Exhibit 99.1

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

GENERAL MATTERS |

|

1 |

|

FORWARD LOOKING STATEMENTS |

|

1 |

|

NON-IFRS MEASURES |

|

4 |

|

EXCHANGE RATE INFORMATION |

|

4 |

|

COMMODITY PRICE INFORMATION |

|

4 |

|

THE CORPORATION |

|

5 |

|

GENERAL DEVELOPMENT OF FRANCO-NEVADA’S BUSINESS |

|

6 |

|

EXPLANATION OF ROYALTIES, STREAMS AND OTHER INTERESTS |

|

13 |

|

TECHNICAL AND THIRD PARTY INFORMATION |

|

15 |

|

FRANCO-NEVADA’S ASSETS |

|

16 |

|

Asset Revenue and Descriptions |

|

17 |

|

Summary of Mineral Reserves and Mineral Resources |

|

21 |

|

Gold Assets |

|

28 |

|

United States |

|

28 |

|

Canada |

|

33 |

|

Australia |

|

37 |

|

Rest of World |

|

40 |

|

PGM Assets |

|

47 |

|

Other Minerals Assets |

|

48 |

|

Exploration Assets |

|

49 |

|

Oil & Gas Assets |

|

52 |

|

TECHNICAL REPORTS |

|

56 |

|

Palmarejo Mining and Technical Information |

|

56 |

|

RESERVES DATA AND OTHER OIL & GAS INFORMATION |

|

69 |

|

RISK FACTORS |

|

80 |

|

DIVIDENDS |

|

93 |

|

CAPITAL STRUCTURE |

|

94 |

|

MARKET FOR SECURITIES |

|

94 |

|

DIRECTORS AND OFFICERS |

|

96 |

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

|

99 |

|

INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

|

100 |

|

REGISTRAR AND TRANSFER AGENT |

|

100 |

|

MATERIAL CONTRACTS |

|

100 |

|

EXPERTS |

|

101 |

|

ADDITIONAL INFORMATION |

|

101 |

|

AUDIT AND RISK COMMITTEE INFORMATION |

|

101 |

|

APPENDIX A FORM 51-101F2 |

|

A-1 |

|

APPENDIX B FORM 51-101F3 |

|

B-1 |

|

APPENDIX C FRANCO-NEVADA CORPORATION AUDIT AND RISK COMMITTEE CHARTER |

|

C-1 |

GENERAL MATTERS

Unless otherwise noted or the context otherwise indicates, the terms “Franco-Nevada”, “Company”, “Corporation”, “our” and “we” refer to Franco-Nevada Corporation and its subsidiaries. For reporting purposes, the Corporation presents its financial statements in United States dollars and in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). All dollar amounts in this Annual Information Form (“AIF”) are expressed in United States dollars, except as otherwise indicated. References to “$” or “dollars” are to United States dollars, references to “C$” are to Canadian dollars, references to “A$” are to Australian dollars and references to “ZAR” are to South African rand.

The information contained in this AIF is as of December 31, 2013, unless otherwise indicated. More current information may be available on our public website at www.franco-nevada.com or on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com or on the website of the United States Securities and Exchange Commission (the “SEC”) at www.sec.gov. In addition, we generally maintain supporting materials on our website which may assist in reviewing (but are not to be considered part of) this AIF including a Glossary of Non-Technical Terms, Glossary of Technical Terms, Certain Oil & Natural Gas Terms and a Metric Conversion Table.

FORWARD LOOKING STATEMENTS

This AIF contains “forward looking information” and “forward looking statements” within the meaning of applicable Canadian securities laws and the U.S. Private Securities Litigation Reform Act of 1995, respectively, which may include, but are not limited to, statements with respect to future events or future performance, management’s expectations regarding Franco-Nevada’s growth, results of operations, estimated future revenues, requirements for additional capital, mineral reserve and mineral resource estimates, production estimates, production costs and revenue, future demand for and prices of commodities, expected mining sequences, business prospects and opportunities. In addition, statements (including data in tables) relating to reserves and resources and gold equivalent ounces are forward looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance can be given that the estimates will be realized. Such forward looking statements reflect management’s current beliefs and are based on information currently available to management. Often, but not always, forward looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Franco-Nevada to be materially different from any future results, performance or achievements expressed or implied by the forward looking statements. A number of factors could cause actual events or results to differ materially from any forward looking statement, including, without limitation: fluctuations in the prices of the primary commodities that drive royalty and stream revenue (gold, platinum group metals, copper, nickel, uranium, silver, iron-ore and oil and gas); fluctuations in the value of the Canadian and Australian dollar, Mexican peso and any other currency in which revenue is generated, relative to the U.S. dollar; changes in national and local government legislation, including permitting and licensing regimes and taxation policies; regulations and political or economic developments in any of the countries where properties in which Franco-Nevada holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Franco-Nevada holds a royalty, stream or other interest, including changes in the ownership and control of such operators; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Franco-Nevada; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; whether or not the Corporation is determined to have PFIC status; excessive cost escalation as well as development, permitting, infrastructure, operating or technical difficulties on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; rate and timing of production differences from resource estimates; risks and hazards associated with the business of development and mining on any of the properties in which Franco-Nevada holds a royalty, stream or other interest, including, but not limited to unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters or civil unrest; and the integration of acquired assets. The forward looking statements contained in this AIF are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation of the properties in which Franco-Nevada holds a royalty, stream or other interest by the owners or operators of

such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; the Corporation’s ongoing income and assets relating to determination of its PFIC status; no adverse development in respect of any significant property in which Franco-Nevada holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; integration of acquired assets; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. However, there can be no assurance that forward looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and investors are cautioned that forward looking statements are not guarantees of future performance. Franco-Nevada cannot assure investors that actual results will be consistent with these forward looking statements. Accordingly, investors should not place undue reliance on forward looking statements due to the inherent uncertainty therein. For additional information with respect to risks, uncertainties and assumptions, please refer to the “Risk Factors” section of this AIF as well as Franco-Nevada’s most recent Management’s Discussion and Analysis filed with the Canadian securities regulatory authorities on www.sedar.com and the SEC on www.sec.gov. The forward looking statements herein are made as of the date of this AIF only and Franco-Nevada does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law.

CAUTIONARY NOTE REGARDING MINERAL AND OIL AND GAS RESERVE AND RESOURCE ESTIMATES

This AIF has been prepared in accordance with the requirements of Canadian securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and reserve estimates included in this AIF have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining and Metallurgy Classification System. NI 43-101 is a rule developed by the Canadian securities regulatory authorities which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits a historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) states whether the historical estimate uses categories other than those prescribed by NI 43-101; and (d) includes any more recent estimates or data available.

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and resource information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Corporation in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code or the SAMREC Code (as such terms are defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws. Accordingly, information containing descriptions of the Corporation’s mineral properties set forth herein may not be comparable to similar information made public by

U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. For more information, see “Reconciliation to CIM Definitions”.

Similarly, the requirements of NI 51-101 for disclosure of oil and gas activities differ significantly from those of the SEC, and disclosure concerning the oil and gas properties in which the Corporation has interests may not be comparable with information made public by companies that report in accordance with U.S. standards. The primary differences between the Canadian requirements and the U.S. standards for oil and gas related disclosure are that:

· NI 51-101 requires disclosure of gross and net reserves using forecast prices, whereas the SEC rules require the disclosure of net reserves estimated using a historical 12-month average price;

· NI 51-101 requires the disclosure of the net present value of future net revenue attributable to all of the disclosed reserves categories, estimated using forecast prices and costs, before and after deducting future income tax expenses, calculated without discount and using discount rates of 5%, 10%, 15% and 20%, whereas the SEC rules require disclosure of the present value of future net cash flows attributable to proved reserves only, estimated using a constant price (the historical 12-month average price) and a 10% discount rate;

· NI 51-101 requires a one-year reconciliation of gross proved reserves, gross probable reserves and gross proved plus probable reserves, based on forecast prices and costs, for various product types, whereas the SEC rules require a three-year reconciliation of net proved reserves, based on constant prices and costs, for less specific product types; and

· NI 51-101 requires reserves to show a hurdle rate of return, whereas the SEC rules require reserves to be cash flow positive on an undiscounted basis.

NON-IFRS MEASURES

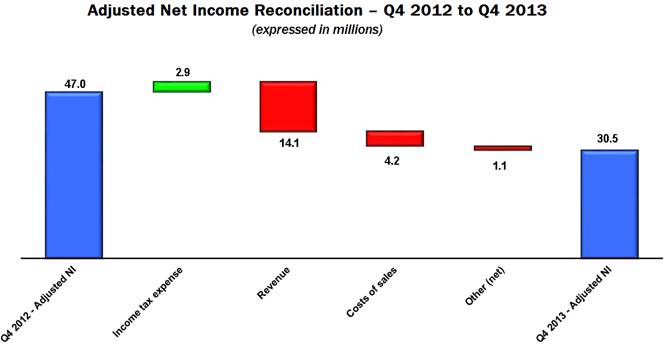

Franco-Nevada included in its 2011, 2012 and 2013 years, the following Non-IFRS Measures:

“EBITDA” is defined by the Corporation as net income (loss) excluding income tax expense/recovery, finance income and costs, and depletion and depreciation.

“Adjusted EBITDA” is defined by the Corporation as net income (loss) excluding income tax expense/recovery, finance income and costs, foreign exchange gains/losses and other income/expenses, gains/losses on sale of investments, losses from equity investees, and depletion and depreciation and impairment charges related to royalties, streams, working interests and investments.

“Adjusted Net Income” is defined by the Corporation as net income (loss) excluding foreign exchange gains/losses, gains/losses on sale of investments, impairment charges related to royalties, streams, working interests and investments, unusual non-recurring items, and the impact of taxes on these items. “EBITDA” is defined by the Corporation as net income (loss) excluding income tax expense/recovery, finance income, finance expenses and depletion and depreciation.

Franco-Nevada plans to continue using these methods.

