UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Exchange on Which Registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

As

of June 30, 2022, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $

As of April 11, 2023, there were shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements by Qualigen Therapeutics, Inc. that involve risks and uncertainties and reflect our judgment as of the date of this Report. These statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Such forward-looking statements may relate to, among other things, potential future development, testing and launch of products and product candidates. Actual events or results may differ from our expectations due to a number of factors.

These forward-looking statements include, but are not limited to, statements about:

| ● | our ability to successfully develop any drugs or therapeutic devices; |

| ● | our ability to progress our drug candidates or therapeutic devices through preclinical and clinical development; |

| ● | our ability to obtain the requisite regulatory approvals for our clinical trials and to begin and complete such trials according to any projected timeline; |

| ● | our ability to complete enrollment in our clinical trials as contemplated by any projected timeline; |

| ● | the likelihood that future clinical trial data will be favorable or that such trials will confirm any improvements over other products or lack negative impacts; |

| ● | our ability to successfully commercialize any drugs or therapeutic devices; |

| ● | our ability to procure or earn sufficient working capital to complete the development, testing and launch of our prospective therapeutic products; |

| ● | the likelihood that patents will issue on our owned and in-licensed patent applications; |

| ● | our ability to protect our intellectual property; |

| ● | our ability to compete; |

| ● | our ability to maintain or expand market demand and/or market share for our diagnostic products; |

| ● | our ability to maintain our diagnostic sales and marketing engine without interruption once our distribution agreement with Sekisui expires. |

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and healthcare, regulatory and scientific developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Annual Report. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate, are consistent in some future periods with the forward-looking statements contained in this Annual Report, they may not be predictive of results or developments in other future periods. Any forward-looking statement that we make in this Annual Report speaks only as of the date of this Annual Report, and we disclaim any intent or obligation to update these forward-looking statements beyond the date of this Annual Report, except as required by law. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Future filings with the Securities and Exchange Commission (the “SEC”), future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may also contain forward-looking statements. Because such statements include risks and uncertainties, many of which are beyond our control, actual results may differ materially from those expressed or implied by such forward-looking statements. The forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

| 3 |

PART I

As used in this Annual Report, unless the context suggests otherwise, “we,” “us,” “our,” “the Company” or “Qualigen” refer to Qualigen Therapeutics, Inc.

Item 1. Business

Overview

We are a diversified life sciences company focused on developing treatments for adult and pediatric cancers with potential for Orphan Drug designation, while also commercializing diagnostics.

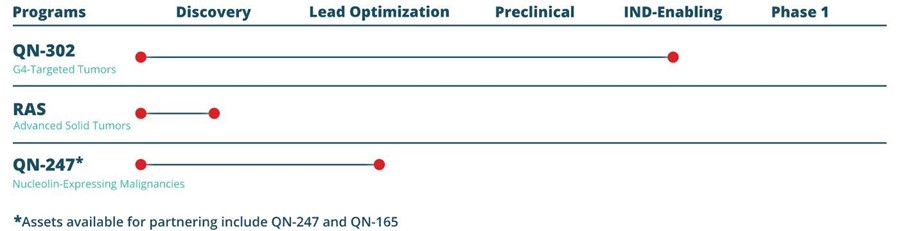

Our cancer therapeutics pipeline includes QN-302, RAS (formerly RAS-F) and QN-247.

Our lead oncology therapeutics program, QN-302, is an investigational small molecule G-quadruplexes (G4)-selective transcription inhibitor with strong binding affinity to G4s prevalent in cancer cells. Such binding could, by stabilizing the G4s against DNA “unwinding,” help inhibit cancer cell proliferation. QN-302 is currently undergoing Good Laboratory Practice (GLP) toxicology studies.

Our RAS portfolio consists of a family of RAS oncogene protein-protein interaction inhibitor small molecules believed to inhibit or block mutated RAS genes’ proteins from binding to their effector proteins. Preventing this binding could stop tumor growth, especially in RAS-driven tumors such as pancreatic, colorectal and lung cancers.

Our investigational QN-247 compound binds nucleolin, a key multi-functional regulatory phosphoprotein that is overexpressed in cancer cells. Such binding could inhibit the cancer cells’ proliferation. The foundational aptamer of QN-247 is QN-165 (formerly referred to as AS1411), which the Company has deprioritized as a drug candidate for treating COVID-19 and other viral-based infectious diseases.

In addition to our oncology drug pipeline, we have an established diagnostics business.

Our revenue driver is our FastPack proprietary blood-based diagnostics platform which includes diagnostic instruments and test kits that are sold commercially primarily in the United States, as well as certain European countries. The FastPack System menu includes a rapid, highly accurate immunoassay diagnostic testing system for cancer, men’s health, hormone function, and vitamin D status. We provide analyzers to our customers (physician offices, clinics and small hospitals) at low cost in order to increase sales volumes of higher-margin test kits.

On May 26, 2022, we acquired a 52.8% interest in NanoSynex, Ltd. (“NanoSynex”). NanoSynex is a micro-biologics diagnostic company domiciled in Israel. NanoSynex’s technology is an Antimicrobial Susceptibility Testing (AST) that aims to enable better targeting of antibiotics for their most suitable uses to ultimately result in faster and more efficacious treatment, hence reducing hospitals mortality and morbidity rates. See Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional details.

Completion of Reverse Recapitalization Transaction with Ritter Pharmaceuticals, Inc.

On May 22, 2020, we completed a “reverse recapitalization” transaction with Qualigen, Inc. (not to be confused with the Company); pursuant to which our merger subsidiary merged with and into Qualigen, Inc. with Qualigen, Inc. surviving as a wholly owned subsidiary of the Company. The Company, which had previously been known as Ritter Pharmaceuticals, Inc., was renamed Qualigen Therapeutics, Inc., and the former stockholders of Qualigen, Inc. acquired, via the recapitalization, a substantial majority of the shares of the Company. Ritter/Qualigen Therapeutics common stock, which was previously traded on the Nasdaq Capital Market under the ticker symbol “RTTR,” commenced trading on Nasdaq, on a post-reverse-stock-split adjusted basis, under the ticker symbol “QLGN” on May 26, 2020. We are no longer pursuing the gastrointestinal disease treatment business on which Ritter Pharmaceuticals, Inc. had focused before the reverse recapitalization transaction.

| 4 |

Cancer Drug Pipeline and Diagnostic Products

Therapeutics Pipeline

Our lead drug compound QN-302 (formerly SOP1812) is being developed to target regulatory regions of cancer genes that down-regulate gene expression in multiple cancer pathways for potential treatment of G4-targeted tumors (e.g., pancreatic cancer). The investigational compounds within our RAS portfolio are designed to suppress the interaction of endogenous RAS with c-RAF, upstream of the KRAS, HRAS and NRAS effector pathways. Our anticancer drug candidate, QN-247 (formerly referred to as ALAN or AS1411-GNP) is aptamer-based and currently in development to treat a variety of cancer types, including liquid and solid tumors.

Our deprioritized programs (and thus not featured in the chart above) include QN-165 (formerly referred to as AS1411), a drug candidate for the potential broad-spectrum treatment of infectious diseases such as COVID-19, and our Selective Target Antigen Removal System (STARS), a therapeutic device product concept, currently in discovery stage, designed to remove circulating tumor cells, viruses, inflammation factors and immune checkpoints.

