Exhibit 99.1

TABLE OF CONTENTS

|

|

Page |

| 1 | |

|

|

|

| 1 | |

|

|

|

| 2 | |

|

|

|

| 3 | |

|

|

|

| 4 | |

|

|

|

| 5 | |

|

|

|

| 11 | |

|

|

|

| 13 | |

|

|

|

| 15 | |

|

|

|

| 20 | |

|

|

|

| 25 | |

|

|

|

| 30 | |

|

|

|

| 37 | |

|

|

|

| 43 | |

|

|

|

| 56 | |

|

|

|

| 56 | |

|

|

|

| 57 | |

|

|

|

| 58 | |

|

|

|

| 61 | |

|

|

|

| 61 | |

|

|

|

| 62 | |

|

|

|

| 62 | |

|

|

|

| 62 | |

|

|

|

| 62 | |

|

|

|

| 62 | |

|

|

|

|

APPENDIX A FRANCO-NEVADA CORPORATION AUDIT AND RISK COMMITTEE CHARTER |

A-1 |

i

Unless otherwise noted or the context otherwise indicates, the terms “Franco-Nevada”, “FNV”, “Company”, “Corporation”, “our” and “we” refer to Franco-Nevada Corporation and its subsidiaries. For reporting purposes, the Corporation presents its financial statements in United States dollars and in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). All dollar amounts in this Annual Information Form (“AIF”) are expressed in United States dollars, except as otherwise indicated. References to “US$”, “$” or “dollars” are to United States dollars, references to “C$” are to Canadian dollars and references to “A$” are to Australian dollars.

The information contained in this AIF is as of December 31, 2017, unless otherwise indicated. More current information may be available on our public website at www.franco-nevada.com or on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com or on the website of the United States Securities and Exchange Commission (the “SEC”) at www.sec.gov. In addition, we generally maintain supporting materials on our website which may assist in reviewing (but are not to be considered part of) this AIF including Franco-Nevada’s 2018 Asset Handbook, a Glossary of Non-Technical Terms, Glossary of Technical Terms, Certain Oil & Natural Gas Terms and a Metric Conversion Table.

This AIF contains “forward looking information” and “forward looking statements” within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995, respectively, which may include, but are not limited to, statements with respect to future events or future performance, management’s expectations regarding Franco-Nevada’s growth, results of operations, estimated future revenues, carrying value of assets, future dividends and requirements for additional capital, mineral reserve and mineral resource estimates, production estimates, production costs and revenue, future demand for and prices of commodities, expected mining sequences, business prospects and opportunities. In addition, statements (including data in tables) relating to reserves and resources and gold equivalent ounces are forward looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance can be given that the estimates and assumptions are accurate and that such reserves and resources and gold equivalent ounces (“GEOs”) will be realized. Such forward looking statements reflect management’s current beliefs and are based on information currently available to management. Often, but not always, forward looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Franco-Nevada to be materially different from any future results, performance or achievements expressed or implied by the forward looking statements. A number of factors could cause actual events or results to differ materially from any forward looking statement, including, without limitation: fluctuations in the prices of the primary commodities that drive royalty and stream revenue (gold, platinum group metals, copper, nickel, uranium, silver, iron-ore and oil and gas); fluctuations in the value of the Canadian and Australian dollar, Mexican peso and any other currency in which revenue is generated, relative to the U.S. dollar; changes in national and local government legislation, including permitting and licensing regimes and taxation policies and the enforcement thereof; regulatory, political or economic developments in any of the countries where properties in which Franco-Nevada holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Franco-Nevada holds a royalty, stream or other interest, including changes in the ownership and control of such operators; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Franco-Nevada; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; whether or not the Corporation is determined to have “passive foreign investment company” (“PFIC”) status as defined in Section 1297 of the United States Internal Revenue Code of 1986, as amended; potential changes in Canadian tax treatment of offshore streams; excessive cost escalation as well as development, permitting, infrastructure, operating or technical difficulties on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; actual mineral content may differ from the reserves and resources contained in technical reports; rate and timing of production differences from resource estimates, other technical reports and mine plans; risks and hazards associated with the business of development and mining on any of the properties in which Franco‑Nevada holds a royalty, stream or other interest, including, but not limited to unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters, terrorism, civil unrest or an outbreak of contagious disease; and the integration of acquired assets. The forward looking statements contained in this AIF are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation of the properties in which Franco‑Nevada holds a royalty, stream or other interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; the Corporation’s ongoing income and assets relating to determination of its PFIC status; no material changes to existing tax treatment; no adverse development in respect of any significant property in which Franco-Nevada holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; integration of acquired assets; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. However, there can be no assurance that forward looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and investors are cautioned that forward looking statements are not guarantees of future performance. Franco-Nevada cannot assure investors that actual results will be consistent with these forward looking statements. Accordingly, investors should not place undue reliance on forward looking statements due to the inherent uncertainty therein. For additional information with respect to risks, uncertainties and

assumptions, please refer to the “Risk Factors” section of this AIF filed with the Canadian securities regulatory authorities on www.sedar.com and the U.S. Securities and Exchange Commission (the “SEC”) on www.sec.gov. The forward looking statements herein are made as of the date of this AIF only and Franco-Nevada does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law.

CAUTIONARY NOTE REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

This AIF has been prepared in accordance with the requirements of Canadian securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and reserve estimates included in this AIF have been prepared by the owners or operators of the relevant properties (as and to the extent indicated by them) in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining and Metallurgy Classification System. NI 43-101 is a rule developed by the Canadian securities regulatory authorities which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits a historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if, among other things, the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) states whether the historical estimate uses categories other than those prescribed by NI 43-101; and (d) includes any more recent estimates or data available.

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and reserve and resource information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Corporation in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code or the SAMREC Code (as such terms are defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws. Accordingly, information containing descriptions of the Corporation’s mineral properties set forth herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. For more information, see “Reconciliation to CIM Definitions”.

The following table sets out the high and low rates of exchange for one U.S. dollar expressed in Canadian dollars during each of the following periods; the average rate of exchange for those periods; and the rate of exchange in effect at the end of each of those periods, each based on the exchange rate published by the Bank of Canada.

|

|

|

Years ended December 31, |

|

|||||||

|

|

|

2017(1) |

|

2016(2) |

|

2015(2) |

|

|||

|

High |

|

$ |

1.3743 |

|

$ |

1.4589 |

|

$ |

1.3990 |

|

|

Low |

|

$ |

1.2128 |

|

$ |

1.2544 |

|

$ |

1.1728 |

|

|

Average for the Period |

|

$ |

1.2986 |

|

$ |

1.3248 |

|

$ |

1.2787 |

|

|

End of Period |

|

$ |

1.2545 |

|

$ |

1.3427 |

|

$ |

1.3840 |

|

(1)As of March 1, 2017, the Bank of Canada began to publish new foreign exchange rates once a day, by 16:30 ET, in the form of a single indicative rate per currency pair, which represents a daily average rate for that currency against the Canadian dollar. The Bank of Canada ceased to publish the noon rate as of April 28, 2017.

(2)Based on the noon rate published by the Bank of Canada.

On March 27, 2018 the daily average exchange rate was US$1.00 = C$1.2869 as published by the Bank of Canada.

2

|

|

|

Spot Commodity Prices |

|

||||||||||||||||

|

|

|

Gold/oz |

|

Silver/oz |

|

Platinum/oz |

|

Palladium/oz |

|

Oil/C$ bbl |

|

Gas/C$ mcf |

|

||||||

|

|

|

(LBMA Gold Price PM) |

|

(LBMA Silver Price) |

|

(London PM Fix) |

|

(London PM Fix) |

|

(Edmonton Light) |

|

(AECO-C) |

|

||||||

|

Average for 2015 |

|

$ |

1,160 |

|

$ |

15.68 |

|

$ |

1,054 |

|

$ |

691 |

|

$ |

57 |

|

$ |

2.56 |

|

|

Average for 2016 |

|

$ |

1,248 |

|

$ |

17.20 |

|

$ |

987 |

|

$ |

613 |

|

$ |

53 |

|

$ |

2.07 |

|

|

Average for 2017 |

|

$ |

1,257 |

|

$ |

17.05 |

|

$ |

948 |

|

$ |

870 |

|

$ |

63 |

|

$ |

2.09 |

|

3

Name, Address and Incorporation

Franco-Nevada was incorporated under the Canada Business Corporations Act on October 17, 2007 and was amalgamated with Franco-Nevada Canada Corporation, its wholly-owned subsidiary, on January 1, 2008. Franco-Nevada’s head office and registered office is currently located at Suite 2000, Commerce Court West, 199 Bay Street, Toronto, Ontario M5L 1G9. Franco-Nevada has additional offices in Hastings, Christ Church, Barbados, Denver, Colorado and Perth, Australia, all of which are used to manage its asset portfolio and pursue new investment opportunities.

