UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission File Number

(Exact name of Registrant as specified in its Charter)

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|||

|

|

|

|

|||||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|||

|

|

|

|

|

|

|

||

Emerging growth company |

|

|

|

|

|

|||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant based on the last reported sale of the common stock on June 30, 2021, on the Nasdaq Global Market, was $

The number of shares of Registrant’s Common Stock outstanding as of February 17, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference certain information from the registrant’s definitive proxy statement for the 2022 Annual Meeting of Stockholders to be filed no later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2021.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

6 |

|

Item 1A. |

16 |

|

Item 1B. |

38 |

|

Item 2. |

38 |

|

Item 3. |

38 |

|

Item 4. |

38 |

|

|

|

|

PART II |

|

|

Item 5. |

39 |

|

Item 6. |

41 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

Item 7A. |

50 |

|

Item 8. |

51 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

77 |

Item 9A. |

77 |

|

Item 9B. |

79 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

79 |

|

|

|

PART III |

|

|

Item 10. |

80 |

|

Item 11. |

80 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

80 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

81 |

Item 14. |

81 |

|

|

|

|

PART IV |

|

|

Item 15. |

82 |

|

Item 16. |

86 |

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes

2

to identify these forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Forward-looking statements in this report include, but are not limited to, statements about:

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this report and are subject to risks and uncertainties. We discuss many of these risks in greater detail in the “Risk Factor Summary” below and under Item 1. “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We qualify all of the forward-looking statements in this report by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity,

3

performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations, except as required by law.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Risk Factors Summary

Our business is subject to numerous risks, as more fully described in “Risk Factors” below. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement or execute our business strategy. In particular, risks associated with our business include, among others:

4

5

PART I

Item 1. Business

Overview

We are a leading provider of silicon timing solutions. Our timing solutions are the heartbeat of our customers’ electronic systems. They solve complex timing problems and enable industry-leading products. We provide solutions that are differentiated by high performance and reliability, programmability, small size, and low power consumption. Our products have been designed into over 250 applications across our target markets, including communications and enterprise, automotive, industrial, aerospace, mobile, Internet of Thing (“IoT”), and consumer. Our current solutions include various types of oscillators, as well as resonators and clock integrated circuits (“ICs”). Our all-silicon solutions are based on three fundamental areas of expertise: micro-electro-mechanical systems (“MEMS”), analog mixed-signal design capabilities, and advanced system-level integration expertise. This expertise allows us to design MEMS resonators, analog circuits, as well as systems and packaging, and put these all together to deliver a system level solution that solves customers’ complex timing problems. In this aspect, we are different than quartz-based providers, who typically have expertise in designing and manufacturing resonators, but usually outsource the analog and packaging. We are also different in that our MEMS resonators are made with silicon, while the quartz suppliers use quartz crystal technology. Our timing solutions are designed to be resilient to environmental stresses. For the communications and enterprise market, our timing solutions provide high performance and resilience in dense, less-controlled environments that experience harsh conditions–an advantage as equipment moves closer to the customer with the rollout of 5G. For the automotive market, our solutions can be utilized in automotive electronics, including advanced driver assistance systems (“ADAS”) for self-driving cars, which require increased timing accuracy. For the industrial market, our products offer programmability and high reliability for the diverse operating conditions of industrial equipment, including high temperatures, mechanical shock and vibration. For the aerospace market, our solutions provide lower acceleration sensitivity for end products that operate in rugged conditions. For the mobile, IoT and consumer market, our silicon-based timing solutions have the advantage of offering high performance at optimal power consumption and size, as our customers fit more functionality into smaller devices.

We commenced commercial shipments of our first oscillator products in 2006. Substantially all of our revenue to date has been derived from sales of oscillator systems across our target end markets. We recently introduced products into the clock IC market, which we began sampling in 2019, and intend to focus on clock IC and timing sync solutions in the future. We seek to aggressively expand our presence in these two markets.

We sell our products primarily through distributors and resellers, who in turn sell to our end customers. Based on sell-through information provided by these distributors, we believe the majority of our end customers are based in the U.S.

We operate a fabless business model, allowing us to focus on the design, sales, and marketing of our products, quickly scale production, and significantly reduce our capital expenditures. We leverage our global network of distributors and resellers to address the broad set of end markets we serve. For our largest accounts, dedicated sales personnel work with the end customer to ensure that our solutions fully address the end customer’s timing needs. Our smaller customers work directly with our distributors to select the optimum timing solution for their needs.

Industry Background

Timing Solutions Enable Innovation and are Rapidly Evolving

The ability to accurately measure and reference time has been essential to many of humankind’s greatest inventions and technological progress. Timing technology has continued to evolve over centuries, forming a critical aspect of broader technological advancement. Timing is the heartbeat of digital electronic systems, ensuring that the system runs smoothly and reliably by providing and distributing clock signals to various critical components such as CPUs, communication and interface chips, and radio frequency components. As electronics are expected to operate at higher performance levels in increasingly challenging environments, while also being more complex and footprint-constrained, we believe they will require more sophisticated timing solutions. For example, as 5G communications networks evolve, we expect that they will require higher precision from a greater number of oscillators and timing devices.

Key Building Blocks of Timing Solutions

Timing solutions comprise three key building blocks: resonators, oscillators, and clock ICs. While simpler systems generally require only an external resonator coupled with a basic embedded oscillator circuit, more complex systems require advanced timing

6

solutions that may integrate a variety of resonators, oscillators, and clock ICs in a single chip package. The complexity of these timing solutions increases significantly when the performance requirements of the systems that use them increase, such as electronic systems required to support the 5G communication network infrastructure.

The key building blocks of SiTime’s timing solutions are:

These three building blocks may be used individually or in combination, depending on the end product’s performance, price, and size requirements.

Limitations of Legacy Quartz-based Solutions

For over 70 years, quartz crystal has been the predominant technology of choice for resonators and will continue to play a role in the timing market. In a quartz oscillator, a quartz crystal resonator is paired with a silicon-based clock IC in a ceramic package. However, quartz timing devices, largely unchanged in decades, have many inherent limitations, including limited frequency ranges, sensitivity to rapid temperature changes, vulnerability to vibration and mechanical shock, susceptibility to frequency jumps at particular temperatures, and limited programmability. Quartz devices must be housed in ceramic packaging, and thus are difficult to integrate into standard semiconductor packages. Quartz products require dedicated manufacturing facilities and have relatively long lead times due to the need to specify various characteristics well in advance of production, without the ability to reconfigure them during the design cycle. In addition, as electronic systems become more complex, feature-rich, and robust, they require more sophisticated timing systems that can seamlessly integrate a variety of resonators, oscillators, and clock ICs in various system-level combinations. This seamless integration is more difficult with legacy quartz systems.