QN-302 (formerly referred to as SOP1812)

We exclusively in-licensed the global rights to the G4 selective transcription inhibitor platform from University College London (“UCL”) in January 2022. The licensed technology comprises lead compound QN-302 (formerly SOP1812) and back-up compounds that target regulatory regions of cancer genes that down-regulate gene expression in multiple cancer pathways. Developed by Dr. Stephen Neidle and his group at UCL, the G-Quadruplex (G4) binding concept is derived from over 30 years in nucleic acid research, including research on G4s, which are higher order DNA and RNA structures formed by sequences containing guanine-rich repeats. G4s are overrepresented in telomeres (a region of repetitive DNA sequences at the end of a chromosome) as well as promoter sequences and untranslated regions of many oncogenes. Their prevalence is therefore significantly greater in cancer cells compared to normal human cells.

G4-selective small molecules such as QN-302 and backup compounds target the regulatory regions of cancer genes, which have a high prevalence of enriched G4s. Stable G4-QN-302 complexes can be impediments to replication, transcription or translation of those cancer genes containing G4s, and the drugs’ binding to G4s are believed to stabilize the G4s against possible “unwinding.” G4 binders like QN-302 could be efficacious in a variety of cancer types with a high prevalence of G4s.

Pancreatic cancer is the tenth most common cancer and third deadliest cancer in the United States and has one of the lowest rates of survival of all cancer types, with 91% of those diagnosed dying from the disease and one in four dying within the first month of diagnosis. The chemotherapy drug Gemcitabine has been standard of care for patients with metastatic pancreatic cancer for more than 15 years. Numerous clinical trials have tested new drugs, either alone or in combination, with Gemcitabine. We believe that QN-302 has the potential to demonstrate superior efficacy and activity against pancreatic ductal adenocarcinoma (“PDAC”) compared to existing agents, with a distinct mechanism of action and promising preclinical target profile.

In-vitro and in-vivo studies have shown that G4 stabilization by QN-302 resulted in inhibition of target gene expression and cessation of cell growth in various cancers, including PDAC, which represents 98% of pancreatic cancers. In in-vitro studies, QN-302 was potent in inhibiting the growth of several PDAC cell lines at low nanomolar concentrations. Similarly, in in-vivo studies, QN-302 showed a longer survival duration in a KPC genetic mouse model for pancreatic cancer than Gemcitabine has historically shown. Additional preclinical in-vivo studies suggest activity in gemcitabine-resistant PDAC. Data further demonstrated that QN-302 had significant anti-tumor activity in three patient-derived PDAC xenograft models. Early safety indicators suggest no significant adverse toxic effects at proposed therapeutic doses in pancreatic cancer mouse in-vivo models.

On January 9, 2023, the U.S. Food and Drug Administration (“FDA”) granted Orphan Drug Designation (“ODD”) to QN-302 for the indication of pancreatic cancer. ODD provides advantages to pharmaceutical companies that are developing investigational drugs or biological products that show promise in treating rare diseases or conditions that affect fewer than 200,000 people in the United States, including seven-year marketing exclusivity and eligibility to receive regulatory support and guidance from the FDA in the design of an overall drug development plan.

| 5 |

There are also economic advantages to receiving ODD, including a 25% federal tax credit for expenses incurred in conducting clinical research on the orphan designated product within the United States. Tax credits may be applied to the prior year or applied to up to 20 years of future taxes. ODD recipients may also have their Prescription Drug User Fee Act (PDUFA) application fees waived, a potential savings of around $3.2 million (as of fiscal year 2023) for applications requiring covered clinical data, and may qualify to compete for research grants from the Office of Orphan Products Development that support clinical studies.

RAS (formerly RAS-F)

In July 2020, we entered into an exclusive worldwide license agreement with University of Louisville (“UofL”) for the intellectual property covering the “RAS” family of pan RAS inhibitor small molecule drug candidates, which are believed to work by blocking RAS mutations directly, thereby inhibiting tumor formation (especially in pancreatic, colorectal and lung cancers). Pursuant to the license agreement, we in-licensed the “RAS” compound family of drug candidates and will seek to identify and develop a lead drug candidate from the compound family and, upon commercialization, will pay UofL royalties in the low-to-mid-single-digit percentages on net sales of RAS inhibitor licensed products.

RAS is the most common oncogene in human cancer. Activating mutations in one of the three human RAS gene isoforms (KRAS, HRAS or NRAS) are present in about one-fourth to one-third of all cancers. For example, mutant KRAS is found in 98% of pancreatic ductal adenocarcinomas, 52% of colon cancers, and 32% of lung adenocarcinomas. For these three cancer types, cancers with mutant KRAS are diagnosed in more than 170,000 people each year in the United States and cause more than 120,000 deaths. Drugs that target signaling downstream of RAS are available; however, such drugs have shown disappointing clinical durability because RAS is a “hub” that activates multiple effectors, so drugs that block a single pathway downstream may not account for the many other activated pathways.

In March 2022 and October 2022, we signed amendments to our sponsored research agreement with UofL to extend our partnership. Under the amended agreement, the collaboration extends until the third quarter of 2023 and commits additional resources to support ongoing discovery and preclinical efforts for the RAS platform.

QN-247 (formerly referred to as ALAN or AS1411-GNP)

QN-247 is an oligonucleotide-based drug candidate that is designed to treat different types of nucleolin-expressing cancers, including liquid and solid tumors. QN-247 inhibits nucleolin, a key multi-functional regulatory phosphoprotein that is overexpressed in cancer cells, and may thereby be able to inhibit the cells’ proliferation. QN-247 has shown promise in preclinical studies for the treatment of acute myeloid leukemia (“AML”). This novel technology may have several other potential applications, including enhancement of radiation therapy, enhancement of tumor imaging, and delivery of other anti-cancer compounds directly to tumor cells.

QN-247 is an enhanced version of QN-165 (which in turn was formerly referred to as AS1411), where the DNA oligonucleotide aptamer is conjugated. A key component of QN-247, DNA oligonucleotide aptamer QN-165, has been shown, primarily on a preclinical basis, to have the potential to target and destroy cancer cells. This component has been administered in Phase 1 and Phase 2 clinical trials to over 100 AML or renal cell carcinoma cancer patients and appears to be well tolerated with no evidence of severe adverse events in such trials, with at least seven patients appearing to have clinical responses.

An in vivo efficacy study with a triple negative breast cancer (TNBC) MDA-MB-231 xenograft mouse model was performed with 12 daily doses (1 mg/kg) of QN-247. This study showed statistically significant reductions in mean tumor volumes for all QN-247 formulations compared to baseline and to vehicle control. QN-247 formulations with higher oligonucleotide loading appeared to reduce tumor volumes more than lower oligonucleotide loading. No evidence of adverse toxicity was observed.

