UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended

or

For the transition period from __________________________ to __________________________

Commission

file number

(Exact name of registrant as specified in its charter)

| State or other jurisdiction | (I.R.S. Employer | |

| of incorporation or organization | Identification No.) |

(Address of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller

reporting company |

| Emerging

growth company |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

The

registrant had shares of common stock outstanding as of March 9, 2021. The aggregate market value of the common

stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second

fiscal quarter (June 30, 2020) was $

ORGENESIS INC.

2020 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The following discussion should be read in conjunction with the financial statements and related notes contained elsewhere in this Annual Report on Form 10-K. Certain statements made in this discussion are “forward-looking statements” within the meaning of 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by the Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used herein, the words “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including the risks relating to the Company’s business, industry, and the Company’s operations and results of operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. The following discussion should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this report.

Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our,” the “Company,” “our Company” or “Orgenesis” refer to Orgenesis Inc., a Nevada corporation, and our majority or wholly-owned subsidiaries, Orgenesis Korea Co. Ltd. (the “Korean Subsidiary”), (formerly known as CureCell); Orgenesis Belgium SRL, a Belgian-based entity (the “Belgian Subsidiary”); Orgenesis Ltd., an Israeli corporation (the “Israeli Subsidiary”); Orgenesis Maryland Inc., a Maryland corporation (the “U.S. Subsidiary”); Orgenesis Switzerland Sarl, which was incorporated in October 2020 (the “Swiss Subsidiary”); Orgenesis Biotech Israel Ltd. (formerly known as Atvio Biotech Ltd.) (“OBI”); Koligo Therapeutics Inc., a Kentucky corporation, purchased in 2020 (“Koligo”); Masthercell Global Inc. (“Masthercell”) and its wholly owned subsidiaries Cell Therapy Holdings S.A., MaSTherCell, S.A. (“MaSTherCell”), a Belgian-based subsidiary and a Contract Development and Manufacturing Organization (“CDMO”) specialized in cell therapy development and manufacturing for advanced medicinal products, and Masthercell U.S., LLC (“Masthercell U.S.”), a U.S.-based CDMO (collectively, “Masthercell”). The Company sold all of its equity interests in Masthercell and its subsidiaries on February 20, 2020.

| 3 |

Forward-looking statements made in this Annual Report on Form 10-K include statements about:

Corporate and Financial

| ● | our ability to increase revenues; |

| ● | our ability to achieve profitability; |

| ● | our ability to manage our research and development programs that are based on novel technologies; |

| ● | our ability to grow the size and capabilities of our organization through further collaboration and strategic alliances to expand our point-of-care cell therapy business; |

| ● | our ability to control key elements relating to the development and commercialization of therapeutic product candidates with third parties; |

| ● | our ability to manage potential disruptions as a result of the coronavirus outbreak; |

| ● | our ability to manage the growth of our company; |

| ● | our ability to attract and retain key scientific or management personnel and to expand our management team; |

| ● | the accuracy of estimates regarding expenses, future revenue, capital requirements, profitability, and needs for additional financing; and |

| ● | our belief that our therapeutic related developments have competitive advantages and can compete favorably and profitably in the cell and gene therapy industry. |

Cell & Gene Therapy Business (“CGT”)

| ● | our ability to adequately fund and scale our various collaboration, license, partnership and joint venture agreements for the development of therapeutic products and technologies; |

| ● | our ability to advance our therapeutic collaborations in terms of industrial development, clinical development, regulatory challenges, commercial partners and manufacturing availability; |

| ● | our ability to implement our point-of-care cell therapy (“POC”) strategy in order to further develop and advance autologous therapies to reach patients; |

| ● | expectations regarding our ability to obtain additional and maintain existing intellectual property protection for our technologies and therapies; |

| ● | our ability to commercialize products in light of the intellectual property rights of others; |

| ● | our ability to obtain funding necessary to start and complete such clinical trials; |

| ● | our ability to further our CGT development projects, either directly or through our JV partner agreements, and to fulfill our obligations under such agreements; |

| ● | our belief that our systems and therapies are as at least as safe and as effective as other options; |

| ● | our Subsidiary’s relationship with Tel Hashomer Medical Research Infrastructure and Services Ltd. (“THM”) and the risk that THM may cancel or, at the very least continue to challenge, the License Agreement with Orgenesis Ltd. as we continue to expand our focus to other therapies; |

| ● | our license agreements with other institutions; |

| ● | expenditures not resulting in commercially successful products; |

| ● | our dependence on the financial results of our POC business; and |

| ● | our ability to grow our POC business and to develop additional joint venture relationships in order to produce demonstrable revenues. |

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” set forth in this Annual Report on Form 10-K for the year ended December 31, 2020, any of which may cause our Company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks may cause the Company’s or its industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. The Company is under no duty to update any forward-looking statements after the date of this report to conform these statements to actual results.

| 4 |

PART I

ITEM 1. BUSINESS

Business Overview

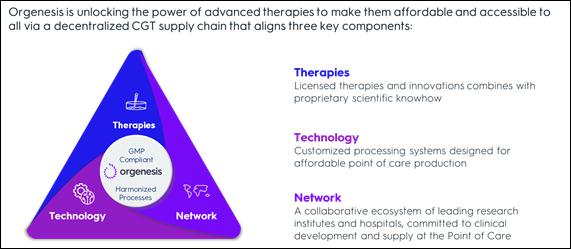

Orgenesis Inc., a Nevada corporation, is a global biotech company working to unlock the potential of cell and gene therapies in an affordable and accessible format (“CGTs”).

CGTs can be centered on autologous (using the patient’s own cells) or allogenic (using master banked donor cells) and are part of a class of medicines referred to as advanced therapy medicinal products (ATMPs). We mostly focus on autologous therapies, with processes and systems that are developed for each therapy using a closed and automated processing system approach that is validated for compliant production near the patient at their point of care for treatment of the patient. This approach has the potential to overcome the limitations of traditional commercial manufacturing methods that do not translate well to commercial production of advanced therapies due to their cost prohibitive nature and complex logistics to deliver the treatments to patients (ultimately limiting the number of patients that can have access to, or can afford, these therapies).

To achieve these goals, we have developed a Point of Care Platform comprised of three enabling components: a pipeline of licensed POCare Therapies that are designed to be processed and produced in closed, automated POCare Technology systems across a collaborative POCare Network. Via a combination of science, technology, engineering, and networking, we are working to provide a more efficient and scalable pathway for advanced therapies to reach patients more rapidly at lowered costs. We also draw on extensive medical expertise to identify promising new autologous therapies to leverage within the POCare Platform either via ownership or licensing.

The POCare Network brings together patients, doctors, industry partners, research institutes and hospitals worldwide with a goal of achieving harmonized, regulated clinical development and production of the therapies.

