UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

ý Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2016

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________ to __________

Commission File No. 0-18958

Grote Molen, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

20-1282850

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

322 West Griffith Road

|

||

|

Pocatello, Idaho 83201

|

||

|

(Address of principal executive offices, including zip code)

|

||

|

(208) 234-9352

|

||

|

(Registrant's telephone number, including area code)

|

||

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

Smaller reporting company ý

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

As of August 15, 2016, there were 22,200,000 shares of the Registrant's common stock, $0.001 par value per share, outstanding.

GROTE MOLEN, INC. AND SUBSIDIARY

FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2016

PART I - Financial Information

|

Item 1. Financial Statements

|

||

|

Condensed Consolidated Balance Sheets as of June 30, 2016 and December 31, 2015 (unaudited)

|

2

|

|

|

Condensed Consolidated Statements of Operations for the Three Months and Six Months Ended June 30, 2016 and 2015 (unaudited)

|

3

|

|

|

Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2016 and 2015 (unaudited)

|

4

|

|

|

Notes to Condensed Consolidated Financial Statements (unaudited)

|

5

|

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

|

10

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

16

|

|

|

Item 4. Controls and Procedures

|

16

|

|

|

PART II - Other Information

|

||

|

Item 1. Legal Proceedings

|

17

|

|

|

Item 1A. Risk Factors

|

17

|

|

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

|

17

|

|

|

Item 3. Defaults upon Senior Securities

|

17

|

|

|

Item 5. Other Information

|

17

|

|

|

Item 6. Exhibits

|

18

|

|

|

Signatures

|

19

|

|

1

|

GROTE MOLEN, INC. AND SUBSIDIARY

|

||||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

||||||||

|

(UNAUDITED)

|

||||||||

|

June 30,

2016 |

December 31,

2015

|

|||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$

|

13,552

|

$

|

9,251

|

||||

|

Accounts receivable

|

25,670

|

27,565

|

||||||

|

Accounts receivable – related parties

|

5,035

|

11,365

|

||||||

|

Inventories

|

864,581

|

708,893

|

||||||

|

Deposits

|

100,400

|

64,685

|

||||||

|

Prepaid expenses

|

403

|

356

|

||||||

|

Total current assets

|

1,009,641

|

822,115

|

||||||

|

Property and equipment, net

|

131,272

|

139,688

|

||||||

|

Intangible assets, net

|

62,820

|

63,068

|

||||||

|

Total assets

|

$

|

1,203,733

|

$

|

1,024,871

|

||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

89,904

|

$

|

73,020

|

||||

|

Accounts payable – related parties

|

3,897

|

1,950

|

||||||

|

Accrued interest payable – related parties

|

61,888

|

53,507

|

||||||

|

Accrued interest payable

|

28,085

|

22,686

|

||||||

|

Current portion of long-term debt – related party

|

-

|

2,943

|

||||||

|

Notes payable – related parties

|

364,399

|

130,127

|

||||||

|

Notes payable

|

167,600

|

136,100

|

||||||

|

Total current liabilities

|

715,773

|

420,333

|

||||||

|

Long-term debt:

|

||||||||

|

Note payable

|

145,928

|

145,139

|

||||||

|

Total long-term debt

|

145,928

|

145,139

|

||||||

|

Total liabilities

|

861,701

|

565,472

|

||||||

|

Stockholders' equity:

|

||||||||

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no shares issued and outstanding

|

-

|

-

|

||||||

|

Common stock, $.001 par value, 100,000,000 shares authorized, 22,200,000 shares issued and outstanding

|

22,200

|

22,200

|

||||||

|

Additional paid-in capital

|

147,800

|

147,800

|

||||||

|

Retained earnings

|

172,032

|

289,399

|

||||||

|

Total stockholders' equity

|

342,032

|

459,399

|

||||||

|

Total liabilities and stockholders' equity

|

$

|

1,203,733

|

$

|

1,024,871

|

||||

See notes to condensed consolidated financial statements

2

|

GROTE MOLEN, INC. AND SUBSIDIARY

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(UNAUDITED)

|

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

|

2016

|

2015

|

2016

|

2015

|

|||||||||||||

|

Revenues:

|

||||||||||||||||

|

Sales

|

$

|

289,383

|

$

|

280,018

|

$

|

458,055

|

$

|

582,194

|

||||||||

|

Sales to related parties

|

12,960

|

11,456

|

16,580

|

26,045

|

||||||||||||

|

Total revenues

|

302,343

|

291,474

|

474,635

|

608,239

|

||||||||||||

|

Cost of revenues:

|

||||||||||||||||

|

Cost of sales

|

203,610

|

197,785

|

326,071

|

412,633

|

||||||||||||

|

Cost of related party sales

|

9,175

|

8,092

|

11,803

|

18,460

|

||||||||||||

|

Total cost of revenues

|

212,785

|

205,877

|

337,874

|

431,093

|

||||||||||||

|

Gross profit

|

89,558

|

85,597

|

136,761

|

177,146

|

||||||||||||

|

Operating costs and expenses:

|

||||||||||||||||

|

Selling, general and administrative

|

110,383

|

112,552

|

228,439

|

222,430

|

||||||||||||

|

Depreciation and amortization

|

4,208

|

4,536

|

8,664

|

9,074

|

||||||||||||

|

Total operating costs and expenses

|

114,591

|

117,088

|

237,103

|

231,504

|

||||||||||||

|

Loss from operations

|

(25,033

|

)

