U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.20549

FORM 10

General Form for Registration of Securities of Small

Business issuers Under Section 12(b) or 12(g) of the

Securities Exchange Act of 1934

Vaccinogen, Inc.

(Name of Small Business Issuer in its Charter)

| Maryland | |

| (State or Other Jurisdiction | (I.R.S. Employer |

| of Incorporation or organization) | Identification No.) |

5300 Westview Drive, Suite 406

Frederick, MD 21703

(Address of Principal Executive Offices) (Zip Code)

(301) 668-8400

(Issuer's Telephone Number)

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Act:

Common Stock, $.0001 Par Value

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filter | ¨ | Accelerated filter ¨ | |

| Non-accelerated filter | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company x |

Item 1. Business.

Overview

Vaccinogen, Inc. (referred to as “Vaccinogen”, “the Company”, “we”, “us”, or “our”), a Maryland corporation, is a biotechnology company focused on the development and commercialization cancer vaccines and immunotherapeutic products for cancers and infectious diseases. Our primary product is OncoVAX®, a cancer vaccine for the post-surgical treatment of Stage II colon cancer. We believe that OncoVAX is the first immunotherapy for Stage II colon cancer.

We currently employ 10 persons. Our executive offices are located at 5300 Westview Drive, Suite 406, Frederick, MD 21703. Our telephone number is (301) 668-8400 and our Internet address is www.vaccinogen.com.

Company History

We are a Maryland corporation that was originally formed as a Delaware corporation on May 2, 2007. On November 23, 2010, the Company changed its domicile from Delaware to Maryland.

Agreements with Intracel Holdings Corporation

License Agreement

On October 10, 2007, we entered into a License Agreement with Intracel (the “License Agreement”), for exclusive rights to use the OncoVAX® technology platform. OncoVAX® is an active specific immunotherapy (“ASI”) that uses the patient’s own cancer cells to block the return of colon cancer following surgery. In consideration of the license, we (i) agreed to issue equity equal to 10% of the fully diluted capitalization of the Company (ii) assumed liabilities of Intracel to OrganonTeknika Corporation (“Organon”) under an October 30, 2007 Letter Agreement between Intacel and Organon; (iii) $450,000 on cash for settling trade payable related to the OncoVAX intellectual property and (iv) royalty payments based on future sales of OncoVAX. The License Agreement provided Intracel with antidilution rights with respect to its 10% equity issuance. The licensing arrangement also contained a provision such that if we obtained certain levels of financing in a specified time period, all rights to OncoVAX® would transfer to us.

| 2 |

Asset Transfer Agreement and Stock Exchange Agreement

On June 24, 2010, we entered into an Asset Transfer Agreement with Intracel pursuant to which we acquired all of the intellectual property associated with OncoVAX®. Upon execution of the transfer agreement, all significant terms of the license agreement were terminated except the provision for royalties on future sales. In consideration of the asset transfer, we agreed to assume all of Intracel’s obligations to Organon and agreed to enter into a stock exchange agreement with Intracel. Under the terms of the June 24, 2010 Stock Exchange Agreement, we issued 3,471,766 shares of its Series B Preferred Stock in exchange for the assets transferred under the Asset Transfer Agreement and all of our common stock and Series AA Preferred Stock held by Intracel. The Series B Preferred Stock issued to Intracel (and its designees) constituted 20% of the issued and outstanding stock of the Company on a fully-diluted basis. Intracel (and the other investors under the Stock Exchange Agreement) were granted anti-dilution rights with respect to its series B preferred stock. In addition, we agreed that Series B Preferred holders’ ownership position (and corresponding anti-dilution rights) would increase to 50% upon failure of us to meet certain defined milestones, which included but were not limited to, us attaining certain levels of financing. We did not meet these criteria and consequently, during December 2010, was required to increase the Series B Preferred holder’ total ownership interest to 50% through the issuance of additional Series B Preferred Stock to Intracel and related parties to Intracel. Currently, Intracel’s ownership percentage is approximately 40% and the remaining 10% resides with related parties to Intracel.

Acquisition of Manufacturing Assets

On October 23, 2007, Vaccinogen acquired out of bankruptcy court in the Netherlands, certain other manufacturing assets that had been previously owned and operated by Intracel’s wholly owned Netherlands based subsidiary. In connection with this asset acquisition, the Company formed its wholly owned subsidiary, Vaccinogen BV, for the purposes of continuing development of OncoVAX®.

Operating Strategy

We will maintain a cGMP facility and outsource clinical activities to contract research organizations (“CRO) in an effort to achieve the following:

| 1. | Complete the pivotal Phase IIIb clinical trial of this autologous vaccine, OncoVax®, which is a new paradigm to prevent the recurrence of stage II colon cancer. The planned trial will closely replicate a successful prior Phase IIIa . |

| 2. | Develop near term revenues by establishing licensing arrangements for distribution of OncoVax® in certain territories as well as for additional carcinoma indications. |

| 3. | Develop diagnostic and therapeutic drug products as well as near-term revenues by exploiting its distinctive Human Monoclonal Antibodies (“HuMabs”) technology. |

| 3 |

Vaccines in Immunotherapy of Cancer

In 2007 a major review of active immunotherapy’s, so called "Cancer Vaccines", (as distinguished from passive immunotherapy with immune stimulators or monoclonal antibodies) and the various scientific and business factors that have contributed to the disappointing results in this field was presented by Finke et al1. Over the past decade many Phase III clinical trials with cancer vaccines have failed to achieve significant clinical results2. It is interesting that one of the first general considerations of the review was "Select the most informative targets". They point out that ideally the target should be tumor-specific and that "it is important to use the intended study population to assess the proportion of tumors that express the target of choice and the proportion of cells within each tumor that express it." We believe this indicates that the review focused on antigen discovery and was emphasizing the use of common antigens and presumably based on the assumption of inter-and intra-tumor homogeneity.

Since 2007, cancer genome DNA sequencing data for several carcinomas have provided what we believe is indisputable evidence of extreme genetic diversity or heterogeneity both within tumors or among tumors. Thus, the concept of tumor homogeneity was in our opinion a mistaken assumption and as such we believe this probably was the weakest underlying biologic premise of the past active specific immunotherapy efforts of the past two decades. Cancer is a genetic disease; the genetic sequencing data of tumor cells over the last few years, based on second-generation DNA sequencing technology, clearly reveals that there has been an underestimation of the degree of tumor heterogeneity and the consequences of this in the antigen discovery process of cancer vaccine development. In erroneously treating cancer as a homogeneous disease, the industry has failed in attempts to adequately train the immune system to recognize the abundant foreign or “non-self” components of an individual tumor and defend the body against it. It is understood that you cannot treat a heterogeneous disease with a homogeneous treatment. It is well recognized that the surgical resection is the only treatment for reducing bulky tumors. In addition, by using the patients’ primary tumor resected at surgery as the source of the antigens, embraces the heterogeneity of cancer cells. It does this by using a cancer vaccine as a preventative measure against metastasis. Thus, cancer vaccines hold tremendous promise.

To further expand on this topic of heterogeneity, Wood et al3asked the question "how many genes are mutated in a human tumor." They analyzed this question in breast and colorectal cancer; they reported that there are ~80 DNA mutations that alter amino acids in a typical cancer. These altered proteins are all candidates for unique markers or tumor-specific antigens. The study included an analysis of the sequences of 20,857 transcripts from 18,191 human genes including the great majority that encode for proteins. Examining the overall distribution of these mutations in different cancers of the same type leads to a new view of cancer genome landscapes. Although the numbers of mutant genes in breast and colorectal cancers were similar, the particular genes that were mutated were quite different, as were the type of mutations found. The surprising discovery that has an enormous impact on cancer vaccines or active specific immunotherapy, is that of the ~80 mutations in an individual tumor only ~3 of these ~80 mutations were common and thus would be shared antigens in two different tumors. Consequently, with polyvalent cancer vaccines, a robust and therapeutic immune response cannot be provided by allogeneic cells or even a relatively minor component of "off the shelf" common antigens. We believe these results demonstrate that the antigen discovery aspect of cancer vaccines takes on a whole new level of complexity and is fraught with new hurdles. Autologous tumor cell vaccines become a much more technologically and immunologically sound approach to cancer vaccines, in our opinion. This, for active immunotherapy cancer treatment advocates, is not all bad. The findings confirm our belief that the genetic lesions that are unique to the original tumor cells, "the trunk of the evolutionary tree" are consistently expressed.