POCare Platform Operations via Subsidiaries

We currently conduct our core business operations ourselves and through our subsidiaries which are all wholly-owned except as otherwise stated below (collectively, the “Subsidiaries”). The Subsidiaries are as follows:

United States

| ● | Orgenesis Maryland Inc. (the “U.S. Subsidiary”) is the center of activity in North America and is currently focused on setting up the POCare Network. |

| ● | Koligo Therapeutics Inc. (“Koligo”) is a Kentucky corporation that we acquired in 2020 and is currently focused on developing the POCare network and therapies. . |

| 5 |

Europe

| ● | Orgenesis Belgium SRL (the “Belgian Subsidiary”) is the center of activity in Europe and is currently focused on process development and the preparation of European clinical trials. |

| ● | Orgenesis Switzerland Sarl (the “Swiss Subsidiary”), was incorporated in October 2020, and is currently focused on providing management services to us. |

Asia

| ● | Orgenesis Ltd. in Israel (the “Israeli Subsidiary”) is a provider of regulatory, clinical and pre-clinical services. |

| ● | Orgenesis Biotech Israel Ltd. (“OBI”), is a provider of cell-processing services in Israel. |

| ● | Korea: Orgenesis Korea Co. Ltd. (the “Korean Subsidiary”), is a provider of processing and pre-clinical services in Korea. We own 94.12% of the Korean Subsidiary. |

Discontinued Operations

Until December 31, 2019, we operated the POCare Platform as one of two business separate business segments.

Historically, the second separate business segment was operated as a Contract Development and Manufacturing Organization (“CDMO”) platform, providing contract manufacturing and development services for biopharmaceutical companies (the “CDMO Business”). The CDMO platform was historically operated mainly through majority owned Masthercell Global (which consisted of the following two subsidiaries: MaSTherCell S.A. in Belgium (“MaSTherCell”), and Masthercell U.S., LLC in the United States (“Masthercell U.S.”) (collectively, the “Masthercell Global Subsidiaries”)).

In February 2020, we and GPP-II Masthercell LLC (“GPP”) sold 100% of the outstanding equity interests of Masthercell (the “Masthercell Business”), which comprised the majority of our CDMO Business, to Catalent Pharma Solutions, Inc. for an aggregate nominal purchase price of $315 million, subject to customary adjustments (the “Masthercell Sale”). After accounting for GPP’s liquidation preference and equity stake in Masthercell as well as other investor interests in our Belgian subsidiary MaSTherCell, distributions to Masthercell option holders and transaction costs, we received approximately $126.7 million. We incurred an additional approximately $5.6 million in transaction costs.

We determined that the Masthercell Business (“Discontinued Operation”) meets the criteria to be classified as a discontinued operation as of the first quarter of 2020. The Discontinued Operation includes the vast majority of the previous CDMO Business, including majority-owned Masthercell, including MaSTherCell, Masthercell U.S. and all of the Masthercell Global Subsidiaries.

Since the Masthercell Sale, we entered into new joint venture agreements with new partners in various jurisdictions. This has allowed us to grow our infrastructure and expand our processing sites into new markets and jurisdictions. In addition, we have engaged some of these joint venture partners to perform research and development services to further develop and adapt our systems and devices for specific purposes. We have been investing manpower and financial resources to focus on developing, manufacturing and rolling out several types of OMPULs to be used and/or distributed through our POCare Network of partners, collaborators, and joint ventures.

The Chief Executive Officer (“CEO”) is the Company’s chief operating decision-maker who reviews financial information prepared on a consolidated basis. Effective from the first quarter of 2020, all of our continuing operations are in the point-of-care business via our POCare Platform. Therefore, no segment report has been presented.

| 6 |

Advanced Therapy Medicinal Products (ATMPs) Overview

Advanced Therapy Medicinal Product (“ATMP”) means one of any of the following medicinal products that are developed and commercialized for human use:

| ● | A somatic cell therapy medicinal product (“STMP”) that contains cells or tissues that have been manipulated to change their biological characteristics or cells or tissues not intended to be used for the same essential functions in the body. |

| ● | A tissue engineered product (“TEP”) that contains cells or tissues that have been modified so that they can be used to repair, regenerate, or replace human tissue. |

| ● | A gene therapy medicinal product (“GTMP”) that engineers genes that lead to a therapeutic, prophylactic, or diagnostic effect and, in many cases, work by inserting “recombinant” genes into the body, usually to treat a variety of diseases, including genetic disorders, cancer, or long-term diseases. In this case, a recombinant gene is a stretch of DNA that is created in the laboratory, bringing together DNA from different sources. |

It is important to note that although STMPs and GTMPs currently dominate the market, in order to access the market potential and trends in the future, other cell products are likely to be essential in all of these categories.

We believe that autologous therapies represent a substantial segment of the ATMP market. Autologous therapies are produced from a patient’s own cells versus allogeneic therapies that are mass-cultivated from donor cells via the construction of master and working cell banks, are then produced on a large scale. Developers and manufacturers of ATMPs (both autologous and allogeneic) currently rely heavily on production using traditional centralized supply chains and manufacturing sites.

CGTs are costly and complex to produce. We also refer to CGTs as “living” drugs since they are based on maintaining the cells vitality. Therefore, there is no possibility to sterilize the products, since such a process involves killing any living organism. Many of these therapies require sourcing of the patient’s cells, engineering them in a sterile environment and then transplanting them back to the patient (so-called “autologous” CGT). This presents multiple logistic challenges as each patient requires its own production batch, and the current processes involve complex laboratory-based types of manipulations requiring highly trained lab technicians. We are leveraging a unique approach to therapy production using the POCare Platform to potentially overcome some of the development and supply chain challenges of affordably bringing autologous therapies to patients.

Allogeneic therapies are costly and complex to produce because autologous therapies are derived from the treated patient and manufactured through a defined protocol before re-administration. We are leveraging a unique approach to therapy production using the POCare Platform to potentially overcome some of the development and supply chain challenges of bringing autologous therapies to patients affordably.

Our Therapies

Products in Clinical Use

KYSLECEL® (autologous Pancreatic Islets)

KYSLECEL is made from a patient’s own pancreatic islets – the cells that make insulin to regulate blood sugar. KYSLECEL is intended to preserve insulin secretory capacity in chronic or acute recurrent pancreatitis patients after total pancreatectomy (TP-IAT). KYSLECEL is a minimally manipulated autologous cell-based product available in the United States and regulated by the Food and Drug Administration (“FDA”). KYSLECEL is produced according to current good tissue practices (cGTP) and in compliance with federal and state regulations. Prior to being acquired by us, Koligo treated approximately 40 patients with KYSLECEL at six U.S. hospitals through a commercial pilot program.

Tissue Genesis Icellator® for Cell Assisted Lipotransfer

The Tissue Genesis Icellator is a point-of-care medical device that isolates stromal and vascular fraction cells (“SVF”) from a patient’s own (autologous) adipose tissue (fat). The Icellator is commercially available in Korea through a medical device distributor. The SVF obtained from the Icellator is for use in cell-assisted lipotransfer, a plastic surgery procedure intended to improve fat engraftments.

| 7 |

It is expected that the Icellator may also become commercially available in Japan in 2021 for use in cell assisted lipotransfer, pending review and approval by the Japanese Pharmaceuticals and Medical Devices Agency.

Cartil-S Autologous Products for the Treatment of Osteoarthritis

Cartil-S is a cell therapy for Osteoarthritis. This product is produced by performing a minimally invasive biopsy of adipose (fat) tissue from a patient, followed by isolation and expansion of adipose-derived stem cells (ADSCs), to be injected arthroscopically. The autologous injectable product helps delay/stop the progression of osteoarthritis, involving the patient’s own stem cells.

Chondroseal Autologous Products for the Treatment of Cartilage Defects (Osteoarthritis)

Chondroseal is a cell therapy for cartilage defects. Following collection of adipose tissue by minimally invasive biopsy that is composed of ADSCs, the cells are combined with a natural gel serving as a scaffold for local cartilage regeneration in the joint.