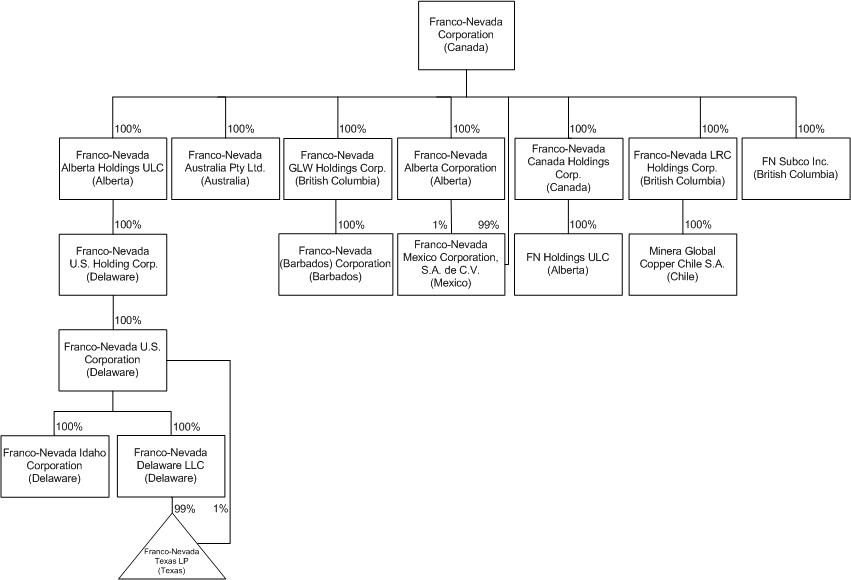

Intercorporate Relationships

Franco-Nevada has sixteen wholly-owned subsidiaries: Franco-Nevada Alberta Holdings ULC, Franco-Nevada U.S. Holding Corp., Franco-Nevada U.S. Corporation, Franco-Nevada Idaho Corporation, Franco-Nevada Delaware LLC, Franco-Nevada Texas LP, Franco-Nevada Australia Pty Ltd., Franco-Nevada GLW Holdings Corp., Franco-Nevada (Barbados) Corporation (“FN Barbados”), Franco-Nevada Alberta Corporation, Franco-Nevada Mexico Corporation, S.A. de C.V., Franco-Nevada Canada Holdings Corp., FN Holdings ULC, Franco-Nevada LRC Holdings Corp., Minera Global Copper Chile S.A. and FN Subco Inc. All subsidiaries are wholly-owned by Franco-Nevada either directly or indirectly and are existing under the laws of the jurisdictions set out below.

4

GENERAL DEVELOPMENT OF FRANCO-NEVADA’S BUSINESS

Overview

Franco-Nevada is the leading gold-focused royalty and stream company by both gold revenue and number of gold assets. The Company has the largest and most diversified portfolio of royalties and streams by commodity, geography, revenue type and stage of project. The portfolio is actively managed with the aim to maintain over 80% of revenue from precious metals (gold, silver & PGM).

The Company does not operate mines, develop projects or conduct exploration. Franco-Nevada’s business model is focused on managing and growing its portfolio of royalties and streams. The advantages of this business model are:

•Exposure to precious metals price optionality;

•A perpetual discovery option over large areas of geologically prospective lands with no additional cost other than the initial investment;

•Limited exposure to many of the risks associated with operating companies;

•A free cash-flow business with limited cash calls;

•A high-margin business that can generate cash through the entire commodity cycle;

•A scalable and diversified business in which a large number of assets can be managed with a small stable overhead; and

•A forward-looking business in which management focuses on growth opportunities rather than operational or development issues.

Franco-Nevada’s financial results in the short-term are primarily tied to the price of commodities and the amount of production from its portfolio of producing assets. Financial results have also been supplemented by acquisitions of new producing assets. Over the longer-term, results are impacted by the availability of exploration and development capital applied by other companies to expand or extend Franco-Nevada’s producing assets or to advance Franco-Nevada’s advanced and exploration assets into production.

Franco-Nevada has a long-term investment outlook and recognizes the cyclical nature of the industry. Franco-Nevada has historically operated by maintaining a strong balance sheet so that it can make investments during commodity cycle downturns.