Silicon Timing Solutions Poised to Disrupt the Market

In recent years, advances in silicon-based manufacturing and packaging techniques have allowed the development of alternatives to quartz crystal technology. We believe that silicon MEMS is an ideal technology for resonator design. Specifically, its ability to integrate with other circuits in standard semiconductor packages has made scalable standard silicon manufacturing possible for resonators and broader timing technology. MEMS and silicon-based technologies can operate in a wide range of frequencies, are more resistant to vibration, mechanical shock, and temperature changes, and are less susceptible to frequency jumps. These technologies are also inherently well-suited to produce timing solutions that are small, and offer high performance, robustness and programmability. Timing solutions based on these technologies are manufactured using semiconductor processes in fabrication plants with high capacity, allowing for cost-effective high-volume manufacturing.

Significant Market Opportunity for Timing Solutions

According to Dedalus Consulting - 2019 Frequency Control Components Global Markets, End-Users, Applications & Competitors: Analysis & Forecasts and our estimates, the global timing market is expected to grow to $10.1 billion by 2024. Dedalus Consulting estimates that oscillators and standalone resonators will represent approximately $5.0 billion and $4.0 billion total addressable markets, respectively, in 2024. Based on our internal estimates, we believe clock ICs represent an approximate $1.0 billion total addressable market. As a subset of the broader timing market, the market for MEMS timing devices is projected to grow from $0.24 billion in 2021 to $1 billion by 2024, representing a compound annual growth rate of 62%, according to internal company estimates.

7

The Opportunity for Advanced Solutions

From high-performance network infrastructure equipment to low-power battery-operated devices, precise timing solutions enable virtually all electronics. The complexity of such timing solutions increases significantly with the performance requirements of the systems in which they are used. Below are some examples of end markets in which we believe our silicon-based timing is enabling or has the potential to enable, greater functionality than legacy solutions:

Communications and Enterprise

Communications infrastructure equipment used in wireless base stations, wired infrastructure equipment, enterprise networks, and cloud data centers must provide high performance and stability in demanding environments, which may include temperature fluctuations, mechanical shocks, and vibration. If the timing solution within the equipment fails, networks can shut down, leading to service disruptions and higher operating costs. According to Gartner, “Recent reports on 5G pilots and testing have identified a wide range of projected data throughput speeds ranging from 10 times up to 1,000 times faster than 4G. Other reports estimate ranges of one to 10 gigabytes per second.”

Automotive, Industrial, and Aerospace

For automotive applications, timing technology must perform reliably over the life of an automobile in an environment characterized by vibration, mechanical shocks, electromagnetic interference, wide temperature ranges, and rapid temperature change. The AECC (Automotive Edge Computing Consortium) estimated in 2020 that “data traffic from connected vehicles will exceed 1,000 times the present volume, surpassing 10 exabytes per month by 2025.” These communication systems will require highly-reliable precise timing. We believe silicon-based timing can address many of the challenges associated with this demanding automotive ecosystem.

Industrial equipment, ranging from factory machinery to medical devices, is often exposed to environments characterized by temperature fluctuation, mechanical shocks, vibration, and electromagnetic interference. We believe silicon-based timing solutions can perform better than legacy quartz-based solutions in demanding industrial environments at comparable cost and with lower power consumption and higher reliability. In addition, with the highly diverse nature of industrial applications and the need for unique operating frequencies, we believe the programmable architecture of silicon timing products provides an advantage.

Timing devices used in aerospace and defense applications such as rockets and satellites need to withstand extreme vibration forces and temperature gradients during operation. Quartz-based solutions can be impacted by vibrating forces acting on the whole system. MEMS timing devices are well-suited for these applications, as they provide up to 50 times better acceleration sensitivity under vibration than comparable quartz-based solutions.

Mobile, IoT and Consumer

The growing reliance on mobile devices and the IoT revolution has enabled the proliferation of billions of internet-connected devices in industrial and consumer applications. These devices range from smartphones and personal wearable devices to electronics embedded in appliances and industrial machinery. Many of these devices need to package a significant amount of electronics in a limited battery-powered and size-constrained form factor, while still requiring high performance and high accuracy. Due to the ability to integrate with ICs, we believe silicon-based timing solutions are well-suited to optimize footprint, reliability, and power consumption of the overall system within mobile, IoT and consumer devices.

Our Solutions and Technology

Our silicon timing solutions comprise:

8

We design each key building block of the timing system, from MEMS resonators to oscillator circuits to clock ICs. Our ability to combine our MEMS resonators with analog-mixed signal components in a fabless semiconductor supply chain allows us to build full timing solutions from the ground up, enabling our customers to focus on their core expertise.

Our flexible and programmable timing solutions offer the following benefits:

Our Strategy

Our objective is to be the leading timing solution provider for advanced and challenging applications. Our solutions not only displace existing products by providing improved performance across a range of operational attributes, but also enable next-generation devices by providing high performance at affordable price points. Key elements of our strategy include:

9

10

Our Products

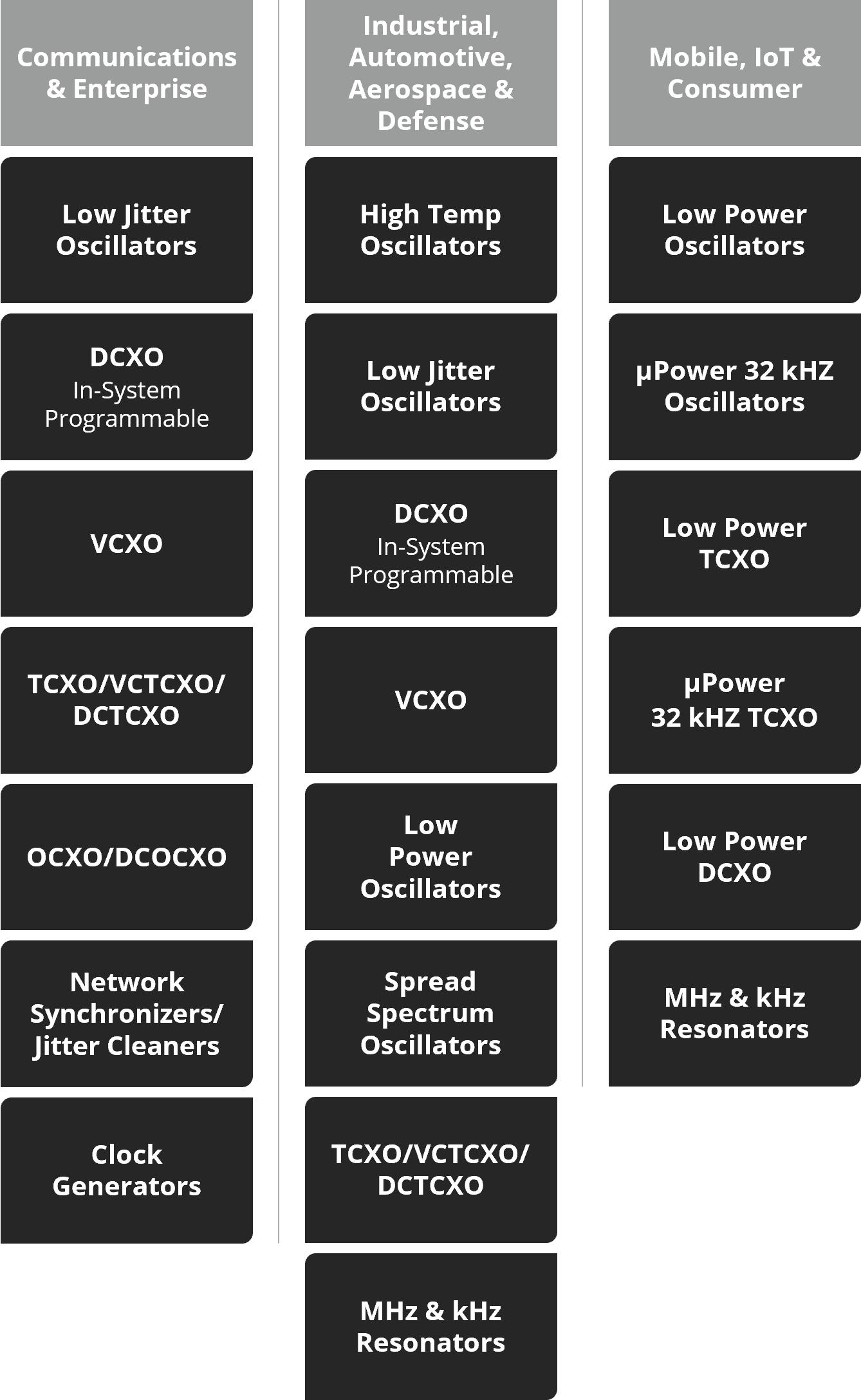

Our silicon timing products are designed to address a wide range of applications across a broad array of end markets. Our product portfolio encompasses oscillators, clock ICs, and resonators. The programmability of our product platforms enables us to generate solutions quickly to customer specifications.

Today, we primarily supply oscillator products that comprise a MEMS resonator and an analog mixed-signal IC that are integrated into a package. The following table illustrates our current portfolio of promoted products by target end market:

11

Our Customers

We primarily sell our timing products to distributors and resellers, who in turn sell our products to our end customers. We work closely with our end customers throughout their design cycles and are able to develop long-term relationships as our technology becomes embedded in their products and at times sell directly to our end customers. As a result, we believe our products are well-positioned to be designed into their current systems and we are well-positioned to develop next generation solutions for their future products.

Pernas Electronics Co., Ltd. (“Pernas”) directly accounted for 24%, 26%, and 17% of our revenue for the years ended December 31, 2021, 2020 and 2019, respectively, Quantek Technology Corporation (“Quantek”) directly accounted for 10%, 18%, and 22% of our revenue for the years ended December 31, 2021, 2020, and 2019, respectively and Arrow Electronics, Inc. (“Arrow”) directly accounted for 14%, 15%, and 19% of our revenue for the years ended December 31, 2021, 2020, and 2019, respectively. Other than Pernas, Quantek, and Arrow, no other single customer accounted for more than 10% of our revenue in the years ended December 31, 2021, 2020, and 2019.

Based on the sell-through information provided to us from distributors and resellers who identify end customers, we believe that the majority of our products sold to Pernas and Quantek are in turn incorporated into products of Apple Inc. (“Apple”), our largest end

12

customer. As a result, we believe revenue attributable to our largest end customer accounted for approximately 22%, 40%, and 35% of our revenue for the years ended December 31, 2021, 2020, and 2019, respectively.

Sales and Marketing

Our customers’ design cycle from initial engagement to volume shipment typically ranges from six months to three years, with product life cycles of up to ten years or more. For many of our products, early engagement with our customers’ technical staff is critical for success. To ensure an adequate level of early engagement, our sales, marketing, and customer and development engineers work closely with our customers and channel partners to understand, identify, and propose solutions to their systems’ challenges. We work closely with our customers, including technology leaders such as Nokia for the communications markets, to anticipate end customer market needs. In some cases, we work with our end customers to better understand the end customers’ market trends and new requirements that are being placed on our customers.

We sell our products worldwide through multiple channels, including our direct sales force and a network of distributors, contract manufacturers, contracted sales representatives, resellers, and independent design houses. Our global sales strategy includes direct sales and distributors covering over 15,000 end customer accounts since inception.

We have a strategic accounts strategy with dedicated account owners and our direct sales force focused on key decision-makers to provide high-value solutions for unique customer requirements. We intend to continue to expand our sales and marketing efforts through increased collaboration with our distributors, resellers, and contracted sales representatives. In addition, we intend to introduce a self-service web portal, which will support 24/7 availability and leverage an inside sales team to support a “self-service model” for customers.

We promote our products and brand through various means including digital marketing and online advertising, press releases, contributed articles, speaking opportunities, trade events, customer events, public relations and industry analyst relations.

Seasonality

Our revenue is subject to some seasonal variation. Based on the production schedules of key customers, our products typically see stronger revenue in the second half of our fiscal year. However, there can be no assurance that this trend will continue.

Manufacturing

We operate a fabless business model and use third-party foundries and assembly and test contractors to manufacture, assemble and test our semiconductor products. This outsourced manufacturing approach allows us to focus our resources on the design, sale, and marketing of our products. In addition, we believe that outsourcing many of our manufacturing and assembly activities provides us with the flexibility needed to respond to new market opportunities and scale for customer demand, simplifies our operations, and significantly reduces our capital commitments.

We subject our third-party manufacturing contractors to rigorous qualification requirements to meet the high quality and reliability standards required of our products. We carefully qualify each of our partners and their processes before applying the technology to our products. Our engineers work closely with our foundries and other contractors to increase yield, lower manufacturing costs, and improve product quality.

13

We have a supply agreement with Bosch under which Bosch has agreed to fabricate our MEMS wafers based on purchase orders placed by us. Bosch has discretion whether to accept our purchase orders, and we can terminate purchase orders for convenience by giving written notice prior to shipment. The initial term of the supply agreement is for ten years through February 2027 and automatically renews unless terminated by either party with three years’ advance notice beginning in February 2024. Other than Bosch, we do not have long-term supply agreements with most of our third-party manufacturing contractors, and we purchase products on a purchase order basis.

Research and Development

We believe that our future success depends on our ability to introduce enhancements on our existing products and to develop new products for both existing and new markets. As a result, a significant majority of our operating expenses has been allocated towards this effort. Our research and development efforts are focused primarily on MEMS and advanced clock IC design and advanced system-level integration for timing solutions.

We have assembled a core team of experienced engineers and systems designers who conduct research and development activities in the United States, the Netherlands, Japan, Taiwan, and Ukraine. As of December 31, 2021, we had 85 engineers worldwide (representing approximately 30% of our total employee base).