1Finke LH, Wentworth K, Blumenstein B, Rudolph NS, Levitsky H, HoosA.Lessons from randomized phase III studies with active cancer immununotherapies—outcomes from the 2006 meeting of the Cancer Vaccine Consortium (CVC). Vaccine 2007;25 (Suppl 2):B97-109; PMID:17916465

2Kudrin A and Hanna MG Jr. (Guest Editors) Special Focus Cancer Commentaries Series, Human Vaccines &Immunotherapeutics, Vol 8 Issue 8, August 2012.

3Wood LD, Parsons DW, Jones S, Lin J, Sjoblom T, Leary RJ, et al. The genomic landscapes of human breast and colorectal and colorectal cancers. Science 2007; 318:1108-13; PMID:17932254

| 4 |

Mainstream pharma continues to advocate for more targeted therapies for smaller patient populations. The hundreds and thousands of cancer mutations identified over the past few years probably makes this approach impractical. There is one evolutionary approach that already exists to address the magnitude of cancer diversity. The immune system is designed by nature to protect against diversity of disease. The immune system constantly protects humans from an array of deadly foreign pathogens, viruses and proteins. With the exception of safe drinking water, no other modality, not even antibiotics, has, in our opinion, had such a major effect on mortality reduction and population survival and growth.

OncoVAX Overview

We believe that OncoVAX is the first colon cancer vaccine to demonstrate effectiveness in both preventing cancer recurrence after surgical resection of the primary tumor and addressing the diversity of cancer cells. Currently in a pivotal Phase III trial under the auspices of an FDA granted Special Protocol Assessment (SPA) and a Fast Track designation, OncoVAX uses the patients live, metabolically active, sterile and nontumorigenic tumor cells to mobilize the body's immune system to prevent the recurrence of colon cancer following surgery. Embracing the now widely recognized heterogeneity of cancer, OncoVAX uses a patient's own tumor to stimulate a broad and effective immune response against the diversity and uniqueness of that patient's cancer cells. The OncoVAX technology platform is being tested in Stage II colon cancer after standard of care surgical resection. The global incidence of Stage I-IV colon cancer is 900,000 patients per year of which 269,000 are Stage II. The prevalence of Stage II, an unmet medical need, has grown with the emergence of more rigorous screening practices and endoscopic examinations. Stage II colon cancer is forecasted to be about 46% of the US and EU colon cancer at diagnosis by 2020.

| 5 |

OncoVAX Clinical Trials in Colon Cancer Patients

Since 1980 investigations by Hanna and colleagues4, 5, 6, 7have translated the principles and procedures of active specific immunotherapy as observed in the L10, inbred and syngeneic guinea pigs into phase I, II, and III adjuvant therapy clinical trials in patients with colon cancer. These clinical trials were designed based on the evidence in the animal models that the immune system can be educated to control a limited systemic tumor burden remaining after surgical excision of solid tumors. In the translation of the animal model studies to the clinic, the antigen discovery selection of the human vaccine was an important decision. In 1977 Fidler and Kripke published in Science8 the discovery of phenotypic heterogeniety in transplanted tumors. Clones derived in vitro from a parent culture of muring malignant melanoma cells varied greatly in their ability to produce metastatic colonies in the lungs upon intravenous inoculation into syngeneic mice. This suggested that the parent tumor is heterogeneous and that highly metastatic tumor cell variants pre-exist in the parental population. Having been present at the NCI laboratories while this work was bering performed and published, Dr. M. G. Hanna Jr. recognized that if intratumoral phenotypic heterogeniety for metastasis exists it would be probable that intertumoral and intratumoral antigenic heterogeneity might also exist. Therefore, it was theorized that the use of autologous tumor cell vaccines from the primary tumor would obviate the antigenic diversity in any immunotherapeutic approach involving tumor cell vaccines. Over 30 years later, we believe this strategy has been validated. Vaccinogen's technology tailors a specific vaccine for each patient from their own tumor, remaining agnostic as to which antigens will prove to be the most functional in individual cases.

Clinical testing of OncoVAX as an adjuvant to surgical resection began in 1980 with a single center pilot study of 5 subjects with colon cancer. To date 757 subjects with colorectal cancer, of which 720 had colon cancer, have been enrolled in trials of OncoVAX (see Table 1 for summary). In addition, a bioequivalency study (2002-01) enrolled 15 patients with colon cancer. This study was conducted to compare the immunogenicity, as determined by the magnitude of delayed type hypersensitivity (DTH) responses to tumor cells alone, of vaccines manufactured by the current, sterile process with historical data from the phase III clinical study (8701). We believe that the results from this study unequivocally support the premise that the immunogenicity of vaccines produced by either process are comparable.

4Hanna MG Jr, Peters LC.Immunotherapy of established micrometastases with Bacillus Calmette-Guerin tumor cell vaccine.Cancer Res 38:204, 1978.

5Hanna MG Jr, Peters LC. BCG immunotherapy: Efficacy of BCTG-induced tumor immunity in guinea pigs with regional tumor and/or visceral micrometastases. In Immunotherapy of Human Cancer. Raven Press, 1978, pp 11-129.

6Hanna MG Jr, Active specific immunotherapy of residual micrometastases: A comparison of postoperative treatment with BCG-tumor cell vaccine to preoperative intratumoral BCG injection. In Immunobiology and Immunotherapy of Cancer. WD Terry, Y Yamamura, eds, Elsevier/North Holland, 1979, pp 331-350

7Hanna MG Jr, Brandhorst JS, Peters LC. Active specific immunotherapy of residual micrometastasis: An evaluation of sources, doses and ratios of BCG with tumor cells. Cancer ImmunolImmunother 7:165, 1979

8Fidler IJ, Kripke ML. Metastasis results from pre-existing variant cells within a malignant tumor. Science 197:4306 893-895, August 1977.

| 6 |

In these trials, excluding the bioequivalency study, 385 subjects were randomized to receive OncoVAX, of which 353 received at least one vaccination; 372 subjects were treated with surgery alone. In addition, subjects with colorectal cancer were enrolled in three separate trials that assessed the effects of ASI with OncoVAX in combination with chemotherapy as adjuvant therapy to surgical resection. Lastly, two trials have been performed using autologous tumor cells/BCG in melanoma (n=86) and renal cell carcinoma (n=14).

| Table 1 | OncoVAX Clinical Trials for Colon Cancer |

|

Protocol Number |

Trial Phase |

Number of Patients |

Number of Vaccine Doses |

Disease and Stage |

Manufacturing* |

| 8101 | I | 5 Treated | 3 | Colon Cancer Stage III/IV | Centralized, Non Validated, Non cGMP |

| 8102 | II/III |

47 Control 50 Treated |

3 | Colorectal Cancer Stage I-IV | Centralized, Non Validated, Non cGMP |

| 5283 | III |

207 Control 205 Treated |

3 | Colon Cancer Stage II/III | Decentralized, Non Validated, Non cGMP |

| 8701 | III |

128 Control 126 Treated |

4 | Colon Cancer Stage I-III | Centralized, Validated, cGMP |

| ASI-2002-01 | I/II | 15 Treated | 4 | Colon Cancer Stage II/III | Centralized, Validated, cGMP |

*Centralized = Manufacture at a single, centralized location; Decentralized = manufacture at each investigational site.

Study 8102 used a three-vaccine regimen as did 5283. In Study 8102, manufacture was conducted at the institution of the principal investigator, Dr. Herbert Hoover9, although this institution changed twice during the study, while in 5283, manufacture was decentralized. Each clinical site manufactured the vaccine, without Quality Assurance or adequate Quality control. While both of these studies provided encouraging clinical results, with respect to tumor immunity as measured by delayed-type hypersensitivity (DTH) and induction of T-cell immunity, neither of these studies demonstrated statistically significant clinical benefit in an Intent to Treat analysis of recurrence free survival or overall survival. In the ECOG study 528310, an analysis by the ECOG statisticians of the correlation of clinical benefit to the quality of the vaccine showed a significant correlation. Further, in study 8102, a subset of subjects underwent DTH testing that revealed a deterioration of the immune response to the standard vaccine at 6 months. It was concluded that a fourth booster immunization at 6 months after surgical resection would enhance the waning immune response to autologous tumor cells. Hence a four vaccine regimen was tested and manufacturing was centralized at the Free University of Amsterdam11. In this study (8701), subjects with Stage II disease demonstrated what we believe were both clinically meaningful and statistically significant outcomes in both recurrence-free interval (p=0.008) and recurrence-free survival (p=0.015). The 5-year event-free rates also demonstrated a clinically and statistically meaningful outcome in overall survival.

