Exhibit 99.1

VIVAKOR 1 April 2024 Management Presentation

VIVAKOR 2 Disclaimer This Confidential Information Overview (this “CIO”) contains confidential information regarding Vivakor , Inc. and its subsidiaries (the “Company”). By accepting this CIO the recipient agrees that it will, and will cause its directors, officers, employees, advisors and other representatives to use this CIO and any other information s upp lied by or on behalf of the Company only to evaluate a possible transaction with the Company (“Transaction”) and for no other purpose, will not divulge or permit others to divulge any such information to an y o ther persons and will not copy or reproduce in whole or in part this CIO. The recipient, by acceptance hereof, acknowledges its duty to comply with this and any certain Confidentiality Agreement between the recipient and the Company. The information contained in this CIO was obtained from the Company and other sources believed by the Company to be reliable. No assurance is given as to the accuracy or completeness of such information. This CIO does not purport to contain all the information that may be required or desired to evaluate the Company or the Trans act ion and any recipient hereof should conduct its own independent analysis of the Company and the data contained or referred to herein and the Transaction. In determining whether or not to proceed with a Tr ansaction, the recipient must rely on its own examination of the Company and the Transaction. No person has been authorized to give any information or make any representation concerning the Company or the Transaction no t c ontained in this CIO and, if given or made, such information or representation must be relied upon as having been authorized by the Company. Statements in this CIO are made as of the date h ere of. The delivery of this CIO at any timer thereafter shall not under any circumstances create an implication that the information herein is correct as of any time subsequent to the date hereof or th at there has been no change in the business, condition (financial or otherwise), assets, operations, results of operations or prospects of the Company since the date hereof. The Company undertakes no obliga tio n to update any of the information contained in this CIO, including any projections, estimates or forward looking statements. Any statement, estimate or projection as to events that may occur in the future (including, but not limited to, projections o f r evenue, expenses and net income) were not prepared with a view toward public disclosure or complying with any guidelines of the American Institute of Certified Public Accountants, any federal or state s ecu rities commission or any other guidelines regarding projected financial information. Such statements, estimates or projections will depend substantially upon, among other things, the Company achiev ing its overall business objectives and other factors (including general economic, financial and regulatory factors) over which the Company may have little or no control. There is no guarantee that any of the se statements, estimates or projections will be attained. Actual results may vary significantly from the statements, estimates and projections in this CIO, and such variations may be material and adverse. This presentation may contain forward - looking statements within the meaning of the "safe harbor" provisions of the Private Secur ities Litigation Reform Act of 1995. Such statements are based upon our current expectations and speak only as of the date hereof. Our actual results may differ materially and adversely from those expresse d i n any forward - looking statements as a result of various factors and uncertainties, including economic slowdown affecting companies, our ability to successfully develop products, rapid change in ou r markets, changes in demand for our future products, legislative, regulatory and competitive developments and general economic conditions. These risks and uncertainties include, but are not limited to, ris ks and uncertainties discussed in Vivakor's filings with the Securities and Exchange Commission, which factors may be incorporated herein by reference. Forward - looking statements may be identified but not limited by the use of the words "anticipates", "expects", "intends", "plans", "should", "could", "would", "may", "will", "believes", "estimates", "potential", or "continue" and variations or similar expr ess ions. We undertake no obligation to revise or update publicly any forward - looking statements for any reason. Disclosures in this CIO assume closing of the acquisition of the Endeavor entities, which is subject to standard closing cond iti ons and may not occur. TN0 TN1 CB2

