As filed with the Securities and Exchange Commission on November 28, 2017

Registration No. 333-220995

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

IRONCLAD ENCRYPTION CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 81-0409475 | ||

| State or other jurisdiction | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization | Classification Code Number) | Identification Number) |

One Riverway, 777 South Post Oak Lane, Suite 1700

Houston, Texas 77056

(888) 362-7972

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

Len E. Walker

One Riverway, 777 South Post Oak Lane, Suite 1700

Houston, Texas 77056

(888) 362-7972

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of communications to:

Ted Schweinfurth

Louann Richard

Baker & McKenzie LLP

2001 Ross Avenue, Suite 2300

Dallas, Texas 75203

(214) 978-3000

(214) 978-3099 (Fax)

Approximate Date of Commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

| Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. x

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

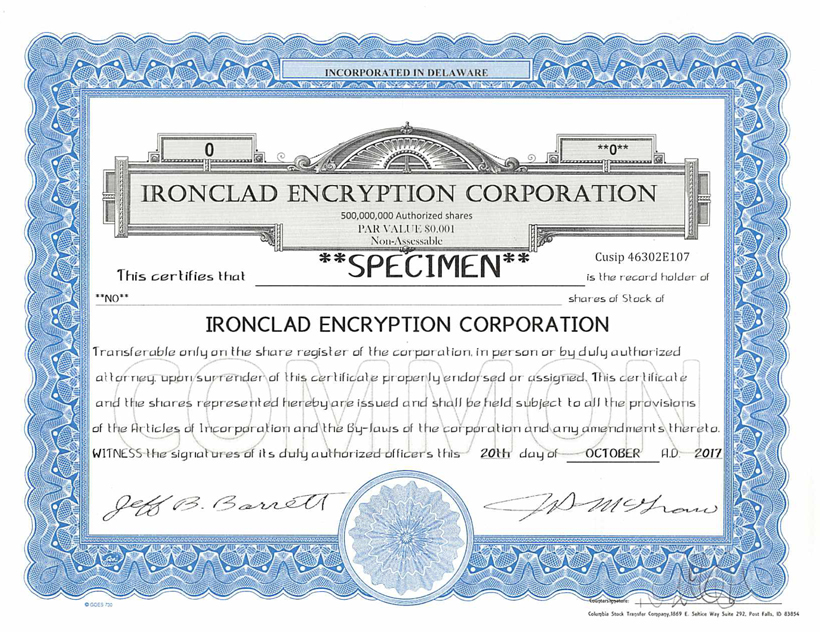

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Price | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee (3) | ||||||||||

| Class A common stock, $0.001 par value per share | 5,482,500 shares | $ | 6.20 | $ | 33,890,250 | $ | 4,220 | |||||||

| Total | 5,482,500 shares | $ | 6.20 | $ | 33,890,250 | $ | 4,220 | |||||||

| (1) | Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any additional shares of the registrant’s Class A common stock that become issuable by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the number of the registrant’s outstanding shares of Class A common stock. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and (o) promulgated under the Securities Act on the basis of the average of the high and low sale prices of the Class A common stock of $6.20 on October 11, 2017 and of $4.85 on November 24, 2017, as reported on the OTC QB. |

| (3) | Registration fee of $4,175.00 previously paid and additional registration fee of $45.00 paid by electronic transfer. |

EXPLANATORY NOTE

IronClad Encryption Corporation is filing this Amendment No. 2 to its Registration Statement on Form S-1 (No. 333-220995) and the prospectus therein to cover the registration of 5,482,500 shares of Class A common stock offered by the holders thereof.

PROSPECTUS

IRONCLAD ENCRYPTION CORPORATION

Up to 5,482,500 shares of Class A common stock

This prospectus relates to the 5,482,500 shares of Class A common stock (the “Shares”) of IronClad Encryption Corporation (“we,” “our,” “ICE,” “IRNC,” “IronClad” or the “Company”), $0.001 par value per share, being registered for possible resale, from time to time, by the holders thereof. Of such shares, 4,257,500 are Shares owned by stockholders of the Company who acquired such Shares directly from the Company in private transactions, 225,000 Shares are Shares issuable to Delaney Equity Group, LLC (“Delaney”) pursuant to a warrant issued to Delaney (the “Delaney Warrant”) and the remaining 1,000,000 Shares are Shares that may be issued pursuant to an investment agreement which establishes a private equity line of credit (“Investment Agreement”) with Tangiers Global, LLC (“Tangiers”), who is deemed to be a statutory underwriter. See the section of this prospectus entitled “The Investment Agreement” for a description of the private equity line and the section entitled “Selling Stockholders” for additional information about Tangiers and the other selling stockholders.

The selling stockholders may sell their Shares at prevailing market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary broker’s transactions, privately-negotiated transactions or through sales to one or more dealers for resale. The maximum number of Shares that can be sold pursuant to the terms of this offering by the selling stockholders is (in the aggregate) 5,482,500 Shares. Funds received by the selling stockholders will be immediately available to such selling stockholders for use by them. The Company will not receive any proceeds from the sale of the selling stockholders’ Shares. However, we will receive the sale price of any Class A common stock that we sell to Tangiers pursuant to the private equity line and that we sell to Delaney pursuant to the exercise of the Delaney Warrant. Any proceeds we receive from the sale of the shares under the private equity line will be used for general corporate purposes. All costs incurred in the registration of the Shares are being borne by the Company.

The offering will terminate thirty-six (36) months from the date that the registration statement relating to the Shares is declared effective, unless earlier fully sold or terminated. The Company intends to maintain the effectiveness of the registration statement of which this prospectus is a part and to allow selling stockholders to offer and sell the Shares for a period of up to three (3) years, unless earlier completely sold, pursuant to Rule 415 of the General Rules and Regulations of the Securities and Exchange Commission (“SEC”).

Our Class A common stock is traded on the OTC QB, one of the OTC Markets Group over-the-counter markets, under the trading symbol “IRNC.” On November 24, 2017, the closing sale price for our Class A common stock was $4.70.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

These securities involve a high degree of risk. See “RISK FACTORS” contained in this prospectus beginning on page 3.

Prospectus dated , 2017

TABLE OF CONTENTS

This summary highlights some information from this prospectus, and it may not contain all the information important to making an investment decision. To understand this offering fully, you should read the following summary together with the more detailed information regarding the Company and the Class A common stock, including “Risk Factors” and the financial statements and related notes, included elsewhere in this prospectus.

The Company

History

IronClad Encryption Corporation, an encryption technology company formerly known as Butte Highlands Mining Company (hereinafter “Butte” or the “Company”), was organized in May 1929 in Delaware as a mining company. Butte ceased operating as a mining company in 1942.