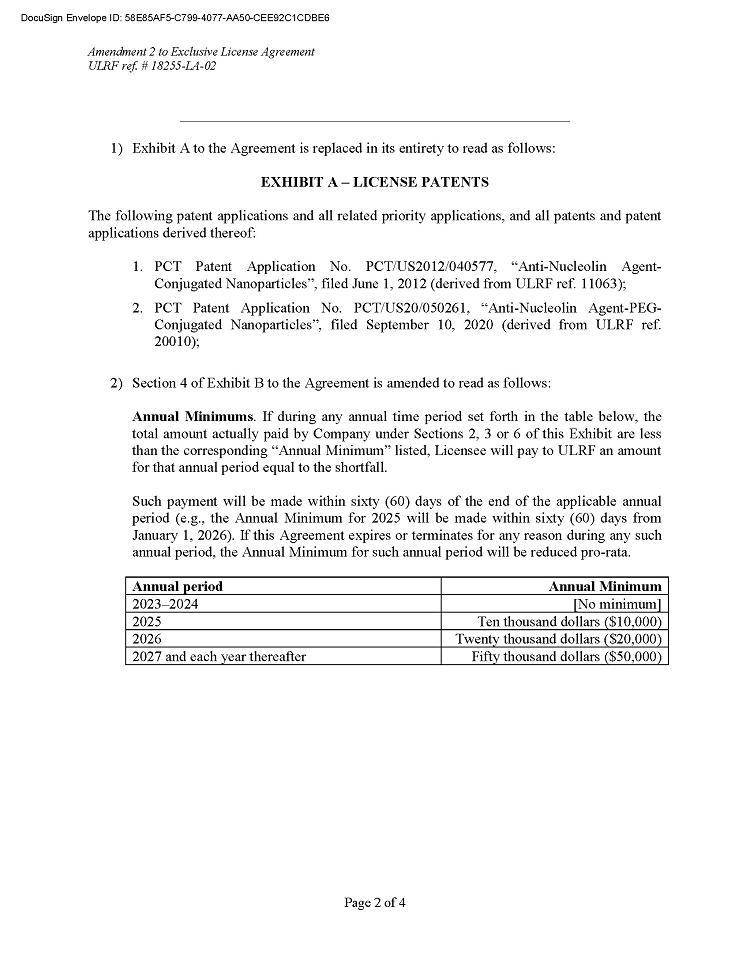

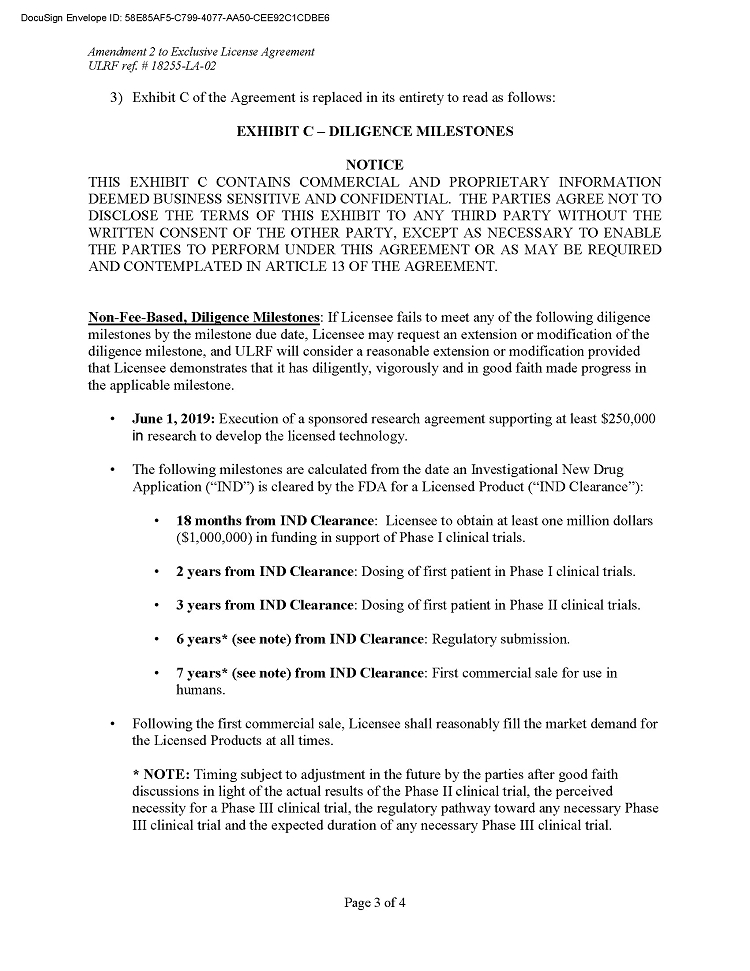

We entered into a sponsored research agreement with UofL in August 2018 which was subsequently amended in October 2020, pursuant to which UofL performed various animal studies to assess antitumor efficacy and safety of different QN-247 compositions. The sponsored research agreement with UofL for QN-247 expired on August 31, 2022, and the license agreement with UofL for QN-247 was amended on January 9, 2023.

| 6 |

QN-165 (formerly referred to as AS1411)

In June 2020, we entered into an exclusive royalty-bearing license agreement with UofL for UofL’s intellectual property for the use of QN-165 as a drug candidate for the treatment of COVID-19. In September 2020 we and UofL jointly filed a U.S. provisional patent application, entitled “Methods of inhibiting or treating coronavirus infection, and methods for delivering an anti-nucleolin agent.” The application was filed in conjunction with Drs. Paula J. Bates and Kenneth E. Palmer from UofL, and covers methods for using QN-165 as an antiviral drug candidate to prevent SARS-CoV-2 from entering the body through mucous membranes in the nose, mouth and eyes. As stated in the patent application, we believe that QN-165 could be administered by means of inhalers, nose spray or eye drops to individuals who have recently come in contact with SARS-CoV-2, or are at high risk of contracting the virus.

We believe that the mechanism by which QN-165 is believed to work, by blocking the ability of viruses to replicate in the body, may also make the drug candidate effective against future mutations in COVID-19 as well as against other dangerous viruses including seasonal influenza. Moreover, we believe that in addition to its proposed use as a therapeutic, QN-165 might be able to be used as a protective defense or prophylaxis against COVID-19 and/or other viral-based diseases such as seasonal influenza.

On July 13, 2021, we submitted an Investigational New Drug (“IND”) application with the FDA seeking approval to commence Phase 1b/2a clinical studies of QN-165 in hospitalized COVID-19 patients. On August 11, 2021, the FDA informed us that additional preclinical studies would be required for the IND application to be cleared to proceed into the clinic with QN-165. We then decided to allocate our resources to focus on our oncology pipeline, and deprioritized the development of QN-165 program. Qualigen is seeking to out-license QN-165 to a partner that has interest and expertise in antiviral development, such as dengue, influenza, RSV and other infectious diseases. Due to its mechanism and in vivo potency, we believe that QN-165 could potentially be developed as a first-line treatment against emerging viruses and biothreats.

FastPack®

The FastPack System is a patent-protected rapid, onsite immunoassay testing system consisting of the FastPack Analyzer and the FastPack test pouch, a single-use, disposable, foil packet which includes the FastPack reagent chemistry. Since the initial conception of the system, we have developed successive versions of the analyzer and test pouch, known as “1.0,” “IP” and “PRO”, and have expanded our assay menu to nine tests, including tests for prostate cancer, thyroid function, metabolic disorders, and research applications. We have sold FastPack products in the United States and overseas for over 20 years, and since inception, our sales of FastPack products have exceeded $127 million. We manufacture the FastPack products at our FDA and International Standards Organization (“ISO”) certified Carlsbad, California facility. As of April 2022 most FastPack sales are distributed through various distribution partners in North America as well as in Europe (primarily Axon Labs in Germany and Switzerland). We also sell direct to clinics and physician offices located throughout North America.

In July 2020, we submitted an official notification to the FDA to commence sales in the United States of our FastPack SARS-CoV-2 IgG test for COVID-19 antibodies, which was designed for use with our new FastPack PRO. The test was previously submitted to the FDA for Emergency Use Authorization (“EUA”). In April 2021, we withdrew this EUA. During the nine months during which the EUA was with the FDA, alternative tests and testing practices became widespread and we determined that there was no longer a viable business case for scale-up of the test.

Strategic Partners

In January 2022, we entered into a royalty-bearing license agreement with UCL, with respect to intellectual property and know-how covering lead and backup compounds for our G4 selective transcription inhibitor program, QN-302.

