UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-Q

S QUARTERLY REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March

31, 2013

£ TRANSITION REPORT UNDER

SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

For the transition period from ______ to

_______

Commission File Number 000-53558

CASABLANCA

MINING LTD.

(Exact name of registrant

as specified in its charter)

| Nevada |

|

80-0214005 |

| (State of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

417 Orchid Avenue

Corona Del Mar, CA 92625 |

|

(Address of principal executive offices)

(619)

717-8047 |

| (Registrant’s telephone number, including area code) |

|

(Former, name, former address, and former

fiscal year, if changed since last report) |

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. S Yes £

No

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). S

Yes £ No (Not required)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2

of the Exchange Act.

| |

Large Accelerated Filer |

£ |

|

Accelerated Filer |

£ |

| |

|

|

|

|

|

| |

Non-Accelerated Filer |

£ |

|

Smaller Reporting Company |

S |

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). S

Yes £ No

As of June 17, 2013 the issuer had 60,960,633 shares of common stock (“Common Stock”) outstanding.

TABLE OF CONTENTS

| |

|

|

PAGE |

| PART I |

FINANCIAL INFORMATION |

|

1 |

| |

|

|

|

| ITEM 1. |

CONSOLIDATED FINANCIAL STATEMENTS AND NOTES |

|

1 |

| |

|

|

|

| ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

13 |

| |

|

|

|

| ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

17 |

| |

|

|

|

| ITEM 4. |

CONTROLS AND PROCEDURES |

|

17 |

| |

|

|

|

| PART II |

OTHER INFORMATION |

|

18 |

| |

|

|

|

| ITEM 1. |

LEGAL PROCEEDINGS |

|

18 |

| |

|

|

|

| ITEM 1A. |

RISK FACTORS |

|

18 |

| |

|

|

|

| ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

|

18 |

| |

|

|

|

| ITEM 3. |

DEFAULTS UPON SENIOR SECURITIES |

|

18 |

| |

|

|

|

| ITEM 4. |

MINING SAFTEY DISCLOSURE |

|

18 |

| |

|

|

|

| ITEM 5. |

OTHER INFORMATION |

|

18 |

| |

|

|

|

| ITEM 6. |

EXHIBITS |

|

19 |

Special Note Regarding Forward-Looking Statements

Information

included in this Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange

Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause the actual results,

performance or achievements of Casablanca Mining Ltd. (the “Company”), to

be materially different from future results, performance or achievements expressed or implied by any forward-looking statements.

Forward-looking statements, which involve assumptions and describe future plans, strategies and expectations of the Company, are

generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,”

“estimate,” “believe,” “intend,” or “project” or the negative of these words or

other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be

incorrect, and there can be no assurance that these projections included in these forward-looking statements will come to pass.

Actual results of the Company could differ materially from those expressed or implied by the forward-looking statements as a result

of various factors. Except as required by applicable laws, the Company has no obligation to update publicly any forward-looking

statements for any reason, even if new information becomes available or other events occur in the future.

*Please note that throughout this Quarterly

Report, and unless otherwise noted, the words "we," "our," "us," the "Company," or "CUAU"

refers to Casablanca Mining Ltd.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

| INDEX |

1 |

| |

|

| Unaudited Consolidated Balance Sheets as of March 31, 2013 and December 31, 2012. |

2 |

| |

|

| Unaudited Consolidated Statements of Operations and Comprehensive Loss for the Three Months Ended March 31, 2013 and 2012. |

3 |

| |

|

| Unaudited Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2013 and 2012. |

4 |

| |

|

| Unaudited Notes to Consolidated Financial Statements. |

5 |

The accompanying

consolidated financial statements have been prepared in accordance with accounting principles generally

accepted in the United States of America (“U.S. GAAP”) for interim financial reporting and pursuant to the rules

and regulations of the Securities and Exchange Commission (“Commission”). While these statements reflect all normal

recurring adjustments that are, in the opinion of management, necessary for fair presentation of the results of the interim period,

they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information,

refer to the consolidated financial statements and footnotes thereto, which are included in the Company’s annual report on

Form 10-K, previously filed with the Commission.

Casablanca Mining Ltd.

(An Exploration Stage Company)

Consolidated Balance Sheets

(Unaudtied)

| | |

March 31,

2013 | | |

December 31,

2012 | |

| ASSETS | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 6,602 | | |

$ | 2,297 | |

| Accounts receivable | |

| 2,179 | | |

| 1,597 | |

| Prepaids | |

| 108,364 | | |

| 92,288 | |

| Total current assets | |

| 117,145 | | |

| 96,182 | |

| | |

| | | |

| | |

| Other Assets | |

| | | |

| | |

| Property and equipment, net | |

| 452,681 | | |

| 452,815 | |

| Mining property | |

| 5,018,526 | | |

| 4,941,573 | |

| Deposit on mining property option | |

| 67,875 | | |

| – | |

| Goodwill | |

| 66,258 | | |

| 66,258 | |

| Total other assets | |

| 5,605,340 | | |

| 5,460,646 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 5,722,485 | | |

$ | 5,556,828 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

| 898,327 | | |

| 910,055 | |

| Due to related parties | |

| 1,683,784 | | |

| 1,563,501 | |

| Notes payable | |

| 392,732 | | |

| 377,978 | |

| Capital lease, current portion | |

| 83,195 | | |

| 72,269 | |

| Total current liabilities | |

| 3,058,037 | | |

| 2,923,803 | |

| | |

| | | |

| | |

| Long-term Liabilities | |

| | | |

| | |

| Capital lease, long-term | |

| 195,562 | | |

| 188,120 | |

| Total long-term liabilities | |

| 195,562 | | |

| 188,120 | |

| | |

| | | |

| | |

| Total liabilities | |

| 3,253,600 | | |

| 3,111,923 | |

| | |

| | | |

| | |

| Stockholders' Equity | |

| | | |

| | |

| Common stock, $.001 par value, 100,000,000 shares

authorized, 60,277,521 and 59,657,521 shares issued and outstanding, respectively | |

| 60,277 | | |

| 59,657 | |

| Additional paid-in capital | |

| 7,819,438 | | |

| 7,662,658 | |

| Stock payable | |

| 193,600 | | |

| – | |

| Accumulated other comprehensive income | |

| 199,168 | | |

| 163,329 | |

| Deficit accumulated during exploration stage | |

| (5,803,598 | ) | |

| (5,440,739 | ) |

| Total stockholders' equity | |

| 2,468,885 | | |

| 2,444,905 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 5,722,485 | | |

$ | 5,556,828 | |

See notes to consolidated

financial statements.

Casablanca Mining Ltd.