Intellectual Property

We rely primarily on patent, copyright, trademark, and trade secret laws, as well as confidentiality and non-disclosure agreements, and other contractual protections, to protect our technologies and proprietary know-how. As of December 31, 2021, we had 83 issued U.S. patents, expiring generally between 2026 and 2039, and 38 pending U.S. patent applications. We also had two foreign issued patents expiring in 2035 and four pending foreign patent applications. Our issued patents and pending patent applications generally relate to our MEMS fabrication process, MEMS resonators, circuits, packaging, and oscillator systems.

In addition to our own intellectual property, we also use third-party licenses for certain technologies embedded in our MEMS solutions. For example, we have a license to certain patents from Bosch relating to the design and manufacture of MEMS-based timing applications. The patent rights obtained under the license agreement expire between 2021 and 2029, and the license agreement expires upon expiration of the last patent licensed under the agreement. We do not believe there will be any significant impact upon expiration of these patents.

We generally control access to and use of our confidential information and trade secrets through the use of internal and external controls, including contractual protections with employees, contractors, and customers. We rely in part on the laws of the United States and international laws to protect our work. All employees and consultants are required to execute confidentiality agreements in connection with their employment and consulting relationships with us. We also require them to agree to disclose and assign to us all inventions conceived or made in connection with the employment or consulting relationship. However, we cannot guarantee that we have entered into such agreements with every such party and we may not have adequate remedies in case of a breach of any such agreements. Our trade secrets could be disclosed to our competitors or others may independently develop substantially equivalent technologies or otherwise gain access to our trade secrets. Trade secrets can be difficult to protect and some courts inside and outside of the United States are less willing or unwilling to protect trade secrets. Despite our efforts to protect our intellectual property, unauthorized parties may still copy, misappropriate, or otherwise obtain and use our software, technology, or other information that we regard as our proprietary intellectual property. In addition, we intend to expand our international operations, and effective patent, copyright, trademark, and trade secret, and other intellectual property protection may not be available or may be limited in some foreign countries.

14

The semiconductor industry is characterized by vigorous protection and pursuit of intellectual property rights and positions, which has resulted in protracted and expensive litigation for many companies. We have in the past received, and we may in the future receive, communications alleging liability for damages or challenging the validity of our intellectual property or proprietary rights. Any litigation, regardless of success or merit, could cause us to incur substantial expenses, reduce our sales, and divert the efforts of our management and other personnel. In the event we receive an adverse result in any litigation, we could be required to pay substantial damages, seek licenses from third parties, which may not be available on reasonable terms or at all, cease sale of products, expend significant resources to develop alternative technology, or discontinue the use of processes requiring the relevant technology.

Competition

The global semiconductor market in general, and the timing market in particular, is highly competitive. We compete in different target markets based on a number of competitive factors. We expect competition to increase and intensify as additional companies enter our markets and as internal resources of large original equipment manufacturers (“OEMs”) grow. Increased competition could result in price pressure, reduced gross margins, and loss of market share, any of which could harm our business, financial condition, and results of operations.

Our competitors range from large, international companies offering a wide range of timing products to smaller companies specializing in narrow market verticals. In the MEMS-based oscillator market, we primarily compete against Microchip Technology Inc. (“MCHP”) through their acquisition of Micrel, Incorporated. In the MEMS-based resonator market, we primarily compete against Murata Manufacturing Co., Ltd. In the analog mixed-signal IC and clocking market, we primarily compete against Renesas Electronics Corporation (through their acquisition of Integrated Device Technology, Inc.), Silicon Laboratories Inc., Texas Instruments Incorporated, Micrel (which is owned by MCHP), and Analog Devices, Inc. In the oscillator market, we primarily compete against quartz crystal suppliers such as Rakon Limited, Daishinku Corporation, Nihon Dempa Kogyo Co., Ltd., TXC Corporation, Seiko Epson Corporation, Kyocera Corporation and Vectron International (which is owned by MCHP). These quartz crystal suppliers typically own their own quartz manufacturing facilities.

Our ability to compete successfully depends on elements both within and outside of our control, including industry and general economic trends. During past periods of downturns in our industry, competition in the markets in which we operate intensified as our customers reduced their purchase orders. Many of our competitors are substantially larger, have greater financial, technical, marketing, distribution, customer support, and other resources, are more established than we are, and have significantly better brand recognition and broader product offerings which may enable them to better withstand similar adverse economic or market conditions in the future. Any such development may materially and adversely affect our current and future target markets and our ability to compete successfully in those markets. We maintain our competitive position through our ability to successfully design, develop, and market complex timing solutions for the customers we serve.

Government Regulation

Our business activities are worldwide and subject to various federal, state, local and foreign regulations and our products are governed by a number of rules and regulations. To date, our compliance with these regulations has not had a material impact on our results of operations.

Human Capital Resources and Empowerment

We believe that our company culture, which promotes innovation, open communication, and teamwork, has been critical to our success. Our success depends largely upon the continued services of our executive officers and other key employees and on our ability to continue to attract, retain and motivate qualified employees, particularly highly-skilled engineers involved in the design, development, support and manufacture of new and existing products and processes and our sales and marketing team which is critical to achieving design wins, creating our brand awareness and reputation, and building long-lasting relationships with our customers and other industry participants. In order for us to attract the best talent, we aim to offer challenging work in an environment that enables our employees to learn, grow, and reach their full potential.

Our human capital resource objectives include identifying, recruiting, retaining, incentivizing and integrating our existing and future employees. We strive to attract and retain the most talented employees in the industry and across the globe by offering competitive compensation and benefits that support their health, financial, and emotional well-being. Our compensation philosophy is based on rewarding each employee’s individual contributions. We use a combination of fixed and variable pay including base salary,

15

bonuses, performance awards and stock-based compensation. The principal purposes of our equity incentive plans are to attract, retain, and motivate selected employees through the granting of stock-based compensation awards. We offer employees benefits that vary by country and are designed to meet or exceed local laws and to be competitive in the marketplace. Examples of benefits offered in the U.S. include: a 401(k) plan with employer contributions; health benefits; life, business travel and disability insurance; additional voluntary insurance; paid time off and parental leave, and paid counseling assistance. For further information concerning our equity incentive plans, see Note 9, Stock-based Compensation, of the Notes to Consolidated Financial Statements contained in Part II, Item 8 of this Annual Report on Form 10-K.

We are committed to the health, safety and wellness of our employees. We provide our employees and their families with access to a variety of health and wellness programs, including benefits that support their physical and mental health. In response to the COVID-19 pandemic, we implemented safety measures designed to protect our employees. We believe we have been able to preserve our business continuity without sacrificing our commitment to keeping our employees safe during the COVID-19 pandemic.

We regularly review our employees and assess the needs of the business to identify our talent needs. We encourage all employees to continue learning and provide internal opportunities for cross functional work to support this. We regularly review succession plans and focus on promoting internal talent to help grow our employees' careers.

We conducted a survey in fiscal 2020 and had a participation rate of over 80% of all our employees and the survey results indicated that we excel in areas including initiative, empowerment, opportunities to learn and grow, and overall culture.