In 2009, Butte registered its shares under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the purpose of becoming a reporting company. The Company’s shares then became listed on the OTCBB, but in time the Company also listed its shares to trade on the OTC QB electronic market, one of the OTC Markets Group over-the-counter markets.

On January 6, 2017, Butte entered into a Share Exchange Agreement with owners of InterLok Key Management, Inc., a Texas corporation (“InterLok”), wherein it issued 56,655,891 shares of its Class A common stock in exchange for 100% of the outstanding shares of InterLok Key Management, Inc. Immediately following the share exchange, the new Board of Directors of the Company (the “Board of Directors”) changed the Company name to IronClad Encryption Corporation (“IronClad”) and changed the stock symbol from BTHI to IRNC. On October 16, 2017, the Company redomiciled in Delaware from Nevada and adopted a certificate of incorporation (the “Certificate of Incorporation”) and bylaws (the “Bylaws”) as a Delaware corporation.

As used herein, references to “Company”, “IronClad,” “Butte”, “we,” “us,” and “our” refer to IronClad Encryption Corporation and its subsidiary (InterLok) on a consolidated basis. The terms “Company”, “IronClad” and “Butte” all refer to the same corporate entity, but the use of the IronClad and Butte names are used to refer to different eras of the Company’s history. The historical eras generally coincide with the changes in business focus in the first weeks of 2017 from the Company’s historical mining activities (Butte) to its current encryption technology activities (IronClad).

Employees

At December 31, 2016, Butte had no full-time employees. The Company’s President served without compensation.

Upon completion of the share exchange on January 6, 2017, the Board of Directors appointed a President, Chief Technology Officer, Vice President of Planning, Vice President of Sales and Vice President of Legal, General Counsel and Secretary.

Subsequent to January 6, 2017, IronClad hired two additional employees; one is the Vice President, Treasurer and Chief Financial Officer and the other is the Director of Product Testing. The Company also uses the services of several outside consultants and contractors to provide additional services.

As of November 28, 2017, the Company has seven employees.

Business

The Company is engaged in the business of developing and licensing the use of cyber software technology that encrypts data files and electronic communications. The Company is currently developing and licensing a new approach that enhances the strength of today’s key-based encryption methods and technology. Through its patented Dynamic Synchronous Key Management and Perpetual Authentication technology, the Company seeks to bring needed innovation to data encryption security by increasing the effectiveness of current encryption products.

Focused on being the next generation data security leader, the Company’s products are designed to utilize the technology referenced above to address the current limitations of encryption technology, including cost, implementation and deployment and human interactions. The Company intends to generate royalty revenue by securing license agreements with leading vendors in each of the technology segments discussed below, through sales of hardware like the ICE Phone, subscriptions, and sales of ICE-enabled security applications, services and maintenance contracts. The Company expects its branded software and security solutions to be launched in the first half of 2018.

IronClad will initially market two products lines, including the ICE Phone and a suite of security applications for enterprise network management. The ICE Phone is designed to be an ultra-secure and ultra-rugged mobile phone platform intended to enable secure communication from the board-room to the military battlefield. The suite of security applications will be marketed as stand-alone applications and modules that seamlessly integrate within security management systems deployed within enterprises.

Risks and Uncertainties Facing the Company

As a development stage company, the Company has no operating history and has experienced losses since its inception. One of the biggest challenges facing the Company is the ability to raise adequate capital to develop and execute opportunities in the encryption technology industry.

Due to financial constraints, the Company has conducted limited operations to date. If the Company were unable to develop strong and reliable sources of funding for growth opportunities, it is unlikely that the Company could develop its operations to return revenue sufficient to further develop its business plan. Moreover, the above assumes that the Company’s efforts are met with customer satisfaction in the marketplace and exhibit steady adoption of its solutions among the potential base of customers, neither of which are currently known or guaranteed.

Achievement of the Company's objectives will depend on its ability to obtain additional financing, to generate revenue from current and planned business operations, and to effectively manage product and software development, operating and capital costs. The Company is in a development stage and has generated no operating revenue, profits or positive cash flows from operations. The Company plans to fund its future operations by potential sales of its common stock or by issuing debt securities. However, there is no assurance that IronClad will be able to achieve these objectives, therefore substantial doubt about its ability to continue as a going concern exists.

Trading Market

Our Class A common stock is traded on the OTC QB, one of the OTC Markets Group over-the-counter markets, under the trading symbol “IRNC.” On November 24, 2017, the closing sale price of our Class A common stock was $4.70.

The Offering

On August 24, 2017, we entered into the Investment Agreement with Tangiers for the potential future issuance and purchase of shares of our Class A common stock. The Investment Agreement establishes what is sometimes termed a private equity line of credit or an equity drawdown facility. In general, the private equity line provides that Tangiers has committed to purchase, from time to time over a 36 month period, shares of our Class A common stock for cash consideration of up to an aggregate of $5,000,000, subject to certain conditions and restrictions. In connection with the Investment Agreement, we entered into a Registration Rights Agreement with Tangiers (the “Registration Rights Agreement”).

Pursuant to the Registration Rights Agreement, we have filed a registration statement of which this prospectus is a part, covering the possible resale by Tangiers of the shares that we issue to Tangiers under the Investment Agreement. The effectiveness of this registration statement is a condition precedent to our ability to sell shares of Class A common stock to Tangiers under the Investment Agreement. Through this prospectus, Tangiers may offer to the public for resale shares of our Class A common stock that we issue to Tangiers pursuant to the Investment Agreement.

For a period of 36 months from the first trading day following the effectiveness of this prospectus, we may, from time to time, at our discretion, and subject to certain conditions that we must satisfy, draw down funds under the Investment Agreement by selling shares of our Class A common stock to Tangiers. Each draw down request must be for at least $5,000 and may, in our discretion, be up to the lesser of $500,000 and a formula amount based on the average price and trading volume of our Class A common stock over a designated period preceding the draw down request. The purchase price of these shares will be at a discount to the volume weighted average price of the Class A common stock during a designated pricing period following the draw down request.

We are under no obligation to request a draw down for any period. If we request a draw down, at least 10 trading days must pass before we submit a subsequent draw down request. The aggregate total of all draws cannot exceed $5,000,000 and no single draw can exceed $500,000. In addition, the Investment Agreement does not permit us to make a draw down if the issuance of shares to Tangiers pursuant to the draw down would result in Tangiers and certain of its affiliates owning more than 9.99% of our outstanding Class A common stock on the date we exercise a draw down. We are registering 1,000,000 shares of Class A common stock for possible issuance under the private equity line.

