UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________________________________

FORM 10-Q

_______________________________________________________

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2019

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36289

_______________________________________________________

Genocea Biosciences, Inc.

(Exact Name of Registrant as Specified in Its Charter)

_______________________________________________________

Delaware | 51-0596811 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

100 Acorn Park Drive | ||

Cambridge, Massachusetts | 02140 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (617) 876-8191

_______________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

Common stock, $0.001 par value per share | GNCA | NASDAQ Capital Market | ||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | x | ||||

Non-accelerated filer | ¨ | Smaller reporting company | x | ||||

Emerging growth company | x | ||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 22, 2019, there were 26,149,689 shares of the registrant’s Common Stock, par value $0.001 per share, outstanding.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, our clinical results and other future conditions. The words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “may”, “plan”, “potential”, “predict”, “project”, “should”, “target”, “will”, “would”, or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in our Annual Report on Form 10-K and other filings with the Securities Exchange Commission (the “SEC”), including the following:

• | our estimates regarding the timing and amount of funds we require to conduct clinical trials for GEN-009, to continue preclinical studies and file an investigational new drug (“IND”) for GEN-011, to continue preclinical studies for our other product candidates and to continue our investments in immuno-oncology; |

• | our estimates regarding expenses, future revenues, capital requirements, the sufficiency of our current and expected cash resources and our need for additional financing; |

• | the timing of, and our ability to, obtain and maintain regulatory approvals for our product candidates; |

• | the potential benefits of strategic partnership agreements and our ability to enter into strategic partnership arrangements; |

• | our intellectual property position; |

• | the rate and degree of market acceptance and clinical utility of any approved product candidate; |

• | our ability to quickly and efficiently identify and develop product candidates; and |

• | our commercialization, marketing and manufacturing capabilities and strategies. |

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make or collaborations or strategic partnerships we may enter into. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This Quarterly Report on Form 10-Q includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

2

Genocea Biosciences, Inc.

Form 10-Q

For the Quarter Ended September 30, 2019

TABLE OF CONTENTS

Page | ||||

3

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Genocea Biosciences, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands)

September 30, 2019 | December 31, 2018 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 46,649 | $ | 26,361 | |||

Prepaid expenses and other current assets | 1,271 | 696 | |||||

Total current assets | 47,920 | 27,057 | |||||

Property and equipment, net | 2,896 | 2,582 | |||||

Operating lease right-of-use asset | 6,516 | — | |||||

Restricted cash | 631 | 316 | |||||

Other non-current assets | 1,324 | 1,160 | |||||

Total assets | $ | 59,287 | $ | 31,115 | |||

Liabilities and stockholders’ equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 686 | $ | 1,659 | |||

Accrued expenses and other current liabilities | 4,111 | 3,816 | |||||

Operating lease liabilities | 1,017 | — | |||||

Current portion of long-term debt | 5,256 | 5,257 | |||||

Total current liabilities | 11,070 | 10,732 | |||||

Non-current liabilities: | |||||||

Warrant liability | 3,183 | 3,472 | |||||

Long-term debt, net of current portion and discount | 8,041 | 9,565 | |||||

Operating lease liabilities, net of current portion | 5,620 | — | |||||

Other non-current liabilities | — | 11 | |||||

Total liabilities | 27,914 | 23,780 | |||||

Commitments and contingencies (Note 9) | |||||||

Stockholders’ equity: | |||||||

Preferred stock | 701 | 701 | |||||

Common stock | 26 | 11 | |||||

Additional paid-in capital | 352,244 | 298,627 | |||||

Accumulated deficit | (321,598 | ) | (292,004 | ) | |||

Total stockholders’ equity | 31,373 | 7,335 | |||||

Total liabilities and stockholders’ equity | $ | 59,287 | $ | 31,115 | |||

See accompanying notes to unaudited condensed consolidated financial statements.

4

Genocea Biosciences, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(unaudited)

(in thousands, except per share data)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Operating expenses: | |||||||||||||||

Research and development | $ | 6,826 | $ | 6,359 | $ | 20,135 | $ | 18,950 | |||||||

General and administrative | 2,758 | 4,101 | 8,992 | 11,682 | |||||||||||

Total operating expenses | 9,584 | 10,460 | 29,127 | 30,632 | |||||||||||

Loss from operations | (9,584 | ) | (10,460 | ) | (29,127 | ) | (30,632 | ) | |||||||

Other income (expense): | |||||||||||||||

Change in fair value of warrants | 2,206 | 2,894 | 289 | 3,093 | |||||||||||

Interest expense, net | (154 | ) | (266 | ) | (755 | ) | (708 | ) | |||||||

Other income (expense) | — | (1 | ) | (1 | ) | 86 | |||||||||

Total other income (expense) | 2,052 | 2,627 | (467 | ) | 2,471 | ||||||||||

Net loss | $ | (7,532 | ) | $ | (7,833 | ) | $ | (29,594 | ) | $ | (28,161 | ) | |||

Comprehensive loss | $ | (7,532 | ) | $ | (7,833 | ) | $ | (29,594 | ) | $ | (28,161 | ) | |||

Net loss per share - basic and diluted | $ | (0.28 | ) | $ | (0.72 | ) | $ | (1.62 | ) | $ | (2.77 | ) | |||

Weighted-average number of common shares used in computing net loss per share | 26,681 | 10,829 | 18,297 | 10,149 | |||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

5

Genocea Biosciences, Inc.

Condensed Consolidated Statements of Stockholders' Equity (Deficit)

(unaudited)

(in thousands)

Preferred Shares Amount | Additional Paid-In Capital | Accumulated Deficit | Total Stockholders' Equity | ||||||||||||||||||||

Common Shares | |||||||||||||||||||||||

Shares | Amount | ||||||||||||||||||||||

Balance at December 31, 2018 | 10,847 | $ | 11 | $ | 701 | $ | 298,627 | $ | (292,004 | ) | $ | 7,335 | |||||||||||

Issuance of common stock, net | 3,200 | 3 | — | 14,023 | — | 14,026 | |||||||||||||||||

Exercise of stock options | 3 | — | — | 12 | — | 12 | |||||||||||||||||

Stock-based compensation expense | — | — | — | 429 | — | 429 | |||||||||||||||||

Net loss | — | — | — | — | (15,567 | ) | (15,567 | ) | |||||||||||||||

Balance at March 31, 2019 | 14,050 | $ | 14 | $ | 701 | $ | 313,091 | $ | (307,571 | ) | $ | 6,235 | |||||||||||

Issuance of common stock, net | 12,074 | 12 | — | 38,155 | — | 38,167 | |||||||||||||||||

Issuance of common stock; ESPP purchase | 24 | — | — | 48 | — | 48 | |||||||||||||||||

Exercise of stock options | 2 | — | — | 9 | — | 9 | |||||||||||||||||

Stock-based compensation expense | — | — | — | 474 | — | 474 | |||||||||||||||||

Net loss | — | — | — | — | (6,495 | ) | (6,495 | ) | |||||||||||||||

Balance at June 30, 2019 | 26,150 | $ | 26 | $ | 701 | $ | 351,777 | $ | (314,066 | ) | $ | 38,438 | |||||||||||

Issuance of common stock, net | — | — | — | (23 | ) | — | (23 | ) | |||||||||||||||

Stock-based compensation expense | — | — | — | 490 | — | 490 | |||||||||||||||||

Net loss | — | — | — | — | (7,532 | ) | (7,532 | ) | |||||||||||||||

Balance at September 30, 2019 | 26,150 | $ | 26 | $ | 701 | $ | 352,244 | $ | (321,598 | ) | $ | 31,373 | |||||||||||

Preferred Shares Amount | Additional Paid-In Capital | Accumulated Deficit | Total Stockholders' Equity (Deficit) | ||||||||||||||||||||

