UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 6, 2013

Gepco, Ltd.

(Name of small business issuer specified in its charter)

| Nevada | 000-53559 | 80-0214025 | ||

| (State or other jurisdiction | (Commission File No.) | (I.R.S. Employer | ||

| of incorporation) | Identification No.) |

9025 Carlton Hills Blvd Ste. B

Santee, CA 92071

(Address of principal executive offices)

909-708-4303

(Registrant’s telephone number)

___________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c )) |

Item 1.01 Entry into a Material Definitive Agreement.

See Item 2.01 below for a description of the amendment to the Stock Purchase Agreement between Gepco, Ltd. and GemVest, Ltd., originally dated October 15, 2013, as filed with the SEC on October 15, 2013.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On October 15, 2013, Gepco, Ltd. (the “Company”) entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with GemVest, Ltd. pursuant to which the Company purchased (the “Acquisition”) 100% of the issued and outstanding capital stock (“GemVest Shares”) of GemVest, Ltd., a Nevada corporation (“GemVest”). The purchase price for the GemVest Shares set forth therein is 150,000,000 shares of the Company’s restricted Common Stock. The transaction is being treated as a reverse acquisition for accounting purposes, and GemVest is deemed the accounting acquiror.

The parties arrived at the purchase price for the GemVest Shares as follows: The 10 day average closing price from September 30, 2013 through October 14, 2013 (the 10 trading days prior to signing the agreement) was $0.0326 which attaches a value of the 150,000,000 shares at $4,890,000, which is the value negotiated by the parties.

Immediately prior to Closing (as defined below), the parties to the Stock Purchase Agreement and the stockholders of GemVest entered into an amendment to the Stock Purchase Agreement whereby the stockholders of GemVest affirmed all of the obligations and representations of GemVest under the Stock Purchase Agreement and agreed to convey 100% of the issued and outstanding GemVest Shares to the Company in consideration for the Purchased Company Shares in a transaction exempt from registration under Section 4(2) of the Securities Act of 1933.

The Acquisition was consummated (the “Closing”) on December 6, 2013, in a transaction exempt from registration under Section 4(2) of the Securities Act of 1933, as amended. Pursuant to the Agreement, GemVest and the Company agreed to the following covenants regarding management of the Company for a period of five years from the date of Closing:

· Angelique de Maison shall serve as Executive Chairman of the Company and of GemVest, Peter Voutsas shall serve as Chief Executive Officer and Chief Investment Officer of the Company and of GemVest, Trisha Malone shall serve as President, Chief Financial Officer and Secretary of the Company and Chief Financial Officer, Chief Operating Officer and Secretary of GemVest, Nicholas Marlin shall serve as Chief Marketing Officer the Company and President and Chief Marketing Officer of GemVest and Ronald Loshin shall serve as Chief Creative Officer of the Company and of GemVest.

· The Board of the Company shall consist of six directors: Angelique de Maison, Peter Voutsas, Trisha Malone, Larry Zielke, Ronald Loshin and Nicholas Marlin. The Board of GemVest shall consist of five directors: Angelique de Maison, Peter Voutsas, Trisha Malone, Ronald Loshin and Nicholas Marlin.

· If the Company’s EBITDA (as defined in GAAP) is not at least $750,000 for the fiscal year ended December 31, 2014, then on a pro rata basis, based on percentage of ownership of Gepco immediately prior to Closing, the shareholders of Gepco shall return to the Company one million shares of the Company’s Common Stock for each $10,000 increment by which EBITDA is less than $750,000.

Subsequent to closing of the Acquisition, GemVest shall remain a wholly owned subsidiary of Gepco. For accounting purposes, GemVest is deemed the accounting acquirer.

The total outstanding common shares of the Company subsequent to the closing of the Acquisition are as follows:

| Existing Company Shareholders | 43,582,555 | |||

| Shares acquired by GemVest Shareholders | 150,000,000 | |||

| Total Shares after consummation of the Acquisition | 193,582,555 |

Shares outstanding of the Company just prior to the close consisted of 43,582,555 shares of which no shares were issued for investor relations services.

As the Company is in a start up phase, it will need to raise capital to fund operations, and alternatives are being explored.

Changes Resulting from the Acquisition. The Company’s business is now the business of GemVest. GemVest is deemed the acquirer of the Company for accounting purposes.

FORM 10 INFORMATION

Information in response to this Item 2.01 corresponds to the Item numbers of Form 10 as promulgated under the Securities and Exchange Act of 1934 and the regulations thereunder. The following information regarding GemVest is set forth below and constitutes all of the information regarding GemVest required to be set forth in a Form 10 (as proscribed under the rules and regulations promulgated under the Securities Exchange Act of 1934, as amended), as if one were being filed by GemVest.

| 2 |

Form 10 Item 1. Description of Business

GemVest, Ltd. (“GemVest” or the “Company”), a division of Gepco, Ltd., (Symbol Gepco, Ltd. (“GEPC”), OTCQB), has created a new business venture headed by our Chief Executive Officer, Peter Voutsas, one of the nation’s most esteemed jewelers and owner of Peter Marco Extraordinary Jewels of Beverly Hills. The Company intends to sell and broker high end rare investment grade diamonds that are obtained from wholesale diamond cutters all over the world with which Peter Voutsas has long, outstanding relationships and from individuals and estates seeking liquidity who possess investment grade diamonds and heirloom quality jewelry.

Business Description:

Peter Voutsas (“Peter”) has also established a worldwide reputation as a purveyor of exquisite, extraordinary fine quality precious stones and jewelry pieces that are retailed in an elegant but friendly environment and sold at competitively reasonable prices. Peter has an international clientele that includes individuals from every continent who are known to be seekers of investment grade stones and exquisite rare heirloom jewelry items. The placing of such exquisite jewelry and gemstones is one of Peter’s most noted talents and helps enable Peter to gain top dollar and quick turnover for virtually each such item.

Through Peter’s reputation and long standing close business ties to the diamond wholesale market, the Company will have direct access to acquiring an unsurpassed collection of the highest investment grade diamonds that are released each year on a wholesale basis. This enables the Company to wholesale these gems to investors, other jewelry retailers throughout the country, and to other wholesalers who need to supplement their own inventory at attractive margins with high turnover. Management anticipates that each wholesale diamond order will carry a ticket value of $300,000 to $5,000,000 and gross margins of approximately 30%-40% that can be expected from their sales with an average sales turn rate of 90-120 days.

Increasingly, Peter has taken advantage of his retail store’s location and his reputation for integrity, fairness, and expertise by becoming “the place to go” to dispose of precious diamonds and other investment grade stones and heirloom jewelry for those desiring to convert highly valued holdings into cash. Because of the high worth of some of these items, some valued in excess of $35 million, Peter has, until now, relied on taking such goods on a consignment basis and earning a modest consignment fee. This has restricted his earnings while impairing his serving his customers to the fullest extent because of their preference for immediate cash. GemVest plans to purchase such items outright, often at very discounted prices, providing the seller immediate cash and providing the Company with gross margins typically anywhere between 30%-70%.

