personnel. Competition for such personnel is intense, and we may not be able to attract and retain such personnel which may negatively impact our share price. We do not have key-man insurance on any of our employees, directors or senior officers and we do not have written employment agreements with any of our employees, directors or senior officers.

| 5 |

We must continue to institute procedures designed to avoid potential conflicts involving our officers and directors. Some of our directors and officers are or may serve on the board of directors of other companies from time to time. Pursuant to the provisions of the Business Corporations Act (Ontario), our directors and senior officers must disclose material interests in any contract or transaction (or proposed contract or transaction) material to us. To avoid the possibility of conflicts of interest which may arise out of their fiduciary responsibilities to each of the boards, all such directors have agreed to abstain from voting with respect to a conflict of interest between the applicable companies. In appropriate cases, we will establish a special committee of independent directors to review a matter in which several directors, or members of management, may have a conflict.

We rely on the expertise of certain persons and must insure that these relationships are developed and maintained. We are dependent on the advice and project management skills of various consultants and joint venture partners contracted by us from time to time. Our failure to develop and maintain relationships with qualified consultants and joint venture partners will have a material adverse effect on our business and operating results.

We must indemnify our officers and directors against certain actions. Our articles contain provisions that state, subject to applicable law, we must indemnify every director or officer, subject to the limitations of the Business Corporations Act (Ontario), against all losses or liabilities that our directors or officers may sustain or incur in the execution of their duties. Our articles further state that no director or officer will be liable for any loss, damage or misfortune that may happen to, or be incurred by us in the execution of his duties if he acted honestly and in good faith with a view to our best interests. Such limitations on liability may reduce the likelihood of litigation against our officers and directors and may discourage or deter our shareholders from suing our officers and directors based upon breaches of their duties to us, though such an action, if successful, might otherwise benefit us and our shareholders.

We do not currently maintain a permanent place of business within the United States. A majority of our directors and officers are nationals or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

The global financial crisis is expected to cause petroleum and natural gas prices to remain volatile for the near future. Recent market events and conditions, including disruptions in the international credit markets and other financial systems and the deterioration of global economic conditions, have caused significant volatility to commodity prices. These conditions are continuing, causing a loss of confidence in the broader U.S. and global credit and financial markets and resulting in the collapse of, and government intervention in, major banks, financial institutions and insurers and creating a climate of greater volatility, less liquidity, widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by governments, concerns about the general condition of the capital markets, financial instruments, banks, investment banks, insurers and other financial institutions caused the broader credit markets to further deteriorate and stock markets to decline substantially. These factors have negatively impacted company valuations and will impact the performance of the global economy going forward. Petroleum and natural gas prices are expected to remain volatile for the near future as a result of market uncertainties over the supply and demand of these commodities due to the current state of the world economies, OPEC actions and the ongoing global credit and liquidity concerns.

Since our sole executive officer does not devote his full time to the performance of his Company duties, he may engage in other work activities to our detriment. James Cassina, our sole executive officer, devotes approximately 75% of his work time to the performance of his Company duties. Although he has an obligation to perform his duties in a manner consistent with our best interests and through his stock ownership in the Company, is incentivized to do so, may encounter conflicts regarding the availability and use of his work time. Although there are no such present conflicts, the development thereof could have a material adverse effect on us.

Risks Factors Relating to Our Common Stock

Our stockholders may have difficulty selling shares of our common stock as there is a limited public trading market for such stock. There is only a limited public market for our common stock, and no assurance can be given that a broad or active public trading market will develop in the future or, if developed, that it will be sustained. Our common stock trades on the Over-the-Counter Bulletin Board. In addition, our common stock has not been qualified under any applicable state blue-sky laws, and we are under no obligation to so qualify or register our common stock, or otherwise take action to improve the public market for such securities. Our common stock could have limited marketability due to the following factors, each of which could impair the timing, value and market for such securities: (i) lack of profits, (ii) need for additional capital, (ii) limited public market for such securities; (iii) the applicability of certain resale requirements under the Securities Act; and (iv) applicable blue sky laws and the other factors discussed in this Risk Factors section.

| 6 |

Possible volatility of stock price. The market price for our common stock may be volatile and is subject to significant fluctuations in response to a variety of factors, including the liquidity of the market for the common stock, variations in our quarterly operating results, regulatory or other changes in the oil and gas industry generally, announcements of business developments by us or our competitors, litigation, changes in operating costs and variations in general market conditions. Because we have a limited operating history, the market price for our common stock may be more volatile than that of a seasoned issuer. Changes in the market price of our securities may have no connection with our operating results. No predictions or projections can be made as to what the prevailing market price for our common stock will be at any time.

We do not anticipate paying dividends on our common stock. We presently plan to retain all available funds for use in our business, and therefore do not plan to pay any cash dividends with respect to our securities in the foreseeable future. Hence, investors in our common stock should not expect to receive any distribution of cash dividends with respect to such securities for the foreseeable future.