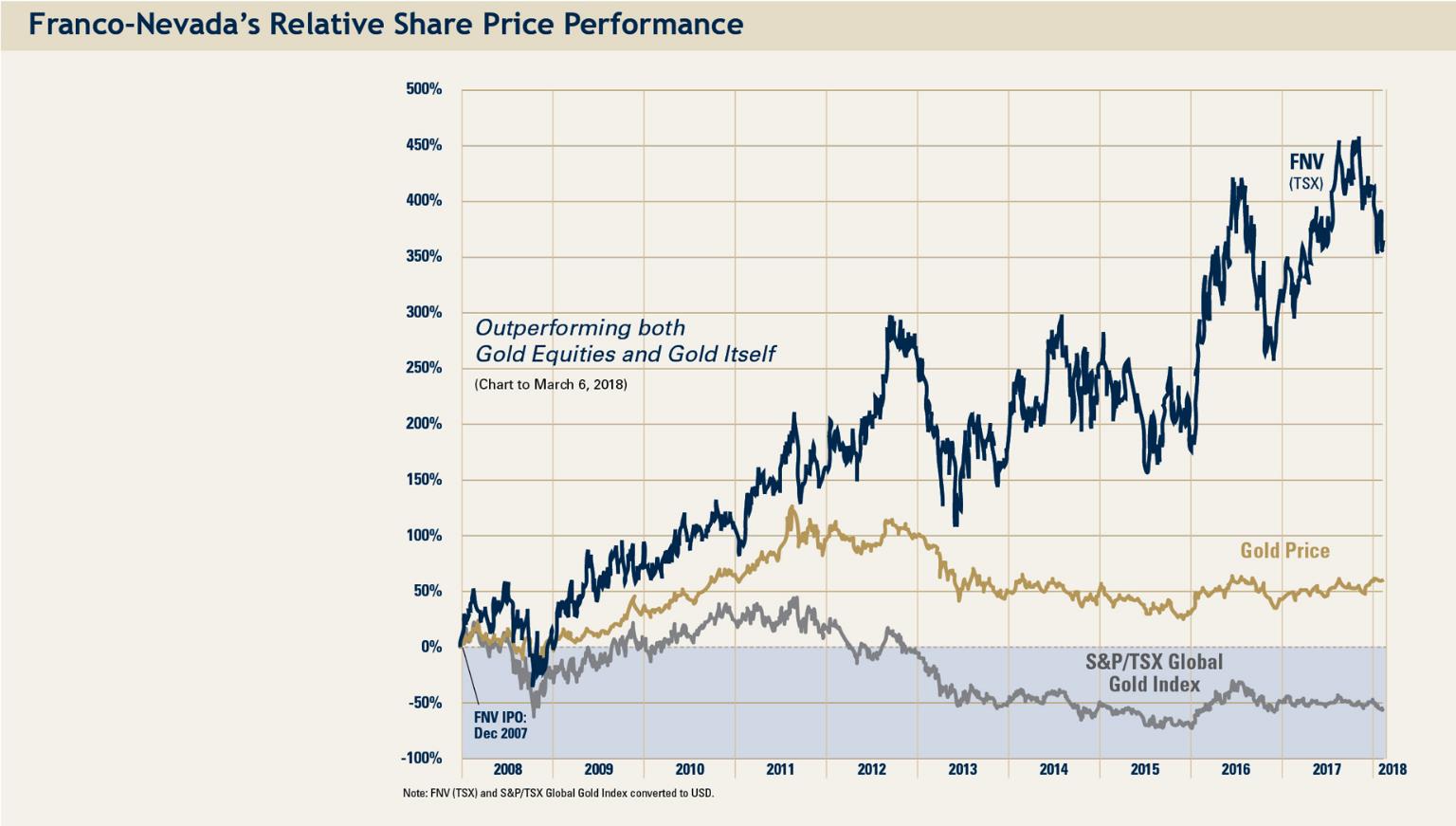

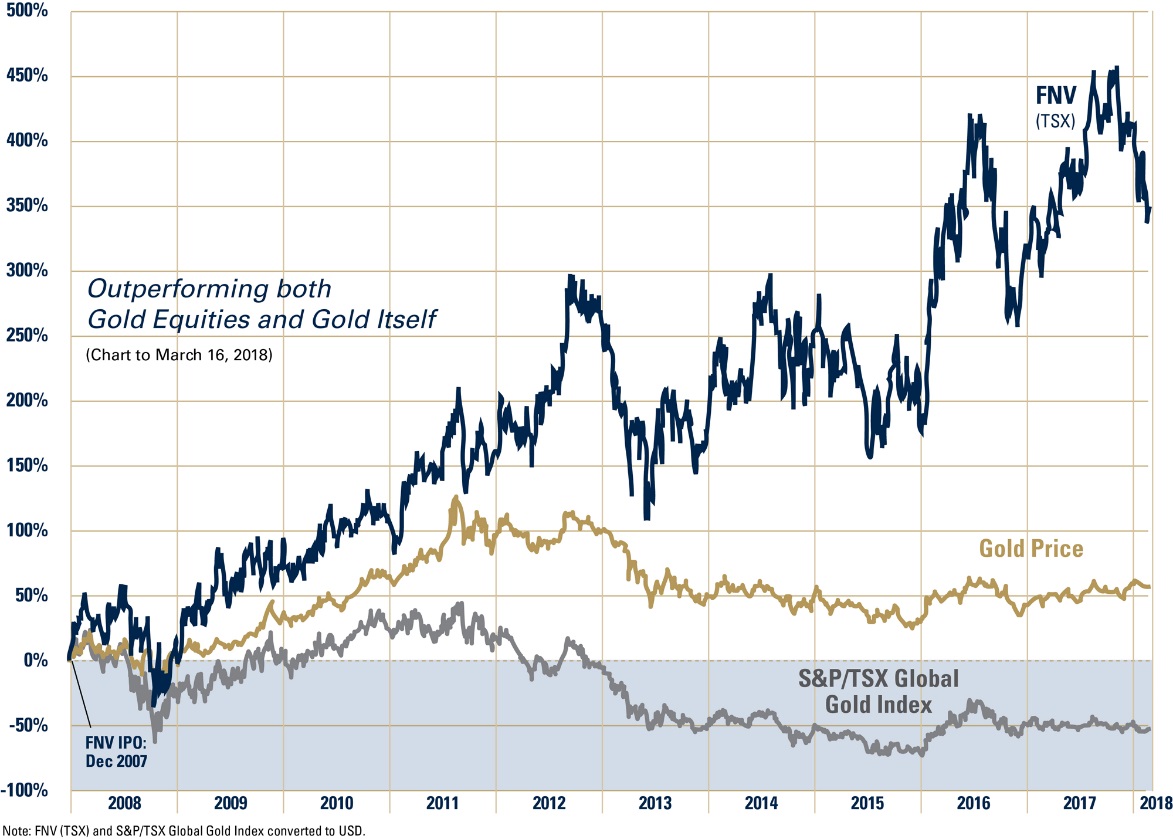

Franco-Nevada’s shares are listed on the Toronto and New York stock exchanges under the symbol FNV. An investment in Franco-Nevada’s shares is expected to provide investors with yield and exposure to gold price and exploration optionality while limiting exposure to many of the risks of operating companies. Since its initial public offering ten years ago, Franco-Nevada has increased its dividend annually and its share price has outperformed the gold price and all relevant gold equity benchmarks.

5

Franco-Nevada’s Relative Share Price Performance

Franco-Nevada currently operates a small organization. As of March 28, 2018, Franco-Nevada has 32 full-time employees and 7 part-time contractors. As such, Franco-Nevada is dependent upon the continued availability and commitment of its key management, whose contributions to the immediate and future operations of Franco-Nevada are of significant importance. From time to time, Franco-Nevada may also need to identify and retain additional skilled management and specialized technical personnel to efficiently operate its business. For additional information, see “Risk Factors”.

Investment Process and Corporate Policies

Franco-Nevada currently does not operate any of the mineral or oil & gas assets in which it has royalty, stream or other interests. However, Franco-Nevada recognizes its business model is dependent on the industry operating in a responsible fashion and actively supports the industry in its efforts and initiatives. Franco-Nevada may from time to time engage in exploration efforts as part of advancing a property or to conduct due diligence in advance of undertaking an investment. When doing so, Franco-Nevada undertakes to be guided by the Principles and Guidance for a Framework of Responsible Exploration as set forth by the e3Plus program of the Prospectors and Developers Association of Canada. A detailed description of Franco-Nevada’s investment process can be found on the Corporation’s website at www.franco-nevada.com.

Franco-Nevada has adopted policies relating to its business conduct, including a code of business conduct and ethics, a business integrity policy, a whistleblower policy, a policy concerning confidentiality, fair disclosure and trading in securities, a discrimination, harassment and equal opportunity policy, an investment principles (environmental, social and governance) policy, a corporate responsibility policy and a health and safety policy. Additional information relating to these and other policies can be found on the Corporation’s website at www.franco-nevada.com and are also contained in Franco-Nevada’s information circular dated March 22, 2018 for its annual and special meeting of shareholders scheduled to be held on May 9, 2018. See “Statement of Governance Practices” in such circular.

6

Three-Year History

2015

Acquisition of Dublin Gulch (Eagle) Royalty Interest

On January 14, 2015, Franco-Nevada acquired royalties on the Eagle deposit located in the Yukon for $7.0 million.

Acquisition of Ring of Fire Royalty Interests

On April 28, 2015, Franco-Nevada acquired certain royalty rights including in the Ring of Fire mining district of Ontario by providing $28.5 million in loan and royalty financing to Noront Resources Ltd.

Franco-Nevada Credit Facility

On May 22, 2015, Franco-Nevada amended its revolving term credit facility with Canadian Imperial Bank of Commerce, as Administrative Agent, which increased the amount available to $750.0 million and extended the maturity to May 2020. On November 12, 2015, the Company entered into an agreement to increase its credit facility to $1.0 billion while maintaining a $250.0 million accordion and extending the maturity to November 2020. On March 22, 2017, the Company extended the maturity to March 2022. On March 7, 2018, the Company further extended the maturity to March 22, 2023.

Acquisition of Antamina Silver Stream

On October 7, 2015, the Company, through a wholly-owned Canadian subsidiary, acquired a silver stream from Teck Resources Limited (“Teck”) on production from the Antamina mine located in Peru. In exchange for a $610.0 million advance payment, the Company will purchase all recovered silver from Teck’s attributable 22.5% interest in the Antamina mine, subject to a fixed silver payability of 90%.

The Company will pay 5% of the spot silver price for each ounce delivered under the stream agreement. The stream will reduce by one-third after 86 million ounces of silver have been delivered under the stream agreement, which is estimated to occur in 30 years assuming current throughput.

Cobre Panama Precious Metals Stream

On October 7, 2015, the Company announced it had finalized terms of a replacement precious metals stream agreement for First Quantum Minerals Ltd.’s (“First Quantum”) Cobre Panama project located in Panama. This stream covered First Quantum’s 80% interest in the Cobre Panama project. For additional Cobre Panama developments, see “2017 – Additional Cobre Panama Precious Metals Stream” below.

Acquisition of Additional Weyburn Unit Working Interest

On November 6, 2015, Franco-Nevada purchased an additional 0.29% working interest in the Weyburn Unit for C$6.4 million.

2016

Equity Financing

On February 19, 2016, the Company completed a bought deal financing with a syndicate of underwriters for 19,228,000 Common Shares, including the exercise in full by the underwriters of an over-allotment option of 2,508,000 Common Shares, at a price of $47.85 per Common Share. The net proceeds to the Company were $883.5 million after deducting underwriters’ commissions and offering expenses of $36.6 million. The Common Shares were sold on a bought deal basis pursuant to an underwriting agreement dated February 11, 2016 (the “2016 Underwriting Agreement”) between Franco-Nevada and a syndicate of investment dealers led by BMO Nesbitt Burns Inc., CIBC World Markets Inc., RBC Dominion Securities Inc. and Scotia Capital Inc.

Acquisition of Antapaccay Precious Metals Stream

On February 26, 2016, the Company through its wholly-owned subsidiary, FN Barbados, acquired, from Glencore plc (“Glencore”), a precious metals stream with reference to production from the Antapaccay mine (the “Glencore Stream”). The Antapaccay mine is located in Southern Peru and is wholly-owned and operated by Glencore and its subsidiaries. FN Barbados made a one-time $500 million advance payment for the Glencore Stream. In accordance with the terms of the stream agreement, gold and silver deliveries to FN Barbados will initially be determined by reference to copper shipments until 630,000 ounces of refined gold and 10 million ounces of refined silver have been delivered. For each 1,000 tonnes of copper in concentrate shipped, FN Barbados will receive 300 ounces of gold and 4,700 ounces of silver until the previously mentioned thresholds are met. Thereafter, FN Barbados will receive 30% of the gold and silver shipped. FN Barbados will make ongoing payments of 20% of the spot gold and silver price per ounce delivered and 30% of the respective spot prices once 750,000 ounces of gold and 12.8 million ounces of silver have been delivered.