Common Shares | |||||||||||||||||||||||

Shares | Amount | ||||||||||||||||||||||

Balance at December 31, 2017 | 3,592 | $ | 3 | $ | — | $ | 258,140 | $ | (264,193 | ) | $ | (6,050 | ) | ||||||||||

Issuance of common stock, net | 6,790 | 7 | 701 | 35,156 | — | 35,864 | |||||||||||||||||

Stock-based compensation expense | — | — | — | 644 | — | 644 | |||||||||||||||||

Net loss | — | — | — | — | (15,890 | ) | (15,890 | ) | |||||||||||||||

Balance at March 31, 2018 | 10,382 | $ | 10 | $ | 701 | $ | 293,940 | $ | (280,083 | ) | $ | 14,568 | |||||||||||

Issuance of common stock, net | 440 | 1 | — | 2,921 | — | 2,922 | |||||||||||||||||

Issuance of common stock; ESPP purchase | 6 | — | — | 31 | — | 31 | |||||||||||||||||

Issuance of Warrants on Debt Modification | — | — | — | 190 | — | 190 | |||||||||||||||||

Stock-based compensation | — | — | — | 592 | — | 592 | |||||||||||||||||

Net loss | — | — | — | — | (4,438 | ) | (4,438 | ) | |||||||||||||||

Balance at June 30, 2018 | 10,828 | $ | 11 | $ | 701 | $ | 297,674 | $ | (284,521 | ) | $ | 13,865 | |||||||||||

Stock-based compensation | — | — | — | 466 | — | 466 | |||||||||||||||||

Net loss | — | — | — | — | (7,833 | ) | (7,833 | ) | |||||||||||||||

Balance at September 30, 2018 | 10,828 | $ | 11 | $ | 701 | $ | 298,140 | $ | (292,354 | ) | $ | 6,498 | |||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

6

Genocea Biosciences, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

Nine Months Ended September 30, | |||||||

2019 | 2018 | ||||||

Operating activities | |||||||

Net loss | $ | (29,594 | ) | $ | (28,161 | ) | |

Adjustments to reconcile net loss to net cash used in operating activities | |||||||

Depreciation and amortization | 825 | 815 | |||||

Stock-based compensation | 1,392 | 1,702 | |||||

Allocation of proceeds to transaction expenses | — | 2,115 | |||||

Change in fair value of warrant liability | (289 | ) | (5,208 | ) | |||

Gain on sale of equipment | (19 | ) | (50 | ) | |||

Write-off of deferred financing fees | — | 355 | |||||

Non-cash interest expense | 471 | 460 | |||||

Changes in operating assets and liabilities | (1,534 | ) | (5,085 | ) | |||

Net cash used in operating activities | (28,748 | ) | (33,057 | ) | |||

Investing activities | |||||||

Purchases of property and equipment | (989 | ) | (213 | ) | |||

Proceeds from sale of equipment | 19 | 72 | |||||

Net cash used in investing activities | (970 | ) | (141 | ) | |||

Financing activities | |||||||

Proceeds from equity offerings, net | — | 2,920 | |||||

Proceeds from issuance of common stock, net | 52,171 | 52,538 | |||||

Payment of deferred financing costs | — | (127 | ) | ||||

Proceeds from long-term debt | — | 592 | |||||

Repayment of long-term debt | (1,919 | ) | (535 | ) | |||

Proceeds from exercise of stock options | 21 | — | |||||

Proceeds from the issuance of common stock under ESPP | 48 | 31 | |||||

Net cash provided by financing activities | 50,321 | 55,419 | |||||

Net increase in cash and cash equivalents | $ | 20,603 | $ | 22,221 | |||

Cash, cash equivalents and restricted cash at beginning of period | 26,677 | 12,589 | |||||

Cash, cash equivalents and restricted cash at end of period | $ | 47,280 | $ | 34,810 | |||

Supplemental cash flow information | |||||||

Cash paid for interest | $ | 843 | $ | 786 | |||

Property and equipment included in accounts payable and accrued expenses | $ | 150 | $ | — | |||

Reclassification of warrants to additional paid-in capital | $ | — | $ | 190 | |||

See accompanying notes to unaudited condensed consolidated financial statements.

7

Genocea Biosciences, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Organization and operations

The Company

Genocea Biosciences, Inc. (the “Company”) is a biopharmaceutical company that was incorporated in Delaware on August 16, 2006 and has a principal place of business in Cambridge, Massachusetts. The Company seeks to discover and develop novel cancer immunotherapies using its ATLASTM proprietary discovery platform. The ATLAS platform profiles each patient's CD4+ and CD8+ T cell immune responses to every potential target or "antigen" in that patient's tumor. Genocea believes that this approach optimizes antigen selection for immunotherapies such as cancer vaccines and cellular therapies. Consequently, the Company believes that ATLAS could lead to more immunogenic and efficacious cancer immunotherapies.

The Company’s most advanced program is GEN-009, a personalized neoantigen cancer vaccine, for which it is conducting a Phase 1/2a clinical trial. The GEN-009 program uses ATLAS to identify neoantigens, or immunogenic tumor mutations unique to each patient, for inclusion in each patient's GEN-009 vaccine. The Company is also advancing GEN-011, a neoantigen-specific adoptive T cell therapy program that also relies on ATLAS, and is targeting an IND filing in the first half of 2020.

The Company is devoting substantially all of its efforts to product research and development, initial market development, and raising capital. The Company has not generated any product revenue related to its primary business purpose to date and is subject to a number of risks similar to those of other early clinical stage companies, including dependence on key individuals, competition from other companies, the need and related uncertainty associated to the development of commercially viable products, and the need to obtain adequate additional financing to fund the development of its product candidates. The Company is also subject to a number of risks similar to other companies in the life sciences industry, including the uncertainty of success of its preclinical and clinical trials, dependence on third parties, the need to obtain additional financing, dependence on key individuals, regulatory approval of products, uncertainty of market acceptance of products, competition from companies with greater financial, technological and other resources, compliance with government regulations, protection of proprietary technology, and product liability. The Company has historical losses from operations and anticipates that it will continue to incur significant operating losses for the foreseeable future as it continues to develop its product candidates.

Effective May 22, 2019, the Company effected a reverse stock split of its issued and outstanding common stock, par value $0.001, at a ratio of one-for-eight, and decreased the number of authorized shares of common stock from 250,000,000 shares to 85,000,000 shares. The share and per share information presented in these financial statements and related notes have been retroactively adjusted to reflect the one-for-eight reverse stock split.

Operating Capital Requirements

Under Accounting Standards Update ("ASU"), 2014-15, Presentation of Financial Statements-Going Concern (Subtopic 205-40), also referred to as Accounting Standards Codification ("ASC") 205-40 (“ASC 205-40”), the Company has the responsibility to evaluate whether conditions and/or events raise substantial doubt about its ability to meet its future financial obligations as they become due within one year after the date that the financial statements are issued. As required by ASC 205-40, this evaluation shall initially not take into consideration the potential mitigating effects of plans that have not been fully implemented as of the date the financial statements are issued. Management has assessed the Company’s ability to continue as a going concern in accordance with the requirement of ASC 205-40.

As reflected in the condensed consolidated financial statements, the Company had available cash and cash equivalents of $46.6 million at September 30, 2019. The Company believes that its cash, cash equivalents and investments will fund its operations into the first quarter of 2021.

In October 2019, the Company entered into a purchase agreement with Lincoln Park Capital ("LPC") pursuant to which LPC purchased $2.5 million of the Company's common stock at a purchase price of $2.587 per share. In addition, for a period of 30 months, the Company has the right, at its sole discretion, to sell up to an aggregate $27.5 million of the Company's common stock (subject to certain limitations) based on prevailing market prices of its common stock at the time of each sale. In consideration for entering into the purchase agreement, the Company issued 289,966 shares of its common stock to LPC as a commitment fee.

