UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-34354

Altisource Portfolio Solutions S.A.

(Exact name of registrant as specified in its charter)

|

Luxembourg (State or other jurisdiction of incorporation or organization) |

|

98-0554932 (I.R.S. Employer Identification No.) |

40, avenue Monterey

L-2163 Luxembourg

Grand Duchy of Luxembourg

(352) 24 69 79 00

(Address and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

|

|

|

|

Common Stock, $1.00 par value |

|

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein and will not be contained, to the best of the Registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

x |

|

|

|

Accelerated filer |

o |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

o |

|

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by nonaffiliates of the registrant as of June 30, 2013 was $1,602,571,543 based on the closing share price as quoted on the NASDAQ Global Market on that day and the assumption that all directors and executive officers of the Company, and their families, are affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of January 31, 2014, there were 22,628,618 outstanding shares of the Registrant’s shares of beneficial interest (excluding 2,784,130 shares held as treasury stock).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed subsequent to the date hereof with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s Annual Meeting of Stockholders to be held on May 21, 2014 are incorporated by reference into Part III of this Report. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2013.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and certain information incorporated herein by reference contain forward-looking statements within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may relate to, among other things, future events or our future performance or financial condition. Words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,” “estimate,” “believe,” “predict,” “potential,” or “continue” or the negative of these terms and comparable terminology are intended to identify such forward-looking statements. Forward-looking statements are not guarantees of future performance and involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially. Important factors that could cause actual results to differ materially from those suggested by the forward-looking statements include, but are not limited to, the risks discussed in Item 1A of Part I “Risk Factors.” We caution you not to place undue reliance on these forward-looking statements which reflect our view only as of the date of this report. We are under no obligation (and expressly disclaim any obligation) to update or alter any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or change in events, conditions or circumstances on which any such statement is based.

Except as otherwise indicated or unless the context requires otherwise, “Altisource,” “we,” “us,” “our” and the “Company” refer to Altisource Portfolio Solutions S.A., a Luxembourg société anonyme, or public limited company, and its wholly-owned subsidiaries.

The Company

Altisource®, together with its subsidiaries, is a premier marketplace and transaction solutions provider for the real estate, mortgage and consumer debt industries offering both distribution and content. We leverage proprietary business process, vendor and electronic payment management software and behavioral science based analytics to improve outcomes for marketplace participants.

We are publicly traded on the NASDAQ Global Select Market under the symbol “ASPS.” We are incorporated under the laws of Luxembourg. On August 10, 2009, we became a stand-alone public company in connection with our separation from Ocwen Financial Corporation (“Ocwen”) (the “Separation from Ocwen”). Prior to our Separation from Ocwen®, our businesses were wholly-owned subsidiaries of Ocwen.

2013 Highlights

Our 2013 highlights include:

· Recognized revenue of $768.4 million, a 35% increase compared to the year ended December 31, 2012;

· Recognized service revenue of $662.1 million, a 42% increase compared to the year ended December 31, 2012;

· Recognized diluted earnings per share of $5.19, a 17% increase compared to the year ended December 31, 2012;

· Generated cash flows from operations of $185.5 million, a 59% increase compared to the year ended December 31, 2012;

· The average number of loans serviced by Ocwen on REALServicing totaled 1.2 million, a 57% increase compared to the year ended December 31, 2012;

· On November 15, 2013, we acquired Equator, LLC (“Equator”), a national leader in mortgage and real estate related business process management solutions, for an initial purchase price of $63.4 million plus

contingent earn-out consideration of up to an additional $80 million over three years, subject to Equator achieving annual performance targets;

· On March 29, 2013, we completed the acquisition of the Homeward Residential, Inc. (“Homeward”) fee-based businesses from Ocwen for an aggregate purchase price of $75.8 million;

· On April 12, 2013, we completed the Residential Capital, LLC (“ResCap”) fee-based business transaction with Ocwen for an aggregate purchase price of $128.8 million;

· On May 7, 2013, we increased borrowings under our senior secured term loan agreement to $400 million. Furthermore, on December 9, 2013, we refinanced the senior secured term loan which included, among other changes, lowering the interest rate of the term loans and

· We repurchased 1.2 million shares of our common stock under our stock repurchase program during the year ended December 31, 2013 at an average price of $116.99 per share.

Reportable Segments

We classify our businesses into the following three reportable segments:

Mortgage Services: Provides services that span the mortgage and real estate lifecycle and are typically outsourced by loan servicers, originators and investors in single family homes. We provide these services primarily for loan portfolios serviced by Ocwen. We also have longstanding relationships with some of the leading capital markets firms, commercial banks, hedge funds, insurance companies and mortgage bankers. Within the Mortgage Services segment, we provide the following services:

Asset management — Asset management services principally include property preservation, property inspection, real estate owned (“REO”) asset management, our consumer real estate portal - Hubzu® and REO brokerage services. We also provide property management, lease management and renovation management services for single family rental properties.

Insurance services — Insurance services include an array of title insurance services, including pre-foreclosure and REO title searches, title commitments, settlement and escrow services and other title insurance services including title insurance for loan originations. We also provide insurance program management and insurance agency and brokerage services applicable to lenders and residential loan servicers.

Residential property valuation — Residential property valuation services principally include traditional appraisal products through our licensed appraisal management company and alternative valuation products primarily through our network of real estate professionals. We generally provide these services for loan servicers, lenders and investors in single family homes.

Default management services — Default management services principally include foreclosure trustee services for loan servicers and non-legal processing and related services for and under the supervision of foreclosure, bankruptcy and eviction attorneys.

Origination management services — Origination management services principally include Mortgage Partnership of America, L.L.C. (“MPA”) and our contract underwriting and quality control businesses. MPA serves as the manager of Best Partners Mortgage Cooperative, Inc. (“BPMC”), which is referred to as the Lenders One Mortgage Cooperative (“Lenders One”), a national alliance of independent mortgage bankers that provides its members with education and training along with revenue enhancing, cost reducing and market share expanding opportunities. We provide other origination related services in the residential property valuation business. In addition, some of the origination related reseller businesses, including the flood certification business, are included in the Technology Services REALSuite business.

Financial Services: Provides collection and customer relationship management services primarily to debt originators and servicers (e.g., credit card, auto lending, retail credit and mortgage) and the utility and insurance industries. Within the Financial Services segment, we provide the following services:

Asset recovery management — Asset recovery management principally includes post-charge-off debt collection services on a contingency fee basis.

Customer relationship management — Customer relationship management principally includes customer care and early stage collections services as well as insurance and claims processing, call center services and analytical support.