|

(31,491

|

)

|

(100,342

|

)

|

(54,358

|

)

|

||||||||

| Other expense: | ||||||||||||||||

|

Interest expense – related parties

|

6,612

|

5,474

|

8,532

|

9,997

|

||||||||||||

|

Interest expense

|

4,405

|

1,990

|

8,493

|

3,680

|

||||||||||||

|

Total other expense

|

11,017

|

7,464

|

17,025

|

13,677

|

||||||||||||

|

Loss before income taxes

|

(36,050

|

)

|

(38,955

|

)

|

(117,367

|

)

|

(68,035

|

)

|

||||||||

|

Income tax (provision) benefit

|

-

|

(34

|

)

|

-

|

(34

|

)

|

||||||||||

|

Net loss

|

$

|

(36,050

|

)

|

$

|

(38,989

|

)

|

$

|

(117,367

|

)

|

$

|

(68,069

|

)

|

||||

|

Net loss per common share -

|

||||||||||||||||

|

Basic and diluted

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

||||

|

Weighted average shares outstanding -

|

||||||||||||||||

|

Basic and diluted

|

22,200,000

|

22,200,000

|

22,200,000

|

22,200,000

|

||||||||||||

See notes to condensed consolidated financial statements

3

|

GROTE MOLEN, INC. AND SUBSIDIARY

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(UNAUDITED)

|

|

Six Months Ended

June 30, |

||||||||

|

2016

|

2015

|

|||||||

|

Net loss

|

$

|

(117,367

|

)

|

$

|

(68,069

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Depreciation and amortization

|

8,664

|

9,074

|

||||||

|

(Increase) decrease in:

|

||||||||

|

Accounts receivable

|

1,895

|

(9,050

|

)

|

|||||

|

Accounts receivable – related parties

|

6,330

|

32,008

|

||||||

|

Inventories

|

(155,688

|

)

|

(187,084

|

)

|

||||

|

Deposits

|

(35,715

|

)

|

152,405

|

|||||

|

Prepaid expenses

|

(47

|

)

|

4

|

|||||

|

Increase (decrease) in:

|

||||||||

|

Accounts payable and accrued expenses

|

16,884

|

22,781

|

||||||

|

Accounts payable – related parties

|

1,947

|

900

|

||||||

|

Accrued interest payable – related parties

|

8,381

|

4,579

|

||||||

|

Accrued interest payable

|

5,399

|

4,391

|

||||||

|

Net cash used in operating activities

|

(259,317

|

)

|

(38,061

|

)

|

||||

|

Cash flows from investing activities

|

-

|

-

|

||||||

|

Net cash used in investing activities

|

-

|

-

|

||||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from long-term note payable

|

5,300

|

22,000

|

||||||

|

Proceeds from notes payable – related parties

|

300,000

|

-

|

||||||

|

Proceeds from notes payable

|

31,500

|

30,000

|

||||||

|

Repayment of notes payable – related parties

|

(65,728

|

)

|

(15,500

|

)

|

||||

|

Repayment of long-term debt – related party

|

(2,943

|

)

|

(22,490

|

)

|

||||

|

Repayment of long-term note payable

|

(4,511

|

)

|

(14,559

|

)

|

||||

|

Net cash provided by (used in) financing activities

|

263,618

|

(549

|

)

|

|||||

|

Net increase (decrease) in cash

|

4,301

|

(38,610

|

)

|

|||||

|

Cash, beginning of the period

|

9,251

|

60,808

|

||||||

|

Cash, end of the period

|

$

|

13,552

|

$

|

22,198

|

||||

See notes to condensed consolidated financial statements

4

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2016

(UNAUDITED)

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNICANT ACCOUNTING POLICIES

Organization

Grote Molen, Inc. ("Grote Molen") was incorporated under the laws of the State of Nevada on March 15, 2004. BrownWick, LLC ("BrownWick"), a wholly owned subsidiary, was formed in the State of Idaho on June 5, 2005. The principal business of Grote Molen and BrownWick (collectively the "Company") is to distribute grain mills, kitchen mixers and related accessories for home use.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of Grote Molen and BrownWick. All significant inter-company balances and transactions have been eliminated.

Basis of Presentation

The accompanying condensed consolidated financial statements as of June 30, 2016 and for the three months and six months ended June 30, 2016 and 2015 are unaudited. In the opinion of management, all adjustments have been made, consisting of normal recurring items, that are necessary to present fairly the consolidated financial position as of June 30, 2016 as well as the consolidated results of operations for the three months and six months ended June 30, 2016 and cash flows for the six months ended June 30, 2016 and 2015 in accordance with U.S. generally accepted accounting principles. The results of operations for any interim period are not necessarily indicative of the results expected for the full year. The interim condensed consolidated financial statements and related notes thereto should be read in conjunction with the audited consolidated financial statements and related notes thereto for the year ended December 31, 2015.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Earnings Per Share

The computation of basic earnings per common share is based on the weighted average number of shares outstanding during the period.