The Company plans to continue to fund its operations through public or private equity offerings, strategic transactions, proceeds from sales of its common stock under its at-the-market equity offering program, or by other means. However, adequate

8

additional financing may not be available to the Company on acceptable terms, or at all. If the Company is unable to raise capital when needed, or on attractive terms, it may be forced to implement cost reduction strategies, including ceasing development of GEN-009, GEN-011, and other corporate programs and activities.

2. Summary of significant accounting policies

Basis of presentation

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring accruals necessary for a fair presentation of the Company’s financial statements for interim periods in accordance with accounting principles generally accepted in the United States (U.S. GAAP).

We operate as one operating segment, which is discovering, researching and developing novel cancer immunotherapies.

The information included in this Quarterly Report on Form 10-Q should be read in conjunction with our audited consolidated financial statements and the accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2018 (“2018 Form 10-K”). Our accounting policies are described in the “Notes to Consolidated Financial Statements” in our 2018 Form 10-K and updated, as necessary, in our Quarterly Reports on Form 10-Q. The December 31, 2018 condensed consolidated balance sheet data presented for comparative purposes was derived from our audited financial statements, but does not include all disclosures required by U.S. GAAP. The results of operations for the three and nine months ended September 30, 2019 are not necessarily indicative of the operating results for the full year or for any other subsequent interim period.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. On an ongoing basis, the Company’s management evaluates its estimates, which include, but are not limited to, estimates related to clinical trial accruals, estimates related to prepaid and accrued research and development expenses, stock-based compensation expense, and warrants to purchase redeemable securities. The Company bases its estimates on historical experience and other market-specific or other relevant assumptions that it believes to be reasonable under the circumstances. Actual results may differ from those estimates or assumptions.

Summary of Significant Accounting Policies

There were no changes to significant accounting policies during the nine months ended September 30, 2019, as compared to the those identified in the 2018 Form 10-K, except for the Company's adoption of ASC Topic 842, Leases on January 1, 2019. The following is the Company's new accounting policy for leases.

Leases

At the inception of the contract, the Company determines if an arrangement is a lease and has a lease term greater than 12 months. Leases that are concluded to be operating leases are included in operating lease right-of-use (“ROU”) assets and operating lease liabilities in the consolidated balance sheets. Leases that are concluded to be finance leases are included in property and equipment and other current liabilities in the consolidated balance sheets.

ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at the lease commencement date based on the present value of lease payments over the lease term. As most of the Company's leases do not provide an implicit rate, the Company uses an estimate of its incremental borrowing rate based on the information available at the lease commencement date in determining the present value of lease payments. The Company uses the implicit rate when readily determinable. The operating lease ROU asset is reduced by deferred lease payments and unamortized lease incentives. The Company's lease terms may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term. The Company has lease agreements with lease and non-lease components, which are generally accounted for separately. The non-lease components generally consist of common area maintenance that is expensed as incurred.

9

Recently adopted accounting standards

Standard | Description | Effect on the financial statements | ||

ASU No. 2016-02, Leases (Topic 842) | In February 2016, the FASB established ASC Topic 842, Leases, (ASC 842) by issuing ASU No. 2016-02, which requires lessees to recognize leases on-balance sheet and disclose key information about leasing arrangements. Topic 842 was subsequently amended by ASU No. 2018-01, Land Easement Practical Expedient for Transition to Topic 842; ASU No. 2018-10, Codification Improvements to Topic 842, Leases; and ASU No. 2018-11, Targeted Improvements. The new standard establishes a right-of-use model ("ROU") that requires a lessee to recognize a ROU asset and lease liability on the balance sheet for all leases with a term longer than 12 months. Leases are classified as finance or operating, with classification affecting the pattern and classification of expense recognition in the income statement. The Company adopted ASC 842 effective January 1, 2019. | The adoption of ASC 842 resulted in the Company recognizing ROU assets and related operating lease liabilities of $1.7 million and $1.8 million, respectively, in our condensed consolidated balance sheet as of January 1, 2019. The Company used the modified retrospective method of adoption, with January 1, 2019 as the effective date of initial application. The Company elected the short-term lease recognition exemption for all leases that qualify. The Company elected the package of practical expedients for leases that commenced prior to January 1, 2019, allowing it not to reassess (i) whether any expired or existing contracts contain leases, (ii) the lease classification for any expired or existing leases and (iii) the initial indirect costs for any existing leases. | ||

ASU No. 2018-07, Compensation-Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting | In June 2018, the FASB issued ASU No. 2018-07, Compensation-Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. The new standard largely aligns the accounting for share-based payment awards issued to employees and nonemployees by expanding the scope of ASC 718 to apply to nonemployee share-based transactions, as long as the transaction is not effectively a form of financing. The Company adopted ASU No. 2018-07 effective January 1, 2019. | The adoption of ASU No. 2018-07 did not have a material impact on the Company's condensed consolidated financial statements. | ||

10

Recently issued accounting standards

Standard | Description | Effect on the financial statements | ||

ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments | In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which amends the impairment model by requiring entities to use a forward-looking approach based on expected losses to estimate credit losses on certain types of financial instruments, including trade receivables and available-for-sale debt securities. The new guidance will be effective for the Company beginning in the first quarter of 2020, with early adoption permitted. | Based on the composition of its investment portfolio and other financial assets, current market conditions and historical credit loss activity, the adoption of this standard is not expected to have a material impact on the consolidated financial position and results of operations and related disclosures of the Company. | ||

ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement | In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement which requires public entities to disclose certain new information and modifies some disclosure requirements. The new guidance will be effective for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. | The Company does not expect that the adoption of this standard will have a material impact on its disclosures. | ||

ASU 2018-15, Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. | In August 2018, the FASB issued ASU 2018-15, Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. ASU 2018-15 requires a customer in a cloud computing arrangement that is a service contract to follow the internal-use software guidance in Accounting Standards Codification 350-40 to determine which implementation costs to defer and recognize as an asset. The new guidance will be effective for annual periods, and interim periods within those annual periods, beginning after December 15, 2019. | The Company does not expect that the adoption of this standard will have a material impact on its consolidated financial position and results of operations and related disclosures. | ||

3. Fair value of financial instruments

The Company has certain financial assets and liabilities recorded at fair value which have been classified as Level 1, 2 or 3 within the fair value hierarchy as described in the accounting standards for fair value measurements.

• | Level 1 - Fair values are determined by utilizing quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access; |

• | Level 2 - Fair values are determined by utilizing quoted prices for similar assets and liabilities in active markets or other market observable inputs such as interest rates, yield curves and foreign currency spot rates; and |

• | Level 3 - Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable. |

The Company's financial assets consist of cash equivalents and the Company's financial liabilities consist of a warrant liability.

The fair value of the Company’s cash equivalents is determined using quoted prices in active markets. The Company's cash equivalents consist of money market funds that are classified as Level 1.

The fair value of the Company’s warrant liability is determined using a Monte Carlo simulation. See Note 7. Warrants. The assumptions used in calculating the estimated fair value of the warrants represent the Company’s best estimates and include probabilities of settlement scenarios, future changes in the Company’s stock price, risk-free interest rates, volatility and probability of the Company being acquired. The estimates are based, in part, on subjective assumptions and could differ materially in the future. The Company’s warrant liability has been classified as Level 3.