We are party to a royalty-bearing license agreement with UofL for the development of RAS and the QN-247 program.

We in-license patents from DIAsource ImmunoAssays S.A. and Future Diagnostics B.V., for reagents that are used in our FastPack Vitamin D assay.

Sales Channels

Prior to April 2022, most of our FastPack sales were through our diagnostics distribution partner Sekisui Diagnostics, LLC (“Sekisui”) pursuant to a distribution agreement. The distribution agreement with Sekisui expired on March 31, 2022, at which time the activities formerly provided by Sekisui reverted to us. As of April 2022, most of our FastPack sales are through various distribution partners in North America, including McKesson Medical-Surgical, Henry Schein Medical, Medline Industries and National Distribution & Contracting, the largest distributors of physician office laboratory products in the United States. Outside of the United States, we sell the FastPack product line through a network of distributors in Europe (primarily Axon Labs in Germany and Switzerland). We also continue to sell our testosterone test kits directly to Low T Center, Inc. (“Low T”), the largest men’s health group in the United States, with 40 locations. Low T was acquired by SynergenX in September 2022. The combined company currently operates 64 locations.

| 7 |

Product sales to McKesson accounted for 48% of our total revenues and product sales to Low T accounted for 26% of our total revenues during the fiscal year ended December 31, 2022. The remaining revenue was comprised of product sales and warranties to other distributors and direct sales accounts.

In October 2020, we entered into an agreement with Yi Xin Zhen Duan Jishu (Suzhou) Ltd (“Yi Xin”), pursuant to which we granted Yi Xin exclusive rights to manufacture and sell new generations of FastPack-based products as well as Yi Xin-manufactured versions of our existing FastPack 1.0, IP and PRO product lines in China. We are entitled to receive royalties on any such sales. After May 1, 2022, Yi Xin has the right to sell its new generations of FastPack-based diagnostic test systems throughout the world, other than to our then-current FastPack customers; and on a worldwide basis, except in the United States, Yi Xin also has the right to sell Yi Xin-manufactured versions of our existing FastPack 1.0, IP and PRO product lines. We are entitled to receive royalties on any of these sales. After March 31, 2022, Yi Xin has the right to buy Qualigen FastPack 1.0, IP and PRO products from us at distributor prices for resale in the United States, again excluding resales toward our then-current FastPack customers.

Manufacturing

We develop, manufacture and assemble our diagnostic products at our approximately 23,000 square feet facility in Carlsbad, California. Our laboratory and manufacturing practices are governed by a series of internally published Standard Operating Procedures, in accordance with FDA and ISO guidelines. While we produce many of our own raw materials and sub-components for diagnostic products, we also purchase certain materials from third-party suppliers such as Amcor, Enstrom, Gilson, Hi-Tech Products, Hamamatsu, Sigma Aldrich, Surmodics, 3M, Thermo Fisher Scientific, and VWR International.

We do not have in-house manufacturing capability for our therapeutics product candidates.

Research and Development

For research and development of our drug candidates, we are leveraging the scientific and technical resources and laboratory facilities of UofL and UCL, through technology licensing, sponsored research, and other consulting agreements, which are focused on aptamer technology and applications. We would engage contract research organizations (“CROs”) for any clinical trials of our drug candidates. We intend to focus our internal research and development on oversight of these organizations and continuing support of the FastPack diagnostic line.

Regulatory Matters

We have obtained 17 FDA clearances/approvals and 28 CE Marks for our diagnostic products (FastPack analyzers, immunoassays, control kits, calibration kits and verifications kits) to date. We have not obtained FDA or other regulatory approval for any drug candidate.

Medical Device Regulatory Clearances and Approvals

The medical devices that we manufacture and market are subject to regulation by numerous worldwide regulatory bodies, including the FDA and comparable international regulatory agencies. These agencies require manufacturers of medical devices to comply with applicable laws and regulations governing development, testing, manufacturing, labeling, marketing and distribution. Medical devices are also generally subject to varying levels of regulatory control based on the risk level of the device.

In the United States, unless an exemption applies, before we can commercially distribute medical devices, we must obtain, depending on the type of device, either premarket notification clearance or premarket approval (“PMA”) from the FDA. The FDA classifies medical devices into one of three classes. Devices deemed to pose lower risks are placed in either class I or II, which typically requires the manufacturer to submit to the FDA a premarket notification requesting permission to commercially distribute the device. Some low-risk devices are exempted from this requirement. Devices deemed by the FDA to pose the greatest risks, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared device, are placed in class III, generally requiring PMA.

The premarket notification process requires that a premarket notification (510(k)) be made to the FDA to demonstrate that a new device is as safe and effective as, or substantially equivalent to, a legally marketed device (the “predicate” device). This process is generally known as obtaining 510(k) clearance for a new device. Under this process, applicants must submit performance data to establish substantial equivalence. In some instances, data from human clinical trials must also be submitted in support of a 510(k) premarket notification. If so, these data must be collected in a manner that conforms to the applicable Investigational Device Exemption (“IDE”) regulations. The FDA must issue a decision finding substantial equivalence before commercial distribution can occur. Changes to cleared devices that do not significantly affect the safety or effectiveness of the device can generally be made without additional 510(k) premarket notifications; otherwise, a new 510(k) is required.

| 8 |

The PMA approval process requires the submission of a PMA application to the FDA to demonstrate that the new device is safe and effective for its intended use. This approval process applies to most Class III devices and generally requires clinical data to support the safety and effectiveness of the device, obtained in adherence with IDE requirements. The FDA will approve the PMA application if it finds that there is a reasonable assurance that the device is safe and effective for its intended purpose and that the proposed manufacturing is in compliance with the Quality System Regulation (“QSR”). For novel technologies, the FDA may seek input from an advisory panel of medical experts and seek their views on the safety, effectiveness and benefit-risk of the device. The PMA process is generally more detailed, lengthier and more expensive than the 510(k) process.

In the European Union (“EU”), we are required to comply with the In-Vitro Diagnostic Regulation (“IVDR”), which became effective May 2021, superseding existing Medical Device Directives. Medical devices that have a valid EC Certificate to the prior Directives (issued before May 2021) can continue to be sold until May 2025 or until the EC Certificate expires, whichever comes first, providing there are no significant changes to the design or intended use. The CE Mark, which is required to sell medical devices in the EU is affixed following a Conformity Assessment and either approval from the appointed independent Notified Body or through self-certification by the manufacturer. The selected pathway to CE marking is based on device risk classification. CE marking indicates conformity to the applicable General Safety and Performance Requirements (“GSPRs”) for the IVDR. The IVDR changes multiple aspects of the regulatory framework for CE marking, such as increased clinical evidence requirements, changes to labeling, and new requirements, including Unique Device Identification (“UDI”), and many new post-market reporting obligations. IVDR also modifies and increases the compliance requirements for the medical device industry and will continue to require significant investment to transition all products by May 2025. The CE mark continues to be a prerequisite for successful registration in many other global geographies.

We are also required to comply with the regulations of every other country where we commercialize products before we can launch or maintain new products on the market.

The FDA and other worldwide regulatory agencies and competent authorities actively monitor compliance to local laws and regulations through review and inspection of design and manufacturing practices, record-keeping, reporting of adverse events, labeling and promotional practices. The FDA can ban certain medical devices, detain or seize adulterated or misbranded medical devices, order recall or market withdrawal of these devices and require notification of health professionals and others with regard to medical devices that present unreasonable risks of substantial harm to the public health. The FDA may also enjoin and restrain a company for certain violations of the Food, Drug and Cosmetic Act (“FDCA”) and the Safe Medical Devices Act, pertaining to medical devices, or initiate action for criminal prosecution of such violations. Regulatory agencies and authorities in the countries where we do business can halt production in or distribution within their respective country or otherwise take action in accordance with local laws and regulations.