Please see the notes to the table on page 19 for additional information regarding Adjusted EBITDA. See also the Corporation’s most recently filed MD&A for further information regarding Non-IFRS Measures and reconciliations to Adjusted EBITDA and Adjusted Net Income.

EXCHANGE RATE INFORMATION

The following table sets out the high and low rates of exchange for one U.S. dollar expressed in Canadian dollars in effect at the end of each of the following periods; the average rate of exchange for those periods; and the rate of exchange in effect at the end of each of those periods, each based on the noon rate published by the Bank of Canada.

|

|

|

Years ended December 31, |

| |||||||

|

|

|

2013 |

|

2012 |

|

2011 |

| |||

|

High |

|

$ |

1.0697 |

|

$ |

1.0418 |

|

$ |

1.0604 |

|

|

Low |

|

$ |

0.9839 |

|

$ |

0.9710 |

|

$ |

0.9449 |

|

|

Average for the Period |

|

$ |

1.0299 |

|

$ |

0.9996 |

|

$ |

0.9891 |

|

|

End of Period |

|

$ |

1.0636 |

|

$ |

0.9949 |

|

$ |

0.9833 |

|

On March 18, 2014 the noon rate was U.S.$1.00 = C$1.1086 as published by the Bank of Canada.

COMMODITY PRICE INFORMATION

|

|

|

Spot Commodity Prices |

| |||||||||||||

|

|

|

Gold /oz |

|

Platinum /oz |

|

Palladium /oz |

|

Oil / C$ bbl |

|

Gas / C$ mcf |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Average for 2011 |

|

$ |

1,569 |

|

$ |

1,720 |

|

$ |

733 |

|

$ |

95 |

|

$ |

3.44 |

|

|

Average for 2012 |

|

$ |

1,669 |

|

$ |

1,552 |

|

$ |

645 |

|

$ |

86 |

|

$ |

2.28 |

|

|

Average for 2013 |

|

$ |

1,411 |

|

$ |

1,487 |

|

$ |

725 |

|

$ |

93 |

|

$ |

3.01 |

|

THE CORPORATION

Name, Address and Incorporation

Franco-Nevada was incorporated under the Canada Business Corporations Act on October 17, 2007 and was amalgamated with Franco-Nevada Canada Corporation, its wholly-owned subsidiary, on January 1, 2008. Franco-Nevada’s head office and registered office is currently located at Suite 2000, Commerce Court West, 199 Bay Street, Toronto, Ontario M5L 1G9. Franco-Nevada has additional offices in Denver, Colorado, Perth, Australia and Hastings, Christ Church, Barbados, all of which are used to manage its asset portfolio and pursue new investment opportunities.

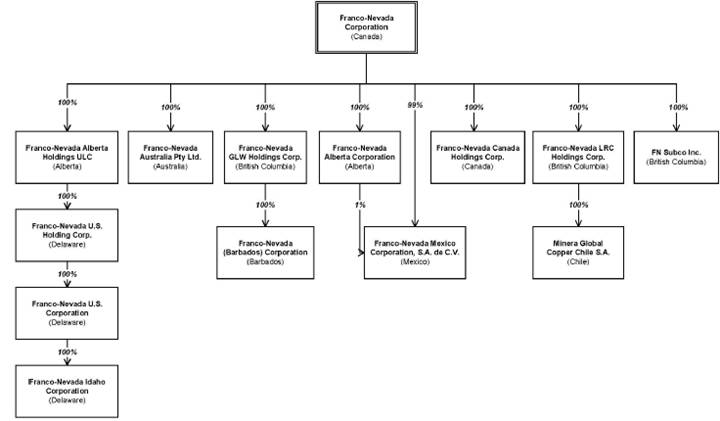

Intercorporate Relationships

Franco-Nevada has thirteen wholly-owned subsidiaries: Franco-Nevada Alberta Holdings ULC, Franco-Nevada U.S. Holding Corp., Franco-Nevada U.S. Corporation (“FN U.S.”), Franco-Nevada Idaho Corporation, Franco-Nevada Australia Pty Ltd., Franco-Nevada GLW Holdings Corp. (“FN GLW”), Franco-Nevada (Barbados) Corporation (“FN Barbados”), Franco-Nevada Alberta Corporation, Franco-Nevada Mexico Corporation, S.A. de C.V., Franco-Nevada Canada Holdings Corp., Franco-Nevada LRC Holdings Corp., Minera Global Copper Chile S.A. and FN Subco Inc. All subsidiaries are wholly-owned by Franco-Nevada either directly or indirectly and are incorporated under the laws of the jurisdictions set out below.

GENERAL DEVELOPMENT OF FRANCO-NEVADA’S BUSINESS

Overview

Franco-Nevada is a gold-focused royalty and stream company with additional interests in platinum group metals (“PGM”), oil & gas and other resource assets. Franco-Nevada is the leading gold royalty and stream company by both gold revenues and number of gold assets. The majority of revenues are generated from a diversified portfolio of properties in the United States, Canada, Mexico, Australia and Africa. The portfolio includes over 370 assets covering properties at various stages from production to early stage exploration. Royalties and streams are mostly revenue or production based. The portfolio also includes profit-based royalties and other forms of periodic future payments. Streams differ from royalties and are generally contracts for the forward purchase of a portion of future precious metal from a mining property.

Franco-Nevada’s assets are mostly mineral and oil & gas royalties or streams but also include some working and equity interests, undeveloped properties, options to acquire royalties and streams and other assets. The mineral royalties and streams are further characterized by commodity as being in the gold, PGM or base metals categories and these in turn are further subdivided by their project status as being either producing, advanced or exploration assets. A majority of the mineral royalties and streams are characterized as being gold and the majority of revenues are from gold assets. Franco-Nevada considers its stream interest in the Palmarejo project to be its only material mineral project for the purposes of NI 43-101. Previously, Franco-Nevada’s royalty interests in the Goldstrike complex were considered to be a material mineral project for the purposes of NI 43-101 but in light of additions to Franco-Nevada’s asset portfolio, the contributions from the Goldstrike complex in 2013, and the expected contribution from the Goldstrike complex in the future compared to the entire portfolio, the Goldstrike complex is no longer considered to be a material mineral project to Franco-Nevada. Franco-Nevada will continue to assess the materiality of its assets as new assets are acquired or move into production. Franco-Nevada’s oil & gas assets are located primarily in the Western Canadian sedimentary basin with a larger amount of revenue generated from conventional oil than from natural gas properties in 2013. The oil & gas assets also include mineral rights to approximately 100,000 gross acres of unproved land in Canada primarily related to oil & natural gas rights as well as working interests in Arctic gas resources.

Mineral royalties and streams are an alternative to other more conventional forms of financing, including equity, convertible securities and debt financings which can be used to finance mineral projects. Franco-Nevada competes directly against these other sources of capital to provide financing for mining and oil & gas projects.

Franco-Nevada currently operates a small organization. As of March 19, 2014, Franco-Nevada has 26 full-time employees and 4 part-time contractors. As such, Franco-Nevada is dependent upon the continued availability and commitment of its key management, whose contributions to the immediate and future operations of Franco-Nevada are of significant importance. From time to time, Franco-Nevada may also need to identify and retain additional skilled management and specialized technical personnel to efficiently operate its business. For additional information, see “Risk Factors”.

Franco-Nevada has several foreign subsidiaries and holds royalties, streams and other interests in numerous jurisdictions around the world. For additional information on risks related to these interests in foreign jurisdictions, see “Risk Factors”.

Corporate Policies

Franco-Nevada currently does not operate any of the mineral or oil & gas assets in which it has royalty/stream interests. However, Franco-Nevada recognizes its business model is dependent on the industry operating in a responsible fashion and actively supports the industry in its efforts and initiatives. Franco-Nevada may from time to time engage in exploration efforts as part of advancing a property or to conduct due diligence in advance of undertaking an investment. When doing so, Franco-Nevada undertakes to be guided by the Principles and Guidance for a Framework of Responsible Exploration as set forth by the e3Plus program of the Prospectors and Developers Association of Canada.

Franco-Nevada has adopted policies relating to its business conduct, including a code of business conduct and ethics, an environmental and corporate social responsibility policy and a health and safety policy. Franco-Nevada was also a leader and founding signatory of the World Gold Council’s Conflict-Free Gold Standard which was published in October 2012. The Corporation also occasionally makes corporate social investments in cooperation with the operators of its assets. In 2012, the Corporation committed to fund $500,000 over

five years to support the new School of Mines at Laurentian University in Sudbury, Ontario. In 2013, the Corporation made its annual contribution of $100,000 under this commitment. Additional information relating to these and other policies are contained in Franco-Nevada’s information circular for its annual and special meeting of shareholders held on May 8, 2013 and will also be contained in Franco-Nevada’s information circular for its annual and special meeting of shareholders scheduled to be held on May 7, 2014. See “Statement of Governance Practices” in such circulars.

Background of Franco-Nevada

Many of Franco-Nevada’s assets were originally acquired and developed by Franco-Nevada Mining Corporation Limited (“Old Franco-Nevada”), Normandy Mining Limited (“Normandy”) and Newmont Mining Corporation (“Newmont”). Old Franco-Nevada was a publicly-listed company on the Toronto Stock Exchange (the “TSX”) from 1983 to 2002 and had originally acquired royalties at the Goldstrike complex along with many other royalties. In February 2002, Newmont acquired Old Franco-Nevada along with Normandy. Old Franco-Nevada’s assets and part of its management team were incorporated into a new division of Newmont called Newmont Capital Limited (“Newmont Capital”). Newmont Capital’s activities included the management of royalty, investment and project portfolios as well as corporate development. Pursuant to an acquisition agreement, Franco-Nevada acquired its initial royalty portfolio from Newmont effective December 20, 2007 and also agreed to assume certain liabilities related to such portfolio. Franco-Nevada then acquired more assets of which the more significant included the Gold Quarry royalty in 2008, the Palmarejo gold stream and Subika royalty in 2009 and the Prosperity gold stream in 2010.

