EXHIBIT 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

This discussion and analysis of the consolidated results of Ballard Power Systems Inc. (“Ballard”, “the Company”, “we”, “us” or “our”) dated March 8, 2011 should be read in conjunction with the audited consolidated financial statements and accompanying notes for the year ended December 31, 2010. The results reported herein have been prepared in accordance with Canadian generally accepted accounting principles (“GAAP”) and are presented in U.S. dollars unless otherwise stated. The effect of significant differences between Canadian and U.S. GAAP has been disclosed in note 23 to the Consolidated Financial Statements for the year ended December 31, 2010.

Additional information relating to the Company, including our Annual Information Form, are filed with Canadian (www.sedar.com) and U.S. securities regulatory authorities (www.sec.gov) and are also available on our website at www.ballard.com.

BUSINESS OVERVIEW

At Ballard, we are building a clean energy growth company. We are recognized as a world leader in proton exchange membrane (“PEM”) fuel cell development and commercialization. Our principal business is the design, development, manufacture, sale and service of fuel cell products for a variety of applications, focusing on motive power (material handling and buses) and stationary power (backup power and distributed generation) markets.

A fuel cell is an environmentally clean electrochemical device that combines hydrogen fuel with oxygen (from the air) to produce electricity. The hydrogen fuel can be obtained from natural gas, kerosene, methanol or other hydrocarbon fuels, or from water through electrolysis. As long as fuel is supplied, the fuel cell produces electricity efficiently and continuously without combustion, with water and heat as the main by-products when hydrogen is used as the fuel source. Ballard® fuel cell products feature high fuel efficiency, low operating temperature, low noise and vibration, compact size, quick response to changes in electrical demand, modular design and environmental cleanliness.

Over the past three years, we have continued to focus on our core fuel cell business and on markets with near-term commercial prospects.

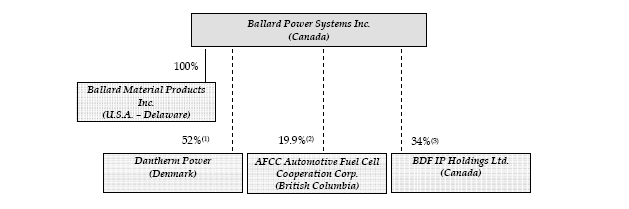

We completed our exit from the automotive business by selling our automotive fuel cell research and development assets to AFCC Automotive Fuel Cell Cooperation Corp. (“AFCC”) on January 31, 2008 (the “AFCC Transaction”). The purpose of the AFCC Transaction was to decrease our investment in automotive fuel cell research and development due to its high cost, uncertainties surrounding government mandates relating to adoption and deployment of automotive fuel cell powered vehicles, the lengthening timeline to automotive fuel cell commercialization, and the negative impacts of these factors on our production volumes and revenues. The AFCC Transaction allowed us to focus our efforts on the development and commercialization of fuel cells for non-automotive applications and buses. In addition, we have continued involvement with automotive products and services for Daimler AG (“Daimler”) and AFCC on a contract basis under which we are paid on a profitable basis. Under the terms of the AFCC Transaction, we retained a 19.9%

Page 1 of 36

interest in AFCC, which is subject to a Share Purchase Agreement under which Ford, either at our option or Ford’s election, could purchase our interest in AFCC at any time on or after January 31, 2013 for $65 million plus interest accruing at LIBOR from January 31, 2008.

In May 2009, we decided to discontinue operations in EBARA Ballard Corporation (“EBARA BALLARD”), our joint venture with Ebara Corporation (“Ebara”), as it became evident that the timeframe to commercialization for the residential cogeneration market in Japan was longer than anticipated, and due to an increasing investment requirement for continued system development work. On our decision to discontinue operations in 2009, we recorded a non-cash gain of $10.8 million (see note 12 to our consolidated financial statements). EBARA BALLARD was formally dissolved in October 2009.

Following the completion of these strategic dispositions, we have focused on bolstering our cash reserves and liquidity to strengthen our capability to execute on our clean energy growth priorities without the need for public market financing.

In December 2008, we executed a transaction to extract value from our tax attributes through a restructuring agreement (“Arrangement”) with Superior Plus Income Fund ("Superior Plus") resulting in a non-dilutive financing for net cash proceeds of approximately $33 million (see note 3 to our consolidated financial statements).

In December 2009, we completed an agreement with a financial institution to monetize our rights under the above noted Share Purchase Agreement with Ford for $37.0 million and a contingent payment of $7.5 million, resulting in a net gain on sale of assets of $34.3 million in 2009. The contingent payment of $7.5 million was subsequently monetized and extinguished in July 2010 for $5.0 million, resulting in an additional net gain on sale of assets of $4.8 million in 2010 (see note 9 to our consolidated financial statements).

In March 2010, we completed a sale and leaseback agreement with Madison Pacific Properties Inc. (“Madison”) to further bolster our cash reserves. On the closing of this transaction on March 9, 2010, we sold our head office building in Burnaby, British Columbia in return for gross cash proceeds of $20.4 million (Canadian $20.8 million). We then leased this property back from Madison for an initial 15-year term plus two renewal options. On the closing of this transaction, we recorded a deferred gain of $9.5 million which will be recognized to income on a straight-line basis over the term of the 15-year lease. Due to the long term nature of the lease, the leaseback of the building qualifies as a capital lease. As a result, we have recorded assets under capital lease of $12.2 million, and a corresponding obligation under capital lease, representing the net present value of the minimum lease payments at the inception of the lease (see note 4 to the consolidated financial statements).

On January 18, 2010, we acquired a controlling interest (the “Acquisition”) in Denmark-based Dantherm Power A/S (“Dantherm Power”), partnering with co-investors Dantherm A/S and Danfoss Ventures A/S. In exchange for an initial investment of 15.0 million Danish Kroner, or approximately $2.9 million, we obtained

Page 2 of 36

a 45% interest in Dantherm Power including the right to nominate a majority of the members of the Board of Directors. Through our ability to elect a majority of the members of the Dantherm Power board, who have the power to determine the strategic operating, investing and financing policies of Dantherm Power, we held effective control over Dantherm Power as of the date of the initial investment. As a result, all assets, liabilities and results of operations of Dantherm Power are consolidated and have been included in our Consolidated Financial Statements for the year ended December 31, 2010. Non-Ballard ownership interests in Dantherm Power are shown as non-controlling interests. On August 31, 2010 we, together with the minority shareholders Dantherm A/S and Danfoss Ventures A/S completed the second tranche of our agreed upon investment in Dantherm Power. In accordance with the terms of the initial acquisition agreement, of the total second tranche investment of 20.0 million Danish Kroner, we made our required investment of 15.0 million Danish Kroner, or approximately $2.6 million, and in return received an additional 7% interest in Dantherm Power, resulting in our now holding a 52% total equity interest. Dantherm Power is focused on the development and production of commercially viable fuel cell-based backup power systems for use in IT and telecom network base stations. Dantherm Power’s results are reported in our core Fuel Cell Products segment (see note 2 to the consolidated financial statements).

We are focused on building a clean energy fuel cell solutions company. We provide our customers the positive economic and environmental benefits unique to fuel cell power. We plan to build value for our shareholders by developing, manufacturing, selling and servicing industry-leading fuel cell products to meet the needs of our customers in select target markets. We are focused on our core competencies of PEM fuel cell design, development, manufacture, sales and service. We are based in Canada, with head office, research and development, testing and manufacturing facilities in Burnaby, British Columbia. In addition, we have sales, research and development and manufacturing facilities in Lowell, Massachusetts and Hobro, Denmark. We report our results in the following reporting units:

1. Fuel Cell Products (core segment): fuel cell products and services for motive power (material handling and bus markets) and stationary power (backup power and distributed generation markets) applications;

2. Contract Automotive (supporting segment): contract technical and manufacturing services provided primarily for Daimler, Ford and AFCC.

3. Material Products (supporting segment): carbon fiber products primarily for automotive transmissions and gas diffusion layers (“GDLs”) for fuel cells.