Our shareholders may experience dilution of their ownership interests because of our future issuance of additional shares of common stock. Our constating documents authorize the issuance of an unlimited number of shares of common stock, without par value. In the event that we are required to issue additional shares of common stock or securities exercisable for or convertible into additional shares of common stock, enter into private placements to raise financing through the sale of equity securities or acquire additional oil and gas property interests in the future from the issuance of shares of our common stock to acquire such interests, the interests of our existing shareholders will be diluted and existing shareholders may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we do issue additional shares, it will cause a reduction in the proportionate ownership and voting power of all existing shareholders. As of the date of this Annual report we have 1,050,000 common share purchase options outstanding to purchase 1,050,000 common shares and 48,043,680 warrants outstanding to purchase 48,043,680 common shares (see Item 5 Operating and Financial Review and Prospects – Share Capital and Reserves and Derivative Warrant Liabilities).

Prospective investors in our Company are urged to seek independent investment advice. Independent legal, accounting or business advisors (i) have not been appointed by, and have not represented or held themselves out as representing the interests of prospective investors in connection with this Annual Report, and (ii) have not “expertized” or held themselves out as “expertizing” any portion of this Annual Report, nor is our legal counsel providing any opinion in connection with us, our business or the completeness or accuracy of this Annual Report. Neither we nor any of our respective officers, directors, employees or agents, including legal counsel, make any representation or expresses any opinion (i) with respect to the merits of an investment in our common stock, including without limitation the proposed value of our common stock; or (ii) that this Annual Report provides a complete or exhaustive description of us, our business or relevant risk factors which an investor may now or in the future deem pertinent in making his, her or its investment decision. Any prospective investor in our common stock is therefore urged to engage independent accountants, appraisers, attorneys and other advisors to (a) conduct such due diligence review as such investor may deem necessary and advisable, and (b) to provide such opinions with respect to the merits of an investment in our Company and applicable risk factors upon which such investor may deem necessary and advisable to rely. We will fully cooperate with any investor who desires to conduct such an independent analysis so long as we determine, in our sole discretion, that such cooperation is not unduly burdensome.

Applicable SEC rules governing the trading of “penny stocks” will limit the trading and liquidity of our common stock and may affect the trade price for our common stock. The Securities and Exchange Commission (“SEC”) has adopted rules which generally define "penny stock" to be any equity security that has a market price (as defined) of less than US$5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities will be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of US$5,000,000 or individuals with a net worth in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 jointly with their spouse.

| 7 |

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the shares that are subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We expect that the penny stock rules will discourage investor interest in and limit the marketability of our common shares.

In addition to the "penny stock" rules described above, The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements will make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our shares and have an adverse effect on the market for our shares.

Risks Factors Relating to Our Business

Our future success is dependent upon our ability to locate, obtain and develop commercially viable oil and gas deposits. Our future success is dependent upon our ability to economically locate commercially viable oil and gas deposits. We may not be able to consistently identify viable prospects, and such prospects, if identified, may not be commercially exploitable. Our inability to consistently identify and exploit commercially viable hydrocarbon deposits would have a material and adverse effect on our business and financial position.

Exploratory drilling activities are subject to substantial risks. Our expected revenues and cash flows will be principally dependent upon the success of any drilling and production from prospects in which we participate. The success of such prospects will be determined by the economical location, development and production of commercial quantities of hydrocarbons. Exploratory drilling is subject to numerous risks, including the risk that no commercially productive oil and gas reservoirs will be encountered. The cost of drilling, completing and operating wells is often uncertain, and drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including unexpected formation and drilling conditions, pressure or other irregularities in formations, blowouts, equipment failures or accidents, as well as weather conditions, compliance with governmental requirements or shortages or delays in the delivery of equipment. Our inability to successfully locate and drill wells that will economically produce commercial quantities of oil and gas could have a material adverse effect on our business and, financial position.

Our drilling and exploration plans will be subject to factors beyond our control. A prospect is a property that has been identified based on available geological and geophysical information that indicates the potential for hydrocarbons. Whether we ultimately drill a property may depend on a number of factors including funding; the receipt of additional seismic data or reprocessing of existing data; material changes in oil or gas prices; the costs and availability of drilling equipment; the success or failure of wells drilled in similar formations or which would use the same production facilities; changes in estimates of costs to drill or complete wells; our ability to attract industry partners to acquire a portion of our working interest to reduce exposure to drilling and completion costs; decisions of our joint working interest owners; and restrictions under provincial regulators.

Our operating results are subject to oil and natural gas price volatility. Our profitability, cash flow and future growth will be affected by changes in prevailing oil and gas prices. Oil and gas prices have been subject to wide fluctuations in recent years in response to changes in the supply and demand for oil and natural gas, market uncertainty, competition, regulatory developments and other factors which are beyond our control. It is impossible to predict future oil and natural gas price movements with any certainty. We do not engage in hedging activities. As a result, we may be more adversely affected by fluctuations in oil and gas prices than other industry participants that do engage in such activities. An extended or substantial decline in oil and gas prices would have a material adverse effect on our access to capital, and our financial position and results of operations.

| 8 |

Unforeseen title defects may result in a loss of entitlement to production and reserves. Although we conduct title reviews in accordance with industry practice prior to any purchase of resource assets, such reviews do not guarantee that an unforeseen defect in the chain on title will not arise and defeat our title to the purchased assets. If such a defect were to occur, our entitlement to the production from such purchased assets could be jeopardized.