Three-Year History

2011

Material Transactions and Developments

Acquisition of Gold Wheaton

On March 14, 2011, pursuant to an arrangement agreement dated as of January 5, 2011 (the “Arrangement Agreement”) between Franco-Nevada and Gold Wheaton Gold Corp. (“Gold Wheaton”), Franco-Nevada acquired all of the outstanding common shares of Gold Wheaton that it did not already own and amalgamated Gold Wheaton with a wholly-owned subsidiary of Franco-Nevada to form FN GLW. Franco-Nevada had previously acquired on January 5, 2011, a 34.5% interest in Gold Wheaton from Quadra FNX Mining Ltd. (“Quadra FNX”) for C$4.65 per share in cash (C$262,558,186 million). Following the acquisition of Gold Wheaton, the Corporation topped up Quadra FNX’s total consideration to C$5.20 per share in cash (an additional C$31,055,269) on March 21, 2011, which was the same consideration received by Gold Wheaton shareholders. The total aggregate purchase price was C$293,613,455 for the 34.5% interest.

The Arrangement Agreement provided Gold Wheaton shareholders (other than Franco-Nevada) with the option to elect to receive either (i) 0.1556 of a Common Share or (ii) C$5.20 in cash (the “Arrangement Consideration”), for each Gold Wheaton common share, subject to applicable caps and pro-ration. In accordance with the Arrangement Agreement, Gold Wheaton shareholders (other than Franco-Nevada) received in the aggregate cash consideration of approximately C$259.5 million and approximately 11.65 million common shares of Franco-Nevada (“Common Shares” and each a “Common Share”). In accordance with the maximum cash and share caps and pro-rationing mechanism under the Arrangement Agreement and as a result of Gold Wheaton shareholder elections, Gold Wheaton shareholders who elected or were deemed to have elected all cash received C$5.20 in cash, for each Gold Wheaton common share. Gold Wheaton shareholders who elected all shares received approximately 0.1262 of a Common Share and approximately C$0.99, for each Gold Wheaton common share.

Gold Wheaton warrants that were outstanding as of 12:01 a.m. (Vancouver time) on March 14, 2011 (the “Effective Time”) became warrants of FN GLW that upon exercise would entitle each holder thereof, at its election, to receive the Arrangement Consideration. Based on the original C$10 per share exercise price of the original Gold Wheaton warrants, the effective exercise price of these FN GLW warrants was C$64.27 per Common Share. The FN GLW warrants expired on July 8, 2013 (the “2013 GLW Warrants”).

Gold Wheaton options that were outstanding at the Effective Time became options of FN GLW that upon exercise will entitle each holder thereof to receive 0.1556 of a Franco-Nevada Common Share.

Prior to the above transaction, on December 31, 2010, Franco-Nevada acquired 10% secured notes of Gold Wheaton from third parties having an aggregate face value of C$100 million. Franco-Nevada purchased the

notes for approximately C$111 million plus accrued interest. The purchase price was equal to the price at which the holder had the right to call the notes in the event of a change of control of Gold Wheaton. Notes with a face value of C$7 million remained outstanding following the closing of the acquisition and were repaid on March 20, 2011.

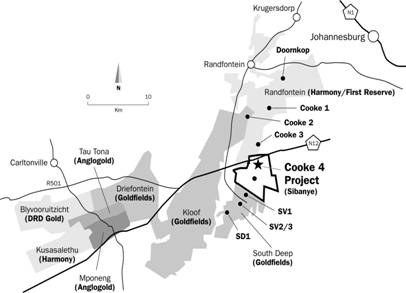

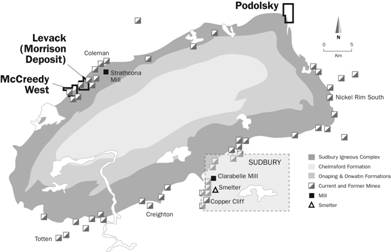

A business acquisition report dated March 22, 2011 in respect of the acquisition of Gold Wheaton was filed by Franco-Nevada on SEDAR at www.sedar.com. For a description of the assets acquired as a result of the acquisition of Gold Wheaton, see “Gold Assets — Canada — Sudbury (Gold), Ontario” and “PGM Assets — Sudbury (PGM), Ontario” and “Gold Assets — Rest of World — MWS, South Africa and Cooke 4, South Africa”.

New York Stock Exchange (“NYSE”) Listing

On September 8, 2011, the Common Shares began trading on the NYSE under the symbol “FNV”.

2011 Public Offering

On September 15, 2011, Franco-Nevada filed a short form base shelf prospectus (the “Base Shelf Prospectus”) in Canada and the U.S. which allowed the Corporation to offer and issue from time to time Common Shares, preferred shares, debt securities, warrants to purchase Common Shares, preferred shares or debt securities and subscription receipts or any combination thereof for an aggregate initial offering price of up to C$1 billion (or the equivalent thereof in other currencies) during the 25-month period that the Base Shelf Prospectus, including any amendments thereto, remained effective.

On November 30, 2011, Franco-Nevada issued 9,200,000 Common Shares (including the full exercise of an over-allotment option) at a price of C$42.50 per share for aggregate gross proceeds of C$391 million. This public offering was made by way of a prospectus supplement to the Base Shelf Prospectus. The Common Shares were sold on a bought-deal basis pursuant to an underwriting agreement dated November 23, 2011 (the “2011 Underwriting Agreement”) between Franco-Nevada and a syndicate of investment dealers led by BMO Capital Markets.

Other Transactions and Developments

Acquisition of the Edikan Royalty Interest

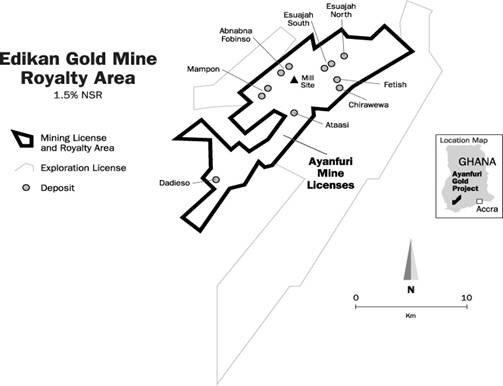

On June 30, 2011, Franco-Nevada acquired for $35 million an effective 1.5% net smelter return (“NSR”) royalty on gold production from the Ayanfuri concession in Ghana. Perseus Mining Limited (“Perseus”) is the operator of this property.

Acquisition of the Canadian Malartic Royalty Interest

On July 12, 2011, Franco-Nevada acquired a 1.5% gross overriding metal royalty encompassing seven mining claims which comprise a portion of Osisko Mining Corporation’s (“Osisko”) Malartic project in Canada. The purchase price was C$9.7 million payable by the issuance of 267,000 Common Shares.

Acquisition of the Phoenix Royalty Interest

On August 31, 2011, Franco-Nevada acquired a 2% NSR royalty payable on part of Rubicon Minerals Corporation’s (“Rubicon”) Phoenix gold project in Red Lake, Ontario lying primarily beneath the waters of Red Lake. Rubicon has an option to repurchase a 0.5% NSR royalty from Franco-Nevada. The purchase price was approximately $23.7 million payable by the issuance of 550,000 Common Shares.

Acquisition of Lumina Royalty Corp.

On September 21, 2011, Franco-Nevada and Lumina Royalty Corp. (“Lumina”) entered into an arrangement agreement pursuant to which Franco-Nevada agreed to acquire all of the outstanding common shares of Lumina by way of a statutory plan of arrangement for consideration payable in Common Shares and 2017 Warrants (as defined below). The transaction closed on December 1, 2011 and Lumina shareholders received an aggregate of 1,383,850 Common Shares and 2017 Warrants (aggregate of 760,769 warrants issued).

With this acquisition, Franco-Nevada acquired the following royalty interests:

· a 1.5% NSR royalty on Teck Resources Ltd.’s Relincho copper/molybdenum project located in Region III, Chile;

· a 1.08% NSR royalty on Lumina Copper Corp.’s Taca Taca copper/gold/molybdenum project located in Salta Province, Argentina;

· certain royalties on Coro Mining Corp.’s San Jorge copper/gold/molybdenum project located in Mendoza Province, Argentina (which royalties have been restructured such that Franco-Nevada receives, among other things, a 7.5% NSR royalty on gold produced from the property); and

· a 2% NSR royalty on open pit mining and a 1% NSR royalty on underground mining on a portion of Los Andes Copper Limited’s Vizcachitas copper/molybdenum project located in Region V, Chile.

2012

Material Transactions and Developments

Acquisition of Cobre Panama Precious Metals Stream

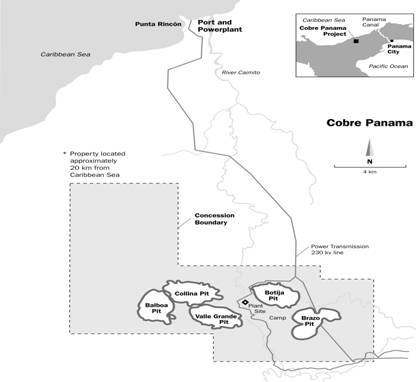

On August 20, 2012, Franco-Nevada announced the acquisition of a precious metals stream on Inmet Mining Corporation’s (“Inmet”) Cobre Panama copper project in Panama (“Cobre Panama”) which is currently owned 80% by a successor to Inmet and 20% by Korea Panama Mining Corp. (“KPMC”).

Under the terms of the agreement (the “Cobre Panama Agreement”) between FN Barbados, Minera Panama, S.A. (“MPSA”), the owner and developer of Cobre Panama, and other Inmet subsidiaries, Franco-Nevada will provide a $1 billion deposit, secured by a pledge of Inmet’s interest in MPSA, to fund a portion of Cobre Panama’s capital costs. In 2013, Inmet was acquired by First Quantum Minerals Ltd. (“First Quantum”) which plans to advance the development of Cobre Panama. Franco-Nevada’s deposit will become available after First Quantum’s funding reaches $1 billion and funding of the deposit will be pro-rata on a 1:3 ratio of First Quantum’s share of the capital costs (First Quantum owns 80% of the project), up to a maximum of $1 billion. First Quantum has requested changes under the security and reporting requirements of the Cobre Panama Agreement. Franco-Nevada is considering changes to achieve a mutually beneficial outcome. Franco-Nevada expects to fund approximately $200 million in 2014 under the Cobre Panama Agreement.