9Hoover HC Jr, Brandhorst J, Peters C, Surdyke MG, et al. Adjuvant active specific immunotherapy for human colorectal cancer – 6.5-year median follow-up of a phase III prospectively randomized trial. J Clin Oncology, 11:3 390-399, 1993

10Vermorken JB, Claessen AME, van Tinteren H, Gall HE, et al. Active specific immunotherapy for stage II and III human colon cancer. A randomized Trial. The Lancet 353 345-350, January 1999

11Harris JE, Ryan L, Hoover HC Jr, Stuart RK, Oken MN, Benson AB, et al. Adjuvant active specific immunotherapy of stage II and III colon cancer with an autologous tumor cell vaccine: ECOG study E5283. Journal of Clinical Oncology Vol 18 148-157, January 2000

| 7 |

Phase IIIa Trial 8701

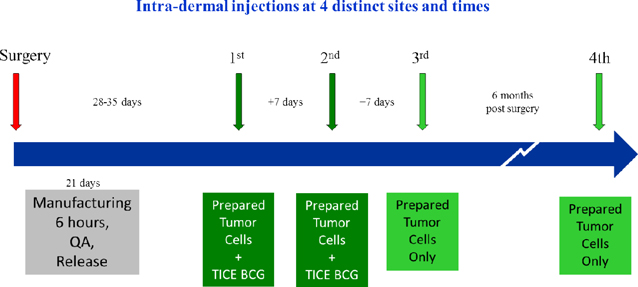

The 8701 Phase IIIa trial was conducted in 254 patients with Stage II or III colon cancer. In this study a planned, prospective stratification by tumor stage, was conducted in order to legitimately analyze the clinical benefit in each stage of tumor. Thus, this was not a retrospective subgroup analysis. Patients were randomized 1:1 to receive surgery and then observation or immunotherapy according to the protocol that Vaccinogen plans to use in the upcoming confirmatory Phase IIIb trial that will be a key use of proceeds from this offering. The treatment schedule is depicted in the figure below. After approximately one month to recover from surgery and regain their full immune function, patients receive isolated irradiated tumor cells in combination with BCG in two injections a week apart. A week later, a third injection of irradiated tumor cells alone was given. A fourth injection was given as a booster six months after the surgery. This was the first clinical trial where the manufacturing process was optimized in a central processing facility to provide for the three induction vaccinations and the boost at 6 months. This turned out to be the optimum regimen for OncoVAX

| 8 |

VACCINATION PROTOCOL FOR ONCOVAX IN 8701 AND PLANNED PHASE IIIb TRIAL

In Study 8701, all patients underwent surgery, and their resected tumors were sent to Vaccinogen’s central processing laboratory. Eight vials of isolated, irradiated tumor cells were sent back to the patient’s clinic along with two vials of BCG.

Recurrence-free survival is the most appropriate endpoint for studies of Stage II colon cancer since patients with recurrent disease will receive treatment with other modalities and their overall survival (OS) will consequently depend in part on the efficacy of other therapies. The outcome of the pre-specified analysis of the stratified Stage II patients from trial 8701 has been particularly informative in planning the upcoming confirmatory Phase IIIb trial in Stage II disease.

| 9 |

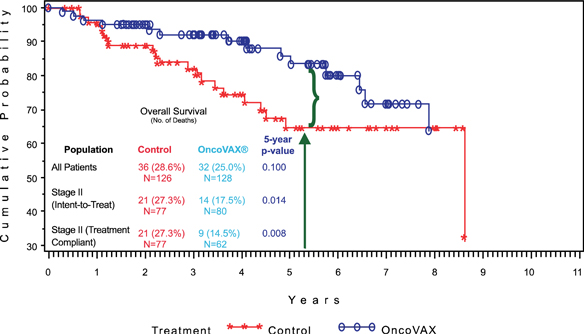

OVERALL SURVIVAL IN STUDY 8701

OncoVAX® - Clinical Results

8701 Study - Overall Survival in Stage II Patients

Trends towards efficacy in OS and RFS were not statistically significant in the full intent-to-treat population. A prespecified stratification of the trial to analyze by tumor stage demonstrated that Stage II patients separately reached statistical significance with a p value of 0.015 on a log rank, and 0.008 on a five year event free analysis.

| 10 |

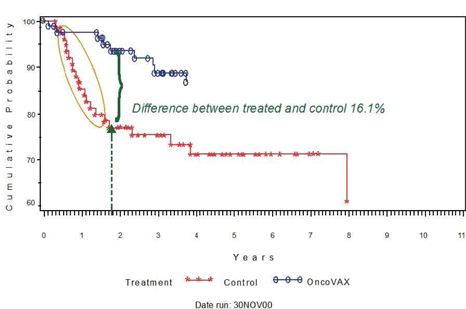

RECURRENCE-FREE SURVIVAL IN STUDY 8701

OncoVAX® - Clinical Results

8701 Study - Recurrence-Free Survival in Stage II Patients

This published, randomized Phase IIIa clinical trial was stratified by tumor stage so that a legitimate analysis by tumor stage could be calculated. These results are for Stage II colon cancer. Some benefit was seen in Stage III colon cancer however the results were not statistically significant. This study was accepted by the FDA as supportive data for the next Phase IIIb clinical trial to be conducted under an FDA granted SPA with fast tract designation. The disease-free survival clinical endpoint will be used for the interim analysis, which is an accepted basis for FDA approval.

The results were published in the British Medical Journal, The Lancet January 30, 1999; 353: 345-350.

| 11 |

RECURRENCE-FREE INTERVAL IN STUDY 8701

OncoVAX® - Clinical Results

8701 Study - Recurrence-Free Interval (RFI) in Stage II Patients

Greatest difference between treated and control in RFI at 18 months post Vx

Patients with Stage II disease who received all four inoculations had superior clinical outcomes to those who received fewer than four inoculations. Relative risk of death or recurrence (recurrence-free survival) for all patients receiving four inoculations was 0.61 (p = 0.034) and relative risk of death or recurrence for patients with Stage II disease receiving four inoculations was 0.40 (p = 0.007). Relative risk of death from any cause in Stage II patients receiving four inoculations was 0.46 (p = 0.046). See the Kaplan-Meier curves in the figure above. Recurrence free survival is the agreed endpoint for Vaccinogen’s Phase IIIb trial.In summary in the surgery only group one can estimate that approximately one out of three patients will reccur with cancer, in the OncoVax treated group one can estimate that one out of ten patients will reccur with cancer.

To emphasize the robustness of the clinical benefit of OncoVAX in these colon cancer patients a recent review of the patient follow-up was conducted by Vermorken and colleagues12. The remarkable result was that the observed delta and significant benefit in recurrence-free survival measured at 5 years was reevaluated at 15 years. The results showed that OncoVAX treated patients versus control at 15 year follow-up was HR=0.62 (95%, CI:34-0.96) log rank p-value 0.03). This type of robust benefit is what is requisite in effective therapies.

12Weger de VA, Turksma AW, Voorham, QJM, Euler Z, et al. Clinical effects of adjuvant active specific immunotherapy differ between patients with microsatellite stable and microsatellite instable colon cancer. Clin Cancer Res Feb 1, 2012, 18;882

| 12 |

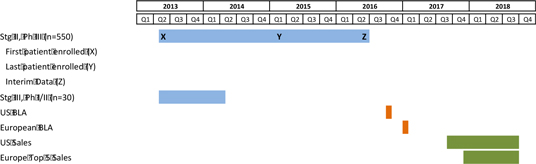

Planned Trials - Stage II Colon Cancer, Phase IIIb Trial

The FDA has requested a second, confirmatory, randomized controlled Phase III trial of OncoVAX in Stage II colon cancer. The principal objective of Vaccinogen is to organize a "best of breed" team to conduct a confirmatory Phase IIIb trial in Stage II colon cancer. The protocol of this trial, including endpoints and the statistical analysis plan is the subject of an SPA agreement granted by the FDA.

This study will be carried out under a Special Protocol Assessment (SPA) that was negotiated with the FDA in 2010. An SPA granted by the FDA provides a mechanism for the sponsors and the FDA to reach agreement on size, execution and analysis of a clinical trial that is intended to form the primary basis for regulatory approval. The primary endpoint of this pivotal Phase IIIb trial is recurrence-free survival (RFS) with an interim analysis after 70 “events,” and a final primary analysis three years following completed enrollment. “Events” are incidents of either recurrent disease or death. The study is powered at 90% to detect a 50% improvement in RFS versus resection only for final analysis with an adjustment for interim analysis. The power calculations in the study assume an event rate and distribution that match those observed in the 8701 Phase IIIa study. If a robust p value is achieved at the interim analysis, the Biologics License Application (BLA) can be filed with the FDA’s center for Biologics Evaluation and Research (CBER) at that point. Past clinical trials using the optimal regimen with four immunizations will be accepted as supportive studies during the FDA review of the BLA.