Estimates of reserves and predictions of future events are subject to uncertainties. Certain statements included in this Annual Report contain estimates of our oil and gas reserves and the discounted future net revenues from those reserves, as prepared by independent petroleum engineers or us. There are numerous uncertainties inherent in such estimates including many factors beyond our control. The estimates are based on a number of assumptions including constant oil and gas prices, and assumptions regarding future production, revenues, taxes, operating expenses, development expenditures and quantities of recoverable oil and gas reserves. Such estimates are inherently imprecise indications of future net revenues, and actual results might vary substantially from the estimates based on these assumptions. Any significant variance in these assumptions could materially affect the estimated quantity and value of reserves. In addition, our reserves might be subject to revisions based upon future production, results of future exploration and development, prevailing oil and gas prices and other factors. Moreover, estimates of the economically recoverable oil and gas reserves, classifications of such reserves and estimates of future net cash flows prepared by independent engineers at different times may vary substantially. Information about reserves constitutes forward-looking statements.

The success of our business is dependent upon our ability to replace reserves. Our future success depends upon our ability to find, develop and acquire oil and gas reserves that are economically recoverable. As a result we must locate, acquire and develop new oil and gas reserves to replace those being depleted by production. Without successful funding for acquisitions and exploration and development activities, our reserves will decline. We may not be able to find and develop or acquire additional reserves at an acceptable cost.

Most of our competitors have substantially greater financial, technical, sales, marketing and other resources than we do. We engage in the exploration for and production of oil and gas, industries which are highly competitive. We compete directly and indirectly with oil and gas companies in our exploration for and development of desirable oil and gas properties. Many companies and individuals are engaged in the business of acquiring interests in and developing oil and gas properties in the United States and Canada, and the industry is not dominated by any single competitor or a small number of competitors. Many of such competitors have substantially greater financial, technical, sales, marketing and other resources, as well as greater historical market acceptance than we do. We will compete with numerous industry participants for the acquisition of land and rights to prospects, and for the equipment and labor required to operate and develop such prospects. Competition could materially and adversely affect our business, operating results and financial condition. Such competitive disadvantages could adversely affect our ability to participate in projects with favorable rates of return.

Shortages of supplies and equipment could delay our operations and result in higher operating and capital costs. Our ability to conduct operations in a timely and cost effective manner is subject to the availability of natural gas and crude oil field supplies, rigs, equipment and service crews. Although none are expected currently, any shortage of certain types of supplies and equipment could result in delays in our operations as well as in higher operating and capital costs.

Our business is subject to interruption from severe weather. Presently, our operations are conducted principally in the central region of Alberta, Canada and in Southwest Texas. The weather in these areas and other areas in which we may operate in the future can be extreme and can cause interruption or delays in our drilling and construction operations.

We are dependent on third-party pipelines and would experience a material adverse effect on our operations were our access to such pipelines be curtailed or the rates charged for use thereof materially increased. Substantially all our sales of natural gas production are effected through deliveries to local third-party gathering systems to processing plants. In addition, we rely on access to inter-provincial pipelines for the sale and distribution of substantially all of our gas. As a result, a curtailment of our sale of natural gas by pipelines or by third-party gathering systems, an impairment of our ability to transport natural gas on inter-provincial pipelines or a material increase in the rates charged to us for the transportation of natural gas by reason of a change in federal or provincial regulations or for any other reason, could have a material adverse effect upon us. In such event, we would have to obtain other transportation arrangements. We may not have economical transportation alternatives and it may not be feasible for us to construct pipelines. In the event such circumstances were to occur, our operating netbacks from the affected wells would be suspended until, and if, such circumstances could be resolved.

| 9 |

Our business is subject to operating hazards and uninsured risks. The oil and gas business involves a variety of operating risks, including fire, explosion, pipe failure, casing collapse, abnormally pressured formations, adverse weather conditions, governmental and political actions, premature reservoir declines, and environmental hazards such as oil spills, gas leaks and discharges of toxic gases. The occurrence of any of these events with respect to any property operated or owned (in whole or in part) by us could have a material adverse impact on us. Insurance coverage is not always economically feasible and is not obtained to cover all types of operational risks. The occurrence of a significant event that is not insured or insured fully could have a material adverse effect on our financial condition.

Our business is subject to restoration, safety and environmental risk. Our present operations are primarily in western Canada and southwest Texas and certain laws and regulations exist that require companies engaged in petroleum activities to obtain necessary safety and environmental permits to operate. Such legislation may restrict or delay us from conducting operations in certain geographical areas. Further, such laws and regulations may impose liabilities on us for remedial and clean-up costs, or for personal injuries related to safety and environmental damages, such liabilities collectively referred to as “asset retirement obligations”. While our safety and environmental activities have been prudent in managing such risks, we may not always be successful in protecting us from the impact of all such risks.