This prospectus also covers the offering for resale of up to 4,482,500 shares of our Class A common stock by the other selling stockholders identified below. Each of the selling stockholders acquired or will acquire these shares from us in private transactions pursuant to exemptions from registration.

The maximum number of Shares that can be sold by the selling stockholders pursuant to the terms of this offering is 5,482,500. The number of shares of Class A common stock issuable to Tangiers which are subject to this prospectus represents approximately 1.5% of our issued and outstanding Class A common stock as of November 28, 2017.

| 2 |

In the future, following the completion of this offering, the Company will likely need to raise additional capital for its operations. The Company anticipates that it may raise such capital by an offering of its shares of Class A common stock. If the Company does effect equity offerings of its securities and if the price paid for shares offered in such an offering is less than paid by the purchasers of Shares, then such purchasers will suffer a dilution in the value of their shares. Furthermore the issuance of such additional shares may impact the ability of any investor to sell their Shares once such shares are eligible for sale. The Company cannot anticipate that it will be able to effect such additional offerings of its securities and then failure of it to do so may severely impact its available capital to develop any products or further its business plan.

A purchase of any Shares is an investment in the Company’s Class A common stock and involves a high degree of risk. Investors should consider carefully the following information about these risks, together with the other information contained in the registration statement of which this prospectus is a part, before the purchase of any Shares. If any of the following risks actually occur, the business, financial condition or results of operations of the Company would likely suffer, the market price of the Class A common stock would likely decline, and investors could lose all or a portion of the value of their investment. The Company has listed the following risk factors which it believes to be those that are material to an investment in our Class A common stock.

Risks Related to Our Business and Our Industry

We lack an operating history, have never had revenues, have no current prospects for significant future revenues, and have losses which we expect to continue into the future. As a result, we may have to suspend or cease operations.

The Company, formerly named Butte Highlands Mining Company, was incorporated on May 3, 1929 for the purpose of mining. On January 6, 2017, Butte completed an exchange of shares of Butte’s Class A common stock for 100% of the capital stock of InterLok and changed Butte’s business focus from mining to patented encryption technology. The Company and its wholly owned subsidiary, InterLok, have no recent profitable operating history upon which an evaluation of our future success or failure can be made. Losses incurred are a result of costs incurred from the issuance of stock and, re-incorporation between states, and legal and accounting costs. We have never had revenues and we do not have any current prospects for future revenues. Our ability to achieve and maintain profitability and positive cash flow depend on:

| · | our ability to sell encrypted software licenses and related hardware, |

| · | our ability to generate revenues and positive cash flows from the sale of encrypted software and hardware, and |

| · | our ability to manage development and operating costs. |

Based on current plans, we expect to incur operating losses and negative cash flows from operations in future periods. This will happen because the costs and expenses associated with the research and development of encryption applications are likely to exceed modest operating revenues (if any) in the near future. As a result, we may not generate revenues, profits or positive net cash flows in the future. Failure to generate revenues or positive cash flows from operating activities could cause us to suspend or cease operations.

Because we are small and do not have much capital, we may have to limit our development activity which may result in a loss of the value of your investment.

Since we are small and do not have much capital, we must limit our development activity. As such we may not be able to complete a software and hardware development program that is as thorough as we would like or as might be expected from potential customers. Therefore, we have not considered and will not consider any activity beyond developing and generating revenue related to our current patented technology.

We have a history of losses, anticipate increasing our operating expenses in the future, and may not be able to maintain or increase profitability or cash flow on a consistent basis. If we cannot maintain or increase our profitability or cash flow, our business, financial condition, and operating results may suffer.

For the last two fiscal years we have incurred net losses, including net losses of approximately $39,733 in fiscal 2016 and $32,750 in fiscal 2015. As a result, we had an accumulated deficit of $213,581 in 2016. We anticipate that our operating expenses will increase substantially in the foreseeable future as we continue to enhance our product and service offerings, broaden our end-customer base, expand our sales channels, expand our operations, hire additional employees, and continue to develop our technology. These efforts may prove more expensive than we currently anticipate, and we may not succeed in establishing and increasing our revenues sufficiently, or at all, to offset these higher expenses.

| 3 |

Revenue growth may slow for a number of possible reasons, including slowing demand for our products or services, increasing competition, a decrease in the growth of our overall market, or a failure to capitalize on growth opportunities. Any failure to establish and increase our revenues as we grow our business could prevent us from establishing, maintaining or increasing profitability or positive cash flow on a consistent basis. If we are unable to meet these risks and challenges as we encounter them, our business, financial condition, and operating results may suffer.

We have incurred significant operating losses in the past two years. As of September 30, 2017, the Company has an accumulated deficit of $7,859,960.

We have incurred operating losses during 2016 and 2015. During 2016, we incurred a net loss of $39,733. During 2015, we incurred a net loss of $32,750. There can be no assurance that we will be profitable in the future. Our continued failure to operate profitably may materially and adversely affect the value of our Class A common stock. Our losses to date have been funded by loans and equity sales. As of September 30, 2017, the Company had an accumulated deficit of $7,859,960 and incurred a net loss of $7,666,292 during the nine months ended September 30, 2017. These deficits and losses may affect the Company in various ways including, but not limited to, making it more difficult to borrow money, sell stock or to maintain a good market price.

The Company has limited operating history through its subsidiary and may increase the risk that we will not be successful.

The Company is a development stage Company and has limited operating history in its current encryption technology activities. The Company is relying on management to develop and implement its business plan through its operating subsidiary. The Company’s subsidiary has limited business history and an investor will be required to make an investment decision based largely on the management and the projected operations in light of the risks, expenses and uncertainties that may be encountered by engaging in the technological development and marketing of encrypted software and hardware.

In order to implement its business plan and further develop its technology, the Company will need additional capital.

The Company will not receive any funds from the sale of the Shares offered herein and will require capital by loans, joint ventures or sales of its securities in order to execute its current business plan, namely to further develop the technology of its platforms for key-based encryption methods. If the Company were unable to locate such financing on terms acceptable to the Company, it is unlikely that the Company could develop its operations to return revenue sufficient to further develop its business plan.

In order to continue operations the Company has undertaken a private offering of its securities in order to raise necessary funds.

In order to raise necessary funds to continue operations and meet its obligations, the Company has undertaken a private offering of its securities in order to raise the necessary funds. There is no assurance that the Company can raise additional funds through its offering and without such influx of such capital, or without capital from other sources such as loans or debt offering, the Company may not be able to continue operations.

No assurance of commercial feasibility.