Technology Services: Comprises our REALSuite of software applications, Equator’s software applications and our information technology (“IT”) infrastructure services. We currently provide our IT infrastructure services to Ocwen and its subsidiaries, Home Loan Servicing Solutions, Ltd. (“HLSS”), Altisource Residential Corporation (“Residential”), Altisource Asset Management Company (“AAMC”) and our other segments. The REALSuite platform provides a fully integrated set of software applications and technologies that manage the end-to-end lifecycle for residential and commercial mortgage loan servicing including the automated management and payment of a distributed network of vendors. A brief description of the key REALSuite and Equator’s software products is below:

REALServicing® — An enterprise residential mortgage loan servicing product that offers an efficient and effective platform for loan servicing including default administration. This technology solution features automated workflows and robust reporting capabilities. The solution spans the loan servicing lifecycle from loan boarding to satisfaction including all collections, payment processing and reporting. We also offer the REALSynergy® enterprise commercial loan servicing system.

REALTrans® — A patented electronic business-to-business exchange that automates and simplifies the ordering, tracking and fulfilling of vendor provided services principally related to mortgages. This technology solution, whether web-based or integrated into a servicing system, connects multiple service providers through a single platform and forms an efficient method for managing a large scale network of vendors.

REALRemit® — A patented electronic invoicing and payment system that provides vendors with the ability to submit invoices electronically for payment and to have invoice payments deposited directly to their respective bank accounts.

REALDoc® — A correspondence management platform that extracts, stores and generates correspondence and is capable of integrating with commercially available servicing, origination and process management applications.

Equator’s Solutions — The EQ Workstation®, EQ Marketplace®, EQ Midsource® and EQ Portal™ platforms can be used a la carte or together as an end-to-end solution. EQ Workstation provides comprehensive, end-to-end workflow and transaction services to manage real estate related activities. EQ Marketplace provides a coordinated means of purchasing a variety of real estate services from vendors including realtors, title, closing, inspection and valuation. EQ Midsource allows users of EQ Workstation to outsource all or specific components of real estate related activities. EQ Portal provides realtors direct access to process real estate transactions with secure exchange of data and documents along with realtor marketing, training and certification.

Corporate Items and Eliminations: Includes costs related to corporate support functions including executive, finance, legal, human resources, vendor management, risk and operational effectiveness and also includes eliminations of transactions between the reporting segments. Corporate Items and Eliminations also include the cost of facilities until approximately 40% of the facilities are occupied by the business units, at which time costs are allocated to the business units.

We classify revenue in three categories: service revenue, revenue from reimbursable expenses and non-controlling interests. In evaluating our performance, we focus on service revenue. Service revenue consists of amounts attributable to our fee-based services. Reimbursable expenses and non-controlling interests are pass-through items for which we earn no margin. Reimbursable expenses consist of amounts we incur on behalf of our customers in performing our fee-based services, but we pass such costs directly on to our customers without any additional markup. Non-controlling interests represent the earnings of Lenders One, a consolidated entity not owned by Altisource, and are included in revenue and reduced from net income to arrive at net income attributable to Altisource.

Separation of the Residential Asset Businesses

On December 21, 2012, we completed the spin-offs of two wholly-owned subsidiaries, Residential and AAMC, into separate publicly traded companies (the “Separation of the Residential Asset Businesses”). Residential’s common stock is listed on the New York Stock Exchange under the symbol “RESI,” and AAMC’s common stock is listed on the New York Stock Exchange’s NYSE MKT under the symbol “AAMC.” We distributed all of the shares of Residential common stock and AAMC common stock to our shareholders of record as of December 17, 2012. Residential is focused on acquiring and managing single family rental properties by acquiring portfolios of sub-performing and non-performing residential mortgage loans throughout the United States. AAMC provides asset management and certain corporate governance services to Residential. Residential and AAMC are further described in Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Customers

We provide services to some of the most respected organizations in their industries, including one of the United States’ largest sub-prime servicers, a government-sponsored enterprise (“GSE”), utility companies, commercial banks, servicers, investors, mortgage bankers and financial service companies across the United States.

Our three largest customers in 2013 accounted for 76% of our total revenue. Our largest customer, Ocwen, accounted for 65% of our total revenue in 2013. From January 1 through September 30, 2013, Ocwen’s residential loan servicing portfolio grew from $203.7 billion in unpaid principal balance (“UPB”) to $434.8 billion. Ocwen is positioned as the fourth largest mortgage servicer in the United States. We believe Ocwen’s highly scalable platform and low cost operating structure positions it to be very competitive as additional mortgage servicing portfolios become available.

Related party revenue primarily consists of revenue earned directly from Ocwen and its subsidiaries and revenue earned from the loans serviced by Ocwen and its subsidiaries when Ocwen designates us as the service provider. We earn additional revenue on the portfolios serviced by Ocwen and its subsidiaries that are not considered related party revenue when a party other than Ocwen selects Altisource as the service provider. Related party revenue as a percentage of segment and consolidated revenue was as follows for the years ended December 31:

|

|

|

2013 |

|

2012 |

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

Mortgage Services |

|

71% |

|

68% |

|

72% |

|

|

Financial Services |

|

30% |

|

< 1% |

|

< 1% |

|

|

Technology Services |

|

49% |

|

42% |

|

39% |

|

|

Consolidated revenue |

|

65% |

|

60% |

|

58% |

|

We record revenue we earn from Ocwen and its subsidiaries under various long-term servicing contracts at rates we believe to be market rates as they are consistent with one or more of the following: the fees we charge to other customers for comparable services; the fees Ocwen pays to other service providers; and fees charged by our competitors.

Our services are provided to customers primarily located in the United States. Financial information for our segments can be found in Note 22 to our consolidated financial statements.

Sales and Marketing

We have experienced sales personnel and relationship managers with subject matter expertise. These individuals maintain relationships throughout the industry sectors we serve and play an important role in generating new client leads as well as identifying opportunities to expand our services with existing clients. Additional leads are also generated through requests for proposal processes from key industry participants. Our sales team works collaboratively and is compensated principally with a base salary and commission for sales generated.

Our primary sales and marketing focus is supporting the growth of Ocwen and its subsidiaries, expanding relationships with MPA’s members and Equator customers and targeting new customers that could have a material positive impact on our results of operations. Given the highly concentrated nature of the industries we serve, the time and effort spent in expanding relationships or winning new relationships is significant.

Intellectual Property

We rely on a combination of contractual restrictions, internal security practices, patents, trademarks, copyrights, trade secrets and other intellectual property to establish and protect our software, technology and expertise. We also own or, as necessary and appropriate, have obtained licenses from third parties to intellectual property relating to our services, processes and business. These intellectual property rights are important factors in the success of our businesses.

As of December 31, 2013, we have been awarded one patent that expires in 2023, three patents that expire in 2024, six patents that expire in 2025, one patent that expires in 2027 and one patent that expires in 2030. In addition, we have registered trademarks, or recently filed applications for registration of trademarks, in a number of countries or groups of countries including the United States, the European Community, India and in eight other countries or groups of countries. These trademarks generally can be renewed indefinitely, provided they are being used.