Rare and highly valued precious stones and jewelry are normally sold within 90-120 days giving the Company 3-4 turns of inventory per year. The Company will hire certified gemologists to ensure that each diamond and gemstone is precisely categorized, given a proper serial number, and provided a proper documentation trail.

Overview of Investment Grade Diamonds

The allure of diamonds is, like gold, they are easily authenticated, eternal lasting and an excellent store of value and safe haven from inflation. Unlike gold or oil, diamonds have exhibited stable pricing and avoided the high price volatility and instability seen in other commodity based stores of value. To date, diamonds have not been touched very much by large inflows and outflows of speculative money. This could change if the new efforts succeed and large speculative inflows materialize into precious “investment grade” diamonds, as may well be underway. Gold investments, rather than jewelry, have long been the primary choice of investors looking for a commodity based asset that preserves value. Gold investments have become the primary driver of the price increase and corresponding growth in the gold industry, pushing annual production to record levels of around $205 billion in 2011 according to the World Gold Council. By comparison, the annual production of polished diamonds has remained modest is still only about $18 billion (source: Bain & Co.).

| 3 |

Furthermore, the sometimes need to sell high-end jewelry and precious stones for cash is an all but universal one. Once GemVest and Peter Voutsas demonstrate the “proof of concept” in the Beverly Hills store and extend the GemVest brand to the acquisition of landmark jewelry and precious stones for cash, we envision a roll out of this business into other major markets in the US and cities throughout the world that are known for their strong jewelry heritage. Those areas plagued by current economic hardships and instability that have a strong jewelry heritage are particularly attractive target markets for our growth.

GemVest has entered into an exclusive and perpetual agreement with Peter Voutsas for his services to develop and manage this business. All purchase and resale business by Peter Marco Jewelers will now be done under the GemVest name. We expect that the proof of concept and a corresponding codification of operating procedures and business practices will have been accomplished within the first six months of operations. Several highly visible appearances of Peter Marco jewelry in conjunction with the entertainment industry will be utilized as well to further enhance the branding and establish Peter as a celebrity to facilitate our rollout into other world center cities.

In addition to securing inventory for resale by purchasing investment grade estate items from individuals and estates, Peter Voutsas also has direct access to diamonds directly from diamond cutters located around the world. This direct source of mined diamonds is available to Peter and GemVest at deep wholesale prices which then enables GemVest to distribute the diamonds and gemstones to other jewelers and investors of investment grade diamonds and gemstones at competitive prices while still earning significant returns. This business too has vast opportunities for international expansion given the availability of sizeable capital that the GemVest venture will provide.

Primary Objectives

| · | To establish GemVest as an international branded investment diamond jewelry merchant business under the well-established Peter Marco Extraordinary Jewelry, Rodeo Drive store front for the acquisitions of exclusive high end jewelry and investment grade precious stones that are acquired from individuals and estates and sold through private transactions to investors and consumers interested in obtaining such rare jewelry and precious stones. |

| · | To complete a proof of concept in demonstrating that the income and profit margins now present in the consignment based acquisition of merchandise and resale structure would be very significantly increased by a multitude of many times by converting to outright purchase and resale of “treasure chest” collector jewelry and other merchandise. To codify all procedures, risk management controls, advertising and merchandising, inventory controls, promotion, valuation and assessment, purchase and sales techniques, etc. so as to enable prudent but timely expansion into other primary domestic and international targeted cities that are noted for populations having exclusive luxury jewelry collections an appreciation for investment grade stones, and an ample number of estates and people seeking to liquidate such exclusive holdings and others who wish to purchase such treasure goods.1 |

| · | To prepare a master national and international target city list, perform site reviews and selections and prepare for such future expansion inclusive of operating manuals, plans for executive recruitment and training, and an initial promotional and public relations campaign that would be used as we enter new markets. Expansion could then take place under GemVest’s direct ownership of satellite stores or, depending on the particular circumstances, through franchising with the “best in class” independent jewelers in selected cites who would operate under a franchise arrangement, inclusive of capital being provided for purchase of conforming merchandise. |

| · | To provide investors with a rare opportunity to participate in this extremely attractive high end of the jewelry and rare precious stone sectors with the prospects of high returns, relatively low risks, and exclusive entertainment event opportunities where Peter Marco jewelry is featured. |

1 With the reach of the Peter Marcos brand across the world, it is not essential that local markets have an active core of buyers. Such merchandise can be sold on the international market.

| 4 |

| · | To establish the first international brand for the liquidation and purchase of rare and timeless treasured heirloom jewelry and precious stones. |

| · | Instill the highest level of cordiality and friendliness in customer service in what is an exclusive and elegant setting. |

Mission

| · | Make GemVest the most trusted, esteemed, and successful trader of pre-owned rare jewelry and precious stones in the international market. |

| · | Establish and implement an international highly recognizable brand known by the international elite for heirloom jewelry and high-end investment grade precious stones. |

| · | To identify additional business opportunities where access to capital, expert knowledge of rare jewelry and precious stones, and reputation are paramount to success. |

| · | Establish GemVest as the preferred place to purchase, sell and exchange investment grade precious stones and fine jewelry. |

| · | Establish a wholesale marketplace for investment grade diamonds that can be sold directly to jewelers, wholesalers, and pre-approved investors over the Internet. |

| · | To select an esteemed investment bank partner interested in pursuing the regulatory filing and sale of bundled $100MM investment grade diamonds to high net worth investors |

| · | To link with expert local jewelers through an Internet supported distribution system such that affiliate jewelers will be able to retail precious diamonds and other investment grade stones on their premises through internet enabled displays and advanced secured distribution system. |

Keys to Success

Some of the key factors that will help GemVest expand its operations include:

| · | Timely access to capital and debt financing sufficient to support increasing capital requirements in order for GemVest to avail itself of expansion opportunities and respond to new business opportunities.2 |

| · | Creating a world-class brand supported by retail storefronts for the acquisition and sale of legacy holdings. |

| · | Establishing proper risk and internal controls to assure that all assets are assessed correctly, properly secured and safeguarded to assure and protect inventory. |

| · | Establishing a high volume “Diamond Exchange” wholesale marketplace for investment grade diamonds. |

| · | Securing adequate umbrella insurance coverage to cover the purchase, sale, transportation of all high valued inventory |

| · | Developing a customized WEB site for promoting the Company’s business and evaluate whether it |

| · | is desirable to make it transactional, such that sellers could submit detailed information about what they wish to sell to the Company (or, if we so choose to other prospect buyers as well) and buyers, be they limited to affiliate jewelers or to the public could submit offers on listed merchandise. 3 |

| · | Maintaining the highest business integrity such that all sellers and buyers can have comfort that they are being treated fairly and with the utmost of respect, that there is transparency, and that there is a consistency in practices across transactions. |

| · | Expanding our visibility and access to sellers of rare jewelry and precious stones such that we will be able to secure a sufficient volume of high worth artifacts to support the buyer base and business overhead. |

| · | Becoming more visible to diamond investors and speculators across the U.S. and globally and to the international investment banking community when we are ready for such relationships. |

| · | Identifying attractive locations in other US cities and worldwide for setting expansion priorities.. |

| · | Improving our logistic/supply chain to enable quicker, secured deliveries and returns. |

| · | Developing a state of the art information system, inclusive of inventory data base, historical purchase and sale prices, number of days in inventory by item and category, any item specific special circumstances, seller and buyer and respective locations, demographics, product interests, etc. that will give us an added competitive advantage and improve our internal controls and IT. |

| · | Implementing a public relations and marketing program that will introduce and reinforce our branding. |

2 We anticipate linking with an international investment bank that wishes to help develop a securitized asset backed portfolio of precious stones.