The termination or expiration of any of our licenses and leases may have a material adverse effect on our results of operations. Our properties are held in the form of licenses and leases and working interests in licenses and leases. If we, or the holder of the license or lease, fail to meet the specific requirement of a license or lease, the license or lease may terminate or expire. We may not meet the obligations required to maintain each license or lease. The termination or expiration of our licenses or leases or the working interests relating to a license or lease may have a material adverse effect on our results of operations and business (See Item 8.A Consolidated Financial Statements and Other Financial Information – Litigation for a discussion of our pending litigation matter involving our Matthews lease).

Compliance with new or modified environmental laws or regulations could have a materially adverse impact on us. We are subject to various Canadian and US laws and regulations relating to the environment. We believe that we are currently in compliance with such laws and regulations. However, such laws and regulations may change in the future in a manner which will increase the burden and cost of compliance. In addition, we could incur significant liability under such laws for damages, clean-up costs and penalties in the event of certain discharges into the environment. In addition, environmental laws and regulations may impose liability on us for personal injuries, clean-up costs, environmental damage and property damage as well as administrative, civil and criminal penalties. We maintain limited insurance coverage for accidental environmental damages, but do not maintain insurance for the full potential liability that could be caused by such environmental damage. Accordingly, we may be subject to significant liability, or may be required to cease production in the event of the noted liabilities.

| ITEM 4 | INFORMATION ON THE COMPANY |

We are amalgamated under the laws of the Province of Ontario. Our primary activities are investment in, exploration and development and production of oil and gas.

We hold a 0.5% non-convertible gross overriding royalty in a natural gas well located in the Haynes area in the Province of Alberta, Canada.

We hold a 5.1975% working interest held in trust through a joint venture partner in a natural gas unit located in the Botha area in the Province of Alberta, Canada.

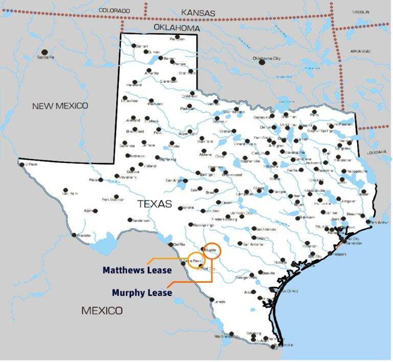

Through Dyami Energy LLC we hold a 75% working interest before payout which reduces to a 61.50% working interest after payout of $12,500,000 of production revenue in the Matthews lease. Directly, we hold a 10% working interest before payout which reduces to a 7.50% working interest after payout of $15,000,000 of production revenue in the Matthews lease. We have entered into a farm out agreement for a portion of our working interests from the surface to the base of the San Miguel formation in the Matthews Lease. The Matthews lease comprises approximately 2,629 gross acres of land in Zavala County, Texas (See Item 8.A Consolidated Financial Statements and Other Financial Information – Litigation).

| 10 |

Through Dyami Energy LLC we hold a 100% working interest in the Murphy Lease comprising approximately 2,637 acres of land in Zavala County, Texas subject to a 10% carried interest on the drilling costs from surface to base of the Austin Chalk formation, and a 3% carried interest on the drilling costs from the top of the Eagle Ford shale formation to basement on the first well drilled into a serpentine plug and for the first well drilled into a second serpentine plug, if discovered.

Our registered office and management office is located at 1 King Street West, Suite 1505, Toronto, Ontario, M5H 1A1, Telephone (416) 364-4039, Facsimile (416) 364-8244. Our books and financial records are located in the registered office and management office. Our Canadian public filings can be accessed and viewed via the System for Electronic Data Analysis and Retrieval (“SEDAR”) at www.sedar.com. Readers can also access and view our Canadian public insider trading reports via the System for Electronic Disclosure by Insiders at www.sedi.ca. Our Registrar and Transfer Agent is Equity Financial Trust Company located at Suite 400, 200 University Avenue, Toronto, Ontario, M5H 4H1. Our U.S. public filings are available at the public reference room of the U.S. Securities and Exchange Commission (“SEC”) located at 100 F Street, N.E., Room 1580, Washington, DC 20549 and at the website maintained by the SEC at www.sec.gov.

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY |

We were incorporated in Ontario, Canada on September 22, 1978, under the Business Corporations Act (Ontario), under the name Bonanza Red Lake Explorations Inc. (“Bonanza Red Lake”). By prospectus dated November 20, 1978 and a further amendment to the Prospectus dated January 10, 1979 we became a reporting issuer in the Province of Ontario and raised $250,000 to acquire interests in and to explore and develop certain mineral lands located near the Town of Red Lake, Ontario, Canada. In 1987, we optioned our mineral lands in Red Lake, Ontario to Pure Gold Resources Inc., who expended sufficient funds during 1988 and 1989 to earn an 85% interest in our eight patented mineral claims, and then discontinued its exploration program on the property. Bonanza Red Lake had subsequently written the carrying amount of these mineral claims down to $1.