International sales of medical devices manufactured in the United States that are not approved by the FDA for use in the United States, or that are banned or deviate from lawful performance standards, are subject to FDA export requirements. Additionally, exported devices are subject to the regulatory requirements of each country to which the device is exported. Some countries do not have medical device regulations, but in most foreign countries, medical devices are regulated. Frequently, regulatory approval may first be obtained in a foreign country prior to application in the United States due to differing regulatory requirements; however, other countries, require approval in the country of origin first. Most countries outside of the United States require that product approvals be recertified on a regular basis. The recertification process requires the evaluation of any device changes and any new regulations or standards relevant to the device and, where needed, conduct appropriate testing to document continued compliance. Where recertification applications are required, they must be approved in order to continue selling our products in those countries.

Medical Device Quality Assurance

We are committed to providing high quality products to our customers and the patients they serve. Our quality system starts with the initial product specification and continues through the design of the product, component specification process and the manufacturing, sale and servicing of the product. Our quality system is intended to build in quality and process control and to utilize continuous improvement concepts throughout the product life. Our quality system is also designed to enable us to satisfy various international quality system regulations, including those of the FDA with respect to products sold in the United States. All of our medical device manufacturing facilities and distribution centers are certified under the ISO 13485 quality system standard, established by the ISO for medical devices, which includes requirements for an implemented quality system that applies to component quality, supplier control, product design and manufacturing operations. This certification can be obtained only after a complete audit of a company’s quality system by an independent outside auditor, and maintenance of the certification requires that these facilities undergo periodic re-examination.

United States—FDA Drug Approval Process

The research, development, testing, and manufacture of product candidates are extensively regulated by governmental authorities in the United States and other countries. In the United States, the FDA regulates drugs under the FDCA and its implementing regulations.

| 9 |

The steps required to be completed before a drug may be marketed in the United States include, among others:

| ● | preclinical laboratory tests, animal studies, and formulation studies, all performed in accordance with the FDA’s Good Laboratory Practice (“GLP”) regulations; |

| ● | submission to the FDA of an IND application for human clinical testing, which must become effective before human clinical trials may begin and for which progress reports must be submitted annually to the FDA; |

| ● | approval by an independent institutional review board (“IRB”) or Ethics Committee (“EC”) at each clinical trial site before each trial may be initiated; |

| ● | adequate and well-controlled human clinical trials, conducted in accordance with applicable IND regulations, Good Clinical Practices (“GCP”), and other clinical trial related regulations, to establish the safety and efficacy of the drug for each proposed indication to the FDA’s satisfaction; |

| ● | submission to the FDA of a New Drug Application (“NDA”) and payment of user fees for FDA review of the NDA (unless a fee waiver applies); |

| ● | satisfactory completion of an FDA pre-approval inspection of one or more clinical trial site(s) at which the drug was studied in a clinical trial(s) and/or of us as a clinical trial sponsor to assess compliance with GCP regulations; |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the drug is produced to assess compliance with current GMPs regulations; |

| ● | agreement with the FDA on the final labeling for the product and the design and implementation of any required Risk Evaluation and Mitigation Strategy (“REMS”); and |

| ● | FDA review and approval of the NDA, including satisfactory completion of an FDA advisory committee review, if applicable, based on a determination that the drug is safe and effective for the proposed indication(s). |

Preclinical tests include laboratory evaluation of product chemistry, toxicity, and formulation, as well as animal studies. The conduct of the preclinical tests and formulation of the compounds for testing must comply with federal regulations and requirements, including GLP regulations. The results of the preclinical tests, together with manufacturing information and analytical data, are submitted to the FDA as part of an IND application, which must become effective before human clinical trials may begin. An IND application will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions about issues such as the conduct of the trials as outlined in the IND application, and places the clinical trial(s) on a clinical hold. In such a case, the IND application sponsor and the FDA must resolve any outstanding FDA concerns or questions before clinical trials can proceed. We cannot be certain that submission of an IND application will result in the FDA allowing clinical trials to begin.

| 10 |

Clinical trials necessary for product approval are typically conducted in three sequential phases, but the Phases may overlap or be combined. The study protocol and informed consent information for study subjects in clinical trials must also be approved by an IRB for each institution where the trials will be conducted, and each IRB must monitor the study until completion. Study subjects must provide informed consent and sign an informed consent form before participating in a clinical trial. Clinical testing also must satisfy the extensive GCP regulations for, among other things, informed consent and privacy of individually identifiable information.

| ● | Phase 1—Phase 1 clinical trials involve initial introduction of the study drug in a limited population of healthy human volunteers or patients with the target disease or condition. These studies are typically designed to test the safety, dosage tolerance, absorption, metabolism and distribution of the study drug in humans, evaluate the side effects associated with increasing doses, and, if possible, to gain early evidence of effectiveness. |

| ● | Phase 2—Phase 2 clinical trials typically involve administration of the study drug to a limited patient population with a specified disease or condition to evaluate the preliminary efficacy, optimal dosages and dosing schedule and to identify possible adverse side effects and safety risks. Multiple Phase 2 clinical trials may be conducted to obtain information prior to beginning larger and more expensive Phase 3 clinical trials. |

| ● | Phase 3—Phase 3 clinical trials typically involve administration of the study drug to an expanded patient population to further evaluate dosage, to provide substantial evidence of clinical efficacy and to further test for safety, generally at multiple geographically dispersed clinical trial sites. These clinical trials are intended to establish the overall risk/benefit ratio of the study drug and to provide an adequate basis for product approval. Generally, two adequate and well-controlled Phase 3 clinical trials are required by the FDA for approval of an NDA. |

Post-approval trials, sometimes referred to as Phase 4 clinical trials, may be conducted after receiving initial marketing approval. These trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication and are commonly intended to generate additional safety data regarding use of the product in a clinical setting. In certain instances, the FDA may mandate the performance of Phase 4 clinical trials as a condition of approval of an NDA or, in certain circumstances, post-approval.

The FDA has various programs, including fast track designation, breakthrough therapy designation, priority review and accelerated approval, which are intended to expedite or simplify the process for the development, and the FDA’s review of drugs (e.g., approving an NDA on the basis of surrogate endpoints subject to post-approval trials). Generally, drugs that may be eligible for one or more of these programs are those intended to treat serious or life-threatening diseases or conditions, those with the potential to address unmet medical needs for those disease or conditions, and/or those that provide a meaningful benefit over existing treatments. For example, a sponsor may be granted FDA designation of a drug candidate as a “breakthrough therapy” if the drug candidate is intended, alone or in combination with one or more other drugs, to treat a serious or life-threatening disease or condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. If a drug is designated as breakthrough therapy, the FDA will take actions to help expedite the development and review of such drug. Moreover, if a sponsor submits an NDA for a product intended to treat certain rare pediatric or tropical diseases or for use as a medical countermeasure for a material threat, and that meets other eligibility criteria, upon approval such sponsor may be granted a priority review voucher that can be used for a subsequent NDA. From time to time, we anticipate applying for such programs where we believe we meet the applicable FDA criteria. A company cannot be sure that any of its drugs will qualify for any of these programs, or even if a drug does qualify, that the review time will be reduced.