3 This could be restricted to invited parties, e.g., past clients.

| 5 |

Company Ownership

The company is a wholly owned division of Gepco, Ltd., publicly traded under the symbol (OTCQB: GEPC) and its shares trade on the OTCQB market.

Company Startup Summary

GemVest is now poised to purchase and resell investment grade diamonds, precious stones and heirloom top of the line jewelry on a volume basis from both the world’s top diamond mining companies and from individuals and estates seeking timely access to liquidity. Included in the company’s attributes are:

| · | A world-class acclaimed (prestigious) retail jewelry nameplate with an aura that connotes exclusivity and exquisiteness. We enter this field with an already very meaningful presence in Peter Voutsas, our CEO and Chief Investment Officer, and an experience and expertise that any new entrant could only wish for. |

| · | The CEO and Chief Investment Officer, Peter Voutsas, is an internationally renowned jeweler with a reputation for integrity, honesty, and high customer satisfaction. We will have the benefit of Peter’s experience, expertise and leadership from the very beginning of our enterprise. There is no need for a learning curve. We are expanding on proven business practices, principles and activities that have made Peter one of the most respected and successful independent jewelers in the world. Few businesses can ever start with such advantages out of the gate. |

| · | The Company is layering strong financial resources on top of proven business practices so that the present and past success can be magnified and most all the risks are very much minimized. |

| · | The access to rare gems including diamonds opens paves the way for an international expansion at an accelerated pace. |

| · | Few products, even other luxury goods makers, are so dependent on reputation as purveyors of luxury jewelry. This is perhaps even more important in the retail arena by our being able to attract owners of rare jewelry and precious stones by the feel of an absolute comfortable and cordial environment that customers experience inside a Peter Marcos store. |

| · | Start-up expenses are relatively modest since the first store front, the buying and selling infrastructure and business relationships to the world wholesale markets are already in place. In addition, the brand is already well established. Nor will there be need to expand current sales staffing until we start adding an Internet based sales channel and expanded beyond the Beverly Hills store. |

Products and Services

GemVest seeks to become a world-wide destination for the purchase and resale of rare investment grade precious stones and jewelry by focusing on becoming:

| · | An international wholesale of high end investment grade precious stones including featured diamonds that would be marketed directly to collectors, investors, other wholesalers who are looking to supplement their own inventory and that of individual jewelry stores operating in high end of local markets |

| · | Heirloom and keepsake “collector and investor” grade diamond and other precious stone jewelry through the highest grade museum and collector pieces that will be marketed to an international clientele, high net worth shoppers, collectors, and investors. |

| 6 |

Market Segmentation

The diamond and jewelry distribution and sales industry is one of the United States’ most concentrated and exclusive industries characterized by a relatively small number of suppliers supplying diamonds to the entire market. As of the last economic census, there were approximately only 9,000 businesses that deal specifically with the sale of diamonds and jewelry on both a wholesale and retail level. Presumably, some of these did so in volumes that were virtually inconsequential. For each of the last five years, the industry has generated more than $54 billion dollars a year of revenue and has provided jobs to more than 70,000 people. Each year, approximately $7 billion dollars of payrolls are disbursed to these employees. Approximately half of the diamond distribution firms in the country are located in New York, California, and Texas.

Size of U.S. Diamond Market

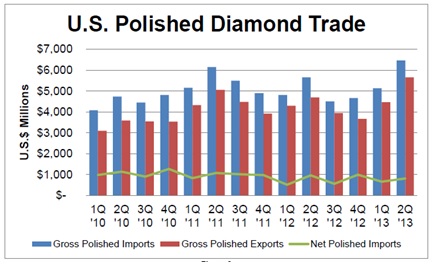

Reflecting its scarcity, by world trade standards, diamond trade is still a modest niche market. Polished diamond imports to the U.S. has risen from $4 billion in Q1 of 2010 to about $6.4 billion in Q1 of 2013 (see U.S. Polished Diamond Export - Import Volume, 2010Q1-2013Q1 graph below). During this same period, U.S. exports rose from #3.1 billion to $5.6 billion, making us a net imported by about $0.75 billion a quarter.

* Source: U.S. Polished Diamond Export - Import Volume, 2010Q1-2013Q1:

Target Market Segment Strategy

As the Company does not intend to market its investment diamond inventories directly to the general public, the marketing campaign required to support this business is quite limited. Foremost, the Company must immediately expand its relationships with other i). diamond distributors, ii). jewelry retailers, and iii). jewelry manufacturers that will continuously supply the business with purchase orders. At the onset of operations, Mr. Voutsas intends to directly approach regional premium jewelry stores to become an ongoing major supplier of such premium stock diamonds. Additionally, the Company will implement an interactive online website for the wholesale sector so that the Company’s target market can easily locate the Company’s contact information and easily find information related to making bulk purchases. Once registered and approved (verified as a qualified customer or business (jeweler)), registered users will be given access to all current inventories of investor diamonds in inventory and available for immediate delivery. All such affiliate jewelers will also be given a special code whereby they can quickly access any diamond that have interest in and show it on their own WEB site through an Internet Link. All such displays by the affiliate jewelers will show their logo and name above such “reserved” diamonds, which makes for an impressive presentation to their customers. Planning for the Internet capability described above is already in the planning and development stage. The Company also plans to hire a specialist marketing firm to place the Company’s inventory in trade directories serving the jewelry industry. In addition, the Management of GemVest, will regularly attend industry events that will allow them to network among potential clients that will regularly purchase diamonds from the business. Mr. Voutsas will also attend selected Christies and Sotheby’s auctions to showcase the Company’s higher-end diamonds.

| 7 |

Currently, total annual diamond sales in the U.S. have reached $5.5 billion, out of total jewelry sales of an estimated $40 billion, which represents approximately 18% of total jewelry sales. This includes everything from engagement rings, anniversary jewelry, ornamental items, watches, etc. The Company’s opportunity is establishing itself as a source of exquisite investment grade diamonds that are desired for speculation and asset protection in addition to demand from consumers seeking exquisite, eye catching beauty.