On March 29, 2000, Bonanza Red Lake entered into a Share Exchange Agreement with 1406768 Ontario Inc. (“1406768 Ontario”). 1406768 Ontario is a company incorporated under the laws of the Province of Ontario by articles of incorporation dated effective March 13, 2000. The purpose of the transaction was to allow Bonanza Red Lake to acquire a company, 1406768 Ontario, which resulted in our owning part of an operating business. At an Annual and Special Meeting of shareholders held on May 10, 2000 we received shareholder approval for the acquisition of 1406768 Ontario; the consolidation of Bonanza Red Lake’s issued and outstanding common shares on a one new common share for every three old common shares basis; a name change from Bonanza Red Lake to Eugenic Corp; a new stock option plan (the “Plan”) authorizing 1,275,000 common shares to be set aside for issuance under the Plan; and authorizing the directors to determine or vary the number of directors of the Company from time to time which pursuant to our Articles provide for a minimum of three and a maximum of ten.

By Articles of Amendment dated August 15, 2000, Bonanza Red Lake consolidated its issued and outstanding common shares on a one new common share for every three old common shares basis and changed the name of the company to Eugenic Corp.

We completed the acquisition of 1406768 Ontario on October 12, 2000 and acquired all of the issued and outstanding shares of 1406768 Ontario for $290,000. The purchase price was satisfied by our issuance of 5,800,000 company units at $0.05 per unit. Each unit consisted of one common share and one common share purchase warrant entitling the holder to purchase one common share of ours at an exercise price of $0.25 per common share until October 12, 2003. As a result of this transaction, the original shareholders of 1406768 Ontario owned 90.7% of our issued shares. The acquisition resulted in a change in business and an introduction of new management for us. The acquisition was accounted for as a reverse take-over of us by 1406768 Ontario. Our net assets acquired at fair value as at October 12, 2000 resulted in a deficiency of assets over liabilities in the amount of $123,170 which was charged to share capital. All of the 5,800,000 outstanding warrants expired on October 12, 2003.

| 11 |

On February 5, 2009, we completed a non-brokered private placement of 2,600,000 units (each a “Unit”) at a purchase price of $0.05 per Unit for gross proceeds of $130,000. Each Unit was comprised of one common share (each a “Unit Share”) and one purchase warrant (each a “Warrant”). Each Warrant is exercisable until February 5, 2014 to purchase one additional share of our common stock (each a “Warrant Share”) at a purchase price of $0.07 per share. 1407271 Ontario Inc. purchased 1,600,000 units. 1407271 Ontario Inc. is owned 100% by our former President, Ms. Sandra Hall. Ms. Hall is also the sole director and officer of 1407271.

On February 25, 2009, we completed a non-brokered private placement of 1,000,256 units (each a “Unit”) at a purchase price of $0.05 per Unit for gross proceeds of approximately $50,013. Each Unit was comprised of one common share (each a “Unit Share”) and one purchase warrant (each a “Warrant”). Each Warrant is exercisable until February 25, 2014 to purchase one additional share of our common stock (each a “Warrant Share”) at a purchase price of $0.07 per share. Sandra Hall, our former president and former director, and Milton Klyman, a director, purchased 600,000 Units and 50,000 Units, respectively.

On February 27, 2009, we purchased all of the issued and outstanding shares issued in the capital stock of 1354166 Alberta Ltd. (“1354166 Alberta”), a company incorporated on October 3, 2007 in the Province of Alberta Canada (the "Transaction") under the Business Corporations Act (Alberta). In connection therewith, we issued to the shareholders of 1354166 an aggregate of 8,910,564 units (each a "Unit") at $0.05 per unit or an aggregate of $445,528 and following the closing repaid $118,000 of shareholders’ loans in 1354166 by cash payment. . Each unit is comprised of one share of our common stock (each a "Share") and one purchase warrant (each a "Warrant"). Each Warrant is exercisable until February 27, 2014 to purchase one additional share of our common stock at a purchase price of $0.07 per share. 1354166 is a private company that has a 5.1975% working interest held in trust through a joint venture partner in a natural gas unit located in the Botha area of Alberta, Canada.

On February 27, 2009, we entered into an agreement with a non-related party, to convert debt in the amount of $62,500 through the issuance of a total of 1,250,000 units at an attributed value of $0.05 per unit (the "Debt Settlement"). Each Unit was comprised of one common share (each a “Unit Share”) and one purchase warrant (each a “Warrant”). Each Warrant is exercisable until February 27, 2014 to purchase one additional share of our common stock (each a “Warrant Share”) at a purchase price of $0.07 per share.

By Articles of Amendment dated November 12, 2009, 1406768 Ontario changed its name to Eagleford Energy Inc. By Articles of Amalgamation dated November 30, 2009 we amalgamated with Eagleford Energy Inc. and upon the amalgamation the amalgamated entity's name became Eagleford Energy Inc.

