UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

For the fiscal year ended December 31 , 2021

OR

For the transition period from to

Commission file number 001-36289

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices, including zip code)

(617 ) 876-8191

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| ☒ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant's common stock held by non-affiliates on June 30, 2021, the last business day of the registrant’s most recently completed second quarter, was: $108,805,512 .

The number of shares outstanding of the registrant’s common stock as of March 15, 2022 was 58,733,759 .

Portions of the Registrant’s definitive proxy statement related to its 2022 annual meeting of stockholders to be filed subsequently are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, our clinical results and other future conditions. The words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “may”, “plan”, “potential”, “predict”, “project”, “should”, “target”, “will”, “would”, or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about:

•our estimates regarding the timing and amount of funds we require to conduct clinical trials for GEN-011, to continue preclinical studies for our other product candidates and to continue our investments in immuno-oncology;

•our estimates regarding the timing and costs of manufacturing GEN-011 for our clinical trial;

•our estimates regarding the timing and amount of funds we require to perform monitoring activities to support the GEN-009 clinical trial;

•our estimates regarding expenses, future revenues, capital requirements, the sufficiency of our current and expected cash resources and our need for additional financing;

•our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately;

•the timing of, and our ability to, obtain and maintain regulatory approvals for our product candidates;

•the effect of the novel coronavirus ("COVID-19") pandemic on the economy generally and on our business and operations specifically, including our research and development efforts, our clinical trials and our employees, and the potential disruptions in supply chains and to our third-party manufacturers, including the availability of materials and equipment, as well as the response of our company and governments to COVID-19, including the associated containment, remediation and vaccination efforts;

•the potential benefits of strategic partnership agreements and our ability to enter into strategic partnership arrangements;

•our expectations regarding our ability to obtain and maintain intellectual property protection for our manufacturing methods and product candidates;

•the rate and degree of market acceptance and clinical utility of any approved product candidate;

•our ability to quickly and efficiently identify and develop product candidates; and

•our commercialization, marketing and manufacturing capabilities and strategy.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and investors should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this Annual Report on Form 10-K, particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make or collaborations or strategic partnerships we may enter into.

This Annual Report on Form 10-K and the documents that we have filed as exhibits to the Annual Report on Form 10-K should be read completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

3

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Item 1A “Risk Factors”. These risks include, but are not limited to the following:

•We require additional financing to execute our operating plan and continue to operate as a going concern.

•We are substantially dependent on the success of the clinical development of GEN-011. Any failure to successfully develop or commercialize the GEN-011 T cell therapy, or any significant delays in doing so, will have a material adverse effect on our business, results of operations and financial condition.

•Because our active product candidates are in an early stage of clinical development, there is a high risk of failure, and we may never succeed in developing marketable products or generating product revenue.

•If we do not obtain regulatory approval for our current and future product candidates, our business will be adversely affected.

•Interim, “topline”, and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to confirmation, audit, and verification procedures that could result in material changes in the final data.

•We may find it difficult to enroll patients in our clinical trials, which could delay or prevent clinical trials of our product candidates.

•Our product candidates, GEN-011 and GEN-009, and our future potential product candidates arising out of our immuno-oncology program, are or will be based on T cell activation, which is a novel approach for cellular therapies, vaccines, immunotherapies and medical treatments.

•Our product candidates are uniquely manufactured for each patient and we may encounter difficulties in manufacturing and scaling our manufacturing capabilities. If we or any of the third-party manufacturers with whom we contract encounter these types of difficulties, our ability to provide our product candidates for clinical trials or our products for patients, if approved, could be delayed or stopped, or we may be unable to maintain a commercially viable cost structure. Some of our third-party manufacturers are located outside the U.S., and we may encounter disruption in clinical material supplies due to logistics, as well as risk of adverse regulatory action due to local regulatory oversight.

•We rely on third parties to conduct technical development, nonclinical studies and clinical trials for our product candidates, including GEN-011 and GEN-009, and any other future product candidates, and if they do not properly and successfully perform their obligations to us, we may not be able to obtain regulatory approvals for our product candidates.

•We rely on third parties to conduct some or all aspects of our product manufacturing, and these third parties may not perform satisfactorily. In some instances, we may rely on a single manufacturer for certain of our products.

•If we are unable to manufacture our products or are unable to obtain regulatory approvals for a manufacturing facility for our products, we may experience delays in product development, clinical trials, regulatory approval and commercial distribution.

•We may not be successful in establishing and maintaining strategic partnerships, which could adversely affect our ability to develop and commercialize products.

•If we are unable to obtain or protect intellectual property rights related to our product candidates, we may not be able to compete effectively in our markets.

•We have in-licensed a portion of our intellectual property, and, if we fail to comply with our obligations under these arrangements, or our licensors fail to obtain and maintain intellectual property rights, we could lose such intellectual property rights or owe damages to the licensor of such intellectual property.

•Our products may cause undesirable side effects or have other properties that delay or prevent their regulatory approval or limit their commercial potential.

•Our level of indebtedness and debt service obligations could adversely affect our financial condition and may make it more difficult for us to fund our operations.

•Our largest stockholder, New Enterprise Associates, could exert significant influence over us and could limit other stockholders' ability to influence the outcome of key transactions, including any change of control.

•If our stock price is volatile, our stockholders could incur substantial losses and we may become involved in securities-related litigation, including securities class action litigation, that could divert management’s attention and harm our business and subject us to significant liabilities.

4

•Provisions in our charter documents and under Delaware law have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our stockholders, and could prevent attempts by our stockholders to replace or remove our current management.

5

PART I

Item 1. Business

Unless the context requires otherwise, references in this Annual Report on Form 10-K to “Genocea”, “we”, “us” and “our” refer to Genocea Biosciences, Inc.