(An Exploration Stage Company)

Consolidated Statements of Operations

(Unaudited)

| | |

For the Three Months Ended | | |

From inception

(June 27, 2008) to | |

| | |

March 31, 2013 | | |

March 31, 2012 | | |

March 31, 2013 | |

| | |

| | |

| | |

| |

| Income | |

$ | 10,989 | | |

$ | – | | |

$ | 97,987 | |

| | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | |

| Mining property expenses | |

| 118,937 | | |

| 194,433 | | |

| 1,189,302 | |

| Payroll expenses | |

| 64,579 | | |

| – | | |

| 517,139 | |

| General and administrative | |

| 80,109 | | |

| 103,135 | | |

| 971,371 | |

| Legal and accounting | |

| 58,972 | | |

| 143,936 | | |

| 879,672 | |

| Total expenses | |

| 322,597 | | |

| 441,504 | | |

| 3,557,484 | |

| | |

| | | |

| | | |

| | |

| Operating loss | |

| (311,608 | ) | |

| (441,504 | ) | |

| (3,459,497 | ) |

| | |

| | | |

| | | |

| | |

| Loss on note restructuring, related party | |

| – | | |

| – | | |

| (2,043,000 | ) |

| Interest expense | |

| (51,251 | ) | |

| (35,031 | ) | |

| (301,101 | ) |

| | |

| | | |

| | | |

| | |

| Net loss | |

$ | (362,859 | ) | |

$ | (476,535 | ) | |

$ | (5,803,598 | ) |

| | |

| | | |

| | | |

| | |

| Loss per share - basic | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

| | |

| | |

| | | |

| | | |

| | |

| Weighted average common shares - basic | |

| 59,767,743 | | |

| 59,646,837 | | |

| | |

See notes to consolidated financial statements.

Statements of Comprehensive Loss

| | |

For the Three Months Ended | | |

From inception

(June 27, 2008) to | |

| | |

March 31, 2013 | | |

March 31, 2012 | | |

March 31, 2013 | |

| | |

| | |

| | |

| |

| Net loss | |

$ | (362,859 | ) | |

$ | (476,535 | ) | |

$ | (5,803,598 | ) |

| | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 35,839 | | |

| 451,239 | | |

| 199,168 | |

| | |

| | | |

| | | |

| | |

| Total comprehensive loss | |

$ | (327,020 | ) | |

$ | (25,296 | ) | |

$ | (5,604,430 | ) |

See notes to consolidated financial statements.

Casablanca Mining Ltd.

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

(Unaudited)

| | |

For the Three Months Ended | | |

From

June 27, 2008

(Inception) to | |

| | |

March

31, 2013 | | |

March

31, 2012 | | |

March

31, 2013 | |

| | |

| | | |

| | | |

| | |

| Cash flows from operating activities | |

| | | |

| | | |

| | |

| Net loss | |

$ | (362,859 | ) | |

$ | (476,535 | ) | |

$ | (5,803,598 | ) |

| | |

| | | |

| | | |

| | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | |

| Shares issued in related party note restructuring | |

| – | | |

| – | | |

| 1,913,000 | |

| Depreciation | |

| 41,670 | | |

| 30,362 | | |

| 366,084 | |

| Shares issued for patent license agreement | |

| – | | |

| – | | |

| 20,000 | |

| Change in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Decrease (increase) in accounts receivable | |

| (582 | ) | |

| (105 | ) | |

| 7,583 | |

| Decrease in accounts receivable- related party | |

| – | | |

| (3,455 | ) | |

| – | |

| Increase in prepaid expenses | |

| (16,076 | ) | |

| (49,447 | ) | |

| (108,364 | ) |

| Increase (decrease) in accounts payable- related party | |

| – | | |

| 4,401 | | |

| – | |

| Increase (decrease) in accounts payable | |

| (11,728 | ) | |

| 106,227 | | |

| (17,346 | ) |

| Cash used in operations | |

| (349,575 | ) | |

| (388,552 | ) | |

| (3,622,641 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from investment activities | |

| | | |

| | | |

| | |

| Cash acquired from Santa Teresa Minerals | |

| – | | |

| – | | |

| 9,390 | |

| Purchase of property and equipment | |

| (13,104 | ) | |

| (38,325 | ) | |

| (619,246 | ) |

| Property - construction in process | |

| – | | |

| (562,893 | ) | |

| (5,866,185 | ) |

| Deposit on mining property option | |

| (67,875 | ) | |

| – | | |

| (67,875 | ) |

| Loan to Santa Teresa Minerals | |

| – | | |

| – | | |

| (1,000,000 | ) |

| Cash used in investing activities | |

| (80,979 | ) | |

| (601,218 | ) | |

| (7,543,916 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Proceeds from stock offering | |

| 351,000 | | |

| 233,334 | | |

| 8,587,433 | |

| Proceeds from notes payable | |

| 11,152 | | |

| 1,533 | | |

| 70,235 | |

| Payments on notes payable | |

| (2,251 | ) | |

| – | | |

| (81,057 | ) |

| Payments on capital lease | |

| (13,769 | ) | |

| (10,189 | ) | |

| (70,225 | ) |

| Proceeds from loans from related parties | |

| 275,457 | | |

| 932,233 | | |

| 3,428,056 | |

| Payments on loans from related parties | |

| (141,479 | ) | |

| (300,000 | ) | |

| (372,365 | ) |

| Cash provided by financing activities | |

| 480,110 | | |

| 856,901 | | |

| 11,562,077 | |

| | |

| | | |

| | | |

| | |

| Effect of foreign exchange rate change | |

| (45,251 | ) | |

| 13,068 | | |

| (388,918 | ) |

| INCREASE/(DECREASE) IN CASH | |

| 4,305 | | |

| (119,801 | ) | |

| 6,602 | |

| | |

| | | |

| | | |

| | |

| BEGINNING CASH | |

| 2,297 | | |

| 137,119 | | |

| – | |

| | |

| | | |

| | | |

| | |

| ENDING CASH | |

$ | 6,602 | | |

$ | 17,318 | | |

$ | 6,602 | |

| | |

| | | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | | |

| | |

| Interest paid | |

$ | 51,237 | | |

$ | 25,000 | | |

$ | 289,750 | |

| Income taxes paid | |

$ | – | | |

$ | – | | |

$ | – | |

| Supplemental disclosure of non-cash investing and financing activities: | |

| | | |

| | | |

| | |

| Property rights acquired via stock issuance | |

$ | – | | |

$ | – | | |

$ | 20,000 | |

| Stock issuance to satisfy due to related party | |

| – | | |

| – | | |

| 14,425 | |

| Stock issuance in related party note restructuring | |

| – | | |

| – | | |

| 2,000,000 | |

| Capital lease for property acquisition | |

| 32,137 | | |

| – | | |

| 291,963 | |

| Property rights acquired via liability assumed | |

| – | | |

| – | | |

| 700,000 | |

| | |

$ | 32,137 | | |

$ | – | | |

$ | 3,026,388 | |

| Acquisition of Santa Teresa Minerals | |

| | | |

| | | |

| | |

| Assets acquired | |

$ | – | | |

$ | – | | |

$ | 3,764,668 | |

| Liabilities assumed | |

| – | | |

| – | | |

| (2,555,926 | ) |

| Goodwill | |

| – | | |

| – | | |

| 66,258 | |

| Total, less cash acquired | |

$ | – | | |

$ | – | | |

$ | 1,275,000 | |

| Common stock issued for acquisition | |

$ | – | | |

$ | – | | |

$ | 1,275,000 | |

| Sale of Sulfatos Chile S.A. | |

| | | |

| | | |

| | |

| Due from applied to due to related party | |

$ | – | | |

$ | 394,272 | | |

$ | 200,000 | |

| Accounts payable applied toward cash payment | |

| – | | |

| 132,235 | | |

| 132,235 | |

| Due to related party applied towards cash payment | |

| – | | |

| 1,673,493 | | |

| 2,067,765 | |

| Sulfatos Chile copper sulfate plant - CIP | |

| – | | |

| (6,242,882 | ) | |

| (6,242,882 | ) |

| Difference applied towards additional paid in capital | |

$ | – | | |

$ | (4,042,882 | ) | |

$ | (3,842,882 | ) |

See notes to consolidated financial statements.