We actively protect our rights and intend to continue our policy of taking all measures we deem reasonable and necessary to develop and protect our patents, trademarks, copyrights, trade secrets and other intellectual property rights.

Industry and Competition

The industry verticals in which we engage are highly competitive and generally consist of a few national vendors as well as a large number of regional, local and in-house providers resulting in a fragmented market with disparate service offerings. From an overall perspective, we compete with global business process outsourcing firms. Our Mortgage Services segment competes with national and regional third party service providers and in-house servicing operations of large mortgage lenders and servicers. Our Financial Services segment competes with other large receivables management companies as well as a fragmented group of smaller companies and law firms focused on collections. Our Technology Services segment competes with data processing and software development companies and in-house technology and software operations of other loan servicers.

Given the diverse nature of services we and our competitors offer, we cannot determine our position in the market with certainty, but we believe we represent only a small portion of very large-sized markets. Given our size, some of our competitors may offer more diversified services, operate in broader geographic markets or have greater financial resources than we do. In addition, some of our larger customers retain multiple providers and continuously evaluate our performance against our competitors.

Competitive factors in our Mortgage Services business include the compliance, quality and timeliness of our services, the size and competence of our network of vendors and the breadth of the services we offer. For Financial Services, competitive factors include the ability to achieve a collection rate comparable to our competitors; the compliance, quality and personal nature of the service; the consistency and professionalism of the service; and the recruitment, training and the retention of our workforce. Competitive factors in our Technology Services business include the quality of the technology-based applications or services; application features and functions; ease of delivery and integration; our ability to maintain, enhance and support the applications or services; our ability to recruit and retain software and other technical employees; and the cost of obtaining, maintaining and enforcing our patents.

Employees

As of December 31, 2013, we had the following number of employees:

|

|

|

United |

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

States |

|

India |

|

Philippines |

|

Luxembourg |

|

Altisource |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Services |

|

346 |

|

2,532 |

|

204 |

|

6 |

|

3,088 |

|

|

Financial Services |

|

920 |

|

1,768 |

|

30 |

|

2 |

|

2,720 |

|

|

Technology Services |

|

458 |

|

901 |

|

8 |

|

1 |

|

1,368 |

|

|

Corporate |

|

109 |

|

443 |

|

9 |

|

10 |

|

571 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total employees |

|

1,833 |

|

5,644 |

|

251 |

|

19 |

|

7,747 |

|

We have not experienced any work stoppages, and we consider our relations with employees to be good. We believe our future success will depend, in part, on our ability to continue to attract, hire and retain skilled and experienced personnel.

Seasonality

Our revenues are seasonal. More specifically, Financial Services’ asset recovery revenue tends to be higher in the first quarter, as borrowers may utilize tax refunds and bonuses to pay debts, and generally declines throughout the rest of the year. Mortgage Services revenue is impacted by REO sales and lawn maintenance, which tend to be at their lowest levels during fall and winter months and highest during spring and summer months.

Government Regulation

Our businesses are subject to extensive laws and regulations by federal, state and local governmental authorities including the Federal Trade Commission (“FTC”), the Consumer Financial Protection Bureau (“CFPB”), the Securities and Exchange Commission (“SEC”) and the state agencies that license our mortgage-related services and collection entities. We also must comply with a number of federal, state and local consumer protection laws including, among others, the Gramm-Leach-Bliley Act, the Fair Debt Collection Practices Act, the Real Estate Settlement Procedures Act (“RESPA”), the Truth in Lending Act (“TILA”), the Fair Credit Reporting Act, the Telephone Consumer Protection Act, the Homeowners Protection Act, the California Homeowner’s Bill of Rights and the Secure and Fair Enforcement for Mortgage Licensing (“SAFE”) Act. These requirements can and do change as statutes and regulations are enacted, promulgated or amended. One such enacted regulation is the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”). The Dodd-Frank Act is extensive and includes reform of the regulation and supervision of financial institutions, as well as the regulation of derivatives, capital market activities and consumer financial services. The Dodd-Frank Act, among other things, created the CFPB, a federal entity responsible for regulating consumer financial services and products. Title XIV of the Dodd-Frank Act contains the Mortgage Reform and Anti-Predatory Lending Act (“Mortgage Act”). The Mortgage Act imposes a number of additional requirements on lenders and servicers of residential mortgage loans by amending and expanding certain existing regulations. In some cases, penalties for noncompliance are significantly increased and could lead to settlements or consent orders affecting us or our customers that may curtail or restrict the business as it is currently conducted.

We are subject to certain federal, state and local consumer protection provisions. We are also subject to licensing and regulation as a mortgage service provider and/or debt collector in a number of states. We are subject to audits and examinations that are conducted by the states. Our employees may be required to be licensed by various state commissions for the particular type of service delivered and to participate in regular continuing education programs. From time to time, we receive requests from state and other agencies for records, documents and information regarding our policies, procedures and practices regarding our mortgage services and debt collection business activities. We are also subject to the requirements of the Foreign Corrupt Practices Act (“FCPA”) and comparable foreign laws, due to our activities in foreign jurisdictions.

Available Information

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information with the SEC. These filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room.

Our principal Internet address is www.altisource.com and we encourage investors to use it as a way of easily finding information about us. We promptly make the reports we file or furnish with the SEC, corporate governance information (including our Code of Business Conduct and Ethics), select press releases and other related information available on this website. The contents of our website are available for informational purposes only and shall not be deemed incorporated by reference in this report.

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we presently deem less significant may also impair our business operations. If any of the following risks actually occur, our business, operating results and financial condition could be materially adversely affected.

Risks Related to Our Business and Industry

Our continuing relationship with Ocwen may inhibit our ability to obtain and retain other customers that compete with Ocwen.

As of December 31, 2013, our Chairman owns or controls more than 13% of Ocwen’s common stock and 26% of our common stock. We derived 65% of our 2013 revenue from Ocwen and its subsidiaries. Given this close and continuing relationship with Ocwen, we may encounter difficulties in obtaining and retaining other customers who compete with Ocwen. Should these and other potential customers view Altisource as part of Ocwen or as too closely related to or dependent upon Ocwen, they may be unwilling to utilize our services, and our growth could be inhibited as a result.

We are dependent on a certain key customer relationship, the loss of which or reduction in the size of which could affect our business and results of operations.