The diamond market itself is fragmented and characterized mostly by vendors targeting "mass" market demand with ordinary diamonds. It is also highly seasonal with year-end gifts and purchases accounting for a very significant portion of annual sales. The market is divided into three echelons: premium end, middle end, and low end. Online diamond retail also has different categories, parallel to the brick-and-mortar stores. BlueNile is typical of the upper-echelon vendors for high-end online diamonds, while Best Gem targets mostly middle end customers.

GemVest will target only in the upper echelon of high quality diamonds, with an average sale expected to be in the hundreds of thousands of dollars. The Company’s initial target is the top 25% of the diamond market, including the top ten percent of upper-echelon buyers. First year sales volume is targeted at $30-60 million.

Technology

GemVest intends to invest in state of the art technology that enables it to conduct commerce throughout the world. We will utilize existing technology commerce solutions when available and efficient and, when necessary, invest in developing proprietary software to support our business. We wish to be fully WEB enabled so as to be able to readily conduct commerce over the Internet on a worldwide basis.

Support of the Retail Heirloom Jewelry Business:

GemVest will invest in the creation of an Internet platform for attracting exclusive collector and investor jewelry and precious investment grade stones for purchase for immediate cash. We wish to establish a platform that offers fair prices, immediate cash, and great convenience and confidentiality. The WEB site will emphasize these features and allow sellers to receive a binding quote subject to all descriptions and ratings of gems being verified at time of receipt. In addition to supporting this commerce, the site will also promote our brand.

In addition, the business will seek an overall IT solution to overseeing and managing satellite locations, evaluating performances on a live basis, and live consolidation of results.

Competitive Edge

GemVest shall utilize its Management who are highly skilled at purchasing diamonds and have longstanding relationships with wholesale sources for investment grade diamonds at between 40% and 70% discounts to Rapaport Prices through its well established trade connections. Discount levels for select qualities of diamonds vary rather significantly and are based on a broad range of factors including the specific physical and technical characteristics of a particular diamond, type of market, location, state of market liquidity, and terms of sale. GemVest will have the benefit of robust funding which will enable the Company to become a repeat buyer of the highest grade precious diamonds and sustain a comprehensive and diverse inventory, sell, through the Rapaport Exchange supplemented by sales to trade sources in the wholesale exchange. With normal turnover, we expect to be able to turnover inventory at 3 to 4 times per year.

| 8 |

Marketing Strategy

GemVest’s Management has extensive, pre-existing relationships with jewelers and industry participants and will extend those relationships electronically through networks like RapNet. The BUY-SIDE will focus on finding distressed sales of estate jewelry and pawnshop situations. The SELL-SIDE will attempt to attain full prices or near full prices as quoted on the Rapaport Price List. Spreads of 30% and higher are quite common under this strategy.

Employees

Upon completion of the Acquisition, the Company has four part-time consultants. Our employees consist of Mr. Voutsas who serves as the Chief Executive Officer and Chief Investment Officer of Gepco, Ltd. and GemVest, Ltd.; Ms. Malone who serves as President, Chief Financial Officer and Secretary of Gepco, Ltd. and as the Chief Operating Officer, Chief Financial Officer and Secretary of GemVest, Ltd.; Mr. Marlin who serves as the Chief Marketing Officer of Gepco, Ltd. and the President and Chief Marketing Officer of GemVest, Ltd. and Mr. Loshin who serves as Chief Creative Officer of Gepco, Ltd. and GemVest, Ltd., all of whom provide services to us on a part-time basis.

To the best of its knowledge, the Company is compliant with local prevailing wage, contractor licensing and insurance regulations, and has good relations with its employees.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this Current Report on Form 8-K contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “may,” “anticipates,” believes,” “should,” “intends,” “estimates,” and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties are outlined in “Risk Factors” and include, without limitation, the Company’s ability to raise additional capital to finance the Company’s activities; the effectiveness, profitability, and the marketability of its products; legal and regulatory risks associated with the Reorganization ; the future trading of the common stock of the Company; the ability of the Company to operate as a public company; the period of time for which the proceeds of the Private Placement will enable the Company to fund its operations; the Company’s ability to protect its proprietary information; general economic and business conditions; the volatility of the Company’s operating results and financial condition; the Company’s ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in the Company’s filings with the SEC, or otherwise.

Information regarding market and industry statistics contained in this Report is included based on information available to the Company that it believes is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. The Company has not reviewed or included data from all sources, and cannot assure investors of the accuracy or completeness of the data included in this Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. The Company does not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

| 9 |

Form 10 Item 1A. Risk Factors

An investment in the Company’s common stock involves a high degree of risk. In determining whether to purchase the Company’s common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Related to our Business

A decline in the price of diamonds could adversely affect

The market price of our stocks, and our financial results and condition, may in the future materially adversely affected by declines in the price of rough and polished diamonds. As prices decline, this may prove to be a less attractive commodity to our investors thus decreasing demand and lowering the market price for our diamonds. If we have diamonds for which we have paid a higher price, and the market declines, we may be forced to sell at a lower price than expected, thus decreasing our profit margin or forcing us to less at a price less than the price which we paid for inventory.

Due to the international nature of the diamond industry, we bear significant foreign currency risk.

The diamond market is international with pricing generally determined by large participants in the global diamond trading centers and exchanges, which prices may be denominated in foreign currency. Thus if purchases are denominated in foreign currency, thus we will become exposed to foreign currency fluctuations relative to the U.S. dollar which may affect our financial results.

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue operations in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such we may have to cease operations and you could lose your investment. Further, we have not considered and will not consider any activity beyond our current exploration program until we have completed our exploration program.

Because we do not have sufficient capital to fund our business plan, we will have to sell additional securities and raise additional capital which will dilute current shareholders ownership positions.

We do not have the capital to fund our business plan. As a result we will have to raise additional capital to maintain operations. There is no assurance that we will be able to secure enough capital to maintain operations and if we cannot raise the capital needed we may have to suspend operations.

We have no operating history upon which an evaluation of our prospects can be made.

We have had no operations in the diamond industry since our inception upon which to evaluate our business prospects. As a result, investors do not have access to the same type of information in assessing their proposed investment as would be available to purchasers in a company with a history of prior substantial operations. We face all the risks inherent in an early stage business, including the expenses, lack of adequate capital and other resources, difficulties, complications and delays frequently encountered in connection with conducting operations, including capital requirements and management’s potential underestimation of initial and ongoing costs. We also face the risk that we may not be able to effectively implement our business plan. If we are not effective in addressing these risks, we will not operate profitably and we may not have adequate working capital to meet our obligations as they become due.

| 10 |

We may be unable to successfully execute any of our identified business opportunities or other business opportunities that we determine to pursue.