The computation of diluted earnings per common share is based on the weighted average number of shares outstanding during the period plus the common stock equivalents which would arise from the exercise of stock options and warrants outstanding using the treasury stock method and the average market price per share during the period. Common stock equivalents are not included in the diluted earnings per share calculation when their effect is anti-dilutive. We have not granted any stock options or warrants since inception of the Company. Therefore, our basic earnings per share is the same as diluted earnings per share for the three months and six months ended June 30, 2016 and 2015.

5

Comprehensive Income (Loss)

Comprehensive income (loss) is the same as net income (loss).

NOTE 2 – DETAIL OF CERTAIN BALANCE SHEET ACCOUNTS

Accounts receivable consist of the following:

|

June 30,

2016 |

December 31,

2015 |

|||||||

|

Trade accounts receivable – related parties

|

$

|

35

|

$

|

6,365

|

||||

|

Employee advances

|

5,000

|

5,000

|

||||||

|

Total accounts receivable – related parties

|

5,035

|

11,365

|

||||||

|

Trade accounts receivable

|

25,670

|

27,565

|

||||||

|

$

|

30,705

|

$

|

38,930

|

|||||

Property and equipment consist of the following:

|

June 30,

2016 |

December 31,

2015 |

|||||||

|

Office equipment

|

$

|

4,335

|

$

|

4,335

|

||||

|

Warehouse equipment

|

16,927

|

16,927

|

||||||

|

Website development

|

2,000

|

2,000

|

||||||

|

Molds

|

150,615

|

150,615

|

||||||

|

173,877

|

173,877

|

|||||||

|

Accumulated depreciation

|

(42,605

|

)

|

(34,189

|

)

|

||||

|

$

|

131,272

|

$

|

139,688

|

|||||

Intangible assets consist of the following:

|

June 30,

2016 |

December 31,

2015 |

|||||||

|

License – definite lived

|

$

|

10,500

|

$

|

10,500

|

||||

|

License – indefinite lived

|

62,720

|

62,720

|

||||||

|

Patent

|

100

|

100

|

||||||

|

73,320

|

73,320

|

|||||||

|

Accumulated amortization

|

(10,500

|

)

|

(10,252

|

)

|

||||

|

$

|

62,820

|

$

|

63,068

|

|||||

6

Notes payable – related parties are unsecured and are comprised of the following:

|

June 30,

2016 |

December 31,

2015 |

|||||||

|

Note payable to a stockholder, due on demand, with interest at 6% per annum

|

$

|

30,000

|

$

|

30,000

|

||||

|

Note payable to a stockholder, due on demand, with interest at 6% per annum

|

3,500

|

3,500

|

||||||

|

Note payable to a stockholder, due on demand, with interest at 6% per annum

|

38,000

|

38,000

|

||||||

|

Note payable to a stockholder, due on demand, with interest at 6% per annum

|

10,000

|

10,000

|

||||||

|

Note payable to a stockholder, due on demand, with interest at 6% per annum

|

5,000

|

5,000

|

||||||

|

Note payable to a stockholder, due on demand, with interest at 8% per annum

|

9,000

|

9,000

|

||||||

|

Note payable to a stockholder, due on demand, with interest at 8% per annum

|

15,000

|

15,000

|

||||||

|

Note payable to a stockholder, due on demand, with interest at 8% per annum

|

2,000

|

10,500

|

||||||

|

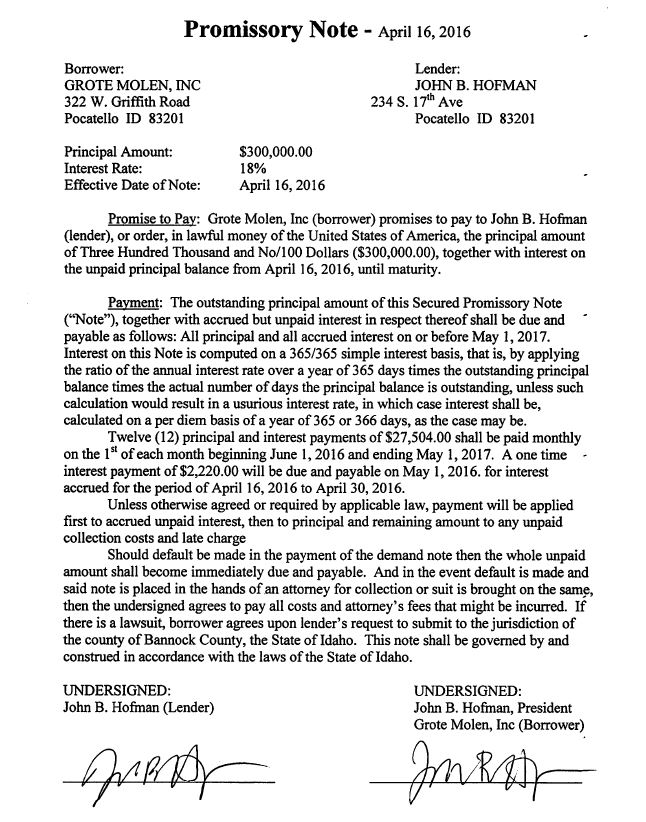

Note payable to a stockholder, due May 1, 2017, with interest at 18% per annum, payable in 12 monthly payments of $27,504

|

242,772

|

|||||||

|

Non-interest bearing advances from stockholders, with no formal repayment terms

|

9,127

|

9,127

|

||||||

|

Total

|

$

|

364,399

|

$

|

130,127

|

||||

Long-term debt – related party is comprised of the following:

|

June 30,

2016 |

December 31,

2015 |

|||||||

|

Note payable to a stockholder, due in monthly installments of $4,000 through February 2016, with interest at 6.97 % per annum

|

$

|

-

|

$

|

2,943

|

||||

|

Less current portion

|

-

|

(2,943

|

)

|

|||||

|

Long-term portion

|

$

|

-

|

$

|

-

|

||||

Interest expense on related party debt was $6,612 and $5,474 for the three months ended June 30, 2016 and 2015 and $8,532 and $9,997 for the six months ended June 30, 2016 and 2015, respectively. Accrued interest payable to related parties was $61,888 and $53,507 at June 30, 2016 and December 31, 2015, respectively.

7

NOTE 4 – NOTES PAYABLE

Short-term notes payable to non-related parties are unsecured and are comprised of the following:

|

June 30,

2016 |

December 31,

2015 |

|||||||

|

Note payable, due on demand, with interest at 8% per annum

|

$

|

15,000

|

$

|

15,000

|

||||

|

Note payable, due on demand, with interest at 8% per annum

|

20,000

|

20,000

|

||||||

|

Note payable, due on demand, with interest at 8% per annum

|

5,000

|

5,000

|

||||||

|

Note payable, due on demand, with interest at 8% per annum

|

7,000

|

7,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

15,000

|

15,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

10,000

|

10,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

4,000

|

4,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

5,600

|

5,600

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

10,000

|

10,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

10,000

|

10,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

10,000

|

10,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

10,000

|

10,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

2,500

|

2,500

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

9,000

|

9,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

3,000

|

3,000

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

20,000

|

-

|

||||||

|

Note payable, due on demand, with interest at 6% per annum

|

5,000

|

-

|

||||||

|

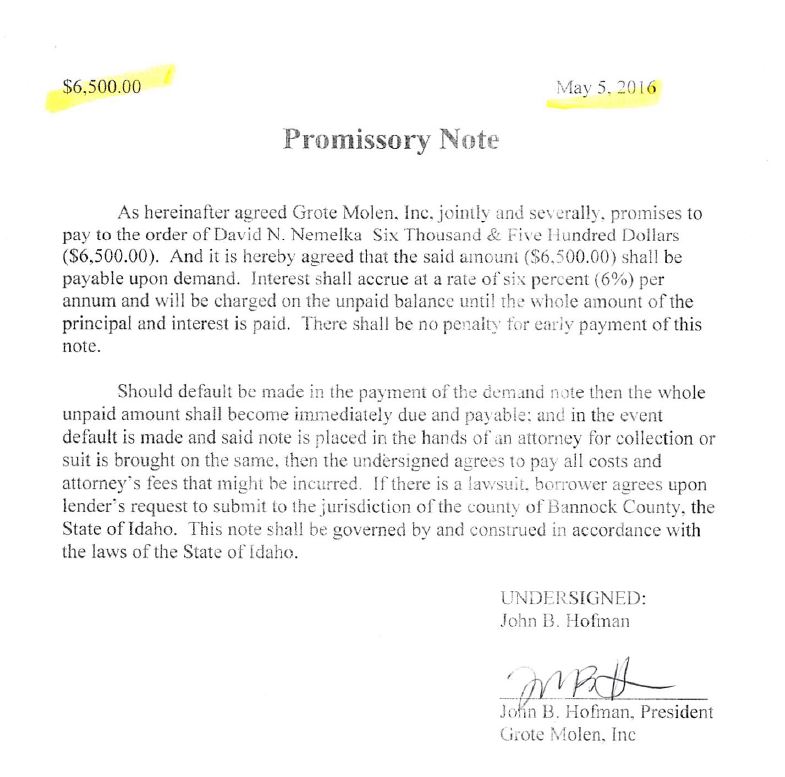

Note payable, due on demand, with interest at 6% per annum

|

6,500

|

-

|

||||||

|

Total

|

$

|

167,600

|

$

|

136,100

|

||||

8

At June 30, 2016 and December 31, 2015, we had a long-term note payable to a bank with a principal balance of $145,928 and $145,139, respectively. The long-term note payable is a line of credit promissory note bearing interest at an indexed rate plus 2% (4.50% at June 30, 2016), requiring monthly interest payments only, and maturing on May 16, 2021. The note payable has a maximum line of credit of $150,000, and is secured by a deed of trust on certain real estate owned by one of the principal stockholders of the Company and by the Company's inventories, property and equipment, and intangible assets.

Accrued interest payable on notes payable was $28,085 and $22,686 at June 30, 2016 and December 31, 2015, respectively.

NOTE 5 – RELATED PARTY TRANSACTIONS

Pursuant to an agreement effective in February 2011, we pay a monthly management fee to a company owned by one of the major stockholders of the Company to manage our day-to-day business activities and to provide business space. Historically we have paid monthly management fees in varying amounts to this related party pursuant to prior agreements approved by the stockholders of the Company. The agreement is on a month-to-month basis and can be cancelled at any time by the vote of management. The agreement was amended and restated on October 31, 2014 to increase the fee to $12,500 effective November 1, 2014. Also included in management fees are monthly payments of $150 to another major stockholder of the Company for expense reimbursement. Included in selling, general and administrative expenses were management fees totaling $37,950 for each of the three-month periods ended June 30, 2016 and 2015 and $75,900 for each of the six-month periods ended June 30, 2016 and 2015.