The Phase IIIb study will enroll 550 patients, randomized 1:1 to receive surgery alone, or surgery plus OncoVAX. Patients will be followed on a regular schedule to see whether and when their cancer might reappear. The experience with OncoVAX in the 8701 study showed that in the relevant Stage II group, disease recurrence happened more quickly and more frequently in those patients who received surgery alone. If the Phase IIIb trial replicates the experience of the 8701 patients, the interim analysis after 2/3 of the expected events should give a clear and statistically significant separation between the Kaplan-Meier curves at that point, and would form the basis for a BLA seeking marketing approval from the FDA. We expect to begin our Phase IIIb trials in the fourth quarter of 2013.

It is important to emphasize that the FDA has agreed that RFS is the most appropriate endpoint to evaluate a trial in Stage II colon cancer. The alternative in cancer studies is often OS. An OS endpoint has several drawbacks in this case. The average age of patients presenting with colon cancer is 65 years, so deaths from causes other than the tumor will dilute the outcome in both arms. Patients in either arm whose disease recurs will receive chemotherapy and other treatments for their metastatic disease, and the success of these treatments will dilute the impact of earlier therapies such as OncoVAX on OS. From a patient perspective, being disease free is clearly a meaningful endpoint.

| 13 |

Planned Trial - Phase I/II Trial in Stage III Colon Cancer

When patients present for colon cancer surgery, it is not clear in advance whether they have Stage II or Stage III disease. Vaccinogen’s planned Phase IIIb trial will enroll only patients with Stage II tumors, but the clinical sites will perform surgery and capture tumors on many Stage III patients. Stage III tumors may hypothetically be more difficult to treat since micrometastases may be more common, more aggressive, or larger. Any vaccination protocol also needs to accommodate the schedule of adjuvant chemotherapy that is given to Stage III colon cancer patients in the period after their surgery. There is a risk that the immunosuppression that accompanies chemotherapy could interfere with the effect of the fourth, booster vaccination. Nonetheless, there is a considerable unmet need in Stage III colon cancer as well as a significant market opportunity.

The expense of conducting a parallel registration program in Stage III disease is likely beyond our current means, but with relatively modest additional funds, we could conduct a small pilot program in parallel to the pivotal Stage II trial to demonstrate the ability to generate vaccine from Stage III patients and to accommodate their adjuvant chemotherapy schedule. This pilot trial will have DTH and safety endpoints to show whether chemotherapy interferes with the expected immunogenicity of the vaccine. This trial should enroll 30 patients and is planned to start one month after the Stage II, Phase IIIb pivotal trial. DTH data will become available for each patient when they receive their third immunization, which is contemplated to be before their chemotherapy begins. Full data from this trial could be available as early as 1Q 2014. A successful outcome of this study could pave the way for a future program in Stage III disease.

| 14 |

Additional Applications of Technology

Our technology may also have application in other tumor types, notably melanoma and renal cell carcinoma (RCC). Clinical development in both these tumor types is more challenging than in Stage II colon cancer because there are approved chemotherapies and numerous investigational agents crowding the landscape in each.

Human Monoclonal Antibodies (“HuMabs”) Program

Monoclonal antibody (Mab) technologies evolved rapidly over the last 20 years. Antibody based therapeutics now make up a significant and growing portion of total pharmaceutical sales. Data Monitor’s Monoclonal Antibody: Update 2009 reports global sales of monoclonal antibodies (Mabs) reached $32.2 billion in 2008 and forecast an increase to nearly $60 billion by 2014. KirhamMaggon of the Knol-Beta Publishing Group reports that global Mab sales reached $48 billion in 2010 and that the top five selling Mab (Remicade, Avastin, Rituxan, Humira and Herceptin) each had sales gains of $1 billion over 2009 levels. An additional $10 billion in sales of Mabs for diagnostics and as reagents for R&D results in a total market approaching $60 billion.

We believe that the ascendancy of Mab in the industry is based on the fundamental role that antibodies play in our natural defense system. Mabs seek out, recognize and bind to a particular site on cells, viruses and other organisms in a highly specific manner. We believe this makes them an effectively targeted approach to fight or detect many diseases. Mabs are a part of the body's own natural disease fighting system. Consequently, they have lower side effects compared to small molecule based treatments. In addition, antibody products generally have a shorter development time and in our opinion attractive IP benefits compared with small molecules. We expect interest in Mab technology will continue to grow particularly in the oncology field as the cancer genome is being revealed. Last year alone over 400 random mutational events were discovered yielding 400 new markers. This number is expected to rise into the thousands (MR Stratton, Science, 331 pp 1553-1558). Most major pharmaceutical companies now have Mab projects in their R&D plans. Hence, M&A and Mab deals in R&D and marketing have increased again last year. We believe that we are well positioned to exploit these developments by building novel fully human monoclonal antibody libraries. We intend to implement a strategy to leverage our planned phase III trial to participate in this burgeoning market.

We believe that our previous Phase III OncoVAX trials, demonstrated that the immunized patients, while mounting a robust and tumoricidal cytotoxic T-cell response, also produced circulating B-cells, which have the potential to differentiate and produce tumor specific, fully human monoclonal antibodies (HuMabs). B-cells are a specialized type of blood cell that retains a memory of the interaction, an immunological history of the protective response. We plan to collect this rare set of B-cells generated from the treated portion of the enrolled patient population. We plan to use the new B-cells and perpetuate them into libraries that can be screened by potential partners to create new therapeutics, vaccines, diagnostics, imaging agents and as research tools.

| 15 |

We believe this novel asset, the B-cell collection, and potentially materials developed during the 8701 trial and predecessor company efforts, represent a valuable asset that can generate significant upfront fees, development milestones and royalties via collaborations and licensing activities that will complement the OncoVAX investment opportunity.

History

The team of scientists led by Michael G. Hanna, Jr., Ph.D., Vaccinogen’s Founder, Chairman and Chief Executive Officer discovered that the autologous colon tumor immunized patients, while mounting a robust and tumoricidal cytotoxic T-cell response, also during a restricted period of time produced circulating B-cells which were capable of being perpetuated into tumor specific, human monoclonal antibody producing cells (HuMabs). A research program was created that over the course of several years assembled a large and most unique array of fully human monoclonal antibodies. These HuMabs were products of the antibody forming B-cells in circulation in the colon tumor immunized patients. HuMabs may be effective in both, diagnosis and treatment of disease, and overcome many of the limitations of cytotoxic drugs. Biopharmaceutical companies that exploit monoclonal antibodies as the source for developing new commercial products have made great strides in new product efficacy and generally experience shorter development cycles. The powerful combination of those two factors has made monoclonal antibodies a most attractive source for the development activities in the biopharmaceutical marketplace.

Competitive Advantage

During the course of the first OncoVAX Phase III trial (8701), Dr. Hanna’s team recognized that the tumor cell destruction was mediated by cytotoxic, specifically immunized T-cells, and also for evidence of a humeral (antibody) mediated immune response. It was discovered that following the second OncoVAX dose involving the patients’ own tumor cells and BCG, the patients produced tumor specific antibody producing circulating B-cells.

We believe our competitive advantage is the unique access to and ownership of a valuable educated B-cell repertoire to be collected from immunized patients in the upcoming Phase III trial as well as the insight and experience from legacy efforts to build a HuMab based business unit. From this institutional knowledge, we should be able to leverage a plethora of new development and production strategies as well as technologies to efficiently and effectively exploit this opportunity. Selected contractors and collaborators will collect blood from patients over the first year of the trial and develop libraries from these unique HuMabs.

We believe that we have two other competitive advantages – these Mabs are fully human and have high avidity binding potential.

| 16 |

The most important point to understand is that no company in our opinion (other than us) can generate antibodies in a set of patients based on a clinical response to a sterile, colon cancer vaccine.