VIVAKOR 3 Vivakor at a Glance Diversified Energy Company (1) Vivakor’s Diversified Energy Solutions ▪ Vivakor, Inc. is a diversified energy Company acquiring clean technology companies and developing environmental solutions ▪ Vivakor’s revenues are diversified across regions and customer segments , supporting stability and reliability in the Company’s business model ▪ Balanced service mix and expansive footprint allow Vivakor to service a variety of blue - chip customers ▪ Environmental Services: Vivakor believes it’s technology is only one approved by KOC to successfully reduce oil concentration in soil to less than 0.5% ▪ Logistics: Vivakor owns and operates over 165 crude oil transportation units in every major oil production basin and over 105 water transportations trucks in south and west Texas ▪ Gathering and Storage: Vivakor moves over 300,000 barrels / month through various assets Strategic Footprint (1) GATHERING AND STORAGE LOGISTICS Environmental Services Transport Pipeline Assets Soil Remediation Storage Tanks Water Transport Crude Transport Current Market (1) Pro forma disclosure includes announced potential acquisition of the Endeavor entities, but not potential merger with Empire Div ersified Energy. TN0TN1 TN2 CB3

VIVAKOR 4 Company Snapshot Overview ▪ Vivakor, Inc. is socially responsible operator, acquirer and developer of clean energy technologies and environmental solutio ns ▪ February 26, 2024 – signed definitive merger agreement with Empire Diversified Energy ▪ March 21, 2024 – signed definitive agreement to acquire Endeavor Entities, encompassing Endeavor Crude, Meridian Equipment Leasi ng, CPE Midcon , Equipment Transport and Silver Fuels Processing Exchange/Ticker Nasdaq: VIVK Stock Price & Valuation $0.80 for $25 Million Market Cap & $75 Million Enterprise Value 52 - Week High/Low $1.48 – $0.44 Average Daily Volume 121,000 Shares/Day (over 30 days thru 3/28/24) Revenue YTD Thru 9/30/23 +286% to $45.4 Million Total Assets at 9/30/23 $76.1 Million Company Name

VIVAKOR 5 Seasoned Management Team with Significant Industry Experience CEO has successfully exited three oil and gas transactions greater than $1B total enterprise value CEO has extensive industry relationships that will be instrumental in the expansion of Vivakor technology Facilities Director has extensive experience i n midstream oil and gas construction and operations Business Development team has a broad range of experiences in the United States, Europe, and the Middle East SPV financing model could allow the Company to raise capital for each project , which would give the company the flexibility to both finance and operate the projects worldwide Legal team has 30+ years of experience in public company reporting and operations Management Highlights James Ballengee Chairman and Chief Executive Officer Executive Management Business Development Legal Chief Financial Officer Chief Accounting Officer Storage and Gathering Logistics Soil Remediation Pro forma disclosure includes announced potential acquisition of the Endeavor entities, but not potential merger with Empire Div ersified Energy. TN0 CB1 CB2

VIVAKOR 6 Key Investment Highlights Increasing Presence within the Environmental Services Market 3 Multiple Levers To Accelerate Growth And Drive Multiple Expansion 7 Seasoned Management Team with Significant Industry Experience 6 Large and Growing Addressable Markets with Favorable Tailwinds 1 Patented Technology Drives Differentiated Environmental Services 2 Simultaneous Expansion of Logistics Operations 4 Serving as an Essential Link in the Energy Value Chain 5 Pro forma disclosure includes announced potential acquisition of the Endeavor entities, but not potential merger with Empire Div ersified Energy. CB0