Page 3 of 36

SELECTED ANNUAL FINANCIAL INFORMATION

Years ended December 31 (Expressed in thousands of U.S. dollars, except per share amounts)

|

2010

|

2009

|

2008

|

||||||||||

|

Product and service revenues

|

$ | 65,019 | $ | 46,722 | $ | 52,726 | ||||||

|

Engineering development revenue

|

– | – | 6,854 | |||||||||

|

Revenues

|

$ | 65,019 | $ | 46,722 | $ | 59,580 | ||||||

|

Net income (loss) attributable to Ballard

|

$ | (34,936 | ) | $ | (3,258 | ) | $ | 31,456 | ||||

|

Net income (loss) per share attributable to Ballard

|

$ | (0.42 | ) | $ | (0.04 | ) | $ | 0.37 | ||||

|

Adjusted EBITDA (1)

|

$ | (25,988 | ) | $ | (38,977 | ) | $ | (35,753 | ) | |||

|

Cash, cash equivalents and short-term investments

|

$ | 74,445 | $ | 82,231 | $ | 85,399 | ||||||

|

Total assets

|

$ | 189,788 | $ | 195,348 | $ | 208,443 | ||||||

|

1

|

Adjusted EBITDA is a non-GAAP measure. We use certain Non-GAAP measures to assist in assessing our financial performance. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. See reconciliation to GAAP in the Supplemental Non-GAAP Measures section.

|

RESULTS OF OPERATIONS – Fourth Quarter of 2010

Revenue and gross margin

| (Expressed in thousands of U.S. dollars) | Three months ended December 31, | |||||||||||||||

| 2010 |

2009

|

$ Change

|

% Change

|

|||||||||||||

|

Fuel Cell Products

|

$ | 13,336 | $ | 7,687 | $ | 5,649 | 73% | |||||||||

|

Contract Automotive

|

3,401 | 4,485 | (1,084 | ) | (24% | ) | ||||||||||

|

Material Products

|

4,346 | 4,344 | 2 | –% | ||||||||||||

|

Revenues

|

21,083 | 16,516 | 4,567 | 28% | ||||||||||||

|

Cost of goods sold

|

15,975 | 14,159 | 1,816 | 13% | ||||||||||||

|

Gross Margin

|

$ | 5,108 | $ | 2,357 | $ | 2,751 | n/a | |||||||||

|

Gross Margin %

|

24% | 14% | n/a | n/a | ||||||||||||

Our revenues for the fourth quarter of 2010 increased 28%, or $4.6 million, to $21.1 million, compared to $16.5 million for the fourth quarter of 2009. Increases in our Fuel Cell Products segment of $5.6 million combined with steady results in our Material Products segment more than offset declines in our Contract Automotive segment of $1.1 million.

In our core Fuel Cell Products business segment, fourth quarter of 2010 revenues improved 73%, or $5.6 million, to $13.3 million compared to the fourth quarter of 2009 as sales increased in all of our markets. Fuel cell bus market revenues increased as a result of new shipments to the Transport for London fuel cell bus program and increased shipments to Daimler AG whereas material handling market revenues improved due to increased shipments to support Plug Power Inc.’s GenDrive™ systems. In our backup power market, revenues increased due to higher shipments and increased work performed on engineering service projects, combined with the acquisition, and subsequent consolidation, of Dantherm Power’s operating results.

Page 4 of 36

Declines in our Contract Automotive segment of $1.1 million resulted from lower shipments of FCvelocity 1100 fuel cell products for Daimler AG’s Hyway 2/3 programs. Material Products segment revenues were consistent quarter over quarter as increased volumes of fuel cell GDL shipments were offset by lower carbon friction material product revenues.

Gross margins increased to $5.1 million, or 24% of revenues, for the fourth quarter of 2010, compared to $2.4 million, or 14% of revenues, for the fourth quarter of 2009. The increase in gross margin is primarily as a result of increased shipments of higher margin fuel cell bus units combined with improved mix of our backup power products and improved warranty performance on our material handling and fuel cell bus products.

Cash Operating Costs

| (Expressed in thousands of U.S. dollars) | ||||||||||||||||||||||||||||||||

| Three months ended December 31, | ||||||||||||||||||||||||||||||||

|

2010

Ballard |

2010

Dantherm Power |

2010

|

2009

|

Ballard $

Change |

Ballard % Change

|

Total $

Change |

Total %

Change |

|||||||||||||||||||||||||

|

Research and

Product Development

|

$ | 4,738 | $ | (399 | ) | $ | 4,339 | $ | 5,495 | $ | (757 | ) | (14% | ) | $ | (1,156 | ) | (21% | ) | |||||||||||||

|

General and Administration

|

3,511 | 380 | 3,891 | 2,803 | $ | 708 | 25% | 1,088 | 39% | |||||||||||||||||||||||

|

Sales and Marketing

|

1,822 | 735 | 2,557 | 1,914 | $ | (92 | ) | (1% | ) | 643 | 34% | |||||||||||||||||||||

|

Operating costs

|

10,071 | 716 | 10,787 | 10,212 | $ | (141 | ) | (1% | ) | 575 | 6% | |||||||||||||||||||||

|

Less: Stock-based compensation

|

(1,182 | ) | - | (1,182 | ) | (860 | ) | $ | (322 | ) | (37% | ) | (322 | ) | (37% | ) | ||||||||||||||||

|

Cash Operating Costs

|

$ | 8,889 | $ | 716 | $ | 9,605 | $ | 9,352 | $ | (463 | ) | (5% | ) | $ | 253 | 3% | ||||||||||||||||

|

1

|

Cash Operating Costs is a non-GAAP measure. We use certain Non-GAAP measures to assist in assessing our financial performance. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. See reconciliation to GAAP in the Supplemental Non-GAAP Measures section.

|

Cash Operating Costs (see Supplemental Non-GAAP Measures) for the fourth quarter of 2010 were $9.6 million, an increase of $0.3 million, or 3%, compared to the fourth quarter of 2009. Excluding Dantherm Power, Cash Operating Costs declined $0.5 million, or 5%, to $8.9 million. The 5% reduction in the fourth quarter of 2010 was primarily as a result of the narrowing of our research efforts, the aggressive pursuit of government funding for our programs, and the redirection of engineering resources to revenue bearing engineering service projects. Government research funding is reflected as a cost offset to research and product development expenses. These expense reductions were partially offset by a provision for allowance for doubtful accounts of $0.6 million included in general and administrative expense, and by the negative effects of a 5% stronger Canadian dollar relative to the U.S. dollar on our Canadian operating cost base.

Page 5 of 36

Adjusted EBITDA

|

(Expressed in thousands of U.S. dollars)

|

Three months ended December 31,

|

|||||||||||||||

|

Adjusted EBITDA

|

2010

|

2009

|

$ Change

|

% Change

|

||||||||||||

|

Adjusted EBITDA

|

$ | (3,126 | ) | $ | (6,443 | ) | $ | 3,317 | 51% | |||||||

|

Adjusted EBITDA attributable to controlling interest in Dantherm Power

|

$ | (229 | ) | $ | - | $ | (229 | ) | n/a | |||||||

|

Adjusted EBITDA attributable to Ballard Power Systems Inc., excluding Dantherm Power

|

$ | (2,897 | ) | $ | (6,443 | ) | $ | 3,546 | 55% | |||||||

|

1

|

Adjusted EBITDA is a non-GAAP measure. We use certain Non-GAAP measures to assist in assessing our financial performance. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. See reconciliation to GAAP in the Supplemental Non-GAAP Measures section.

|

Adjusted EBITDA (see Supplemental Non-GAAP Measures) for the fourth quarter of 2010 improved 51%, or $3.3 million, to ($3.1) million, compared to ($6.4) million in the fourth quarter of 2009. Adjusted EBITDA, excluding the impact related to our controlling ownership interest in Dantherm Power of ($0.2) million, improved 55%, or $3.5 million, to ($2.9) million.

The $3.3 million, or 51%, improvement in Adjusted EBITDA in the fourth quarter of 2010 was driven by gross margin improvements of $2.8 million as a result of the 28% increase in revenues, combined with the overall increase in gross margin as a percentage of revenues from 14% to 24%. The gross margin improvement was partially offset by higher Cash Operating Costs of $0.3 million, or 3%, due primarily to the acquisition of Dantherm Power.