Each of the two principal stockholders of the Company owns a company that is our customer. Sales to these related parties totaled $12,960 and $11,456 for the three months ended June 30, 2016 and 2015, respectively, or approximately 4% and 4%, respectively. Sales to these related parties totaled $16,580 and $26,045 for the six months ended June 30, 2016 and 2015, respectively, or approximately 3% and 4%, respectively. Accounts receivable from these related parties totaled $35 and $6,365 at June 30, 2016 and December 31, 2015, respectively.

Accounts payable to these related parties totaled $3,897 and $1,950 at June 30, 2016 and December 31, 2015, respectively.

See Note 3 for discussion of related party debt and interest expense.

NOTE 6 – CAPITAL STOCK

The Company's preferred stock may have such rights, preferences and designations and may be issued in such series as determined by our Board of Directors. No shares of preferred stock were issued and outstanding at June 30, 2016 and December 31, 2015.

NOTE 7 – SUPPLEMENTAL STATEMENT OF CASH FLOWS INFORMATION

During the six months ended June 30, 2016 and 2015, we had no non-cash financing and investing activities.

During the six months ended June 30, 2016 and 2015, we paid cash for income taxes of $0 and $34, respectively.

During the six months ended June, 2016 and 2015, we paid cash for interest of $3,006 and $4,707, respectively.

NOTE 8 – SIGNIFICANT CUSTOMERS

In addition to the sales to related parties discussed in Note 5, we had sales to one customer that accounted for approximately 12% and 9% of total sales for the six months ended June 30, 2016 and 2015, respectively.

NOTE 9 – RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

There were no new accounting pronouncements issued during the six months ended June 30, 2016 and through the date of this filing that we believe are applicable to or would have a material impact on the consolidated financial statements of the Company.

NOTE 10 – SUBSEQUENT EVENTS

We have evaluated events occurring after the date of our accompanying consolidated balance sheets through the date the financial statements were issued and have identified the following subsequent events that we believe require disclosure.

On July 15, 2016, we received proceeds of $50,000 from an unsecured promissory note payable to an unrelated party. The note is payable on demand and bears interest at an annual rate of 6%. The proceeds from the note were primarily used to retire other notes payable and related accrued interest payable.

On August 9, 2016, we received proceeds of $10,000 from an unsecured promissory note payable to an unrelated party. The note is payable on demand and bears interest at an annual rate of 6%.

9

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. These statements reflect the Company's views with respect to future events based upon information available to it at this time. These forward-looking statements are subject to certain uncertainties and other factors that could cause actual results to differ materially from these statements. These uncertainties and other factors include, but are not limited to the risk factors described in our Annual Report on Form 10-K for the year ended December 31, 2015 in Part I, Item 1A under the caption "Risk Factors." The words "anticipates," "believes," "estimates," "expects," "plans," "projects," "targets" and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, changes in assumptions, future events or otherwise.

You should read the following discussion in conjunction with our condensed consolidated financial statements, which are included elsewhere in this report. The following information contains forward-looking statements. (See "Forward-Looking Statements" and "Risk Factors.")

General

Grote Molen, Inc. ("Grote Molen") was incorporated under the laws of the State of Nevada on March 15, 2004. BrownWick, LLC ("BrownWick"), a wholly owned subsidiary, was formed in the State of Idaho on June 5, 2005. The principal business of Grote Molen and BrownWick (collectively the "Company") is to distribute electrical and hand operated grain mills, kitchen mixers and related accessories for home use.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported in the financial statements, including the notes thereto, and related disclosures of commitments and contingencies, if any. We consider our critical accounting policies to be those that require the more significant judgments and estimates in the preparation of financial statements, including the following:

Accounts Receivable

Trade accounts receivable are carried at original invoice amount less an estimate made for doubtful accounts. We determine the allowance for doubtful accounts by identifying potential troubled accounts and by using historical experience and future expectations applied to an aging of accounts. Trade accounts receivable are written off when deemed uncollectible. Recoveries of trade accounts receivable previously written off are recorded as income when received. We determined that no allowance for doubtful accounts was required at June 30, 2016 and December 31, 2015.

Inventories

Inventories, consisting primarily of grain mills, kitchen mixers, parts and accessories, are stated at the lower of cost or market, with cost determined using primarily the first-in-first-out (FIFO) method. We purchase substantially all inventories from two foreign suppliers, and have been dependent on those suppliers for substantially all inventory purchases since we commenced operations.

10

Deposits

At times, we are required to pay advance deposits toward the purchase of inventories from our principal suppliers. Such advance payments are recorded as deposits, a current asset in the accompanying consolidated financial statements.

Property and Equipment

Property and equipment are carried at cost, less accumulated depreciation. Depreciation is computed using the straight-line method based on the estimated useful lives of the assets, which range from 3 to 10 years. When assets are retired or otherwise disposed of, the cost and related accumulated depreciation are removed and any resulting gain or loss is recognized in operations for the period. The cost of maintenance and repairs is charged to operations as incurred. Significant renewals and betterments are capitalized.