Overview

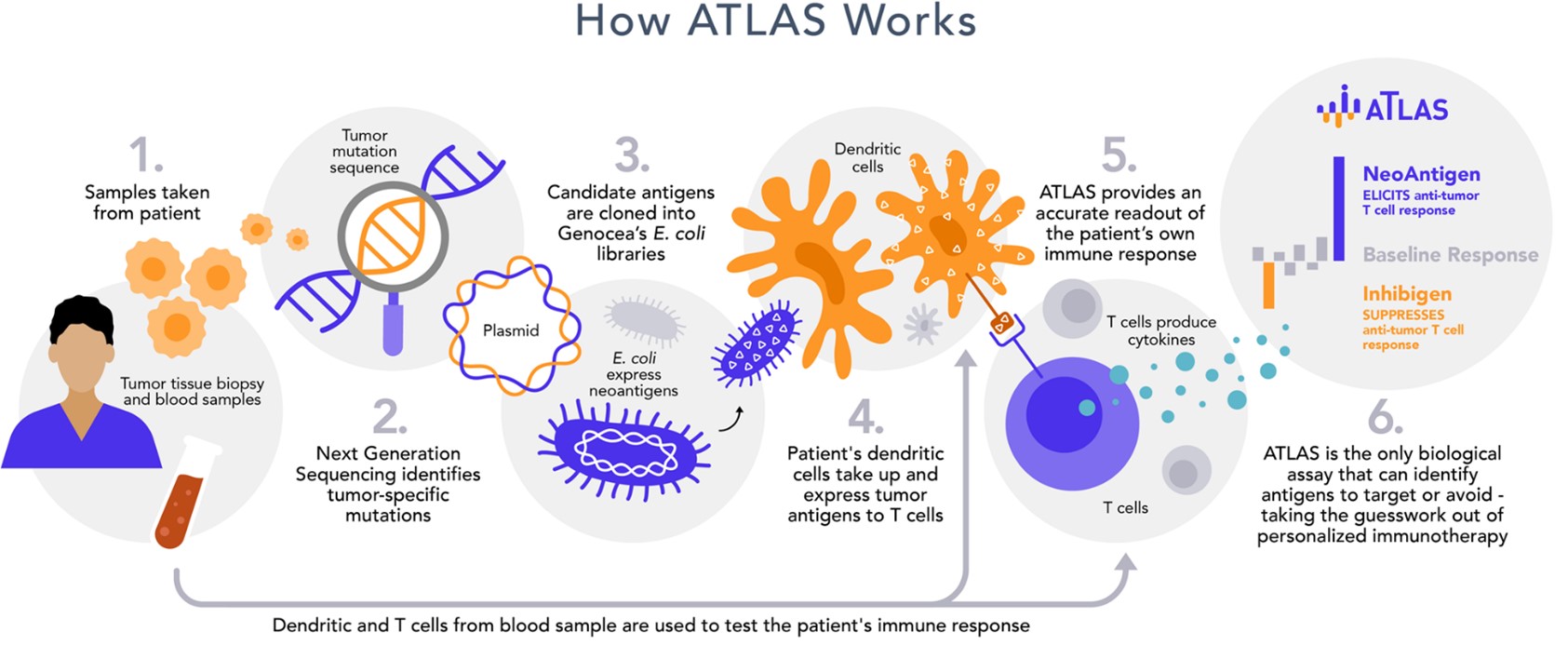

We are a biopharmaceutical company dedicated to discovering and developing novel cancer immunotherapies using our proprietary ATLASTM platform. The ATLAS platform can profile each patient's CD4+ and CD8+ T cell immune responses to every potential target or “antigen” identified by next-generation sequencing of that patient's tumor. ATLAS zeroes in on both antigens that activate anti-tumor T cell responses and inhibitory antigens, or InhibigensTM, that drive pro-tumor immune responses. We believe this approach ensures that cancer immunotherapies, such as cellular therapies and vaccines, focus T cell responses on the tumor antigens most vulnerable to T cell targeting. Consequently, we believe that ATLAS may enable more immunogenic and efficacious cancer immunotherapies.

GEN-011 is an investigational next-generation solid tumor cell therapy candidate comprised of CD4+ and CD8+ neoantigen-targeted peripheral T cells ("NPTs") which are specific for up to 30 antigens, designed to limit tumor escape. GEN-011 is comprised of T cells extracted from the patient’s peripheral blood and specific for ATLAS-prioritized neoantigens. NPTs have minimal bystander, non-tumor-specific cells, and are designed to be devoid of Inhibigen-specific cells which may be detrimental to clinical response. GEN-011 has the potential to be differentiated from other cell therapies because of the breadth of surface-presented neoantigens it targets and the ease of manufacturing tumor-relevant T cells extracted from readily accessible peripheral blood. TiTAN is an open-label, multi-center Phase 1/2a trial evaluating the safety, tolerability, T cell persistence and proliferation, and clinical efficacy of GEN-011. The TiTAN clinical trial is testing two dosing regimens. Initial data from the TiTAN trial is expected during the American Association for Cancer Research (“AACR”) Annual Meeting 2022 to be held from April 8 - 13, 2022.

GEN-009 is an investigational neoantigen vaccine delivering adjuvanted synthetic long peptides from ATLAS-identified neoantigens. We reported long-term immunogenicity and clinical response data from our GEN-009 neoantigen vaccine Phase 1 clinical trial in November 2021, and we continue to monitor patients to further evaluate these efficacy signals.

ATLAS platform

Harnessing and directing T cells to kill tumor cells is increasingly viewed as having potential to treat many cancers. Cellular therapies or vaccines employing this approach may be most effective when targeting specific differences from normal tissue present in the patient, such as antigens arising from genetic mutations or cancer-causing viruses. However, the discovery of optimal antigens for such immunotherapies has been particularly challenging for two reasons. First, the number of candidate antigens can be very large, with up to thousands of candidates per patient in some cancers. Second, the genetic diversity of human T cell responses means that effective antigens may vary from person to person. An effective antigen selection system must therefore account both for each patient's tumor and for their T cell repertoire.

ATLAS selects antigens through an ex vivo assay that unveils CD4+ and CD8+ T cell immune responses each patient has made to nearly any possible tumor-specific antigen, including candidate neoantigens, tumor-associated antigens and tumor-associated viral antigens. In doing so, we believe that ATLAS provides the most comprehensive and accurate system for identifying the right and wrong antigens for cancer immunotherapies. Previously, all candidate antigens were thought either to be targets of effective anti-tumor responses (stimulatory) or irrelevant. However, using ATLAS, we have identified Inhibigens and demonstrated, in preclinical studies, that such antigens can promote rapid tumor growth, reduce or eliminate the protection of an otherwise effective vaccine, and dampen or reverse the effects of checkpoint inhibitors ("CPI"). We therefore believe that both by identifying the optimal antigens and by excluding Inhibigens, ATLAS enables differentiated immune responses and clinical efficacy.

6

We believe ATLAS has the potential to be a key tool in optimizing antigen selection for therapies across a number of diseases beyond cancer. We have previously demonstrated its effectiveness in identifying novel protective antigens for infectious disease therapies. In addition, while we believe Inhibigens should be avoided in cancer immunotherapies, they could prove to be beneficial in other therapies such as treatment of autoimmune disease.

Intellectual property

Our ATLAS and immuno-oncology intellectual property portfolio comprises nine patent families and two additional potential patent families, all but one of which are wholly owned by us. The first patent family, in-licensed from the President and Fellows of Harvard College ("Harvard"), is directed to one arm of the ATLAS method for identifying antigens. This patent family is comprised of issued United States ("U.S.") patents, with patent terms ranging from 2027 to 2031, as well as granted foreign patents. The second family is directed to expanded ATLAS methods for identifying antigens, as currently practiced by us. This family is comprised of issued U.S. patents, with patent terms ranging from 2029 to 2030, as well as granted foreign patents and pending U.S. and foreign applications. The third family is directed to ATLAS-based methods for selecting or deselecting Inhibigens and stimulatory antigens, cancer diagnosis, prognosis and patient selection, as well as related compositions. This patent family is comprised of an issued U.S. patent with a patent term to 2038, pending applications in eleven foreign jurisdictions, and a pending U.S. application. Additional patents issuing from these applications are expected to have patent terms until at least 2038. The fourth, fifth and sixth families are directed to various methods using ATLAS-identified antigens. These families comprise pending U.S. and foreign applications. Patents issuing from these applications are expected to have patent terms until at least 2039. The three further families and two additional potential families currently comprise a pending U.S. patent application, Patent Cooperation Treaty ("PCT") applications, or U.S. provisional applications and are directed to further methods using ATLAS-identified antigens, to dose regimens for GEN-009, and to our cell-based therapy GEN-011.

