Securities and Exchange Commission

Washington, D. C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report:

(Name of Registrant as specified in its charter)

| (State or Other Jurisdiction | (Commission | (I.R.S. Employer |

| of Incorporation) | File Number) | Identification No.) |

(Address and telephone number of principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0. 0001 per share | FDOC | N/A |

Item 2.01 Completion of Acquisition or Disposition of Assets.

As used in this report, unless otherwise indicated, the terms “we”, “us”, “our”, “Company” and “FDOC” refer to Fuel Doctor Holdings, Inc.

Our shares of common stock, par value $0.0001 per share, are referred to herein as our “shares”. “U.S. Dollars” refers to the legal currency of the United States.

On March 28, 2023, the Company entered into a Securities Exchange Agreement (the “Acquisition Agreement”) with the stockholders of Charging Robotics Ltd., an Israeli corporation (“Charging Robotics”). Pursuant to the Acquisition Agreement, at the closing, which occurred on April 7, 2023, the Company acquired 100% of the issued and outstanding stock of Charging Robotics (the “Acquisition”), making Charging Robotics a wholly-owned subsidiary of the Company, in exchange for the issuance of a total of 921,750,000 newly issued shares of the Company’s common stock.

About Charging Robotics

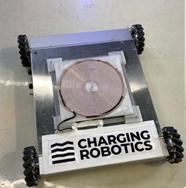

Charging Robotics, was formed in February 2021, as an Israeli corporation, to focus on an innovative wireless electric vehicles (EV) charging technology At the heart of the technology is a wireless power transfer module that uses resonance coils to transfer energy wirelessly from the robot to the vehicle. The robotic platform is small enough to fit under the vehicle, it automatically positions itself for maximum efficiency charging and returns to its docking station at the end of the charging operation.

In July 2021, Charging Robotics concluded a proof of concept, successfully demonstrating the capabilities of its electric vehicle wireless charging robot Charging Robotics mission is to overcome one of today’s biggest challenges in wireless charging of electric vehicles-seamless, highly efficient battery charging for both manned and unmanned vehicles. The robotic platform carries an energy transmitting coil, batteries and supporting electronics. The second component of the system is an EV simulating unit, which houses the target batteries to be charged, an energy receiving coil and the supporting electronics. The robot navigates from its home position along a predefined route to the starting position, which is a point close to the optimal charging position. Charging occurs at the maximum rate when both coils are perfectly aligned. Following arrival to the starting position, the alignment process begins. As the energy was transmitted from the Robot transmitting coil to the receiving coil, the robot was ordered to move in small increments in order to optimize the charging rate.

The EV Market

The EV market is growing globally[1], the main growth factors are favorable government policies and support in terms of subsidies and grants, growing sensitivity toward a cleaner environment, and demand for zero-emission vehicles, heavy investments from the vehicle manufacturers and economic reasons[2]. EV market growth requires charging infrastructure to grow as well. EV chargers are used to provide charging to electric vehicles with a battery and the electrical source that helps to charge the battery. Currently the most common and leading solution are charging cables. Under a scenario where EV will hit 30% market share by 2030, the International Energy Agency forecasts that as many as 30 million public chargers would be needed to serve regular passenger vehicles – a number 50 times more than today’s installed based[3].

We aim to become world’s first wireless charging solution that is set on an autonomous robot for seamless charging experience. Our growth strategy is to primarily focus on public parking lots. Later in our strategy we aim to address private mass markets. In addition to entering markets with our technology, we aim to expand our development, design, and manufacturing capabilities.

Industry Overview and Market Challenges

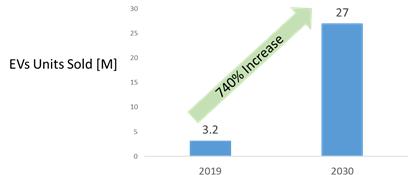

After entering commercial markets in the first half of the decade, EV sales have soared to 7.2M vehicles in 2019, surpassing 2018 – already a record year. Number of electric cars sold is expected to grow to 26.9M by year 2030[4].

By the end of 2019, there were only 7.3 million electric vehicle chargers installed worldwide, and according to some research entities, developing public charging infrastructures to meet the demand is a key challenge to the EV industry[5].

A lack of public charging stations is keeping people from giving up their gas-drinking vehicles. A recent University of California Davis survey of EV owners in California founCharging Robotics, Ltd. Financial Statementsd that 20% switched back to a gas car because charging was too much of burden[6].

Some countries are taking major actions to face the challenge. The US Bipartisan Infrastructure Law[7] passed in November 2021, as an example, includes a budget of $7.2B designated solely to EV charging infrastructure. It's part of the White House's broader goal to fight climate change and get more Americans into zero-emission vehicles.

Currently, the main charging solution that is adopted globally is cable charging. But this is about to change. Wireless charging technology for the automotive industry is expected to be the fastest growing segment of the wireless charging solutions entire market by year 2027[8].

The automotive wireless charging market is highly driven by an increase in sales of EVs and their demand for the safer, convenient, and faster wireless charging system compared to cables[9].

An increase in R&D activities by the leading automotive giants such as BMW, Nissan, and Chevrolet is expected to boost the growth of the market. The Mercedes Benz model S550e–the hybrid version of Flagship S class sedan adopted Qualcomm’s wireless charging technology. This suggests that the wireless charging market has huge potential in the electric vehicles & consumer electronics sector[10].

Our Solution

A robotic wireless charging system platform that will carry the Wireless Power Transfer from charging station or charging truck, to a customer’s vehicle that needs electric charging. State-Of-The-Art Autonomous Wireless Power Transfer (WPT) technology will charge the vehicle quickly and autonomously.

Main characteristics:

- Fully autonomous and wireless- a robotic platform that is fully autonomous and wireless or plugged into a 230V/110V socket and travel freely. It can return to a charging station and charge itself. GPS-based location transmitter & communication via cellular network. AI based system for robot navigation. Bluetooth communication with the vehicle or a receiver on a vehicle.