Products in Clinical Development

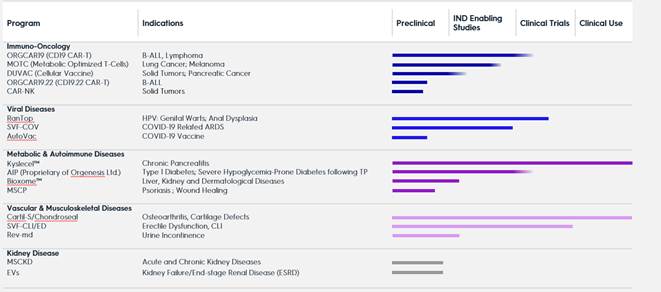

The following chart depicts our therapeutic development pipeline.

Products in Clinical Trials

RanTop, Ranpirnase Topical Formulation

We are currently developing a novel topical formulation of an active RNA-degrading enzyme, called Ranpirnase. Ranpirnase combats viral infections by targeting double-stranded RNA including miRNA precursors, via RNA degradation catalysis. It acts through a dual mechanism: 1) Inhibition of viral replication; and 2) induction of host cell apoptosis. Ranpirnase was previously developed for the treatment of human papillomavirus (HPV)-related pathologies such as external genital warts (EGW) and anal dysplasia. It has demonstrated clinical efficacy and good tolerability in a Phase IIa clinical study for the treatment of HPV-associated EGW. The initiation of a clinical Phase IIb for EGW is planned for 2021.

Tissue Geneseis Icellator® for Erectile Dysfunction and COVID-19 (SVF-CLI-ED)

| 8 |

The safety of the Tissue Genesis Icellator, and use of SVF produced by the Icellator, has previously been tested in a number of pilot clinical trials in the United States. Orgenesis has prioritized the clinical development of the Icellator for potential use in the treatment of erectile dysfunction and COVID-19 related respiratory complications. Pending review and approval of the FDA of the clinical trials, we expect to start a phase 2 trial in erectile dysfunction and a phase 1 trial for COVID -19 in 2021.

The Tissue Genesis Icellator is also being used by research collaborators in FDA-regulated clinical trials to test the use of SVF during rotator cuff surgery. These trials are investigator sponsored initiatives that Orgenesis will continue to support.

Products in IND Enabling Studies

We are engaged in the following IND-enabling studies:

Generation of Autologous Insulin-Producing Cells (AIPs) from Adult Liver Cells (“Trans-differentiation technology”)

Orgenesis Ltd. has trans-differentiation in-vitro technology that has demonstrated in animal models the capacity to induce a shift in the developmental fate of cells from the liver or other tissues, transdifferentiating them into “pancreatic beta cell-like” AIP cells for patients with Type 1 Diabetes (“T1D”), acute pancreatitis and other insulin deficient diseases. For the treatment of diabetes, cells are derived from the liver or other adult tissue and are trans-differentiated to become AIP cells. This technology, which has yet to be proven in human clinical trials, has shown in relevant animal models that the human derived AIP cells produce insulin in a glucose-sensitive manner. No adverse effects were observed in any of the animal studies. This trans-differentiation technology is licensed by the Israeli Subsidiary and is based on the work of Prof. Sarah Ferber, a researcher at Tel Hashomer Medical Research Infrastructure and Services Ltd. (“THM”) in Israel. The development plan calls for conducting additional pre-clinical safety and efficacy studies with respect to diabetes and other potential indications prior to initiating human clinical trials.

With respect to the trans-differentiation technology, we have exclusive rights to seven (7) United States and twelve (12) foreign issued patents, five (5) pending patent applications in the United States, twenty four (24) pending patent applications in foreign jurisdictions, including, Australia, Brazil, Canada, China, Europe, India, Israel, Panama, South Korea, and Singapore. These patents and patent applications relate, among others, to the trans-differentiation of cells (including hepatic cells) to cells having pancreatic β-cell-like phenotype and function and to their use in the treatment of degenerative pancreatic disorders, including diabetes, pancreatic cancer and pancreatitis.

On June 11, 2019, the FDA granted Orphan Drug Designation for our AIP cells as a cell replacement therapy for the treatment of severe hypoglycemia-prone diabetes resulting from total pancreatectomy (“TP”) due to chronic pancreatitis. The incidence of diabetes following TP is 100%, resulting in immediate and lifelong insulin-dependence with the loss of both endogenous insulin secretion and that of the counter-regulatory hormone, glucagon. Glycemic control after TP is notoriously difficult with conventional insulin therapy due to complete insulin dependence and loss of glucagon-dependent counter-regulation. Patients with this condition experience both severe hyperglycemic and hypoglycemic episodes.

On April 29, 2019, we received Institutional Review Board (“IRB”) approval to collect liver biopsies from patients at Rambam Medical Center located in Haifa, Israel for a planned study to confirm the suitability of liver cells for personalized cell replacement therapy for patients with insulin-dependent diabetes resulting from total or partial pancreatectomy. The first patients were enrolled during 2020. The goal of the proposed study, entitled “Collection of Human Liver Biopsy and Whole Blood Samples from Type 1 Diabetes Mellitus (T1DM), Total or Partial Pancreatectomy Patients for Potential use as an Autologous Source for Insulin Producing Cells in Future Clinical Studies,” is to confirm the suitability of the liver cells for personalized cell replacement therapy, as well as eligibility of patients to participate in a future clinical study, as defined by successful AIP cell production from their own liver biopsy. The secondary objective of the study is to evaluate patients’ immune response to AIPs based on the patient’s blood samples and followed by subcutaneous implantation into the patients’ arm which would represent the first human trial.

| 9 |

The trans-differentiation technology is from a licensing agreement entered into as of February 2, 2012 by the Israeli Subsidiary and THM pursuant to which the Israeli Subsidiary, Orgenesis Ltd, was granted a worldwide royalty bearing and exclusive license (the “THM License Agreement”). By using therapeutic agents that efficiently convert a sub-population of liver cells into pancreatic islets phenotype and function, this approach allows the diabetic patient to be the donor of his own therapeutic tissue. While we believe that this provides a major competitive advantage to the cell transformation technology of the Israeli Subsidiary, we also believe that our expanded focus to other therapies and business activities may continue to prompt THM to inquire of such activities as they may relate to our compliance with the terms or direction in regards to the THM License Agreement. While we have not received any notice of cancellation of the THM License Agreement, we have received an allegation regarding the scope of the rights by THM that may present future challenges for our Israeli Subsidiary to continue to develop, manufacture, sell and market the products pursuant to the milestones and time schedule specified in the development plan of the THM License Agreement.

ORG-CAR19, Autologous CD-19 CAR-T

Chimeric antigen receptor T cells (also known as CAR-T cells) are T cells that have been genetically engineered to produce an artificial T-cell receptor for use in immunotherapy. CAR-T cell therapy uses T cells engineered with CARs for cancer therapy. The premise of CAR-T immunotherapy is to modify T cells to recognize cancer cells in order to more effectively target and destroy them. Physicians harvest T cells from patients, genetically alter them, then infuse the resulting CAR-T cells into patients to attack their tumors. CAR-T cells can be either derived from T cells in a patient’s own blood (autologous) or derived from the T cells of another healthy donor (allogeneic). Once isolated from a person, these T cells are genetically engineered to express a specific CAR, which programs them to target an antigen that is present on the surface of tumors. After CAR-T cells are infused into a patient, they act as a “living drug” against cancer cells. When they come in contact with their targeted antigen on a cell, CAR-T cells bind to it and become activated, then proceed to proliferate and become cytotoxic.