Immuno-oncology programs

GEN-011

We believe that GEN-011 represents a new category of adoptive T cell therapy for solid tumors, neoantigen-targeted peripheral T cells ("NPTs"). The first neoantigen-targeted T cell therapy to demonstrate clinical efficacy in patients with solid tumors is tumor-infiltrating lymphocyte ("TIL") therapy. TILs consist of a subset of lymphocytes that have invaded a tumor but, importantly, are not all necessarily specific for tumor antigens. TIL therapy requires a fresh, uncontaminated, viable tumor resection from each patient, from which TILs will be obtained. These TILs are then non-specifically expanded ex vivo in the presence of high dose interleukin-2 ("IL-2") and infused into that same patient, who has undergone lymphodepletion preconditioning, followed by high dose IL-2 treatment. In certain patients with solid tumors resistant to CPI therapy, TIL therapy has resulted in durable clinical responses.

We believe that GEN-011, if approved, may offer efficacy, patient accessibility and cost advantages over other neoantigen-targeting solid tumor adoptive T cell therapies.

7

The potential efficacy advantages derive from the following product features:

•Targeting up to 30 tumor-specific antigens simultaneously to limit tumor escape, with minimal bystander, non-tumor-specific T cells;

•Avoiding T cells specific for Inhibigens that may be detrimental to clinical response;

•Including both CD4+ and CD8+ tumor antigen-specific T cells; and

•Using peripheral blood-derived T cells, which are believed to have potential for superior activity and persistence.

The potential patient accessibility and cost advantages derive from the fact that:

•No extra surgery or viable tumor is required as starter material;

•GEN-011 can treat any patient, while some adoptive T cell therapies engineer T cells for applicability to certain human leukocyte antigen types and specific tumor-associated antigens, often limiting their clinical utility to certain subsets of western Caucasians with tumors that express specific targets; and

•The GEN-011 cell expansion process does not require T cell receptor ("TCR") vector design or transduction.

We are conducting the TiTAN trial, treating patients with GEN-011 as monotherapy for tumors that have not achieved an adequate response after CPI therapy. Our target indications include melanoma, non-small cell lung cancer, small cell lung cancer, squamous cell carcinoma of the head and neck, urothelial carcinoma, renal cell carcinoma, cutaneous squamous cell carcinoma, and anal squamous cell carcinoma. In the second quarter of 2021, we dosed the first patient in the study.

The TiTAN trial contains two patient cohorts:

•Cohort A patients receive multiple fractional doses of GEN-011 without lymphodepletion followed by an intermediate dose of daily IL-2 to maximize the tumor-killing potential of the infused cells with lower toxicity; and

•Cohort B patients receive one of two levels of intensifying pre-treatment lymphodepletion, a single administration of GEN-011 after lymphodepletion and then either an intermediate or high dose course of IL-2. Early clinical experience has suggested that NPTs may be more sensitive to cytokine stimulation, which could allow the use of lower doses of chemotherapy and IL-2 to obtain the same T cell proliferation. By optimizing dosing of the concomitant medications, we expect to be able to establish a preferred treatment regimen.

The TiTAN trial’s objectives are safety, clinical activity including overall response rate and duration of response, and GEN-011’s proliferation and persistence as well as T cell penetration into the tumor. Our manufacturing process for the TiTAN trial consists of ATLAS and PLANETTM. As of March 3, 2022, we had completed screening 23 patient samples with ATLAS in the TiTAN trial. On average in these samples, ATLAS had prioritized 12 neoantigens (range 0-43) and identified 16 Inhibigens (range 1-82) per patient. T cells specific for only the prioritized neoantigens (and therefore not the Inhibigens) were expanded in the PLANET process. Of the 17 patient samples that had entered the PLANET process, 100% had either successfully yielded a released drug product (14) or were in process (3). Of the 14 manufactured GEN-011 drug products, six had been administered to patients across both the multi-dose and single dose cohorts, with the remaining eight available for dosing upon patient need. We expect to have initial data from the first five patients at the AACR Annual Meeting 2022 from April 8 - 13, 2022. There are eight sites currently accruing patients, and we expect to dose patients throughout 2022. However, patient accrual to clinical trials and subsequent dosing and trial participation are dependent upon both patient choice and health, and investigator decisions. Predictions of data availability and release of results may be affected by individual patient events among other factors.

We believe our PLANET process also has some key advantages as it:

•Uses peripheral blood, potentially expanding accessible patient population;

•Has a robust process designed for reliable production; and

•Is a single-use technology for modularity and rapid scalability.

8

The following is a summary of our PLANET process:

GEN-009

GEN-009 is a neoantigen vaccine candidate delivering adjuvanted synthetic long peptides spanning ATLAS-identified anti-tumor neoantigens. The phase 1/2a clinical trial evaluating GEN-009 is currently collecting long-term data across a range of solid tumor types. Part A of the trial is assessing the monotherapy GEN-009 for safety, immunogenicity and ability to prevent disease relapse in certain cancer patients with no detectable tumor at the time of vaccination but with a risk of relapse. Part B of the trial is assessing the safety, immunogenicity and preliminary anti-tumor activity of GEN-009 in combination with CPI therapy in patients with advanced or metastatic tumors.

We have observed the following from our data, most recently presented at the Society for Immunotherapy of Cancer's ("SITC") Annual Meeting in November 2021:

In Part A of the trial, we have observed the following in the eight dosed patients:

•100% of patients had measurable CD4+ and/or CD8+ T cell responses to their GEN-009 vaccine;

•Responses were detected against 99% of the administered vaccine neoantigens (N=88 administered antigens), a response rate in excess of that which has been reported previously by others in response to candidate neoantigen vaccines;

•GEN-009 was well tolerated, with no dose-limiting toxicities observed; and

•Only two of the eight vaccinated patients have developed a recurrence of their targeted tumor, with up to 36 months of follow-up.

In Part B of the trial, we continue to evaluate immune responses and efficacy in two cohorts of patients, those who are checkpoint-sensitive and those who are checkpoint-resistant.

•In the checkpoint-sensitive cohort, we believe we have shown compelling signals of response.

◦Of the nine checkpoint-sensitive patients, four have independent RECIST criteria responses after administration of GEN-009 that appear to be attributable to GEN-009.

◦Of those four patients, one patient achieved a complete response and three patients achieved a partial response after vaccination.

9

•In the checkpoint-resistant cohort, we believe that GEN-009 has shown early evidence of stabilization of disease.