The amount of gold and silver deliverable under the Cobre Panama Agreement is indexed to copper in concentrate produced from Cobre Panama and approximates 86% of the payable precious metals attributable to First Quantum’s 80% ownership. Beyond the initial contemplated mine life, the precious metals deliverable under the stream will be based on a fixed percentage of the precious metals in concentrate. Under the terms of the Cobre Panama Agreement, Franco-Nevada will pay $400 per ounce (“ounce” or “oz”) for gold and $6 per ounce for silver (subject to an annual adjustment for inflation) for the first 1,341,000 ounces of gold and 21,510,000 ounces of silver, respectively, delivered to Franco-Nevada under the agreement. Thereafter Franco-Nevada will pay the greater of $400 per ounce for gold and $6 per ounce for silver (subject to an annual adjustment for inflation), respectively, and one half of the then prevailing market price (collectively, the “Fixed Price”) based on a fixed percentage of the precious metals in concentrate.

KPMC did not participate in the transaction. An amended and restated shareholders’ agreement between Inmet and KPMC provides that the precious metals stream will not adversely impact KPMC’s economic interest in or funding requirements for Cobre Panama.

Following an extensive review of the project, First Quantum provided an update in January 2014. The revised project will have an initial installed capacity of 70 million tonnes per annum (“Mtpa”) which is higher than anticipated in the Inmet plan although first concentrate production is now only expected in fourth quarter of 2017. The increased capacity is expected to deliver metal to Franco-Nevada at an increased rate which would be partially offset by the construction delay. The new plan envisions a 34 year mine life with potential further expansion from 70 Mtpa to 100 Mtpa after 10 years of operation.

Acquisition of Weyburn Net Royalty Interest

On November 13, 2012, the Company acquired an 11.71% net royalty interest in the Weyburn Unit for C$400 million in cash from Penn West Petroleum Ltd. and Penn West Petroleum. The acquisition increased the Company’s exposure to the Weyburn Unit, a long-life oil project located in Saskatchewan, and had an effective date of October 1, 2012.

Other Transactions and Developments

Acquisition of Additional Royalty in Bronzewing

On January 11, 2012, Franco-Nevada increased its NSR royalty on Navigator Resources Limited’s (“Navigator”) Bronzewing mine in Western Australia from 1% to 2% for A$4.5 million.

Acquisition of Working Interest in Weyburn Unit

On February 23, 2012, Franco-Nevada acquired an additional 1.15% working interest in the Weyburn Unit in southeast Saskatchewan for approximately C$55 million, increasing its total working interest in the Weyburn Unit to 2.26% at that time,

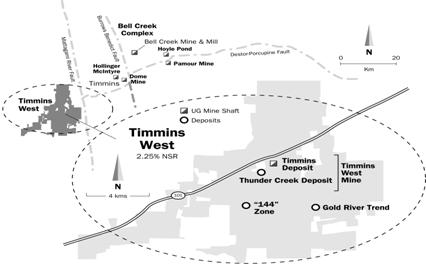

Acquisition of Timmins West Royalty Interest

On February 29, 2012, Franco-Nevada acquired a 2.25% NSR royalty from Lake Shore Gold Corp. (“Lake Shore”) on the Timmins West Complex located in Ontario for $35 million. In addition to the royalty, Franco-Nevada acquired 10,050,591 common shares of Lake Shore for C$15 million.

2013

Material Transactions and Developments

Credit Facility

On January 23, 2013, the Company replaced its $175.0 million credit facility with a $500.0 million unsecured revolving term credit facility with Canadian Imperial Bank of Commerce, as Administrative Agent. See “Material Contracts” for the other parties to the credit agreement. The facility has a four year term and may be used for general corporate purposes, including working capital requirements and funding acquisitions. On March 19, 2014, the Company extended its credit facility for an additional two years with the amended expiry being March 19, 2019.

Base Shelf Prospectus

Franco-Nevada’s Base Shelf Prospectus filed on September 15, 2011 expired on October 15, 2013. On October 29, 2013, Franco-Nevada filed a new short form base shelf prospectus (the “2013 Base Shelf Prospectus”) in Canada and the U.S. which allows the Corporation to offer and issue from time to time Common Shares, preferred shares, debt securities, warrants to purchase Common Shares, preferred shares or debt securities and subscription receipts or any combination thereof for an aggregate initial offering price of up to C$1 billion (or the equivalent thereof in other currencies) during the 25-month period that the 2013 Base Shelf Prospectus, including any amendments thereto, remains effective.

Other Transactions and Developments

Acquisition of Brucejack Royalty Interest

On May 13, 2013, Franco-Nevada acquired an existing 1.2% NSR royalty covering Pretium Resources Inc.’s Brucejack gold project in northwestern British Columbia for $45.0 million in cash. The NSR royalty becomes payable after approximately 500,000 ounces of gold and 17.9 million ounces of silver have been produced. The project includes two principal deposits, the Valley of the Kings and the West Zone.

Acquisition of Golden Meadows Royalty Interest

On May 9, 2013, Franco-Nevada acquired a newly created 1.7% NSR royalty covering Midas Gold Corp.’s (“Midas Gold”) project in Idaho for $15.0 million in cash subject to an option by Midas Gold to re-acquire one-third of the royalty for $9.0 million for a period of three years. As part of the transaction, Franco-Nevada also subscribed for 2,000,000 Midas Gold common share purchase warrants having an exercise price of C$1.23 per common share and a ten year term.

Acquisition of Sissingue Royalty Interest

On May 29, 2013, Franco-Nevada acquired a 0.5% NSR royalty on certain tenements that comprise the Sissingue gold project located in Côte d’Ivoire and operated by Perseus. The purchase price was A$2.0 million in cash.

Dividend Reinvestment Plan

On July 9, 2013, Franco-Nevada adopted a Dividend Reinvestment Plan (the “DRIP”), to provide, among other things, eligible holders of Franco-Nevada’s Common Shares with a means to reinvest dividends declared and payable to them as shareholders (less any withholding tax) in additional Common Shares of Franco-Nevada. Currently, such Common Shares are issued from treasury at a 3% discount to the market price. The discount may be adjusted in future but cannot exceed 5%. Shareholders were able to participate in the DRIP starting with the October 2013 dividend payment.

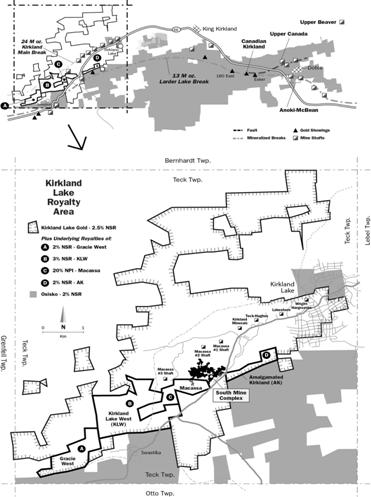

Acquisition of Kirkland Lake Royalty Interest

On October 31, 2013, Franco-Nevada acquired a 2.5% NSR royalty on Kirkland Lake Gold Inc.’s (“Kirkland Lake”) properties in Kirkland Lake, Ontario for $50.0 million in cash. Kirkland Lake has a three-year option to buy back 1% of the NSR for $36.0 million (less the royalty proceeds attributable to the buy-back portion of the NSR that have been paid to Franco-Nevada prior to the date of the buy back).

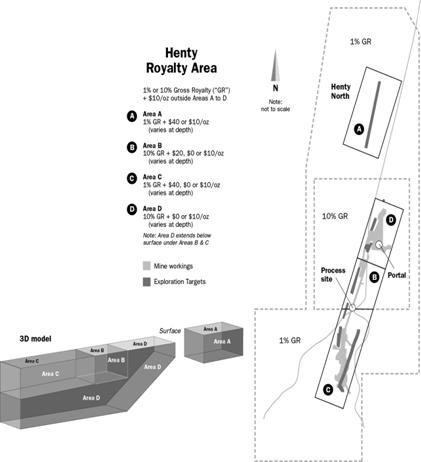

Acquisition of Barrick Royalty Portfolio Interests

On November 4, 2013, Franco-Nevada completed its acquisition of a portfolio of approximately 20 royalties from Barrick Gold Corporation (“Barrick”) for $20.9 million in cash. Producing royalties have been added to the Company’s portfolio from the Osborne copper/gold mine and Henty gold mine, both in Australia, as well as a 3% NSR royalty on Premier Gold Mines Ltd.’s Hardrock project, located in Ontario, which has been classified as an advanced royalty. The majority of the remaining royalties are classified as exploration covering over 2,000 square kilometres of prospective geology.

2014

Other Transactions and Developments

Acquisition of Sabodala Gold Stream

On January 15, 2014, Franco-Nevada acquired a 6% gold stream on Teranga Gold Corporation’s (“Teranga”) Sabodala gold project located in Senegal, Africa. Under the terms of the gold stream agreement, Franco-Nevada funded a $135.0 million deposit in exchange for 22,500 ounces of gold per year, payable monthly, for the first six years of the agreement, after which the Company will purchase 6% of the gold produced from Sabodala. Franco-Nevada will pay 20% of the market price of gold for each ounce delivered under the agreement.

Acquisition of Cerro Moro Royalty Interest

On January 31, 2014, Franco-Nevada entered into an agreement with AngloGold Ashanti Limited (“AngloGold Ashanti”) to acquire an existing 2% NSR royalty on Yamana Gold Inc.’s (“Yamana”) Cerro Moro project in Argentina for the Argentine peso equivalent of $23.5 million (at the official Argentine peso exchange rate) in cash. Cerro Moro is an advanced high grade gold-silver exploration deposit which is Yamana’s priority development asset. The transaction is expected to close during the first half of 2014.