We currently generate approximately 65% of our revenue from Ocwen and its subsidiaries. Ocwen is contractually obligated to purchase certain services from our Mortgage Services, Financial Services and Technology Services segments under service agreements that extend through August 2025 subject to termination under certain provisions. The loss of Ocwen as a customer or their failure to pay us would significantly reduce our revenue and adversely affect our results of operations. Further, Ocwen has grown significantly in recent years through acquisitions of mortgage servicing rights and acquisitions of companies with mortgage servicing rights and mortgage origination platforms. As a result of Ocwen’s growth, we have grown. If Ocwen does not continue to acquire mortgage

servicing rights or does not grow its mortgage origination business, our business and results of operations could be negatively impacted.

Significant regulatory scrutiny of foreclosure practices of the servicing industry has resulted in settlements between banks and servicers and government entities, on-going monitoring of banks and servicers by regulatory authorities, investigations of banks and servicers and private lawsuits. If Ocwen were to be negatively impacted in a significant way by this regulatory scrutiny or other actions, Altisource’s business and results of operations could be negatively impacted.

We have key customer relationships, other than Ocwen, the loss of which could affect our business and results of operations.

While no individual client, other than Ocwen, represents more than 10% of our consolidated revenue, we are exposed to customer concentration. Most of our customers are not contractually obligated to continue to use our services at historical levels or at all. The loss of any of these key customers or their failure to pay us could reduce our revenue and adversely affect results of operations.

The strength of the economy and the housing market can affect demand for our services.

The performance and growth of our origination services business is dependent on the volume of loan originations by third parties. In the event of an economic slowdown, increase in interest rates or any other factor that would likely lead to a decrease in the level of origination transactions, including refinancing transactions, our origination services growth prospects could be adversely affected. Further, in the event that adverse economic conditions or other factors lead to a decline in levels of home ownership and a reduction in the aggregate number of United States mortgage loans outstanding, our revenues from our software applications could be adversely affected.

Our business is subject to substantial competition.

The markets for our services are very competitive. Our competitors vary in size and in the scope and breadth of the services they offer. We compete for existing and new customers against both third parties and the in-house capabilities of our customers. Some of our competitors have substantial resources and some have widely used technology platforms which they seek to use as a competitive advantage to drive sales of other products and services. In addition, we expect the markets in which we compete will continue to attract new competitors and new technologies. These new technologies may render our existing technologies obsolete, resulting in operating inefficiencies and increased competitive pressure. There can be no assurance we will be able to compete successfully against current or future competitors or that competitive pressures we face in the markets in which we operate will not materially adversely affect our business, financial condition and results of operations.

Our intellectual property rights are valuable and any inability to protect them or challenges to our right to use them could reduce the value of our services or increase our costs.

Our patents, trademarks, trade secrets, copyrights and other intellectual property rights are important assets. The efforts we have taken to protect these proprietary rights may not be sufficient or effective. The unauthorized use of our intellectual property or significant impairment of our intellectual property rights could harm our business, make it more expensive to do business or hurt our ability to compete. Protecting our intellectual property rights is costly and time consuming.

Although we seek to obtain patent protection for our innovations, it is possible we may not be able to protect some of these innovations. Changes in patent law, such as changes in the law regarding patentable subject matter, can also impact our ability to obtain patent protection for our innovations. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important. Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient or an issued patent may be deemed invalid or unenforceable.

Further, as our technology solutions and services develop, we may become increasingly subject to infringement claims by others. Any claims, whether with or without merit, could:

· be expensive and time-consuming to defend;

· cause us to cease making, licensing or using technology solutions that incorporate the challenged intellectual property;

· require us to redesign our technology solutions, if feasible;

· divert management’s attention and resources and/or

· require us to enter into royalty or licensing agreements in order to obtain the right to use necessary technologies.

Technology failures or defects, development delays or installation difficulties could damage our business operations and increase our costs.

Disruptions, failures or defects in our technology or delays in the development of, or installation difficulties with, our next generation technology may interrupt or delay our ability to provide services to our customers. Any sustained and repeated disruptions in these services may have an adverse impact on our and our customers’ results of operations.

As part of our business and operation of our technology, we electronically receive, process, store and transmit confidential and sensitive business information of our customers. In addition, we collect personal consumer data such as names and addresses, social security numbers, driver’s license numbers and payment history records. The secure transmission of this information over the Internet is essential to maintaining consumer confidence. Security breaches and acts of vandalism could result in a compromise or breach of the technology we use to protect our customers’ business and personal information and transaction data and could result in the assessment of penalties or could otherwise cause interruptions in our operations. Furthermore, Congress or individual states could enact new laws regulating electronic commerce that could adversely affect us and our results of operations.

We have a long sales cycle for many of our services and technology solutions and if we fail to close sales after expending significant time and resources to do so, our business, financial condition and results of operations may be adversely affected.

We may experience a long sales cycle for developing certain services. We may expend significant time and resources in pursuing a particular service or customer that does not generate revenue.

In addition, many of our services in the Technology Services segment are based on sophisticated software and computing systems with long sales cycles. We may encounter delays when developing new technology solutions and services. We may experience difficulties in installing or integrating our technologies on platforms used by our customers. Further, defects in our technology solutions, errors or delays in the processing of electronic transactions or other difficulties could result in interruption of business operations, delay in market acceptance, additional development and remediation costs, loss of customers, negative publicity or exposure to liability claims.

Delays due to the length of our sales cycle or costs incurred that do not result in sales could have a material adverse effect on our business, financial condition or results of operations.

Our business is subject to extensive regulation, and failure to comply with existing or new regulations may adversely impact us.

Our business is subject to extensive regulation by federal, state and local governmental authorities including the FTC, the CFPB, the SEC and the state and local agencies that license or oversee certain of our mortgage related services, including insurance services, and collection services. We also must comply with a number of federal, state and local consumer protection laws including, among others, the Gramm-Leach-Bliley Act, the Fair Debt Collection Practices Act, RESPA, TILA, the Fair Credit Reporting Act, the Telephone Consumer Protection Act, the Homeowners Protection Act, the California Homeowner’s Bill of Rights, the SAFE Act, the Mortgage Act and the FCPA. These requirements can and do change as statutes and regulations are enacted, promulgated or amended.

The ongoing economic uncertainty and troubled housing market have resulted in increased regulatory scrutiny of all participants involved in the mortgage industry. This scrutiny has included federal and state governmental agency review of all aspects of the mortgage lending and servicing industries, including an increased legislative and regulatory focus on consumer protection practices. One such enacted regulation is the Dodd-Frank Act (see further description in the “Government Regulation” section in Item 1 of Part I, “Business”). In some cases, penalties for noncompliance are significantly increased and could lead to settlements or consent orders on us, or our customers, that may curtail or restrict our business as it is currently conducted.