We currently have a limited corporate infrastructure. In order to pursue business opportunities, we will need to continue to build our infrastructure and operational capabilities. Our ability to do any of these successfully could be affected by any one or more of the following factors:

| · | our ability to raise substantial additional capital to fund the implementation of our business plan; | |

| · | our ability to execute our business strategy; | |

| · | the ability of our products to achieve market acceptance; | |

| · | our ability to manage the expansion of our operations and any acquisitions we may make, which could result in increased costs; | |

| · | our ability to attract and retain qualified personnel; | |

| · | our ability to manage our third party relationships effectively; and | |

| · | our ability to accurately predict and respond to the rapid changes in our industry and the evolving demands of the markets we serve. |

Our failure to adequately address any one or more of the above factors could have a significant impact on our ability to implement our business plan with respect to marketing and selling our nutritional supplement products and our ability to pursue any related opportunities that arise.

We have a history since inception of losses, and we may not be able to cover our costs of operation or achieve profitability in the future.

For the years ended December 31, 2012 and 2011, Gepco, Ltd. incurred net losses of $577,340 and $673,306, respectively. There can be no assurances that we will generate sufficient revenues in the future to cover our costs of operation or that we will be profitable. If we cannot cover our costs of operation, either through profits or otherwise securing sufficient capital to fund our costs of operation, it would be very unlikely that we would achieve profitability, and we may be required to cease our operations.

We may not be able to effectively control and manage our proposed business plan, which would negatively impact our operations.

If our business and markets grow and develop (and there are there are no assurances what growth and development will occur, if any), it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing expanding product offerings and in integrating any acquired businesses with our own. Such occurrences will increase demands on our existing management, workforce and facilities. Failure to satisfy increased demands could interrupt or adversely affect our operations and cause administrative inefficiencies.

| 11 |

Economic declines may have a material adverse effect on our sales, and a slow recovery could prevent us from achieving our financial goals.

We cannot predict the extent to which economic conditions will change and many economists predict that the economic decline will be prolonged, that any recovery may be weak, and that conditions may deteriorate further before there is any improvement or even after some improvement has occurred. Continuing weak economic conditions in the United States or abroad as a result of the current global economic downturn, lower consumer spending (especially discretionary items), lower consumer confidence, continued high or higher levels of unemployment, higher inflation or even deflation, higher commodity prices, such as the price of oil, political conditions, natural disaster, labor strikes or other factors could negatively impact our sales or ability to achieve profitability.

Natural disasters, armed hostilities, terrorism, labor strikes or public health issues could have a material adverse effect on our business.

Armed hostilities, terrorism, natural disasters, or public health issues, whether in the United States or abroad could cause damage and disruption to our company, our suppliers, our manufacturers, or our customers or could create political or economic instability, any of which could have a material adverse impact on our business. Although it is impossible to predict the consequences of any such events, they could result in a decrease in demand for our product or create delay or inefficiencies in our supply chain by making it difficult or impossible for us to deliver products to our customers, or for our manufacturers to deliver products to us, or suppliers to provide component parts.

We rely on key personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our success depends in large part upon the abilities and continued service of Peter Voutsas, our chief executive officer. There can be no assurance that we will be able to retain the services of Peter Voutsas. Our failure to retain the services of our key personnel could have a material adverse effect on the Company. In order to support our projected growth, we will be required to effectively recruit, hire, train and retain additional qualified management personnel. Our inability to attract and retain the necessary personnel could have a material adverse effect on the Company. We have no “key man” insurance on any of our key employees.

Risks Related to the Company’s Common Stock

There is not an active liquid trading market for the Company’s common stock.

The Company files reports under the Securities Exchange Act of 1934, as amended, and its common stock is eligible for quotation on the OTCQB. However, there is no regular active trading market in the Company’s common stock, and we cannot give an assurance that an active trading market will develop. If an active market for the Company’s common stock develops, there is a significant risk that the Company’s stock price may fluctuate dramatically in the future in response to any of the following factors, some of which are beyond our control:

| · | variations in our quarterly operating results; | |

| · | announcements that our revenue or income are below analysts’ expectations; | |

| · | general economic slowdowns; | |

| · | sales of large blocks of the Company’s common stock; | |

| · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; and | |

| · | fluctuations in stock market prices and volumes, which are particularly common among highly volatile securities of early stage technology companies. |

| 12 |

The ownership of our common stock is highly concentrated among a few shareholders.

Our executive officers and directors will beneficially own approximately 137,265,000 shares of our outstanding common stock (70.91%). Two other shareholders hold 24,000,000 shares constituting 12.4% or our outstanding common stock. As a result, they have the ability to exercise control over our business by, among other items, their voting power with respect to the election of directors and all other matters requiring action by stockholders. Such concentration of share ownership may have the effect of discouraging, delaying or preventing, among other items, a change in control of the Company.

The Company’s common stock will be subject to the “penny stock” rules of the SEC, which may make it more difficult for stockholders to sell the Company’s common stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| · | that a broker or dealer approve a person's account for transactions in penny stocks; and | |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| · | obtain financial information and investment experience objectives of the person; and | |

| · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| · | sets forth the basis on which the broker or dealer made the suitability determination; and | |

| · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The regulations applicable to penny stocks may severely affect the market liquidity for the Company’s common stock and could limit an investor’s ability to sell the Company’s common stock in the secondary market.

As an issuer of “penny stock,” the protection provided by the federal securities laws relating to forward-looking statements does not apply to the Company.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company’s failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

| 13 |

The Company has not paid dividends in the past and does not expect to pay dividends in the foreseeable future. Any return on investment may be limited to the value of the Company’s common stock.

No cash dividends have been paid on the Company’s common stock. We expect that any income received from operations will be devoted to our future operations and growth. The Company does not expect to pay cash dividends in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as the Company’s board of directors may consider relevant. If the Company does not pay dividends, the Company’s common stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

Form 10 Item 2. Management’s Discussion and Analysis of Financial Conditions and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes appearing elsewhere in this Report. This discussion and analysis may contain forward-looking statements based on assumptions about our future business. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, but not limited to, those set forth under “Risk Factors” and elsewhere in this Report.

For a discussion of our financial statements prior to the Acquisition, see our financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended December 31, 2012 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2013, June 30, 2013, and September 30, 2013. Until the Acquisition, we had conducted only nominal business operations.

Overview.

GemVest, Ltd. was incorporated on October 2, 2013 in the State of Nevada. GemVest is a start-up development stage company that has had no revenue or expenses since its inception.

The Company intends to sell and broker high end rare investment grade diamonds that are obtained from wholesale diamond cutters all over the world with which our Chief Executive Officer, Peter Voutsas, has long, outstanding relationships and from individuals and estates seeking liquidity who possess investment grade diamonds and heirloom quality jewelry.

As the Company was a shell company prior to the acquisition of GemVest, GemVest is the acquiror for accounting purposes, and future financial reporting shall be set forth as if GemVest acquired the Company.

Critical Accounting Policies and Estimates.

Basis of Presentation

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America.