We are developing a new and advanced anti-CD19 CAR-T therapy for treating B-cell Acute lymphoblastic leukemia (B-ALL) and lymphoma patients, based on a clinically used CAR-T therapy licensed from Kecellitics Biotech. B-ALL is driven by malignant B-cell, expressing the B-cell surface protein, CD19. Orgenesis is also working on combining the CD19 with CD22 CAR on a single, bi-specific CD19/22 CAR-T that can target both antigens simultaneously for the treatment of blood cancers.

Dual Cellular vaccine (DUVAC), Therapy for Pancreatic Cancer

The DUVAC cell-based immunotherapy, licensed from Columbia University, is based on autologous dendritic cells and macrophages. These cells are key coordinators of the innate and adaptive immune system and have critical roles in the induction of antitumor immunity. The cells are exposed to whole cancer cells constitute the most comprehensive source of cancer antigens and by so boosting the patient immune system and direct it against the tumor. The DUVAC vaccine can be a developed for a wide range of solid tumor, but our initial focus is on pancreatic cancer.

Metabolically Optimized T-Cells (MOTC): Therapy for melanoma and lung cancer

In the early stages of cancer, some lymphocytes successfully attack and infiltrate the tumor microenvironment, surround the tumor cells, and mount an anti-tumor response. TIL therapy is a clinically validated personalized cancer treatment based on infusion of autologous TILs expanded ex vivo from tumors. Once expanded, the TILs are infused back into the patient where they attack the cancer cells with a high degree of specificity. Orgenesis is developing an advanced cellular biomanufacturing platform integrated with metabolic control. The expanded TILs possess an optimized metabolic state referred to as MOTC (Metabolically Optimized T-Cells), which can potentially lead to a more robust therapeutic response, especially for solid tumors such as lung cancer and melanoma.

| 10 |

Products in Pre-Clinical Studies

CAR-NK, Therapy for Solid Tumors

We have licensed from Caerus Therapeutics (a related party) a unique CAR platform that contains additional immunological effectors that aim to address significant challenges emerged in the development process of CAR technologies such as: safety, viability, immunosuppression by tumor microenvironment and dense desmoplastic stroma. Orgenesis aims target this CAR platform Natural Killer Cells (CAR-NK) platform for the treatment of solid tumors.

Autologous Cell-Based Vaccine for protecting against SARS-CoV-2

We are working on developing a cell-based vaccine platform for the prevention of viral diseases. The initial target for the platform is SARS-CoV-2 (severe acute respiratory syndrome coronavirus 2, the causative agent of COVID-19). This cell-based vaccine platform utilizes an autologous approach. The goal is to enable the COVID-19 engineered cells will have the ability to activate an endogenous immune response and induce the production of neutralizing antibodies as well as cellular response.

Bioxomes

Exosomes are small, membrane-enclosed extracellular vesicles implicated in cell-to-cell communication. Exosomes may serve as a valuable therapeutic modality because of their ability to transfer a wide variety of therapeutic payloads among cells that can influence a cell in multiple ways, and they can be designed to reach specific cell types. We are developing a proprietary manufacturing process for exosome like structures, termed Bioxomes. Bioxomes can carry specific therapeutic cargo into target cells. Orgenesis is developing this platform technology to treat liver fibrosis, dermatology, and other indications.

MSCP

Orgenesis is developing a personalized cell-based therapy product for wound healing and psoriasis. The product is based on Adipose-Derived Stem Cells (ADSCs). Following expansion, the ADSCs are formulated with Topiramate, a well-known substrate used in other indications, and a commercially available hyaluronic acid (HA), a well-known dermal filler, for topical treatment.

Muscle-derived Mesenchymal Stem Cells for Human Regenerative Medicine

An innovative and patented technology licensed by Revatis that enables the isolation of pluripotent adult Mesenchymal Stem Cells (MSCs) from a minimally invasive muscle micro-biopsy. The isolated autologously undifferentiated muscle-derived MSCs are developed to explore autologous therapeutics fields in humans such as Urine Incontinence

Kidney Disease

We are also developing multiple Proprietary cell and cell derived products therapies for treating kidney failure and End-Stage Renal Disease (ESRD).

KT-DM-103 and KT-CP-203 (3D-Printed Pancreatic Islets)

Koligo had exclusively licensed patents and technology from the University of Louisville Research Foundation related to the revascularization and 3D printing of cell and tissue for transplant (“3D-V” technology platform). Orgenesis is developing this technology for potential autologous and allogeneic pancreatic islet transplant to treat type 1 diabetes (KT-DM-103) and chronic pancreatitis (KT-CP-203). The 3D-V technology platform may also support improved transplantation of other cell and tissue types in additional to pancreatic islets.

| 11 |

POCare Platform Strategy

Our aim is to provide a pathway to bring ATMPs in the cell and gene therapy industry from research to patients worldwide through our POCare Platform. We define point of care as a process of collecting, processing, and administering cells within the patient care environment, namely through academic partnerships in a hospital setting. We believe that this approach is an attractive proposition for personalized medicine because of our strategic partnerships with suppliers that help us to customize closed systems into effective mobile clean room facilities. This will potentially help to minimize or eliminate the need for cell transportation, which is a high-risk and costly aspect of the supply chain.

We aim to build value in various aspects of our company ranging from supply related processes including development and distribution systems, clinical and regulatory services, engineering and devices such as OMPULs discussed below, delivery systems, therapies including immuno-oncology, anti-aging, anti-viral, metabolic, nephrology, dermatology, orthopedic, as well as regenerative technologies.

Over time, we have worked to develop and validate POCare Technologies that can be combined within mobile production units for advanced therapies. In 2020, we made significant investments in the development of several types of Orgenesis Mobile Processing Units and Labs (OMPULs) with the expectation of use and/or distribution through our POCare Network of partners, collaborators, and joint ventures.

In 2020 we made significant investments in the development of several types of OMPULs and have made significant progress in the validation, risk analysis, regulatory and other related tasks relating to the OMPULS. We anticipate distributing and using the OMPULS through our POCare Network of partners, collaborators, and joint ventures. OMPULs are designed for the purpose of validation, development, performance of clinical trials, manufacturing and/or processing of potential or approved cell and gene therapy products in a safe, reliable, and cost-effective manner at the point of care, as well as the manufacturing of such CGTs in a consistent and standardized manner in all locations. The design delivers a potential industrial solution for us to deliver CGTs to most clinical institutions at the point of care.

*For illustrative purposes only

Currently, we are finalizing the development over 30 OMPUL-based POC processing locations worldwide and, with the assistance of our partners, we are adapting the local requirements of each partner with the target of achieving a capacity to process and supply CGTs to as many as 2,000 patients annually. The responsibility for setting up the OMPULS falls on the joint venture partners, who are also responsible for marketing and distribution worldwide. As we expand operations, the OMPUL setup cost is expected to decline proportionately. Most of our POC revenue to date is in support of the implementation of our technologies and therapies in our partners’ POC activities, which will be the basis for future royalties and supply revenues.