Net income (loss)

|

(Expressed in thousands of U.S. dollars)

|

Three months ended December 31,

|

|||||||||||||||

|

Net income (loss)

|

2010

|

2009

|

$ Change

|

% Change

|

||||||||||||

|

Net income (loss) attributable to Ballard Power Systems Inc.

|

$ | (8,430 | ) | $ | 25,634 | $ | (34,064 | ) | (133% | ) | ||||||

|

Net loss attributable to controlling interest in Dantherm Power

|

(325 | ) | - | (325 | ) | n/a | ||||||||||

|

Net income (loss) attributable to Ballard Power Systems Inc., excluding Dantherm Power

|

$ | (8,105 | ) | $ | 25,634 | $ | (33,739 | ) | (132% | ) | ||||||

Net loss attributable to Ballard for the fourth quarter of 2010 was ($8.4) million, or ($0.10) per share, compared to net income of $25.6 million, or $0.31 per share, in the fourth quarter of 2009. Net income in the fourth quarter of 2009 was significantly impacted by the positive effect of a gain on sale of assets of $34.3 million resulting from the initial monetization of the Share Purchase Agreement with Ford whereas net loss in the fourth quarter of 2010 includes the negative impact of our controlling interest in Dantherm Power of $0.3 million.

Page 6 of 36

Cash provided by operating activities

|

(Expressed in thousands of U.S. dollars)

|

Three months ended December 31,

|

|||||||||||||||

|

Cash provided by operating activities

|

2010

|

2009

|

$ Change

|

% Change

|

||||||||||||

|

Cash provided by operating activities

|

$ | 1,995 | $ | 1,578 | 417 | 26% | ||||||||||

|

Cash provided by operating activities attributable to Dantherm Power

|

$ | 123 | $ | – | 123 | n/a | ||||||||||

|

Cash provided by operating activities, excluding Dantherm Power

|

$ | 1,872 | $ | 1,578 | $ | 294 | 19% | |||||||||

Cash provided by operating activities in the fourth quarter of 2010 increased by $0.4 million to $2.0 million, compared to $1.6 million in the fourth quarter of 2009. Cash provided by operating activities, excluding the impact of Dantherm Power of $0.1 million, improved by $0.3 million to $1.9 million.

The improved cash flow from operating activities in the fourth quarter of 2010 of $0.3 million, excluding the results of Dantherm Power, was driven by lower cash operating losses of $0.8 million partially offset by lower working capital improvements of $0.5 million.

The cash provided by operating activities of Dantherm Power of $0.1 million in the fourth quarter of 2010 has improved from ($1.6) million used in the third quarter of 2010, ($2.0) million used in the second quarter of 2010 and ($2.8) million used in the first quarter of 2010. In order to reduce potential future funding requirements, Dantherm Power initiated cost reduction efforts in the third quarter of 2010 including a 25% workforce reduction (8 positions).

RESULTS OF OPERATIONS – 2010

Revenue and gross margin

| (Expressed in thousands of U.S. dollars) | Years ended December 31, | |||||||||||||||

|

2010

|

2009

|

$ Change

|

% Change

|

|||||||||||||

|

Fuel Cell Products

|

$ | 32,784 | $ | 24,142 | $ | 8,642 | 36% | |||||||||

|

Contract Automotive

|

11,271 | 9,170 | 2,101 | 23% | ||||||||||||

|

Material Products

|

20,964 | 13,410 | 7,554 | 56% | ||||||||||||

|

Revenues

|

65,019 | 46,722 | 18,297 | 39% | ||||||||||||

|

Cost of goods sold

|

54,808 | 40,795 | 14,013 | 34% | ||||||||||||

|

Gross Margin

|

$ | 10,211 | $ | 5,927 | $ | 4,284 | n/a | |||||||||

|

Gross Margin %

|

16% | 13% | n/a | n/a | ||||||||||||

Our revenues for the year ended December 31, 2010 increased 39% (meeting our guidance target for growth in excess of 35%), or $18.3 million, to $65.0 million, compared to $46.7 million for 2009. Increases in our Fuel Cell Products segment of $8.6 million combined with increases in our Contract Automotive segment of $2.1 million and increases in our Material Products segment of $7.6 million.

Page 7 of 36

In our core Fuel Cell Products business segment, 2010 revenues increased 36%, or $8.6 million, to $32.8 million compared to 2009. Significantly higher material handling revenues as a result of increased shipments to support Plug Power Inc.’s GenDrive™ systems and increased shipments of hydrogen-based units in our backup power market drove the increase. Fuel cell bus market revenues improved slightly in 2010 as new shipments to Daimler AG, Transport for London, Sunline Transit Agency and Advanced Public Transportation System bv and others were in excess of our 2009 shipments for the B.C. Transit 2010 Olympic ($6.0 million) and Transport of London fuel cell bus programs. Revenues in 2010 were also positively impacted by the consolidation of Dantherm Power’s operating results which contributed $2.5 million of revenue.

The following table provides a summary of our fuel cell stack shipments:

|

Three months ended December 31,

|

Year ended December 31,

|

|||||||||||||||||||||||

|

2010

|

2009

|

% Change

|

2010

|

2009

|

% Change

|

|||||||||||||||||||

|

Material handling

|

345 | 102 | 238% | 1,100 | 182 | 504% | ||||||||||||||||||

|

Backup power

|

706 | 409 | 73% | 1,716 | 1,225 | 40% | ||||||||||||||||||

|

Other

|

68 | 40 | 70% | 198 | 69 | 187% | ||||||||||||||||||

|

Fuel Cell Stack Shipments

|

1,119 | 551 | 103% | 3,014 | 1,476 | 104% | ||||||||||||||||||

In our supporting Contract Automotive and Material Products business segments, 2010 revenues increased 43%, or $9.7 million, to $32.2 million compared to 2009. Improvements in our Contract Automotive segment of $2.1 million, or 23%, resulted from increased contract manufacturing of FCvelocity 1100 fuel cell products for Daimler AG’s Hyway 2/3 programs partially offset by lower automotive testing and engineering services provided to AFCC. Improvements in our Material Products segment of $7.6 million, or 56%, represents increased volumes of carbon friction material products related to the recovery in the U.S. automotive sector in 2010 combined with increased shipments of fuel cell GDL products.

Gross margins increased to $10.2 million, or 16% of revenues, for 2010 compared to $5.9 million, or 13% of revenues, for 2009. The increase in gross margin is primarily a result of increased shipments of carbon fiber products and light-duty automotive products combined with improved margins on our backup power products and improved warranty performance on our material handling and fuel cell bus products. Gross margins in 2009 were also negatively impacted by more aggressive product pricing on our back-up power products in order to encourage market adoption.

Page 8 of 36

Cash Operating Costs

| (Expressed in thousands of U.S. dollars) | Year ended December 31, | |||||||||||||||||||||||||||||||

|

2010

Ballard |

2010

Dantherm Power |

2010

|

2009

|

Ballard $

Change |

Ballard % Change

|

Total $

Change |

Total %

Change |

|||||||||||||||||||||||||

|

Research and Product Development

|

$ | 20,228 | $ | 3,584 | $ | 23,812 | $ | 26,628 | $ | (6,400 | ) | (24% | ) | $ | (2,816 | ) | (11% | ) | ||||||||||||||

|

General and Administration

|

11,572 | 1,743 | 13,315 | 10,801 | $ | 771 | 7% | 2,514 | 23% | |||||||||||||||||||||||

|

Sales and Marketing

|

7,482 | 1,379 | 8,861 | 7,203 | $ | 279 | 4% | 1,658 | 23% | |||||||||||||||||||||||

|

Operating costs

|

39,282 | 6,706 | 45,988 | 44,632 | $ | (5,350 | ) | (12% | ) | 1,356 | 3% | |||||||||||||||||||||

|

Less: Stock-based compensation

|

(4,057 | ) | - | (4,057 | ) | (3,033 | ) | $ | (1,024 | ) | (34% | ) | (1,024 | ) | (34% | ) | ||||||||||||||||

|

Cash Operating Costs

|

$ | 35,225 | $ | 6,706 | $ | 41,931 | $ | 41,599 | $ | (6,374 | ) | (15% | ) | $ | 332 | 1% | ||||||||||||||||

|

1

|

Cash Operating Costs is a non-GAAP measure. We use certain Non-GAAP measures to assist in assessing our financial performance. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. See reconciliation to GAAP in the Supplemental Non-GAAP Measures section.

|

Cash Operating Costs (see Supplemental Non-GAAP Measures) for 2010 were $41.9 million, an increase of $0.3 million, or 1%, compared to 2009. Excluding Dantherm Power’s Cash Operating Costs of $6.7 million, Cash Operating Costs declined $6.4 million, or 15%, to $35.2 million. This 15% reduction is due primarily to a 7% workforce reduction initiated in March 2009 and a 20% workforce reduction initiated in August 2009 combined with the narrowing of our research efforts and the aggressive pursuit of government funding for our programs. Government research funding is reflected as a cost offset to research and product development expenses. These expense reductions in 2010 were partially offset by a provision for allowance for doubtful accounts of $0.7 million included in general and administrative expense, increased investment in sales and marketing capacity in support of commercial efforts, and by the negative effects of a 10% stronger Canadian dollar relative to the U.S. dollar on our Canadian operating cost base.