Even if the Company’s plans and projects are successfully initiated, there can be no assurance that such plans and projects will have any commercial success or advantage. Also, there is no assurance that the Company’s initiatives will perform as intended in the marketplace.

Our current research and development efforts may not produce successful products or enhancements to our platform that result in significant revenue, cost savings or other benefits in the near future, if at all.

We must continue to dedicate significant financial and other resources to our research and development efforts. However, developing products and enhancements to our platform is expensive and time consuming, and there is no assurance that such activities will result in significant new marketable products or enhancements to our platform, design improvements, cost savings, revenue or other expected benefits. If we spend significant resources on research and development and are unable to generate an adequate return on our investment, our business and results of operations may be materially and adversely affected.

| 4 |

If the data security market does not adopt our data security platform, our sales will not grow as quickly as anticipated, or at all, and our business, results of operations and financial condition would be harmed.

We are seeking to disrupt the data security market with our patented encryption technology. However, organizations that use legacy products and services for their data security needs may believe that these products and services sufficiently achieve their purpose. Organizations may also believe that our products and services only serve the needs of a portion of the data security market. Accordingly, organizations may continue allocating their information technology (“IT”) budgets for legacy products and services and may not adopt our data security platform. If the market for data security solutions does not adopt our data security platform, if end-customers do not recognize the value of our platform compared to legacy products and services, or if we are otherwise unable to sell our products and services to organizations, then our revenue may not grow, which would have a material adverse effect on our operating results and financial condition.

Slow development of a market for our products would materially and adversely affect our results of operations.

The demand for our products depends on, among other things, the introduction and widespread acceptance of our encryption software and hardware. While management believes that such demand exists and will develop, there can be no assurance as to the rate of development of such demand. Slow development of the demand for our products and services would adversely affect our short-term results of operations. If the demand for our products and services develops more slowly than management currently anticipates, we may need to raise additional capital sooner than currently projected to enable us to sustain our operations long enough to achieve profitability.

If we fail to manage growth effectively, our business would be harmed.

We have restructured our operations significantly since the founding of our Company, and anticipate that further changes to our operations and headcount may be required. Our operating structure has also been altered, and any changes or future growth will place significant demands on our management, employees, infrastructure and other resources. We will also need to continue to improve our financial and management controls and reporting systems and procedures. We may encounter delays or difficulties in implementing any of these systems. Additionally, to manage any future change, we will need to hire, train, integrate and retain a number of highly skilled and motivated employees. If we do not effectively hire, train, integrate and retain sufficient highly qualified personnel to support any future growth, and if we do not effectively manage the associated increases in expenses, our business, results of operations and financial condition would be harmed.

Furthermore, growth forecasts are subject to significant uncertainty and are based on assumptions and estimates, which may not prove to be accurate. Forecasts relating to our market opportunity and the expected growth in the data encryption market and other markets, including the forecasts or projections referenced in this prospectus, may prove to be inaccurate. Even if these markets experience the forecasted growth, we may not grow our business at similar rates, or at all. Our growth will be affected by many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the forecasts of our market opportunity and market growth included in this prospectus should not be taken as indicative of our future growth.

If we are unable to sell products, solutions and maintenance services to new customers, as well as renewals of our products, solutions and services to those customers, our future revenue and operating results will be harmed.

Our future success depends, in part, on our ability to increase sales of our solutions to new customers. This may require increasingly sophisticated and costly sales efforts and may not result in additional sales. The rate at which new customers purchase solutions depends on a number of factors, including those outside of our control, such as customers’ perceived need for security and general economic conditions. If our efforts to sell our products and services to new customers are not successful, our business and operating results may suffer.

Furthermore, customers that purchase our platform have no contractual obligation to renew their subscriptions and support and maintenance services after the initial contract period, and given our limited operating history, we may not be able to accurately predict our renewal rates. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including the level of their satisfaction with our platform, our customer support, customer budgets and the pricing of our platform compared with the products and services offered by our competitors. If our customers renew their subscriptions, they may renew for shorter contract lengths or on other terms that are less economically beneficial to us. We cannot assure you that our customers will renew their subscriptions, and if our customers do not renew their subscriptions or renew on less favorable terms, our revenue may grow more slowly than expected, if at all.

| 5 |

If we do not accurately predict, prepare for, and respond promptly to the rapidly evolving technological and market developments and changing end-customer needs in the network security market, our prospects will be harmed.

The data security market is characterized by rapidly changing technology, changing customer needs, evolving operating system standards and frequent introductions of new offerings. Additionally, many of our potential end-customers operate in markets characterized by rapidly changing technologies and business plans, which require them to add numerous network access points and adapt increasingly complex enterprise networks, incorporating a variety of hardware, software applications, operating systems, and networking protocols. As their technologies and business plans grow more complex, we expect these customers to face new and increasingly sophisticated methods of attack. We face significant challenges in ensuring that our platform effectively identifies and responds to these advanced and evolving attacks without disrupting our customers’ network performance.

The process of developing this new technology is expensive, complex and uncertain. The success of new products and enhancements depends on several factors, including appropriate component costs, timely completion and introduction, differentiation of new products and enhancements from those of our competitors, and market acceptance. To build our competitive position, we must commit significant resources to developing new products or enhancements to our platform before knowing whether these investments will be cost- effective or achieve the intended results. There can be no assurance that we will successfully identify product opportunities, develop and bring new products or enhancements to market in a timely manner, or achieve market acceptance of our platform, or that products and technologies developed by others will not render our platform obsolete or noncompetitive. If we expend significant resources on researching and developing products or enhancements to our platform and such products or enhancements are not successful, our business, financial position and results of operations may be adversely affected.

These risks are greater in the mobile IT market because software is deployed on phones and tablets that run on different operating systems such as iOS, Android and Windows Phone, and these multiple operating systems change frequently in response to consumer demand. As a result, we may need to release new software updates at a much greater pace than a traditional enterprise software company that supports only PCs. We may experience technical design, engineering, marketing and other difficulties that could delay or prevent the development, introduction or marketing of new solutions and enhancements. As a result, we may not be successful in introducing solutions in a timely or appropriately responsive manner, or at all. If we fail to address these changes successfully, our business and operating results could be materially harmed.

Our products may become quickly outdated.

The data security market for our products is characterized by rapidly changing technology. Accordingly, we believe that our future success depends on our ability to develop products that can meet market needs on a timely basis. Although the market expects rapid introduction of new products or product enhancements to respond to new threats, the development of these products is difficult and the timetable for commercial release and availability is uncertain as there can be long time periods between releases and availability of new products. There can be no assurance that we will even be successful in developing and marketing, on a timely basis, such new products or enhancements, or that our new products or enhancements will adequately address the changing needs of the marketplace, or that we will be able to respond effectively to technological changes introduced by strategic partners or future competitors.