- Seamless charging- The robot travels under the car and charges it without driver or operator assistance. EV can leave the parking space while the robot is still under the car.

- Motherships- Motherships act as a smart grid element

- Efficient Charging- The Charging coils are dynamically aligned by the robot to maximize the charging rate and efficiency. Robot can identify the type and model of the car to be charged. System can act as an energy storage for smart grid. leverage high low electricity prices and grid load balancing

How it works: Step I- Customer submits charging request to current location by App, step II- Robot approaches vehicle. AI identifies vehicle type for charging method and owner for billing, step III- Robot moves to optimal charging position and charging begins. Step IV- When battery is fully charged or as instructed by the customer, the robot returns to home for self-charging. Customer is billed for electricity transferred.

Competition

To the best of our knowledge, we are the only company who aims to solve EV wireless charging challenges by developing an autonomous robot that is not attached to any cable.

Wireless charging solutions that are currently being developed are usually in the form of a pad or surface. Companies such as: Robert Bosch GmbH (Germany), Continental AG (Germany), WiTricity Corporation (US), ZTE Corporation (China), and HELLA KGaA Hueck & Co. (Germany), Qualcomm Technologies Inc. acquired by WiTricity Corporation are just a partial list of companies.

Below is a competitive analysis of our technology in comparison to all other EV charging technologies, existing or in development. Analysis is based on the company’s best knowledge and understating.

Strategy and Business Model

Our goal is to become a global leading EV wireless charging player by providing solutions that make charging effortless, affordable and widespread. We intend to achieve our goal by implementing the following strategies:

B2B channel as a market penetration - Our go to market strategy is based on offering our solutions on a B2B base. We intend to approach owners and/or operators of public parking spaces with our solution Such public parking spaces include all types of public parking lots such as: Shopping malls, office buildings, entertainment centers. Hospitals, sports centers etc.

Variety of business models We intend to offer different types of business models to increase our technology adoption. Such business models are selling robots to end users, operating the robots and generating revenues from selling electricity and renting robots to end users.

Addressing niche markets that requires alternative to cable charging Since the foundation of our company, we came across other potential niche EV charging market that are in search for alternative for cables. An example for such market is charging stations for handicap people. Our robot could potentially be a unique and optimal solutions for EV handicap people that are struggling with cable charging.

Cooperation with EV charging infrastructure companies and EV manufacturers Part of our strategy is to establish cooperation or JVs with EV charging infrastructure companies and EV manufacturers. We believe that together with these entities we could work on additional robot versions, enhance relevant robot or charging capabilities and create faster go to market channels

Building a brand We believe Charging Robotics can become a global known brand for robot charging. We intend to make significant efforts in growing our brand recognition and building a global market footprint and market position.

Government Regulation

We are subject to the same regulation as regular charging stations. Since government is playing a major role in the growth of the EVSE market as it mandates policies and setting targets related to the adoption of electric vehicles and charging infrastructure there are markets where regulation could potentially impact our growth and success. We intend to focus on these markets and countries where we believe regulation could boost our technology adoption and sales.

Intellectual Property

We intend to seek patent protection as well as other effective intellectual property rights for our products and technologies in the United States and internationally. Our policy is to pursue, maintain and defend intellectual property rights developed internally and to protect the technology, inventions and improvements that are commercially important to the development of our business.

We also rely on trade secrets, know-how, and continuous innovation to develop and maintain our competitive position. We cannot be certain that future patent applications will be granted with respect to any patent applications filed by us in the future, nor can we be sure that any patents granted to us in the future will be commercially useful in protecting our technology.

Our success depends, in part, on an intellectual property portfolio that supports future revenue streams and erects barriers to our competitors.

Despite these measures, any of our intellectual property and proprietary rights could be challenged, invalidated, circumvented, infringed or misappropriated. Intellectual property and proprietary rights may not be sufficient to permit us to take advantage of current market trends or otherwise to provide competitive one.

Employees

As of the date of this prospectus, we have one senior management position who is engaged in full time position. In addition, we have seven employees in full or part-time capacities. All of our employees are located in Israel.

None of our employees are represented by labor unions or covered by collective bargaining agreements. We believe that we maintain good relations with all our employees. However, in Israel, we are subject to certain Israeli labor laws, regulations and national labor court precedent rulings, as well as certain provisions of collective bargaining agreements applicable to us by virtue of extension orders issued in accordance with relevant labor laws by the Israeli Ministry of Economy and which apply such agreement provisions to our employees even though they are not part of a union that has signed a collective bargaining agreement.

All of our employment agreements include employees’ undertakings with respect to non-competition and assignment to us of intellectual property rights developed in the course of employment and confidentiality. Our consulting agreement with our CFO includes provisions with respect to assignment to us of intellectual property rights developed in the course of employment and confidentiality. The enforceability of such provisions is subject to Israeli law.

Properties

Our corporate headquarters, which includes our offices and research and development facility, is located at 30 Dov Hoz St., Kiryat Ono 5555626, Israel, where we currently occupy approximately 2,100 square feet. We lease our facilities and our lease ends on February 28, 2023. At the end of the term, we have the option to extend the lease for an additional two years. Our monthly rent payment is NIS 13,780 (approximately $4,200) plus VAT at a rate of 17%, as required under Israeli law. In 2023, we plan to move into a larger office space to support our growth. The rent payment is expected to be doubled.

Legal Proceedings

We are not aware of any pending or threatened legal proceedings involving our company or its assets.

RISK FACTORS

Risks Related to Our Financial Condition and Capital Requirements

We are a development-stage company and have a limited operating history on which to assess the prospects for our business, have incurred significant losses since the date of our inception, and anticipate that we will continue to incur significant losses until we are able to successfully commercialize our products.

We are a development-stage company with a limited operating history. We have incurred net losses since our inception, including net losses of approximately $810,000 for the year ended December 31, 2022. As of December 31, 2022, we had accumulated losses of approximately $1,6200,00.