Intangible Assets

Intangible assets are recorded at cost, less accumulated amortization. Amortization of definitive lived intangible assets is computed using the straight-line method based on the estimated useful lives or contractual lives of the assets, which range from 10 to 30 years.

Impairment of Long-Lived Assets

We periodically review our long-lived assets, including intangible assets, for impairment when events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. No events or changes in circumstances have occurred to indicate that the carrying amount of our long-lived assets may not be recoverable. Therefore, no impairment loss was recognized during the three months and six months ended June 30, 2016 and 2015.

Revenue Recognition

We record revenue from the sales of grain mills, kitchen mixers and accessories in accordance with the underlying sales agreements when the products are shipped, the selling price is fixed and determinable, and collection is reasonably assured.

Warranties

We provide limited warranties to our customers for certain of our products sold. We perform warranty work at our service center in Pocatello, Idaho or at other authorized service locations. Warranty expenses have not been material to our consolidated financial statements.

11

Income Taxes

We account for income taxes in accordance with FASB ASC Topic 740, Income Taxes, using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

FASB ASC Topic 740, Income Taxes, requires us to determine whether it is more likely than not that a tax position will be sustained upon examination based upon the technical merits of the position. If the more-likely-than-not threshold is met, we must measure the tax position to determine the amount to recognize in our consolidated financial statements. We performed a review of our material tax positions in accordance with recognition and measurement standards established by ASC Topic 740 and concluded we had no unrecognized tax benefit that would affect the effective tax rate if recognized for the three months and six months ended June 30, 2016 and 2015.

We include interest and penalties arising from the underpayment of income taxes, if any, in our consolidated statements of operations in general and administrative expenses. As of June 30, 2016 and December 31, 2015, we had no accrued interest or penalties related to uncertain tax positions.

Fair Value of Financial Instruments

Our financial instruments consist of cash, accounts receivable, accounts payable and notes payable. The carrying amount of cash, accounts receivable and accounts payable approximates fair value because of the short-term nature of these items. We believe the carrying amount of the notes payable approximates fair value because the interest rates on the notes approximate market rates of interest.

Results of Operations

Sales

Our business is not seasonal; however, our quarterly sales, including sales to related parties, may fluctuate materially from period to period. At times, we derive a significant portion of our revenues from sales to related parties. Each of our two principal stockholders owns a company that may be a significant customer. Our sales were comprised of the following:

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

|

2016

|

2015

|

2016

|

2015

|

|||||||||||||

|

Sales

|

$

|

289,383

|

$

|

280,018

|

$

|

458,055

|

$

|

582,194

|

||||||||

|

Sales – related parties

|

12,960

|

11,456

|

16,580

|

26,045

|

||||||||||||

|

|

||||||||||||||||

|

Total sales

|

$

|

302,343

|

$

|

291,474

|

$

|

474,635

|

$

|

608,239

|

||||||||

Sales to related parties totaled approximately 4% and 4% of total sales for the three months ended June 30, 2016 and 2015, and approximately 3% and 4% of total sales for the six months ended June 30, 2016 and 2015, respectively.

Our total sales increased $10,869, or approximately 4%, during the three months ended June 30, 2016 compared to the three months ended June 30, 2015. On a year-to-date basis, however, our total sales decreased $133,604, or approximately 22%, during the six months ended June 30, 2016 compared to the six months ended June 30, 2015. While we experienced an increase in sales in 2015 attributable to the successful introduction of our new WonderMix kitchen mixer, we believe year-to-date sales in 2016 were negatively impacted by a continuing overall slow-down in the preparedness market and a prolonged slow economic recovery in the United States. We believe sales of the Wondermix will also increase in 2016; however, there can be no assurance that we will be successful in these endeavors.

12

Cost of Sales

Total cost of sales for the three months ended June 30, 2016 was $212,785, compared to $205,877 for the three months ended June 30, 2015, an increase of $6,908, or approximately 3%. On a year-to-date basis, total cost of sales for the six months ended June 30, 2016 was $337,874, compared to $431,093 for the six months ended June 30, 2015, a decrease of $93,219, or approximately 22%. Our cost of sales consists of the purchase price of our products incurred to our suppliers plus inbound shipping costs. We do not manufacture our own products. Our costs to purchase products for resale remained relatively constant during the first six months of 2016. Therefore, the increase in our cost of sales during the three months ended June 30, 2016 compared to the three months ended June 30, 2015 was primarily attributed to the increase in sales volume, and the decrease in our cost of sales during the six months ended June 30, 2016 compared to the six months ended June 30, 2015 was primarily attributed to the decrease in sales volume. Included in cost of sales were costs of related party sales of $9,175 and $8,092 for the three months ended June 30, 2016 and 2015, and $11,803 and $18,460 for the six months ended June 30, 2016 and 2015, respectively. Total cost of sales as a percentage of total sales was approximately 70% and 71% for the three months ended June 30, 2016 and 2015, and approximately 71% and 71% for the six months ended June 30, 2016 and 2015, respectively.

Cost of sales as a percentage of sales may fluctuate from period to period, based on the mix of products sold during a particular period and pricing arrangements with our suppliers. In addition, we purchase substantially all inventories from two foreign suppliers, and have been dependent on those suppliers for substantially all inventory purchases since we commenced operations. International manufacturing is subject to factors that can have a material impact on our costs of sales, including: availability of labor at costs consistent with historical levels; changes in labor or other laws; instability of social, political and economic factors; freight costs, including domestic and international customs and tariffs; unexpected changes in regulatory environments; costs and availability of manufacturing materials; and other factors.