Effective June 10, 2010, we retained Gar Wood Securities, LLC (“Gar Wood”) to act as Investment Banker/Financial Advisor to the Company for a period of two years. Under the terms of the Gar Wood engagement, we agreed to pay a fee of 6% of the gross proceeds raised and issue 1,500,000 common share purchase warrants. (

On November 5, 2010 we terminated the agreement with Gar Wood dated June 10, 2010. As a result 36,430 warrants were cancelled out of the 333,333 warrants issued exercisable at $1.00 expiring December 10, 2011 and 18,215 warrants were cancelled out of the 166,667 warrants issued exercisable at $1.50 expiring June 10, 2012. On December 10, 2011 296,903 warrants exercisable at US $1.00 expired. During the year ended August 31, 2012 all of the remaining warrants expired unexercised.

During the fiscal year ended August 31, 2010, 1,100,000 of our common share purchase warrants were exercised at $0.07 expiring February 5, 2014 for proceeds of $77,000 and 1,000,000 of our common share purchase warrants were exercised at $0.07 expiring February 27, 2014 for proceeds of $70,000.

On August 31, 2010 we acquired a 10% working interest before payout and a 7.5% working interest after payout of production revenue of $15 million in the Matthews lease comprising approximately 2,629 gross acres of land in Zavala County, Texas (the “Lease Interest”). As consideration for the Lease Interest we paid on closing $212,780 (US$200,000), satisfied by US$25,000 in cash and $186,183 (US$175,000) satisfied by the issuance of a 5% secured promissory note.US$100,000 of principal together with accrued interest is due and payable on February 28, 2011 and US$75,000 of principal together with accrued interest is due and payable on August 31, 2011. The note was secured by the Lease Interest.

| 12 |

On August 31, 2010, we acquired 100% of the issued and outstanding membership interests of Dyami Energy LLC, a Texas limited liability corporation for consideration of $4,218,812. (US$3,965,422) satisfied by (i) the issuance of 3,418,467 units of the Company. Each unit is comprised of one common share and one-half a purchase warrant. Each full warrant is exercisable into one additional common share at US$1.00 per share on or before August 31, 2014 (the “Units’) and (ii) the assumption of $1,021,344 (US$960,000) of Dyami Energy debt by way of a secured promissory note payable to Benchmark Enterprises LLC (“Benchmark”). The note bears interest at 6% per annum, is secured by Dyami’s interest in the Matthews and Murphy leases and was payable on December 31, 2011 or upon the Company closing a financing or series of financings in excess of US$4,500,000. The due date of the note has been extended until November 30, 2012 with an interest rate of 10% per annum. On January 3, 2012 we issued 515,406 pre forward split common shares to shares Benchmark as full settlement of interest due at December 31, 2011 in the amount of $103,028.

Dyami Energy holds a 75% working interest before payout and a 61.50% working interest after payout of production revenue of $12.5 million in the Matthews Lease comprising approximately 2,629 gross acres of land in Zavala County, Texas and a 100% working interest in a mineral lease comprising approximately 2,637 acres of land in Zavala County, Texas (the “Murphy Lease”) subject to a 10% carried interest on the drilling costs from surface to base of the Austin Chalk formation, and a 3% carried interest on the drilling costs from the top of the Eagle Ford shale formation to basement on the first well drilled into a serpentine plug and for the first well drilled into a second serpentine plug, if discovered (collectively the “Leases”).

The Members of Dyami entered into lock up agreements on closing and placed 50% of the Units in escrow (1,709,234 common shares and 854,617 purchase warrants) until such time that we receive a National Instrument 51-101 compliant report from an independent engineering firm indicating at least 100,000 boe of proven reserves on either the Murphy Lease or any formation below the San Miguel on the Matthews Lease (the “Report”). In the event the Report is not received by Dyami Energy within two years of the closing date of the acquisition, the escrow units are to be returned to us for cancellation. On August 31, 2012 we cancelled the 50% of Units held in escrow as the conditions precedent had not been satisfied and the time allowed for performance expired.

In connection with the Dyami Energy acquisition, we entered into a one year employment agreement with Eric Johnson and reserved 850,000 common share purchase warrants, exercisable on an earn-out basis, for the purchase of 850,000 common shares of our stock at a price of US$1.00 per share during a period of five years from the date of issuance. On April 13, 2011 the employment agreement was terminated.

During the fiscal year ended August 31, 2010 we spent $10,046 on exploration expenditures related to the Matthews Lease.