◦This group of seven patients initially started their CPI therapy but quickly progressed and transitioned to standard-of-care therapy which generally consists of radiation and/or chemotherapy. After completing the standard-of-care therapy, these patients received GEN-009 vaccination.

◦Of the seven patients, one patient achieved a partial response and two achieved prolonged disease stabilization lasting up to 12 months, longer than their prior duration of disease control.

We believe the GEN-009 data confirm the potential antigen selection advantages of ATLAS, the potential efficacy advantage of a personalized vaccine, and suggest a differentiating advantage for GEN-011.

Other research activities

In addition to our two clinical programs, we are conducting research in several areas, including:

•Exploring Inhibigen biology to gain a more comprehensive understanding, in collaboration with Dana-Farber Cancer Institute and the University of Minnesota;

•Further optimizing ATLAS;

•Identifying TCRs to ATLAS-identified shared neoantigens, in collaboration with the University of Minnesota;

•Exploring T cell responses to oncoviruses associated with certain cancers such as Epstein-Barr virus and human papilloma virus;

•Identifying shared antigen immunotherapies encompassing shared neoantigens and non-mutated tumor-associated antigens; and

•Exploring the potential for novel antigens of protective T cell responses to SARS-CoV-2 ("COVID-19") to provide effectiveness against multiple virus strains.

Since these other research activities are early stage, we cannot provide specific timelines for if, or when, these activities may result in new clinical candidates.

Competition

The biotechnology and pharmaceutical industries are characterized by intense and rapidly changing competition to develop new technologies and proprietary products. Although we believe that our proprietary patent portfolio and T cell cellular therapy and vaccine expertise provide us with competitive advantages, we face potential competition from many different sources, including larger and better-funded pharmaceutical companies. Not only must we compete with other immuno-oncology companies but any products that we may commercialize will have to compete with existing therapies and new therapies that may become available in the future.

There are several companies attempting to develop cellular therapies targeted towards neoantigens, either through transferring T cells that have been transduced with TCRs that recognize tumor antigens, or TILs, or T cells from the peripheral blood that have been expanded on multiple tumor-specific antigens. These include Achilles Therapeutics Ltd., Adaptimmune Therapeutics plc, BioNTech SE, F. Hoffmann-La Roche AG, Iovance Biotherapeutics Inc., Instil Bio, Inc., Lyell Immunopharma, Inc., Neogene Therapeutics, B.V., PACT Pharma Inc., and Ziopharm Oncology Inc. We believe that the ATLAS platform's true neoantigen selection will lead to better targeted and more effective cell therapy. However, there can be no assurance that one or more of these companies, or other companies, will not achieve similar or superior clinical results in the future as compared to GEN-011, or that our future clinical trials will be successful.

Similarly, there are other companies attempting to develop new neoantigen cancer vaccines, including BioNTech SE, CureVac AG, Genentech, Inc., Gritstone Oncology Inc., Merck & Co., Inc., Moderna Inc., Nouscom AG, and Vaccibody AS. We believe that GEN-009 has advantages against each of these product candidates based on the potential power of the ATLAS platform to comprehensively identify for each cancer patient the neoantigens to which such patient has a pre-existing immune response. We believe that selecting neoantigens for personal cancer vaccines using ATLAS will lead to more effective vaccines. However, there can be no assurance that one or more of these companies, or other companies, will not achieve similar or superior clinical results in the future as compared to GEN-009, or that our future clinical trials will be successful.

Many of our competitors, either alone or with their strategic partners, have substantially greater financial, technical and human resources than we do and greater experience in the discovery and development of product candidates, obtaining U.S. Food and Drug Administration ("FDA"), and other regulatory approvals of cellular therapies or vaccines and the commercialization of those cellular therapies or vaccines. Accordingly, our competitors may be more successful than us in obtaining regulatory approval for cellular therapies and vaccines and achieving widespread market acceptance. Our competitors’ cellular therapies or vaccines may be more effective, or more effectively marketed and sold, than any we may commercialize and may render our products obsolete or non-competitive.

10

Mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. We expect any cellular therapies or vaccines that we develop and commercialize to compete based on, among other things, efficacy, safety, convenience of administration and delivery, price, the level of generic competition, and the availability of reimbursement from government and other third-party payors.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient, or are less expensive than any products that we may develop. Our competitors also may obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for our products, which could result in our competitors establishing a strong market position before we are able to enter the market. In addition, our ability to compete may be affected in many cases by insurers or other third-party payors seeking to encourage the use of generic products.

Intellectual Property

We strive to protect and enhance the proprietary technology, inventions, and improvements that are commercially important to our business, including seeking, maintaining, and defending patent rights, whether developed internally or licensed from third parties. We also rely on trade secrets relating to our proprietary technology platform and on know-how, continuing technological innovation and in-licensing opportunities to develop, strengthen and maintain our proprietary position in the cellular therapy and vaccine fields. We additionally rely on regulatory protection afforded through data exclusivity, market exclusivity, and patent term extensions where available. Still further, we utilize trademark protection for our company name, and expect to do so for products and/or services as they are marketed.

Our commercial success may depend in part on our ability to obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business; defend and enforce our patents; preserve the confidentiality of our trade secrets; and operate without infringing the valid enforceable patents and proprietary rights of third parties. Our ability to stop third parties from making, using, selling, offering to sell or importing our products may depend on the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities. With respect to both licensed and company-owned intellectual property, we cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our commercial products and methods of manufacturing the same.

We have developed or in-licensed numerous patents and patent applications and possess substantial know-how and trade secrets relating to the development and commercialization of cellular therapy and vaccine products. The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the date of filing the non-provisional application. In the U.S., a patent’s term may be lengthened by patent term adjustment ("Patent Term Adjustment"), which compensates a patentee for administrative delays by the U.S. Patent and Trademark Office ("U.S. PTO") in granting a patent, or may be shortened, if a patent is terminally disclaimed over an earlier-filed patent.

The term of a patent that covers an FDA-approved drug may also be eligible for patent term extension, which permits patent term restoration of a U.S. patent as compensation for the patent term lost during the FDA regulatory review process. The Hatch-Waxman Act permits a patent term extension of up to five years beyond the expiration of the patent. The length of the patent term extension is related to the length of time the drug is under regulatory review. A patent term extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved drug may be extended. Moreover, a patent can only be extended once, and thus, if a single patent is applicable to multiple products, it can only be extended based on one product. Similar provisions are available in Europe and other foreign jurisdictions to extend the term of a patent that covers an approved drug. When possible, depending upon the length of clinical trials and other factors involved in the filing of a biologics license application ("BLA"), we expect to apply for patent term extensions for patents covering our product candidates and their methods of use.