Revenue Recognition

Revenue is recognized net of indirect taxes, rebates and trade discounts and consists primarily of the sale of products, and services rendered.

| 14 |

Revenue is recognized in accordance with Accounting Standards Codification Topic No. 605-10-S99 “Revenue Recognition” (ASC 605-10-S99) when the following criteria are met:

| · | evidence of an arrangement exists; |

| · | delivery has occurred or services have been rendered and the significant risks and rewards of ownership have been transferred to the purchaser; |

| · | transaction costs can be reliably measured; |

| · | the selling price is fixed or determinable; and |

| · | collectability is reasonably assured. |

Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and impairment. Land is not depreciated. Repairs and maintenance are charged to operations as incurred.

Property and equipment is depreciated on a straight-line basis over its expected useful life. The depreciation methods, and estimated remaining useful lives are reviewed at least annually.

Upon classification of property and equipment as held for sale it is reviewed for impairment. The impairment charged to the income statement is the excess of the carrying value of the property and equipment over its expected fair value less costs to sell.

Estimates

The presentation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Fair Value of Financial Instruments

The carrying amounts for the Company’s cash, investments, accounts payable, accrued liabilities and current portion of long term debt approximate fair value due to the short-term maturity of these instruments.

Investments

Investments presently consist of funds invested in debt securities available for sale. Investments are recorded at their amortized cost basis in accordance with Accounting Standards Codification 320 “Investments – Debt and Equity Securities” (ASC 320). Investments in debt securities that are classified as available for sale and equity securities that have readily determined fair values that are classified as available for sale are measured subsequently at fair value.

Intangible Assets

In accordance with Accounting Standards Codification Topic 985-20 “Costs of Software to be Sold, Leased or Marketed” (ASC 985-20), the Company has capitalized development costs incurred after the technological feasibility of our Wikifamilies.com product had been established until the product was available for general release to customers. In accordance with Accounting Standards Codification Topic 350-20 "Intangibles - Goodwill and Other" (ASC 350-20) intangible assets that have finite lives are amortized over the period during which the asset is expected to contribute directly or indirectly to future cash flows of the entity (useful lives).

Other Comprehensive Income

We follow Accounting Standards Codification Topic No. 220, "Comprehensive Income" (ASC 220). This statement establishes standards for reporting comprehensive income and its components in financial statements. Comprehensive income, as defined, includes all changes in equity (net assets) during a period from transactions and other events and circumstances from non-owner sources. Examples of items to be included in comprehensive income, which are excluded from net income, include unrealized gains and losses on available-for-sale securities.

| 15 |

Income Taxes

Accounting Standards Codification Topic No. 740 “Income Taxes” (ASC 740) requires the asset and liability method of accounting be used for income taxes. Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Earnings (Loss) Per Share

Per Accounting Standards Codification Topic 260 “Earnings Per Share” (ASC 260), basic EPS is determined using net income divided by the weighted average shares outstanding during the period. Diluted EPS is computed by dividing net income by the weighted average shares outstanding, assuming all dilutive potential shares of Common Stock were issued.

Basic EPS is determined using net income divided by the weighted average shares outstanding during the period. Diluted EPS is computed by dividing net income by the weighted average shares outstanding, assuming all dilutive potential common shares were issued.

Results of Operations

GemVest is a development stage company that has had no revenue or expenses since its inception.

Revenues

We expect revenues for the balance of the year December 31, 2013 to grow as we begin to implement our business plan. The rate at which our revenues will increase will depend on how quickly we can begin sales and the amount of sales generated.

Selling, General and Administrative Expenses

We expect selling, general and administrative expenses for the balance of the year ending December 31, 2013 to trend marginally upward as we begin to bring in additional sales and marketing personnel necessary to grow our business and to service the significant demand we expect for our products and services.

Net Income (Loss)

GemVest is a development stage company that has had no revenue or expenses since its inception and therefore no net income or loss.

Financial Condition, Liquidity and Capital Resources

GemVest is a development stage company that has had no revenue or expenses since its inception.

Future Financing

We plant to rely on equity sales of our common shares in order to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund planned acquisitions, expansions and exploration activities or if we are able to secure additional financing, whether such financing shall be on favorable terms.

| 16 |

Off-Balance Sheet Arrangements

As of December 6, 2013, GemVest did not have any off-balance sheet debt nor did it have any transactions, arrangements, obligations (including contingent obligations) or other relationships with any unconsolidated entities or other persons that have or are reasonably likely to have a material current or future effect on financial condition, changes in financial condition, results of operations, liquidity, capital expenditures, capital resources, or significant components of revenue or expenses material to investors.

Form 10 Item 3. Properties

Gepco, Ltd. has use of an administrative office in San Diego, CA, that is provided to us without charge by our President, Chief Financial Officer and Secretary.

GemVest has use of retail space in Beverly Hills, CA that is provided without charge by our Chief Executive Officer and Chief Investment Officer.

Form 10 Item 4. Security Ownership of Certain Beneficial Owner and Management

The following table sets forth information regarding the beneficial ownership of our common stock as of December 6, 2013 (after the Acquisition) for: (i) each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock; (ii) each of our named executive officers and directors; and (iii) all of our current named executive officers and directors as a group. Unless otherwise noted, we believe that each beneficial owner named in the table has sole voting and investment power with respect to the shares shown, subject to community property laws where applicable. An asterisk (*) denotes beneficial ownership of less than one percent.

| Beneficial Ownership | ||||||||

| Name (1) | Number of Shares | Percent of Class (2) | ||||||

| Unicorn Funds Foundation | 12,000,000 | 6.20 | % | |||||

| Gil-Galad Foundation | 12,000,000 | 6.20 | % | |||||

| Total 5% Owners as a group | 24,000,000 | 12.40 | % | |||||

| Trisha Malone | 10,265,000 | 5.30 | % | |||||

| Angelique de Maison (3) | 88,500,000 | 45.72 | % | |||||

| Peter Voutsas | 37,500,000 | 19.37 | % | |||||

| Larry A. Zielke | 1,000,000 | 0.52 | % | |||||

| All executive officers and directors as a group (four persons) | 137,265,000 | 70.91 | % | |||||

| (1) The address for each of the above noted individuals is c/o 9025 Carlton Hills Blvd., Ste. B, Santee, CA 92071. | ||||

| (2) The percentage ownership reflected in the table is based on 193,582,555 shares of Common Stock outstanding as of December 6, 2013. | ||||

| (3) Includes 18,500,000 shares owned by Kensington & Royce, Ltd. of which Ms. De Maison is an Officer and Majority Shareholder. |

| 17 |

Form 10 Item 5. Directors and Executive Officers

| Name | Age | Position with Company |

| Angelique de Maison | 43 | Executive Chairman, Gepco, Ltd. and Gemvest, Ltd. |

| Peter Voutsas | 52 | Chief Executive Officer, Chief Investment Officer and Director, Gepco, Ltd. and Gemvest, Ltd. |

| Trisha Malone | 38 | President, Chief Financial Officer, Secretary, Director Gepco, Ltd.; Chief Operating Officer, Chief Financial Officer, Secretary, Director Gemvest, Ltd. |

| Nic Marlin | 30 | Chief Marketing Officer, Gepco, Ltd.; President and Chief Marketing Officer, Gemvest, Ltd. |

| Ronald Loshin | 71 | Chief Creative Officer, Gepco, Ltd. and Gemvest, Ltd. |

| Larry A. Zielke | 65 | Vice President, Corporate Counsel and Director, Gepco, Ltd. |

