SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

SI-BONE, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

þ No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

INVITATION TO 2022 ANNUAL MEETING OF STOCKHOLDERS

DATE: Thursday, June 16, 2022

TIME: 8:00 a.m., local time

April 22, 2022

Dear Stockholders:

Please join me at the Annual Meeting of Stockholders of SI-BONE, Inc. on June 16, 2022. This year, we will be conducting a virtual annual meeting due to the continuing public health impact of coronavirus disease (COVID-19). You will not be able to attend the meeting in person, but we do encourage our stockholders participate in our annual meeting online by way of our live webcast as outlined in this proxy statement. At the annual meeting, we will ask you to:

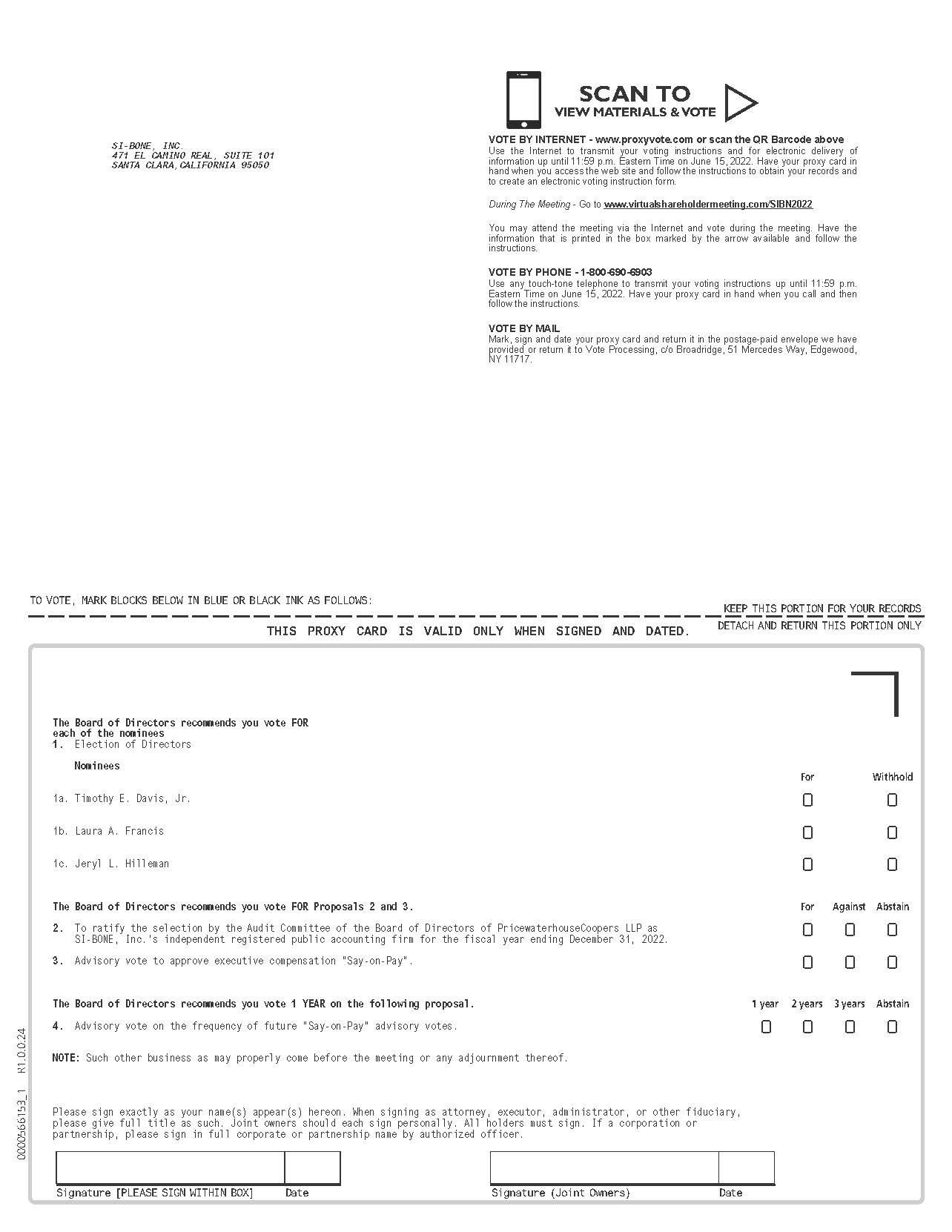

1. Elect the Board of Directors’ three nominees, Timothy E. Davis, Jr., Laura A. Francis and Jeryl L. Hilleman, as directors serving in Class I of the Board of Directors of SI-BONE, each to serve until the next annual meeting in which directors in Class I shall be elected, or until a successor is duly elected and qualified;

2. Ratify the selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022;

3. Provide an advisory, non-binding vote on the compensation of our named executive officers, as disclosed in this proxy statement;

4. Indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of our named executive officers; and

5. Conduct any other business properly brought before the meeting.

Members of the Board of Directors will also be present.

Whether or not you are able to attend the annual meeting by webcast, it is important that your shares be represented. We have provided in the accompanying proxy statement instructions on how to vote your shares. Please vote as soon as possible.

Sincerely yours,

| /s/ Laura Francis | ||

| Laura Francis | ||

| Chief Executive Officer | ||

SI-BONE, INC.

471 El Camino Real, Suite 101

Santa Clara, California 95050

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 16, 2022

Dear Stockholder:

You are cordially invited to attend the virtual Annual Meeting of Stockholders of SI-BONE, Inc., a Delaware corporation. The meeting will be a completely virtual meeting of stockholders and will be held on Thursday, June 16, 2022 at 8:00 a.m. local time by live webcast as described in the proxy statement accompanying this notice. The Annual Meeting is being held for the following purposes:

1. To elect the Board of Director’s three nominees for director to serve until the 2025 Annual Meeting of Stockholders or until their successors are elected and qualified.

2. To ratify the selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

3. To provide an advisory, non-binding vote on the compensation of our named executive officers, as disclosed in this proxy statement.

4. To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of our named executive officers.

5. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this notice.

You will be able to attend the virtual Annual Meeting and submit your questions and vote your shares online during the meeting by visiting www.virtualshareholdermeeting.com/SIBN2022 and using your 16-digit control number to enter the virtual Annual Meeting. If you determine to attend the Annual Meeting by webcast, you will only be able to participate by using your 16-digit control number provided on the proxy or information card to enter the Annual Meeting. Without your 16-digit control number, you will only be able to enter as a guest in listen-only mode and will not be able to vote. Therefore, it is important to retain a copy of your proxy or information card you receive to enable you to gain participation access to the virtual Annual Meeting.