11

As of March 15, 2022, our ATLAS and immuno-oncology intellectual property portfolio comprises nine patent families and two additional potential patent families, all but one of which are wholly owned by us. The first patent family, in-licensed from Harvard, is directed to one arm of the ATLAS method for identifying antigens. This first patent family includes U.S. Patents 9,051,564, 9,920,314 and 10,662,423, and patents granted in Europe, Canada, and Australia. U.S. Patent 10,662,423 and the granted foreign patents in this family are expected to expire in February 2027. U.S. Patents 9,920,314 and 9,051,564 include Patent Term Adjustments and extend until June 2028 and December 2031, respectively. The second family is directed to expanded ATLAS methods for identifying antigens, as currently practiced by us. This second patent family includes U.S. Patents 8,313,894, 9,045,791, 9,873,870, 10,570,387 and 11,162,093, a pending U.S. patent application, granted patents in Europe, Canada, and Australia, and a pending application in Europe. The granted foreign patents in this family have a patent term until July 2029. U.S. Patents 8,313,894 and 9,045,791 have terms that include Patent Term Adjustments and extend until August 2030 and August 2029, respectively. U.S. Patents 9,873,870, 10,570,387 and 11,162,093 have terms that extend until July 2029. The third family is directed to ATLAS-based methods for selecting or deselecting Inhibigens and stimulatory antigens, cancer diagnosis, prognosis and patient selection, as well as related compositions. This third family currently comprises U.S. Patent 10,859,566 with a patent term until March 2038, pending applications in eleven foreign jurisdictions, and a pending U.S. application. The fourth, fifth and sixth families are directed to various methods using ATLAS-identified antigens. Each of these families comprises a pending U.S. patent application and foreign patent applications, claiming first priority to provisional applications filed in late 2018. The three further families currently comprise a pending U.S. patent application or Patent Cooperation Treaty ("PCT") applications, and are directed to further methods using ATLAS-identified antigens, to dose regimens for GEN-009, and to our cell-based therapy GEN-011.

The two potential patent families each comprise U.S. provisional applications filed in late 2021. These applications are directed to methods using ATLAS-identified antigens for auto-immune conditions and to improved methods relating to our cell-based therapy GEN-011.

License Agreements

Harvard

We have an exclusive license agreement with Harvard, granting us an exclusive, worldwide, royalty-bearing, sublicensable license to one patent family, to develop, make, have made, use, market, offer for sale, sell, have sold and import licensed products and to perform licensed services related to the ATLAS discovery platform. We are also obligated to pay Harvard milestone payments up to $1.6 million in the aggregate upon the achievement of certain development and regulatory milestones. As of December 31, 2021, we have paid or accrued $0.3 million in aggregate milestone payments.

Upon commercialization of our products covered by the licensed patent rights or discovered using the licensed methods, we are obligated to pay Harvard royalties on the net sales of such products and services sold by us, our affiliates, and our sublicensees. This royalty varies depending on the type of product or service and is in the low single digits. The sales-based royalty due by our sublicensees is the greater of the applicable royalty rate or a percentage in the high single digits or the low double digits of the royalties we receive from such sublicensee, depending on the type of product. Based on the type of commercialized product or service, royalties are payable until the expiration of the last-to-expire valid claim under the licensed patent rights or for a period of ten years from first commercial sale of such product or service. The royalties payable to Harvard are subject to reduction, capped at a specified percentage, for any third-party payments required to be made. In addition to the royalty payments, if we receive any additional consideration (cash or non-cash) under any sublicense, we must pay Harvard a percentage of the value of such consideration, excluding certain categories of consideration, varying from the low single digits up to the low double digits depending on the scope of the license that includes the sublicense.

This license agreement with Harvard will expire on a product-by-product or service-by-service and country-by-country basis until the expiration of the last-to-expire valid claim under the licensed patent rights. We may terminate the agreement at any time by giving Harvard advance written notice. Harvard may also terminate the agreement (i) in the event of a material breach by us that remains uncured; (ii) in the event of our insolvency, bankruptcy, or similar circumstances; or (iii) if we challenge the validity of any patents licensed to us.

Oncovir

We have a license and supply agreement with Oncovir, Inc. (“Oncovir”) under which Oncovir will manufacture and supply an immunomodulator and vaccine adjuvant, Hiltonol® (poly-ICLC) (“Hiltonol”), to us for use in connection with the research, development, use, sale, manufacture, commercialization and marketing of products combining Hiltonol with our technology (the “Combination Product”). Hiltonol is the adjuvant component of GEN-009, which will consist of synthetic long peptides of neoantigens identified using our proprietary ATLAS platform, formulated with Hiltonol.

12

Oncovir granted us a non-exclusive, assignable, royalty-bearing worldwide license, with the right to grant sublicenses through one tier, to certain of Oncovir’s intellectual property in connection with the research, development, or commercialization of Combination Products, including the use of Hiltonol, but not the use of Hiltonol for manufacturing or the use or sale of Hiltonol alone. The license will become perpetual, fully paid-up, and royalty-free on the later of January 25, 2028 or the date on which the last valid claim of any patent licensed to us under the agreement expires.

Under this agreement, we are obligated to pay Oncovir low to mid six-figure milestone payments upon the achievement of certain clinical trial milestones for each Combination Product and the first marketing approval for each Combination Product in certain territories, as well as tiered royalties in the low-single digits on a product-by-product basis based on the net sales of Combination Products.

We may terminate the agreement upon a decision to discontinue the development of the Combination Product or upon a determination by us or an applicable regulatory authority that Hiltonol or a Combination Product is not clinically safe or effective. The agreement may also be terminated by either party due to a material uncured breach by the other party, or due to the other party’s bankruptcy, insolvency, or dissolution.

Trade Secrets

We may rely, in some circumstances, on trade secrets to protect our technology. However, trade secrets can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with our employees, consultants, scientific advisors and contractors. We also seek to preserve the integrity and confidentiality of our data and trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations, and systems, agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our consultants, contractors, or collaborators use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

Government Regulation

We primarily operate in the United States ("U.S.") and conduct our clinical trials in the U.S. If we expand outside of this geographic area, other governmental regulations may become applicable. Biological products such as adoptive cell therapies and vaccines are subject to regulation under the Federal Food, Drug, and Cosmetic Act (“FD&C Act”) and the Public Health Service Act (“PHS Act”), and other federal, state, local and foreign statutes and regulations. Both the FD&C and PHS Acts and their corresponding regulations govern, among other things, the testing, manufacturing, safety, efficacy, labeling, packaging, storage, record keeping, distribution, reporting, advertising and other promotional practices involving biological products. Clinical testing of biological products is subject to FDA review and authorization before initiation. In addition, FDA approval must be obtained before marketing of biological products. The process of obtaining regulatory review and approval and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources, and we may not be able to obtain the required regulatory approvals.