11

The following table sets forth the Company's assets and liabilities that are measured at fair value on a recurring basis as of September 30, 2019 and December 31, 2018 (in thousands):

Quoted prices in active markets | Significant other observable inputs | Significant unobservable inputs | |||||||||||||

Total | (Level 1) | (Level 2) | (Level 3) | ||||||||||||

September 30, 2019 | |||||||||||||||

Assets: | |||||||||||||||

Cash equivalents | $ | 46,391 | $ | 46,391 | $ | — | $ | — | |||||||

Total assets | $ | 46,391 | $ | 46,391 | $ | — | $ | — | |||||||

Liabilities: | |||||||||||||||

Warrant liability | $ | 3,183 | $ | — | $ | — | $ | 3,183 | |||||||

Total liabilities | $ | 3,183 | $ | — | $ | — | $ | 3,183 | |||||||

December 31, 2018 | |||||||||||||||

Assets: | |||||||||||||||

Cash equivalents | $ | 24,651 | $ | 24,651 | $ | — | $ | — | |||||||

Total assets | $ | 24,651 | $ | 24,651 | $ | — | $ | — | |||||||

Liabilities: | |||||||||||||||

Warrant liability | $ | 3,472 | $ | — | $ | — | $ | 3,472 | |||||||

Total liabilities | $ | 3,472 | $ | — | $ | — | $ | 3,472 | |||||||

The following table reflects the change in the Company’s Level 3 warrant liability from December 31, 2018 through September 30, 2019 (in thousands):

Warrant Liability | ||||

Balance at December 31, 2018 | $ | 3,472 | ||

Change in fair value | (289 | ) | ||

Balance at September 30, 2019 | $ | 3,183 | ||

4. Accrued expenses and other current liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

September 30, | December 31, | ||||||

2019 | 2018 | ||||||

Research and development | $ | 1,421 | $ | 759 | |||

Payroll and employee-related | 2,037 | 2,147 | |||||

Other current liabilities | 653 | 910 | |||||

Total | $ | 4,111 | $ | 3,816 | |||

5. Long-term debt

In the second quarter of 2018, the Company entered into an amended and restated loan and security agreement (the “2018 Term Loan”) with Hercules Capital, Inc. (“Hercules”), which provided a $14.0 million term loan. The 2018 Term Loan will mature on May 1, 2021 and accrues interest at a floating rate per annum equal to the greater of (i) 7.75% or (ii) the sum of 2.75% plus the prime rate. The 2018 Loan Agreement provided for interest-only payments until June 1, 2019. Since the Company met certain performance milestones, interest-only payments have been extended until June 1, 2020. Thereafter, payments will include equal installments of principal and interest through maturity. The 2018 Term Loan may be prepaid subject to a prepayment charge. The Company is obligated to pay an additional end of term charge of 6.7%.

12

The 2018 Term Loan is secured by a lien on substantially all assets of the Company, other than intellectual property. Hercules has a perfected first-priority security interest in certain cash, cash equivalents and investment accounts. The 2018 Term Loan contains non-financial covenants, representations and a (“Material Adverse Effect”) provision. There are no financial covenants. A Material Adverse Effect means a material adverse effect upon: (i) the business, operations, properties, assets or condition (financial or otherwise) of the Company; or (ii) the ability of the Company to perform the secured obligations in accordance with the terms of the loan documents, or the ability of agent or lender to enforce any of its rights or remedies with respect to the secured obligations; or (iii) the collateral or agent’s liens on the collateral or the priority of such liens. Any event that has a Material Adverse Effect or would reasonably be expected to have a Material Adverse Effect is an event of default under the Loan Agreement and repayment of amounts due under the Loan Agreement may be accelerated by Hercules under the same terms as an event of default. As of September 30, 2019, the Company was in compliance with all covenants of the 2018 Term Loan. The 2018 Term Loan is automatically redeemable upon a change in control. The Company believes acceleration of the repayment of amounts outstanding under the loan is remote, and therefore the debt balance is classified according to the contractual payment terms at September 30, 2019.

In connection with a previously issued term loan in 2014 and the 2018 Term Loan, the Company issued common stock warrants to Hercules (the “First Warrant and Second Warrant”, respectively). See Note 7. Warrants.

As of September 30, 2019 and December 31, 2018, the Company had outstanding borrowings of $13.3 million and $14.8 million, respectively. Interest expense was $0.4 million for each of the three months ended September 30, 2019 and 2018 and $1.3 million and $1.2 million for the nine months ended September 30, 2019 and 2018, respectively. At September 30, 2019, the 2018 Term Loan bears an effective interest rate of 10.9%.

Future principal payments, including the End of Term Charges, are as follows (in thousands):

September 30, 2019 | |||

2020 | $ | 7,407 | |

2021 | 6,453 | ||

Total | $ | 13,860 | |

6. Stockholders' equity

As of September 30, 2019, the Company has authorized 85,000,000 shares of common stock at $0.001 par value per share and 25,000,000 shares of preferred stock at $0.001 par value per share. As of September 30, 2019, 26,149,689 shares of common stock and 1,635 shares of preferred stock were issued and outstanding. As of December 31, 2018, 10,846,397 shares of common stock were issued and outstanding and 1,635 shares of preferred stock were issued and outstanding.

In October 2019, the Company entered into a purchase agreement with LPC pursuant to which LPC purchased $2.5 million of the Company’s common stock at a purchase price of $2.587 per share. In addition, for a period of 30 months, the Company has the right, at its sole discretion, to sell up to an aggregate $27.5 million of the Company's common stock (subject to certain limitations) based on prevailing market prices of its common stock at the time of each sale. In consideration for entering into the purchase agreement, the Company issued 289,966 shares of its common stock to LPC as a commitment fee.

2019 Public Offering

On June 21, 2019, the Company entered into an underwriting agreement relating to the underwritten public offering of 10,500,000 shares of the Company’s common stock, par value $0.001 per share, at a price to the public of $3.50 per share, for gross proceeds of approximately $36.8 million (the “2019 Public Offering”). The Company also granted the underwriters an option to purchase up to an additional 1,575,000 shares of common stock (“Overallotment Option”). On June 26, 2019, the underwriters exercised this option in full. The Company received approximately $5.5 million in gross proceeds from the underwriter’s exercise of the Overallotment Option. In connection with the 2019 Public Offering, inclusive of the Overallotment Option, the Company incurred approximately $3.9 million of offering-related expenses, resulting in total net proceeds of $38.4 million.

Private Placement

In February 2019, the Company completed a private placement financing transaction (the “Private Placement”). The Company issued 3,199,998 shares (the “Shares”) of common stock, prefunded warrants (the “Pre-Funded Warrants”) to purchase 531,250 shares of common stock (the “Pre-Funded Warrant Shares”), and warrants (the “Private Placement Warrants”) to purchase up to 932,812 shares of common stock (the “Warrant Shares”). The Shares, Pre-Funded Warrants and Private Placement Warrants (collectively, the

13

“Units”) were sold at a purchase price of $4.02 per Unit. The Company received net cash proceeds of approximately $13.8 million for the purchase of the Shares, Pre-Funded Warrant Shares and Warrant Shares. See Note 7. Warrants.

The Company had the option to issue additional shares of common stock in a second closing (the “Second Closing”) for gross proceeds of up to $24.2 million. The Second Closing was conditioned on top-line results from Part A of our Phase 1/2a clinical trial for GEN-009 and a decision by our board of directors to proceed with the Second Closing. In June 2019, the Company announced top-line results from this trial but elected not to proceed with the Second Closing. In lieu of the Second Closing the Company proceeded with the 2019 Public Offering.

2018 Public Offering

In January 2018, the Company entered into two underwriting agreements, the first relating to the underwritten public offering of 6,670,625 shares of the Company’s common stock, par value $0.001 per share, and accompanying warrants to purchase up to 3,335,313 shares of common stock (“2018 Public Offering Warrants”), at a combined price of $8.00 per share, for gross proceeds of approximately $53.4 million (the “2018 Common Stock Offering”) and the second relating to the underwritten public offering of 1,635 shares of the Company’s Series A convertible preferred stock, par value $0.001 per share, which are convertible into 204,375 shares of common stock, and accompanying warrants to purchase up to 102,188 shares of common stock for gross proceeds of approximately $1.6 million (the “Preferred Stock Offering,” and together with the 2018 Common Stock Offering, the “January 2018 Financing”). The Company received approximately $1.0 million in gross proceeds and issued 119,718 shares of common stock and warrants to purchase up to 179,757 shares of common stock from the underwriters' exercise of their overallotment option.