7

Restructuring of Castle Mountain Royalty

On June 16, 2016, Franco-Nevada and NewCastle Gold Ltd. (“NewCastle”) completed the restructuring of Franco-Nevada’s existing royalties at the Castle Mountain gold project in California, U.S., into a single 2.65% royalty covering a larger property for C$2.2 million in cash.

In addition, Franco-Nevada purchased units of NewCastle which were exchanged for 3,174,545 common shares and 1,587,272 warrants in Equinox Gold Corp. (“Equinox”) in connection with the merger of NewCastle, Anfield Gold Corp. and Trek Mining Inc. to form Equinox Gold in December 2017. The warrants have an expiry date of May 9, 2021.

Kirkland Lake Buy-Back

In October 2016, Kirkland Lake Gold Inc. (“Kirkland Lake”) exercised its option to buy back 1% of an overlying 2.5% NSR for an aggregate cash consideration of $30.3 million ($36.0 million less royalty proceeds attributable to the buy-back portion of the NSR paid to Franco-Nevada prior to the date of the buy-back). The NSR, which covers all of Kirkland Lake’s properties (including the Macassa mine), was acquired in October 2013 for $50.0 million.

Acquisition of STACK Royalty Portfolio and Mineral Title

On December 19, 2016, Franco-Nevada, through a wholly-owned U.S. subsidiary, acquired a package of royalty rights in the Sooner Trend, Anadarko Basin, Canadian and Kingfisher counties (“STACK”) shale play in Oklahoma’s Anadarko Basin for a price of $100.0 million. The two primary operators of the lands are Newfield Exploration Company and Devon Energy Corporation. Both companies have stated that STACK is a major focus of their capital spending, a portion of which is expected to be on the royalty lands. Full-field development is getting underway and is expected to grow royalty revenue in future years. The royalties consist of mineral title rights and GORRs which apply to approximately 1,200 acres (net after royalties) that, with pooling, provides exposure to an estimated gross acreage of 74,880 acres with an estimated average royalty rate of 1.61%.

2017 & 2018 Recent Developments

Acquisition of Midland Basin Royalty Portfolio

On March 13, 2017, Franco-Nevada, through a wholly-owned U.S. subsidiary, entered into an agreement to purchase a royalty portfolio in the Midland Basin of West Texas for $110.0 million. Following completion of title due diligence, the first part of the portfolio was acquired for $89.8 million and closed on May 24, 2017. The acquisition of the second part of the portfolio closed on August 8, 2017. The total purchase price was $114.6 million including adjustments for title due diligence and the acquisition of the second part of the portfolio. The Midland Basin forms the eastern half of the broader Permian Basin.

FN Barbados Credit Facility

On March 20, 2017, the Company’s wholly-owned subsidiary, FN Barbados, entered into an unsecured revolving credit facility (the “FNBC Credit Facility”). The FNBC Credit Facility provides for the availability over a one-year period of up to $100.0 million in borrowings. On February 21, 2018, FN Barbados extended the FNBC Credit Facility to March 20, 2019.

Acquisition of Railroad Royalty Interest

On May 26, 2017, Franco-Nevada, through a wholly-owned U.S. subsidiary, acquired an existing 1% NSR on certain claims that comprise the Railroad deposit located on the Carlin Trend in north-central Nevada for cash consideration of $0.9 million.

Acquisition of Additional STACK Royalty Portfolio and Mineral Title

On June 30, 2017, Franco-Nevada, through a wholly-owned U.S. subsidiary, entered into an agreement to purchase for $27.6 million, a second package of mineral title in the core of the STACK shale play in Oklahoma from a private company. The transaction closed on November 1, 2017. The Company has the right to royalties on production beginning from June 1, 2017. Revenue from the royalties attributable to the mineral title is expected to grow with further development of the play.

Acquisition of Royalty on the Orion Thermal Project

On September 29, 2017, Franco-Nevada acquired a 4% GORR applicable to the Clearwater Formation within the Orion Thermal Project (“Orion”) in the Cold Lake region of Alberta from Osum Oil Sands Corp. (“Osum”) for cash consideration of C$92.5 million. Osum will use a portion of the proceeds to fund expansions at Orion. On January 28, 2018, Osum announced plans to double production by accelerating the expansion of Phase 2C, which will now be constructed with the Phase 2B expansion. Together, the two phases are expected to increase production capacity to over 18,000 barrels per day.

Acquisition of Delaware Basin Royalty Portfolio

On October 16, 2017, the Company, through a wholly-owned U.S. subsidiary, entered into an agreement to purchase a royalty portfolio in the Delaware Basin constituting the western portion of the Permian Basin for $101.3 million. The royalties are derived principally from mineral title which provides a perpetual interest in royalty lands. The transaction closed on February 20, 2018 and has an effective date of October 1, 2017.

8

Additional Cobre Panama Precious Metals Stream

On September 7, 2017, the Company announced it had agreed to terms with First Quantum to purchase an additional precious metals stream on the Cobre Panama project for $178.0 million. This agreement was expanded to $356.0 million on January 22, 2018 to also include a precious metals stream on Korea Resources Corp.’s (“KORES”) 10% indirect interest. The purchase price was paid as a one-time advance payment on March 16, 2018. Franco-Nevada now has exposure to the precious metals produced from 100% of the ownership of the Cobre Panama project comprising two precious metals streams with slightly different terms:

|

· |

Fixed Payment Stream – First Quantum’s original 80% interest in the Cobre Panama project which has been in place since 2015. |

|

· |

Floating Payment Stream – First Quantum’s additional 10% interest in the project and KORES’ 10% indirect interest. |

Under the terms of the Fixed Payment Stream, Franco-Nevada will provide a maximum of $1 billion pro-rated to First Quantum’s share of the capital costs. As of December 31, 2017, Franco-Nevada has provided $727 million with the remaining $273 million to be funded to project completion.

The amount of precious metals deliverable under both the Fixed Payment Stream and Floating Payment Stream is indexed off total project metal-in-concentrate shipped. The main difference between the Fixed Payment Stream and the Floating Payment Stream is the ongoing price per ounce paid. The ongoing payment of the Fixed Payment Stream is fixed per ounce payments of $418/oz gold and $6.27/oz silver with a 1.5% annual inflation factor until 1,341,000 ounces of gold and 21,510,000 ounces of silver have been delivered following which the ongoing payment will be the greater of the fixed price and 50% of the spot price. The Floating Payment Stream ongoing price per ounce for deliveries is 20% of the spot price until 604,000 ounces of gold and 9,618,000 ounces of silver have been delivered following which the ongoing payment will be 50% of the spot price.

Acquisition of Bowen Basin Coal Royalties

On February 28, 2018, Franco-Nevada, through a wholly-owned subsidiary, acquired a portfolio of metallurgical coal royalties located in the Bowen Basin of Queensland, Australia for a cash consideration of A$4.2 million. The portfolio includes certain claims that comprise the producing Moorvale mine, Olive Downs project which had filed permitting applications, and another 33 exploration tenements. The Bowen Basin Coal royalty is a production payment of A$0.10 per tonne, adjusted for consumer price index changes since December 31, 1997.

9

2018 Guidance

The following contains forward looking statements about our guidance for 2018. Reference should be made to the “Forward Looking Statements” section at the beginning of this AIF. For a description of material factors that could cause our actual results to differ materially from the forward looking statements below, please see the “Forward Looking Statements” section of this AIF and the “Risk Factors” section of this AIF filed with the Canadian securities regulatory authorities on www.sedar.com and our most recent Form 40-F filed with the SEC on www.sec.gov. 2018 guidance is based on assumptions including the forecasted state of operations from our assets based on the public statements and other disclosures by the third-party owners and operators of the underlying properties (subject to our assessment thereof).