U.S biological products development process

The process required by the FDA before a biological product may be marketed in the U.S. generally involves the following process:

•completion of nonclinical laboratory tests and animal studies according to good laboratory practices (“GLP”) and applicable requirements for the humane use of laboratory animals or other applicable regulations;

•submission to the FDA of an Investigational New Drug Application ("IND") which must become effective before human clinical trials may begin and must be updated annually and when certain changes are made;

•performance of adequate and well-controlled human clinical trials according to the FDA’s regulations commonly referred to as good clinical practices (“GCP”) and any additional requirements for the protection of human research subjects and their health information, to establish the safety and efficacy of the proposed biological product for its intended use, including approval by an independent Institutional Review Board (“IRB”), representing each clinical site before each clinical trial may be initiated;

•submission to the FDA of a BLA for marketing approval that includes substantive evidence of safety, purity, and potency from results of nonclinical testing and clinical trials;

•satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the biological product is produced to assess compliance with good manufacturing practices (“GMPs”) to assure that the facilities, methods and controls are adequate to preserve the biological product’s identity, strength, quality and purity and, if applicable, the FDA’s current good tissue practices (“GTP”) for the use of human cellular and tissue products;

13

•potential FDA audit of the nonclinical and clinical trial sites that generated the data in support of the BLA; and

•FDA review and approval, or licensure, of the BLA.

Before testing any biological product candidate in humans, the product candidate enters the preclinical study stage. Preclinical studies, also referred to as nonclinical studies, include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies to assess the potential safety and activity of the product candidate. The conduct of the preclinical studies must comply with federal regulations and requirements including GLPs.

The clinical trial sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND. Some preclinical studies may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA places the clinical trial on a clinical hold within that 30-day time period. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. The FDA also may impose clinical holds on a biological product candidate at any time before or during clinical trials due to safety concerns or non-compliance. If the FDA imposes a clinical hold, studies may not recommence without FDA authorization and then only under terms authorized by the FDA. Accordingly, we cannot be sure that submission of an IND will result in the FDA allowing clinical trials to begin, or that, once begun, issues will not arise that suspend or terminate such studies.

Clinical trials involve the administration of the biological product candidate to healthy volunteers or patients under the supervision of qualified investigators, generally physicians not employed by the trial sponsor or under its control. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety, including stopping rules that assure a clinical trial will be stopped if certain adverse events (“AEs”) should occur. Each protocol and any amendments to the protocol must be submitted to the FDA as part of the IND. Clinical trials must be conducted and monitored in accordance with the FDA’s regulations comprising the GCP requirements, including the requirement that all research subjects provide informed consent. Further, each clinical trial must be reviewed and approved by an IRB, at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of trial participants and considers such items as whether the risks to individuals participating in the clinical studies are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the form and content of the informed consent that must be signed by each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed.

Clinical trials are typically conducted in three sequential phases that may overlap or be combined:

•Phase 1. The biological product is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients who have the disease or condition the product is intended to treat.

•Phase 2. The biological product is evaluated in a limited patient population with a specified disease or condition to identify possible AEs and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance, optimal dosage and dosing schedule.

•Phase 3. Clinical studies are undertaken to further evaluate safety, purity, and potential of the biological product in an expanded patient population at geographically dispersed clinical trial sites. These clinical studies are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product approval and product labeling. Generally, two adequate and well-controlled Phase 3 clinical trials are required by the FDA for BLA approval, but in disease settings where better therapies are urgently needed, including advanced malignancies, the FDA may accept smaller datasets with compelling efficacy as justification for accelerated approval. To date, cell therapies for malignancies, such as CAR-T, have been approved under accelerated approval.

Post-approval clinical studies, sometimes referred to as Phase 4 clinical studies, may be conducted after initial marketing approval. These clinical studies are used to gain additional experience from the treatment of patients in the intended therapeutic indication, particularly for long-term safety follow-up.

14

During all phases of clinical development, regulatory agencies require extensive monitoring and auditing of all clinical activities, clinical data and clinical trial investigators. Annual progress reports detailing the results of the clinical studies must be submitted to the FDA. Written IND safety reports must be promptly submitted to the FDA and the investigators for serious and unexpected AEs, any findings from other studies, tests in laboratory animals or in vitro testing that suggest a significant risk for human subjects, or any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure. The sponsor must submit an IND safety report within 15 calendar days after the sponsor determines that the information qualifies for reporting. The sponsor also must notify the FDA of any unexpected fatal or life-threatening suspected adverse reaction within seven calendar days after the sponsor’s initial receipt of the information. Phase 1, Phase 2 and Phase 3 clinical studies may not be completed successfully within any specified period, if at all. The FDA or the sponsor or its data safety monitoring board may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the biological product has been associated with unexpected serious harm to patients. Sponsors of all controlled clinical trials, except for Phase 1 trials, are required to submit certain clinical trial information for inclusion in the public clinical trial registry and results data bank maintained by the National Institutes of Health.

Concurrent with clinical studies, companies must also develop additional information about the physical characteristics of the biological product as well as finalize a process for manufacturing the product in commercial quantities in accordance with GMP requirements. To help reduce the risk of the introduction of adventitious agents with use of biological products, the PHS Act emphasizes the importance of manufacturing control for products whose attributes cannot be precisely defined. The manufacturing process must be capable of consistently producing quality batches of the product candidate and, among other things, the sponsor must develop methods for testing the identity, strength, quality, potency and purity of the final biological product. Additionally, appropriate packaging must be selected and tested, and stability studies must be conducted to demonstrate that the biological product candidate does not undergo unacceptable deterioration over its shelf life.

U.S. review and approval processes

After the completion of clinical trials of a biological product, FDA approval of a BLA must be obtained before commercial marketing of the biological product. The BLA must include results of product development, laboratory and animal studies, human studies, information on the manufacture and composition of the product, proposed labeling and other relevant information. In addition, under the Pediatric Research Equity Act, a BLA or supplement to a BLA must contain data to assess the safety and effectiveness of the biological product for the claimed indications in all relevant pediatric subpopulations and to support dosing and administration for each pediatric subpopulation for which the product is safe and effective. The FDA may grant deferrals for submission of data or full or partial waivers. The testing and approval processes require substantial time and effort, and there can be no assurance that the FDA will accept the BLA for filing and, even if filed, that any approval will be granted on a timely basis, if at all, and for what indications will be approved, if any.

Under the Prescription Drug User Fee Act (“PDUFA”), as re-authorized for an additional five years in 2017, each BLA must be accompanied by a significant user fee. PDUFA also imposes annual program fees based on each approved biologic. Fee waivers or reductions are available in certain circumstances, including a waiver of the application fee for the first application filed by a small business.

Within 60 days following submission of the application, the FDA reviews the BLA to determine if it is substantially complete before the agency accepts it for filing. The FDA may refuse to file any BLA that it deems incomplete or not properly reviewable at the time of submission and may request additional information. In this event, the BLA must be resubmitted with the additional information. The resubmitted application also is subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review of the BLA. The FDA reviews the BLA to determine, among other things, whether the proposed product is safe and potent, or effective, for its intended use, and has an acceptable purity profile, and whether the product is being manufactured in accordance with GMP regulations to assure and preserve the product’s identity, safety, strength, quality, potency and purity. The FDA may refer applications for novel biological products or biological products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. During the biological product approval process, the FDA also will determine whether a Risk Evaluation and Mitigation Strategy (“REMS”), is necessary to assure the safe use of the biological product. If the FDA concludes a REMS is needed, the sponsor of the BLA must submit a proposed REMS; the FDA will not approve the BLA without a REMS, if required.