We have embarked on a strategy of collaborative arrangements with strategically situated regional joint venture partners around the world. We believe that these parties have the expertise, experience and strategic location to advance our POCare Platform.

| 12 |

Strategic CGT Therapeutics Collaborations

Collaborations, partnerships, joint ventures and license agreements are a key component of our POC strategy.

Our POC technology collaborators and partners include Mircod, , Cure Therapeutics, Columbia University in the City of New York, Caerus Therapeutics Corporation, Sescom Ltd., UC Davis, SBH Sciences, Inc., The Johns Hopkins University and others.

In addition, we have collaborations and joint ventures for setting up POCare Platform operations facilities in jurisdictions throughout the world, including various countries in North America, Europe, Latin America, Asia, the Middle East, and Australia.

For more information, see Note 11, “Collaboration and Licensing Agreements” of the “Notes to the Financial Statements” included in Item 8.

CDMO Business

Regarding the Masthercell Sale, see Note 3 to Item 8 of this Annual Report.

Current Development Facilities

OBI

OBI is a specialized process and technology development wholly owned subsidiary focused on custom-made process development, upscaling design from lab to industry innovation and automation procedures, which are extremely essential in the cell therapy industry. OBI is located in Bar-Lev Industrial Park utilizing the exclusive Israeli innovative ecosystem and highly experienced and talented associates including Ph.D. holders and biotechnology engineers. The center provides end to end solutions to cell therapy industrialization, process development capabilities and proficiency, custom-made engineering and a unique platform for creative design and process optimization. OBI occupies 1300 square meters of labs and offices resulting in an efficient and unique environment for cell therapy development. In connection with the Masthercell Sale, for a period of 3 years in the European Union and five years in the United States and the rest of the world from the closing date of the Masthercell Sale, we agreed that OBI will not manufacture products on a contract basis for third-party customers in any jurisdiction other than the State of Israel, but it may conduct such CDMO business in the State of Israel, solely for customers located within the State of Israel or with respect to therapies intended for distribution solely within the State of Israel.

The Korean Subsidiary

The Korean Subsidiary has a particular focus on developing innovative cell therapies. Together, with promising in-house research programs, the technologies are currently under development for the rapidly growing Korean market offering the most favorable environment for the cell therapy industry in the world. Through close collaboration with leading medical and academic facilities, the Korean Subsidiary is accelerating the development of foreign technologies in Korea. In connection with the Masthercell Sale, for a period of 3 years in the European Union and five years in the United States and the rest of the world from the closing date of the Masthercell Sale, we agreed that the Korean Subsidiary will not manufacture cell and gene products on a contract basis for third-party customers in any jurisdiction other than South Korea, but it may conduct CDMO business in South Korea, solely for customers located within South Korea and with respect to therapies intended for distribution solely within South Korea.

Koligo

Koligo maintains commercial production facilities for KYSLECEL at an FDA-registered establishment in Indiana. The Tissue Genesis Icellators, and associated reagents and kits, are made by contract manufacturers and warehoused at our facility in Texas. Koligo also maintains development labs at the Indiana and Texas locations to support continued development.

| 13 |

The Belgian subsidiary

The Belgian subsidiary specializes in developing and validating proprietary and licensed advanced cell and gene therapies. The subsidiary benefits both from its central position in Europe and its being in the leading Walloon biotech cluster. Located near Namur, at Novalis Science Park, the Belgian subsidiary collaborates with leading medical and academic facilities which enables it to cover the drug product life cycle from research to clinical stage through pre-clinical and quality control. It occupies innovative facilities for the development and quality control of therapies in R&D and GMP grades.

Its talented and highly experienced staff and collaborators, including Ph.D. holders, quality assurance experts and biotechnology manufacturing engineers, contribute to the POCare platform development and roll-out. The subsidiary provides quality assurance and supply activities for the global POCare network. It has developed smart and agile methodologies to ensure compliant and harmonized decentralization operations at POCare.

Notable 2020 Activities

On April 7, 2020, we entered into an Asset Purchase Agreement (the “Tamir Purchase Agreement”) with Tamir Biotechnology, Inc. (“Tamir” or “Seller”), pursuant to which we agreed to acquire certain assets and liabilities of Tamir related to the discovery, development and testing of therapeutic products for the treatment of diseases and conditions in humans, including all rights to ranpirnase and use for antiviral therapy (collectively, the “Purchased Assets and Assumed Liabilities” and such acquisition, the “Tamir Transaction”). The Tamir Transaction closed on April 23, 2020. We paid $2.5 million in cash and issued an aggregate of 3,400,000 shares (the “Shares”) of our common stock to Tamir resulting in a total consideration of $20.2 million. In November 2020, we filed a registration statement on Form S-3 to register the resale of the Shares as required by the Tamir Purchase Agreement.

On September 26, 2020, we entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with Orgenesis Merger Sub, Inc., a Delaware corporation and our wholly-owned subsidiary (“Merger Sub”), Koligo Therapeutics Inc., a Kentucky corporation (“Koligo”), the shareholders of Koligo (collectively, the “Shareholders”) and Long Hill Capital V, LLC, solely in its capacity as the representative, agent and attorney-in-fact of the Shareholders. The Merger Agreement provided for the acquisition of Koligo by us through the merger of Merger Sub with and into Koligo, with Koligo surviving as our wholly-owned subsidiary (the “Merger”). The Merger closed on October 15, 2020.

Koligo’s operations include (a) the manufacture and sale of KYSLECEL® (autologous pancreatic islets) for chronic and acute recurrent pancreatitis diseases in the United States; (b) development and commercialization of the Tissue Genesis Icellator® platform, a cell isolation system acquired by Koligo from Tissue Genesis, LLC prior to our acquisition of Koligo; and (c) preclinical development of the “3D-V” technology platform, a system exclusively licensed by Koligo from the University of Louisville Research Foundation intended for the revascularization and 3D printing of cell and tissue for transplant applications. Koligo maintains facilities in Indiana and Texas.

The Tissue Genesis assets acquired by Koligo included the entire inventory of Tissue Genesis Icellator® devices, related kits and reagents, a broad patent portfolio to protect the technology, registered trademarks, clinical data, and existing business relationships for commercial and development stage use of the Icellator technology

Pursuant to the terms of the Merger Agreement, an aggregate of 2,061,713 shares of our common stock were issued to Koligo’s Shareholders who were accredited investors (with certain Shareholders who were not accredited investors being paid solely in cash in the amount of approximately $20 thousand) in accordance with the terms of the Merger Agreement. In connection with the Merger, we assumed an aggregate of approximately $1.9 million of Koligo’s liabilities, which were substantially all of Koligo’s liabilities at the closing of the Merger. In addition, we issued 66,910 shares to Maxim Group LLC for advisory services in connection with the Merger. In November 2020, we filed a registration statement on Form S-3 to register the resale of 1,425,962 shares of our common stock as required by the Merger Agreement.

| 14 |

In addition, according to the agreement between the parties, we also funded an additional cash consideration of $500 thousand (with $100 thousand of such reducing the ultimate consideration payable to Koligo) for the acquisition of the assets of Tissue Genesis, LLC (“Tissue Genesis”) by Koligo that was consummated on October 14, 2020. The Tissue Genesis assets include the entire inventory of Tissue Genesis Icellator® devices, related kits and reagents, a broad patent portfolio to protect the technology, registered trademarks, clinical data, and existing business relationships for commercial and development stage use of the Icellator technology. The Icellator device is already commercially available in Korea and the Bahamas, and is expected to gain regulatory approval in Japan during the first quarter of 2021, subject to completion of manufacturing tests requested by the Japanese Pharmaceutics and Medical Devices Agency. Tissue Genesis already initiated U.S. FDA IDE Phase 1 pilot trials SVF cells in the treatment of erectile dysfunction, critical limb ischemia, tissue repair, and other therapeutic indications.