Preferred Stock

Each share of preferred stock is convertible at any time at the option of the holder, provided that the holder will be prohibited from converting the preferred stock into shares of common stock if, as a result of such conversion, the holder, together with its affiliates, would own more than 9.99% of the total number of shares of common stock then issued and outstanding. Each share of preferred stock is convertible into 125 shares of common stock, subject to certain adjustments upon stock dividends and stock splits.

The preferred stock ranks pari passu on an as-converted to common stock basis with the common stock as to distributions of assets upon the Company’s liquidation, dissolution or winding up, whether voluntarily or involuntarily, or a “Fundamental Transaction,” as defined in the Certificate of Designation. Shares of preferred stock have no voting rights, except as required by law and except that the consent of the holders of a majority of the outstanding preferred stock is required to amend the terms of the preferred stock. The holders of preferred stock shall be entitled to receive dividends in the same form as dividends actually paid on shares of common stock when, as and if such dividends are declared and paid on shares of the common stock, on an as-if-converted-to-common stock basis.

The Company determined that the preferred stock should be equity classified in accordance with ASC 480, Distinguishing Liabilities from Equity (“ASC 480”) for the periods ended September 30, 2019 and December 31, 2018, respectively. For the nine months ended September 30, 2018, the Company recorded $0.3 million in additional paid-in capital as a result of the preferred stock’s beneficial conversion feature.

Issuance Costs

In connection with the January 2018 Financing, the Company incurred approximately $4.0 million of issuance costs. The Company allocated approximately $2.6 million of the issuance costs to the common and preferred stock, and recorded these amounts within additional paid-in capital, and approximately $1.4 million of the issuance costs to the 2018 Public Offering Warrants. As the 2018 Public Offering Warrants were classified as liabilities, the Company immediately expensed the issuance costs allocated to the 2018 Public Offering Warrants in the three months ended March 31, 2018.

Warrants

See Note 7. Warrants.

Hercules

In connection with the 2018 Loan Agreement with Hercules, see Note 5. Long-term debt, the Company also entered into an amendment to the November 2014 equity rights letter agreement (the “Amended Equity Rights Letter Agreement”). Hercules has the right to participate in any one or more subsequent private placement equity financings of up to $2.0 million on the same terms and conditions as purchases by the other investors in each subsequent equity financing. The Amended Equity Rights Letter Agreement

14

will terminate upon the earlier of (1) such time when Hercules has purchased $2.0 million of subsequent equity financing securities in the aggregate, and (2) the later of (a) the repayment of all indebtedness under the Loan Agreement, or (b) the expiration or termination of the exercise period for the Second Warrant. See Note 7. Warrants.

At-the-market equity offering program

In 2015, the Company entered into an agreement, as amended, with Cowen and Company, LLC to establish an at-the-market equity offering program (“ATM”) pursuant to which it was able to offer and sell shares of its common stock at prevailing market prices from time to time. Through September 30, 2019, the Company has sold an aggregate of approximately 0.5 million shares under the ATM and received approximately $4.0 million in net proceeds after deducting commissions.

7. Warrants

As of September 30, 2019, the Company had the following potentially issuable shares of common stock related to unexercised warrants outstanding:

Shares | Exercise price | Expiration date | Classification | ||||||||

First Warrant | 9,216 | $ | 65.92 | Q4 2019 | Equity | ||||||

Second Warrant | 41,177 | $ | 6.80 | Q2 2023 | Equity | ||||||

2018 Public Offering Warrants | 3,616,944 | $ | 9.60 | Q1 2023 | Liability | ||||||

Private Placement Warrants | 932,812 | $ | 4.52 | Q1 2024 | Equity | ||||||

Pre-Funded Warrants | 531,250 | $ | 0.08 | Q1 2039 | Equity | ||||||

5,131,399 | |||||||||||

First and Second Warrant

The exercise price and the number of shares are subject to adjustment upon a merger event, reclassification of the shares of common stock, subdivision or combination of the shares of common stock or certain dividends payments. The Company determined that the First and Second Warrant should be equity classified in accordance with ASC 480 for all periods presented.

2018 Public Offering Warrants

The exercise price and the number of shares are subject to adjustment upon a merger event, reclassification of the shares of common stock, subdivision or combination of the shares of common stock or certain dividends payments. In the event of an “Acquisition,” defined generally to include a merger or consolidation resulting in the sale of 50% or more of the voting securities of the Company, the sale of all, or substantially all, of the assets or voting securities of the Company, or other change of control transaction, as defined in the 2018 Public Offering Warrants, the Company will be obligated to use its best efforts to ensure that the holders of the 2018 Public Offering Warrants receive new warrants from the surviving or acquiring entity (the “Acquirer”). The new warrants to purchase shares in the Acquirer shall have the same expiration date as the 2018 Public Offering Warrants and a strike price that is based on the proportion of the value of the Acquirer’s stock to the Company’s common stock. If the Company is unable, despite its best efforts, to cause the Acquirer to issue new warrants in the Acquisition as described above, then, if the Company’s stockholders are to receive cash in the Acquisition, the Company will settle the 2018 Public Offering Warrants in cash and if the Company’s stockholders are to receive stock in the Acquisition, the Company will issue shares of its common stock to each Warrant holder.

The Company determined that the 2018 Public Offering Warrants should be liability classified in accordance with ASC 480. As the 2018 Public Offering Warrants are liability-classified, the Company remeasures the fair value of the Warrants at each reporting date. The Company initially recorded the 2018 Public Offering Warrants at their estimated fair value of approximately $18.2 million. In connection with the Company's remeasurement of the 2018 Public Offering Warrants to fair value, the Company recorded income of approximately $2.2 million and $2.9 million for the three months ended September 30, 2019 and 2018, respectively, and expense of $0.3 million and income of $5.2 million for the nine months ended September 30, 2019 and 2018, respectively. The fair value of the warrant liability is approximately $3.2 million and $3.5 million as of September 30, 2019 and December 31, 2018, respectively. See Note 3. Fair Value Measurements.

15

The following table details the assumptions used in the Monte Carlo simulation models used to estimate the fair value of the Warrant Liability as of September 30, 2019 and December 31, 2018, respectively:

September 30, 2019 | December 31, 2018 | |||||||

Stock price | $ | 2.90 | $ | 2.32 | ||||

Volatility | 114.7 | % | 111.3 | % | ||||

Remaining term (years) | 3.3 | 4.1 | ||||||

Expected dividend yield | — | — | ||||||

Risk-free rate | 1.6 | % | 2.4%-2.5% | |||||

Range of annual acquisition event probability | 20% | 0.0%-30.0% | ||||||

Private Placement and Prefunded Warrants

The exercise price of the warrants is subject to appropriate adjustment in the event of stock dividends, subdivisions, stock splits, stock combinations, reclassifications, reorganizations or a change of control affecting our common stock. The Company determined that the Private Placement Warrants and the Pre-Funded Warrants should be equity classified in accordance with ASC 480 for the period ended September 30, 2019. The Company also determined that the Pre-Funded Warrants should be included in the determination of basic earnings per share in accordance with ASC 260, Earnings per Share.