15

Before approving a BLA, the FDA will inspect the facilities at which the product is manufactured. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with GMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving a BLA, the FDA will typically inspect one or more clinical sites to assure that the clinical trials were conducted in compliance with IND study requirements and GCP requirements. For a cell or gene therapy product, the FDA also will not approve the product if the manufacturer is not in compliance with the GTP requirements. To assure GMP, GTP and GCP compliance, an applicant must incur significant expenditure of time, money and effort in the areas of training, record keeping, production, and quality control.

Notwithstanding the submission of relevant data and information, the FDA may ultimately decide that the BLA does not satisfy its regulatory criteria and deny approval. Data obtained from clinical trials are not always conclusive, and the FDA may interpret data differently than we interpret the same data. If the agency decides not to approve the BLA in its present form, the FDA will issue a complete response letter that usually describes all of the specific deficiencies in the BLA identified by the FDA. The deficiencies identified may be minor, for example, requiring labeling changes, or major, for example, requiring additional clinical trials. Additionally, the complete response letter may include recommended actions that the applicant might take to place the application in a condition for approval. If a complete response letter is issued, the applicant may either resubmit the BLA, addressing all of the deficiencies identified in the letter, or withdraw the application.

If a product receives regulatory approval, the approval may be significantly limited to specific diseases and dosages or the indications for use may otherwise be limited, which could restrict the commercial value of the product. Further, the FDA may require that certain contraindications, warnings or precautions be included in the product labeling. The FDA may impose restrictions and conditions on product distribution, prescribing, or dispensing in the form of a REMS, or otherwise limit the scope of any approval. In addition, the FDA may require post-marketing clinical trials, sometimes referred to as Phase 4 clinical trials, designed to further assess a biological product’s safety and effectiveness, and testing and surveillance programs to monitor the safety of approved products that have been commercialized.

U.S. fraud and abuse, transparency and privacy laws

In the U.S., our business activities are subject to numerous other federal, state and local laws designed to, for example, prevent fraud and abuse; promote transparency in interactions with others in the healthcare industry; protect the privacy of individual information; ensure integrity of research or protect human subjects involved in research. These laws are enforced by various federal and state enforcement authorities, including but not limited to, the U.S. Department of Justice ("DOJ"), and individual U.S. Attorney offices within the DOJ, the U.S. Department of Health and Human Services (“HHS”), HHS’ various divisions, including but not limited to, the Centers for Medicare & Medicaid Services (“CMS”), the Office of Inspector General, the Office for Human Research Protections, and the Office of Research Integrity, and other state and local government agencies.

Although we currently have no products approved for commercial sale, we may be subject to various federal and state laws pertaining to healthcare fraud and abuse, including anti-kickback laws and false claims laws, for activities related to future sales of any of our product candidates that may in the future receive regulatory and marketing approval. Anti-kickback laws generally prohibit a pharmaceutical manufacturer from soliciting, offering, receiving, or paying any remuneration to generate business, including the purchase, prescription or use of a particular drug. False claims laws generally prohibit anyone from knowingly and willingly presenting, or causing to be presented, any claims for payment for reimbursed drugs or services to third-party payors (including Medicare and Medicaid) that are false or fraudulent. Although the specific provisions of these laws vary, their scope is generally broad and there may not be regulations, guidance or court decisions that apply the laws to particular industry practices. There is therefore a possibility that our practices might be challenged under such laws.

Laws and regulations have also been enacted by the federal government and various states to regulate the sales and marketing practices of pharmaceutical manufacturers with marketed products. The laws and regulations generally limit financial interactions between manufacturers and healthcare providers; require manufacturers to adopt certain compliance standards; require disclosure to the government and public of such interactions; regulate drug pricing and/or require the registration of pharmaceutical sales representatives. Many of these laws and regulations contain ambiguous requirements or require administrative guidance for implementation. Given the lack of clarity in laws and their implementation, any future activities (if we obtain approval and/or reimbursement from federal healthcare programs for our product candidates) could be subject to challenge.

We may be subject to privacy and security laws in the various jurisdictions in which we operate, obtain or store personally identifiable information. Numerous U.S. federal and state laws govern the collection, use, disclosure and storage of personal information. Various foreign countries also have, or are developing, laws governing the collection, use, disclosure and storage of personal information. Globally, there has been an increasing focus on privacy and data protection issues that may affect our business. See “Risk Factors - Risks Related to Our Business and Industry”.

16

If our operations are found to be in violation of any of the health regulatory laws described above, or any other laws that apply to us, we may be subject to penalties, including, without limitation, civil, criminal, and administrative penalties, damages, monetary fines, disgorgement, possible exclusion from participation in Medicare, Medicaid and other federal healthcare programs, contractual damages, reputational harm, diminished profits and future earnings, and curtailment or restructuring of our operations.

Reimbursement

The commercial success of any approved products will depend, in part, on the availability of coverage and adequate reimbursement for such products from third-party payors, such as government healthcare programs, private health insurers, and managed care organizations. These third-party payors are increasingly challenging the prices charged for medical products and services and imposing controls to manage costs. The containment of healthcare costs has become a priority of federal and state governments and drug prices have been a focus in this effort. Governments have shown significant interest in implementing cost-containment programs, including price controls, restrictions on reimbursement and requirements for substitution of generic products. Adoption of price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit our net revenue and results. Third-party payors may limit coverage to specific products on an approved list or formulary, which might not include all of the FDA-approved products for a particular indication. In addition, there is significant uncertainty regarding the reimbursement status of newly approved healthcare products. Third-party payors are increasingly examining the medical necessity and cost-effectiveness of medical products and services, in addition to their safety and efficacy. We may need to conduct expensive pharmacoeconomic studies in order to demonstrate the cost-effectiveness of our products. If third-party payors do not consider our products to be cost-effective compared to other therapies, the payors may not cover our products after approval as a benefit under their plans or, if they do, the level of payment may not be sufficient to allow us to sell our products on a profitable basis. Further, we may have to offer discounts or rebates to purchasers before purchasers will agree to purchase our products or to third-party payors in order to obtain and maintain acceptable reimbursement levels and access for patients at copay levels that are reasonable and customary. We may also have to enter into value-based arrangements with such entities in which the amount ultimately paid for our products depends on the performance of our products, as measured by metrics such as patient outcomes or cost savings. Utilization of any of our approved products may be affected by whether third-party payors provide incentives to healthcare providers to use our products as part of a “pay for performance” program intended to improve the quality of care provided to patients. Novel and expensive cell therapies requiring the unique manufacture of products for each patient have experienced and continue to experience coverage and reimbursement challenges. For example, third-party payors may impose coverage criteria more extensive than compliance with FDA labeling. We may have to negotiate coverage and reimbursement on a case-by-case basis. Reimbursement, particularly if the cost of the therapy is reimbursed as part of a standard procedure, may not be adequate.