If we delay or fail to introduce new products, our results of operations and financial condition would be materially adversely affected. Even if we develop timely and successful products and services, there can be no assurance that others will not introduce technology or services that significantly diminish the value of ours or render them obsolete.

We plan to introduce, and will continue to introduce, new encrypted software and hardware, and we may not gain broad market acceptance for these new solutions.

We plan to release new encrypted software and hardware in order to meet the market’s rapidly evolving demands. The return on our investments in these development efforts may be lower, or may develop more slowly, than we expect. Further, we cannot assure you that these solutions will gain broad market acceptance and that they will prove to be profitable in the longer term. Additionally, we intend to continue introducing new data security solutions to respond to the needs of our customers. If we fail to achieve high levels of market acceptance for these solutions or if market acceptance is delayed, we may fail to justify the amount of our investment in developing and bringing them to market, and our business, operating results and financial performance could be adversely affected.

Additionally, the Company is developing its proprietary software and intends to effect beta and other testing to ensure efficient launch and usability. However, the Company’s software may experience or develop unanticipated “bugs” that would either delay its release or impede its use once released. Such delays or problems could impact the Company’s ability to generate revenue or could negatively affect any contractual relationships with users of the software.

| 6 |

If our products do not interoperate with our end-customers’ infrastructure, sales of our products and services could be negatively affected, which would harm our business.

Our products must interoperate with our end-customers’ existing infrastructure, which could have different specifications, utilize multiple protocol standards, deploy products from multiple vendors, and contain multiple generations of products that have been added over time. As a result, when problems occur in a network, it may be difficult to identify the sources of these problems. If we find errors in the existing software or defects in the hardware used in our customers’ infrastructure or problematic network configurations or settings, we may have to modify our software or hardware so that our products will interoperate with our customers’ infrastructure. In such cases, our products may be unable to provide significant performance improvements for applications deployed in our customers’ infrastructure. These issues could cause longer installation times for our products and could cause order cancellations, either of which would adversely affect our business, results of operations and financial condition.

Changes in features and functionality by operating system providers and mobile device manufacturers could cause us to make short-term changes in engineering focus or product development or otherwise impair our product development efforts or strategy and harm our business.

IronClad’s software platforms depend on interoperability with operating systems, such as those provided by Apple, Google and Microsoft, as well as other device manufacturers. Because mobile operating systems are released more frequently than legacy PC operating systems, and there is typically limited advance notice of changes in features and functionality of operating systems and mobile devices, we may be forced to divert resources from our product roadmap in order to accommodate these changes. In addition, if we fail to enable IT departments to support operating system upgrades upon release, our business and reputation could suffer. This could disrupt our product roadmap and cause us to delay introduction of planned solutions, features and functionality, which could harm our business.

If functionality similar to that offered by our products is incorporated into existing network infrastructure products, organizations may decide against adding our appliances to their network, which would have an adverse effect on our business.

Large, well-established providers of encryption software and hardware offer, and may continue to introduce, data security features that compete with our products, either in stand-alone security products or as additional features in their network infrastructure products. The inclusion of, or the announcement of an intent to include, functionality perceived to be similar to that offered by our security solutions in networking products that are already generally accepted as necessary components of network architecture may have an adverse effect on our ability to market and sell our products. Furthermore, even if the functionality offered by network infrastructure providers is more limited than our products, a significant number of end-customers may elect to accept such limited functionality in lieu of adding appliances from an additional vendor such as us.

Many organizations have invested substantial personnel and financial resources to design and operate their networks and have established deep relationships with other providers of networking products, which may make them reluctant to add new components to their networks, particularly from other vendors such as us. In addition, an organization’s existing vendors or new vendors with a broad product offering may be able to offer concessions that we are not able to match because we currently plan to offer only network security products and have fewer resources than many of our competitors. If organizations are reluctant to add additional network infrastructure from new vendors or otherwise decide to work with their existing vendors, our ability to increase our market share and improve our financial condition and operating results will be adversely affected.

Fluctuating economic conditions make it difficult to predict revenue for a particular period, and a shortfall in revenue may harm our operating results.

Our revenue will depend significantly on general economic conditions and the demand for products in the IT security market. Economic weakness, customer financial difficulties, and constrained spending on IT security may result in decreased revenue and earnings. Such factors could make it difficult to accurately forecast our sales and operating results and could negatively affect our ability to provide accurate forecasts to our contract manufacturers and manage our contract manufacturer relationships and other expenses. If we do not succeed in convincing customers that our platform should be an integral part of their overall approach to IT security and that a fixed portion of their annual IT budgets should be allocated to our platform, general reductions in IT spending by our customers are likely to have a disproportionate impact on our business, results of operations and financial condition.

General economic weakness may also lead to longer collection cycles for payments due from our customers, an increase in customer bad debt, restructuring initiatives and associated expenses, and lack of investment in our Company. Furthermore, weakness and uncertainty in worldwide credit markets may adversely impact the ability of our potential customers to adequately fund their expected capital expenditures, which could lead to delays or cancellations of planned purchases of our platform.

| 7 |

Our billings may be variable and difficult to predict.

A substantial majority of our billings in any particular period will be derived from sales to customers with whom we began to engage during that same period and therefore our sales may be variable and difficult to predict. Given this unpredictability, we may be unable to accurately forecast our sales in any given period. A failure to accurately predict the level of demand for our solutions may adversely impact our future revenue and operating results, and we are unlikely to forecast such effects with any certainty in advance.

We may acquire other businesses which could require significant management attention, disrupt our business, dilute stockholder value, and adversely affect our operating results.

As part of our business strategy, we may make investments in complementary companies, products, or technologies. However, we have not made any significant acquisitions to date, and as a result, our ability as an organization to acquire and integrate other companies, products or technologies in a successful manner is unproven. We may not be able to find suitable acquisition candidates, and we may not be able to complete such acquisitions on favorable terms, if at all. If we do complete acquisitions, we may not ultimately strengthen our competitive position or achieve our goals, and any acquisitions we complete could be viewed negatively by our end-customers, investors, and securities analysts. In addition, if we are unsuccessful at integrating such acquisitions, or the technologies associated with such acquisitions, into our Company, the revenue and operating results of the combined company could be adversely affected.