Acquisition of Fire Creek/Midas Portfolio Interests

On February 11, 2014, Franco-Nevada entered into a gold purchase agreement with Klondex Mines Ltd. (“Klondex”) and acquired a 2.5% NSR royalty on Klondex’s Fire Creek and Midas properties, both of which are located in Nevada, U.S., for a total consideration of $35.0 million in cash. Under the terms of the gold purchase agreement, Klondex will deliver 38,250 ounces of gold, payable monthly, by December 31, 2018 following which the NSR royalty will become payable on gold produced from the Fire Creek and Midas properties.

New Prosperity Permitting

On February 27, 2014 the Government of Canada announced that it will not issue the federal authorizations necessary for Taseko Mines Limited’s (“Taseko”) New Prosperity project to proceed. Franco-Nevada has committed to provide a $350 million deposit and certain warrant consideration for the construction of New Prosperity when the project is fully permitted and financed. Franco-Nevada’s financing commitment remains available to Taseko but can be terminated at the option of Franco-Nevada.

2014 Guidance

The following contains forward looking statements about Franco-Nevada’s guidance for 2014. Reference should be made to the “Forward Looking Statements” section at the beginning of this AIF. For a description of material factors that could cause our actual results to differ materially from the forward looking statements in the following, please see the “Forward Looking Statements” and the “Risk Factors” sections of this AIF.

In 2013, Franco-Nevada realized 241,402 Gold Equivalent Ounces (“GEOs”) from its mineral assets and $67.0 million in revenue from its oil & gas assets. This compares to Franco-Nevada’s original 2013 guidance made in March 2013 of 215,000 to 235,000 GEOs and $55-$65 million for oil & gas revenue. GEO production benefited from the strength of the rest-of-world gold and the PGM assets more than offsetting weakness from

the U.S. and Canada gold assets especially the net profit royalties. Oil & gas revenues benefited from stronger than expected prices and a narrowing in differentials.

For 2014, Franco-Nevada is expecting to receive between 245,000 to 265,000 GEOs from its mineral assets and $60.0 to $70.0 million in revenue from its oil & gas assets. Of the 245,000 to 265,000 GEOs, Franco-Nevada expects to receive 130,000 to 140,000 GEOs under its various stream agreements compared with 123,387 ounces in 2013.

GEOs include our gold, platinum, palladium and other mineral assets. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces, before the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking into account the NPI economics. Platinum, palladium and other minerals were converted to GEOs by dividing associated revenue by the average gold price for the period. For the 2014 guidance, platinum and palladium metals have been converted to GEOs using assumed commodity prices of $1,300/oz Au, $1,400/oz Pt and $725/oz Pd. The WTI oil price is assumed to average $95 per barrel with higher discounts for Canadian oil than experienced in 2013. 2014 guidance assumes the continued steady state of operations from our assets and is also based on the assumptions set out below.

In addition, we expect to fund approximately $200.0 million in 2014 in connection with our precious metals stream agreement on Cobre Panama.

More specifically, we expect the following with respect to key producing assets for 2014:

· Gold — U.S.: Overall GEOs from U.S. gold assets are expected to be higher in 2014. Goldstrike royalty ounces for 2014 are expected to be slightly higher than 2013 due to higher production on grounds covered by our NSR and net profit interests (“NPI”) claims. At Gold Quarry, we expect 11,250 royalty ounces in 2014 as payments will be based on the minimum royalty provision. In addition, GEOs are expected from the Fire Creek/Midas transaction which will start delivering ounces in mid-2014. Hollister is expected to remain on care and maintenance throughout 2014.

· Gold — Canada: GEOs earned from Canadian assets in 2014 are expected to be in-line with 2013 levels with projected increases from Detour Lake, as it reaches production capacity, and a full year of production from the new Kirkland Lake royalty. These increases are expected to be partially offset by lower production from the Sudbury and Golden Highway assets and NPI royalties.

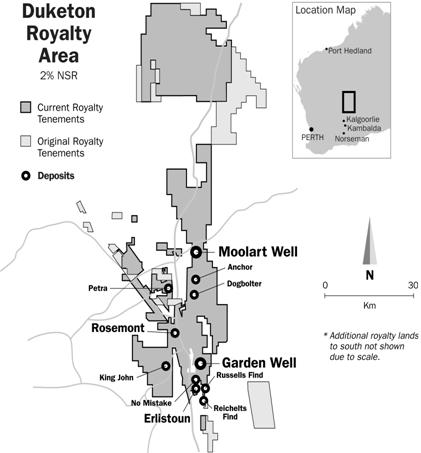

· Gold — Australia: We expect Australian GEOs to be slightly higher in 2014 than 2013. Duketon gold production is expected to increase as the operator, Regis Resources Ltd. (“Regis”), has reported that Rosemont, the third operation on the Duketon property, has completed construction and commissioning commenced in October 2013. In addition, Regis reported that construction on the plant expansion started in the fourth quarter of 2013 which is expected to increase long-term gold production from both Garden Well and Rosemont.

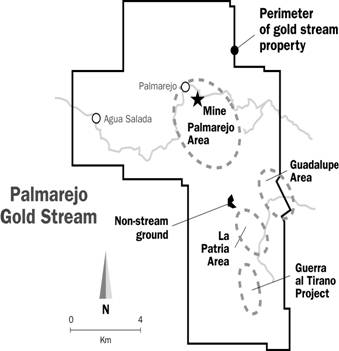

· Gold — Rest of World: 2014 Rest of World gold assets are expected to generate higher GEOs in 2014 than 2013. Our 50% gold stream over Palmarejo includes an annual minimum provision of 50,000 ounces, payable monthly. At Mine Waste Solutions (“MWS”), we expect to earn higher stream ounces. We expect to receive 22,500 ounces under the newly acquired Sabodala gold stream. At Tasiast, where we hold a 2% NSR, we anticipate 2014 to be consistent with what was earned in 2013. At Subika, royalty ounces are expected to be lower than in 2013 as mining moves off of ground covered by our royalty. At Edikan, where we have an effective 1.5% NSR, we expect slightly higher production in 2014.

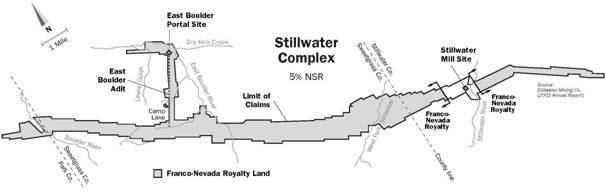

· PGM: Sudbury stream ounces for 2014 are expected to be lower as mining at Podolsky ceased in 2013. At Stillwater, 2014 royalty ounces are expected to be consistent with 2013 levels.

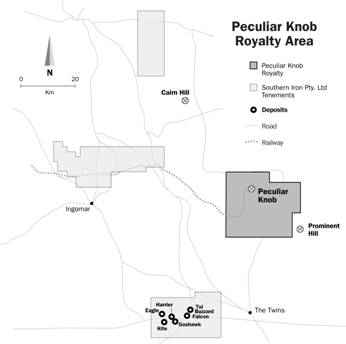

· Other minerals: Overall, GEOs from other minerals are expected to be higher in 2014 than 2013 with Peculiar Knob, an iron-ore project in South Australia, and Osborne, a recent addition to the portfolio, being significant contributors.

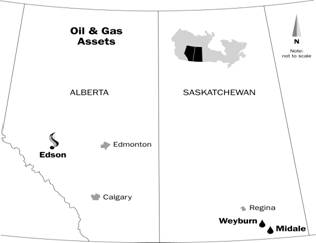

· Oil & Gas: For 2014, oil & gas revenues are expected to be $60.0 million to $70.0 million with slightly lower volumes and price discounts offset by reduced capital spending.

EXPLANATION OF ROYALTIES, STREAMS AND OTHER INTERESTS

A royalty is a payment to a royalty holder by a property owner or an operator of a property and is typically based on a percentage of the minerals or other products produced or the revenues or profits generated from the property. The granting of a royalty to a person usually arises as a result of: (i) paying part of the consideration payable to land owners, prospectors or junior mining companies for the purchase of their property interests; (ii) providing capital in exchange for granting a royalty; or (iii) converting a participating interest in a joint venture relationship into a royalty.

Royalties are not typically working interests in a property. Therefore, depending on the nature of the royalty interest and the laws applicable to the royalty and project, the royalty holder is generally not responsible for, and has no obligation to contribute, additional funds for any purpose, including, but not limited to, operating or capital costs, or environmental or reclamation liabilities. Typically, royalty interests are established through a contract between the royalty holder and the property owner, although many jurisdictions permit the holder to also register or otherwise record evidence of a royalty interest in applicable mineral title or land registries. The unique characteristics of royalties may provide royalty holders with special commercial benefits not available to the property owner because the royalty holder may enjoy the upside potential of the property with reduced risk.

Revenue-based Royalties: The majority of revenues that Franco-Nevada receives are royalties based on revenues from the value of production. The key types of revenue-based royalties are described in general terms below:

Net Smelter Return (“NSR”) royalties are based on the value of production or net proceeds received by the operator from a smelter or refinery. These proceeds are usually subject to deductions or charges for transportation, insurance, smelting and refining costs as set out in the royalty agreement. For gold royalties, the deductions are generally minimal, while for base metal projects the deductions can be much more substantial. This type of royalty generally provides cash flow that is free of any operating or capital costs and environmental liabilities. A smaller percentage NSR in a project can effectively equate to the economic value of a larger percentage profit or working interest in the same project.

Gross Royalties (“GR”) or Gross Overriding Royalties (“GOR”) are based on the total revenue stream from the sale of production from the property with few, if any, deductions. Some contracts refer to gross proceeds (“GP”) which have been characterized as comparable to GRs in this document.

Overriding Royalties (“ORR”) and Lessor or Freehold Royalties (“FH”) are based on the proceeds from gross production and are usually free of any operating, capital and environmental costs. These terms are usually applied in the oil & gas industry.