8. Stock and employee benefit plans

Stock-based compensation expense

Total stock-based compensation expense is recognized for stock options and restricted stock awards granted to employees and non-employees and has been reported in the Company’s condensed consolidated statements of operations as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Research and development | $ | 182 | $ | 156 | $ | 534 | $ | 456 | |||||||

General and administrative | 308 | 310 | 858 | 1,246 | |||||||||||

Total | $ | 490 | $ | 466 | $ | 1,392 | $ | 1,702 | |||||||

Stock options

The following table summarizes stock option activity for employees and non-employees (shares in thousands):

Shares | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term (years) | Aggregate Intrinsic Value | |||||||||

Outstanding at December 31, 2018 | 893 | $ | 18.79 | $ | — | |||||||

Granted | 673 | $ | 4.38 | |||||||||

Exercised | (5 | ) | $ | 4.32 | ||||||||

Cancelled | (163 | ) | $ | 20.32 | ||||||||

Outstanding at September 30, 2019 | 1,398 | $ | 11.72 | 8.16 | $ | — | ||||||

Exercisable at September 30, 2019 | 461 | $ | 22.90 | 6.20 | $ | — | ||||||

Performance-based awards

The Company granted stock awards to certain employees, executive officers and consultants, which contain performance-based vesting criteria. Milestone events are specific to the Company’s corporate goals, which include, but are not limited to, certain clinical development milestones, business development agreements, and capital fundraising events. Stock-based compensation expense associated with these performance-based stock options is recognized if the performance conditions are considered probable of being achieved, using management’s best estimates. The Company determined that none of the performance-based milestones were probable

16

of achievement during the three and nine months ended September 30, 2019, and did not recognize stock-based compensation expense for this period. As of September 30, 2019, there were 7,042 performance-based common stock awards outstanding for which the probability of achievement was not deemed probable.

Employee stock purchase plan

On February 10, 2014, the Company’s board of directors adopted the 2014 Employee Stock Purchase Plan (the “2014 ESPP”). The 2014 ESPP, as amended, authorizes the issuance of up to 337,597 shares of common stock to participating eligible employees. The 2014 ESPP provides for six-month option periods commencing on January 1 and ending June 30, and commencing July 1 and ending December 31 of each calendar year.

9. Commitments and contingencies

Lease commitments

In May 2019, the Company entered into a lease extension for office and laboratory space through February 2025. In July 2019, the Company exercised an option for additional office and laboratory space from March 2020 through February 2025. The Company’s lease obligations associated with the additional lab and office space is $7.2 million and will be reflected as a lease liability upon it’s right to use the space in March 2020. The Company also has a lease for office space through February 2020. The right to use asset and lease liability were calculated using incremental borrowing rates of 8.25% for the lab and office space and 10% for the office space. For the three months ended September 30, 2019 and 2018 lease expense was $0.4 million and $0.4 million, respectively. For the nine months ended September 30, 2019 and 2018 lease expense was $1.1 million and $1.2 million, respectively.

In March 2019, the Company entered into a sublease agreement for a portion of the office space lease through February 2020. Since the Company retained its obligations under the sublease, it did not adjust the lease liability, however the sublease is being reflected as a reduction of lease expense.

Maturities of lease liabilities are as follows (in thousands):

September 30, 2019 | |||

2019 | $ | 410,433 | |

2020 | 1,476,644 | ||

2021 | 1,473,800 | ||

2022 | 1,510,601 | ||

2023 and thereafter | 3,400,844 | ||

Total lease payments | 8,272,322 | ||

Less imputed interest | (1,635,192 | ) | |

Total | $ | 6,637,130 | |

At September 30, 2019 and December 31, 2018, the Company has an outstanding letter of credit of $0.6 million and $0.3 million, respectively, with a financial institution related to a security deposit for the office and lab space lease, which is secured by cash on deposit and expires on February 28, 2025.

10. Net loss per share

The Company computes basic and diluted loss per share using a methodology that gives effect to the impact of outstanding participating securities (the “two-class method”). For both the three and nine-month periods ended September 30, 2019 and 2018, respectively, there is no income allocation required under the two-class method or dilution attributed to weighted average shares outstanding in the calculation of diluted loss per share.

The following common stock equivalents, presented on an as converted basis, were excluded from the calculation of net loss per share for the periods presented, due to their anti-dilutive effect (in thousands):

17

Nine Months Ended September 30, | |||||

2019 | 2018 | ||||

Stock options | 1,398 | 712 | |||

Warrants | 4,600 | 3,668 | |||

Total | 5,998 | 4,380 | |||

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following information should be read in conjunction with the unaudited consolidated financial information and the notes thereto included in this Quarterly Report on Form 10-Q. The following disclosure contains forward-looking statements that involve risk and uncertainties. Our actual results and timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those discussed in our Annual Report on Form 10-K.

Overview

We are a biopharmaceutical company that seeks to discover and develop novel cancer immunotherapies using the ATLAS™ proprietary discovery platform. The ATLAS platform profiles each patient's CD4+ and CD8+ T cell immune responses to every potential target or “antigen” in that patient's tumor. We believe that this approach optimizes antigen selection for immunotherapies such as cancer vaccines and cellular therapies. Consequently, we believe that ATLAS could lead to more immunogenic and efficacious cancer immunotherapies.

Our most advanced program is GEN-009, a personalized neoantigen cancer vaccine, for which we are conducting a Phase 1/2a clinical trial. The GEN-009 program uses ATLAS to identify neoantigens, or immunogenic tumor mutations unique to each patient, for inclusion in each patient's GEN-009 vaccine. We are also advancing GEN-011, a neoantigen-specific adoptive T cell therapy program that also relies on ATLAS, and are targeting an IND filing in the first half of 2020.

ATLAS Platform

Harnessing and directing the T cell arm of the immune system to kill tumor cells is increasingly viewed as having potential in the treatment of many cancers. This approach has been effective against hematologic malignancies and, more recently, certain solid tumors. Vaccines or cellular therapies employing this approach must target specific differences from normal tissue present in a tumor, such as genetic mutations. However, the discovery of optimal antigens for such immunotherapies has been particularly challenging for two reasons. First, the genetic diversity of human T cell responses means that effective antigens vary from person to person. Second, the number of candidate antigens can be very large, with up to thousands of candidates per patient in some cancers. An effective antigen selection system must therefore account both for each patient's tumor and for their T cell repertoire.

ATLAS achieves this by employing components of the T cell arm of the human immune system from each patient. Using ATLAS, we measure each patient's T cell responses to a comprehensive set of candidate neoantigens, tumor-associated antigens or tumor-associated viral antigens for their own cancer, allowing us to select those targets associated with the anti-tumor T cell responses that may kill that individual's cancer. We believe that ATLAS represents the most comprehensive and accurate system for antigen discovery.

The T cell responses we have seen with ATLAS appear to challenge the orthodoxy. Since 2017, we have been presenting data that highlights there is little overlap between ATLAS outputs and predicted epitopes using in silico approaches, which are widely used in the field. Additionally, ATLAS has identified an apparently novel candidate neoantigen profile, that of inhibitory T cell responses. Previously, all candidate neoantigens were thought either to be “good ,” meaning targets of effective anti-tumor responses, or irrelevant. Using ATLAS, we have profiled approximately 200 cancer patients' CD4+ and CD8+ T cell responses to their tumors. At the meeting of the Society for Immunotherapy of Cancer in November 2018, we presented data from preclinical research in which ATLAS-identified inhibitory neoantigens promoted tumor progression, reinforcing the importance of accounting for each patient's pre-existing immune responses in antigen selection, and suggesting the high stakes for choosing the right antigens. We are not aware of another platform that is utilizing such comprehensive biological neoantigen profiling.

The ATLAS portfolio comprises three patent families. The first two families comprise issued U.S. patents, with patent terms until at least 2031 and 2030 respectively, as well as issued foreign patents and pending U.S. and foreign applications. The third is directed to ATLAS-based methods for cancer diagnosis, prognosis and patient selection, as well as related compositions. This patent

18

family currently comprises a pending PCT application and a pending U.S. application. Patents issuing from these applications are expected to have a patent term until at least March 2038.