As of December 31, 2021, we had 279 full-time equivalent employees located in the United States, France, Malaysia, the Netherlands, Taiwan, Japan and Ukraine, including 137 in research and development, 109 in sales, general, and administrative, and 33 in operations. We consider relations with our employees to be good and have never experienced a work stoppage.

Corporate Information

We were incorporated in Delaware on December 3, 2003. Our principal executive offices are located at 5451 Patrick Henry Drive, Santa Clara, California 95054, and our telephone number is (408) 328-4400. Our corporate website address is www.sitime.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K. Unless the context requires otherwise, references in this Annual Report on Form 10-K to “SiTime,” “the company,” “we,” “us” and “our” refer to SiTime Corporation and its wholly-owned subsidiaries on a consolidated basis.

Available Information

Our website is located at https://www.sitime.com. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are available, free of charge, on our investor relations website as soon as reasonably practicable after we file such material electronically with or furnish it to the Securities and Exchange Commission (the “SEC”). The SEC also maintains a website that contains our SEC filings. The address of the website is www.sec.gov.

Item 1A. Risk Factors.

Risks Related to Our Business and Our Industry

The COVID-19 pandemic could adversely affect our business, results of operations, and financial condition.

The effects of the ongoing COVID-19 pandemic on our business are evolving and difficult to predict. To date, the COVID-19 pandemic has significantly and negatively impacted the global economy and it is unclear how long the pandemic will continue to do so. To combat the spread of COVID-19, the United States and other foreign countries in which we operate have from time to time imposed measures such as quarantines and “shelter-in-place” orders that restrict business operations and travel and require individuals to work from home (“WFH”), which has impacted all aspects of our business as well as those of the third-parties we rely upon for our manufacturing, assembly, testing, shipping, and other operations. Among other things, the continued COVID-19 pandemic may result in:

16

The COVID-19 pandemic has also caused significant uncertainty and volatility in global financial markets and the trading prices for the common stock of technology companies, including us. Due to such volatility, we may not be able to raise additional capital, if needed, on favorable terms, or at all. Further adverse economic events resulting from the COVID-19 pandemic, including a recession, depression, or other sustained economic downturn, could materially and adversely affect our business, access to capital markets, and the value of our common stock.

In addition, given the inherent uncertainty surrounding COVID-19 due to rapidly changing governmental directives, public health challenges, and economic disruption and the duration of the foregoing, the potential impact that the COVID-19 pandemic could have on the other risk factors described in this “Risk Factors” section remain unclear.

As a result of the COVID-19 pandemic, we believe we have experienced some delay and disruption in the manufacture, shipment, and sales of our products. In addition, we believe the production capabilities of our suppliers has been, and will likely continue to be, impacted as a result of quarantines, closures of production facilities, lack of supplies, or delays caused by restrictions on travel or WFH orders. Further, as WFH orders terminate and individuals return to work in offices, we may experience a reduction in demand for certain of our products that are incorporated in our customers’ products that experienced higher demand as a result of the increase in WFH during the COVID-19 pandemic. The continued disruption in the manufacture, shipment and sales of our products may negatively and materially impact our operating results. The resumption of normal business operations after such disruptions may be delayed and resurgences of COVID-19 could result in continued disruption to us, our suppliers, and/or our customers. As a result, the effects of the COVID-19 pandemic could have a material adverse impact on our business, results of operations, and financial condition in the future.

A downturn in the worldwide economy may harm our business.

The COVID-19 pandemic could cause an extended downturn in the worldwide economy, which would likely result in reduced demand for our products and our customers’ products. Reduced demand for our products could result in significant decreases in sales and margins. In addition, the deterioration in credit markets could limit our ability to obtain external financing to fund our operations and capital expenditures. We may experience losses on our holdings of cash and investments due to failures of financial institutions and other parties. Adverse economic conditions may also result in a higher rate of losses on our accounts receivables due to credit defaults. As a result, a downturn in the worldwide economy could have a material adverse effect on our business, results of operations, and financial condition.

We depend on third parties for our wafer fabrication, assembly, packaging, and testing operations, which exposes us to certain risks that may harm our business.

We operate an outsourced manufacturing business model. As a result, we rely on third parties for all of our manufacturing operations, including wafer fabrication, assembly, packaging, and testing. Although we use multiple third-party supplier sources, we depend on these third parties to supply us with material of a requested quantity in a timely manner that meets our standards for yield, cost, and manufacturing quality. The manufacturing processes of our third-party suppliers for our products require specialized technology that requires certain raw and engineered materials. Many major components, product equipment items, engineered materials, and raw materials, that are procured or subcontracted by our third-party suppliers for manufacturing of our products are procured or subcontracted on a single or sole-source basis. Except for our agreement with Bosch for MEMS wafers, we do not have any long-term supply agreements with any of our other manufacturing suppliers. These third-party manufacturers often serve customers that are larger than us or require a greater portion of their services, which may decrease our relative importance and negotiating leverage with these third parties.

If market demand for wafers or production and assembly materials increases, if a supplier of our wafers fails to procure materials needed for manufacture of our products, or if a supplier of our wafers ceases or suspends operations, our supply of wafers and other materials could become limited. We currently have a ten-year supply agreement with Bosch for the fabrication of our MEMS wafers. This agreement expires in 2027 and may be terminated with three years’ advance notice beginning in February 2024. We currently rely on Bosch for our MEMS fabrication, and TSMC for our analog circuits fabrication, and any disruption in their supply of wafers or

17

any increases in their wafer or materials prices could adversely affect our gross margins and our ability to meet customer demands in a timely manner, or at all, and lead to reduced revenue. There are currently a number of industry-wide supply constraints affecting the supply of analog circuits manufactured by certain foundries, including TSMC, and affecting outsourced semiconductor assembly and test providers (“OSATs”), which has limited and may continue to limit our ability to fully satisfy an increase in demand for some of our products. Moreover, wafers constitute a large portion of our product cost. If we are unable to negotiate volume discounts or otherwise purchase wafers at favorable prices and in sufficient quantities in a timely manner, our ability to ship our solutions to our customers on time and in the quantity required could be adversely affected, which in turn could cause an unanticipated decline in our sales, harm to our customer relationships, and our gross margins to be adversely affected.

To ensure continued wafer supply, we may be required to establish alternative wafer supply sources, which could require significant expenditures and limit our negotiating leverage. We currently rely on Bosch and TSMC as our primary foundries and suppliers for our MEMS timing devices and analog circuits, respectively, and only a few foundry vendors have the capability to manufacture our most advanced solutions, in particular with respect to our MEMS solution. If we engage alternative supply sources, we may incur additional costs and encounter difficulties and/or delays in qualifying the supply sources. For example, we have a license agreement with Bosch under which Bosch granted us a license to use certain patents. Under this agreement, we are required to pay a royalty fee to Bosch if we engage third parties to manufacture, or if we decide to manufacture ourselves, certain generations of our MEMS wafers through March 31, 2024. In addition, shipments could be significantly delayed while these sources are qualified for volume production. If we are unable to maintain our relationship with Bosch or TSMC, our ability to produce high-quality products could suffer, which in turn could harm our business, financial condition, and results of operations.