We have devoted substantially all of our financial resources to develop our products. We have financed our operations primarily through funding provided by our former parent company. The amount of our future net losses will depend, in part, on completing the development of our products, the rate of our future expenditures and our ability to obtain funding through the issuance of our securities, strategic collaborations or grants. We expect to continue to incur significant losses until we are able to successfully commercialize our products. We anticipate that our expenses will increase substantially if and as we:

• continue the development of our products;

• establish a sales, marketing, distribution and technical support infrastructure to commercialize our products;

• seek to identify, assess, acquire, license, and/or develop other products and subsequent generations of our current products;

• seek to maintain, protect, and expand our intellectual property portfolio;

• seek to attract and retain skilled personnel; and

• create additional infrastructure to support our operations as a public company and our product development and planned future commercialization efforts.

Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

Our audited financial statements for the period ended December 31, 2022 contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. This going concern opinion could materially limit our ability to raise additional funds through the issuance of equity or debt securities or otherwise. Future financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. Until we can generate significant recurring revenues, we expect to satisfy our future cash needs through debt or equity financing. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the scope of, or eliminate research or development plans for, or commercialization efforts with respect to our products. This may raise substantial doubts about our ability to continue as a going concern.

We have not generated any significant revenue from the sale of our current products and may never be profitable.

While we have commenced pre-commercialization efforts, we have not generated any significant revenue since our inception. Our ability to generate revenue and achieve profitability depends on our ability to successfully complete the development of, and to commercialize, our products. Our ability to generate future revenue from product sales depends heavily on our success in many areas, including but not limited to:

• completing development of our products;

| • | establishing and maintaining supply and manufacturing relationships with third parties that can provide adequate (in amount and quality) products to support market demand for our products; |

• launching and commercializing products, either directly or with a collaborator or distributor;

• addressing any competing technological and market developments;

• identifying, assessing, acquiring and/or developing new products;

• negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter;

• maintaining, protecting and expanding our portfolio of intellectual property rights, including patents, trade secrets and know-how; and

• attracting, hiring and retaining qualified personnel.

We expect that we will need to raise substantial additional capital before we can expect to become profitable from sales of our products. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We expect that we will require substantial additional capital to commercialize our products. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future capital requirements will depend on many factors, including but not limited to:

• the scope, rate of progress, results and cost of product development, and other related activities;

• the cost of establishing commercial supplies of our products;

• the cost and timing of establishing sales, marketing, and distribution capabilities; and

• the terms and timing of any collaborative, licensing, and other arrangements that we may establish.

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our products. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be

desirable, and we may be required to relinquish rights to some of our technologies or products or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of our products or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

Our operating results and financial condition may fluctuate.

Even if we are successful in marketing its products to the market, our operating results and financial condition may fluctuate from quarter to quarter and year to year and are likely to continue to vary due to several factors, many of which will not be within our control. If our operating results do not meet the guidance that we provide to the marketplace or the expectations of securities analysts or investors, the market price of the Common Stock will likely decline. Fluctuations in the our operating results and financial condition may be due to several factors, including those listed below:

• the degree of market acceptance of our products and services;

• the mix of products and services that we sell during any period;

• long sale cycles;

• changes in the amount that we spend to develop, acquire or license new products, technologies or businesses;

• changes in the amounts that we spend to promote our products and services;

• changes in the cost of satisfying our warranty obligations and servicing our installed base of systems;

• delays between our expenditures to develop and market new or enhanced systems and consumables and the generation of sales from those products;

• development of new competitive products and services by others;

• difficulty in predicting sales patterns and reorder rates that may result from a multi-tier distribution strategy associated with new product categories;

• litigation or threats of litigation, including intellectual property claims by third parties;

• changes in accounting rules and tax laws;

• changes in regulations and standards;

• the geographic distribution of our sales;

• our responses to price competition;

• general economic and industry conditions that affect end-user demand and end-user levels of product design and manufacturing;

• changes in interest rates that affect returns on our cash balances and short-term investments;

• changes in dollar-shekel exchange rates that affect the value of our net assets, future revenues and expenditures from and/or relating to our activities carried out in those currencies; and

• the level of research and development activities by our company.

Due to all of the foregoing factors, and the other risks discussed herein, you should not rely on quarter-to-quarter comparisons of our operating results as an indicator of our future performance.

Risks Related to Our Business and Industry

We operats in an evolving market which makes it difficult to evaluate our business and future prospects.

Our products are designed to compete in a rapidly evolving market. The market for alternative automobile charing technologies is an early stage. Accordingly, our business and future prospects may be difficult to evaluate. We cannot accurately predict the extent to which demand for its products and services will develop, if at all. The challenges, risks and uncertainties frequently encountered by companies in rapidly evolving markets could impact the our ability to do the following:

• generate sufficient revenue to reach and maintain profitability;

• acquire and maintain market share;

• achieve or manage growth in operations;

• develop and renew contracts;

• attract and retain additional engineers and other highly-qualified personnel;

• successfully develop and commercially market new products;

• adapt to new or changing policies and spending priorities of governments and government agencies; and

• access additional capital when required and on reasonable terms.

If we fail to successfully address these and other challenges, risks and uncertainties, its business, results of operations and financial condition would be materially harmed.

We face uncertainty and adverse changes in the economy.

Adverse changes in the economy could negatively impact the our business. Future economic distress may result in a decrease in demand for the our products and/or a decrease in the demand for electric vehicles, which could have a material adverse impact on the Company’s operating results and financial condition. Uncertainty and adverse changes in the economy could also increase costs associated with developing products, increase the cost and decrease the availability of sources of financing, and increase our exposure to material losses from bad debts, any of which could have a material adverse impact on our financial condition and operating results.

We depend on key personnel to operate our business. An inability to retain, attract, and integrate qualified personnel would harm our ability to develop and successfully grow our business.