Casablanca Mining Ltd.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Unaudited

NOTE 1: ORGANIZATION

Casablanca

Mining Ltd. (the “Company” or “Casablanca”) is a Nevada corporation engaged in the acquisition, exploration,

development, and operation of precious metal properties. The Company is an “exploration stage company” as defined in

the Accounting Standards Codification Topic No. 915 “Development Stage Entities” (ASC 915).

Casablanca

was incorporated as USD Energy Corp. on June 27, 2008. On December 31, 2010, the Company acquired Santa Teresa Minerals, S.A.,

a limited liability company organized under the laws of Chile (“ Santa Teresa Minerals ”). Unless context requires otherwise, references to the "Company" or "we"

refer to Casablanca and its consolidated subsidiaries. On February 4, 2011, the Company changed its name from USD Energy Corp.

to Casablanca Mining Ltd.

The acquisition

of Santa Teresa Minerals was accounted for as a purchase. Accordingly, the operating statements and statements of cash flows of

the Company from December 31, 2010, through December 31, 2012, reflect the combined operations of Casablanca Mining Ltd. and Santa

Teresa Minerals while the operating statements of the Company prior to December 31, 2010 reflect the historical operations of Casablanca

only.

The Company’s

accounting and reporting policies conform to U.S. GAAP applicable to exploration stage enterprises.

NOTE 2: GOING CONCERN

The Company’s

financial statements at March 31, 2013, and for the period from inception (June 27, 2008) through March 31, 2013, have been prepared

on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in the normal

course of business. The Company has incurred a loss of $5,803,598 from inception through March

31, 2013. In addition, the Company has not generated any material revenues. These conditions raise substantial doubt as to the

Company’s ability to continue as a going concern.

The Company

may not be able to obtain additional funds that it may require. The Company does not presently have adequate cash from operations

to meet its long-term needs. Except for the lines of credit of Santa Teresa Minerals, as discussed under "Note 8: Debt,"

the Company does not currently have any established third-party bank credit arrangements. The Company will seek additional funds

through equity or debt financings, if available on terms and schedules acceptable to the Company. If the additional funds that

the Company may require are not available to it, the Company may be required to curtail significantly or eliminate some or all

of its development programs.

These conditions

raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include

any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification

of liabilities that may result from the outcome of this uncertainty.

NOTE 3: SIGNIFICANT ACCOUNTING POLICIES

Cash and Cash Equivalents

For purposes of

the statement of cash flows, the Company considers all highly liquid investments purchased with an original maturity of three months

or less to be cash equivalents.

Principles of Consolidation

The consolidated financial

statements include the financial statements of Casablanca, its wholly owned subsidiary Santa Teresa Minerals, and the subsidiaries

and mining projects owned by Santa Teresa Minerals. All significant inter-company balances and transactions have been eliminated

in consolidation.

Foreign Currency Translation

The financial statements

of Casablanca’s wholly-owned subsidiary, Santa Teresa Minerals are measured using the local currency (the Chilean Peso (CLP)

is the functional currency. Assets and liabilities of Santa Teresa Minerals are translated at exchange rates as of the balance

sheet date. Revenues and expenses are translated at average rates of exchange in effect during the period. The resulting cumulative

translation adjustments have been recorded as a component of comprehensive income (loss), included as a separate item in the statement

of comprehensive loss. The exchange rate at March 31, 2013 was 471.30 Chilean Pesos per United States Dollar, based on historical

rates from www.xe.com.

The Company is exposed

to movements in foreign currency exchange rates. In addition, the Company is subject to risks including adverse developments in

the foreign political and economic environment, trade barriers, managing foreign operations, and potentially adverse tax consequences.

There can be no assurance that any of these factors will not have a material negative impact on the Company's financial condition

or results of operations in the future.

Revenue Recognition

The Company recognizes

revenues and the related costs when persuasive evidence of an arrangement exists, delivery and acceptance has occurred or service

has been rendered, the price is fixed or determinable, and collection of the resulting receivable is reasonably assured. Amounts

invoiced or collected in advance of product delivery or providing services are recorded as deferred revenue. The Company accrues

for warranty costs, sales returns, bad debts, and other allowances based on its historical experience.

Allowance for Doubtful Accounts

The

Company allows for an estimated amount of receivables that may not be collected. The Company estimates its allowance for doubtful

accounts based on historical experience and customer relationships. As of March 31, 2013, no allowance has been recognized.

Inventory

Inventories consist of small amounts

of gold recovered during mineral exploration and are stated at the market value on the date recovered. As of March 31, 2013, there

was no gold recorded in inventory.

Property and Equipment

Property and equipment

are stated at cost less accumulated depreciation. Depreciation is computed principally on the straight-line method over the estimated

useful life of each type of asset, which ranges from three to five years. Major improvements are capitalized, while expenditures

for repairs and maintenance are expensed when incurred. Upon retirement or disposition, the related costs and accumulated depreciation

are removed from the accounts, and any resulting gains or losses are credited or charged to income.

Mining Properties and Equipment

The Company follows the

successful efforts method of accounting. All developmental costs have been capitalized. Depreciation and depletion of producing

properties will be computed on the unit-of-production method based on estimated proved reserves. Repairs and maintenance will be

expensed, while renewals and betterments will be generally capitalized.

At least quarterly, or

more frequently if conditions indicate that long-term assets may be impaired, the carrying value of our properties will be compared

to management's future estimated pre-tax cash flow from the properties. If undiscounted cash flows are less than the carrying value,

then the asset value will be written down to fair value. Impairment of individually significant unproved properties will be assessed

on a property-by-property basis, and impairment of other unproved properties is assessed and amortized on an aggregate basis.

Proven and Probable Reserves

The definition of proven

and probable reserves is set forth in SEC Industry Guide 7. Proven reserves are reserves for which (a) quantity is computed from

dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed

sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well

defined that size, shape, depth and mineral content of reserves are well-established. Probable reserves are reserves for which

quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection,

sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than

that for proven reserves, is high enough to assume continuity between points of observation. In addition, reserves cannot be considered

proven and probable until they are supported by a feasibility study, indicating that the reserves have had the requisite geologic,

technical and economic work performed and are economically and legally extractable at the time of the reserve determination.

Mineral Acquisition Costs

The costs of acquiring

land and mineral rights are considered tangible assets. Significant acquisition payments are capitalized. General, administrative

and holding costs to maintain an exploration property are expensed as incurred. If a mineable ore body is discovered, such costs

are amortized when production begins using the units-of-production method. If no mineable ore body is discovered or such rights

are otherwise determined to have diminished value, such costs are expensed in the period in which the determination is made.

Design, Construction, and Development Costs

Certain costs to design

and construct processing facilities and mine may be incurred prior to establishing proven and probable reserves. Under these circumstances,

we classify the project as an exploration stage project and expense substantially all costs, including design, engineering, construction,

and installation of equipment. Certain types of equipment, which have alternative uses or significant salvage value, may be capitalized.