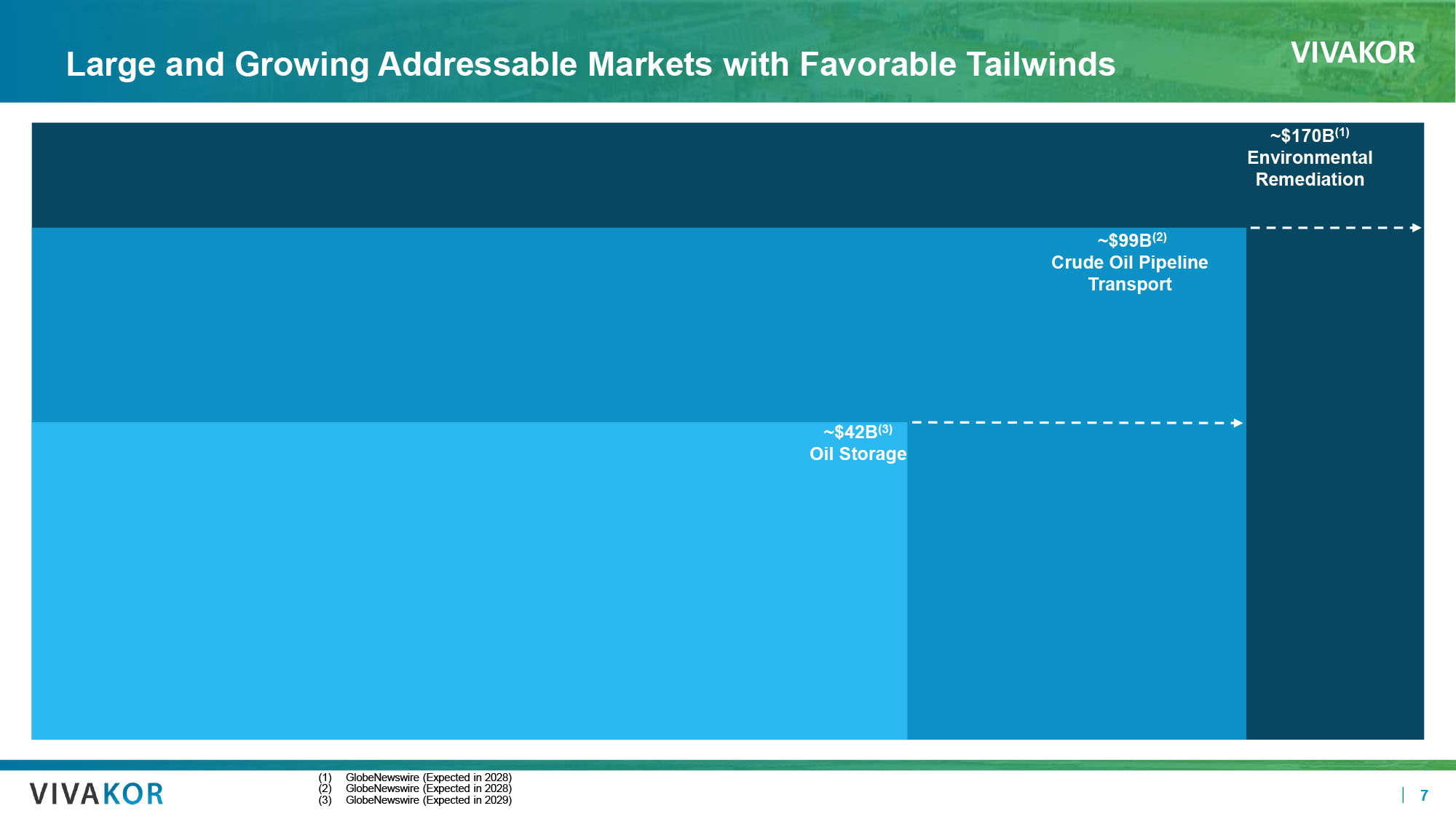

VIVAKOR 7 Large and Growing Addressable Markets with Favorable Tailwinds ~$99B (2) Crude Oil Pipeline Transport ~$170B (1) Environmental Remediation ~$42B (3) Oil Storage (1) GlobeNewswire (Expected in 2028) (2) GlobeNewswire (Expected in 2028) (3) GlobeNewswire (Expected in 2029) CB0

VIVAKOR 8 Gathering and Storage Serve as an Essential Link in the Energy Value Chain Gathering and Storage Overview ▪ Stronghold in the midstream crude oil storage and gathering services ▪ Assets and services include the following: » Pipeline gathering assets » Oil is gathered from wells by pipeline and shipped by pipe to a large tank » Oil is shipped from the large tank to pipelines for transport to storage hubs or refiners » Pipeline injection stations » Crude trucks deliver into tanks at these stations » Crude is pumped from these tanks into a pipeline » Volume and quality monitored at the station » Storage tanks used to store crude oil ▪ Trucks, Rail, Barge, Pipeline » Crude treating facilities for contaminants to make oil saleable » Issues such as metals and H2S are common items treated Gathering and Storage Footprint Key Locations ▪ Mountrail County, North Dakota ▪ Kingfisher, Oklahoma ▪ Delhi, Louisiana ▪ Midland, Texas ▪ Colorado City, Texas ▪ Southern New Mexico Vivakor’s Presence within Gathering and Storage ▪ Vivakor - owned assets are complimentary to the logistics assets in that Vivakor trucks transport crude to these assets ▪ Vivakor has assets in multiple crude basins » North Dakota - Bakken » Delaware Basin » Permian Basin » South Arkansas ▪ Vivakor currently moves over 300,000 barrels per month through their various assets Key Stats 17 Facilities 10k Barrels / Day 250k Barrels of Storage Pro forma disclosure includes announced potential acquisition of the Endeavor entities, but not potential merger with Empire Div ersified Energy. TN0