Any integration process may require significant time and resources, and we may not be able to manage the process successfully. We may not successfully evaluate or utilize the acquired technology or personnel, or accurately forecast the financial impact of an acquisition transaction, including accounting charges. We may have to pay cash, incur debt or issue equity securities to pay for any such acquisition, each of which could adversely affect our financial condition or the value of our Class A common stock. The sale of equity or issuance of debt to finance any such acquisitions could result in dilution to our stockholders. The incurrence of indebtedness would result in increased fixed obligations and could also include covenants or other restrictions that would impede our ability to manage our operations.

The Company’s officers and directors beneficially own a significant majority, and will continue to own a majority, of the Company’s Class A common stock and, as a result, can exercise control over stockholder and corporate actions.

Our officers and directors are collectively the beneficial owners of a majority of the Company’s outstanding Class A common stock and assuming sale of all the Shares, will still own a majority of the Company's then outstanding Class A common stock upon closing of the offering. As such, they will be able to control most matters requiring approval by stockholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s Class A common stock or prevent stockholders from realizing a premium over the market price for their Shares.

The Exchange Act requires, among other things, that companies maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain the requisite disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight are required. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on the development of the Company’s business, financial condition and results of operations.

The Company has a small financial and accounting organization. Being a public company strains the Company’s resources, diverts management’s attention and affects its ability to attract and retain qualified officers and directors.

As a reporting company, the Company is already subject to the reporting requirements of the Exchange Act. However, the requirements of these laws and the rules and regulations promulgated thereunder entail significant accounting, legal and financial compliance costs which are potentially prohibitive to the Company as it develops its business plan, products and scope. These costs have made, and will continue to make, some activities more difficult, time consuming or costly and may place significant strain on its personnel, systems and resources.

| 8 |

If we do not effectively establish and train a qualified sales force, we may be unable to add new customers or increase sales to our existing customers in the future, and our business will be adversely affected.

We will be substantially dependent on our direct sales force to obtain new customers and increase sales with these customers in the future. There is significant competition for sales personnel with the skills and technical knowledge that we require. Our ability to achieve significant revenue growth will depend, in large part, on our success in recruiting, training and retaining sufficient numbers of sales personnel to support our growth. New hires require significant training and may take significant time before they achieve full productivity. Our new hires may not become productive as quickly as we expect, and we may be unable to hire or retain sufficient numbers of qualified individuals in the markets where we do business or plan to do business.

In addition, because we were recently formed, a large percentage of our sales force will need to be hired and will be new to our Company. If we are unable to hire and train a sufficient number of effective sales personnel, or the sales personnel we hire are not successful in obtaining new customers or increasing sales to our existing customer base, our business will be adversely affected.

We operate in a rapidly evolving industry and changes in existing technologies or the emergence of new products or technologies could reduce demand for our products and significantly harm our business.

The encryption market is characterized by rapid technological change, frequent product introductions, new protocols, evolving industry standards, consolidation among our competitors, suppliers and customers, and evolving customer preferences. The introduction of new products by our competitors or us or new entrants into the storage market could render our existing products obsolete or uncompetitive. Additionally, changes in existing technologies could cause demand for our products to decline. For example, if changes in technology result in a significant reduction in cyber-attacks, enterprises may not need to utilize our encrypted software and hardware. One or more new technologies also could be introduced that compete effectively with our products or that cause our products to no longer be of significant benefit to our customers, and demand for our products could be reduced significantly.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

The Financial Industry Regulation Authority (“FINRA”) has adopted rules that apply to broker-dealers in recommending an investment to a customer. The broker-dealers must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative, low-priced securities such as ours to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information.

Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low-priced securities such as ours will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend buying our Class A common stock to their customers and this may have the effect of reducing the level of trading activity and liquidity of our Class A common stock. Further, many brokers charge higher transactional fees for penny stock transactions such as buying our Class A common stock. As a result, fewer broker-dealers may be willing to make a market in our Class A common stock, reducing our stockholder’s ability to resell shares of our Class A common stock.

The Company’s stock may be considered a penny stock and any investment in the Company’s stock will be considered a high-risk investment and subject to restrictions on marketability.

If the Shares commence trading, the trading price of the Company’s Class A common stock may be below $5.00 per Share. If the price of the Class A common stock is below such level, trading in its Class A common stock would be subject to the requirements of certain rules promulgated under the Exchange Act. These rules require additional disclosure by broker-dealers in connection with any trades generally involving any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such rules require the delivery, before any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith, and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally institutions). For these types of transactions, the broker-dealer must determine the suitability of the penny stock for the purchaser and receive the purchaser’s written consent to the transaction before sale. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in the Company’s Class A common stock which could impact the liquidity of the Company’s Class A common stock.

| 9 |

We face significant competition and expect this competition to intensify, which could prevent us from increasing our revenue, reduce our gross margins, and result in the loss of market share.

The market for encryption technology is highly competitive and we expect competition to intensify in the future. Other companies have introduced, and may in the future introduce, new products in the same market we intend to enter. Currently, we expect to face competition from existing encryption products on the market. Further, many of our competitors have substantially greater financial, sales and other resources than we do and may in some cases benefit from lower costs than we do. In some cases, they also have more recognizable brands than our own.

Competition will likely result in pricing pressure on our products and services, and we anticipate that pricing pressure will increase in the future. Competition may in some instances result in a negative impact on the length of our sales cycle, and we may experience longer sales cycles in future periods due to increased competition. In particular, if a large number of orders, or a large dollar value order, is delayed or cancelled, our financial results may be harmed. Competition may result in reduced gross margins for our products, increased sales and marketing expenses and a failure to increase market share.

We face intense competition in our market, especially from larger, well-established companies, and we may lack sufficient financial or other resources to improve our competitive position.

The market for network security and encryption products is intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. Many of our potential competitors could have substantial competitive advantages such as:

| · | greater name recognition and longer operating histories; |

| · | larger sales and marketing budgets and resources; |

| · | broader distribution and established relationships with distribution partners and end-customers; |

| · | greater customer support resources; |

| · | greater resources to make acquisitions; |

| · | lower labor and development costs; |

| · | larger and more mature intellectual property portfolios; and |

| · | substantially greater financial, technical and other resources. |

In addition, some of our potential larger competitors have substantially broader and more diverse product offerings and can leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that discourages users from purchasing our products, including through selling at zero or negative margins, product bundling, or closed technology platforms. Potential end-customers may also prefer to purchase from their existing suppliers rather than a new supplier regardless of product performance or features. As a result, even if the features of our platform are superior, customers may not purchase our products.