Profit-based Royalties: Franco-Nevada also receives a portion of its revenues from royalties that are calculated based on profits, as described below:

Net Profit Interest (“NPI”) is based on the profit realized after deducting costs related to production as set out in the royalty agreement. NPI payments generally begin after payback of capital costs. Although the royalty holder is generally not responsible for providing capital, covering operating losses or environmental liabilities, increases in production costs will affect net profits and royalties payable.

Net Royalty Interest (“NRI”) is paid net of operating and capital costs similar to an NPI.

Fixed Royalties: Franco-Nevada has a small number of fixed royalties. These are royalties that are paid based on a set rate per tonne mined, produced or processed or even a minimum for a period of time rather than as a percentage of revenue or profits. These types of royalties are more common for iron ore, coal and industrial minerals and usually do not have exposure to changes in the underlying commodity price.

The royalty types listed above can include additional provisions that allow them to change character in different circumstances or have varying rates. Some examples are as follows:

Minimum Royalty (“MR”) is a provision included in some royalties that requires fixed payments at a certain level even if the project is not producing, or the project is producing at too low a rate to achieve the minimum.

Advance Minimum Royalty (“AMR”) is similar to an MR except that, once production begins, the minimum payments already paid are often credited against subsequent royalty payments from production that exceeds the minimum.

Sliding Scale Royalty (“Sliding Scale” or “ss”) refers to royalties where the royalty percentage is variable. Generally this royalty percentage is indexed to metal prices or a production threshold. Generally, a minimum or maximum percentage would be applied to such a royalty.

Capped Royalty (“Capped”) refers to royalties that expire or cease payment after a particular cumulative royalty amount has been paid or a set production volume threshold or time period has been reached.

Royalties can be commodity specific and, for instance, apply only to gold or hydrocarbons or have varying royalty structures for different commodities from the same property. Royalties can be restricted or varied by metallurgy, ore type or even by stratigraphic horizon. Generally, the contract terms for royalties in the oil & gas business are more standardized than those found in the mineral business.

Streams: Streams are distinct from royalties. They are metal purchase agreements where, in exchange for an upfront deposit and ongoing payments for metal delivered, the holder purchases all or a portion of one or more metals produced from a mine, at a preset price. In the case of gold, the agreements typically provide for the purchase price to be the spot price at the time of delivery with a fixed price per ounce (typically $400 for gold with a small inflationary adjustment) payable in cash and the balance paid by applying the upfront deposit. Once the upfront deposit is fully applied, the purchase price is typically the lesser of the fixed price per ounce payable in cash (with a small inflationary adjustment) and the spot price at the time of delivery. Gold streams are well suited to co-product production providing incentive to the operator to produce the gold. Because streams can also be used as a form of financing a gold project, the stream structure may also help maintain the borrowing capacity for the project. Streams can provide higher leverage to commodity price changes as a result of the fixed purchase price per ounce.

Working Interests (“WI”): A working interest is significantly different than a royalty or stream in that a holder of a WI owns an undivided possessory interest in the land or leasehold itself, and is liable for its share of capital, operating and environmental costs, usually in proportion to its ownership percentage, and it receives its pro-rata share of revenue. Minority working or equity interests are not considered to be royalties because of the ongoing funding commitments, although they can be similar in their calculations to NPIs.

Example of a Royalty (NSR or NPI) versus a Stream

Assume for one ounce of gold, a sales price of $1,300, a “stream cost” of $400 per ounce and an “all-in sustaining cost”(1) of $873 per ounce. Also assume that Franco-Nevada has a 4% NSR, a 4% NPI or WI or a 4% stream.

|

|

|

NSR |

|

Stream |

|

Developed |

| |||

|

One ounce sold at |

|

$ |

1,300 |

|

$ |

1,300 |

|

$ |

1,300 |

|

|

Applicable cost |

|

— |

|

$ |

400 |

|

$ |

873 |

(1) | |

|

Margin for calculation |

|

$ |

1,300 |

|

$ |

900 |

|

$ |

427 |

|

|

|

|

|

|

|

|

|

| |||

|

NSR, Stream or NPI % |

|

4 |

% |

4 |

% |

4 |

% | |||

|

Revenue per ounce to FNV |

|

$ |

52 |

|

$ |

36 |

|

$ |

17 |

|

(1) For applicable costs for a developed NPI or WI, Franco-Nevada is, for illustrative purposes, assuming Barrick’s 2013 all-in sustaining cash cost measure, as Barrick represents the largest gold company by production and reserves, as well as being the operator at five of Franco-Nevada’s assets. Excluded from the all-in sustaining measure are general and administrative costs as Franco-Nevada also has such costs which have not been reflected in the applicable cost for NSRs or streams.

Based on the above economics, a comparable percentage NSR is more than three times more valuable than an equivalent Developed NPI or WI and 44% more valuable than a stream interest. With changes to the gold price, the NPI or WI would demonstrate the most leverage while the NSR would provide the most down side protection. The stream provides commodity price leverage similar to a low cost operating company with more certainty as to future costs.

TECHNICAL AND THIRD PARTY INFORMATION

Except where otherwise stated, the disclosure in this AIF relating to properties and operations on the properties in which Franco-Nevada holds royalty or stream interests is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at March 10, 2014 (except where stated otherwise), and none of this information has been independently verified by Franco-Nevada. Specifically, as a royalty or stream holder, Franco-Nevada has limited, if any, access to properties included in its asset portfolio. Additionally, Franco-Nevada may from time to time receive operating information from the owners and operators of the properties, which it is not permitted to disclose to the public. Franco-Nevada is dependent on the operators of the properties and their qualified persons to provide information to Franco-Nevada (such as the Palmarejo Report (as defined below)) or on publicly available information to prepare required disclosure pertaining to properties and operations on the properties on which Franco-Nevada holds royalty or stream interests and generally has limited or no ability to independently verify such information. Although Franco-Nevada does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Franco-Nevada’s royalty or stream interest. Franco-Nevada’s royalty or stream interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of the property.

Except where otherwise noted, the disclosure in this AIF relating to mineral reserve and mineral resource statements for individual properties is made as at December 31, 2013. In addition, numerical information presented in this AIF which has been derived from information publicly disclosed by owners or operators may have been rounded by Franco-Nevada and, therefore, there may be some inconsistencies within this AIF with respect to significant digits presented.

The disclosure in this AIF of a scientific or technical nature for the Palmarejo project is based on a technical report dated January 1, 2013 prepared for Coeur d’Alene Mines Corporation (now known as Coeur Mining, Inc. (“Coeur”)) and Franco-Nevada in accordance with NI 43-101 (as was in force at such time), except for information dated subsequent to the Palmarejo Report which is based on Coeur’s public disclosure. The technical report for the Palmarejo project (the “Palmarejo Report”) is entitled “Palmarejo Project SW Chihuahua State, Mexico YE 2012 — Technical Report” and was prepared by or under the supervision of Donald J. Birak, Senior Vice President — Exploration, Coeur at the time of the Palmarejo Report, Keith Blair, Manager, Applied Geoscience LLC at the time of the Palmarejo Report, and Klaus Triebel, Senior Corporate Resource Geologist, Coeur at the time of the Palmarejo Report, each of whom is a “qualified person” for the purposes of NI 43-101 and who also reviewed the disclosure of scientific and technical information in this AIF regarding the Palmarejo project. The Palmarejo Report has been filed on SEDAR under Franco-Nevada’s profile at www.sedar.com and is available on the SEC’s website at www.sec.gov.

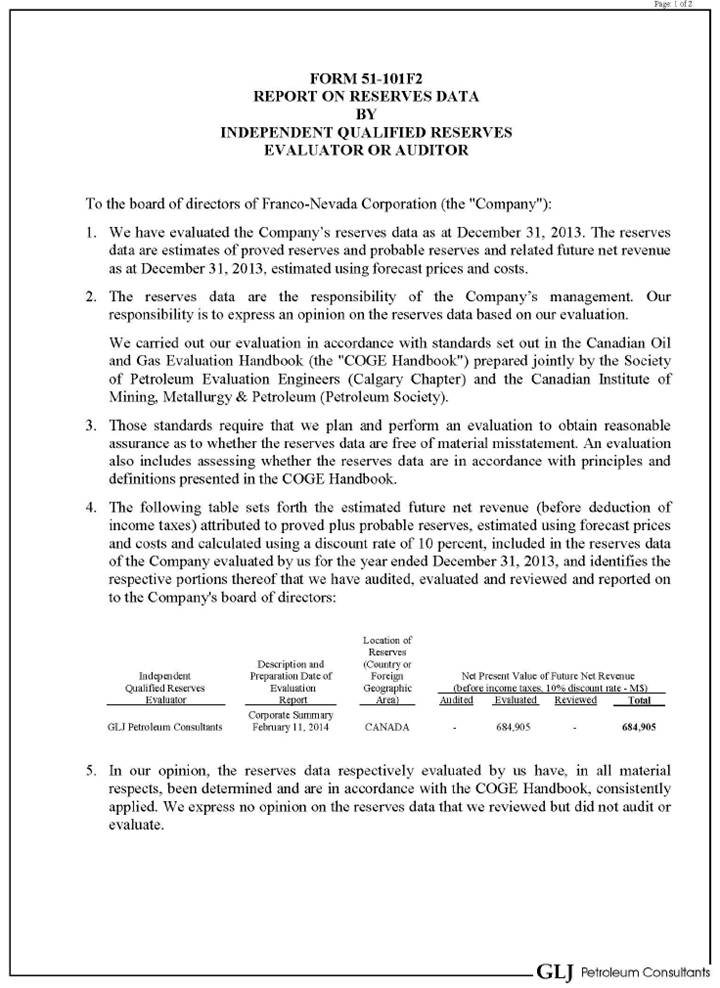

The disclosure in this AIF for the reserve assessment and evaluation of the oil & gas reserves including the Weyburn Unit, Midale Unit and Edson Property (each as defined below), was prepared by GLJ Petroleum Consultants Ltd. (“GLJ”) for Franco-Nevada and was dated February 18, 2014, with a preparation date of February 11, 2014 and an effective date of December 31, 2013, in accordance with NI 51-101.