Fully Human Monoclonal Antibodies

The industry’s original Mab products were mouse or chimeric or humanized resulting in significant drug development challenges as they:

| • | Do not interact efficiently with the human immune system, |

| • | Have rapid clearance, potency issues, |

| • | Can cause allergic reactions, |

| • | Often trigger a human anti-mouse antibody (HAMA) response, and |

| • | Often require royalty payments to third party owners of the tools and methods to optimize the drug product. |

By contrast, Vaccinogen’sHuMabs are fully human (not humanized) and carcinoma tumor specific. Their properties allow them to be administered safely to humans in large quantities with potential application in chronic as well as acute disease settings. They are also expected to be of interest in the vaccine, imaging and diagnostics markets. Furthermore, they may have applications in indications beyond the cancer market.

Immune Libraries

We believe that our repertoire of educated B-cells from OncoVAX immunized patients will allow the creation of a unique library comprised solely of human “immune” responses from immunized patients. This means that the antibodies were created naturally in the human body (matured in-vivo). These antibodies are far more “potent” and vastly superior to those developed in-vitro (outside the body) in their ability to bind with and neutralized the target disease.

These two characteristics, “fully human” and “immune”, provide us with what we believe is valuable competitive advantage and an asset that can complement the OncoVAX investment opportunity.

We intend to launching a pivotal Phase III trial of autologous colon tumor vaccines. The 275 treated patients will yield immune B-cells from which multiple phage expression libraries can be produced. Our intended approach to exploit this market opportunity is to execute strategic partnerships with a select group of qualified pharma and genomics companies, allowing them access to its monoclonal library. Our partners will “mine” the libraries using antigens or target molecules they own, to identify potential antibodies for further development. Ultimately, we expect these antibodies will be developed and commercialized into products for use in the detection, treatment, and prevention of malignant diseases. This is very timely since based on the explosion of genomic research into cancer cells, discoveries of the random mutational events have in 2011 alone yielded 400 new markers and possibly 1,000 in 2012. The utility of safe and effective high avidity HuMab to these new markers would be a powerful application.

| 17 |

The business model may provide us with multiple potential funding events as our partners explore, discover, qualify, and ultimately commercialize a product using one of our antibodies. In general terms, the potential funding events for each single antibody targeted for a specific indication will follow a pattern similar to the following.

|

Development Stage |

Agreement Stage | Timing |

| Exploration | Technology Access | Lump-sum on signing, and annual renewal fees |

| Discovery | Technology Development | Lump-sum on identification of target antibody |

| Qualification | Developmental Collaboration | Payments at various stages throughout the FDA approval process |

| Commercialization | Royalty | Quarterly payments |

Technology access and collaboration agreements can generate $2 million to $5 million per antibody target and provide for enrollment of more than one target per Agreement, as well as royalties ranging from 5% to 15% of sales.

| 18 |

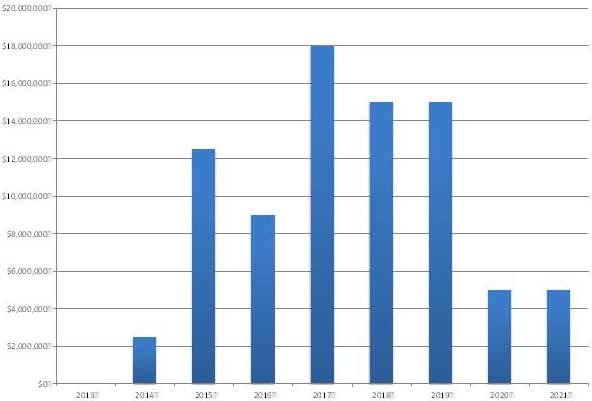

HuMabs FORECAST OF LICENSING REVENUE

The landscape of the biopharmaceutical industry is undergoing transformation. The patents for some of the most successful commercial pharmaceutical products are expiring. Pharmaceutical companies are discovering that the scientific breakthroughs in the area of human genetics can easily render a successful product obsolete at a very early stage in its product life cycle. Over 400 known cancer genes were discovered in 2011 and thousands of complete cancer genome sequences will be available by 2018. So, we expect that the drug makers are searching for ways to respond to the need for developing new products quickly, while reducing development costs and lowering their exposure to the risk of unplanned obsolescence.

We believe that the HuMab derived from phage libraries of our immune B-cells can be used to diagnose, treat or prevent tumor progression. The safety of the fully HuMab has been declared by the European Medicines Agency which stated that as a tumor imaging agent, the treatments could not be given sooner than once a month. One treatment program that Vaccinogen holds several patents on and has investigated with HuMab is pretargeting. This approach consisted of injecting maximum tolerable dose of HuMab conjugated to a proprietary linker. Once the tumor is saturated, inject a radioisotope, toxin or chemotherapeutic dose, which will bind to the tumor bound antibody linker and spare the normal tissue. We did several patients with a variety of late stage carcinomas and the approach showed promise in preventing progression of tumors.

| 19 |

The pharmaceutical industry appears to have settled on monoclonal antibodies as one answer to these challenges. Human monoclonal antibodies offer the industry a safer and less expensive path to a more expeditious product development cycle, shortening the time to market for each new drug and allowing the pharmaceuticals to strength their product portfolios. We believe that our fully human immune repertoire is unique and extensive therefore attractive to strategic partners.

Prostate vs. Colon Cancer Vaccines

The global incidence of Stage I-IV colon cancer is about 900,000 cases per year, which is larger than the 780,000 cases of prostate cancer supporting market forecasts for Dendreon, Bavarian Nordic and other, less advanced, competitors. With respect to the Stage II (and potentially Stage III) colon cancer market addressed by OncoVAX, Vaccinogen estimates the collective incidence is about 269,000 cases of Stage II and about 420,000 cases of Stage III colon cancers, a collective market that is only slightly smaller than the targeted patient populations for therapeutic prostate cancer vaccines.

There are important differences between hormone refractory prostate and Stage II colon cancers. All patients with hormone refractory prostate cancer are likely to die of their disease and have an urgent need for therapy. No current therapy, including the vaccines under development, cures these patients. Months of extended life represent the best outcome to date. The majority of patients with Stage II colon cancer are cured by surgery. Unfortunately the minority that is not surgically cured is significant (circa 30%) and the patients who relapse will likely die of their disease. Post-surgical Stage II colon cancer patients typically have a very low burden of tumor cells, giving the best opportunity for an immunologic cure as well as deferral of relapse. There is no way to tell in advance which Stage II patients are at most risk of relapse and so Vaccinogen’s market models assume that all Stage II patients are candidates for immunotherapy.

| 20 |

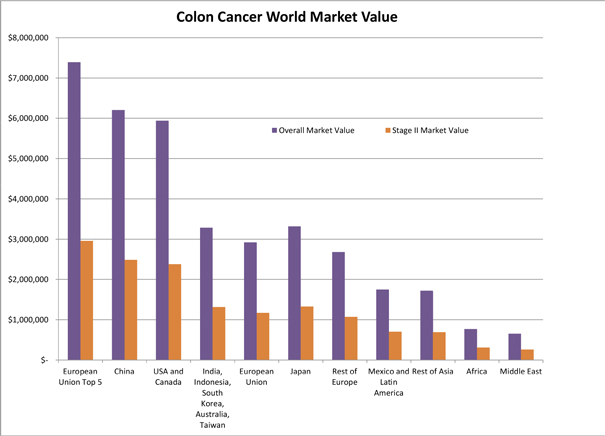

Colon Cancer Commercial Market Opportunity

COLON CANCER WORLD MARKET VALUE

$Amounts in Thousands

Colon cancer represents the third most common form of cancer in both the US and Europe. American Cancer Society statistics suggest there will be about 102,000 new cases of colon cancer diagnosed within the US. The European Cancer Observatory estimates that there were about 245,000 new cases of colon cancer across Europe.

Colon cancer is segmented at diagnosis into four disease stages. In Stage I, the cancer is confined to the mucosa and sub-mucosa of the colon. Stage II tumors have penetrated farther into the muscles around the colon, but the tumor has not visibly spread to lymph nodes of more distant sites. Stage III tumors have either advanced local spread or have spread to lymph nodes. Stage IV tumors have distant metastases at diagnosis.

| 21 |

Statistical information on the relative staging of colon cancer is collected and analyzed by a variety of government and industry groups. One of the most comprehensive cancer tumor registries for the US market is the Surveillance, Epidemiology and End Results Data (SEER) database. The Journal of the National Cancer Institute also publishes a variety of analytical studies largely relying on the SEER database for evaluation of cancer incidence, staging and survival.