Conditions in our market could change rapidly and significantly as a result of technological advancements, partnering by our competitors or continuing market consolidation. New start-up companies that innovate and large competitors that are making significant investments in research and development may invent similar or superior products and technologies that compete with our products and technology. Our potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources. If we are unable to compete successfully, or if competing successfully requires us to take costly actions in response to the actions of our competitors, our business, financial condition and results of operations could be adversely affected.

| 10 |

Our failure to adequately protect personal information could have a material adverse effect on our business.

A wide variety of provincial, state, national, and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer, and other processing of personal data. These data protection and privacy-related laws and regulations are evolving and may result in ever-increasing regulatory and public scrutiny and escalating levels of enforcement and sanctions. Our failure to comply with applicable laws and regulations, or to protect such data, could result in enforcement action against us, including fines, imprisonment of Company officials and public censure, claims for damages by end-customers and other affected individuals, damage to our reputation and loss of goodwill, any of which could have a material adverse effect on our operations, financial performance, and business.

Evolving and changing definitions of personal data and personal information, within the European Union, the United States, and elsewhere, especially relating to classification of IP addresses, machine identification, location data, and other information, may limit or inhibit our ability to operate or expand our business, including limiting strategic partnerships that may involve the sharing of data. Even the perception of privacy concerns, whether or not valid, may harm our reputation and inhibit adoption of our products by potential end-customers.

If our security measures are breached or unauthorized access to customer data is otherwise obtained or our customers experience data losses, our brand, reputation and business could be harmed and we may incur significant liabilities.

Our customers will rely on our encryption solutions to secure and store their data, which may include financial records, credit card information, business information, customer information, health information, other personally identifiable information or other sensitive personal information. A breach of our encryption methods or other events that cause the loss or public disclosure of, or access by third parties to, our customers’ stored files or data could have serious negative consequences for our business, including possible fines, penalties and damages, reduced demand for our solutions, an unwillingness of our customers to use our solutions, harm to our brand and reputation and time-consuming and expensive litigation.

The techniques used to obtain unauthorized access, disable or degrade service or sabotage systems change frequently, often are not recognized until launched against a target and may originate from less regulated or remote areas around the world. As a result, we may be unable to proactively prevent these techniques, implement adequate preventative or reactionary measures or enforce the laws and regulations that govern such activities. If our customers experience any data loss, or any data corruption or inaccuracies, whether caused by security breaches or otherwise, our brand, reputation and business could be harmed.

If an actual or perceived breach of network security occurs in our internal systems, our services may be perceived as not being secure and clients may curtail or stop using our solutions.

As a provider of data security solutions, we will be a high profile target and our networks and solutions may have vulnerabilities that may be targeted by hackers and could be targeted by attacks specifically designed to disrupt our business and harm our reputation. We will not succeed unless the marketplace continues to be confident that we provide effective encryption protection. If a breach of network security occurs in our internal systems it could adversely affect the market’s perception of our solutions. We may not be able to correct any security flaws or vulnerabilities promptly, or at all. In addition, such a security breach could impair our ability to operate our business. If this happens, our business and operating results could be adversely affected.

Additionally, the ability of our future solutions to operate effectively could be negatively impacted by many different elements unrelated to our solutions. For example, a user’s experience may suffer from an incorrect setting in his or her mobile device, an issue relating to his or her employer’s corporate network or an issue relating to the underlying mobile operating system, none of which we control. Even though technical problems experienced by users may not be caused by our solutions, users often perceive the underlying cause to be a result of poor performance of our solution. This perception, even if incorrect, could harm our business and reputation.

Because our solutions could be used to collect and store personal information of our customers’ employees or customers, privacy concerns could result in additional cost and liability to us or inhibit sales of our solutions.

Personal privacy has become a significant issue in the United States and in other countries where we may offer our solutions. The regulatory framework for privacy issues worldwide is currently complex and evolving, and it is likely to remain uncertain for the foreseeable future. Many federal, state and foreign government bodies and agencies have adopted or are considering adopting laws and regulations regarding the collection, use and disclosure of personal information. In the United States, these include rules and regulations promulgated under the authority of the Federal Trade Commission, the Health Insurance Portability and Accountability Act of 1996 and state breach notification laws. Internationally, virtually every jurisdiction in which we may eventually operate has established its own data security and privacy legal framework with which we or our customers must comply, including the Data Protection Directive established in the European Union, or the EU, and the Federal Data Protection Act recently passed in Germany.

| 11 |

In addition to government regulation, privacy advocacy and industry groups may propose new and different self-regulatory standards that either legally or contractually apply to us. Because the interpretation and application of privacy and data protection laws are still uncertain, it is possible that these laws may be interpreted and applied in a manner that is in conflict with one another, and is inconsistent with our encryption practices or the features of our solutions. If so, in addition to the possibility of fines, lawsuits and other claims, we could be required to fundamentally change our business activities and practices or modify our encryption software and hardware, which could have an adverse effect on our business. Any inability to adequately address privacy concerns, even if unfounded, or comply with applicable privacy or data protection laws, regulations and policies, could result in additional cost and liability to us, damage our reputation, inhibit sales and harm our business.

Furthermore, the costs of compliance with, and other burdens imposed by, the laws, regulations, and policies that are applicable to the businesses of our customers may limit the use and adoption of, and reduce the overall demand for, our solutions. Privacy concerns, whether valid or not valid, may inhibit market adoption of our solutions particularly in certain industries and possibly, foreign countries.

Our use of open source software could impose limitations on our ability to commercialize our solutions.

Our solutions might contain software modules licensed for use from third-party authors under open source licenses. Use and distribution of open source software may entail greater risks than use of third-party commercial software, as open source licensors generally do not provide warranties or other contractual protections regarding infringement claims or the quality of the code. Some open source licenses might contain requirements that we make available source code for modifications or derivative works we create based upon the type of open source software we use. If we combine our proprietary solutions with open source software in a certain manner, we could, under certain of the open source licenses, be required to release the source code of our proprietary solutions to the public or offer our solutions to users at no cost. This could allow our competitors to create similar solutions with lower development effort and time and ultimately could result in a loss of sales for us.

The terms of many open source licenses have not been interpreted by U.S. courts, and there is a risk that such licenses could be construed in a manner that could impose unanticipated conditions or restrictions on our ability to commercialize our solutions. In such event, we could be required to seek licenses from third parties in order to continue offering our solutions, to re-engineer our solutions or to discontinue the sale of our solutions in the event re-engineering cannot be accomplished on a timely basis, any of which could materially and adversely affect our business and operating results.

If we are unable to hire, retain, train, and motivate qualified personnel and senior management, our business could suffer.

Our future success depends, in part, on our ability to continue to attract and retain highly skilled personnel. The loss of the services of our senior management or any of our key personnel, the inability to attract or retain qualified personnel, or delays in hiring required personnel, particularly in engineering and sales and marketing, could significantly delay or prevent the achievement of our development and strategic objectives, and may adversely affect our business, financial condition and operating results.