The stockholder list will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/SIBN2022. Instructions on how stockholders of record can view the stockholder list during the Annual Meeting are posted at www.virtualshareholdermeeting.com/SIBN2022. The record date for the Annual Meeting is April 18, 2022. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the 2022 Stockholders’ Meeting to Be Held on June 16, 2022 via live webcast at www.virtualshareholdermeeting.com/SIBN2022. You will need the 16-digit control number provided on the proxy or information card in order to gain access to the Annual Meeting by live webcast.

The proxy statement and annual report to stockholders

are available at www.proxyvote.com.

By Order of the Board of Directors

| /s/ Michael A. Pisetsky | ||

| Michael A. Pisetsky | ||

Secretary and Chief Legal Officer | ||

Santa Clara, California

April 22, 2022

You are cordially invited to attend the meeting by live webcast as described in the proxy statement accompanying this notice. Whether or not you expect to attend the meeting, please vote as soon as possible in order to ensure your representation at the meeting. You may vote over the internet or by a toll-free telephone number, or you may vote by mailing a completed, signed and dated proxy card or voting instruction card in the envelope provided with the proxy card or voting instruction card. Please note that any stockholder attending the virtual Annual Meeting may vote online during the meeting, even if the stockholder has already returned a proxy card or voting instruction card. Please see the instructions in the attached proxy statement and on your proxy card or voting instruction card.

SI-BONE, Inc.

471 El Camino Real, Suite 101

Santa Clara, California 95050

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 16, 2022

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 16, 2022

This proxy statement and our 2022 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, are available on our website at https://investor.si-bone.com/financial-information/annual-reports and www.proxyvote.com. We intend to mail these proxy materials on or about April 22, 2022 to all stockholders of record entitled to vote at the annual meeting.

MEETING AGENDA

| Proposal Number | Proposal | Vote Required for Approval | |||||||||||||||

| 1 | To elect the Board of Directors' three nominees for director to serve until the 2025 Annual Meeting of Stockholders or until their successors are elected and qualified. | The three nominees receiving the most “For” votes will be elected; withheld votes will have no effect | |||||||||||||||

| 2 | To ratify the selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | “For” votes from the holders of a majority of shares present, via webcast or represented by proxy and entitled to vote on the matter | |||||||||||||||

| 3 | To provide an advisory non-binding vote on the compensation of our named executive officers, as disclosed in this proxy statement. | “For” votes from the holders of a majority of shares present via webcast or represented by proxy and entitled to vote on the matter. | |||||||||||||||

| 4 | To indicate, on an advisory basis, the frequency of stockholder advisory votes on executive compensation | The frequency receiving “For” votes from the holders of a majority of shares present via webcast or represented by proxy and entitled to vote on the matter will be the frequency approved. | |||||||||||||||

Table of Contents

Page | |||||

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because our Board of Directors (the “Board” or “Board of Directors”) is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the virtual annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the internet.

We intend to mail these proxy materials on or about April 22, 2022 to all stockholders of record entitled to vote at the annual meeting.

What is included in the proxy materials?

The proxy materials include:

•This proxy statement, which includes information regarding the proposals to be voted on at the Annual Meeting, the voting process, corporate governance, the compensation of our directors and certain executive officers, and other required information;

•Our 2021 Annual Report to Stockholders, which is our Annual Report on Form 10-K for the fiscal year ended December 31, 2021; and

•The proxy card or a voting instruction card for the Annual Meeting.

How do I attend the annual meeting?

The annual meeting will be held on Thursday, June 16, 2022 at 8:00 a.m. local time by live webcast. There will not be a physical meeting location and you will not be able to attend the meeting in person physically. We invite you to attend the annual meeting by live webcast. The live audio webcast will be held on Thursday, June 16, 2022, and will begin promptly at 8:00 a.m. local time. Online check-in will begin approximately 15 minutes prior to the start of the Annual Meeting. We encourage our stockholders to access the meeting in advance of the designated start time to have ample time for check-in procedures. To attend the Annual Meeting virtually via the internet, please visit www.virtualshareholdermeeting.com/SIBN2022. To attend by live webcast you will need the 16-digit control number provided on the proxy or information card you receive in order to gain access to the annual meeting. Therefore, it is important to retain a copy of your proxy or information card you receive to enable you to gain access to the annual meeting. However, as noted above, you do not need to attend the annual meeting to vote your shares. Instead, you may simply complete, sign and return a proxy card, or follow the instructions below to submit your proxy over the telephone or on the internet.

If you do not have your 16-digit control number, you will be able to access and listen to the Annual Meeting, but you will not be able to vote your shares or submit questions during the Annual Meeting. See caption below titled “Attending the Annual Meeting as a Guest.”

Attending the Annual Meeting as a Guest

Guests may enter the Annual Meeting in “listen-only” mode by entering the Annual Meeting at www.virtualshareholdermeeting.com/SIBN2021 and entering the information requested in the “Guest Login” section. Guests will not have the ability to vote at the Annual Meeting.

Why is SI-BONE having a virtual Annual Meeting?

Due to the continuing public health concerns regarding the COVID-19 outbreak and to assist in protecting the health and well-being of our stockholders and employees and facilitate stockholder participation in the Annual Meeting, this year’s annual meeting of our stockholders will be held virtually via the internet. Stockholders attending virtually via the internet will be able to listen and vote regardless of location via the internet at www.virtualshareholdermeeting.com/SIBN2022 by using the 16-digit control number included on your proxy card or information card and the instructions that accompanied your proxy materials.

1

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 18, 2022 will be entitled to vote at the annual meeting. On this record date, there were 33,883,545 shares of common stock outstanding and entitled to vote

Stockholder of Record: Shares Registered in Your Name

If on April 18, 2022, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote via webcast at the meeting or vote by proxy. Whether or not you plan to attend the meeting via webcast, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 18, 2022, your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. Many stockholders of record will provide you with a 16-digit control number via email or in your Notice of Availability or voting instruction form in order to attend and vote your shares at the virtual Annual Meeting. If you did not receive a 16-digit control number via email or on your Notice of Availability or voting instruction form, you will be provided with other instructions from your broker, bank or other stockholder of record that must be followed, including any requirement to obtain a valid legal proxy, in order for your broker, bank or other stockholder of record to vote your shares per your instructions or to attend and vote your shares at the Annual Meeting. Many brokers, banks or other stockholders of record allow a stockholder to obtain a valid legal proxy either online or by mail, and we recommend that you contact your broker, bank or other stockholder of record to do so.