Adjusted EBITDA

| (Expressed in thousands of U.S. dollars) | Year ended December 31, | |||||||||||||||||||||||||||||||

|

EBITDA and Adjusted EBITDA

|

2010

|

2009

|

$ Change

|

% Change

|

||||||||||||

|

Adjusted EBITDA

|

$ | (25,988 | ) | $ | (38,977 | ) | $ | 12,989 | 33% | |||||||

|

Adjusted EBITDA attributable to controlling interest in Dantherm Power

|

$ | (2,637 | ) | $ | – | $ | (2,637 | ) | n/a | |||||||

|

Adjusted EBITDA attributable to Ballard Power Systems Inc., excluding Dantherm Power

|

$ | (23,351 | ) | $ | (38,977 | ) | $ | 15,626 | 40% | |||||||

|

1

|

Adjusted EBITDA is a non-GAAP measure. We use certain Non-GAAP measures to assist in assessing our financial performance. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. See reconciliation to GAAP in the Supplemental Non-GAAP Measures section.

|

Page 9 of 36

Adjusted EBITDA (see Supplemental Non-GAAP Measures) for 2010 improved 33%, or $13.0 million, to ($26.0) million, compared to ($39.0) million in 2009. Adjusted EBITDA, excluding the impact related to our controlling ownership interest in Dantherm Power of ($2.6) million, improved 40%, or $15.6 million, to ($23.4) million.

The $13.0 million, or 33%, improvement in Adjusted EBITDA in the 2010 was assisted by gross margin improvements of $4.3 million as a result of the 39% increase in revenues, combined with the overall increase in gross margin as a percentage of revenues from 13% to 16%. Cash Operating Costs were held steady in 2010 as the benefits of a 7% workforce reduction initiated in March 2009 and a 20% workforce reduction initiated in August 2009 were offset by the acquisition and consolidation of Dantherm Power’s Cash Operating Costs of $6.7 million and the negative impacts of a 10% stronger Canadian dollar relative to the U.S. dollar on our Canadian operating cost base. Adjusted EBITDA for 2009 also includes restructuring and related expenses of $6.2 million relating to the above noted workforce reductions.

Net loss

|

(Expressed in thousands of U.S. dollars)

|

Year ended December 31,

|

|||||||||||||||

|

Net loss

|

2010

|

2009

|

$ Change

|

% Change

|

||||||||||||

|

Net loss attributable to Ballard Power Systems Inc.

|

$ | (34,936 | ) | $ | (3,258 | ) | $ | (31,678 | ) | (972% | ) | |||||

|

Net loss attributable to controlling interest in Dantherm Power

|

(3,411 | ) | – | $ | (3,411 | ) | n/a | |||||||||

|

Net loss attributable to Ballard Power Systems Inc., excluding Dantherm Power

|

$ | (31,525 | ) | $ | (3,258 | ) | $ | (28,267 | ) | (868% | ) | |||||

Net loss attributable to Ballard for the year ended December 31, 2010 was ($34.9) million, or ($0.42) per share, compared to ($3.3) million, or ($0.04) per share, in 2009.

Net loss in 2009 was significantly impacted by the positive effect of a gain on sale of assets of $34.3 million resulting from the initial monetization of the Share Purchase Agreement with Ford and a non-cash gain of $10.8 million related to our decision to discontinue operations in EBARA BALLARD in May 2009. Net loss in 2010 includes the negative impact of our controlling interest in Dantherm Power of $3.4 million and the positive impact of a gain on sale of assets of $4.8 million related to the stub period monetization of the Share Purchase Agreement with Ford.

Page 10 of 36

Cash used in operating activities

|

(Expressed in thousands of U.S. dollars)

|

Year ended December 31,

|

|||||||||||||||

|

Cash used in operating activities

|

2010

|

2009

|

$ Change

|

% Change

|

||||||||||||

|

Cash used in operating activities

|

$ | (29,312 | ) | $ | (26,962 | ) | (2,350 | ) | (9% | ) | ||||||

|

Cash used in operating activities attributable to Dantherm Power

|

$ | (6,192 | ) | $ | – | (6,192 | ) | n/a | ||||||||

|

Cash used in operating activities, excluding Dantherm Power

|

$ | (23,120 | ) | $ | (26,962 | ) | $ | 3,842 | 14% | |||||||

Cash used in operating activities in the year ended December 31, 2010 increased by ($2.4) million to ($29.3) million, compared to ($27.0) million for 2009. On a comparable year-over-year basis, excluding the negative impact of Dantherm Power of ($6.2) million and the negative impacts of a 10% stronger Canadian dollar relative to the U.S. dollar on our Canadian operating cost base of approximately ($4.0) million, cash flow from operations would have been ($19.1) million, an improvement of approximately 30% over 2009, meeting guidance.

The reduced cash used in operating activities in 2010 of $3.8 million, excluding the results of Dantherm Power, was driven by lower cash operating losses of $9.3 million as a result of lower operating expenses and higher gross margins, partially offset by lower working capital improvements of $5.4 million in 2010 as compared to 2009.

The cash used in operating activities of Dantherm Power of ($6.2) million in 2010 was driven by costs of development work on the new 5kW direct hydrogen backup system. In order to reduce potential future funding requirements, Dantherm Power initiated cost reduction efforts in the third quarter of 2010 including a 25% workforce reduction (8 positions).

RESULTS OF OPERATIONS (Additional details) - 2010

|

(Expressed in thousands of U.S. dollars)

|

Year ended December 31,

|

|

2010

Ballard |

2010

Dantherm Power |

Total

2010 |

Total

2009 |

Ballard $ Change

|

Ballard % Change

|

Total $

Change |

Total %

Change |

|||||||||||||||||||||||||

|

Research and Product Development

|

$ | 20,228 | $ | 3,584 | $ | 23,812 | $ | 26,628 | $ | (6,400 | ) | (24% | ) | $ | (2,816 | ) | (11% | ) | ||||||||||||||

|

General and Administration

|

11,572 | 1,743 | 13,315 | 10,801 | $ | 771 | 7% | 2,514 | 23% | |||||||||||||||||||||||

|

Sales and Marketing

|

7,482 | 1,379 | 8,861 | 7,203 | $ | 279 | 4% | 1,658 | 23% | |||||||||||||||||||||||

|

Operating costs

|

39,282 | 6,706 | 45,988 | 44,632 | $ | (5,350 | ) | (12% | ) | 1,356 | 3% | |||||||||||||||||||||

|

Restructuring and related Costs

|

55 | 230 | 285 | 6,229 | $ | (6,174 | ) | (99% | ) | (5,944 | ) | (95% | ) | |||||||||||||||||||

|

Acquisition Charges

|

243 | – | 243 | 529 | $ | (286 | ) | (54% | ) | (286 | ) | (54% | ) | |||||||||||||||||||

|

Depreciation and Amortization

|

5,759 | 695 | 6,454 | 6,580 | $ | (821 | ) | (12% | ) | (126 | ) | (2% | ) | |||||||||||||||||||

|

Operating expenses

|

$ | 45,339 | $ | 7,631 | $ | 52,970 | $ | 57,970 | $ | (12,631 | ) | (22% | ) | $ | (5,000 | ) | (9% | ) | ||||||||||||||

Page 11 of 36

Research and product development expenses for 2010 were $23.8 million, a decrease of $2.8 million, or 11%, compared to 2009. Excluding Dantherm Power’s expenses of $3.6 million, research and product development expense declined $6.4 million, or 24%. This reduction is due primarily to a 7% workforce reduction initiated in March 2009 and a 20% workforce reduction initiated in August 2009 combined with the narrowing of our research efforts and the aggressive pursuit of government funding for our programs. Government research funding is reflected as a cost offset to research and product development expenses. Expense reductions in 2010 were partially offset by the negative effects of a 10% stronger Canadian dollar relative to the U.S. dollar.