Selling, General and Administrative Expenses

Selling general and administrative expenses remained relatively constant in 2016 compared to 2015. Our selling, general and administrative expenses were $110,383 for the three months ended June 30, 2016, compared to $112,552 for the three months ended June 30, 2015, a decrease of $2,169, or approximately 2%. Our selling, general and administrative expenses were $228,439 for the six months ended June 30, 2016, compared to $222,430 for the six months ended June 30, 2015, an increase of $6,009, or approximately 3%.

Pursuant to an agreement effective in February 2011, we pay a monthly management fee to a company owned by one of the major stockholders of the Company to manage our day-to-day business activities and to provide business space. Historically we have paid monthly management fees in varying amounts to this related party pursuant to prior agreements. The agreement is on a month-to-month basis and can be cancelled at any time by the vote of management. The agreement was amended and restated on October 31, 2014 to increase the monthly fee to $12,500 effective November 1, 2014. Also included in management fees are monthly payments of $150 to another major stockholder of the Company for expense reimbursement. Included in selling, general and administrative expenses were management fees to related parties totaling $37,950 for each of the three-month periods ended June 30, 2016 and 2015 and $75,900 for each of the six-month periods ended June 30, 2016 and 2015.

13

Depreciation and Amortization Expense

Depreciation and amortization expense remained fairly constant and was $4,208 and $4,536 for the three months ended June 30, 2016 and 2015, and $8,664 and $9,074 for the six months ended June 30, 2016 and 2015, respectively.

Other Expense: Interest Expense

Other expense includes interest expense on our indebtedness, a significant portion of which is indebtedness to related parties. Total interest expense – related parties was $6,612 and $5,474 for the three months ended June 30, 2016 and 2015, and $8,532 and $9,997 for the six months ended June 30, 2016 and 2015, respectively. The increase in interest expense in the quarter ended June 30, 2016 was attributed to a new 18%, $300,000 promissory note from a related party in April 2016. The decrease in interest expense to related parties on a year-to-date basis in the current year is due to the repayment in full of the long-term debt to related parties and a partial payment of notes payable – related parties during the six months ended June 30, 2016, partially offset by additional interest attributed to the $300,000 promissory note in April 2016.

Other expense also includes interest expense to non-related parties of $4,405 and $1,990 for the three months ended June 30, 2016 and 2015 and $8,493 and $3,680 for the six months ended June 30, 2016 and 2015, respectively. The increase in interest expense to non-related parties in 2016 is primarily due to additional notes payable to non-related parties in 2015 and 2016.

Liquidity and Capital Resources

As of June 30, 2016, we had total current assets of $1,009,641, including cash of $13,552, and current liabilities of $715,773, resulting in working capital of $293,868. Our current assets and working capital included inventories of $864,581 and deposits of $100,400. Generally, we are required to pay significant advance deposits toward the purchase of inventories from our principal suppliers.

In addition, as of June 30, 2016, we had total stockholders' equity of $342,032. We have financed our operations, the acquisition of inventories, and the payment of vendor deposits from our operations, short-term loans from our principal stockholders and non-related parties, a long-term note payable from a bank, and from the issuance of our common stock. In April 2016, we borrowed $300,000 from a principal stockholder.

For the six months ended June 30, 2016, net cash used in operating activities was $259,317, as a result of our net loss of $117,367 and increases in inventories of $155,688, deposits of $35,715 and prepaid expenses of $47, partially offset by non-cash expenses of $8,664, decreases in accounts receivable of $1,895 and accounts receivable – related parties of $6,330, and increases in accounts payable and accrued expenses of $16,884, accounts payable – related parties of $1,947, accrued interest payable – related parties of $8,381 and accrued interest payable of $5,399.

By comparison, for the six months ended June 30, 2015, net cash used in operating activities was $38,061, as a result of our net loss of $68,069 and increases in accounts receivable of $9,050 and inventories of $187,084, offset by non-cash expenses of $9,074, decreases in accounts receivable – related parties of $32,008, deposits of $152,405 and prepaid expenses of $4, and increases in accounts payable and accrued expenses of $22,781, accounts payable – related parties of $900, accrued interest payable – related parties of $4,579 and accrued interest payable of $4,391.

14

We had no net cash provided by or used in investing activities for the six months ended June 30, 2016 and 2015.

For the six months ended June 30, 2016, net cash provided by financing activities was $263,618, comprised of proceeds from long-term note payable of $5,300, proceeds from notes payable – related parties of $300,000 and proceeds from notes payable of $31,500, partially offset by repayment of notes payable – related parties of $65,728, repayment of long-term debt – related party of $2,943 and repayment of long-term note payable of $4,511.

For the six months ended June 30, 2015, net cash used in financing activities was $549, comprised of proceeds from long-term note payable of $22,000 and proceeds from notes payable of $30,000, offset by repayment of notes payable – related parties of $15,500, repayment of long-term debt – related party of $22,490 and repayment of long-term note payable of $14,559.