Who can ask questions at the Annual Meeting?

If you are attending the Annual Meeting as a stockholder of record or as a beneficial owner, questions can be submitted by accessing the meeting center at www.virtualshareholdermeeting.com/SIBN2022, entering your 16-digit control number and following the instructions. Instructions on how to ask questions and participate in the Annual Meeting are posted at www.virtualshareholdermeeting.com/SIBN2022. Guests will not have the ability to ask questions during the Annual Meeting.

List of Stockholders

A list of stockholders entitled to vote at the Annual Meeting will be available for examination for any purpose germane to the Annual Meeting during normal business hours for ten days prior to the Annual Meeting at our corporate headquarters. Due to the COVID-19 pandemic, please email us at StockholderCommunications@si-bone.com to arrange a time to review. The stockholder list will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/SIBN2022. Instructions on how stockholders of record can view the stockholder list during the Annual Meeting are posted at www.virtualshareholdermeeting.com/SIBN2022.

What am I voting on?

There are four matters scheduled for a vote:

•Election of three directors (Proposal No. 1);

•Ratification of selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as independent registered public accounting firm of SI-BONE for its fiscal year ending December 31, 2022 (Proposal No. 2);

•Advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules (Proposal No. 3); and

•Advisory indication of the preferred frequency of stockholder advisory votes on the compensation of our named executive officers (Proposal No. 4)

2

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters, to the extent permitted under Rule 14a-4(c)(1) under the Exchange Act, in accordance with their best judgment.

How do I vote?

You may either vote “For” all of the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the ratification of selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as independent registered public accounting firm of SI-BONE for its fiscal year ending December 31, 2022, and the advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules, you may vote “For” or “Against” or abstain from voting. With regard to your advisory vote on how frequently we should solicit stockholder advisory approval of executive compensation, you may vote for any one of the following: one year, two years or three years, or you may abstain from voting on that matter. For any of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote via webcast at the annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy through the internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote via webcast even if you have already voted by proxy.

•To vote during the meeting at the live webcast, if you are a stockholder of record as of the record date, follow the instructions at www.virtualshareholdermeeting.com/SIBN2022. You will need the 16-digit control number provided on the proxy card in order to gain access to the annual meeting via webcast.

•To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

•To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the enclosed proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Time on June 15, 2022, to be counted.

•To vote through the internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide control number from the enclosed proxy card. Your internet vote must be received by 11:59 p.m. Eastern Time on June 15, 2022 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote at the live webcast, you may be able to do so if your broker has provided you with a 16-digit control number, or if you have otherwise received a valid proxy. See “Who can vote at the annual meeting? - Stockholder of Record: Shares Registered in Your Name” above. To receive a valid proxy, follow the instructions from your broker or bank included with these proxy materials, or contact your broker or other agent to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

3

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 18, 2022.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or via webcast at the annual meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all of the nominees for director, “For” the ratification of selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as independent registered public accounting firm of SI-BONE for its fiscal year ending December 31, 2022, “For” the advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules, and for “one year” on how frequently we should solicit stockholder advisory approval of executive compensation. If any other matter is properly presented at the meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange (“NYSE”), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, Proposals 1, 3 and 4 are considered to be “non-routine” under NYSE rules meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under NYSE rules meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to the attention of our Chief Legal Officer and Secretary at 471 El Camino Real, Suite 101, Santa Clara, California 95050.

•You may attend the annual meeting and vote via webcast. Simply attending the meeting will not, by itself, revoke your proxy.

4

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent, or you may attend the virtual annual meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

When are Stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 23, 2022, to SI-BONE, Inc., Attn: Michael A. Pisetsky, Chief Legal Officer, 471 El Camino Real, Suite 101, Santa Clara, California 95050; provided, however, that if the 2023 annual meeting of stockholders is held before May 17, 2023 or after July 16, 2023, then your proposal must be submitted in writing a reasonable amount of time before the 2023 annual meeting of stockholders.

If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, your proposal must be submitted in writing and received by our Secretary at our executive offices located at 471 El Camino Real, Suite 101, Santa Clara, California 95050, not later than the close of business on March 18, 2023, nor earlier than the close of business on February 16, 2023; provided, however, that in the event that the date of the annual meeting is held earlier than May 17, 2023, or held later than July 16, 2023, notice by the stockholder to be timely must be so received not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made.

Stockholders wishing to make stockholder proposals or nominations for directors should consult our bylaws, which contain additional requirements and information regarding these matters.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, (a) for the proposal to elect directors, votes “For,” votes “Withheld” and broker non-votes, (b) with respect to the ratification of selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as independent registered public accounting firm of SI-BONE for its fiscal year ending December 31, 2022, and the advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules, votes “For” and “Against,” abstentions and, if applicable, broker non-votes, (c) with respect to the proposal regarding frequency of stockholder advisory votes to approve executive compensation, votes for frequencies of one year, two years or three years, abstentions and broker non-votes, and (d) for any other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes.

Abstentions will be counted towards the vote total for each of Proposals No. 2 and No. 3, and will have the same effect as “Against” votes. For Proposal 4, abstentions will be counted towards the vote total, and will have the same effect as votes against each of the proposed voting frequencies. Broker non-votes on Proposals 1, 3 and 4 and will have no effect and will not be counted towards the vote total for any of those proposals. As Proposal No. 2 is a “routine” matter we do not expect there to be any broker non-votes, but if there are broker non-votes, they will have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.”

5

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

| Proposal Number | Proposal Description | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non-Votes | ||||||||||||||||||||||

| 1 | Election of Directors | The three nominees receiving the most “For” votes will be elected; withheld votes will have no effect | Not applicable | No effect | ||||||||||||||||||||||

| 2 | Ratification of the selection of PricewaterhouseCoopers LLP as SI-BONE’s independent registered public accounting firm for the fiscal year ending December 31, 2022 | “For” votes from the holders of a majority of shares present via webcast or represented by proxy and entitled to vote on the matter | Against | No effect | ||||||||||||||||||||||

| 3 | Advisory vote on the compensation of our named executive officers | “For” votes from the holders of a majority of shares present via webcast or represented by proxy and entitled to vote on the matter | Against | No effect | ||||||||||||||||||||||

| 4 | Advisory vote on the frequency of stockholder advisory votes on executive compensation | The frequency receiving the votes of the holders of a majority of shares present via webcast or represented by proxy and entitled to vote on the matter will be the frequency approved. | Against each of the proposed voting frequencies | No effect | ||||||||||||||||||||||

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting via webcast or represented by proxy. On the record date, there were 33,883,545 shares outstanding and entitled to vote. Thus, the holders of 16,941,773 shares must be present via webcast or represented by proxy at the meeting to have a quorum.