Our success and growth strategy depend on our ability to attract and retain key management and operating personnel, including skilled developers, marketing personnel, project managers, product managers and content editors. Our future success depends on our continuing ability to attract, develop, motivate and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract and retain them. Experienced developers and marketing personnel, who are critical to the success of our business, are also in particularly high demand. Competition for their talents is intense and retaining such individuals can be difficult.

If we fail to manage rapid growth effectively, our brand, business, financial condition and results of operations could be adversely affected.

Rapid growth may impose significant responsibilities on our management, including the need to identify, recruit and integrate additional employees with relevant expertise, expand the scope of our current technological platform and invest in improved controls over technology, financial reporting and information disclosure. If we fail to manage the growth of our business and operations effectively, the quality of our service and the efficiency of our operations could suffer, which could adversely affect our business, financial condition, and results of operations.

In addition, our rapid growth may make it difficult to evaluate our future performance. Our ability to forecast our future results of operations is subject to a number of uncertainties, including our ability to model future growth. If we fail to achieve the necessary level of efficiency in our company as it grows, or if we are not able to accurately forecast future growth, our business would be negatively impacted.

If critical components or raw materials used to manufacture the our products become scarce or unavailable, then we may incur delays in manufacturing and delivery of its products, which could damage its business.

We obtain hardware components, various subsystems and systems from a limited group of suppliers. We do not have long-term agreements with any of these suppliers that obligate it to continue to sell us components, subsystems, systems or products. Our reliance on these suppliers involves significant risks and uncertainties, including whether its suppliers will provide an adequate supply of required components, subsystems or systems of sufficient quality, will increase prices for the components, subsystems or systems and will perform their obligations on a timely basis.

In addition, certain raw materials and components used in the manufacture of our products are periodically subject to supply shortages, and its business is subject to the risk of price increases and periodic delays in delivery. If we are unable to obtain components from third-party suppliers in the quantities and of the quality that it requires, on a timely basis and at acceptable prices, then it may not be able to deliver its products on a timely or cost-effective basis to its customers, which could cause customers to terminate their contracts with the Company, increase our costs and seriously harm our business, results of operations and financial condition. Moreover, if any of our suppliers become financially unstable, then it may have to find new suppliers. It may take several months to locate alternative suppliers, if required, or to redesign our products to accommodate components from different suppliers. We may experience significant delays in manufacturing and shipping its products to customers and incur additional development, manufacturing and other costs to establish alternative sources of supply if we loose any of these sources or is required to redesign its products. We cannot predict if it will be able to obtain replacement components within the time frames that it requires at an affordable cost, if at all.

Our products may be subject to recall or returns.

Products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, safety concerns, packaging issues and inadequate or inaccurate labeling disclosure. If any of the Company’s equipment were to be recalled due to an alleged product defect, safety concern or for any other reason, we could be required to incur unexpected expenses of the recall and any legal proceedings that might arise in connection with the recall. We may lose a significant amount of sales and may not be able to replace those sales at an acceptable margin or at all. In addition, a product recall may require significant management time and attention. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management time and attention and potential legal fees, costs and other expenses.

If we releass defective products or services, our operating results could suffer.

Products and services designed and released by us involve complex software programs and physical products, which are difficult to develop and distribute. While we have quality controls in place to detect and prevent defects in its products and services before they are released, these quality controls are subject to human error, overriding, and reasonable resource constraints. Therefore, these quality controls and preventative measures may not be effective in detecting and preventing defects in our products and services before they have been released into the marketplace. In such an event, we could be required, or decide voluntarily, to suspend the availability of the product or services, which could significantly harm its business and operating results.

Our products and services are complex and could have unknown defects or errors, which may give rise to legal claims against us, diminish our brand or divert our resources from other purposes.

Despite testing, our products have contained defects and errors and may in the future contain defects, errors or performance problems when first introduced, when new versions or enhancements are released or even after these products have been used by our customers for a period of time. These problems could result in expensive and time-consuming design modifications or warranty charges, delays in the introduction of new products or enhancements, significant increases in the our service and maintenance costs, exposure to liability for damages, damaged customer relationships and harm to our reputation, any of which could materially harm our results of operations and ability to achieve market acceptance. In addition, increased development and warranty costs could be substantial and could significantly reduce the our operating margins.

The markets in which we plas to competes are characterized by rapid technological change, which requires us to develop new products and product enhancements, and could render our existing products obsolete.

Continuing technological changes in the market for our products could make its products less competitive or obsolete, either generally or for particular applications. Our future success will depend upon its ability to develop and introduce a variety of new capabilities and enhancements to its planned product and service offerings, as well as introduce a variety of new product offerings, to address the changing needs of the markets in which it offers products. Delays in introducing new products and enhancements, the failure to choose correctly among technical alternatives or the failure to offer innovative products or enhancements at competitive prices may cause existing and potential customers to purchase our competitors’ products.

If we are unable to devote adequate resources to develop new products or cannot otherwise successfully develop new products or enhancements that meet customer requirements on a timely basis, its products could lose market share, its revenue and profits could decline, and we could experience operating losses.

If we fail to successfully promote our products and brand, this could have a material adverse effect on our business, prospects, financial condition and results of operations.

We believe that brand recognition is an important factor to its success. If we fail to promote our brands successfully, or if the expenses of doing so are disproportionate to any increased net sales it achieves, it would have a material adverse effect on our business, prospects, financial condition and results of operations. This will depend largely on our ability to maintain trust, be a technology leader, and continue to provide high-quality and secure technologies, products and services. Any negative publicity about us or its industry, the quality and reliability of the our technologies, products and services, our risk management processes, changes to our technologies, products and services, its ability to effectively manage and resolve customer complaints, its privacy and security practices, litigation, regulatory activity, and the experience of sbuyers with our products or

services, could adversely affect the our reputation and the confidence in and use of our technologies, products and services. Harm to our brand can arise from many sources, including; failure by us or our partners to satisfy expectations of service and quality; inadequate protection of sensitive information; compliance failures and claims; litigation and other claims; employee misconduct; and misconduct by our partners, service providers, or other counterparties. If we do not successfully maintain a strong and trusted brand, its business could be materially and adversely affected.