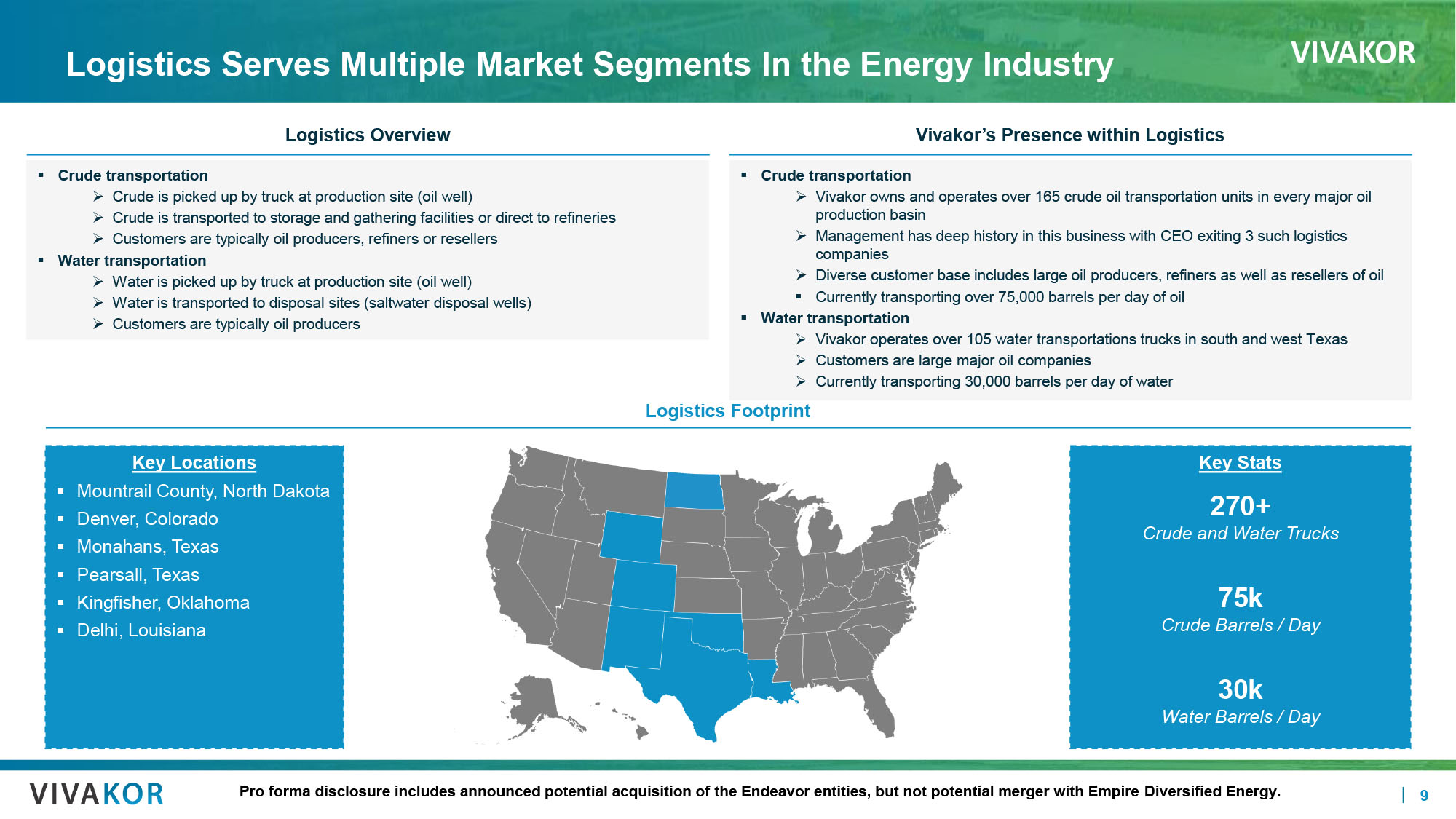

VIVAKOR 9 Logistics Serves Multiple Market Segments In the Energy Industry Logistics Overview ▪ Crude transportation » Crude is picked up by truck at production site (oil well) » Crude is transported to storage and gathering facilities or direct to refineries » Customers are typically oil producers, refiners or resellers ▪ Water transportation » Water is picked up by truck at production site (oil well) » Water is transported to disposal sites (saltwater disposal wells) » Customers are typically oil producers Logistics Footprint Key Locations ▪ Mountrail County, North Dakota ▪ Denver, Colorado ▪ Monahans, Texas ▪ Pearsall, Texas ▪ Kingfisher, Oklahoma ▪ Delhi, Louisiana Vivakor’s Presence within Logistics ▪ Crude transportation » Vivakor owns and operates over 165 crude oil transportation units in every major oil production basin » Management has deep history in this business with CEO exiting 3 such logistics companies » Diverse customer base includes large oil producers, refiners as well as resellers of oil ▪ Currently transporting over 75,000 barrels per day of oil ▪ Water transportation » Vivakor operates over 105 water transportations trucks in south and west Texas » Customers are large major oil companies » Currently transporting 30,000 barrels per day of water Key Stats 270+ Crude and Water Trucks 75k Crude Barrels / Day 30k Water Barrels / Day Pro forma disclosure includes announced potential acquisition of the Endeavor entities, but not potential merger with Empire Div ersified Energy. TN0

VIVAKOR 10 Environmental Services Driven By Patented Technology Recover hydrocarbons from contaminated soil Potential to clean a minimum of ~20 tons / hour of contaminated material Each has the capacity to extract ~500 tons of material or more per day ~250 barrels of extracted hydrocarbons per day if material has at least 10% oil per ton Patented & Proprietary Technology RPCs have successfully cleansed contaminated soil containing up to 20% hydrocarbon content Return usable oil and clean soil Competitors are limited to projects containing less than 5% hydrocarbon contamination Vivakor believes RPCs are significantly more advanced than competing oil remediation technologies Remediation Processing Centers Differentiated Technology Before After TN0 CB1