If a project is determined to contain proven and probable reserves, costs incurred in anticipation of production can be capitalized.

Such costs include development drilling to further delineate the ore body, removing overburden during the pre-production phase,

building access ways, constructing facilities, and installing equipment. Interest costs, if any, incurred during the development

phase, would be capitalized until the assets are ready for their intended use. The cost of start-up activities and on-going costs

to maintain production are expensed as incurred. Costs of abandoned projects are charged to operations upon abandonment.

If a project commences

commercial production, amortization and depletion of capitalized costs is computed on a unit-of–production basis over the

expected reserves of the project based on estimated recoverable gold equivalent ounces.

Exploration Costs

Exploration costs are charged

to expense as incurred. Costs to identify new mineral resources, to evaluate potential resources, and to convert mineral resources

into proven and probable reserves are considered exploration costs.

Asset Retirement Obligation

The Company’s financial

statements will reflect the fair value for any asset retirement obligation, consisting of future plugging and abandonment expenditures

related to our properties, which can be reasonably estimated. The asset retirement obligation will be recorded as a liability at

its estimated present value at the asset's inception, with an offsetting increase to producing properties on the balance sheet.

Periodic accretion of the discount of the estimated liability will be recorded as an expense in the statements of operations. As

of March 31, 2013, there have been no asset retirement obligations recorded.

Estimates

The presentation of financial

statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Income Taxes

Accounting Standards Codification

Topic No. 740 “Income Taxes” (ASC 740) requires the asset and liability method of accounting be used for income taxes.

Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributable

to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change

in tax rates is recognized in income in the period that includes the enactment date.

Fair Value of Financial Instruments

The carrying amounts for the Company’s

cash, accounts payable, accrued liabilities, capital leases, and notes payable approximate fair value due to the short-term maturity

of these instruments.

Earnings (Loss) Per Share

Per ASC Topic 260 “Earnings

Per Share,” basic EPS is determined using net income (loss) divided by the weighted average shares outstanding during the

period. Diluted EPS is computed by dividing net income (loss) by the weighted average shares outstanding, assuming all potentially

dilutive shares of Common Stock were issued.

NOTE 4: SULFATOS CHILE/BLUESTONE

S.A.

On February 15, 2012, Santa

Teresa Minerals sold its 60% equity interest in Sulfatos Chile to Bluestone S.A., an entity organized under the laws of Chile (“Bluestone”),

pursuant to the stock purchase agreement dated January 26, 2012, as amended. The interests in Sulfatos Chile were sold in exchange

for (a) Santa Teresa Minerals receiving 2,000 shares of common stock of Bluestone, representing 20% of the outstanding capital

stock of Bluestone at the time; and (b) $2.2 million, with $1.1 million paid by cancellation of a demand loan made to Santa Teresa

Minerals by Angelique de Maison in January 2012, which loan had been assigned by Ms. de Maison to Bluestone, and the balance of

$1.1 million to be paid in monthly installments from time to time upon demand by Santa Teresa Minerals. A total of $2,200,000 has

been paid as of March 31, 2013. Santa Teresa Minerals retained an obligation to provide $214,000 to Sulfatos Chile, which was paid

with the proceeds from the purchase price.

The Company determined

this transaction to be a related party transaction since both companies had a common officer and director. The $4,040,000 difference

between the value of the interest and the consideration received was recorded through additional paid-in capital. The 20% interest

in Bluestone S.A. was valued at $nil, Bluestone’s historical cost.

On October 21, 2012, Santa

Teresa Minerals sold its 20% interest in Bluestone S.A. which represented its remaining equity interest in Sulfatos Chile (the

“Interests”), to Lustros, Inc., an entity organized under the laws of Utah (“Lustros”) and owned by former

officers and directors of the Company, pursuant to the Waiver Agreement dated October 16, 2012. The Interests were sold in exchange

for (a) Santa Teresa Minerals cancelling $200,000 in advances from Suprafin, Ltd; and (b) a waiver to any claim of ownership in

Sulfatos, Lustros or any of their related parties. See “Note 8: Debt”. The net effect of the interest sold and consideration

received on both transactions was recorded as contributed capital of $3,842,882.

NOTE 5: Mining Property/Land and Deposits on Mining

Options

The following table sets

forth our mining property/land and deposits on mining options at the date indicated. The Company follows the successful efforts

method of accounting. All developmental costs have been capitalized. As of the stated dates no impairment on these properties was

deemed necessary.

| | |

March 31, 2013 | | |

December 31, 2012 | |

| | |

| | | |

| | |

| Mining Property/Land | |

$ | 5,018,526 | | |

$ | 4,941,573 | |

| Deposit on mining property options | |

$ | 67,875 | | |

$ | – | |

On January 25, 2013, Santa

Teresa Minerals, S.A., acquired the option to purchase 80% of the Las Palmas gold mine in Chile. Santa Teresa has the right to

mine the property during a one-year option period. The Company may continue to make purchase payments totaling $2 million (USD)

over a period of 30 months to acquire Las Palmas or decline to purchase the property. An initial payment of $67,875 was made on

the acquisition date and a subsequent payment of $50,000 was made on May 15, 2013

In June, 2011, Santa Teresa

Minerals, acquired a 70% ownership interest in each of the mining properties currently known as “Teresita uno de veinte”

and “Los Pinos uno de treinta” (or the “Los Pinos Project ”). The interests were transferred to

Santa Teresa Minerals on June 29, 2011. We paid $200,000 at the closing of the purchase, and $100,000 on each of the six month,

12 month and 18 month anniversaries of the purchase agreement. The 12 month anniversary payment of $100,000 was made on July 3,

2012 and the 18 month anniversary payment of $100,000 was made on December 30, 2012. We are obligated to pay $200,000 on each of

the 24 and 30 month anniversaries of the purchase agreement, and $300,000 on the 36 month anniversary of the purchase agreement.

NOTE 6: PROPERTY AND EQUIPMENT

The following table sets

forth our property and equipment at the date indicated. These assets, are

being depreciated over their remaining useful lives.

| | |

March 31, 2013 | | |

December 31, 2012 | |

| | |

| | | |

| | |

| Office Equipment | |

$ | 115,946 | | |

$ | 114,215 | |

| Furniture and Fixtures | |

| 113,086 | | |

| 108,906 | |

| Computer Equipment | |

| 60,684 | | |

| 58,783 | |

| Mining/Heavy Equipment | |

| 302,040 | | |

| 296,316 | |

| Vehicles | |

| 175,129 | | |

| 142,992 | |

| Office Improvements | |

| 79,494 | | |

| 78,307 | |

| Total Property and Equipment | |

| 846,379 | | |

| 799,519 | |

| | |

| | | |

| | |

| Less Accumulated Depreciation | |

| 393,698 | | |

| 346,704 | |

| | |

| | | |

| | |

| Net Property and Equipment | |

$ | 452,681 | | |

$ | 452,815 | |

| | |

| | | |

| | |

For the three months ended

March 31, 2013, depreciation expense was $41,670 compared to $30,362 for the three months ended March 31, 2012.