We currently primarily rely on Advanced Semiconductor Engineering, Inc. (“ASE”), Carsem (M) Sdn. Bhd. (“Carsem”), and United Test and Assembly Center Ltd. (“UTAC”) for assembly and testing, as well as Daishinku Corp. (“Daishinku”) and UTAC for ceramic packaging for some of our products. We enter into capacity agreements with certain of our OSATs from time to time which may adversely impact our gross margins and results of operations if we do not purchase required minimum quantities.

Certain of our manufacturing, packaging, assembly, and testing facilities are located outside of the United States, including Malaysia, Taiwan, and Thailand, where we are subject to increased risk of political and economic instability, difficulties in managing operations, difficulties in enforcing contracts and our intellectual property, severe weather, and employment and labor difficulties. Additionally, public health crises, such as an outbreak of contagious diseases like the COVID-19 pandemic, may affect the production capabilities of our suppliers, including as a result of quarantines, closures of production facilities, lack of supplies, or delays caused by restrictions on travel or work-from-home orders. Restrictions like these could limit our suppliers’ ability to operate their manufacturing facilities.

Any of these factors could result in manufacturing and supply problems, and delays in our ability to provide our solutions to our customers on a timely basis, or at all. If we experience manufacturing problems at a particular location, we may be required to transfer manufacturing to a new location or supplier. Converting or transferring manufacturing from a primary location or supplier to a backup facility could be expensive and could take several quarters or more. During such a transition, we would be required to meet customer demand from our then-existing inventory, as well as any partially finished goods that could be modified to the required product specifications. In addition, our end customers may require requalification with a new wafer manufacturer. We typically maintain at least a three-month supply of our MEMS wafers for which Bosch is our primary supplier. We do not otherwise maintain sufficient inventory to address a lengthy transition period. As a result, we may not be able to meet customer needs during such a transition, which could damage our customer relationships. Although we maintain business disruption insurance, this insurance may not be adequate to cover any losses we may experience as a result of such difficulties.

If one or more of the third parties we rely on for our manufacturing operations terminates its relationship with us, or if we encounter any problems with our manufacturing supply chain, our ability to ship our solutions to our customers on time and in the quantity required would be adversely affected, which in turn could cause an unanticipated decline in our sales, harm to our customer relationships and loss of customers.

A portion of our operations is located outside of the United States, which subjects us to additional risks, including increased complexity and costs of managing international operations and geopolitical instability.

We outsource the fabrication and assembly of all of our products to third parties that are primarily located in Germany and Asia. In addition, we conduct research and development activities in the United States, Japan, the Netherlands, Taiwan, and Ukraine and work with third-party contractors in Russia. We also conduct marketing and administrative functions in the United States, Japan, the Netherlands, China, Taiwan, Malaysia, and Ukraine. Certain of the critical functions for our business are performed in locations outside of the United States. In addition, members of our sales force are located in various locations outside of the United States. In addition, approximately 94%, 93% and 93% of our revenue for the years ended December 31, 2021, 2020 and 2019, respectively, was from distributors with ship-to locations outside the United States, although we believe the majority of our end customers are based in

18

the U.S. based on sell-through information provided by these distributors. As a result of our international focus, we face numerous challenges and risks, including:

These risks could harm our international operations, delay new product releases, increase our operating costs, and hinder our ability to grow our operations and business and, consequently, our business, financial condition, and results of operations could suffer. For example, we rely on TSMC in Taiwan for the fabrication of our analog circuits and have sales force personnel in Taiwan and China. If political tensions between China and Taiwan were to increase further, it could disrupt our business and adversely affect our financial condition and results of operations given that we rely primarily on TSMC in Taiwan for our analog circuits. In addition, given the current political and military situation in Russia and Ukraine, or if the relationship between Russia and the United States worsens further, or if either Russia or the United States imposes significant new economic sanctions or restrictions on doing business, and we are restricted or precluded from continuing our operations in Russia or Ukraine, it could disrupt our business, our costs could increase, and our product development efforts, business, financial condition, and results of operations could be significantly harmed. Further, the ongoing COVID-19 pandemic has led to travel, work-from-home, and other restrictions, which has significantly impacted our domestic and international operations and the operations of our suppliers, distributors, partners, and customers. At this point, the extent to which the COVID-19 pandemic may impact our business remains uncertain but it may materially adversely affect our business, financial condition or results of operations.

19

We currently depend on one end customer for a large portion of our revenue. The loss of, or a significant reduction in orders from our customers, including this end customer, could significantly reduce our revenue and adversely impact our operating results.

We believe that our operating results for the foreseeable future will continue to depend to a significant extent on revenue attributable to Apple, our largest end customer. Sales attributable to this end customer have historically accounted for a large portion of our revenue and accounted for approximately 22%, 40% and 35% of our revenue for the years ended December 31, 2021, 2020 and 2019, respectively. Revenue attributable to this end customer increased from 2019 to 2020 and increased in absolute dollars but decreased as a percentage of revenue from years ended December 31, 2020 to 2021. We anticipate revenue attributable to this customer will fluctuate from period to period, although we expect to remain dependent on this end customer for a substantial portion of our revenue for the foreseeable future. Although we sell our products to this customer through distributors on a purchase order basis, including Pernas Electronics Co., Ltd. (“Pernas”), Arrow Electronics, Inc. (“Arrow”), and Quantek Technology Corporation (“Quantek”), we have a development and supply agreement, which provides a general framework for certain transactions with Apple. This agreement continues until either party terminates for material breach. Under this agreement, we have agreed to develop and deliver new products to this end customer at its request, provided it also meets our business purposes, and have agreed to indemnify it for intellectual property infringement or any injury or damages caused by our products. This end customer does not have any minimum or binding purchase obligations to us under this agreement and could elect to discontinue making purchases from us with little or no notice. If our end customers were to choose to work with other manufacturers or our relationships with our customers is disrupted for any reason, it could have a significant negative impact on our business. Any reduction in sales attributable to our larger customers, including our largest end customer, would have a significant and disproportionate impact on our business, financial condition, and results of operations.

Because most of our sales are made pursuant to standard purchase orders, orders may be cancelled, reduced, or rescheduled with little or no notice and without penalty. Cancellations of orders could result in the loss of anticipated sales without allowing us sufficient time to reduce our inventory and operating expenses. In addition, changes in forecasts or the timing of orders from our customers expose us to the risks of inventory shortages or excess inventory. This in turn could cause our operating results to fluctuate.

Our end customers, or the distributors through which we sell to these customers, may choose to use products in addition to ours, use a different product altogether, or develop an in-house solution. In addition, the inability of our customers or their contract manufacturers to obtain sufficient supplies of third-party components used with our products could result in a decline in the demand of our products and a loss of sales. Any of these events could significantly harm our business, financial condition, and results of operations. In addition, if our distributors’ relationships with our end customers, including our larger end customers, are disrupted for inability to deliver sufficient products or for any other reason, it could have a significant negative impact on our business, financial condition, and results of operations.