If you are a stockholder of record your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote via webcast at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting or the holders of a majority of shares present at the meeting via webcast or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement and Annual Report to Stockholders are available at www.proxyvote.com.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

Our Board of Directors currently has nine members. There are three directors in Class I, the class the term of which expires in 2022: Timothy E. Davis, Jr., Laura A. Francis and Jeryl L. Hilleman. Each is currently a member of our Board. If elected at the annual meeting, each of the three nominees would serve until the 2025 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is our policy to encourage directors and nominees for director to attend the Annual Meeting. All of our then-continuing directors and the nominees attended our 2021 annual meeting of stockholders.

Mr. Davis was previously elected by our stockholders, and Ms. Francis is our Chief Executive Officer. Ms. Hilleman was recommended for nomination to the Nominating and Corporate Governance Committee by a number of our non-management directors.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected.

| Name | Age | Position | Class | ||||||||

| Timothy “Ted” Davis, Jr | 52 | Lead Independent Director | I | ||||||||

| Laura A. Francis | 55 | CEO | I | ||||||||

| Jeryl L. Hilleman | 64 | Director | I | ||||||||

| Jeffrey W. Dunn | 67 | Executive Chairman | II | ||||||||

| John G. Freund | 68 | Director | II | ||||||||

| Gregory K. Hinckley | 75 | Director | II | ||||||||

| Helen Loh | 59 | Director | III | ||||||||

| Mika Nishimura | 58 | Director | III | ||||||||

| Keith C. Valentine | 54 | Director | III | ||||||||

The following is a brief biography of each nominee and each director whose term will continue after the annual meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2025 ANNUAL MEETING

Timothy E. Davis, Jr. has served as a member of our Board of Directors since our inception in April 2008. Mr. Davis has served as President and Chief Executive Officer of TissueTech, Inc., a privately held parent company of Bio-Tissue, Inc. and Amniox Medical, Inc., which focuses on the development and clinical application of human birth tissue-based products, since January 2022. From February 2017 through December 2021, Mr. Davis served as President and Chief Executive Officer of Active Implants, LLC, a company that provides orthopedic implant solutions. From January 2014 through September 2015, Mr. Davis served as Chief Executive Officer of MicroPort Orthopedics, Inc., a multinational producer of orthopedic products, following the purchase of Wright Medical Group’s OrthoRecon Business in January 2014. From December 2006 to January 2014, Mr. Davis served in a number of executive positions for Wright Medical Technology, Inc., a subsidiary of Wright Medical Group, Inc., including President of the OrthoRecon business. From 2004 to 2006, Mr. Davis was a Partner with MB Venture Partners, LLC, a medical technology and life sciences venture capital firm. From 1997 to 2004, Mr. Davis held various positions, ultimately serving as Vice President, with Vector Fund Management, a healthcare and life sciences focused venture capital fund. Early in his career, Mr. Davis worked in the healthcare management consulting and pharmaceutical industries. Mr. Davis received a B.E. degree in Biomedical Engineering from Vanderbilt University and an M.B.A. from the J.L. Kellogg Graduate School of Management at Northwestern University. We believe Mr. Davis’

experience in the industry, his experience in compensation matters, and his knowledge of our company enable him to make valuable contributions to our Board of Directors.

Laura A. Francis has served as our Chief Executive Officer and as a member of our Board of Directors since April 2021. Previously, she served as our Chief Operating Officer from July 2019 to April 2021, and as our Chief Financial Officer from May 2015 to April 2021. Prior to joining us, Ms. Francis was the Chief Financial Officer for Auxogyn, Inc., a women’s health company, from December 2012 to September 2014. From September 2004 to December 2012, Ms. Francis served as Vice President of Finance, Chief Financial Officer and Treasurer for Promega Corporation, a life science reagent company. From March 2002 to September 2004, Ms. Francis served as the Chief Financial Officer of Bruker BioSciences Corporation, a public life science instrumentation company. From May 2001 to March 2002, Ms. Francis served as Chief Operating Officer and Chief Financial Officer of Nutra-Park Inc., an agricultural biotechnology company. From April 1999 to May 2001, Ms. Francis was Chief Financial Officer of Hypercosm, Inc., a software company. From October 1995 to April 1999, Ms. Francis was an engagement manager with McKinsey & Company, a consulting firm. Early in her career, Ms. Francis was an audit manager with Coopers & Lybrand, an accounting firm. Since January 2019, Ms. Francis has served as a member of the board of directors of ShockWave Medical, Inc, a medical device company. Ms. Francis received a B.B.A. from the University of Wisconsin and an M.B.A. from Stanford University. She is a Certified Public Accountant (inactive) in the State of California. We believe Ms. Francis’s experience in the industry, her role as our Chief Executive Officer, and her knowledge of our company enable her to make valuable contributions to our Board of Directors.

Jeryl L. Hilleman has served as a member of our Board of Directors since December 2019. Ms. Hilleman brings extensive experience in life sciences and served as a public company CFO for close to 20 years. Most recently, from June 2014 to November 2019, Ms. Hilleman served as the Chief Financial Officer for Intersect ENT, Inc., a commercial drug delivery company focusing on patients with ear, nose and throat conditions. Prior to Intersect ENT, Ms. Hilleman served as Chief Financial Officer of other public healthcare companies including Ocera Therapeutics, Inc., a biopharmaceutical company; Amyris, Inc., a renewable products company; and Symyx Technologies, a life sciences automation company. Ms. Hilleman has served as a member of the board of directors and the chair of the Audit Committee of NovoCure, Limited and Minerva Neurosciences, Inc. since July 2018, and of Talis Biomedical since March 2021. From January 2005 to July 2016, Ms. Hilleman served as a member of the board of directors of Xenoport, Inc., a biopharmaceutical company. Ms. Hilleman received a B.A. in History from Brown University and an M.B.A. from the Wharton School at the University of Pennsylvania. We believe Ms. Hilleman’s financial experience, experience with medical device companies and her knowledge of our company enable her to make valuable contributions to our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2023 ANNUAL MEETING