NOTE 7: GOODWILL

In connection with the

Santa Teresa Minerals acquisition, Casablanca issued 25,500,000 shares of Common Stock valued at $.05 per share for a total value

of $1,275,000. This was recorded as Common Stock at par value of $25,500 with the remaining $1,249,500 recorded as additional paid-in

capital. In connection with the acquisition, and in accordance with ASC Topic 805-30 “Business Combinations – Goodwill

or Gain from Bargain Purchase Including Consideration Transferred,” we recorded goodwill in the amount of $66,258, representing

the amount by which the total liabilities of Santa Teresa Minerals exceeded the total book value of the assets of Santa Teresa

Minerals. In accordance with ASC Topic 350-20 "Intangibles - Goodwill and Other," goodwill was assessed and as of March

31, 2013, no impairment was noted.

NOTE 8: DEBT

In connection with the

closing of the Exchange Agreement (as defined below), the Company issued a note with a principal amount of $1,087,000 (the “Camus

Note”) to Juan Carlos Camus Villegas (“Mr. Camus”), one of the Santa Teresa Shareholders and presently an

officer and director of the Company, in exchange for a note in the same amount owed by Santa Teresa Minerals to him.

On August 16, 2011, the

Company entered into an Exchange Agreement with Mr. Camus pursuant to which the Camus Note was cancelled, upon certain terms and

conditions, in exchange for $130,000 in cash, 2,000,000 shares of common stock of the Company, valued at a fair value of $1.00

per share, and a new non-convertible promissory note in the amount of $1,000,000 (the “ New Promissory Note ”).

The New Promissory Note,

which does not contain the anti-dilutive features of the Camus Note, bears interest at a rate of 10% per annum, payable monthly

in arrears. Principal and accrued and unpaid interest was due and payable on November 1, 2012, which was extended 90 days, to January

31, 2013, and was extended again on January 31, 2013 to January 31, 2014 while the Company seeks to secure outside capital. The

loan will become payable immediately upon demand by Mr. Camus following certain events; including the Company’s insolvency,

bankruptcy, or general assignment for the benefit of creditors and/or if Mr. Camus no longer is a director of the Company (unless

Mr. Camus is not a director because of his voluntary resignation as a director). During the three months ended March 31, 2013,

the Company did not pay any interest to Mr. Camus under this note.

In April 2010, prior to

the Company’s acquisition of Santa Teresa Minerals, Metales Acer LTDA, loaned Santa Teresa Minerals 19,970,700 Chilean Pesos

or approximately $41,702. The loan did not bear interest and did not specify a maturity date. During the twelve months ended December

31, 2012, Metales Acer LTDA loaned Santa Teresa Minerals an additional $521,800. During the three months ended March 31, 2013,

additional loans from Juan Carlos Camus Villegas and Metales Acer LTDA of $275,457 were made to cover operations and repayment

of $141,479. The balance of the loans from Metals Acer LTDA was $683,784. Juan Carlos Camus Villegas, our Chief Executive Officer

and a director, is the CEO of Metales Acer LTDA. Santa Teresa Minerals may from time to time repay all or a portion of this outstanding

debt.

In December 2011, Suprafin,

Ltd. provided a total of $300,000 to the Company for short-term working capital needs. This balance was paid in full in January

2012. Zirk Engelbrecht, the Company’s former President and a director, is the Chief Executive Officer, sole director and

sole shareholder of Suprafin, Ltd. Suprafin, Ltd. provided an additional $201,802 to the Company during the six months ended December

31, 2012 for working capital purposes. $200,000 was applied to the purchase of Santa Teresa Minerals’ 20% equity interest

in Bluestone S.A. See “Note 4: Sulfatos Chile/Bluestone S.A.” The balance due to Suprafin, Ltd. at March 31, 2013 is

$6,960. Mr. Engelbrecht is no longer considered a related party to the Company.

From December 2011 through

February 15, 2011, Ms. de Maison provided a total of $1,100,000 in working capital advances in the form of an unsecured demand

loan with no interest and no set terms of repayment to the Company’s subsidiary, Santa Teresa Minerals. In February 2012,

these advances were assigned to Bluestone SA, of which Ms. de Maison is a major shareholder, and were applied to the purchase of

Santa Teresa Minerals’ 60% equity interest in Sulfatos Chile by Bluestone S.A in February 2012. See “Note 4: Sulfatos

Chile/Bluestone SA.” Ms. de Maison is no longer considered a related party to the Company.

Santa Teresa Minerals has

several lines of credit with Banco Security with a total limit of CLP 179,350,194 or approximately $385,772. These lines of credit

have historically been rolled over at the due date into a new line of credit with a revised due date and interest rate.

The following table sets

forth the consolidated indebtedness of Casablanca and Santa Teresa Minerals at the date indicated. Inter- company transactions

have been eliminated in the consolidated balance sheets:

| Description | |

Terms | |

Balance Due at

March 31, 2013 | | |

Balance Due at

December 31, 2012 | |

| | |

| |

| | | |

| | |

| Loans with Metales Acer LTDA 4/30/10 | |

Interest Free, No Repayment Date | |

$ | 683,784 | | |

$ | 563,502 | |

| Note to Juan Carlos Camus | |

See Note 8 | |

| 1,000,000 | | |

| 1,000,000 | |

| | |

Total Related Party Debt | |

$ | 1,683,784 | | |

$ | 1,563,502 | |

| | |

| |

| | | |

| | |

| Line of Credit with Banco Security | |

Due 3/11/13 - 8.5% | |

$ | 31,932 | | |

$ | 31,508 | |

| Line of Credit with Banco Security | |

Due 2/17/13 - 8.8% | |

| 151,425 | | |

| 143,783 | |

| Line of Credit with Banco Security | |

Due 2/17/13 - 8.8% | |

| 191,688 | | |

| 190,301 | |

| Line of Credit with Banco Security | |

Due 6/28/13 - 8.8% | |

| 10,207 | | |

| 10,071 | |

| Suprafin Short Term Advance | |

No Set Terms | |

| 6,960 | | |

| 1,802 | |

| MasterCard Credit Card with Banco Security | |

Revolving Credit Card | |

| 520 | | |

| 513 | |

| | |

Total Loans Payable | |

$ | 392,732 | | |

$ | 377,978 | |

| | |

| |

| | | |

| | |

| | |

Total Debt | |

$ | 2,076,516 | | |

$ | 1,941,480 | |

NOTE 9: RELATED PARTY TRANSACTIONS

On August 16, 2011, the

Company entered into an Exchange Agreement with Mr. Camus pursuant to which the Camus Note was cancelled, upon certain terms and

conditions, in exchange for $130,000 in cash, 2,000,000 shares of common stock of the Company, valued at a fair value of $1.00

per share, and a new non-convertible promissory note in the amount of $1,000,000 (the “ New Promissory Note ”).

The New Promissory Note,

which does not contain the anti-dilutive features of the Camus Note, bears interest at a rate of 10% per annum, payable monthly

in arrears. Principal and accrued and unpaid interest was due and payable on November 1, 2012, which was extended 90 days, to January

31, 2013 and was extended again on January 31, 2013 to January 31, 2014, while the Company seeks to secure outside capital. The

loan will become payable immediately upon demand by Mr. Camus following certain events; including the Company’s insolvency,

bankruptcy, or general assignment for the benefit of creditors and/or if Mr. Camus no longer is a director of the Company (unless

Mr. Camus is not a director because of his voluntary resignation as a director). During the three months ended March 31, 2013,

the Company did not pay Mr. Camus any interest under this note.