If we are unable to expand or further diversify our customer base, our business, financial condition, and results of operations could suffer.

We sell our products primarily through distributors and resellers, who in turn sell to our end customers. We also sell directly to our end customers. For the years ended December 31, 2021, 2020 and 2019, our top three distributors by revenue together accounted for approximately 48%, 59%, and 59% of our revenue, respectively. Based on our shipment information, we believe that revenue attributable to our ten largest end customers accounted for 49%, 58%, and 57% of our revenue in the years ended December 31, 2021, 2020 and 2019, respectively. Sales attributable to our largest end customer accounted for approximately 22%, 40%, and 35%, respectively of our revenue for the years ended December 31, 2021, 2020 and 2019, respectively. We expect the composition of our largest end customers to vary from period to period, and that revenue attributable to our largest ten end customers in any given period may decline over time. Our relationships with existing customers may deter potential customers who compete with these customers from buying our silicon timing systems solutions. If we are unable to expand or further diversify our customer base, it could harm our business, financial condition, and results of operations.

Because we do not have long-term purchase commitments with our customers, orders may be cancelled, reduced, or rescheduled with little or no notice, which in turn exposes us to inventory risk, and may cause our business and results of operations to suffer.

We sell our products primarily through distributors and resellers, with no long-term or minimum purchase commitments from them or their end customers. Substantially all of our sales to date have been made on a purchase order basis, which orders may be cancelled, changed, or rescheduled with little or no notice or penalty. As a result, our revenue and operating results could fluctuate materially and could be materially and disproportionately impacted by purchasing decisions of our customers, including our larger customers. In the future, our distributors or their end customers may decide to purchase fewer units than they have in the past, may alter their purchasing patterns at any time with limited or no notice, or may decide not to continue to purchase our silicon timing systems solutions at all, any of which could cause our revenue to decline materially and materially harm our business, financial condition, and results of operations. Cancellations of, reductions in, or rescheduling of customer orders could also result in the loss of anticipated sales without

20

allowing us sufficient time to reduce our inventory and operating expenses, as a substantial portion of our expenses are fixed at least in the short term. In addition, changes in forecasts or the timing of orders expose us to the risks of inventory shortages or excess inventory. As we no longer intend to acquire inventory to pre-build custom products, we may not be able to fulfill increased demand in the short term. Any of the foregoing events could materially and adversely affect our business, financial condition, and results of operations.

Our revenue and operating results may fluctuate from period to period, which could cause our stock price to fluctuate.

Our revenue and operating results have fluctuated in the past and may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. We expect our revenue to fluctuate in the future primarily based on the volume of shipments of our products and average selling price ("ASP") changes. Though our ASP increased in 2021 compared to 2020, we may not be able to sustain ASP increases in the future. Factors relating to our business that may contribute to fluctuations in our operating results include the following factors, as well as other factors described elsewhere in this report:

As a result of these and other factors, you should not rely on the results of any prior quarterly or annual periods, or any historical trends reflected in such results, as indications of our future revenue or operating performance. Fluctuations in our revenue and operating results could cause our stock price to decline and, as a result, you may lose some or all of your investment.

Our success and future revenue depend on our ability to achieve design wins and to convince our current and prospective customers to design our products into their product offerings. If we do not continue to win designs or our products are not designed into our customers’ product offerings, our results of operations and business will be harmed.

We sell our silicon timing systems solutions to customers who select our solutions for inclusion in their product offerings. This selection process is typically lengthy and may require us to incur significant design and development expenditures and dedicate scarce engineering resources in pursuit of a single design win with no assurance that our solutions will be selected. If we fail to convince our current or prospective customers to include our products in their product offerings or to achieve a consistent number of design wins, our business, financial condition, and results of operations will be harmed.

21

Because of our extended sales cycle, our revenue in future years is highly dependent on design wins we are awarded in prior years. It is typical that a design win will not result in meaningful revenue for a year or more, if at all. If we do not continue to achieve design wins in the short term, our revenue in the following years will deteriorate.

Further, a significant portion of our revenue in any period may depend on a single product design win with a large customer. As a result, the loss of any key design win or any significant delay in the ramp of volume production of the customer’s products into which our product is designed could adversely affect our business, financial condition, and results of operations. We may not be able to maintain sales to our key customers or continue to secure key design wins for a variety of reasons, and our customers can stop incorporating our products into their product offerings with limited notice to us and suffer little or no penalty.

If we fail to anticipate or respond to technological shifts or market demands, or to timely develop new or enhanced products or technologies in response to the same, it could result in decreased revenue and the loss of our design wins to our competitors. Due to the interdependence of various components in the systems within which our products and the products of our competitors operate, customers are unlikely to change to another design, once adopted, until the next generation of a technology. As a result, if we fail to introduce new or enhanced products that meet the needs of our customers or penetrate new markets in a timely fashion, and our designs do not gain acceptance, we will lose market share and our competitive position.

The loss of a key customer or design win, a reduction in sales to any key customer, a significant delay or negative development in our customers’ product development plans, or our inability to attract new significant customers or secure new key design wins could seriously impact our revenue and materially and adversely affect our business, financial condition, and results of operations.

We may experience difficulties demonstrating the value to customers of newer solutions if they believe existing solutions are adequate to meet end customer expectations. If we are unable to sell new generations of our product, our business would be harmed.

As we develop and introduce new solutions, we face the risk that customers may not value or be willing to bear the cost of incorporating these newer solutions into their product offerings, particularly if they believe their customers are satisfied with prior offerings. Regardless of the improved features or superior performance of the newer solutions, customers may be unwilling to adopt our new solutions due to design or pricing constraints. Because of the extensive time and resources that we invest in developing new solutions, if we are unable to sell new generations of our solutions, our revenue could decline and our business, financial condition, and results of operations would be negatively affected.

Some of our customer and other third-party agreements provide for joint and/or custom product development, which subject us to a number of risks, and any failure to execute on any of these arrangements could have a material adverse effect on our business, results of operations, and financial condition.

We have entered into development, product collaboration and technology licensing arrangements with some of our customers and other third parties, and we expect to enter into new arrangements of these kinds from time to time in the future. These agreements may increase risks for us, such as the risks related to timely delivery of new products, risks associated with the ownership of the intellectual property developed, risks that such activities may not result in products that are commercially successful or available in a timely fashion, and risks that third parties involved may abandon or fail to perform their obligations related to such agreements. In addition, such arrangements may provide for exclusivity periods during which we may only sell specified products or technologies to that particular customer. Any failure to timely develop commercially successful products under such arrangements as a result of any of these and other challenges could have a material adverse effect on our business, results of operations, and financial condition.

The success of our products is dependent on our customers’ ability to develop products that achieve market acceptance, and our customers’ failure to do so could negatively affect our business.