Revenue Model, Business Development and Licenses

The Orgenesis Point of Care (POCare) Platform is comprised of three enabling components: a multitude of licensed cell based POCare Therapeutics that are produced in closed, automated POCare Technology systems across a collaborative POCare Network. Our therapies include, but are not limited to, autologous, cell-based immunotherapies, therapeutics for metabolic diseases, anti-viral diseases, and tissue regeneration. We are establishing and positioning the business to bring point-of-care therapies to patients in a scalable way working directly with hospitals and through regional JV partners and JVs active in autologous cell therapy product development, including facilities in various countries in North America, Europe, Latin America, Asia, the Middle East, and Australia. The POCare Platform’s goal is to enable a rapid, globally harmonized pathway for these therapies to reach large numbers of patients at lowered costs through efficient, and decentralized production. The Network brings together industry partners, research institutes and hospitals worldwide to achieve harmonized, regulated clinical development and production of the therapies.

We are focused on technology in licensing and therapeutic collaborations, and we out license therapies marketing rights and manufacturing rights to partners and / or to the JVs. In many cases, the JVs are responsible for the preparation of clinical trials, local regulatory approvals and regional marketing activities. Such licensing includes exclusive or nonexclusive, sublicensable, royalty bearing rights and license to the Orgenesis Background IP as required solely to manufacture, distribute and market and sell Orgenesis Products within the relevant territories. In consideration of the rights and the licenses so granted, we receive a royalty in the range of ten percent of the net sales generated by the JV Entity and/or its sublicensees (as applicable) with respect to the Orgenesis Products.

In addition, in many cases, once the JV entities become profitable, we are entitled (in addition to any of its rights as holder of the JV Entity and prior to any other distributions of dividends by the JV Entity to shareholders of the JV Entity) and in addition to any royalties to which we may be entitled pursuant to a Orgenesis License Agreement, to receive from the JV entity royalties at a range of 10 to 15 percent of the JV entity’s audited US GAAP profit after tax.

Further to revenues generated from out licenses we generate revenues from POCare services and sales which is comprised of:

| ● | R&D services provided to out licensing partners |

The Company has signed POCare Master Services Agreements (“MSAs”) with its JV partners. In terms of the MSAs, we provide certain broadly defined development services that relate to our licensed therapies designed to develop or enhance the therapy with the objective of preparing it for clinical use. Such services, per therapy, include regulatory services, pre-clinical studies, intellectual property services, development services, and GMP process translation.

| ● | Hospital supply |

Hospital services includes the sale or lease of products and the performance of processing services to our POCare hospitals or other medical providers. We either work directly with hospitals or receive payments through our regional JV partnerships.

| 15 |

| ● | Cell process development revenue |

We provide cell process development services in some regions to third party customers. Those services are unique to the customers who retain the ownership of the intellectual property created through the process.

Our POCare therapy revenue is as follows:

| Year Ended December 31, | ||||||||

| Revenue stream: | 2020 | 2019 | ||||||

| (in thousands) | ||||||||

| POC and hospital services | $ | 6,068 | $ | 3,109 | ||||

| Cell process development services | 1,584 | 790 | ||||||

| Total | $ | 7,652 | $ | 3,899 | ||||

Cost of Research and Development and Research and Development Services

We incurred $83,986 and $14,014 thousand in cost of sales, research and development and research and development services in the fiscal years ended December 31, 2020 and December 31, 2019, respectively, of which $196 and $812 thousand was covered by grant funding. Part of the expense was funded by share issues. Our research and development scope was expanded to the evaluation and development of new cell therapies related technologies in the field of immuno-oncology, liver pathologies and tissue regeneration.

Competition in the Cell Therapy Field

The biopharmaceutical industry is intensely competitive. There is continuous demand for innovation and speed, and as the cell-based therapies market evolves, there is always the risk that a competitor may be able to develop other compounds or drugs that are able to achieve similar or better results for indications. Potential competition includes major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies, universities, and other research institutions. Many of these competitors have substantially greater financial, technical, and other resources, such as larger research and development staff and experienced marketing and manufacturing organizations with established sales forces. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies.

Currently, we are not aware of any other companies pursuing a business model similar to what we are developing under our POCare Platform. However, our competitors in the CGT field who are significantly larger and better capitalized than us could undertake strategies similar to what we are pursuing and even develop them at a much more rapid rate. These potential competitors include the same multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies, universities, and other research institutions that are operating in the CGT field. In that respect, smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies.

Intellectual Property

We will be able to protect our technology and products from unauthorized use by third parties only to the extent it is covered by valid and enforceable claims of our patents or is effectively maintained as trade secrets. Patents and other proprietary rights are thus an essential element of our business.

Our success will depend in part on our ability to obtain and maintain proprietary protection for our product candidates, technology, and know-how, to operate without infringing on the proprietary rights of others, and to prevent others from infringing our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing U.S. and foreign patent applications related to our proprietary technology, inventions, and improvements that are important to the development of our business. We also rely on trade secrets, know-how, continuing technological innovation, and in-licensing opportunities to develop and maintain our proprietary position.

| 16 |

In addition, we own or have exclusive rights to twenty eight (28) United States patents, thirty six (36) foreign-issued patents, twenty five (25) pending patent applications in the United States, forty five (45) pending patent applications in foreign jurisdictions, including Australia, Brazil, Canada, China, Europe, Hong Kong, India, Israel, Japan, Mexico, New Zealand, North Korea, Russia, Singapore, South Africa, and South Korea, and two (2) international Patent Cooperation Treaty (“PCT”) patent applications. These patents and patent applications relate, among others, to (1) dendritic and macrophages based vaccines, and their use for treating cancer and viral diseases; (2) compositions comprising ranpirnase and other ribonucleases for treating viral diseases; (3) tumor infiltrating lymphocytes (TILs) and their use for treating cancer; (4) compositions comprising immune cells, ribonucleases, or antibodies for treating COVID-19; (5) whole-cell antiviral vaccines; (6) therapeutic compositions comprising exosomes, bioxomes, and redoxomes; (7) bioreactors for cell cultureand automated devices for supporting cell therapies: and (8) scaffolds, including alginate and sulfated alginate scaffolds, polysaccharides thereof, and scaffolds for use for cell propagation, transplantations, and in the treatment of autoimmune diseases.

We have a pending U.S. patent applications directed, among others, to dendritic and macrophages based vaccines, and their use for treating cancer and viral diseases. If issued, this application would expire in 2038.

We have pending U.S. patent applications directed, among others, to compositions comprising ranpirnase and other ribonucleases for treating viral diseases. If issued, these applications would expire between 2039 and 2040. Counterpart patents applications were filed in Australia, Canada, China, Europe, Hong Kong, Japan, Mexico, New Zealand, North Korea, Russian Federation, Singapore, South Africa, and were also filed as International (“PCT”) applications. If issued, these applications would expire between 2035 and 2037. These expiration dates do not include any patent term extensions that might be available following the grant of marketing authorizations.