General and administrative expenses for 2010 were $13.3 million, an increase of $2.5 million, or 23%, compared to 2009. Excluding Dantherm Power’s expenses of $1.7 million, general and administrative expense increased $0.8 million, or 7%. Reductions due to the above noted workforce reductions initiated in 2009 were offset by a provision for allowance for doubtful accounts of $0.7 million, an adjustment in 2010 to reduce non-cash share compensation expense awarded in 2009 of $0.4 million, the negative effects of a 10% stronger Canadian dollar relative to the U.S. dollar, and increased accounting advisory fees as a result of our upcoming convergence to IFRS.

Sales and marketing expenses for 2010 were $8.9 million, an increase of $1.7 million, or 23% compared to 2009. Excluding Dantherm Power’s expenses of $1.4 million, sales and marketing expense increased $0.3 million, or 4%. This increase is due primarily to the negative effects of a 10% stronger Canadian dollar, relative to the U.S. dollar.

Restructuring and related expenses for 2010 were $0.3 million and relate to a 25% workforce reduction initiated at Dantherm Power in August 2010. Restructuring and related expenses for 2009 were $6.2 million and relate to the 20% workforce reduction initiated in August 2009 and the 7% workforce reduction initiated in March 2009.

Acquisition charges for 2010 and 2009 were $0.2 million and $0.5 million, respectively, and relate to costs incurred for the acquisition of Dantherm Power.

Depreciation and amortization expense was $6.5 million for 2010, an increase of $0.1 million, or 2%, compared to 2009. Depreciation and amortization expense in 2010 was impacted by a fourth quarter of 2010 acceleration of depreciation expense of $2.3 million for equipment that was considered no longer in use or impaired. Depreciation and amortization expense for 2009 was impacted by a fourth quarter of 2009 acceleration of amortization expense of $2.5 million for patents that were considered no longer in use. Excluding the impacts above, depreciation and amortization expense was relatively flat as increases as a result of the amortization of intangible assets acquired from Dantherm Power were offset by the impact of certain assets becoming fully depreciated or amortized in 2009. Acquired intangible assets are amortized on a straight-line basis over 5-years.

Page 12 of 36

Investment and other income for 2010 was $0.1 million, compared to $6.0 million for 2009. The following table provides a breakdown of our investment and other income for the reported periods:

|

(Expressed in thousands of U.S. dollars)

|

Year ended December 31,

|

|

2010

|

2009

|

$ Change

|

% Change

|

|||||||||||||

|

Investment return (loss) less interest

cost on employee future benefit plans

|

$ | (12 | ) | $ | 743 | $ | (755 | ) | (101% | ) | ||||||

|

Curtailment gain on employee future benefit plans

|

– | 1,055 | (1,055 | ) | (100% | ) | ||||||||||

|

Investment income

|

247 | 387 | (140 | ) | (36% | ) | ||||||||||

|

Foreign exchange gain (loss)

|

(407 | ) | 3,187 | (3,594 | ) | (113% | ) | |||||||||

|

Other income

|

300 | 623 | (323 | ) | (52% | ) | ||||||||||

|

Investment and other income

|

$ | 128 | $ | 5,995 | $ | (5,897 | ) | (98% | ) | |||||||

Curtailment gain on employee future benefit plans was $1.1 million for 2009 and resulted from a freeze in future benefits of a defined benefit pension plan applicable for our current and former employees in the United States. As a result of the curtailment, there will be no further current service cost related to this defined benefit pension plan.

Investment return (loss) less interest cost on employee future benefit plans was nil for 2010 as the negative impact of a 0.5% decrease in the discount rate on our curtailed defined benefit pension plan for our United States employees was offset by the actual return on plan assets in the year. The gain in 2009 of $0.7 million was primarily a result of a recovery in the capital markets which resulted in increased actual returns on plan assets in the year. We account for future employee benefits using the fair value method of accounting. As a result, employee future benefit plan assets and accrued benefit obligations are recorded at their fair values on each balance sheet date with the actual return on plan assets and any net actuarial gains or losses recognized immediately in the statement of operations. The fair values are determined directly by reference to quoted market prices.

Investment income was $0.2 million for 2010, a decrease of $0.1 million, compared to 2009. The decline in 2010 was a result of lower cash balances. We classify our cash, cash equivalents and short-term investments as held-for-trading and measure these assets at fair value with changes in fair value recognized in income. The fair values are determined directly by reference to quoted market prices.

Foreign exchange gains and losses are attributable to the effect of the changes in the value of the Canadian dollar, relative to the U.S. dollar, on our Canadian dollar-denominated net monetary position. The foreign exchange loss in 2010 of $0.4 million resulted primarily from the impact of a strengthening Canadian dollar on our Canadian dollar-denominated net liability position. At December 31, 2010, our Canadian dollar-denominated liabilities (capital lease obligations, warranty obligations and accounts payable and accrued liabilities) exceeded our Canadian dollar-denominated assets (cash and short-term investments). The foreign exchange gain in 2009 of $3.2 million resulted primarily from the impact of a strengthening

Page 13 of 36

Canadian dollar on our Canadian dollar-denominated net asset position. At December 31, 2009, our Canadian dollar-denominated assets exceeded our Canadian dollar-denominated liabilities. Compared to the U.S. dollar, the Canadian dollar strengthened from 1.22 at December 31, 2008 to 1.05 at December 31, 2009 and to 0.99 at December 31, 2010. See note 21 to our consolidated financial statements for additional information about the significance of financial instruments to our financial position and performance, the nature and extent of risks arising from those financial instruments to which we are exposed, and how we manage those risks.

Interest expense was $1.0 million for 2010 and relates primarily to the sale and leaseback of our head office building in Burnaby, British Columbia. Due to the long term nature of the lease, the leaseback of the building qualifies as a capital lease.

Gain on sale of assets was $4.8 million for 2010, compared to $34.3 million for 2009. The 2009 gain of $34.3 million resulting from the initial monetization of the Share Purchase Agreement with Ford whereas the 2010 gain of $4.8 million related to the stub period monetization of the Share Purchase Agreement with Ford. The Share Purchase Agreement with Ford has now been fully monetized.

Equity in income of associated companies for 2009 was $8.4 million. On the announcement of our decision in May 2009 to discontinue operations in EBARA BALLARD, the $10.8 million of historic recorded equity losses in EBARA BALLARD in excess of our net investment in EBARA BALLARD, was reversed to net income. This second quarter of 2009 non-cash gain was partially offset by the share of the losses of EBARA BALLARD of $2.4 million recorded in 2009 prior to the announcement of the discontinuance. EBARA BALLARD was formally dissolved in October 2009.

Net loss attributed to non-controlling interests for 2010 was $3.9 million and represent the non-controlling interest of Dantherm A/S and Danfoss A/S in the losses of Dantherm Power as a result of their 55% total equity interest from acquisition on January 18, 2010 to August 31, 2010 and their 48% total equity interest from September 1, 2010 to December 31, 2010.

Page 14 of 36

SUMMARY OF QUARTERLY RESULTS

The following table provides summary financial data for our last eight quarters:

|

(Expressed in thousands of U.S. dollars, except per share amounts)

|

Quarter ended

|

|

Dec 31,

2010

|

Sep 30,

2010 |

June 30,

2010

|

Mar 31,

2010 |

|||||||||||||

|

Revenues

|

$ | 21,083 | $ | 16,528 | $ | 15,526 | $ | 11,882 | ||||||||

|

Net income (loss) attributable to Ballard

|

$ | (8,430 | ) | $ | (5,610 | ) | $ | (10,851 | ) | $ | (10,045 | ) | ||||

|

Net income (loss) per share attributable to Ballard, basic and diluted

|

$ | (0.10 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | (0.12 | ) | ||||

|

Weighted average common shares outstanding (000’s)

|

84,140 | 84,128 | 84,127 | 84,012 | ||||||||||||

|

Dec 31,

2009

|

Sep 30,

2009 |

Jun 30,

2009

|

Mar 31,

2009

|

|||||||||||||

|

Revenues

|

$ | 16,516 | $ | 9,047 | $ | 13,075 | $ | 8,084 | ||||||||

|

Net income (loss) attributable to Ballard

|

$ | 25,634 | $ | (11,352 | ) | $ | 1,583 | $ | (19,123 | ) | ||||||

|

Net income (loss) per share attributable to Ballard, basic and diluted

|

$ | 0.31 | $ | (0.14 | ) | $ | 0.02 | $ | (0.23 | ) | ||||||

|

Weighted average common shares outstanding (000’s)

|

83,974 | 83,955 | 83,941 | 82,662 | ||||||||||||

Summary of Quarterly Results: There were no significant seasonal variations in our quarterly results. Variations in our net income (loss) for the above periods were affected primarily by the following factors:

|

●

|

Revenues: Variations in fuel cell product and service revenues reflect the timing of our customers’ fuel cell vehicle, bus and field cell product deployments. Variations in fuel cell service product and service revenues also reflect the timing of work performed and the achievements of milestones under long-term fixed price contracts. Product revenues in the second quarter of 2009 were positively impacted by the shipments of fuel cell bus modules related to the B.C. Transit 2010 Olympic fuel cell bus program totaling $6.0 million. Product and service revenues also include the consolidated results of Dantherm Power as of the date of acquisition of January 18, 2010.