For 2018, the Company is pleased to provide the following guidance:

|

|

|

2018 Guidance |

|

2017 Actual |

|

2016 Actual |

|

|||

|

Mineral assets - GEO production(1)(2) |

|

|

460,000 – 490,000 GEOs |

|

|

497,745 GEOs |

|

|

464,383 GEOs |

|

|

Oil & Gas assets – Revenue(3) |

|

|

$50.0 million - $60.0 million |

|

|

$47.0 million |

|

|

$30.1 million |

|

|

(1) |

Of the 460,000 to 490,000 GEOs, Franco-Nevada expects to receive 305,000 to 335,000 GEOs under its various stream agreements, compared to 350,827 GEOs in 2017. |

|

(2) |

In forecasting GEOs for 2018, gold, silver, platinum and palladium metals have been converted to GEOs using commodity prices of $1,300/oz Au, $17.00/oz Ag, $950/oz Pt and $1,050/oz Pd. |

|

(3) |

In forecasting revenue from Oil & Gas assets for 2018, the WTI oil price is assumed to average $55 per barrel with a $4.80 per barrel price differential between the Edmonton Light and realized prices for Canadian oil. |

More specifically, we expect the following with respect to our key asset categories for 2018:

•Precious Metals – Latin America: GEOs from Latin America are expected to decrease, reflecting decreased production from Candelaria as 2018 is a transition year as Lundin Mining Corporation (“Lundin”) implements its revised mine plan. Over the life of mine, Franco-Nevada will receive higher cumulative precious metals ounces, than previously expected based on Lundin’s November 30, 2017 technical report. Less gold ounces from Guadalupe-Palmarejo are expected as 2017 was a very strong production year. These decreases in GEOs will be partially offset by a production increase from Antapaccay as the mine sequencing moves to a new phase of production with higher grades. Guidance for 2018 assumes no GEOs will be realized from Cobre Panama before year end.

•Precious Metals – U.S.: GEOs from U.S. gold assets are expected to be slightly lower in 2018 compared to 2017. Lower production is expected at South Arturo due to the end of mining in Phase 2 and the beginning of stripping in phase 1 and El Nino. Bald Mountain’s production is anticipated to be lower in 2018 due to the transitioning of mining from the Top pit to Vantage basin. This will be partly offset by higher production from Goldstrike, as a result of mine sequencing.

•Precious Metals – Canada: GEOs earned from Canadian assets in 2018 are expected to increase, reflecting increased production from Detour, Hemlo, Sudbury and Golden Highway.

•Precious Metals – Rest of World: GEOs from Rest of World assets are forecasted to increase compared to 2017, reflecting production increases from Tasiast and Subika due to recently completed expansions partially being offset by a production decrease from Mine Waste Solutions (“MWS”) as 2017 was an exceptionally strong year.

•Other Minerals: GEOs from other minerals are expected to be slightly lower in 2018.

•Oil & Gas: Oil & gas revenues are expected to increase in 2018 compared to 2017, as a result of an increase in revenue primarily from Weyburn and Orion Thermal Project.

We expect to fund between $230 to $250 million of the Cobre Panama precious metals stream deposit in 2018, exclusive of the $356.0 million funded pursuant to the closing of the additional stream. In 2017, the Company funded a total of $264.4 million, for a total of $726.6 million of its $1 billion commitment.

In addition, the Company estimates depletion and depreciation expense to be $250.0 million to $280.0 million for 2018.

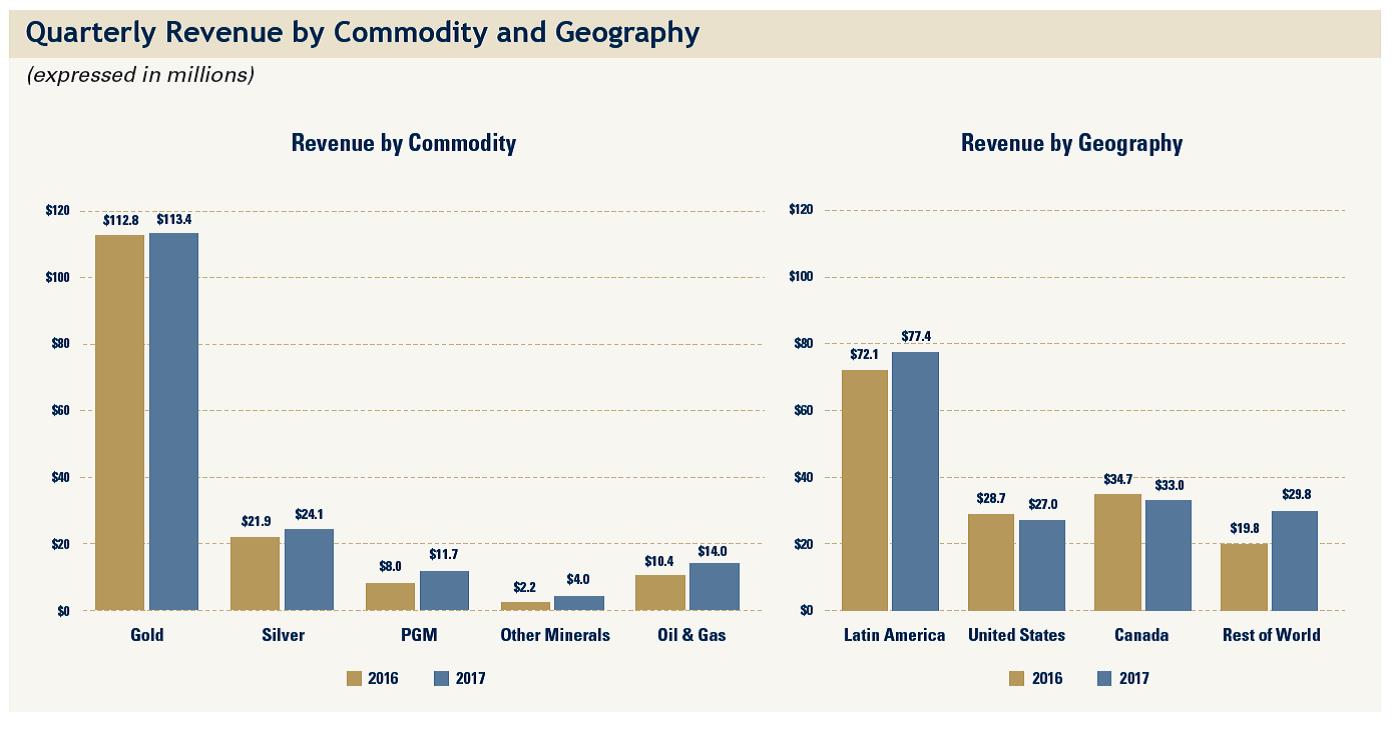

Franco-Nevada strives to generate greater than 80% of revenue from precious metals over a long-term horizon which includes gold, silver and PGM. In the short-term, we may diverge from the long-term target based on opportunities available. With 90.3% of revenue earned from precious metals in 2017, the Company has the flexibility to consider diversification opportunities outside of the precious metals’ space and increase its exposure to other commodities.

10

EXPLANATION OF ROYALTIES, STREAMS AND OTHER INTERESTS

A royalty is a payment to a royalty holder by a property owner or an operator of a property and is typically based on a percentage of the minerals or other products produced or the revenues or profits generated from the property. The granting of a royalty to a person usually arises as a result of: (i) paying part of the consideration payable to land owners, prospectors or junior mining companies for the purchase of their property interests; (ii) providing capital in exchange for granting a royalty; or (iii) converting a participating interest in a joint venture relationship into a royalty.

Royalties are not typically working interests in a property. Therefore, depending on the nature of the royalty interest and the laws applicable to the royalty and project, the royalty holder is generally not responsible for, and has no obligation to contribute, additional funds for any purpose, including, but not limited to, operating or capital costs, or environmental or reclamation liabilities. Typically, royalty interests are established through a contract between the royalty holder and the property owner, although many jurisdictions permit the holder to also register or otherwise record evidence of a royalty interest in applicable mineral title or land registries. The unique characteristics of royalties may provide royalty holders with special commercial benefits not available to the property owner because the royalty holder may enjoy the upside potential of the property with reduced risk.

Revenue-based Royalties: The majority of royalty revenues that Franco-Nevada receives are royalties based on revenues from the value of production. The key types of revenue-based royalties are described in general terms below:

Net Smelter Return (“NSR”) royalties are based on the value of production or net proceeds received by the operator from a smelter or refinery. These proceeds are usually subject to deductions or charges for transportation, insurance, smelting and refining costs as set out in the royalty agreement. For gold royalties, the deductions are generally minimal, while for base metal projects the deductions can be much more substantial. This type of royalty generally provides cash flow that is free of any operating or capital costs and environmental liabilities. A smaller percentage NSR in a project can effectively equate to the economic value of a larger percentage profit or working interest in the same project.

Gross Royalties (“GR”) or Gross Overriding Royalties (“GORR”) are based on the total revenue stream from the sale of production from the property with few, if any, deductions. Some contracts refer to gross proceeds (“GP”) which have been characterized as comparable to GRs in this document.

Overriding Royalties (“ORR”) and Lessor or Freehold Royalties (“FH”) are based on the proceeds from gross production and are usually free of any operating, capital and environmental costs. These terms are usually applied in the oil & gas industry.