We have pending U.S. patent applications directed, among others, to therapeutic compositions comprising exosomes, bioxomes, and redoxomes. If issued, these applications would expire in 2040. Counterpart patents applications were filed in Australia, Brazil, Canada, China, Europe, India, Israel, India, Japan and South Korea. If issued, these applications would expire in 2039. These expiration dates do not include any patent term extensions that might be available following the grant of marketing authorizations.

We have pending U.S. patent applications directed, among others, to automated devices for supporting cell therapies. If issued, these applications would expire between 2035 and 2038.

We have a pending U.S. provisional patent application directed, among others, to tumor infiltrating lymphocytes (TILs) and their use for treating cancer. If converted into a non-provisional application and issued, this application would expire in 2041, without including any patent term extensions that might be available following the grant of marketing authorizations.

| 17 |

We have pending U.S. provisional patent applications directed, among others, to compositions comprising immune cells, ribonucleases, or antibodies for treating COVID-19. If converted into a non-provisional application and issued, this application would expire in 2041, without including any patent term extensions that might be available following the grant of marketing authorizations.

Granted U.S. patents, which are directed among others to scaffolds, including alginate and sulfated alginate scaffolds, polysaccharides thereof, and scaffolds for use for cell propagation, transplantations, and in the treatment of autoimmune diseases, will expire between 2025 and 2036. Counterpart patents granted in Australia, France, Germany, Israel, Switzerland, and the United Kingdom, will expire between 2026 and 2035. These expiration dates do not include any patent term extensions that might be available following the grant of marketing authorizations.

We have pending U.S. patent applications directed, among others, to bioconjugates comprising sulfated polysaccharides and diverse bioactive peptides, and their use in the treatment of inflammatory conditions. If issued, these applications would expire in 2038. Counterpart patents applications were filed in China, Europe, Israel, Japan, and South Korea. If issued, these applications would expire between 2026 and 2038. These expiration dates do not include any patent term extensions that might be available following the grant of marketing authorizations

Orgenesis Ltd, has exclusive rights to six (6) United States patents, fourteen (14) foreign-issued patents, five (5) pending patent applications in the United States, twenty six (26) pending patent applications in foreign jurisdictions, including Australia, Brazil, Canada, China, Europe, India, Israel, Japan, Mexico, Panama, Singapore, and South Korea. These patents and patent applications relate, among others, to the trans-differentiation of cells (including hepatic cells) to cells having pancreatic β-cell-like phenotype and function and to their use in the treatment of degenerative pancreatic disorders, including diabetes, pancreatic cancer and pancreatitis. Granted U.S. patents, which are directed among others to trans-differentiation to pancreatic β-cell-like phenotype and function cells and to their use in the treatment of degenerative pancreatic disorders, including diabetes, pancreatic cancer and pancreatitis, will expire between 2024 and 2035. Counterpart patents granted in Australia, France, Germany, Israel, Switzerland, and the United Kingdom, will expire between 2024 and 2035. These expiration dates do not include any patent term extensions that might be available following the grant of marketing authorizations.

Orgenesis Ltd, has pending U.S. patent applications directed, among others, to the trans-differentiation of cells, to cells having pancreatic β-cell-like phenotype and function and to their use in the treatment of degenerative pancreatic disorders, including diabetes, pancreatic cancer and pancreatitis. If issued, these applications would expire between 2038 and 2040. Counterpart patents applications were filed in Australia, Brazil, Canada, China, Europe, India, Israel, Mexico, Panama, Singapore, South Korea, and were also filed as International (“PCT”) applications. If issued, these applications would expire between 2034 and 2039. These expiration dates do not include any patent term extensions that might be available following the grant of marketing authorizations.

Government Regulation

Development Business

We are required to comply with the regulatory requirements of various local, state, national and international regulatory bodies having jurisdiction in the countries or localities where we manufacture products or where our customers’ products are distributed. In particular, we are subject to laws and regulations concerning research and development, testing, manufacturing processes, equipment and facilities, including compliance with cGMPs, labeling and distribution, import and export, facility registration or licensing, and product registration and listing. As a result, our facilities are subject to regulation in Israel and South Korea. We are also required to comply with environmental, health and safety laws and regulations, as discussed below. These regulatory requirements impact many aspects of our operations, including manufacturing, developing, labeling, packaging, storage, distribution, import and export and record keeping related to customers’ products. Noncompliance with any applicable regulatory requirements can result in government refusal to approve facilities for manufacturing products or products for commercialization.

Our customers’ products must undergo pre-clinical and clinical evaluations relating to product safety and efficacy before they are approved as commercial therapeutic products. The regulatory authorities that have jurisdiction in the countries in which our customers intend to market their products may delay or put on hold clinical trials, delay approval of a product or determine that the product is not approvable. The regulatory agencies can delay approval of a drug if our manufacturing facilities are not able to demonstrate compliance with cGTPs, pass other aspects of pre-approval inspections (i.e., compliance with filed submissions) or properly scale up to produce commercial supplies. The government authorities having jurisdiction in the countries in which our customers intend to market their products have the authority to withdraw product approval or suspend manufacture if there are significant problems with raw materials or supplies, quality control and assurance or the product is deemed adulterated or misbranded. In addition, if new legislation or regulations are enacted or existing legislation or regulations are amended or are interpreted or enforced differently, we may be required to obtain additional approvals or operate according to different manufacturing or operating standards or pay additional fees. This may require a change in our manufacturing techniques or additional capital investments in our facilities.

| 18 |

Certain products manufactured by us involve the use, storage and transportation of toxic and hazardous materials. Our operations are subject to extensive laws and regulations relating to the storage, handling, emission, transportation and discharge of materials into the environment and the maintenance of safe working conditions. We maintain environmental and industrial safety and health compliance programs and training at our facilities.

Prevailing legislation tends to hold companies primarily responsible for the proper disposal of their waste even after transfer to third party waste disposal facilities. Other future developments, such as increasingly strict environmental, health and safety laws and regulations, and enforcement policies, could result in substantial costs and liabilities to us and could subject the handling, manufacture, use, reuse or disposal of substances or pollutants at our facilities to more rigorous scrutiny than at present.

Our development operations involve the controlled use of hazardous materials and chemicals. Although we believe that our procedures for using, handling, storing and disposing of these materials comply with legally prescribed standards, we may incur significant additional costs to comply with applicable laws in the future. Also, even if we are in compliance with applicable laws, we cannot completely eliminate the risk of contamination or injury resulting from hazardous materials or chemicals. As a result of any such contamination or injury, we may incur liability or local, city, state or federal authorities may curtail the use of these materials and interrupt our business operations. In the event of an accident, we could be held liable for damages or penalized with fines, and the liability could exceed our resources. Compliance with applicable environmental laws and regulations is expensive, and current or future environmental regulations may impair our contract manufacturing operations, which could materially harm our business, financial condition and results of operations.

The costs associated with complying with the various applicable local, state, national and international regulations could be significant and the failure to comply with such legal requirements could have an adverse effect on our results of operations and financial condition. See “Risk Factors — Risks Related to Development and Regulatory Approval of Our Therapies and Product Candidates — Extensive industry regulation has had, and will continue to have, a significant impact on our business, especially our product development, manufacturing and distribution capabilities.” for additional discussion of the costs associated with complying with the various regulations.