We are subject to certain additional federal, state and local consumer protection regulations. We also are subject to licensing and regulation as a mortgage services provider, mortgage origination underwriter, valuation provider, appraisal management company, asset manager, property manager, title insurance agency, other insurance related services, agent and provider, real estate broker and/or debt collector in a number of states. We are subject to audits and examinations that are conducted by the states in which we do business. Our employees and subsidiaries may be required to be licensed by various state commissions for the particular type of service sold and to participate in regular continuing education programs. From time to time, we receive requests from state and other agencies for records, documents and information regarding our policies, procedures and practices for our mortgage services and debt collection business activities. We incur significant ongoing costs to comply with governmental regulations.

As a result of increased federal and state governmental scrutiny of the mortgage industry, legislation has been enacted to address the mortgage market, with particular focus on loans that are in default. In addition, national servicing standards have been implemented that, among other things, require very specific loan modification and foreclosure procedures to be followed. This legislation and these standards have further reduced the number of loans entering the foreclosure process and have negatively impacted our default services revenue and profit. It is unclear when or if volumes will increase in the future.

The volume of new or modified laws and regulations has increased in recent years and, in addition, some individual municipalities have begun to enact laws that restrict mortgage services activities. If regulators impose new or more restrictive requirements, we may incur significant additional costs to comply with such requirements which could further adversely affect our results of operations or financial condition. In addition, our failure to comply with these laws and regulations can possibly lead to civil and criminal liability, loss of licensure, damage to our reputation in the industry, fines and penalties and litigation, including class action lawsuits or administrative enforcement actions. Any of these outcomes could harm our results of operations or financial condition.

If we fail to comply with privacy regulations imposed on providers of services to financial institutions, our business could be harmed.

As a provider of services to financial institutions, we are bound by the same limitations on disclosure of the information we receive from their customers that apply to the financial institutions themselves. If we fail to comply with these regulations, we could be exposed to lawsuits or to governmental proceedings, our customer relationships and reputation could be harmed and we could be inhibited in our ability to obtain new customers. In addition, the adoption of more restrictive privacy laws or rules in the future on the federal or state level could have an adverse impact on us by increasing our costs or requiring changes in our services.

Our customers are subject to government regulation, requiring our customers to, among other things, oversee their vendors and maintain documentation that demonstrates their oversight. If our performance does not meet our customers’ standards, our results of operations could be adversely affected.

Our customers are subject to a variety of government regulations, including those promulgated by the CFPB. Certain regulations require our customers to oversee their vendors and document the procedures performed to demonstrate that oversight. Altisource, as a vendor, is subject to oversight by our customers. If we do not meet the standards established by our customers or if any other oversight procedures result in a negative outcome for Altisource, we may lose customers or may no longer be granted referrals for certain services, negatively impacting our business and results of operations.

We rely on third party vendors for many aspects of our business. If our vendor oversight process is ineffective or we face difficulties managing our relationships with third party vendors, our results of operations could be adversely affected.

We rely on third party vendors to provide goods and services in relation to many aspects of our operations. Our dependence on these vendors makes our operations vulnerable to such third parties’ failure to perform adequately under our contracts with them. In addition, where a vendor provides services that we are required to provide under a contract with a client, we are responsible for such performance and could be held accountable by the client for any failure of performance by our vendors. We evaluate the competency and solvency of our third party vendors. Additionally, we perform ongoing vendor oversight activities to identify any performance or other issues related to these vendors. If a vendor fails to provide the services that we require or expect, or fails to meet contractual requirements, such as service levels or compliance with applicable laws, the failure could negatively impact our business by adversely affecting our ability to serve our customers and/or subjecting us to litigation and regulatory risk for ineffective vendor oversight. Such a failure could adversely affect the reliability and quality of the services we provide our customers and could adversely affect our results of operations.

If financial institutions at which we hold escrow and trust funds fail, it could have a material adverse impact on our company.

We hold customers’ assets in escrow and trust accounts at various financial institutions, pending completion of certain real estate activities. We also hold cash in trust accounts at various financial institutions where contractual obligations mandate maintaining dedicated bank accounts for Financial Services collections. These amounts are held in escrow and trust accounts for limited periods of time and are not included in the accompanying consolidated balance sheets. We may become liable for funds owed to third parties as a result of the failure of one or more of these financial institutions, and there is no guarantee we would recover the funds deposited, whether through Federal Deposit Insurance Corporation coverage, private insurance or otherwise.

We may be subject to claims of legal violations or wrongful conduct which may cause us to pay unexpected litigation costs or damages or modify our products or processes.

From time to time, we may be subject to costly and time-consuming legal proceedings that claim legal violations or wrongful conduct. These lawsuits may involve clients, our clients’ customers, vendors, competitors and/or other large groups of plaintiffs and, if resulting in findings of violations, could result in substantial damages. Alternatively, we may be forced to settle some claims out of court and change existing company practices, services and processes that are currently revenue generating. This could lead to unexpected costs or a loss of revenue.

Our debt makes us more sensitive to the effects of economic change; our level of debt and provisions in our debt agreements could limit our ability to react to changes in the economy or our industry.

Our debt makes us more vulnerable to changes in our results of operations because a portion of our cash flows from operations is dedicated to servicing our debt and is not available for other purposes. Additionally, increases in interest rates will negatively impact our cash flows as the interest on our debt is variable. The provisions of our debt agreement could have other negative consequences to us including the following:

· limiting our ability to borrow money for our working capital, capital expenditure, debt service requirements or other general corporate purposes;

· limiting our flexibility in planning for, or reacting to, changes in our operations, our business or the industry in which we compete and

· placing us at a competitive disadvantage by limiting our ability to invest in the business.

Our ability to make payments on our indebtedness depends on our ability to generate cash in the future. If we do not generate sufficient cash flows to meet our debt service and working capital requirements, we may need to seek additional financing or sell assets. This may make it more difficult for us to obtain financing on terms that are acceptable to us, or at all. Without any such financing, we could be forced to sell assets to make up for any shortfall

in our payment obligations under unfavorable circumstances. If necessary, we may not be able to sell assets quickly enough or for sufficient amounts to enable us to meet our obligations.

In addition, our debt agreement contains covenants that limit our flexibility in planning for or reacting to changes in our business and our industry including limitations on incurring additional indebtedness, making investments, granting liens and merging or consolidating with other companies. Complying with these covenants may impair our ability to finance our future operations or capital needs or to engage in other favorable business activities.

Our failure to comply with the covenants contained in our debt agreement, including as a result of events beyond our control, could result in an event of default which could materially and adversely affect our operating results and our financial condition.

Our debt agreement requires us to comply with various operational, reporting and other covenants that limit us from engaging in certain types of transactions. If there were an event of default under our debt agreement that was not cured or waived, the holders of the defaulted debt could cause all amounts outstanding with respect to that debt to be immediately due and payable. We cannot assure you that our assets or cash flows would be sufficient to fully repay borrowings under our outstanding debt instruments, either upon maturity or if accelerated, upon an event of default or that we would be able to refinance or restructure the payments on those debt instruments.