The results of the preclinical studies and of the clinical studies, together with other detailed information, including information on the manufacture and composition of the drug, are submitted to the FDA in the form of an NDA requesting approval to market the product for one or more proposed indications. The testing and approval process requires substantial time, effort and financial resources. Unless the applicant qualifies for an exemption, the filing of an NDA typically must be accompanied by a substantial “user fee” payment to the FDA. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and efficacy of the product in the proposed patient population to the satisfaction of the FDA. After an NDA is accepted for filing, the FDA substantively reviews the application and may deem it to be inadequate, and companies cannot be sure that any approval will be granted on a timely basis, if at all. The FDA may also refer the application to an appropriate advisory committee, typically a panel of clinicians, for review, evaluation and a recommendation as to whether the application should be approved, but is not bound by the recommendations of the advisory committee.

| 11 |

Before approving an NDA, the FDA usually will inspect the facility or the facilities at which the drug is manufactured and determine whether the manufacturing and production and testing facilities are in compliance with cGMP regulations. The FDA also may audit the clinical trial sponsor and one or more sites at which clinical trials have been conducted to determine compliance with GCPs and data integrity. If the NDA and the manufacturing facilities are deemed acceptable by the FDA, it may issue an approval letter, and, if not, the Agency may issue a Complete Response Letter (“CRL”). An approval letter authorizes commercial marketing of the drug with specific prescribing information for a specific indication(s). A CRL indicates that the review cycle of the application is complete and the application is not ready for approval. A CRL may require additional clinical data and/or an additional pivotal Phase 3 clinical trial(s), and/or other significant, expensive and time-consuming requirements related to clinical trials, preclinical studies or manufacturing. Even if such additional information is submitted, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval. The FDA could also require, as a condition of NDA approval, post-marketing testing and surveillance to monitor the drug’s safety or efficacy or impose other conditions, or a REMS that may include both special labeling and controls, known as Elements to Assure Safe Use, on the distribution, prescribing, dispensing and use of a drug product. Once issued, the FDA may withdraw product approval if, among other things, ongoing regulatory requirements are not met, certain defects exist in the NDA, or safety or efficacy problems occur after the product reaches the market.

Intellectual Property

Information regarding the issued patents and pending patent applications, as of December 31, 2022, is as follows:

| Subject Matter | Issued | Pending | Geographic Scope | Patent Term | ||||

| Qualigen Patents and Trademarks | ||||||||

| FastPack 1.0, IP, and PRO | 2 | 0 | U.S., Japan | 2024-2032 | ||||

| FastPack 2.0 | 23 | 0 | U.S., Europe, China, Japan | 2032-2042 | ||||

| STARS | 9 | 6 | U.S., Europe, Canada, China, Japan, Korea | 2030-2045 | ||||

| Qualigen Trademarks | 13 | 9 | U.S., Europe, Canada, China, Japan, Korea | N/A | ||||

| Qualigen + Gen-Probe (Joint) | 24 | 0 | U.S., Austrialia, Canada, China, Japan | 2028 | ||||

| Total Qualigen | 71 | 15 | ||||||

| In-Licensed Patents | ||||||||

| FastPack 1.0, IP, and PRO | 1 | 0 | Europe | 2030 | ||||

| Univ College London (UCL) | ||||||||

| QN-302 | 2 | 11 | U.S., Europe, Australia, Canada, China, Hong Kong, India, Japan, Korea, Russia | 2030-2040 | ||||

| Univ of Louisville (ULRF) | ||||||||

| RAS | 0 | 12 | U.S, Europe, Australia, Canada, China, Hong Kong, India, Israel, Japan, Korea, Mexico, Russia, South Africa | 2039* | ||||

| QN-247 | 44 | 3 | U.S., Europe, Canada, China, Hong Kong, Japan | 2032-2038 | ||||

| DiaSource | ||||||||

| Total In-Licensed | 47 | 26 | ||||||

| TOTAL | 118 | 41 |

*Anticipated patent term

Human Capital Management

As of March 31, 2023, we had 38 employees, 31 of whom were full-time employees. None of our employees is represented by a labor union or covered by a collective bargaining agreement.

Employee Engagement, Benefits & Development. We recognize that attracting, motivating and retaining talent at all levels is vital to our continued success. Our employees are a significant asset and we aim to create an equitable, inclusive and empowering environment in which our employees can grow and advance their careers, with the overall goal of developing, retaining and expanding our workforce, as needed, to support our current pipeline and future business goals. By focusing on employee retention and engagement, we also improve our ability to support our business and operations, our pipeline, and also protect the long-term interests of our shareholders. We frequently benchmark our compensation practices and benefits programs against those of comparable companies in our industry and in the geographic area where we are located. In our efforts to recruit and retain a diverse and exceptional workforce, we provide our employees with competitive cash compensation, opportunities to own equity, and an employee benefit program that promotes well-being, including healthcare, a 401(k) Plan, and paid time-off.

Diversity & Inclusion. Our success also depends on our ability to attract, engage and retain a diverse group of employees. We value diversity across our workforce and we will continue to focus on diversity and inclusion initiatives. With respect to our employees overall, approximately fifty percent (50%) are people of color and approximately forty-five percent (45%) are women. We seek to have an inclusive and positive culture that is centered on our shared corporate mission and values, and that is free from discrimination of any kind, including sexual or other discriminatory harassment. Our employees have multiple avenues available through which inappropriate behavior can be reported. All reports of inappropriate behavior are promptly investigated with appropriate action taken to stop such behavior.

Additional Information

Ritter Pharmaceuticals, Inc. (our predecessor) was formed as a Nevada limited liability company on March 29, 2004 under the name Ritter Natural Sciences, LLC. In September 2008, this company converted into a Delaware corporation under the name Ritter Pharmaceuticals, Inc. On May 22, 2020, upon completing the “reverse recapitalization” transaction with Qualigen, Inc., Ritter Pharmaceuticals, Inc. was renamed Qualigen Therapeutics, Inc. Qualisys Diagnostics, Inc. was formed as a Minnesota corporation in 1996, reincorporated to become a Delaware corporation in 1999, and then changed its name to Qualigen, Inc. in 2000. Qualigen, Inc. is now a wholly-owned subsidiary of the Company.

Our website address is www.qualigeninc.com. We post links to our website to the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, information statements, beneficial ownership reports and any amendments to those reports or statements filed or furnished pursuant to Sections 13(a), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All such filings are available through our website free of charge. However, the information contained on or accessed through our website does not constitute part of this Annual Report, and references to our website address in this Annual Report are inactive textual references only. All such reports are also available free of charge via EDGAR through the SEC website at www.sec.gov.

| 12 |

Item 1A. Risk Factors

An investment in our common stock involves risks. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, as well as in our other filings with the SEC, in evaluating our business. If any of the following risks actually occur, our business, financial condition, operating results and future prospects could be materially and adversely affected. In that case, the trading price of our common stock may decline and you might lose all or part of your investment. The risks described below, which are the risks we judge (rightly or wrongly) to be the most significant to investors, are not the only ones we face. Additional risks that we currently do not judge to be among the “most significant” may also impair our business, financial condition, operating results and prospects.

Certain statements below are forward-looking statements. For additional information, see the section of this Annual Report under the caption “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business Generally

Our business strategy is high-risk

We are focusing our resources and efforts primarily on development of therapeutic product candidates, which requires extensive cash needs for research and development activities. This is a high-risk strategy because there is no assurance that our products will ever become commercially viable, that we will prevent other companies from depriving us of market share and profit margins by selling products based on our inventions and developments, that we will successfully manage a company in a new area of business and on a different scale than we have operated in the past, that our product candidates will be able to achieve the desired therapeutic results, or that our cash resources will be adequate to develop our product candidates until we become profitable, if ever. This may make our stock an unsuitable investment for many investors.