|

|

●

|

Operating expenditures: Operating expenses have declined in the first two quarters of 2010 and the last three quarters of 2009 as a result of the 20% workforce reduction initiated in August 2009 and the 7% workforce reduction initiated in March 2009. Operating expenses also include restructuring and related expenses of $4.8 million in the third quarter of 2009 and $1.4 million in the first quarter of 2009 as a result of the above workforce reduction initiatives. Operating expenses also include the impact of changes in the value of the Canadian dollar, versus the U.S. dollar, on our Canadian dollar denominated expenditures. Operating expenses also include the consolidated results of Dantherm Power as of the date of acquisition of January 18, 2010.

|

Page 15 of 36

|

●

|

Depreciation and amortization: Depreciation and amortization expense has been impacted in the four quarters of 2010 as a result of the acquisition of intangible assets in Dantherm Power, and the subsequent amortization over a 5-year period. Depreciation and amortization expense increased in the fourth quarter of 2010 due an acceleration of depreciation expense of $2.3 million for equipment that was considered no longer in use or impaired. Depreciation and amortization expense increased in the fourth quarter of 2009 due an acceleration of amortization expense of $2.5 million for patents that were no longer in use.

|

|

●

|

Investment and other income: Investment and other income has varied in each quarter due to fluctuations in the Canadian dollar, relative to the U.S. dollar, on our Canadian dollar-denominated cash and short-term investments. Investment and other income in the fourth quarter of 2009 was positively impacted by a $1.1 curtailment gain resulting from a freeze in future benefits of a defined benefit pension plan applicable for our current and former employees in the United States.

|

|

●

|

Gain on sale of assets: The net loss for the third quarter of 2010 and the net income for the fourth quarter of 2009 were positively impacted by gains on the monetization of the Share Purchase Agreement with Ford of $4.8 million and $34.3 million, respectively.

|

|

●

|

Equity income (loss) of associated companies: The net income for the second quarter of 2009 was significantly impacted by a $10.8 million gain recorded on the discontinuance of operations in Ebara Ballard Corporation, representing the reversal of our historic recorded equity losses in Ebara Ballard Corporation in excess of our net investment in Ebara Ballard Corporation at that time. Net loss for the first quarter of 2009 was impacted by equity losses in Ebara Ballard Corporation of approximately $2.4 million.

|

CASH FLOWS AND LIQUIDITY

Cash, cash equivalents and short-term investments were $74.4 million as at December 31, 2010, compared to $82.2 million at the end of 2009. The decrease of $7.8 million in 2010 was driven by a net loss (excluding non-cash items) of $32.8 million, net capital expenditures of $3.5 million, and the payment of accrued costs related to the 2009 monetization of the AFCC Share Purchase Agreement of $1.4 million. These outflows were partially offset by net cash proceeds of $20.0 million from the sale and leaseback of our head office building in Burnaby, British Columbia, the $4.8 million cash gain on the extinguishment of the contingent payment related to the above 2009 monetization of the AFCC Share Purchase Agreement, and working capital inflows of $3.5 million. The above cash outflows in 2010 include total net cash outflows by Dantherm Power of $6.2 million.

For the year ended December 31, 2010, working capital requirements resulted in cash inflows of $3.5 million compared to inflows of $8.5 million for 2009. In 2010, net cash inflows of $3.5 million were driven by increased accounts payable and accrued liabilities of $2.9 million due primarily to higher 2010 accrued annual employee bonuses as compared to 2009 combined with higher payables to suppliers

Page 16 of 36

as a result of our increased inventory and production levels. In addition, net cash inflows in 2010 benefited from lower prepaid expenses of $1.3 million as a result of lower insurance and information technology license renewal costs and higher deferred revenue of $1.0 million as a result of the receipt of customer payment in advance of work performed on certain of our engineering development contracts partially offset by cash outflows as a result of increased inventory of $2.4 million due to the buildup of inventory to support expected future fuel cell shipments in 2011. In 2009, net working capital cash inflows of $8.5 million were driven by lower accounts receivable of $6.1 million due primarily to collections of our fuel cell bus and contract automotive product and service revenues, higher accrued warranty liabilities of $4.0 million due primarily to product shipments for the B.C. Transit 2010 Olympic and APTS fuel cell bus programs, reduced inventory levels of $1.4 million and higher accounts payable and accrued liabilities of $1.6 million. These working capital inflows in 2009 were partially offset by cash outflows from the draw down of deferred revenue of $3.7 million due primarily to amounts earned under the First Energy distributed power generator program.

Investing activities resulted in cash inflows of $38.3 million for 2010, compared to cash inflows of $19.7 million in 2009. Investing activities in 2010 include net proceeds received on the closing of the head office building sale and leaseback transaction with Madison of $20.0 million, net proceeds of $4.8 million on the extinguishment of the contingent payment related to the 2009 monetization of the Share Purchase Agreement with Ford less the payment of accrued costs of $1.4 million related to the initial monetization which closed in December 2009, and net cash received of $0.9 million on the acquisition of Dantherm Power. On the date of acquisition of our controlling interest in Dantherm Power for $2.9 million, we acquired total cash and cash equivalents in Dantherm Power of $3.8 million, resulting in a net cash inflow of $0.9 million on acquisition (see note 2 to our consolidated financial statements). Investing activities in 2009 include gross proceeds received on the closing of the AFCC Monetization of $37.0 million. Changes in short-term investments resulted in cash inflows of $17.7 million in 2010 as compared to outflows of $7.6 million in 2009. Balances changed between cash equivalents and short-term investments as we make investment decisions with regards to the term of investments and our future cash requirements. Capital spending (net of proceeds on sale) of $3.5 million in 2010, and $4.6 million in 2009, was primarily for manufacturing equipment in order to build production capacity. The cash flows used for other investing activities in 2009 of $5.1 million include an investment in the now discontinued EBARA Ballard Corporation of $5.0 million.

Financing activities resulted in cash outflows of $0.4 million in 2010, compared to cash outflows of $3.5 million in 2009. Financing activities in 2010 primarily represent the minority partner cash contribution to Dantherm Power for the second tranche investment of 5.0 million Danish Kroner, or $0.9 million in August 2010 less capital lease payments of $0.8 million as a result of the sale and leaseback agreement with Madison, and treasury stock purchases of $0.6 million under our market purchase restricted share unit plan. Financing activities in 2009 primarily represent the payment of closing costs of $3.2 million which were accrued at December 31, 2008 on the closing of the Arrangement with Superior Plus Income Fund.

Page 17 of 36

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2010, we had cash, cash equivalents and short-term investments totaling $74.4 million. We will use our funds to meet net funding requirements for the development and commercialization of products in our target markets. This includes research and product development for fuel cells and material products, the purchase of equipment for our manufacturing and testing facilities, the further development of business systems and low-cost manufacturing processes and the further development of our sales and marketing, product distribution and service capabilities.

At this stage of our development, we may record net losses for at least the next few years as we continue to make significant investments in research and product and market development activities necessary to commercialize our products. Our actual funding requirements will vary based on the factors noted above, our relationships with our lead customers and strategic partners, our success in developing new channels to market and relationships with customers, our success in generating revenue growth from near-term product opportunities, our working capital requirements, foreign exchange fluctuations, and the progress and results of our research, development and demonstration programs.

Our financial strategy is to manage our cash resources with strong fiscal discipline, focus on markets with high product and service revenue growth potential, license technology in cases where it is advantageous to us, and access available government funding for research and development projects. Our current financing principle is to maintain cash balances sufficient to fund at least six quarters of operating cash consumption at all times.