Our failure to maintain certain debt to EBITDA ratios contained in our debt agreement could result in required payments to the lenders of a percentage of our excess cash flow, which could materially and adversely affect our ability to use our excess cash flow for other purposes.

Our debt agreement requires us to distribute 50% of our excess cash flow, as defined in the debt agreement, if our debt to EBITDA ratio exceeds 3.50 to 1.00 and 25% of our excess cash flow if our debt to EBITDA ratio is 3.50 to 1.00 or less, but greater than 2.75 to 1.00. If we were required to distribute a portion of our excess cash flow to our lenders, we may be limited in our ability to grow our business through acquisitions or investments in technology and we may be limited in our ability to repurchase our common stock. We cannot assure you that we will maintain debt to EBITDA ratios at levels that will not require us to distribute a portion of our excess cash flow to lenders.

Risks Related to our Growth Strategy

Our ability to grow is affected by our ability to retain and expand our existing client relationships and our ability to attract new customers.

Our ability to retain existing customers and expand those relationships and attract new customers is subject to a number of risks including the risk that we do not:

· maintain or improve the compliance and quality of services we provide to our customers;

· meet or exceed the expectations of our customers;

· successfully leverage our existing client relationships to sell additional services and

· attract other servicers and non-distressed home sellers as new customers.

If our efforts to retain and expand our client relationships and to attract new customers do not prove effective, it could have a material adverse effect on our business and results of operations and our ability to grow our operations.

Our ability to expand existing relationships and attract new customers is also affected by broader economic factors and the strength of the overall housing market, which can reduce demand for our services and increase competition for each customer’s business. See “The strength of the economy and the housing market can affect demand for our services.”

If we do not adapt our services to changes in technology or in the marketplace, or if our ongoing efforts to upgrade our technology and particularly our efforts to complete development of our next generation technology are not successful, we could lose customers and have difficulty attracting new customers for our services.

The markets for our services are characterized by constant technological change, frequent introduction of new services and evolving industry standards. We are currently in the process of developing and introducing our next generation technology. Our future success will be significantly affected by our ability to complete our current efforts and in the future enhance, primarily through use of automation, econometrics and behavioral science principles, our services and develop and introduce new services that address the increasingly sophisticated needs of our customers and their customers. These initiatives carry the risks associated with any new service development effort including cost overruns, delays in delivery and performance effectiveness. There can be no assurance that we will be successful in developing, marketing and selling new services that meet these changing demands or completing the development of our next generation technology. In addition, we may experience difficulties that could delay or prevent the successful development, introduction and marketing of these services. Finally, our services and their enhancements may not adequately meet the demands of the marketplace and achieve market acceptance. Any of these results would have a negative impact on our financial condition and results of operations and our ability to grow our operations.

Our growth objectives are dependent on the timing and market acceptance of our new service offerings.

Our ability to grow may be adversely affected by difficulties or delays in service development or the inability to gain market acceptance of new services to existing and new customers. There are no guarantees that new services will prove to be commercially successful.

Our business is dependent on the trend towards outsourcing.

Our continued growth at historical rates is dependent on the industry trend towards outsourced services. There can be no assurance this trend will continue, as organizations may elect to perform such services themselves or may be prevented from outsourcing services. A significant change in this trend could have a materially adverse effect on our continued growth.

Our strategy to make acquisitions to accelerate growth initiatives involves potential risks.

During 2013, we acquired fee-based businesses from Ocwen and acquired Equator. We intend to continue to consider acquisitions of other businesses that could complement our business. In addition to considering acquisitions that could offer us greater access in our current markets, we also consider acquisitions of entities offering greater access and expertise in other asset types and markets that are related to ours but we do not currently serve. As we acquire businesses, we may face a number of risks including a loss of focus on our daily operations, the need for additional management, constraints on operating resources, constraints on financial resources from integration and system conversion costs, the inability to maintain key pre-acquisition relationships with customers, suppliers and employees and other integration risks. Moreover, any acquisition may result in the incurrence of additional amortization expense of related intangible assets which could reduce our profitability.

We may be unable to achieve some or all of the benefits we expect from the continued relationship with Residential following the Separation of the Residential Asset Businesses.

We may not be able to fully achieve the strategic and financial benefits we expect from our relationship with Residential following the Separation of the Residential Asset Businesses, or such benefits may be delayed. These outcomes may occur if, among other things, Residential is not successful in fully executing its strategy to acquire non-performing loan portfolios with a portion of the portfolios converting to single family rental assets or if Residential is not successful in continuing to raise equity and debt to support its growth.

Risks Related to International Business

Our international operations subject us to additional risks which could have an adverse effect on our results of operations.

We have reduced our operating expenses by utilizing lower cost labor in foreign countries such as India and the Philippines. As of December 31, 2013, 5,895 of our employees were based in India and the Philippines. These countries are subject to relatively higher degrees of political and social instability and may lack the infrastructure to withstand political unrest or natural disasters. Such disruptions can decrease efficiency and increase our costs in these countries. Weakness of the United States dollar in relation to the currencies used in these foreign countries may also reduce the savings achievable through this strategy. Furthermore, the practice of utilizing labor based in foreign countries has come under increased scrutiny in the United States and, as a result, some of our customers may require us to use labor based in the United States. We may not be able to pass on the increased costs of higher-priced United States-based labor to our customers which ultimately could have an adverse effect on our results of operations.

In many foreign countries, particularly in those with developing economies, it is common to engage in business practices that are prohibited by laws and regulations applicable to us, such as the FCPA. Any violations of the FCPA or local anti-corruption laws by us, our subsidiaries or our local agents, could have an adverse effect on our business and reputation and result in substantial financial penalties or other sanctions.

Any political or economic instability in these countries could result in our having to replace or reduce these labor sources which may increase our labor costs and have an adverse impact on our results of operations.

Altisource is a Luxembourg company and it may be difficult to enforce judgments against it or its directors and executive officers.

Altisource is a public limited company organized under the laws of Luxembourg. As a result, Luxembourg law and the articles of incorporation govern the rights of shareholders. The rights of shareholders under Luxembourg law may differ from the rights of shareholders of companies incorporated in other jurisdictions. A significant portion of the assets of Altisource are located outside the United States. It may be difficult for investors to enforce, in the United States, judgments obtained in United States courts against Altisource or its directors based on the civil liability provisions of the United States securities laws or to enforce, in Luxembourg, judgments obtained in other jurisdictions including the United States.

A significant change of the Luxembourg tax regime or of its interpretation by the Luxembourg tax authorities could adversely affect our results of operations.