Officers and Directors of Gepco, Ltd. prior to the Acquisition:

Trisha Malone. Ms. Malone is the Chief Financial Officer and Secretary of Lustros Inc. since April 18, 2012. Ms. Malone has more than 19 years of experience in finance and accounting including experience in corporate governance, securities regulation, financial controls requirements, and financial management. From 2000 to 2006, Ms. Malone served as Corporate Controller for Xsilogy, Inc., a leading wireless sensor network company, and as the division controller after Xsilogy’s acquisition by SYS Technologies, Inc., a public company engaged in government contracting. From 2006 to 2008, Ms. Malone was the Corporate Controller for Satellite Security Corporation, a developer of satellite tracking systems. Since 2008, Ms. Malone has been self-employed as an independent accounting consultant and is presently consulting as Corporate Controller for several private companies. From 2007 to 2009, Ms. Malone served as the Corporate Controller for Lenco Mobile Inc., which operates in the high growth mobile marketing and Internet sectors, and served as Corporate Secretary for Lenco until June 2010. From June 2010 to September 2012 Ms. Malone served as Chief Financial Officer and a Director of Wikifamilies, Inc., a public company that operates in the technology services industry. Ms. Malone was also a Director of Casablanca Mining, Ltd. from its inception on June 27, 2008 until August 30, 2012 and was the Chief Executive Officer of Casablanca from inception until January 2009 and the Chief Financial Officer from inception through December 2011. Ms. Malone has a degree in Business Administration from Grossmont College. She has also pursued extended studies in corporate law, benefits administration, and human resources. Ms. Malone’s extensive experience in finance, accounting, corporate governance, and securities regulation led to the conclusion that she should serve as a director of the Company.

Larry A. Zielke. Mr. Zielke has maintained a commercial law practice in Damascus, Ohio since 2001. Mr. Zielke served as director, Senior Vice-President and General Counsel of Lustros, Inc. in 2012 during the company’s startup in Chile. From 1994 to 2000, Mr. Zielke was General Counsel and Corporate Secretary of Sakhalin Energy Investment Company Ltd., resident first in Moscow and subsequently on Sakhalin Island. During this period, Mr. Zielke was a member of Sakhalin Energy’s Executive Management team that achieved the first export of oil from Russia by a non-Russian company, was the company’s lead negotiator for project financing from EBRD, OPIC and JEXIM, and was responsible for risk management and corporate compliance. From 1979 to 1994, he served as in-house counsel to Babcock & Wilcox and various other affiliates of McDermott International, Inc., which included experience from Cairo to Jakarta while residing in Dubai, United Arab Emirates. Mr. Zielke holds a Juris Doctor degree from the University of Akron, a B.S. in engineering physics and a Mechanical Engineer degree from Ohio State University. His engineering background included research for nuclear reactor core heat transfer design. In addition to being a licensed attorney, he was previously a licensed professional engineer. Mr. Zielke’s extensive experience in business and the law led to the conclusion that he should serve as a director of the Company.

Officers and Directors Added in the Acquisition:

Angelique De Maison – Founder and Executive Chairman. Ms. de Maison is responsible for the financing, vision and strategic direction of the Company. She is an accomplished investor, business strategist, capital formation expert and expert business advisor. Founder and CEO of Kensington & Royce, Ltd., a private investment company since 2006. Kensington & Royce has already successfully funded four companies from inception to public market, including Lustros, Inc. (LSTS).

| 18 |

Peter Voutsas – Founder, Chief Executive Officer, Chief Investment Officer and Director. With 38 years of experience in the jewelry business and great relationships all over the world in the industry, Peter Voutsas has been extremely successful. Mr. Voutsas grew up in a single parent household in a poor family and poor neighborhood in New York, At the age of 14 he had an opportunity over the summer to work at Albithel Jewelry Manufacturing Company in Manhattan, one of the finest jewelry manufacturing company in the United States at the time. He was hired to clean the lavatories and office and as a messenger boy. He was allowed to watch the jewelers and learn when his regular work was completed. After six months he became a jeweler then polisher and eventually a diamond setter. At 16 years of age his mother remarried and his family relocated to Europe while Mr. Voutsas stayed on his own in New York

During the end of his traveling career Mr. Voutsas had a partnership opportunity to open and run a retail jewelry store in Beverly Hills California called James Elliot/Bez Ambar. Originally there were four partners, however, in 2009 he had an opportunity to buy his partners out and take over the store. He renamed the store Peter Marco Extraordinary Jewels of Beverly Hills after his two sons Peter and Marco. He has been in this location for approximately twelve years. Peter Marco Extraordinary Jewels of Beverly Hills’ location at 252 North Rodeo Drive 90210 is on one of the finest shopping streets in the world with 25 feet of window space on the famous Via Rodeo.

Nicholas Marlin – President, Chief Marketing Officer and Director. Nicholas Marlin is a highly successful entrepreneur with expertise in management, marketing and the Internet. He Co-Founded a leading online dating website, OneGoodLove.com. Mr. Marlin founded his own marketing company in 2008, Marlin Marketing, specializing in online marketing and advertising. Mr. Marlin earned his B.S. in Business Admin from Chapman University and an MBA in General Management from Cal Poly. He is also a former Olympic-level gymnast and US National Champion in the sport.

Ronald S. Loshin – Chief Visionary Officer and Director. Mr. Loshin has served as an expert consultant to the consumer banking and automobile industries since Founding Bank Lease consultant, Inc, in 1981. He is noted as one of the nation’s leading authorities in automobile leasing and finance. During his career, Mr. Loshin has consulted with virtually every major national and regional bank, auto manufacturer and their captive finance companies, investment banks, and service companies to the auto finance industry. More recently, Mr. Loshin has specialized in venture capital, business development, the Internet and the entertainment industry. Mr. Loshin has held the post of Post-Doctoral Fellow at UC Berkeley following his education at New York University, The London School of Economics and UC, Berkeley. Mr. Loshin is the Co-Author of The Auto Lending and Leasing Manual published by Warren, Gorham and Lamont and Founded and serves as the Co-Managing Director of The Association Of Consumer Vehicle Lessors (ACVL.net) whose member account for over 85% of all consumer automobile leasing in the US. He is Co-Founder of First Wives World, Inc. (firstwivesworld.com), the leading Internet resource center for women experiencing divorce. Mr. Loshin has served as Board member of The New York Ballet Theater and is actively working on funding for both Broadway musicals and a movie for a leading Broadway Producer. He continues to serve as a scholar consultant for The Gerson Lehrman Group (GLG).

Director Nomination

Criteria for Board Membership. In the future, in selecting candidates for appointment or re-election to the Board, the Board of Directors will consider the appropriate balance of experience, skills and characteristics required of the Board of Directors. Nominees for director will be selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment, and willingness to devote adequate time to Board duties. The current board members were selected by the Custodian based upon their experience of working with public companies and due to their working relationship with respect to Lustros Inc.