In addition, many members of our management team only joined us in the last year as part of our investment in the expansion of our business. Our productivity and the quality of our solutions may be adversely affected if we do not integrate and train our new employees quickly and effectively. Furthermore, if we are not effective in retaining our key personnel, our business could be adversely impacted and our operating results and financial condition could be harmed.

Competition for highly skilled personnel is often intense. We may not be successful in attracting, integrating or retaining qualified personnel to fulfill our current or future needs. Also, to the extent we hire personnel from competitors, we may be subject to allegations that they have been improperly solicited, or that they have divulged proprietary or other confidential information, or that their former employers own their inventions or other work product.

The Company relies on key executives whose absence or loss could adversely affect the business.

The Company relies on the services of its key executives. The loss of the services of any such executive could adversely affect the business. Additionally, because our Chief Technology Officer has other outside business activities, he will only be devoting 70% of his time or approximately thirty hours per week to our operations.

| 12 |

Costs incurred because the Company is a public company may affect the Company’s profitability.

As a public company, the Company incurs significant legal, accounting, and other expenses, and the Company is subject to the rules and regulations of the Securities and Exchange Commission relating to public disclosure that generally involve a substantial expenditure of financial resources to prepare those disclosures. In addition, the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, requires changes in corporate governance practices of public companies. The Company expects that full compliance with such rules and regulations will significantly increase the Company’s legal and financial compliance costs and make some activities more time-consuming and costly, which may negatively affect the Company’s financial results. To the extent the Company’s earnings are reduced as a result of the financial impact of the Company’s SEC reporting or compliance costs, the Company’s ability to develop an active trading market for the Company’s securities could be harmed.

We may be unable to protect our intellectual property adequately, which could harm our business, financial condition and results of operations.

We believe that our intellectual property is an essential asset of our business. We rely on a combination of patent, copyright, trademark and trade secret laws, as well as confidentiality procedures and contractual provisions, to establish and protect our intellectual property rights in the United States and abroad. The filing of a patent application or trademark application does not guarantee the issuance of a corresponding patent or trademark. Thus, our efforts to secure intellectual property rights may not result in enforceable rights against third parties. Any U.S. or other patents that we acquire may not be sufficiently broad to protect our proprietary technologies, and given the costs of obtaining patent protection, we may choose not to seek patent protection for certain of our proprietary technologies or in certain jurisdictions. Further, the enforceability of any U.S. or other patent we obtain would be limited by the term of said patent.

Variations in patent and trademark laws across different jurisdictions may also affect our ability to protect our proprietary technologies consistently across the globe. The efforts we have taken to protect our intellectual property may not be sufficient or effective, and our trademarks, copyrights and patents may be held invalid or unenforceable. We may not be effective in policing unauthorized use of our intellectual property, and even if we do detect violations, litigation may be necessary to enforce our intellectual property rights. Any enforcement efforts we undertake, including litigation, could be time consuming and expensive, could divert management’s attention and may result in a court determining that our intellectual property rights are unenforceable. If we are not successful in cost-effectively protecting our intellectual property rights, our business, financial condition and results of operations could be harmed.

Claims by others that we infringe their proprietary technology or other rights could harm our business.

Companies in the data encryption security industry own large numbers of patents, copyrights, trademarks, domain names, and trade secrets and frequently enter into litigation based on allegations of infringement, misappropriation, or other violations of intellectual property or other rights. Third parties may in the future assert claims of infringement of intellectual property rights against us. As the number of products and competitors in our market increases and overlaps occur, infringement claims may increase. In addition, future litigation may involve patent holding companies or other adverse patent owners who have no relevant product revenue and against whom our own patents may therefore provide little or no deterrence or protection. In addition, we have not registered our trademarks in all of our geographic markets and failure to secure those registrations could adversely affect our ability to enforce and defend our trademark rights.

Any claim of infringement by a third party, even those without merit, could cause us to incur substantial costs defending against the claim, could distract our management from our business and could require us to cease use of such intellectual property. Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. Although third parties may offer a license to their technology or other intellectual property, the terms of any offered license may not be acceptable to us and the failure to obtain a license or the costs associated with any license could cause our business, financial condition, and operating results to be materially and adversely affected.

In addition, some licenses may be non-exclusive, and therefore our competitors may have access to the same technology licensed to us. If a third party does not offer us a license to its technology or other intellectual property on reasonable terms, or at all, we could be enjoined from continued use of such intellectual property. As a result, we may be required to develop alternative, non-infringing technology, which could require significant time (during which we would be unable to continue to offer our affected products or services), effort, and expense and may ultimately not be successful. Furthermore, a successful claimant could secure a judgment or we may agree to a settlement that prevents us from distributing certain products or performing certain services or that requires us to pay substantial damages, royalties or other fees. Any of these events could seriously harm our business, financial condition, and operating results.

| 13 |

We could be subject to additional tax liabilities.

We are subject to U.S. federal, state, local and sales taxes in the United States and may become subject to foreign income taxes, withholding taxes and transaction taxes in several foreign jurisdictions. Significant judgment is required in evaluating our tax positions and our worldwide provision for taxes. During the ordinary course of business, there are many activities and transactions for which the ultimate tax determination is uncertain. In addition, our tax obligations and effective tax rates could be adversely affected by changes in the relevant tax, accounting and other laws, regulations, principles and interpretations, including those relating to income tax nexus, by recognizing tax losses or lower than anticipated earnings in jurisdictions where we have lower statutory rates and higher than anticipated earnings in jurisdictions where we have higher statutory rates, by changes in foreign currency exchange rates, or by changes in the valuation of our deferred tax assets and liabilities.

We may be audited in various jurisdictions, and such jurisdictions may assess additional taxes, sales taxes and value-added taxes against us. Although we believe our tax estimates are reasonable, the final determination of any tax audits or litigation could be materially different from our historical tax provisions and accruals, which could have a material adverse effect on our operating results or cash flows in the period or periods for which a determination is made.

U.S. federal, state and local government sales are subject to a number of challenges and risks that may adversely impact our business.

Sales to U.S. federal, state, and local governmental agencies may in the future account for a significant portion of our revenue. Sales to such government entities are subject to the following risks:

| · | selling to governmental agencies can be highly competitive, expensive and time consuming, often requiring significant upfront time and expense without any assurance that such efforts will generate a sale; |

| · | government certification requirements applicable to our products may change and, in doing so, restrict our ability to sell into the U.S. federal government sector until we have attained the revised certification; |