Vaccinogen’s analysis of available colon cancer data suggests that the proportion of Stage I and IV patients has remained relatively constant over the past decade. However, there has been an on-going increase in the proportion of patients being diagnosed with earlier stage localized disease (Stage II), largely resulting from more consistent screening practices in the US and improving diagnostic technologies (fecal occult blood tests, sigmoidoscopy, colonoscopy, CEA screening). Available data suggests that Stage III is still a significant, but declining, percentage of reported colon cancers.

The table below highlights some the shifts in historical and anticipated incidence of Stage I-IV colon cancer in the US.

COLON CANCER INCIDENCE BY STAGE

| 1990s1 | 20042 | 2010E3 | 2020E3 | |||||||||||||

| Stage I | 15 | % | 8 | % | 10 | % | 10 | % | ||||||||

| Stage II | 36 | % | 39 | % | 40 | % | 46 | % | ||||||||

| Stage III | 28 | % | 39 | % | 37 | % | 31 | % | ||||||||

| Stage IV | 22 | % | 14 | % | 13 | % | 13 | % | ||||||||

| 1 Journal of the National Cancer Institute, Vol. 96, No. 19 | ||||||||||||||||

| 2 SEER Data | ||||||||||||||||

| 3 Company Estimates | ||||||||||||||||

Epidemiology to Market Characteristics

In Stage I colon cancer, the disease is treated completely through surgical intervention. There is an unmet medical need with respect to more effective Stage II colon cancer therapies, since recommended surgical intervention does not appear to fully eradicate micrometastases and leads to recurrence rates of approximately 30%. Chemotherapy is not recommended in Stage II colon cancer, with numerous studies suggesting no benefit. More serious Stage III colon cancer is treated with a combination of surgery and chemotherapy as a standard of care. Advanced Stage IV cases involve treatment with chemotherapeutics and/or surgical intervention.

| 22 |

Stage II Tumor Colon Cancer Market

While the Stage II colon cancer market is considerable, Vaccinogen’sOncoVAX production methodology requires a total of about 3 grams of tumor to provide enough material for the production of a full complement of vaccine for a course of therapy. Based on prior clinical trial experience, Vaccinogen estimates that about 30% of surgically resected Stage II tumors will not meet minimum size requirements for vaccine production. Vaccinogen’s colon cancer market models and forecasts reduce the targeted Stage II total market to reflect this minimum tumor size constraint. Vaccinogen further adjusted down targeted Stage II colon cancer figures by an additional 10% to account for potential logistical problems inherent with its centralized manufacturing requirements, damages, etc.

A review of available data on estimated annual colon cancer incidence is produced by the American Cancer Society, European Cancer organizations, SEER and the Journal of the National Cancer Institute. This statistical work and related assumptions provides the foundation for determining the scope and magnitude of colon cancer across major global regions, and was further segmented to evaluate distinct Stage II colon cancer market opportunities for OncoVAX.

United States Trend

The overall incidence of colorectal cancer has actually been declining modestly in the US, from a total of about 112,000 cases in 2007 to 102,000 cases in 2011. The reasons for this decline are not completely understood, but may include factors such as reduced smoking, higher aspirin use, changes in diet, etc. For purposes of forecasting, the Company has assumed a modest decline in the net number of new colon cancers over the next ten years. This reduction in overall colon cancer cases in the US is largely offset by a greater proportion of disease detected at Stage II.

More rigorous screening for colon cancer has led to improvement in earlier detection, giving a significant redistribution of the TNM (tumor, node, metastases) staging of the disease. Over the past decade, there has been a gradual shift toward earlier detection and therefore more localized disease as well as relative declines in advanced disease. Vaccinogen estimates that Stage IV disease has declined significantly over the past 20 years and now account for only about 13% of cases in the US. Stage III has also been gradually declining, with a corresponding increase in earlier disease increasing the proportion of patients with Stage II disease. Vaccinogen projects that the proportion of overall cancer assigned to Stage II should gradually increase to 46% of colon cancer patients in 2020 and beyond.

European Trends

The European market for colon cancer is considerably larger than the US and still growing, owing to sheer population demographics. Vaccinogen estimates that many of the more wealthy major European markets (France, Germany, Italy, Spain, UK) have characteristics closely mirroring US colon cancer staging, but with a slightly higher proportion of Stage III and Stage IV disease. This trend is even more pronounced toward Stages III and IV in other Eastern European geographies with less comprehensive screening. For Eastern Europe (and other less developed healthcare economies), Stage II is estimated to represent about 20%-25% of total colon cancer diagnosis. Similar to the shift in the US, Vaccinogen projects that Stage II colon cancer should gradually build to a level of about 45% of all cases in major EU economies and to about 35% of all cases in emerging Europe by 2020.

| 23 |

Rest of World (ROW)

Rates of colon cancer are actually rising in Japan, and changes in diet and higher rates of obesity are seen as key drivers for increasing colon cancer incidence through major emerging economies such as China. While sheer population demographics suggest a significant incidence of colon cancer in the region, the lack of rigorous screening protocols suggest that disease is usually detected at even later stages than in the US or Europe. Vaccinogen forecasts assume that only about 25%-26% of colon cancer is Stage II across the collective rest of world geographies. Vaccinogen forecasts that this proportion of Stage II cases will gradually increase, but only reach about the 35%-36% level by 2020.

Global Totals

These factors point to a considerable market for OncoVAX in a growing and sizeable global market for Stage II colon cancer. In the US, Vaccinogen estimates that the overall number of Stage II colon cancer cases will range between 41,000 to 46,000 over the next decade. For the top five major European countries, Vaccinogen forecasts growth in the Stage II colon cancer market will increase from about 61,000 in 2010, to a level of 74,000 by 2020. Other rest of world geographies are collectively estimated to grow from a level of about 201,000 in 2010 to about 252,000 by 2020, albeit largely confined with less developed healthcare economies.

OncoVAX Market Penetration Assumptions

Geographies with high insurance coverage as well as comprehensive government-controlled healthcare are major market opportunities for OncoVAX. The enormous populations in numerous developing and emerging economies are also attractive, although the high price anticipated for OncoVAX will be a barrier in many poorer economies.

The uptake in new cancer medications is a function of relative levels of effectiveness, physician education as well as reimbursement. Since OncoVAX is expected to provide a significant improvement in survival benefit for Stage II cancer patients, Vaccinogen anticipates rapid and healthy market penetration within the colon cancer treatment community following approval. These market penetration trajectory assumptions are applied against the total addressable market forecasts for each year to derive a net OncoVAX vaccine volume forecast.

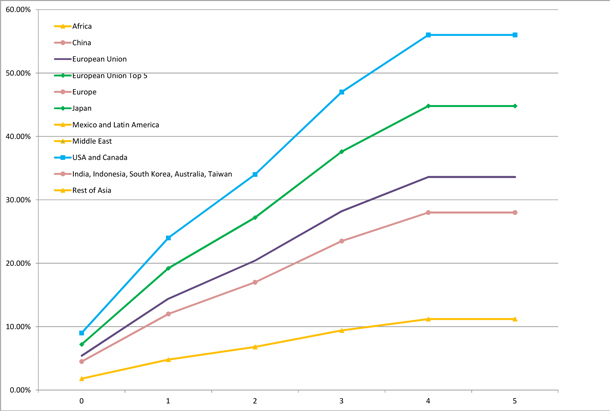

The following chart highlights our forecast for relative share uptake in addressable Stage II colon cancer populations across the US, Europe Top 5, Other Geographies. The fundamental assumption in the analysis is strong uptake in traditional US oncology markets, somewhat lower net penetration across Europe and lower relative penetration across the collective Rest of World (ROW) economies.

Our market penetration assumptions anticipate relatively solid uptake in US Stage II colon cancer markets, with utilization rising steadily to over 50% of the adjusted Stage II markets by 2020. Vaccinogen is forecasting a similarly robust uptake, but lower net share uptake, for OncoVAX in major European economies. Owing to more strict healthcare utilization pressures in Eastern Europe, the Company is anticipating that European uptake will run at a level of about one-half that of the US. This also accounts for divergent healthcare reimbursement trends across various Western and Eastern European geographies.