Our planned international operations will expose us to additional market and operational risks, and failure to manage these risks may adversely affect our business and operating results.

We expect to derive a substantial percentage of our sales from international markets. Accordingly, we will face significant operational risks from doing business internationally, including:

• fluctuations in foreign currency exchange rates;

• potentially longer sales and payment cycles;

• potentially greater difficulties in collecting accounts receivable;

• potentially adverse tax consequences;

• reduced protection of intellectual property rights in certain countries, particularly in Asia and South America;

• difficulties in staffing and managing foreign operations;

• laws and business practices favoring local competition;

• costs and difficulties of customizing products for foreign countries;

• compliance with a wide variety of complex foreign laws, treaties and regulations;

• an outbreak of a contagious disease, such as coronavirus, which may cause us, third party vendors and manufacturers and/or customers to temporarily suspend our or their respective operations in the affected city or country;

• tariffs, trade barriers and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets; and

• being subject to the laws, regulations and the court systems of many jurisdictions.

Significant disruptions of our information technology systems or breaches of our data security could adversely affect our business.

A significant invasion, interruption, destruction or breakdown of our information technology systems and/or infrastructure by persons with authorized or unauthorized access could negatively impact our business and operations. We could also experience business interruption, information theft and/or reputational damage from cyber-attacks, which may compromise our systems and lead to data leakage either internally or at our third-party providers. Our systems are expected to be the target of malware and other cyber-attacks. Although we have invested in measures to reduce these risks, we cannot assure you that these measures will be successful in preventing compromise and/or disruption of our information technology systems and related data.

We rely on business partners, and they may be given access to sensitive and proprietary information in order to provide services and support to our customers.

We rely on various business partners, including third-party service providers, vendors, licensing partners, development partners and licensees, among others, in some areas of the our business. In some cases, these third parties are given access to sensitive and proprietary information in order to provide us services and support. These third parties may misappropriate our information and engage in unauthorized use of it. The failure of these third parties to provide adequate services and technologies, or the failure of the third parties to adequately maintain or update their services and technologies, could result in a disruption to our business operations. Further, disruptions in the financial markets and economic downturns may adversely affect our business partners and they may not be able to continue honoring their obligations to us. Alternative arrangements and services may not be available to us on commercially reasonable terms or we may experience business interruptions upon a transition to an alternative partner or vendor. If we lose one or more significant business partners, our business could be harmed.

We may be subject to electronic communication security risks.

A significant potential vulnerability of electronic communications is the security of transmission of confidential information over public networks. Anyone who is able to circumvent the our security measures could misappropriate proprietary information or cause interruptions in its operations. We may be required to expend capital and other resources to protect against such security breaches or to alleviate problems caused by such breaches.

Risks Related to Our Intellectual Property

If we are unable to obtain and maintain effective intellectual property rights for our products, we may not be able to compete effectively in our markets.

Historically, we have relied on trade secret protection and confidentiality agreements to protect the intellectual property related to our technologies and products. Our success depends in large part on intellectual property protection in the United States and in other countries with respect to our proprietary technology and new products.

We may seek to protect our proprietary position by filing patent applications in Israel, the United States and in other countries, with respect to our novel technologies and products, which are important to our business. Patent prosecution is expensive and time consuming, and we may not be able to file and prosecute all necessary or desirable patent applications at a reasonable cost or in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development output before it is too late to obtain patent protection.

If we seek patent protection, we cannot offer any assurances about which, if any, patent applications will issue, the breadth of any such patent or whether any issued patents will be found invalid and unenforceable or will be threatened by third parties. Any successful opposition to these patents or any other patents owned by or licensed to us after patent issuance could deprive us of rights necessary for the successful commercialization of any new products that we may develop.

Further, there is no assurance that all potentially relevant prior art relating to our patent applications has been found, which can invalidate a patent or prevent a patent from issuing from a pending patent application. Even if patents do successfully issue, and even if such patents cover our products, third parties may challenge their validity, enforceability, or scope, which may result in such patents being narrowed, found unenforceable or invalidated. Furthermore, even if they are unchallenged, our patent applications and any future patents may not adequately protect our intellectual property, provide exclusivity for our new products, or prevent others from designing around our claims. Any of these outcomes could impair our ability to prevent competition from third parties, which may have an adverse impact on our business. If we cannot obtain and maintain effective patent rights for our products, we may not be able to compete effectively, and our business and results of operations would be harmed.

Further, international trade conflicts could have negative consequences on the demand for our products and services outside Israel. Other risks of doing business internationally include political and economic instability in the countries of our customers and suppliers, changes in diplomatic and trade relationships and increasing instances of terrorism worldwide. Some of these risks may be affected by Israel’s overall political situation

.

Intellectual property rights of third parties could adversely affect our ability to commercialize our products, and we might be required to litigate or obtain licenses from third parties in order to develop or market our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms.

It is inherently difficult to conclusively assess our freedom to operate without infringing on third party rights. Our competitive position may be adversely affected if existing patents or patents resulting from patent applications issued to third parties or other third-party intellectual property rights are held to cover our products or elements thereof, or our manufacturing or uses relevant to our development plans. In such cases, we may not be in a position to develop or commercialize products or our product candidates unless we successfully pursue litigation to nullify or invalidate the third-party intellectual property right concerned or enter into a license agreement with the intellectual property right holder, if available on commercially reasonable terms. There may also be pending patent applications that if they result in issued patents, could be alleged to be infringed by our new products. If such an infringement claim should be brought and be successful, we may be required to pay substantial damages, be forced to abandon our new products or seek a license from any patent holders. No assurances can be given that a license will be available on commercially reasonable terms, if at all.