We do not currently have enough working capital to fully execute our strategic plan.

We have suffered recurring losses from operations, and we will need capital to support our intended development of our therapeutics business. We believe that future financings will be necessary in order for us to properly execute our strategic plan. However, there can be no assurance that such future financings will be available to us (or, if they are, that they can be consummated on desirable terms).

We may, in the short and long-term, seek to raise capital through the issuance of equity securities or through other financing sources. To the extent that we seek to raise additional funds by issuing equity securities, our stockholders may experience significant dilution. Any debt financing, if available, may include financial and other covenants that could restrict our use of the proceeds from such financing or impose other business and financial restrictions on us. In addition, we may consider alternative approaches such as licensing, joint venture, or partnership arrangements to provide long term capital. Additional funding may not be available to us on acceptable terms, or at all. In addition, any future financing (depending on the terms and conditions) may be subject to the approval of Alpha Capital Anstalt (“Alpha”), a related party and the holder of our 8% Senior Convertible Debenture (the “Debenture”), and/or trigger certain adjustments to the Debenture or warrants held by Alpha. See Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional details regarding the Debenture.

Servicing our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay this debt.

Our ability to make payments to Alpha of principal or interest on our indebtedness or to make any potential prepayments for the Debenture, to the extent applicable, depends on our future performance, which is subject to economic, financial, competitive and other factors beyond our control. If the assumptions underlying our cash flow guidance are incorrect, our business may not continue to generate cash flow from operations in the future sufficient to service our indebtedness and make necessary capital expenditures.

Commencing June 1, 2023 and continuing on the first day of each month thereafter until the earlier of (i) December 22, 2025 and (ii) the full redemption of the Debenture (each such date, a “Monthly Redemption Date”), we must redeem $110,000 plus accrued but unpaid interest, liquidated damages and any amounts then owing under the Debenture (the “Monthly Redemption Amount”). The Monthly Redemption Amount must be paid in cash; provided that after the first two monthly redemptions, we may elect to pay all or a portion of a Monthly Redemption Amount in shares of our common stock, based on a conversion price equal to the lesser of (i) the then applicable conversion price of the Debenture and (ii) 85% of the average of the VWAPs (as defined in the Debenture) for the five consecutive trading days ending on the trading day that is immediately prior to the applicable Monthly Redemption Date. We may also redeem some or all of the then outstanding principal amount of the Debenture at any time for cash in an amount equal to 105% of the then outstanding principal amount of the Debenture being redeemed plus accrued but unpaid interest, liquidated damages and any amounts then owing under the Debenture. These monthly redemption and optional redemptions are subject to the satisfaction of the Equity Conditions (as defined in the Debenture), which include a condition that we have obtained stockholder approval for such share issuances.

| 13 |

The Debenture accrues interest at the rate of 8% per annum, which begins accruing on December 1, 2023, and will be payable on a quarterly basis. Interest may be paid in cash or shares of common stock or a combination thereof at our option; provided that interest may only be paid in shares if the Equity Conditions have been satisfied, including the stockholder approval condition as described above.

If we are unable to obtain stockholder approval for the issuance of shares of common stock under the Debenture, we will required to make any required payments to Alpha in cash. If we are unable to generate cash flow sufficient to service our indebtedness and make necessary capital expenditures, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt or issuing additional equity, equity-linked or debt instruments on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. If we are unable to engage in any of these activities or engage in these activities on desirable terms, we may be unable to meet our debt obligations, which would materially and adversely impact our business, financial condition and operating results.

Risks Related to Our Therapeutics and Diagnostics Pipeline

Our product candidates are still in the early stages of development. We have not begun clinical trials or obtained regulatory approval for any drug candidate. We may never obtain approval for any of our drug candidates.

We are still early in our development efforts and have not yet begun enrollment in any clinical trials evaluating QN-302, RAS, or QN-247. There can be no assurance that QN-302, RAS, and/or QN-247 will achieve success in their clinical trials or obtain regulatory approval.

Our ability to generate revenues from QN-302, RAS, and/or QN-247 will depend on the successful development and eventual commercialization of such drug candidates. The success of these products will depend on several factors, including the following:

| ● | successful completion of preclinical studies and clinical trials; |

| ● | acceptance of an IND application by the FDA or other clinical trial or similar applications from foreign regulatory authorities for our future clinical trials for our pipeline; |

| ● | timely and successful enrollment of patients in, and completion of, clinical trials with favorable results; |

| ● | demonstration of safety, efficacy and acceptable risk-benefit profiles of our products to the satisfaction of the FDA and foreign regulatory agencies; |

| ● | receipt and related terms of marketing approvals from applicable regulatory authorities, including the completion of any required post-marketing studies or trials; |

| ● | obtaining and maintaining patent, trade secret and other intellectual property protection and regulatory exclusivity for our products; |

| ● | developing and implementing marketing and reimbursement strategies; |

| ● | establishing sales, marketing and distribution capabilities and launching commercial sales of our products, if and when approved, whether alone or in collaboration with others; |

| ● | acceptance of our drugs, if and when approved, by patients, the medical community and third-party payors; |

| ● | effectively competing with other therapies; |

| ● | obtaining and maintaining third-party payor coverage and adequate reimbursement; and |

| ● | maintaining a continued acceptable safety profile of the products following approval. |

Many of these factors are beyond our control, and it is possible that none of our drug candidates will ever obtain regulatory approval even if we expend substantial time and resources seeking such approval. If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize our drug candidates. For example, our business could be harmed if results of the clinical trials of QN-302, RAS, QN-247, any other drug candidates vary adversely from our expectations.

| 14 |

Drug development involves a lengthy and expensive process. We may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of QN-302, RAS, and/or QN-247.

Most drug candidates fail, and taking a drug candidate from concept through clinical trials and regulatory approval is not easy or guaranteed. We are unable to predict when or if our drug candidates, will prove effective or safe in humans or will obtain marketing approval. Before obtaining marketing approval from regulatory authorities for the sale of these products, we must complete preclinical development and then conduct extensive clinical trials to demonstrate the safety and efficacy of these products for humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to the outcome. A failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim or preliminary results of a clinical trial do not necessarily predict final results.

We may experience numerous unforeseen events that could delay or prevent our ability to obtain marketing approval or commercialize our drug candidates, including:

| ● | regulators or IRBs or ECs may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| ● | we may experience delays in reaching, or fail to reach, agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites; |

| ● | clinical trials for our drug candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials, delay clinical trials or abandon product development programs; |

| ● | the number of patients required for clinical trials for our drug candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate, participants may drop out of these clinical trials at a higher rate than we anticipate or the duration of these clinical trials may be longer than we anticipate; |

| ● | competition for clinical trial participants from investigational and approved therapies may make it more difficult to enroll patients in our clinical trials; |

| ● | our third-party contractors may fail to meet their contractual obligations to us in a timely manner, or at all, or may fail to comply with regulatory requirements; |

| ● | we may have to suspend or terminate clinical trials for our drug candidates for various reasons, including a finding that the participants are being exposed to unacceptable health risks; |

| ● | our drug candidates may have undesirable or unexpected side effects or other unexpected characteristics, causing us or our investigators, regulators or IRBs/ECs to suspend or terminate the trials; |

| ● | the cost of clinical trials for our drug candidates may be greater than we anticipate; and |

| ● | the supply or quality of our drug candidates, or other materials necessary to conduct clinical trials may be insufficient or inadequate and result in delays or suspension of our clinical trials. |

Our product development costs will increase if we experience delays in preclinical studies or clinical trials or in obtaining marketing approvals. We do not know whether any of our planned preclinical studies or clinical trials will begin on a timely basis or at all, will need to be restructured or will be completed on schedule, or at all. For example, the FDA may place a partial or full clinical hold on any of our clinical trials for a variety of reasons.