The analysis takes a somewhat conservative view of the opportunity for OncoVAX in major Pacific Rim and other ROW geographies. Japan and the growing China market represent significant market opportunities, although much of Asia is still too poor to afford expensive new oncology products. While the sheer size of populations within the region is large, We anticipate that the market penetrations will run at a rate lower than those seen in the major markets. Market penetration rates are decidedly lower for the rest of the world, where the year six penetration is forecast at about 11%. The richest economy in the ROW bucket is Japan, where considerable unmet medical need and ability to pay is balanced against very slow regulatory and reimbursement processes.

| 24 |

ONCOVAX MARKET PENETRATION ASSUMPTIONS BY GEOGRAPHY

OncoVAX Pricing

We anticipate pricing for OncoVAX in the US at about $54,000. For benchmarking purposes, it is worth highlighting that the announced US price for Dendreon’sProvenge is $93,000. The model contemplates a $45,000 price point for OncoVAX in the top five European geographies and $38,000/treatment for other European as well as Pacific Rim/ROW geographies. Naturally, the efficacy demonstrated in the contemplated Phase IIIb trial will be important for OncoVAX pricing.

If successful, OncoVAX could provide significant economic benefits to the healthcare system in addition to direct benefits to individual patients. The elimination or lengthy deferral of expensive chemotherapy, surgery and radiotherapy, and general end-of-life care should provide a significant benefit to the paying systems. Of course, extra years of life and economic productivity are to be expected based on the results of OncoVAX’s previous Phase III trials. If as many as half the patients who would otherwise have suffered a near-term recurrence of their cancer are spared that fate by treatment with OncoVAX, the savings to the healthcare system will be large.

| 25 |

A recently published January 2011 study on projections on the cost of cancer care in the US in the Journal of the National Cancer Institute suggest that the average male (>65 years old) colorectal patient has initial costs of about $52,000 for the first 12 months of care, annual continuing costs of about $4,500, and final year of life costs of about $86,000. The clear need to reduce colorectal cancer recurrence is further reinforced by a June 2007 study entitled “Projecting the National Economic Burden of Colorectal Cancer for the U.S. through the Year 2020”. This study estimates that by the year 2020, projected costs of colorectal cancer care in the U.S. for initial, continuing and last year of life phases will grow by about 50% to levels of $5.1 billion, $3.8 billion and $4.3 billion, respectively.

Stage III Colon Cancer Opportunity

The shift in colon cancer diagnosis to earlier Stage II disease is expected to lead to a gradual reduction in the proportion of patients diagnosed with later Stage III disease. We believe that OncoVAX has significant potential in Stage III disease, and plans to conduct an inexpensive pilot study with a surrogate endpoint to test the feasibility of giving the vaccine in conjunction with chemotherapy. We do not plan to conduct registrational studies for Stage III disease as a use of proceeds from this offering. Larger studies in Stage III disease could begin after successful data from Stage II trials. Such a timeline could introduce a label indication for Stage III disease in a 2019 timeframe. Although Stage III is modestly declining, it still represents a potentially attractive commercial target. Our modeling suggests a US market for Stage III of about 35,000 cases in 2020. Europe Top 5 Stage III colon cancer collectively should be over 57,000 cases, while ROW geographies will account for over 241,000 cases in 2020. Our current revenue forecast contains no revenues from Stage III.

| 26 |

2013-2015: Costs to Pivotal Data & Approval

Manufacturing Costs

We have a manufacturing facility operating under cCMP standards and protocols in Emmen, The Netherlands that will process all tumors for the planned clinical trials. We expect cGMP recertification inspection in the 3rd quarter of 2013 with re-certfiiedcGMP status in the 4th quarter of 2013. The facility is expected to cost $2.1 million to operate in 2013, rising to $4.9 and $7.4 million for 2014 and 2015. The Emmen facility’s six employees are anticipated to increase to eighteen by year-end 2014. Each tumor has a projected variable cost to process of approximately $3,500. The company has projected the hiring of a US based VP of Manufacturing in 2013.

Research and Development

We anticipate spending $39 million in R&D in the period 2013 through 2015. Third party costs associated with the 550 patient pivotal trial are estimated at $45,000 per patient, and total $23.8 million over 2013-2015. The third party trial costs for the 30 patient, Stage III, Phase I/II trial are estimated at approximately $31,000 per patient, and total $1.0 million over the clinical trial period. We estimate spending $5.0 million on the HuMabs project between 2013 and 2015.

To support the R&D effort we anticipate increasing R&D headcount from one to thirteen by year-end 2014. Additional hires are expected to include a Vice Presidents of Regulatory and Clinical Affairs, a Director of Regulatory, Director of HuMabs and additional clinical support staff. Costs for these staff and associated expenses are projected to be approximately $2.6 million a year.

Sales & Marketing

We have a Business Development Managing Director based in The Netherlands. We plan to hire a Director of Marketing and Director of BD - HuMabs and a US Vice President of Business Development in 2014. The company projects two additional hires in 2015. The Sales and Marketing expense reflect these personnel costs.

General & Administrative

We currently have six employees allocated to G&A with plans to add eight additional employees by year end 2014 and six more employees in 2015, bringing the total to twenty by the end of 2014.

Preparatory Equipment

In 2013, we anticipate spending on average $87,500 at each of approximately 47 clinical trial sites on preparatory equipment (including nitrogen freezers, glove boxes, centrifuges, etc.).

Manufacturing Build Out

We plan to explore the feasibility and cost of upgrading its Emmen facility to qualify as a commercial vaccine-manufacturing site. Emmen currently has the projected capacity to manufacture 3,500 vaccines, the equivalent of over $150 million in sales at current pricing. The financial forecast also includes $23 million in 2016 towards the cost of building an additional manufacturing facility.

| 27 |

2015 – 2016: Costs to Commercialize

Revenues

OncoVAX sales are projected to start in Q3 2017 in the US and Q4 2018 in Europe. In 2017, Vaccinogen anticipates selling approximately 188 vaccines in the US at approximately $54,000 per vaccine treatment.

We anticipate a rest of world partnership in which its partner both manufactures and distributes the vaccine and pays upfront fees, milestones and a royalty modeled at 20% to Vaccinogen. The model estimates $217 million in OncoVAX upfront milestones for one region. There is upside potential in the licensing of additional regions, indications and partners sharing in the development costs of the OncoVAX Project.

We estimate12 HuMabs licensing deals from 2013 through 2017. The projected revenue for this period is approximately $42.0 Million.

Royalties Owed

We have agreed to pay Organon (now part of Merck) a royalty of 10% of the net sales of OncoVAX (and all other TICE BCG related products) until payment of $3.5 million (and accrued interest) and 3% for five years thereafter.

We are also required to pay Intracel a royalty in conjunction with the Asset Transfer Agreement tiered between 3% and 5% of sales.

Supplies

OrganonTeknika produces a key product (TICE BCG) used in processing our OncoVAX vaccines. We previously acquired from OrganonTeknika (now part of Merck) all TICE BCG necessary for conducting our Phase III trials. We believe we will be able to procure addition quantities of TICE BCG from Organon as necessary in the future.

We believe that we have exclusive use of TICE BCG with autologous cancer cells through our current patent portfolio.

Manufacturing Costs

Our forecast assumes spending $10.3 and $23.51 million on Manufacturing in 2016 and 2017. Within the 2016 budget is a $15 million expenses in preparation of the commercialization of OncoVAX in Q3 2017.

Research and Development

Our forecast assumes spending $8.7 and $9.3 million on R&D in 2016 and 2017.

| 28 |

Sales and Marketing

We anticipate spending approximately $10.7 and $26.7 million on Sales and Marketing in 2016 and 2017. The increase in 2017 is to support the pre launch and launch commercialization of OncoVAX.

General & Administrative

We anticipate General and Administrative spend of $8.2 and $14.0 million in 2016 and 2017.

Intellectual Property

Intellectual property protection is important to our ability to successfully commercialize its innovative technology. We have broad patents covering the OncoVAX technology in the U.S. and seven other countries, Australia, Switzerland, Germany, France, Great Britain, Ireland and Italy, with a related patent application pending in Canada. These patents and applications provide broad coverage for the production of autologous cancer vaccines. The key protection of OncoVAX, in addition to considerable expertise protected as trade secrets, is the broad, issued patent protection around the production of autologous, sterile, metabolically active cancer vaccines developed by us. This patent, entitled “Sterile Immunogenic Non-Tumorigenic Tumor Cell Composition and Methods” was issued in 2009 and expires no sooner than 2025. We believe that sterility will be required for any product to reach the US market and likely in any other market with an approved sterile vaccine like the one we have developed. This could result in a regulatory barrier to entry to competitors. Our intellectual property is pledged as collateral under certain financing arrangements. See “Description of Securities—The Abell Foundation Financings, —Agreements with OrganonTeknika Corporation.”

We hold 1 U.S. patents to related technologies and including the sterility patent referred to above, 2 U.S. patents total.