Jeffrey W. Dunn has served as our Executive Chairman since April 2021, as Chairman of our Board of Directors since our inception in April 2008 until April 2021, and as our President and Chief Executive Officer from April 2008 until April 2021. Prior to joining us, Mr. Dunn served as Chief Executive Officer of INBONE Technologies, Inc., an ankle replacement and small bone fusion medical device company, from December 2006 to April 2008, until its sale to Wright Medical Technology, Inc. in April 2008. From August 2000 to June 2006, Mr. Dunn was the Chief Executive Officer of Active Decisions, Inc., a software as a service business, until its sale to Knova Software, Inc. From December 1999 to June 2000, Mr. Dunn was the Chief Executive Officer of Velogic, Inc., an internet performance testing software company, until its sale to Keynote Systems Inc. From June 1999 to December 1999, Mr. Dunn was the Chief Executive Officer of EnterpriseLink Inc., a provider of enterprise Internet enablement software, until its sale to Merant, Inc. From November 1994 to June 1998, Mr. Dunn was Chief Executive Officer of AccelGraphics Inc., a 3D graphics system supplier, until its sale to Evans and Sutherland Computer Corporation. As well, during his career, Mr. Dunn held executive positions with Evans and Sutherland, Cygnet Systems, Inc., Avnet, Inc. and Xerox Corporation. Mr. Dunn received a B.A. from Colgate University and an M.B.A. from Babson College. We believe Mr. Dunn’s experience in the industry, his prior role as our President and Chief Executive Officer, and his knowledge of our company enable him to make valuable contributions to our Board of Directors.

John G. Freund, M.D. has served as a member of our Board of Directors since January 2013. Dr. Freund founded Skyline Ventures, a venture capital firm, in October 1997 and has served as a Managing Director of Skyline since then. In 2016, Dr. Freund co-founded and was CEO of Arixa Pharmaceuticals, Inc. an antibiotic company, which was acquired by Pfizer in 2020. Prior to joining Skyline, Dr. Freund served as Managing Director in the private equity group of Chancellor Capital Management, a private capital investment firm. In November 1995, Dr. Freund co-founded Intuitive Surgical, Inc., a medical device company, and served on its board of directors until March 2000. From 1988 to 1994, he held various positions at Acuson Corporation, a maker of ultrasound equipment that is now part of Siemens, most recently as Executive Vice President. Prior to joining Acuson, Dr. Freund was a general partner of Morgan Stanley Venture Partners from 1987 to 1988. From 1982 to 1988, Dr. Freund was at Morgan Stanley & Co., an investment banking company, where he co-founded the Healthcare Group in the Corporate Finance Department in 1983. Dr. Freund has served on the board of directors of each of Collegium Pharmaceuticals, Inc., a biotechnology company, and Sutro Biopharma, Inc., a biotechnology company, since 2014. Dr. Freund also serves on the board of directors of six U.S. registered investment funds managed by affiliates of the Capital Group, Inc. He also previously served on the board of directors of a number of publicly traded companies, including Tetraphase Pharmaceuticals, Inc., a biopharmaceutical company, Map Pharmaceuticals, Inc., a biopharmaceutical company, MAKO Surgical Corp., a medical device company, Proteon Therapeutics, Inc., a biotechnology company, Concert Pharmaceuticals, Inc., a biopharmaceutical company and was Chairman of XenoPort, Inc., a biopharmaceutical company. Dr. Freund is a member of the Advisory Board for the Harvard Business School Healthcare Initiative. Dr. Freund received a B.A. in History from Harvard College, an M.D. from Harvard Medical School, and an M.B.A. from Harvard Business School, where he was a Baker Scholar. We believe Dr. Freund’s experience with medical device companies, his role in the venture capital industry, and his knowledge of our company enable him to make valuable contributions to our Board of Directors.

Gregory K. Hinckley has served as a member of our Board of Directors since January 2011. Mr. Hinckley served as President of Mentor Graphics Corporation, an electronic design automation company, from November 2000 until his retirement in July 2017, and served on the board of directors from January 1999 to June 2016. From January 1997 to November 2000, he served as Executive Vice President. He has also served as the Chief Financial Officer of Mentor Graphics, first from January 1997 to July 2007 and again from December 2008 to July 2017. Previously, he served on the board of directors of Super Micro Computer, Inc., a manufacturer of servers, from January 2009 to February 2015; Intermec, Inc., a developer of automated identification and data collection solutions, from July 2004 to September 2013; and Amkor Technology, a semiconductor test and assembly company, from November 1997 to July 2007. From August 1992 to January 1997, Mr. Hinckley served as Senior Vice President, Finance of VLSI Technology, Inc., a designer and manufacturer of custom and semi-custom integrated circuits. From January 1989 to November 1991, he served as Senior Vice President and Chief Financial Officer of Crowley Maritime Corporation, a marine solutions, transportation, and logistics company. From February 1983 to January 1989, Mr. Hinckley served as Vice President and Chief Financial Officer, and since April 2017, Mr. Hinckley has served on the board of directors of Bio-Rad Laboratories, a manufacturer and supplier of products and systems for the life science research and healthcare markets. Previously, Mr. Hinckley held a number of senior officer positions with Raychem Corporation, a developer of products and services for the aerospace, automotive and telecommunications industries. Mr. Hinckley received a B.A. in Physics and Mathematics from Claremont McKenna College and was a Fulbright Scholar in applied mathematics at Nottingham University. He received an M.S. in Applied Physics from the University of California, San Diego and an M.B.A. from Harvard Business School. We believe Mr. Hinckley’s financial experience, his familiarity of serving on the boards of public companies, and his knowledge of our company enable him to make valuable contributions to our Board of Directors.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2024 ANNUAL MEETING

Helen Loh has served as a member of our Board of Directors since April, 2021. Since 2004, Ms. Loh has served as a marketing executive at Charles Schwab, most recently as Managing Director of Digital Channels, Education & Client Marketing. From 1999 to 2004, Ms. Loh served as Vice President of Marketing and Product at seeUthere Technologies, an enterprise event management software company. Earlier in her career, Ms. Loh held marketing roles at SINA Corporation, MySoftware Company, and the Clorox Company. Ms. Loh began her career as a management consultant at Marakon, a global strategy consulting firm. Ms. Loh has served on the board of directors of the Charles Schwab Foundation since November 2014. Ms. Loh received a B.S. in Industrial Engineering from Stanford University, and a M.B.A. from Stanford Business School. We believe that Ms. Loh’s experience with digital and consumer marketing will enable her to make valuable contributions to our Board of Directors.