Within the U.S., if we obtain appropriate approval in the future to market any of our current product candidates, we may seek coverage for those products under Medicaid, Medicare, and the 340B drug pricing programs. These programs are administered by various federal and state agencies and provide prescription drug benefits to individuals who are age 65 and over, low income, or disabled or allow healthcare providers that serve vulnerable populations to purchase prescription drugs at discounted prices. In the future, we may also seek to sell any approved product candidates to government purchasers. In order to obtain coverage for our products under government benefit programs, or to sell products to government purchasers, we may be required to track and report prices for our products, offer discounts to certain purchasers, or pay rebates on certain utilization.

In the U.S., federal and state governments continue to propose and pass legislation designed to reform delivery of, or payment for, health care, which include initiatives to reduce the cost of health care. For example, in March 2010, the U.S. Congress enacted the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act (the “Healthcare Reform Act”) which expanded healthcare coverage through Medicaid expansion and the implementation of the individual mandate for health insurance coverage and which included changes to the coverage and reimbursement of drug products under government healthcare programs. In recent years, there have been ongoing efforts to modify or repeal all or certain provisions of the Healthcare Reform Act. For example, tax reform legislation was enacted at the end of 2017 that eliminates the tax penalty for individuals who do not maintain sufficient health insurance coverage beginning in 2019 (the so-called “individual mandate”). In addition, a case that challenges the constitutionality of the Healthcare Reform Act, California v. Texas, was argued before the U.S Supreme Court in November 2020. In June 2021, the Supreme Court held that the plaintiffs lacked standing to challenge the Healthcare Reform Act. Notwithstanding the Supreme Court's ruling, we cannot say for certain whether there will be future challenges to the Healthcare Reform Act or what impact, if any, such challenges may have on our business. Changes resulting from these proceedings could have a material impact on our business.

17

There have been other recent reform initiatives, including a number of initiatives focused on drug pricing. For example, legislation passed in 2019 revised how certain prices reported by manufacturers under the Medicaid Drug Rebate Program are calculated, and regulations issued in late 2020 will further revise price reporting under the Medicaid Drug Rebate Program. Additional healthcare reform efforts have sought to address certain issues related to the COVID-19 pandemic, including an expansion of telehealth coverage under Medicare and accelerated or advanced Medicare payments to healthcare providers.

Healthcare reform efforts have been and may continue to be subject to scrutiny and legal challenge. For example, courts temporarily enjoined regulations that would implement a new “most favored nation” payment model for select drugs covered under Medicare Part B that was to take effect on January 1, 2021 and would limit payment based on international drug price, and CMS subsequently issued a notice of proposed rulemaking to rescind and remove the regulations. As another example, revisions to regulations under the federal anti-kickback statute would remove protection for traditional Medicare Part D discounts offered by pharmaceutical manufacturers to pharmacy benefit managers and health plans. Pursuant to court order, the removal was delayed, and recent legislation imposed a moratorium on implementation of the rule until January 1, 2026.

There have also been other efforts by government officials or legislators to implement measures to regulate prices or payment for pharmaceutical products, including legislation on drug importation. Recently, there has been considerable public and government scrutiny of pharmaceutical pricing and proposals to address the perceived high cost of pharmaceuticals. There have been recent state legislative efforts to address drug costs, which generally have focused on increasing transparency around drug costs or limiting drug prices.

Adoption of new legislation at the federal or state level could affect demand for, or pricing of, our product candidates if approved for sale. We cannot, however, predict the ultimate content, timing, or effect of any changes to the Healthcare Reform Act or other federal and state reform efforts. There is no assurance that federal or state healthcare reform will not adversely affect our future business and financial results.

Manufacturing

We do not have any manufacturing facilities. We currently rely, and expect to continue to rely, on third parties for the manufacture of our product candidates for nonclinical studies and clinical trials, as well as for commercial manufacture if our product candidates receive marketing approval.

Some of our third-party contract manufacturing organizations are located outside the U.S. Therefore, in addition to regulations in the U.S., we may be subject to a variety of foreign regulations for the manufacturing and development of our product candidates.

Business Update Regarding COVID-19

The current COVID-19 pandemic has presented a substantial public health and economic challenge around the world and is affecting our employees, patients, communities and business operations, as well as the U.S. economy and financial markets. The full extent to which the COVID-19 pandemic will directly or indirectly affect our business, results of operations and financial condition will depend on future developments that are highly uncertain and cannot be accurately predicted, including new information that may emerge concerning COVID-19, the actions taken to contain or treat COVID-19, and its economic impact on local, regional, national and international markets.

To date, we have been able to continue our operations and do not anticipate any material interruptions for the foreseeable future. However, we are continuing to assess the potential impact of the COVID-19 pandemic on our business and operations, including our supply chain, research activities and clinical trials.

Our third-party contract manufacturing partners continue to operate their manufacturing facilities at or near normal levels. While we currently do not anticipate any interruptions in our supply chain, it is possible that the COVID-19 pandemic and response efforts may have an impact in the future on us and/or our third-party suppliers and contract manufacturing partners' ability to manufacture our products or the products of our partners.

18

Information about our Executive Officers

The following information sets forth the name, age and position of our executive officers as of March 15, 2022.

William "Chip" Clark, age 53, has served as our President and Chief Executive Officer ("CEO") since February 2011 after serving as our Chief Business Officer from August 2010 to February 2011. Mr. Clark has also served on our board of directors since February 2011. Prior to joining Genocea, he served as Chief Business Officer at Vanda Pharmaceuticals, a biopharmaceutical company he co-founded in 2004. While at Vanda, he led the company’s strategic and business development activities and played a central role in raising more than $400 million through business development deals and equity financings. Prior to Vanda, Mr. Clark was a principal at Care Capital, a venture capital firm investing in biopharmaceutical companies, after serving in a variety of commercial and strategic roles at SmithKline Beecham (now GlaxoSmithKline). Mr. Clark has also served on the board of directors of iBio, Inc. since August 2021. Mr. Clark received an M.B.A. from The Wharton School of the University of Pennsylvania and a B.A. from Harvard University.

Girish Aakalu, Ph.D., age 47, has served as our Chief Business Officer since December 2018. In this role, he leads Genocea’s business development efforts. His broad skill set spans business development, corporate and R&D strategy, product portfolio management, commercial planning, and alliance management. Prior to joining Genocea, Dr. Aakalu was employed by the Ipsen Group, from May 2015 until December 2018, where he was most recently Vice President: Global Head of External Innovation, and Pfizer, Inc., from October 2007 until May 2015, where he held the title of Executive Director: Head of Strategy, Innovation & Operations for Pfizer’s External R&D Innovation team prior to his departure. His previous roles also include business development and oncology pipeline market planning positions at Genentech, Inc. and life science consulting experience at L.E.K Consulting. He received both a Ph.D. in cellular and molecular neurobiology and an M.S. in biology from the California Institute of Technology and a B.A. in biophysics with general and departmental honors from Johns Hopkins University. He has also completed executive education in corporate governance at the Kellogg School of Management at Northwestern University.