Altisource is organized under the laws of, and headquartered in, Luxembourg. This allows Altisource to benefit from a favorable tax treatment. It is possible that changes in Luxembourg taxation statutes, administrative practice or applicable regulations may cause a reduction in, or an elimination of, the benefits we receive under the existing Luxembourg tax treatment, which could result in a significant increase to our income tax expense and adversely affect our results of operations.

Risks Related to Our Employees

Our success depends on our directors, executive officers and key personnel.

Our success is dependent on the efforts and abilities of our directors, executive officers and other key employees many of whom have significant experience in the real estate and mortgage, financial services and technology industries. In particular we are dependent on the services of William C. Erbey, our Chairman of the Board, and William B. Shepro, our Chief Executive Officer, as well as the services of key personnel at each of our segments. The loss of the services of any of these directors, executives or key personnel, for any reason, could have a material adverse effect upon our business, results of operations and financial condition.

Our inability to attract and retain skilled employees may adversely impact our business.

Our business is labor intensive and places significant importance on our ability to recruit, train and retain skilled employees. Additionally, demand for qualified technical and software professionals conversant in certain technologies may exceed supply as new and additional skills are required to keep pace with evolving computer

technology. Our ability to locate and train employees is critical to achieving our growth objective. Our inability to attract and retain skilled employees or an increase in wages or other costs of attracting, training or retaining skilled employees could have a materially adverse effect on our business, financial condition and results of operations.

Risks Related to Our Relationships

We could have conflicts of interest with Ocwen, HLSS, Residential, AAMC, our Chairman, our CEO or management due to his, her or their relationship with Ocwen, HLSS, Residential or AAMC, which may be resolved in a manner adverse to us.

We do a substantial amount of business with Ocwen, Residential and AAMC and provide certain services to HLSS. Conflicts may arise between Ocwen, HLSS, Residential or AAMC and us because of our ongoing agreements with them and because of the nature of our respective businesses.

Our Chairman is also the Chairman of Ocwen, HLSS, Residential and AAMC. As a result, he has obligations to us as well as to these other entities and could have conflicts of interest with respect to matters potentially or actually involving or affecting us and Ocwen, HLSS, Residential or AAMC, as the case may be. Our Chairman also has substantial investments in Ocwen, HLSS, Residential and AAMC, and certain of our other officers and directors own stock or options in one or more of Ocwen, HLSS, Residential and AAMC. Such ownership interests could create, or appear to create, conflicts of interest with respect to matters potentially or actually involving or affecting us and Ocwen, HLSS, Residential and AAMC, as the case may be.

We follow policies, procedures and practices to avoid potential conflicts with respect to our dealings with Ocwen, HLSS, AAMC and Residential, including our Chairman recusing himself from negotiations regarding, and approvals of, transactions with these entities. We also manage potential conflicts of interest through oversight by independent members of our Board of Directors (independent directors constitute a majority of our Board of Directors), and we will also seek to manage these potential conflicts through dispute resolution and other provisions of our agreements with Ocwen, HLSS, Residential and AAMC. There can be no assurance that such measures will be effective, that we will be able to resolve all conflicts with Ocwen, HLSS, Residential or AAMC or that the resolution of any such conflicts will be no less favorable to us than if we were dealing with a third party that had none of the connections we have with these businesses.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

Our principal executive offices are located in leased office space in Luxembourg, Grand Duchy of Luxembourg. A summary of our principal leased office space as of December 31, 2013 and the segments primarily occupying each location is as follows:

|

|

|

Mortgage |

|

Financial |

|

Technology |

|

Corporate and |

|

|

|

|

|

|

|

|

|

|

|

Luxembourg |

|

X |

|

X |

|

X |

|

X |

|

|

|

|

|

|

|

|

|

|

|

United States |

|

|

|

|

|

|

|

|

|

Atlanta, GA |

|

X |

|

X |

|

X |

|

X |

|

Boston, MA |

|

|

|

|

|

X |

|

|

|

Dallas, TX |

|

X |

|

|

|

|

|

|

|

Irvine, CA |

|

X |

|

|

|

X |

|

|

|

Los Angeles, CA |

|

|

|

|

|

X |

|

|

|

Louisville, KY |

|

X |

|

|

|

X |

|

|

|

Plano, TX |

|

|

|

|

|

X |

|

|

|

Sacramento, CA |

|

|

|

X |

|

|

|

|

|

Seattle, WA |

|

|

|

|

|

X |

|

|

|

St. Louis, MO |

|

X |

|

|

|

|

|

|

|

Tempe, AZ |

|

|

|

X |

|

|

|

|

|

Vestal, NY |

|

|

|

X |

|

|

|

|

|

Winston-Salem, NC |

|

|

|

|

|

X |

|

X |

|

|

|

|

|

|

|

|

|

|

|

Pasay City, Philippines |

|

X |

|

X |

|

X |

|

X |

|

|

|

|

|

|

|

|

|

|

|

India |

|

|

|

|

|

|

|

|

|

Bangalore |

|

X |

|

X |

|

X |

|

X |

|

Goa |

|

|

|

X |

|

|

|

|

|

Mumbai |

|

X |

|

X |

|

X |

|

X |

We do not own any real property. We consider these facilities to be suitable and adequate for the management and operations of our business.

From time to time, we are involved in legal proceedings arising in the ordinary course of business. We record a liability for litigation if an unfavorable outcome is probable and the amount of loss can be reasonably estimated, including expected insurance coverage. For proceedings where a range of loss is determined, we record a best estimate of loss within the range. When legal proceedings are material, we disclose the nature of the litigation, and to the extent possible, the estimate of loss or range of loss. In the opinion of management, after consultation with legal counsel and considering insurance coverage where applicable, the outcome of current legal proceedings, both individually and in the aggregate, will not have a material impact on our financial condition, results of operations or cash flows. Our businesses are also subject to extensive regulation which may result in regulatory proceedings against us. See Item 1A of Part I, “Risk Factors” above.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is listed on the NASDAQ Global Select Market under the symbol “ASPS.” The following table sets forth the high and low close of day sales prices for our common stock, for the periods indicated, as reported by the NASDAQ Global Select Market:

|

|

|

2013 |

| ||||

|

Quarter ended |

|

Low |

|

High |

| ||

|

|

|

|

|

|

| ||

|

March 31 |

|

$ |

67.35 |

|

$ |

96.02 |

|

|

June 30 |

|

69.43 |

|

100.15 |

| ||

|

September 30 |

|

95.22 |

|

142.30 |

| ||

|

December 31 |

|

132.88 |

|

170.19 |

| ||

|

|

|

2012 |

| ||||

|

Quarter ended |

|

Low |

|

High |

| ||

|

|

|

|

|

|

| ||

|

March 31 |

|

$ |

48.55 |

|

$ |

64.78 |

|

|

June 30 |

|

52.35 |

|

73.23 |

| ||

|

September 30 |

|

70.70 |

|

91.06 |

| ||

|

December 31 |

|

84.56 |

|

124.33 |

| ||

The number of holders of record of our common stock as of January 31, 2014 was 70. The number of beneficial stockholders is substantially greater than the number of holders as a large portion of our common stock is held through brokerage firms.