The success of our silicon timing systems solutions is heavily dependent on the timely introduction, quality, and market acceptance of our customers’ products incorporating our solutions, which are impacted by factors beyond our control. Our customers’ products are often very complex and subject to design complexities that may result in design flaws, as well as potential defects, errors, and bugs. We have in the past been subject to delays and project cancellations as a result of design flaws in the products developed by our customers, changing market requirements, such as the customer adding a new feature, or because a customer’s product fails their end customer’s evaluation or field trial. In other cases, customer products are delayed due to incompatible deliverables from other vendors. We incur significant design and development costs in connection with designing our products for customers’ products that may not ultimately achieve market acceptance. If our customers discover design flaws, defects, errors, or bugs in their products, or if they experience changing market requirements, failed evaluations or field trials, or incompatible deliverables from other vendors, they may delay, change, or cancel a project, and we may have incurred significant additional development costs and may not be able to recoup our costs, which in turn would adversely affect our business, financial condition, and results of operations.

22

Our target customer and product markets may not grow or develop as we currently expect, and if we fail to penetrate new markets and scale successfully within those markets, our revenue and financial condition would be harmed.

Our target markets include the communications and enterprise, automotive, industrial, aerospace, and mobile, IoT, and consumer markets. Substantially all of our revenue for the years ended December 31, 2021, 2020 and 2019 was derived from sales in the IoT and mobile, industrial, and consumer markets. In 2017, we began introducing products for the automotive market. In addition, within the timing market, substantially all of our revenue to date has been attributable to sales of MEMS oscillators. We intend to focus on clock IC and timing sync solutions in the future. Any deterioration in our target customer or product markets or reduction in capital spending to support these markets could lead to a reduction in demand for our products, which would adversely affect our revenue and results of operations. Further, if our target customer markets, including the 5G communications or IoT and mobile markets, do not grow or develop in ways that we currently expect, demand for our technology may not materialize as expected, which would also negatively impact our business, financial condition, and results of operations.

We may be unable to predict the timing or development of trends in our target markets with any accuracy. If we fail to accurately predict market requirements or market demand for these solutions, our business will suffer. A market shift towards an industry standard that we may not support could significantly decrease the demand for our solutions.

Our future revenue growth, if any, will depend in part on our ability to expand within our existing markets, our ability to continue to penetrate emerging markets, such as the 5G communications market, which we entered in 2019, and our ability to enter into new markets, such as the industrial, medical, and military markets. Each of these markets presents distinct and substantial challenges and risks and, in many cases, requires us to develop new customized solutions to address the particular requirements of that market. Meeting the technical requirements and securing design wins in any of these new markets will require a substantial investment of our time and resources. We cannot assure you that we will secure design wins from these or other new markets, or that we will achieve meaningful revenue from sales in these markets. If any of these markets do not develop as we currently anticipate or if we are unable to penetrate them and scale in them successfully, our revenue could decline.

The average selling prices of our individual products have fluctuated historically over time and may do so in the future, which could harm our revenue and gross margins.

Although on average selling prices of our products have increased over time as we introduce higher end products, the average selling prices of our individual products generally decrease over time. Our revenue is derived from sales to large distributors and, in some cases, we have agreed in advance to price reductions, generally over a period of time ranging from two months to three years, once the specified product begins to ship in volume. However, our customers may change their purchase orders and demand forecasts at any time with limited notice due in part to fluctuating end-market demand, which can sometimes lead to price renegotiations. Although these price renegotiations can sometimes result in the average selling prices of the specified product fluctuating over the shorter term, we expect average selling prices of individual products generally to decline over the longer term as that product and our end customers’ products mature.

We seek to offset the anticipated reductions in our average selling prices of individual products by reducing the cost of our products through improvements in manufacturing yields and lower wafer, assembly, and testing costs, developing new products, enhancing lower-cost products on a timely basis, and increasing unit sales. However, if we are unable to offset these anticipated reductions in our average selling prices, our business, financial condition, and results of operations could be negatively affected.

If we are not able to successfully introduce and ship in volume new products in a timely manner, our business and revenue will suffer.

We have developed products that we anticipate will have product life cycles of ten years or more, as well as other products in more volatile high growth or rapidly changing areas, which may have shorter life cycles. Our future success depends, in part, on our ability to develop and introduce new technologies and products that generate new sources of revenue to replace, or build upon, existing revenue streams. If we are unable to repeatedly introduce, in successive years, new products that ship in volume, or if our transition to these new products does not successfully occur prior to any decrease in revenue from our prior products, our revenue will likely decline significantly and rapidly.

Our gross margins may fluctuate due to a variety of factors, which could negatively impact our results of operations and our financial condition.

Our gross margins may fluctuate due to a number of factors, including customer and product mix, market acceptance of our new products, timing and seasonality of the end-market demand, yield, wafer pricing, packaging, and testing costs, competitive pricing dynamics, the impact of the COVID-19 pandemic, and geographic and market pricing strategies.

23

To attract new customers or retain existing customers, we have in the past and will in the future offer certain customers favorable prices, which would decrease our average selling prices and likely impact gross margins. Further, we may also offer pricing incentives to our customers on earlier generations of products that inherently have a higher cost structure, which would negatively affect our gross margins. In addition, in the event our customers, including our larger end customers, exert more pressure with respect to pricing and other terms with us, it could put downward pressure on our margins.

Because we do not operate our own manufacturing, assembly, or testing facilities, we may not be able to reduce our costs as rapidly as companies that operate their own facilities, and our costs may even increase, which could further reduce our gross margins. For instance, we expect to see increases in our manufacturing costs in fiscal year 2022 due to an industry wide increase in costs. We rely primarily on obtaining yield improvements and volume-based cost reductions to drive cost reductions in the manufacture of existing products, introducing new products that incorporate advanced features and optimize die size, and other price and performance factors that enable us to increase revenue while maintaining gross margins. To the extent that such cost reductions or revenue increases do not occur at a sufficient level and in a timely manner, our business, financial condition, and results of operations could be adversely affected.

In addition, we maintain an inventory of our products at various stages of production and in some cases as finished good inventory. We hold these inventories in anticipation of customer orders. If those customer orders do not materialize in a timely manner, we may have excess or obsolete inventory which we would have to reserve or write-down, and our gross margins would be adversely affected.

Our revenue in recent periods may not be indicative of future performance and our revenue may fluctuate over time.

Our recent revenue should not be considered indicative of our future performance. For the years ended December 31, 2021, 2020 and 2019, our revenue was $218.8 million, $116.2 million, and $84.1 million, respectively. You should not rely on our revenue for any previous quarterly or annual periods as any indication of our revenue for future fiscal periods. As we grow our business, our revenue may fluctuate in future periods due to a number of reasons, which may include slowing demand for our products, increasing competition, the impact of the COVID-19 pandemic, a decrease in the growth of our overall market or market saturation, and our failure to capitalize on growth opportunities.

If we are unable to manage our growth effectively, we may not be able to execute our business plan and our operating results could suffer.