Reconciliation to CIM Definitions

In this AIF, Franco-Nevada has disclosed a number of resource and reserve estimates covering properties related to the mineral assets that are not based on Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions, but instead have been prepared in reliance upon JORC, SAMREC and SEC Industry Guide 7 (collectively, the “Acceptable Foreign Codes”). Estimates based on Acceptable Foreign Codes are recognized under NI 43-101 in certain circumstances.

In each case, the mineral resources and mineral reserves reported in this AIF are based on estimates previously disclosed by the relevant property owner or operator, without reference to the underlying data used to calculate the estimates. Accordingly, Franco-Nevada is not able to reconcile the resource and reserve estimates prepared in reliance on an Acceptable Foreign Code with that of CIM definitions. Franco-Nevada previously sought confirmation from one of its technical advisory firms, that is comprised of engineers experienced in the preparation of resource and reserve estimates using CIM and each of the Acceptable Foreign Codes, of the extent to which an estimate prepared under an Acceptable Foreign Code would differ from that prepared under CIM definitions. Franco-Nevada was advised that, while the CIM definitions are not identical to those of the Acceptable Foreign Codes, the resource and reserve definitions and categories are

substantively the same as the CIM definitions mandated in NI 43-101 and will typically result in reporting of substantially similar reserve and resource estimates. Such advisors further confirmed, without reference to the procedures in which the estimates prepared using Acceptable Foreign Codes that are reproduced in this AIF were conducted, that in the course of their preparation of a resource or reserve estimate they would effectively use the same procedures to prepare and report the resource or reserve estimate regardless of the reliance on CIM or any of the Acceptable Foreign Codes. Such advisors noted two provisos to this confirmation, being (i) SEC Industry Guide 7 prohibits the reporting of resources, and will only permit reporting of reserves, and (ii) it is now generally accepted practice that staff at the SEC expect to see metals prices based on historic three year average prices, while each of CIM and the other Acceptable Foreign Codes permits the author of a resource or reserve estimate to use his or her discretion to establish a reasonable assumed metal price in such calculations. See “Cautionary Note Regarding Mineral and Oil and Gas Reserve and Resource Reporting Estimates”.

FRANCO-NEVADA’S ASSETS

Franco-Nevada’s assets are categorized by commodity and stage of development. By commodity, assets are either “Gold”, “PGM”, “Other Minerals” or “Oil & Gas”. The categories of Gold and PGM are together referred to as “Precious Metals”. The categories other than Oil & Gas are collectively referred to as “Mineral Assets”. For presentation purposes, “Gold” encompasses some silver assets and polymetallic exploration prospects. “PGM” encompasses the platinum group metals including palladium. “Other Minerals” includes base metals, iron ore, coal, industrial and miscellaneous minerals. “Producing” assets are those that have generated revenue from steady-state operations to Franco-Nevada or are expected to in the next year. “Advanced” are assets on projects that in management’s view have a reasonable possibility of generating steady-state revenue to Franco-Nevada in the next five years or includes properties under development, permitting, feasibility or advanced exploration. “Exploration” represents assets on early stage exploration properties that are speculative and are expected to require more than five years to generate revenue, if ever, or are currently not active.

For accounting purposes, the number of assets has been counted in different manners depending on the category. Royalties on a producing or advanced property are generally counted as a single asset even if Franco-Nevada has multiple different royalties on the property, such as at the Goldstrike complex. Streams covering a group of mines in close proximity and operated by a common operator such as the Sudbury streams have also been counted as one asset. However, royalties and streams on producing properties that have significant co-products have been counted twice, such as the Robinson royalties for gold and copper or the Sudbury streams for gold and PGM. Exploration royalties are simply counted by the number of royalty contracts and no effort has been made to consolidate royalties on the same property. Franco-Nevada’s wholly-owned undeveloped oil & gas land positions and its working interests in Arctic gas resources are additional assets of the Corporation. However, for the purposes of tabulating an indicative number of assets, the undeveloped oil & gas land positions and certain working interests are not counted. More detail on Franco-Nevada’s oil & gas land positions can be found in the section entitled “Oil & Gas Assets”.

As of March 19, 2014, Franco-Nevada estimates that it holds 235 Mineral Assets and 137 Oil & Gas Assets for a total of 372 assets and another 160 undeveloped Oil & Gas agreements.

Franco-Nevada Asset Tabulation at March 19, 2014

|

|

|

Gold |

|

PGM |

|

Other |

|

Total |

|

Oil & |

|

TOTAL |

|

|

Producing |

|

38 |

|

3 |

|

6 |

|

47 |

|

137 |

|

184 |

|

|

Advanced |

|

29 |

|

0 |

|

6 |

|

35 |

|

— |

|

35 |

|

|

Exploration |

|

130 |

|

2 |

|

21 |

|

153 |

|

# |

(1) |

153 |

|

|

TOTAL |

|

197 |

|

5 |

|

33 |

|

235 |

|

137 |

|

372 |

|

(1) 160 undeveloped Oil & Gas agreements not included in asset counts.

Asset Revenue and Descriptions

The following table sets forth Franco-Nevada’s principal assets and revenue related to each. The table and following asset descriptions should be read with the following considerations:

· For presentation purposes, the table has simplified the details of some royalties and streams and should be read in conjunction with the more detailed descriptions of the assets that follow.

· The terminology and ranges of some of our interests have also been simplified for presentation purposes.

· Except where otherwise stated, information of a technical nature in the asset descriptions, including all of the mine information, is based solely on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as of March 10, 2014. None of this information has been independently verified by Franco-Nevada or its consultants. See “Technical and Third Party Information”.

· Each asset is described in a comparable manner as reported by the property owner or operator, unless otherwise noted. As a result, units of measurement and numbers of significant digits may not be consistent between asset descriptions.

· Except where otherwise stated, reserve and resource figures are for the calendar year ends.

· Some information publicly reported by owners or operators may relate to a larger property than the area covered by Franco-Nevada’s royalty or stream interest.

· Schematic representations of the properties are meant to be indicative of Franco-Nevada’s understanding of what it is permitted to publicly disclose of the positioning of its royalty or stream interests relative to current operations and should not be treated as fully scaled or complete representations from the operators of those projects.

The subsequent tables characterize the Revenue and Adjusted EBITDA from the Company’s assets by commodity, geography and type. The Company uses Revenue and Adjusted EBITDA as core financial metrics when evaluating performance. These tables set forth how the Company performed against these measures.