Dividends

We have never declared or paid cash dividends on our common stock, and we do not anticipate paying any cash dividends in the foreseeable future. Additionally, the payment of cash dividends may be limited by Luxembourg law and by covenants in our debt agreement.

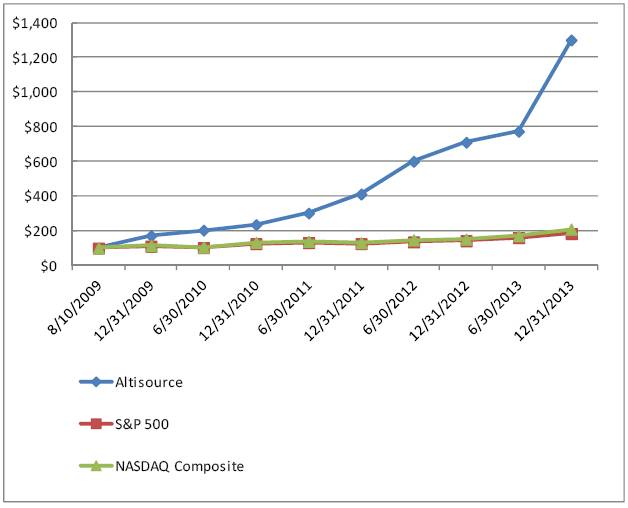

Stock Performance Graph

The graph below compares the cumulative total stockholder return on our common stock with the cumulative total return on the S&P’s 500 Index for the period commencing on August 10, 2009, the first trading day of our common stock, and ending on December 31, 2013. The graph assumes an investment of $100 at the beginning of this period and does not include the effects of the post-distribution values of Residential and AAMC, which were distributed to Altisource shareholders in December 2012. The comparisons in the graphs below are based upon historical data and are not indicative of, nor intended to forecast, future performance of our common stock.

|

|

|

08/10/09 |

|

12/31/09 |

|

06/30/10 |

|

12/31/10 |

|

06/30/11 |

|

12/31/11 |

|

06/30/12 |

|

12/31/12 |

|

06/30/13 |

|

12/31/13 |

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

Altisource |

|

$ |

100.00 |

|

$ |

172.05 |

|

$ |

202.79 |

|

$ |

235.33 |

|

$ |

301.64 |

|

$ |

411.31 |

|

$ |

600.25 |

|

$ |

710.25 |

|

$ |

772.95 |

|

$ |

1,300.25 |

|

|

S&P 500 |

|

100.00 |

|

110.72 |

|

102.34 |

|

124.88 |

|

131.13 |

|

124.87 |

|

135.26 |

|

141.46 |

|

159.50 |

|

183.53 |

| ||||||||||

|

NASDAQ Composite |

|

100.00 |

|

113.90 |

|

105.87 |

|

133.16 |

|

139.22 |

|

130.76 |

|

147.32 |

|

151.56 |

|

170.83 |

|

209.64 |

| ||||||||||

Securities Authorized for Issuance under Equity Compensation Plans

The information required by this item is incorporated herein by reference to our definitive proxy statement in connection with our 2014 annual meeting of shareholders to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934.

Issuer Purchases of Equity Securities

In May 2012, our shareholders approved a new stock repurchase program, which replaced the previous stock repurchase program. Under the program, we are authorized to purchase up to 3.5 million shares of our common stock in the open market in addition to amounts previously purchased under the prior program. From authorization of the previous program in May 2010 through December 31, 2013, we have purchased approximately 3.7 million shares of our common stock in the open market at an average price of $63.04 per share. We purchased 1.2 million shares of common stock at an average price of $116.99 per share during the year ended December 31, 2013 and 0.3 million shares at an average price of $63.25 per share during the year ended December 31, 2012. As of December 31, 2013, approximately 2.3 million shares of common stock remain available for repurchase under the program. Luxembourg law limits share repurchases to approximately the balance of Altisource Portfolio Solutions S.A. (unconsolidated parent company) retained earnings, less shares repurchased. As of December 31, 2013, approximately $14 million was available to repurchase our common stock under Luxembourg law. Our senior secured term loan also limits the amount we can spend on share repurchases in any year and may prevent repurchases in certain circumstances. As of December 31, 2013, approximately $55 million was available to repurchase our common stock under our senior secured term loan.

The following table presents information related to our repurchases of our equity securities during the three months ended December 31, 2013:

|

Period |

|

Total |

|

Weighted |

|

Total |

|

Maximum number |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Common stock: |

|

|

|

|

|

|

|

|

| |

|

October 1 — 31, 2013 |

|

79,172 |

|

$ |

148.13 |

|

79,172 |

|

2,572,335 |

|

|

November 1 — 30, 2013 |

|

280,405 |

|

149.02 |

|

280,405 |

|

2,291,930 |

| |

|

December 1 — 31, 2013 |

|

— |

|

— |

|

— |

|

2,291,930 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Total shares of common stock |

|

359,577 |

|

$ |

148.82 |

|

359,577 |

|

2,291,930 |

|

(1) Includes shares withheld from employees to satisfy tax withholding obligations that arose from the exercise of stock options.

(2) In May 2012, our shareholders authorized us to purchase up to 3.5 million shares of our common stock in the open market.

The provisions of our senior secured term loan agreement, as amended, limit, among other things, our ability to incur additional debt, pay dividends and repurchase stock.

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data as of and for the years ended December 31, 2013, 2012, 2011, 2010 and 2009 has been derived from our audited consolidated financial statements.

The historical results presented below may not be indicative of our future performance and do not necessarily reflect what our financial position as of December 31, 2009 and results of operations for the year ended December 31, 2009 would have been had we operated as a separate, stand-alone entity for the period prior to the Separation from Ocwen.

The selected consolidated financial data should be read in conjunction with the information contained in Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto in Item 8 of Part II, “Financial Statements and Supplementary Data.”

|

|

|

For the years ended December 31, |

| |||||||||||||

|

(in thousands, except per share data) |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

|

2009 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Revenue |

|

$ |

768,357 |

|

$ |

568,360 |

|

$ |

423,687 |

|

$ |

301,378 |

|

$ |

202,812 |

|

|

Cost of revenue |

|

492,480 |

|

366,201 |

|

275,849 |

|

189,059 |

|

126,797 |

| |||||

|

Gross profit |

|

275,877 |

|

202,159 |

|

147,838 |

|

112,319 |

|

76,015 |

| |||||

|

Selling, general and administrative expenses |

|

113,810 |

|

74,712 |

|

62,131 |

|

57,352 |

|