During the three months

ended March 31, 2013, additional loans from Juan Carlos Camus Villegas and Metales Acer LTDA of $275,457 were made to cover operations

and repayment of $141,479. On March 31, 2013, the balance of the loans from Metals Acer LTDA was $683,784.

NOTE 10: STOCKHOLDERS’

EQUITY

On February 15, 2013, the

Company issued 620,000 shares of its Common Stock to five individual purchasers at an average price of $0.25 per share, pursuant

to a Subscription Agreement dated to the same. The Company received $155,000 in proceeds.

On March 15, 2013, the

Company sold 701,000 shares of its Common Stock to five individual purchasers at an average price of $0.28 per share, pursuant

to a Subscription Agreement dated the same. The Company received $196,000 in proceeds. These shares had not been issued as of March

31, 2013, as such they were accounted for as stock payable.

NOTE 11: NEW ACCOUNTING PRONOUNCEMENTS

In February 2013, the FASB

issued authoritative guidance on the reporting of reclassifications out of accumulated other comprehensive income. The guidance

requires an entity to present, either on the face of the statement where net income is presented or in the notes, significant amounts

reclassified out of accumulated other comprehensive income by the respective line items of net income if the amount is reclassified

to net income in its entirety in the same reporting period. The guidance is effective for fiscal years beginning after December

15, 2012, with early adoption permitted. The adoption of this guidance did not have a material effect on the Company’s financial

condition, results of operations or cash flows.

The Company has implemented

all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the consolidated

financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements

that have been issued that might have a material impact on its financial position or results of operations.

NOTE 12: CAPITAL LEASE

On September 30,

2011, Santa Teresa Minerals entered into a capital lease agreement with Banco Santander Chile to lease two vehicles. The terms

of the lease are 49 months with an interest rate of 9.48%. Monthly payments are CLP 723,332 estimated at $1,510.

On November 30,

2011, Santa Teresa Minerals entered into a capital lease agreement with Banco Santander Chile to lease two vehicles. The terms

of the lease are 49 months with an interest rate of 9.86%. Monthly payments are CLP 633,373 estimated at $1,323.

On March 8, 2012, Santa

Teresa Minerals entered into a capital lease agreement with Banco Santander Chile to lease a gold wash-plant. The terms of the

lease are 49 months with an interest rate of 10.9%. Monthly payments are CLP 2,140,946, estimated at $4,471.

On January 31, 2013,

Santa Teresa Minerals entered into a capital lease agreement with Banco Santander Chile to lease a vehicle. The terms of the lease

are 48 months with an interest rate of 19%. Monthly payments are CLP 386,495, estimated at $818. The buyout clause in this lease

requires one additional monthly payment at the end of month 48 for $818.

| Future lease payments are as follows: |

US$ |

|

|

CLP |

|

| 2013 |

|

$ |

51,480 |

|

|

$ |

24,285,858 |

|

| 2014 |

|

|

97,621 |

|

|

|

46,052,803 |

|

| 2015 |

|

|

96,109 |

|

|

|

45,339,258 |

|

| 2016 |

|

|

33,547 |

|

|

|

15,825,837 |

|

| |

|

$ |

278,757 |

|

|

$ |

131,503,756 |

|

NOTE 13: SUBSEQUENT EVENTS

On May 6, 2013 the Company

issued 701,000 shares of its Common Stock sold to five individual purchasers on March 15, 2013. These shares had not been issued

as of March 31, 2013, as such they were accounted for as stock payable.

On May 15, 2013 the Company

made a subsequent payment of $50,000 toward the $2 million (USD) purchase of 80% of the Las Palmas gold mine in Chile. A total

of $117,875 has been paid toward this option to date.

Item 2. Management’s Discussion and Analysis

of Financial Condition and Results of Operations

This Quarterly Report

on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections.

We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,”

“foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking

statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other

factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from

those expressed or forecasted. You should read this report completely and with the understanding that actual future results may

be materially different from what we expect. The forward looking statements included in this report are made as of the date of

this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update

forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise.

References in this Quarterly

Report to the “Company”, “we”, “us” or “our” refer to Casablanca Mining Ltd., a

Nevada corporation (“Casablanca”), and its consolidated subsidiary Santa Teresa Minerals, S.A., a limited liability

company organized under the laws of Chile (“Santa Teresa Minerals”). The following discussion of our financial condition

and results of operations should be read in conjunction with the financial statements and related notes to the financial statements

included elsewhere in this filing as well as with Management’s Discussion and Analysis of Financial Condition and Results

of Operations contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012 filed with

the Commission.

On December 31, 2010, the

Company acquired Santa Teresa Minerals. For a discussion of our financial statements prior to the acquisition of Santa Teresa Minerals

(the “Santa Teresa Acquisition”), see our financial statements and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended

December 31, 2009 and our Annual Report on Form 10-K for the year ended December 31, 2010. The transaction was accounted for as

a business combination or a purchase, and the operating statements of the Company prior to December 31, 2010 reflect the historical

operations of Casablanca Mining Ltd. only. Prior to the Santa Teresa Acquisition, we conducted only nominal business operations.

As such, comparisons to financial periods prior to the Santa Teresa Acquisition may not be meaningful.

Overview

The Company engages in

the acquisition, exploration, development, and operation of precious metal properties in South America since its acquisition of

Santa Teresa Minerals. Our gold mining operations are based near Santiago, Chile, which we operate through our wholly owned subsidiary,

Santa Teresa Minerals. Santa Teresa Minerals currently has, directly and indirectly through various equity interests, mining rights

in a historically producing gold mine , “Free Gold,” and in exploration projects, the “Casuto Project,”

consisting of Los Azules 1-3, Tauro 1-6, Los Chipi 1-16, the “Los Pinos Project,” consisting of Los Pinos 1-30 and

Teresita 1-20, and the “Las Palmas Project” consisting of Keyla Uno 1-20 and Keyla Dos 1-34.

Results

of Operations

Income

Income for the three months

ended March 31, 2013 was $10,989 from the sale of goods, primarily scrap metal, as compared to $0 for the three months ended March

31, 2012.

We have had only minimal

revenues generated to date as we have concentrated our efforts in obtaining permits, conducting mining tests, obtaining samples,

and constructing plants.

Operating Expenses

For the three months ended

March 31, 2013, operating expenses were $322,597 compared to $441,504 for the three months ended March 31, 2012. Operating expenses

were primarily associated with the operations of Santa Teresa Minerals in the ordinary course of business as well as legal and

accounting expenses required by a public company. The Company’s operating expenses were reduced from the previous year as

a result of efforts to focus solely on the development of its gold properties.

Santa Teresa Minerals has

incurred significant expenses since inception, mostly as the result of capital expenditures for equipment and infrastructure, exploration

costs, development of technology, salaries for mining personnel, legal, accounting and office expenses. These expenses are expected

to continue to increase as mining activity begins and as exploration efforts increase with the development of the Los Pinos and

Las Palmas mines.