VIVAKOR 11 Increasing Presence within the Environmental Services Market Environmental Services Overview Environmental Services Footprint Key Locations ▪ Kuwait ▪ Houston, Texas ▪ Vernal, Utah Vivakor’s Presence within Environmental Services ▪ Vivakor currently has 2 machines in Kuwait for soil remediation » Anticipated to receive fee received for each ton process (Vivakor receives ½ of proceeds from oil sales) » Vivakor’s technology is solely approved by KOC to reduce oil concentration in soil to less than 0.5% » Opportunities for additional projects across the Middle East due to success of this project ▪ Crude oil storage tank bottoms » Houston facility can process 40 tons / hour (Vivakor to receive a fee of $300 – $500 / ton to obtain solids) » Estimated recovering 1.5 barrels / ton of solids processed » Strategically located facility within a 20 - mile radius of 1.5k crude oil tanks in Houston area (~300 to be cleaned annually) » Facility is complete and awaiting `permits – expected to be operational Q2 2024 ▪ Processing of raw bitumen crude ▪ Lease on a large property in Utah that allows them to mine raw bitumen for $5 per ton ▪ Soils contaminated with crude oil created by spills / accidents / improper storage » Large scale projects worldwide to clean up after spills and accidents – high percentage of oil in the soil » Fee - based business with upside from oil recoveries » Locations where crude has been stored in open pits with no containment » Customers are governments or large oil companies responsible for the sites ▪ Crude oil storage tank bottoms – high oil recoveries from this material » Crude storage tanks must be cleaned and inspected often with 5 - year required inspections » Change in products stored (crude grades, refined products) » There are solids trapped in all crude oil and over time these solids settle to the bottom of the tank » These solids must be disposed of when tanks are cleaned – tank owners pay fee to dispose of solids » Most solids go to land fill or incineration and solids typically have high percentage of oil trapped inside ▪ Processing of raw bitumen crude mined from ground which produces asphalt and oil fuel Kuwait Key Stats 60 Tons / Hour Current Processing Capacity Completed Factory Acceptance Test, Houston Completed Kuwait Oil Company Test TN0 TN1 TN2