Our Immuno-Oncology Programs

Our cancer immunotherapies consist of vaccines that are designed to educate T cells to recognize and attack specific targets, as well as cellular therapies intended to introduce T cells that have been educated to attack these targets, thereby killing cancer cells. Data published in recent years indicate that an individual’s response to neoantigens drives the efficacy of immune checkpoint inhibitor, or ICI, therapy and that it is possible to vaccinate an individual against his or her own neoantigens. We believe that neoantigen vaccines could be used in combination with existing treatment approaches for cancer, including ICI therapy, to potentially direct and enhance an individual’s T cell response to his or her cancer, thereby potentially effecting better clinical outcomes. Data also support the potential of isolating and expanding T cell populations targeting specific neoantigens, through adoptive cell therapy, for therapeutic benefit.

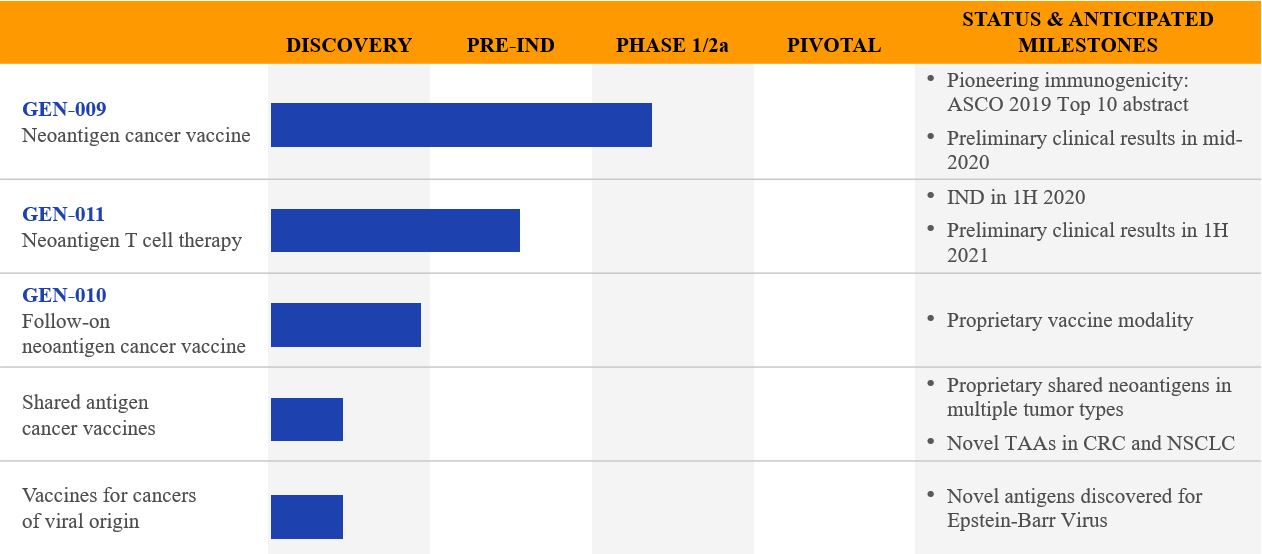

The following table describes our active immuno-oncology programs in development:

Our lead immuno-oncology program, GEN-009, is an adjuvanted neoantigen peptide vaccine candidate. Using ATLAS to identify specific neoantigens, we then manufacture a personalized vaccine for each patient using only those neoantigens determined by ATLAS to be stimulatory to that patient's immune system. We are currently conducting a Phase 1/2a clinical trial for GEN-009 across a range of solid tumor types:

• | Part A of the trial is assessing the safety and immunogenicity of GEN-009 as monotherapy in certain cancer patients with no evidence of disease; and |

• | Part B of the trial, which we have recently initiated, is designed to assess the safety, immunogenicity, and preliminary antitumor activity of GEN-009 in combination with ICI therapy in patients with advanced or metastatic tumors. |

At the Annual Meeting of the American Society of Clinical Oncology in June 2019 and the European Society for Medical Oncology Congress in September 2019, we presented the first data from Part A of the ongoing clinical trial. In the data from the first seven evaluable patients:

• | 100% of patients (N=7 patients) had measurable CD4+ and CD8+ T cell responses to their GEN-009 vaccine; |

• | Responses were detected against 98% of the administered vaccine neoantigens (N=58 administered antigens), which has not been previously established for neoantigen vaccination administered without checkpoint inhibition; |

• | GEN-009 elicited CD8+ T cell responses ex vivo, which is a measure of effector function, for 38% of vaccine neoantigens (N=7 patients); |

• | GEN-009 elicited broad immune responses using an in vitro stimulation assay, which is a measure of central memory, with 86% of neoantigens eliciting a CD4+ response (N=5 patients) and 33% of neoantigens eliciting a CD8+ response (N=2 patients); and |

• | GEN-009 was well tolerated, with no dose-limiting toxicities observed. |

19

We anticipate reporting preliminary clinical results for our GEN-009 Part B clinical trial in mid-2020. As with any open label study, we may slow or pause enrollment to evaluate a smaller set of patients in an effort to assure that a preliminary clinical signal is seen. We expect to pause enrollment of our GEN-009 Part B clinical trial to evaluate preliminary clinical results for an initial cohort of patients. We anticipate reporting these preliminary clinical results for our GEN-009 Part B clinical trial in mid-2020. Based upon this evaluation, we will consider whether it is appropriate to continue the study.

In addition to GEN-009, we also are advancing preclinical work on GEN-011, an adoptive T cell therapy to neoantigens identified by ATLAS, for which we expect to file an IND with the U.S. Food and Drug Administration in the first half of 2020, with preliminary clinical results anticipated in the first half of 2021.

We continue to explore additional program opportunities. We also continue to evaluate GEN-010, our vaccine candidate employing next-generation antigen delivery technology, which we may advance to provide an opportunity for better immunogenicity and/or efficiency of production. In addition, we are using ATLAS to pursue discovery of novel candidate antigens for non-personalized cancer immunotherapies. Such programs could target shared neoantigens, non-mutated, shared tumor-associated antigens, and cancers of viral origin such as cancers driven by Epstein-Barr Virus infection.

Financing and business operations

We commenced business operations in August 2006. We have financed our operations primarily through the issuance of our equity securities, debt financings, and amounts received through grants. As of September 30, 2019, we had received an aggregate of $396.8 million in gross proceeds from the issuance of equity securities and gross proceeds from debt facilities and an aggregate of $7.9 million from grants. At September 30, 2019, our cash and cash equivalents were $46.6 million.

Since inception, we have incurred significant operating losses. Our net losses were $29.6 million for the nine months ended September 30, 2019, and our accumulated deficit was $321.6 million as of September 30, 2019. We expect to incur significant expenses and increasing operating losses for the foreseeable future. Our net losses may fluctuate significantly from quarter-to-quarter and year-to-year. We will need to generate significant revenue to achieve profitability, and we may never do so.

In October 2019, we entered into a purchase agreement with LPC pursuant to which LPC purchased $2.5 million of our common stock at a purchase price of $2.587 per share. In addition, for a period of 30 months, we have the right, at our sole discretion, to sell up to an aggregate $27.5 million of our common stock (subject to certain limitations) based on prevailing market prices of our common stock at the time of each sale. In consideration for entering into the purchase agreement, we issued 289,966 shares of our common stock to LPC as a commitment fee.

In June 2019, we completed an underwritten public offering in which we sold 10.5 million shares of our common stock at a price of $3.50 per share, for gross proceeds of approximately $36.8 million. This underwritten public offering also included an overallotment option for the underwriters for 1.6 million shares, which they exercised in full on June 26, 2019. This generated additional gross proceeds of $5.5 million. The Company incurred approximately $3.9 million of offering-related expenses, resulting in total net proceeds of $38.4 million.

In February 2019, we completed a private placement financing transaction in which we issued the Shares, Pre-funded Warrant Shares and Warrants for net cash proceeds of approximately $13.8 million.