Interest Expense

Interest accrued or paid

on notes payable, resulted in interest expense of $51,251 for the three months ended March 31, 2013 compared to $35,031 in interest

expense for the three months ended March 31, 2012. Interest expense is mainly related to bank loans and lines of credit for Santa

Teresa Minerals and the promissory note with Mr. Camus, which increased during the quarter ended March 31, 2013. Mr. Camus continues

to fund short-term capital needs for the Santa Teresa subsidiary.

Mr. Camus was initially

issued a convertible promissory note in the principal amount of $1,087,000 and bearing no interest on December 31, 2010 in connection

with the Santa Teresa Acquisition. This convertible promissory note was later exchanged on August 16, 2011 for a nonconvertible

promissory note in the principal amount of $1,000,000 and bearing interest at 10% per annum.

Other Expense

We incurred no “other

expense” for the three months ended March 31, 2013. The Company incurred no “other expense” for the three months

ended March 31, 2012.The Company has had a total loss of $(2,043,000) as a result of restructuring the promissory note with Mr.

Camus from inception until March 31, 2013.

Net Loss

For the three months ended

March 31, 2013, net losses were $362,859, compared to net losses of $476,535 for the three months ended March 31, 2012. Net losses

were due to the operational expenses, interest expense and other expenses associated with developing its mining properties.

Financial Condition, Liquidity

and Capital Resources

As of March 31, 2013, our

principal sources of capital included proceeds from a private placement of our common stock and proceeds from loans from related

parties. Cash on hand was $6,602 at March 31, 2013 compared to $2,297 at December 31, 2012.

Santa Teresa Minerals also

has several lines of credit with Banco Security, which provides liquidity for operations. These lines of credit have historically

been rolled over at the due date into a new line of credit with a revised due date and interest rate.

During the next twelve

months, the Company plans to satisfy its cash requirements by income from operations as well as additional equity financing and

contributions from its current principal shareholders and other investors. The Company intends to undertake additional private

placements of its securities in order to raise future development and operating capital. The Company depends upon capital to be

derived from contributions from its principal shareholders and future financing activities such as subsequent offerings of its

securities. There can be no assurance that the Company will be successful in raising the capital it requires through the sale of

its securities.

Going forward, Santa Teresa

Minerals expects to incur average monthly costs, including capital purchases, of approximately $200,000 as it begins production

at its Los Pinos properties. Santa Teresa Minerals also expects to incur further exploration costs and costs to develop additional

properties as set forth in its plan of operations.

Los Pinos

1800 tons of material moved

in March of which 1650 was for 4 ventilation shafts and 150 was “disfrute” or gold bearing material. Vein samples

taken averaged 58.32 Au (g/T). Once 1 ventilation shaft is complete the Company will apply for Exploitation Permit and can

start selling to ENAMI once approved. Lautaro Manriquez and 4 members of his team (mine manager, metallurgist, geologist

and lawyer) have visited Los Pinos mine. They have confirmed our internal production plan. Chile de Cuprum Resources

has sent option to purchase letter. Minera y Inversiones is interested in investing. Superficie (top soil) has .08

y 5.3 g/t. This shows higher concentration of gold over larger area than we originally expected.

Las Palmas

Our new director, Lautaro

Manriquez and 4 members of his team (mine manager, metallurgist, geologist and lawyer) have visited Las Palmas mine to perform

a review. They have confirmed our internal production plan and overall plan to mine. Ambiental Chile, a mining consulting

firm in Chile, has completed the “closing plan” and the “extraction plan,” which will be presented to the

mining regulatory agencies in Chile. The Company plans to move its orange trammel from San Jose Las Dichas to Las Palmas

because the concentration is much higher and it is next to the ocean (water supply).

Casuto Project

On our Casuto Project properties

are awaiting easement to be granted by the court, which should occur in the next three months.

Free Gold

Awaiting further development

plans to be considered by the Company over the next 60 days.

Las Dichas

The company has a 50/50

joint venture at the San Jose Las Dichas alluvial gold property. The company does not own the mining rights and splits the

gold production 50/50 with the property's owner. During the first quarter a lack of water caused the company to cease production

temporarily. During this time, management reviewed operations and is considering moving its equipment to the alluvial portion

of the Las Palmas property. This is expected in Q2 or Q3 2013.

Foreign Currency Translation

The financial statements

of Casablanca Mining’s wholly-owned subsidiary, Santa Teresa Minerals are measured using the local currency (the Chilean

Peso (CLP)) as the functional currency. Assets and liabilities of Santa Teresa are translated at exchange rates as of the balance

sheet date. Revenues and expenses are translated at average rates of exchange in effect during the period. The resulting cumulative

translation adjustments have been recorded as a component of comprehensive income (loss), included as a separate item in stockholders'

equity. As of March 31, 2013, the Company recognized $35,839 from foreign currency translation adjustment from exchange rate changes,

as compared to $451,239 for the period ended March 31, 2012.

The Company is exposed

to movements in foreign currency exchange rates. In addition, the Company is subject to risks including adverse developments in

the foreign political and economic environment, trade barriers, managing foreign operations and potentially adverse tax consequences.

There can be no assurance that any of these factors will not have a material negative impact on the Company's financial condition

or results of operations in the future.

Off-Balance Sheet Arrangements

We have no significant

off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition,

changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources

that are material to stockholders.

Critical Accounting Estimates and Policies

The discussion and analysis

of our financial condition and plan of operations is based upon our consolidated financial statements, which have been prepared

in accordance with U.S. generally accepted accounting principles (“GAAP”). The preparation of these financial statements

requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses, and

related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates including, among others,

those affecting revenue, the allowance for doubtful accounts, the salability of inventory and the useful lives of tangible and

intangible assets. The discussion below is intended as a brief discussion of some of the judgments and uncertainties that can impact

the application of these policies and the specific dollar amounts reported on our financial statements. We base our estimates on

historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of

which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from

other sources. Actual results may differ from these estimates under different assumptions or conditions, or if management made

different judgments or utilized different estimates. Many of our estimates or judgments are based on anticipated future events

or performance, and as such are forward-looking in nature, and are subject to many risks and uncertainties, including those discussed

elsewhere in this Quarterly Report on Form 10-Q. We do not undertake any obligation to update or revise this discussion to reflect

any future events or circumstances.

We have identified below

some of our accounting policies that we consider critical to our business operations and the understanding of our results of operations.

This is not a complete list of all of our accounting policies, and there may be other accounting policies that are significant

to us. For a detailed discussion on the application of these and our other accounting policies, see the Notes To The Consolidated

Financial Statements, included in this Quarterly Report on Form 10-Q or the Annual Report on Form 10-K filed for the year ending

December 31, 2012.

Proven and Probable Reserves

The definition of proven

and probable reserves is set forth in SEC Industry Guide 7. Proven reserves are reserves for which (a) quantity is computed from

dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed

sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well

defined that size, shape, depth and mineral content of reserves are well-established. Probable reserves are reserves for which

quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection,

sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than

that for proven reserves, is high enough to assume continuity between points of observation. In addition, reserves cannot be considered

proven and probable until they are supported by a feasibility study, indicating that the reserves have had the requisite geologic,

technical and economic work performed and are economically and legally extractable at the time of the reserve determination.