It is also possible that we have failed to identify relevant third-party patents or applications. Patent applications in the United States and in most of the other countries are published approximately 18 months after the earliest filing for which priority is claimed, with such earliest filing date being commonly referred to as the priority date. Therefore, patent applications covering our new products or platform technology could have been filed by others without our knowledge. Additionally, pending patent applications which have been published can, subject to certain limitations, be later amended in a manner that could cover our platform technologies, our new products or the use of our new products. Third party intellectual property right holders may also actively bring infringement claims against us. We cannot guarantee that we will be able to successfully settle or otherwise resolve such infringement claims. If we are unable to successfully settle future claims on terms acceptable to us, we may be required to engage in or continue costly, unpredictable and time-consuming litigation and may be prevented from or experience substantial delays in pursuing the development of and/or marketing our new products. If we fail in any such dispute, in addition to being forced to pay damages, we may be temporarily or permanently prohibited from commercializing our new products that are held to be infringing. We might, if possible, also be forced to redesign our new products so that we no longer infringe the third party’s intellectual property rights. Any of these events, even if we were ultimately to prevail, could require us to divert substantial financial and management resources that we would otherwise be able to devote to our business.

We may be involved in lawsuits to protect or enforce our intellectual property, which could be expensive, time consuming, and unsuccessful.

Competitors may infringe our intellectual property. If we were to initiate legal proceedings against a third party to enforce a patent covering one of our new products, the defendant could counterclaim that the patent covering our product candidate is invalid and/or unenforceable. In patent litigation in the United States, defendant counterclaims alleging invalidity and/or unenforceability are commonplace. Grounds for a validity challenge could be an alleged failure to meet any of several statutory requirements, including lack of novelty, obviousness, or non-enablement. Grounds for an unenforceability assertion could be an allegation that someone connected with prosecution of the patent withheld relevant information from the United States Patent and Trademark Office, or USPTO, or made a misleading statement, during prosecution. The validity of U.S. patents may also be challenged in post-grant proceedings before the USPTO. The outcome following legal assertions of invalidity and unenforceability is unpredictable.

Derivation proceedings initiated by third parties or brought by us may be necessary to determine the priority of inventions and/or their scope with respect to our patent or patent applications or those of our licensors. An unfavorable outcome could require us to cease using the related technology or to attempt to license rights to it from the prevailing party. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms. Our defense of litigation or interference proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees. In addition, the uncertainties associated with litigation could have a material adverse effect on our ability to raise the funds necessary to continue our research programs, license necessary technology from third parties, or enter into development partnerships that would help us bring our new products to market.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. There could also be public announcements of the results of hearings, motions, or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a material adverse effect on the price of our Common Stock.

We may be subject to claims challenging the inventorship of our intellectual property.

We may be subject to claims that former employees, collaborators or other third parties have an interest in, or right to compensation, with respect to our current patent and patent applications, future patents or other intellectual property as an inventor or co-inventor. For example, we may have inventorship disputes arise from conflicting obligations of consultants or others who are involved in developing our products. Litigation may be necessary to defend against these and other claims challenging inventorship or claiming the right to compensation. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property. Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

We may not be able to protect our intellectual property rights throughout the world.

Filing, prosecuting, and defending patents on products, as well as monitoring their infringement in all countries throughout the world would be prohibitively expensive, and our intellectual property rights in some countries can be less extensive than those in the United States. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as federal and state laws in the United States.

A substantial part of our commercial success will depend on its ability to maintain, establish and protect its intellectual property assets, maintain trade secret protection, register copyrights and trademarks, and operate without infringing the proprietary rights of third parties. There is a further risk that the claims of a patent application, when filed, may change in scope during examination by the patent offices. Further, if and where a patent is granted, there can be no guarantee that such patent will be valid or enforceable or that the patent will be granted in other jurisdictions

Competitors may use our technologies in jurisdictions where we have not obtained patent protection to develop their own products and may also export otherwise infringing products to territories where we have patent protection, but enforcement is not as strong as that in the United States. These products may compete with our products. Future patents or other intellectual property rights may not be effective or sufficient to prevent them from competing.

Many companies have encountered significant problems in protecting and defending intellectual property rights in foreign jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, trade secrets, and other intellectual property protection, which could make it difficult for us to stop the marketing of competing products in violation of our proprietary rights generally. Proceedings to enforce our patent rights in foreign jurisdictions, whether or not successful, could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our future patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially meaningful. Accordingly, our efforts to monitor and enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

We may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result in litigation and adversely affect our business.

A significant portion of our intellectual property has been developed by our employees in the course of their employment for us. Under the Israeli Patent Law, 5727-1967, or the Patent Law, inventions conceived by an employee during the scope of his or her employment with a company are regarded as “service inventions,” which belong to the employer, absent an agreement between the employee and employer providing otherwise. The Patents Law also provides that if there is no agreement between an employer and an employee determining whether the employee is entitled to receive consideration for service inventions and on what terms, this will be determined by the Israeli Compensation and Royalties Committee, or the Committee, a body constituted under the Patents Law. Case law clarifies that the right to receive consideration for “service inventions” can be waived by the employee and that in certain circumstances, such waiver does not necessarily have to be explicit. The Committee will examine, on a case-by-case basis, the general contractual framework between the parties, using interpretation rules of the general Israeli contract laws. Further, the Committee has not yet determined one specific formula for calculating this remuneration, but rather uses the criteria specified in the Patents Law. Although we generally enter into agreements with our employees pursuant to which such individuals assign to us all rights to any inventions created during and as a result of their employment with us, we may face claims demanding remuneration in consideration for assigned inventions. As a consequence of such claims, we could be required to pay additional remuneration or royalties to our current and/or former employees, or be forced to litigate such monetary claims (which will not affect our proprietary rights), which could negatively affect our business.

Risks Related to Our Common Stock

We are an “emerging growth company” and our compliance with the reduced reporting and disclosure requirements applicable to “emerging growth companies” may make our Common Stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we have elected to take advantage of certain exemptions and relief from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” These provisions include, but are not limited to: being permitted to have only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and plan of operation disclosures; being exempt from compliance with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act; being subject to reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and not being required to hold nonbinding advisory votes on executive compensation or on any golden parachute payments not previously approved.