VIVAKOR 12 Environmental Services Positioned For International Expansion Current Market Target Market 5M Tons Sludge Material Available in Kuwait 20 Tons / Hour RPC Processing Capacity Per Facility Current Project: Kuwait Kuwait TN0

VIVAKOR 13 Vivakor Has A Strong Foundation Positioned to Deliver Growth and Profitability Assets Overview: Current and Target Operating Asset Locations Breakdown Current Market Target Market Current Facilities Target Facilities $45.4 Million 2023A Revenue YTD thru 9/30/23 7 Target Facilities 8 Number of States with Operations 17 Current Facilities Key Stats Pro forma disclosure includes announced potential acquisition of the Endeavor entities, but not potential merger with Empire Div ersified Energy. TN0

VIVAKOR 14 Multiple Levers To Accelerate Growth And Drive Multiple Expansion Significant Inorganic Upside Scale Production Scale technical facilities for increased production worldwide Expand Ecosystem Expand distribution and partner ecosystem to enhance platform worldwide International Expansion Expand into new geographic markets such as Europe and MENA Proven, Repeatable M&A Playbook Potential acquisitions to scale production and expand into other Infrastructure and Environmental Services

VIVAKOR 15 Merger with Empire Diversified Energy Definitive Agreement Signed February 26, 2024 • Synergies expected to provide infrastructure for expansion and accelerate revenue growth • Primary operations in Follansbee, West Virginia, where it operates The Port of West Virginia within its Eco - Industrial Complex, situated along the Ohio River, with nearly 1,000 acres of contiguous land where it serves as the crossroads of the East Coast and Midwest through its trimodal (road, river, rail) terminal facility • Empire’s flagship waste - to - energy pyrolysis plant, which is slated to come online in the second fiscal quarter of this year, is intended to provide behind - the - grid electrical power to The Port, while producing salable hydrochloric acid and excess gas into the market • Upon a successful closing of the Merger, we intend to construct and deploy our fourth Remediation Processing Center (RPC IV) at The Port of West Virginia, where Empire currently operates, as well as integrate our transportation and midstream assets into existing operations • Closing subject to standard closing conditions • Currently targeting a close by the end of the third quarter ending September 30, 2024 CB0

VIVAKOR 16 Acquisition of Endeavor Entities Definitive Agreement Signed March 21, 2024 • Operates in the midstream segment of the oil industry, which targets oil logistics, gathering and storage, including crude oil and produced water trucking and disposal services, and also operate a crude oil pipeline gathering system and pipeline injection stations • 10 - year take or pay contracts that provide minimum revenue levels • In the process of constructing a new station located in the Permian Basin that is expected to add an additional 30 , 000 barrels per month for a new minimum of 230 , 000 barrels per month • $ 120 Million transaction valuation based on and adjustable on $ 12 million EBITDA in 2024 • Closing subject to standard closing conditions • Currently targeting a close by the end of the third quarter ending September 30 , 2024 Encompassing Endeavor Crude, Meridian Equipment Leasing, CPE Midcon , Equipment Transport and Silver Fuels Processing CB0

VIVAKOR 17 Thank You Corporate : 5220 Spring Valley, Suite 415 Dallas, TX 75254 p949 - 281 - 2606 info@vivakor.com Investor Relations : ClearThink Capital p917 - 658 - 7878 nyc@clearthink.capital For more information, please visit: vivakor.com