Profit-based Royalties: Franco-Nevada also receives a portion of its revenues from royalties that are calculated based on profits, as described below:

Net Profit Interest (“NPI”) is based on the profit realized after deducting costs related to production as set out in the royalty agreement. NPI payments generally begin after payback of capital costs. Although the royalty holder is generally not responsible for providing capital, covering operating losses or environmental liabilities, increases in production costs will affect net profits and royalties payable.

Net Royalty Interest (“NRI”) is paid net of operating and capital costs similar to an NPI.

Fixed Royalties: Franco-Nevada has a small number of fixed royalties. These are royalties that are paid based on a set rate per tonne mined, produced or processed or even a minimum for a period of time rather than as a percentage of revenue or profits. These types of royalties are more common for iron ore, coal and industrial minerals and usually do not have exposure to changes in the underlying commodity price.

The royalty types listed above can include additional provisions that allow them to change character in different circumstances or have varying rates. Some examples are as follows:

Minimum Royalty (“MR”) is a provision included in some royalties that requires fixed payments at a certain level even if the project is not producing, or the project is producing at too low a rate to achieve the minimum.

Advance Minimum Royalty (“AMR”) is similar to an MR except that, once production begins, the minimum payments already paid are often credited against subsequent royalty payments from production that exceeds the minimum.

Sliding Scale Royalty (“Sliding Scale” or “ss”) refers to royalties where the royalty percentage is variable. Generally this royalty percentage is indexed to metal prices or a production threshold. Generally, a minimum or maximum percentage would be applied to such a royalty.

Capped Royalty (“Capped”) refers to royalties that expire or cease payment after a particular cumulative royalty amount has been paid or a set production volume threshold or time period has been reached.

Royalties can be commodity specific and, for instance, apply only to gold or hydrocarbons or have varying royalty structures for different commodities from the same property. Royalties can be restricted or varied by metallurgy, ore type or even by stratigraphic

11

horizon. Generally, the contract terms for royalties in the oil & gas business are more standardized than those found in the mineral business.

Streams: Streams are distinct from royalties. They are metal purchase agreements where, in exchange for an upfront deposit and ongoing payments for metal delivered, the holder purchases all or a portion of one or more metals produced from a mine, at a preset price. In the case of gold, the agreements typically provide for the purchase price to be the spot price at the time of delivery with a fixed price per ounce (typically $400 with a small inflationary adjustment or a percentage of spot price for gold) payable in cash and the balance paid by applying the upfront deposit. Once the upfront deposit is fully applied, the purchase price is typically, in the case of streams which provide for a fixed price per ounce as opposed to a percentage of the spot price, the lesser of the fixed price per ounce payable in cash and the spot price at the time of delivery. Precious metals streams are well suited to co-product production providing incentive to the operator to produce the precious metals. Because streams can also be used as a form of financing a project, the stream structure may also help maintain the borrowing capacity for the project. Streams can provide higher leverage to commodity price changes as a result of the fixed purchase price per ounce.

Working Interests (“WI”): A working interest is significantly different than a royalty or stream in that a holder of a WI owns an undivided possessory interest in the land or leasehold itself, and is liable for its share of capital, operating and environmental costs, usually in proportion to its ownership percentage, and it receives its pro-rata share of revenue. Minority working or equity interests are not considered to be royalties because of the ongoing funding commitments, although they can be similar in their calculations to NPIs.

Example of a Royalty (NSR or NPI) versus a Stream

Assume for one ounce of gold, a sales price of $1,300, a “stream cost” of $400 per ounce and an “all-in sustaining cost”(1) of $750 per ounce. Also assume that Franco-Nevada has a 4% NSR, a 4% NPI or WI or a 4% stream.

|

|

|

|

|

|

|

|

|

Developed |

|

|

|

|

|

NSR |

|

Stream |

|

NPI or WI |

|

|||

|

One ounce sold at |

|

$ |

1,300 |

|

$ |

1,300 |

|

$ |

1,300 |

|

|

Applicable cost |

|

|

— |

|

$ |

400 |

|

$ |

750 |

(1) |

|

Margin for calculation |

|

$ |

1,300 |

|

$ |

900 |

|

$ |

550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NSR, Stream or NPI % |

|

|

4 |

% |

|

4 |

% |

|

4 |

% |

|

Revenue per ounce to FNV |

|

$ |

52 |

|

$ |

36 |

|

$ |

22 |

|

|

(1) |

For applicable costs for a developed NPI or WI, Franco-Nevada is, for illustrative purposes, assuming Barrick Gold Corporation’s (“Barrick”) 2017 all-in sustaining cash cost measure, as Barrick is the operator of two assets at which Franco-Nevada has NPI interests. |

Based on the above economics, a comparable percentage NSR is greater than 2.35 times more valuable than an equivalent Developed NPI or WI and 44% more valuable than a stream interest. With changes to the gold price, the NPI or WI would demonstrate the most leverage while the NSR would provide the most down side protection. The stream provides commodity price leverage similar to a low cost operating company with more certainty as to future costs.

12

TECHNICAL AND THIRD PARTY INFORMATION

Except where otherwise stated, the disclosure in this AIF relating to properties and operations on the properties in which Franco-Nevada holds royalty, stream or other interests is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at March 16, 2018 (except where stated otherwise), and none of this information has been independently verified by Franco-Nevada. Specifically, as a royalty or stream holder, Franco-Nevada has limited, if any, access to properties included in its asset portfolio. Additionally, Franco-Nevada may from time to time receive operating information from the owners and operators of the properties, which it is not permitted to disclose to the public. Franco-Nevada is dependent on the operators of the properties and their qualified persons to provide information to Franco-Nevada or on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which Franco-Nevada holds royalty, stream or other interests and generally has limited or no ability to independently verify such information. Although Franco-Nevada does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Franco-Nevada’s royalty, stream or other interest. Franco-Nevada’s royalty, stream or other interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

Except where otherwise noted, the disclosure in this AIF relating to mineral reserve and mineral resource statements for individual properties is made as at December 31, 2017. In addition, numerical information presented in this AIF which has been derived from information publicly disclosed by owners or operators may have been rounded by Franco-Nevada and, therefore, there may be some inconsistencies between the significant digits presented in this AIF and the information publicly disclosed by owners and operators.

Franco-Nevada considers its stream interests in the Antapaccay project, the Antamina project, the Candelaria project and the Cobre Panama project to be its only material mineral projects for the purposes of NI 43-101. Franco-Nevada will continue to assess the materiality of its assets as new assets are acquired or move into production. Previously, the Corporation provided selected mineral asset descriptions for certain revenue contributors (excluding the material projects) but has not done so in this year’s AIF since these assets are not material. As well, the Corporation previously provided oil and gas reserves data. Given the current proportion of oil and gas assets in its overall portfolio, Franco-Nevada is not providing oil and gas reserves data. For additional information, please refer to Franco-Nevada’s 2018 Asset Handbook which can be found on our website.

Information contained in this AIF with respect to each of the Antapaccay project, the Antamina project, the Candelaria project and the Cobre Panama project has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101.

The disclosure contained in this AIF of a scientific or technical nature for the Antapaccay project is based on (i) the information disclosed in the document entitled “Antapaccay Mining and Technical Information” and dated effective February 10, 2016, which document was prepared by Compañía Minera Antapaccay S.A. (“CM Antapaccay”), the owner and operator of the Antapaccay project and an indirect wholly-owned subsidiary of Glencore, available on CM Antapaccay’s website at www.glencoreperu.pe; (ii) the Glencore Statement of Resources & Reserves as at December 31, 2017; and (iii) the news release dated February 1, 2018 of Glencore containing the Glencore 2017 Production Report, each available on Glencore’s website.

Unless otherwise noted, the disclosure contained in this AIF of a scientific or technical nature for the Antamina project is based on (i) the information disclosed in the annual information form of Teck dated February 26, 2018 and filed under Teck’s SEDAR profile on February 28, 2018; (ii) the technical report entitled “Technical Report, Mineral Reserves and Resources, Antamina Deposit, Peru 2010” and dated January 31, 2011, which technical report was prepared for Compañía Minera Antamina S.A. (“CM Antamina”), and filed under Teck’s SEDAR profile on March 22, 2011; and (iii) the news release dated February 1, 2018 of Glencore containing the Glencore 2017 Production Report, available on Glencore’s website.