Mineral Acquisition Costs

The costs of acquiring

land and mineral rights are considered tangible assets. Significant acquisition payments are capitalized. General, administrative

and holding costs to maintain an exploration property are expensed as incurred. If a mineable ore body is discovered, such costs

are amortized when production begins using the units-of-production method. If no mineable ore body is discovered or such rights

are otherwise determined to have diminished value, such costs are expensed in the period in which the determination is made.

Exploration Costs

Exploration costs are charged

to expense as incurred. Costs to identify new mineral resources, to evaluate potential resources, and to convert mineral resources

into proven and probable reserves are considered exploration costs.

Design, Construction, and Development Costs

Certain costs to design

and construct processing facilities and mine may be incurred prior to establishing proven and probable reserves. Under these circumstances,

we classify the project as an exploration stage project and expense substantially all costs, including design, engineering, construction,

and installation of equipment. Certain types of equipment, which have alternative uses or significant salvage value, may be capitalized.

If a project is determined to contain proven and probable reserves, costs incurred in anticipation of production can be capitalized.

Such costs include development drilling to further delineate the ore body, removing overburden during the pre-production phase,

building access ways, constructing facilities, and installing equipment. Interest costs, if any, incurred during the development

phase, would be capitalized until the assets are ready for their intended use. The cost of start-up activities and on-going costs

to maintain production are expensed as incurred. Costs of abandoned projects are charged to operations upon abandonment.

If a project commences

commercial production, amortization and depletion of capitalized costs is computed on a unit-of–production basis over the

expected reserves of the project based on estimated recoverable gold equivalent ounces.

Income Taxes

Accounting Standards Codification

Topic No. 740 “Income Taxes” (ASC 740) requires the asset and liability method of accounting be used for income taxes.

Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributable

to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change

in tax rates is recognized in income in the period that includes the enactment date.

Factors that May Affect Future Operating Results

We are subject to various

risks that may materially harm our business, financial condition and results of operations. You should carefully consider the risks

and uncertainties described below and the other information in this filing before deciding to purchase our Common Stock. If any

of these risks or uncertainties actually occurs, our business, financial condition or operating results could be materially harmed.

In that case, the trading price of our Common Stock could decline and you could lose all or part of your investment.

Going Concern

We have not attained profitable

operations and are dependent upon obtaining financing to pursue any extensive activities. For these reasons, our auditors stated

in their report on our audited financial statements that they have doubt that we will be able to continue as a going concern without

further financing.

Contractual Obligations

We are a smaller reporting

company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this

item.

Recently Issued Accounting Pronouncements

The Company has implemented

all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the consolidated

financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements

that have been issued that might have a material impact on its financial position or results of operations.

Item 3. Quantitative and Qualitative

Disclosures About Market Risk

Not applicable.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and

Procedures

Disclosure controls

and procedures are controls and procedures that are designed to ensure that information required to be disclosed in our reports

filed under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules

and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information

required to be disclosed by our company in the reports that it files or submits under the Exchange Act is accumulated and communicated

to our management, including its principal executive and principal financial officers, or persons performing similar functions,

as appropriate to allow timely decisions regarding required disclosure. Our management carried out an evaluation under the

supervision and with the participation of our Principal Executive Officer and Principal Financial Officer, of the effectiveness

of the design and operation of our disclosure controls and procedures pursuant to Rules 13a-15(e) and 15d-15(e) under the

Securities Exchange Act of 1934 ("Exchange Act"). Based upon that evaluation, our Principal Executive Officer and Principal

Financial Officer have concluded that our disclosure controls and procedures were not effective as of March 31, 2013, due to the

material weaknesses resulting from no member of our Board of Directors qualifying as an audit committee financial expert as defined

in Item 407(d)(5)(ii) of Regulation S-K, and controls were not designed and in place to ensure that all disclosures required were

originally addressed in our financial statements. Please refer to our Annual Report for the year ended December 31, 2012 on Form

10-K as filed with the SEC on April 30, 2013, for a complete discussion relating to the foregoing evaluation of Disclosures and

Procedures.

Changes in Internal

Control Over Financial Reporting

Our management has also

evaluated our internal control over financial reporting, and there have been no significant changes in our internal controls or

in other factors that could significantly affect those controls subsequent to the date of our last evaluation.

The Company is not required by current SEC rules

to include, and does not include, an auditor's attestation report. The Company's registered public accounting firm has not attested

to Management's reports on the Company's internal control over financial reporting.

PART

II – OTHER INFORMATION

Item 1. Legal Proceedings

We know of no material,

existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending

litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder,

is an adverse party or has a material interest adverse to our interest.

Item 1A. Risk Factors

Not applicable.

Item 2. Unregistered Sales of

Equity Securities and Use of Proceeds

Quarterly Issuances:

On February 15, 2013,

the Company authorized the sale of 620,000 shares of Common Stock at a price of $0.25 per share, pursuant to a private placement

subscription offering, with an aggregate offering price of $155,000.

On March 15, 2013,

the Company authorized the sale of 700,000 shares of Common Stock at a price of $0.28 per share, pursuant to a private placement

subscription offering, with an aggregate offering price of $196,000.

Subsequent Issuances:

None.

Item 3. Defaults Upon Senior Securities

None other than

those disclosed hereto in Note 8 of the Notes to the Financial Statements.

Item 4. Mining Safety Disclosure

As of March 31, 2013, we

were an exploration company and had not engaged in any actual mining activities that would result in mining violations. While we

hold various interests in mining properties, we do not own any real property.

Item 5. Other Information

Quarterly Events

On February 13, 2013, Santa Teresa Minerals, S.A., acquired the

option to purchase 80% of the Las Palmas gold mine in Chile. Santa Teresa has the right to mine the property during a one-year

option period. The Company may continue to make purchase payments over a period of 30 months to acquire Las Palmas or decline to

purchase the property. A copy of the Agreement is attached as an exhibit hereto.

On March 21, 2013, William Farley resigned as a Director of the

Company. The resignation was not the result of any disagreement with the Company on any matter relating to the Company’s

operations, policies or practices.

On March 27, 2013, the Company appointed Lautaro Manriquez as a

Director of the Company and Mr. Manriquez accepted such appointment

On March 27, 2013, the Company changed its principal executive office

address to 417 Orchid Avenue, Corona Del Mar, California 92625.

Item 6. Exhibits

| Exhibit No. |

|

Description |

| |

|

|

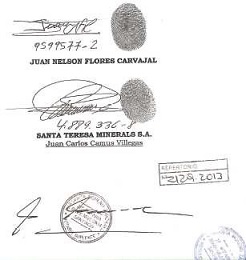

| 10.1 |

|

Las Palmas Option Agreement dated January 25, 2013, between Juan Carlos Camus Villegas and Santa Theresa Minerals S.A. filed herewith. |

| |

|

|

| 10.2 |

|

Amendment No. 3 to Stock Purchase Agreement dated September

1, 2011, between Casablanca Mining Ltd. and Angelique de Maison. Incorporated by reference to the Current Report on Form 8-K filed

on September 6, 2011. |

| |

|

|

|

10.3 |

|

Exchange Agreement, dated August 16, 2011, between Casablanca

Mining Ltd. and Juan Carlos Camus Villegas. Incorporated by reference to the Current Report on Form 8-K filed on August 18, 2011. |

| |

|

|

| 4.1 |