On March 31, 2011 we entered into a Farmout Agreement (the “Farmout”) from surface to the base of the San Miguel formation (the “San Miguel”) on the Matthews Lease located in Zavala County, Texas. Under the Farmout, the farmee may spend up to US$1,050,000 on exploration and development of the San Miguel to earn a maximum of 42.50% working interest (31.875% net revenue interest). Under the terms of the Farmout, the farmee may earn an initial 25% of the Company’s working interest in the San Miguel by paying 100% of the costs to drill, complete, equip and perform an injection operation on a test well to a depth of approximately 3,500 feet (the “Initial Test Well”). After the performance of the Initial Test Well, the farmee may increase its working interest to 50% of the Company’s working interest by spending the entire $1,050,000 on additional operations on the San Miguel in a good faith effort to produce hydrocarbons. We received US$647,536 from the farmee against costs of $711,395 related to the drilling, completion and injection operation of the Matthews/Dyami #3 well. As of the date of this Annual Report we have not assigned any interest to the farmee in the San Miguel formation.

During the fiscal year ended August 31, 2011 we drilled four wells we spent $3,262,782 on exploration expenditures related to the Matthews and Murphy Leases.

During the year ended August 31, 2011, 500,000 of our common share purchase warrants were exercised at $0.07 expiring February 5, 2014 for proceeds of $35,000; 625,247 of our common share purchase warrants were exercised at $0.07 expiring February 27, 2014 for proceeds of $44,475; and 2,575,000 of our common share purchase warrants were exercised at $0.20 expiring April 14, 2011 for proceeds of $515,000.

During the year ended August 31, 2011 we received $2,878,736 and issued demand promissory notes bearing interest at 10% per annum. Interest is payable annually on the anniversary date of the notes.

During the year ended August 31, 2011 we paid $98,440 of secured notes and a $110,000 loan payable.

As of the close of business on March 16, 2012, we completed a two-for-one forward stock split, pursuant to which one (1) newly-issued share of the Company’s common stock was issued to each holder of a share of common stock.

| 13 |

During the year ended August 31, 2012 we completed a financing of 12,575,000 units in the capital of the Company for net proceeds of $2,086,718.

During the year ended August 31, 2012, we issued 17,150,000 units as full settlement of debt and shareholders’ loans in the amount of $857,500 and issued 3,278,392 common shares as full settlement of interest due on a secured note and shareholders’ loans in the amount of $369,885.

During the year ended August 31, 2012, we received cash of $321,845 and US$175,000 and issued demand promissory notes bearing interest at 10% per annum.

During the twelve months ended August 31, 2012, we paid $73,380 of secured notes and US$480,000 of shareholders’ loans.

For the twelve months ended August 31, 2012, we incurred $1,559,763 in exploration expenditures related to the leases in Zavala County, Texas.

During the year ended August 31, 2012, the lessors of the Matthews Lease expressed their belief that the lease had terminated and filed a petition in the District Court, Zavala County, Texas, seeking a declaration that the lease has terminated. We disagree and believe that we are in compliance with the terms of the lease. We are defending the allegation and countersuing the lessors for repudiation of the lease and seeking damages (See Item 8.A Consolidated Financial Statements and Other Financial Information – Litigation).

Subsequent to our year ended August 31, 2012, we completed a financing of 2,249,790 units in the capital of the Company for US$0.20 per unit for net proceeds of $405,650. Each unit is comprised on one common share and one-half a common share purchase warrant with each full warrant entitling the holder to acquire one common share of the Company at US$0.50 or a period of three years from the date of issue.

We intend to apply additional capital to further enhance our property interests. As part of our oil and gas development program, management of the Company anticipates further expenditures to expand its existing portfolio of proved reserves. Amounts expended on future exploration and development is dependent on the nature of future opportunities evaluated by us. These expenditures could be funded through cash held by the Company or through cash flow from operations. Any expenditure which exceeds available cash will be required to be funded by additional share capital or debt issued by us, or by other means. Our long-term profitability will depend upon our ability to successfully implement our business plan.

Our past primary source of liquidity and capital resources has been proceeds from the issuance of share capital, loans and advances and cash flow from our oil and gas operations.

Our registered office and principal place of business in Ontario is located at 1 King Street West, Suite 1505, Toronto, Ontario M5H 1A1. Our telephone number at that address is (416) 364-4039.

| B. | BUSINESS OVERVIEW |

Directly and through our wholly owned subsidiaries 1354166 Alberta and Dyami Energy we are primarily engaged in the development, acquisition and production of oil and gas interests located in Alberta, Canada and Texas, USA.

We have a 0.5% Non Convertible Overriding Royalty (“NCOR”) in a natural gas well located in Haynes, Alberta, Canada a 5.1975% working interest in a natural gas unit located in Alberta, Canada.

We also have an 85% working interest before payout (69% working interest after payout) in Matthews lease comprising 2,629 gross acres of land in Zavala County, Texas. We have entered into a farm out agreement for a portion of our working interests from the surface to the base of the San Miguel formation in the Matthews Lease. As of the date of this Annual Report, we have not assigned any working interest in the San Miguel formation (See, Item 8.A Consolidated Financial Statements and Other Financial Information - Litigation).