At June 30, 2016, we had short-term notes payable – related parties totaling $364,399, which are payable to our principal stockholders, are unsecured, bear interest at rates ranging from 6% to 18% per annum and are generally due on demand. In April 2016, we borrowed $300,000 from a principal stockholder. The note bears interest at 18% and is payable in 12 monthly payments of $27,504 through May 2017. The note had a balance of $242,772 as of June 30, 2016.

In addition, at June 30, 2016, we had short-term notes payable to non-related parties totaling $167,600, which are unsecured, bear interest at rates ranging from 6% to 8% per annum and are due on demand.

At December 31, 2015, our long-term debt – related party was comprised of the remaining principal balance of $2,943 of a note payable to a principal stockholder. The note was paid in full in February 2016.

At June 30, 2016, we had a long-term note payable to a bank with a principal balance of $145,928. The long-term note payable is a line of credit promissory note bearing interest at an indexed rate plus 2% (4.5% at June 30, 2016), requiring monthly interest payments only and maturing on May 16, 2021. For the past several months, we have made monthly payments of principal and interest in varying amounts. The note payable has a maximum line of credit of $150,000 and is secured by a deed of trust on certain real estate owned by one of the principal stockholders of the Company and by the Company's inventories, property and equipment, and intangible assets.

Accrued interest payable – related parties was $61,888 and $53,507 at June 30, 2016 and December 31, 2015, respectively. Accrued interest payable to non-related parties was $28,085 and $22,686 at June 30, 2016 and December 31, 2015, respectively.

In the event sales during 2016 do not meet our expectations, we may require additional funding from the sale of our common stock or debt in order to meet our obligations. Depending on the requirement to pay advance deposits on orders from our suppliers, we estimate we may require $50,000 to $100,000 of additional funding in 2016. No assurances can be given that, if required, such funding will be available to us on acceptable terms or at all.

15

Recent Accounting Pronouncements

There were no new accounting pronouncements issued during the six months ended June 30, 2016 and through the date of this filing that we believe are applicable to or would have a material impact on the consolidated financial statements of the Company.

Off-Balance Sheet Arrangements

Pursuant to an agreement effective in February 2011, we pay a monthly management fee to a company owned by one of the major stockholders of the Company to manage our day-to-day business activities and to provide business space. Historically we have paid monthly management fees in varying amounts to this related party pursuant to prior agreements. The agreement is on a month-to-month basis and can be cancelled at any time by the vote of management. The agreement was amended and restated on October 31, 2014 to increase the fee to $12,500 effective November 1, 2014.

Also included in management fees are monthly payments of $150 to another major stockholder of the Company for expense reimbursement.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not Applicable. The Company is a "smaller reporting company."

Item 4. Controls and Procedures

Evaluation of disclosure controls and procedures.

Under the supervision and with the participation of our management, including our President and Treasurer who serves as our principal executive and principal financial officer, we evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 ("the Exchange Act") as of June 30, 2016, the end of the period covered by this report. Based upon that evaluation, our President and Treasurer concluded that our disclosure controls and procedures as of June 30, 2016 were effective such that the information required to be disclosed by us in reports filed under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms and (ii) accumulated and communicated to our management, including our President and Treasurer, as appropriate to allow timely decisions regarding disclosure. A controls system cannot provide absolute assurance that the objectives of the controls system are met, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected.

Changes in internal controls over financial reporting.

There was no change in our internal control over financial reporting during the quarter ended June 30, 2016 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

16

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

We are not a party to any material pending legal proceedings.

Item 1A. Risk Factors

See the risk factors described in Item 1A of the Company's 2015 annual report on Form 10-K filed with the SEC on March 30, 2016.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

During the three months ended June 30, 2016 we had no unregistered sales of equity securities.

Item 3. Defaults upon Senior Securities

Not Applicable.

Item 4. Mine Safety Disclosures

Not Applicable.

Item 5. Other Information

Not Applicable.

17

Item 6: Exhibits

The following exhibits are filed as part of this report:

|

Exhibit No.

|

Description of Exhibit

|

|

3.1

|

Articles of Incorporation (1)

|

|

3.2

|

Bylaws (1)

|

|

10.1

|

Promissory Note dated April 16, 2016*

|

|

10.2

|

Promissory Note dated May 5, 2016*

|

|

31.1

|

Section 302 Certification of Chief Executive and Chief Financial Officer*

|

|

32.1

|

Section 1350 Certification of Chief Executive Officer and Chief Financial Officer*

|

|

101 INS

|

XBRL Instance Document*

|

|

101SCH

|

XBRL Taxonomy Extension Schema*

|

|

101 CAL

|

XBRL Taxonomy Extension Calculation Linkbase*

|

|

101 DEF

|

XBRL Taxonomy Extension Definition Linkbase*

|

|

101 LAB

|

XBRL Taxonomy Extension Label Linkbase*

|

|

101 PRE

|

XBRL Taxonomy Extension Presentation Linkbase*

|

(1) Incorporated by reference from Exhibit Numbers 3.1 and 3.2 of the Company's registration statement on Form 10 filed with the SEC on May 14, 2010.

* Exhibits filed with this report.

18

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Grote Molen, Inc.

|

|

|

Dated: August 15, 2016

|

By /s/ John B. Hofman

|

|

John B. Hofman

|

|

|

President, Secretary and Treasurer

|

|

|

(Principal Executive and Accounting Officer)

|

19