Stockholder Nominees. The Company’s Board of Directors will consider written proposals from stockholders for nominees for director, provided such proposals meet the requirements described herein and in our Bylaws. Any such nominations should be submitted to the Board of Directors c/o the Secretary of the Company at our principal executive offices, located at 9025 Carlton Hills Blvd., Ste. B, Santee, CA 92071, and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written Proxy to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of the Company’s Common Stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of the nominee. All such items should be submitted in the time frame described in the Bylaws of the Company and under the caption, “Deadlines for Submission of Stockholder Proposal or Nominations” above.

| 19 |

Process for Identifying and Evaluating Nominees. The Board believes the Company is well-served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for Board membership, the Board will re-nominate incumbent directors who continue to qualify for Board service and remain willing to serve as directors. If an incumbent director chooses not to stand for re-election, or if a vacancy on the Board occurs between annual stockholder meetings, the Nominating Committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee. Director candidates will be selected based on input from members of the Board, senior management and, if the committee deems it appropriate, a third-party search firm. The Board will evaluate each candidate’s qualifications and check relevant references; in addition, such candidates will be interviewed by at least one member of the Board. Candidates meriting serious consideration will meet with all members of the Board. Based on this input, the committee will evaluate which of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board, or presented for the approval of the stockholders, as appropriate. We have not paid any fees to any third party to assist in identifying or evaluating director candidates. The Nominating Committee will use a similar process to evaluate nominees recommended by Stockholders.

Board Meetings and Committees

Our current Board held no meetings during the fiscal year ended December 31, 2012. We have no committees of the Board of Directors, and all functions of an Audit Committee, a Compensation Committee and the Nominating Committee are performed by the full Board of Directors. During the last fiscal year, no director attended fewer than 75% of the sum of the total number of meetings of the Board of Directors and the total number of meetings of the committees upon which that director served, held subsequent to his becoming a director or his appointment to such committee. While members of our Board of Directors are not required to attend our Special Meeting of stockholders, they are encouraged to attend.

Communication between Stockholders and Directors

Stockholders or other interested parties may communicate with any director or committee of the Board by writing to them c/o Investor Relations, 9025 Carlton Hills Blvd., Ste. B, Santee, CA 92071 or by sending an e-mail to investorrelations@gepcoltd.com or by calling Trisha Malone at (909) 708-4303. Comments or questions regarding the Company’s accounting, internal controls or auditing matters should also be referred to Ms. Malone. All appropriate communications will be compiled by our Secretary and submitted to the Board of Directors or an individual director, as appropriate, on a periodic basis.

Fees of Independent Registered Public Accounting Firm and Board Preapproval of Registered Public Accounting Firm Services

Gruber & Co., LLC audited our financial statements for the fiscal year ended December 31, 2011. Aggregate fees billed to us by Gruber & Co., LLC for professional services rendered with respect to fiscal year ended December 31, 2011 were as follows:

| 2011 | ||||

| Audit Fees | $ | 12,500 | ||

| Audit-Related Fees | 0 | |||

| Tax Fees | 0 | |||

| All Other Fees | 0 | |||

| $ | 12,500 | |||

| 20 |

M&K CPAs LLC audited our financial statements for the fiscal year ended December 31, 2012. Aggregate fees billed to us by M&K CPAs LLC for professional services rendered with respect to the fiscal year ended December 31, 2012 were as follows:

| 2012 | ||||

| Audit Fees | $ | 4,000 | ||

| Audit-Related Fees | 0 | |||

| Tax Fees | 0 | |||

| All Other Fees | 0 | |||

| $ | 4,000 | |||

In the above table, in accordance with the SEC’s definitions and rules, “audit fees” are fees we paid for professional services for the audit of our consolidated financial statements included in our Form 10-K and the review of financial statements included in Form 10-Qs, and for services that are normally provided by the accountants in connection with statutory and regulatory filings or engagements; “audit-related fees” are fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements; and “tax fees” are fees for tax compliance, tax advice and tax planning.

All audit related services, tax services and other services rendered by the Company’s principal accountant were pre-approved by the Company’s Board of Directors at the time. The Board of Directors has adopted a pre-approval policy that provides for the pre-approval of all of the services that were performed for the Company by its principal accountant.

Audit Committee Report and Compensation Committee Report

The Company has not had either an audit committee or compensation committee in 2012 and has no current plans to establish either during 2013. Further, neither of our directors qualifies as “independent” or provides any independent oversight of our audit or compensation processes.

Item 6. Executive Compensation

The following table provides information as to compensation of all named executive officers of the Company, as defined under Item 402 of Regulation S-K, for each of the Company’s last two fiscal years, or the last fiscal year if the named executive officer was not a named executive officer in the previous fiscal year.

SUMMARY COMPENSATION TABLE

| Name and principal position | Year | Salary | All Other Compensation | Total | ||||

|

Trisha Malone, Chief Financial Officer and Director (1) |

2012 2011 |

$45,000 $5,775 |

$25,000 (3) $0 |

$70,000 $5,775 | ||||

|

Larry A. Zielke, Vice President, Corporate Counsel and Director (2) |

2012 2011 |

n/a n/a |

n/a n/a |

n/a n/a |

(1) Ms. Malone served as a director from November 5, 2010, and Chief Financial Officer from June 23, 2010 through her resignation on September 13, 2012. Ms. Malone was appointed as Custodian of the Company on April 2, 2013 by the Eighth Judicial District Court of Clark County, Nevada pursuant to Nevada Revised Statutes 78.347. On April 9, 2013 the duly appointed Custodian of the Company appointed Trisha Malone as a Member of the Board of Directors as well as Chief Executive Officer, Chief Financial Officer and Secretary of the Company.

(2) On April 9, 2013 the duly appointed Custodian of the Company appointed Larry A. Zielke as a Member of the Board of Directors as well as Vice President and Corporate Counsel of the Company.

(3) The “All Other Compensation” paid to Ms. Malone in 2012 consisted of 250,000 restricted shares of Common Stock the Board of Directors of the Company elected to issue on July 10, 2012 as equity awards in lieu of partial payment to director and Chief Financial Officer Trisha Malone. The five day market value on the day of the grants was $0.10 per share. The value of these shares at the market price was recorded as legal and professional fee expense.

No executive officer received compensation during the fiscal year ended December 31, 2012 in excess of $100,000.

| 21 |

There are no outstanding equity awards or options to any executive officer issued or outstanding for services to the Company.

Employment Agreements

The Company has not entered into any employment contracts.

Director Compensation

| Name | Fees earned or paid in cash ($) |

Stock awards ($) (1) |

Option awards ($) |

Non-equity incentive plan compensation ($) |

Nonqualified deferred compensation earnings ($) |

All other compensation ($) |

Total ($) |

| Thomas Hudson | – | $52,500 | – | – | – | – | $52,500 |