In addition, we hold a 100% working interest in the Murphy lease comprising approximately 2,637 acres of land in Zavala County, Texas subject to a 10% carried interest on the drilling costs from surface to base of the Austin Chalk formation, and a 3% carried interest on the drilling costs from the top of the Eagle Ford shale formation to basement on the first well drilled into a serpentine plug and for the first well drilled into a second serpentine plug, if discovered.

| 14 |

We have a 0.3% Net Smelter Return Royalty on 8 patented mining claims located in Red Lake, Ontario, Canada.

For the three fiscal years ending August 31, 2012, 2011 and 2010 the total revenue, net of royalties derived from the sale of our natural gas interests in Canada was as follows:

| Total | ||||

| August 31, 2012 | $ | 39,218 | ||

| August 31, 2011 | $ | 56,916 | ||

| August 31, 2010 | $ | 80,864 | ||

We sell our natural gas production to integrated oil and gas companies and marketing agencies. Sales prices are generally set at market prices available in Canada or the United States.

The level of activity in the Canadian oil and gas industry is influenced by seasonal weather patterns. Wet weather and spring thaw make the ground unstable and municipalities and provincial transportation departments enforce road bans that may restrict the level of activity. Seasonal factors and unexpected weather patterns may lead to declines in production activity and increased consumer demand or changes in supply during certain months of the year may influence the commodity prices.

There is an existing and available market for the oil and gas produced from the properties. However, the prices obtained for production are subject to market fluctuations, which are affected by many factors, including supply and demand. Numerous factors beyond our control, which could affect pricing include:

| • | the level of consumer product demand; |

| • | weather conditions; |

| • | the foreign supply of oil and gas; |

| • | the price of foreign imports; |

| • | volatility in market prices for oil and natural gas; |

| • | ability to raise financing; |

| • | reliance on third party operators; |

| • | ability to find or produce commercial quantities of oil and natural gas; |

| • | liabilities inherent in oil and natural gas operations; |

| • | dilution of interests in oil and natural gas properties; |

| • | general business and economic conditions; |

| • | the ability to attract and retain skilled staff; |

| • | uncertainties associated with estimating oil and natural gas reserves; |

| • | competition for, among other things, financings, acquisitions of reserves, undeveloped lands and skilled personnel; and |

| • | governmental regulation and environmental legislation (See, Item 3.D Risk Factors Relating to our Business). |

We caution that the foregoing list of important factors is not exhaustive. Investors and others who base themselves on our forward-looking statements should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. We also caution readers not to place undue reliance on these forward-looking statements. Moreover, the forward-looking statements may not be suitable for establishing strategic priorities and objectives, future strategies or actions, financial objectives and projections other than those mentioned above.

We do not have a reliance on raw materials, as we operate in an extractive industry.

We do not have a reliance on any significant patents.

The oil and gas business is highly competitive in every phase. Many of our competitors have greater financial and technical resources, and have established multi-national operations, secured land rights and licenses, which we may not have. As a result, we may be prevented from participating in drilling and acquisition programs (See, Item 3.D Key Information - Risk Factors).

| 15 |

Governmental Regulation/Environmental Issues

Our oil and gas operations are subject to various United States and Canadian governmental regulations including those imposed by the Texas Railroad Commission and Alberta Energy Resources Conversation Board and Alberta Utilities Commission. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, by-products thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state, provincial and local laws and regulations relating primarily to the protection of human health and the environment. To date, expenditures related to complying with these laws, and for remediation of existing environmental contamination, have not been significant in relation to the results of operations of our company. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations. These regulations may adversely affect our operations and cost of doing business. It is likely that these laws and regulations will become more stringent in the future (See, Item 3.D Key Information - Risk Factors).

| C. | ORGANIZATIONAL STRUCTURE |

We have two wholly owned subsidiaries. 1354166 Alberta Ltd. is a company incorporated under the Business Corporations Act (Alberta) and Dyami Energy LLC is a Texas Limited Liability company.

| D. | PROPERTY, PLANTS AND EQUIPMENT |

Our executive offices consist of approximately 140 square feet of office space and are rented at $1,500 per month on a month to month basis. The address of our executive offices is 1 King Street West, Suite 1505, Toronto, Ontario Canada.

Canada

We hold directly a 0.5% NCOR in a natural gas well located in Haynes, Alberta, Canada.

We hold through our wholly owned subsidiary 1354166 Alberta a 5.1975% working interest in a natural gas unit located in Botha, Alberta, Canada.

We have a 0.3% Net Smelter Return Royalty on eight patented mining claims located in Red Lake, Ontario, Canada.

United States

We hold through our wholly owned subsidiary Dyami Energy a 75% working interest before payout and a 61.5% working interest after payout of $12,500,000 of production in Matthews lease comprising approximately 2,629 gross acres of land in Zavala County, Texas. In addition, we hold directly a 10% working interest before payout and a 7.5% working interest after payout of $15,000,000 of production in Matthews lease. We entered into a farm out agreement for a portion of our working interests from the surface to the base of the San Miguel formation in the Matthews Lease. To date we have not assigned any interest in the San Miguel formation (See, Item 8.A Consolidated Financial Statements and Other Financial Information - Litigation).