Mika Nishimura has served as a member of our Board of Directors since March 2021. Since 2011, Ms. Nishimura has served as an Operational Partner with Gilde Healthcare Partners. Ms. Nishimura is a board member for Accuray, Inc., a radiation therapy company and is a board advisor to Tristel, plc, a UK-based company. From 2016 to April 2020, Ms. Nishimura was Vice President, Commercialization at nVision Medical Corporation, an early clinical-stage company focused on early detection of ovarian cancer acquired by Boston Scientific. From 2011 to 2015, Ms. Nishimura was Vice President, Commercial Development at Auxogyn, which was acquired by Progyny in 2015. Earlier in her career, Ms. Nishimura was Vice President, International Sales Operations and Marketing at ev3 Inc. Ms. Nishimura has a BA in Economics from Yale University and an MBA from Harvard Graduate School of Business Administration. We believe that Ms. Nishimura’s experience working for medical device companies across multiple phases of commercialization will enable her to make valuable contributions to our Board of Directors.

Keith C. Valentine has served as a member of our Board of Directors since August 2015. Since July 2015, Mr. Valentine has also served as President, Chief Executive Officer and a member of the board of directors of SeaSpine Holdings Corporation, a global medical technology company. From January 2007 to January 2015, he served as President and Chief Operating Officer of NuVasive, Inc., a medical device company. From December 2004 to January 2007, he served as President of NuVasive. From January 2001 to December 2004, he held various senior executive roles in marketing, development and operations at NuVasive. Previously, Mr. Valentine served as Vice President of Marketing at ORATEC Interventions, Inc., a medical device company acquired by Smith & Nephew PLC, and spent eight years in various roles with Medtronic Sofamer Danek including Vice President of Marketing for the Rods Division and Group Director for the BMP Biologics program, Interbody Sales Development, and International Sales and Marketing. Mr. Valentine received a B.B.A. in Management and Biomedical Sciences from Western Michigan University. We believe Mr. Valentine’s experience working for medical device companies and his knowledge of our company enable him to make valuable contributions to our Board of Directors.

Each of our directors, other than Mr. Dunn and Ms. Francis, is independent as defined under the Nasdaq Global Market listing standards. See “Independence of the Board of Directors” immediately below.

7

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

FAMILY RELATIONSHIPS

There are no family relationships among the directors and executive officers.

INDEPENDENCE OF THE BOARD OF DIRECTORS

As required under the Nasdaq Global Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board. The Board consults with SI-BONE’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and SI-BONE, its senior management and its independent auditors, the Board has affirmatively determined that the following seven directors are independent directors within the meaning of the applicable Nasdaq listing standards: Mr. Davis, Dr. Freund, Ms. Hilleman, Mr. Hinckley, Ms. Loh, Ms. Nishimura and Mr. Valentine. In making this determination, the Board found that none of the directors or nominees for director other than Mr. Dunn and Ms. Francis had a material or other disqualifying relationship with SI-BONE and that each of these directors is “independent” as that term is defined under the rules of the Nasdaq Global Market. Mr. Dunn is not independent given his position as our former President and Chief Executive Officer, and Ms. Francis is not independent given her position as our Chief Executive Officer. Accordingly, a majority of our directors are independent, as required under applicable Nasdaq listing rules.

TERM OF SERVICE OF DIRECTORS

As described in Proposal 1 above, our directors serve for staggered three-year terms. We believe that a classified board, with a supermajority vote of our stockholders required to amend our certificate of incorporation and bylaws and thereby change this structure and/or to take other significant stockholder actions, is in the best long-term interest of our stockholders because it improves board stability and encourages long-term planning. These governance structures are also shared among a majority of our peer companies, including among our compensation peer groups described below. As our company matures, we will continue to evaluate this and other decisions we have made regarding our corporate governance structures. Members of our leadership team hold regular meetings with investors and their governance representatives to discuss their views. While some stockholders have, as a matter of general application, a preference for one-year terms for directors and simple majority voting to amend our certificate of incorporation or bylaws, we have not generally encountered significant or specific objections to the corporate governance decisions we have made.

BOARD SKILLS AND ATTRIBUTES

The following matrix provides information regarding the members of our Board, including certain types of knowledge, skills, experiences and attributes possessed by one or more of our directors which our Board believes are relevant to our business and industry. The matrix does not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill and experience listed below may vary among the members of the Board.

| Knowledge, Skills, Experience | |||||||||||||||||||||||||||||

Davis | Dunn | Francis | Freund | Hilleman | Hinckley | Loh | Nishimura | Valentine | |||||||||||||||||||||

Public Company CEO/Exec Chair (last 5 years) | • | • | • | ||||||||||||||||||||||||||

Public Company CFO | • | • | • | ||||||||||||||||||||||||||

Senior Executive Leadership | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||

Financial Literacy/Expertise | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||

Medical Device Industry Experience | • | • | • | • | • | • | • | ||||||||||||||||||||||

Corporate Governance | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||

Commercial | • | • | • | • | |||||||||||||||||||||||||

Digital Marketing; DTP/DTC Marketing | • | • | • | ||||||||||||||||||||||||||

Reimbursement/Payors | • | • | • | • | • | ||||||||||||||||||||||||

Clinical/Medical | • | • | • | • | • | ||||||||||||||||||||||||

| Regulatory | • | • | |||||||||||||||||||||||||||

| R&D | • | • | |||||||||||||||||||||||||||

| Business Development/M&A | • | • | • | • | • | • | • | • | |||||||||||||||||||||

| Strategic Planning | • | • | • | • | • | • | • | • | |||||||||||||||||||||

| Public Relations | • | • | • | ||||||||||||||||||||||||||

| International | • | • | • | • | • | • | • | ||||||||||||||||||||||

| Risk Management | • | • | • | • | • | • | |||||||||||||||||||||||

| Cybersecurity | • | • | |||||||||||||||||||||||||||

| Legal/Compliance/Risk Management | • | • | • | • | • | • | |||||||||||||||||||||||

| Human Resources | • | • | • | • | • | • | • | ||||||||||||||||||||||

The following matrix provides race/ethnicity, as well as gender, of the members of our Board, as self-identified by members of the Board.