Costs related to clinical trials can be unpredictable and there can be no guarantee that our current balances of cash and cash equivalents combined with proceeds received from other sources, will be sufficient to fund our trials or operations through this period. These funds will not be sufficient to enable us to conduct pivotal clinical trials for, seek marketing approval for, or commercially launch GEN-009, GEN-011 or any other product candidate. Accordingly, we will be required to obtain further funding through public or private equity offerings, debt financings, collaboration and licensing arrangements, or other sources. Adequate additional financing may not be available to us on acceptable terms, or at all, which could result in a decision to pause or delay development or advancement of clinical trials for one or more of our product candidates. Similarly, we may decide to pause or delay development or advancement of clinical trials for one or more of our product candidates if we believe that such development or advancement is imprudent or impractical.

Financial Overview

20

Research and development expenses

Research and development expenses consist primarily of costs incurred to advance our preclinical and clinical candidates, which include:

• | personnel-related expenses, including salaries, benefits, stock-based compensation expense, and travel; |

• | expenses incurred under agreements with contract research organizations, contract manufacturing organizations, consultants, and other vendors that conduct our clinical trials and preclinical activities; |

• | costs of acquiring, developing, and manufacturing clinical trial materials and lab supplies; and |

• | facility costs, depreciation, and other expenses, which include direct and allocated expenses for rent and maintenance of facilities, insurance, and other supplies. |

The following table identifies research and development expenses for our product candidates as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Discovery and pre-IND | $ | 2,289 | $ | 3,793 | $ | 4,797 | $ | 14,304 | |||||||

Phase 1/2a programs | 3,768 | 1,630 | 13,076 | 1,630 | |||||||||||

Other research and development | 769 | 936 | 2,262 | 3,016 | |||||||||||

Total research and development | $ | 6,826 | $ | 6,359 | $ | 20,135 | $ | 18,950 | |||||||

Discovery and Pre-IND includes costs incurred to support our discovery research and translational science efforts up to the initiation of Phase 1 development. Phase 1/2a programs are Phase 1 or Phase 2 development activities. Other research and development includes costs that are not specifically allocated to active product candidates, including facilities costs, depreciation expense, and other costs.

We expect that our overall research and development expenses will increase due to our continued development of our clinical operations and our supply chain capabilities for our GEN-009 program, as well as our advancement of GEN-011 through preparation and submission of an IND and subsequent initiation of a clinical trial.

General and administrative expenses

General and administrative expenses consist principally of salaries and related costs for personnel, including stock-based compensation and travel, in executive and other administrative functions. Other general and administrative expenses include facility costs, communication expenses, and professional fees associated with corporate and intellectual property legal expenses, consulting, and accounting services.

We anticipate that our general and administrative expenses will increase in the future to support the continued research and development of our product candidates and to operate as a public company. Additionally, if and when we believe regulatory approval of our first product candidate appears likely, we anticipate that we will increase costs in preparation for commercial operations.

Other income (expense)

Other income (expense) consists of the change in warranty liability, interest expense, net of interest income, and other expense for miscellaneous items, such as transaction expenses.

Critical Accounting Policies and Significant Judgments and Estimates

We believe that several accounting policies are important to understanding our historical and future performance. We refer to these policies as critical because these specific areas generally require us to make judgments and estimates about matters that are uncertain at the time we make the estimate, and different estimates—which also would have been reasonable—could have been used. The preparation of financial statements in conformity with U.S. GAAP requires us to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. On an ongoing basis, we evaluate estimates, which include prepaid and accrued research and development expenses, stock-based compensation expense, and the fair value of our warrant liability. We base our estimates on historical experience and other market-specific or other relevant assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from those estimates or assumptions.

There were no changes to our critical accounting policies during the nine months ended September 30, 2019, as compared to the those identified in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2018. It is important

21

that the discussion of our operating results that follow be read in conjunction with the critical accounting policies disclosed in our Annual Report on Form 10-K, as filed with the SEC on February 28, 2019.

Results of Operations

Comparison of the three months ended September 30, 2019 and September 30, 2018

Three Months Ended September 30, | Increase | ||||||||||

(in thousands) | 2019 | 2018 | (Decrease) | ||||||||

Operating expenses: | |||||||||||

Research and development | $ | 6,826 | $ | 6,359 | $ | 467 | |||||

General and administrative | 2,758 | 4,101 | (1,343 | ) | |||||||

Total operating expenses | 9,584 | 10,460 | (876 | ) | |||||||

Loss from operations | (9,584 | ) | (10,460 | ) | (876 | ) | |||||

Other income (expense): | |||||||||||

Change in fair value of warrants | 2,206 | 2,894 | (688 | ) | |||||||

Interest expense, net | (154 | ) | (266 | ) | (112 | ) | |||||

Other income (expense) | — | (1 | ) | (1 | ) | ||||||

Total other income | 2,052 | 2,627 | (575 | ) | |||||||

Net loss | $ | (7,532 | ) | $ | (7,833 | ) | $ | (301 | ) | ||

Research and development expenses

Research and development expenses increased $0.5 million in the three months ended September 30, 2019, as compared to the three months ended September 30, 2018. The increase was primarily due to increased external manufacturing costs and clinical investigator costs to support GEN-009 clinical trials partially offset by decreased consulting expenses due to an increase in full time employees.

General and administrative expenses

General and administrative expenses decreased $1.3 million in the three months ended September 30, 2019, as compared to the three months ended September 30, 2018. The decrease was primarily due to a reduction in legal expenses partially offset by increased headcount.

Change in fair value of warrants

Change in fair value of warrants reflects the non-cash change in fair value of warrants. Certain warrants issued in 2018 were recorded at their fair value on the date of issuance and are remeasured at the end of each reporting period.

Interest expense, net

Interest expense, net, consists primarily of interest expense on our long-term debt facilities and non-cash interest related to the amortization of debt discount and issuance costs, offset by interest earned on our cash equivalents.

22

Comparison of the nine months ended September 30, 2019 and September 30, 2018

Nine Months Ended September 30, | Increase | ||||||||||

(in thousands) | 2019 | 2018 | (Decrease) | ||||||||

Operating expenses: | |||||||||||

Research and development | $ | 20,135 | $ | 18,950 | $ | 1,185 | |||||

General and administrative | 8,992 | 11,682 | (2,690 | ) | |||||||

Total operating expenses | 29,127 | 30,632 | (1,505 | ) | |||||||

Loss from operations | (29,127 | ) | (30,632 | ) | (1,505 | ) | |||||

Other income (expense): | |||||||||||

Change in fair value of warrants | 289 | 3,093 | (2,804 | ) | |||||||

Interest expense, net | (755 | ) | (708 | ) | 47 | ||||||

Other income (expense) | (1 | ) | 86 | (87 | ) | ||||||

Total other income (expense) | (467 | ) | 2,471 | (2,938 | ) | ||||||

Net loss | $ | (29,594 | ) | $ | (28,161 | ) | $ | 1,433 | |||

Research and development expenses

Research and development expenses increased $1.2 million in the nine months ended September 30, 2019, as compared to the nine months ended September 30, 2018. The increase was primarily due to higher external manufacturing costs and higher clinical investigator costs, as well as increased headcount-related costs, partially offset by decreased consulting expenses.

General and administrative expenses

General and administrative expenses decreased $2.7 million in the nine months ended September 30, 2019, as compared to the nine months ended September 30, 2018. The decrease was primarily due to a reduction in legal expenses partially offset by increased headcount.

Change in fair value of warrants

Change in fair value of warrants reflects the non-cash change in fair value of warrants. Certain warrants issued in 2018 were recorded at their fair value on the date of issuance and are remeasured as of any warrant exercise date and at the end of each reporting period.

Interest expense, net

Interest expense, net, consists primarily of interest expense on our long-term debt facilities and non-cash interest related to the amortization of debt discount and issuance costs, offset by interest earned on our cash equivalents.

Liquidity and Capital Resources

Overview