In addition, while we are an “emerging growth company,” we will not be required to comply with any new financial accounting standard until such standard is generally applicable to private companies. As a result, our financial statements may not be comparable to companies that are not “emerging growth companies” or elect not to avail themselves of this provision.

We may remain an “emerging growth company” until as late as December 31, 2027, the fiscal year-end following the fifth anniversary of the completion of this initial public offering, though we may cease to be an “emerging growth company” earlier under certain circumstances, including if (i) we have more than $1.07 billion in annual revenue in any fiscal year, (ii) we become a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates as of the end of the second quarter of that fiscal year, or (iii) we issue more than $1.0 billion of non-convertible debt over a three-year period.

The exact implications of the JOBS Act are still subject to interpretations and guidance by the SEC and other regulatory agencies, and we cannot assure you that we will be able to take advantage of all of the benefits of the JOBS Act. In addition, investors may find our common stock less attractive to the extent we rely on the exemptions and relief granted by the JOBS Act. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may decline or become more volatile.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial fraud.

In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting, or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related Commission regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

Our Common Stock may be considered a “penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell.

Our Common Stock, which is currently quoted for trading on the over the counter market, may be considered to be a “penny stock” if it does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Securities Exchange Act for 1934, as amended (the “Exchange Act”). Our Common Stock may be a “penny stock” if it meets one or more of the following conditions: (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange; (iii) it is not quoted on the NASDAQ Capital Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our Common Stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

We may be subject to securities litigation, which is expensive and could divert management attention.

In the past, companies that have experienced volatility in the market price of their stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Litigation of this type could result in substantial costs and diversion of management’s attention and resources, which could seriously hurt our business. Any adverse determination in litigation could also subject us to significant liabilities.

If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they adversely change their recommendations or publish negative reports regarding our business or our shares, our share price and trading volume could decline.

The trading market for our Common Stock will be influenced by the research and reports that industry or securities analysts may publish about us, our business, our market or our competitors. We do not have any control over these analysts and we cannot provide any assurance that analysts will cover us or provide favorable coverage. If any of the analysts who may cover us adversely change their recommendation regarding our shares, or provide more favorable relative recommendations about our competitors, our share price would likely decline. If any analyst who may cover us were to cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our share price or trading volume to decline.

We have no operating experience as a publicly traded company in the U.S.

We have no operating experience as a publicly traded company in the U.S. Although at least one individual who now constitutes our management team has experience managing a publicly-traded company, there is no assurance that the past experience of our management team will be sufficient to operate our company as a publicly traded company in the United States, including timely compliance with the disclosure requirements of the SEC. Following the completion of this offering, we will be required to develop and implement internal control systems and procedures in order to satisfy the periodic and current reporting requirements under applicable SEC regulations and comply with the Nasdaq listing standards. These requirements will place significant strain on our management team, infrastructure and other resources. In addition, our management team may not be able to successfully or efficiently manage our company as a U.S. public reporting company that is subject to significant regulatory oversight and reporting obligations.

Raising additional capital will cause dilution to our existing stockholders and may affect the rights of existing stockholders.

We may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the issuance of equity or convertible debt securities, stockholders’ ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a holder of our Common Stock.

Sales of a substantial number of shares of our Common Stock in the public market by our existing stockholders could cause our share price to fall.

Sales of a substantial number of shares of our Common Stock in the public market, or the perception that these sales might occur, could depress the market price of our Common Stock and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that sales may have on the prevailing market price of our Common Stock.

We have never paid, and we currently do not intend to pay dividends.

We have never declared or paid any cash dividends on our Common Stock. We currently intend to retain any future earnings to finance operations and to expand our business and, therefore, do not expect to pay any cash dividends in the foreseeable future. As a result, capital appreciation, if any, of our Common Stock will be investors’ sole source of gain for the foreseeable future. In addition, Israeli law may limit our declaration or payment of dividends and may subject our dividends to Israeli withholding taxes.

Risks Related to Our Location and Operations in Israel

We are exposed to fluctuations in currency exchange rates.

A major portion of our business is conducted, and a material portion of our operating expenses is incurred, outside the United States, mainly in New Israeli Shekels (“NIS”). Therefore, we are exposed to currency exchange fluctuations in other currencies, particularly in NIS and the risks related thereto. Our primary expenses paid in NIS are employee salaries, fees for consultants and subcontractors and lease payments on our Israeli facilities. As a result, we are affected by foreign currency exchange fluctuations through both translation risk and transaction risk. Thus, we are exposed to the risks that: (a) the NIS may appreciate relative to the dollar; (b) the NIS devalue relative to the dollar; (c) the inflation rate in Israel may exceed the rate of devaluation of the NIS; or (d) the timing of such devaluation may lag behind inflation in Israel. In any such event, the dollar cost of our operations in Israel would increase and our dollar-denominated results of operations would be adversely affected. Our operations also could be adversely affected if we are unable to effectively hedge against currency fluctuations in the future.

Our headquarters, research and development and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel.

Our executive offices and research and development facilities are located in Israel. In addition, all of our key employees, officers and directors are residents of Israel. Accordingly, political, economic and military conditions in Israel may directly affect our business. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its neighboring Arab countries, the Hamas (an Islamist militia and political group that controls the Gaza strip) and the Hezbollah (an Islamist militia and political group based in Lebanon). Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its trading partners could negatively affect business conditions in Israel in general and our business in particular, and adversely affect our product development, operations and results of operations. Ongoing and revived hostilities or other Israeli political or economic factors, such as, an interruption of operations at the Tel Aviv airport, could prevent or delay shipments of our components or products.