The disclosure contained in this AIF of a scientific or technical nature for the Candelaria project is based on (i) the technical report entitled “Technical Report for the Candelaria Copper Mining Complex, Atacama Province, Region III, Chile” dated November 30, 2017, which technical report was prepared for Lundin and filed under Lundin’s SEDAR profile on November 30, 2017 (the “Candelaria Technical Report”); (ii) the technical report entitled “Technical Report for the Candelaria Copper Mining Complex, Atacama Province, Region III, Chile” dated January 17, 2017 which technical report was prepared for Lundin and filed under Lundin’s SEDAR profile on January 17, 2017; and (iii) the management’s discussion and analysis of Lundin for the year ended December 31, 2017, dated as of February 15, 2018 and filed under Lundin’s SEDAR profile on February 15, 2018.

The disclosure contained in this AIF for the Cobre Panama project is based on (i) the technical report entitled “Cobre Panamá Project -- Colón Province, Republic of Panamá -- NI 43 - 101 Technical Report” and dated June 30, 2015, which was prepared for First Quantum and filed under First Quantum’s SEDAR profile on July 22, 2015 (“Cobre Panama Technical Report”); and (ii) the information disclosed in the annual information form of First Quantum, dated March 27, 2018 and filed under First Quantum’s SEDAR profile on March 27, 2018.

The technical and scientific information contained in this AIF relating to the Antapaccay project, the Antamina project, the Candelaria project and the Cobre Panama project was reviewed and approved in accordance with NI 43-101 by Phil Wilson, C.Eng., Vice President, Technical of the Corporation and a “Qualified Person” as defined in NI 43-101.

13

Reconciliation to CIM Definitions

In this AIF, Franco-Nevada has disclosed a number of resource and reserve estimates covering properties related to the mineral assets that are not based on Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions, but instead have been prepared in reliance upon JORC, SAMREC and SEC Industry Guide 7 (collectively, the “Acceptable Foreign Codes”). Estimates based on Acceptable Foreign Codes are recognized under NI 43-101 in certain circumstances.

In each case, the mineral resources and mineral reserves reported in this AIF are based on estimates previously disclosed by the relevant property owner or operator, without reference to the underlying data used to calculate the estimates. Accordingly, Franco-Nevada is not able to reconcile the resource and reserve estimates prepared in reliance on an Acceptable Foreign Code with that of CIM definitions. Franco-Nevada previously sought confirmation from one of its technical advisory firms, that is comprised of engineers experienced in the preparation of resource and reserve estimates using CIM and each of the Acceptable Foreign Codes, of the extent to which an estimate prepared under an Acceptable Foreign Code would differ from that prepared under CIM definitions. Franco-Nevada was advised that, while the CIM definitions are not identical to those of the Acceptable Foreign Codes, the resource and reserve definitions and categories are substantively the same as the CIM definitions mandated in NI 43-101 and will typically result in reporting of substantially similar reserve and resource estimates. Such advisors further confirmed, without reference to the procedures in which the estimates prepared using Acceptable Foreign Codes that are reproduced in this AIF were conducted, that in the course of their preparation of a resource or reserve estimate they would effectively use the same procedures to prepare and report the resource or reserve estimate regardless of the reliance on CIM or any of the Acceptable Foreign Codes. Such advisors noted two provisos to this confirmation, being (i) SEC Industry Guide 7 prohibits the reporting of resources, and will only permit reporting of reserves, and (ii) it is now generally accepted practice that staff at the SEC expect to see metals prices based on historic three year average prices, while each of CIM and the other Acceptable Foreign Codes permits the author of a resource or reserve estimate to use his or her discretion to establish a reasonable assumed metal price in such calculations. See “Cautionary Note Regarding Mineral Reserve and Resource Reporting Estimates”.

14

Franco-Nevada’s assets are categorized by commodity and stage of development. By commodity, assets are either “Precious Metals”, “Other Minerals” or “Oil & Gas”. “Precious Metals” includes gold, silver and PGM. The categories other than Oil & Gas are collectively referred to as “Mineral Assets”. For presentation purposes, “Precious Metals” encompasses gold, silver, some polymetallic exploration prospects, and platinum group metals including palladium. “Other Minerals” includes base metals, iron ore, coal, industrial and miscellaneous minerals. “Producing” assets are those that have generated revenue from steady-state operations for Franco Nevada or are expected to in the next year. “Advanced” assets are interests on projects which are not yet producing, but where in management’s view, the technical feasibility and commercial viability of extracting a mineral resource are demonstrable. “Exploration” assets represent interests on projects where technical feasibility and commercial viability of extracting a mineral resource are not demonstrable.

Management uses the following criteria in its assessment of technical feasibility and commercial viability:

(i)Geology: there is a known mineral deposit which contains mineral reserves or resources; or the project is adjacent to a mineral deposit that is already being mined or developed and there is sufficient geologic certainty of converting the deposit into mineral reserves or resources.

(ii)Accessibility and authorization: there are no significant unresolved issues impacting the accessibility and authorization to develop or mine the mineral deposit, and social, environmental and governmental permits and approvals to develop or mine the mineral deposit appear obtainable.

For accounting purposes, the number of assets has been counted in different manners depending on the category. Royalties on a producing or advanced property are generally counted as a single asset even if Franco-Nevada has multiple different royalties on the property, such as at the Goldstrike complex. Streams covering a group of mines in close proximity and operated by a common operator such as the Sudbury streams have also been counted as one asset. However, royalties and streams on producing properties that have significant co-products have been counted twice, such as the Robinson royalties for gold and copper or the Sudbury streams for gold and PGM. Exploration royalties are simply counted by the number of royalty contracts and no effort has been made to consolidate royalties on the same property. Franco-Nevada’s oil & gas interests are subdivided into Producing Assets, which are assets that are currently producing oil or natural gas, or Exploration Assets, which are undeveloped assets that are not producing oil or natural gas. Franco-Nevada’s oil & gas interests consist of a variety of working interests and royalty interests which are derived from a large number of underlying leases, contractual agreements and mineral title covering land positions in western Canada, Quebec, the Canadian Arctic and Oklahoma and Texas in the United States. For accounting purposes, these leases, contracts and mineral title have been grouped into distinct land areas and tabulated as individual assets. In many cases, Franco-Nevada owns multiple royalties or working interests that pertain to the same land area, and in these circumstances, the interests are counted as a single asset.

As of March 28, 2018, Franco-Nevada estimates that it holds 294 Mineral Assets and 82 Oil & Gas Assets for a total of 376 assets.

|

Franco-Nevada Asset Tabulation at March 28, 2018 |

|

||||||||||||

|

|

|

|

Precious Metals |

|

|

Other Minerals |

|

|

Oil & Gas |

|

|

TOTAL |

|

|

Producing |

|

|

43 |

|

|

7 |

|

|

57 |

|

|

107 |

|

|

Advanced |

|

|

29 |

|

|

7 |

|

|

— |

|

|

36 |

|

|

Exploration |

|

|

138 |

|

|

70 |

|

|

25 |

|

|

233 |

|

|

TOTAL |

|

|

210 |

|

|

84 |

|

|

82 |

|

|

376 |

|

|

|

15

Summary of Mineral Reserves and Mineral Resources

The mineral reserves and mineral resources tabulated in this AIF reflect the most recent publicly disclosed figures by the operators of the assets (converted to a 100% basis where appropriate) in which Franco-Nevada has interests. However, Franco-Nevada’s interests often do not cover the entire mineral reserve and mineral resource that is publicly reported by the operator.

|

|

|

|

|

|

Mineral Reserves |

|

|

% of Mineral |

|

||||||||||||||||||

|

|

|

|

|

|

Proven |

|

|

Probable |

|

|

Proven & Probable |

|

|

Reserves & |

|

||||||||||||

|

|

|

|

|

|

Tonnes |

|

Grade |

|

Contained |

|

|

Tonnes |

|

Grade |

|

Contained |

|

|

Tonnes |

|

Grade |

|

Contained |

|

|

Resources Covered |

|

|

GOLD - LATIN AMERICA |

|

Notes |

|

|

000s |

|

g/t |

|

000 oz |

|

|

000s |

|

g/t |

|

000 oz |

|

|

000s |

|

g/t |

|

000 oz |

|

|

by FNV Interest |

|

|

Cobre Panama |

|

4 |

|

|

345,600 |

|

0.10 |

|

1,122 |

|

|

2,837,000 |

|

0.06 |

|

5,819 |

|

|

3,182,600 |

|

0.07 |

|

6,941 |

|

|

100 |

% |

|

Candelaria |

|

1, 5 |

|

|

442,365 |

|

0.13 |

|

1,831 |

|

|

55,120 |

|

0.16 |

|

289 |

|

|

497,485 |

|

0.13 |

|

2,120 |

|

|

80 |

% |

|

Antapaccay |

|

6 |

|

|

216,000 |

|

0.11 |

|

737 |

|

|

466,000 |

|

0.09 |

|

1,316 |

|

|

682,000 |

|

0.09 |

|

2,053 |

|

|

100 |

% |

|

Guadalupe-Palmarejo |

|

1, 3, 7 |

|

|

1,425 |

|

2.51 |

|

115 |

|

|

8,540 |

|

2.15 |

|

591 |

|

|

9,965 |

|

2.20 |

|

706 |

|

|

77 |

% |

|

Cerro Moro |

|

8 |

|

|

— |

|

— |

|

— |

|

|

1,954 |

|

11.38 |

|

715 |

|

|

1,954 |

|

11.38 |

|

715 |

|

|

100 |

% |

|

Calcatreu |

|

9 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

CentroGold (Gurupi) |

|

10 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

San Jorge |

|

11 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Taca Taca |

|

12 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Volcan |

|

1, 13 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

GOLD - UNITED STATES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldstrike |

|

1, 14 |

|

|

53,995 |

|

3.46 |

|

6,008 |

|

|

13,797 |

|

5.44 |

|

2,411 |

|

|

67,792 |

|

3.86 |

|

8,419 |

|

|

65 |

% |

|

Gold Quarry |

|

1, 15 |

|

|

not available |

|

|

not available |

|

|

not available |

|

|

not available |

|

||||||||||||

|

Marigold |

|

1, 16 |

|

|

— |

|

— |

|

— |

|

|

205,100 |

|

0.48 |

|

3,190 |

|

|

205,100 |

|

0.48 |

|

3,190 |

|

|

100 |

% |

|

Midas/Fire Creek |

|

3, 17 |

|

|

226 |

|

21.18 |

|

154 |

|

|

470 |

|

14.04 |

|

212 |

|

|

696 |

|

16.36 |

|

366 |

|

|

100 |

% |

|

Bald Mountain |

|

1, 18 |

|

|

6,490 |

|

0.69 |

|

143 |

|

|

88,726 |

|

0.55 |

|

1,555 |

|

|

95,216 |

|

0.55 |

|

1,698 |

|

|

77 |

% |

|

South Arturo |

|

1, 19 |

|

|

3,778 |

|

3.28 |

|

398 |

|

|

2,595 |

|

2.52 |

|

210 |

|

|

6,373 |

|

2.97 |

|

608 |

|

|

100 |

% |

|

Mesquite |

|

20 |

|

|

5,627 |

|

0.49 |

|

89 |

|

|

59,491 |

|

0.54 |

|

1,040 |

|

|

65,119 |

|

0.54 |

|

1,129 |

|

|

100 |

% |

|

Hollister |

|

3, 21 |

|

|

46 |

|

18.96 |

|

28 |

|

|

135 |

|

18.94 |

|

82 |

|

|

181 |

|

18.96 |

|

110 |

|

|

100 |

% |

|

Stibnite Gold |

|

3, 22 |

|

|

— |

|

— |

|

— |

|

|

88,964 |

|

1.60 |

|

4,578 |

|

|

88,964 |

|

1.60 |

|

4,578 |

|

|

100 |

% |

|

Castle Mountain |

|

23 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Pinson |

|

1, 3, 24 |

|

|

5,717 |

|

0.91 |

|

168 |

|

|

1,056 |

|

5.19 |

|

176 |

|

|

6,856 |

|

1.56 |

|

344 |

|

|

0 |

% |

|

Robinson |

|

25 |

|

|

110,513 |

|

0.15 |

|

533 |

|

|

8,860 |

|

0.12 |

|

34 |

|

|

119,374 |

|

0.15 |

|

576 |

|

|

100 |

% |

|

Sandman |

|

26 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

GOLD - CANADA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sudbury |

|

1, 27 |

|

|

— |

|

— |

|

— |

|

|

486 |

|

1.01 |

|

16 |

|

|

486 |

|

1.01 |

|

16 |

|

|

100 |

% |

|

Detour Lake |

|

28 |

|

|

89,800 |

|

1.23 |

|

3,564 |

|

|

418,300 |

|

0.91 |

|

12,250 |

|

|

508,100 |

|

0.97 |

|

15,814 |

|

|

100 |

% |

|

Golden Highway - Holt |

|

29 |

|

|

1,770 |

|

4.00 |

|

229 |

|

|

1,830 |

|

4.40 |

|

257 |

|

|

3,600 |

|

4.20 |

|

486 |

|

|

100 |

% |

|

Golden Highway - Taylor |

|

30 |

|

|

445 |

|

5.50 |

|

78 |

|

|

646 |

|

4.30 |

|

89 |

|

|

1,090 |

|

4.80 |

|

167 |

|

|

100 |

% |

|

Golden Highway - Holloway |

|

31 |

|

|

— |

|

— |

|

— |

|

|

54 |

|

5.80 |

|

10 |

|

|

54 |

|

5.80 |

|

10 |

|

|

100 |

% |

|

Golden Highway - Hislop |

|

32 |

|

|

— |

|

— |

|

— |

|

|

176 |

|

5.80 |

|

33 |

|

|

176 |

|

5.80 |

|

33 |

|

|

100 |

% |

|

Hemlo |

|

1, 33 |

|

|

935 |

|

3.66 |

|

110 |

|

|

23,993 |

|

2.16 |

|

1,664 |

|

|

24,928 |

|

2.21 |

|

1,774 |

|

|

20 |

% |

|

Musselwhite |

|

34 |

|

|

3,940 |

|

7.22 |

|

910 |

|

|

4,910 |

|

5.92 |

|

930 |

|

|

8,840 |

|

6.50 |

|

1,850 |

|

|

100 |

% |

|

Kirkland Lake |

|

35 |

|

|

386 |

|

16.68 |

|

207 |

|

|

2,620 |

|

21.72 |

|

1,830 |

|

|

3,010 |

|

20.98 |

|

2,030 |

|

|

100 |

% |

|

Timmins West |

|

36 |

|

|

407 |

|

3.59 |

|

47 |

|

|

6,055 |

|

3.11 |

|

606 |

|

|

6,462 |

|

3.14 |

|

653 |

|

|

100 |

% |

|

Canadian Malartic |

|

1, 37 |

|

|

49,980 |

|

0.95 |

|

1,520 |

|

|

131,018 |

|

1.15 |

|

4,858 |

|

|

180,998 |

|

1.10 |

|

6,378 |

|

|

12 |

% |

|

Brucejack |

|

1, 38 |

|

|

4,700 |

|

12.57 |

|

1,900 |

|

|

13,800 |

|

15.33 |

|

6,800 |

|

|

18,500 |

|

14.63 |

|

8,700 |

|

|

100 |

% |

|

Hardrock |

|

39 |

|

|

— |

|

— |

|

— |

|

|

141,715 |

|

1.02 |

|

4,647 |

|

|

141,715 |

|

1.02 |

|

4,647 |

|

|

100 |

% |

|

Red Lake (Phoenix) |

|

40 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Courageous Lake |

|

41 |

|

|

12,000 |

|

2.41 |

|

1,000 |

|

|

79,000 |

|

2.17 |

|

5,500 |

|

|

91,000 |

|

2.20 |

|

6,500 |

|

|

100 |

% |

|

Dublin Gulch (Eagle Deposit) |

|

42 |

|

|

27,000 |

|

0.80 |

|

685 |

|

|

90,000 |

|

0.62 |

|

1,778 |

|

|

116,000 |

|

0.66 |

|

2,463 |

|

|

100 |

% |

|

Goldfields |

|

43 |

|

|

1,228 |

|

1.90 |

|

75 |

|

|

21,105 |

|

1.39 |

|

945 |

|

|

22,333 |

|

1.42 |

|

1,020 |

|

|

100 |

% |

|

Red Mountain |

|

44 |

|

|

1,308 |

|

7.82 |

|

329 |

|

|

645 |

|

6.93 |

|

144 |

|

|

1,953 |

|

7.53 |

|

473 |

|

|

100 |

% |

|

Monument Bay |

|

45 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

GOLD - AUSTRALIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Duketon |

|

1, 46 |

|

|

9,800 |

|

0.95 |

|

298 |

|

|

42,200 |

|

1.21 |

|

1,636 |

|

|

52,000 |

|

1.16 |

|

1,933 |

|

|

100 |

% |

|

Henty |

|

47 |

|

|

55 |

|

4.90 |

|

8 |

|

|

10 |

|

5.20 |

|

2 |

|

|

65 |

|

5.40 |

|

10 |

|

|

100 |

% |

|

Aphrodite |

|

48 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Yandal (Bronzewing) |

|

49 |

|

|

1,400 |

|