Davis | Dunn | Francis | Freund | Hilleman | Hinckley | Loh | Nishimura | Valentine | |||||||||||||||||||||

Part I: Demographic Background | |||||||||||||||||||||||||||||

African American or Black | |||||||||||||||||||||||||||||

Alaskan Native or Native American | |||||||||||||||||||||||||||||

| Asian | • | • | |||||||||||||||||||||||||||

| Hispanic or Latinx | |||||||||||||||||||||||||||||

| Indian or South Asian | |||||||||||||||||||||||||||||

| Native Hawaiian or Pacific Islander | |||||||||||||||||||||||||||||

| Middle Eastern or North African | |||||||||||||||||||||||||||||

| White | • | • | • | • | • | • | • | ||||||||||||||||||||||

Two or More Races or Ethnicities | |||||||||||||||||||||||||||||

LGBTQ+ | |||||||||||||||||||||||||||||

| Did not Disclose Demographic Background | |||||||||||||||||||||||||||||

Part II: Gender Identity | |||||||||||||||||||||||||||||

| Male | • | • | • | • | • | ||||||||||||||||||||||||

Female | • | • | • | • | |||||||||||||||||||||||||

| Non-Binary | |||||||||||||||||||||||||||||

| Did Not Disclose Gender | |||||||||||||||||||||||||||||

BOARD LEADERSHIP STRUCTURE

Our Board of Directors is currently chaired by Mr. Dunn. We believe that the separation of the two roles of Executive Chairman and Chief Executive Officer is most beneficial in furthering SI-BONE’s ability to develop and implement strategy. In particular, in making this determination, Mr. Dunn, as our former Chief Executive Officer, will continue to have intimate knowledge of our operations, both historically and currently, which will enable him to continue to act as a bridge between management and the Board. Further, Mr. Dunn as Executive Chairman alleviates the need for Ms. Francis to take on the responsibilities of Chairman, enabling her to focus on her responsibilities in her role as our Chief Executive Officer. In addition, since January 1, 2022, Mr. Davis has resumed his role as our Lead Independent Director.

The Board of Directors believes that our stockholders are best served at this time by having a Lead Independent Director who is an integral part of our Board structure and a critical aspect of effective corporate governance. Mr. Davis previously served as our Lead

8

Independent Director from June 2019 until Mr. Dunn ceased to be our Chief Executive Officer in April 2021.Mr. Davis brings considerable skills and experience, as described above, to the role. We believe as well that Mr. Davis can effectively oversee and drive the activities of the Board, including:

•coordinate with the committee chairs regarding meeting agendas and informational requirements; and

•perform such other duties as may be necessary from time to time to ensure the effective functioning of the Board.

ROLE OF THE BOARD IN RISK OVERSIGHT

One of the key functions of our Board of Directors is informed oversight of our risk management process. In particular, our Board is responsible for monitoring and assessing strategic risk exposure. Our executive officers are responsible for the day-to-day management of the material risks we face. Our Board administers its oversight function directly as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. For example, our Audit Committee is responsible for overseeing the management of risks associated with our financial reporting, accounting and auditing matters and cybersecurity; our Compensation Committee oversees the management of risks associated with our compensation policies and programs; and our Nominating and Corporate Governance Committee oversees the management of risks associated with director independence, conflicts of interest, composition and organization of our Board, director succession planning, development of and reporting on our sustainability program, and oversight of healthcare, regulatory, and fraud and abuse compliance.

Cybersecurity

We recognize the importance of protecting our information technology (“IT”) systems. With this in mind, we focus on IT and cybersecurity measures on both an enterprise-wide operational level and on an individual employee level. Accordingly, we have in place various methods and levels of IT and cybersecurity measures which are aimed at protecting IT systems to help secure long-term value for our shareholders and other stakeholders.

By way of example, these measures generally include the following:

–The alignment and implementation of formally recognized security frameworks into IT operations and control best practices;

–Utilization of detection and protection technologies such as endpoint detection response, vulnerability and patch management programs, and enhanced incident response capabilities;

–Ongoing end-user security awareness training;

–Ongoing security metric reporting to senior organizational leaders; and

–Formal periodic risk assessments and maturity assessments to gauge current level of operational efficiency and effectiveness.

Our Audit Committee and senior management are responsible for overseeing matters relating to our IT and cybersecurity practices and initiatives and our Audit Committee is briefed regularly by our senior management on cybersecurity matters. To further assist our Audit Committee, we also have designated specific roles who oversee cybersecurity for the Company.

MEETINGS OF THE BOARD OF DIRECTORS

Our Board of Directors met six times during 2021. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

9

BOARD COMMITTEES AND MEETINGS

Our Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal 2021 for each of the Board committees (Mr. Dunn did not serve on any committees in 2021, and neither Mr. Dunn nor Ms. Francis has served on any committee to date):

Name | Audit | Compensation | Nominating and Corporate Governance | |||||||||||||||||

Timothy E. Davis | X | X* | ||||||||||||||||||

John G. Freund, M.D.(1) | X | X | ||||||||||||||||||

Jeryl L. Hilleman(2) | X* | X | ||||||||||||||||||

Gregory K. Hinckley | X | |||||||||||||||||||

Helen Loh(3) | X | |||||||||||||||||||

Mika Nishimura(4) | X | |||||||||||||||||||

Keith C. Valentine | X* | |||||||||||||||||||

Mark J. Foley(5) | X | |||||||||||||||||||

Karen A Licitra(5) | X | |||||||||||||||||||

Total meetings in fiscal 2021 | 8 | 10 | 4 | |||||||||||||||||

* Committee Chairperson

(1) Dr. Freund served on the Nominating and Corporate Governance Committee until June 10, 2021, the date of our 2021 annual meeting of stockholders, at which time he left the Nominating and Corporate Governance Committee and joined the Compensation Committee.

(2) Ms. Hilleman joined the Nominating and Corporate Governance Committee on June 10, 2021.

(3) Ms. Loh joined our Board in April 2021 and joined the Nominating and Corporate Governance Committee on June 10, 2021.

(4) Ms. Nishimura joined our Board in March 2021 and joined the Compensation Committee on June 10, 2021.

(5) Mr. Foley and Ms. Licitra ceased to be a member of our Board and the Compensation Committee on June 10, 2021.

Our Board has adopted a written charter for each of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each of these charters are available to stockholders on SI-BONE’s website at www.si-bone.com.