2011 OUTLOOK

We expect revenues for 2011 to be at least 30% higher than our 2010 revenues of $65.0 million, or at least $84.5 million. Consistent with the past couple of years, we expect a majority of our 2011 revenue to be realized in the second half of the year, with second half revenue representing about two third’s of the full year total (as compared to 58% in the last half of 2010). Our revenue outlook for 2011 is based on our internal revenue forecast which reflects an assessment of overall business conditions and takes into account actual sales in the first two months of 2011, sales orders received for units and services to be delivered in 2011, and an estimate with respect to the generation of new sales in each of our markets. Our 2011 revenue outlook is also supported by our 12-month committed order book for products and services of $35.0 million at December 31, 2010 ($22.7 million at December 31, 2009). The primary risk factor that could cause us to miss our revenue guidance for 2011 are delays from forecast in terms of closing and shipping expected sales orders, primarily in our bus and backup power markets.

We expect Adjusted EBITDA (see Supplemental Non-GAAP Measures section) in 2011 to be in excess of 40% better than our 2010 Adjusted EBITDA of ($26.0) million, or lower than ($15.6) million. The key drivers for this expected improvement in

Page 18 of 36

Adjusted EBITDA for 2011 are expected increases in gross margins driven primarily by the above noted minimum 30% expected increase in revenues combined with the maintenance of Cash Operating Costs (see Supplemental Non-GAAP Measures section) at approximately their current levels. Consistent with the expectation that approximately two thirds of our 2011 revenue will fall in the last half of the year, Adjusted EBITDA is expected to be materially improved in the last half of 2011, as compared to the first half of 2011. Our Adjusted EBITDA outlook for 2011 is based on our internal Adjusted EBITDA forecast and takes into account our forecasted gross margin related to the above revenue forecast, the costs of our current and forecasted Cash Operating Costs, and assumes an average U.S. dollar exchange rate of 1.00 in relation to the Canadian dollar. The primary risk factor that could cause us to miss our Adjusted EBITDA guidance for 2011 are lower than expected gross margins due to (i) lower revenues from forecast due to unexpected delays in terms of closing and shipping expected sales orders; (ii) shifts in product sales mix negatively impacting projected gross margin as a percentage of revenues; or (iii) delays in the timing of our projected product cost reductions. In addition, Adjusted EBITDA could also be negatively impacted by unexpected increases in Cash Operating Costs due to (i) increased product development costs due to unexpected delays in new product introductions or by lower than anticipated government cost recoveries; or (ii) by negative foreign exchange impacts as a result of a higher than expected Canadian dollar. A 1% increase in the Canadian dollar, relative to the U.S. dollar, negatively impacts Cash Operating Costs by approximately $0.5 million.

Similar to prior years and consistent with our revenue and Adjusted EBITDA performance expectations for the year and the resulting impacts on gross margin and working capital, we expect cash used in operating activities in 2011 to be materially higher in the first and second quarters of 2011, as compared to the third and fourth quarters of 2011. Cash used in operating activities in the first two quarters of 2011 is expected to be negatively impacted by the buildup of inventory to support higher product shipments in the third and fourth quarters, the payment of accrued 2010 annual employee bonuses (now paid in cash versus the prior practice of settling through a dilutive treasury share distribution), and by the timing of revenues and the related customer collections which are also skewed towards the last half of the year.

Finally, we will continue our focus on maintaining a strong liquidity position. We ended 2010 with cash, cash equivalents and short-term investments of $74.4 million. We believe that with continued focus on improving gross margin performance, managing our Cash Operating Costs and our working capital requirements, we have sufficient liquidity to reach profitability without the need for additional public market financing. However, circumstances could change which would make it advantageous for us to access additional capital.

OFF-BALANCE SHEET ARRANGEMENTS & CONTRACTUAL OBLIGATIONS

Periodically, we use foreign exchange contracts to manage our exposure to currency rate fluctuations and platinum forward purchase contracts to manage our exposure to platinum price fluctuations. We record these contracts at their fair value as either

Page 19 of 36

assets or liabilities on our balance sheet. Any changes in fair value are recorded in our consolidated statements of operations. At December 31, 2010, we had outstanding platinum forward purchase contracts to purchase a total of $3.1 million of platinum at an average rate of $1,738 per troy ounce, resulting in an unrealized gain of $0.1 million.

As at December 31, 2009, we did not have any other material obligations under guarantee contracts, retained or contingent interests in transferred assets, outstanding derivative instruments or non-consolidated variable interests.

We have committed to make future capital contributions of $0.2 million in Chrysalix, in which we have a limited partnership interest.

At December 31, 2010 we had the following contractual obligations and commercial commitments:

|

(Expressed in thousands of U.S. dollars)

|

Payments due by period,

|

|

Contractual Obligations

|

Total

|

Less than

one year |

1-3 years

|

3-5 years

|

After 5

years |

|||||||||||||||

|

Operating leases

|

$ | 26,688 | $ | 2,551 | $ | 5,078 | $ | 5,328 | $ | 13,731 | ||||||||||

|

Capital leases

|

21,113 | 1,591 | 3,182 | 3,398 | 13,941 | |||||||||||||||

|

Asset retirement obligations

|

3,980 | – | – | – | 3,980 | |||||||||||||||

|

Total contractual obligations

|

$ | 52,781 | $ | 4,142 | $ | 8,260 | $ | 8,726 | $ | 31,652 | ||||||||||

In addition to the contractual purchase obligations above, we have commitments to purchase $1.2 million of capital assets as at December 31, 2010. Capital expenditures pertain to our regular operations and will be funded through either capital leases or cash on hand.

The Arrangement with Superior Plus includes an indemnification agreement dated December 31, 2008 (the "Indemnity Agreement"), which sets out the parties’ continuing obligations to the other. The Indemnity Agreement has two basic elements: it provides for the indemnification by each of the parties to the other for breaches of representations and warranties or covenants as well as, in our case, any liability relating to our business which is suffered by Superior Plus. Our indemnity to Superior Plus with respect to our representation relating to the existence of our tax pools immediately prior to the completion of the Arrangement is limited to an aggregate of $7.4 million (Canadian $7.4 million) with a threshold amount of $0.5 million (Canadian $0.5 million) before there is an obligation to make a payment. Second, the Indemnity Agreement provides for adjustments to be paid by us, or to us, depending on the final determination of the amount of our Canadian non-capital losses, scientific research and development expenditures and investment tax credits generated to December 31, 2008, to the extent that such amounts are more or less than the amounts estimated at the time the Arrangement was executed. At December 31, 2009, we have not accrued any amount owing, or receivable, as a result of the Indemnity Agreement.

RELATED PARTY TRANSACTIONS

Related parties include shareholders with a significant ownership interest in us,

Page 20 of 36

together with their subsidiaries and affiliates, our key management personnel, our equity-accounted investees, and our minority interest partners in Dantherm Power subsequent to the closing of the Dantherm Power acquisition on January 18, 2010. Related parties also include Ebara Ballard Corporation and EBARA Corporation prior to the discontinuance of our operations in Ebara Ballard Corporation in May 2009. Revenues and costs recognized from such transactions reflect the prices and terms of sale and purchase transactions with related parties, which are in accordance with normal trade practices.

Related party transactions and balances are as follows:

|

(Expressed in thousands of U.S. dollars)

|

Years Ended December 31,

|

|||||||

|

Transactions with related parties

|

2010

|

2009

|

||||||

|

Revenues

|

$ | 134 | $ | 380 | ||||

|

Purchases

|

1,301 | 78 | ||||||

|

Net investments and advances

|

– | 5,000 | ||||||

|

(Expressed in thousands of U.S. dollars)

|

As at December 31,

|

|||||||

|

Balances with related parties

|

2010

|

2009

|

||||||

|

Accounts receivable

|

$ | 153 | $ | – | ||||

|

Accounts payable and accrued liabilities

|

$ | 517 | $ | – | ||||

OUTSTANDING SHARE DATA

|

As at March 9, 2011

|

||||

|

Common share outstanding

|

84,212,712 | |||

|

Options outstanding

|

6,151,177 | |||

CRITICAL ACCOUNTING POLICIES, ESTIMATES AND JUDGMENT APPLIED

Our consolidated financial statements are prepared in accordance with Canadian GAAP, which require us to apply judgment when making estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, the reported amounts of revenues and expenses of the reporting period, as well as disclosures made in the accompanying notes to the financial statements. The estimates and associated assumptions are based on past experience and other factors that are considered relevant. Actual results could differ from these estimates. The following are our most critical accounting estimates, which are those that require management’s most challenging, subjective and complex judgments, requiring the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods. The application of these and other accounting policies are described more fully in note 1 to the consolidated financial statements.