Outside of the United States, we have, in certain territories, corresponding issued patents related to OncoVAX. Patent expiration dates may be subject to patent term extension depending on certain factors. In addition, following expiration of a basic product patent or loss of patent protection resulting from a legal challenge, it may be possible to continue to obtain commercial benefits from other characteristics such as clinical trial data, product manufacturing trade secrets, uses for products, and special formulations of the product or delivery mechanisms.

We intend to continue using our scientific experience to pursue and patent new developments to enhance our position in the cancer field. Patents, if issued, may be challenged, invalidated, declared unenforceable, circumvented or may not cover all applications we desire. Thus, any patent that we own or license from third parties may not provide adequate protection against competitors. Our pending patent applications, those we may file in the future, or those we may license from third parties may not result in issued patents. Also, patents may not provide us with adequate proprietary protection or advantages against competitors with, or who could develop, similar or competing technologies, or who could design around our patents. In addition, future legislation may impact our competitive position in the event brand-name and follow-on biologics do not receive adequate patent protection. From time to time, we have received invitations to license third-party patents.

| 29 |

We also rely upon unpatented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain our competitive position, in part by using confidentiality agreements. Our policy is to require our officers, employees, consultants, contractors, manufacturers, outside scientific collaborators and sponsored researchers and other advisors to execute confidentiality agreements. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us be kept confidential and not disclosed to third parties except in specific limited circumstances. We also require signed confidentiality agreements from companies that receive our confidential data. For employees, consultants and contractors, we require agreements providing that all inventions conceived while rendering services to us shall be assigned to us as our exclusive property. We hold considerable proprietary expertise related to the OncoVAX technology, including the production of autologous cancer vaccines.

We have brand names for our OncoVAX products and related technologies, and anticipates filing 5 trademark applications for these and related marks.

Competition

The biotechnology and biopharmaceutical industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. Pharmaceutical and biotechnology companies, academic institutions and other research organizations are actively engaged in the discovery, research and development of products designed to address prostate cancer and other indications. There are products currently under development by other companies and organizations that could compete with OncoVAX or other products that we are developing.

Our competitors include major pharmaceutical companies. These companies may have significantly greater financial resources and expertise in research and development, manufacturing, pre-clinical testing, conducting clinical trials, obtaining regulatory approvals and marketing. In addition, smaller competitors may collaborate with these large established companies to obtain access to their resources.

Competition among products approved for sale will be based upon, among other things, efficacy, reliability, product safety, price-value analysis, and patent position. Our competitiveness will also depend on our ability to advance our product candidates, license additional technology, maintain a proprietary position in our technologies and products, obtain required government and other approvals on a timely basis, attract and retain key personnel and enter into corporate relationships that enable us and our collaborators to develop effective products that can be manufactured cost-effectively and marketed successfully.

Regulatory

General

Government authorities in the United States and other countries extensively regulate, among other things, the pre-clinical and clinical testing, manufacturing, labeling, storage, record-keeping, advertising, promotion, export, marketing and distribution of biologic products. In the United States, the FDA subjects pharmaceutical and biologic products to rigorous review under the Federal Food, Drug, and Cosmetic Act, the Public Health Service Act and other federal statutes and regulations.

| 30 |

FDA Approval Process

To obtain approval of our product candidates from the FDA, we must, among other requirements, submit data supporting safety and efficacy as well as detailed information on the manufacture and composition of the product candidate. In most cases, this entails extensive laboratory tests and pre-clinical and clinical trials. The collection of these data, as well as the preparation of applications for review by the FDA, are costly in time and effort, and may require significant capital investment. We may encounter significant difficulties or costs in our efforts to obtain FDA approvals that could delay or preclude us from marketing any products we may develop.

A company typically conducts human clinical trials in three sequential phases, but the phases may overlap. Phase 1 trials consist of testing of the product in a small number of patients or healthy volunteers, primarily for safety at one or more doses. Phase 1 trials in cancer are often conducted with patients who are not healthy and who have end-stage or metastatic cancer. Phase 2 trials, in addition to safety, evaluate the efficacy of the product in a patient population somewhat larger than Phase 1 trials. Phase 3 trials typically involve additional testing for safety and clinical efficacy in an expanded population at geographically dispersed test sites. Prior to commencement of each clinical trial, a company must submit to the FDA a clinical plan, or “protocol,” which must also be approved by the Institutional Review Boards at the institutions participating in the trials. The trials must be conducted in accordance with the FDA’s good clinical practices. The FDA may order the temporary or permanent discontinuation of a clinical trial at any time.

To obtain marketing authorization, a company must submit to the FDA the results of the pre-clinical and clinical testing, together with, and among other things, detailed information on the manufacture and composition of the product, in the form of a new drug application or, in the case of a biologic such as OncoVAX, a biologics license application.

We are also subject to a variety of regulations governing clinical trials and sales of our products outside the United States. Whether or not FDA approval has been obtained, approval of conduct of a clinical trial or authorization of a product by the comparable regulatory authorities of foreign countries and regions must be obtained prior to the commencement of marketing the product in those countries. The approval process varies from one regulatory authority to another and the time may be longer or shorter than that required for FDA approval. In the E.U., Canada and Australia, regulatory requirements and approval processes are similar, in principle, to those in the United States.

Fast Track Designation/Priority Review

Congress enacted the Food and Drug Administration Modernization Act of 1997 (the “Modernization Act”) in part to ensure the availability of safe and effective drugs, biologics and medical devices by expediting the development and review for certain new products. The Modernization Act establishes a statutory program for the review of Fast Track products, including biologics. A Fast Track product is defined as a new drug or biologic intended for the treatment of a serious or life-threatening condition that demonstrates the potential to address unmet medical needs for this condition. Under the Fast Track program, the sponsor of a new drug or biologic may request that the FDA designate the drug or biologic as a Fast Track product at any time during the development of the product, prior to a new drug application submission.

| 31 |

Post-Marketing Obligations

The Food and Drug Administration Amendments Act of 2007 expanded FDA authority over drug products after approval. All approved drug products are subject to continuing regulation by the FDA, including record-keeping requirements, reporting of adverse experiences with the product, sampling and distribution requirements, notifying the FDA and gaining its approval of certain manufacturing or labeling changes, complying with certain electronic records and signature requirements, submitting periodic reports to the FDA, maintaining and providing updated safety and efficacy information to the FDA, and complying with FDA promotion and advertising requirements. Failure to comply with the statutory and regulatory requirements can subject a manufacturer to possible legal or regulatory action, such as warning letters, suspension of manufacturing, seizure of product, injunctive action, criminal prosecution, or civil penalties.

The FDA may require post-marketing studies or clinical trials to develop additional information regarding the safety of a product. These studies or trials may involve continued testing of a product and development of data, including clinical data, about the product’s effects in various populations and any side effects associated with long-term use. The FDA may require post-marketing studies or trials to investigate known serious risks or signals of serious risks or identify unexpected serious risks and may require periodic status reports if new safety information develops. Failure to conduct these studies in a timely manner may result in substantial civil fines.

Drug and biologics manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies, and to list their products with the FDA. The FDA periodically inspects manufacturing facilities in the United States and abroad in order to assure compliance with the applicable cGMP regulations and other requirements. Facilities also are subject to inspections by other federal, foreign, state or local agencies. In complying with the cGMP regulations, manufacturers must continue to assure that the product meets applicable specifications, regulations and other post-marketing requirements. We must ensure that any third-party manufacturers continue to ensure full compliance with all applicable regulations and requirements. Failure to comply with these requirements subjects the manufacturer to possible legal or regulatory action, such as suspension of manufacturing or recall or seizure of product.

Also, newly discovered or developed safety or efficacy data may require changes to a product’s approved labeling, including the addition of new warnings and contraindications, additional pre-clinical or clinical studies, or even in some instances, revocation or withdrawal of the approval. Violations of regulatory requirements at any stage, including after approval, may result in various adverse consequences, including the FDA’s withdrawal of an approved product from the market, other voluntary or FDA-initiated action that could delay or restrict further marketing, and the imposition of civil fines and criminal penalties against the manufacturer and Biologics License Applications (“BLA”) holder. In addition, later discovery of previously unknown problems may result in restrictions on the product, manufacturer or BLA holder, including withdrawal of the product from the market. Furthermore, new government requirements may be established that could delay or prevent regulatory approval of our products under development, or affect the conditions under which approved products are marketed.

| 32 |

Federal Anti-Kickback, False Claims Laws &The Federal Physician Payment Sunshine Act