POCare Therapies Portfolio

Our therapeutic portfolio pipeline is diverse and addresses various unmet clinical needs. It is predominantly comprised of novel autologous cell therapies, implying that patients receive cells that originate from their own body, virtually eliminating the risk of an immune response and rejection and thus easing various regulatory hurdles. In addition, by leveraging Orgenesis’ vast experience and proven track record in developing and optimizing cell processing, these selective therapies are adapted to be produced in closed, automated technology systems, reducing the need for high grade cleanroom environments. The systems enable each stage of the manufacturing process (cell sorting, expansion, genetic modifications, quality control) to be optimized in order to substantially reduce the cost burden for patients and making the therapies widely accessible. Notably, our therapeutic pipeline is developed by researchers from our network and are subsequently outlicensed and validated in multi-center clinical trials conducted across point of care partner sites leveraging the robustness of the Orgenesis network. Once approved these therapies are distributed to leading medical institutions globally within the our network and thus granting the inventors a royalty-based commercialization horizon.

Regulatory Process in the United States

Our potential product candidates are subject to regulation as a biological product under the Public Health Service Act and the Food, Drug and Cosmetic Act. The FDA generally requires the following steps for pre-market approval or licensure of a new biological product:

| ● | Pre-clinical laboratory and animal tests conducted in compliance with the Good Laboratory Practice, or GLP, requirements to assess a drug’s biological activity and to identify potential safety problems, and to characterize and document the product’s chemistry, manufacturing controls, formulation, and stability; |

| 19 |

| ● | Submission to the FDA of an Investigational New Drug, or IND, application, which must become effective before clinical testing in humans can start; |

| ● | Obtaining approval of Institutional Review Boards, or IRBs, of research institutions or other clinical sites to introduce a first human biologic drug candidate into humans in clinical trials; |

| ● | Conducting adequate and well-controlled human clinical trials to establish the safety and efficacy of the product for its intended indication conducted in compliance with Good Clinical Practice, or GCP, requirements; |

| ● | Compliance with current Good Manufacturing Practices (“cGMP”) regulations and standards; |

| ● | Submission to the FDA of a Biologics License Application (“BLA”) for marketing that includes adequate results of pre-clinical testing and clinical trials; |

| ● | The FDA reviews the marketing application in order to determine, among other things, whether the product is safe, effective and potent for its intended uses; and |

| ● | Obtaining FDA approval of the BLA, including inspection and approval of the product manufacturing facility as compliant with cGMP requirements, prior to any commercial sale or shipment of the pharmaceutical agent. The FDA may also require post marketing testing and surveillance of approved products or place other conditions on the approvals. |

Regulatory Process in Europe

The European Union (“EU”) has approved a regulation specific to cell and tissue therapy products, the Advanced Therapy Medicinal Product (“ATMP”) regulation. For products that are regulated as an ATMP, the EU directive requires:

| ● | Compliance with current cGMP regulations and standards, pre-clinical laboratory and animal testing; |

| ● | Filing a Clinical Trial Application (“CTA”) with the various member states or a centralized procedure; |

| ● | Voluntary Harmonization Procedure (“VHP”), a procedure which makes it possible to obtain a coordinated assessment of an application for a clinical trial that is to take place in several European countries; |

| ● | Obtaining approval of ethic committees of research institutions or other clinical sites to introduce the AIP into humans in clinical trials; |

| ● | Adequate and well-controlled clinical trials to establish the safety and efficacy of the product for its intended use; |

| ● | Submission to EMEA for a Marketing Authorization (“MA”); and |

| ● | Review and approval of the MAA (“Marketing Authorization Application”). |

As in the U.S., prior to the general regulatory process of a new biologic products, we will prosecute an Orphan Drug Designation for treatment of Patients with Established Diabetes Mellitus (“DM”) Induced by Total pancreatectomy. In the EU, in order to be qualified, the prevalence must be below 5 per 10,000 of the EU population, except where the expected return on investment is insufficient to justify the investment.

Authorized orphan medicines benefit from 10 years of protection from market competition with similar medicines with similar indications once they are approved. Companies applying for designated orphan medicines pay reduced fees for regulatory activities. This includes reduced fees for protocol assistance, marketing-authorization applications, inspections before authorization, applications for changes to marketing authorizations made after approval, and reduced annual fees.

Clinical Trials

Typically, both in the U.S. and the EU, clinical testing involves a three-phase process, although the phases may overlap. In Phase I, clinical trials are conducted with a small number of healthy volunteers or patients and are designed to provide information about product safety and to evaluate the pattern of drug distribution and metabolism within the body. In Phase II, clinical trials are conducted with groups of patients afflicted with a specific disease in order to determine preliminary efficacy, optimal dosages and expanded evidence of safety. In some cases, an initial trial is conducted in diseased patients to assess both preliminary efficacy and preliminary safety and patterns of drug metabolism and distribution, in which case it is referred to as a Phase I/II trial. Phase III clinical trials are generally large-scale, multi-center, comparative trials conducted with patients afflicted with a target disease in order to provide statistically valid proof of efficacy, as well as safety and potency. In some circumstances, the FDA or EMA may require Phase IV or post-marketing trials if it feels that additional information needs to be collected about the drug after it is on the market. During all phases of clinical development, regulatory agencies require extensive monitoring and auditing of all clinical activities, clinical data, as well as clinical trial investigators. An agency may, at its discretion, re-evaluate, alter, suspend, or terminate the testing based upon the data that have been accumulated to that point and its assessment of the risk/benefit ratio to the patient. Monitoring all aspects of the study to minimize risks is a continuing process. All adverse events must be reported to the FDA or EMA.

| 20 |

The FDA has granted Orphan Drug designation for our AIP cells as a cell replacement therapy for the treatment of severe hypoglycemia-prone diabetes resulting from TP due to chronic pancreatitis. The FDA’s Orphan Drug Designation Program provides orphan status to drugs and biologics which are defined as those intended for the safe and effective treatment, diagnosis or prevention of rare diseases/disorders that affect fewer than 200,000 people in the United States. Orphan designation qualifies the sponsor of the drug for various development incentives, including eligibility for seven years of market exclusivity upon regulatory approval, exemption from FDA application fees, tax credits for qualified clinical trials, and other potential assistance in the drug development process.

Employees

As of December 31, 2020, we had an aggregate of 111 employees working at our company and subsidiaries. In addition, we retain the services of outside consultants for various functions including clinical work, finance, accounting and business development services. Most of our senior management and professional employees have had prior experience in pharmaceutical or biotechnology companies. None of our employees are covered by collective bargaining agreements. We believe that we have good relations with our employees.

Corporate and Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports are available free of charge though our website (http://www.orgenesis.com) as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”). Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated by reference into this report or any other documents we file, with or furnish to, the SEC.

Our common stock is listed and traded on the Nasdaq Capital Market under the symbol “ORGS.”

As used in this Annual Report on Form 10-K and unless otherwise indicated, the term “Company” refers to Orgenesis Inc. and its Subsidiaries. Unless otherwise specified, all amounts are expressed in United States Dollars.

ITEM 1A. RISK FACTORS

Summary of Risk Factors