REVENUE RECOGNITION

Revenues are generated primarily from product sales and services in our core Fuel

Page 21 of 36

Cell Products and supporting Contract Automotive and Material Products segments. We have also historically earned revenues by providing engineering development services in our core Fuel Cell Products and supporting Contract Automotive segments. Product revenues are derived primarily from standard equipment and material sales contracts and from long-term fixed price contracts. Service revenues are derived primarily from cost-plus reimbursable contracts. Engineering development revenues are derived primarily from long-term fixed price contracts.

On standard equipment and material sales contracts, revenues are recorded when the product is shipped to the customer, the risks of ownership are transferred to the customer, the price is fixed and determinable, and collection is reasonably assured. Provisions are made at the time of sale for warranties. Revenue recognition for standard equipment and material sales contracts does not usually involve significant estimates.

On cost-plus reimbursable contracts, revenues are recognized as costs are incurred, and include applicable fees earned as services are provided. Revenue recognition for cost-plus reimbursable contracts does not usually involve significant estimates.

On long-term fixed price contracts, revenues are recorded on the percentage-of-completion basis over the duration of the contract, which consists of recognizing revenue on a given contract proportionately with its percentage of completion at any given time. The percentage of completion is determined by dividing the cumulative costs incurred as at the balance sheet date by the sum of incurred and anticipated costs for completing a contract.

|

●

|

The determination of anticipated costs for completing a contract is based on estimates that can be affected by a variety of factors such as variances in the timeline to completion, the cost of materials, the availability and cost of labour, as well as productivity.

|

|

●

|

The determination of potential revenues includes the contractually agreed amount and may be adjusted based on the estimate of our attainment on achieving certain defined contractual milestones. Management’s judgment is required in determining the probability that the revenue will be received and in determining the measurement of that amount.

|

Estimates used to determine revenues and costs of long-term fixed price contracts involve uncertainties that ultimately depend on the outcome of future events and are periodically revised as projects progress. There is a risk that a customer may ultimately disagree with our assessment of the progress achieved against milestones or that our estimates of the work required to complete a contract may change. The cumulative effect of changes to anticipated revenues and anticipated costs for completing a contract are recognized in the period in which the revisions are identified. In the event that the anticipated costs exceed the anticipated revenues on a contract, such loss is recognized in its entirety in the period it becomes known.

During the years ended months ended December 31, 2010 and 2009, there were no material adjustments to revenues relating to revenue recognized in a prior period.

Page 22 of 36

ASSET IMPAIRMENT

Asset impairment incorporates an evaluation of our goodwill as well as our long-lived assets for impairment.

Goodwill is subject to at least an annual assessment of impairment by applying a fair value based test at the reporting unit level. An impairment loss is recognized to the extent that the carrying amount of goodwill for each reporting unit exceeds its estimated fair market value. The fair market values of the reporting units are derived from certain valuation models, which may consider various factors such as normalized and estimated future earnings, price earnings multiples, terminal values and discount rates. All factors used in the valuation models are based on management’s estimates and are subject to uncertainties and judgments. Changes in any of these estimates could affect the fair value of the reporting units and, consequently, the value of the reported goodwill. We perform the annual review of goodwill as at December 31 of each year, more often if events or changes in circumstances indicate that it might be impaired. Based on the impairment tests performed as at December 31, 2010 and 2009, we have concluded that no goodwill impairment provision was required.

In addition, we review our long-lived assets, which include intangible assets, and property, plant and equipment, for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. To determine whether impairment exists, we compare the estimated undiscounted future cash flows that are projected to be generated by those assets to their respective carrying value. If the undiscounted future cash flows are lower than the carrying value, then the assets are written down to fair market value and an impairment loss is recognized. Estimated undiscounted cash flows reflect management’s estimates, and changes in those estimates could affect the carrying amount of the long-lived assets. During the years ended December 31, 2010 and 2009, we have concluded that there were no circumstances which required us to test for impairment of our long-lived assets.

During the year ended December 31, 2010, we recorded an acceleration of depreciation expense of $2.3 million for property, plant and equipment that were no longer in use. During the year ended December 31, 2009, we recorded an acceleration of amortization expense of $2.5 million for patents that were no longer in use.

WARRANTY PROVISION

A provision for warranty costs is recorded on product sales at the time of shipment. In establishing the accrued warranty liabilities, we estimate the likelihood that products sold will experience warranty claims and the cost to resolve claims received. In making such determinations, we use estimates based on the nature of the contract and past and projected experience with the products. Should these estimates prove to be incorrect, we may incur costs different from those provided for in our warranty provisions. During the years ended December 31, 2010 and 2009 we recorded provisions to accrued warranty liabilities of $2.4 million and $3.7 million, respectively, for new product sales.

Page 23 of 36

We review our warranty assumptions and make adjustments to accrued warranty liabilities quarterly based on the latest information available and to reflect the expiry of contractual obligations. Adjustments to accrued warranty liabilities are recorded in cost of product and service revenues. As a result of these reviews and the resulting adjustments, our warranty provision and cost of revenues for the years ended December 31, 2010 and 2009 were adjusted downwards by a net amount of $1.6 million and $0.5 million, respectively. The adjustments to reduce accrued warranty liabilities were primarily due to contractual expirations and improved lifetimes of our fuel cell products.

INVENTORY PROVISION

In determining the lower of cost and net realizable value of our inventory and establishing the appropriate provision for inventory obsolescence, we estimate the likelihood that inventory carrying values will be affected by changes in market pricing or demand for our products and by changes in technology or design which could make inventory on hand obsolete or recoverable at less than cost. We perform regular reviews to assess the impact of changes in technology and design, sales trends and other changes on the carrying value of inventory. Where we determine that such changes have occurred and will have a negative impact on the value of inventory on hand, appropriate provisions are made. If there is a subsequent increase in the value of inventory on hand, reversals of previous write-downs to net realizable value are made. Unforeseen changes in these factors could result in additional inventory provisions, or reversals of previous provisions, being required. During the years ended December 31, 2010 and 2009, inventory provisions of $0.5 million and $0.9 million, respectively, were recorded as a charge to cost of product and service revenues.

INVESTMENTS

We have made strategic investments in other companies or partnerships that are developing technology with potential fuel cell applications. Each of these investments is either accounted for by the equity method or carried at cost, depending on whether or not we have the ability to exercise significant influence over the company or partnership. We regularly review such investments and should circumstances indicate that an impairment of value has occurred that is other than temporary, we would record this impairment in the earnings of the current period. Given that these entities are in the development stage, there is significant judgment required in determining whether impairment has occurred in the value of these investments. During the year ended December 31, 2010, no write-downs of our investments were recorded. During the year ended December 31, 2009, we recorded a gain of $10.8 million representing the reversal of historic equity losses (including $2.4 million of equity losses recorded in 2009 prior to the wind-up) in excess of our net investment in EBARA BALLARD as a result of the announcement of our intentions to discontinue operations in EBARA BALLARD.

Page 24 of 36

INCOME TAXES

We use the liability method of accounting for income taxes. Under this method, future income tax assets and liabilities arise from temporary differences between the tax bases of assets and liabilities and their carrying amounts reported in the financial statements. Future income tax assets also reflect the benefit of unutilized tax losses than can be carried forward to reduce income taxes in future years. Such method requires the exercise of significant judgment in determining whether or not our future tax assets are “more likely than not” to be recovered from future taxable income and therefore, can be recognized in the consolidated financial statements. Also estimates are required to determine the expected timing upon which tax assets will be realized and upon which tax liabilities will be settled, and the enacted or substantially enacted tax rates that will apply at such time.

NEW ACCOUNTING PRONOUNCEMENTS AND DEVELOPMENTS

Convergence with International Financial Reporting Standards

In February 2008, Canada’s Accounting Standards Board (“AcSB”) confirmed that Canadian GAAP, as used by public companies, will be converged with International Financial Reporting Standards (“IFRS”) effective January 1, 2011. The transition from Canadian GAAP to IFRS will be applicable for the Company for the first quarter of 2011 when we will prepare both the current and comparative financial information using IFRS. We must also present an opening IFRS statement of financial position as at January 1, 2010, our date of transition to IFRS (“Transition Date”) which will form part of our interim financial report for the quarter ended March 31, 2011.

The Company’s consolidated financial statements for the year ended December 31, 2011 will be our first annual financial statements that comply with IFRS. As 2011 will be our first year of reporting under IFRS, IFRS 1 First-time Adoption of IFRS will be applicable.