Below is a description of each committee of the Board.

Audit Committee

Our Audit Committee consists of Mr. Davis, Mr. Hinckley, and Ms. Hilleman, each of whom satisfies the independence requirements under the Nasdaq Global Market listing standards and Rule 10A-3(b)(1) of the Exchange Act. The chairperson of our Audit Committee is Ms. Hilleman. Our Board has determined that each of Mr. Davis, Mr. Hinckley, and Ms. Hilleman are “audit committee financial experts” within the meaning of SEC regulations. Our Board has also determined that each member of our Audit Committee has the requisite financial expertise required under the applicable requirements of the Nasdaq Global Market. In arriving at this determination, the Board has examined each audit committee member’s scope of experience and the nature of their employment in the corporate finance sector.

10

The primary purpose of the Audit Committee is to discharge the responsibilities of our Board with respect to our accounting, financial, and other reporting and internal control practices and to oversee our independent registered public accounting firm. Specific responsibilities of our Audit Committee include, but are not limited to:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; evaluating the qualifications, independence and performance of the independent registered public accounting firm;

•determining the scope of the annual audit and the audit fee;

•reviewing our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC;

•considering the adequacy of our internal controls;

•developing and overseeing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•reviewing related party transactions; reviewing and discussing the adequacy and effectiveness of our accounting and financial reporting processes and internal controls and the annual audits of our financial statements;

•approving (or, as permitted, pre-approving) all audit and all permissible non-audit service to be performed by the independent registered public accounting firm;

•reviewing our guidelines and policies with respect to financial and information security risk management; and

•reviewing, at least annually, the Audit Committee charter and the committee’s performance.

Our Board reviews the Nasdaq listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of SI-BONE’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq listing standards).

Report of the Audit Committee of the Board of Directors

Our Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2021 with management of SI-BONE. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in SI-BONE’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Jeryl L. Hilleman (Chairperson)

Gregory K. Hinckley

Timothy E. Davis

The material in this report is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of SI-BONE under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

11

Compensation Committee

Our Compensation Committee consists of Mr. Davis, Dr. Freund and Ms. Nishimura, each of whom our Board has determined to be independent under the Nasdaq Global Market listing standards, and a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. The chairperson of our Compensation Committee is Mr. Davis.

The primary purpose of our Compensation Committee is to discharge the responsibilities of our Board to oversee our compensation policies, plans, and programs and to review and determine the compensation to be paid to our executive officers, directors, and other senior management, as appropriate. Specific responsibilities of our Compensation Committee include:

•reviewing and approving, or in the case of our Chief Executive Officer, recommending that our Board approve, the compensation of our executive officers;

•reviewing and recommending to our Board the compensation of our directors;

•reviewing and approving, or recommending that our Board approve, the terms of compensatory arrangements with our executive officers;

•administering our employee stock purchase and equity incentive plans;

•selecting independent compensation consultants and assessing whether there are any conflicts of interest with any of the committee’s compensation advisors;

•reviewing and approving, or recommending that our Board approve, incentive compensation and equity plans, severance agreements, change-of-control protections, and any other compensatory arrangements for our executive officers and other senior management, as appropriate;

•reviewing and establishing general policies relating to compensation and benefits of our employees; and

•reviewing our overall compensation philosophy.

Compensation Committee Processes and Procedures

Typically, our Compensation Committee meets at least four times annually and with greater frequency if necessary. The agenda for each meeting is usually developed by the chair of the Compensation Committee, in consultation with the Chief Legal Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his or her compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of SI-BONE. In addition, under the charter, the Compensation Committee has the authority to obtain, at the expense of SI-BONE, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

During the past fiscal year, after taking into consideration the six factors prescribed by the SEC and Nasdaq described above, the Compensation Committee engaged Compensia, Inc., a national compensation consulting firm with compensation expertise relating to technology and life science companies, as compensation consultants. The Compensation Committee requested that Compensia:

•evaluate the efficacy of SI-BONE’s existing compensation strategy and practices in supporting and reinforcing SI-BONE’s long-term strategic goals;

12

•assist in refining SI-BONE’s compensation strategy and in developing and implementing an executive compensation program to execute that strategy;

•benchmark SI-BONE’s use of its equity in its compensation program against equity utilization of its peers;

•review the adequacy and appropriateness of SI-BONE’s compensation of its independent directors and recommend annually updates to the Company’s non-employee director compensation policy; and

•perform an annual independent compensation risk assessment.

As part of its engagement, the Compensation Committee requested Compensia to develop a comparative group of companies and to perform analyses of competitive performance and compensation levels for that group. Compensia also conducted individual interviews with members of the Compensation Committee and senior management to learn more about SI-BONE’s business operations and strategy, key performance metrics and strategic goals, as well as the labor markets in which SI-BONE competes. Compensia ultimately developed recommendations that were presented to the Compensation Committee for its consideration. Following an active dialogue with Compensia, the Compensation Committee approved the recommendations of Compensia.

Historically, the Compensation Committee has made most of the significant adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the fourth quarter of the preceding year and the first quarter of the year. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of SI-BONE’s compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the Board conducts the evaluation of his or her performance, which determines any adjustments to his or her compensation as well as awards to be granted. For all executives and directors as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive and director compensation paid at other companies identified by the consultant.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Ms. Hilleman, Ms. Loh and Mr. Valentine. Our Board of Directors has determined Ms. Hilleman, Ms. Loh and Mr. Valentine each to be independent under the Nasdaq Global Market listing standards. The chairperson of our Nominating and Corporate Governance Committee is Mr. Valentine.

Specific responsibilities of our Nominating and Corporate Governance Committee include:

•identifying, evaluating, and selecting, or recommending that our Board approve, nominees for election to our Board;

•overseeing the process of evaluating the performance of our Board of Directors;

•reviewing developments in corporate governance practices;

•evaluating the adequacy of our corporate governance practices and reporting;

•reviewing management succession plans;

•developing and making recommendations to our Board regarding corporate governance guidelines and matters;

•overseeing management of our environmental, social and governance oversight program; and

•overseeing administration of our healthcare compliance program.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as

13

possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of SI-BONE, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of SI-BONE’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Potential director nominees are reviewed in the context of the current composition of the Board, the operating requirements of SI-BONE and the long-term interests of its stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity (including gender, racial and ethnic diversity), age, skills and such other factors as it deems appropriate, given the current needs of the Board and SI-BONE, to maintain a balance of knowledge, experience and capability.