Significant preclinical or clinical trial delays also could shorten any periods during which we may have the exclusive right to commercialize our drug candidates or allow our competitors to bring products to market before we do and impair our ability to successfully commercialize our drug candidates.

Any delays in the commencement or completion, or termination or suspension, of our future clinical trials, if any, could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects.

Before we can initiate clinical trials of a drug candidate, we must submit the results of preclinical studies to the FDA along with other information as part of an IND or IDE application or similar regulatory filing, and the FDA (or corresponding foreign regulatory body) must approve the application. We have not yet submitted our IND application for QN-302 for pancreatic cancer. While we expect to submit the IND application during the first half of 2023, we cannot guarantee the timing for submitting the IND application for QN-302, and we do not know when this IND application (or any other IND application) would be approved, if ever.

| 15 |

Before obtaining marketing approval from the FDA for the sale of QN-302, RAS, QN-247, or any other future drug candidate, we must conduct extensive clinical studies to demonstrate safety and efficacy. Clinical testing is expensive, time consuming and uncertain as to outcome. The FDA may require us to conduct additional preclinical studies for any drug candidate before it allows us to initiate clinical trials under any IND application, which may lead to additional delays and increase the costs of our preclinical development programs.

Any delays in the commencement or completion of our ongoing, planned or future clinical trials could significantly increase our costs, slow down our development and approval process and jeopardize our ability to commence product sales and generate revenues. We do not know whether our planned trials will begin on time or at all, or be completed on schedule, if at all. The commencement and completion of clinical trials can be delayed for a number of reasons, including delays related to:

| ● | the FDA disagreeing as to the design or implementation of our clinical trials or with our recommended dose for any of our pipeline programs; |

| ● | obtaining FDA authorization to commence a trial or reaching a consensus with the FDA on trial design; |

| ● | obtaining approval from one or more IRBs/ECs; |

| ● | IRBs/ECs refusing to approve, suspending or terminating the trial at an investigational site, precluding enrollment of additional subjects, or withdrawing their approval of the trial; |

| ● | changes to clinical trial protocol; |

| ● | clinical sites deviating from trial protocol or dropping out of a trial; |

| ● | failing to manufacture or obtain sufficient quantities of drug candidate, or, if applicable, combination therapies for use in clinical trials; |

| ● | patients failing to enroll or remain in our trial at the rate we expect, or failing to return for post-treatment follow-up; |

| ● | patients choosing an alternative treatment, or participating in competing clinical trials; |

| ● | lack of adequate funding to continue the clinical trial; |

| ● | patients experiencing severe or unexpected drug-related adverse effects; |

| ● | occurrence of serious adverse events in trials of the same class of agents conducted by other companies; |

| ● | selecting or being required to use clinical end points that require prolonged periods of clinical observation or analysis of the resulting data; |

| ● | a facility manufacturing our drug candidates, or any of their components, including without limitation, our own facilities being ordered by the FDA to temporarily or permanently shut down due to violations of cGMP, regulations or other applicable requirements, or infections or cross-contaminations in the manufacturing process; |

| ● | lack of stability of our clinical trial material or any quality issues that arise with the clinical trial material; |

| ● | any changes to our manufacturing process that may be necessary or desired; |

| ● | Our, or our third-party contractors, not performing data collection or analysis in a timely or accurate manner or improperly disclosing data prematurely or otherwise in violation of a clinical trial protocol; or |

| ● | any third-party contractors becoming debarred or suspended or otherwise penalized by the FDA or other government or regulatory authorities for violations of regulatory requirements, in which case we may need to find a substitute contractor, and we may not be able to use some or all of the data produced by such contractors in support of our marketing applications. |

| 16 |

We could also encounter delays if a clinical trial is suspended or terminated by us, by the IRBs/ECs of the institutions in which such trials are being conducted, by a Data Safety Monitoring Board for such trial or by the FDA. Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using the product under investigation, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial. In addition, changes in regulatory requirements and policies may occur, and we may need to amend clinical trial protocols to comply with these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs/ECs for reexamination, which may impact the costs, timing or successful completion of a clinical trial.

If we experience delays or difficulties enrolling patients in our ongoing or planned clinical trials, our receipt of necessary regulatory approval could be delayed or prevented.

We may not be able to initiate or continue our ongoing or planned clinical trials for our products if we are unable to identify and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA. In addition, some of our competitors may have ongoing clinical trials for products that would treat the same patients as QN-302, RAS or QN-247, and patients who would otherwise be eligible for our clinical trials may instead enroll in clinical trials of our competitors’ products. In addition, introduction of new drugs or devices to the marketplace may have an effect on the number of patients available or timing of the availability of the patients.

Our inability to enroll a sufficient number of patients for our clinical trials would result in significant delays or may require us to abandon one or more clinical trials altogether.

Adverse side effects or other safety risks associated with QN-302, RAS, and/or QN-247 product candidates could delay or preclude approval, cause us to suspend or discontinue any clinical trials or abandon further development, limit the commercial profile of an approved label, or result in significant negative consequences following regulatory approval, if any.

Results of our planned clinical trials could reveal a high and unacceptable severity and prevalence of side effects or unexpected characteristics. Undesirable side effects caused by our products could result in the delay, suspension or termination of clinical trials by us or the FDA for a number of reasons.

Moreover, if our products are associated with undesirable side effects in clinical trials or have characteristics that are unexpected, we may elect to abandon or limit their development to more narrow uses or subpopulations in which the undesirable side effects or other characteristics are less prevalent, less severe or more acceptable from a risk-benefit perspective, which may limit the commercial expectations for our products, if approved. We may also be required to modify our study plans based on findings in our clinical trials. Many drug candidates that initially showed promise in early stage testing have later been found to cause side effects that prevented further development. In addition, regulatory authorities may draw different conclusions or require additional testing to confirm these determinations.

It is possible that as we test our drug candidates in larger, longer and more extensive clinical trials, including with different dosing regimens, or as the use of our drug candidates becomes more widespread following any regulatory approval, illnesses, injuries, discomforts and other adverse events that were observed in earlier trials, as well as conditions that did not occur or went undetected in previous trials, will be reported by patients.

The development and commercialization of pharmaceutical and device products are subject to extensive regulation, and we may not obtain regulatory approvals for QN-302, RAS, QN-247 or any other product candidates, on a timely basis or at all.

The clinical development, manufacturing, labeling, packaging, storage, recordkeeping, advertising, promotion, export, import, marketing, distribution, adverse event reporting, including the submission of safety and other post-marketing information and reports, and other possible activities relating to QN-302, RAS and QN-247, as well as any other product candidate that we may develop in the future, are subject to extensive regulation.

Regulatory approval of drugs in the United States requires the submission of an NDA to the FDA and we are not permitted to market any pharmaceutical product candidate in the United States until we obtain approval from the FDA of the NDA for that product. An NDA must be supported by extensive clinical and preclinical data, as well as extensive information regarding pharmacology, chemistry, manufacturing and controls.

| 17 |