Any armed conflicts, terrorist activities or political instability in the region could adversely affect business conditions, could harm our results of operations and the market price of our Common Stock and could make it more difficult for us to raise capital. Parties with whom we do business may sometimes decline to travel to Israel during periods of heightened unrest or tension, forcing us to make alternative arrangements when necessary, in order to meet our business partners face to face. Several countries, principally in the Middle East, still restrict doing business with Israel and Israeli companies, and additional countries may impose restrictions on doing business with Israel and Israeli companies if hostilities in Israel or political instability in the region continues or increases. Similarly, Israeli companies are limited in conducting business with entities from several countries. For instance, in 2008, the Israeli legislature passed a law forbidding any investments in entities that transact business with Iran.

Our commercial insurance does not cover losses that may occur as a result of an event associated with the security situation in the Middle East. Although the Israeli government has in the past covered the reinstatement value of certain damages that were caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will be maintained or, if maintained, will be sufficient to compensate us fully for damages incurred. Any losses or damages incurred by us could have a material adverse effect on our business.

Our operations may be disrupted as a result of the obligation of management or key personnel to perform military service.

Our employees and consultants in Israel, including members of our senior management, may be obligated to perform up to 42 days, and in some cases longer periods, of military reserve duty generally until they reach the age of 45 (or older, for citizens who hold certain positions in the Israeli armed forces reserves) and, in the event of a military conflict, may be called to active duty. In response to increases in terrorist activity, there have been periods of significant call-ups of military reservists. It is possible that there will be similar large-scale military reserve duty call-ups in the future. Our operations could be disrupted by the absence of a significant number of our officers, directors, employees and consultants. Such disruption could materially adversely affect our business and operations.

DESCRIPTION OF SECURITIES

Common Stock

We are authorized to issue 2,990,000,000 shares of common stock, $0.0001 par value per share, of which 314,406,030 shares were issued and outstanding just prior to the closing of the Acquisition.

Each outstanding share of common stock regardless of class is entitled to one vote, either in person or by proxy, on all matters that may be voted upon by their holders at meetings of the stockholders.

Holders of our common stock:

| i | have equal ratable rights to dividends from funds legally available therefore, if declared by our Board of Directors; |

| ii | are entitled to share ratably in all of our assets available for distribution to holders of common stock upon our liquidation, dissolution or winding up; |

| iii | do not have preemptive, subscription or conversion rights or redemption or sinking fund provisions; and |

| iv | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote at all meetings of our stockholders. |

The holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than fifty percent (50%) of outstanding shares voting for the election of directors can elect all of our directors if they so choose and, in such event, the holders of the remaining shares will not be able to elect any of our directors.

Preferred Stock

We may issue up to 10,000,000 shares of our preferred stock, par value $0.0001 per share, from time to time in one or more series. As of the date hereof, we have issued no shares of our preferred stock.

Warrants

We have no warrants to outstanding.

Options

We have no options to outstanding.

MARKET PRICE OF THE COMPANY’S COMMON STOCK

Our common stock is listed for quotation on the OTC Markets under the ticker symbol “FDOC,”.

The following table sets forth, for the periods indicated, the high and low closing sales prices of our common stock (where the end of the quarter was on a weekend or holiday and in cases where there was otherwise no trading activity, the high and low prices nearest and prior to the date have been used):

| FISCAL YEAR ENDED DECEMBER 31, 2021: | HIGH | LOW | |||||

| March 31, 2021 | $ | 0.120 | $ | 0.017 | |||

| June 30, 2021 | $ | 0.139 | $ | 0.031 | |||

| September 30, 2021 | $ | 0.100 | $ | 0.046 | |||

| December 31, 2021 | $ | 0.140 | $ | 0.068 | |||

| FISCAL YEAR ENDED DECEMBER 31, 2022: | |||||||

| March 31, 2022 | $ | 0.488 | $ | 0.130 | |||

| June 30, 2022 | $ | 0.480 | $ | 0.251 | |||

| September 30, 2022 | $ | 0.370 | $ | 0.274 | |||

| December 31, 2022 | $ | 0.339 | $ | 0.198 | |||

(b) Holders

As of December 31, 2022, there were approximately 128 holders of record of our common stock, not including holders who hold their shares in street name and as of the same date 2,876,817 shares are held in “street name.”

(c) Dividends

The Company has never declared or paid any cash dividends. It is the present policy of the Company to retain earnings to finance the growth and development of the business and, therefore, the Company does not anticipate paying dividends on its Common Stock in the foreseeable future.

Item 2.02 Results of Operations and Financial Condition.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is a discussion of the financial condition and results of operations of Charging Robotics, Ltd. This management’s discussion and analysis of financial condition and results of operations should be read in conjunction with our financial statements and the related notes, and the other financial information included in this current report.

Forward-Looking Statements

We make forward-looking statements in this Form 8-K that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “could,” “will,” “would,” “ongoing,” “future” or the negative of these terms or other similar expressions. Forward-looking statements include, but are not limited to, such matters as:

| ∎ | our ability to compete in our industry; |

| ∎ | our expectations regarding our financial performance, including our revenue, costs and EBITDA; |

| ∎ | the sufficiency of our cash, cash equivalents, and investments to meet our liquidity needs; |

| ∎ | our ability to attract, retain, and maintain good relations with our customers; |

| ∎ | our ability to anticipate market needs or develop new or enhanced offerings and services to meet those needs; |

| ∎ | our ability to stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to our business both in the U.S. and internationally and our expectations regarding various laws and restrictions that relate to our business; |

| ∎ | our ability to anticipate the effects of existing and developing laws and regulations, including with respect to taxation, and privacy and data protection that relate to our business; |

| ∎ | our ability to effectively manage our growth and maintain our corporate culture; |

| ∎ | our ability to identify, recruit, and retain skilled personnel, including key members of senior management; |

| ∎ | our ability to successfully identify, manage, consummate and integrate any existing and potential acquisitions; |

| ∎ | our ability to maintain, protect, and enhance our intellectual property; |

| ∎ | our ability to manage the increased expenses associated and compliance demands with being a public company; and |

| ∎ | other factors detailed herein under “Risk Factors.” |