|

|

|

|

|

|

|

|

|

Revenue ($ millions) |

|

| |||||||

|

|

|

Asset |

|

Operator |

|

Interest and % |

|

2013 |

|

2012 |

|

2011 |

|

Notes | |||

|

G O L D |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

|

UNITED STATES |

|

Goldstrike |

|

Barrick Gold Corporation |

|

NSR 2-4%, NPI 2.4-6% |

|

$ |

21.2 |

|

$ |

55.7 |

|

$ |

45.0 |

|

1, 2, P |

|

|

Gold Quarry |

|

Newmont Mining |

|

NSR 7.29% |

|

20.7 |

|

18.6 |

|

17.9 |

|

1, 3, P | ||||

|

|

Marigold |

|

Silver Standard Resources |

|

NSR 1.75-5%, GR 0.5-4% |

|

8.8 |

|

10.9 |

|

10.3 |

|

1, 2, 3, 5, P | ||||

|

|

Fire Creek/Midas |

|

Klondex Mines Ltd. |

|

NSR 2.5%, Fixed to 2018 |

|

— |

|

— |

|

— |

|

3, Px2 | ||||

|

|

Bald Mountain |

|

Barrick Gold Corporation |

|

NSR/GR 0.875-5% |

|

3.8 |

|

8.8 |

|

3.9 |

|

1, 2, 3, 5, P | ||||

|

|

Mesquite |

|

New Gold Inc. |

|

NSR 0.5-2% |

|

2.3 |

|

3.9 |

|

4.8 |

|

2, P | ||||

|

|

Other (8 assets) |

|

|

|

|

|

2.3 |

|

3.8 |

|

5.5 |

|

8, Px3, Ax4 | ||||

|

CANADA |

|

Sudbury |

|

KGHM International Ltd. |

|

Stream 50% |

|

11.6 |

|

15.4 |

|

14.3 |

|

1, 7, P | |||

|

|

Golden Highway |

|

St Andrew Goldfields Ltd. |

|

NSR 2-15% |

|

12.5 |

|

14.3 |

|

10.8 |

|

3, 5, Px3 | ||||

|

|

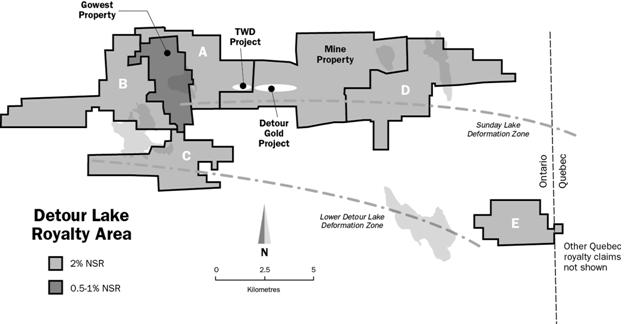

Detour Lake |

|

Detour Gold Corporation |

|

NSR 2% |

|

5.9 |

|

— |

|

— |

|

P | ||||

|

|

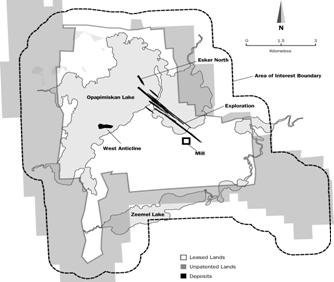

Musselwhite |

|

Goldcorp Inc. |

|

NPI 5% |

|

3.7 |

|

6.3 |

|

5.1 |

|

6, P | ||||

|

|

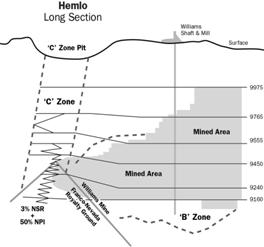

Hemlo |

|

Barrick Gold Corporation |

|

NSR 3%, NPI 50% |

|

3.1 |

|

7.5 |

|

1.4 |

|

1, 6, P | ||||

|

|

Kirkland Lake |

|

Kirkland Lake Gold Inc. |

|

NSR 2.5-5.5%, NPI 20% |

|

0.6 |

|

0.1 |

|

0.2 |

|

2, 3, P | ||||

|

|

Timmins West |

|

Lake Shore Gold Corp. |

|

NSR 2.25% |

|

3.2 |

|

2.0 |

|

— |

|

P | ||||

|

|

Other (9 assets) |

|

|

|

|

|

3.0 |

|

0.4 |

|

0.6 |

|

Px2, Ax6 | ||||

|

AUSTRALIA |

|

Duketon |

|

Regis Resources Ltd. |

|

NSR 2% |

|

7.9 |

|

5.3 |

|

3.1 |

|

1, P | |||

|

|

Henty |

|

Unity Mining Limited |

|

GR 1%/10%, Ounce-based |

|

1.1 |

|

2.7 |

|

4.5 |

|

2, P | ||||

|

|

Other (13 assets) |

|

|

|

|

|

0.7 |

|

3.6 |

|

1.9 |

|

Px5, Ax8 | ||||

|

REST OF WORLD |

|

Palmarejo |

|

Coeur Mining, Inc. |

|

Stream 50% |

|

83.5 |

|

96.0 |

|

101.9 |

|

3, 7, P | |||

|

|

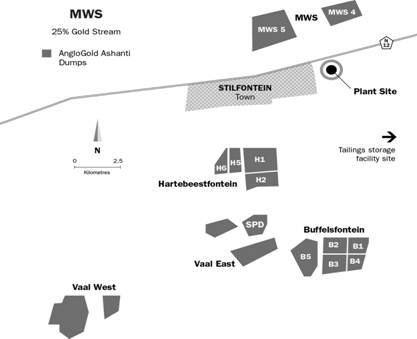

MWS |

|

AngloGold Ashanti Limited |

|

Stream 25% |

|

35.7 |

|

33.0 |

|

32.3 |

|

7, P | ||||

|

|

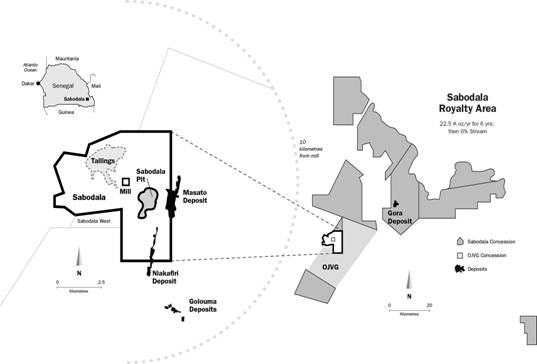

Sabodala |

|

Teranga Gold Corporation |

|

Stream 6%, Fixed to 2019 |

|

— |

|

— |

|

— |

|

3, P | ||||

|

|

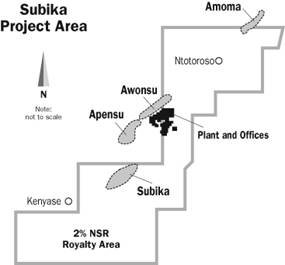

Subika |

|

Newmont Mining |

|

NSR 2% |

|

14.4 |

|

3.2 |

|

— |

|

1, P | ||||

|

|

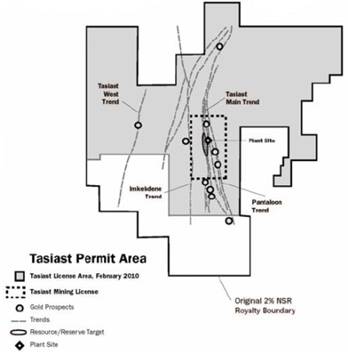

Tasiast |

|

Kinross Gold Corporation |

|

NSR 2% |

|

6.6 |

|

6.4 |

|

2.8 |

|

P | ||||

|

|

Edikan |

|

Perseus Mining Limited |

|

NSR 1.5% |

|

4.1 |

|

5.1 |

|

1.5 |

|

P | ||||

|

|

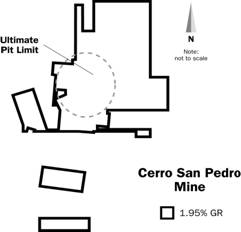

Cerro San Pedro |

|

New Gold Inc. |

|

GR 1.95% |

|

3.3 |

|

5.5 |

|

5.9 |

|

1, P | ||||

|

|

Cooke 4 |

|

Sibanye Gold Limited |

|

Stream 7% |

|

3.5 |

|

3.3 |

|

27.3 |

|

7, P | ||||

|

|

Cobre Panama |

|

First Quantum Minerals |

|

Streams (indexed) |

|

— |

|

— |

|

— |

|

A | ||||

|

|

Other (10 assets) |

|

|

|

|

|

6.4 |

|

8.8 |

|

5.8 |

|

Px2; Ax8 | ||||

|

|

|

130 Exploration Assets |

|

|

|

|

|

— |

|

— |

|

— |

|

E | |||

|

|

|

|

|

|

|

|

|

$ |

269.9 |

|

$ |

320.6 |

|

$ |

306.8 |

|

|

|

P G M |

|

|

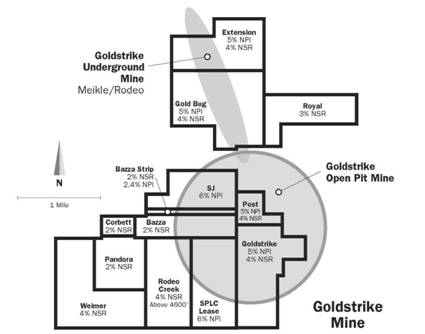

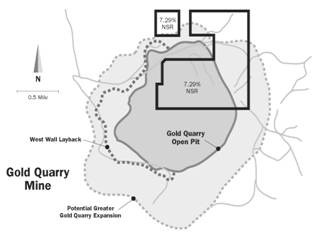

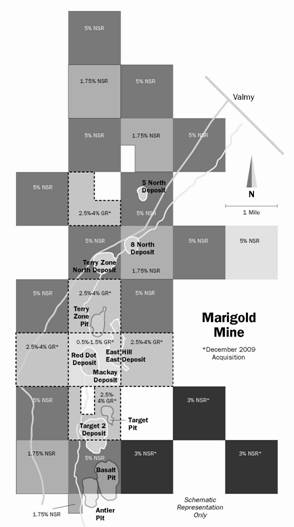

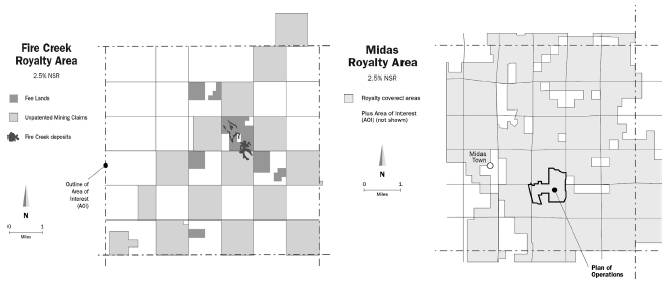

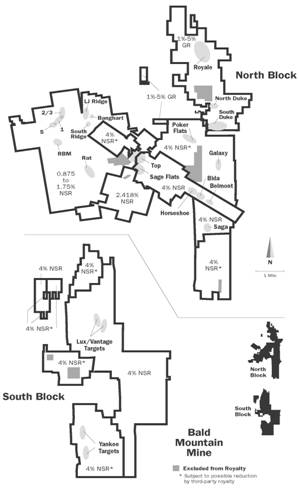

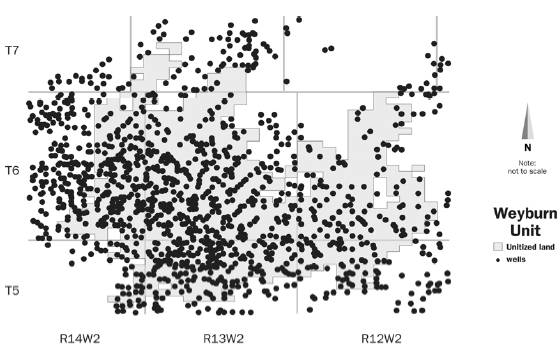

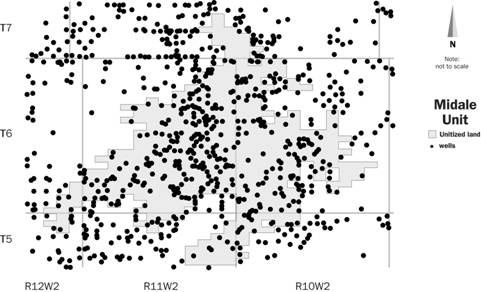

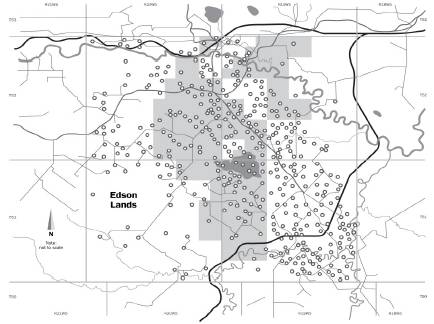

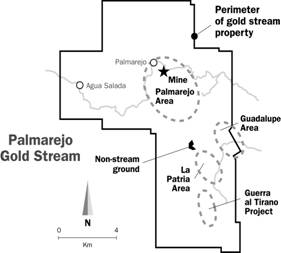

|